The global pharmaceutical landscape is undergoing a tectonic shift, and at its epicenter lies India. Long celebrated as the “Pharmacy of the World” for its sheer production volume, India is now rapidly evolving from a tactical, low-cost sourcing destination into a strategic, indispensable nexus for the global drug supply chain. This transformation is not accidental; it is the culmination of decades of deliberate policy, a deep-seated legacy of scientific expertise, and a powerful confluence of geopolitical and economic forces. For business leaders, pharmaceutical executives, and investment strategists, understanding the depth and trajectory of this evolution is no longer optional—it is a prerequisite for building a resilient, competitive, and profitable future.

The statistics paint a compelling picture of India’s current standing. The nation ranks as the third-largest pharmaceutical producer by volume globally 1 and is the world’s largest provider of generic medicines, supplying a staggering 20% of the global demand by volume.1 Its influence on developed markets is profound, with the United States relying on India for over 40% of its generic drugs and the United Kingdom for 25% of all its medicines.1 The Indian pharmaceutical market, valued at approximately $50-58 billion in 2024, is on a steep growth curve, with projections soaring to $130 billion by 2030.2

However, these figures only tell part of the story. The true significance of India’s role has been magnified by recent global crises. The COVID-19 pandemic served as a harsh, unignorable stress test for global supply chains, brutally exposing the vulnerabilities of over-reliance on a single manufacturing hub, namely China.7 The resulting disruptions catalyzed a fundamental re-evaluation of sourcing strategies across boardrooms worldwide. The conversation shifted almost overnight from a narrow focus on cost-saving to a broader, more urgent imperative of supply chain security and resilience. This paradigm shift has elevated India’s status from a tactical sourcing option to a strategic necessity for global pharmaceutical companies.

This report will dissect the multifaceted forces driving India’s growing importance in Active Pharmaceutical Ingredient (API) manufacturing. We will explore the historical policy masterstrokes that laid the groundwork, analyze the current market dynamics and government-led initiatives fueling the surge, and navigate the complex competitive arena, particularly the critical relationship with China. Finally, we will look to the horizon, charting the future frontiers of innovation, technology, and value creation that will define the next chapter for the world’s pharmacy. The central question for you, the reader, is this: How can your organization strategically leverage India’s dynamic and evolving API ecosystem to not just survive, but thrive in the new era of global pharmaceuticals?

The Crucible of Creation: How India Forged its Pharmaceutical Dominance

India’s journey to becoming a global pharmaceutical powerhouse was not a matter of chance but of design. It was forged in the crucible of post-colonial economic policy and fueled by a unique legislative environment that cultivated a specific, and now highly valuable, set of industrial capabilities. To understand where the Indian API industry is going, one must first understand how it was built.

The 1970 Patent Act: The Masterstroke that Birthed an Industry

In the mid-20th century, India faced a public health paradox: as one of the world’s poorest nations, it suffered from some of the highest drug prices, a direct consequence of its dependence on expensive, patent-protected imports from multinational corporations (MNCs). The turning point came in 1970 with the passage of the Indian Patents Act, a landmark piece of legislation enacted under the government of Indira Gandhi. It was a deliberate, radical policy choice that prioritized national public health interests over the profits of foreign pharmaceutical giants.10

The Act’s most transformative provision was its treatment of pharmaceutical patents. It abolished product patents for medicines, food, and chemicals, instead recognizing only process patents.10 This seemingly technical distinction had revolutionary consequences. It meant that while an MNC held the patent for a specific drug molecule (the “what”), Indian companies were legally free to develop and patent their own, different method of manufacturing that same molecule (the “how”). This unleashed a wave of “reverse engineering,” where Indian scientists would deconstruct a patented drug and devise novel, non-infringing synthetic routes to produce it.11

This policy single-handedly birthed India’s generic drug industry and propelled the rise of domestic champions like Cipla and Ranbaxy, which became world-renowned for their prowess in process chemistry and their ability to produce affordable generic versions of life-saving drugs.12 The impact was global. For instance, when Western companies were marketing anti-AIDS drugs for $12,000 per person per year, Cipla was able to offer a formulation for just $350, dramatically increasing access to treatment across the developing world.

This era of process-only patents did not last forever. To comply with its obligations as a member of the World Trade Organization (WTO) and the TRIPS (Trade-Related Aspects of Intellectual Property Rights) agreement, India amended its patent law, notably in 1999 and 2005, to reintroduce product patents.11 However, it did so with crucial safeguards to protect public health, such as provisions for compulsory licensing (allowing the government to authorize generic production in emergencies) and the much-debated Section 3(d), which aims to prevent the “evergreening” of patents through trivial modifications of existing drugs.11

The legacy of the 1970 Act, however, runs far deeper than just enabling a generics industry. It systematically cultivated a nationwide expertise in process chemistry innovation. For over three decades, the primary challenge for Indian pharmaceutical scientists was not discovering new molecules but rather inventing more efficient, cost-effective, and elegant ways to synthesize existing ones. This fostered a deep, path-dependent capability in process R&D, optimization, and scaling-up—a fundamentally different skill set from novel drug discovery. This 50-year legacy of process excellence is the bedrock upon which India’s modern API and Contract Development and Manufacturing Organization (CDMO) industry is built. When global firms now turn to India as part of a “China Plus One” strategy, they are not merely accessing lower-cost labor; they are tapping into a world-class reservoir of process innovation that was decades in the making.

India’s API Market Today: A Tale of Volume and Value

The foundation laid by the 1970 Patent Act has enabled the Indian API industry to grow into the formidable force it is today. A statistical snapshot reveals an industry of immense scale and global significance, yet one defined by a crucial strategic dichotomy between its dominance in production volume and its more modest share of global market value.

The Indian API market is on a robust growth trajectory. According to Mordor Intelligence, the market size is estimated at USD 14.77 billion in 2025 and is projected to reach USD 22.02 billion by 2030, growing at a Compound Annual Growth Rate (CAGR) of 8.31%. Other forecasts are even more bullish, with one report projecting a market value of USD 37.11 billion by 2032 at a CAGR of 12.33%. Praxis Global Alliance offers a slightly more conservative estimate, projecting the market to expand from $18 billion in 2024 to $22 billion by 2030, reflecting a CAGR of 8.3%. This growth is underpinned by a vast production base. India manufactures over 500 different APIs and holds a commanding 57% share of all APIs on the World Health Organization (WHO) prequalified list, a testament to its quality and breadth.3

This scale is further validated by India’s regulatory track record. The country boasts the highest number of US Food and Drug Administration (FDA)-approved manufacturing facilities outside of the United States, a critical credential for exporting to regulated markets.1

However, the most telling statistics lie in the comparison between volume and value. While India accounts for approximately 20% of the global supply volume of generic APIs, it holds only an 8% share of the global API industry by value.3 This disparity is the single most important strategic data point for understanding the Indian API industry. It reveals a historical concentration on producing high-volume, low-margin “commodity” generics. The business model was built on being the most cost-effective producer of relatively simple, off-patent molecules.

This volume-value gap is both the industry’s greatest challenge and its most significant opportunity. A business model predicated on cost leadership in commodities is inherently vulnerable to price erosion and fierce competition from other low-cost manufacturing hubs, particularly China.21 Therefore, sustainable future growth cannot come from simply producing

more of the same products. It must come from producing more valuable products. The entire strategic thrust of the Indian government and the industry’s leading players—from the Production Linked Incentive (PLI) scheme to the push into complex chemistry and biologics—is a concerted effort to close this value gap by systematically moving up the value chain. For business professionals, this means the most promising opportunities are not in playing the old game of commodity generics, but in participating in the new game of high-value, complex API manufacturing.

Table 1: India’s API Market at a Glance (Key Statistics & Projections)

| Metric | Value (2024/2025) | Projected Value (2030-2032) | CAGR (%) | Source(s) |

| Indian API Market Size | USD 14.77 Billion (2025) | USD 22.02 Billion (2030) | 8.31% | |

| Indian API Market Size | USD 13.03 Billion (2023) | USD 37.11 Billion (2032) | 12.33% | |

| Indian API Market Size | USD 18 Billion (2024) | USD 22 Billion (2030) | 8.3% | |

| Global API Market Share (by Volume) | ~20% | N/A | N/A | 7 |

| Global API Market Share (by Value) | ~8% | N/A | N/A | 3 |

| Number of Different APIs Produced | 500+ | N/A | N/A | 19 |

| Share of WHO Prequalified APIs | 57% | N/A | N/A | 18 |

The Engine Room: Policy and People Powering the API Surge

India’s ascent in the API sector is being actively steered by a confluence of proactive government policy and a deep reservoir of human capital. The narrative has shifted decisively from a passive, market-led evolution to a dynamic, state-supported strategic push. This new chapter is defined by the “Atmanirbhar Bharat” (Self-Reliant India) initiative, a comprehensive strategy aimed at transforming India into a resilient and globally competitive manufacturing hub.

Atmanirbhar Bharat: Government as a Strategic Catalyst

The Atmanirbhar Bharat initiative represents a fundamental change in India’s industrial policy. It is a direct response to the supply chain vulnerabilities exposed during the COVID-19 pandemic, which underscored the risks of depending heavily on a single country for critical raw materials. For the pharmaceutical sector, this meant confronting the stark reality of its reliance on China for 70-80% of certain essential APIs and Key Starting Materials (KSMs).20

Under this new paradigm, the Indian government has moved beyond rhetoric to become a strategic catalyst, launching targeted interventions designed to de-risk the supply chain, encourage domestic investment, and build indigenous capabilities from the ground up.8 This is not about protectionism; it is about building strategic autonomy in a sector critical to national health security. The two flagship programs spearheading this transformation are the Production Linked Incentive (PLI) scheme and the development of Bulk Drug Parks.

The Production Linked Incentive (PLI) Scheme: A Multi-Billion Dollar Bet on Self-Reliance

At the heart of the government’s strategy lies the Production Linked Incentive (PLI) scheme, a sophisticated and targeted policy instrument designed to catalyze domestic manufacturing. It is not a blanket subsidy but a precision-guided incentive aimed squarely at the areas of greatest import dependency.

The scheme for pharmaceuticals, launched in 2020, came with an initial outlay of ₹6,940 crore (approximately $850 million) for critical bulk drugs, part of a broader ₹15,000 crore (approx. $1.8 billion) PLI scheme for the overall pharmaceutical sector.8 The core mechanism is simple yet powerful: the government provides financial incentives to companies based on their incremental sales of specific, domestically manufactured products over a six-year period. These products were not chosen at random; they are the 50+ critical bulk drugs, APIs, and intermediates for which India’s import reliance on China was most acute.

The early results of this strategic bet have been promising. As of March 2025, the scheme has spurred the domestic production of 38 critical APIs that were previously almost entirely imported, including vital molecules like Penicillin G, Clavulanic Acid, Atorvastatin, and Metformin. For several of these high-demand ingredients, import dependence has already been slashed by as much as 50%. The policy has successfully mobilized over ₹2,500 crore ($300 million) in private sector investment, leading to the sanctioning of 35 new greenfield manufacturing facilities and the creation of over 25,000 direct jobs.

However, the path to self-reliance is not without its challenges. The PLI scheme’s success in specific product categories has not yet translated into a significant reduction in India’s overall reliance on Chinese imports. China has responded strategically, not by competing on the PLI-supported products where the incentives are hard to beat, but by aggressively cutting prices on a wide range of other commodity APIs to defend its market share.

This dynamic is effectively creating a “two-speed” Indian API market. On one hand, there is a high-growth, government-supported, and de-risked segment for the PLI-targeted molecules. On the other, there is the vast “red ocean” of traditional commodity APIs, which remains locked in a fierce price war with Chinese producers. For investors and corporate strategists, this divergence is critical. The PLI list is not merely a policy document; it is a strategic roadmap pointing directly to the most secure and potentially profitable segments of the Indian API market for the foreseeable future. Aligning investment with these government-backed priorities represents the clearest path to capitalizing on India’s push for self-reliance.

Table 2: The Production Linked Incentive (PLI) Scheme: Key Features and Targeted Impact

| Aspect | Details |

| Scheme Objective | To enhance India’s manufacturing capabilities, reduce import dependence (especially on China), and promote production of high-value goods and critical APIs, KSMs, and Drug Intermediates.8 |

| Financial Outlay | ₹6,940 Crore (approx. $850M) for critical bulk drugs; part of a broader ₹15,000 Crore (approx. $1.8B) scheme for the pharma sector.8 |

| Key Targeted Products | 50+ fermentation-based and chemical synthesis-based bulk drugs where import dependence is high. Examples include Penicillin G, Clavulanic Acid, Atorvastatin, Acyclovir, and Metformin. |

| Reported Achievements | – Domestic production of 38 critical APIs commenced. – 50% reduction in import dependence for several targeted APIs. – 35 new greenfield plants sanctioned. – Mobilized >₹2,500 Crore ($300M) in private investment. – Created >25,000 direct jobs. |

| Key Challenges | – Has not yet significantly reduced overall import reliance on China. – China has responded with aggressive price cuts on non-PLI products, maintaining competitive pressure on the broader market. |

The Strategic Role of Bulk Drug Parks

If the PLI scheme is the financial engine of India’s self-reliance strategy, the development of Bulk Drug Parks is its physical infrastructure backbone. These are not just industrial estates; they are purpose-built ecosystems designed to create critical mass and attack the fundamental cost advantages enjoyed by competitors like China.

A Bulk Drug Park is a designated, large-scale tract of land with common infrastructure facilities specifically for the manufacturing of APIs. The Indian government has given ‘in-principle’ approval for three such parks in key pharmaceutical states: Gujarat, Himachal Pradesh, and Andhra Pradesh. The core objective is to drive down the manufacturing cost of bulk drugs by providing shared, world-class facilities such as common effluent treatment plants, uninterrupted power grids, steam and cooling lines, and common testing laboratories.

This approach directly addresses a key structural disadvantage that individual Indian manufacturers have faced. China’s dominance in the API sector is built, in part, on massive, state-supported industrial clusters that provide these common utilities at a subsidized cost, creating enormous economies of scale that are difficult for standalone plants to match. By creating its own Bulk Drug Parks, India is attempting to replicate this “cluster effect.”

For a pharmaceutical company, the strategic advantages of locating within one of these parks are manifold. It significantly reduces the initial capital expenditure (CAPEX) required to set up a new plant, as the company does not need to build its own expensive utility infrastructure. It also lowers ongoing operational expenditure (OPEX), particularly for complex and costly processes like waste treatment, which is a major focus of environmental regulations. By leveraging resource optimization and economies of scale, these parks help the industry meet stringent environmental standards at a much lower cost. For any company planning to establish new API manufacturing capacity in India, the decision of whether to locate within a Bulk Drug Park is a critical strategic consideration, offering a clear path to lower costs, streamlined logistics, and a more favorable regulatory environment.

The Competitive Arena: Navigating Geopolitics and Market Headwinds

While government initiatives provide a powerful tailwind, the Indian API industry operates within a fiercely competitive global arena shaped by complex geopolitical relationships, intense market pressures, and stringent regulatory demands. Successfully navigating this environment requires a clear-eyed understanding of the key players and prevailing forces.

The Dragon in the Room: Deconstructing India’s Symbiotic and Antagonistic Relationship with China

The relationship between the Indian and Chinese pharmaceutical industries is the single most important dynamic in the global API landscape. It is not a simple rivalry but a deeply intertwined, complex web of dependency and competition—a relationship that is both symbiotic and antagonistic.

The core of this relationship is India’s profound dependency on China for the foundational elements of drug manufacturing. India imports approximately 70% of its total API and KSM requirements from China.20 This dependency is even more acute for certain essential medicines, where the reliance can be as high as 80-100%. For a list of 45 specific APIs, India has historically been 100% dependent on Chinese imports. This situation arose for a simple economic reason: China, with its massive state-supported economies of scale, government subsidies, and lower power and fuel costs, became the world’s cheapest producer of these chemical building blocks.

However, this dependency is now a source of major strategic vulnerability, a fact laid bare by the pandemic. In response, India’s PLI scheme was designed to break this hold, at least for the most critical molecules. China’s reaction has been telling. Rather than ceding ground, it has engaged in a strategic price war. To counter the new domestic production in India, Chinese manufacturers have aggressively slashed the prices of non-PLI APIs. For example, the landed cost of Chinese-made Atorvastatin in India is now 20% cheaper than the domestic price, while Ofloxacin is 22% cheaper, effectively squeezing the margins of Indian producers in the non-supported commodity segments.

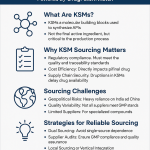

A deeper analysis reveals an even more critical vulnerability. The dependency is not just on finished APIs, but more fundamentally on the upstream Key Starting Materials (KSMs) and intermediates. As one report notes, “Even where APIs are manufactured locally, KSMs are primarily sourced from China”. This means that simply building a new API plant in India under the PLI scheme does not fully de-risk the supply chain; it merely shifts the point of dependency one step further upstream. A disruption in the supply of KSMs from China would still bring Indian API production to a grinding halt.

This is why the Indian government’s initiatives explicitly target not just APIs but also KSMs and Drug Intermediates (DIs). The strategic implication is profound: the next major wave of investment and opportunity in India lies in backward integration. Companies that invest in building domestic capacity for KSM and fine chemical manufacturing will be the ones to create truly resilient and valuable supply chains. They will be most aligned with the government’s long-term vision of genuine self-reliance and will be best positioned to capture the highest value in the evolving ecosystem. This goes far beyond the surface-level “India vs. China” rivalry and points to the true frontier of strategic investment.

Table 3: India vs. China API Ecosystem: A Comparative Analysis

| Parameter | India | China | Strategic Implication |

| API Production (Volume) | World’s #2 generic API supplier (~20% share). | World’s #1 API supplier (~40% share). | India is a major player but still trails China in overall scale. |

| API Production (Value) | Lower value share (~8%) due to focus on commodity generics. | Higher value share due to scale and broader portfolio. | India’s key strategic goal is to move up the value chain. |

| KSM & Intermediates | Heavily dependent on imports, primarily from China. | Dominant global producer, creating a key leverage point. | This is India’s most critical vulnerability; backward integration is the key opportunity. |

| Cost of Production | Cost-effective, but facing pressure from China. | Generally lower due to economies of scale and subsidies. | Bulk Drug Parks are India’s direct response to close this cost gap. |

| Regulatory Compliance | Highest number of US FDA-approved plants outside the US. | Quality and compliance have been historical concerns, though improving. | India’s strong regulatory track record is a key competitive advantage. |

| Government Support | Strong, targeted support via PLI schemes and Bulk Drug Parks.8 | Massive, long-standing state support and subsidies. | India is adopting a more state-led industrial policy to compete. |

| Innovation Focus | Historically process chemistry; now moving to complex APIs & biologics.7 | Strong in process chemistry; also investing heavily in novel drug R&D. | India is leveraging its process skills to climb the value ladder. |

| Labor & Talent | Large pool of skilled chemists and engineers, but facing talent crunch.7 | Vast labor pool, with increasing numbers of skilled scientists. | Talent management is becoming a critical differentiator for Indian firms. |

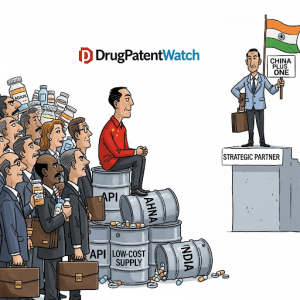

The “China Plus One” Tailwind: India’s Golden Geopolitical Opportunity

As global corporations re-evaluate the risks of concentrating their supply chains in a single country, a powerful trend has emerged: the “China Plus One” (C+1) strategy. This business approach, which involves diversifying manufacturing and sourcing to at least one other country besides China, has become a dominant theme in global boardrooms, creating a golden geopolitical opportunity for India.33

This is not a theoretical concept; it is a tangible business reality. Leading Indian Contract Development and Manufacturing Organizations (CDMOs) like Syngene, Neuland Labs, and Divi’s Laboratories are reporting a significant increase in Requests for Quotations (RFQs) from global pharmaceutical giants looking to de-risk their supply chains.32 Crucially, they are successfully converting these inquiries into concrete pilot projects and commercial contracts. For example, Neuland Labs has secured projects from a large innovator client specifically moving its operations out of China, while TheraNym Bio (an Aurobindo Pharma subsidiary) signed a decade-long manufacturing deal with Merck.

The shift is also becoming more sophisticated. Initially, the focus was on moving late-stage commercial manufacturing. However, over the past year, there has been a notable change in sentiment, with companies now looking to move earlier-stage development work to India as well. This indicates a deeper level of trust and a more strategic, long-term commitment to India as a development and manufacturing partner. While the full financial monetization of this trend is expected to play out over the next three to five years, the momentum is undeniable.32 This shift is further catalyzed by potential legislation like the US BIOSECURE Act, which aims to reduce American dependence on Chinese biotech suppliers and is already prompting clients to proactively build post-China sourcing strategies.33

However, this massive influx of complex projects is creating a critical bottleneck in the Indian ecosystem: talent. While physical infrastructure and manufacturing capacity can be built with capital, the sudden surge in demand for highly skilled scientists, process engineers, and quality control experts is outstripping the available supply. This has led to what industry insiders describe as “very high attrition at the entry level” and rampant “employee poaching” as companies compete for a limited pool of top-tier talent.

This “war for talent” means that a company’s ability to attract, train, and retain its human capital is rapidly becoming as important as its physical capital. The most successful Indian CDMOs in the C+1 era will be those with superior human resource strategies—robust in-house training programs, strong employee retention policies, and strategic partnerships with academic institutions like the National Institutes of Pharmaceutical Education and Research (NIPERs) to build a sustainable talent pipeline. For a global pharmaceutical company selecting an Indian partner, evaluating their talent management and retention strategy is no longer a soft metric; it is a crucial point of due diligence to ensure project stability and long-term success.

Navigating the Headwinds: Critical Challenges on the Path to Dominance

Despite the powerful tailwinds of government support and geopolitical shifts, India’s path to API dominance is not without significant obstacles. The industry faces a challenging operating environment characterized by intense regulatory pressure, relentless price erosion in key markets, and persistent infrastructure gaps.

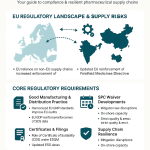

Regulatory Scrutiny: The very credential that grants Indian firms access to lucrative regulated markets—their approval by agencies like the US FDA and the European Medicines Agency (EMA)—is also a source of constant pressure. Indian manufacturing facilities are among the most frequently inspected in the world, and this scrutiny is exacting. The issuance of FDA Form 483s (inspectional observations) and, more seriously, Warning Letters is a persistent challenge for the industry.25 Recent examples include citations issued to major players like Sun Pharma and Glenmark for issues ranging from potential microbial contamination and poor aseptic practices to inadequate testing procedures and failures in stability programs.39 Maintaining a state of constant compliance with evolving Current Good Manufacturing Practices (cGMP) requires relentless vigilance and significant, continuous investment in quality systems, technology, and training.

Price Erosion: The US generics market, the largest export destination for Indian pharma, is notoriously competitive. The business model is built on driving down costs for healthcare systems, which translates into severe and continuous price erosion for manufacturers. While recent drug shortages in the US have temporarily eased this pressure, limiting erosion to single-digit percentages, the long-term trend remains a reality. This constant downward pressure on prices squeezes profit margins, making it difficult to fund the very investments in quality and technology that regulators demand.

Infrastructure and Finance: While the government’s Bulk Drug Parks initiative is a major step forward, many of India’s thousands of small and medium-sized enterprises (SMEs) in the pharmaceutical sector lack the capital to upgrade their facilities to meet stringent international standards.19 Furthermore, meeting increasingly strict environmental regulations requires substantial investment in sophisticated technologies like waste treatment plants and solvent recovery systems, adding another layer of cost pressure.

These twin pressures of intense regulatory scrutiny from above and severe price erosion from below are creating a powerful evolutionary force within the Indian API industry. It is a “survival of the fittest” environment that is compelling the sector to consolidate and innovate. A company cannot remain competitive by cutting corners on quality, as the regulatory risk is too high. At the same time, it cannot afford to be compliant if its margins on low-cost commodity drugs are too thin to support the necessary investments.

This strategic vise is forcing the industry’s hand. The only viable path forward is to escape the commodity trap by moving up the value chain into more complex, higher-margin products like High-Potency APIs (HPAPIs) and biosimilars. These segments offer healthier profit margins that can justify the investment in world-class quality systems and technology. This dynamic will likely drive a wave of consolidation, with larger, well-capitalized players acquiring smaller firms that cannot cope with the dual pressures. For investors and strategists, this signals a flight to quality and highlights potential M&A opportunities among the industry’s most compliant and technologically advanced firms.

The Horizon: Charting the Future Frontiers of Indian API Manufacturing

As the Indian API industry navigates the crosscurrents of global competition and domestic policy, its future trajectory is becoming clear. The path to sustainable growth and global leadership lies not in expanding the old model of high-volume, low-cost production, but in charting a course towards new frontiers of value, complexity, and technology. This strategic pivot is already underway, redefining what it means to be the “Pharmacy of the World.”

Moving Up the Value Chain: The Strategic Pivot to High-Value APIs

The most significant shift in the Indian pharmaceutical landscape is the deliberate and accelerating pivot from commodity APIs to complex, high-value products. This is the industry’s core strategic response to the challenges of price erosion and intense competition. This move is unfolding across several key segments:

High-Potency APIs (HPAPIs): The demand for HPAPIs, particularly for targeted oncology therapies, is surging globally. These are highly complex molecules that are effective at very low doses and require specialized, high-containment manufacturing facilities to ensure worker safety and prevent cross-contamination. Recognizing the high margins and technological barrier to entry in this segment, leading Indian companies are making significant investments. Firms like Aurigene Pharmaceutical Services and Sai Life Sciences are building state-of-the-art HPAPI manufacturing suites designed to handle compounds with Occupational Exposure Limits (OEL) below 1 microgram per cubic meter (μg/m³), corresponding to the highest containment level, OEB 5.9 Aurigene now boasts one of the largest HPAPI manufacturing capacities in all of Asia, a clear signal of the industry’s ambition in this space.

Biologics and Biosimilars: While India’s current share of the global biologics API market is a modest 4% , this segment represents one of the most significant long-term growth opportunities. Biologics are large, complex molecules produced through living systems, and as patents on many blockbuster biologics expire, the demand for more affordable biosimilar versions is exploding. The Indian biosimilars market is projected to grow at a staggering CAGR of between 17% and 23% through 2033.42 This growth is fueled by India’s strong base in biotechnology and the potential to dramatically reduce the cost of these life-changing therapies.

Contract Development and Manufacturing (CDMO): The “China Plus One” trend is directly fueling the boom in India’s CDMO sector. Global pharma companies are increasingly outsourcing not just manufacturing but also complex development work to Indian partners. The Indian CDMO market is forecast to more than double in size, growing from an estimated $22.5 billion in 2024 to $44.6 billion by 2029.

This pivot into HPAPIs and biologics represents a fundamental change in the Indian pharma business model. It is a move away from imitation (the reverse-engineering of simple generics) and towards complex execution. Manufacturing an HPAPI is as much an engineering and industrial hygiene challenge as it is a chemistry one. Manufacturing a biologic involves mastering the intricacies of cell culture, fermentation, and complex downstream purification. These disciplines require entirely different skill sets, quality control paradigms, and massive capital investments compared to traditional small-molecule generic production. Consequently, not all of India’s existing generic players will be able to make this leap. A new class of industry leaders is emerging, defined not by their historical scale in generics but by their demonstrated expertise in these new, complex modalities. This creates a clear and compelling opportunity for targeted investment in the companies that are successfully navigating this technological transition.

The Technology Frontier: Embracing Next-Generation Manufacturing

To compete in these high-value segments and meet the exacting standards of global regulators, Indian manufacturers are increasingly embracing a suite of next-generation manufacturing technologies. This adoption is driven by a dual imperative: the need for greater efficiency and the quest for unparalleled quality and compliance.

Continuous Manufacturing: A paradigm shift from traditional batch-based production, continuous manufacturing is gaining significant traction in India.7 In this model, raw materials are fed continuously into an integrated production line, and the finished product emerges at the other end. This approach offers numerous advantages, including a smaller physical footprint, reduced waste, lower energy consumption, and, most importantly, superior product consistency.

Green Chemistry and Sustainability: With both domestic and international environmental regulations becoming more stringent, sustainability is no longer an afterthought but a core business consideration. Indian companies are actively investing in green chemistry principles to reduce their environmental impact. This includes the adoption of eco-friendly solvents, the implementation of sophisticated solvent recovery systems to minimize emissions, and the construction of advanced waste treatment plants.17 This focus on sustainability not only ensures compliance but also positions Indian firms as responsible partners in the global supply chain.

Automation and Artificial Intelligence (AI): To optimize complex processes and enhance quality control, manufacturers are integrating automation and AI into their operations. AI and machine learning algorithms are being deployed to analyze process data, predict deviations, optimize reaction conditions, and reduce production costs, bringing a new level of intelligence and control to the factory floor.9

The adoption of these advanced technologies is more than just a play for efficiency; it is a powerful strategy for regulatory risk mitigation. A major source of regulatory citations is process variability and a lack of demonstrable control. Continuous manufacturing, in particular, addresses this head-on. By operating in a steady state and incorporating Process Analytical Technology (PAT) to monitor quality attributes in real-time, it generates a vast and continuous stream of data. This data-rich environment provides an unprecedented level of process understanding and allows a manufacturer to prove to regulators like the FDA that their process has been stable and under control throughout the entire manufacturing run. It shifts the regulatory conversation from a retrospective look at final batch testing to a proactive demonstration of consistent process control. Therefore, an investment in these technologies is also an investment in “regulatory-proofing” one’s operations, which can lead to smoother inspections, faster approvals, and a more stable and predictable business.

Turning Data into Dominance: The Imperative of Competitive Intelligence

As the Indian API market matures, becoming more innovative and more competitive, the strategic use of data is emerging as a critical differentiator. In this new landscape, the ability to transform raw information into actionable competitive intelligence is paramount. Patent data, in particular, represents one of the most valuable yet historically underutilized sources of strategic insight.

Systematic monitoring and analysis of patent filings provide a unique window into the R&D pipelines of competitors, revealing their research directions, technological priorities, and potential market entries years before any products are publicly announced. This functions as an early warning system, allowing companies to anticipate competitive threats, identify “white space” opportunities in crowded therapeutic areas, and make more informed decisions about their own R&D and portfolio strategy.

Navigating this complex data landscape requires specialized tools. Platforms like DrugPatentWatch have become indispensable for this work, offering a fully integrated database that covers drug patents across more than 130 countries, along with critical information on API vendors, patent litigation, clinical trials, formulation details, and regulatory status.46 For an Indian API manufacturer, the strategic applications of such a platform are evolving rapidly. Historically, the goal might have been to find a patent to challenge or a process to work around, a legacy of the 1970 Patent Act. Today, the use case is far more sophisticated.

As Indian companies increasingly operate as CDMO partners for global innovators under the “China Plus One” model, their need for IP intelligence has shifted from adversarial to collaborative. The primary goal is no longer just to find generic opportunities, but to deeply understand a client’s patent portfolio and the broader IP landscape to ensure that a proposed manufacturing process has “freedom to operate” and does not infringe on any third-party patents.

This requires a nuanced analysis of different patent types—from composition and process patents to formulation and usage patents. By leveraging a comprehensive intelligence platform like DrugPatentWatch, an Indian CDMO can conduct thorough due diligence on potential partnerships, map a client’s technology platform against the competitive landscape, and identify potential IP risks or opportunities. This ability transforms the Indian company from a mere “pair of hands” providing a manufacturing service into a knowledgeable, value-added strategic partner. It allows them to engage in more sophisticated conversations with clients, command higher-value contracts, and build stickier, more resilient business relationships, ultimately turning data into a source of durable competitive advantage.

Synthesis and Strategic Outlook: The Future of the World’s Pharmacy

India’s pharmaceutical sector stands at a profound inflection point. The journey from a high-volume, low-cost manufacturer of commodity generics to a sophisticated, value-driven hub for complex APIs and innovation is well underway. This transformation, driven by a potent mix of strategic government policy, deep-seated scientific capabilities, and powerful geopolitical tailwinds, is reshaping the global pharmaceutical supply chain. India is no longer just the world’s pharmacy in terms of volume; it is becoming the world’s strategic partner for resilient and innovative drug manufacturing.

The path forward, however, is not without its complexities. The immense opportunities presented by the “China Plus One” strategy, proactive government support through PLI schemes and Bulk Drug Parks, and the push into new technological frontiers are balanced by significant challenges. Persistent regulatory scrutiny from global agencies, a “war for talent” that creates human capital bottlenecks, and the relentless competitive pressure from a strategically-reacting China are formidable headwinds.

Success in this new era will not be determined by scale alone. It will be defined by strategic agility. The winning firms will be those that can successfully navigate this complex landscape: the ones that align their investments with government priorities, that master the complex execution of high-value APIs and biologics, that invest in next-generation technology not just for efficiency but for regulatory resilience, and that leverage data and competitive intelligence to become indispensable strategic partners to their global clients. The future of the world’s pharmacy is being written today, and it is a story of increasing complexity, value, and strategic importance.

Key Takeaways

- The Value Gap is the Core Strategic Driver: India’s high share of global API volume but low share of value is the central challenge. The entire industry and government strategy, from the PLI scheme to the push into biologics, is aimed at closing this gap by moving from commodity products to high-value, complex APIs.

- Government Policy is a Strategic Roadmap: The PLI scheme and Bulk Drug Parks are not just subsidies; they are a clear roadmap to the most secure and profitable investment areas. Aligning with these government-prioritized segments (critical APIs, KSMs) offers a de-risked path to growth, away from the fierce price competition in the broader commodity market.

- KSM Dependency is the Real Vulnerability: Beyond APIs, India’s reliance on China for Key Starting Materials (KSMs) is the deeper supply chain risk. The next major strategic and investment frontier is in backward integration into fine chemical and KSM manufacturing to achieve true self-reliance.

- The “China Plus One” Strategy is Creating a Talent War: The influx of complex development projects is causing a shortage of high-skilled scientific talent in India, leading to high attrition and poaching. A company’s human capital strategy is now as critical as its physical infrastructure for ensuring project success and stability.

- Technology is a Tool for Regulatory Mitigation: The adoption of advanced manufacturing technologies like continuous manufacturing is not just about efficiency. It provides a data-rich environment that allows companies to prove process control to regulators, thereby mitigating regulatory risk and potentially speeding up approvals.

- Competitive Intelligence is Evolving from Adversarial to Collaborative: The strategic use of patent data is shifting. For CDMOs, it’s no longer just about challenging patents for generic entry but about understanding the IP landscape to ensure freedom-to-operate and act as a knowledgeable partner to innovator clients, a service for which platforms like DrugPatentWatch are essential.

Frequently Asked Questions (FAQ)

1. How can a smaller or medium-sized Indian API manufacturer compete in an environment increasingly dominated by large, well-capitalized players?

Smaller and medium-sized enterprises (SMEs) can compete effectively by adopting a niche strategy rather than trying to compete on scale. Instead of focusing on high-volume commodity APIs where they will be outmatched on price, they should target specialized, lower-volume, but higher-margin products. This could include developing expertise in a specific therapeutic area, mastering a difficult-to-execute chemical synthesis, or focusing on orphan drug APIs. Furthermore, SMEs can leverage the Bulk Drug Park ecosystem to reduce their capital expenditure on infrastructure. Collaborating with other SMEs to form clusters can also create shared resources and collective bargaining power.

2. What are the key non-financial risks a global pharma company should assess when selecting an Indian CDMO partner for a “China Plus One” project?

Beyond financial stability and technical capability, the most critical non-financial risks are talent retention and regulatory culture. A global company should conduct deep due diligence on a potential partner’s employee attrition rates, particularly for key scientific and quality personnel. High turnover is a major red flag for project continuity and knowledge loss. Secondly, assess the “quality culture” of the organization. This goes beyond checking their inspection history; it involves understanding if quality is a top-down management priority, how they handle deviations and CAPAs (Corrective and Preventive Actions), and whether their systems are proactive or merely reactive. A partner with a weak quality culture poses a significant long-term regulatory risk.

3. Will the Indian government’s push for self-reliance lead to higher drug prices globally?

This is unlikely in the long run. While shifting production from the absolute lowest-cost producer (often China) may involve some initial cost adjustments, the Indian government’s strategy is designed to increase competition and scale, which historically leads to lower prices. The PLI schemes and Bulk Drug Parks are aimed at making Indian production more cost-competitive, not less.28 By creating a robust alternative to China, India’s self-reliance push actually introduces more competition into the global supply chain, which should exert downward pressure on prices over time and, more importantly, increase supply chain resilience, preventing the kind of price spikes seen during shortages.

4. With the focus on biologics and HPAPIs, is there still a future for traditional small-molecule generic API manufacturing in India?

Absolutely, but the nature of the market is changing. While the high-growth, high-margin opportunities are in complex APIs, the traditional small-molecule market will remain the bedrock of global medicine supply by volume. The future for this segment in India will be defined by extreme efficiency and technological adoption. Companies that remain in this space will need to be masters of cost control, leveraging technologies like continuous manufacturing and automation to protect razor-thin margins. There will also likely be significant consolidation, with larger, more efficient players acquiring smaller ones. The market isn’t disappearing, but the bar for survival and profitability is getting much higher.

5. How can a company use patent intelligence to predict the next big therapeutic areas for API manufacturing in India?

By analyzing patent filing trends, a company can spot emerging patterns. Using a tool like DrugPatentWatch, an analyst can track the velocity and geographic spread of patent filings by both global innovators and leading Indian firms. A sudden increase in patent applications related to a specific biological pathway (e.g., GLP-1 agonists for obesity) or a new technology platform (e.g., antibody-drug conjugates) is a strong leading indicator of future R&D and manufacturing demand. By combining this patent data with clinical trial data and market analysis, a company can build a predictive model to identify which therapeutic areas will require significant API and CDMO capacity in India in the next 3-5 years, allowing them to make strategic investments ahead of the curve.

References

- Indian Pharmaceutical Industry: Creating Global Impact, accessed July 31, 2025, https://ispe.org/pharmaceutical-engineering/march-april-2025/indian-pharmaceutical-industry-creating-global-impact

- Pharmaceutical industry in India – Wikipedia, accessed July 31, 2025, https://en.wikipedia.org/wiki/Pharmaceutical_industry_in_India

- Annual Report 2020-21 – Department of Pharmaceuticals, accessed July 31, 2025, https://pharma-dept.gov.in/sites/default/files/english%20Annual%20Report%202020-21.pdf

- Decoding Indian Pharmaceuticals and API Export-Import Data and …, accessed July 31, 2025, https://www.cybex.in/blogs/decoding-indian-pharmaceuticals-and-api-export-import-data-and-analysis-10103

- Why India’s Pharmaceutical Industry Remains Poised for Growth in 2025 – Invest UP, accessed July 31, 2025, https://invest.up.gov.in/wp-content/uploads/go/pressnews31012025-3.pdf

- India’s pharmaceutical market for FY 2023-24 is valued at USD 50 billion with domestic consumption valued at USD 23.5 billion and export valued at USD 26.5 billion – Press Release: Press Information Bureau, accessed July 31, 2025, https://www.pib.gov.in/PressReleaseIframePage.aspx?PRID=2085345

- Indian API Industry: Global Growth & Impact – Salvavidas Pharma, accessed July 31, 2025, https://salvavidaspharma.com/blog/indian-api-industry-global-growth-impact/

- India Strengthens Pharmaceutical Self-Reliance Through …, accessed July 31, 2025, https://medgatetoday.com/india-strengthens-pharmaceutical-self-reliance-through-production-linked-incentive-pli-scheme/

- Understanding How APIs Enable Indian Pharmaceutical Companies …, accessed July 31, 2025, https://api.drreddys.com/articles/7-ways-how-active-pharmaceutical-ingredients-apis-enable-indian-pharmaceutical-companies

- India Pharmaceuticals – Under-Told Stories Project, accessed July 31, 2025, https://www.undertoldstories.org/2001/03/15/india-pharmaceuticals/

- The new patent regime: Implications for patients in India – PMC, accessed July 31, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC2900001/

- History of Patent Law in India: Evolution, Key Reforms, and Impact – The Legal School, accessed July 31, 2025, https://thelegalschool.in/blog/history-of-patent-law-in-india

- India and the Patent Wars – OAPEN Library, accessed July 31, 2025, https://library.oapen.org/bitstream/handle/20.500.12657/30765/642737.pdf?sequence=1&isAllowed=y

- India’s Pharma Ache – YaleGlobal Online, accessed July 31, 2025, https://archive-yaleglobal.yale.edu/content/indias-pharma-ache

- Indian Pharmaceutical Patent Law and the Effects of Novartis Ag v. Union of India – Washington University Open Scholarship, accessed July 31, 2025, https://openscholarship.wustl.edu/cgi/viewcontent.cgi?article=1500&context=law_globalstudies

- API Market in India – Active Pharmaceutical Ingredients – Size, Share …, accessed July 31, 2025, https://www.mordorintelligence.com/industry-reports/india-active-pharmaceutical-ingredients-market

- India Active Pharmaceutical Ingredients (API) Market: A …, accessed July 31, 2025, https://www.pharmiweb.com/press-release/2025-03-04/india-active-pharmaceutical-ingredients-api-market-a-comprehensive-analysis-2024-2035

- Indian API market to expand to $22 bn by 2030, at a CAGR of 8.3 pc: Report, accessed July 31, 2025, https://www.praxisga.com/media/pharma-and-life-sciences/indian-api-market-to-expand-to-22-bn-by-2030-at-a-cagr-of-8-3-pc-report

- Volume vs Value: The Next Frontier for India’s API Industry, accessed July 31, 2025, https://www.macsenlab.com/blog/volume-vs-value-for-api-industry/

- Can India Reclaim API Throne from China? – BioSpectrum India, accessed July 31, 2025, https://www.biospectrumindia.com/features/73/25074/can-india-reclaim-api-throne-from-china.html

- China now fighting a losing battle in India’s bulk drugs market …, accessed July 31, 2025, https://www.financialexpress.com/business/industry/china-now-fighting-a-losing-battle-in-indias-bulk-drugs-market/3908778/

- Drug shortage in the US to prove beneficial for Indian pharma companies, accessed July 31, 2025, https://www.expresspharma.in/drug-shortage-in-the-us-to-prove-beneficial-for-indian-pharma-companies/

- Indian pharma and the case for tempered take on tariff gains for US – The Financial Express, accessed July 31, 2025, https://www.financialexpress.com/business/healthcare-indian-pharma-and-the-case-for-tempered-take-on-tariff-gains-for-us-3752772/

- Consumers are now actively seeking generic substitutes for branded medicines: Sujit Paul, Zota Healthcare, accessed July 31, 2025, https://economictimes.indiatimes.com/small-biz/entrepreneurship/consumers-are-now-actively-seeking-generic-substitutes-for-branded-medicines-sujit-paul-zota-healthcare/articleshow/122987675.cms

- Challenges Faced by India’s Pharmaceutical Industry – TaxTMI, accessed July 31, 2025, https://www.taxtmi.com/article/detailed?id=13991

- India: The World’s Pharmacy – PIB, accessed July 31, 2025, https://www.pib.gov.in/PressNoteDetails.aspx?NoteId=152038&ModuleId=3

- Production Linked Incentive (PLI) scheme for Pharmaceuticals – National Portal of India, accessed July 31, 2025, https://www.india.gov.in/production-linked-incentive-pli-scheme-pharmaceuticals

- testbook.com, accessed July 31, 2025, https://testbook.com/ias-preparation/bulk-drug-park#:~:text=A%20Bulk%20Drug%20Park%20is,of%20bulk%20drugs%20in%20India.

- Bulk Drug Parks in India – Objectives, APIs, KSMs, DIs & More, accessed July 31, 2025, https://testbook.com/ias-preparation/bulk-drug-park

- Challenges Faced by API Manufacturers in India and How They Are …, accessed July 31, 2025, https://sites.google.com/view/challenges-faced-by-api-manufa

- High Potent API Manufacturing (HPAPI) Services | CDMO Company, accessed July 31, 2025, https://www.aurigeneservices.com/services/manufacturing/high-potent-api

- ‘China Plus 1’ Drives Early Wins for India’s Pharma Sector, Full Gains Expected in 3–5 Years, accessed July 31, 2025, https://www.outlookbusiness.com/corporate/china-plus-1-drives-early-wins-for-indias-pharma-sector-full-gains-expected-in-35-years

- China 1 strategy gains momentum in pharma, but full monetisation still 2-3 years away: Goldman Sachs | Company Business News – Mint, accessed July 31, 2025, https://www.livemint.com/companies/news/china-1-strategy-gains-momentum-in-pharma-but-full-monetisation-still-2-3-years-away-goldman-sachs-11750823023398.html

- China Plus One Strategy: Assessing India’s Economic Opportunities – Sleepy Classes, accessed July 31, 2025, https://sleepyclasses.com/china-plus-one-strategy/

- Everything You Need to Know About China Plus One – Z2Data, accessed July 31, 2025, https://www.z2data.com/insights/everything-you-need-to-know-about-china-plus-one

- China Plus One Strategy in Action: Benefits and Opportunities – Spherical Insights, accessed July 31, 2025, https://www.sphericalinsights.com/blogs/china-plus-one-strategy-in-action-benefits-and-opportunities

- China Plus One Strategy: Meaning, Formation & Benefits – 5paisa, accessed July 31, 2025, https://www.5paisa.com/stock-market-guide/generic/china-plus-one-strategy

- China+1 strategy gains momentum in pharma, but full monetisation still 2-3 years away: Goldman Sachs – The Economic Times, accessed July 31, 2025, https://m.economictimes.com/industry/healthcare/biotech/pharmaceuticals/china1-strategy-gains-momentum-in-pharma-but-full-monetisation-still-2-3-years-away-goldman-sachs/articleshow/122060553.cms

- Glenmark Pharmaceuticals Limited – 708270 – 07/11/2025 – FDA, accessed July 31, 2025, https://www.fda.gov/inspections-compliance-enforcement-and-criminal-investigations/warning-letters/glenmark-pharmaceuticals-limited-708270-07112025

- FDA hands down citations to 3 drugmakers after inspections found …, accessed July 31, 2025, https://www.fiercepharma.com/manufacturing/fda-hands-down-manufacturing-citations-3-drugmakers-after-inspections-found

- HPAPI Development & Manufacturing Services | – Sai Life Sciences, accessed July 31, 2025, https://www.sailife.com/resources/high-potent-active-pharmaceutical-ingredients-hpapis/

- India Biosimilars Market Size & Outlook, 2020-2027 – Grand View Research, accessed July 31, 2025, https://www.grandviewresearch.com/horizon/outlook/biosimilars-market/india

- India Biosimilar Market Size, Companies and Growth, 2033 – IMARC Group, accessed July 31, 2025, https://www.imarcgroup.com/india-biosimilar-market

- How to Track Competitor R&D Pipelines Through Drug Patent …, accessed July 31, 2025, https://www.drugpatentwatch.com/blog/how-to-track-competitor-rd-pipelines-through-drug-patent-filings/

- Patent research as a tool for competitive intelligence in brand protection – RWS, accessed July 31, 2025, https://www.rws.com/blog/patent-research-as-a-tool/

- DrugPatentWatch | Software Reviews & Alternatives – Crozdesk, accessed July 31, 2025, https://crozdesk.com/software/drugpatentwatch

- DrugPatentWatch – RapidAPI, accessed July 31, 2025, https://rapidapi.com/drugpatentwatch/api/drugpatentwatch

- Over half of the active pharmaceutical ingredients (API) for prescription medicines in the U.S. come from India and the European Union | Quality Matters | U.S. Pharmacopeia Blog, accessed July 31, 2025, https://qualitymatters.usp.org/over-half-active-pharmaceutical-ingredients-api-prescription-medicines-us-come-india-and-european

- EMA Approves Propellant with 1000-Fold Lower Global Warming Potential for Trixeo and Riltrava Aerosphere – GeneOnline News, accessed July 31, 2025, https://www.geneonline.com/ema-approves-propellant-with-1000-fold-lower-global-warming-potential-for-trixeo-and-riltrava-aerosphere/

- Trump’s tariff move on India may backfire, pharma industry leaders …, accessed July 31, 2025, https://m.economictimes.com/industry/healthcare/biotech/pharmaceuticals/trumps-tariff-move-on-india-may-backfire-pharma-industry-leaders-say/articleshow/123011650.cms

- List of Pharma Api – Live Stock Quotes, Stock Price Update and Analysis from Equitymaster.com, accessed July 31, 2025, https://www.equitymaster.com/stockquotes/pharmaapi/list-of-pharma-api-sector

- India Exports of pharmaceutical products to United States – 2025 …, accessed July 31, 2025, https://tradingeconomics.com/india/exports/united-states/pharmaceutical-products

- US drug supply chain exposure to China – Brookings Institution, accessed July 31, 2025, https://www.brookings.edu/articles/us-drug-supply-chain-exposure-to-china/

- Dr Reddy’s, Sun Pharma and other pharma stocks fall up to 3% as Trump threatens 25% tariff on India, accessed July 31, 2025, https://economictimes.indiatimes.com/markets/stocks/news/dr-reddys-sun-pharma-and-other-pharma-stocks-fall-up-to-3-as-trump-threatens-25-tariff-on-india/articleshow/123013385.cms

- Effect of Product Patents on the Indian Pharmaceutical Industry – Centre for WTO Studies, accessed July 31, 2025, https://wtocentre.iift.ac.in/Papers/3.pdf

- Aurobindo To Lupin: Pharma Companies Under Pressure As US Price Erosion Continues, accessed July 31, 2025, https://www.ndtvprofit.com/markets/pharma-companies-under-pressure-as-us-price-erosion-continues

- Is the Era of Generics Over? A Critical Look at an Evolving Market and the Potential Oasis for Few – Amarin Technologies, accessed July 31, 2025, https://amarintech.com/is-the-era-of-generics-over-a-critical-look-at-an-evolving-market-and-the-potential-oasis-for-few/

- US Drug Price Cuts May Hit Indian Pharma – India Briefing, accessed July 31, 2025, https://www.india-briefing.com/news/us-drug-price-cuts-may-hit-indian-pharma-37434.html/

- Maximizing Growth: Pharma’s China-Plus-One Strategy – SpendEdge, accessed July 31, 2025, https://www.spendedge.com/biotechnology-pharmaceutical-life-sciences/why-pharma-industry-needs-to-take-china-plus-one-strategy-seriously/

- India Biosimilar Contract Manufacturing Market Size, Growth Report 2035, accessed July 31, 2025, https://www.marketresearchfuture.com/reports/india-biosimilar-contract-manufacturing-market-51873

- China+1 opens larger share for India in global pharma manufacturing beyond generics: BCG report – The Economic Times, accessed July 31, 2025, https://m.economictimes.com/industry/healthcare/biotech/pharmaceuticals/china1-opens-larger-share-for-india-in-global-pharma-manufacturing-beyond-generics-bcg-report/articleshow/117600435.cms

- China Plus One Strategy: Advantages & Impact on India – Pocketful, accessed July 31, 2025, https://www.pocketful.in/blog/china-plus-one-strategy/

- (PDF) CHINA PLUS ONE STRATEGY: INDIA’S OPPORTUNITY TO BRIDGE TRADE GAP WITH CHINA – ResearchGate, accessed July 31, 2025, https://www.researchgate.net/publication/390664623_CHINA_PLUS_ONE_STRATEGY_INDIA’S_OPPORTUNITY_TO_BRIDGE_TRADE_GAP_WITH_CHINA

- Overcoming Formulation Challenges in Generic Drug Development – DrugPatentWatch, accessed July 31, 2025, https://www.drugpatentwatch.com/blog/overcoming-formulation-challenges-in-generic-drug-development/

- How to Find a Reputable Active Pharmaceutical Ingredient (API) Supplier: A Comprehensive Guide – DrugPatentWatch, accessed July 31, 2025, https://www.drugpatentwatch.com/blog/how-to-find-a-reputable-api-supplier/

- Drug Discovery Digest, accessed July 31, 2025, https://www.drugdiscoverydigest.com/?article-id=27343188&article-title=potential-breakthrough-in-treating-prostate-cancer