Last updated: July 27, 2025

Introduction

In the dynamic landscape of the pharmaceutical industry, Bionpharma has established itself as a notable player, primarily focusing on generic and biosimilar products. As the sector witnesses unprecedented innovation coupled with intensifying competition, understanding Bionpharma’s market position, core strengths, and strategic initiatives is vital for stakeholders aiming to navigate this complex environment effectively. This comprehensive analysis explores Bionpharma’s competitive standing, key differentiators, growth strategies, and forecasts future trajectory amid evolving regulatory and commercial challenges.

Company Overview

Founded in 2011, Bionpharma has rapidly expanded within the highly competitive generic and biosimilar segments. Headquartered in Florida, USA, the company leverages a vertically integrated supply chain, encompassing manufacturing, R&D, and commercialization. Bionpharma has garnered approval for over 100 generic medicines and intends to broaden its product portfolio, focusing on high-value therapeutic areas such as oncology, immunology, and specialty care.

Market Positioning and Reputation

Bionpharma positions itself as a mid-tier manufacturer with a strategic focus on high-margin biosimilars and complex generics. Its competitive edge stems from an ability to deliver affordable, quality medicines aligned with increasing global demand for cost-containment in healthcare. While not yet on par with industry giants like Teva or Sandoz, Bionpharma's agility and innovation-driven approach allow it to carve niche segments and selectively expand its footprint in emerging markets and hospital formularies.

The company's reputation hinges on its commitment to regulatory compliance, quality assurance, and strategic partnerships. Bionpharma's recent USFDA approvals and growth in international markets underscore its increasing credibility and accelerated market penetration.

Strengths

1. Robust Product Pipeline and Focused Portfolio

Bionpharma emphasizes developing biosimilars and complex generics, which often face higher barriers but offer substantial profit margins. Its pipeline includes biosimilars in oncology and autoimmune diseases, aligning with industry trends toward biologic replacements. This focus positions Bionpharma as a competitive innovator ready to capitalize on the biosimilar wave, driven by patent expirations on blockbuster biologics like Humira and Remicade.

2. Vertical Integration and Quality Assurance

The company's vertically integrated manufacturing ensures stringent quality control, cost efficiencies, and supply chain resilience. Bionpharma invests in state-of-the-art facilities compliant with cGMP standards, reducing dependency on external suppliers and enhancing regulatory confidence.

3. Strategic Regulatory Achievements

Bionpharma’s ability to secure FDA approvals for complex generics and biosimilars enhances its market access. Its proactive engagement with regulatory agencies facilitates smoother approval pathways and supports timely product launches, a critical advantage in a competitive environment.

4. Global Market Expansion

Bionpharma targets emerging markets with high unmet needs, leveraging strategic partnerships and local compliance expertise. This expansion diversifies revenue streams and reduces reliance on saturated US markets, positioning the company for sustained growth amid global healthcare shifts.

5. Innovation and R&D Investment

Continued investment in R&D underpins Bionpharma's innovation strategy, enabling development of complex molecules and formulations. Its focus on technological advancement grants a competitive edge in producing biosimilars with reduced development timelines and costs.

Weaknesses

1. Limited Brand Recognition

Compared to major pharmaceutics, Bionpharma’s relatively modest market presence limits negotiating influence with large healthcare providers and insurance entities, potentially impacting market share growth.

2. Capital-Intensive Biosimilar Development

Biosimilar manufacturing entails high upfront costs, complex logistics, and rigorous regulatory hurdles. These factors pose risks, especially when regulatory landscapes rapidly evolve or if approval timelines extend.

3. Dependence on Regulatory Approvals

Bionpharma’s growth hinges on securing timely regulatory approvals. Any delays or rejections could significantly impair expansion plans and erode investor confidence.

4. Competitive Pressure from Industry Giants

Established players with extensive pipelines and global reach can outmaneuver Bionpharma via aggressive pricing, patent challenges, or strategic acquisitions, pressuring margins.

Strategic Insights

1. Strengthening Pipeline Diversification

Bionpharma should diversify its biosimilar portfolio across multiple therapeutic areas, reducing dependency on a few high-stakes molecules and mitigating regulatory risks.

2. Enhancing Global Partnerships

Forming alliances with local manufacturers, government agencies, and healthcare providers will facilitate faster market penetration, especially in Asia, Latin America, and Eastern Europe.

3. Focusing on Value-Added Formulations

Innovating with novel delivery systems, combination products, or extended-release formulations can distinguish Bionpharma’s offerings, foster premium pricing, and elevate market positioning.

4. Strategic Acquisitions and Collaborations

Acquiring or partnering with emerging biotech firms possessing innovative biosimilar candidates can accelerate development timelines and expand pipeline robustness.

5. Investing in Digital and Supply Chain Technologies

Adopting digital supply chain solutions and data analytics will improve forecasting, inventory management, and quality control, reducing costs and enhancing responsiveness to market changes.

Future Outlook

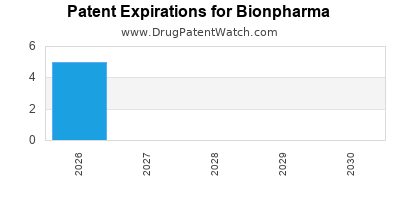

Bionpharma’s trajectory aligns with the ongoing biosimilar wave, driven by patent expirations on blockbuster biologics and global healthcare policy shifts favoring affordable therapies. Its strategic focus on complex generics and biosimilars, coupled with regulatory strength and international expansion efforts, positions it as a competitive player over the next five years.

However, competitive dynamics will intensify with established giants and new entrants optimizing their biologic portfolios. Bionpharma’s success hinges on resilient R&D, strategic partnerships, and adaptive regulatory strategies.

Key Takeaways

- Positioning: Bionpharma remains a focused yet agile company within the generic and biosimilar markets, emphasizing complex biologic products.

- Strengths: Core advantages include a robust pipeline, vertical integration, regulatory expertise, and global expansion initiatives.

- Weaknesses: Limited brand recognition and high R&D costs for biosimilars pose challenges.

- Strategic Moves: Diversifying pipeline, enhancing global collaborations, and investing in innovative formulations will bolster growth.

- Outlook: A promising future exists amid expanding biosimilar adoption, provided Bionpharma navigates regulatory and competitive hurdles effectively.

FAQs

1. How does Bionpharma differentiate itself from larger generic manufacturers?

Bionpharma focuses on complex generics and biosimilars with a strategic emphasis on innovation, regulatory agility, and niche therapeutic areas, enabling it to compete without extensive global scale.

2. What are the primary growth markets for Bionpharma?

Emerging markets in Asia, Latin America, and Eastern Europe are strategic targets, driven by demand for affordable biologics and generics.

3. What regulatory challenges does Bionpharma face?

Securing timely FDA approvals and navigating complex biosimilar regulatory pathways remain key hurdles, requiring proactive engagement and compliance strategies.

4. How critical are biosimilars to Bionpharma’s future?

Biosimilars represent the core growth engine, leveraging patent expirations on blockbuster biologics to capture substantial market share.

5. What strategic actions could enhance Bionpharma’s competitive edge?

Expanding the pipeline via acquisitions, strengthening global partnerships, and investing in formulation innovations are pivotal steps.

Sources:

[1] IQVIA, 2022 Data Insights.

[2] Bionpharma official website, 2023.

[3] FDA Registration and Approval Database, 2023.

[4] Industry analysis reports, 2023.

[5] Market forecasts from Global Market Insights, 2023.