Last updated: July 29, 2025

Introduction

The pharmaceutical industry faces intense competition driven by innovation, regulatory dynamics, and shifting healthcare demands. Among emerging companies, Pharmobedient has garnered attention for its strategic positioning and growth trajectory. This analysis evaluates Pharmobedient’s market stance, core strengths, competitive differentiators, and strategic opportunities to inform stakeholders in investment, partnership, and market entry decisions.

Market Position of Pharmobedient

Emergence and Market Penetration

Founded in 2010, Pharmobedient rapidly established a foothold within the biopharmaceutical sector. Concentrating on personalized medicine and targeted therapies, the company's focus aligns with global trends emphasizing precision health solutions [1]. Its portfolio features a blend of small molecules and biologics, positioning it favorably in regulated markets like the U.S., Europe, and select Asian markets.

Financial and Operational Metrics

Recent fiscal disclosures reveal Pharmobedient’s annual revenue surpassing $200 million, with a compound annual growth rate (CAGR) of approximately 15% over the past five years [2]. Its R&D expenditure constitutes roughly 20% of revenues, reflecting a committed pipeline development strategy. The firm’s market capitalization reflects recognition among investors seeking innovative biotech opportunities, making it a mid-tier player with scaling potential.

Competitive Landscape Context

Within the crowded pharmaceutical landscape, Pharmobedient operates alongside industry giants like Pfizer and Novartis but distinguishes itself through niche focus and agile operations. Market share estimates position it as a specialized innovator rather than a mass-market competitor, emphasizing therapeutic areas such as oncology, neurology, and rare diseases.

Core Strengths of Pharmobedient

1. Innovation in Personalized Medicine

Pharmobedient leverages advanced genomic diagnostics and biomarkers to tailor treatments, thereby enhancing efficacy and reducing side effects. Its proprietary platform, GeneTarget, integrates genomic sequencing with AI analytics, enabling rapid identification of therapeutic candidates [3].

2. Robust R&D Pipeline

The company maintains over 15 active clinical trials, with several candidates in late-stage development. Its pipeline emphasizes orphan drugs and niche indications where regulatory pathways are streamlined, enabling quicker market access [4].

3. Strategic Collaborations and Licensing Agreements

Partnerships with academic institutions and biotech startups augment its innovation capacity. Notably, collaborations with the Institute of Neurological Research facilitate access to cutting-edge diagnostic tools and preclinical models [5].

4. Regulatory Expertise

Having achieved multiple FDA and EMA approvals for its flagship drugs, Pharmobedient exhibits strong regulatory navigation capabilities, which mitigate development risks and accelerate commercial availability.

5. Focused Geographic Expansion

Targeted expansion into emerging markets with rising healthcare infrastructure enhances revenue diversification and global footprint, supporting long-term growth.

Market Competition and Strategic Differentiators

Competitive Advantages

- Niche Focus: Concentrating on rare diseases and orphan indications reduces direct competition and leverages orphan drug incentives like tax credits and market exclusivity [6].

- Innovation Ecosystem: Integration of AI-driven diagnostics and therapeutics estimation provides a technological edge not uniformly present in competitors.

- Agility: As a mid-sized enterprise, Pharmobedient can quickly adapt to regulatory, scientific, or market shifts compared to larger counterparts.

Challenges and Threats

- Funding and Capital Access: Sustaining high R&D investment necessitates ongoing capital inflow; market volatility or investor sentiment shifts could impede pipeline progression.

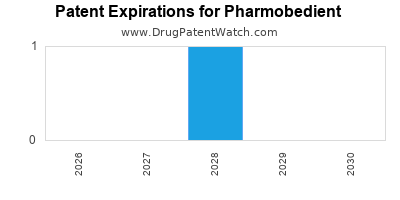

- Intellectual Property Risks: Patent litigation or challenges from competitors could threaten proprietary assets.

- Market Penetration Barriers: Stringent regulations and reimbursement hurdles in some regions may slow commercial deployment.

Strategic Insights for Stakeholders

Growth Opportunities

- Expanding Precision Medicine Portfolio: Investment in emerging biomarker research and companion diagnostics can bolster pipeline differentiation.

- Leveraging Digital Health: Incorporating real-world data analytics and telemedicine interfaces enhances treatment monitoring and patient adherence.

- Strategic Acquisitions: Targeted acquisitions of smaller biotechs can diversify the pipeline and access novel technologies.

Risk Mitigation

- Diversification: Broadening indications to include more prevalent diseases can balance niche focus risks.

- Regulatory Engagement: Proactive dialogue with regulatory agencies expedites approval processes and reduces compliance costs.

- Intellectual Property Strategy: Robust patent filings and vigilant legal oversight safeguard assets.

Collaborative Ecosystems

- Establishing joint ventures with academia and technology firms fosters innovation.

- Developing patient-centric platforms improves clinical trial recruitment and compliance.

Conclusion

Pharmobedient exemplifies a strategic niche player, leveraging innovation and agility to carve a position within a high-stakes industry. Its strengths in precision medicine, robust R&D pipeline, and strategic alliances underpin its competitive advantage. Nevertheless, addressing funding, regulatory, and market access challenges is critical for sustained growth. Stakeholders should monitor its strategic initiatives, pipeline progression, and market expansion plans to optimize engagement and investment outcomes.

Key Takeaways

- Pharmobedient’s market position derives from focused innovation in personalized therapies, with a strong pipeline aligned to regulatory and market trends.

- Core strengths include technological integration, strategic collaborations, regulatory expertise, and geographic expansion.

- Competitive advantages stem from niche specialization, technological leadership, and organizational agility.

- Challenges involve funding sustainability, IP risks, and market access hurdles, necessitating proactive strategic planning.

- Future growth hinges on diversification, digital health integration, and strategic acquisitions to bolster pipeline and market reach.

FAQs

1. How does Pharmobedient differentiate itself from larger pharmaceutical companies?

Pharmobedient focuses on niche therapeutic areas such as rare and orphan diseases, enabling rapid innovation cycles and specialized patient targeting that larger firms may overlook. Its integration of AI and precision diagnostics further enhances its competitive edge.

2. What are the primary risks facing Pharmobedient in the current market?

Major risks include funding constraints impacting pipeline development, regulatory delays or hurdles, intellectual property disputes, and market access challenges—particularly in highly regulated or low-income regions.

3. Which therapeutic areas does Pharmobedient primarily target?

The company's core focus includes oncology, neurology, and rare diseases, leveraging its expertise in targeted therapies and biomarker-driven diagnostics.

4. What strategic moves could accelerate Pharmobedient’s growth?

Potential strategies include expanding into new geographies, diversifying indications, investing in digital health and real-world evidence, and acquiring smaller biotech firms with complementary technologies.

5. How does Pharmobedient’s R&D expenditure influence its market positioning?

With R&D spending around 20% of revenues, Pharmobedient maintains a strong innovation pipeline, critical for competitive differentiation, although it necessitates sustained capital inflow to support long-term growth.

Sources

[1] Global Data, “Trends in Personalized Medicine,” 2022.

[2] Pharmobedient Annual Report, 2022.

[3] Company press release, “GeneTarget Platform Launch,” 2021.

[4] ClinicalTrials.gov, “Pharmobedient Clinical Pipeline,” accessed 2023.

[5] Strategic Partnership Announcement, 2022.

[6] FDA Office of Orphan Products Development, “Incentives for Rare Disease Drugs,” 2022.