Introduction: The Generic Drug Revolution and Its $400 Billion Impact

The U.S. healthcare landscape is profoundly shaped by the presence and availability of generic drugs. These medications, often perceived simply as cheaper versions of their brand-name counterparts, are in fact the bedrock of affordable medicine in the nation. They represent a monumental success in public health policy, creating a competitive marketplace that drives down costs and expands patient access to essential treatments. The journey to bring a generic drug to market, however, is a high-stakes endeavor, a complex interplay of rigorous science, intricate regulation, and aggressive legal strategy. This guide provides an exhaustive, expert-level roadmap to navigating this process, from the initial identification of a product opportunity to the multifaceted challenges of securing approval from the U.S. Food and Drug Administration (FDA) and achieving commercial success.

Defining a Generic Drug: More Than Just a Copy

At its core, a generic drug is a medication that the FDA has determined to be a therapeutic equivalent to a brand-name drug that is already on the market.1 This brand-name product is officially referred to as the

Reference Listed Drug (RLD). To be approved, a generic drug must meet a stringent set of criteria demonstrating its sameness to the RLD in several key areas:

- Active Pharmaceutical Ingredient (API): The generic must contain the exact same active ingredient, which is the component responsible for the drug’s therapeutic effect.1

- Strength and Dosage Form: It must be identical in strength (e.g., 10 mg) and dosage form (e.g., tablet, capsule, injectable).3

- Route of Administration: The method of delivery (e.g., oral, topical, intravenous) must be the same.1

- Intended Use and Labeling: It must have the same use indications and its labeling must, with few exceptions, be the same as the RLD’s.1

- Quality and Performance: The generic must meet the same exacting standards for identity, strength, purity, quality, and stability. All manufacturing, packaging, and testing sites must pass the same quality inspections as those of brand-name drug manufacturers.1

A crucial distinction lies in the inactive ingredients, or excipients. These are substances like fillers, binders, colorings, and flavorings that do not have a therapeutic effect. While the API must be identical, U.S. trademark laws often prevent a generic drug from looking exactly like the brand-name product.3 Consequently, generics typically differ in physical characteristics such as color, shape, and size. These differences in inactive ingredients are permitted as long as the generic manufacturer can prove they do not alter the drug’s safety, performance, or effectiveness.1 This requirement—to be therapeutically identical yet physically distinct—creates a subtle but significant challenge in managing patient and physician perceptions, where the familiar appearance of a brand-name pill can be a powerful psychological anchor.

The scientific foundation of the entire generic approval system is the principle of bioequivalence. A generic manufacturer must conduct studies to prove that its product delivers the same amount of the active ingredient into a patient’s bloodstream over the same period of time as the RLD.2 By demonstrating bioequivalence, the generic drug is considered to be therapeutically equivalent, meaning it can be substituted for the brand-name drug with the expectation that it will produce the same clinical effect and safety profile.1

The Immense Economic Footprint of Generics in the U.S. Healthcare System

The economic impact of the generic drug industry is nothing short of staggering. By providing lower-cost alternatives after brand-name patents and exclusivities expire, generics introduce competition that dramatically reduces prices for patients, insurers, and government programs alike. The numbers paint a clear picture of an industry that is central to the financial sustainability of the U.S. healthcare system.

According to the Association for Accessible Medicines (AAM), in 2022 alone, generic and biosimilar drugs generated $408 billion in savings.9 Over the preceding decade, these savings amounted to more than

$2.9 trillion.9 This immense value is delivered through widespread adoption. Today, more than

90% of all prescriptions dispensed in the United States are for generic drugs.9 Yet, this overwhelming majority of medicines accounts for less than

18% of the nation’s total spending on prescription drugs.9 This disparity highlights the profound efficiency of the generic market in controlling healthcare expenditures.

The U.S. generic drug market is not just a source of savings but also a significant economic sector in its own right. Market analyses valued the U.S. generic drug market at approximately $95.87 billion in 2024, with projections showing steady growth to $131.8 billion by 2033.11 This growth is fueled by a continuous pipeline of blockbuster drugs losing patent protection, an aging population with increasing healthcare needs, and a persistent focus on cost-containment by payers.

However, the very success of the generic model—its ability to drive prices down through fierce competition—creates a precarious business environment. The immense societal savings are a direct result of price erosion that can leave manufacturers with wafer-thin profit margins, particularly for older products with numerous competitors.13 This financial pressure can threaten the stability of the supply chain, sometimes leading to market exits by manufacturers and contributing to drug shortages.15 Thus, the system’s greatest strength is inextricably linked to its greatest vulnerability.

Overview of the Journey: Navigating the FDA and the Patent Minefield

The path to generic drug approval is a dual-track challenge that demands both scientific precision and legal acumen. A prospective generic manufacturer must successfully navigate two parallel and often intersecting gauntlets:

- The Regulatory Gauntlet: This involves preparing and submitting an Abbreviated New Drug Application (ANDA) to the FDA. The ANDA is a comprehensive dossier of scientific data designed to prove that the generic product is a high-quality, bioequivalent copy of the RLD. It requires meticulous attention to detail in areas of chemistry, manufacturing, and bioanalytical science.

- The Legal Minefield: This involves confronting the intellectual property of the brand-name drug manufacturer. The generic applicant must strategically address every patent listed by the brand company as protecting the RLD. This process often culminates in high-stakes patent litigation that can determine whether a generic can launch years before a patent’s natural expiration date.

The entire framework governing this dual-track process was established by a single, transformative piece of legislation: the Drug Price Competition and Patent Term Restoration Act of 1984, more commonly known as the Hatch-Waxman Act.16 Understanding this Act is the essential first step in understanding the modern generic drug industry. The following sections will deconstruct this journey, providing a detailed guide to the legal foundations, regulatory requirements, scientific standards, and commercial strategies that define the quest for generic drug approval in the United States.

The Legal Bedrock: Understanding the Hatch-Waxman Act

Before 1984, the path to market for a generic drug was arduous and uncertain. Generic manufacturers were often required to conduct their own expensive and time-consuming clinical trials to independently establish the safety and efficacy of their products, even though the active ingredient was identical to an already-approved brand-name drug.18 This significant barrier to entry meant that few generics reached the market, and brand-name drugs often enjoyed a prolonged monopoly long after their patents had expired. The landscape was permanently altered with the passage of the Drug Price Competition and Patent Term Restoration Act of 1984, a landmark law that created the modern generic drug industry as we know it today.20

A Historic Compromise: Balancing Innovation with Affordability

The Hatch-Waxman Act was born of a grand legislative compromise, meticulously crafted to balance two competing and vital public interests: the need to incentivize the development of new, innovative medicines and the need to make those medicines affordable and accessible to the public through generic competition.16 It achieved this balance by creating a quid pro quo between the brand-name (innovator) and generic pharmaceutical industries.

For the generic industry, the Act created a streamlined and expedited approval pathway that eliminated the need for duplicative clinical trials. For the innovator industry, it provided new mechanisms to extend intellectual property rights to compensate for the time and value lost during the lengthy FDA regulatory review process.16 Upon signing the legislation, President Ronald Reagan highlighted this dual benefit:

“The legislation will speed up the process of Federal approval of inexpensive generic versions of many brand name drugs, make the generic versions more widely available to consumers, and grant pharmaceutical firms added incentives to develop new drugs. Everyone wins, particularly our elderly Americans.” 23

This foundational compromise remains the central principle of pharmaceutical regulation in the United States, shaping the strategic decisions of every company in the sector.

Key Pillars of the Act: The ANDA Pathway, Patent Term Restoration, and Safe Harbor

The Hatch-Waxman Act established several critical mechanisms that form the operational framework for generic drug approval.

The Abbreviated New Drug Application (ANDA) Pathway

The most significant provision for the generic industry was the creation of the modern ANDA pathway under Section 505(j) of the Federal Food, Drug, and Cosmetic Act.17 This pathway allows a generic manufacturer to submit an “abbreviated” application that relies on the FDA’s previous finding of safety and effectiveness for the RLD.16 Instead of conducting new clinical trials, the ANDA applicant’s primary scientific burden is to demonstrate bioequivalence and prove that it can manufacture a high-quality product consistently.25 This provision single-handedly made the development of low-cost generics economically viable.

Patent Term Restoration

To compensate innovator companies for the patent life eroded during the years-long process of clinical development and FDA review, Title II of the Act created a system for patent term extension.16 Under this provision, an innovator can apply to have the term of one patent covering its product extended. The length of the extension is based on a formula that accounts for a portion of the time spent in regulatory review. The total extension is capped at a maximum of 5 years, and the total effective patent life post-approval cannot exceed 14 years.26 This ensures that innovators have a meaningful period of market exclusivity to recoup their substantial R&D investments.

The “Bolar” Exemption (Safe Harbor)

Prior to the Act, a generic company that began developing its product before the brand’s patents expired could be sued for patent infringement. This meant that development could not even begin until after patent expiry, creating a de facto extension of the brand’s monopoly for the several years it took to develop the generic and get it approved. The Hatch-Waxman Act resolved this issue by creating a statutory “safe harbor”.21 Codified in 35 U.S.C. § 271(e)(1), this provision states that it is not an act of patent infringement to make, use, or sell a patented invention “solely for uses reasonably related to the development and submission of information under a Federal law which regulates the manufacture, use, or sale of drugs”.27 This crucial exemption allows generic companies to conduct all the research and development necessary for an ANDA submission—including formulation work and bioequivalence studies—while the brand’s patents are still in force, enabling them to be ready to launch their product on the very day the relevant patents expire.21

While this provision is essential for timely generic entry, it also inadvertently provides a significant strategic advantage to brand-name companies. The act of filing an ANDA that challenges a patent requires the generic firm to notify the brand manufacturer, effectively giving the innovator an early and detailed warning of impending competition. This notice reveals who the challenger is and the basis of their legal arguments, allowing the brand company ample time to mount a robust legal defense, prepare for the launch of its own “authorized generic,” or execute other lifecycle management strategies designed to blunt the impact of the generic’s arrival. The very mechanism created to aid generics also serves to arm their primary competitor.

The Birth of a Modern Industry: How the Act Transformed Pharmaceuticals

The impact of the Hatch-Waxman Act was immediate and profound. It fundamentally restructured the U.S. pharmaceutical market, unleashing a wave of generic competition that continues to this day. Before the Act, only about 35% of top-selling drugs with expired patents had any generic competitors; after the Act, this figure rose to nearly 100%.16 The generic substitution rate—the percentage of prescriptions filled with a generic when one is available—skyrocketed from 18.6% in 1984 to over 90% today.9 In its first year, the FDA received approximately 1,050 ANDAs, with projected annual savings of $1 billion.18

The Act also created the two central pillars of the patent and exclusivity system: the FDA’s publication Approved Drug Products with Therapeutic Equivalence Evaluations (the Orange Book), which lists all approved drugs and the patents and exclusivities that protect them, and the patent certification system (Paragraphs I, II, III, and IV), which requires generic applicants to formally state their legal position with respect to every patent listed in the Orange Book for the RLD.17

However, the Act’s framework is not a static set of rules but a dynamic battleground where the intended “balance” is constantly being tested. The original legislation contained provisions that innovator companies quickly learned to exploit to delay generic competition beyond the Act’s intent. For example, by listing new patents in the Orange Book after a generic had already filed its ANDA, a brand company could trigger multiple, successive 30-month stays on the generic’s approval. This gaming of the system led to legislative corrections, most notably in the Medicare Prescription Drug, Improvement, and Modernization Act of 2003 (MMA), which, among other changes, limited brand companies to a single 30-month stay against each ANDA filer.18 This history demonstrates that the generic approval pathway is not merely a scientific and regulatory process but an evolving legal landscape where the strategic actions of companies directly influence and shape the laws and regulations that govern them.

The Regulatory Gauntlet: A Step-by-Step Guide to the ANDA Process

The Abbreviated New Drug Application (ANDA) is the comprehensive legal and scientific dossier that a generic drug manufacturer submits to the FDA to request approval. While “abbreviated,” the process is anything but simple. It is a rigorous, multi-stage journey that demands meticulous preparation, deep scientific expertise, and responsive communication with the agency. The entire process is now governed by the performance goals and procedures established under the Generic Drug User Fee Amendments (GDUFA), a program where the industry pays user fees to fund the FDA’s review activities in exchange for more predictable and timely reviews.28

Preparing for Submission: The Critical Role of Pre-ANDA Meetings

For many generic products, particularly those classified as “complex,” early and effective communication with the FDA is a critical step in de-risking the development program. Complex products can include drugs with intricate formulations (like liposomes or emulsions), complex delivery systems (like transdermal patches or auto-injectors), or those for which demonstrating bioequivalence is not straightforward.29 For these products, the GDUFA program has established a formal framework for pre-ANDA meetings to provide scientific and regulatory guidance to applicants before they finalize their development programs and submit their ANDAs.31

The two primary types of pre-ANDA meetings are:

- Product Development (PDEV) Meetings: These are science-focused meetings intended to discuss specific issues encountered during an ongoing development program. An applicant might use a PDEV meeting to get the FDA’s feedback on a novel bioequivalence study design, to discuss the characterization of a complex API, or to clarify expectations for a drug-device combination product. The goal is to resolve scientific uncertainties early, thereby preventing deficiencies that could lead to a rejection or delay during the formal ANDA review.31

- Pre-Submission (PSUB) Meetings: These meetings are held closer to the time of submission and are designed to provide the applicant an opportunity to give the FDA review team a “heads-up” about the overall structure and content of their forthcoming ANDA. This is particularly useful for complex applications with unique data packages or novel analytical methods, allowing the applicant to orient the reviewers and potentially streamline the subsequent assessment.31

To secure one of these meetings, a prospective applicant must submit a complete meeting package to the FDA, which includes a detailed background on the product, specific and focused questions, and all relevant supporting data and scientific justifications.31 The FDA will grant a meeting if it determines that the issues are complex enough that they cannot be adequately addressed through a simpler written communication (known as a Controlled Correspondence) and that a meeting would significantly improve the efficiency of the eventual ANDA review.31

Assembling the Dossier: Key Modules of the eCTD Format

All ANDA submissions to the FDA must be in the Electronic Common Technical Document (eCTD) format.34 The eCTD is a standardized, global format for submitting regulatory information to health authorities. It is organized into five distinct modules:

- Module 1: Administrative and Regional Information. This module contains forms and information specific to the U.S. region, such as the signed application Form FDA 356h, patent certifications, and draft labeling.34

- Module 2: Summaries. This module provides high-level summaries of the critical information contained in the subsequent modules. For an ANDA, the most important document here is the Quality Overall Summary (QOS), which summarizes the extensive Chemistry, Manufacturing, and Controls (CMC) data from Module 3.

- Module 3: Quality. This is the comprehensive CMC section of the application. It contains exhaustive detail on the drug substance (API) and the finished drug product, including their composition, manufacturing processes, quality control tests and specifications, and stability data.35

- Module 4: Nonclinical Study Reports. This module is generally not applicable to ANDAs, as they rely on the RLD’s original nonclinical safety findings.

- Module 5: Clinical Study Reports. For an ANDA, this module contains the full study reports for the pivotal bioequivalence studies, as well as any other clinical or in vitro studies conducted to demonstrate equivalence to the RLD.

The FDA Review Clock: From Filing Acceptance to Target Action Date

Once the eCTD dossier is submitted via the FDA’s Electronic Submission Gateway, the formal review process begins.

- Filing Review: The application first goes to the FDA’s Division of Filing Review. This is an initial administrative and scientific check to ensure the ANDA is sufficiently complete to permit a substantive review. The FDA checks for major omissions, such as a missing bioequivalence study or a grossly inadequate CMC section. If the application is found to be incomplete, the agency will issue a Refuse-to-Receive (RTR) letter, and the application will not be filed. The applicant must then correct the deficiencies and resubmit the entire application, which also requires paying a new filing fee.36

- Substantive Review and the GDUFA Clock: If the ANDA is accepted for filing, the formal review “clock” begins. Under the GDUFA III commitment letter, the FDA agrees to performance goals for reviewing and acting on applications by a specific Target Action Date (TAD).38 For a standard original ANDA, the goal is to issue a decision within

10 months of the submission date. For priority submissions (e.g., for drugs in shortage or first generics), the goal is shortened to 8 months.38 While the original Hatch-Waxman Act specified a 180-day review timeline, the GDUFA goals are the operative timelines that applicants and the industry now follow.39

Navigating FDA Feedback: Responding to Information Requests and Complete Response Letters (CRLs)

During the substantive review, various FDA disciplines—including bioequivalence, clinical, pharmacology/toxicology, and CMC—will assess their respective sections of the ANDA. It is common for reviewers to have questions or require clarifications.

- Mid-Cycle Communications: The FDA communicates these queries to the applicant through formal channels, typically Information Requests (IRs) or Discipline Review Letters (DRLs).36 Prompt, complete, and scientifically sound responses to these communications are critical to keeping the review on track.

- The Complete Response Letter (CRL): If, at the end of the 10-month review cycle, the FDA has identified deficiencies that preclude approval, the agency will issue a Complete Response Letter (CRL).36 The CRL details all of the outstanding issues that must be satisfactorily addressed before the application can be approved.41 It is important to note that a CRL is not a final rejection; it is an official notification that the review cycle is complete and the application, in its current form, is not approvable.

- Responding to a CRL: The applicant generally has one year to submit a response to the CRL.36 This response is submitted as an amendment to the ANDA. Depending on the nature of the deficiencies, the amendment will be classified as major or minor, which determines the length of the next review cycle. A major amendment, which is common for an initial CRL, will trigger a new 8- to 10-month review clock.38

The high frequency of CRLs indicates that a first-cycle approval is more of an exception than a rule. FDA data from a sample period in fiscal year 2025 shows 899 Complete Responses were issued, compared to 483 full approvals.42 This reality means that generic companies must build the time and cost of at least one CRL response—and the subsequent review cycle—into their project timelines and financial models. A realistic projection for approval is often closer to 18-24 months than the initial 10-month goal. Recently, in a move toward greater transparency, the FDA has begun publishing redacted CRLs for products that have eventually been approved, offering the entire industry a valuable opportunity to learn from the common pitfalls and deficiencies cited by the agency.41

Proving Sameness: The Science of Bioequivalence (BE)

The entire abbreviated approval pathway for generic drugs rests on a single, powerful scientific premise: if a generic drug can be shown to be bioequivalent to an innovator drug, it can be presumed to be therapeutically equivalent. This allows the generic to leverage the extensive safety and efficacy data from the innovator’s original New Drug Application (NDA), bypassing the need for new, large-scale clinical trials.44 Mastering the science and execution of bioequivalence studies is therefore the most critical scientific hurdle in any ANDA submission.

The Core Principle: Demonstrating Therapeutic Equivalence to the RLD

Bioequivalence means that there is no significant difference in the rate and extent to which the active ingredient from two pharmaceutical equivalents or alternatives becomes available at the site of drug action when administered at the same molar dose under similar conditions.45 For most systemically acting drugs, it is impractical or impossible to measure drug concentrations at the specific site of action (e.g., a receptor in the brain). Therefore, the concentration of the drug in the blood or plasma is used as a surrogate. The fundamental assumption is that if the concentration-time profiles in the blood are the same, the concentration profiles at the site of action will also be the same, leading to the same therapeutic effect.8

Designing the Pivotal BE Study: Crossover vs. Parallel Designs

The pivotal bioequivalence study is the centerpiece of the clinical data in an ANDA. Its design must be robust and scientifically sound to withstand FDA scrutiny.

- Study Population: BE studies are typically conducted in a small number of healthy volunteers, usually between 24 and 48 subjects, under tightly controlled conditions.47 The subjects are generally healthy adults aged 18-55 to minimize variability not related to the drug product itself.47

- Study Designs:

- Two-Way Crossover Design: This is the gold standard and most frequently used design for BE studies.48 In this design, a group of subjects is randomized to receive either the generic product (Test) or the brand-name product (Reference) in the first study period. After a “washout” period long enough to ensure the first drug is completely eliminated from their bodies, they “cross over” and receive the other product in the second period. The key advantage is that each subject serves as their own control, which significantly reduces variability and increases the statistical power of the study.45

- Parallel Design: This design is used when a crossover study is not feasible, primarily for drugs with extremely long elimination half-lives that would require an impractically long washout period.48 In a parallel study, one group of subjects receives only the Test product, and a separate group receives only the Reference product. This design requires more subjects to achieve the same statistical power as a crossover study because it is subject to inter-subject variability.45

- Replicate Design: For drugs that are known to be highly variable in their absorption, the FDA recommends a replicate crossover design.48 In this design, subjects receive one or both of the products more than once. This allows for the estimation of within-subject variability for both the Test and Reference products and can help demonstrate bioequivalence with fewer subjects than a standard non-replicate design would require for a highly variable drug.45

- Study Conditions: The conditions under which the drug is administered are critical. Studies are typically conducted under fasting conditions. However, for certain drugs, particularly modified-release products or those whose absorption is known to be affected by food, the FDA will also require a fed study, where the drug is administered after a standardized high-fat, high-calorie meal.48

Key Pharmacokinetic (PK) Endpoints: Cmax, AUC, and Statistical Analysis

During a BE study, a series of blood samples are drawn from each subject over a specific period. These samples are analyzed to determine the concentration of the drug in the plasma at each time point, generating a concentration-versus-time curve for each subject for each product. From these curves, several key pharmacokinetic (PK) parameters are calculated.45

The primary PK parameters for determining bioequivalence are:

- Cmax (Maximum Concentration): This is the highest observed concentration of the drug in the plasma. It is a measure of the rate of drug absorption.

- AUC (Area Under the Curve): This represents the total exposure of the body to the drug over time. It is calculated from the concentration-time curve and is a measure of the extent of drug absorption. The two most common AUC measures are AUC0−t (from time zero to the last measurable concentration) and AUC0−∞ (from time zero extrapolated to infinity).

To establish bioequivalence, these PK parameters for the Test and Reference products are compared using statistical methods. The FDA’s standard for bioequivalence is that the 90% Confidence Interval (CI) for the ratio of the population geometric means (Test/Reference) for both Cmax and AUC must fall entirely within the acceptance limits of 80.00% to 125.00%.48

This statistical standard is frequently misunderstood. It does not mean that the generic drug’s potency can be 20% lower or 25% higher than the brand’s. The 90% confidence interval is a statistical measure of the range within which the true ratio of the population means is likely to fall. For a study to successfully meet this criterion, the observed geometric mean ratio of the tested products must be very close to 100%. Any significant deviation from 100%, when combined with the natural variability of the study, would likely cause the 90% CI to breach the 80-125% boundaries. In practice, the average performance of approved generics is nearly identical to that of their brand-name counterparts, typically differing by only a few percentage points.2

A critical regulatory requirement that reinforces scientific rigor is the mandate for applicants to submit data from all BE studies conducted on the final formulation, including any failed attempts.49 This rule prevents the practice of “cherry-picking” a successful result from multiple studies and forces manufacturers to scientifically understand and resolve any formulation issues that cause a study to fail. A failed BE study is not just a sunk cost; it becomes part of the regulatory submission that must be thoroughly explained, demonstrating that the root cause of the failure has been identified and corrected in the formulation that is ultimately submitted for approval. This increases the upfront scientific burden but ultimately ensures a more robust and reliable generic product.

Ensuring Quality: Mastering Chemistry, Manufacturing, and Controls (CMC)

While bioequivalence demonstrates that a generic drug performs like the brand, the Chemistry, Manufacturing, and Controls (CMC) section of the ANDA provides the evidence that the product is a high-quality pharmaceutical that can be produced consistently and reliably. The CMC section, which comprises Module 3 of the eCTD, is an exhaustive dossier detailing every aspect of the drug substance and the finished drug product.35 It is often the most voluminous and technically dense part of the submission, and deficiencies in this section are a common reason for the FDA to issue a Complete Response Letter.

The Drug Substance (API): Characterization, Purity, and Stability

The foundation of any drug product is its Active Pharmaceutical Ingredient (API). The ANDA must contain a comprehensive data package for the API, demonstrating its identity, quality, and purity.35 Key components include:

- Characterization: Detailed information elucidating the API’s physicochemical structure and properties. This includes data from various analytical techniques to confirm its identity and structure.

- Manufacturing Process: A full description of how the API is synthesized. This information is often highly proprietary to the API manufacturer. To protect this trade-secret information, the API manufacturer typically submits these details directly to the FDA in a Drug Master File (DMF). The ANDA applicant then obtains a Letter of Authorization from the DMF holder, which allows the FDA to reference the confidential information in the DMF during the review of the ANDA.34

- Impurity Profile: A thorough analysis of all potential impurities, including those arising from the manufacturing process (process impurities) and those that form over time (degradants). The applicant must propose and justify limits for these impurities.35

- Stability: Data from long-term stability studies are required to demonstrate that the API remains stable under specified storage conditions and to establish a retest period.1

The Drug Product: Formulation, Excipients, and Quality Attributes

This part of the CMC section focuses on the finished dosage form—the actual tablet, capsule, or injectable that the patient receives. It integrates the API with various inactive ingredients (excipients) to create a safe, stable, and effective product.

- Formulation and Composition: The ANDA must provide the complete qualitative and quantitative composition of the drug product, listing every ingredient and its amount per dosage unit.37

- Manufacturing Process: A detailed, step-by-step description of the manufacturing process for the drug product must be provided, from the initial weighing of ingredients to the final packaging of the finished product. This includes critical process parameters that must be controlled to ensure product quality.35

- Specifications: For every drug product, the applicant must establish a set of specifications, which the FDA defines as the quality standard comprising tests, analytical procedures, and acceptance criteria used to confirm the quality of the product.51 These specifications are applied to every batch of the drug product before it is released for distribution and are designed to ensure identity, strength, quality, purity, and potency.

- Stability: Extensive stability testing data on the finished drug product, packaged in its proposed commercial container closure system, is required. These studies are conducted under various temperature and humidity conditions to establish the product’s shelf life and recommended storage conditions.1

The FDA evaluates this vast amount of information using a science- and risk-based approach known as Question-Based Review (QbR). This method focuses on identifying the Critical Quality Attributes (CQAs) of the drug product—those physical, chemical, or biological attributes that must be controlled to ensure the desired product quality—and assessing how the applicant’s manufacturing process and control strategy ensure these CQAs are consistently met.34

Manufacturing and Facilities: Adherence to Current Good Manufacturing Practices (cGMP)

A scientifically sound product design is meaningless if it cannot be manufactured consistently at a commercial scale. Therefore, a cornerstone of the FDA’s quality oversight is ensuring that all facilities involved in the manufacturing, testing, and packaging of a drug adhere to Current Good Manufacturing Practices (cGMP).1 These regulations, found in 21 CFR Parts 210 and 211, establish minimum requirements for the methods, facilities, equipment, and controls used in drug manufacturing.52

As part of the ANDA review, the FDA will assess all facilities listed in the application for cGMP compliance. This often involves a pre-approval inspection (PAI), where FDA investigators visit the facility to verify that it is capable of producing the drug in accordance with the commitments made in the ANDA and in compliance with cGMP regulations.53 An unacceptable inspection, where significant deficiencies are observed, will result in a hold on the ANDA’s approval until the issues are corrected.

This oversight does not end with approval. All drug manufacturing facilities are subject to routine, risk-based surveillance inspections by the FDA to ensure ongoing cGMP compliance.53 A negative post-approval inspection can have severe consequences, including warning letters, product recalls, or even injunctions that force a facility to shut down production.54 Because many generic companies produce dozens of different products at a single facility, a cGMP compliance failure at one site can have a catastrophic ripple effect, disrupting the supply of multiple essential medicines and causing significant financial and reputational harm. This makes robust investment in quality systems not just a regulatory requirement, but a critical business continuity and risk mitigation strategy.

The increasing globalization of the pharmaceutical supply chain adds another layer of complexity. A substantial portion of the APIs and finished generic drugs supplied to the U.S. market are manufactured in other countries, with India and China being major sources.13 This requires the FDA to conduct a large number of foreign inspections and exposes the U.S. drug supply to geopolitical risks, such as the potential imposition of tariffs, which could render low-margin generics financially unsustainable and disrupt the availability of affordable medicines for American patients.13

The Labeling Mandate: The “Same As” Requirement and Its Exceptions

In the world of generic drugs, the product’s label is not a marketing tool; it is a critical component of the regulatory approval standard. The FDA’s framework is built on the principle that if a generic drug is therapeutically equivalent to the RLD, then the information provided to prescribers and patients about its use must also be equivalent. This is enforced through the “same as” labeling requirement, a mandate that is fundamental to the ANDA pathway but which also comes with crucial exceptions that create both strategic opportunities and legal complexities.

Mirroring the Brand: Content Requirements for Generic Labeling

The Federal Food, Drug, and Cosmetic Act requires that a generic drug’s proposed labeling be the “same as” the labeling approved for its RLD.6 This requirement applies to the entire labeling package, which includes:

- Prescribing Information (PI): The detailed document for healthcare professionals that includes indications, dosage and administration, contraindications, warnings and precautions, adverse reactions, and clinical pharmacology.

- FDA-Approved Patient Labeling: This includes any Medication Guides, Patient Package Inserts, or Instructions for Use that are required for the RLD.

- Carton and Container Labeling: The labels affixed to the immediate container (e.g., bottle, vial) and outer packaging (e.g., carton).56

The purpose of this requirement is to ensure that healthcare providers and patients can use the generic product in the same safe and effective manner as the brand-name drug, reinforcing the concept of substitutability.

Permissible Differences: Navigating Patents, Exclusivity, and Manufacturer-Specific Information

While the “same as” rule is strict, the FDA’s regulations recognize that some differences in labeling are necessary and permissible, primarily those that arise “because the generic drug product and the reference listed drug are produced or distributed by different manufacturers”.56

The most significant permissible differences include:

- Omission of Protected Information (“Skinny Labels”): This is a critical strategic tool for generic manufacturers. If an RLD is protected by patents or regulatory exclusivity for a specific indication (method of use) or other aspect of its labeling, the ANDA applicant can “carve out” or omit that protected information from its proposed labeling.6 This allows the generic to be approved and marketed for the remaining, non-protected uses, often years before the brand’s full intellectual property portfolio expires.

- Manufacturer-Specific Details: The generic label will naturally differ in its identification of the manufacturer, packer, and/or distributor.6 It will also list its specific inactive ingredients, which may differ from the RLD’s.1

- Formatting and Guideline Compliance: The FDA allows for minor revisions to comply with current labeling guidelines or other agency guidance, ensuring the label format is up-to-date.56

This “skinny label” strategy, while a well-established regulatory pathway, has become a fierce legal battleground. Innovator companies have increasingly pursued litigation arguing that even with a carved-out indication, a generic manufacturer is “inducing” infringement by physicians who may prescribe the drug for the still-patented use. Recent court decisions have created significant legal uncertainty, transforming what was once a straightforward regulatory tactic into a high-risk legal gamble. A generic company can now fully comply with FDA regulations for a skinny label launch and still face the threat of enormous patent infringement damages.

The Dynamic Environment: The Process for Updating Labels Post-RLD Changes

An ANDA holder’s labeling responsibilities are ongoing and do not end with approval. Because the generic label must maintain its sameness to the RLD label, the ANDA holder must diligently monitor for any FDA-approved changes to the RLD’s labeling and update its own label accordingly.6

When the FDA approves a labeling change for an RLD—such as the addition of a new warning, a revised dosage regimen, or a new adverse reaction—the generic manufacturer must act promptly. They are required to submit an amendment (for a pending ANDA) or a supplement (for an approved ANDA) to the FDA with revised labeling that conforms to the updated RLD label.56 Failure to do so in a timely manner can result in the generic drug being considered misbranded and could even lead the FDA to withdraw the ANDA’s approval.56 ANDA holders can monitor for these changes by routinely checking the FDA’s Drugs@FDA database or by subscribing to the agency’s drug safety labeling change notifications.6

This system places generic manufacturers in a legally passive and potentially vulnerable position regarding drug safety. They are prohibited from unilaterally strengthening a warning or adding a new risk to their label based on new safety data they might discover. They must wait for the RLD holder to act first. This has become a central issue in product liability litigation, where generic companies have successfully argued that federal law (the “same as” requirement) preempts state-law claims that they failed to warn about a risk, as they are legally barred from changing their labels independently. This regulatory paradox, designed to ensure consistency, can delay the communication of new safety information and has been the subject of extensive legal and legislative debate.

The Strategic Blueprint: The FDA’s Orange Book

In the complex world of generic pharmaceuticals, the FDA’s publication, Approved Drug Products with Therapeutic Equivalence Evaluations, is the indispensable strategic blueprint. Known universally as the Orange Book for the color of its original print cover, this document is the official, comprehensive resource for information on approved drugs, their therapeutic equivalence ratings, and, most critically, the patents and exclusivities that protect them.58 For any company looking to enter the generic market, mastering the Orange Book is not just a regulatory necessity; it is the first and most fundamental step in identifying opportunities and formulating a winning business strategy.

Decoding the Data: Patents, Exclusivities, and Therapeutic Equivalence Codes

The Orange Book is a rich database containing several types of critical information that guide the actions of generic drug developers.58

- Patent Listings: When an innovator company submits a New Drug Application (NDA), it is required to identify and submit to the FDA information on any patents that claim the drug substance (API), the drug product (formulation), or an approved method of using the drug.58 The FDA lists these patent numbers and their expiration dates in the Orange Book. It is crucial to understand that the FDA performs only a ministerial role in this process; it does not verify the validity or enforceability of the patents that are submitted for listing.17 This creates a system where the Orange Book patent list is the definitive source for regulatory purposes, even if the patents themselves are later challenged and found to be invalid.

- Exclusivity Information: The Orange Book is also the official repository for all FDA-granted marketing exclusivities. It lists the type of exclusivity (e.g., New Chemical Entity, Orphan Drug) and, most importantly, the date on which that exclusivity period expires.58

- Therapeutic Equivalence (TE) Codes: The Orange Book assigns TE codes to multisource drug products. A product with a code beginning with “A” (e.g., “AB”) is considered by the FDA to be therapeutically equivalent to its RLD and can be substituted at the pharmacy level. A code beginning with “B” indicates that the FDA does not consider the products to be therapeutically equivalent.

Identifying Opportunities: Using the Orange Book for Portfolio Selection

For a generic company’s business development and portfolio strategy team, the Orange Book is the primary hunting ground for new product opportunities.62 By systematically analyzing the data, strategists can:

- Identify Future Patent Expiries: Companies can scan the Orange Book for high-revenue brand-name drugs with key patents set to expire in the coming years. This allows them to build a long-range development pipeline.

- Assess the Intellectual Property (IP) Landscape: Before committing millions of dollars to development, a company can use the Orange Book to get a clear picture of a target drug’s IP defenses. How many patents are listed? What is their scope (e.g., a strong composition of matter patent versus a weaker method-of-use patent)? Are there multiple layers of protection? This initial assessment is fundamental to determining the feasibility and risk of developing a generic version.

- Evaluate Exclusivity Barriers: The Orange Book provides the expiration dates for all regulatory exclusivities. A company’s launch timeline is dictated by the last-to-expire barrier, whether that is a patent or an exclusivity period. A thorough analysis must account for both. For example, even if a company successfully challenges all of a drug’s patents, it cannot launch until the brand’s 5-year New Chemical Entity (NCE) exclusivity has expired.

The Foundation of Your Patent Strategy

The information in the Orange Book is not merely informational; it directly dictates the legal and regulatory strategy an ANDA applicant must pursue. As will be discussed in detail, the Hatch-Waxman Act requires that an ANDA submission must contain a certification for every patent listed in the Orange Book for the RLD.22 The nature of the patents listed—and their expiration dates—determines which certification strategy is viable and what the subsequent legal and commercial consequences will be.

The patent listings themselves can be a strategic tool for innovator companies. The timing and accuracy of these listings can be used to create hurdles for generic competitors. For instance, a brand company is required to submit patent information within 30 days of a patent’s issuance for it to be considered “timely filed”.60 A late listing may prevent the brand from being able to trigger a 30-month litigation stay against a generic that has already submitted its ANDA. Conversely, some brand companies have been accused of listing patents of questionable relevance to create additional legal obstacles for generic challengers. The FDA has a formal process for third parties to dispute the accuracy or relevance of a patent listing, highlighting that the integrity of the Orange Book’s data is itself a point of strategic contention.59

Making the Call: Patent Certifications and Their Consequences

The Hatch-Waxman Act requires that every ANDA submission contain a formal declaration addressing each patent listed in the Orange Book for the corresponding RLD. This declaration, known as a patent certification, is the legal and strategic heart of the application. It is where the generic applicant formally states its intentions regarding the innovator’s intellectual property. The choice of certification is a pivotal business decision that dictates the timing of market entry, the risk of litigation, and the potential to earn a highly lucrative period of market exclusivity.

The Four Paths: An In-Depth Look at Paragraph I, II, III, and IV Certifications

There are four types of patent certifications, each corresponding to a specific paragraph in the Code of Federal Regulations (21 CFR 314.94(a)(12)).63 An ANDA applicant must make one of these four certifications for every unexpired patent listed for the RLD.

- Paragraph I Certification: This certification states that the required patent information has not been filed by the innovator company in the Orange Book. This is a rare occurrence.

- Paragraph II Certification: This certification states that the patent in question has already expired. For a drug protected by multiple patents, an applicant might file Paragraph II certifications for those that have expired and other certifications for those still in force.

- Paragraph III Certification: This certification is a statement that the generic company will not market its product until the date the patent expires. It is a non-confrontational approach that concedes the patent’s validity and applicability.

- Paragraph IV Certification: This is a direct challenge to the innovator’s intellectual property. The certification states that, in the applicant’s opinion, the patent is invalid, unenforceable, or will not be infringed by the manufacture, use, or sale of the proposed generic drug.63

Paragraph III: The Strategy of Waiting

Choosing to file a Paragraph III certification is a conservative, lower-risk strategy. The applicant essentially agrees to honor the patent and wait for its natural expiration. The FDA can fully review the ANDA and, if it meets all scientific and regulatory standards, grant it a tentative approval.66 This means the application is approvable from a quality and bioequivalence standpoint, but a final approval letter cannot be issued until the patent expiry date listed in the certification.

This strategy avoids the immense cost and uncertainty of patent litigation. However, it also forgoes any opportunity for early market entry and, crucially, relinquishes any chance to obtain 180-day market exclusivity. A Paragraph III filer will likely enter the market on the same day as several other generic competitors who also chose to wait, leading to immediate and intense price competition from day one.

Paragraph IV: The Declaration of a Challenge

A Paragraph IV certification is a declaration of intent to enter the market before the patent expires. It is an aggressive, high-risk, high-reward strategy that lies at the center of the Hatch-Waxman framework’s balance between innovation and competition.67 By filing a Paragraph IV certification, the generic applicant is asserting that it has a valid legal argument to overcome the innovator’s patent protection.

Under the law, the submission of an ANDA with a Paragraph IV certification is considered a technical or “artificial” act of patent infringement.67 This unique legal construct gives the patent holder immediate grounds to file a lawsuit, allowing the patent dispute to be litigated and resolved

before the generic product actually launches and causes any commercial harm. The Paragraph IV pathway is the sole mechanism for a generic company to potentially enter the market prior to patent expiry and is the only way to become eligible for the valuable 180-day first-to-file exclusivity period.69

The decision between a Paragraph III and Paragraph IV filing is therefore a critical inflection point in a generic drug’s lifecycle. It is a multi-million dollar business decision that requires a sophisticated analysis of legal risk (the strength of the innovator’s patents), financial cost (the high price of litigation), and market reward (the potential value of early entry and 180-day exclusivity). This choice has also driven innovator companies to develop defensive patenting strategies, creating complex “patent thickets” around their most valuable products. By obtaining and listing numerous patents covering various aspects of a drug—its formulation, its crystalline structure, its methods of use—innovators can significantly raise the cost and complexity of a Paragraph IV challenge, forcing a generic challenger to litigate on multiple fronts simultaneously and potentially deterring all but the most well-resourced competitors.

The High-Stakes Battle: Navigating Paragraph IV Patent Litigation

Filing a Paragraph IV certification is akin to firing the starting pistol in a legal race. It sets in motion a highly structured and time-sensitive process of notification and litigation that is unique to the pharmaceutical industry. This process is designed to resolve patent disputes in a predictable timeframe, but it is also a strategic battleground where every move can have profound financial consequences for both the brand-name and generic companies.

Initiating the Challenge: The Paragraph IV Notice Letter

Once the FDA officially accepts an ANDA containing a Paragraph IV certification for review, the clock starts ticking for the applicant. Within 20 days of this acceptance, the generic company must send a formal Notice Letter to the NDA holder and to the owner of the patent that is being challenged.67 This is not a simple notification. The letter must provide a “detailed statement of the factual and legal basis” for the generic applicant’s assertion that the patent is invalid, unenforceable, or will not be infringed.67 This document effectively serves as a preview of the generic company’s legal arguments and is the formal trigger for the ensuing litigation.

The 30-Month Stay: A Critical Shield for Brand Manufacturers

Upon receiving the Paragraph IV Notice Letter, the innovator company faces a critical decision and a tight deadline. It has 45 days to file a patent infringement lawsuit against the ANDA applicant.71 The consequence of this action is enormous: if a lawsuit is filed within this 45-day window, it automatically triggers a

30-month stay on the FDA’s ability to grant final approval to the ANDA.71

This 30-month stay is one of the most powerful provisions in the Hatch-Waxman Act for brand manufacturers. It provides a lengthy, guaranteed period of protection from generic competition, regardless of the ultimate merits of the patent case.67 The stay expires after 30 months, or earlier if a district court rules in favor of the generic company. This period gives the brand company time to litigate the patent dispute fully or, just as importantly, to execute commercial strategies to defend its market share. The stay transforms the act of filing a lawsuit from a purely legal action into a potent business tactic for delaying generic entry. A brand company might choose to sue on a relatively weak patent simply to secure the automatic 30-month delay, using that time to attempt to switch the market to a newer, patent-protected version of the drug or to prepare for the launch of its own authorized generic.

Litigation Strategy: Arguing Invalidity, Unenforceability, or Non-Infringement

Hatch-Waxman patent litigation typically unfolds in federal district court and revolves around a few core legal arguments. The generic company, as the defendant, will seek to prove one or more of the following:

- Non-Infringement: The generic product’s formulation or method of manufacture does not fall within the scope of the patent’s legal claims.

- Invalidity: The U.S. Patent and Trademark Office (USPTO) should not have granted the patent in the first place because it fails to meet the statutory requirements for patentability, such as being novel and non-obvious over the prior art.

- Unenforceability: The patent cannot be enforced because the patent holder engaged in inequitable conduct, such as intentionally misleading or withholding material information from the USPTO during the patent application process.

Risks vs. Rewards: The Financial Calculus of a Patent Challenge

The decision to pursue a Paragraph IV challenge is a calculated gamble with enormous potential upsides and downsides.

- The Risks: Patent litigation is extraordinarily expensive, with legal fees often running into the millions or tens of millions of dollars.74 If the generic company loses the lawsuit and is found to infringe a valid patent, it will be barred from entering the market until the patent expires. An even greater risk comes from an “at-risk” launch. If the 30-month stay expires before the litigation is fully resolved, the generic company has the option to launch its product. However, if it does so and an appellate court later rules in the brand’s favor, the generic company can be liable for catastrophic damages, including the brand’s lost profits, which can easily run into the hundreds of millions or even billions of dollars.75

- The Rewards: The primary reward is early market entry, potentially years ahead of patent expiration. This is coupled with the grand prize: 180-day market exclusivity. For a blockbuster drug, this six-month period of limited competition can generate revenue far exceeding the costs of litigation.67 The high potential payoff is why these challenges are so common. Data suggests that generic challengers have a high overall success rate—around 76% when accounting for wins in court, favorable settlements, and cases that are dropped by the brand—making the risk a rational one for many companies to take.67

The high stakes and inherent uncertainty of litigation also lead to a high rate of settlements. It is often more economically rational for both parties to settle the case and agree on a specific date for generic entry than to risk an all-or-nothing outcome in court. However, some of these settlements, particularly those involving a “reverse payment” from the brand company to the generic, have drawn intense antitrust scrutiny from the Federal Trade Commission (FTC), which argues they can be illegal agreements to delay competition at the expense of consumers.76

The Grand Prize: Securing 180-Day Market Exclusivity

At the heart of the Hatch-Waxman Act’s incentive structure is the 180-day period of marketing exclusivity. This is the ultimate prize for generic companies willing to undertake the risk and expense of challenging an innovator’s patents. This six-month period of limited competition can be transformative for a generic company, often representing the most profitable phase of a product’s lifecycle and providing the financial return that justifies the entire Paragraph IV strategy.

The “First-to-File” Incentive: A Six-Month Competitive Advantage

The law grants a 180-day period of marketing exclusivity to the first ANDA applicant (or applicants) to submit a “substantially complete” application containing a Paragraph IV certification against a patent listed in the Orange Book.70 During this 180-day period, the FDA is prohibited from approving any other ANDA for the same drug that also contains a Paragraph IV certification.78

This creates a powerful “first-to-file” system. Being the first company to the FDA’s door with a valid application can be worth hundreds of millions of dollars. This dynamic fosters an intense race among generic competitors to prepare and submit their ANDAs as quickly as possible, often on the earliest legally permissible date. For a New Chemical Entity (NCE), this is four years after the brand drug’s approval.69 If multiple companies submit substantially complete ANDAs with Paragraph IV certifications on the same day, they may be required to share the 180-day exclusivity.

Triggering and Forfeiting Exclusivity: Understanding the Nuances

The rules governing when the 180-day exclusivity period begins and when it can be lost are complex and have evolved over time.

- Triggering the Clock: Under the current law, as amended by the Medicare Modernization Act of 2003 (MMA), the 180-day exclusivity clock for a first applicant is triggered by its first date of commercial marketing of the generic drug.77 This gives the first filer control over when its exclusivity period begins.

- Forfeiture Provisions: The MMA introduced a critical set of “forfeiture” provisions to prevent a situation where a first filer could indefinitely block other generics from the market by never launching its own product (a practice known as “parking” exclusivity).79 A first applicant can now lose, or forfeit, its eligibility for exclusivity under several conditions, including 78:

- Failure to Market: If the first applicant fails to market its product within 75 days of its ANDA approval or within 75 days of a final court decision finding the challenged patents to be invalid or not infringed.

- Withdrawal of Application: If the applicant withdraws its ANDA or amends its patent certification from a Paragraph IV to a Paragraph III.

- Failure to Obtain Tentative Approval: If the applicant fails to obtain tentative approval from the FDA within 30 months of submitting its ANDA.

- Collusive Agreements: If the applicant enters into an agreement with the brand company that is found by the FTC or a court to be anti-competitive.

- Patent Expiration: If all of the patents that qualified the applicant for exclusivity expire.

These forfeiture provisions create a new layer of strategic complexity. A first filer can win the patent litigation but still lose its valuable exclusivity if it is not prepared to launch its product in a timely manner. This forces companies to coordinate their legal, regulatory, and commercial launch strategies with precision, as a delay in manufacturing or a last-minute regulatory issue could cost them their most significant competitive advantage.

The Commercial Impact: Maximizing Revenue During the Exclusivity Window

The commercial value of 180-day exclusivity is immense. When the first generic launches, it typically captures a significant portion of the brand’s market share very quickly. With only one generic competitor on the market, prices do not immediately collapse. The first generic can often price its product at a modest discount to the brand (e.g., 15-30% less) and still gain widespread adoption from payers and pharmacy benefit managers.67

This dynamic changes dramatically the day after the 180-day exclusivity period ends. On day 181, the FDA can approve all other pending ANDAs, leading to the simultaneous launch of multiple generic competitors. This flood of new supply triggers a rapid and severe price war, with prices often plummeting by 80-90% or more from the original brand price.80 The market becomes commoditized, and profit margins shrink dramatically. Consequently, the entire financial model for a Paragraph IV challenge is often built around maximizing sales and profit during that crucial six-month window of limited competition.

Navigating Other Market Barriers: Understanding Innovator Exclusivities

While patents are the most prominent form of intellectual property protecting brand-name drugs, they are not the only barrier to generic competition. The Hatch-Waxman Act and other legislation also created several types of non-patent, FDA-administered marketing exclusivities. These exclusivities provide an innovator with a fixed period of protection from generic competition, and they operate independently of the patent portfolio.58 A generic company’s market entry date is determined by the last-expiring barrier, whether it is a patent or an exclusivity period. Therefore, a comprehensive strategic analysis must account for all potential exclusivity protections.

New Chemical Entity (NCE) Exclusivity (5-Year)

This is one of the most powerful forms of exclusivity. It is granted to a drug product that contains a new chemical entity (NCE), which the FDA defines as an active ingredient (or “moiety”) that has never before been approved in any application submitted to the agency.60

- Duration and Effect: NCE exclusivity provides five years of market protection, starting from the date of the brand’s NDA approval. During this period, the FDA is generally prohibited from even receiving an ANDA for a generic version of the drug.61

- The Paragraph IV Exception: There is a critical exception to this rule. A generic applicant that intends to challenge a patent with a Paragraph IV certification is permitted to submit its ANDA one year early, at the four-year mark (this date is often referred to as “NCE-1”).69 This allows the 30-month litigation stay to run concurrently with the final year of NCE exclusivity, facilitating a more timely generic launch.

New Clinical Investigation Exclusivity (3-Year)

This form of exclusivity is designed to incentivize innovators to conduct additional research on already-approved drugs. It is granted for an NDA or a supplement to an NDA that contains reports of new clinical investigations (other than bioavailability studies) that were essential for the approval of the change.60 Examples of changes that can qualify for 3-year exclusivity include:

- A new indication or claim

- A change in dosage form or strength

- A switch from prescription to over-the-counter (OTC) status

- Duration and Effect: This exclusivity provides three years of protection from the date of the new approval. Unlike NCE exclusivity, it does not block the submission of an ANDA. Instead, it blocks the FDA from granting final approval to an ANDA for the specific condition of use that is protected by the exclusivity.60 This type of exclusivity is a key tool in brand companies’ lifecycle management strategies. By developing a new formulation or indication for a drug as its primary patents are nearing expiration, an innovator can gain a fresh three-year period of protection for that specific improvement, a tactic sometimes used to “hop” the market to a new version just before the original becomes subject to generic competition.

Special Cases: The Impact of Orphan Drug and Pediatric Exclusivities

Two other important exclusivities can significantly delay generic entry for certain products.

- Orphan Drug Exclusivity (ODE): Under the Orphan Drug Act, medications developed to treat rare diseases or conditions (defined as those affecting fewer than 200,000 people in the U.S.) can be granted orphan drug status. Upon approval, such a drug receives seven years of market exclusivity for the approved orphan indication.60 During this period, the FDA cannot approve another application, whether from a brand or a generic, for the same drug for the same use.82 This is a very strong form of protection designed to encourage development in commercially challenging therapeutic areas.

- Pediatric Exclusivity (PED): To encourage drug manufacturers to study their products in children, the Best Pharmaceuticals for Children Act (BPCA) created pediatric exclusivity. If an innovator company conducts pediatric studies in response to a formal Written Request from the FDA, it is granted an additional six months of market protection.60 This six-month period is tacked on to all existing patents and exclusivities (such as NCE or ODE) that protect the drug.60 For a blockbuster drug generating billions of dollars in annual sales, this six-month extension can be worth a fortune and is a powerful incentive for innovators. For generic companies, it represents a six-month delay in their planned market launch.

Turning Data into Dominance: Competitive Intelligence with DrugPatentWatch

In the hyper-competitive generic pharmaceutical industry, information is power. The ability to accurately assess the patent landscape, predict market entry dates, and anticipate competitor moves is not just an advantage; it is a prerequisite for survival and success. While the FDA’s Orange Book provides the foundational data, leading generic companies supplement this with sophisticated competitive intelligence tools and platforms to gain a deeper, more actionable understanding of the market. Platforms like DrugPatentWatch have become essential for transforming raw data into a decisive competitive edge.

Beyond the Orange Book: Aggregating Global Patent and Litigation Data

The Orange Book is the definitive source for U.S.-listed patents and exclusivities, but it represents only a fraction of the data needed for a comprehensive strategic analysis. Specialized business intelligence platforms like DrugPatentWatch aggregate a much broader universe of information, providing a 360-degree view of a drug’s competitive landscape.83 This includes:

- Global Patent Data: Tracking patent filings and their status in more than 130 countries, which is critical for companies planning global launches.85

- Patent Applications: Monitoring pending patent applications can provide early warnings of an innovator’s lifecycle management strategies, such as attempts to patent new formulations or uses.

- Detailed Litigation Tracking: Following the play-by-play of Paragraph IV lawsuits, including key court filings, decisions, and settlement terms. This data provides invaluable insights into the likely outcomes and timelines of patent challenges.85

- Clinical Trial Information: Monitoring clinical trials can reveal competitors’ development activities for both generic and innovative products.

Informing Portfolio Decisions and Forecasting Market Entry

By integrating these diverse data streams, platforms like DrugPatentWatch allow companies to move beyond simple patent-expiry date-watching to sophisticated, data-driven portfolio management.83 A company can:

- Identify High-Value Opportunities: Filter and screen for drug candidates based on market size, patent complexity, and the level of existing generic competition.

- Conduct Due Diligence: Perform deep dives on target products to fully understand the patent and regulatory risks before committing significant R&D resources.

- Forecast Launch Timelines: Build more accurate financial models by incorporating the likely impact of litigation stays, potential settlement dates, and competitor activities into launch date projections.

- Track API and Finished Product Suppliers: Identify potential partners and assess the robustness of the supply chain for a given product.84

Assessing Competitor Strategies and Identifying “First-to-File” Opportunities

Perhaps the most critical use of these platforms is for competitive intelligence. In the race to be the “first-to-file” for 180-day exclusivity, knowing what your competitors are doing is paramount. These tools provide real-time alerts and comprehensive dashboards that allow a company to track which of its rivals have filed ANDAs for a particular drug, which patents they are challenging, and the status of those applications.85

This information is vital for making strategic decisions. If intelligence reveals that several competitors have already filed a Paragraph IV challenge for a blockbuster drug, a company might decide that the opportunity for exclusivity is gone and pivot its resources to a less crowded, more profitable target. Conversely, identifying a high-value drug with no known challengers can signal a prime “first-to-file” opportunity.

The widespread adoption of these advanced data aggregation tools has professionalized competitive intelligence within the generic industry. What was once a laborious process conducted by specialized legal and consulting teams can now be managed in-house, enabling faster and more agile decision-making.85 However, this democratization of data also means that the “information advantage” any single company can hold is smaller and more fleeting. When all major competitors are using the same sophisticated tools, they are likely to identify the same opportunities at the same time. This intensifies the competition and shifts the basis of competitive advantage from simply

identifying the opportunity to executing the development, regulatory, and legal strategies faster and more flawlessly than anyone else.

The Business Realities of the Generic Market

Securing FDA approval is only one part of the journey. Success in the generic drug industry requires navigating a harsh commercial environment characterized by significant upfront costs, relentless price pressure, and complex supply chain challenges. Understanding these business realities is just as important as mastering the regulatory science.

The GDUFA Effect: How User Fees Have Reshaped the Industry

The Generic Drug User Fee Amendments (GDUFA), first enacted in 2012 and subsequently reauthorized, fundamentally changed the financial equation for generic manufacturers.28 Before GDUFA, the FDA’s generic drug program was chronically underfunded, leading to a massive backlog of unreviewed applications and unpredictable review times.88 GDUFA authorized the FDA to collect user fees from the industry to provide a stable and predictable funding stream for its review activities.89

These fees are substantial and take several forms 28:

- ANDA Filing Fee: A one-time fee paid upon submission of an ANDA. For fiscal year 2025, this fee is expected to be over $320,000.37

- Drug Master File (DMF) Fee: A one-time fee paid by API manufacturers when their DMF is first referenced in an ANDA.

- Facility Fees: Annual fees paid for each manufacturing facility, with foreign facilities paying a higher rate than domestic ones.

- Program Fee: An annual fee, introduced in GDUFA II and refined in GDUFA III, paid by ANDA holders. The fee is tiered based on the number of approved ANDAs a company owns, with large portfolio holders paying the most.

While GDUFA has been successful in reducing the ANDA backlog and making review times more predictable, the high, non-refundable fees have also created a significant barrier to entry.14 For smaller companies or those targeting niche products with lower revenue potential, the upfront cost of a single ANDA filing can be prohibitive. This “pay-to-play” system has arguably contributed to consolidation within the industry, favoring larger players with the scale and capital to absorb these costs across a broad portfolio.

The Economics of Erosion: Price Dynamics After the First Generic Launch

The defining characteristic of the generic market is intense and rapid price erosion. The financial benefit to the healthcare system is a direct consequence of the fierce competition that ensues once a brand-name drug loses exclusivity. The relationship between the number of competitors and the price of a drug is well-documented and stark.

| Number of Generic Competitors | Approximate Price Reduction vs. Brand Price | Strategic Implication |

| 1 Competitor | 30% – 39% 14 | The highly profitable 180-day exclusivity window. |

| 2-3 Competitors | 50% – 70% 14 | Prices fall rapidly as the market opens to broader competition. |

| 5+ Competitors | ~85% 25 | The market approaches full commoditization. |

| 10+ Competitors | 70% – 95% 14 | Margins are razor-thin; only the most efficient manufacturers can compete. |

This brutal price decay underscores the critical importance of market entry timing. Being the first or one of the first generics to launch is essential for capturing a period of higher prices and profitability before the market becomes fully commoditized. This dynamic is the primary driver behind the high-risk, high-reward strategy of Paragraph IV patent challenges.

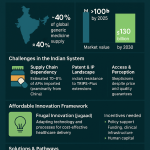

Emerging Challenges: Complex Generics, Supply Chain Pressures, and Global Competition

The generic industry is currently grappling with several transformative challenges that are reshaping the competitive landscape.

- The Shift to Complex Generics: The market for traditional, easy-to-make oral solid dosage forms is largely saturated. The future of growth and profitability lies in complex generics—products like long-acting injectables, metered-dose inhalers, transdermal patches, and drug-device combinations.14 These products are scientifically difficult and expensive to develop, creating higher barriers to entry and thus the potential for more limited competition and more sustainable margins.92

- Supply Chain Fragility: The industry’s relentless focus on cost reduction has led to a highly globalized and concentrated supply chain. A significant percentage of the APIs and finished drugs for the U.S. market are produced in a small number of foreign countries, particularly India.13 This reliance creates vulnerabilities to geopolitical events, trade disputes, natural disasters, and quality control issues at a handful of large facilities, all of which can lead to drug shortages.15

- Market Sustainability: The extreme price erosion in hyper-competitive markets is creating what some analysts have called a “tragedy of the commons.” The rational pursuit of market share by individual companies drives prices so low that profitability is eroded for everyone. At these unsustainable price points, manufacturers have little incentive to invest in quality upgrades or maintain redundant manufacturing capacity. This can lead to companies discontinuing older, less profitable but medically necessary products, further exacerbating the problem of drug shortages.14

The Future of Generics: Trends and Predictions

The generic drug industry is at a strategic inflection point. The old model of simply replicating blockbuster pills is no longer a sustainable path to growth. The companies that thrive in the coming decade will be those that can successfully navigate a landscape defined by increasing scientific complexity, technological disruption, and a shifting geopolitical environment. The global generic drug market is projected to continue its robust expansion, growing from a value of around $450 billion in the mid-2020s to over $700 billion by the early 2030s, fueled by a historic wave of patent expirations for some of the world’s best-selling drugs.95

The Rise of Complex Generics and Biosimilars

The clear trajectory for the industry is a strategic pivot away from commoditized simple generics toward higher-value, harder-to-make products.

- Complex Generics: As previously discussed, these products represent the next frontier of generic competition. Success in this space will require a fundamental shift in capabilities, from being fast followers with manufacturing scale to becoming science- and technology-driven organizations with significant R&D expertise in areas like drug delivery, device engineering, and advanced analytical science.92 The companies that can master these complexities will be rewarded with higher barriers to entry, less competition, and more durable profit margins.