DOXYCYCLINE Drug Patent Profile

✉ Email this page to a colleague

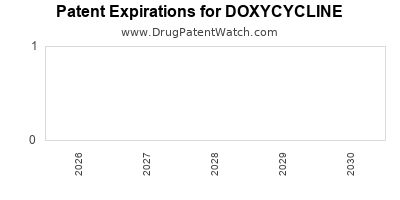

When do Doxycycline patents expire, and when can generic versions of Doxycycline launch?

Doxycycline is a drug marketed by Alembic, Apotex, Changzhou Pharm, Cosette, Dr Reddys, Dr Reddys Labs Sa, Impax Labs Inc, Lupin, Lupin Ltd, Macleods Pharms Ltd, Prinston Inc, Rising, Sandoz Inc, Strides Pharma, Strides Pharma Intl, Sun Pharm Inds Ltd, Watson Labs, Zydus Pharms, Chartwell, Hikma, Mylan Labs Ltd, Chartwell Rx, Heritage, Lannett Co Inc, Sun Pharm Industries, Pliva, Bausch, Actavis Labs Fl Inc, Ajanta Pharma Ltd, Amneal Pharms, Bionpharma, Halsey, Heather, Hikma Intl Pharms, Interpharm, Mutual Pharm, Nesher Pharms, Par Pharm, Pvt Form, Ranbaxy, Superpharm, Warner Chilcott, Zhejiang Yongtai, Zydus Lifesciences, Amneal, Aspiro, Gland, Kindos, Ph Health, Precision Dose Inc, Slate Run Pharma, Steriscience, West-ward Pharms Int, Actavis Elizabeth, Aurobindo Pharma Usa, Acella, Amneal Pharms Co, Avet Lifesciences, Chartwell Molecular, Epic Pharma Llc, Heritage Pharma, Mylan, Novel Labs Inc, Pharmobedient, Praxgen, and Torrent. and is included in one hundred and twenty-one NDAs.

The generic ingredient in DOXYCYCLINE is doxycycline hyclate. There are twenty-eight drug master file entries for this compound. Seventy-three suppliers are listed for this compound. Additional details are available on the doxycycline hyclate profile page.

DrugPatentWatch® Litigation and Generic Entry Outlook for Doxycycline

A generic version of DOXYCYCLINE was approved as doxycycline hyclate by STRIDES PHARMA on March 29th, 1982.

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for DOXYCYCLINE?

- What are the global sales for DOXYCYCLINE?

- What is Average Wholesale Price for DOXYCYCLINE?

Summary for DOXYCYCLINE

| US Patents: | 0 |

| Applicants: | 66 |

| NDAs: | 121 |

| Finished Product Suppliers / Packagers: | 32 |

| Raw Ingredient (Bulk) Api Vendors: | 1 |

| Clinical Trials: | 389 |

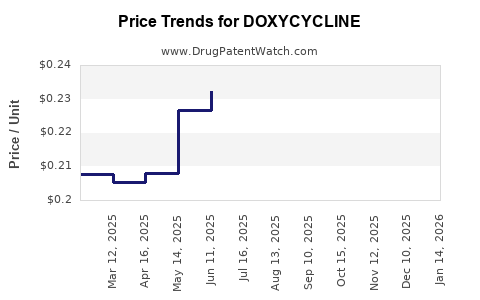

| Drug Prices: | Drug price information for DOXYCYCLINE |

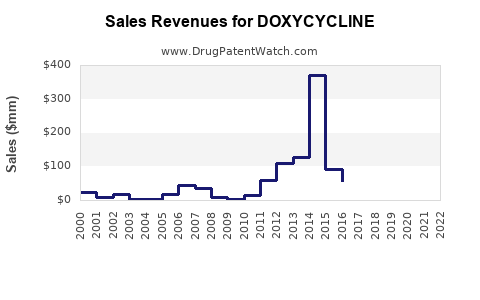

| Drug Sales Revenues: | Drug sales revenues for DOXYCYCLINE |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for DOXYCYCLINE |

| What excipients (inactive ingredients) are in DOXYCYCLINE? | DOXYCYCLINE excipients list |

| DailyMed Link: | DOXYCYCLINE at DailyMed |

See drug prices for DOXYCYCLINE

Recent Clinical Trials for DOXYCYCLINE

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Mayo Clinic | PHASE4 |

| Nyanza Reproductive Health Society | PHASE4 |

| University of Washington | PHASE4 |

Pharmacology for DOXYCYCLINE

| Drug Class | Tetracycline-class Drug |

Medical Subject Heading (MeSH) Categories for DOXYCYCLINE

Anatomical Therapeutic Chemical (ATC) Classes for DOXYCYCLINE

Paragraph IV (Patent) Challenges for DOXYCYCLINE

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| ORACEA | Delayed-release Capsules | doxycycline | 40 mg | 050805 | 1 | 2008-12-12 |

US Patents and Regulatory Information for DOXYCYCLINE

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sun Pharm Industries | DOXYCYCLINE | doxycycline | TABLET;ORAL | 065471-003 | Apr 17, 2009 | DISCN | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Mutual Pharm | DOXYCYCLINE HYCLATE | doxycycline hyclate | CAPSULE;ORAL | 062418-001 | Jan 28, 1983 | DISCN | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Hikma | DOXYCYCLINE | doxycycline hyclate | INJECTABLE;INJECTION | 062569-001 | Mar 9, 1988 | DISCN | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Sun Pharm Inds Ltd | DOXYCYCLINE | doxycycline | CAPSULE;ORAL | 065053-002 | Nov 22, 2000 | AB | RX | No | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Rising | DOXYCYCLINE HYCLATE | doxycycline hyclate | TABLET, DELAYED RELEASE;ORAL | 090431-001 | Dec 28, 2010 | DISCN | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

EU/EMA Drug Approvals for DOXYCYCLINE

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Pfizer Limited | Doxirobe | Doxycycline | EMEA/V/C/000044Treatment of periodontal disease in dogs.Periodontal pocket probing depths >=4 mm are evidence of disease that may be responsive to treatment with the Doxirobe Gel. Use of this product as directed should result in attachment level gains, periodontal pocket depth reductions, local antimicrobial effect and improved gingival health. Noticeable improvements in these parameters should be evident within 2-4 weeks following treatment. The response in individual dogs is dependent on the severity of the condition and rigor of adjunctive therapy. | Withdrawn | no | no | no | 1999-09-16 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

Market Dynamics and Financial Trajectory for Doxycycline

More… ↓