Last updated: July 27, 2025

Introduction

Doxycycline, a broad-spectrum tetracycline antibiotic, has played a pivotal role in antimicrobial therapy since its introduction in the 1960s. Its efficacy against a wide array of bacterial infections, coupled with its well-characterized pharmacokinetic profile, has sustained its relevance in clinical practice. This analysis explores the evolving market dynamics and financial trajectory of doxycycline, emphasizing factors influencing supply, demand, regulatory landscape, and competitive positioning.

Pharmacological Profile and Clinical Applications

Doxycycline’s versatility underpins its continued prominence. It is effective against respiratory tract infections, acne, Lyme disease, Malaria prophylaxis, and certain sexually transmitted infections (STIs) [1]. Its oral bioavailability, long half-life, and favorable tissue penetration confer clinical convenience. Additionally, doxycycline’s relatively low cost enhances its accessibility, especially in resource-limited settings.

Market Overview and Key Drivers

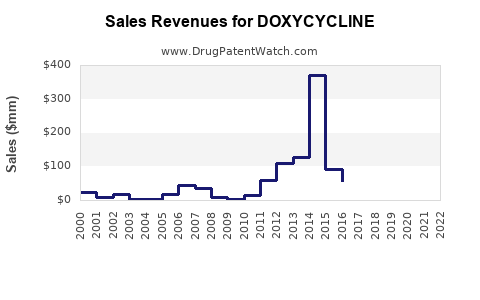

The global doxycycline market has exhibited steady growth, driven by increasing awareness of infectious diseases, rising antibiotic resistance, and expanding indications. The anticipated market size was valued at approximately USD 575 million in 2022 and is projected to grow at a CAGR of 3-5% over the next five years [2].

Key drivers include:

- Endemic infectious diseases: Lyme disease, malaria, and bacterial skin infections sustain demand.

- Antimicrobial resistance: Growing resistance to other antibiotics positions doxycycline as a preferred alternative.

- Oral formulation preference: Its convenient administration promotes adherence and broadens outpatient use.

- Emerging indications: Research into doxycycline’s role in inflammatory conditions and COVID-19-related complications influences market expansion.

Competitive Landscape and Market Share

The doxycycline market features a diverse mix of patented formulations and generic equivalents. Major pharmaceutical companies, including Pfizer, Teva, and Mylan, dominate the generic segment, capitalizing on cost-effective manufacturing.

Market share consolidation has been driven by patent expiries, typically around the late 2000s, leading to a proliferation of generics that dominate sales volumes globally [3].

Biosimilar and novel formulations have yet to significantly impact the doxycycline market due to its long-established profile; however, ongoing research into topical and controlled-release formulations could influence future competitive dynamics.

Regulatory Landscape and Patent Status

Doxycycline’s patent protection expired decades ago, leading to an extensive generic market and price erosion. Regulatory agencies like the FDA oversee manufacturing standards, with most formulations approved as generics or off-patent drugs.

Regulatory challenges currently center on:

- Ensuring consistent quality in manufacturing.

- Navigating approval pathways for new formulations or delivery methods.

- Monitoring off-label uses that may lack robust evidence.

The absence of patent protections continues to influence market entry and pricing strategies, emphasizing cost competitiveness over innovation.

Supply Chain and Manufacturing Trends

Supply chain stability is critical, given doxycycline’s widespread use. Recent challenges include:

- Raw material shortages: Fluctuations in tetracycline precursor availability due to geopolitical and environmental factors.

- Manufacturing disruptions: COVID-19-related production halts impacted global supply, prompting strategic stockpiling.

- Regulatory compliance: Maintaining adherence to Good Manufacturing Practices (GMP) is crucial for global markets.

Manufacturers are increasingly adopting advanced manufacturing technologies to enhance scalability and ensure consistent quality.

Impact of Antibiotic Resistance and Stewardship Programs

Global antibiotic stewardship initiatives aim to curb misuse and resistance development. These efforts influence doxycycline’s demand:

- Reduced usage in certain indications: Policies restrict over-the-counter sales in some regions.

- Enhanced clinical guidelines: Recommending alternative antibiotics in resistant infections could dampen growth.

- Monitoring resistance patterns: Continuous surveillance informs prescribing practices and market forecasts.

Nevertheless, doxycycline remains a cornerstone antibiotic, especially where resistance to other classes has surged.

Emerging Trends and Future Opportunities

Recent research explores doxycycline’s potential beyond traditional indications:

- Anti-inflammatory and antiviral properties: Investigations into doxycycline’s role in managing COVID-19 and other inflammatory processes could create new markets.

- Topical and delivery innovations: Developing formulations with improved bioavailability or targeted delivery may command premium pricing.

- Biological modifications: Patent-protected derivatives or combination therapies could rejuvenate interest amid commoditization.

However, regulatory hurdles and the generic landscape act as barriers to rapid commercialization.

Financial Trajectory and Investment Outlook

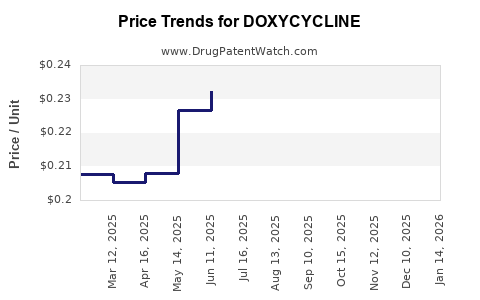

The doxycycline market’s low-cost, high-volume nature positions it as a stable but mature segment. Revenue growth is constrained by:

- Price erosion: Due to generic competition.

- Regulatory constraints: Limiting new product differentiation.

- Usage restrictions: Emerging stewardship policies.

Investors favor established players with diversified infectious disease portfolios over pure doxycycline-focused entities.

Future financial performance hinges on:

- Maintaining supply chain reliability.

- Advancing new formulations or indications.

- Navigating resistance and stewardship policies effectively.

Overall, the financial trajectory remains steady, with moderate growth potential rooted in emerging applications and regional demand expansion.

Regional Market Dynamics

- North America: Largest market share, driven by high healthcare expenditure, antibiotic stewardship policies, and chronic infectious disease management.

- Europe: Similar trends with increasing regulation influencing prescribing habits.

- Asia-Pacific: Rapid growth, fueled by expanding healthcare infrastructure, infectious disease burden, and affordability, presents significant opportunities.

- Emerging markets: Focus on affordability and availability continues to drive demand, despite regulatory and resistance challenges.

Conclusion

Doxycycline's market dynamics are characterized by steady demand, a mature competitive landscape, and evolving regulatory considerations. While the threat of antibiotic resistance and generic price erosion temper prospects for explosive growth, expanding indications, regional demand, and research into novel formulations underpin a stable financial outlook. Strategic focus on supply chain resilience, innovation within generics, and cautious exploration of new indications will determine future trajectory.

Key Takeaways

- Market stability is maintained through extensive generic production, with growth driven primarily by regional demand and emerging indications.

- Pricing pressures remain significant due to patent expiries and generic competition, constraining margins.

- Supply chain robustness is vital amid raw material shortages and geopolitical influences affecting manufacturing.

- Regulatory and stewardship policies influence prescribing patterns, impacting demand trajectories.

- Innovation prospects, including new formulations and potential new indications, offer moderate upside in a mature market.

FAQs

1. What are the primary clinical indications driving doxycycline sales?

Doxycycline is predominantly used to treat respiratory infections, Lyme disease, malaria prophylaxis, STIs, and acne, sustaining consistent global demand [1].

2. How does antibiotic resistance impact doxycycline’s market prospects?

Rising resistance to other antibiotics positions doxycycline as an alternative therapy, positively influencing demand. However, stewardship policies limiting broad-spectrum antibiotic use could restrict its application in certain settings.

3. What challenges does the doxycycline market face due to patent expiries?

Patent expiries have led to widespread generic production, reducing prices and profit margins, limiting incentives for innovation but ensuring affordability and widespread access.

4. Are there any innovative formulations of doxycycline on the horizon?

Research into topical, controlled-release, and combination formulations is ongoing, aiming to improve pharmacokinetics and patient adherence, potentially opening new market segments.

5. How might regional differences influence doxycycline market growth?

Emerging markets, particularly in Asia-Pacific, exhibit rapid growth owing to expanding healthcare access and disease prevalence, providing revenue opportunities despite challenges like regulatory variability.

Sources:

[1] Pharmacology textbooks, clinical guidelines.

[2] MarketsandMarkets, Global Antibiotics Market Report, 2022.

[3] IMS Health, Pharmaceutical Market Data, 2022.