Section 1: The Regulatory Battlefield: A Primer on the Hatch-Waxman Act and Market Exclusivity

To the uninitiated, the pharmaceutical industry appears to be a domain of pure scientific discovery, where the success of a company is dictated by the efficacy of its molecules in the laboratory and the clinic. While innovation is undeniably the lifeblood of the sector, the financial outcomes for both innovator and generic drug companies are governed by a far more terrestrial force: a complex, often arcane, and deliberately adversarial legal and regulatory framework. For the sophisticated investor, understanding this framework is not an academic exercise; it is the essential first step in deciphering the market signals that precede major shifts in a company’s revenue trajectory. The architecture of this system, primarily established by the Drug Price Competition and Patent Term Restoration Act of 1984, commonly known as the Hatch-Waxman Act, was engineered to create a state of perpetual, structured conflict between brand-name drug manufacturers and their generic challengers. This conflict, far from being a flaw in the system, is its core engine, generating predictable catalysts that an astute analyst can identify and leverage for significant investment advantage.

The Genesis of the Modern Generic Industry

Prior to 1984, the generic drug market in the United States was nascent and economically challenging. Generic manufacturers faced a formidable regulatory barrier: to gain approval for a copy of a brand-name drug, they were often required to conduct their own expensive and time-consuming clinical trials to independently establish the drug’s safety and effectiveness.1 This requirement largely negated the cost advantages of generic manufacturing, making it difficult to compete with established brand-name products. The result was a market with limited competition, higher drug prices, and reduced patient access. In 1984, only 19% of prescriptions filled in the U.S. were for generic drugs.1

The landscape was irrevocably altered by the passage of the Hatch-Waxman Act.1 This landmark legislation, sponsored by Senator Orrin Hatch and Representative Henry Waxman, fundamentally restructured the relationship between innovator and generic pharmaceutical companies. Its central innovation was the creation of the Abbreviated New Drug Application (ANDA) under section 505(j) of the Federal Food, Drug, and Cosmetic Act (FD&C Act).1 The ANDA process streamlined the approval pathway for generic drugs by allowing manufacturers to rely on the FDA’s prior finding of safety and effectiveness for the innovator’s product, known as the Reference Listed Drug (RLD).1 Instead of repeating costly clinical trials, a generic applicant needed only to demonstrate that its product was bioequivalent to the RLD—meaning it delivered the same amount of active ingredient into a patient’s bloodstream over the same period of time.5 This single change dramatically lowered the barrier to entry, transforming the economic calculus of the generic business model and laying the foundation for the robust generic industry that exists today, which now accounts for over 90% of prescriptions filled in the U.S..1

The “Grand Bargain” of Hatch-Waxman

The Act’s passage was not a unilateral victory for the generic industry. It was a carefully constructed compromise, a “grand bargain” designed to balance the competing interests of fostering generic competition and preserving the incentives for costly, high-risk pharmaceutical innovation.1

For the generic industry, the primary benefits were the creation of the ANDA pathway and a crucial “safe harbor” provision. This safe harbor protects generic manufacturers from patent infringement lawsuits for activities reasonably related to developing and submitting data to the FDA for the ANDA.1 This allows them to conduct the necessary bioequivalence studies and prepare their applications before the innovator’s patents expire, ensuring they are ready to launch as soon as the legal path is clear.

For the innovator industry, the Act provided two significant concessions. First, it established a mechanism for restoring a portion of a patent’s term that is lost during the lengthy FDA regulatory review process, thereby extending the effective life of a patent.1 Second, and of paramount importance to the investment framework detailed in this report, it created new forms of government-granted market exclusivity that are entirely independent of a drug’s patent status.5 These exclusivity periods provide a guaranteed monopoly, preventing the FDA from approving generic competitors for a defined period, even if there are no patents on the drug or if all existing patents have been successfully challenged.

This deliberate balancing act created a system defined by inherent tension. It sought to promote competition by making it easier for generics to enter the market, while simultaneously protecting innovators by granting them powerful, patent-independent monopolies. The result is a system where direct, legally sanctioned conflict is the primary mechanism for mediating these opposing goals. The law does not seek to avoid litigation; rather, it channels competitive forces into a predictable legal and regulatory arena. For an investor, this means the system generates its own catalysts on a knowable schedule. The tension between the five-year New Chemical Entity (NCE) exclusivity designed to protect innovators and the four-year carve-out for patent challengers is not an oversight but the core engine of the system. This predictable, legally mandated conflict point is what transforms a regulatory deadline into a powerful, recurring investment signal.

The Orange Book: The Official Rulebook

Central to the functioning of the Hatch-Waxman framework is the FDA’s publication, Approved Drug Products with Therapeutic Equivalence Evaluations, more commonly known as the Orange Book.9 The Orange Book is far more than a simple catalog of approved drugs; it is the critical nexus that links the FDA’s regulatory authority with the U.S. patent system.1

When an innovator company receives approval for a New Drug Application (NDA), it is required to submit to the FDA a list of all patents that it believes could reasonably be asserted against a generic manufacturer seeking to market a copy of its drug.9 The FDA’s role is purely ministerial; it lists these patents in the Orange Book without assessing their validity or relevance. This list becomes the definitive public record of the intellectual property claims surrounding a particular drug.

For a generic company preparing an ANDA, the Orange Book serves as the official rulebook and target list. The company must review every patent listed for the RLD and make a formal certification to the FDA regarding its intentions for each one.6 This certification process is the gateway to the litigation that defines the competitive landscape. The Orange Book’s public, centralized nature ensures that all potential competitors—and by extension, all investors—are working from the same set of facts regarding a drug’s patent portfolio, making it the foundational data source for any analysis of potential patent challenges.

Decoding Market Exclusivity

A critical distinction for any pharmaceutical investor is the difference between patent protection and regulatory exclusivity. Patents are a form of intellectual property granted by the U.S. Patent and Trademark Office (USPTO) that provide the owner with the right to exclude others from making, using, or selling an invention for a limited time, typically 20 years from the filing date.12 Regulatory exclusivity, by contrast, is a right granted by the FDA upon a drug’s approval that prevents the agency from approving a competing generic application for a specified period.5 These two forms of protection are distinct and can run concurrently.8 A drug may have many years of patent life remaining but no regulatory exclusivity, or it may have its regulatory exclusivity expire while still being protected by multiple patents.

The most powerful form of regulatory exclusivity, and the one that is central to this report’s thesis, is New Chemical Entity (NCE) exclusivity. An NCE is a drug that contains an “active moiety”—the molecule or ion responsible for the drug’s therapeutic effect—that has never before been approved by the FDA.5 In recognition of the significant innovation involved in bringing a completely new molecule to market, the Hatch-Waxman Act grants a five-year period of market exclusivity to any drug approved as an NCE.5

The impact of this five-year exclusivity on the generic industry is profound. During this period, the FDA is statutorily barred from even accepting an ANDA for review, creating an ironclad, patent-independent monopoly for the innovator company.5 This five-year quiet period provides the innovator with a crucial window to establish its product in the market, build brand recognition, and begin recouping its substantial research and development investment without the threat of generic competition.

However, the Act includes a critical carve-out, a feature that creates the very signal this report is designed to analyze. While the FDA cannot approve a generic during the five-year NCE exclusivity period, a generic company is permitted to submit its ANDA after only four years if, and only if, that application contains a certification challenging one of the innovator’s Orange Book-listed patents.8 This date—exactly four years from the NCE’s approval date—is known as the “NCE-1” date (i.e., NCE exclusivity minus one year). This structural feature of the law is the starting gun for the race to market. It dictates that the earliest possible pathway for a generic version of a new chemical entity must be preceded by litigation. The law effectively channels all the pent-up competitive pressure from the generic industry into a single, predictable event: the filing of a patent challenge on the NCE-1 date.

Section 2: The Paragraph IV Challenge: Weaponizing Patent Law for Market Entry

The legal instrument at the heart of the Hatch-Waxman conflict is the Paragraph IV certification. It is the mechanism by which a generic company formally declares its intent to challenge an innovator’s intellectual property. For investors, understanding the Paragraph IV process is crucial, as it is not merely a legal filing but a calculated strategic business decision. This decision is driven by a complex interplay of legal risk assessment, commercial ambition, and the pursuit of one of the most powerful financial incentives in the pharmaceutical industry: the 180-day period of generic market exclusivity.

The Four Certifications

When a generic company files an ANDA, it must address every patent listed in the Orange Book for the brand-name drug it seeks to copy. The law provides four possible certifications the company can make for each patent 7:

- Paragraph I Certification: A statement that the required patent information has not been filed with the FDA.

- Paragraph II Certification: A statement that the patent has already expired.

- Paragraph III Certification: A statement that the generic company will wait to market its product until the date the patent expires.

- Paragraph IV Certification: A statement that the patent “is invalid, unenforceable, or will not be infringed by the manufacture, use, or sale of the [generic] drug for which the application is submitted”.6

While the first three certifications represent a decision to wait for the innovator’s patent protection to lapse naturally, a Paragraph IV certification is an aggressive, proactive declaration of war. It is a direct challenge to the innovator’s monopoly and the legal trigger for the entire litigation process that follows.

The Mechanics of the Challenge

The filing of a Paragraph IV certification sets in motion a highly structured and time-sensitive sequence of events that defines the pre-launch legal battle.

First, the act of submitting an ANDA with a Paragraph IV certification is defined by statute as an “artificial act of infringement”.7 This clever legal construction gives the brand-name patent holder immediate legal standing to sue the generic applicant for patent infringement, even though the generic product is not yet on the market and no actual infringement has occurred. This allows the patent dispute to be litigated and potentially resolved before the generic launch can disrupt the market.

Second, the generic filer is required to send a formal “notice letter” to the brand company and any other patent holders within 20 days of receiving confirmation from the FDA that its ANDA is sufficiently complete for review.7 This notice letter must include a detailed statement outlining the factual and legal basis for the generic company’s belief that the patent is invalid, unenforceable, or not infringed.6

Third, upon receiving this notice letter, the brand company has a critical 45-day window to respond by filing a patent infringement lawsuit against the generic applicant.7 The decision to file suit within this window is of immense strategic importance because it triggers one of the most powerful defensive tools available to the innovator: the 30-month stay. If a lawsuit is filed in time, the FDA is automatically prohibited from granting final approval to the generic’s ANDA for a period of up to 30 months from the date the notice letter was received.3 This stay acts as a temporary injunction, providing the innovator with a significant period of guaranteed market exclusivity—and protected revenue—while the patent dispute is adjudicated in court. The stay can be shortened if the court rules in the generic’s favor or if the patent expires, but it provides a crucial buffer for the brand company to execute defensive lifecycle management strategies.7

The Ultimate Prize: 180-Day Exclusivity

The immense cost and risk of engaging in patent litigation would be a significant deterrent for many generic companies were it not for the extraordinary incentive built into the Hatch-Waxman Act. To encourage generic companies to undertake these challenges and clear away weak or invalid patents, the law offers a powerful reward: a 180-day period of market exclusivity for the “first-to-file” challenger.21

The first generic applicant (or group of applicants, if they file on the same day) to submit a “substantially complete” ANDA containing a Paragraph IV certification is generally eligible for this prize.7 If this first filer successfully navigates the litigation and receives FDA approval, it is granted a six-month period during which the FDA will not approve any other generic versions of the same drug.7

The economic value of this 180-day exclusivity is difficult to overstate. Instead of entering a crowded, commoditized market where prices are immediately driven down by multiple competitors, the first generic entrant enjoys a temporary duopoly with the brand-name drug.7 This privileged market position allows the first generic to price its product at only a moderate discount to the brand—often just 15-25% lower—while rapidly capturing a majority of the market share.7 For a blockbuster drug with billions in annual sales, this six-month period can generate hundreds of millions of dollars in high-margin revenue, often accounting for the vast majority of the total return on investment for that product.7 The historic case of Barr Laboratories’ challenge to Eli Lilly’s Prozac provides a vivid illustration. During its six-month exclusivity period, Barr’s generic fluoxetine captured over 80% of the market, and the company’s gross profit margin nearly doubled, demonstrating the transformative financial power of a successful first-to-file challenge.19

This dynamic is further underscored by the dramatic price erosion that occurs after the 180-day period ends. Data consistently shows that once multiple generics enter the market, a “pricing death spiral” ensues. With just two generic competitors, prices can fall by over 50% compared to the brand. With six or more competitors, the average price plummets by a staggering 80-95%.26 This stark contrast highlights the immense value of being the sole generic competitor for six months, a prize that justifies the significant upfront risk and expense of litigation.

The 180-day exclusivity is not merely a reward for a successful legal challenge; it is a financial incentive of such immense value that it fundamentally alters the strategic calculus for generic firms. A normal generic business model involves competing on price in a crowded market, leading to razor-thin margins. The 180-day exclusivity offers a temporary escape from this commoditization, creating a “lottery ticket” effect. This powerful incentive creates a “race to be first” on the NCE-1 date and encourages challenges even against patents that might otherwise seem strong. The potential reward for being the first filer is so disproportionately large that the decision to file is driven less by a pure assessment of legal victory probability and more by the potential to secure this coveted “first-to-file” status. This explains the observable trend of Paragraph IV certifications becoming a “routine part of doing business” for nearly all generic companies and why blockbuster drugs frequently attract multiple challengers on the very same day.19

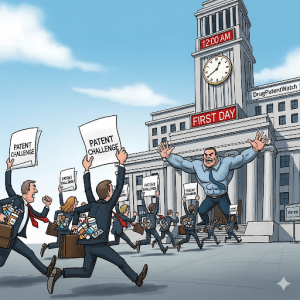

Section 3: The NCE-1 Date: The Starting Gun for Generic Competition

Within the intricate timeline of a drug’s lifecycle, the New Chemical Entity minus one (NCE-1) date stands out as a singular event of immense strategic importance. It is more than a simple regulatory deadline; it is the starting gun for generic competition, a focal point where the commercial ambitions of the generic industry collide with the defensive imperatives of the brand-name innovator. For investors, the NCE-1 date is a pre-scheduled catalyst, a moment when private assessments of a drug’s patent strength are made public through the observable actions of market participants.

Defining the NCE-1 Date

As established in Section 1, a New Chemical Entity (NCE) is granted a five-year period of market exclusivity by the FDA upon its initial approval. The NCE-1 date is defined as the day that falls exactly four years after the NCE’s approval date, or precisely one year before its five-year exclusivity period expires.15 Its significance stems from the statutory carve-out in the Hatch-Waxman Act: it is the earliest possible moment that a generic company can submit an Abbreviated New Drug Application (ANDA) that contains a Paragraph IV patent challenge.15 Any ANDA for an NCE filed before this date will not be accepted by the FDA for review.

Significance for Generic Companies

For generic drug manufacturers, the NCE-1 date is the most critical day on their strategic calendar for any new product launch. It represents the first opportunity to stake a claim for the immensely valuable 180-day market exclusivity period awarded to the first Paragraph IV filer.15

The “first-to-file” status is paramount. Missing the NCE-1 filing window means ceding the first-mover advantage, and the associated profit potential, to a competitor who was better prepared.15 Because this first-to-file status can be shared among all companies that submit a “substantially complete” ANDA on the same day, the NCE-1 date often precipitates a coordinated rush of filings.25 Multiple generic companies, having independently conducted their due diligence and prepared their applications in secret, will submit their ANDAs on the exact same day to ensure they are part of the first wave of challengers and thus eligible to share in the 180-day exclusivity period.

Significance for Brand-Name Companies

For the innovator company that developed the NCE, the NCE-1 date serves as a stark “warning bell”.15 It marks the official end of the four-year quiet period and the beginning of the active legal defense of their blockbuster asset’s revenue stream. While the company is aware of the date well in advance, the arrival of the NCE-1 date transforms the threat of generic competition from a distant future concern into an immediate reality.

Shortly after the NCE-1 date, the innovator will begin to receive the Paragraph IV notice letters from the generic challengers. The receipt of these letters formally triggers the 45-day window for the brand company to initiate patent infringement litigation.7 This is the first active step in the company’s defensive strategy, allowing it to secure the 30-month stay of FDA approval and begin the long process of defending its intellectual property in court.

The NCE-1 Date as a Market Event and Consensus Indicator

The NCE-1 date should be viewed by investors not just as a procedural deadline but as a significant market event that reveals crucial information. The number and identity of the challengers that emerge on this specific day provide a powerful, public signal about the collective, expert opinion on the vulnerability of the innovator’s patent portfolio.

This is because the decision to file a Paragraph IV challenge is a costly and resource-intensive undertaking. It requires not only significant legal expenditure but also the successful development of a bioequivalent version of the drug, including formulation work and stability testing.6 Generic companies do not commit these resources without first conducting extensive due diligence on the target drug’s patents to identify potential weaknesses. All potential challengers are aware of the same NCE-1 deadline and are motivated by the same “first-to-file” incentive.

Therefore, the number of companies that independently conduct this research, conclude that a challenge is a worthwhile business risk, and proceed to file on the very first day possible serves as a powerful consensus indicator. It is not just one company’s opinion; it is the aggregated result of the private, pre-filing analysis conducted by dozens of specialized legal and scientific teams across the entire generic industry. A high number of filers on the NCE-1 date signals a broad consensus that the patents are vulnerable. Conversely, the absence of any filers on the NCE-1 date signals an equally powerful consensus that the innovator’s patent fortress is perceived as being too strong to attack. An investor can thus use this public, observable event to gauge the collective wisdom of the most informed participants in the market.

Section 4: Decoding the Signal: An Investor’s Framework for Analyzing NCE-1 Challenges

The events of the NCE-1 date, while rich with information, can appear chaotic. To translate this raw data into an actionable investment thesis, a structured analytical framework is required. This section synthesizes the preceding legal and strategic concepts into a repeatable, multi-step process for investors. The framework moves from an initial quantitative assessment of the signal’s strength to a more nuanced qualitative analysis of its quality, culminating in an initial, testable investment hypothesis.

Step 1: Quantifying the Signal – The Number of Challengers

The analysis begins with the most direct and publicly available data point: the number of “Potential First Applicant ANDAs Submitted” for a given drug product, as reported by the FDA on its Paragraph IV Certification List.25 This number represents the strength of the initial signal and can be categorized into four primary scenarios, each with a distinct initial interpretation for the innovator company’s stock.

- Scenario A: Zero Challengers. This is a powerful bullish signal for the innovator. The absence of any Paragraph IV filings on the NCE-1 date suggests a strong industry consensus that the drug’s patent portfolio is robust, well-constructed, and not susceptible to a successful legal challenge. It implies that the innovator is likely to enjoy the full extent of its patent-protected monopoly, delaying the “patent cliff” and securing its revenue stream for longer than the market may have anticipated.

- Scenario B: A Single Challenger. This is a more ambiguous signal, and its interpretation is highly dependent on the identity of the challenger. It could represent a single, highly aggressive generic company that believes it has identified a unique legal angle or a novel “design-around” that others have missed. Alternatively, it could be a more speculative “prospecting” attempt by a firm known for filing challenges primarily to induce a favorable settlement from the innovator. The signal is mildly bearish for the innovator, as it introduces litigation risk, but it does not yet indicate a broad consensus of patent vulnerability.

- Scenario C: Multiple (2-3) Challengers. This is a clear bearish signal for the innovator. The fact that two or three separate, well-resourced teams have independently conducted due diligence and decided to invest in a costly patent challenge indicates a developing consensus that one or more key patents are vulnerable. The probability of a successful challenge and an earlier-than-expected generic entry increases significantly.

- Scenario D: A Flood (4+) of Challengers. This is a strongly bearish signal for the innovator. A large number of filers on the NCE-1 date is the equivalent of shouting “fire” in a crowded theater. It signals a widespread belief across the generic industry that the innovator’s patents are highly susceptible to invalidation or non-infringement arguments. It is often described as “blood in the water,” suggesting that the path to market is perceived as relatively clear. This scenario also implies that the market for the drug is large enough to be highly profitable for multiple generic players even after the initial 180-day exclusivity period has ended.

Step 2: Qualitative Overlays – Assessing the Quality of the Signal

After quantifying the initial signal, the investor must add layers of qualitative analysis to assess its quality and reliability. The raw number of challengers is the starting point, but the context behind the challenges is what refines the investment thesis.

- Who are the Challengers? The credibility of the signal is heavily influenced by the identity and track record of the generic companies filing the challenges. A Paragraph IV certification from a top-tier, well-capitalized generic manufacturer with a history of successful litigation (such as Teva, Sandoz, or Viatris) carries significantly more weight than a challenge from a smaller, less experienced, or more speculative player. The former indicates a serious, well-funded legal assault, while the latter may be more easily dismissed or settled.

- What is Being Challenged? The Patent Thicket Analysis. An innovator’s defense rarely rests on a single patent. Instead, most modern blockbuster drugs are protected by a “patent thicket”—a dense, overlapping web of secondary patents designed to create a formidable barrier to entry.30 These secondary patents can cover formulations, methods of use, manufacturing processes, crystalline forms (polymorphs), and delivery devices.31 An investor must analyze the

type of patent being challenged. - Primary vs. Secondary Patents: The foundational patent is the “composition of matter” patent, which covers the active molecule itself. This is typically the strongest and most difficult patent to invalidate.35 Challenges against weaker secondary patents are far more common and generally have a higher probability of success.36 An investor needs to determine if the generic challengers are mounting a high-risk assault on the core of the innovator’s intellectual property fortress or if they are targeting the weaker, outer walls. AbbVie’s defense of Humira, while a biologic governed by a different statute, serves as the ultimate case study in the power of a patent thicket to deter competition, even when the primary patent has expired.33 The sheer volume and complexity of the thicket can make litigation economically unviable for challengers, forcing them into settlements that favor the innovator.

- What is the Size of the Prize? Market Analysis. The intensity of the NCE-1 challenge is directly proportional to the commercial value of the target drug. Blockbuster drugs with annual sales exceeding $1 billion are virtually guaranteed to attract multiple challengers.37 To assess the “prize” from the generic’s perspective, an investor can build a simple Net Present Value (NPV) model. This involves estimating the potential peak sales for the generic, making assumptions about market share capture (which can be very high during the 180-day exclusivity period) and the likely price discount relative to the brand (e.g., 30-40%), and factoring in development and litigation costs.39 A larger prize will attract more competitors and justify more aggressive litigation strategies.

Step 3: Integrating Advanced Data – Predictive Modeling

For the most sophisticated investors, the analysis can be enhanced by developing quantitative models to predict litigation outcomes. While no model can be perfectly accurate, a data-driven approach can provide a probabilistic edge.

Logistic regression models, for example, can be used to predict a binary outcome (e.g., generic win/loss) based on a variety of input variables.40 Key variables for such a model could include:

- Historical success rates of the specific generic and brand companies involved in litigation.

- The track record of the law firms representing each side.

- The specific judicial district where the case is filed, as certain districts like Delaware and New Jersey handle a disproportionate number of these cases and have judges with deep expertise.41

- The type of patent being challenged (e.g., composition of matter vs. method of use).

- Data from international patent challenges, as an invalidation decision in Europe can sometimes signal a higher probability of a similar outcome in the U.S..43

This level of analysis is impossible without access to a structured, comprehensive database of historical patent litigation. This is where specialized data platforms become indispensable, providing the raw material needed to build and validate such predictive models.43

The following table provides a practical summary of this multi-step framework, designed to help an investor quickly categorize an NCE-1 event and formulate an initial, data-driven investment thesis.

| Signal Strength (Number of Filers) | Initial Interpretation (Bullish/Bearish for Innovator) | Likely Implication for Patents | Key Qualitative Factors to Analyze | Initial Investment Thesis (Hypothesis) |

| 0 | Strongly Bullish | Perceived as ironclad; challenge deemed not economically viable. | N/A | Long Innovator. |

| 1 | Neutral to Mildly Bearish | A single novel challenge theory or a strategic attempt to secure a settlement. | Identity and litigation track record of the single challenger. | Hold/Monitor; await further litigation developments. |

| 2-3 | Bearish | Developing consensus on patent vulnerability. | Market size, identity/track record of challengers, type of patents being challenged (primary vs. secondary). | Initiate Short Innovator / consider Long key Challenger(s). |

| 4+ | Strongly Bearish | Widespread consensus that patents are highly vulnerable (“blood in the water”). | All of the above, plus assessment of potential for an “at-risk” launch prior to final appeal. | Strong Short Innovator / Long select “first-to-file” Challenger(s). |

Section 5: The Role of Competitive Intelligence: Leveraging Data for an Edge with DrugPatentWatch

The analytical framework detailed in the previous section is powerful in theory, but its practical execution is entirely dependent on access to timely, accurate, and highly specialized data. Standard financial data terminals and public news sources are insufficient for this task, as they lack the granular detail on patent filings, regulatory status, and legal proceedings required for a nuanced analysis. Executing this strategy requires a dedicated competitive intelligence platform. This section provides a practical guide to using one such platform, DrugPatentWatch, to implement the NCE-1 signal framework and gain a significant informational edge.

The Need for Specialized Data

An investor attempting to track NCE-1 events must synthesize information from disparate and often user-unfriendly sources: the FDA’s Orange Book for patent listings, the agency’s Paragraph IV Certification List for challenger data, USPTO databases for patent details, and federal court dockets (PACER) for litigation tracking. This manual process is slow, inefficient, and prone to error. A specialized platform like DrugPatentWatch aggregates, structures, and analyzes this complex mix of regulatory, patent, and legal data, transforming it into actionable business intelligence.45

Systematic Monitoring with DrugPatentWatch

The first step in leveraging the NCE-1 signal is building a proactive monitoring system. DrugPatentWatch provides the essential tools for this process.

- Tracking NCE-1 Dates: The platform offers curated lists and a searchable database of drugs with upcoming NCE-1 dates.28 An investor can use this feature to build a forward-looking calendar of potential market-moving events, allowing them to conduct due diligence on target companies and their patent portfolios well in advance of the NCE-1 catalyst. This proactive approach is fundamental to being prepared to act when the signal emerges.

- Real-Time Alerts: The platform’s customizable email alert system is a critical tool for timeliness.45 An investor can set up alerts for specific drugs, companies, or even entire therapeutic classes. When a Paragraph IV certification is filed and made public by the FDA, the investor receives an immediate notification. This allows for a reaction time that is significantly faster than waiting for the information to be disseminated through mainstream financial news, providing a crucial edge in a time-sensitive, event-driven strategy.

- Identifying Challengers and Patents: Once an alert is received, DrugPatentWatch provides detailed information on which generic companies have filed the ANDAs and, crucially, which specific Orange Book-listed patents are being challenged.45 This data is the direct input for the quantitative and qualitative steps of the analytical framework, allowing the investor to immediately assess the strength and quality of the NCE-1 signal.

Deep Dive Analysis and Litigation Tracking

The NCE-1 filing is only the beginning of a process that can last for years. A robust investment thesis requires continuous monitoring of the subsequent legal battle.

- Integrated Litigation Database: DrugPatentWatch integrates litigation data with its patent and regulatory information, allowing an investor to track the entire lifecycle of a challenge from a single interface.43 This includes monitoring the initial lawsuit filing by the brand company (which confirms the start of the 30-month stay), key pre-trial rulings (such as claim construction or

Markman hearings), and the ultimate outcomes, whether a trial verdict or a settlement agreement. The platform’s ability to track confidential settlement terms, when they become public through contractual disputes, is particularly valuable.46 - Analyzing Historical Precedent: The platform’s deep historical database is an invaluable resource for building predictive models and assessing the credibility of a challenge. An investor can research the litigation track record of a specific generic company to see how often its challenges succeed. They can analyze the defensive record of an innovator company or the historical rulings of a specific judge. This ability to “study failed patent challenges to develop a better strategy” provides a data-driven foundation for assessing the probabilities of various outcomes.46

Advanced Research and Strategic Application

Beyond basic monitoring and tracking, advanced features on platforms like DrugPatentWatch enable a deeper level of analysis.

- AI-Powered Research: The platform’s AI Research Assistant can synthesize information from a vast array of external sources to answer complex, nuanced questions that go beyond the structured database.46 For example, an investor could ask the assistant to summarize the key arguments from a recent court hearing or to find scientific literature that could be used as prior art to challenge a specific patent. This provides a powerful layer of contextual research that can significantly enhance the analytical process.

- Identifying Low-Competition Opportunities: The NCE-1 analysis can be integrated into a broader investment strategy focused on the generic industry. By using DrugPatentWatch to monitor NCE-1 events, an investor can identify drugs that attract few or no challengers. This can be a strong signal that the post-exclusivity market for that drug will have low competition, presenting a potentially lucrative opportunity for the generic companies that do eventually enter.47 The platform’s tools for assessing market size, historical sales, and the number of existing ANDA approvals are essential for this type of analysis.46

To make the application of this framework tangible, the following table presents a watchlist of upcoming NCE-1 dates for several significant drugs, sourced from DrugPatentWatch data. This provides a concrete list of upcoming catalysts that can be monitored and analyzed using the methods described in this report.

| Brand Name | Generic Name (Active Ingredient) | Innovator Company | NCE-1 Date | Number of Protecting Patents |

| WELIREG | belzutifan | Merck Sharp Dohme | August 2025 | 2 |

| KORSUVA | difelikefalin acetate | Vifor Intl | August 2025 | 12 |

| QULIPTA | atogepant | Abbvie | September 2025 | 5 |

| LIVMARLI | maralixibat chloride | Mirum | September 2025 | 8 |

| SCEMBLIX | asciminib hydrochloride | Novartis | October 2025 | 4 |

| LEQVIO | inclisiran sodium | Novartis | December 2025 | 9 |

| CIBINQO | abrocitinib | Pfizer | January 2026 | 3 |

| PYRUKYND | mitapivat sulfate | Agios Pharms Inc | February 2026 | 9 |

| CAMZYOS | mavacamten | Bristol Myers Squibb | April 2026 | 2 |

| MOUNJARO / ZEPBOUND | tirzepatide | Eli Lilly And Co | May 2026 | 3 |

| VTAMA | tapinarof | Organon Llc | May 2026 | 11 |

| AMVUTTRA | vutrisiran sodium | Alnylam Pharms Inc | June 2026 | 13 |

Source: Adapted from DrugPatentWatch data 28

Section 6: Case Studies in Action: Learning from the Titans of Pharma

A theoretical framework is only as valuable as its application to real-world events. This section examines several seminal pharmaceutical patent battles through the lens of the NCE-1 signal and the analytical framework developed in this report. By retrospectively analyzing these historical cases, we can validate the framework’s predictive power, illustrate the complex strategic maneuvers employed by both innovator and generic companies, and derive critical lessons for future investment decisions.

Case Study 1: Lipitor (atorvastatin) – The Blockbuster Under Siege

Pfizer’s Lipitor was, for a time, the best-selling drug in the history of the pharmaceutical industry. Its massive commercial success made it an inevitable and highly attractive target for the generic industry, representing the archetypal “flood of challengers” scenario.

- The Signal: As the end of Lipitor’s NCE exclusivity approached, Pfizer was faced with a barrage of Paragraph IV certifications from multiple generic challengers. The most significant of these was from the Indian generic giant Ranbaxy Laboratories, which was the first to file a challenge and thus stood to gain the lucrative 180-day exclusivity period.48 The sheer number of challengers, led by a credible and aggressive first-filer, constituted a strongly bearish signal for Pfizer’s future revenue stream. It signaled a widespread industry consensus that at least some of the patents in Lipitor’s protective portfolio were vulnerable.

- The Litigation and Settlement: The ensuing legal battle was complex and protracted, spanning multiple years and jurisdictions.48 Ultimately, rather than risk an adverse court ruling that could have led to an even earlier generic launch, Pfizer entered into a comprehensive settlement agreement with Ranbaxy in 2008. The agreement was a strategic concession: it granted Ranbaxy a license to launch its generic version of Lipitor in the U.S. on a fixed date—November 30, 2011—well before the expiration of some of Pfizer’s secondary patents, but later than Ranbaxy might have hoped for from an outright court victory.48

- Pfizer’s Defensive Strategy: Faced with the certainty of generic entry, Pfizer executed a masterful and multi-pronged defensive strategy to manage the inevitable revenue cliff. Recognizing that it could not stop the first generic, it sought to control and compete with it. First, Pfizer launched its own “authorized generic” (AG) through a partnership with Watson Pharmaceuticals.50 An AG is a generic version of the drug produced by the brand company itself; it does not require a separate ANDA approval and can be launched immediately to compete with the first independent generic. This allowed Pfizer to capture a significant portion of the generic market’s revenue that would have otherwise gone entirely to Ranbaxy. Second, Pfizer implemented an aggressive rebate program called “Lipitor-For-You,” which offered privately insured patients a coupon card that lowered their co-payment for the branded drug to a level competitive with or even below the generic co-pay.50 This strategy, combined with substantial rebates to insurance plans and pharmacy benefit managers (PBMs), successfully preserved a significant portion of Lipitor’s market share during Ranbaxy’s 180-day exclusivity period.

- Investment Implications: A retrospective analysis shows how the NCE-1 framework could have guided an investment thesis. The initial signal—a flood of credible challengers—correctly predicted a high probability of eventual generic entry before the final patent expiries. An investor could have initiated a short position in Pfizer based on the market underestimating this risk. The subsequent settlement with Ranbaxy provided a firm catalyst date. As the 2011 launch date approached, an investor could have increased their short position in Pfizer, anticipating the dramatic 80-90% revenue drop that typically follows generic entry, while also potentially taking a long position in Ranbaxy to capture the upside from its highly profitable 180-day exclusivity period.51

Case Study 2: Plavix (clopidogrel) – The “At-Risk” Launch

The patent battle over Plavix, a blockbuster anti-platelet drug marketed by Sanofi-Aventis and Bristol-Myers Squibb, highlights the extreme risks and potential rewards of one of the most aggressive generic strategies: the “at-risk” launch.

- The Signal: The primary challenger for Plavix was the Canadian generic manufacturer Apotex, which filed a Paragraph IV certification against the core patent. The signal was initially ambiguous—a single, albeit aggressive, challenger.

- The Litigation and Outcome: The litigation was a rollercoaster. In a critical decision in 2011, a federal court held that while Apotex’s product would infringe the patent, the patent itself was invalid on the grounds of obviousness and lack of utility.52 Emboldened by this district court victory, and before the appeals process was complete, Apotex made the high-stakes decision to launch its generic version “at risk”.53 An “at-risk” launch occurs when a generic company begins marketing its product before all patent litigation has been finally resolved. If the initial court decision is upheld on appeal, the generic company reaps enormous profits. However, if the decision is overturned and the patent is ultimately found to be valid and infringed, the company is liable for massive damages, typically based on the brand’s lost profits during the at-risk period. In the background, Sanofi engaged in aggressive commercial tactics, attempting to sow doubt among physicians and pharmacists about the quality and bioequivalence of the generic versions, a strategy that later drew scrutiny from competition authorities.54

- Investment Implications: This case study serves as a crucial lesson in volatility and the importance of monitoring the entire legal process, not just the initial trial. The district court’s invalidity ruling would have been a strong signal to increase a short position in Sanofi/BMS and go long Apotex. However, the “at-risk” nature of the launch introduced a binary risk profile. An investor would need to understand that the entire thesis could be reversed by a single appellate court decision. This underscores the need for careful position sizing and a deep understanding of the legal nuances of the appeals process when dealing with an at-risk launch scenario. The potential for a catastrophic loss for the generic company is as real as the potential for a massive windfall.

Case Study 3: Humira (adalimumab) – The Fortress Defense (A Biosimilar Analogy)

While Humira is a biologic drug governed by the Biologics Price Competition and Innovation Act (BPCIA), not the Hatch-Waxman Act, its story is the definitive case study on the power of a patent thicket and provides indispensable lessons for any investor evaluating an innovator’s defensive capabilities against small-molecule NCE challenges.

- The Strategy: AbbVie’s defense of Humira was a masterclass in creating an impenetrable legal fortress. Instead of relying on a few core patents, AbbVie constructed a massive patent thicket, filing 247 patent applications and ultimately securing over 130 granted patents in the U.S..33 The vast majority of these were secondary patents covering formulations, methods of use, and manufacturing processes, filed long after Humira was first approved.34 This strategy was uniquely successful in the U.S., which has a more permissive environment for such filings compared to Europe, where AbbVie held far fewer patents.33

- The Outcome: The primary patent on the adalimumab molecule expired in the U.S. in 2016. However, the patent thicket worked precisely as intended. Despite multiple biosimilar developers receiving FDA approval, none were able to launch. Faced with the prospect of litigating over 100 patents—a process that would be astronomically expensive and time-consuming—every single biosimilar challenger eventually capitulated and entered into a settlement agreement with AbbVie.34 These settlements created a staggered entry schedule, allowing the first biosimilars to launch in the U.S. only in January 2023, more than six years after the primary patent expired and over four years after biosimilars had launched in Europe.33 The delay is estimated to have cost the U.S. healthcare system over $19 billion.33

- Investment Implications: The Humira case provides a critical counterpoint to the standard NCE-1 framework. It demonstrates that for certain blockbuster drugs, the quantity, density, and complexity of the patent portfolio can be a more powerful deterrent than the perceived legal quality of any single patent. An investor applying the framework to a small-molecule drug protected by a Humira-like thicket might need to heavily discount the bearish signal from multiple challengers. The high probability of a long, drawn-out legal battle culminating in settlements favorable to the innovator would temper an aggressive short thesis. It teaches investors to analyze not just the likelihood of a single patent falling, but the economic viability of a challenger hacking its way through the entire legal jungle.

Case Study 4: The Failed Assault – A Lesson in Risk Management

It is essential to analyze cases where the NCE-1 signal pointed in one direction, but the ultimate legal outcome went the other way. These cases serve as a vital reminder that the framework provides a probabilistic, not a deterministic, tool.

- The Signal: Imagine a scenario where a blockbuster NCE drug attracts multiple, credible Paragraph IV challengers on its NCE-1 date. Based on our framework, this is a strongly bearish signal for the innovator. An investor might initiate a short position in the innovator and long positions in the challengers.

- The Outcome: Despite the initial signal, the innovator company mounts a vigorous and successful legal defense. It may present compelling “secondary considerations of non-obviousness,” such as evidence that its invention solved a long-felt need where others had failed, or that it produced unexpected and superior results.57 The district court, and subsequently the appellate court, rules in favor of the innovator, upholding the validity of the key patents and blocking generic entry until their natural expiration.36

- Investment Implications: This scenario represents the primary risk of the NCE-1 strategy. The initial bearish signal is invalidated by the court’s decision. The innovator’s stock would likely rally strongly on the news, as the market reprices the company’s earnings based on a longer period of monopoly revenue. Conversely, the stocks of the generic challengers would decline, reflecting the loss of a major revenue opportunity and the write-off of significant R&D and legal expenditures. This case study underscores the absolute necessity of rigorous risk management. It demonstrates that the initial thesis must be continuously tested against new information from the litigation process. It also highlights the importance of appropriate position sizing to ensure that a single adverse legal ruling does not result in a catastrophic loss for the portfolio.

Section 7: Investment Strategies and Risk Mitigation

The culmination of this analysis is the translation of the NCE-1 signal framework into concrete, actionable investment strategies. This final section outlines how an investor can construct and manage positions to capitalize on the market shifts predicted by the framework. Crucially, it also provides a rigorous assessment of the significant risks inherent in this event-driven approach, ensuring that the pursuit of alpha is balanced with a disciplined approach to risk mitigation.

Formulating the Investment Thesis

The NCE-1 signal and subsequent qualitative analysis provide the foundation for several distinct, event-driven investment theses.

- Shorting the Innovator: This is the most direct application of a strong bearish signal. When a blockbuster drug with a significant contribution to an innovator’s revenue faces a “flood” of four or more credible challengers on its NCE-1 date, an investor can formulate a thesis that the market is underestimating the probability of an earlier-than-expected loss of exclusivity. The strategy involves initiating a short position in the innovator’s stock, with the expectation that the stock price will decline as the litigation progresses unfavorably for the brand or as a settlement with an early entry date is announced. The ultimate catalyst for the thesis would be the actual launch of a generic competitor, which typically leads to an 80-90% erosion of brand sales within a year.35

- Going Long the “First-to-File” Generic: In the same bearish scenario for the innovator, an investor can take a long position in the stock of the most promising “first-to-file” generic challenger. The thesis here is that the market is undervaluing the enormous potential earnings stream from the 180-day exclusivity period.38 This strategy is particularly attractive if the challenger is a smaller, pure-play generic company, as a single blockbuster launch can be transformative to its financials, as was seen in the Prozac case.19 Likely “winners” in a major patent cliff scenario are often the large, well-established generic and biosimilar manufacturers like Teva and Sandoz, who have the scale and legal expertise to execute these challenges successfully.59

- Pairs Trading: A more sophisticated, market-neutral strategy is to execute a pairs trade. This involves simultaneously taking a long position in the generic challenger’s stock and a short position in the innovator’s stock. The goal of a pairs trade is to isolate the alpha generated from the specific outcome of the patent litigation, while hedging against broader market movements or sector-wide risks. If the generic challenger is successful, its stock should outperform the innovator’s stock, leading to a profit on the spread between the two positions, regardless of whether the overall market goes up or down.

Portfolio Construction and Timing

This is a classic event-driven strategy, and its success depends heavily on timing and dynamic position management.

- Initiating the Position: The initial position is typically taken on or shortly after the NCE-1 date, once the number and identity of the challengers become public information.

- Dynamic Sizing: The initial position should be viewed as a starting point. An investor must actively monitor the litigation process for key milestones that can either increase or decrease the probability of the thesis playing out. Favorable developments for the generic challenger—such as a positive claim construction (Markman) ruling, the institution of an Inter Partes Review (IPR) by the Patent Trial and Appeal Board (PTAB), or a victory at the district court level—could be triggers to increase the size of the position. Conversely, unfavorable rulings would be a signal to reduce or exit the position.

- Position Sizing and Risk Management: Given the often binary, “win-or-lose” nature of patent litigation, disciplined position sizing is paramount. A full loss on a generic challenger’s stock (e.g., due to an at-risk launch followed by an adverse appellate ruling) is a real possibility. Therefore, positions should be sized appropriately to ensure that a single negative outcome does not have an outsized impact on the overall portfolio.

A Rigorous Look at the Risks

Investing based on patent litigation is a high-risk, high-reward endeavor. An investor must have a clear-eyed view of the numerous factors that can invalidate the initial thesis.

- Inherent Litigation Uncertainty: The outcome of a patent trial is fundamentally unpredictable. A patent that appears weak based on prior art may be upheld by a jury, while a seemingly strong patent can be invalidated on a legal technicality.60 The average cost of patent litigation through trial can be $3 million or more, and the median time to trial is over two years, creating a long period of uncertainty.41

- Settlement Risk: The most common outcome of a Paragraph IV challenge is not a court verdict but a settlement agreement.62 Settlements introduce a different kind of risk to the investment thesis. The terms are often confidential, and the agreed-upon generic entry date may be a compromise that is only moderately positive for the generic and moderately negative for the innovator. This can lead to a muted stock price reaction for both companies, failing to deliver the dramatic alpha the initial thesis predicted. While “pay-for-delay” settlements have faced intense antitrust scrutiny, settlements that simply involve a licensed entry date are common and legal.48

- The “At-Risk” Launch Gamble: As the Plavix case demonstrated, a generic company that launches at-risk is making an enormous gamble.53 If an initial court victory is overturned on appeal, the generic company can be liable for treble damages based on the brand’s lost profits, an amount that could easily bankrupt the company. This represents the maximum downside risk for an investor on the long side of the trade.

- The Evolving and Complex Legal Landscape: The legal framework is not static. The introduction of the Inter Partes Review (IPR) process in 2012 created a parallel pathway for challenging patents that has added significant complexity.63 IPRs are administrative trials conducted before the PTAB within the patent office. They are generally faster and cheaper than district court litigation and, crucially, use a lower standard of proof (“preponderance of the evidence”) to invalidate a patent, compared to the “clear and convincing evidence” standard used in federal court.57 This has led to significantly higher invalidation rates in IPR proceedings, making them an attractive tool for generic challengers.63 However, an IPR loss can have a devastating “estoppel” effect, preventing the challenger from raising the same arguments again in district court.57 For an investor, this means tracking two parallel legal battles, each with different rules, standards, and strategic implications.

To provide clarity on these two critical battlegrounds, the following table compares the key features of traditional district court litigation under Hatch-Waxman with the IPR process at the PTAB.

| Feature | District Court Litigation (Hatch-Waxman) | PTAB Inter Partes Review (IPR) |

| Venue | U.S. Federal District Court | Patent Trial and Appeal Board (PTAB) at USPTO |

| Standard of Proof for Invalidity | Clear and Convincing Evidence | Preponderance of the Evidence |

| Presumption of Validity | Patent is presumed valid | No presumption of validity |

| Scope of Challenge | All grounds of invalidity (novelty, obviousness, enablement, written description, etc.) | Limited to novelty and obviousness based on patents and printed publications only |

| Average Cost | High ($5M – $10M+ per case) | Lower (~$350k – $500k per patent) |

| Speed to Final Decision | Slow (2-3+ years) | Fast (typically 12-18 months from institution) |

| Estoppel Effect on Challenger | Narrow (res judicata on decided issues) | Broad (estopped from raising any ground that was or reasonably could have been raised) |

Source: Adapted from 57

This table highlights the critical strategic trade-offs a generic challenger faces. The IPR offers a faster, cheaper path with a lower burden of proof, but it is limited in scope and carries a significant estoppel risk. The district court is more expensive and slower, but it allows for a broader range of attacks and has a higher standard of proof that is more favorable to the patent holder. An investor must understand which path a challenger is pursuing, or if they are pursuing both in parallel, to accurately assess the litigation risk.

Conclusion: The Future of NCE-1 Analysis in Pharmaceutical Investing

The central thesis of this report is that the NCE-1 date for a New Chemical Entity is not merely a regulatory footnote but a powerful, data-driven, and recurring signal in an industry often characterized by scientific and regulatory opacity. The deliberately adversarial framework of the Hatch-Waxman Act ensures that the transition from monopoly to competition is preceded by a period of structured, public conflict. The number and quality of the patent challengers that emerge on the NCE-1 date provide a clear, early indication of the generic industry’s collective assessment of an innovator’s patent strength. For the prepared investor, this signal offers a significant informational edge.

However, the signal is not deterministic. As the case studies and risk analysis have demonstrated, patent litigation is a complex and uncertain process. A disciplined analytical framework, which moves from the initial quantitative signal to nuanced qualitative overlays, is essential for translating the NCE-1 event into a robust investment thesis. This process is not possible without the aid of specialized competitive intelligence platforms, such as DrugPatentWatch, which aggregate the necessary regulatory, patent, and litigation data into an accessible and analyzable format. By leveraging these tools to systematically monitor upcoming catalysts, track litigation milestones, and analyze historical precedents, an investor can move beyond simple speculation and make informed, data-driven decisions.

Looking forward, the strategic landscape continues to evolve. The growing prominence of biologic drugs and their biosimilar competitors, governed by the more complex and still-developing framework of the BPCIA, presents new challenges and opportunities.65 The “patent dance” for biosimilars is a different and often more protracted process than the Hatch-Waxman litigation for small molecules, requiring investors to develop new analytical expertise.69 Furthermore, major policy shifts, such as the drug price negotiation provisions of the Inflation Reduction Act, are set to alter the economic incentives for both innovators and generics, which will undoubtedly influence future patent challenge strategies.31

Despite these changes, the fundamental principle will remain: where there are valuable monopolies protected by intellectual property, there will be challenges. The conflict between innovation and access is a permanent feature of the pharmaceutical industry. For investors who take the time to master the rules of this complex battlefield, the NCE-1 signal will continue to serve as a vital tool for anticipating market shifts, managing risk, and capturing alpha in one of the world’s most dynamic and important sectors.

Works cited

- 40th Anniversary of the Generic Drug Approval Pathway | FDA, accessed August 5, 2025, https://www.fda.gov/drugs/cder-conversations/40th-anniversary-generic-drug-approval-pathway

- www.fda.gov, accessed August 5, 2025, https://www.fda.gov/drugs/abbreviated-new-drug-application-anda/hatch-waxman-letters#:~:text=The%20%22Drug%20Price%20Competition%20and,Drug%2C%20and%20Cosmetic%20Act%20(FD%26C

- Hatch-Waxman Act – Practical Law, accessed August 5, 2025, https://uk.practicallaw.thomsonreuters.com/Glossary/PracticalLaw/I2e45aeaf642211e38578f7ccc38dcbee

- What is Hatch-Waxman? – PhRMA, accessed August 5, 2025, https://phrma.org/resources/what-is-hatch-waxman

- Small Business Assistance: Frequently Asked Questions for New …, accessed August 5, 2025, https://www.fda.gov/drugs/cder-small-business-industry-assistance-sbia/small-business-assistance-frequently-asked-questions-new-drug-product-exclusivity

- Mastering Paragraph IV Certification – Number Analytics, accessed August 5, 2025, https://www.numberanalytics.com/blog/mastering-paragraph-iv-certification

- What Every Pharma Executive Needs to Know About Paragraph IV …, accessed August 5, 2025, https://www.drugpatentwatch.com/blog/what-every-pharma-executive-needs-to-know-about-paragraph-iv-challenges/

- FDA Is Evolving on Qualifications for ‘New Chemical Entity’ | Troutman Pepper Locke, accessed August 5, 2025, https://www.troutman.com/insights/fda-is-evolving-on-qualifications-for-new-chemical-entity.html

- Approved Drug Products with Therapeutic Equivalence Evaluations, accessed August 5, 2025, https://www.fda.gov/drugs/drug-approvals-and-databases/approved-drug-products-therapeutic-equivalence-evaluations-orange-book

- www.fda.gov, accessed August 5, 2025, https://www.fda.gov/drugs/drug-approvals-and-databases/approved-drug-products-therapeutic-equivalence-evaluations-orange-book#:~:text=The%20publication%20Approved%20Drug%20Products,Act)%20and%20related%20patent%20and

- Freshly Squeezed: Orange Book History and Key Updates at 45, accessed August 5, 2025, https://www.fdli.org/2025/05/freshly-squeezed-orange-book-history-and-key-updates-at-45/

- Drug Patent Life: The Complete Guide to Pharmaceutical Patent Duration and Market Exclusivity – DrugPatentWatch, accessed August 5, 2025, https://www.drugpatentwatch.com/blog/how-long-do-drug-patents-last/

- New Chemical Entity Exclusivity Determinations for Certain Fixed- Combination Drug Products | FDA, accessed August 5, 2025, https://www.fda.gov/files/drugs/published/New-Chemical-Entity-Exclusivity-Determinations-for-Certain-Fixed-Combination-Drug-Products.pdf

- New Chemical Entity Exclusivity Determinations for Certain Fixed-Combination Drug Products October 2014 – FDA, accessed August 5, 2025, https://www.fda.gov/regulatory-information/search-fda-guidance-documents/new-chemical-entity-exclusivity-determinations-certain-fixed-combination-drug-products

- Understanding NCE-1 : Filing Strategy Simplified, accessed August 5, 2025, https://springbiosolution.com/blogs/new-chemical-entity-nce-minus-1/

- Understanding Recent Trends in ANDA Submissions One Year Prior …, accessed August 5, 2025, https://www.ipdanalytics.com/sample-reports-1/understanding-recent-trends-in-anda-submissions-one-year-prior-to-expiration-of-nce-exclusivity-(nce-1)

- The timing of 30‐month stay expirations and generic entry: A cohort study of first generics, 2013–2020, accessed August 5, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC8504843/

- FDA ANDAs containing paragraph IV patent certifications, accessed August 5, 2025, https://www.gabionline.net/policies-legislation/FDA-ANDAs-containing-paragraph-IV-patent-certifications

- Paragraph IV Explained – ParagraphFour.com, accessed August 5, 2025, https://paragraphfour.com/paragraph-iv-explained/

- How Patent Litigation Influences Drug Approvals and Market Entry …, accessed August 5, 2025, https://patentpc.com/blog/how-patent-litigation-influences-drug-approvals-and-market-entry

- A new history and discussion of 180-day exclusivity – PubMed, accessed August 5, 2025, https://pubmed.ncbi.nlm.nih.gov/19999288/

- The 180-Day Rule Supports Generic Competition. Here’s How., accessed August 5, 2025, https://accessiblemeds.org/resources/blog/180-day-rule-supports-generic-competition-heres-how/

- “The Law of 180-Day Exclusivity” by Erika Lietzan and Julia Post, accessed August 5, 2025, https://scholarship.law.missouri.edu/facpubs/644/

- The Law of 180-Day Exclusivity (Open Access) – Food and Drug Law Institute (FDLI), accessed August 5, 2025, https://www.fdli.org/2016/09/law-180-day-exclusivity/

- Patent Certifications and Suitability Petitions | FDA, accessed August 5, 2025, https://www.fda.gov/drugs/abbreviated-new-drug-application-anda/patent-certifications-and-suitability-petitions

- From Chaos to Clarity: Streamlining Your Generic Drug Portfolio …, accessed August 5, 2025, https://www.drugpatentwatch.com/blog/from-chaos-to-clarity-streamlining-your-generic-drug-portfolio/

- Drug Competition Series – Analysis of New Generic … – HHS ASPE, accessed August 5, 2025, https://aspe.hhs.gov/sites/default/files/documents/510e964dc7b7f00763a7f8a1dbc5ae7b/aspe-ib-generic-drugs-competition.pdf

- 29 Drugs Facing NCE-1 / Abbreviated New Drug Application …, accessed August 5, 2025, https://www.drugpatentwatch.com/p/nce-1/

- Sprinting Towards the New Chemical Entity -1 Designation | Freyr – Global Regulatory Solutions and Services Company, accessed August 5, 2025, https://www.freyrsolutions.com/blog/sprinting-towards-the-new-chemical-entity-1-designation

- FACT SHEET: BIG PHARMA’S PATENT ABUSE COSTS AMERICAN …, accessed August 5, 2025, https://www.csrxp.org/fact-sheet-big-pharmas-patent-abuse-costs-american-patients-taxpayers-and-the-u-s-health-care-system-billions-of-dollars-2/

- Patent Defense Isn’t a Legal Problem. It’s a Strategy Problem. Patent …, accessed August 5, 2025, https://www.drugpatentwatch.com/blog/patent-defense-isnt-a-legal-problem-its-a-strategy-problem-patent-defense-tactics-that-every-pharma-company-needs/

- What is a patent challenge, and why is it common in generics?, accessed August 5, 2025, https://synapse.patsnap.com/article/what-is-a-patent-challenge-and-why-is-it-common-in-generics

- The Global Patent Thicket: A Comparative Analysis of …, accessed August 5, 2025, https://www.drugpatentwatch.com/blog/how-do-patent-thickets-vary-across-different-countries/

- AbbVie’s successful hard-ball with Humira legal strategy unlikely to …, accessed August 5, 2025, https://www.pharmaceutical-technology.com/comment/abbvies-successful-hard-ball-with-humira/

- Strategic Patenting by Pharmaceutical Companies – Should Competition Law Intervene? – PMC, accessed August 5, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC7592140/

- Accelerating biosimilar market access: the case for allowing earlier standing | Journal of Law and the Biosciences | Oxford Academic, accessed August 5, 2025, https://academic.oup.com/jlb/article/12/1/lsae030/7942247

- Full article: Continuing trends in U.S. brand-name and generic drug competition, accessed August 5, 2025, https://www.tandfonline.com/doi/full/10.1080/13696998.2021.1952795

- PHARMACEUTICAL PATENT CHALLENGES AND THEIR IMPLICAITONS FOR INNOVATION AND GENERIC COMPETION HENRY GRABOWSKI A CARLOS BRAIN B AN, accessed August 5, 2025, https://www.aeaweb.org/conference/2015/retrieve.php?pdfid=3499&tk=r6QR3A3H

- Evaluating Biosimilar Development Projects: An Analytical …, accessed August 5, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11955401/

- 5 Ways to Predict Patent Litigation Outcomes – DrugPatentWatch …, accessed August 5, 2025, https://www.drugpatentwatch.com/blog/5-ways-to-predict-patent-litigation-outcomes/

- Patent Litigation Statistics: An Overview of Recent Trends – PatentPC, accessed August 5, 2025, https://patentpc.com/blog/patent-litigation-statistics-an-overview-of-recent-trends

- Hatch-Waxman 2023 Year in Review – Fish & Richardson, accessed August 5, 2025, https://www.fr.com/insights/thought-leadership/articles/hatch-waxman-2023-year-in-review-2/

- The Role of Litigation Data in Predicting Generic Drug Launches – DrugPatentWatch, accessed August 5, 2025, https://www.drugpatentwatch.com/blog/the-role-of-litigation-data-in-predicting-generic-drug-launches/

- White Paper Part 2: Failure to Launch: Barriers to Biosimilar Market …, accessed August 5, 2025, https://accessiblemeds.org/resources/reports/white-paper-part-2-failure-launch-barriers-biosimilar-market-adoption/

- DrugPatentWatch | Software Reviews & Alternatives – Crozdesk, accessed August 5, 2025, https://crozdesk.com/software/drugpatentwatch

- DrugPatentWatch not only saved us valuable time in tracking patent …, accessed August 5, 2025, https://www.drugpatentwatch.com/

- Uncovering Lucrative Low-Competition Generic Drug Opportunities …, accessed August 5, 2025, https://www.drugpatentwatch.com/blog/uncovering-lucrative-low-competition-generic-drug-opportunities/

- Pfizer and Ranbaxy Settle Lipitor Patent Litigation Worldwide | Pfizer, accessed August 5, 2025, https://www.pfizer.com/news/press-release/press-release-detail/pfizer_and_ranbaxy_settle_lipitor_patent_litigation_worldwide

- Who holds the patent for Atorvastatin? – Patsnap Synapse, accessed August 5, 2025, https://synapse.patsnap.com/article/who-holds-the-patent-for-atorvastatin

- Managing the challenges of pharmaceutical patent expiry: a case study of Lipitor, accessed August 5, 2025, https://www.emerald.com/jstpm/article-split/7/3/258/249506/Managing-the-challenges-of-pharmaceutical-patent

- The End of Exclusivity: Navigating the Drug Patent Cliff for …, accessed August 5, 2025, https://www.drugpatentwatch.com/blog/the-impact-of-drug-patent-expiration-financial-implications-lifecycle-strategies-and-market-transformations/

- Federal Court finds PLAVIX patent invalid – Smart & Biggar, accessed August 5, 2025, https://www.smartbiggar.ca/insights/publication/federal-court-finds-plavix-patent-invalid

- NBER WORKING PAPER SERIES NO FREE LAUNCH: AT-RISK ENTRY BY GENERIC DRUG FIRMS Keith M. Drake Robert He Thomas McGuire Alice K. N, accessed August 5, 2025, https://www.nber.org/system/files/working_papers/w29131/w29131.pdf

- Skadden, accessed August 5, 2025, https://www.skadden.com/-/media/files/publications/2013/05/french_autorite_de_la_concurrence_fines_sanofi_0.pdf

- AbbVie’s Enforcement of its ‘Patent Thicket’ For Humira Under the BPCIA Does Not Provide Cognizable Basis for an Antitrust Violation | Mintz, accessed August 5, 2025, https://www.mintz.com/insights-center/viewpoints/2231/2020-06-18-abbvies-enforcement-its-patent-thicket-humira-under

- First Biosimilar to Adalimumab (Humira) Enters the U.S. Market After Years of Legal Battles, accessed August 5, 2025, https://www.the-rheumatologist.org/article/first-biosimilar-to-adalimumab-enters-the-u-s-market-after-years-of-legal-battles/

- Handling Drug Patent Invalidity Claims – DrugPatentWatch …, accessed August 5, 2025, https://www.drugpatentwatch.com/blog/handling-drug-patent-invalidity-claims/

- 11 Famous Supreme Court Patent Cases that Changed US Patent Law – GreyB, accessed August 5, 2025, https://www.greyb.com/blog/famous-supreme-court-patent-cases/

- The $400 Billion Patent Cliff: Big Pharma’s Revenue Crisis, accessed August 5, 2025, https://americanbazaaronline.com/2025/08/04/the-400-billion-patent-cliff-big-pharmas-revenue-crisis-465788/

- Maximizing Patent ROI: Key Strategies & Risks – UpCounsel, accessed August 5, 2025, https://www.upcounsel.com/investing-in-patents

- Risk Management for Innovative Tech Companies and Patent Portfolio Managers, accessed August 5, 2025, https://henry.law/blog/minimize-intrinsic-patent-risks/

- Then, now, and down the road: Trends in pharmaceutical patent settlements after FTC v. Actavis, accessed August 5, 2025, https://www.ftc.gov/enforcement/competition-matters/2019/05/then-now-down-road-trends-pharmaceutical-patent-settlements-after-ftc-v-actavis

- Disrupting the Balance: The Conflict Between Hatch-Waxman and …, accessed August 5, 2025, https://jipel.law.nyu.edu/vol-6-no-1-2-shepherd/

- Filing Multiple, Detailed Patents vs. a Single, More General Patent – Thomas | Horstemeyer, accessed August 5, 2025, https://thip.law/insights/filing-multiple-detailed-patents-vs-a-single-more-general-patent/

- BPCIA: Beyond the Hatch-Waxman Act – Pharmaceutical Law Group, accessed August 5, 2025, https://www.pharmalawgrp.com/bpcia/

- Comparison of the Hatch-Waxman Act and the BPCIA – Fish …, accessed August 5, 2025, https://www.fr.com/wp-content/uploads/2019/03/Comparison-of-Hatch-Waxman-Act-and-BPCIA-Chart.pdf

- The Economics of Biosimilars – PMC, accessed August 5, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC4031732/

- The Biologics Price Competition and Innovation Act: Potential …, accessed August 5, 2025, https://scholarlycommons.law.northwestern.edu/cgi/viewcontent.cgi?article=1238&context=njtip

- Biosimilars, Shall We Do the Patent Dance? – S.J. Quinney College …, accessed August 5, 2025, https://www.law.utah.edu/news-articles/biosimilars-shall-we-do-the-patent-dance/

- Accelerating biosimilar market access: the case for allowing earlier standing – PMC, accessed August 5, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11697977/

- You Can Dance if You Want To? Initial Interpretations of the BPCIA’s Patent Dance with Sandoz and Amgen – UC Law SF Scholarship Repository, accessed August 5, 2025, https://repository.uclawsf.edu/cgi/viewcontent.cgi?article=1012&context=hastings_science_technology_law_journal

- BPCIA Litigations – Big Molecule Watch, accessed August 5, 2025, https://www.bigmoleculewatch.com/bpcia-patent-litigations/