The biopharmaceuticals narrative has long been dominated by the spectacular rise of biologics. These complex, living-cell-derived therapies have captivated R&D pipelines, captured a growing share of the market, and rightly earned their reputation as the future of medicine. However, a deeper look at the data reveals a compelling and often overlooked story: the enduring strategic significance of the small-molecule drug. Despite the industry’s focus on biologics, a surprising trend is playing out in the corridors of regulatory approval. FDA statistics show that more than half of all novel drug approvals continue to be for small molecules, not biologics, a reality that demands a fundamental re-evaluation of R&D, intellectual property, and business development strategies.

From 2012 to 2022, small-molecule drugs consistently accounted for a substantial portion of new FDA approvals, comprising approximately 57% of all novel therapies to reach the market.1 While the year-over-year performance of biologics has fluctuated, occasionally reaching a high of 50% in 2022, the compact compounds have demonstrated a remarkable, and recent, surge. In 2024, for example, small-molecule therapies made up 27 of the 50 novel drugs approved by the FDA, representing 62% of the total.1 That momentum has only accelerated in 2025, where, as of mid-year, 18 of the 25 drugs approved so far—a full 72%—are small molecules.1

This statistical reality forces a crucial question: why, in an age of unprecedented investment in gene therapies, monoclonal antibodies, and vaccines, does the small molecule not only persist but thrive? The answer lies not in a single factor but in a complex interplay of chemistry, economics, and regulatory policy. For the industry’s most discerning professionals—the R&D leaders, IP strategists, and investors who must navigate this evolving landscape—understanding this phenomenon is not merely an academic exercise. It is a critical component of building a resilient and profitable portfolio.

It is worth noting that a closer examination of the approval data reveals nuances in classification that can influence these percentages. For instance, some analyses classify peptides and oligonucleotides, often grouped as TIDES, separately from both small molecules and biologics. In 2024, of the 50 new drugs approved, some sources categorize 30 as small molecules and 4 as TIDES, with the remaining 16 being biologics.3 Another analysis counts 32 small molecules (64%), stating this figure includes peptides up to 40 amino acids, explaining the higher percentage.4 These subtle differences in definition underscore a powerful point: the value of this analysis lies not in the raw numbers alone, but in a thorough understanding of the underlying trends and the strategic implications they carry. The consistency of the overarching trend, regardless of the precise percentage, is what truly matters.

The Shifting Sands of Innovation: A Foundational Comparison of Therapeutic Modalities

To appreciate the strategic calculus that drives the pharmaceutical industry, one must first understand the fundamental differences between its two dominant therapeutic modalities: small molecules and biologics. These differences are not simply a matter of scale; they represent distinct approaches to drug development, manufacturing, and commercialization, each with its own set of advantages and disadvantages.

The ABCs of Drug Structure: Size, Synthesis, and Stability

At a basic level, the distinction between small molecules and biologics comes down to their molecular architecture. Small-molecule drugs are, by definition, chemically synthesized compounds with a low molecular weight, typically under 1,000 daltons.1 Their compact, stable, and often crystalline structure makes them easy to manufacture and allows them to be administered in a variety of patient-friendly forms, most notably as an oral solid dose like a tablet or capsule.6 A key characteristic of these drugs is their ability to easily penetrate cell membranes and, in some cases, cross the blood-brain barrier to target intracellular proteins, enzymes, or receptors.1 Their stability at room temperature also simplifies storage, labeling, and distribution logistics.7

Biologics, on the other hand, are a different class of medicine entirely. They are complex molecules derived from living organisms or their cells, such as plants, animals, or microorganisms.6 These molecules are often hundreds or even thousands of times larger than small-molecule drugs and include therapeutic proteins, monoclonal antibodies, and vaccines.1 Because of their size and complexity, biologics cannot be administered orally, as they would be destroyed by the digestive system.11 Instead, they must be given via injection or infusion, which can increase the cost of treatment and negatively impact patient adherence.1 Their organic nature also makes them sensitive to light, temperature, and other environmental factors, necessitating specialized equipment and handling throughout the manufacturing and storage process.1

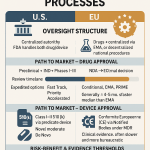

A Tale of Two Regulatory Pathways: NDAs vs. BLAs

The fundamental structural differences between these two drug classes are mirrored in their distinct regulatory pathways. Small-molecule drugs are reviewed and approved by the FDA’s Center for Drug Evaluation and Research (CDER) through a New Drug Application (NDA).8 Following the expiration of their patents and a period of market exclusivity, generic versions can be approved through a streamlined Abbreviated New Drug Application (ANDA) process, which relies on demonstrating bioequivalence to the original drug.6 This pathway was codified by the Hatch-Waxman Act, which was designed to facilitate generic competition and reduce healthcare costs.12

Biologics, in contrast, are regulated by either CDER or the Center for Biologics Evaluation and Research (CBER), depending on their complexity.14 They are subject to a Biologics License Application (BLA) process, which has more stringent requirements around manufacturing than the NDA pathway.6 The development of biologics is so intertwined with their production that an industry aphorism has emerged: “The process is the product”.14 This is because the living cell line and the specific manufacturing protocol used to create a biologic are integral to its final composition, safety, and efficacy. Any change to the manufacturing process, from raw materials to temperature and pressure, can alter the final molecule, making consistency a paramount concern for regulators.14 This complexity is a significant reason why up to half of a regulatory application for a new biologic is focused solely on the manufacturing process.15

The pathway for follow-on biologics, known as biosimilars, was established later by the Biologics Price Competition and Innovation Act (BPCIA) of 2010.12 Unlike generics, which must be chemically identical, biosimilars are simply required to be “highly similar” to the reference product.6 This regulatory distinction, while subtle, has profound implications for intellectual property and market dynamics.

| Property | Small Molecules | Biologics |

| Molecular Size | Low molecular weight (typically <900 Da) 1 | High molecular weight (hundreds to thousands of times larger) 1 |

| Synthesis | Chemically synthesized in a lab 6 | Derived from living organisms/cells 6 |

| Stability | Generally stable, can be stored at room temperature 7 | Sensitive to light, heat, and other factors; require specialized storage 1 |

| Administration Route | Oral (pill, capsule), topical, or injection 7 | Injection or infusion only 1 |

| Mechanism of Action | Can penetrate cell membranes to target intracellular proteins 1 | Tend to act on cell surfaces or extracellular components 11 |

| FDA Pathway | New Drug Application (NDA) 8 | Biologics License Application (BLA) 6 |

| Follow-on Products | Generics (ANDA Pathway) 6 | Biosimilars (BPCIA Pathway) 6 |

The Strategic Calculus of Drug Development: Dollars, Daltons, and Data

With a foundational understanding of the differences between small molecules and biologics established, we can now turn to the critical question facing every C-suite, portfolio manager, and investor: which modality offers the most favorable risk-return profile? This is a sophisticated question that goes far beyond surface-level assumptions about cost and complexity and delves into the nuanced reality of development timelines, clinical trial success rates, and the legal frameworks that shape market exclusivity.

The Cost Conundrum: Unpacking the Economics of R&D

A common belief holds that biologics are far more expensive and time-consuming to develop than small molecules. A comprehensive study reviewed in a JAMA publication challenges this premise, revealing that the true economics are more complex and, in some ways, counterintuitive.16 The study, which analyzed data from 599 new therapeutic agents approved between 2009 and 2023, provides a remarkable side-by-side comparison of the two modalities.

The data indicates that the median development times are almost identical, with biologics averaging 12.6 years from discovery to approval and small molecules taking a nearly identical 12.7 years.16 The median development costs, while slightly higher for biologics at $3.0 billion compared to $2.1 billion for small molecules, are not statistically different.16 These figures include the costs of failed projects, which are a major component of the total price tag for any new drug.

Here’s where the story takes an unexpected turn: Biologics had significantly higher clinical trial success rates at every phase of development.16 This finding is a powerful refutation of the idea that biologics are inherently riskier. While a single, successful biologic project might have a higher upfront cost, a company needs to fund fewer failed projects to achieve a single success. This lower attrition rate de-risks the entire pipeline and makes a successful biologic a more predictable, and therefore more valuable, asset in a portfolio.

This lower clinical risk profile, combined with their higher median peak revenues of $1.1 billion (versus $0.5 billion for small molecules), helps explain why biologics have been a magnet for investment.16 In an analysis of project value, a preclinical biologic candidate was found to have a net present value (NPV) that was 2.5 times higher than that of a small molecule, reflecting the higher probability of clinical success.18 This is a crucial distinction: while the raw cost of a single project may be similar, the probability of reaching a commercial endpoint is not, which changes the entire investment calculus.

| Small Molecules | Biologics | |

| Median R&D Cost | ~$2.1 Billion 16 | ~$3.0 Billion 16 |

| Median Development Time | ~12.7 Years 16 | ~12.6 Years 16 |

| Clinical Trial Success Rate | Lower than biologics at every phase 16 | Higher than small molecules at every phase 16 |

| Median Patent Count | 3 patents 16 | 14 patents 16 |

| Median Time to Competition | 12.6 Years 16 | 20.3 Years 16 |

| Median Annual Treatment Cost | $33,000 16 | $92,000 16 |

| Median Peak Revenue | $0.5 Billion 16 | $1.1 Billion 16 |

Fortifying the Franchise: IP Strategy for the Modern Era

In the pharmaceutical industry, intellectual property is not a secondary concern; it is the fundamental economic engine that fuels innovation and creates value.19 The differences in how companies protect small molecules versus biologics are profound and speak directly to their long-term strategic value.

The same JAMA study noted a stark difference in the number of patents protecting each modality. On average, a biologic is protected by a median of 14 patents, compared to just 3 patents for a small molecule.16 This is not an accident; it is a deliberate and multi-layered strategy known as building a “patent thicket”.19 For small molecules, whose core composition patent may expire first, companies must create a formidable fortress of secondary patents covering new formulations, methods of use, or manufacturing processes.19 A generic competitor must then navigate this legal minefield, attempting to either invalidate or design around dozens of patents. This strategic approach is a powerful deterrent and a core component of lifecycle management for a small-molecule drug.

For biologics, the dense patent landscape reflects the complexity of the “process is the product” approach. Patents may cover not only the molecule itself but also the specific cell lines, vectors, and purification methods used to produce it.14 This creates a high barrier to entry that is more difficult for biosimilar manufacturers to overcome, a factor that contributes to the significant disparity in time to competition. The median time to biosimilar competition for a biologic is a remarkable 20.3 years, compared to just 12.6 years for a small molecule to face generic competition.16

This legal and economic reality has been further amplified by government policy. The 2022 Inflation Reduction Act (IRA) created a differential in Medicare price negotiation eligibility that has become a major strategic consideration. Biologics are exempt from price negotiation for 11 years after approval, while small-molecule drugs are only exempt for seven years.1 This “pill penalty,” as some have called it, creates a significant financial incentive for companies to favor biologics, as it grants them a much longer period of market freedom before price controls take effect.1

“There is little evidence to support biologics having longer periods of market exclusivity or protection from negotiation. As a result of differential treatment, US law appears to overly reward the development of biologics relative to small-molecule drugs.” — Excerpt from a study published in JAMA Internal Medicine 16

This dynamic highlights a crucial disconnect. While the statutory rationale for this differential treatment was the premise that biologics are riskier and more expensive to develop and have weaker patent protection, the evidence suggests the opposite: biologics have higher clinical success rates, similar R&D costs, and much more extensive patent portfolios.16 This means that US policy is actively channeling investment into a therapeutic modality that is, in some key metrics, already the more durable and profitable choice. For companies aiming to gain a competitive edge, monitoring this complex landscape is paramount. Platforms such as

DrugPatentWatch allow organizations to systematically track and analyze these patent filings, providing an early warning system for competitive threats and an invaluable source of intelligence on competitor R&D pipelines.24

Accelerating the Pipeline: The Role of Technology in R&D

While the legal and economic frameworks are powerful drivers, the scientific landscape is also evolving in ways that favor both modalities. For small molecules, the rise of advanced technologies is fundamentally reshaping the discovery and development process. Artificial intelligence (AI) and machine learning (ML) are enabling faster, more accurate prediction of drug-like molecular structures, allowing researchers to optimize for safety, potency, and bioavailability with unprecedented speed.1 High-throughput screening and structure-based design, bolstered by automation and imaging, are also improving success rates and shortening lead optimization timelines.25

Perhaps most compelling are the new approaches that are opening up previously “undruggable” targets. For example, research is exploring the potential of small molecules to modulate biological pathways at the RNA level, a domain once thought to be accessible only to nucleic acid-based biologics.25 This kind of creative thinking and technological advancement is breathing new life into the small-molecule pipeline and ensuring its continued relevance in a biotech-driven world.

Case Studies in Competitive Advantage: From Bench to Blockbuster

For an expert audience, theoretical frameworks are only as valuable as their application in the real world. To that end, let us examine two recent, high-profile drug approvals that exemplify the strategic realities discussed: the small molecule Rezdiffra and the biologic Kisunla. These case studies provide tangible examples of how market, regulatory, and IP strategies unfold in practice.

The Small Molecule Triumph: Rezdiffra (Resmetirom)

Rezdiffra (resmetirom) is a small-molecule drug that received accelerated FDA approval on March 14, 2024, for the treatment of noncirrhotic non-alcoholic steatohepatitis (NASH) with liver fibrosis.26 This approval was a major milestone, as it was the first time a therapy was approved for this widespread and progressive liver disease, which was previously a massive unmet medical need.26

The story of Rezdiffra demonstrates a sophisticated commercial strategy for a modern small molecule. The drug’s launch has been a resounding success, with Madrigal Pharmaceuticals reporting net sales of $212.8 million in the second quarter of 2025 alone and more than 23,000 patients on the therapy as of June 30, 2025.28 This rapid market uptake and strong sales performance immediately validate the commercial potential of a well-targeted small molecule addressing a significant patient population.

The intellectual property strategy for Rezdiffra is a textbook example of lifecycle management. While the drug’s New Chemical Entity (NCE) exclusivity expires in March 2029, a new U.S. patent was recently issued that extends its patent protection to February 2045.28 This new patent specifically covers the drug’s FDA-approved dosing regimen, which will be listed in the FDA’s Approved Drug Products with Therapeutic Equivalence Evaluations, commonly known as the Orange Book.21 This strategic move creates a powerful, long-term barrier to generic competition, illustrating that a well-crafted patent thicket can give a small molecule a market exclusivity period that rivals or even exceeds that of many biologics. It proves that small-molecule drugs are not a relic of the past but an enduring platform for innovation and durable market franchises.

The Biologic Blockbuster: Kisunla (Donanemab)

In a parallel development, the biologic Kisunla (donanemab), a monoclonal antibody, received FDA approval in July 2024 for the treatment of early-stage Alzheimer’s disease.1 This approval was based on compelling Phase 3 data showing that the therapy slowed cognitive and functional decline by up to 35% and significantly reduced the brain amyloid plaques believed to contribute to the disease.30

The story of Kisunla exemplifies the high-stakes, high-reward nature of biologic development. As a first-in-class therapy in a devastating and widespread disease, it has the potential to become a colossal blockbuster. GlobalData analysts forecast that Kisunla could generate global sales of approximately $3.8 billion by 2033, a figure that underscores the immense value a single, successful biologic can create.32 While it faces direct competition from another approved biologic, Leqembi (lecanemab), the massive market and the high barriers to entry inherent in biologic manufacturing and IP strategy limit the number of serious competitors.33

A high-value biologic like Kisunla can serve as the financial and strategic anchor for a company’s entire portfolio. The sheer size of its potential market, combined with the extensive IP protection and long exclusivity periods afforded to biologics, makes it a durable asset that can generate revenue for years and fund further R&D in other therapeutic areas. This is why, despite the resurgence of small molecules, investment in large-molecule therapies continues to grow at a remarkable pace.34

| Rezdiffra (Small Molecule) | Kisunla (Biologic) | |

| Target Disease | Non-alcoholic Steatohepatitis (NASH) 26 | Alzheimer’s Disease (AD) 30 |

| Approval Pathway | Accelerated Approval (NDA) 26 | BLA 36 |

| Key Clinical Data | Resolution of NASH, improvement in liver scarring 26 | Slowed cognitive decline (up to 35%), cleared amyloid plaques 30 |

| Market Potential | Rapid market uptake with strong initial sales 28 | Forecasted global sales of ~$3.8B by 2033 32 |

| IP Strategy | Lifecycle management via new patent covering dosing regimen; protection extended to 2045 28 | High number of patents (median of 14 for biologics) and long statutory exclusivity 16 |

From Data to Decision: Strategic Insights for the C-Suite

The data and case studies presented here provide a clear mandate for pharmaceutical and biotech leaders: strategic planning can no longer be based on outdated assumptions. A nuanced, data-driven approach is essential for navigating the complexities of modern drug development.

For R&D Teams: Optimizing Portfolio Strategy

The evidence suggests that a hybrid portfolio—one that strategically balances both small molecules and biologics—is the most resilient and profitable model. Small molecules offer a faster, more predictable path to market for addressing new targets, especially with the aid of AI and other technological accelerants. Their oral bioavailability and lower manufacturing costs make them ideal for treating chronic, widespread diseases and serve as a reliable source of revenue. Meanwhile, biologics, with their higher clinical success rates and potential for higher peak revenues, serve as the high-value, durable assets that can anchor a company’s long-term financial stability. A successful portfolio is not about choosing one over the other but about strategically allocating resources to both.

For IP and Legal Teams: Building Robust Patent Defenses

The data shows that a biologic’s IP advantage is not inherent but is a product of deliberate strategy, extensive R&D, and favorable government policy. For legal and IP teams, this means that a robust, multi-layered patent strategy is no longer a luxury but a core element of the corporate plan. For small molecules, a thicket of formulation and method-of-use patents is essential for extending the product lifecycle and creating a powerful deterrent to generic entry. For biologics, the focus must be on protecting the entire ecosystem of innovation, including the manufacturing process, cell lines, and novel combinations. The differential treatment under the IRA has fundamentally changed the calculus, and IP teams must now model the financial impact of the “pill penalty” into their long-term forecasts and strategic decisions.

For Business Development and Investors: Identifying Opportunities

For business development teams and investors, the trends are creating new avenues for value creation. The high volume of small-molecule approvals means there are more opportunities for licensing agreements and M&A, particularly for companies with promising small-molecule assets that have strong patent protection and a clear path to market for a high-value unmet need, as was the case with Rezdiffra. Conversely, a high-value biologic offers a massive, durable asset that can be a target for acquisition or a powerful anchor for a portfolio. By leveraging data platforms that track patent filings and regulatory approvals, these professionals can gain a crucial early-mover advantage in identifying and capitalizing on these opportunities.

Key Takeaways

- Small Molecules are Not “Old Tech”: The FDA approval trend proves their enduring strategic importance. They are not a relic of the past but a thriving, evolving platform for innovation.

- Economics are Nuanced: Despite common perception, the R&D costs and timelines for small molecules and biologics are similar. However, biologics have higher clinical success rates and stronger IP protection, which can lead to a more favorable risk-adjusted return on investment.

- The “Pill Penalty” is Real: The IRA’s differential treatment actively favors the development of biologics, which receive a much longer period of exemption from price negotiation. This is a crucial, policy-driven factor that shapes investment decisions.

- IP is the New R&D: The strategic use of patent thickets for small molecules and process patents for biologics is critical for creating long-term value and delaying competition. A nuanced understanding of the patent landscape is as important as the science itself.

- Competitive Intelligence is Crucial: Leveraging patent and pipeline data provides an essential early warning system, allowing companies to anticipate market shifts, identify competitive threats, and make data-driven decisions that drive competitive advantage.

Frequently Asked Questions (FAQ)

Q: How do advancements in AI and machine learning specifically benefit small-molecule drug development, and is this advantage sustainable?

A: AI and machine learning are revolutionizing small-molecule development by accelerating the discovery and optimization phases. They can rapidly screen billions of compounds to identify those with the highest potential for binding to a specific target, thereby reducing the time and cost of early-stage research. This is particularly sustainable for small molecules because their simpler, well-defined chemical structures are highly amenable to computational modeling and predictive analytics, allowing for targeted synthesis and “fail faster” approaches. While biologics also benefit from AI in areas like protein folding, the fundamental chemical predictability of small molecules gives this modality a unique and long-term advantage in the digital age.

Q: With the growing focus on personalized and precision medicine, are small-molecule drugs capable of the same specificity as biologics?

A: The conventional wisdom is that biologics, with their highly specific binding sites, are more targeted than small molecules. However, the field is evolving rapidly. While a small molecule may have a higher potential for off-target effects due to its size, new technologies and design principles are enabling a new generation of small molecules that are highly selective for specific disease pathways.25 For example, researchers are now designing small molecules that can modulate gene expression at the RNA level, a level of precision once thought to be the sole domain of large-molecule therapies. The approval of therapies like Rezdiffra for a specific liver condition demonstrates that small molecules can be highly effective and targeted for unmet medical needs.

Q: Does the higher cost of biologic treatments disproportionately impact patient access, and what role do biosimilars play in this dynamic?

A: Yes, the median annual cost of biologic treatments at $92,000 is significantly higher than the $33,000 median for small molecules, which can create substantial barriers to patient access.16 This is where the Biologics Price Competition and Innovation Act (BPCIA) plays a crucial role. By creating a regulatory pathway for biosimilars, the BPCIA was designed to foster competition and reduce healthcare costs.12 While biologics receive a statutory 12 years of exclusivity, the entry of biosimilars, which are required to be “highly similar” to the reference product, is expected to drive down prices and increase patient access over time. The long-term impact of this legislation is still unfolding as more blockbuster biologics lose exclusivity, and their corresponding biosimilars enter the market.

Q: How does the “process is the product” concept for biologics affect a company’s ability to protect its intellectual property over time?

A: The “process is the product” principle is both a challenge and a strategic advantage for intellectual property. While a small molecule’s core IP often resides in its chemical composition, a biologic’s value is deeply tied to the proprietary manufacturing process used to create it.14 This means that a company can secure patents on its unique cell lines, expression systems, or purification methods, creating a formidable barrier to entry that is distinct from the primary molecule patent.22 For a biosimilar manufacturer, replicating the exact process to create a “highly similar” product is a complex and capital-intensive endeavor, which is why biologics are protected by a thicker web of patents and have a much longer median time to competition than small molecules.16

Q: Given the IRA’s “pill penalty” favoring biologics, why would a company still choose to invest in small molecules?

A: The IRA’s differential treatment does create a powerful incentive to develop biologics, but it doesn’t eliminate the strategic rationale for small molecules. A small molecule’s lower manufacturing cost, simpler logistics, and the possibility of a faster clinical trial pathway for certain indications still make it a compelling investment. Furthermore, a company can employ a sophisticated IP strategy—using formulation, method-of-use, and combination patents—to build a robust patent thicket that extends the drug’s market exclusivity for years, as seen in the case of Rezdiffra.28 This strategic approach, combined with the proven market for small molecules, ensures that they will remain a vital and profitable part of the pharmaceutical ecosystem for the foreseeable future.

Works cited

- The Rise of Small-Molecule Drugs in FDA Approvals – Definitive …, accessed September 22, 2025, https://www.definitivehc.com/blog/small-molecule-drug-rise

- www.definitivehc.com, accessed September 22, 2025, https://www.definitivehc.com/blog/small-molecule-drug-rise#:~:text=But%20recent%20years%20have%20shown,%25)%20are%20small%2Dmolecule%20drugs.

- The Pharmaceutical Industry in 2024: An Analysis of the FDA Drug …, accessed September 22, 2025, https://www.mdpi.com/1420-3049/30/3/482

- FDA Novel Drug Approvals 2024 — Small Molecules Rise to 64% | CCDC, accessed September 22, 2025, https://www.ccdc.cam.ac.uk/discover/blog/small-molecules-fda-novel-drug-approvals-2024/

- www.patheon.com, accessed September 22, 2025, https://www.patheon.com/us/en/insights-resources/blog/what-are-small-molecule-drugs.html#:~:text=Small%2Dmolecule%20drugs%20are%20low,enzymes%2C%20receptors%2C%20or%20proteins.

- What Are Biologic and Small Molecule Drugs Used For? – GoodRx, accessed September 22, 2025, https://www.goodrx.com/drugs/biologics/vs-small-molecule-drugs

- What are Small Molecule Drugs? – Patheon pharma services, accessed September 22, 2025, https://www.patheon.com/us/en/insights-resources/blog/what-are-small-molecule-drugs.html

- Regulatory Knowledge Guide for Small Molecules – NIH SEED Office, accessed September 22, 2025, https://seed.nih.gov/sites/default/files/2024-03/Regulatory-Knowledge-Guide-for-Small-Molecules.pdf

- Difference Between Small Molecule and Large Molecule Drugs – Caris Life Sciences, accessed September 22, 2025, https://www.carislifesciences.com/difference-between-small-molecule-and-large-molecule-drugs/

- Differences between Biologics and Small Molecules | UCL Therapeutic Innovation Networks, accessed September 22, 2025, https://www.ucl.ac.uk/therapeutic-innovation-networks/differences-between-biologics-and-small-molecules

- Small Molecules vs. Biologics: Key Drug Differences – Allucent, accessed September 22, 2025, https://www.allucent.com/resources/blog/points-consider-drug-development-biologics-and-small-molecules

- Commemorating the 15th Anniversary of the Biologics Price Competition and Innovation Act, accessed September 22, 2025, https://www.fda.gov/drugs/cder-conversations/commemorating-15th-anniversary-biologics-price-competition-and-innovation-act

- BPCIA: Beyond the Hatch-Waxman Act – Pharmaceutical Law Group, accessed September 22, 2025, https://www.pharmalawgrp.com/bpcia/

- Regulatory Knowledge Guide for Biological Products – NIH SEED Office, accessed September 22, 2025, https://seed.nih.gov/sites/default/files/2024-03/Regulatory-Knowledge-Guide-Biological-Products.pdf

- Building Biologics – Genentech, accessed September 22, 2025, https://www.gene.com/stories/building-biologics

- Differential Legal Protections for Biologics vs Small-Molecule Drugs …, accessed September 22, 2025, https://pubmed.ncbi.nlm.nih.gov/39585667/

- 1 Differential Legal Protections for Biologics vs. Small-Molecule Drugs in the US Olivier J. Wouters, PhD1, accessed September 22, 2025, http://eprints.lse.ac.uk/126180/1/2024.08.03_manuscript.pdf

- Investigating investment in biopharmaceutical R&D – PMC, accessed September 22, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC5100010/

- The Pharmaceutical Patent Playbook: Forging Competitive Dominance from Discovery to Market and Beyond – DrugPatentWatch, accessed September 22, 2025, https://www.drugpatentwatch.com/blog/developing-a-comprehensive-drug-patent-strategy/

- Drug Patents: How Pharmaceutical IP Incentivizes Innovation and Affects Pricing, accessed September 22, 2025, https://www.als.net/news/drug-patents/

- Patent Listing in FDA’s Orange Book – Congress.gov, accessed September 22, 2025, https://www.congress.gov/crs-product/IF12644

- Patents to biological medicines in combination: is two really better than one?, accessed September 22, 2025, https://www.penningtonslaw.com/news-publications/latest-news/2022/patents-to-biological-medicines-in-combination-is-two-really-better-than-one

- Small-Molecules Are More Cost Effective Than Biologics, Tufts …, accessed September 22, 2025, https://www.managedhealthcareexecutive.com/view/small-molecules-are-more-cost-effective-than-biologics-tufts-researchers-find

- How to Track Competitor R&D Pipelines Through Drug Patent …, accessed September 22, 2025, https://www.drugpatentwatch.com/blog/how-to-track-competitor-rd-pipelines-through-drug-patent-filings/

- Small molecules – AstraZeneca, accessed September 22, 2025, https://www.astrazeneca.com/r-d/next-generation-therapeutics/small-molecule.html

- Drug Trials Snapshots: REZDIFFRA – FDA, accessed September 22, 2025, https://www.fda.gov/drugs/drug-approvals-and-databases/drug-trials-snapshots-rezdiffra

- Rezdiffra (resmetirom) FDA Approval History – Drugs.com, accessed September 22, 2025, https://www.drugs.com/history/rezdiffra.html

- Madrigal Pharmaceuticals Reports Second-Quarter 2025 Financial Results and Provides Corporate Updates, accessed September 22, 2025, https://ir.madrigalpharma.com/news-releases/news-release-details/madrigal-pharmaceuticals-reports-second-quarter-2025-financial

- Rezdiffra patent expiration – Pharsight, accessed September 22, 2025, https://pharsight.greyb.com/drug/rezdiffra-patent-expiration

- FDA Approves Donanemab for Early Alzheimer’s Disease Treatment – Butler Hospital, accessed September 22, 2025, https://www.butler.org/memoryandaging/fda-approves-donanemab-for-early-alzheimers-disease-treatment

- Donanemab, Kisunla, FDA approved, Alzheimer’s drug – UCLA Easton Center, accessed September 22, 2025, https://eastonad.ucla.edu/patient-care/alzheimers-disease-treatments/donanemab

- Alzheimer’s disease market expected to reach $19.3bn across the 8MM by 2033, accessed September 22, 2025, https://www.clinicaltrialsarena.com/analyst-comment/alzheimers-disease-market-8mm-2033/

- Alzheimer’s Drugs Market Size & Opportunities, 2025-2032 – Coherent Market Insights, accessed September 22, 2025, https://www.coherentmarketinsights.com/market-insight/alzheimers-drugs-market-1373

- Biological Drug Market Trends, Share, Growth Anaysis | 2034 – Fact.MR, accessed September 22, 2025, https://www.factmr.com/report/biological-drug-market

- Biologics Market Size, Share & Growth Analysis Report, 2030, accessed September 22, 2025, https://www.grandviewresearch.com/industry-analysis/biologics-market

- APPLICATION NUMBER: – 761248Orig1s000 RISK ASSESSMENT and RISK MITIGATION REVIEW(S) – accessdata.fda.gov, accessed September 22, 2025, https://www.accessdata.fda.gov/drugsatfda_docs/nda/2024/761248Orig1s000RiskR.pdf