Executive Summary

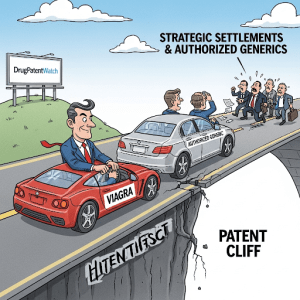

The anticipated “patent cliff” for Pfizer’s blockbuster drug, Viagra (sildenafil citrate), did not result in the typical rapid, uncontrolled market erosion often seen with the expiration of pharmaceutical patents. This report analyzes Pfizer’s multi-faceted strategy, which transformed an expected “free-for-all” into a more managed market transition. Key elements of this approach included proactive and layered patent management, strategic litigation settlements with generic manufacturers, and the innovative deployment of an authorized generic. These deliberate actions allowed Pfizer to control the timing and terms of generic entry, retain a significant portion of the sildenafil market through its own authorized generic, and ultimately mitigate the sharp revenue decline commonly associated with patent expirations. The outcome was a controlled descent, demonstrating a sophisticated approach to intellectual property defense and market management.

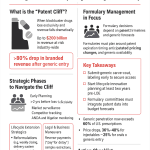

1. Introduction: The Anticipated “Generic Cliff” for Viagra

The pharmaceutical industry frequently faces a phenomenon known as the “patent cliff,” a period when a drug’s patent protection expires, paving the way for the entry of cheaper generic alternatives. This event typically leads to a steep and rapid decline in the innovator company’s sales, with market share reductions often exceeding 80% within the first year of generic competition.1 The financial implications for pharmaceutical companies can be severe, necessitating strategic responses to mitigate revenue erosion and maintain profitability.

Viagra, with its active ingredient sildenafil citrate, stands as a prominent example of a global pharmaceutical success story. Launched as the first oral medication for erectile dysfunction (ED), it achieved blockbuster status and became synonymous with sexual performance enhancement.3 At its peak, Viagra generated over $2 billion in worldwide annual sales, with U.S. sales alone reaching approximately $1.14 billion in 2012.2 Given its immense popularity and substantial revenue contribution, the impending expiration of Viagra’s primary patent was a critical event for Pfizer and a closely watched development across the pharmaceutical landscape.

Despite the conventional expectation of a “free-for-all” market influx following such a significant patent expiry, Viagra’s generic entry proved to be a notably more managed and controlled process. This report delves into the specific strategies and market dynamics that allowed Pfizer to navigate this transition, preventing the chaotic and immediate widespread generic competition that often characterizes a patent cliff.

2. Viagra’s Patent Landscape and Strategic Extensions

The journey of sildenafil citrate began in the early 1990s when Pfizer researchers were developing a compound (initially called UK-92480) for the treatment of hypertension and angina.2 During clinical trials, an unexpected side effect—spontaneous erections—was observed, leading to a shift in research focus towards erectile dysfunction.8 This serendipitous discovery ultimately led to the development of Viagra.

Pfizer secured two pivotal patents in the United States for sildenafil, demonstrating a deliberate strategy to protect the compound across different therapeutic applications. The first, US5250534, was filed in 1992 and covered the substance sildenafil and its use for cardiovascular diseases, marketed under the brand name Revatio. This patent expired on September 27, 2012.9 The second, US6469012, was filed in 1994, specifically protecting the use of sildenafil to treat erectile dysfunction, which became the blockbuster drug Viagra. This patent was published in 2002 and was initially set to expire on October 22, 2019.2

Pfizer actively pursued regulatory mechanisms to extend the market exclusivity of Viagra. A crucial maneuver involved leveraging pediatric exclusivity provisions through the U.S. Food and Drug Administration (FDA). By conducting special pediatric testing for Revatio’s effect on pulmonary arterial hypertension, Pfizer successfully extended the expiration of the US6469012 patent by an additional six months, pushing the effective expiry date to April 22, 2020.2 This extension provided Pfizer with valuable additional time to maximize revenue before widespread generic competition.

The “patent cliff” for Viagra was not a uniform global event; patent protections and their expirations varied significantly across international markets. In the European Union, the patent covering the use of sildenafil in ED expired earlier, in 2013, leading to generic competition in that region years before the U.S. market opened.2 Similarly, Pfizer’s patent on sildenafil citrate expired in Brazil in 2010.10 In Canada, Pfizer faced a significant challenge when the Supreme Court of Canada invalidated its patent on Viagra in November 2012 and April 2013 due to insufficient disclosure in the original application, resulting in immediate generic entry.8 Other countries like China and Egypt also saw earlier generic availability due to differing patent enforcement or government policies.6

The table below summarizes the key patent expiry dates for Viagra (sildenafil) in the U.S. and select international markets:

| Patent Number | Indication | Location | Original Expiry Date | Extension Type | Extended Expiry Date | Key Context |

| US5250534 | Cardiovascular (Revatio) | U.S. | Sep 27, 2012 | N/A | N/A | Compound patent |

| US6469012 | Erectile Dysfunction (Viagra) | U.S. | Oct 22, 2019 | Pediatric Exclusivity | Apr 22, 2020 | Method of use patent |

| N/A | Erectile Dysfunction | European Union | 2013 | N/A | N/A | Patent on use expired |

| N/A | Sildenafil Citrate | Brazil | 2010 | N/A | N/A | Patent expired |

| 2,163,446 | Erectile Dysfunction (Viagra) | Canada | 2014 (intended) | N/A | N/A | Patent invalidated 2012/2013 |

The approach taken by Pfizer, securing two distinct patents for the same active ingredient (sildenafil) but for different indications (cardiovascular and erectile dysfunction), illustrates a sophisticated strategy of intellectual property portfolio management. While the Revatio patent expired earlier in 2012, the Viagra patent for ED extended significantly longer, to 2020 with the added pediatric exclusivity.9 This layering of patents around a single compound is a form of “evergreening,” where pharmaceutical companies continuously seek new patents for new uses, formulations, or methods of use on existing compounds. This proactive IP management is a core strategy employed to prolong market exclusivity, effectively transforming a singular, sharp patent cliff into a series of staggered, more manageable transitions, thereby helping to maintain revenue streams over a longer period.2

Furthermore, the varying patent expiration and invalidation dates across different regions, such as the EU in 2013, Canada in 2012/2013, and Brazil in 2010, compared to the U.S. in 2020, underscore that Pfizer’s intellectual property protection was not uniformly successful globally.2 This global disparity highlights that pharmaceutical companies must adopt a highly localized and adaptive global IP strategy. Earlier expirations or invalidations in some markets can serve as valuable learning experiences, allowing the company to refine its approach and allocate resources more effectively in other, often more lucrative, markets like the U.S. This also means that the “patent cliff” is rarely a single, simultaneous global event, providing opportunities for companies to shift focus and resources to regions where exclusivity remains, thereby diversifying and stabilizing overall revenue.

3. The Role of Patent Litigation and Settlements

The landscape for generic drug entry in the United States is largely governed by the Drug Price Competition and Patent Term Restoration Act of 1984, commonly known as the Hatch-Waxman Act.17 This landmark legislation was designed to strike a balance: encouraging pharmaceutical innovation through patent protection while simultaneously promoting generic competition to make medications more affordable for consumers.

Under the Hatch-Waxman framework, generic manufacturers can challenge existing brand-name drug patents by filing an Abbreviated New Drug Application (ANDA) with a “Paragraph IV certification.” This certification asserts that the brand-name patent is either invalid, unenforceable, or will not be infringed by the generic product.19 To incentivize these challenges, the Act grants a 180-day period of market exclusivity to the first generic applicant to successfully file a Paragraph IV certification. During this period, the FDA generally will not approve other generic applications for the same product, creating a temporary duopoly between the brand and the first generic.17 Conversely, if the brand manufacturer initiates a patent infringement lawsuit within 45 days of receiving a Paragraph IV notice, an automatic 30-month regulatory stay is triggered. This stay delays the generic’s final FDA approval, providing brand companies with significant protected revenue while the patent dispute is resolved.19

Pfizer actively engaged in patent litigation to defend its Viagra franchise. In 2010, Pfizer sued Teva Pharmaceuticals USA Inc. over Teva’s plans to introduce a generic version of Viagra.5 Pfizer initially prevailed in an August 2011 federal district court case, where the court ruled that Teva’s product would infringe Pfizer’s US6469012 patent and affirmed the patent’s validity and enforceability. This decision initially prevented Teva from receiving FDA approval for its generic until October 2019.10

However, despite winning the initial trial, Pfizer made a strategic decision to settle its litigation with Teva in December 2013.5 This confidential settlement allowed Teva to launch its generic version of Viagra in the U.S. on December 11, 2017, a date significantly

before the main patent’s April 2020 expiration.4 In exchange for this early entry, Teva agreed to pay Pfizer an undisclosed royalty for a license to produce its generic version.5 Teva had already received tentative FDA approval for its generic prior to the settlement.13

This settlement with Teva was not an isolated incident. Mylan also settled patent litigation related to Viagra with Pfizer in April 2015, securing the ability to launch its generic sildenafil citrate products as early as December 11, 2017, under a similar royalty-bearing license.27 Pfizer also had other litigation pending against various generic companies, though no trials were scheduled in those cases, suggesting a broader pattern of strategic settlements to manage the generic landscape rather than engaging in protracted legal battles with every challenger.22

The decision by Pfizer to settle with Teva, even after winning the initial litigation that would have prevented generic entry until 2019, represents a calculated market control mechanism. By settling, Pfizer avoided the inherent uncertainty, substantial costs, and potential for adverse rulings associated with prolonged litigation.20 More importantly, this agreement allowed Pfizer to exert significant control over the timing and terms of the first generic entry. The royalty stream secured from Teva ensured continued revenue from the generic version, and by permitting an earlier, controlled launch, Pfizer effectively prevented a truly uncontrolled influx of generics. This strategy effectively traded a shorter period of absolute monopoly for a longer period of controlled, profitable competition, thereby mitigating the sharpness of the “patent cliff.” It also strategically positioned Pfizer to pre-empt the full benefit of the 180-day exclusivity period for Teva, which would typically grant the first generic a significant head start without direct competition from the brand manufacturer.

This scenario also highlights a crucial aspect of the Hatch-Waxman Act’s 180-day exclusivity provision. While this exclusivity is designed to incentivize generic challenges, Teva’s eligibility for this period 26 was effectively diluted by Pfizer’s strategic response. As will be discussed in the next section, Pfizer’s concurrent launch of its own authorized generic significantly altered the competitive landscape during what would otherwise have been Teva’s exclusive generic window. This demonstrates how regulatory incentives, while intended to promote generic competition, can be strategically navigated by brand companies to maintain a degree of market control.

4. Pfizer’s Authorized Generic Strategy (Greenstone)

A key component of Pfizer’s strategy to manage Viagra’s patent expiration was the deployment of an “authorized generic” (AG). An authorized generic is a generic drug product that is manufactured by the original brand-name drug company or its subsidiary, but sold without the brand name.30 These products are chemically identical to the brand drug, are manufactured to the same rigorous standards, and often produced in the very same facilities as the branded version, yet they are typically priced lower than the original brand.30

Pfizer’s subsidiary, Greenstone LLC, launched its own authorized generic version of sildenafil citrate in the U.S. on December 11, 2017.4 This launch date was critically important, as it coincided precisely with the date Teva’s independent generic was permitted to enter the market under the settlement agreement.5 Greenstone’s sildenafil was strategically priced at $30 to $35 per pill, which was approximately half or even less than the $65-a-pill retail cost of branded Viagra.4 This aggressive pricing aimed to capture market share from both the premium-priced branded version and any nascent competition from other generic manufacturers.

To further bolster its authorized generic strategy and adapt to evolving healthcare delivery models, Greenstone entered into an exclusive supply agreement with Roman, a prominent digital healthcare clinic for men, in January 2020.31 This partnership allowed Roman members remote access to the only FDA-approved authorized generic version of Viagra. This collaboration leveraged the growing trend of telehealth and online pharmacies, providing convenient and discreet access to the medication.34 A significant aspect of this collaboration was the emphasis on the quality and consistency of the generic sildenafil, explicitly stating that it was “backed by the quality manufacturing, distribution and support of Pfizer,” thereby aiming to build and maintain patient confidence in the product.31

The concurrent launch of Pfizer’s authorized generic with Teva’s entry had a profound impact on the competitive dynamics. While Teva was the first ANDA applicant with a Paragraph IV certification and thus eligible for 180 days of generic drug exclusivity 26, the simultaneous introduction of Greenstone’s product meant that Teva did not enjoy a period of

uncontested generic exclusivity.36 Instead, it immediately faced direct competition from the brand manufacturer’s own generic offering.

The following table outlines major generic sildenafil entrants in the U.S. market and their launch timelines:

| Manufacturer | Type | FDA Approval Date | U.S. Commercial Launch Date | Key Context |

| Teva | Independent Generic | Mar 9, 2016 | Dec 11, 2017 | Settlement with Pfizer; First ANDA Filer |

| Greenstone (Pfizer) | Authorized Generic | N/A | Dec 11, 2017 | Pfizer subsidiary; Concurrent launch with Teva |

| Mylan | Independent Generic | Mar 25, 2019 | Dec 11, 2017 (per settlement) | Settlement with Pfizer |

| Aurobindo Pharma Ltd | Independent Generic | Jun 11, 2018 | N/A | |

| Amneal Pharms NY | Independent Generic | Jun 27, 2018 | N/A | |

| Hetero Labs Ltd V | Independent Generic | Jun 11, 2018 | N/A | |

| Rubicon | Independent Generic | Jun 11, 2018 | N/A | |

| Torrent | Independent Generic | Jun 11, 2018 | N/A | |

| Chartwell Rx | Independent Generic | Mar 22, 2019 | N/A | |

| APPCO | Independent Generic | Mar 2, 2020 | N/A | |

| Reyoung | Independent Generic | Jun 12, 2020 | N/A | |

| Novitium Pharma | Independent Generic | Aug 29, 2023 | N/A | |

| Cadila Pharms Ltd | Independent Generic | Nov 28, 2023 | N/A | |

| Jubilant Generics | Independent Generic | Dec 20, 2024 | N/A |

The strategic choice by Pfizer to launch its own generic at a significantly lower price, precisely at the same time as the first independent generic (Teva), represents a deliberate act of “defensive cannibalization.” By offering a cheaper, chemically identical product, Pfizer aimed to capture a portion of the market that would inevitably shift from its high-priced branded product to generics. This approach allowed Pfizer to retain revenue within its own corporate umbrella, rather than losing it entirely to external generic manufacturers.4 This move significantly mitigated the “free-for-all” by ensuring Pfizer remained a dominant player in the generic segment from day one, rather than retreating solely to its branded product. It also immediately exerted downward pressure on generic prices, benefiting consumers while simultaneously shaping the competitive landscape in a manner favorable to the innovator.

Furthermore, the authorized generic strategy effectively diluted the market advantage typically granted by Hatch-Waxman’s 180-day exclusivity. While Teva was indeed the first independent generic applicant and eligible for this exclusivity 26, Pfizer’s authorized generic launched simultaneously.4 This meant Teva did not experience a period of sole generic competition. This maneuver prevented Teva from fully capitalizing on its “first-mover” status in the generic space, as it immediately faced a strong, quality-assured competitor from the original manufacturer. This demonstrates how brand companies can strategically counter regulatory incentives designed to favor generic entry, thereby maintaining a tighter grip on market share and pricing during the critical initial phase of generic competition.

5. Market Response: Pricing, Market Share, and Competition

The entry of generic sildenafil, spearheaded by Teva and Pfizer’s authorized generic, initiated a significant transformation in the pricing landscape for erectile dysfunction medication. Greenstone’s authorized generic, priced at $30-$35 per pill, immediately undercut the branded Viagra’s retail price of approximately $65 per pill.33 This initial price reduction set a new benchmark for the market.

General market trends for generic drugs indicate that prices typically decline by about 20% when there are approximately three generic competitors, and this erosion deepens to 70% to 80% relative to the pre-generic entry price in markets with 10 or more competitors within three years of the first generic entry.38 Sildenafil citrate, as a generic drug, has been a leading contributor to patient savings, with estimates suggesting it generated $1.633 billion in savings.39 Beyond traditional pharmacies, the rise of telehealth services and online pharmacies, such as Ro and Hims, further intensified price competition. These platforms offered sildenafil at highly competitive rates, starting as low as $4 per dose for Ro and Hims, and even $2 per pill through services like Lemonaid Health.32 This direct-to-consumer model bypassed traditional pharmacy markups, making the medication more accessible and affordable to a broader demographic.

Despite the intense generic competition, which included over 500 erectile dysfunction drugs globally, branded Viagra demonstrated surprising resilience. In Q3 2020, years after generic entry in the U.S. and Europe, Viagra reported a 29% increase in global sales between Q2 and Q3 of that year. This growth was primarily driven by larger-than-anticipated sales in China, following its significant COVID-19 recovery, and strong sales in other international markets outside of the EU, U.S., and Japan.16 This indicates the continued strength of the brand in certain regions and its diversification strategy.

The combined “Viagra franchise” (encompassing both the branded product and Pfizer’s authorized generic) maintained a leading 45.35% share of the overall erectile dysfunction drugs market in 2024.35 This substantial market retention, years after the primary patent expiration, underscores the enduring power of brand equity and prescriber familiarity.35 While Teva’s AB-rated sildenafil tablets, offered at a deep discount, did contribute to eroding traditional trademark loyalty 35, Pfizer’s authorized generic effectively mitigated the full impact of this competition by capturing a significant portion of the price-sensitive market. The overall generic sildenafil market is projected to continue its significant growth, with an estimated value of USD 4.4 billion by the end of 2037.34 This expansion is largely driven by the increasing preference for generic sildenafil due to its enhanced affordability and accessibility.34

The market for generic sildenafil saw a rapid expansion in manufacturers following the initial entries. While Teva received FDA approval in March 2016 41, a wave of other manufacturers gained approval in subsequent years. By June 2018, companies such as Ajanta Pharma, Amneal Pharms, Aurobindo Pharma, Hetero Labs, Rubicon, and Torrent had received FDA approval for their generic sildenafil products. Many more followed in 2019, 2020, and beyond, including Chartwell Rx, Mylan, APPCO, Sunshine, Reyoung, Macleods Pharms, Novitium Pharma, Cadila Pharms, and Jubilant Generics.41

The broader ED drug market also includes other phosphodiesterase-5 (PDE5) inhibitors, such as tadalafil (Cialis) and vardenafil (Levitra), which faced their own patent expirations around 2017-2018.4 Cialis, notably, benefited from its dual-indication label for benign prostatic hyperplasia, which helped sustain its cash flows despite the entry of generic tadalafil.35 The increasing penetration of telehealth and online pharmacies has been a significant market driver, offering convenience, discretion, and competitive pricing that has expanded access to ED treatments for a wider patient population.32

The table below illustrates the pricing trends for Viagra and its generic counterparts in the U.S. market:

| Product Name | Manufacturer | Approximate Price per Pill/Dose (Key Time Points) | Market Share (2024, ED Market) |

| Viagra (Brand) | Viatris (formerly Pfizer) | ~$65 (pre-2017) | 45.35% (Viagra franchise) 35 |

| Greenstone Sildenafil | Greenstone (Pfizer) | $30-$35 (Dec 2017 launch) 33 | Included in Viagra franchise |

| Teva Sildenafil | Teva | Deep discount (Dec 2017 launch) 35 | Eroding trademark loyalty 35 |

| Ro Sildenafil | Ro | $4-$10 | N/A (Telehealth platform) 32 |

| Hims Sildenafil | Hims | Starts at $4 | N/A (Telehealth platform) 32 |

| Lemonaid Health Sildenafil | Lemonaid Health | $2 | N/A (Telehealth platform) 35 |

The conventional expectation is that brand-name drugs lose 80-90% of their market share within a year of generic entry.1 However, the sustained market presence of the Viagra franchise, retaining a leading 45.35% share of the ED market in 2024 35, years after generic competition began, indicates a “softer landing” than typically anticipated from a patent cliff. While Viagra’s global sales did decline significantly (by almost 70% between 2012 and 2018) 15, the continued high market share for the combined brand and authorized generic is notable. This outcome suggests that Pfizer’s multi-pronged strategy—encompassing strategic settlements, the launch of its authorized generic, leveraging strong brand loyalty, and diversifying into global markets—successfully created a managed transition. The authorized generic, in particular, allowed Pfizer to retain a significant portion of the generic market, effectively converting brand sales into authorized generic sales rather than losing them entirely to external competitors. This demonstrates the enduring power of brand equity and strategic market intervention in mitigating the full impact of generic competition.

The emergence and rapid growth of telehealth platforms, such as Ro and Hims, further accelerated the adoption of generic sildenafil and intensified price competition. Pfizer’s Greenstone subsidiary partnered with Roman (part of Ro) to distribute its authorized generic 31, and other telehealth services like Hims also offered generic sildenafil.32 These platforms provided convenient, discreet access to medication and offered sildenafil at very competitive prices, often significantly undercutting traditional pharmacy costs.32 This development acted as a significant catalyst for generic sildenafil adoption and price erosion. By bypassing traditional pharmacy markups and embracing direct-to-consumer models, these platforms made generic sildenafil more accessible and affordable to a broader demographic.34 This trend, while highly beneficial for consumers, also intensified competition and further drove down prices across the market, impacting the profitability of all players in the ED treatment space. It represents a fundamental shift in drug distribution and consumer engagement, which pharmaceutical companies must now actively integrate into their post-patent strategies.

6. Global Variations in Generic Entry

The experience of Viagra’s patent expiration was not uniform across the globe, highlighting the complex interplay of international patent laws, regulatory frameworks, and market dynamics. Unlike the controlled generic entry observed in the U.S. market, Viagra faced earlier and often more abrupt generic competition in several other major international markets.

In the European Union, the patent covering the use of sildenafil in erectile dysfunction expired in 2013.2 This meant that generic versions of sildenafil became available in European countries years before they did in the United States, leading to earlier price erosion and market share shifts for Pfizer in that region. Similarly, in Brazil, Pfizer’s patent on sildenafil citrate expired in 2010, allowing for generic entry.10

Canada presented a particularly challenging scenario for Pfizer. The Supreme Court of Canada invalidated Pfizer’s patent on Viagra in November 2012 and April 2013, citing insufficient disclosure in the original patent application.8 This ruling led to the immediate launch of generic sildenafil (Novo-Sildenafil) by Teva Canada on the very day the Supreme Court released its decision. In response, Pfizer was compelled to reduce the price of branded Viagra in Canada to remain competitive.10 In Egypt, the government approved Viagra for sale in 2002 but soon allowed local companies to produce generic versions, prioritizing affordability for its population.10 China, while a significant market for Viagra sales (contributing to its Q3 2020 growth) 16, also saw Pfizer face trademark challenges and widespread manufacture and sale of sildenafil citrate drugs, as its patent claims were not widely enforced there.6

The divergent patent landscapes and generic entry dynamics across the U.S., EU, Canada, Brazil, and China underscore that for a multinational pharmaceutical company, a “patent cliff” is not a single, synchronized event but rather a series of distinct regional challenges.2 This allows for a staggered approach to market defense, where lessons learned or strategies refined in one market (e.g., managing early generic entry in Europe) can inform or necessitate different tactics in another (e.g., the U.S. with its specific Hatch-Waxman framework). It also highlights the critical importance of diversifying revenue streams globally to offset losses in markets where exclusivity is lost earlier, enabling the company to reallocate resources and focus on regions where patent protection remains or new growth opportunities emerge.

The stark contrast between the controlled U.S. generic entry, managed through strategic litigation, settlements, and the authorized generic strategy, and the more immediate or abrupt generic influx in countries like Canada (due to patent invalidation) or Egypt (due to government policy) is a compelling illustration. This difference emphasizes that the degree to which a brand manufacturer can manage a patent cliff is heavily dependent on the specific regulatory and legal environment of each jurisdiction.8 Robust patent systems, combined with the strategic flexibility to engage in litigation and launch authorized generics, provide tools for market control that may not exist in other countries with different legal interpretations, public health priorities, or enforcement mechanisms. This underscores the critical role of comprehensive legal and regulatory intelligence in shaping a pharmaceutical company’s global business strategy in the face of patent expirations.

7. Lessons Learned: Mitigating the “Patent Cliff”

The case of Viagra provides several valuable lessons for pharmaceutical companies navigating the challenges of patent expirations:

- Proactive Intellectual Property Management: A robust and multi-layered patent strategy is paramount. This includes not only securing initial compound and method-of-use patents but also actively seeking extensions, such as pediatric exclusivity, and exploring new therapeutic indications for existing compounds (“evergreening”) to prolong market protection. This approach creates a more durable portfolio of intellectual assets.2

- Strategic Litigation and Settlements: Engaging in patent litigation, even when initial court rulings favor the innovator, can be a precursor to strategic settlements. These agreements, while sometimes controversial, offer a means to control the timing and terms of generic entry, secure royalty streams, and avoid the prolonged uncertainty and high costs associated with protracted legal battles. Such settlements can transform an unpredictable generic flood into a more managed release.28

- Authorized Generic Deployment: The strategic launch of an authorized generic, either concurrently with or shortly after the first independent generic, is a powerful defensive maneuver. This allows the innovator company to retain a significant portion of the generic market share by effectively “cannibalizing” its own brand sales, thereby preventing revenue from being entirely captured by external competitors. This strategy ensures the innovator remains a key player in the post-patent market.36

- Leveraging Brand Equity and Global Diversification: Strong brand loyalty, cultivated over years of market presence and direct-to-consumer marketing, can provide a degree of resilience even after generic entry.2 Furthermore, diversifying sales geographically and capitalizing on growth in emerging markets can help offset revenue declines in established markets post-patent expiry, providing a buffer against localized market erosion.16

- Adaptation to New Distribution Channels: Embracing and partnering with emerging distribution channels, such as telehealth and online pharmacies, is crucial. These platforms can ensure continued access and competitive pricing for authorized generics, effectively reaching price-sensitive consumers and adapting to evolving patient preferences for convenience and discretion.31

8. Conclusion: A Controlled Descent, Not a Free-for-All

The narrative surrounding Viagra’s patent expiration, initially framed as an impending “generic cliff” that would lead to a market “free-for-all,” ultimately unfolded as a testament to Pfizer’s sophisticated and multi-faceted strategic planning. The absence of an uncontrolled market deluge can be attributed to several deliberate actions taken by the innovator company.

Firstly, Pfizer’s proactive intellectual property management, including the strategic pursuit of a pediatric exclusivity extension, successfully prolonged the primary patent life of Viagra in the crucial U.S. market until April 2020.4 This provided additional years of protected revenue and time to prepare for generic competition.

Secondly, Pfizer’s engagement in strategic litigation and subsequent settlements with key generic players, notably Teva and Mylan, played a pivotal role in controlling the generic entry timeline.5 By allowing earlier, royalty-bearing generic launches, Pfizer avoided prolonged legal battles and secured a revenue stream from the generic versions, effectively managing the transition rather than reacting to it.

Thirdly, the simultaneous launch of Pfizer’s own authorized generic (Greenstone’s sildenafil) with the first independent generic entry by Teva was a critical defensive maneuver.4 This strategy of “defensive cannibalization” ensured that Pfizer retained a significant portion of the market share that inevitably shifted from branded to generic products, preventing a complete erosion of its revenue by external competitors.

Finally, the inherent strength of the Viagra brand and Pfizer’s ability to leverage growth in diverse international markets, such as China, contributed to the overall resilience of the franchise even as generic competition intensified in established markets.16

In summation, these concerted actions transformed the anticipated “patent cliff” into a more managed and less precipitous decline in revenue for Pfizer. The company successfully retained a significant presence in the sildenafil market through its authorized generic, even as overall prices fell due to the eventual entry of multiple generic manufacturers. Viagra’s experience serves as a compelling case study, demonstrating how a sophisticated approach to intellectual property defense and proactive market management can convert a potential “free-for-all” into a controlled descent, preserving value for the innovator in the face of patent expiration.

Works cited

- The Patent Cliff: From Threat to Competitive Advantage – Esko, accessed July 23, 2025, https://www.esko.com/en/blog/patent-cliff-from-threat-to-competitive-advantage

- How Pfizer Kept Viagra Generic Competition at Bay After Patent Expiration, accessed July 23, 2025, https://www.drugpatentwatch.com/blog/viagras-resilience-in-the-face-of-generic-competition-a-pharmaceutical-market-analysis/

- Viagra® vs. Sildenafil: What’s the Difference? | Good Health by Hims, accessed July 23, 2025, https://www.hims.com/blog/viagra-vs-sildenafil

- Is generic Viagra available in the U.S.? – Drugs.com, accessed July 23, 2025, https://www.drugs.com/medical-answers/generic-viagra-available-2933640/

- Viagra to go generic in 2017 according to Pfizer agreement – CBS News, accessed July 23, 2025, https://www.cbsnews.com/news/viagra-to-go-generic-in-2017-according-to-pfizer-agreement/

- Accidental Inventions – Sildenafil Citrate | The little blue pill which changed the world – R K Dewan – Patent and Trademark Attorney in India, accessed July 23, 2025, https://www.rkdewan.com/articles/accidental-inventions-sildenafil-citrate-the-little-blue-pill-which-changed-the-world/

- Pfizer just might postpone Viagra’s patent cliff – Fierce Pharma, accessed July 23, 2025, https://www.fiercepharma.com/pharma/pfizer-just-might-postpone-viagra-s-patent-cliff

- Teva Canada Ltd v Pfizer Canada Inc – Wikipedia, accessed July 23, 2025, https://en.wikipedia.org/wiki/Teva_Canada_Ltd_v_Pfizer_Canada_Inc

- Drug Patents containing Sildenafil Citrate – Pharsight, accessed July 23, 2025, https://pharsight.greyb.com/ingredient/sildenafil-citrate-patent-expiration

- Sildenafil – Wikipedia, accessed July 23, 2025, https://en.wikipedia.org/wiki/Sildenafil

- US6469012B1 – Pyrazolopyrimidinones for the treatment of impotence – Google Patents, accessed July 23, 2025, https://patents.google.com/patent/US6469012B1/en

- What happens when lifestyle drugs like Viagra and Cialis lose patent protections?, accessed July 23, 2025, https://ipwatchdog.com/2017/04/12/lifestyle-drugs-viagra-cialis-lose-patent-protections/id=81619/

- Pfizer Settles Viagra® Patent Litigation With Teva, accessed July 23, 2025, https://www.pfizer.com/news/press-release/press-release-detail/pfizer_settles_viagra_patent_litigation_with_teva

- Pfizer, Teva Settle Patent Litigation on Viagra – Pharmaceutical Technology, accessed July 23, 2025, https://www.pharmtech.com/view/pfizer-teva-settle-patent-litigation-viagra-0

- Chart: Viagra Sales Went Soft as Exclusivity Expired – Statista, accessed July 23, 2025, https://www.statista.com/chart/29581/worldwide-sales-of-viagra/

- Viagra outdoes competition with Q3 sales – Pharmaceutical Technology, accessed July 23, 2025, https://www.pharmaceutical-technology.com/analyst-comment/viagra-competition-q3-sales/

- The 180-Day Rule Supports Generic Competition. Here’s How., accessed July 23, 2025, https://accessiblemeds.org/resources/blog/180-day-rule-supports-generic-competition-heres-how/

- Hatch-Waxman Letters – FDA, accessed July 23, 2025, https://www.fda.gov/drugs/abbreviated-new-drug-application-anda/hatch-waxman-letters

- What Every Pharma Executive Needs to Know About Paragraph IV Challenges, accessed July 23, 2025, https://www.drugpatentwatch.com/blog/what-every-pharma-executive-needs-to-know-about-paragraph-iv-challenges/

- Key Strategies for Successfully Challenging a Drug Patent – DrugPatentWatch, accessed July 23, 2025, https://www.drugpatentwatch.com/blog/key-strategies-for-successfully-challenging-a-drug-patent/

- Pfizer-Teva-Tussle-Over-Viagra – C&EN – American Chemical Society, accessed July 23, 2025, https://cen.acs.org/articles/88/i14/Pfizer-Teva-Tussle-Over-Viagra.html

- Pfizer Wins Viagra Patent Trial, accessed July 23, 2025, https://www.pfizer.com/news/press-release/press-release-detail/pfizer_wins_viagra_patent_trial

- Pfizer Wins Viagra Patent Trial – Fierce Pharma, accessed July 23, 2025, https://www.fiercepharma.com/pharma/pfizer-wins-viagra-patent-trial

- First generic version of Viagra in the U.S. approved by FDA – BioPharma Dive, accessed July 23, 2025, https://www.biopharmadive.com/news/first-generic-version-of-viagra-in-the-us-approved-by-fda/415432/

- Teva Settles Viagra® Patent Litigation with Pfizer, accessed July 23, 2025, https://ir.tevapharm.com/news-and-events/press-releases/press-release-details/2013/Teva-Settles-Viagra-Patent-Litigation-with-Pfizer/default.aspx

- ANDA 077342 ANDA APPROVAL Teva Pharmaceuticals USA, Inc …, accessed July 23, 2025, https://www.accessdata.fda.gov/drugsatfda_docs/appletter/2016/077342Orig1s000ltr.pdf

- Mylan Settles Patent Litigation Related to Viagra, accessed July 23, 2025, https://investor.mylan.com/news-releases/news-release-details/mylan-settles-patent-litigation-related-viagrar

- New Report on Patent Litigation Settlements Says that they are Critically Necessary to Ensure Prompt Generic and Biosimilar Market Entry – FDA Law Blog, accessed July 23, 2025, https://www.thefdalawblog.com/2025/06/new-report-on-patent-litigation-settlements-says-that-they-are-critically-necessary-to-ensure-prompt-generic-and-biosimilar-market-entry/

- Paragraph IV Patent Certifications July 7, 2025 – FDA, accessed July 23, 2025, https://www.fda.gov/media/166048/download

- AUTHORIZED GENERICS FROM PFIZER – AmerisourceBergen, accessed July 23, 2025, https://www.amerisourcebergen.com/-/media/assets/amerisourcebergen/greenstone-authorized-generics-sell-sheet.pdf?la=en&hash=40944D0DBF6C90C5B2363AA94EEAB2B1F3836F8D

- Pfizer’s Greenstone and Digital Men’s Health Clinic Roman Collaborate to Offer Patients Remote Access to the Only FDA-Approved Authorized Generic Version of Viagra® (sildenafil citrate), accessed July 23, 2025, https://www.pfizer.com/news/press-release/press-release-detail/pfizers-greenstone-and-digital-mens-health-clinic-roman

- Generic Viagra (Sildenafil): Price, Where to Buy and More – Medical News Today, accessed July 23, 2025, https://www.medicalnewstoday.com/articles/generic-viagra

- Little Blue Pill Goes Generic Today, and Pfizer Joins In – Medscape, accessed July 23, 2025, https://www.medscape.com/viewarticle/889846

- Sildenafil Market Size, Industry Trend & Analysis By 2032 – Business Research Insights, accessed July 23, 2025, https://www.businessresearchinsights.com/market-reports/sildenafil-market-109422

- Erectile Dysfunction Drugs Market Size, Growth, Share & Trends Report 2030, accessed July 23, 2025, https://www.mordorintelligence.com/industry-reports/erectile-dysfunction-drugs-market

- Entry Delays and Fighting Brands: Evidence from Generics and Authorized Generics* – GitHub Pages, accessed July 23, 2025, https://rubaiyat-alam.github.io/website/pharma_ag_rubaiyat_conti.pdf

- Study: Delaying authorized generics is on the decline | RAPS, accessed July 23, 2025, https://www.raps.org/news-and-articles/news-articles/2025/6/study-delaying-authorized-generics-is-on-the-decli

- Drug Competition Series – Analysis of New Generic Markets Effect of Market Entry on Generic Drug Prices – HHS ASPE, accessed July 23, 2025, https://aspe.hhs.gov/sites/default/files/documents/510e964dc7b7f00763a7f8a1dbc5ae7b/aspe-ib-generic-drugs-competition.pdf

- Estimating Cost Savings from New Generic Drug Approvals in 2018, 2019, and 2020 – FDA, accessed July 23, 2025, https://www.fda.gov/media/161540/download

- Sildenafil Citrate Market Size & Share – Forecast Report 2037, accessed July 23, 2025, https://www.researchnester.com/reports/sildenafil-citrate-market/2582

- Generic Viagra Availability – Drugs.com, accessed July 23, 2025, https://www.drugs.com/availability/generic-viagra.html