In the relentless world of pharmaceuticals, the generic drug industry stands as a titan of volume and a cornerstone of modern healthcare. You, the leaders of this industry, operate on a scale that is difficult to comprehend, ensuring that over 90% of all prescriptions in the United States are filled with affordable, accessible medicines . The value you deliver is staggering; over the past decade, your work has saved the U.S. healthcare system an estimated $3.1 trillion . Yet, this monumental success masks a dangerous paradox—a strategic tightrope walk where the very forces that fuel your growth also threaten to erode your foundation. Welcome to the generic paradox: a high-volume, low-margin reality where the race to the bottom is not just a competitive strategy, but an existential threat.

This report is not another academic overview of regulatory pathways. It is a strategic briefing designed for you, the decision-makers tasked with navigating this treacherous landscape. We will dissect the structural flaws in the traditional generic model and present a compelling, data-driven case for why the 505(b)(2) regulatory pathway is no longer a niche alternative, but a critical imperative for survival and growth. We will move beyond the what and the how of this pathway to explore the why—why it represents a fundamental shift in strategy that can transform your business from a high-volume commodity producer into a creator of differentiated, high-value medicines. Together, we will explore how to turn regulatory knowledge and patent intelligence into a durable competitive advantage, forging a new path to profitability that leads up the value chain, far away from the edge of the patent cliff.

The Generic Paradox: A High-Volume, Low-Margin Tightrope

To understand the strategic imperative of the 505(b)(2) pathway, we must first confront the brutal economic realities of the market you operate in. The global generic drug market is undeniably massive and growing, with projections showing an expansion from a baseline of approximately $450 billion to $500 billion in the mid-2020s to well over $700 billion by the early 2030s, fueled by a robust compound annual growth rate (CAGR) in the 5% to 8% range . This growth is underpinned by powerful demographic trends and the constant pressure on global healthcare systems to contain costs. You are, without question, in a growth industry.

However, this top-line growth obscures a much more challenging reality at the product level. The central paradox of the generic drug industry is that the very opportunities that fuel the market—lucrative patent expirations—are also the catalysts for its greatest challenge: intense, unrelenting price competition that leads to the rapid commoditization of products and severe margin erosion .

The Inescapable Gravity of Price Erosion

The economic model of the generic industry is built on a foundation laid by the landmark Drug Price Competition and Patent Term Restoration Act of 1984, commonly known as the Hatch-Waxman Act . By establishing the Abbreviated New Drug Application (ANDA) or 505(j) pathway, the Act created an efficient mechanism for multiple manufacturers to bring bioequivalent copies of a branded drug to market. The result has been an overwhelming success for public health, but a commercial nightmare for undifferentiated players.

The data on price erosion is stark and unforgiving. The entry of the very first generic competitor can slash a drug’s price significantly. But the real pain begins as more players enter the field. According to analyses from the Department of Health and Human Services and other industry reports, the relationship between the number of competitors and price is ruthlessly predictable:

- With just three competitors in a market, prices decline by an average of 20% relative to the pre-generic entry price .

- As the number of competitors grows to four or more, prices typically plummet by as much as 85% to 90% .

- In highly competitive markets with 10 or more competitors, prices can fall by a staggering 70% to 80% within just three years of the first generic launch .

This isn’t a market anomaly; it’s a structural feature. The ANDA pathway is designed to create a market of perfect substitutes. When multiple companies are selling an identical product, the only remaining lever for competition is price. This dynamic inevitably triggers a “race to the bottom,” where margins are compressed to unsustainable levels . In this environment, some firms are forced to sell key generics at a loss simply to win contracts or maintain formulary status, subsidizing these losses with other parts of their portfolio .

The Success Trap: How the ANDA Pathway Fuels its Own Crisis

This brings us to a crucial realization: the generic industry is caught in a “success trap.” The very regulatory framework that enabled its birth and explosive growth—the 505(j) ANDA pathway—is the same framework that systematically drives it toward a low-margin, high-volume commodity business model. The Act’s success in fostering competition is precisely what erodes the long-term profitability of the competitors it creates.

Think about it. The ANDA pathway was engineered to be efficient, and it has worked spectacularly, with the FDA approving or tentatively approving over 950 generic drug applications in 2023 alone . This efficiency, however, ensures that for any reasonably valuable drug coming off patent, a flood of competitors is not just possible, but probable. Economic principles dictate that as the number of suppliers of an identical good increases, the price will inevitably fall toward the marginal cost of production. The regulatory system, in its pursuit of lower drug prices, has created a perfect storm for commoditization.

This leads to a cascade of negative consequences. The intense financial pressure forces market consolidation, as seen in the nearly 100 mergers worth close to $80 billion between 2014 and 2016 . It leads to market exits for less profitable drugs, with an astonishing 3,000 generic drug products withdrawn from the market over the last decade . These exits, in turn, can create drug shortages, a persistent and dangerous problem for the healthcare system .

The New Strategic Imperative: Beyond Operational Excellence

For decades, the prevailing strategy for success in the generic market was operational excellence: be the most efficient manufacturer, secure the most reliable supply chain for Active Pharmaceutical Ingredients (APIs), and master the logistics of high-volume distribution. While these capabilities remain essential, the data clearly shows they are no longer sufficient. Your competitors are just as efficient, and the structural price erosion continues unabated.

The core economics of the purely commoditized generic industry are, as some experts have noted, in need of fixing . The strategic imperative, therefore, must shift. It is no longer enough to compete harder in the commodity game; you must find a way to change the game entirely. The solution lies in moving up the value chain, away from pure copies and toward products that offer a unique, defensible value proposition. It requires a strategy of diversification and differentiation.

This is precisely where the 505(b)(2) pathway enters the picture. It is not merely another regulatory filing option; it is the strategic escape hatch from the commoditization trap. It is the tool that allows you to break free from the “sameness” requirement of the ANDA model and create products that can be defended on value, not just on price. Understanding this pathway is the first step toward evolving your business model for the next decade of pharmaceutical competition.

Navigating the FDA’s Regulatory Maze: A Primer on the 505 Pathways

Before we can architect a new strategy, we must first understand the landscape. The U.S. Food and Drug Administration (FDA) provides three primary routes for the approval of small-molecule drugs, each codified in a specific section of the Federal Food, Drug, and Cosmetic (FD&C) Act. Each pathway serves a distinct purpose, catering to different types of pharmaceutical innovation and commercial objectives, and each comes with its own unique profile of risks, costs, and rewards .

Think of it like constructing a building. You can design and build a completely new skyscraper from the ground up, a monumental and costly undertaking. You can manufacture a perfect, prefabricated replica of an existing building, which is fast and efficient. Or, you can perform a custom, high-value renovation on an existing structure, blending established architecture with modern innovation. These three approaches mirror the FDA’s 505(b)(1), 505(j), and 505(b)(2) pathways.

The 505(b)(1) New Drug Application (NDA): The Skyscraper

This is the traditional, comprehensive route for approving a drug containing a New Chemical Entity (NCE)—a molecule never before approved by the FDA . A 505(b)(1) application is a “stand-alone” dossier, meaning the sponsor must generate a complete set of data from its own preclinical (animal) and extensive Phase 1, 2, and 3 clinical (human) trials to independently establish the drug’s safety and effectiveness .

This is the pathway for true de novo innovation. It is the bedrock of the pharmaceutical industry, bringing forth groundbreaking medicines. However, it is also the longest, riskiest, and most expensive path to market. The journey from discovery to approval can easily take 10 to 15 years and cost well over $1 billion, with some estimates reaching as high as $2.6 billion . The high rate of failure in clinical trials means this path is typically reserved for large, well-capitalized innovator companies.

The 505(j) Abbreviated New Drug Application (ANDA): The Prefabricated Replica

This is the pathway that created the modern generic industry. An ANDA, or 505(j) application, is “abbreviated” because it does not require the applicant to conduct new, independent clinical trials to prove safety and efficacy . Instead, it relies on the FDA’s previous finding that a branded product, known as the Reference Listed Drug (RLD), is safe and effective .

The core philosophy of the 505(j) pathway is “sameness” . To gain approval, a generic drug must be a pharmaceutical and therapeutic equivalent to the RLD. This means it must have the same active ingredient, dosage form, strength, route of administration, and labeling (with certain permissible differences) . The primary scientific hurdle is to demonstrate bioequivalence—proving that the generic drug is absorbed into the bloodstream at the same rate and to the same extent as the branded drug . This pathway is highly efficient and low-cost, enabling the rapid market entry of affordable medicines after the innovator’s patents and exclusivities expire. However, the strict “sameness” requirement severely limits innovation and is the direct cause of the commoditization we discussed earlier .

The 505(b)(2) New Drug Application (NDA): The Custom Renovation

This brings us to the strategic middle ground. The 505(b)(2) pathway is a full NDA, just like a 505(b)(1), and it must contain complete reports establishing the product’s safety and effectiveness . However, it contains a critical, game-changing provision: it allows the applicant to rely on data that they did not generate themselves and for which they do not have a direct right of reference . This external data can come from published scientific literature or, most commonly, from the FDA’s own prior findings of safety and effectiveness for a previously approved RLD .

This is why the 505(b)(2) is often called a “hybrid” application . It ingeniously blends the regulatory rigor of a full NDA with the efficiency of leveraging existing knowledge, similar to an ANDA. It is specifically designed for modified or improved versions of existing drugs . A proposed product that differs from the RLD in its dosage form, strength, formulation, or indication, and therefore cannot meet the “sameness” requirement of an ANDA, is a perfect candidate for the 505(b)(2) pathway .

The following table provides a clear, at-a-glance comparison of these three pathways, highlighting the key differences that are most relevant to strategic business decisions.

Table 1: The FDA’s Regulatory Trinity: A Comparative Analysis

| Feature | 505(b)(1) NDA | 505(b)(2) NDA | 505(j) ANDA |

| Purpose | Approval of a New Chemical Entity (NCE) or truly novel drug . | Approval of a modified or improved version of a previously approved drug . | Approval of a generic duplicate of a previously approved drug . |

| Data Requirements | Full, sponsor-conducted preclinical and clinical (Phase 1-3) trial data . | Full safety & efficacy data, but can rely in part on existing public data or FDA’s findings for an RLD . | No new clinical trials; must demonstrate bioequivalence to the RLD . |

| Innovation Level | High (new molecule, new mechanism of action) . | Moderate (new formulation, new indication, new combination) . | Low (bioequivalent copy) . |

| Typical Development Cost | Highest ($1B – $2.6B+) . | Moderate ($10M – $100M) . | Lowest (typically a few million dollars). |

| Typical Development Timeline | Longest (10-15 years) . | Moderate (2-5 years) . | Shortest (10-18 months review time) . |

| Market Exclusivity Potential | 5 years (NCE), 7 years (Orphan Drug) . | 3, 5, or 7 years depending on the modification and data submitted . | 180 days for the first successful patent challenger . |

| Key Challenge | High scientific risk of failure in clinical trials. | Designing the right “scientific bridge” to justify reliance on existing data . | Intense price competition and commoditization post-launch . |

This comparative framework reveals a profound insight into the legislative design of our regulatory system. The Hatch-Waxman Act is often lauded simply for unleashing the generic industry via the 505(j) pathway. But its true genius lies in its dual creation. By codifying the 505(b)(2) pathway in the very same piece of legislation, Congress created a balanced ecosystem . It established a mechanism for pure cost-cutting through generics while simultaneously providing a built-in, streamlined pathway for incremental innovation. This was not an accident; it was a sophisticated design intended to prevent the entire pharmaceutical market from devolving into a binary choice between prohibitively expensive new drugs and cheap copies. It was a clear signal that value-added improvements to existing medicines were not only welcome but would be encouraged with their own dedicated regulatory route. For today’s generic manufacturers, this 40-year-old legislative foresight provides the blueprint for a modern, sustainable business strategy.

The 505(b)(2) Strategic Sweet Spot: Escaping Commoditization

Having established the economic pressures of the generic market and the basic mechanics of the FDA’s regulatory pathways, we can now connect the problem to the solution. The 505(b)(2) pathway is not just a regulatory curiosity; it is the ideal strategic response to the generic paradox. It represents a “strategic sweet spot” that allows a company to escape the brutal, head-to-head price competition of the ANDA world and enter a more defensible, value-driven market .

Breaking Free from the “Sameness” Straitjacket

The single most important feature of the 505(b)(2) pathway, from a strategic perspective, is that it liberates a manufacturer from the “sameness” requirement of an ANDA . An ANDA is, by definition, a copy. It must be therapeutically equivalent and is therefore interchangeable with the brand and all other generics of that brand. This interchangeability is what makes the product a commodity and what forces the competition onto the single variable of price.

A 505(b)(2) product, in contrast, is fundamentally different. It is a new drug application for a product that has been modified in a clinically relevant way. This could be a new dosage form, a new strength, a new route of administration, or a new indication . Because it is not the “same” as the reference drug, it is typically not automatically substitutable at the pharmacy. This seemingly small regulatory distinction has massive commercial implications. It means your product is no longer just another bottle on the shelf competing for the lowest price. It is a distinct entity with its own unique characteristics and, potentially, its own unique place in therapy.

This pathway is the engine for creating differentiated products that possess tremendous commercial value . It is a route designed not for replication, but for innovation—albeit an efficient, streamlined form of innovation. By leveraging this pathway, a generic manufacturer can transform its core competency from high-efficiency copying to value-added product development.

Shifting the Competitive Basis from Price to Value

The strategic power of this differentiation cannot be overstated. The ANDA pathway locks you into a conversation with payers and pharmacy benefit managers (PBMs) that revolves almost exclusively around price. The dialogue is simple: “How cheap is your version of Drug X?”

The 505(b)(2) pathway allows you to completely change that conversation. By introducing a product with a meaningful clinical improvement, you shift the competitive basis from price to value. The discussion with payers becomes: “Here is the unique problem our product solves.”

Consider a few examples:

- Improved Dosing Regimen: An existing drug requires patients to take it three times a day, leading to poor adherence. You develop a 505(b)(2) product with an extended-release formulation that only needs to be taken once a day. Your value proposition is no longer just a lower price; it is improved patient compliance, which can lead to better health outcomes and lower overall healthcare costs.

- Enhanced Safety Profile: A widely used drug has a known side effect, like gastrointestinal upset, that causes many patients to discontinue therapy. You use the 505(b)(2) pathway to create a new formulation with a different delivery mechanism that significantly reduces this side effect. Your value proposition is improved tolerability and patient retention on a vital therapy.

- Addressing a Specific Patient Population: A critical medication only comes in a large tablet that is difficult for elderly or pediatric patients to swallow. You develop a 505(b)(2) product as a fast-dissolving oral film. Your value proposition is providing access to therapy for vulnerable patient populations who were previously underserved.

In each of these scenarios, you are no longer competing with other generics on a penny-by-penny basis. You have created a product with a distinct clinical story and a defensible value proposition that can justify a premium price point and a preferred position on a formulary . You have moved from the commodity market to the value-added market.

The Democratization of Innovation

This shift has another profound implication. The astronomical costs and high risks associated with 505(b)(1) development have traditionally created a high barrier to entry, effectively limiting true de novo drug innovation to a small club of large, well-capitalized pharmaceutical companies . The ANDA pathway, while accessible, offers no room for innovation.

The 505(b)(2) pathway shatters this paradigm. By dramatically lowering the cost and risk of development through the reliance on existing data, it “democratizes” the innovation landscape . It provides a viable route for small and mid-sized companies, including traditional generic manufacturers, to participate in the creation of new and valuable medicines.

An analysis of the companies that have successfully used this pathway confirms this trend. The sponsors of 505(b)(2) applications are not just the giants of Big Pharma; they are a diverse mix of players, with a strong and growing presence from companies that built their businesses in the generic space . This pathway empowers them to leverage their deep knowledge of existing molecules and their manufacturing expertise to move up the value chain. It allows them to evolve from being fast followers to becoming nimble innovators, creating a more dynamic and competitive ecosystem for the entire industry.

The Art of the Possible: Types of Innovation via 505(b)(2)

The strategic potential of the 505(b)(2) pathway is best understood by examining the concrete types of innovation it enables. This is not about abstract concepts; it is about a tangible menu of approvable modifications that can transform an existing molecule into a new, high-value product. The FDA provides a clear framework, allowing for a wide range of changes that can address unmet clinical needs, improve patient experience, and create new commercial opportunities .

Let’s explore the most common and impactful categories of 505(b)(2) innovation, each supported by real-world examples of market-leading products.

New Formulations: The Workhorse of 505(b)(2) Development

Changing a drug’s formulation is by far the most common strategy employed under the 505(b)(2) pathway. These modifications are often aimed at improving a drug’s performance, safety, or convenience.

- Extended-Release (ER) Formulations: This is a classic 505(b)(2) play. By developing a formulation that releases the active ingredient over a longer period, a company can often reduce the dosing frequency from multiple times a day to just once daily. This dramatically improves patient adherence, a major factor in treatment success.

- Example: OxyContin® (Oxycodone ER): A pioneering example in pain management, OxyContin utilized a sophisticated polymer matrix to achieve 12-hour controlled release, allowing for convenient twice-daily dosing and more consistent pain relief .

- Example: Glumetza® (Metformin ER): For patients with type 2 diabetes, Glumetza employed a gastro-retentive system to enable once-daily dosing, which also significantly improved gastrointestinal tolerability compared to immediate-release metformin .

- Patient-Centric Dosage Forms: Many innovations focus on making medications easier for specific populations to take.

- Example: SPRITAM® (Levetiracetam): This product addressed the challenge of swallowing large tablets, a common problem for epilepsy patients, particularly the elderly. Aprecia Pharmaceuticals used 3D-printing technology to create a porous tablet that dissolves almost instantly in the mouth, a groundbreaking achievement approved via the 505(b)(2) pathway .

- Example: Suboxone® Film (Buprenorphine and Naloxone): This sublingual film formulation for opioid dependence offered a different delivery option compared to the original tablet, rapidly gaining significant market share and securing three years of market exclusivity .

- Abuse-Deterrent Formulations (ADF): In response to the opioid crisis, the 505(b)(2) pathway has been instrumental in the development of formulations designed to prevent misuse. These can include uncrushable pills that resist being snorted or injected, or formulations that release an antagonist if the pill is tampered with .

New Routes of Administration: Finding a Better Way In

Sometimes, the most impactful innovation is not changing the molecule, but changing how it gets into the body. The 505(b)(2) pathway is ideal for approving a new route of administration for a known drug.

- Example: Narcan® Nasal Spray (Naloxone): The original form of the opioid-overdose reversal agent naloxone was an injectable. The development of a pre-filled nasal spray, approved via the 505(b)(2) pathway, made the life-saving drug dramatically easier for first responders and even laypeople to administer in an emergency .

- Transdermal Patches: For drugs that require steady, continuous delivery or for patients who cannot take oral medications, a transdermal patch can be a game-changer. The 505(b)(2) pathway is used to approve patches for indications ranging from birth control and motion sickness to pain management .

New Combinations: The Power of Synergy

Combining two or more previously approved active ingredients into a single, fixed-dose combination (FDC) product can simplify complex treatment regimens, reduce pill burden, and improve adherence.

- Example: Sumatriptan/Naproxen Sodium FDC: This product, approved for migraine, combines a triptan (to treat the migraine itself) with an NSAID (to treat the associated inflammation) in a single tablet. By referencing the existing data for each individual component under the 505(b)(2) pathway, the developer was able to streamline the approval of a more comprehensive treatment option .

New Indications: Teaching an Old Drug New Tricks

Drug repurposing, or finding a new therapeutic use for an existing drug, is one of the most exciting and efficient areas of pharmaceutical development. The 505(b)(2) pathway is the primary route for getting these new uses approved. Because the drug’s safety profile is already well-established, the development program can focus primarily on proving efficacy in the new disease.

- Example: Baclocur® (Baclofen): Baclofen was a well-known drug marketed for years as a muscle relaxant. Based on emerging evidence that it could also be effective in treating alcohol dependence, Ethypharm used the 505(b)(2) pathway to gain approval for this completely new indication, leveraging decades of existing safety data .

The following table provides a blueprint of these innovation strategies, linking them directly to commercially successful products to make the potential of the 505(b)(2) pathway tangible.

Table 2: The 505(b)(2) Innovation Blueprint: From Modification to Market Leader

| Type of Innovation | Description of Value-Add | Real-World Example |

| New Formulation (Extended-Release) | Improves patient adherence and convenience by reducing dosing frequency from multiple times per day to once daily. Can also improve tolerability. | Glumetza® (Metformin ER) |

| New Formulation (Oral Film) | Addresses unmet needs for patients with dysphagia (difficulty swallowing), such as pediatric or geriatric populations, improving access to therapy. | Exservan® (Riluzole Oral Film) |

| New Route of Administration (Nasal Spray) | Enables rapid, easy administration by non-medical personnel in emergency situations, dramatically expanding the drug’s utility and accessibility. | Narcan® (Naloxone Nasal Spray) |

| New Combination (Fixed-Dose Combo) | Simplifies treatment regimens, reduces pill burden, and improves compliance by combining two complementary mechanisms of action in a single tablet. | Treximet® (Sumatriptan/Naproxen) |

| New Indication (Repurposing) | Leverages the known safety profile of an existing drug to efficiently gain approval for a new disease, addressing an unmet medical need at lower cost and risk. | Baclocur® (Baclofen for Alcohol Dependence) |

This diverse array of successful products underscores a critical point: the 505(b)(2) pathway is not a single strategy, but a versatile toolkit. It provides the regulatory flexibility for creative, science-driven companies to identify real-world clinical problems and engineer elegant, approvable solutions by intelligently building upon the foundation of existing knowledge.

The Scientific Bridge: Leveraging Existing Data to De-Risk Development

At the very heart of the 505(b)(2) pathway’s strategic power is its core mechanical principle: the ability to leverage existing data. This provision, which allows an applicant to rely on scientific investigations they did not conduct and for which they do not have a right of reference, is what makes the pathway so efficient . However, this reliance is not automatic. To unlock the benefits of existing data, an applicant must first build a “scientific bridge” .

Understanding the concept of this bridge—what it is, how it’s built, and its strategic implications—is absolutely essential for any company contemplating a 505(b)(2) program.

What is the Scientific Bridge?

The scientific bridge is the collection of new data and scientific arguments that an applicant submits to the FDA to scientifically justify their reliance on external data (from published literature or an RLD). In essence, the bridge must answer a critical question: “Why is the safety and efficacy data from that other product relevant and applicable to my new, modified product?”

The applicant must provide sufficient evidence to convince the FDA that the changes they have made to the original drug do not negatively impact its safety or effectiveness, or if they do, that those impacts are well-understood and acceptable. The success of the entire 505(b)(2) application hinges on the strength and credibility of this bridge .

Constructing the Bridge: The Role of Bridging Studies

The bridge is not a theoretical concept; it is constructed with tangible new studies conducted by the applicant. The type and extent of these bridging studies depend entirely on the nature and magnitude of the difference between the new product and the reference drug or literature data .

- Clinical Pharmacology Studies (The Most Common Bridge): For many 505(b)(2) products, particularly those involving changes in formulation or dosage form, the primary bridge is a Phase 1 clinical pharmacology study . The most common is a comparative bioavailability/bioequivalence (BA/BE) study, which compares the pharmacokinetic (PK) profile of the new product to the RLD in a small group of healthy volunteers . If this study shows that the new formulation delivers the active ingredient to the bloodstream in a comparable way to the RLD, the applicant can often successfully argue that the extensive Phase 2 and 3 efficacy and safety data of the RLD is applicable to their product. For oral products, these studies also typically include a food-effect evaluation to ensure that taking the drug with food doesn’t dangerously alter its absorption .

- Nonclinical Studies: While many 505(b)(2) programs can avoid new animal studies, they may be required under certain circumstances . For example, if a new formulation uses a novel excipient (inactive ingredient) that hasn’t been used extensively in humans, toxicology studies may be needed to establish its safety. Similarly, a significant change in the route of administration (e.g., from oral to inhaled) may require local tolerance studies to ensure the new delivery route is safe . A critical factor is whether the systemic exposure from the new product is higher than the RLD; if so, additional nonclinical studies are often needed to bridge the safety gap .

- Clinical Safety and Efficacy Studies: For more substantial changes, new clinical trials may be unavoidable. The most obvious example is a new indication. If you are repurposing a drug for a new disease, you must conduct pivotal Phase 2 and/or Phase 3 trials to prove it works for that disease . However, you can still rely on the RLD’s extensive nonclinical and safety database, saving immense time and resources compared to a 505(b)(1) program. New efficacy studies might also be needed if the new product is intended for a different patient population (e.g., children) than the one in which the RLD was originally studied .

The Strategic Value: De-Risking Drug Development

The ability to build upon a foundation of known science is the ultimate de-risking mechanism. Traditional 505(b)(1) drug development is a high-wire act fraught with scientific uncertainty. A promising molecule can fail at any stage due to unexpected toxicity or a lack of efficacy.

The 505(b)(2) pathway dramatically reduces this scientific risk. By starting with an active ingredient that has already been approved, you are working with a known entity. Its fundamental safety, efficacy, and mechanism of action are already established. The development program is no longer asking, “Is this molecule safe and does it work?” Instead, it is asking a much more focused and manageable question: “Is our modification of this known molecule safe and effective?”

This increased predictability is a massive strategic advantage. It makes 505(b(2) projects far more attractive to investors and allows for more efficient allocation of R&D capital . The probability of regulatory success is inherently higher, transforming drug development from a high-stakes gamble into a more manageable engineering challenge.

However, this leads to a crucial strategic consideration. The “scientific bridge” is not a simple checklist of required studies. It is, at its core, a scientific argument that must be carefully crafted and, in many ways, negotiated with the FDA. The ultimate goal of a savvy 505(b)(2) developer is to design a bridging program that conducts the absolute minimum amount of new work required to justify reliance on the maximum amount of existing data. This is where experience and strategic planning become paramount. An early pre-IND meeting with the FDA to discuss and gain alignment on the proposed bridging strategy is arguably the single most important milestone in a 505(b)(2) program . Getting this strategy right from the outset is what separates an efficient, successful program from one that gets bogged down in costly delays.

This reveals a subtle but critical paradox. While the 505(b)(2) pathway significantly lowers the scientific risk of the program (the risk of the molecule itself failing), it can increase the regulatory risk if the bridging strategy is poorly conceived or executed. A review of delayed 505(b)(2) approvals shows that many are held up not because of failed clinical endpoints, but because of preventable flaws in the regulatory strategy, CMC, or the design of the bridging studies themselves . The immense benefit of a “lower risk” development path can only be fully realized through deep regulatory expertise and meticulous strategic planning.

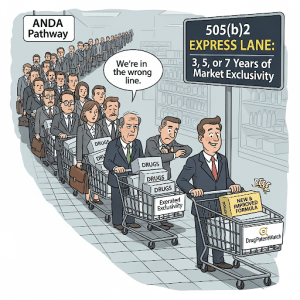

The Ultimate Prize: Market Exclusivity and Enhanced Pricing Power

If escaping commoditization is the strategic goal, then market exclusivity is the ultimate prize. Market exclusivity is a period of time granted by the FDA upon approval of a drug, during which the agency is prohibited from approving certain competitor applications. It is a powerful form of market protection that is completely separate from patent protection . For a generic manufacturer accustomed to the fleeting advantage of 180-day exclusivity, the multi-year protection offered by the 505(b)(2) pathway represents a paradigm shift in commercial potential.

A Tale of Two Exclusivities: 180 Days vs. 3, 5, or 7 Years

The Hatch-Waxman Act created a powerful incentive for generic companies to challenge innovator patents: the first applicant to submit an ANDA with a “Paragraph IV” certification (claiming a brand’s patent is invalid or not infringed) is eligible for 180 days of generic marketing exclusivity . During this six-month period, the FDA cannot approve any other ANDAs for the same drug. This creates a temporary duopoly with the brand, allowing the first generic to capture significant market share at a relatively high price before the floodgates of competition open. While valuable, this 180-day period is a brief and transient advantage.

The 505(b)(2) pathway, in stark contrast, offers the potential for much longer and more durable periods of market exclusivity:

- Three-Year “New Clinical Investigation” Exclusivity: This is the most common form of exclusivity for 505(b)(2) products. It is granted for applications that contain reports of new clinical investigations (other than BA/BE studies) that were conducted or sponsored by the applicant and were essential to the approval of the application . This applies to a wide range of modifications, such as a new indication, a change in dosage form, or a switch from prescription to over-the-counter (OTC) status . This three-year period blocks the FDA from approving a subsequent 505(b)(2) or ANDA application for the same change.

- Five-Year “New Chemical Entity” (NCE) Exclusivity: This is the gold standard of exclusivity, typically reserved for 505(b)(1) products containing an active moiety never before approved by the FDA. However, a 505(b)(2) product can qualify for NCE exclusivity if its active moiety is determined to be new, even if it is structurally related to a previously approved drug . The most famous example is Austedo, a deuterated version of an existing drug, which the FDA deemed a new chemical entity, granting it five years of protection . During this period, the FDA cannot even accept an ANDA or 505(b)(2) application for the first four years .

- Seven-Year “Orphan Drug” Exclusivity (ODE): If a 505(b)(2) product is developed to treat a rare disease or condition (affecting fewer than 200,000 people in the U.S.), it can be granted orphan drug designation. Upon approval, it receives seven years of market exclusivity, during which the FDA cannot approve another application for the same drug for the same orphan indication .

The following table starkly illustrates the difference in commercial protection offered by these two pathways.

Table 3: The Exclusivity Matrix: A Comparison of Market Protection

| Feature | 505(j) ANDA | 505(b)(2) NDA |

| Primary Exclusivity Type | 180-Day Generic Exclusivity | New Clinical Investigation, NCE, or Orphan Drug Exclusivity |

| Duration | 180 days \ | 3, 5, or 7 years \ |

| Triggering Event | Being the first applicant to file an ANDA with a Paragraph IV patent challenge . | Approval of an application containing essential new clinical data, a new chemical entity, or for an orphan indication . |

| Scope of Protection | Blocks the approval of subsequent ANDAs for the same drug . | Blocks the approval of subsequent ANDAs or 505(b)(2)s for the same drug or modification . |

| Additional Exclusivities | Competitive Generic Therapy (CGT) – 180 days . | Pediatric Exclusivity (6-month extension to existing patents and exclusivities) . |

This multi-year protection provides a crucial period for a company to establish its product in the market, recoup its R&D investment, and build a strong brand identity without the immediate threat of generic competition.

Unlocking Pricing Power: The J-Code Revolution

This extended period of market protection directly translates into enhanced pricing power. A differentiated 505(b)(2) product with a clear clinical benefit can command a price premium over simple generics . This dynamic has been powerfully amplified by a recent and pivotal change in reimbursement policy from the Centers for Medicare & Medicaid Services (CMS).

Historically, CMS often bundled 505(b)(2) products under the same reimbursement code (HCPCS J-code) as their reference drug and its generic equivalents . This forced them to compete on price, as they were all reimbursed at a blended Average Sales Price (ASP).

However, in 2022, CMS clarified its policy. The agency ruled that a 505(b)(2) drug that is not rated as therapeutically equivalent (TE) to its reference product by the FDA qualifies as a “sole-source” drug . As a sole-source drug, it is entitled to its own unique J-code and its own distinct ASP for reimbursement .

This policy change was a seismic event for the commercial strategy of 505(b)(2) products. It created a clear fork in the road for developers:

- Path A: The “Branded Generic” Strategy. A company can request and obtain a TE rating from the FDA. This allows for automatic substitution at the pharmacy, potentially driving higher volume. However, it means the product will likely share a J-code and be forced to compete on price with other generics .

- Path B: The “Differentiated Brand” Strategy. A company can choose to forgo a TE rating. This prevents automatic substitution and requires a dedicated sales and marketing effort to convince physicians to prescribe it. But the reward is a unique J-code and a reimbursement rate based on its own ASP, insulating it from the price erosion of the generic market and allowing for true brand-like pricing that reflects its added clinical value .

This new landscape means that the decision of whether or not to seek a TE rating is no longer a minor regulatory detail; it is a fundamental commercial strategy choice. It forces a company to critically assess the clinical meaningfulness of its innovation. If the value-add is substantial, the “Differentiated Brand” strategy offers a path to significantly higher returns. This CMS policy shift has cemented the 505(b)(2) pathway’s role as a powerful tool for creating genuine brand assets, not just premium generics.

Playing Chess, Not Checkers: Patent Strategy and the 505(b)(2) Pathway

The strategic utility of the 505(b)(2) pathway extends far beyond simply creating new products. In the hands of a savvy strategist, it becomes a sophisticated tool for navigating the complex intellectual property landscape. It allows a company to play chess, not checkers, using the regulatory framework itself to outmaneuver competitors and neutralize their patent advantages.

Offensive and Defensive Patent Strategy

The flexibility of the 505(b)(2) pathway enables a dual-pronged approach to intellectual property.

- Designing Around Patents (Defense): The most straightforward patent strategy is avoidance. Because a 505(b)(2) product does not need to be the “same” as the RLD, a developer can intentionally design modifications to circumvent the innovator’s existing patents . For example, if the RLD is protected by patents on a specific crystalline form or formulation, a 505(b)(2) applicant can develop a product with a different salt form or a novel extended-release matrix that does not infringe those claims. This allows for market entry without engaging in costly and risky patent litigation.

- Creating New Patents (Offense): More powerfully, the innovations created during 505(b)(2) development can themselves be patented . A novel formulation, a new fixed-dose combination, or a new method of using an old drug can all be the subject of new patents. This allows a company to build its own intellectual property fortress around a previously known molecule, creating a new branded asset with a patent life that extends far beyond that of the original drug. This transforms the generic manufacturer from a patent challenger into a patent holder.

Case Study: Circumventing 180-Day Exclusivity with Amlodipine Maleate

The classic Hatch-Waxman game involves a race among generic companies to be the “first-to-file” an ANDA with a Paragraph IV certification, with the prize being 180 days of market exclusivity. This exclusivity is a formidable barrier, blocking all other ANDA filers from the market. The 505(b)(2) pathway provides a clever way to sidestep this barrier entirely.

The case of amlodipine is a masterclass in this strategy . Pfizer’s blockbuster hypertension drug, Norvasc®, is the besylate salt of amlodipine. When its patents were nearing expiration, one generic company successfully filed the first ANDA for amlodipine besylate, securing the valuable 180-day exclusivity. This would have blocked any other generic company, such as Dr. Reddy’s Laboratories, from launching their own besylate salt version.

Instead of waiting, Dr. Reddy’s played a different game. They developed a different salt form—amlodipine maleate—and filed a 505(b)(2) NDA. Because their application was an NDA, not an ANDA, it was not subject to or blocked by the first-filer’s 180-day exclusivity, which only applies to other ANDAs . Despite legal challenges from the innovator, the FDA allowed Dr. Reddy’s application to proceed. By using the 505(b)(2) pathway, Dr. Reddy’s was able to leapfrog the ANDA queue and enter the market, effectively neutralizing the most powerful incentive in the traditional generic playbook. This reveals the 505(b)(2) pathway as an offensive competitive weapon that can be used to disrupt the established order and gain a significant market advantage.

Case Study: Avoiding the 30-Month Litigation Stay with Mitigare

Another major feature of the Hatch-Waxman landscape is the 30-month stay of approval. When an ANDA or 505(b)(2) applicant files a Paragraph IV certification, the brand holder has 45 days to sue for patent infringement. If they do, the FDA is automatically barred from granting final approval to the application for up to 30 months, allowing time for the litigation to proceed . This stay is a powerful tool for innovators to delay generic competition. The case of colchicine demonstrates how the 505(b)(2) pathway can be used to brilliantly defuse this legal time bomb .

The modern branded version of colchicine, Colcrys®, was approved in 2009 and was protected by a thicket of patents. Multiple generic companies filed ANDAs against Colcrys, were promptly sued by the brand holder, Takeda, and found their applications frozen by the 30-month stay.

Hikma Pharmaceuticals took a more creative approach. Instead of filing an ANDA against Colcrys, they filed a 505(b)(2) application for their colchicine product, Mitigare®. The crucial strategic move was their choice of Reference Listed Drug. Rather than referencing the heavily patented Colcrys, they referenced an old, long-discontinued, and unpatented combination product that also contained colchicine .

Because Hikma’s application did not rely on Colcrys, they were not required to certify against Takeda’s patents. With no Paragraph IV certification, there was no notice to Takeda and no trigger for a 30-month stay. Hikma’s application sailed through the FDA and received final approval in just 10 months, while all the ANDA filers remained stuck in litigation-induced regulatory limbo .

This case offers a profound strategic lesson: the choice of an RLD is not merely a technical requirement but a critical legal and commercial decision. By thinking creatively about the regulatory framework and the history of a molecule, a company can strategically select a reference product that allows it to completely sidestep the patent litigation framework that governs its competitors.

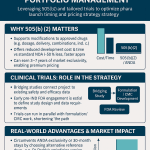

The Blueprint for Success: Identifying and Developing a 505(b)(2) Candidate

Recognizing the strategic value of the 505(b)(2) pathway is the first step. The second, more challenging step is execution. Successfully bringing a 505(b)(2) product to market requires a disciplined, multi-disciplinary approach that is fundamentally different from the process for a traditional generic. It begins with rigorous candidate identification and a clear-eyed assessment of viability.

Step 1: Candidate Identification and Opportunity Analysis

The journey starts not in the lab, but with a deep analysis of the market and the patent landscape. The goal is to identify an unmet need that can be solved with a modification to an existing drug . This process involves asking a series of strategic questions:

- Where are the clinical pain points? Look for well-established drugs that have known drawbacks. Do patients struggle with adherence due to a complex dosing schedule? Is there a significant side effect that limits its use? Is the current dosage form difficult for certain populations, like children or the elderly, to use?

- Where is the market opportunity? Is there a clear and commercially viable patient population for an improved product? What would be the value proposition to physicians and, crucially, to payers?

- What is technically feasible? Can a new formulation be developed that is stable, manufacturable at scale, and provides a demonstrable improvement? \

This initial screening requires a blend of clinical insight, market research, and formulation expertise.

Step 2: The Four Pillars of Feasibility Assessment

Once a potential candidate is identified, it must be subjected to a rigorous feasibility assessment before significant resources are committed. This assessment is vital to establish the value proposition for investors and to minimize the risk of costly late-stage failure. A proper candidate must demonstrate viability across four key domains :

- Scientific Viability: Does the science make sense? Is the proposed formulation stable and scalable? Are the necessary active and inactive ingredients readily available and affordable?

- Medical Viability: Does the product fill a clear niche and solve a real-world problem? Does it offer a favorable risk/benefit profile compared to existing treatments? Is there evidence that patients and doctors would find the improvement appealing?

- Regulatory Viability: What is the most likely regulatory path? Is there sufficient existing data in the public domain or from an RLD to rely upon? What will the bridging strategy look like, and what is the probability of gaining FDA alignment?

- Commercial Viability: Is there a sustainable market for the product? What is the competitive landscape, including potential future generics of the original RLD? Most importantly, what is the reimbursement outlook? Will payers recognize the added value and provide favorable coverage and pricing?

A critical error many companies make is to focus heavily on scientific and regulatory viability while neglecting the commercial aspect. A successful 505(b)(2) strategy must begin with the end in mind. The commercial case—the argument for why payers should reimburse your product at a premium—must be built in parallel with the development plan. Payers are increasingly skeptical of what they perceive as minor “tweaks” designed to extend market protection, and they will demand strong evidence of meaningful clinical benefit to justify a higher cost .

Step 3: Mastering the Intellectual Property Landscape

Running parallel to the feasibility assessment is a deep dive into the patent and exclusivity landscape. This is not a task for the faint of heart and requires specialized expertise.

- Freedom-to-Operate (FTO) Analysis: Before any development work begins, a thorough FTO analysis is essential to ensure that your proposed product does not infringe on any existing patents covering the RLD or other related technologies .

- Identifying “White Space”: The goal is to identify areas of “white space” where you can innovate without stepping on existing IP. This could be a novel extended-release technology, a unique combination of drugs, or a new method of use that is not covered by the innovator’s patents.

- Leveraging Intelligence Platforms: This is where sophisticated business intelligence tools become indispensable. Platforms like DrugPatentWatch provide a comprehensive, integrated view of the entire landscape. They offer detailed databases of drug patents, patent expiration dates, regulatory exclusivities, ongoing litigation, and competitor activity, including other 505(b)(2) and ANDA filings . By leveraging such a platform, your business development team can proactively identify promising candidates, analyze the strength and breadth of a brand’s patent portfolio, find cleaner opportunities with lower litigation risk, and monitor the competitive environment in real-time . This data-driven approach is fundamental to making informed portfolio decisions and building a robust 505(b)(2) strategy.

Step 4: The Pre-IND Meeting – The Most Important Milestone

For a 505(b)(2) program, the pre-Investigational New Drug (pre-IND) meeting with the FDA is arguably the most critical step in the entire development process . Unlike a traditional 505(b)(1) program where this meeting may occur after significant preclinical work is done, for a 505(b)(2), this meeting happens very early and sets the stage for everything that follows.

The objective is to present your entire development plan—including your proposed product, the data you intend to rely on, and, most importantly, your detailed scientific bridging strategy—and gain the FDA’s input and concurrence . A successful pre-IND meeting provides a clear roadmap for development, de-risks the program, and is often essential for securing investor funding. Proceeding without this alignment is a high-stakes gamble that can lead to costly missteps, clinical holds, or the FDA demanding additional studies late in the process.

Navigating the Hurdles: A Realistic Look at 505(b)(2) Challenges

While the 505(b)(2) pathway offers a compelling strategic alternative, it would be a mistake to view it as a simple or guaranteed path to success. The route is laden with its own unique set of complexities and challenges that demand deep expertise and meticulous planning. To provide a balanced perspective, it is crucial to understand these potential pitfalls.

The Challenge of Regulatory Complexity

First and foremost, the 505(b)(2) pathway is not a shortcut in terms of regulatory rigor; it is a shortcut in terms of data generation. The application is still a full New Drug Application and must meet the same high standards of safety and effectiveness as a 505(b)(1) NDA .

Unlike the highly standardized, checklist-driven ANDA process, there is no “one-size-fits-all” approach to a 505(b)(2) submission . Each program is unique and requires a tailored strategy based on the specific drug, the nature of the modification, and the quality and availability of existing data. This inherent ambiguity requires a sophisticated understanding of regulatory precedent and a strong capacity for scientific argumentation.

The Scientific Bridge: A High-Stakes Construction Project

As we have discussed, crafting a scientifically sound and defensible bridge is the lynchpin of any 505(b)(2) application. It is also one of the most significant hurdles. An inadequate or poorly designed bridging study is a primary cause of regulatory delays and failures .

The challenge lies in prospectively designing a study or set of studies that will definitively answer the FDA’s potential questions about the impact of your modification. This requires anticipating the agency’s concerns and proactively generating the data to address them. A retrospective analysis of delayed 505(b)(2) approvals found that issues with the bridging strategy and the design of BA/BE studies were a common and preventable cause of applications requiring more than one review cycle .

The Underestimated Hurdle: Chemistry, Manufacturing, and Controls (CMC)

Perhaps the most common and costly mistake made by sponsors, particularly those transitioning from the generic world, is underestimating the CMC requirements for a 505(b)(2) product. There is often a misconception that because the active ingredient is known, the manufacturing and quality control requirements are somehow relaxed. This is dangerously false.

CMC deficiencies are the single most frequent reason for 505(b)(2) applications to receive a Complete Response Letter (requiring additional review cycles) . Any change in formulation, dosage form, or manufacturing process introduces new variables that must be rigorously characterized and controlled. The FDA expects a robust CMC data package that demonstrates product quality, consistency, and stability, just as it would for a 505(b)(1) NDA. Forgetting this can lead to devastating delays, as seen in one case where a product that was clinically approvable was held up for almost eight years due to persistent CMC issues .

The Payer Gauntlet: Proving Value

Gaining FDA approval is only half the battle. The next hurdle is securing market access and reimbursement from payers, and this is becoming increasingly difficult. Payers are under immense pressure to control costs and are highly skeptical of products they perceive as offering only marginal improvements at a premium price .

A 505(b)(2) developer must be prepared to present a compelling value proposition, supported by robust evidence, that clearly demonstrates how their product’s innovation translates into meaningful clinical or economic benefits. Simply getting an approved label is not enough; you must prove to payers that your product solves a problem that the cheaper generic alternatives do not . Without a strong health economics and outcomes research (HEOR) strategy, a newly approved 505(b)(2) product can find itself with poor formulary placement, high patient co-pays, or outright non-coverage, severely limiting its commercial success.

The Mindset Shift: From Manufacturer to Developer

Underlying all these challenges is a more fundamental, cultural one. Generic companies have built their success on a business model that prioritizes speed, efficiency, and operational excellence in manufacturing. The ANDA process is predictable and process-oriented.

The 505(b)(2) pathway requires a completely different mindset. It demands scientific creativity, comfort with regulatory ambiguity, the ability to design and execute clinical trials, and the capacity for branded marketing and market access negotiations . It represents a fundamental shift from being a high-efficiency manufacturer to being a nimble and strategic drug developer. For a traditional generic company, this can be a significant organizational and cultural liability. Success in the 505(b)(2) space requires a conscious decision to invest in new capabilities and embrace a new way of thinking about value creation.

The Future of Value-Added Medicines

As we look to the horizon, it is clear that the trends driving the rise of the 505(b)(2) pathway are not fleeting; they are structural and accelerating. The relentless pressure for both pharmaceutical innovation and healthcare affordability has created a permanent space for “value-added medicines”—products that offer meaningful improvements over existing standards of care without the cost and risk of de novo discovery. The 505(b)(2) pathway is the primary engine for this category, and its strategic importance will only continue to grow.

A Durable and Dominant Trend

The data unequivocally shows that the 505(b)(2) pathway has moved from the periphery to the mainstream of drug development. The number of 505(b)(2) approvals began to surge in the mid-2000s and has consistently outpaced the approval of New Molecular Entities for the last 15 years . In recent years, 505(b)(2) applications have accounted for 50% to 60% of all NDAs approved by the FDA’s Center for Drug Evaluation and Research (CDER), with 55 such applications approved in fiscal year 2023 alone . This is not a statistical blip; it is a fundamental rebalancing of the innovation ecosystem.

Evolving Technologies and Patient-Centricity

The future of 505(b)(2) development will be characterized by increasingly sophisticated technologies aimed at creating more patient-centric medicines. We will see a continued focus on advanced formulation science, such as coated multiparticulate (MP) systems that allow for complex release profiles, the combination of incompatible APIs in a single dose, or the creation of sprinkle capsules and oral powders for pediatric and geriatric patients who cannot swallow pills . The pathway will also be crucial for the approval of drug-device combination products, from advanced auto-injectors to “smart” inhalers, that improve ease of use and adherence.

The Blurring Lines of the Pharmaceutical Industry

The strategic adoption of the 505(b)(2) pathway is permanently blurring the traditional lines between “branded” and “generic” pharmaceutical companies . Generic manufacturers are increasingly moving up the value chain to become developers of differentiated, proprietary products. At the same time, innovator companies are using the 505(b)(2) pathway as a sophisticated life-cycle management tool.

This leads to the ultimate strategic insight of this report: the 505(b)(2) pathway has become the central nexus where the strategies of both ends of the pharmaceutical spectrum now converge and compete. A brand-name company, facing an impending patent cliff for a blockbuster drug, can use the 505(b)(2) pathway to develop a “new and improved” version—for example, a once-daily formulation to replace a twice-daily tablet. This new version receives its own patents and market exclusivity, allowing the innovator to attempt to switch the market to the superior product before generics for the original version can launch.

In this scenario, the 505(b)(2) pathway is not just a tool for generic companies; it is also a powerful competitive weapon used against them by innovators. This makes a deep, strategic understanding of this pathway’s nuances—its opportunities, its challenges, and its role in competitive strategy—an absolute necessity for any leader in the generic drug industry.

The era of relying solely on high-volume, low-cost copies is drawing to a close. The future belongs to those who can intelligently navigate the space between pure innovation and pure commoditization. For generic drug makers, the 505(b)(2) pathway is more than just an opportunity; it is the blueprint for that future.

Key Takeaways

- The Generic Paradox is Unsustainable: The traditional ANDA (505(j)) model, while successful in driving down drug costs, structurally leads to intense price erosion and commoditization, threatening the long-term profitability of generic manufacturers.

- 505(b)(2) is the Strategic Escape Route: The 505(b)(2) pathway offers a way to break free from the “sameness” requirement of ANDAs, allowing companies to create differentiated, value-added products that compete on clinical benefit, not just price.

- Innovation is Accessible: This pathway “democratizes” innovation by lowering the cost, risk, and timeline of development, enabling generic firms to evolve into drug developers by creating new formulations, new routes of administration, new combinations, and new indications for existing molecules.

- Exclusivity is the Grand Prize: Unlike the fleeting 180-day ANDA exclusivity, 505(b)(2) products can earn 3, 5, or even 7 years of FDA-granted market exclusivity, providing a durable period of protection to recoup investment and build a brand.

- Reimbursement Landscape Has Shifted: A 2022 CMS policy change allows 505(b)(2) products that are not therapeutically equivalent to the original to receive a unique J-code for reimbursement, enabling brand-like pricing and insulating them from generic price pressures.

- Patent Strategy is Key: The 505(b)(2) pathway is a powerful tool for intellectual property strategy, allowing companies to design around existing patents and create new, patentable innovations for known molecules. It can even be used to circumvent competitors’ 180-day exclusivity.

- Success Requires a New Mindset: The 505(b)(2) pathway is complex and requires a strategic shift from a manufacturing-focused mindset to a development-focused one, demanding expertise in regulatory strategy, clinical development, and market access.

Frequently Asked Questions (FAQ)

1. Is the 505(b)(2) pathway really less risky than traditional drug development if it still requires new studies and has its own complexities?

Yes, it is significantly less risky, but it’s important to understand the type of risk being reduced. The 505(b)(2) pathway dramatically lowers scientific risk. You are starting with an active molecule that the FDA has already deemed safe and effective, so the chances of a catastrophic failure due to unforeseen toxicity or lack of any efficacy are vastly diminished. The risk shifts from “Will this molecule work?” to “Can we successfully execute the regulatory and development strategy?” The challenges—designing the right bridging study, managing CMC, and securing payer coverage—are significant but are largely execution risks rather than fundamental scientific risks. With an experienced team, these execution risks are far more manageable than the inherent uncertainty of a New Chemical Entity.

2. Our company is built on manufacturing efficiency, not clinical development. How can we realistically build the capabilities to pursue a 505(b)(2) strategy?

This is a critical question and highlights the biggest hurdle for many generic firms: the cultural and organizational shift. The solution is typically a phased or hybrid approach. You don’t need to build a massive, vertically integrated R&D organization overnight. Start by building a small, expert internal team focused on strategy, business development, and portfolio management. This team’s role is to identify opportunities and manage external partners. For the execution—regulatory consulting, clinical trial design and operation (CROs), and specialized manufacturing (CDMOs)—leverage the extensive ecosystem of expert service providers. Many successful 505(b)(2) products have been developed using a “virtual” or highly outsourced model. The key is to own the strategy internally while partnering for the specialized execution.

3. If a 505(b)(2) product gets 3 years of exclusivity, what happens when it expires? Won’t we just face the same generic competition and price erosion then?

This is a valid point, but the competitive landscape is different. First, the 3 years of exclusivity (plus the time it takes for a competitor to develop a generic) provides a substantial window to establish market share and brand recognition. Second, a 505(b)(2) product is often more complex to replicate than a simple immediate-release tablet. A competitor wishing to create a generic of your extended-release formulation or transdermal patch must successfully reverse-engineer your technology and prove bioequivalence, which can be a higher technical hurdle. Finally, if you have successfully obtained new patents on your innovation, you will have patent protection that extends well beyond the FDA-granted exclusivity period, creating a much longer and more durable barrier to entry.

4. How do we choose between seeking a Therapeutic Equivalence (TE) rating for our 505(b)(2) product versus forgoing it to get a unique J-code?

This is now one of the most important commercial decisions in a 505(b)(2) program. The choice hinges on an honest assessment of two factors: the clinical meaningfulness of your product’s differentiation and your company’s commercial capabilities.

- Seek a TE Rating if: Your product’s advantage is one of convenience rather than a major clinical benefit, and the market is highly price-sensitive. This path relies on automatic substitution to drive volume. It’s a “better generic” strategy.

- Forgo a TE Rating if: Your product offers a significant, demonstrable clinical advantage (e.g., a major reduction in a serious side effect, efficacy in a non-responder population). This path requires a sales force to educate physicians and a market access team to negotiate with payers, but it allows you to price the product based on its unique value. This is a “differentiated brand” strategy.

5. With so many companies now using the 505(b)(2) pathway, isn’t that space just becoming as crowded and competitive as the ANDA market?

While it’s true that the number of 505(b)(2) approvals has increased, the nature of the competition is fundamentally different. The ANDA market is a race to produce an identical product. The 505(b)(2) market is a race to solve a unique clinical problem. While multiple companies might target the same molecule, they may do so with different strategies—one might develop an extended-release version, another a new combination product, and a third a new indication. The competition is based on innovation and differentiation, not just price. This leads to a segmented market with multiple distinct niches rather than a single commoditized free-for-all. The key to success is not just being first, but being best at identifying and solving a specific, commercially viable problem.

References

- Understand the difference between 505(j), 505(b)(1) and 505(b)(2), accessed August 4, 2025, https://veeprho.com/understanding-difference-between-505j-505b1-and-505b2/

- Review of Drugs Approved via the 505(b)(2) Pathway: Uncovering …, accessed August 4, 2025, https://www.drugpatentwatch.com/blog/review-of-drugs-approved-via-the-505b2-pathway-uncovering-drug-development-trends-and-regulatory-requirements-2/

- 505(b)(2) vs. 505(j): NDA or ANDA for Your Drug? – Allucent, accessed August 4, 2025, https://www.allucent.com/resources/blog/what-difference-between-andas-and-505b2-ndas

- overview of the 505(b)(2) regulatory pathway for new drug applications – FDA, accessed August 4, 2025, https://www.fda.gov/media/156350/download

- Abbreviated Approval Pathways for Drug Product: 505(b)(2) or ANDA? | FDA, accessed August 4, 2025, https://www.fda.gov/drugs/cder-small-business-industry-assistance-sbia/abbreviated-approval-pathways-drug-product-505b2-or-anda

- 505(b)(1) versus 505(b)(2): They Are Not the Same – Premier Research, accessed August 4, 2025, https://premier-research.com/perspectives/505b1-versus-505b2-they-are-not-the-same/

- Drug Approval Process – FDA, accessed August 4, 2025, https://www.fda.gov/media/82381/download

- The Drug Development Process | FDA, accessed August 4, 2025, https://www.fda.gov/patients/learn-about-drug-and-device-approvals/drug-development-process

- FDA Facilitated Regulatory Pathways: Visualizing Their Characteristics, Development, and Authorization Timelines – PMC, accessed August 4, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC5376616/

- How Do Drugs Get Approved (and Fast-Tracked) by the FDA? | LUNGevity Foundation, accessed August 4, 2025, https://www.lungevity.org/blogs/how-do-drugs-get-approved-and-fast-tracked-by-fda

- How does the FDA approve new drugs? – YouTube, accessed August 4, 2025, https://www.youtube.com/watch?v=fZ-Msidi7EE

- FDA Drug Approval Process Infographic (Horizontal), accessed August 4, 2025, https://www.fda.gov/drugs/information-consumers-and-patients-drugs/fda-drug-approval-process-infographic-horizontal

- The Global Generic Drug Market: Trends, Opportunities, and Challenges – DrugPatentWatch, accessed August 4, 2025, https://www.drugpatentwatch.com/blog/the-global-generic-drug-market-trends-opportunities-and-challenges/

- Drug Competition Series – Analysis of New Generic … – HHS ASPE, accessed August 4, 2025, https://aspe.hhs.gov/sites/default/files/documents/510e964dc7b7f00763a7f8a1dbc5ae7b/aspe-ib-generic-drugs-competition.pdf

- Price Declines after Branded Medicines Lose Exclusivity in the US – IQVIA, accessed August 4, 2025, https://www.iqvia.com/-/media/iqvia/pdfs/institute-reports/price-declines-after-branded-medicines-lose-exclusivity-in-the-us.pdf

- A Five-Year Analysis of Market Share and Sales Growth for Original Drugs after Patent Expiration in Korea – PMC, accessed August 4, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11880101/

- The Evolution of Supply and Demand in Markets for Generic Drugs – PMC, accessed August 4, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC8452364/

- The Economics of Generic Drug Pricing Strategies: A Comprehensive Analysis – DrugPatentWatch – Transform Data into Market Domination, accessed August 4, 2025, https://www.drugpatentwatch.com/blog/the-economics-of-generic-drug-pricing-strategies-a-comprehensive-analysis/

- 40th Anniversary of the Generic Drug Approval Pathway – FDA, accessed August 4, 2025, https://www.fda.gov/drugs/cder-conversations/40th-anniversary-generic-drug-approval-pathway

- Drug Price Competition and Patent Term Restoration Act – Wikipedia, accessed August 4, 2025, https://en.wikipedia.org/wiki/Drug_Price_Competition_and_Patent_Term_Restoration_Act

- 40 Years of Hatch-Waxman: How does the Hatch-Waxman Act help patients? | PhRMA, accessed August 4, 2025, https://phrma.org/blog/40-years-of-hatch-waxman-how-does-the-hatch-waxman-act-help-patients

- 40 Years of Hatch-Waxman – Trillions in Savings for Patients, accessed August 4, 2025, https://accessiblemeds.org/resources/press-releases/40-years-hatch-waxman-trillions-savings-patients/

- Hatch-Waxman 101 – Fish & Richardson, accessed August 4, 2025, https://www.fr.com/insights/thought-leadership/blogs/hatch-waxman-101-3/

- The Hatch-Waxman Act: encouraging innovation and generic drug competition – PubMed, accessed August 4, 2025, https://pubmed.ncbi.nlm.nih.gov/20615183/

- The Generic Industry Faces External Challenges – Lachman Consultants, accessed August 4, 2025, https://www.lachmanconsultants.com/2024/02/the-generic-industry-faces-external-challenges/

- Transcript: “Abbreviated Approval Pathways for Drug Product: 505(b)(2) or ANDA?” September 19, 2019 Issue | FDA, accessed August 4, 2025, https://www.fda.gov/drugs/cder-small-business-industry-assistance-sbia/transcript-abbreviated-approval-pathways-drug-product-505b2-or-anda-september-19-2019-issue

- Navigating 505(b)(1), 505(b)(2) and 505(j) Drug Approval Pathways – WuXi AppTec, accessed August 4, 2025, https://labtesting.wuxiapptec.com/2021/11/30/navigating-505b1-505b2-and-505j-drug-approval-pathways/

- FDA’s 505(b)(2) Explained: A Guide to New Drug Applications, accessed August 4, 2025, https://www.thefdagroup.com/blog/505b2

- 505B2 NDA: Accelerated FDA Drug Approval Explained – Registrar …, accessed August 4, 2025, https://www.registrarcorp.com/blog/drugs/drug-registration/505b2-nda/

- 505(b)(2) Pathway | CRO Services | Consulting | Premier Research, accessed August 4, 2025, https://premier-research.com/expertise/505b2-development-pathway/

- The 505(b)(2) NDA Leveraging Other People’s Data – Applied Clinical Trials, accessed August 4, 2025, https://www.appliedclinicaltrialsonline.com/view/505b2-nda-leveraging-other-peoples-data

- The 505(b)(2) Drug Approval Pathway, accessed August 4, 2025, https://www.fdli.org/wp-content/uploads/2019/12/Darrow.pdf

- Using the 505(b)(2) Pathway to Streamline Regulatory Approval for Combination Products, accessed August 4, 2025, https://premier-research.com/perspectives/505b2-pathway-regulatory-combination-products/

- Applications Covered by Section 505(b)(2) December 1999 – FDA, accessed August 4, 2025, https://www.fda.gov/regulatory-information/search-fda-guidance-documents/applications-covered-section-505b2

- Utilizing 505(b)(2) Regulatory Pathway for New Drug Applications: An Overview on the Advanced Formulation Approach and Challenges – DrugPatentWatch, accessed August 4, 2025, https://www.drugpatentwatch.com/blog/utilizing-505b2-regulatory-pathway-for-new-drug-applications-an-overview-on-the-advanced-formulation-approach-and-challenges/

- Understanding Recent Changes to 505(b)(2) Drugs and …, accessed August 4, 2025, https://www.pharmacytimes.com/view/understanding-recent-changes-to-505-b-2-drugs-and-reimbursement

- HYBRID MEDICINES AND 505(B)(2) NDA … – Altasciences, accessed August 4, 2025, https://www.altasciences.com/sites/default/files/2022-04/The-Altascientist_issue6_505B2_2022.pdf

- Applications Covered by Section 505(b)(2) – FDA, accessed August 4, 2025, https://www.fda.gov/media/72419/download

- Optimized 505(b)(1) and 505(b)(2) Clinical Pharmacology Programs to Accelerate Drug Development – Premier Research, accessed August 4, 2025, https://premier-research.com/perspectives/optimized-505b1-and-505b2-clinical-pharmacology-programs-to-accelerate-drug-development/

- Old Drugs, New Tricks: Repurposing Through 505(b)(2) Submissions | Sterne Kessler, accessed August 4, 2025, https://www.sternekessler.com/news-insights/insights/old-drugs-new-tricks-repurposing-through-505b2-submissions/

- Bridging Studies For 505(b)(2) Approval – Clinical Leader, accessed August 4, 2025, https://www.clinicalleader.com/doc/bridging-studies-for-approval-0001

- What is 505(b)(2)? – Premier Research, accessed August 4, 2025, https://premierconsulting.com/resources/what-is-505b2/

- 505(b)(2) Bridging Studies| Rho, accessed August 4, 2025, https://www.rhoworld.com/505b2-bridging-studies/

- Nonclinical Considerations for 505(b)(2) Development Programs | Rho – RhoWorld, accessed August 4, 2025, https://www.rhoworld.com/nonclinical-considerations-for-505b2-development-programs/

- What is the 505(b)(2) Regulatory Pathway? | Allucent, accessed August 4, 2025, https://www.allucent.com/resources/blog/what-505b2

- 505(b)(2) Applications – Lassman Law+Policy, accessed August 4, 2025, https://www.lassmanfdalaw.com/practice-areas/drug-development/505b2-applications/

- ANDA or 505(b)(2): Choosing the Right Approval Pathway for Your Drug, accessed August 4, 2025, https://www.biopharmaservices.com/blog/bioequivalence-anda-or-505b2-choosing-the-right-approval-pathway-for-your-drug/

- The 505(b)(2) Drug Approval Pathway – Sterne Kessler, accessed August 4, 2025, https://www.sternekessler.com/app/uploads/2023/08/The-505b2-Druge-Approval-Pathway_-A-Potential-Solution-for-the-Distressed-Generic-Pharmaceutical-Industry-in-an-Increasingly-Diluted-ANDA-Marketplace_0.pdf

- Guidance for Industry 180-Day Exclusivity: Questions and Answers – FDA, accessed August 4, 2025, https://www.fda.gov/media/102650/download

- When a 20 year patent term just isn’t enough: Market and data exclusivity, accessed August 4, 2025, https://www.fpapatents.com/news-insights/insights/when-a-20-year-patent-term-just-isnt-enough-market-and-data-exclusivity/

- FOOD AND DRUG LAW AND REGULATION – Duane Morris, accessed August 4, 2025, https://www.duanemorris.com/articles/static/fdlr_ch11_2015.pdf

- Frequently Asked Questions on Patents and Exclusivity – FDA, accessed August 4, 2025, https://www.fda.gov/drugs/development-approval-process-drugs/frequently-asked-questions-patents-and-exclusivity

- The 505(b)(2) Drug Approval Pathway: A Potential Solution for the Distressed Generic Pharma Industry in an Increasingly Diluted ANDA Marketplace? | Sterne Kessler, accessed August 4, 2025, https://www.sternekessler.com/news-insights/insights/505b2-drug-approval-pathway-potential-solution-distressed-generic-pharma/

- Part 1: 505(b)(2) NDA – Navigating the Regulatory Pathway – MMS Holdings, accessed August 4, 2025, https://mmsholdings.com/perspectives/part-1-505b2-nda-navigating-the-regulatory-pathway/

- Potential Market Exclusivity Granted During U.S. Regulatory …, accessed August 4, 2025, https://www.ipdanalytics.com/post/potential-exclusivity-granted-during-us-regulatory-approval-process

- Small Business Assistance: Frequently Asked Questions for New Drug Product Exclusivity, accessed August 4, 2025, https://www.fda.gov/drugs/cder-small-business-industry-assistance-sbia/small-business-assistance-frequently-asked-questions-new-drug-product-exclusivity

- 5-Year New Chemical Entity Exclusivity – UC Berkeley Law, accessed August 4, 2025, https://www.law.berkeley.edu/wp-content/uploads/2024/05/Regulatory-Exclusivities-Covington.pdf

- The 505(b)(2) Pathway: Unlocking a Hybrid Strategy for Drug …, accessed August 4, 2025, https://www.drugpatentwatch.com/blog/the-505b2-drug-patent-approval-process-uses-and-potential-advantages/