DOXYCYCLINE HYCLATE Drug Patent Profile

✉ Email this page to a colleague

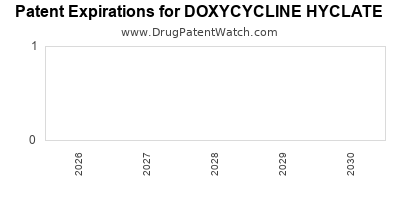

Which patents cover Doxycycline Hyclate, and when can generic versions of Doxycycline Hyclate launch?

Doxycycline Hyclate is a drug marketed by Pliva, Bausch, Actavis Labs Fl Inc, Ajanta Pharma Ltd, Alembic, Amneal Pharms, Bionpharma, Changzhou Pharm, Chartwell, Halsey, Heather, Hikma Intl Pharms, Interpharm, Mutual Pharm, Nesher Pharms, Par Pharm, Pvt Form, Ranbaxy, Strides Pharma, Sun Pharm Industries, Superpharm, Warner Chilcott, Watson Labs, Zhejiang Yongtai, Zydus Lifesciences, Amneal, Aspiro, Dr Reddys, Gland, Heritage, Kindos, Lupin Ltd, Ph Health, Precision Dose Inc, Slate Run Pharma, Steriscience, West-ward Pharms Int, Actavis Elizabeth, Aurobindo Pharma Usa, Impax Labs Inc, Lupin, Prinston Inc, Rising, Zydus Pharms, Acella, Amneal Pharms Co, Apotex, Avet Lifesciences, Chartwell Molecular, Dr Reddys Labs Sa, Epic Pharma Llc, Heritage Pharma, Mylan, Novel Labs Inc, Pharmobedient, Praxgen, Strides Pharma Intl, and Torrent. and is included in eighty-seven NDAs.

The generic ingredient in DOXYCYCLINE HYCLATE is doxycycline hyclate. There are twenty-eight drug master file entries for this compound. Seventy-seven suppliers are listed for this compound. Additional details are available on the doxycycline hyclate profile page.

DrugPatentWatch® Litigation and Generic Entry Outlook for Doxycycline Hyclate

A generic version of DOXYCYCLINE HYCLATE was approved as doxycycline hyclate by STRIDES PHARMA on March 29th, 1982.

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for DOXYCYCLINE HYCLATE?

- What are the global sales for DOXYCYCLINE HYCLATE?

- What is Average Wholesale Price for DOXYCYCLINE HYCLATE?

Summary for DOXYCYCLINE HYCLATE

| US Patents: | 0 |

| Applicants: | 58 |

| NDAs: | 87 |

| Finished Product Suppliers / Packagers: | 69 |

| Raw Ingredient (Bulk) Api Vendors: | 120 |

| Clinical Trials: | 25 |

| Patent Applications: | 2,782 |

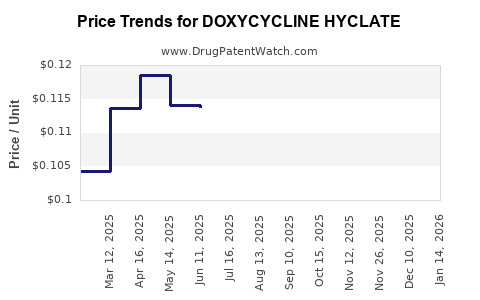

| Drug Prices: | Drug price information for DOXYCYCLINE HYCLATE |

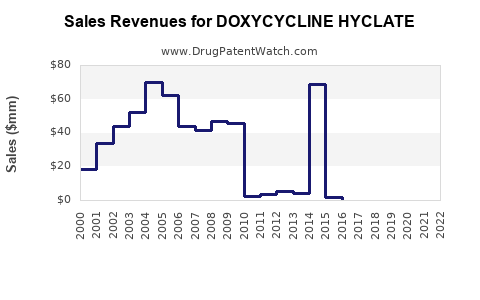

| Drug Sales Revenues: | Drug sales revenues for DOXYCYCLINE HYCLATE |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for DOXYCYCLINE HYCLATE |

| What excipients (inactive ingredients) are in DOXYCYCLINE HYCLATE? | DOXYCYCLINE HYCLATE excipients list |

| DailyMed Link: | DOXYCYCLINE HYCLATE at DailyMed |

See drug prices for DOXYCYCLINE HYCLATE

Recent Clinical Trials for DOXYCYCLINE HYCLATE

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Chinese University of Hong Kong | Phase 4 |

| Zhuzhou Qianjin Pharmaceutical Co., Ltd., 801, Zhuzhou, China | Phase 1/Phase 2 |

| The Jinnah Postgraduate Medical Centre, Rafiqui، Sarwar Shaheed Rd, Karachi Cantonment, Karachi, Karachi City, Sindh 75510 | Phase 1/Phase 2 |

Pharmacology for DOXYCYCLINE HYCLATE

| Drug Class | Tetracycline-class Drug |

Anatomical Therapeutic Chemical (ATC) Classes for DOXYCYCLINE HYCLATE

Paragraph IV (Patent) Challenges for DOXYCYCLINE HYCLATE

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| DORYX MPC | Delayed-release Tablets | doxycycline hyclate | 60 mg and 120 mg | 050795 | 1 | 2017-09-28 |

| DORYX MPC | Delayed-release Tablets | doxycycline hyclate | 50 mg | 050795 | 1 | 2015-11-05 |

| DORYX MPC | Delayed-release Tablets | doxycycline hyclate | 80 mg | 050795 | 1 | 2015-07-01 |

| DORYX MPC | Delayed-release Tablets | doxycycline hyclate | 200 mg | 050795 | 1 | 2014-05-19 |

| DORYX MPC | Delayed-release Tablets | doxycycline hyclate | 150 mg | 050795 | 1 | 2008-12-19 |

US Patents and Regulatory Information for DOXYCYCLINE HYCLATE

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Alembic | DOXYCYCLINE HYCLATE | doxycycline hyclate | TABLET, DELAYED RELEASE;ORAL | 213075-004 | Jan 3, 2022 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Ajanta Pharma Ltd | DOXYCYCLINE HYCLATE | doxycycline hyclate | TABLET;ORAL | 211584-001 | Jun 1, 2020 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Warner Chilcott | DOXYCYCLINE HYCLATE | doxycycline hyclate | CAPSULE;ORAL | 062594-001 | Dec 5, 1985 | DISCN | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Pvt Form | DOXYCYCLINE HYCLATE | doxycycline hyclate | CAPSULE;ORAL | 062631-002 | Jul 24, 1986 | DISCN | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Lupin | DOXYCYCLINE HYCLATE | doxycycline hyclate | TABLET, DELAYED RELEASE;ORAL | 208741-007 | Aug 11, 2023 | DISCN | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Market Dynamics and Financial Trajectory for Doxycycline Hyclate

More… ↓