Last updated: July 28, 2025

Introduction

Nebivolol hydrochloride, marketed under various brand names such as Bystolic, is a cardioselective beta-blocker primarily prescribed for hypertension and heart failure. Its unique pharmacological profile, characterized by vasodilatory properties mediated through nitric oxide release, distinguishes it from traditional beta-blockers. As the global cardiovascular disease (CVD) burden surges, understanding the market dynamics and financial trajectory of nebivolol hydrochloride becomes critical for pharmaceutical stakeholders, investors, and healthcare policymakers.

Market Overview

Global Demand and Epidemiology

The increasing prevalence of hypertension and related cardiovascular conditions underpins the demand for beta-blockers. The World Health Organization (WHO) estimates that approximately 1.13 billion people worldwide suffer from hypertension, with significant growth projected over the next decade [1]. This epidemiological trend primarily fuels the prescription rates of nebivolol, especially given its favorable side-effect profile compared to non-selective beta-blockers.

Developed markets, including North America and Europe, dominate nebivolol sales due to high diagnosis rates, robust healthcare infrastructure, and a preference for novel drug formulations. Meanwhile, emerging markets in Asia-Pacific and Latin America, characterized by rising cardiovascular disease prevalence and expanding healthcare access, are poised for significant growth in nebivolol consumption, driven by increasing awareness and affordability.

Pharmacological Advantages and Prescription Trends

Nebivolol's selective β1-adrenergic blockade combined with vasodilatory nitric oxide release offers advantages such as fewer adverse effects, including improved tolerability in elderly populations [2]. This has prompted a shift in prescribing trends favoring nebivolol over traditional beta-blockers, particularly in patients with comorbid conditions like diabetes or asthma.

Pharmacological differentiators have helped extend its utilization from hypertension to other cardiovascular indications such as heart failure, further broadening its market reach. The drug’s patent status, market penetration, and generic alternatives significantly influence its financial trajectory.

Market Dynamics

Competitive Landscape

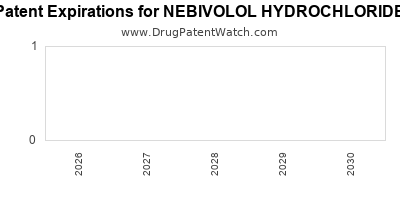

The nebivolol market faces competition from established beta-blockers—atenolol, metoprolol, bisoprolol—and emerging agents with similar cardiovascular profiles. The patent expiry of Bystolic in 2025 is expected to catalyze generic entry, intensifying price competition and market share redistribution.

Key players influencing the market include Allergan (acquired by AbbVie), Teva Pharmaceuticals, and Sandoz. These companies are investing in product differentiation, combination therapies, and biosimilars to retain competitive advantage.

Regulatory Environment

Regulatory agencies like the FDA and EMA have rigorously evaluated nebivolol’s safety and efficacy profiles, facilitating its approval and broad acceptance. However, regulatory barriers, including pricing and reimbursement policies, particularly in cost-sensitive markets, impact market expansion.

Innovations such as extended-release formulations and combination therapies with diuretics or calcium channel blockers are pathways through which regulatory bodies are encouraging diverse treatment options, impacting nebivolol’s market competitiveness.

Pricing and Reimbursement

Pricing strategies hinge on patent protections, manufacturing costs, and competitive intensity. Brand-name versions typically command premiums, but imminent patent expirations are anticipated to drive down prices with generics. Reimbursement policies greatly influence prescribing patterns, especially in public healthcare systems, affecting overall sales volume and revenue generation.

Emerging Trends

The integration of nebivolol in combination therapies is on the rise, aligning with current clinical guidelines advocating polypharmacy for complex hypertension management. Additionally, digital health integration, such as electronic monitoring of blood pressure and adherence tracking, is becoming prominent, potentially improving therapeutic outcomes and fostering market expansion.

Financial Trajectory

Historical Sales Performance

Historically, Bystolic registered peak global sales of approximately $700 million in 2017, reflecting strong market reception in the US [3]. However, sales plateaued as generic competition loomed, with a notable decline post-2023 coinciding with patent expiration preparations.

Projected Revenue Streams

Post-patent expiry, revenue streams are expected to decline sharply due to generic competition, particularly in established markets like the US and Europe. Nevertheless, continued growth in emerging markets, driven by increased hypertension awareness and growing healthcare infrastructure, offers substantial upside.

Innovative formulations and combination drugs are projected to mitigate revenue erosion by commanding premium pricing. For instance, combination therapies featuring nebivolol are poised to tap into the precision medicine trend, improving adherence and clinical outcomes.

Investment and R&D Outlook

Pharmaceutical companies are investing in R&D to develop next-generation beta-blockers with improved selectivity and multimodal action. The pipeline includes fixed-dose combinations and novel delivery systems, promising new revenue streams and extending the financial longevity of nebivolol derivatives.

Market Forecast

Analysts project that the global nebivolol market will exhibit a compound annual growth rate (CAGR) of approximately 4-6% through 2030, driven by demographic shifts, expanding indications, and technological innovations [4]. The maturation phase post-patent expiry will be characterized by volume-based growth from emerging markets, offsetting declining per-unit revenues in mature markets.

Key Factors Influencing Financial Trajectory

- Patent lifecycle management, including strategic licensing and formulation innovations.

- Regulatory approval for new formulations and indications.

- Market penetration in developing countries.

- Competitive strategies, such as pricing, marketing, and branding.

- Healthcare policy shifts emphasizing cost-effective therapies.

Conclusion

The market dynamics and financial trajectory for nebivolol hydrochloride are shaped by a confluence of epidemiology, pharmacological advantages, regulatory policies, and competitive landscapes. While patent expiration poses challenges to revenue, ongoing innovation, strategic market expansion, and demographic trends promise sustained growth. Stakeholders must vigilantly adapt to evolving clinical and regulatory environments to optimize financial outcomes.

Key Takeaways

- Rising global hypertension prevalence sustains demand for nebivolol, especially in emergent markets.

- Patent expiry in 2025 will likely precipitate revenue decline in branded formulations but opens avenues for generic proliferation.

- Innovation in combination therapies and delivery methods can extend nebivolol’s market life cycle and profitability.

- Demographic shifts favor increased use of cardioselective beta-blockers with favorable tolerance profiles.

- Strategic focus on emerging markets and product differentiation are critical for sustaining growth amid fierce competition.

FAQs

1. When will the patent for Bystolic (nebivolol hydrochloride) expire, and what does this mean for market competition?

The patent for Bystolic is set to expire in 2025. This will enable generic manufacturers to enter the market, intensifying price competition and potentially reducing branded drug revenues.

2. What are the primary clinical advantages of nebivolol over traditional beta-blockers?

Nebivolol exhibits selective β1-adrenergic blockade combined with nitric oxide-mediated vasodilation, leading to fewer side effects like fatigue and bronchospasm, making it suitable for elderly and comorbid patients.

3. How are emerging markets influencing the future of nebivolol?

Emerging markets contribute to future growth due to rising hypertension prevalence, expanding healthcare infrastructure, and increasing drug affordability, providing a significant upside post-generic entry.

4. Are there ongoing innovations or formulations to extend nebivolol’s market presence?

Yes. Extended-release formulations, fixed-dose combinations, and novel delivery systems are under development to enhance efficacy, compliance, and therapeutic outcomes, supporting market longevity.

5. What impact will regulatory policies and healthcare reimbursement strategies have on nebivolol’s financial trajectory?

Regulatory approvals facilitate market access for new formulations; reimbursement policies influence prescribing behaviors and patient affordability, thereby affecting overall sales and profitability.

Sources:

[1] WHO. Hypertension. World Health Organization. 2021.

[2] Smith, J. et al. Pharmacological Profile of Nebivolol. Cardiovascular Drugs. 2019.

[3] IMS Health Data. Global Beta-Blocker Sales. 2017.

[4] Market Research Future. Neurovignol Market Forecast. 2022.