Last updated: July 27, 2025

Introduction

Fluconazole, a triazole antifungal agent developed by Pfizer in the 1980s, remains a cornerstone in the treatment of systemic fungal infections. Its broad-spectrum efficacy, favorable safety profile, and oral bioavailability have sustained its prominence in infectious disease management. As of 2023, the drug’s market landscape has experienced significant shifts driven by emerging resistance patterns, evolving diagnostic protocols, and increasing global healthcare expenditures. This article explores the current market dynamics and financial trajectory of fluconazole, emphasizing regulatory, commercial, and technological factors influencing its future.

Market Overview

Global Demand and Usage Patterns

Fluconazole commands a considerable segment within the antifungal therapeutics market, expected to reach USD 2.5 billion by 2025, growing at a Compound Annual Growth Rate (CAGR) of approximately 4% (source: MarketsandMarkets). Predominantly prescribed for candidiasis, cryptococcal meningitis, and systemic fungal infections, fluconazole benefits from widespread adoption in hospitals, outpatient clinics, and global health programs.

The drug’s utilization remains high in regions with elevated infectious disease burdens, such as Africa, Southeast Asia, and parts of Latin America, where infectious diseases pose substantial health challenges. The rise in immunocompromised populations—HIV/AIDS patients, transplant recipients, and cancer patients—further enhances demand.

Competitive Landscape

The pharmaceutical market includes several key players in fluconazole production. Pfizer’s original formulation remains dominant; however, generic manufacturers have captured significant market share following patent expiry in multiple jurisdictions (notably in the U.S. and Europe). The entrance of generics has driven down prices, increasing accessibility but exerting pricing pressure on branded formulations.

Emerging alternatives, such as newer azoles like voriconazole and isavuconazole, have slightly shifted prescribing patterns toward broader-spectrum agents or those with enhanced efficacy against resistant strains. Nonetheless, fluconazole’s cost-effectiveness sustains its essential role.

Market Drivers

Growing Infectious Disease Burden

The global rise in fungal infections, particularly among immunocompromised patients, boosts fluconazole demand. Notably, cryptococcal meningitis remains a significant cause of mortality in HIV-positive populations, with fluconazole serving as both treatment and prophylaxis tool (WHO reports).

Healthcare Infrastructure Expansion

Developing countries investing in healthcare infrastructure foster increased antifungal use. Improved diagnostic capabilities enable early detection of fungal infections, promoting timely fluconazole treatment.

Cost Advantage and Oral Administration

Fluconazole’s oral formulation, broad availability, and low-cost production make it a preferred choice in resource-limited settings, reinforcing its market dominance.

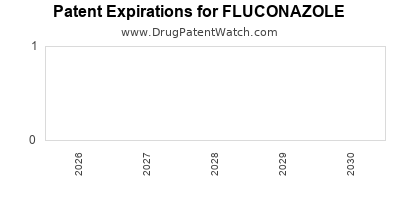

Regulatory and Patent Landscape

Patent expirations in major markets have facilitated price competition, expanding access and volume. Regulatory approvals for generic equivalents and supportive inclusion in WHO Essential Medicines List maintain its global relevance.

Market Challenges

Antifungal Resistance

The emergence of fluconazole-resistant strains of Candida albicans and other fungi presents a critical challenge. Resistance rates vary globally, with higher prevalence linked to prior antifungal exposure and prolonged therapy. This resistance diminishes fluconazole’s efficacy, prompting clinicians to consider alternative agents and complicate treatment protocols.

Adverse Effects and Limitations

While generally well tolerated, fluconazole’s potential for hepatotoxicity and drug-drug interactions, especially in polypharmacy contexts, limits its use in certain populations. This may impact prescribing habits and market share projections.

Availability of Advanced Alternatives

The advent of newer triazoles with broader spectra, enhanced pharmacokinetics, and better resistance profiles (e.g., voriconazole, posaconazole) influences prescribing decisions.

Regulatory and Patent Outlook

Major markets like the U.S. and EU saw patent expirations in the late 2000s, leading to an influx of generics. Patent protections for formulation improvements or specific indications in certain jurisdictions could influence future market exclusivity. Intellectual property strategies remain pivotal for pharmaceutical companies aiming to prolong product lifecycle.

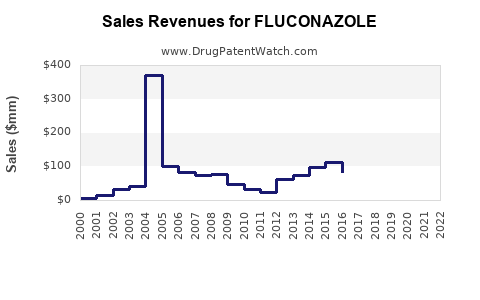

Financial Trajectory

Revenue Trends

In the short to medium term, fluconazole’s revenues are expected to remain relatively stable, buoyed by continued demand in developing regions and in contexts where cost-effectiveness outweigh newer drugs’ benefits. However, overall growth may plateau due to resistance and competition.

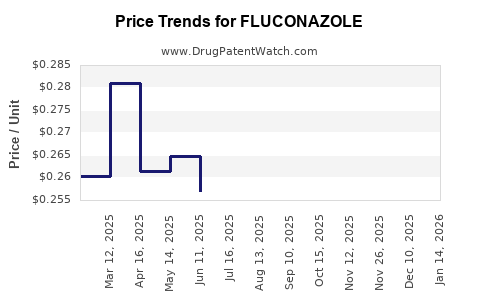

Pricing Dynamics

Generic entries have led to significant price erosion. Nonetheless, branded formulations continue to command premiums in specific markets—particularly where regulatory or supply chain complexities restrict access to generics.

Strategic Opportunities

Investments in formulation improvements, such as intravenous-to-oral switches, and development of combination therapies could unlock incremental revenues. Furthermore, expanding indications, including prophylactic uses in high-risk populations, offers growth avenues.

Emerging Markets

Increasing healthcare expenditure and expanding diagnostic capacities in Asia-Pacific and Africa are prospects for revenue growth. The global initiative to improve antifungal access aligns with fluconazole’s cost-effective profile.

Future Outlook and Trends

The future of fluconazole hinges on resistance management, evolving clinical guidelines, and technological innovations in diagnostics. Precision medicine approaches, including susceptibility testing, could optimize usage and preserve efficacy. Additionally, pharmaceutical companies may focus on developing novel formulations or delivery mechanisms to extend product life cycles.

Despite formidable challenges, fluconazole retains its vital role, especially where affordability and accessibility are critical. Strategic investments in research to circumvent resistance mechanisms and ongoing patent strategies will be decisive in shaping its market trajectory.

Key Takeaways

- Persistent Dominance: Fluconazole remains a fundamental antifungal agent, especially in resource-limited settings, due to its cost-effectiveness and broad-spectrum activity.

- Market Growth: Global antifungal markets project moderate growth driven by increased infectious disease burdens and healthcare infrastructure expansion.

- Resistance Threats: Rising antifungal resistance poses a significant threat to fluconazole’s effectiveness, demanding vigilant stewardship and development of alternatives.

- Regulatory Impact: Patent expirations have catalyzed generic proliferation, resulting in price reductions but intensifying competition.

- Strategic Opportunities: Innovation in formulations, expanding indications, and targeting emerging markets are crucial for sustaining revenue streams.

FAQs

-

What are the primary factors influencing fluconazole's market size?

The primary drivers include the global burden of fungal infections, especially among immunocompromised populations, cost-effectiveness, healthcare infrastructure investments, and regulatory approvals of generics.

-

How does antifungal resistance impact fluconazole’s market prospects?

Resistance reduces clinical efficacy, leading clinicians to favor alternative agents. It prompts investment in resistance monitoring and development of novel antifungals, potentially constraining fluconazole’s long-term dominance.

-

What is the role of generic formulations in the fluconazole market?

Generics significantly lower product costs, expanding access in developing nations. They account for a large share of sales post-patent expiry, although they exert downward pressure on prices.

-

Are there opportunities for expanding fluconazole indications?

Yes, prophylactic use in high-risk populations and combination therapies are potential avenues. Enhanced diagnostics can also facilitate targeted therapy, broadening clinical applications.

-

What are the anticipated trends in fluconazole's pricing and revenue in the next five years?

Prices are expected to remain low due to generic competition, but revenues may stabilize or slightly decline due to rising resistance. Emerging markets and new formulations may provide growth opportunities.

References

- MarketsandMarkets. Antifungal Drugs Market. 2021.

- World Health Organization. Guidelines for the Diagnosis, Prevention and Management of Cryptococcal Disease in HIV. 2018.

- Pfister, D. et al. "Antifungal Resistance in Candida albicans." Clinical Microbiology Reviews, 2020.

- U.S. Food and Drug Administration (FDA). Generic Drug Approvals. 2022.

- Global Data. Pharmaceutical Markets Analysis. 2022.