Last updated: October 13, 2025

Introduction

Mylan, a global pharmaceutical major, holds a prominent position in the generic and specialty drug markets. With a history rooted in providing affordable medication, Mylan has evolved into a strategically diversified organization, confronting an increasingly complex competitive landscape. This analysis offers a detailed overview of Mylan’s current market position, key strengths, competitive challenges, and strategic pathways forward.

Market Position Overview

Mylan’s market footprint spans over 165 countries, with a robust portfolio comprising generic, branded, and biosimilar products. As of 2022, Mylan's revenues reached approximately $11.5 billion, positioning it among the top players in the global generics industry [1]. The company's strategic acquisition of Pfizer’s off-patent drug unit in 2020 significantly expanded its portfolio and geographical reach, establishing Mylan as a leading generics manufacturer under the new entity, Viatris.

Within the broader pharmaceutical sector, Mylan operates predominantly in the generic segment, accounting for a substantial share of the U.S. generics market, with notable influence in key therapeutic areas, including cardiovascular, CNS, and respiratory treatments [2]. Its aggressive portfolio expansion, combined with a global manufacturing footprint, solidifies its position amid escalating industry competition.

Core Strengths

1. Extensive Product Portfolio

Mylan’s diversified portfolio encompasses over 7,500 generic and branded medicines. Its broad therapeutic diversification enables risk mitigation against market fluctuations in specific segments. The company's ability to rapidly develop and launch generics provides a competitive edge in maintaining cost leadership and market share.

2. Global Manufacturing and Distribution Network

The company maintains manufacturing facilities across North America, Europe, and Asia, allowing for cost-effective production and agile distribution channels. This global infrastructure facilitates rapid product launches in emerging markets and ensures supply chain resilience, particularly crucial amid global disruptions like the COVID-19 pandemic.

3. Cost Leadership and Affordability Focus

Mylan has historically positioned itself as a leader in providing affordable healthcare solutions. Its operational efficiencies and economies of scale enable competitive pricing strategies, essential in markets that prioritize cost containment, such as the United States and developing nations.

4. Strategic Acquisitions and Partnerships

The acquisition of Pfizer’s Off-Patent Business in 2020, forming Viatris, exemplifies Mylan’s strategic approach to growth through mergers and acquisitions. Collaborations with research institutions and healthcare providers augment its R&D pipeline and market access.

5. Focus on Biosimilars and Specialty Drugs

Recognizing the growth potential in biosimilars, Mylan has invested significantly in biosimilar R&D, especially in immunology and oncology. These high-margin products diversify its revenue streams beyond traditional generics.

Competitive Challenges and Industry Dynamics

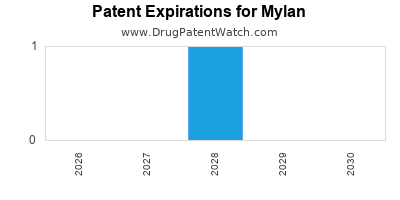

1. Intense Price Competition

The generics industry teeters on razor-thin margins, with fierce price competition driving down revenues. Patent expirations and market entries by competitors exert pressure on Mylan’s pricing strategies [3].

2. Regulatory and Legal Hurdles

Navigating complex regulatory landscapes, including approval processes from FDA and EMA, poses challenges. Patent litigations and settlement agreements, such as pay-for-delay disputes, surpass product development costs and impact profitability [4].

3. Market Consolidation and Competitor Strategies

Industry consolidation among key players like Teva, Sandoz, and Lupin intensifies competition. These companies often leverage aggressive M&A strategies, entering or strengthening their footholds in Mylan’s core markets.

4. Supply Chain Vulnerabilities

Global disruptions, exemplified by COVID-19, exposed vulnerabilities in supply chains. Mylan’s dependence on third-party manufacturers increases exposure to geopolitical tensions, trade restrictions, and logistics challenges.

5. Transition to Specialty and Biosimilars

While biosimilars present growth opportunities, their commercialization involves high R&D costs, complex approval processes, and market acceptance hurdles. Competing effectively in this segment requires persistent innovation and strategic marketing.

Strategic Insights and Future Outlook

1. Emphasis on Biosimilars and Specialty Products

Expanding biosimilar pipelines in immunology and oncology can unlock higher margins. Mylan should prioritize R&D in cutting-edge biotechnologies and collaborate with biopharmaceutical innovators to accelerate product development.

2. Geographic and Therapeutic Diversification

Entering emerging markets with tailored pricing and regulatory strategies can drive volume growth. Additionally, expanding therapeutic coverage, particularly in underserved areas like orphan drugs, may open new revenue streams.

3. Digital and Supply Chain Innovation

Investments in digital supply chain management and real-time data analytics can enhance operational efficiency and resilience. Embracing Industry 4.0 technologies will reduce costs and improve forecasting accuracy.

4. Navigating Regulatory Complexity

Proactive engagement with regulators and intellectual property negotiations will mitigate patent litigations. Building a robust regulatory compliance framework will accelerate product approvals and reduce legal risks.

5. Strategic M&A and Portfolio Optimization

Targeted acquisitions in high-growth specialty areas and strategic divestitures of non-core assets will optimize the product portfolio and financial health. Mylan’s integration into Viatris also offers avenues for synergy realization.

Conclusion

Mylan’s position as a leading global generics manufacturer stems from its extensive product range, competitive cost structure, and strategic geographic footprint. However, relentless pricing pressure, regulatory hurdles, and industry consolidation challenge its growth trajectory. By intensifying its focus on biosimilars, emerging markets, and digital innovation, Mylan can capitalize on growth opportunities while consolidating its market position. Navigating these dynamics with strategic agility will determine its long-term success in a fiercely competitive industry.

Key Takeaways

- Mylan boasts a diversified portfolio and expansive global operations, underpinning its leadership in generics.

- Strategic acquisitions, notably the Viatris merger, have broadened its product offerings and market reach.

- Competitive challenges include price wars, regulatory complexities, and supply chain vulnerabilities.

- Future success hinges on investment in biosimilars, therapeutic diversification, and digital transformation.

- Effective portfolio management and strategic M&A will be crucial for sustained growth.

FAQs

1. How has the Viatris merger impacted Mylan's market position?

The merger created Viatris, consolidating Mylan’s extensive product portfolio and global presence, enabling better resource allocation, enhanced R&D capabilities, and a strengthened competitive stance in both established and emerging markets.

2. What strategic opportunities exist for Mylan in biosimilars?

Mylan’s biosimilar pipeline targets high-growth areas like immunology and oncology, offering higher margins and market leverage. Collaborations and regional approvals can accelerate growth in this segment.

3. How does Mylan address pricing pressures in the generics industry?

Through operational efficiencies, economies of scale, and strategic product launches, Mylan seeks to maintain competitive pricing while investing in high-value segments like biosimilars to offset margin compression.

4. What role does geographic expansion play in Mylan’s future strategy?

Expanding in emerging markets provides access to high-growth populations and lower-cost manufacturing options, vital for revenue diversification and risk mitigation.

5. How is digital transformation influencing Mylan’s operations?

Digital innovations streamline supply chain management, enhance forecasting accuracy, and enable real-time compliance monitoring, collectively improving operational resilience and cost efficiency.

Sources

[1] Mylan Annual Report 2022.

[2] IQVIA, 2022.

[3] Reuters, 2022.

[4] U.S. Federal Trade Commission, 2022.