The pharmaceutical industry stands at a pivotal juncture, grappling with the dual imperatives of fostering groundbreaking innovation and ensuring widespread patient access to life-saving therapies. At the heart of this dynamic lies the burgeoning field of biosimilars, poised to redefine market competition and healthcare economics. This report delves into the intricate world of biosimilars, dissecting their unique characteristics, the complex intellectual property (IP) landscape they inhabit, and the strategic maneuvers required to harness their potential for competitive advantage.

Introduction: The Dawn of the Biosimilar Era

The pharmaceutical landscape is undergoing a profound transformation, driven by the increasing demand for affordable, high-quality biologic therapies. As blockbuster biologics approach and lose patent protection, biosimilars are emerging not merely as cheaper alternatives, but as a pivotal strategic imperative for healthcare systems, payers, and pharmaceutical companies alike.

Context of Biologics and Their Cost Burden

Biological medicines represent a revolutionary class of therapeutics, comprising complex, large molecules derived from living organisms . These sophisticated therapies, often produced through cutting-edge biotechnology, offer critical treatment options for chronic and often debilitating conditions such as diabetes, autoimmune diseases, and various cancers . Their inherent complexity and the advanced technology required for their production contribute significantly to their high cost. For instance, in 2023, biologics accounted for a substantial 40% (€87.6 billion) of the total spending on medicines in the European Union, and a similar 38-40% in the United States.

This disproportionately high cost creates significant access barriers for patients globally. Many individuals may be prevented from receiving prompt treatment, optimal doses, or even sustained therapy due to financial constraints . The economic reality is clear: the inherently high cost and complex nature of originator biologics directly fuels the demand for more affordable alternatives. This dynamic creates a fertile ground for biosimilar market growth, as healthcare systems and patients actively seek to alleviate financial burdens without compromising treatment efficacy. The substantial market share commanded by biologics means that even a modest percentage reduction in cost can translate into billions of dollars in savings, making biosimilars a critical component of healthcare sustainability. This fundamental economic pressure, stemming from the high research and development (R&D) and manufacturing costs of biologics, which then translate into high market prices, inevitably leads to limited patient access and strain on healthcare budgets. Biosimilars, by their very nature, step into this void, making their emergence a direct response to these pervasive economic pressures within the biologic market. This interwoven relationship is a fundamental driver of the entire biosimilar industry.

The Rise of Biosimilars as a Market Force

The biosimilar market is poised for significant expansion, primarily driven by the impending patent expirations of numerous blockbuster biologics. Projections paint a compelling picture of growth: the global biosimilar market was valued at USD 26.5 billion in 2024 and is anticipated to skyrocket to USD 185.1 billion by 2033, demonstrating a robust Compound Annual Growth Rate (CAGR) of 24.1% from 2025-2033. Other analyses echo this sentiment, estimating growth from $28.5 billion in 2024 to $69.2 billion by the end of 2029, at a CAGR of 19.4%. This impressive trajectory is fueled by the increasing number of patent expirations for major biologics, which effectively open the door for competitors to introduce lower-priced versions .

Beyond patent cliffs, regulatory support plays a crucial role in facilitating market entry. For example, the European Medicines Agency (EMA) has proposed streamlined pathways, including the potential to waive comparative efficacy studies for certain biosimilars, thereby decreasing development burdens and accelerating time to market . The accelerated pace of patent expirations for blockbuster biologics, coupled with increasing regulatory support and an insatiable demand for cost-effective treatments, signals a strong and sustained upward trajectory for the biosimilar market. This is not a fleeting trend but a fundamental, long-term shift in pharmaceutical economics, creating a compelling strategic opportunity for companies positioned to capitalize on it. The rationale is clear: patent expirations act as the primary trigger for biosimilar market entry. When regulatory agencies actively work to streamline approval pathways, for instance, through the EMA’s proposed waivers for clinical efficacy studies, the barriers to entry for biosimilar developers are lowered. This, in turn, makes biosimilar development more attractive and profitable. The underlying, persistent demand for affordable biologics from patients and healthcare systems then ensures market uptake. These factors collectively create a powerful, self-reinforcing cycle that drives significant market growth.

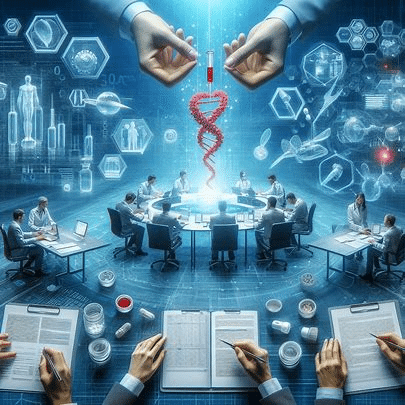

Understanding Biosimilars: A Strategic Imperative

To effectively navigate the biosimilar landscape, one must first grasp the fundamental distinctions that set these complex medicines apart from their small-molecule counterparts and their originator biologics. This understanding is not merely academic; it is the bedrock upon which successful patent strategies and market entry plans are built.

Defining Biosimilars vs. Originator Biologics

At its core, a biosimilar is a biological medicine that is highly similar to another already approved biological medicine, known as the ‘reference medicine’ or ‘originator biologic’ . While the term “similar” might suggest a simple copy, the reality is far more nuanced. Biosimilars are highly similar but not identical to their originator counterparts. This is a critical distinction, primarily due to the inherent natural variability and complex manufacturing processes involved in producing biological medicines, which rely on living cells or organisms . In fact, even different batches of the originator drug exhibit natural variations.

For a biosimilar to gain approval, regulatory bodies such as the EMA and the U.S. Food and Drug Administration (FDA) demand comprehensive comparability studies. These studies must unequivocally demonstrate that there are no clinically meaningful differences between the biosimilar and the reference medicine in terms of safety, quality, and efficacy . This rigorous evaluation allows regulators to avoid unnecessary repetition of the extensive clinical trials already conducted for the reference medicine. In the European Union, the EMA and the Heads of Medicines Agencies (HMA) have affirmed that EU-approved biosimilars are interchangeable from a scientific viewpoint. This means a biosimilar can be used in place of its reference product, or vice versa, and even in place of another biosimilar of the same reference product, provided the product information is carefully considered. The safety profile of biosimilars is robust, supported by extensive real-world data, with safety data from 1 million patient-treatment years demonstrating their safety and interchangeability.

The “highly similar, not identical” nature of biosimilars is a critical distinction that shapes their regulatory pathway, manufacturing complexities, and market perception. This nuanced similarity, rather than exact replication, is what necessitates a different regulatory approach compared to small-molecule generics and influences the patent strategies employed by both originators and biosimilar developers. Unlike small-molecule generics, which are chemically synthesized and can be replicated identically, biologics are products of living systems. This biological origin introduces inherent microheterogeneity, meaning that no two batches, even of the same originator biologic, are absolutely identical. Consequently, a biosimilar cannot be an exact copy but must demonstrate that its inherent variability falls within the acceptable range of variability observed in the originator. This scientific reality directly informs the “highly similar” regulatory standard, which in turn dictates the extensive comparability studies required for approval. This unique scientific and regulatory context differentiates biosimilars from generics and profoundly impacts the types of patents that can be asserted or challenged.

Biosimilars vs. Small Molecule Generics

The pharmaceutical lexicon often conflates biosimilars with generic drugs, yet a fundamental distinction exists, rooted in their molecular complexity and origin. Biosimilars are characterized as large-molecule medications, derived from living organisms such as yeast, bacteria, plants, or animal cells. They are inherently complex . In stark contrast, generic drugs involve small-molecule medicines, like aspirin or ibuprofen, which are synthesized using chemical processes and possess much simpler, well-defined structures .

This fundamental difference translates into distinct regulatory and commercial landscapes. Generic drugs are chemically identical to their original branded counterparts in terms of active ingredients, allowing for a more straightforward approval pathway that typically does not require extensive clinical testing beyond demonstrating bioequivalence. This streamlined process contributes to their significant cost-effectiveness, often leading to discounts of 80-85% compared to brand-name drugs. Biosimilars, while demonstrating high similarity and no clinically meaningful differences in safety, purity, or potency compared to their reference products, are not identical due to the natural variability inherent in biological systems. Consequently, their development process is far more intricate and costly, often taking 7-8 years and exceeding $100 million in investment, including necessary clinical studies. This complexity means biosimilars typically offer a more modest, though still substantial, cost reduction of about a third lower than the brand-name biologic products.

The stark differences in molecular complexity, manufacturing origin, and development costs between biosimilars and generics lead to distinct regulatory pathways, pricing structures, and competitive dynamics. This means that strategies successful for generic drug entry cannot be simply replicated for biosimilars; a more sophisticated, biologically and legally informed approach is required. Small molecules are simple chemical entities, allowing for their identical chemical synthesis and straightforward bioequivalence testing to prove therapeutic equivalence. Biologics, however, are large, complex molecules produced in living organisms, leading to inherent microheterogeneity. This fundamental difference in molecular nature drives the divergence in development costs (significantly higher for biosimilars), regulatory requirements (an abbreviated but still rigorous comparability exercise for biosimilars, versus simple bioequivalence for generics), and ultimately, their pricing and market competition dynamics. Therefore, a company’s strategic approach to biosimilars must account for these unique complexities, rather than treating them as merely “large generics.”

The Patent Landscape: A Battleground of Exclusivity

The pharmaceutical industry thrives on innovation, and patents are its lifeblood, providing the exclusive rights necessary to recoup the colossal investments in drug development. However, this protective mechanism often transforms into a formidable barrier, particularly in the biologics space, where patent strategies are intricate and fiercely contested.

Types of Patents for Biologic Drugs

Pharmaceutical patents are legal rights granted to inventors or companies, providing exclusive rights to produce and sell their innovation for a specified period, typically 20 years from the filing date. This exclusivity is crucial for allowing companies to recoup the immense costs associated with R&D and clinical trials, which can exceed $2.6 billion for a new drug . For biologic drugs, the scope of patent protection extends far beyond the core active ingredient, encompassing a multifaceted array of claims :

- Product Patents: These are foundational, protecting the core active ingredient, protein sequence, or DNA that constitutes the medicine . They ensure no other company can manufacture, use, or sell the patented invention without permission during the patent term.

- Process Patents: These patents safeguard innovative manufacturing procedures or chemical processes developed to produce a specific pharmaceutical product. This can include novel purification methods, optimized cell culture conditions, or advanced bioprocessing variables.1 They are vital for enhancing efficiency and effectiveness in production.

- Use Patents (Method of Use): Also known as “method of use” patents, these protect specific therapeutic applications of a known product, such as discovering new indications for an existing drug .

- Formulation Patents: These protect the unique combination of ingredients in a drug, including special carriers, delivery mechanisms, or excipients that optimize the drug’s performance, stability, or patient compliance.1 Examples include buffer-free systems, high-concentration formulations, or specific excipient combinations that enhance stability.1

- Combination Patents: These cater to drugs that combine multiple active ingredients to create a new therapy, protecting synergistic approaches to disease management.

- Delivery Device Patents (Tertiary Patents): These patents cover medical devices paired with an active ingredient, such as pre-filled syringes or autoinjectors, to prolong market exclusivity and improve patient convenience.5

The multi-faceted nature of biologic patents, extending beyond the core molecule to encompass manufacturing processes, formulations, and even delivery devices, highlights the comprehensive IP protection strategies employed by originator companies. For biosimilar developers, this implies a complex web of claims to navigate, requiring a sophisticated understanding of each patent type’s scope and vulnerability. Biologics are inherently complex, not just in their active therapeutic ingredient but also in how they are manufactured, formulated, delivered, and ultimately used by patients. This inherent complexity provides numerous avenues for patenting. Originator companies strategically leverage this to create a broad protective shield around their products, aiming to maximize their period of market exclusivity. For biosimilar companies, this means that simply waiting for the “main” patent on the active ingredient to expire is often insufficient for market entry. They must meticulously analyze and potentially challenge a multitude of secondary patents, each protecting a different aspect of the reference product’s lifecycle. This necessitates a detailed, multi-dimensional patent strategy that goes beyond a simple “copycat” approach.

Data Exclusivity vs. Patent Protection

In the realm of pharmaceutical intellectual property, data exclusivity and patent protection, while often intertwined, represent distinct legal frameworks. Data exclusivity is a regulatory protection that operates independently of patent rights. In the United States, the Biologics Price Competition and Innovation Act (BPCIA) of 2009 grants original biologic products a 12-year period of data exclusivity from the date of first licensure . During this time, the FDA is legally prevented from approving any biosimilar application that relies on the original manufacturer’s safety and efficacy data . Furthermore, there’s a 4-year period within this 12-year window during which biosimilar manufacturers are prohibited from even submitting an application that references the original data. This period can be extended by an additional 6 months if pediatric studies are conducted.

Across the Atlantic, the European Union employs an “8+2+1” approach to exclusivity for biologics. This framework provides an initial 8-year data exclusivity period, during which generic or biosimilar manufacturers cannot reference the original product’s data in their applications . This is followed by an additional 2-year period of market exclusivity, meaning that even if a biosimilar is approved, it cannot be marketed until this period concludes. An extra year of market exclusivity can be granted if the original product gains approval for new therapeutic indications that offer significant clinical benefit over existing therapies.

Data exclusivity periods provide an absolute, albeit time-limited, barrier to biosimilar entry, independent of patent strength. This means that even if a biosimilar successfully navigates the patent landscape, it cannot enter the market until these regulatory exclusivity periods expire. This dual layer of protection significantly impacts market entry timelines and necessitates careful strategic planning for biosimilar developers. Patents protect inventions—the molecule, the process, the formulation. Data exclusivity, conversely, protects the clinical trial data that an innovator company generates to prove a drug’s safety and efficacy to regulatory authorities. This distinction is crucial because even if a patent is found to be weak or invalid, the data exclusivity period remains in force, providing an unassailable barrier for a set duration. Therefore, biosimilar companies must meticulously track both patent expiration dates and data exclusivity periods. The longer data exclusivity period in the US (12 years) compared to the EU’s “8+2+1” model (up to 11 years) creates different market entry dynamics and investment calculations across regions, directly influencing global biosimilar development strategies.

Originator Strategies to Maintain Exclusivity

As biosimilars emerge as a significant competitive force, originator biologic manufacturers employ sophisticated strategies to extend their market exclusivity, often leveraging the complexities of intellectual property law.

Patent Thickets

Among the most formidable intentional barriers to biosimilar entry, particularly in the United States, are “patent thickets”. This term describes a strategic maneuver by reference biologic manufacturers to create a dense web of overlapping, often weaker, follow-on patents around their original product . The primary purpose of these thickets is to deter competitors from entering the market, effectively extending the duration of their monopolies. These secondary patents are frequently filed long after the initial biologic has been launched, covering various aspects such as new formulations, additional indications, specific dosages, alternative routes of administration, or other incidental features. Crucially, each of these secondary patents can provide up to 20 years of protection from its filing date, creating a multi-layered and protracted barrier to competition.

The impact of patent thickets is profound. They lead to costly and inefficient monopolies, hindering patient access to more affordable treatments and even creating a barrier to domestic biosimilar manufacturing and associated employment opportunities. Former FDA Commissioner Scott Gottlieb explicitly described patent thickets around reference biologics as “purely designed to deter the entry of approved biosimilars”. A prime example of this strategy is AbbVie’s Humira, for which the company secured over 250 patents, effectively delaying biosimilar entry in the US until 2023, despite its initial launch in 2002. Similarly, Merck sought 129 patents for its cancer drug Keytruda, including claims on seemingly trivial changes like sterile packaging.

Patent thickets are not merely defensive; they are an aggressive, proactive strategy designed to exploit the patent system’s breadth to create an almost impenetrable legal fortress around blockbuster biologics. This tactic significantly distorts market competition, delaying the entry of affordable biosimilars and imposing substantial costs on healthcare systems and patients. Originator companies face immense revenue loss as their primary patents expire. To mitigate this, they strategically file numerous secondary patents on minor modifications or ancillary aspects of the drug. Each new patent, even if weak or incremental, can trigger a new 20-year protection period from its filing date. This creates a dense, multi-layered “thicket” that biosimilar developers must individually challenge, incurring significant legal costs and delays. The sheer volume and staggered filing of these patents make it economically prohibitive for many biosimilar companies to clear the path, thereby extending the originator’s monopoly far beyond the original innovation’s patent life. This directly impacts patient access and healthcare costs.

Evergreening

Closely related to patent thickets is the strategy known as “evergreening.” This practice involves pharmaceutical manufacturers obtaining additional patents to impede competition from biosimilars and generics . Evergreening often focuses on minor modifications to the original drug, such as changes in dosing frequency, the introduction of combination therapies, or alterations in formulation, which may offer user benefits but typically provide no significant new clinical advantages. It can also extend to patenting aspects seemingly unrelated to the original drug’s core therapeutic effect, such as manufacturing characteristics. The overarching goal of evergreening is to maximize a drug’s revenues after its original patent expires, allowing the originator to maintain high prices and/or a substantial market share through the evergreened product.

Evidence suggests the widespread use of this strategy: 78% of new patents for top-selling drugs are filed post-approval, primarily serving to protect existing drugs rather than fostering novel therapies. For instance, Merck reportedly spent years patenting Keytruda’s subcutaneous injection method, a move that could extend its market exclusivity, rather than directing those resources towards developing entirely new drugs .

The consequences of evergreening are far-reaching. It delays the entry of generic and biosimilar alternatives, leading to increased litigation and potentially stifling genuine innovation by redirecting R&D focus from breakthrough discoveries to the lifecycle management of existing drugs. Critics argue that evergreening can result in “unjust enrichment” by extending monopoly rights without commensurate public value, effectively allowing companies to profit from minor tweaks rather than significant scientific advancements.

Evergreening represents a critical tension between incentivizing innovation and ensuring public access to affordable medicines. While proponents argue that such practices represent legitimate incremental innovation deserving of protection, critics contend that it is a legal loophole exploited to extend monopolies, raising ethical questions about resource allocation in pharmaceutical R&D and its impact on global health equity. The patent system is fundamentally designed to reward genuine innovation. However, evergreening pushes the boundaries of what constitutes “innovation” by allowing companies to secure patents on minor, non-clinically significant changes or even on aspects of the manufacturing process that do not represent a new therapeutic breakthrough. This practice enables originators to “evergreen” their revenue streams, effectively extending their monopolies. The economic incentive shifts from developing truly novel therapies to legally defending existing ones, potentially diverting valuable R&D resources away from addressing unmet medical needs. This practice, while often legal, raises significant concerns about the balance between intellectual property rights and public health interests, particularly regarding drug affordability and access.

Biosimilar Strategies for Market Entry and Competition

Despite the formidable barriers erected by originator companies, biosimilar developers are employing sophisticated strategies to penetrate the market, leveraging regulatory pathways, legal challenges, and innovative approaches to manufacturing and commercialization.

Navigating Regulatory Pathways (FDA & EMA)

The journey to market for biosimilars is fundamentally shaped by the regulatory frameworks established by leading agencies like the FDA in the US and the EMA in Europe. These pathways are designed to ensure the safety, purity, and potency of biosimilars while streamlining the approval process compared to novel biologics.

In the United States, the Biologics Price Competition and Innovation Act (BPCIA) of 2009 created an abbreviated regulatory pathway for biosimilars . This landmark legislation allows biosimilar manufacturers to demonstrate “biosimilarity” to a reference product, rather than undertaking entirely new, comprehensive clinical trials. The standard is rigorous: a biosimilar must be “highly similar” to the reference product, with “no clinically meaningful differences” in terms of safety, purity, and potency . While analytical and at least one human pharmacokinetic (PK) and/or pharmacodynamic (PD) study are typically required, the FDA retains flexibility. Comparative clinical efficacy and safety studies may not always be necessary if robust analytical data sufficiently demonstrate biosimilarity. Immunogenicity assessment, however, remains a critical factor. A further designation under the BPCIA is “interchangeability,” which requires the biosimilar to produce the “same clinical result” as the reference product in any given patient and permits pharmacy-level substitution without prescriber intervention, much like small-molecule generics . The first biosimilar to achieve this interchangeable status is granted one year of market exclusivity.

In Europe, the EMA has been a pioneer, approving the first biosimilar in 2006. The EMA is responsible for evaluating the majority of biosimilar applications within the EU. Biosimilar marketing authorization applications in Europe benefit from reduced data requirements but necessitate comprehensive comparability studies with the reference medicine. Significantly, the EMA has proposed streamlined pathways that could potentially waive comparative efficacy studies (CES) for biosimilars where the mechanism of action is well-understood and robust analytical similarity has been demonstrated. In such cases, reliance on comparative pharmacokinetic (PK) trials may suffice. This progressive approach is anticipated to reduce clinical development burdens and accelerate time to market for biosimilar companies. Furthermore, EU-approved biosimilars are considered scientifically interchangeable, a position reinforced by the EMA and HMA.

The evolution of biosimilar regulatory pathways, particularly the EMA’s move towards waiving certain clinical studies, signifies a growing global confidence in the scientific rigor of biosimilar development. This regulatory tailoring directly impacts development costs and timelines, making biosimilar ventures more economically viable and accelerating patient access to affordable treatments. Initial biosimilar approval pathways were, by necessity, cautious. They required extensive clinical data to build confidence in these new product categories, given their complexity and the novelty of the regulatory approach. However, as scientific understanding of biologics and advanced analytical techniques progressed, and as substantial real-world data accumulated (for example, 1 million patient-treatment years of safety data for EU biosimilars), regulatory bodies gained increased confidence. This growing confidence allows for a more risk-based, tailored approach to data requirements, such as waiving confirmatory clinical efficacy studies in instances where analytical and functional data are sufficiently robust. This streamlining directly reduces the cost and time associated with biosimilar development, making these projects more attractive for investment and ultimately benefiting patients through earlier access to more affordable medicines.

Freedom-to-Operate (FTO) Analysis

In the high-stakes environment of biosimilar development, a rigorous Freedom-to-Operate (FTO) analysis is not merely a legal formality but a strategic cornerstone. This critical assessment identifies potential patent barriers that could impede a biosimilar’s commercialization and helps mitigate the risk of costly infringement lawsuits. A comprehensive FTO involves meticulously scrutinizing existing patents related to the drug compound, its formulations, manufacturing methods, and therapeutic uses. It is imperative to conduct this analysis early in the development lifecycle, ideally as soon as the active pharmaceutical ingredient (API), target therapeutic indication, intended dose, and formulation are defined. Overlooking a single patent can lead to protracted and expensive litigation or significant delays in market launch.

DrugPatentWatch stands out as a vital tool for conducting robust FTO analysis and competitive intelligence in the biopharmaceutical sector. This platform offers a comprehensive, integrated database of drug patents, covering both US and international jurisdictions . It provides crucial data on patent expiration dates, ongoing litigation, tentative approvals, and detailed patent family information . For biosimilar developers, DrugPatentWatch enables users to track competitor patent portfolios, identify generic entry opportunities, and monitor biosimilar and 505(b)(2) activity through automated reports and custom dashboards . This deep intelligence allows companies to anticipate competitive moves, identify emerging threats, and develop responsive strategies that capitalize on market opportunities. For example, the platform provides insights into confidential royalty and settlement terms, which are invaluable for strategic planning . It also offers granular details on API manufacturers and finished product suppliers, essential for supply chain planning . The ability to search by pharmacology, drug patent expiration, application name, trade name, and biologics license application further enhances its utility for strategic decision-making.

A compelling real-world example of strategic FTO in action is Pfizer’s approach with its cancer drug Xalkori. When faced with Shire’s ROS1 inhibitor patents, Pfizer’s FTO team meticulously mapped all of Shire’s claims related to kinase selectivity ratios. This deep dive led to the discovery of a polymorphic form of Xalkori with 30% higher bioavailability. By filing a new patent on this distinct crystalline structure, Pfizer successfully circumvented Shire’s composition claims, ultimately leading to an impressive $2.1 billion in incremental sales from the new indication. This case exemplifies how a robust FTO analysis can transform potential legal liabilities into significant commercial victories.

A robust FTO analysis is not merely a compliance exercise but a strategic imperative that transforms potential legal liabilities into competitive advantages. By proactively identifying and navigating patent landscapes, biosimilar companies can mitigate litigation risks, optimize development pathways, and strategically time market entry, ultimately safeguarding their substantial investments. The dense patent thickets surrounding biologics make patent infringement a high risk for biosimilar developers. A comprehensive FTO analysis, conducted early and continuously, allows companies to map the IP landscape, identify potential blocking patents, and assess their strength. This proactive intelligence enables informed decisions: whether to design around a patent, challenge its validity, or seek a license. Tools like DrugPatentWatch facilitate this by providing granular data on patent expirations, litigation, and competitor strategies. This strategic foresight helps avoid costly late-stage surprises and enables a more efficient allocation of R&D and legal resources, turning potential roadblocks into opportunities for market differentiation or early entry.

Patent Litigation and the “Patent Dance” (BPCIA)

The landscape of biosimilar patent litigation in the United States is primarily governed by the Biologics Price Competition and Innovation Act (BPCIA) of 2009. A unique feature of this framework is a pre-litigation process colloquially known as the “patent dance”. This structured information exchange aims to facilitate the early identification of relevant patents and streamline potential disputes between the biosimilar applicant and the reference product sponsor (RPS). The “patent dance” is typically triggered when the biosimilar firm submits its Biologics License Application (BLA) to the FDA.

The “patent dance” involves several key steps:

- Information Exchange: Within 20 days of the FDA accepting its abbreviated BLA (aBLA) for review, the biosimilar applicant is statutorily required to provide the RPS with a confidential copy of its full aBLA and other manufacturing information.

- Patent List Exchange: The RPS then has 60 days to provide the biosimilar applicant with a list of patents it reasonably believes could be infringed, indicating willingness to license any of them.

- Response to Claims: Within another 60 days, the biosimilar applicant must provide a detailed, claim-by-claim statement outlining the factual and legal bases for any assertions of invalidity, unenforceability, or non-infringement, or whether it would accept a license.

- Negotiation and First Wave Litigation: After the RPS responds, the parties engage in a 15-day good-faith negotiation period to agree on a list of patents for immediate litigation (the “first wave”). If no agreement is reached, both parties exchange lists for court action.

- Second Wave Litigation: A “second wave” of litigation can be triggered by the biosimilar’s 180-day notice of commercial marketing, which can be provided before or after FDA approval. During this phase, the RPS can assert any remaining patents not included in the first wave and may seek a preliminary injunction to prevent the biosimilar from launching.

Despite its structured nature, the “patent dance” presents significant challenges for biosimilar developers. Unlike generic drug manufacturers, who can often initiate patent litigation much earlier due to shorter development times, biosimilar manufacturers can only begin this process after completing extensive and costly Phase 3 clinical trials, which typically take around 4.6 years. This timing often means that litigation concerning secondary patents occurs after the primary patent has already expired. Furthermore, the judicial “ripeness” doctrine can prevent earlier initiation of litigation, as courts may deem a dispute premature if the biosimilar product or its approval is not yet certain. Launching a biosimilar “at risk”—marketing it while patent litigation is ongoing—carries immense financial hazards, as an adverse infringement finding could lead to damages totaling hundreds of millions of dollars, potentially far exceeding anticipated earnings.

A landmark Supreme Court ruling in Sandoz v. Amgen (2017) significantly impacted the “patent dance” . The Court held that the patent dance is not mandatory; a biosimilar applicant can choose to opt out . However, this decision shifts control over the timing and scope of litigation to the RPS, who can then immediately seek a declaratory judgment for infringement . The Court also clarified that the 180-day notice of commercial marketing can be provided either before or after FDA approval .

In practice, most BPCIA litigations (approximately 67% of terminated cases) end in settlements or stipulated voluntary dismissals rather than full judicial resolution. These settlements often involve delayed launch dates for biosimilars, a pragmatic approach to mitigate the risks and costs of protracted litigation. For example, AbbVie reached numerous settlements with biosimilar developers for Humira, allowing staggered market entry in 2023 in the US, well after the initial patent expiration.

The “patent dance” is a high-stakes legal chess match, where strategic decisions regarding participation, information disclosure, and litigation timing can significantly influence market entry and profitability. The prevalence of settlements, often involving delayed launches and royalty payments, underscores a pragmatic industry approach to mitigate protracted, costly litigation, balancing immediate market access against long-term legal certainty. The BPCIA aims to provide a structured framework for resolving patent disputes efficiently. However, the non-mandatory nature of the “patent dance” and the timing constraints (biosimilars can only initiate litigation after lengthy and costly Phase 3 trials) create strategic leverage points for both originators and biosimilar developers. Originators can use the threat of litigation and the complexity of patent thickets to extract favorable settlement terms, such as delayed market entry. Biosimilar companies, facing the high cost and uncertainty of full litigation or “at-risk” launches, often find settlement a more predictable and financially viable path. This leads to a landscape where market entry is frequently negotiated rather than purely litigated, highlighting the importance of legal strategy and business acumen in addition to scientific development.

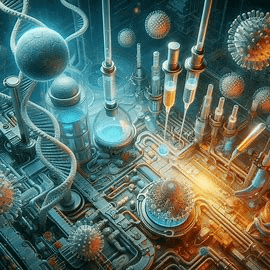

Innovation in Manufacturing and Formulation

Beyond merely demonstrating “biosimilarity” to a reference product, leading biosimilar manufacturers are strategically investing in innovation across their manufacturing processes and product formulations. This proactive approach not only enhances their competitiveness but also provides opportunities to create new intellectual property (IP) and potentially circumvent existing originator patents.

Innovation in manufacturing processes is crucial due to the inherent complexity and variability of biologics. Biosimilar manufacturers must independently develop specialized cell lines and optimized production protocols to consistently produce biologically comparable products. This involves navigating challenges such as differences in expression systems (e.g., CHO vs. HEK293 cells), precise control over cell culture conditions (e.g., pH, oxygen, nutrients), and refined bioprocessing variables like purification methods or buffer composition to achieve consistent post-translational modification (PTM) profiles.2 Patents can be secured for these novel purification methods or other process improvements, providing a defensive moat and a competitive edge.1

Similarly, advancements in formulation strategies are a key area of innovation. Biosimilar companies are developing enhanced formulations to improve product stability, patient comfort, and tolerability.1 This includes exploring buffer-free systems, high-concentration formulations, and novel excipients (e.g., stabilizers like trehalose, specific amino acid combinations) that minimize physical and chemical degradation.1 For example, patents exist for liquid pharmaceutical compositions of adalimumab that incorporate histidine buffering agents and sugar stabilizers to enhance stability . Such formulation innovations can differentiate a biosimilar from its reference product and other biosimilars in the market.

Furthermore, the development of improved delivery devices, such as pre-filled syringes or autoinjectors, represents another avenue for patentable innovation.5 These devices enhance patient convenience and compliance, adding significant value beyond the drug substance itself.

Beyond merely replicating the reference product, biosimilar companies are strategically investing in novel manufacturing processes and enhanced formulations. This not only allows for cost efficiencies and improved patient experience but also creates new intellectual property, providing a defensive moat against originator claims and a basis for competitive differentiation in a crowded market. Biosimilars cannot be identical to originators due to inherent biological variability and differences in manufacturing processes. This inherent scientific reality creates opportunities for innovation in aspects other than the precise molecular structure of the active ingredient itself, such as how the biologic is produced or formulated. By developing unique, patentable manufacturing processes (e.g., optimized cell lines, novel purification methods) or improved formulations (e.g., better stability, higher concentration, novel excipients, user-friendly delivery devices), biosimilar companies can achieve significant cost advantages, enhance their product profiles, and create their own intellectual property. This newly generated IP can serve as a defensive shield against originator patent claims (for example, by demonstrating that their process or formulation does not infringe) and as a competitive advantage for market differentiation, allowing them to move beyond a simple “copycat” status to offer added value to patients and healthcare systems.

Impact and Future Outlook of the Biosimilar Market

The biosimilar market is not just growing; it is fundamentally reshaping the pharmaceutical landscape, with profound implications for healthcare costs, patient access, and the strategic calculus of both innovator and biosimilar companies.

Economic Impact and Cost Savings

The introduction of biosimilars has a demonstrably positive economic impact, leading to significant reductions in healthcare costs by providing more affordable alternatives to expensive biologic medications . Studies have estimated substantial cost savings: for instance, the introduction of biosimilars for rheumatoid arthritis could lead to savings of up to 30%, and for cancer treatment, up to 25%.

The cumulative savings generated by biosimilars are impressive. In 2022, generic and biosimilar drugs combined generated a record $408 billion in savings for the US healthcare system, a notable increase from $373 billion in 2021. Focusing solely on biosimilars, they generated $12.4 billion in savings in 2023, bringing the total savings since their introduction in 2015 to $36 billion. This economic benefit is driven by competitive pricing: the average sales price (ASP) for biosimilars is typically 50% less than the reference brand biologic price at the time of launch . Moreover, the very presence of biosimilar competition has a ripple effect, reducing the ASP of their corresponding reference biologics by an average of 25% .

This competitive pressure translates directly into significant revenue loss for originator biologic manufacturers. IQVIA, a leading healthcare data science company, projected that the market introductions of new biosimilars and generics would increase projected losses for originator products from $111 billion to a staggering $192 billion by the end of 2028 . Of this, $59 billion is attributed specifically to biologics . Major blockbuster drugs such as Humira, lisdexamfetamine (Vyvanse), rivaroxaban (Xarelto), and ustekinumab (Stelara) are notable contributors to this projected impact, with biosimilar competition for Stelara expected to begin in 2025 .

“Biosimilar launches achieve a 53% market share and a 53% reduction in average drug costs after 5 years of biosimilar competition.”

— Samsung Bioepis’ First Quarter (Q1) 2025 Biosimilar Market Report

The economic impact of biosimilars extends far beyond simple price reduction; it fundamentally alters market dynamics, driving down costs for both biosimilars and their reference products, and creating substantial savings that can be reinvested into healthcare systems. This competitive pressure forces originators to adapt their strategies, leading to a more dynamic and cost-efficient market overall. Biosimilars enter the market at a significant discount compared to their reference products. This direct competition creates immediate downward pressure on prices, forcing originator companies to lower their own prices to retain market share. This dynamic, often described as a “race to the bottom” or at least a significant price erosion across the entire drug class, generates billions in savings for payers and patients. These savings, in turn, can be reallocated to fund new, innovative therapies, expand access to existing treatments, or improve other areas of patient care. This mechanism demonstrates that biosimilars are not merely about “copying” existing drugs but about stimulating a broader economic shift towards affordability and sustainability within the pharmaceutical sector.

Impact on Patient Access and Affordability

Perhaps the most compelling argument for biosimilars lies in their ability to dramatically improve patient access to critical biologic therapies by making them more affordable . The statistics are telling: since 2015, biosimilars have enabled an astounding 495 million more days of patient therapy that would simply not have occurred without the increased access provided by biosimilar competition. This expanded access is particularly vital for patients suffering from chronic conditions like cancer, autoimmune diseases, and diabetes, where long-term treatment costs can be prohibitively high .

However, despite these clear benefits, the uptake of biosimilars has, in some areas, been slower than initially anticipated. Several factors contribute to this inertia. Patient education gaps and a lack of awareness among healthcare professionals can lead to hesitancy and a reluctance to switch from an originator biologic to a biosimilar, even when scientific evidence supports interchangeability . Financial hurdles, such as rebate incentives offered by originator companies to pharmacy benefit managers (PBMs), can inadvertently favor the continued use of higher-priced brand-name drugs . Additionally, the “nocebo effect”—where negative patient expectations about a biosimilar can lead to perceived adverse outcomes—can be a concern when transitioning patients .

The “interchangeability” designation is a crucial regulatory tool designed to overcome some of these barriers. This designation, unique to the US, allows pharmacists to substitute an interchangeable biosimilar for its reference biologic at the pharmacy level without consulting the prescriber, much like generic small-molecule drugs . This streamlined substitution process is vital for increasing biosimilar uptake. Recognizing its importance, the FDA recently issued draft guidance proposing the removal of the requirement for additional switching studies to demonstrate biosimilar interchangeability . If finalized, this change could significantly reduce development costs and accelerate the market entry of interchangeable biosimilars, thereby further improving patient access and affordability.

While biosimilars offer a clear pathway to enhanced patient access and affordability, their full potential is often constrained by a complex interplay of market dynamics, educational deficits, and entrenched stakeholder behaviors. Overcoming these adoption barriers requires multi-faceted strategies, including regulatory streamlining (e.g., interchangeability guidance), robust patient and provider education, and addressing financial incentives that disfavor biosimilar uptake. The promise of biosimilars is undeniably lower cost and wider access to critical therapies. However, simply having an approved biosimilar on the market does not automatically guarantee widespread adoption. Factors such as a lack of awareness among healthcare professionals and patients, perceived (though not clinically meaningful) differences between biosimilars and originators, and existing financial incentives within the healthcare system (for instance, the complex rebate structures offered by originators to PBMs) can create significant inertia. The interchangeability designation is a key regulatory tool designed to directly address this, as it allows pharmacists to substitute biosimilars more readily, removing a layer of friction. Therefore, concerted efforts to streamline this designation and to educate all stakeholders—from prescribers to patients and payers—are crucial to translate the scientific and economic benefits of biosimilars into real-world patient access and affordability.

Future Trends in Biosimilar Development

The biosimilar market is not a static entity; it is a rapidly evolving landscape characterized by dynamic growth, technological innovation, and continuous regulatory adaptation.

Market Expansion: The global biosimilar market is projected to continue its robust growth, with forecasts indicating a valuation of $72.29 billion by 2035, at a CAGR of 7.5% . A significant driver of this expansion will be the increasing number of monoclonal antibodies (mAbs) facing patent expirations in the coming decade . Key therapeutic areas poised for substantial biosimilar penetration include oncology, autoimmune diseases, and other chronic conditions, where high-cost biologics currently dominate treatment paradigms . The United States is projected to experience the highest Compound Annual Growth Rate (CAGR) in the global biosimilars market between 2025 and 2035. This rapid growth is largely driven by the expiration of patents on several blockbuster biologics, such as Keytruda (pembrolizumab), Stelara (ustekinumab), and Eylea (aflibercept), all of which represent multi-billion-dollar opportunities .

Technological Advancements: The future of biosimilar development is increasingly intertwined with cutting-edge technologies, particularly Artificial Intelligence (AI) and Machine Learning (ML). These technologies are being leveraged to significantly improve the efficiency and accuracy of the development process, thereby reducing both time and cost . AI can process vast datasets to identify potential biosimilar candidates, optimize formulation and dosage forms by predicting physicochemical properties and stability, and streamline clinical trials through improved patient selection and stratification. In manufacturing, AI and ML algorithms are being applied to cell line development, fault detection, and quality prediction, enabling real-time adjustments and proactive anomaly detection to ensure consistent product quality. AI can also aggregate and correlate disparate datasets to provide a holistic “similarity score,” offering robust evidence to support regulatory submissions.

Regulatory Evolution: Regulatory frameworks globally are continuously evolving, reflecting scientific advancements and accumulated clinical experience. There is a discernible trend towards increased reliance on robust analytical data and a strategic exploration of alternatives to extensive human clinical studies. The pursuit of global regulatory harmonization is a critical objective, aiming to reduce development costs, streamline approvals, and enhance patient access worldwide . However, significant challenges persist, including differing national requirements regarding local reference product sourcing, the necessity for comparative animal toxicology studies in some regions, variations in clinical study designs, and requirements for local ethnic population data . Overcoming these disparities will require sustained international collaboration and a commitment to unified standards.

Impact of the Inflation Reduction Act (IRA): In the United States, the Inflation Reduction Act (IRA), passed in 2022, introduces drug price-setting provisions that have sparked debate regarding their potential impact on biosimilar competition and investment incentives . While well-intended to lower drug costs, concerns have been raised that the timelines outlined in the law may not provide sufficient opportunity for biosimilars to enter the market before price negotiations for reference products begin . This uncertainty about future profitability could potentially discourage investment in future biosimilar development . Conversely, some initial data suggest a modest boost to oncology biosimilar uptake through Medicare reimbursement, though its overall impact remains limited by pre-existing competitive market conditions .

The future of the biosimilar market is characterized by rapid technological advancement, particularly in AI/ML, and an ongoing push for global regulatory convergence. These forces, coupled with evolving legislative landscapes like the IRA, demand continuous strategic adaptation from all stakeholders to capitalize on emerging opportunities while navigating new complexities and potential disincentives. The increasing number of patent expirations creates a massive market opportunity, particularly in high-value therapeutic areas like oncology and immunology. Simultaneously, technological advancements, especially in AI and ML, are poised to revolutionize the development process, making it faster and more cost-effective. However, regulatory frameworks, while evolving towards efficiency and harmonization, still present hurdles. Furthermore, new legislation, such as the IRA, introduces unforeseen complexities that can impact investment incentives. Companies must continuously monitor these interwoven trends—market opportunities, technological capabilities, regulatory shifts, and policy changes—to formulate agile and effective patent and commercial strategies.

Key Takeaways

- Economic Imperative: Biosimilars are not merely a cost-saving measure but a fundamental shift towards healthcare sustainability. The high cost of originator biologics creates an undeniable demand for affordable alternatives, driving significant market growth and generating billions in savings that can be reinvested into healthcare systems.

- Nuanced Identity: Biosimilars are “highly similar, not identical” to their reference products. This distinction, rooted in biological complexity, necessitates a rigorous, tailored regulatory pathway that differs significantly from small-molecule generics, impacting development costs and market entry strategies.

- IP as a Double-Edged Sword: While patents are crucial for incentivizing innovation, originator strategies like patent thickets and evergreening can be leveraged to extend monopolies, distorting market competition and delaying patient access to affordable treatments.

- Strategic Navigation: Biosimilar developers must employ multi-faceted strategies, including meticulous Freedom-to-Operate (FTO) analyses (supported by tools like DrugPatentWatch) to navigate complex patent landscapes, strategic engagement in the BPCIA “patent dance” (often leading to settlements), and continuous innovation in manufacturing processes and formulations to create new IP and differentiate products.

- Patient Access is Paramount: Despite the clear benefits of affordability and expanded treatment options, biosimilar uptake faces challenges from patient and provider education gaps, and financial incentives that can favor originator products. Regulatory streamlining, particularly for interchangeability, is crucial to unlock the full potential of biosimilars for patient access.

- Dynamic Future: The biosimilar market is characterized by rapid technological advancements (especially AI/ML), ongoing efforts towards global regulatory harmonization, and evolving legislative landscapes. Success in this environment demands continuous strategic adaptation, foresight, and a proactive approach to both scientific development and intellectual property management.

FAQ Section

1. How do biosimilars contribute to healthcare cost savings, and what is the scale of this impact?

Biosimilars significantly reduce healthcare costs by introducing competition to the market for expensive biologic medications. They are typically launched at a lower price point than their reference products, and their presence often compels originator companies to reduce their prices to retain market share. This competitive dynamic generates substantial savings for patients, payers, and healthcare systems. For example, biosimilars alone generated $12.4 billion in savings in 2023, contributing to a total of $36 billion in savings since their introduction in 2015. The average sales price for biosimilars is often 50% less than the reference brand biologic price at launch, and competition can reduce the price of the originator by an average of 25% .

2. What are the primary differences in regulatory approval pathways for biosimilars in the US and Europe, and how do these affect market entry?

In the US, the Biologics Price Competition and Innovation Act (BPCIA) provides a 12-year data exclusivity period for originator biologics, meaning no biosimilar can be approved during this time . Biosimilars must demonstrate “high similarity” with “no clinically meaningful differences” in safety, purity, and potency, often requiring analytical and PK/PD studies, and sometimes comparative clinical trials . The “interchangeability” designation, allowing pharmacy-level substitution, requires additional studies, though recent FDA guidance may waive switching studies . In Europe, the EMA employs an “8+2+1” exclusivity model (8 years data exclusivity, 2 years market exclusivity, plus 1 optional year). The EMA also evaluates biosimilars based on comprehensive comparability, and increasingly, proposes waiving comparative efficacy studies if analytical data is robust, potentially accelerating market entry. These differences in exclusivity periods and data requirements influence development timelines and market entry strategies for biosimilar companies across regions.

3. How do originator companies use patent thickets and evergreening to delay biosimilar market entry, and what are the implications?

Originator companies employ patent thickets by filing numerous overlapping secondary patents on formulations, manufacturing processes, indications, or delivery devices, often long after the primary patent . Each new patent can provide up to 20 years of protection, creating a dense legal barrier that biosimilar developers must navigate, often through costly and protracted litigation. Evergreening involves patenting minor modifications to existing drugs that offer no significant clinical advantage, solely to extend market exclusivity . These strategies delay biosimilar entry, maintain high drug prices, and can divert R&D resources from novel drug discovery to defending existing products, ultimately impacting patient access and healthcare costs .

4. What is the “patent dance” under the BPCIA, and how has the Supreme Court’s ruling in Sandoz v. Amgen affected it?

The “patent dance” is a pre-litigation information exchange framework under the BPCIA, designed to resolve patent disputes between biosimilar applicants and reference product sponsors (RPS) before market entry. It involves a structured exchange of confidential manufacturing information, patent lists, and infringement/invalidity contentions, leading to negotiations and potentially two waves of litigation. The Supreme Court’s ruling in Sandoz v. Amgen declared that the “patent dance” is not mandatory . While biosimilar applicants can opt out, this decision shifts control over the timing and scope of litigation to the RPS, who can then immediately seek a declaratory judgment for infringement . This has led to a prevalence of settlements, often involving delayed market entry for biosimilars, as a way to mitigate litigation risks.

5. How are technological advancements, particularly AI and Machine Learning, shaping the future of biosimilar development?

AI and Machine Learning (ML) are increasingly revolutionizing biosimilar development by improving efficiency and accuracy, thereby reducing development time and cost . These technologies can be used to:

- Optimize Formulation: Predict physicochemical properties, stability, and bioavailability to design better drug delivery systems.

- Streamline Clinical Trials: Enhance patient selection and stratification, accelerating trial timelines and reducing attrition rates.

- Improve Manufacturing: Accelerate cell line development, detect faults in production, and predict product quality, leading to more consistent and cost-effective manufacturing.

- Support Regulatory Submissions: Aggregate and correlate diverse datasets to generate holistic “similarity scores,” providing robust evidence for regulatory approval.These advancements are making the development of complex biosimilars more feasible and efficient, contributing to market growth and increased patient access.

References

- European Medicines Agency. (n.d.). Biosimilar medicines overview. Retrieved from https://www.ema.europa.eu/en/human-regulatory-overview/biosimilar-medicines-overview

- U.S. Food and Drug Administration. (2017). What is a biosimilar?. Retrieved from https://www.fda.gov/media/108905/download

- Government of Newfoundland and Labrador. (n.d.). Frequently Asked Questions – Health Professionals. Retrieved from https://www.gov.nl.ca/hcs/files/Frequently-Asked-Questions-Health-Professionals.pdf

- Therapeutics Letter. (2023). Therapeutics Letter 123 examines biologics and biosimilars. Retrieved from https://www.ncbi.nlm.nih.gov/books/NBK598450/

- MedPak. (n.d.). Biosimilar vs. Generic Drugs. Retrieved from https://medpak.com/biosimilar-vs-generic-drugs/

- GoodRx. (n.d.). Biosimilar vs. Generic Drugs. Retrieved from https://www.goodrx.com/drugs/biologics/biosimilar-vs-generic

- Stevenson, J. G., & Goodman, P. (2013). FDA Biosimilar Approval Pathway. Pharmacotherapy: The Journal of Human Pharmacology and Drug Therapy, 33(10), 1086-1092. Retrieved from https://pmc.ncbi.nlm.nih.gov/articles/PMC3737980/

- Sarpatwari, A., & Kesselheim, A. S. (2013). The Biologics Price Competition and Innovation Act: A Path Forward for Biosimilars. Journal of Law, Medicine & Ethics, 41(4), 868-877. Retrieved from https://pmc.ncbi.nlm.nih.gov/articles/PMC3827854/

- Bioslice Blog. (2025). The European Medicines Agency proposes streamlined pathway for the approval of biosimilar medicinal products in the EU. Retrieved from https://www.biosliceblog.com/2025/06/the-european-medicines-agency-proposes-streamlined-pathway-for-the-approval-of-biosimilar-medicinal-products-in-the-eu/

- European Medicines Agency. (n.d.). Biosimilar medicines: marketing authorisation. Retrieved from https://www.ema.europa.eu/en/human-regulatory-overview/marketing-authorisation/biosimilar-medicines-marketing-authorisation

- Krishtel, L. (2019). Patent Thickets and Drug Pricing. Retrieved from https://www.allhealthpolicy.org/wp-content/uploads/2019/05/Krishtel.Slides-AHP-DrugPatentWebinar-051619.pdf

- PatSnap Synapse. (n.d.). What are the types of pharmaceutical patents?. Retrieved from https://synapse.patsnap.com/blog/what-are-the-types-of-pharmaceutical-patents

- MGA. (2021). Patent Thickets: A Barrier to Biosimilars. Retrieved from https://getmga.com/wp-content/uploads/2022/04/PatentThickets_May2021_FINAL.pdf

- DrugPatentWatch. (n.d.). The Dark Reality of Drug Patent Thickets: Innovation or Exploitation?. Retrieved from https://www.drugpatentwatch.com/blog/the-dark-reality-of-drug-patent-thickets-innovation-or-exploitation/

- SIRM. (2024). Evergreening: Policy Options. Retrieved from https://www.sirm.nl/docs/Publicaties/Evergreening-policy-options-ZiN-English-report.pdf?v=1713291509

- IJLSSS. (n.d.). Patent Evergreening in the Pharmaceutical Industry: Legal Loophole or Strategic Innovation?. Retrieved from https://ijlsss.com/patent-evergreening-in-the-pharmaceutical-industry-legal-loophole-or-strategic-innovation/

- PatSnap Synapse. (2025). How Long Is Data Exclusivity for Biologics in the US and EU?. Retrieved from https://synapse.patsnap.com/article/how-long-is-data-exclusivity-for-biologics-in-the-us-and-eu

- Duke University. (n.d.). Data Exclusivity for Biologics in the US. Retrieved from https://fds.duke.edu/db/attachment/1592

- European Medicines Agency. (n.d.). Data exclusivity. Retrieved from https://www.ema.europa.eu/en/glossary-terms/data-exclusivity

- DrugPatentWatch. (n.d.). Conducting a Biopharmaceutical Freedom-to-Operate (FTO) Analysis: Key Considerations for Generic Drug Stability Testing. Retrieved from https://www.drugpatentwatch.com/blog/conducting-a-biopharmaceutical-freedom-to-operate-fto-analysis-key-considerations-for-generic-drug-stability-testing/

- DrugPatentWatch. (n.d.). Conducting a Biopharmaceutical Freedom-to-Operate (FTO) Analysis: Strategies for Efficient and Robust Results. Retrieved from https://www.drugpatentwatch.com/blog/conducting-a-biopharmaceutical-freedom-to-operate-fto-analysis-strategies-for-efficient-and-robust-results/

- Big Molecule Watch. (n.d.). Biosimilar Litigations. Retrieved from https://biologicshq.com/spotlight-on-biosimilar-litigations/

- Park, M. J., et al. (2024). Accelerating biosimilar market access: the case for allowing earlier standing. Journal of Law and the Biosciences, 12(1), lsae030. Retrieved from https://pmc.ncbi.nlm.nih.gov/articles/PMC11697977/

- PatSnap Synapse. (n.d.). What role do IP rights play in biologics and biosimilars?. Retrieved from https://synapse.patsnap.com/article/what-role-do-ip-rights-play-in-biologics-and-biosimilars

- I-MAK. (2024). Biologics, Biosimilars, and Patents Guide. Retrieved from https://www.i-mak.org/wp-content/uploads/2024/05/Biologics-Biosimilars-Guide_IMAK.pdf

- Crozdesk. (n.d.). DrugPatentWatch. Retrieved from https://crozdesk.com/software/drugpatentwatch

- GeneOnline AI. (2025). DrugPatentWatch article highlights navigating patent landscape and agency communication as key to biosimilar approval. Retrieved from https://www.geneonline.com/drugpatentwatch-article-highlights-navigating-patent-landscape-and-agency-communication-as-key-to-biosimilar-approval/

- Zuniga-Pflucker, J. C., et al. (2025). Innovative Formulation Strategies for Biosimilars: Trends Focused on Buffer-Free Systems, Safety, Regulatory Alignment, and Intellectual Property Challenges. Pharmaceuticals, 18(6), 760. Retrieved from https://pmc.ncbi.nlm.nih.gov/articles/PMC12196224/

- Park, M. J., et al. (2025). Accelerating biosimilar market access: the case for allowing earlier standing. Journal of Law and the Biosciences, 12(1), lsae030. Retrieved from https://academic.oup.com/jlb/article/12/1/lsae030/7942247

- NBER. (n.d.). Strategic Patenting: Evidence from the Biopharmaceutical Industry. Retrieved from https://www.nber.org/papers/w34024

- Research Journal of Pharmacy and Technology. (n.d.). Formation of patent strategy at all stages of biosimilar development and Implementation. Retrieved from https://rjptonline.org/HTMLPaper.aspx?Journal=Research%20Journal%20of%20Pharmacy%20and%20Technology;PID=2018-11-7-65

- Academic Entrepreneurship for Medical and Health Scientists. (n.d.). Intellectual Property Protection for Biologics. Retrieved from https://academicentrepreneurship.pubpub.org/pub/d8ruzeq0

- Nelson, K. M. (2017). Pharmaceutical Patent Litigation and the Emerging Biosimilars: A Conversation with Kevin M. Nelson, JD. Journal of Managed Care & Specialty Pharmacy, 23(4), 450-456. Retrieved from https://pmc.ncbi.nlm.nih.gov/articles/PMC5394541/

- Winston & Strawn. (n.d.). What Is the Patent Dance?. Retrieved from https://www.winston.com/en/legal-glossary/patent-dance

- Number Analytics. (n.d.). Mastering BPCIA in Patent Litigation. Retrieved from https://www.numberanalytics.com/blog/mastering-bpcIA-patent-litigation

- Goodwin Law. (2025). Where were biologics-related patents involved in BPCIA litigation invented?. Retrieved from https://www.goodwinlaw.com/en/insights/blogs/2025/03/where-were-biologics-related-patents-involved-in-bpcia-litigation-invented

- Big Molecule Watch. (n.d.). BPCIA Litigations. Retrieved from https://www.bigmoleculewatch.com/bpcia-patent-litigations/

- SoftwareSuggest. (n.d.). DrugPatentWatch. Retrieved from https://www.softwaresuggest.com/drugpatentwatch

- DrugPatentWatch. (n.d.). Biosimilar Patent Dance: Leveraging PTAB Challenges for Strategic Advantage. Retrieved from https://www.drugpatentwatch.com/blog/biosimilar-patent-dance-leveraging-ptab-challenges-for-strategic-advantage/

- GreyB. (n.d.). Biologics Patents Expiring. Retrieved from https://www.greyb.com/blog/biologics-patents-expiring/

- FDA Purple Book. (n.d.). Patent List. Retrieved from https://purplebooksearch.fda.gov/patent-list

- Jenner & Block. (n.d.). The Biosimilar Regulatory Pathway and the Patent Dance. Retrieved from https://www.jenner.com/a/web/pjTABXAWvtwg9iwnp1c2QN/4HRMZQ/The_Biosimilar_Regulatory_Pathway_and_the_Patent_Dance.pdf

- Journal of Scientometric Research. (n.d.). Biosimilars: An Overview. Retrieved from https://www.jscires.org/sites/default/files/JScientometRes-9-2s-37.pdf

- Zuniga-Pflucker, J. C., et al. (2025). Innovative Formulation Strategies for Biosimilars: Trends Focused on Buffer-Free Systems, Safety, Regulatory Alignment, and Intellectual Property Challenges. Pharmaceuticals, 18(6), 760. Retrieved from https://pmc.ncbi.nlm.nih.gov/articles/PMC12196224/

- Patent Docs. (n.d.). Follow-on Biologics. Retrieved from https://www.patentdocs.org/followon_biologics/

- Number Analytics. (n.d.). Economics of Biosimilars: Cost Savings & Market Dynamics. Retrieved from https://www.numberanalytics.com/blog/economics-biosimilars-cost-savings-market-dynamics

- Mulcahy, A. W., et al. (2018). Biosimilar Cost Savings in the United States: Initial Experience and Future Potential. RAND Health Quarterly, 7(4), 11. Retrieved from https://pmc.ncbi.nlm.nih.gov/articles/PMC6075809/

- IMARC Group. (n.d.). Biosimilar Market 2024, Size and Share. Retrieved from https://www.imarcgroup.com/biosimilar-market

- GlobeNewswire. (2025). Biosimilars Market on the Rise: Expected 19.4% CAGR Over Next Five Years. Retrieved from https://www.globenewswire.com/news-release/2025/06/27/3106650/0/en/Biosimilars-Market-on-the-Rise-Expected-19-4-CAGR-Over-Next-Five-Years.html

- Center for Biosimilars. (n.d.). Breaking Down Biosimilar Barriers: Interchangeability. Retrieved from https://www.centerforbiosimilars.com/view/breaking-down-biosimilar-barriers-interchangeability

- Sarpatwari, A., et al. (2024). Biosimilars: An Update for Clinicians. Mayo Clinic Proceedings, 99(1), 127-140. Retrieved from https://pmc.ncbi.nlm.nih.gov/articles/PMC10786443/

- BioPharm International. (n.d.). The Evolving Cost-Benefit Landscape of Biosimilar Drug Development. Retrieved from https://www.biopharminternational.com/view/the-evolving-cost-benefit-landscape-of-biosimilar-drug-development

- Pharmacy Times. (2024). Study: Sales Price of Originator Declines After Introduction of Biosimilars. Retrieved from https://www.pharmacytimes.com/view/study-sales-price-of-originator-declines-after-introduction-of-biosimilars

- DrugPatentWatch. (n.d.). Biosimilar Patent Dance: Leveraging PTAB Challenges for Strategic Advantage. Retrieved from https://www.drugpatentwatch.com/blog/biosimilar-patent-dance-leveraging-ptab-challenges-for-strategic-advantage/

- SoftwareSuggest. (n.d.). DrugPatentWatch. Retrieved from https://www.softwaresuggest.com/drugpatentwatch

- Zuniga-Pflucker, J. C., et al. (2025). Innovative Formulation Strategies for Biosimilars: Trends Focused on Buffer-Free Systems, Safety, Regulatory Alignment, and Intellectual Property Challenges. Pharmaceuticals, 18(6), 760. Retrieved from https://pmc.ncbi.nlm.nih.gov/articles/PMC12196224/

- Journal of Scientometric Research. (n.d.). Biosimilars: An Overview. Retrieved from https://www.jscires.org/sites/default/files/JScientometRes-9-2s-37.pdf

- Patent Docs. (n.d.). Follow-on Biologics. Retrieved from https://www.patentdocs.org/followon_biologics/

- Shea, T. (2015). Formulation Patents for Biologics. Retrieved from https://www.formulation.org.uk/images/mibio2015/presentations/timshea.pdf

- Venable LLP. (n.d.). Biosimilars and the BPCIA. Retrieved from https://www.venable.com/-/media/files/publications/2018/06/biosimilars-and-the-bpcia.pdf?rev=5ca3638b6bc540acbdc0bff30b43b9a8&hash=0815F00D8BDDC2F873F5A23FF219A4FD

- UC Law SF. (n.d.). The BPCIA and Declaratory Judgment: The Real Dance Partners. Retrieved from https://repository.uclawsf.edu/cgi/viewcontent.cgi?article=1012&context=hastings_science_technology_law_journal

- MarketsandMarkets. (n.d.). Biosimilars Market. Retrieved from https://www.marketsandmarkets.com/Market-Reports/biosimilars-40.html

- PR Newswire. (2025). Biosimilars Market worth US$72.29 billion by 2035 with 7.5% CAGR | MarketsandMarkets™. Retrieved from https://www.prnewswire.com/news-releases/biosimilars-market-worth-us72-29-billion-by-2035-with-7-5-cagr–marketsandmarkets-302483557.html

- Accessible Meds. (n.d.). Report: 2022 U.S. Generic and Biosimilar Medicines Savings Report. Retrieved from https://accessiblemeds.org/resources/reports/2022-savings-report/

- Accessible Meds. (n.d.). Report: 2023 U.S. Generic and Biosimilar Medicines Savings Report. Retrieved from https://accessiblemeds.org/resources/reports/2023-savings-report-2/

- Cohen, J. T., et al. (2024). The Value of Biosimilars to Healthcare Systems and Patients: A Review. Pharmaceuticals, 17(12), 1599. Retrieved from https://pmc.ncbi.nlm.nih.gov/articles/PMC12185555/

- Accessible Meds. (2025). AAM-2024-Generic-Biosimilar-Medicines-Savings-Report. Retrieved from https://accessiblemeds.org/wp-content/uploads/2025/01/AAM-2024-Generic-Biosimilar-Medicines-Savings-Report.pdf

- Managed Healthcare Executive. (2024). Biosimilars to Lead to $192 Billion Loss for Originators by 2028. Retrieved from https://www.managedhealthcareexecutive.com/view/biosimilars-to-lead-to-192-billion-loss-for-originators-by-2028

- Center for Biosimilars. (2024). IQVIA Projects $192 Billion Loss for Originators by 2028 Thanks to Biosimilar, Generic Competition. Retrieved from https://www.centerforbiosimilars.com/view/iqvia-projects-192-billion-loss-for-originators-by-2028-thanks-to-biosimilar-generic-competition

- Sarpatwari, A., et al. (2024). Financial Evaluation of Biosimilar Development Opportunities: A Comprehensive Framework. Pharmaceuticals, 17(12), 1599. Retrieved from https://pmc.ncbi.nlm.nih.gov/articles/PMC11955401/

- Towards Healthcare. (n.d.). Biosimilars Market Skyrockets by 17.6% Solid CAGR till 2034. Retrieved from https://www.towardshealthcare.com/insights/biosimilars-market

- Number Analytics. (n.d.). The Future of Biosimilars: Trends and Opportunities. Retrieved from https://www.numberanalytics.com/blog/future-of-biosimilars-trends-opportunities

- Simoens, S., et al. (2023). Evolving global regulatory landscape for approval of biosimilars: current challenges and opportunities for convergence. Expert Opinion on Biological Therapy, 23(12), 1219-1229. Retrieved from https://pubmed.ncbi.nlm.nih.gov/40418186/

- SoftwareSuggest. (n.d.). DrugPatentWatch. Retrieved from https://www.softwaresuggest.com/drugpatentwatch

- DrugPatentWatch. (n.d.). Biosimilar Patent Dance: Leveraging PTAB Challenges for Strategic Advantage. Retrieved from https://www.drugpatentwatch.com/blog/biosimilar-patent-dance-leveraging-ptab-challenges-for-strategic-advantage/

- DrugPatentWatch. (n.d.). Conducting a Biopharmaceutical Freedom-to-Operate (FTO) Analysis: Strategies for Efficient and Robust Results. Retrieved from https://www.drugpatentwatch.com/blog/conducting-a-biopharmaceutical-freedom-to-operate-fto-analysis-strategies-for-efficient-and-robust-results/

- DrugPatentWatch. (n.d.). Conducting a Biopharmaceutical Freedom-to-Operate (FTO) Analysis: Key Considerations for Generic Drug Stability Testing. Retrieved from https://www.drugpatentwatch.com/blog/conducting-a-biopharmaceutical-freedom-to-operate-fto-analysis-key-considerations-for-generic-drug-stability-testing/

- Academic Entrepreneurship for Medical and Health Scientists. (n.d.). Intellectual Property Protection for Biologics. Retrieved from https://academicentrepreneurship.pubpub.org/pub/d8ruzeq0

- Park, M. J., et al. (2025). Accelerating biosimilar market access: the case for allowing earlier standing. Journal of Law and the Biosciences, 12(1), lsae030. Retrieved from https://academic.oup.com/jlb/article/12/1/lsae030/7942247

- Zuniga-Pflucker, J. C., et al. (2025). Innovative Formulation Strategies for Biosimilars: Trends Focused on Buffer-Free Systems, Safety, Regulatory Alignment, and Intellectual Property Challenges. Pharmaceuticals, 18(6), 760. Retrieved from https://pmc.ncbi.nlm.nih.gov/articles/PMC12196224/

- PatentPC. (n.d.). The Role of Patents in Drug Formulation. Retrieved from https://patentpc.com/blog/role-of-patents-in-drug-formulation

- IQVIA. (n.d.). Assessing the Biosimilar Void in the US. Retrieved from https://www.iqvia.com/insights/the-iqvia-institute/reports-and-publications/reports/assessing-the-biosimilar-void-in-the-us

- Arnold Ventures. (n.d.). Policy Brief: Biosimilars. Retrieved from https://assets.arnoldventures.org/uploads/PDFs/AV_Policy-Brief_Biosimilars.pdf

- Center for Biosimilars. (n.d.). Patent Dance Insights: A Q&A on Reducing Legal Battles in the Biosimilar Landscape. Retrieved from https://www.centerforbiosimilars.com/view/patent-dance-insights-a-q-a-on-reducing-legal-battles-in-the-biosimilar-landscape

- Biosimilars IP. (n.d.). The BPCIA and Declaratory Judgment: The Real Dance Partners. Retrieved from https://www.biosimilardevelopment.com/doc/the-bpcia-and-declaratory-judgment-the-real-dance-partners-0001

- Grabowski, H. G., et al. (2014). The Biosimilar Pathway: A New Frontier for Competition in Biologics. Health Affairs, 33(1), 10-17. Retrieved from https://pmc.ncbi.nlm.nih.gov/articles/PMC4031732/

- Genefic. (n.d.). Case Studies on Successful Biosimilar Launches: Transforming Healthcare. Retrieved from https://genefic.com/case-studies-on-successful-biosimilar-launches-transforming-healthcare/

- Towards Healthcare. (n.d.). Biosimilars Market Growth Driven by Patent Expirations and Rising Demand. Retrieved from https://www.towardshealthcare.com/insights/biosimilars-market

- Clinical Research News. (2024). Trends in Biosimilars. Retrieved from https://www.clinicalresearchnewsonline.com/news/2024/11/22/trends-in-biosimilars

- DrugPatentWatch. (n.d.). The Importance of Pharmaceutical Competitor Analysis. Retrieved from https://www.drugpatentwatch.com/blog/the-importance-of-pharmaceutical-competitor-analysis/

- DrugPatentWatch. (n.d.). Cracking the Biosimilar Code: A Deep Dive into Effective IP Strategies. Retrieved from https://www.drugpatentwatch.com/blog/cracking-the-biosimilar-code-a-deep-dive-into-effective-ip-strategies/

- GeneOnline AI. (2025). DrugPatentWatch Suggests 5 Strategies for Biopharma FTO Analysis to Minimize Patent Infringement Risk. Retrieved from https://www.geneonline.com/drugpatentwatch-suggests-5-strategies-for-biopharma-fto-analysis-to-minimize-patent-infringement-risk/