Last updated: July 28, 2025

Introduction

Ani Pharms has emerged within the highly competitive pharmaceutical industry as a notable player, carving a niche through distinctive product offerings and strategic initiatives. This analysis evaluates Ani Pharms’ market position, core strengths, and strategic opportunities essential for sustainable growth amid evolving industry dynamics.

Market Position of Ani Pharms

Ani Pharms operates primarily in the generic and specialty pharmaceutical sectors, emphasizing high-demand therapeutic areas such as oncology, infectious diseases, and chronic conditions. Its market positioning is characterized by niche specialization and geographical focus, predominantly in emerging markets and select developed regions.

The company has demonstrated solid revenue growth over recent years, largely driven by expanding product portfolios, strategic licensing agreements, and acquisitions of regional pharmaceutical companies. Its market share remains competitive within targeted therapeutic segments, benefiting from increasing global demand for affordable medications.

However, Ani Pharms faces intensifying competition from both multinational giants like Pfizer and Novartis, and regional firms leveraging local market insights. The company's ability to differentiate hinges on innovation, regulatory agility, and supply chain resilience.

Core Strengths of Ani Pharms

1. Focused Product Portfolio

Ani Pharms emphasizes high-margin therapeutics within specialized niches, including oncology, antiviral agents, and rare disease treatments. This targeted approach minimizes direct price competition and enhances brand recognition within these segments.

2. Robust R&D Capabilities

Investments in research and development underpin Ani Pharms’ capacity to develop biosimilars, generics, and novel formulations. The company's R&D pipeline prioritizes unmet medical needs, fostering partnerships with biotech firms and academic institutions.

3. Cost-Effective Manufacturing

Ani Pharms benefits from strategically located manufacturing facilities that enable cost efficiencies. Its operational excellence in production processes, including quality compliance, facilitates competitive pricing and reliable supply chains.

4. Strategic Alliances and Licensing

Agreements with global pharmaceutical innovators for licensing and co-development bolster Ani Pharms’ market access and diversify its therapeutic portfolio. These partnerships often expedite regulatory approvals and market entry.

5. Regulatory Expertise in Key Markets

Strong regulatory expertise allows Ani Pharms to navigate complex approval pathways swiftly. This capability is critical for timely product launches and sustaining intellectual property rights.

Strategic Insights and Opportunities

1. Geographic Diversification

Expanding into emerging markets such as Southeast Asia, Latin America, and Africa offers growth prospects through increasing healthcare infrastructure and demand for affordable medicines. Tailoring regulations and market entry strategies is essential.

2. Investment in Biosimilar Development

With the global biosimilar market projected to grow significantly (expected to reach USD 74 billion by 2025), Ani Pharms should prioritize biosimilar pipeline expansion. Developing biosimilars for blockbuster biologics can deliver high revenue margins and competitive differentiation.

3. Digital Transformation and Data Analytics

Leveraging digital platforms for supply chain optimization, pharmacovigilance, and market analytics can improve efficiency and responsiveness. Adoption of AI-driven drug discovery can accelerate pipeline development and reduce R&D costs.

4. Enhance Intellectual Property Strategies

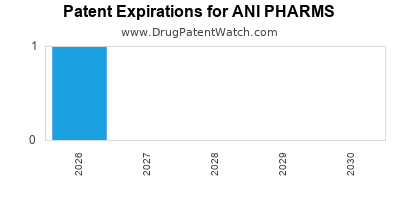

Aggressive patent filing, strategic patent litigation, and licensing negotiations are key to maintaining exclusivity and revenue streams. Protecting proprietary formulations and manufacturing processes sustains competitive advantage.

5. Strategic Acquisitions and Partnerships

Acquiring regional firms or forming alliances with biotech innovators can expand ANI’s market reach and technological capabilities. Targeted acquisitions can also facilitate diversification into adjacent sectors such as diagnostics and personalized medicine.

Challenges and Risk Mitigation

While opportunities abound, ANI Pharms faces significant challenges including pricing pressures from payers, regulatory variability across jurisdictions, and potential supply chain disruptions. Building resilience through diversified manufacturing locations, investing in regulatory intelligence, and maintaining robust quality assurance practices are critical mitigating strategies.

Competitive Landscape Overview

Ani Pharms operates amidst a vibrant and consolidated industry landscape, with key competitors including:

- Multinational Active Pharmaceutical Ingredients (API) producers and generic pharmaceutical firms (e.g., Teva, Mylan/Merck)

- Regional players with localized manufacturing and distribution networks

- Biotech firms venturing into biologics and biosimilars

Ani Pharms’ differentiated approach—focusing on niche therapeutic areas, cost-effective operations, and strategic alliances—positions it well to compete effectively, provided it continues to innovate and adapt to market shifts.

Conclusion

Ani Pharms has established a resilient market position through focused product development, strategic collaborations, and operational efficiencies. To sustain growth and enhance competitiveness, it must accelerate biosimilar development, expand geographically, and harness digital transformation. Focusing on these strategic avenues will enable Ani Pharms to navigate industry challenges and capitalize on emerging opportunities effectively.

Key Takeaways

- Ani Pharms’ niche specialization and strategic alliances underpin its competitive edge amidst industry consolidation.

- Prioritizing biosimilar pipeline expansion offers significant revenue potential aligned with industry growth forecasts.

- Geographic diversification enhances growth prospects, especially in emerging markets with rising healthcare demands.

- Digital transformation initiatives can streamline operations, reduce costs, and accelerate drug development.

- Robust IP management and strategic acquisitions are vital for sustaining market exclusivity and expanding technological capabilities.

FAQs

Q1: What are the primary therapeutic areas Ani Pharms focuses on?

A1: Ani Pharms concentrates on oncology, antiviral agents, and rare diseases, leveraging niche markets to avoid direct price competition and foster specialized expertise.

Q2: How does Ani Pharms differentiate itself from larger competitors?

A2: Through focused therapeutic portfolios, cost-efficient manufacturing, rapid regulatory navigation, and strategic licensing partnerships, Ani Pharms offers targeted solutions with agility unmatched by larger firms.

Q3: What growth opportunities exist for Ani Pharms in emerging markets?

A3: Emerging markets present opportunities due to increasing healthcare infrastructure, rising patient populations, and demand for affordable medications, provided Ani Pharms tailors its market entry approaches effectively.

Q4: Why is biosimilar development critical for Ani Pharms’ future?

A4: The global biosimilar market is expanding rapidly, offering high margins and growth potential. Developing biosimilars can help Ani Pharms compete in high-value biologic segments and expand market share.

Q5: What strategic risks does Ani Pharms face, and how can they mitigate these?

A5: Risks include pricing pressures, regulatory hurdles, and supply chain disruptions. Mitigation strategies involve diversifying manufacturing, investing in regulatory expertise, and building resilient supply networks.

Sources

- Pharmaceutical Industry Outlook 2023

- Global Biosimilars Market Report

- Emerging Markets Healthcare Growth

- Digital Transformation in Pharma

- Intellectual Property Strategies in Pharma