In the pharmaceutical industry the prevailing model for success was once one of monolithic self-sufficiency. Giants of the sector operated as vertically integrated fortresses, controlling every aspect of a drug’s journey from the initial spark of discovery in their own labs to the final pill produced in their own sprawling manufacturing plants. This paradigm, however, has been fundamentally and irrevocably reshaped. Today, the industry operates not as a collection of isolated citadels, but as a dynamic, interconnected, and profoundly collaborative ecosystem. The score for this new pharmaceutical symphony is written for a different set of lead instruments: the Active Pharmaceutical Ingredient (API), the very heart of a medicine’s therapeutic power, and the Contract Development and Manufacturing Organization (CDMO), the indispensable orchestra that brings that therapeutic potential to life.

The pressures forcing this evolution are immense and unrelenting. The journey to bring a single new drug to market is a high-stakes gauntlet, with the average capitalized cost now soaring to an astonishing $2.6 billion.1 This staggering figure, coupled with punishingly long development timelines and high attrition rates, has made the old model of in-house-only development a financially untenable risk for all but the largest and most capitalized players. Consequently, the industry has embraced a strategic pivot towards outsourcing, a trend that is not merely tactical but structural. It represents a fundamental re-evaluation of where value is created and how risk is managed. In 2024, it is estimated that approximately 50% of the pharmaceutical industry’s colossal $300 billion investment in research and development was allocated to external partners, a testament to the depth of this transformation.

This report serves as a comprehensive strategic analysis for business development professionals, market analysts, and executive leaders within the pharmaceutical, biotechnology, and CDMO sectors. It moves beyond surface-level definitions to dissect the intricate, symbiotic relationship between API development and the CDMO landscape. The central thesis is that in this new era, competitive advantage is no longer derived from owning every asset but from mastering the strategic orchestration of external partnerships. It is about understanding the science of the API, the business of the CDMO, and the complex interplay between them across the entire drug development lifecycle.

The shift towards outsourcing is far more profound than a simple cost-cutting exercise; it is a sophisticated re-architecting of the industry’s risk profile. In the past, a pharmaceutical company might invest hundreds of millions of dollars in building a dedicated manufacturing facility for a promising drug candidate in Phase III clinical trials. If that drug subsequently failed to gain approval—a common occurrence—the company was left with a hugely expensive, underutilized, or even useless asset, a monument to a failed investment. By partnering with a CDMO, that same company transforms a massive, high-risk capital expenditure (CapEx) into a more predictable and manageable operational expenditure (OpEx).5 This strategic externalization of financial and operational risk has not only liberated capital for large pharma but has also become the primary engine of innovation for the entire sector. It has enabled the proliferation of smaller, more agile biotechnology firms that can now focus their precious capital and intellectual resources on their core competency—pioneering drug discovery—without the crippling burden of becoming manufacturing experts overnight. The modern CDMO ecosystem, therefore, is not just a service industry; it is a foundational pillar of modern biopharmaceutical innovation.

Navigating this new landscape requires a new playbook. For pharmaceutical and biotech companies, it demands a sophisticated approach to partner selection and relationship management. For CDMOs, it requires a deep understanding of client needs, a proactive business development strategy, and the ability to articulate a unique value proposition in an increasingly crowded market. This report will provide the data, analysis, and strategic frameworks necessary to master this new symphony, turning the complex interplay of APIs and CDMOs into a powerful and sustainable competitive advantage.

Deconstructing the Core Components: A Deep Dive into APIs and CDMOs

To effectively navigate the modern pharmaceutical landscape, a granular understanding of its two most critical components is essential. The Active Pharmaceutical Ingredient (API) represents the scientific core of any therapy, while the Contract Development and Manufacturing Organization (CDMO) represents the strategic and operational engine that translates that science into a viable medical product. These two elements are inextricably linked, and a mastery of their individual characteristics and their symbiotic relationship is the foundation of successful business development.

The Heart of the Matter: Understanding the Active Pharmaceutical Ingredient (API)

At its most fundamental level, every medicine is composed of two primary elements: the API and the excipients. While often overshadowed in public discourse by the final branded product, the API is the single most important component, the very reason the medicine exists.

Defining the API: The Biologically Active Core

The Active Pharmaceutical Ingredient is the specific chemical compound or substance within a drug product that is biologically active and responsible for producing the desired therapeutic effect.8 Whether it’s the acetaminophen in a pain relief tablet, the atorvastatin in a cholesterol-lowering medication, or the complex monoclonal antibody in a cancer therapy, the API is the molecule that interacts with the body’s biological systems to diagnose, cure, mitigate, treat, or prevent a disease.8

It is crucial to distinguish the API from the other components of a finished drug, known as excipients. Excipients are chemically and pharmacologically inactive substances—such as binders, fillers, coatings, and preservatives—that serve as the vehicle to deliver the API to the patient in a stable, effective, and palatable form.7 While essential for the final drug product, excipients do not possess therapeutic properties themselves; their role is to support the function of the API. A drug simply cannot work without its API; it is the sine qua non of pharmacology.

A Spectrum of Molecules: Small vs. Large

The universe of APIs is vast and diverse, but it can be broadly categorized into two major classes: synthetic small molecules and large-molecule biologics. This distinction is not merely academic; it dictates everything from the manufacturing process and regulatory pathway to the therapeutic application and market dynamics.

Synthetic Chemical APIs (Small Molecules)

For much of the pharmaceutical industry’s history, small molecules have been the bedrock of drug development. These are relatively simple compounds with a low molecular weight, typically produced through a series of controlled chemical synthesis reactions.11 Their small size often allows them to be administered orally and to easily pass through cell membranes to reach their intracellular targets.

Within this category, a further distinction is made between innovative and generic APIs. Innovative APIs are novel chemical entities developed and patented by an originator company. Generic APIs, by contrast, are chemically equivalent to the innovative API but are produced by other manufacturers after the original patents have expired. While the API itself is the same, the manufacturing method may differ, presenting a significant market opportunity for both API producers and generic drug companies.

Biologics and Advanced Therapies (Large Molecules)

The frontier of modern medicine is increasingly dominated by large molecules, or biologics. Unlike small molecules synthesized from chemical precursors, biologics are complex, high-molecular-weight substances derived from or produced by living organisms.14 This class includes a wide array of groundbreaking therapies:

- Peptide and Protein APIs: These include therapeutic peptides for diseases like diabetes and cancer, as well as larger proteins like monoclonal antibodies, which form the basis of many targeted immunotherapies.

- Oligonucleotide APIs: These are short strands of RNA or DNA used in therapies that can precisely target genetic drivers of disease, with applications in neuromuscular and ophthalmologic conditions.

- Cell and Gene Therapies: These represent the most complex biologics, involving the modification of patient or donor cells to treat disease at the genetic level.

The active component in a biologic drug is often referred to as a bulk process intermediate (BPI), reflecting its origin from a biological manufacturing process rather than a purely chemical one. While biologics are currently fewer in number than small molecule drugs, they are rapidly becoming the top-selling and most innovative products on the market, driving significant demand for specialized development and manufacturing capabilities.

The Manufacturing Blueprint: From Raw Materials to Purified Substance

The creation of an API is a journey of transformation, converting basic raw materials into a highly purified, potent, and consistent substance through a complex and rigorously controlled process. This journey is a cornerstone of the pharmaceutical value chain, demanding immense scientific expertise and unwavering adherence to quality standards.

The process typically begins with raw materials or starting chemical compounds, which undergo a series of multi-step chemical reactions.7 Each step produces an

intermediate, a substance that is itself a temporary product on the path to the final API. This synthetic route can be long and complex, sometimes involving dozens of distinct steps.

Once the final chemical synthesis is complete, the crude API must undergo extensive purification to remove any unreacted starting materials, residual solvents, byproducts, and other impurities. This is a critical stage, as the purity of the API directly impacts the safety and efficacy of the final drug product. Common purification techniques include:

- Crystallization: The purified API is often crystallized to achieve a specific solid form with consistent properties, such as stability and solubility.

- Separation and Filtration: Techniques like chromatography and filtration are used to isolate the API from the reaction mixture.

- Drying and Milling: The API is then dried to remove any remaining solvents and may be milled to achieve a specific particle size distribution, which can be crucial for its formulation into a final drug product.

Throughout this entire process, from the first reaction to the final packaging, every step must be conducted in compliance with Current Good Manufacturing Practices (cGMP). These are stringent regulations enforced by bodies like the U.S. Food and Drug Administration (FDA) that govern all aspects of production, from facility design and equipment validation to personnel training and documentation. Rigorous quality control checks are performed at every stage to ensure the API’s identity, strength, quality, and purity before it is released to a drug product manufacturer.

The Strategic Partner: Demystifying the Contract Development and Manufacturing Organization (CDMO)

As the complexity and cost of API and drug product development have escalated, a new type of organization has risen to prominence, evolving from a simple service provider to an indispensable strategic partner: the CDMO. Understanding this evolution and the immense value a CDMO provides is critical for any business development strategy in the pharmaceutical space.

The Evolution from CMO to CDMO: From Hired Hands to Strategic Brains

The outsourcing landscape was once dominated by the Contract Manufacturing Organization (CMO). A CMO’s role was relatively straightforward: to manufacture a product on behalf of another company according to a pre-defined process.4 The relationship was largely transactional, with the pharma company providing the “recipe” and the CMO providing the manufacturing capacity.

However, as the industry evolved, this model proved insufficient. The line between developing a manufacturing process and executing it began to blur. Pharma companies, especially smaller biotechs, needed more than just production capacity; they needed expertise in formulation, analytical development, process optimization, and regulatory strategy. This gave rise to the Contract Development and Manufacturing Organization (CDMO). The addition of the “D” for “Development” signifies a fundamental paradigm shift. A CDMO offers an integrated, end-to-end suite of services that spans the entire product lifecycle, from the earliest stages of development through to commercial manufacturing and distribution.5 This evolution has transformed the outsourcing relationship from a simple client-vendor dynamic to a deeply collaborative partnership, with the CDMO acting as a strategic extension of the client’s own R&D and manufacturing teams.19

The CDMO Value Proposition: Solving Pharma’s Core Challenges

The rapid growth and integration of CDMOs into the pharmaceutical value chain are driven by their ability to solve some of the most pressing challenges faced by drug developers. Their value proposition is multifaceted, addressing critical needs for cost, speed, expertise, and flexibility.

- Cost Management and Capital Avoidance: The most immediate benefit of partnering with a CDMO is economic. It allows a drug developer to avoid the immense capital expenditure required to build, equip, and staff its own cGMP-compliant manufacturing facilities—an investment that can easily run into the hundreds of millions of dollars.5 This converts a fixed cost into a variable one, allowing for more manageable cash flow and freeing up capital for core R&D activities.

- Accelerated Speed to Market: Time is the most valuable currency in pharmaceutical development. CDMOs can significantly accelerate project timelines by providing immediate access to established facilities, validated equipment, and experienced personnel, eliminating the lengthy process of building and validating a new plant from scratch.5

- Access to Specialized Expertise and Technology: The pharmaceutical frontier is increasingly specialized. A single company, particularly a small biotech, cannot be an expert in everything. CDMOs serve as hubs of specialized knowledge and technology, offering deep expertise in areas like complex API synthesis, advanced formulations, biologics manufacturing, or specific dosage forms like injectables or softgels.6 This allows clients to tap into world-class capabilities on demand.

- Flexible Capacity and Scalability: Market demand for a new drug can be unpredictable. A CDMO provides the crucial ability to scale production up or down as needed, from producing small batches for early-phase clinical trials to manufacturing millions of doses for a global commercial launch.6 This flexibility is nearly impossible to achieve efficiently with a fixed in-house facility.

- Navigating Regulatory Complexity: The global regulatory landscape is a labyrinth of ever-changing requirements. Experienced CDMOs have dedicated regulatory affairs teams that are well-versed in the standards of the FDA, European Medicines Agency (EMA), and other international bodies.5 Their expertise in preparing and managing regulatory submissions is invaluable for ensuring compliance and avoiding costly delays.

- Focus on Core Competencies: Ultimately, by outsourcing the complex and resource-intensive tasks of development and manufacturing, CDMOs enable their clients to do what they do best: discover and market innovative new medicines.4 This strategic division of labor optimizes the entire value chain, fostering greater efficiency and innovation across the industry.

The rise of the “one-stop-shop” CDMO model is not merely a matter of convenience; it is a direct and necessary response to the escalating scientific complexity of modern therapeutics. As APIs become more intricate and formulations more advanced, the traditional, siloed approach of using separate vendors for drug substance and drug product development has become fraught with risk.24 The physical and chemical properties of a complex API—its crystalline form (polymorph), particle size, and flowability, for instance—have a direct and profound impact on how it can be successfully formulated into a stable drug product with the desired bioavailability.

In a fragmented outsourcing model, a subtle change made by an API manufacturer to optimize their synthesis process could have disastrous and unforeseen consequences for the formulation team at a completely different company, leading to batch failures, project delays, and significant financial losses. The integrated CDMO shatters these silos. By co-locating the teams responsible for both API synthesis and final formulation, a continuous, real-time feedback loop is created.26 The chemists synthesizing the API can work hand-in-hand with the scientists developing the tablet or injection, ensuring that the properties of the drug substance are perfectly optimized for the final drug product from the very beginning. This seamless integration eliminates the perilous handoffs and information gaps inherent in a multi-vendor model, dramatically de-risking the entire development pathway. This shift has elevated the CDMO selection process from a late-stage procurement decision to a critical, front-loaded strategic choice, transforming the CDMO from a mere vendor into a true co-development partner.

The Drug Development Gauntlet: Mapping the CDMO’s Role from Lab to Launch

The journey of a new drug from a laboratory concept to a patient’s hands is a long, arduous, and highly regulated process. It is a gauntlet of scientific, clinical, and regulatory challenges where the vast majority of candidates fail. Understanding the distinct phases of this journey and pinpointing where and how a CDMO can add critical value is fundamental to both successful drug development for a sponsor and effective business development for a CDMO.

A Phase-by-Phase Journey Through the Drug Development Lifecycle

While nuances exist for different drug types and regions, the overall drug development process follows a structured pathway defined by regulatory authorities like the U.S. FDA. This pathway is designed to rigorously assess the safety and efficacy of a new therapeutic before it can be made widely available.

Step 1: Discovery and Development

This is the genesis of a new medicine. It begins in the laboratory with basic research to understand a disease at the molecular level and identify a “target,” such as a specific protein or gene involved in the disease process.29 Scientists then search for or design compounds that can interact with this target to produce a beneficial effect. This phase involves screening thousands, sometimes millions, of potential compounds to identify a handful of promising “lead compounds”.30 These leads are then optimized through medicinal chemistry to improve their potency, selectivity, and drug-like properties.

Step 2: Preclinical Research

Before a drug candidate can be tested in humans, it must undergo extensive preclinical testing. This stage uses laboratory (in vitro) and animal (in vivo) models to answer basic questions about the compound’s safety and biological activity.28 Key studies in this phase assess the drug’s pharmacology (how it affects the body), pharmacokinetics (how the body absorbs, distributes, metabolizes, and excretes it), and toxicology (its potential to cause harm).30 The goal is to gather enough data to demonstrate that the compound is reasonably safe to proceed with initial human trials. This is also the stage where the Chemistry, Manufacturing, and Controls (CMC) section of the regulatory filing begins to take shape, detailing the manufacturing process and product specifications.

Step 3: Clinical Research (Phases I, II, III)

This is the most time-consuming and expensive part of the process, where the drug is tested in human volunteers and patients. It is typically divided into three sequential phases:

- Phase I: The first studies in humans, typically involving a small group of healthy volunteers (20-100). The primary goal is to assess the drug’s safety, determine a safe dosage range, and identify side effects.29

- Phase II: The drug is administered to a larger group of patients (100-300) who have the target disease. This phase aims to obtain preliminary data on the drug’s efficacy (whether it works in patients) and to further evaluate its safety profile.

- Phase III: These are large-scale, pivotal trials involving several hundred to several thousand patients. The goal is to definitively confirm the drug’s effectiveness, monitor side effects, compare it to commonly used treatments, and collect information that will allow the drug to be used safely.29

Step 4: FDA Review and Registration

If the data from the clinical trials demonstrate that the drug is both safe and effective, the sponsor company submits a New Drug Application (NDA) or Biologics License Application (BLA) to the FDA. This application is an exhaustive dossier containing all the data from the preclinical and clinical studies, as well as detailed information on the drug’s manufacturing process (the CMC section), and proposed labeling.28 FDA review teams of physicians, statisticians, chemists, and other scientists thoroughly examine all submitted data to decide whether to approve the drug for marketing.

Step 5: Post-Market Safety Monitoring

The FDA’s oversight does not end with a drug’s approval. The agency continues to monitor the safety of all drugs on the market through post-market surveillance programs. This can involve requiring companies to conduct further (Phase IV) studies to assess long-term risks and benefits, and tracking adverse event reports submitted by healthcare professionals and patients.

Pinpointing the Outsourcing Decision: When and Why CDMOs are Engaged

A CDMO’s involvement is not a single event but a dynamic partnership that evolves in scope and scale as a drug candidate progresses through the development lifecycle. The decision to outsource and the specific services required are tailored to the unique needs of each phase.

Early-Stage Support (Preclinical & Phase I)

In the early stages, speed, flexibility, and scientific problem-solving are paramount. A drug developer, often a small biotech with limited resources, needs a partner who can quickly translate a lab-scale synthesis into a robust process capable of producing the first batches of cGMP-compliant material. Key CDMO services at this stage include:

- Process Development & Optimization: Taking the initial synthesis route from the discovery lab and making it scalable, reproducible, and safe.

- Pre-formulation Studies: Characterizing the physical and chemical properties of the API to determine the best way to formulate it into a dosage form.31

- Analytical Method Development: Creating and validating the tests needed to ensure the API’s quality and purity.

- Small-Scale cGMP Manufacturing: Producing the initial batches of API required for pivotal toxicology studies and the first-in-human Phase I clinical trials.1

The goal here is not large volume, but high quality and rapid turnaround to meet critical development milestones and support the Investigational New Drug (IND) application filing.

Mid-to-Late-Stage Partnership (Phase II & III)

As a drug candidate shows promise and moves into larger clinical trials, the demands on manufacturing increase significantly. The focus shifts from initial process feasibility to robustness, efficiency, and scale-up. The CDMO’s role becomes more integrated, acting as the primary manufacturing arm for the clinical program. Services expand to include:

- Process Scale-Up: Transitioning the manufacturing process from the small scale used for Phase I to the larger scales needed to supply Phase II and III trials, which can involve hundreds or thousands of patients.

- Process Optimization & Validation: Further refining the manufacturing process to improve yield, reduce costs, and ensure consistency across larger batches.

- Clinical Trial Material (CTM) Manufacturing: Producing larger quantities of the API and the final formulated drug product under strict cGMP conditions for use in global clinical trials.18

- Stability Studies: Conducting long-term studies to determine the drug product’s shelf life and appropriate storage conditions.

- Regulatory Support: Providing critical CMC documentation and support for regulatory filings and interactions with health authorities like the FDA and EMA.22

Commercial Scale-Up and Launch

Successfully navigating Phase III is a major milestone, but the final hurdle is preparing for commercial launch. This involves the ultimate scale-up of the manufacturing process to meet projected market demand, which could mean producing metric tons of API annually. The CDMO’s role at this stage is to ensure a seamless transition from clinical supply to a robust, reliable, and cost-effective commercial supply chain. Key activities include:

- Technology Transfer: Formally transferring the validated manufacturing process to the commercial-scale facility.

- Process Performance Qualification (PPQ): Running the final validation batches to prove that the process consistently produces a product that meets all quality specifications at commercial scale.

- Large-Scale Commercial Manufacturing: Routine, large-scale production of the API and finished drug product.23

- Supply Chain Management: Expanding beyond manufacturing to include services like final packaging, labeling, and global distribution logistics.18

The Power of Integration: The Strategic Advantage of a Single-Source Partner

Across this entire development gauntlet, a powerful trend is the growing preference for integrated, single-source CDMO partners who can manage both the drug substance (API) and the final drug product.25 This “one-stop-shop” approach offers profound strategic advantages over a fragmented model that relies on multiple, disconnected vendors.

An integrated partner simplifies the entire drug development value chain. Communication is streamlined, project management is unified, and the complex, time-consuming, and often problematic process of technology transfer between different companies is eliminated.25 When the team developing the API is in constant communication with the team formulating the drug product, potential issues can be identified and resolved early, preventing costly delays. For example, if the formulation team discovers that the API’s particle size is affecting tablet dissolution, they can provide immediate feedback to the API synthesis team to adjust the crystallization or milling process. This continuous feedback loop ensures that the drug substance and drug product are co-optimized at every stage, leading to a more robust final product and a faster, more efficient path to market.27 By consolidating these critical activities under one roof, a sponsor company can significantly reduce complexity, mitigate risk, and accelerate its journey from the lab to the launch.

The Global CDMO Market Landscape: A Data-Driven Analysis

The business of pharmaceutical outsourcing is no longer a niche segment but a massive, dynamic, and rapidly growing global market. For business development professionals on both sides of the partnership—the sponsor company seeking services and the CDMO providing them—a clear, data-driven understanding of the market’s size, growth trajectory, regional nuances, and underlying drivers is essential for making informed strategic decisions.

Sizing Up the Opportunity: Market Valuations and Growth Trajectories

The scale of the CDMO market is immense and continues to expand at a robust pace, reflecting the industry’s deep and structural reliance on outsourcing. Market analyses from multiple sources paint a consistent picture of strong growth, though specific figures may vary based on the scope and methodology of the report.

According to Fortune Business Insights, the global CDMO market was valued at an impressive USD 238.92 billion in 2024. This figure is projected to climb to USD 255.01 billion in 2025 and reach USD 465.24 billion by 2032, demonstrating a compound annual growth rate (CAGR) of 9.0% over the forecast period. Another analysis from Biospace projects a similar trajectory, with the market growing from USD 184.90 billion in 2024 to USD 368.70 billion by 2034, at a CAGR of 7.2%.

Drilling down into specific segments reveals equally compelling growth stories. The market for API contract manufacturing, which constitutes the largest service segment within the CDMO industry, is a significant driver of this expansion. One market report forecasts the global API CDMO market alone will reach a value of $136.1 billion by 2028, growing at a CAGR of 6.7%. Furthermore, the specialized segment focused on supporting drugs in the early clinical phases—the Investigational New Drug (IND) CDMO market—is also on a steep upward curve, projected to grow from USD 5.61 billion in 2025 to USD 10.26 billion by 2034.

The following table consolidates these key market forecasts, providing a clear snapshot of the scale and momentum of the opportunity for CDMOs and their partners.

| Market Segment | 2024 Valuation (USD) | Projected Valuation (USD) | Forecast Period | CAGR (%) | Source(s) |

| Overall CDMO Market | 238.92 Billion | 465.24 Billion | 2025-2032 | 9.0% | |

| API CDMO Market | Not specified | 136.1 Billion | 2021-2028 | 6.7% | |

| IND CDMO Market | 5.25 Billion | 10.26 Billion | 2025-2034 | 6.93% |

This powerful growth is not a temporary surge but a reflection of a long-term strategic shift in the pharmaceutical industry’s operating model, promising sustained demand for CDMO services for the foreseeable future.

A World of Opportunity: Regional Market Dynamics

The CDMO market is a global enterprise, but its character and concentration vary significantly by region. Understanding these geographical nuances is crucial for targeting business development efforts and for building resilient, geographically diversified supply chains.

- North America: This region stands as the dominant force in the global CDMO market, commanding a market share of 38.59% in 2024.36 The United States, in particular, is the largest single market, buoyed by a high concentration of pharmaceutical and biotechnology companies, substantial R&D investment, and a robust regulatory framework.39 North America’s leadership is especially pronounced in high-value, complex areas like biologics and advanced therapies, where its deep scientific expertise and advanced infrastructure provide a significant competitive advantage. The sheer volume of clinical trial activity in the U.S.—with nearly 6,000 trials registered in 2024—further fuels the demand for domestic CDMO services.

- Asia-Pacific: While North America currently leads in value, the Asia-Pacific region is the engine of global growth and, by some measures, the largest market by share.37 It is projected to experience the fastest growth, with one report forecasting a CAGR of

8.9%. This rapid expansion is driven by several factors. Countries like India and China offer significant cost advantages, with operational costs that can be 30-50% lower than in Western markets. This, combined with a growing number of domestic pharmaceutical companies, strong government support for the life sciences sector, and expanding technical capabilities, has made the region an increasingly attractive hub for outsourcing, particularly for API and generic drug manufacturing.38 - Europe: Europe represents a mature and highly sophisticated CDMO market, holding the second-largest market share. It is home to many well-established CDMOs with strong regulatory track records and deep expertise, particularly in injectable formulations and complex small molecules. The region is also projected to see robust growth, with some analyses suggesting it could be the fastest-growing region with a CAGR of 7.7%, driven by increasing R&D investments and the rise of biologics and biosimilars.

The Forces of Attraction: Key Drivers of Pharmaceutical Outsourcing

The powerful tailwinds propelling the CDMO market forward are rooted in the fundamental economic, scientific, and strategic realities of the modern pharmaceutical industry. Understanding these drivers is key to appreciating the sustainability of the outsourcing trend.

“The pharmaceutical industry is undergoing a significant transformation in how companies approach their commercial operations. Over the next five years, we expect to see large pharma outsourcing more than 50 percent of their commercial activities.”

— Martin Bate, Senior Director at IQVIA

- Intense Economic Pressures: As previously noted, the escalating cost of R&D is a primary driver. Outsourcing allows companies to mitigate financial risk by converting the fixed costs of building and maintaining manufacturing infrastructure into more predictable variable costs, thereby optimizing resource allocation.43

- Increasing Scientific Complexity: The therapeutic landscape is shifting decisively towards more complex modalities. The rise of biologics, biosimilars, cell and gene therapies, and high-potency APIs for oncology requires highly specialized manufacturing facilities, equipment, and scientific expertise.36 It is often more efficient and effective to outsource these complex manufacturing processes to a CDMO that has dedicated its resources to mastering them, rather than attempting to build these niche capabilities in-house.

- The Looming Patent Cliff: Many blockbuster drugs have recently lost or are about to lose patent protection, opening the floodgates to generic competition. This “patent cliff” creates a dual demand for CDMOs: originator companies look for partners to help develop next-generation products or more complex formulations to extend product lifecycles, while generic companies require cost-effective, high-volume manufacturing of generic APIs and finished drug products.

- A Strategic Focus on Core Competencies: Perhaps the most fundamental driver is the strategic realization that a single company cannot be the best at everything. By entrusting the complexities of development and manufacturing to expert CDMO partners, pharmaceutical and biotech companies can sharpen their focus and dedicate their internal resources to their true core competencies: discovering novel drug candidates, running innovative clinical trials, and successfully commercializing new medicines.45 This strategic division of labor creates a more efficient, specialized, and ultimately more productive ecosystem for the entire industry.

The CDMO Business Development Playbook: From Prospecting to Partnership

In the dynamic and highly competitive CDMO market, success is not a matter of chance. It is the result of a deliberate, sophisticated, and data-driven business development strategy. For CDMOs looking to not just survive but thrive, the playbook has evolved far beyond traditional sales tactics. It now requires a deep understanding of the market, a clearly articulated value proposition, a robust digital presence, and the strategic use of intelligence to identify and engage the right partners at the right time.

Crafting a Winning Go-to-Market Strategy

Before a single sales call is made, a successful CDMO must lay a strong strategic foundation. This involves looking inward to define its unique strengths and looking outward to understand the needs of its target audience.

Defining Your Value Proposition in a Crowded Market

In a market with hundreds of CDMOs, simply stating “we offer manufacturing services” is insufficient. A powerful business development strategy begins with a clear and compelling unique value proposition (UVP). What makes your organization different and better than the competition? The answer must be specific and tailored to the needs of potential clients. A strong UVP might be built around:

- Specialized Technological Expertise: Perhaps the CDMO is a leader in a high-demand area like continuous manufacturing, high-potency API (HPAPI) handling for oncology drugs, or complex bioconjugation for antibody-drug conjugates (ADCs).

- A Flawless Regulatory Track Record: A history of successful FDA and EMA inspections and a reputation for impeccable quality can be a powerful differentiator, especially for clients with late-stage assets where regulatory risk is a primary concern.

- Therapeutic Area Focus: Deep expertise in a specific disease area, such as oncology or rare diseases, allows the CDMO to understand the unique challenges and nuances of those products.

- Client Segment Specialization: Some CDMOs excel at serving the needs of small, virtual, or emerging biotech companies, offering a high-touch, flexible partnership model that larger clients may not require.50

The UVP must be more than an internal motto; it must be the central message that informs all marketing and sales activities, concisely communicating why a potential partner should choose you over anyone else.

Building an Authoritative Digital Presence

In today’s B2B environment, the buyer’s journey almost always begins online. A CDMO’s digital presence is its virtual front door, and it must be both welcoming and authoritative. A multi-channel digital strategy is essential for building brand awareness, demonstrating expertise, and generating qualified leads.

- Content Marketing as a Tool for Trust: The most effective way to demonstrate expertise is to share it. High-quality content marketing is not about selling; it’s about educating and building trust. This can take many forms:

- White Papers and Case Studies: In-depth documents that explore a technical challenge and showcase how the CDMO successfully solved it for a client.

- Authoritative Blog Posts: Articles that discuss industry trends, regulatory updates, or new manufacturing technologies, establishing the CDMO as a thought leader.

- Webinars and Podcasts: Hosting or participating in digital events allows the CDMO’s experts to share their knowledge directly with a targeted audience, answering questions and building relationships.53

- Search Engine Optimization (SEO): Creating great content is only half the battle; potential clients need to be able to find it. SEO is the practice of optimizing website and content structure to rank highly in search engine results for relevant keywords (e.g., “small molecule API scale-up,” “sterile fill-finish CDMO”). This ensures a steady stream of inbound traffic from companies actively seeking the services the CDMO provides.

- Professional Social Media Engagement: Platforms like LinkedIn are invaluable for B2B engagement in the pharmaceutical industry. It’s a space to share content, participate in industry discussions, highlight company milestones, and connect directly with decision-makers at target companies.

Measuring What Matters: KPIs and ROI in B2B Pharma Services

Demonstrating the return on investment (ROI) for marketing and sales in an industry with sales cycles that can last for years is a significant challenge. Success cannot be measured by short-term metrics alone. A sophisticated approach to measurement is required, focusing on Key Performance Indicators (KPIs) that track progress along the entire customer journey.

The basic formula for marketing ROI is straightforward:

ROI=Marketing Spend(Revenue−Marketing Spend)×100%

56

However, in the CDMO world, attributing revenue directly to a single marketing campaign can be difficult. Therefore, a broader set of KPIs should be tracked:

- Lead Generation & Quality: Tracking not just the number of leads, but their quality. How many are from ideal client profiles? How many convert to a formal proposal request?

- Website and Content Engagement: Metrics like time on page for a technical white paper, or the number of downloads, can indicate strong interest.

- Proposal Success Rate: What percentage of proposals submitted result in a signed contract?

- Customer Acquisition Cost (CAC): The total sales and marketing cost required to acquire a new customer.

- Customer Lifetime Value (CLV): The total revenue a CDMO can expect from a single client over the course of the relationship. A high CLV can justify a higher initial CAC.

Case Study in Action: The Power of Persistent Nurturing

The experience of Metrics Contract Services, a CDMO specializing in oral dosage forms, provides a powerful real-world example. Recognizing that their sales team was too busy closing deals to effectively prospect, they partnered with a specialized marketing and sales firm, Athena SWC. The strategy was built on the understanding that CDMO sales cycles are long and require consistent, patient lead nurturing. Athena’s team executed a high-volume outreach program of calls and emails, averaging 45 “touches” to initiate a conversation with a prospect. The goal was not to force a sale but to keep the Metrics brand “top of mind” so that when a prospect did have a project need, Metrics was the first company they called. This patient, process-driven approach yielded spectacular results, generating nearly $20 million in quoted projects and securing $4 million in new, closed business. This case demonstrates that in the CDMO sector, ROI is often the result of sustained, strategic engagement rather than short-term campaigns.

The Ultimate Lead Generation Engine: Leveraging Patent Data for Competitive Intelligence

While a strong digital presence is crucial for attracting inbound interest, the most proactive and powerful business development strategies involve actively identifying and pursuing ideal clients before they even issue a Request for Proposal (RFP). In the pharmaceutical industry, there is no richer source of this predictive intelligence than the global patent system.

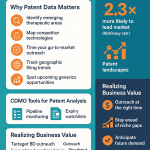

Why Patent Data is a Goldmine for Business Development

A patent application is far more than a legal document; it is a public declaration of a company’s most vital strategic secrets. It lays out their R&D priorities, their latest technological breakthroughs, and their roadmap for future products.59 For a CDMO’s business development team, this data is a goldmine for several reasons:

- Early Insight: Patent applications are often published 18 months after filing, providing a window into a company’s pipeline years before a product reaches the market or is even announced publicly.

- Uncovering Needs: The technical details within a patent can reveal potential manufacturing challenges—a complex synthesis route, a poorly soluble compound—that a CDMO can proactively offer solutions for.

- Identifying “White Spaces”: Analyzing the patent landscape can reveal therapeutic areas or technologies with limited patent activity but high market potential, indicating less crowded and potentially more profitable areas for innovation and partnership.

- Competitive Intelligence: Monitoring the patent filings of competitors provides invaluable insight into their strategies, allowing a CDMO to anticipate market shifts and position itself accordingly.

A Practical Guide: Using Patent Intelligence Platforms

Harnessing this data requires a systematic approach. While one can use free public databases, specialized platforms often provide more efficient and integrated tools for business development.

- Step 1: Identify Target Companies and Technologies. The process begins by searching patent databases for companies and technologies that align with the CDMO’s core capabilities. This can be done using free tools like Google Patents or the USPTO’s public search portal, or more advanced commercial platforms. Key search parameters include:

- Assignee: The name of the company that owns the patent.

- Keywords: Terms related to specific diseases, drug classes, or manufacturing processes (e.g., “antibody-drug conjugate,” “lyophilization”).

- Classification Codes: Using standardized codes like the Cooperative Patent Classification (CPC) system (e.g., A61K for medical preparations) to find highly relevant patents.

- Step 2: Analyze the Pipeline Stage. The status of a patent provides crucial timing information. A “patent pending” application indicates a company has an active R&D program and will almost certainly require API and drug product for preclinical toxicology studies and Phase I trials in the near future. This is a prime signal of an impending need for CDMO services.

- Step 3: Anticipate and Address Technical Needs. A deep dive into the patent’s “claims” and “examples” sections can reveal the specifics of the molecule and its synthesis. Is it a highly potent compound requiring specialized containment? Is the synthesis low-yielding and in need of process optimization? A savvy CDMO can use this intelligence to craft a highly targeted and compelling outreach, demonstrating that they have already understood the client’s potential challenges and have solutions ready.

- Step 4: Monitor Macro Trends for Strategic Planning. This is where patent analysis transcends simple lead generation and becomes a tool for corporate strategy. By aggregating patent filing data across the industry, a CDMO can spot powerful market trends. For example, a sharp, sustained increase in patent filings for antibody-drug conjugates (ADCs) is a clear signal of future market demand for the highly specialized capabilities required to produce them, such as HPAPI handling, bioconjugation suites, and sterile fill-finish for biologics. This is not just a collection of individual sales leads; it is a forecast that can justify multi-million-dollar capital investments in new facilities and technologies. CDMOs are already making these investments in HPAPI capacity, driven by the booming oncology sector. By using patent intelligence to guide these strategic bets, a CDMO can build the capacity the market will need before the wave of RFPs arrives, capturing high-value market share and leaving reactive competitors scrambling to catch up.

The DrugPatentWatch Advantage: From Data to Deals

While public databases are useful, specialized commercial intelligence platforms like DrugPatentWatch offer a significant advantage by integrating disparate data sources into a single, actionable interface. DrugPatentWatch goes beyond simple patent searches to provide a holistic view of the pharmaceutical landscape. The platform integrates patent data with crucial business intelligence on:

- Drug Development Pipelines: Tracking which drugs are in which phase of development.

- Litigation: Monitoring patent challenges (like Paragraph IV filings) that can signal an accelerated timeline for generic entry and a potential need for new manufacturing partners.65

- Patent Expirations: Providing clear timelines for when branded drugs will lose exclusivity, a key trigger for generic API and drug product manufacturing opportunities.

- Formulation and Supplier Information: Identifying which companies are formulating final drug products and who is supplying the API, allowing for highly targeted business development.65

By leveraging such a comprehensive tool, a CDMO’s business development team can move from reactive selling to proactive, intelligence-driven market engagement, identifying high-potential partners and understanding their needs with unparalleled depth and precision.61

The Other Side of the Table: How Pharma and Biotech Choose Their CDMO Partner

For a CDMO’s business development efforts to be truly effective, they must be grounded in a deep understanding of the customer’s perspective. What are the critical factors that a pharmaceutical or biotechnology company weighs when entrusting its most valuable asset—a promising drug candidate—to an external partner? The selection process is a rigorous, multi-faceted due diligence exercise that goes far beyond a simple price comparison. It is about finding a partner capable of navigating the scientific, regulatory, and logistical complexities of drug development.

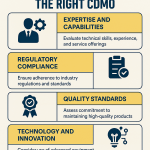

The Ultimate Selection Checklist: A Sponsor’s Perspective

When a sponsor company issues an RFP and begins evaluating potential CDMOs, they are typically assessing candidates against a comprehensive set of criteria. CDMOs that can demonstrate excellence across these domains will have a significant competitive advantage.

- Technical Expertise and Relevant Experience: This is the foundational requirement. Does the CDMO have a proven, demonstrable track record with the specific type of molecule (e.g., small molecule, biologic, peptide), dosage form (e.g., oral solid, sterile injectable), and stage of development?.69 A sponsor developing a complex ADC will heavily favor a CDMO that can showcase successful past projects in that exact area over a generalist. Experience translates into an innate ability to anticipate potential problems in process development and scale-up, which is invaluable.

- Quality and Regulatory Compliance: In the pharmaceutical world, quality is non-negotiable. Sponsors will conduct a thorough review of a CDMO’s regulatory history, including its inspection records with the FDA, EMA, and other major health authorities.69 A strong history of cGMP compliance, a robust and well-documented Quality Management System (QMS), and a culture of quality are paramount.71 Any past warning letters or significant compliance issues will be a major red flag.

- Technological Capabilities and Facilities: The sponsor needs to be confident that the CDMO has the right tools for the job. This involves assessing the modernity and condition of their facilities and equipment. Do they have state-of-the-art analytical instruments? Do they employ advanced manufacturing technologies like continuous processing or automation? Can they handle highly potent or sensitive compounds? The scientific and technical teams are also scrutinized for their depth of knowledge and problem-solving skills.70

- Capacity and Scalability: The ideal partner can support a project’s entire lifecycle. A key question is whether the CDMO has the capacity to not only handle the immediate needs of an early-phase trial but also to seamlessly scale up production to meet the demands of late-stage trials and, ultimately, commercial launch.69 Sponsors prefer to avoid the time, cost, and risk of transferring a project to a different CDMO mid-stream. Therefore, a clear and credible scalability pathway is a critical selection criterion.

- Project Management and Communication: A successful partnership hinges on clear, transparent, and frequent communication. Sponsors look for a CDMO with strong project management processes, including a dedicated project manager who serves as a single point of contact.69 They will evaluate the CDMO’s track record for meeting deadlines and their approach to proactive problem-solving and communication when challenges inevitably arise.

- Cost and Financial Stability: While cost is always a factor, savvy sponsors understand that the cheapest option is rarely the best value. They will scrutinize proposals for transparency, looking for hidden costs related to things like analytical testing, regulatory submissions, or raw material procurement.70 Beyond the project quote, the overall financial health of the CDMO is also critical. A financially stable partner is more likely to be reliable over the long term and to have the resources to invest in maintaining and upgrading its facilities and technologies.

- Cultural Fit: This is an often-overlooked but vital component. A CDMO partnership is a long-term, highly collaborative relationship. Sponsors seek a partner whose values, communication style, and working culture align with their own. This alignment fosters trust and turns a transactional arrangement into a true, synergistic partnership.

Beyond the RFP: The Shift to Strategic Partnerships

The increasing complexity of drug development and the desire to mitigate risk are driving a significant evolution in the nature of sponsor-CDMO relationships. The industry is moving away from purely transactional, project-by-project engagements and toward more integrated, long-term strategic partnerships.

This shift is reflected in how sponsors approach the selection process. They are no longer just looking for a vendor to complete a task; they are looking for a partner to share in the journey. This is borne out by industry survey data, which shows a clear preference for deeper relationships.

A preferred provider agreement often involves a sponsor consolidating a significant portion of its outsourcing work with a small number of pre-vetted, trusted CDMOs. This streamlines the procurement process and fosters deeper institutional knowledge and collaboration. A strategic partnership goes even further, deeply integrating the CDMO into the sponsor’s development process. In this model, the CDMO may contribute its own expertise to process design, share in the risks and rewards of the project, and act as a true extension of the sponsor’s team.

For CDMO business development teams, this trend has profound implications. It means that the goal is not just to win a single project, but to build a relationship based on trust, performance, and shared strategic goals. It requires a shift in mindset from being a service provider to being a problem-solver and a long-term collaborator. Demonstrating a deep understanding of the sponsor’s science, their commercial goals, and the broader market landscape is no longer a “nice-to-have”—it is the price of entry for securing these high-value, strategic partnerships that will define the future of the industry.77

Navigating the Horizon: Challenges and Opportunities Shaping the Future of CDMOs

The CDMO industry, while buoyed by powerful growth drivers, is not without its challenges. The landscape is being actively reshaped by powerful geopolitical forces, intense competitive pressures, and the relentless pace of scientific innovation. For business development professionals, understanding these headwinds and tailwinds is critical for navigating the market, mitigating risks for clients, and positioning their organizations to capitalize on the next wave of growth. The CDMOs that succeed will be those that demonstrate resilience, adaptability, and a forward-looking vision.

Headwinds and Hurdles: Addressing Key Industry Challenges

Several significant challenges are testing the capabilities and business models of CDMOs worldwide. These are not minor operational issues but structural shifts that demand strategic responses.

Supply Chain Resilience and Geopolitical Shifts

The COVID-19 pandemic served as a stark wake-up call, exposing profound vulnerabilities in the highly globalized pharmaceutical supply chain.79 Shortages of critical raw materials, shipping bottlenecks, and over-reliance on single geographic regions for key intermediates and APIs highlighted the fragility of the system. In response, supply chain resilience has moved from a logistical concern to a C-suite-level strategic imperative.

This trend has been dramatically accelerated by rising geopolitical tensions, most notably crystallized in the proposed BIOSECURE Act in the United States.79 This bipartisan legislation aims to prevent U.S. federal funding from going to healthcare companies that use the equipment or services of certain designated Chinese “biotechnology companies of concern,” including industry giants like WuXi AppTec.82 While the bill’s final form and passage remain uncertain, its impact has already been profound. It has triggered a massive strategic re-evaluation across the industry, with an estimated 80% of U.S. biopharma companies having some level of engagement with a China-based CDMO.

The result is a powerful push towards “reshoring” (bringing manufacturing back to the U.S.), “near-shoring” (moving it to nearby countries like Mexico or Canada), and “friend-shoring” (shifting it to allied nations in Europe or other parts of Asia like India and South Korea).85 This presents a monumental challenge for companies deeply integrated with Chinese CDMOs, who face the daunting task of transferring complex manufacturing processes, a process that can take years and cost millions of dollars. However, for CDMOs based in the U.S., Europe, and other preferred regions, the BIOSECURE Act represents a once-in-a-generation business opportunity, potentially redirecting billions of dollars in contract services to their facilities.84

Rising Competition and Client Expectations

The growth of the CDMO market has naturally attracted more players, leading to increased competition. This is not just coming from new CDMO startups; large pharmaceutical companies with excess internal capacity are also entering the contract manufacturing space, further crowding the field. In this environment, clients have become more demanding. They expect not only high quality and competitive pricing but also faster turnaround times, greater operational flexibility, and seamless, transparent communication from their CDMO partners. CDMOs that rely on outdated systems or fail to provide a superior customer experience risk being left behind by more agile and client-centric competitors.

The War for Talent

The very innovation that is driving growth in the pharmaceutical industry is also creating a critical bottleneck: human talent. The demand for highly specialized scientists, engineers, and quality assurance professionals—particularly those with experience in complex areas like cell and gene therapy manufacturing—is far outpacing the available supply. This “war for talent” makes it difficult for CDMOs to recruit and retain the expert workforce needed to execute these advanced projects. This challenge is especially acute for smaller and mid-sized CDMOs competing against larger, better-funded organizations. Investing in workforce training, development, and retention has become as critical as investing in new equipment.

The Next Wave of Innovation: Growth Frontiers for CDMOs

Amidst these challenges lie immense opportunities for growth and differentiation. The CDMOs that will lead the market in the coming decade will be those that invest in the capabilities needed to support the cutting edge of pharmaceutical science and manufacturing technology.

Advanced Therapies: The High-Stakes World of Cell and Gene Therapy (CGT)

The field of Advanced Therapy Medicinal Products (ATMPs), which includes cell and gene therapies, represents one of the most exciting and fastest-growing segments of the pharmaceutical industry. The CDMO market supporting these therapies is projected to grow at a blistering CAGR of over 18%, reaching an estimated USD 37.27 billion by 2034.92 These therapies, such as CAR-T cells for cancer, offer the potential for transformative, and in some cases curative, outcomes for patients with devastating diseases.

However, their manufacturing is extraordinarily complex, presenting a unique set of challenges that are perfectly suited for specialized CDMOs to solve:

- “Vein-to-Vein” Complexity: Autologous therapies, which are made from a patient’s own cells, involve a highly personalized and logistically intense supply chain. It begins with collecting cells from the patient at a hospital, shipping them to a manufacturing facility, genetically engineering them, expanding the cell population, and shipping the final, living drug product back to the hospital for infusion into the same patient—all within a very tight timeframe.94

- Scalability Hurdles: Autologous therapies require a “scale-out” model (many small, parallel manufacturing runs, one for each patient) rather than a traditional “scale-up” model (making ever-larger batches). This demands a completely different approach to facility design, automation, and quality control.94

- Exorbitant Costs: The labor-intensive, highly specialized nature of CGT manufacturing means that the cost per patient can exceed $100,000, creating significant pressure to improve process efficiency.

- Stringent Quality and Safety Control: The use of viral vectors for gene delivery and the fact that the product is composed of living cells necessitate exceptionally rigorous quality control to ensure patient safety and prevent contamination.96

For CDMOs that can master this complexity, the rewards are substantial. They can position themselves as indispensable partners to the innovative companies pioneering these life-saving treatments, capturing a significant share of this high-growth market.98

The Factory of the Future: Continuous Manufacturing (CM)

Another transformative frontier is the shift away from traditional, centuries-old batch manufacturing towards Continuous Manufacturing (CM). In batch processing, materials are loaded into a vessel, a process is run, and the product is discharged, with significant downtime between each step. In CM, raw materials are fed continuously into an integrated, uninterrupted production line, and the finished product emerges continuously at the other end.

The benefits of CM are profound:

- Enhanced Efficiency and Speed: CM can dramatically reduce production timelines. In a notable case study with Roche, implementing an integrated CM process for a drug substance and drug product reduced the total lead time from a staggering 15 months to just 50 hours.

- Improved Quality and Consistency: By operating in a steady state with real-time monitoring and control, CM produces a more consistent product with less batch-to-batch variability.

- Reduced Footprint and Costs: CM facilities are often 70% smaller than their batch counterparts and can reduce overall production costs by as much as 40%.

Despite these advantages, adoption has been slow due to high upfront capital investment, technical complexity, and the industry’s innate conservatism. This creates a clear opportunity for forward-thinking CDMOs to invest in building CM platforms and expertise, offering this next-generation manufacturing technology as a service to clients who cannot or will not make the investment themselves.

The Rise of the “Intelligent CDMO”: The Impact of Artificial Intelligence (AI)

Artificial intelligence is poised to revolutionize every aspect of the CDMO industry, from the factory floor to the sales pipeline. The “Intelligent CDMO” will leverage AI to drive unprecedented levels of efficiency, quality, and strategic insight.

- In Operations: AI and machine learning algorithms can optimize manufacturing processes in real-time, predict equipment failures before they happen (predictive maintenance), and use computer vision to improve quality control inspections.104 Generative AI can analyze data from manufacturing deviations to rapidly identify root causes and suggest effective corrective and preventive actions (CAPAs).104

- In Business Development and Strategy: AI can transform how CDMOs find and win new business. Machine learning models can analyze market data to improve demand forecasting, while AI-driven tools can streamline the partner selection process by systematically scoring potential CDMOs against a client’s specific technical and regulatory needs.107 AI can even be used to generate tailored marketing content, such as technical white papers and case studies, to attract new clients.109

- The Future: Agentic AI: Looking further ahead, the concept of “Agentic AI” envisions systems that move beyond prediction to autonomous action. An Agentic AI could one day monitor a CDMO’s entire supply chain and production schedule and autonomously make adjustments in real-time based on shifting market demand, raw material availability, and production capacity, ushering in a new era of hyper-efficient, self-optimizing manufacturing.

Conclusion: Forging the Future of Medicine, Together

The pharmaceutical industry has embarked on a journey of profound transformation, moving decisively away from a model of siloed self-sufficiency and toward an era defined by strategic collaboration and specialized expertise. At the heart of this new paradigm lies the powerful and intricate relationship between the Active Pharmaceutical Ingredient—the scientific soul of a medicine—and the Contract Development and Manufacturing Organization—the operational engine that brings it to the world. This is no longer a simple, transactional exchange of services for a fee; it has evolved into a deeply integrated partnership that is fundamental to the very process of innovation.

For business development professionals operating within this dynamic ecosystem, the path to success has been redrawn. It is a path that demands a more holistic and strategic approach than ever before. For leaders at pharmaceutical and biotech firms, it requires recognizing that the selection of a CDMO is not a procurement task but a critical strategic decision that can determine the fate of a development program. It involves looking beyond the bottom line of a proposal to assess a potential partner’s technical prowess, regulatory acumen, and cultural alignment, seeking not just a vendor but a true collaborator.

For business development leaders at CDMOs, the challenge and opportunity are even greater. Success is no longer guaranteed by simply having available capacity. It hinges on the ability to anticipate the market’s trajectory, to invest proactively in the technologies and capabilities that will be needed tomorrow—from the complexities of cell and gene therapy to the efficiencies of continuous manufacturing and the intelligence of AI. It requires leveraging sophisticated tools, particularly the rich intelligence embedded in patent data, to move beyond reactive selling and engage potential clients with a deep, pre-existing understanding of their scientific challenges and strategic needs. The goal must be to transform the sales process from a pitch into a consultation, positioning the organization as an indispensable partner in the shared, complex journey of bringing new medicines to patients.

The future of medicine will not be forged in isolation. It will be the product of a symphony of collaboration, a fusion of pioneering science from biotech and pharma innovators with the specialized development and manufacturing power of their CDMO partners. The leaders who master this new score—who build bridges of trust, align strategic goals, and leverage data to navigate the path forward—will be the ones who not only achieve commercial success but also accelerate the delivery of life-changing therapies to the patients who need them most.

Key Takeaways

- The Paradigm Shift to Outsourcing is Structural: The move to outsource development and manufacturing, driven by the ~$2.6 billion cost of bringing a new drug to market, is a permanent strategic shift. It’s a risk management tool that converts high-risk CapEx into manageable OpEx, enabling innovation, particularly for smaller biotech firms.

- Integration is the New Imperative: The increasing complexity of APIs and drug products makes the “one-stop-shop” CDMO model, which integrates drug substance (API) and drug product (formulation) development, a critical success factor. This model de-risks development by eliminating problematic handoffs and creating a continuous feedback loop.

- The CDMO Market is a High-Growth Global Enterprise: The global CDMO market is valued at over $238 billion and is projected to grow at a robust CAGR of ~9.0%. While North America is the current market leader by value, the Asia-Pacific region is the largest by share and the fastest-growing, driven by cost advantages and expanding capabilities.

- Patent Intelligence is a Superpower for Business Development: Patent data provides an unparalleled early-warning system for a company’s R&D pipeline and future manufacturing needs. CDMOs can leverage platforms like DrugPatentWatch to move from reactive selling to proactive, intelligence-driven engagement, and even use macro patent trends to guide strategic capital investments.

- Partner Selection is a Multi-Factor Strategic Decision: Sponsor companies select CDMOs based on a rigorous evaluation of technical expertise, quality and regulatory track record, technological capabilities, scalability, project management, and cultural fit—not just cost. The trend is moving away from transactional vendors toward long-term strategic partners.

- Geopolitics are Reshaping the Supply Chain: The proposed BIOSECURE Act is a major catalyst accelerating the “friend-shoring” of pharmaceutical manufacturing away from China. This presents a significant challenge for reliant companies but a massive opportunity for CDMOs in the U.S., Europe, and other allied nations.

- The Future of CDMO Growth is in Specialization and Technology: The key future growth frontiers for CDMOs lie in mastering high-complexity areas. This includes building specialized capabilities for Advanced Therapies (Cell & Gene Therapy), investing in next-generation platforms like Continuous Manufacturing, and integrating Artificial Intelligence to optimize both operations and business strategy.

Frequently Asked Questions (FAQ)

1. What is the fundamental difference between a CMO and a CDMO, and why has the industry shifted towards the CDMO model?

A Contract Manufacturing Organization (CMO) traditionally focuses solely on the manufacturing aspect of a drug product according to a process provided by the client. The relationship is primarily transactional. A Contract Development and Manufacturing Organization (CDMO), however, offers a much broader, integrated suite of services that includes both development and manufacturing. This includes crucial early-stage activities like process development, formulation, and analytical method development. The industry has shifted decisively towards the CDMO model because modern drugs are increasingly complex. The properties of the Active Pharmaceutical Ingredient (API) and the final drug formulation are deeply intertwined, and separating their development creates significant risk, cost, and delays. The integrated CDMO model provides a “one-stop-shop” that streamlines the entire process, fostering better communication and a more strategic, collaborative partnership.

2. How can a CDMO effectively use patent data to find new clients before an RFP is even issued?

Patent data is a powerful tool for proactive business development. When a company files a patent, it publicly discloses its R&D direction and the technical specifics of a new molecule or technology. A CDMO can monitor patent databases (like the USPTO, Google Patents, or specialized platforms like DrugPatentWatch) for filings in its areas of expertise. A “patent pending” status is a key indicator that a company has an active program and will soon need materials for preclinical and clinical studies. By analyzing the technical details within the patent, the CDMO can anticipate potential manufacturing challenges (e.g., a complex synthesis, potential for low yield) and approach the potential client with a tailored, solution-oriented proposal, demonstrating deep understanding and value before the formal procurement process even begins.

3. What is the “BIOSECURE Act” and how is it expected to impact the global CDMO landscape?

The BIOSECURE Act is proposed U.S. legislation that aims to prevent federal funds from being used to contract with certain Chinese biotechnology companies of concern, including major CDMOs. Its goal is to strengthen U.S. national security and reduce reliance on foreign adversaries for critical pharmaceutical supply chains. While not yet law, it has already prompted a major industry shift. Companies are actively seeking to move their manufacturing out of China to mitigate risk, a trend known as “reshoring” or “friend-shoring.” This creates a significant challenge for companies with established Chinese partners but presents a massive business opportunity for CDMOs located in the United States, Europe, India, and other allied nations, who are poised to capture this redirected business.

4. Why are Advanced Therapies like Cell and Gene Therapy (CGT) considered a major growth area for CDMOs, despite the manufacturing challenges?

Advanced Therapies are a major growth frontier precisely because of their manufacturing challenges. These therapies, such as CAR-T, are often personalized (“vein-to-vein”), logistically complex, and require highly specialized facilities and expertise that most biotech and even large pharma companies do not possess in-house. The challenges—including managing patient-specific “scale-out” manufacturing, ensuring sterility and quality control for living cells, and navigating a novel regulatory landscape—create a high barrier to entry. This makes outsourcing to a specialized CDMO not just an option, but often a necessity. CDMOs that invest in mastering this complexity can command premium pricing and establish themselves as indispensable partners in one of the fastest-growing and most innovative sectors of medicine, which is projected to grow at a CAGR of over 18%.

5. How is Artificial Intelligence (AI) expected to change the way CDMOs operate and compete in the future?

AI is set to transform the CDMO industry on two main fronts: operations and strategy. Operationally, AI will drive efficiency and quality by optimizing manufacturing processes in real-time, enabling predictive maintenance to reduce downtime, and automating quality control. Strategically, AI will enhance business development by improving demand forecasting and streamlining the identification and vetting of potential clients. For example, AI can analyze vast datasets to score a potential partner’s pipeline for its fit with the CDMO’s capabilities. In the future, more advanced “Agentic AI” may even autonomously manage supply chains and production schedules. CDMOs that successfully integrate AI into their workflows will gain a significant competitive advantage through superior efficiency, higher quality, and more intelligent, data-driven business decisions.

References

- When should you outsource drug development – DrugPatentWatch, accessed July 31, 2025, https://www.drugpatentwatch.com/blog/when-should-you-outsource-drug-development/

- Pharmaceutical R&D Outsourcing Market Trends & Demand by 2032 – Straits Research, accessed July 31, 2025, https://straitsresearch.com/report/pharmaceutical-rd-outsourcing-market

- Pharma R&D Services Market Forecast to Grow at 5% p.a., Reaching ~$129B by 2029 – Market Report by DeciBio Consulting LLC | Morningstar, accessed July 31, 2025, https://www.morningstar.com/news/business-wire/20250728307609/pharma-rd-services-market-forecast-to-grow-at-5-pa-reaching-129b-by-2029-market-report-by-decibio-consulting-llc

- Contract manufacturing organization – Wikipedia, accessed July 31, 2025, https://en.wikipedia.org/wiki/Contract_manufacturing_organization

- What is a CDMO & How Do They Help Pharma Companies? – Medical Packaging Inc, accessed July 31, 2025, https://medpak.com/cdmo-pharma/

- What is a CDMO & How Can CDMO Services Benefit Your Pharma Development?, accessed July 31, 2025, https://www.upm-inc.com/what-is-a-cdmo

- Active pharmaceutical ingredient (API) chemicals: a critical review of current biotechnological approaches – PMC, accessed July 31, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC8973766/

- Definition of active pharmaceutical ingredient – NCI Dictionary of Cancer Terms, accessed July 31, 2025, https://www.cancer.gov/publications/dictionaries/cancer-terms/def/active-pharmaceutical-ingredient

- Active Pharmaceutical Ingredient (API) – Biocon, accessed July 31, 2025, https://www.biocon.com/businesses/generics/api-overview/

- Active ingredient, accessed July 31, 2025, https://en.wikipedia.org/wiki/Active_ingredient

- What Are APIs in Pharmaceutical Manufacturing? – Bachem, accessed July 31, 2025, https://www.bachem.com/articles/blog/what-are-apis-in-pharmaceutical-manufacturing/

- Active Pharmaceutical Ingredients (APIs) and Drug Development | Blog – Biosynth, accessed July 31, 2025, https://www.biosynth.com/blog/active-pharmaceutical-ingredients-apis-and-drug-development

- Active Pharmaceutical Ingredients & Intermediates (APIs), accessed July 31, 2025, https://www.pharmaceutical-technology.com/buyers-guide/active-pharmaceutical-ingredients/

- Active Pharmaceutical Ingredient (API) Process Development | Esco Aster, accessed July 31, 2025, https://escoaster.com/Products/api-process-development

- CDMO | CMO | Contract manufacturing services | API production – PharmaCompass.com, accessed July 31, 2025, https://www.pharmacompass.com/pharma-blog/overview-of-gmp-contract-manufacturing-of-apis-from-clinical-production-to-commercial-manufacturing-by-contract-manufacturing-organizations-cmo

- Enhancing Drug Development: A Comprehensive Guide to API …, accessed July 31, 2025, https://www.seqens.com/knowledge-center/enhancing-drug-development-comprehensive-guide/

- What is Contract Manufacturing in Pharma? | AbbVie CMO, accessed July 31, 2025, https://www.abbviecontractmfg.com/news-and-insights/fun-science-friday/what-is-contract-manufacturing-in-pharma.html

- CDMO in Pharma and Biotech: What is it and why do you need one – PharmaSource, accessed July 31, 2025, https://pharmasource.global/content/cdmo-explained-an-overview-of-contract-development-and-manufacturing-organisations-in-pharma/

- CDMO: What Is It and How It Benefits Your Business – Adragos Pharma, accessed July 31, 2025, https://adragos-pharma.com/cdmo-what-is-it-and-how-it-benefits-your-business/

- The Importance of a CDMO: Understanding The Role They Play, accessed July 31, 2025, https://upperton.com/the-importance-of-a-cdmo-understanding-the-role-they-play/

- CDMO Support: Success in Early Phase Drug Product Development & Manufacturing, accessed July 31, 2025, https://pci.com/resources/cdmo-early-phase-drug-product-development-and-manufacturing/

- Why Partnering with a CDMO is Essential for Successful Drug Development – SEQENS, accessed July 31, 2025, https://www.seqens.com/knowledge-center/why-partnering-cdmo-essential-successful-drug-development/

- Our CDMO Services & Capabilities – Patheon, accessed July 31, 2025, https://www.patheon.com/us/en/our-capabilities.html