Introduction: Beyond the Generic Cliff and the NME Gamble

Welcome. If you’re reading this, you’re likely standing at the precipice of a decision that will define your company’s trajectory for the next decade. In the modern pharmaceutical landscape, we are caught in a profound paradox. On one hand, we have the 505(b)(1) pathway for New Molecular Entities (NMEs)—the noble quest for breakthrough innovation. This is the path of high science and high stakes, a journey that can take 10 to 15 years and consume upwards of $2.6 billion, with a staggering rate of failure in clinical trials.1 It is, for many, a gamble too rich for their blood.

On the other hand, we have the 505(j) Abbreviated New Drug Application (ANDA) pathway, the engine of the generic drug market. This route, born from the landmark Hatch-Waxman Amendments of 1984, was designed to foster competition and drive down costs.4 And it has been wildly successful—perhaps too successful. The very efficiency that fuels the generic market has created a “success trap,” an environment of perfect substitutes where the only competitive lever is price.2 This inevitably leads to a brutal “race to the bottom,” where margins are compressed to unsustainable levels and market exits become commonplace.2

So, where do you turn? How do you innovate without betting the company on a single molecule? How do you compete without being crushed by the commoditization of the generic cliff?

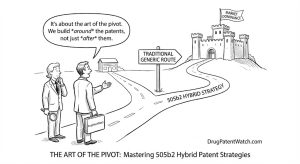

This is where the pivot comes in. There is a third way, a strategic middle ground that is no longer a niche alternative but a core imperative for survival and growth. I’m talking about the 505(b)(2) New Drug Application. This pathway is not merely a regulatory shortcut; it is a meticulously designed, intelligent approach that allows you to create new, differentiated, and proprietary products on a foundation of established science.7 It is the strategic escape hatch from the pharmaceutical paradox.2

This report is your guide to mastering that pivot. We will move beyond the simple mechanics of the 505(b)(2) filing and delve into the art of the hybrid patent strategy. This is the sophisticated integration of a dual-pronged intellectual property approach: building a new, offensive patent portfolio around your innovation while simultaneously leveraging the defensive moat of FDA-granted market exclusivities. It is this combination that transforms a clever regulatory filing into a durable, high-value commercial asset. We will explore how to identify winning candidates, navigate the complex IP landscape, build a bulletproof value story for payers, and execute a program that delivers a powerful return on investment. This is not just about getting a drug approved; it’s about building a resilient, diversified portfolio and achieving market dominance. Let’s begin.

Deconstructing the Regulatory Gauntlet: 505(b)(1) vs. 505(b)(2) vs. 505(j)

To master the 505(b)(2) pathway, you first need to understand its context within the broader regulatory landscape. The Drug Price Competition and Patent Term Restoration Act of 1984, better known as the Hatch-Waxman Amendments, fundamentally reshaped pharmaceutical development in the United States by clarifying and codifying three distinct pillars of drug approval.4 Understanding the purpose, requirements, and limitations of each is the foundational first step in building any successful drug development strategy.

Think of it like constructing a building. You have three options: design and build a completely new skyscraper from the ground up, manufacture a perfect prefabricated replica of an existing building, or perform a custom, high-value renovation on an existing structure.9 Each path serves a different purpose and comes with a vastly different blueprint, budget, and timeline.

The 505(b)(1) NDA: The Mountain of De Novo Innovation

The 505(b)(1) New Drug Application (NDA) is the traditional path for true innovation. This is our skyscraper. It is a “stand-alone” application, meaning it must contain a complete and independent demonstration of a drug’s safety and effectiveness.10 The sponsor is responsible for generating the entire data package from scratch, including comprehensive preclinical toxicology studies and a full suite of Phase 1, 2, and 3 clinical trials.9

This pathway is reserved for New Chemical Entities (NCEs) or New Molecular Entities (NMEs)—molecules that have never before been approved by the FDA. The investment required is monumental, with development costs frequently exceeding $1 billion and timelines stretching over a decade.1 The risk is equally immense, but the reward for success is the potential for a blockbuster drug with a long period of market exclusivity.

The 505(j) ANDA: The Race to the Bottom of “Sameness”

At the opposite end of the spectrum lies the 505(j) Abbreviated New Drug Application (ANDA). This is our prefabricated replica. The ANDA pathway is the engine of the generic industry, designed to bring low-cost copies of branded drugs to market after their patents and exclusivities have expired.5

The core philosophy of the 505(j) pathway is “sameness”.2 An ANDA applicant does not need to conduct new clinical trials to re-prove safety and efficacy. Instead, it relies on the FDA’s previous finding that the original branded product, known as the Reference Listed Drug (RLD), is safe and effective. The primary scientific hurdle is to demonstrate that the generic drug is a pharmaceutical and therapeutic equivalent to the RLD—that it has the same active ingredient, dosage form, strength, route of administration, and labeling, and is bioequivalent.2 This is a highly efficient, low-cost path to market, but it results in a commodity product with little to no differentiation.

The 505(b)(2) Hybrid: The Best of Both Worlds?

Between these two extremes lies the 505(b)(2) pathway—our custom, high-value renovation. Legally, a 505(b)(2) is a full New Drug Application, submitted under section 505(b)(1) and approved under 505(c), just like a traditional NDA.9 It must contain complete reports establishing the product’s safety and effectiveness.

However, it contains a critical, game-changing twist. The 505(b)(2) pathway gives the FDA express permission to rely on data that was not generated by the applicant and for which the applicant does not have a right of reference.1 This external data can come from two primary sources: the FDA’s own prior findings of safety and/or effectiveness for an approved RLD, or data from published scientific literature.7

This provision is designed to avoid the unnecessary duplication of studies on what is already known about a drug, thereby streamlining development.4 But this reliance is not automatic. The defining feature—and the core strategic challenge—of a 505(b)(2) application is the requirement to establish a “scientific bridge.” The applicant must provide sufficient new data, often through targeted “bridging studies” (such as comparative pharmacokinetics), to scientifically justify the reliance on the external data and demonstrate the safety and efficacy of the specific modifications made to the new product.8

This hybrid nature is what makes the 505(b)(2) pathway so powerful. It allows for meaningful innovation—a new dosage form, a new indication, a new combination—without the full cost and time burden of a 505(b)(1) program. It creates a differentiated product with the potential for its own patents and market exclusivity, unlike a 505(j) generic.

The existence of this middle path fundamentally alters the risk calculus of pharmaceutical R&D. It moves us beyond a binary world of billion-dollar NMEs versus low-margin generics. Instead, it creates a “value continuum,” a spectrum of risk and reward. The types of innovations possible under 505(b)(2) range from relatively simple formulation changes that are “almost generic” to complex drug-device combinations or even NCEs that rely on extensive literature for approval.10 This allows a company to strategically choose its level of risk and investment. A simple reformulation is a lower-risk, lower-reward project compared to repurposing a drug for a completely new indication that requires significant new clinical work. This enables a far more nuanced and sophisticated approach to capital allocation and portfolio management than the simple NME-versus-generic model allows.

At-a-Glance Comparison of Regulatory Pathways

To crystallize these differences, the following table provides a side-by-side comparison of the three pathways across key strategic dimensions.

| Feature | 505(b)(1) NDA | 505(b)(2) NDA | 505(j) ANDA |

| Purpose | Approval of a New Molecular Entity (NME) or major new innovation.12 | Approval of a modified version of an existing drug (e.g., new formulation, indication, combination).4 | Approval of a generic copy of a Reference Listed Drug (RLD).5 |

| Data Requirements | Full, sponsor-conducted preclinical and clinical (Phase 1-3) data package.10 | Hybrid: Relies on existing data (RLD findings, literature) plus new, sponsor-conducted “bridging studies”.9 | Bioequivalence data to demonstrate “sameness” to the RLD. No new clinical safety/efficacy trials required.5 |

| Innovation Level | High (new molecule, new mechanism of action).12 | Moderate (innovation on an existing molecule).12 | Low (replication of an existing drug).12 |

| Typical Dev. Cost | Highest ($1B – $2.6B+).1 | Moderate ($5M – $200M).3 | Lowest (typically a few million dollars).12 |

| Typical Timeline | Longest (10-15 years).1 | Moderate (3-8 years).3 | Shortest (ANDA review ~10-18 months).13 |

| Market Exclusivity | 5-year NCE, 7-year Orphan Drug Exclusivity (ODE).1 | 3-year new clinical investigation, 5-year NCE, 7-year ODE possible.1 | Generally none, except for 180-day exclusivity for the first-to-file Paragraph IV challenger.13 |

| Primary IP Strategy | Obtain broad composition of matter and method of use patents on the new molecule. | Obtain narrower patents on the specific innovation (formulation, delivery device, method of use) and leverage FDA exclusivity. | Challenge the RLD’s existing patents (Paragraph IV) or wait for expiration. |

The Strategic Value Proposition: Why 505(b)(2) is Your Firm’s Competitive Escape Hatch

Understanding the mechanics of the 505(b)(2) pathway is one thing. Grasping its profound strategic value is another. For companies caught between the punishing economics of the generic market and the high-risk gamble of NME development, this pathway is more than just an alternative—it’s a lifeline. It offers a route to create differentiated, high-value medicines by fundamentally shifting the competitive basis from price to value.2

Escaping the Commoditization Trap

The traditional generic business model is caught in what can be described as a “success trap”.2 The 505(j) ANDA pathway, designed for efficiency, ensures that for any reasonably valuable drug coming off patent, a flood of competitors is not just possible, but probable. When multiple companies are selling an identical product, the market becomes one of perfect substitutes, and the only remaining lever for competition is price.

This dynamic triggers an inevitable race to the bottom. With just three competitors in a market, prices can decline by an average of 20% relative to the pre-generic entry price. As the number of competitors grows, prices plummet. In highly competitive markets with 10 or more competitors, prices can fall by a staggering 70% to 80% within just three years of the first generic launch.2 This intense pressure leads to market exits for less profitable drugs—an astonishing 3,000 generic drug products have been withdrawn from the market over the last decade—which in turn can create dangerous drug shortages.2

The 505(b)(2) pathway provides a strategic escape hatch from this trap. By allowing for meaningful modifications, it enables a company to break free from the “sameness” requirement of the ANDA model. You are no longer selling a commodity; you are selling a unique product with a distinct value proposition. This allows you to shift the entire competitive basis from a brutal fight over price to a sophisticated conversation about value.

De-Risking the Innovation Engine

The single greatest advantage of the 505(b)(2) pathway is its capacity to de-risk the development process. The journey of a 505(b)(1) NME is fraught with peril, with the vast majority of candidates failing in clinical trials, often due to unforeseen safety or efficacy issues. The 505(b)(2) approach mitigates this risk at its very source.

By starting with an active ingredient whose fundamental safety and efficacy profile is already well-established and accepted by the FDA, you eliminate a huge portion of the unknown.1 The development program is no longer asking, “Is this molecule safe and does it work?” Instead, it is asking a much more focused and answerable question: “Is our specific modification safe and does it deliver the intended benefit?” This intrinsic de-risking of the development program has a powerful ripple effect.

From an investor’s perspective, this increased predictability is golden. A well-designed 505(b)(2) program with a clear regulatory path and a strong commercial case is an exceptionally attractive investment opportunity compared to the high-wire act of NME development.6 A successful Pre-IND meeting with the FDA, where the agency concurs with the proposed bridging strategy, can effectively unlock significant funding and dramatically increase the asset’s valuation.2

The Democratization of Branded Drug Development

For decades, the world of branded pharmaceuticals was the exclusive domain of large, well-capitalized innovator companies. The sheer cost and complexity of 505(b)(1) development created an insurmountable barrier to entry for most. The 505(b)(2) pathway has changed that.

By significantly lowering the cost, time, and risk of developing a differentiated, proprietary product, the pathway has effectively democratized innovation. It provides a tangible opportunity for smaller and mid-sized companies, including those who have historically operated solely in the generic space, to enter the branded market.6

The data bears this out. An analysis of 505(b)(2) approvals from 1993 to 2016 found that a significant portion were sponsored by small or generic manufacturers, leading to a “blurring of the distinction between generic and brand-name manufacturers”.6 This trend is not merely an interesting observation; it signals a fundamental market shift. The economic pressures of the mature generic market are a powerful force pushing strategically-minded generic companies to evolve. They are no longer content to be mere replicators; they are using the 505(b)(2) pathway to become innovators in their own right. This pathway is their evolutionary response, a necessary adaptation for survival and growth in an increasingly challenging environment.

The Innovator’s Playbook: Avenues for 505(b)(2) Differentiation

The strategic value of the 505(b)(2) pathway lies in its flexibility. It provides a broad canvas for innovation, allowing companies to make meaningful improvements to existing medicines that can enhance patient care, open new markets, and create significant commercial value.1 The most successful strategies, however, are not born from innovation for its own sake. They begin by identifying a tangible clinical or patient “pain point” associated with the Reference Listed Drug and then engineering a specific solution. The technical modification is the

means, but solving a real-world problem is the end that creates value. Let’s explore the primary avenues for this problem-oriented innovation.

New Formulations & Delivery Systems

Perhaps the most common and powerful use of the 505(b)(2) pathway is the development of new formulations and delivery systems. The goal here is to improve patient convenience, compliance, safety, or efficacy.8

- Extended-Release (ER) Formulations: Many older drugs require dosing two or three times a day, which can be a major barrier to patient adherence. Developing a once-daily ER formulation can dramatically improve compliance and quality of life, a clear value proposition for both patients and physicians.2

- Orally Disintegrating Tablets (ODTs): For patient populations with difficulty swallowing (dysphagia), such as pediatric or geriatric patients, or for those experiencing nausea and vomiting, an ODT that dissolves rapidly in the mouth without water can be a game-changer.26

- Novel Delivery Systems: The possibilities extend far beyond oral tablets. Transdermal patches can provide steady, continuous drug delivery, avoiding the peaks and troughs of oral dosing. Nasal sprays can offer rapid onset of action for acute conditions. And long-acting injectables (LAIs) can transform the treatment paradigm for chronic conditions like schizophrenia by ensuring medication adherence for weeks or even months at a time.6 Products like

Aristada, a long-acting injectable version of aripiprazole, and Synera, a heated transdermal patch combining two anesthetics for faster action, are prime examples of this strategy in action.

New Indications (Drug Repurposing)

Drug repurposing—finding a new therapeutic use for an existing molecule—is one of the highest-value plays in the 505(b)(2) playbook. This strategy allows a company to open entirely new markets, often for diseases with significant unmet needs, while leveraging the extensive existing safety data of the original drug.4

A classic example is Pentamidine. Originally approved for treating sleeping sickness, research uncovered a new indication as a treatment and prophylaxis for a specific type of pneumonia common in AIDS patients. This new use qualified for seven years of orphan drug exclusivity. The company then combined this new indication with a new formulation (an aerosolized dosage form to reduce side effects), creating a blockbuster product and immense shareholder value.19

New Combinations

Many diseases are multifactorial and are best treated with a combination of therapies. However, requiring patients to take multiple pills a day can be burdensome and lead to poor compliance. Creating a fixed-dose combination (FDC) product, where two or more active ingredients are combined into a single pill, can be a powerful 505(b)(2) strategy.4

The value proposition is clear: improved convenience, reduced pill burden, and potentially enhanced efficacy through synergistic action. Successful examples include Contrave, which combines the previously approved drugs naltrexone and bupropion for a new indication in weight loss, and FOSAMAX PLUS D, which added a weekly dose of Vitamin D to the osteoporosis drug alendronate, reflecting its use in the original clinical trials.15

Prodrugs and Molecular Modifications

Sometimes, an otherwise effective molecule is hampered by poor pharmacokinetic properties. It might be poorly absorbed, metabolized too quickly, or unable to reach its target site effectively. A prodrug strategy can solve these problems.9

A prodrug is a biologically inactive compound that is metabolized in the body to produce the active drug. By chemically modifying the parent molecule, developers can engineer a “smarter” version with improved absorption, enhanced ability to cross biological barriers like the blood-brain barrier, or a more targeted delivery to specific tissues.9

Aristada (aripiprazole lauroxil) is a quintessential example; it is an inactive prodrug that is slowly converted to the active drug aripiprazole after injection, enabling its long-acting profile.27

Other Key Modifications

The flexibility of the 505(b)(2) pathway extends to several other valuable modifications:

- New Route of Administration: Switching from an oral tablet to an injectable, or from a tablet to a liquid, can improve bioavailability, cater to specific patient needs, or enhance the patient experience.4

- New Dosage Form or Strength: Developing a lower-strength tablet for pediatric use or a higher-strength version for a more severe patient population can fill important clinical niches.4

- Rx-to-OTC Switch: For the right candidate, transitioning a prescription drug to an over-the-counter product represents a massive commercial opportunity, opening up a much broader consumer market.4

Each of these avenues represents a path to creating a new, differentiated product that can be defended with its own intellectual property and market exclusivity, moving it far beyond the realm of a simple generic copy.

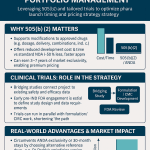

The Hybrid IP Strategy: Weaving a Moat of Patents and Exclusivity

A successful 505(b)(2) program is not just a regulatory achievement; it is a masterclass in intellectual property strategy. The true power of this pathway is unlocked when you move beyond simply gaining FDA approval and instead construct a formidable, multi-layered moat of protection around your asset. This is the essence of the hybrid IP strategy: a dual-pronged approach that synergistically combines the defensive shield of FDA-granted market exclusivity with an offensive portfolio of new patents covering your specific innovation.2

Pillar 1: Leveraging FDA Market Exclusivity

Market exclusivity is a statutory provision, entirely separate from patents, that the FDA grants upon approval of certain drugs. During this period, the FDA is prohibited from approving subsequent applications for similar products, effectively creating a temporary market monopoly. For a 505(b)(2) applicant, several types of exclusivity are on the table 1:

- 3-Year “New Clinical Investigation” Exclusivity: This is the most common form of exclusivity awarded to 505(b)(2) products. It is granted if the application contains reports of new clinical investigations (other than bioavailability studies) that were essential for approval.1 This exclusivity protects the specific change that was approved (e.g., the new indication, the new dosage form).

- 5-Year New Chemical Entity (NCE) Exclusivity: While typically associated with 505(b)(1) NDAs, a 505(b)(2) product can qualify for 5-year NCE exclusivity if its active moiety has never been approved by the FDA in any form.1 This can occur, for example, when a drug has been marketed for years outside the U.S. and the applicant relies on foreign data and literature to support a first-time U.S. approval.

- 7-Year Orphan Drug Exclusivity (ODE): If the 505(b)(2) product is developed to treat a rare disease or condition (affecting fewer than 200,000 people in the U.S.), it can be granted orphan drug designation, which comes with seven years of market exclusivity upon approval.1

- 6-Month Pediatric Exclusivity: If the sponsor conducts pediatric studies requested by the FDA, an additional six months of exclusivity can be added to any existing patents and other exclusivities.10

This FDA-granted exclusivity provides a crucial, predictable period of market protection, allowing the company to recoup its investment and establish a market foothold, regardless of the patent situation.

Pillar 2: Building an Offensive Patent Portfolio

While exclusivity is powerful, it is finite. The second, and arguably more critical, pillar of the hybrid strategy is to build a new, robust patent portfolio around your innovation. The very changes that make your product eligible for the 505(b)(2) pathway—the new formulation, the novel delivery device, the new method of use, the new combination—are themselves patentable inventions.2

This is an offensive strategy. You are not just defending against generics of your RLD; you are creating new intellectual property that you own and can assert. Upon approval, these new patents can be listed in the FDA’s “Approved Drug Products with Therapeutic Equivalence Evaluations,” more commonly known as the Orange Book.10 This listing puts the world on notice of your patent rights and creates a significant barrier to any future company wishing to create a generic version of

your 505(b)(2) product. This new patent estate can provide protection for up to 20 years from the filing date, extending your product’s commercial life far beyond the expiration of the RLD’s patents and any FDA exclusivity period.

Defensive Strategy: Navigating the RLD’s Patent Estate

Before you can build your own fortress, you must navigate the existing landscape. A critical early step in any 505(b)(2) program is a thorough Freedom-to-Operate (FTO) analysis to ensure your proposed product does not infringe on any valid, existing patents of the RLD.2

When you submit your 505(b)(2) application, you must address the patents listed in the Orange Book for the RLD you are relying upon. This is done through a patent certification. Often, this will be a “Paragraph IV” certification, in which you state that your product does not infringe the RLD’s patent(s) or that the patent(s) are invalid or unenforceable.30

Filing a Paragraph IV certification is an act of patent war. It typically triggers an infringement lawsuit from the RLD sponsor within 45 days. The filing of this lawsuit automatically imposes a 30-month stay on the FDA’s ability to grant final approval to your product, unless the litigation is resolved in your favor sooner.30 While often viewed as a burden, this 30-month stay can be a strategic asset. For a company preparing to launch a new branded or “branded generic” product, this period provides a valuable and predictable two-and-a-half-year window. It’s a protected runway to execute all the necessary pre-commercialization activities—building a sales force, educating physicians, negotiating with payers, and scaling up manufacturing—without the immediate pressure of market entry. It transforms a legal delay into a commercial advantage.

A Critical Pitfall: The Risk of Inequitable Conduct

There is a subtle but profound danger lurking within the 505(b)(2) process: the risk of inequitable conduct. This arises from an inherent tension in the arguments you must make to two different government agencies.21

- To the FDA: You argue that your new product is similar enough to the RLD that it is scientifically appropriate to rely on the RLD’s existing safety and efficacy data.

- To the U.S. Patent and Trademark Office (USPTO): To obtain a patent on your innovation, you must argue that your new product is novel and non-obvious over all prior art, including the RLD.

If your team withholds information from the USPTO that is material to patentability—for example, literature that you used to support your “similarity” argument to the FDA—you could be accused of inequitable conduct. A finding of inequitable conduct by a court is catastrophic. It can render the entire patent unenforceable, and this “infectious unenforceability” can potentially spread to related patents. In the worst-case scenario, it can even lead to antitrust liability for asserting a patent you knew or should have known was unenforceable.21

How do you mitigate this risk? The key is scrupulous, proactive communication and information sharing between your regulatory and patent prosecution teams from day one. There must be no silos. The team prosecuting the patent must be fully aware of all arguments and data being submitted to the FDA, and vice versa. This ensures consistency in your positions and, crucially, that all material information is disclosed to the USPTO, fulfilling your duty of candor.

From Approval to Access: Commercialization and Reimbursement Strategy

In the complex world of pharmaceuticals, achieving FDA approval is not the finish line; it is merely the entry ticket to the main event. The ultimate gatekeepers to commercial success are the payers—the insurance companies, pharmacy benefit managers (PBMs), and government agencies that decide whether to cover a drug and how much to pay for it. For a 505(b)(2) product, navigating this payer gauntlet is the most critical phase of the journey, and it begins with answering the one question that matters most to them: “Is this meaningful innovation, or just a tweak?”.9

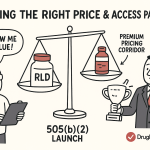

A Fork in the Road: The “Branded Generic” vs. “Differentiated Brand” Decision

Until recently, the reimbursement landscape for many 505(b)(2) products was murky. They were often bundled under the same reimbursement codes as their generic counterparts, limiting their pricing power. However, a pivotal policy shift by the Centers for Medicare & Medicaid Services (CMS) in 2022 has revolutionized the commercial strategy for these products.34

CMS clarified that 505(b)(2) drugs that are not therapeutically interchangeable with their RLD should be considered “sole source” drugs. This designation entitles them to their own unique Healthcare Common Procedure Coding System (HCPCS) J-code for reimbursement.34 This policy has created a clear fork in the road for every 505(b)(2) developer, forcing a fundamental business model decision early in the development process.

- Path A: The “Branded Generic” Strategy (Seek Therapeutic Equivalence): Under this model, the goal is to obtain a Therapeutic Equivalence (TE) rating from the FDA, such as an “AB” rating, which signifies that the product is substitutable for the RLD at the pharmacy level.2 The product would likely be reimbursed under the same J-code as the other generics, competing primarily on price and volume. This is a lower-margin, lower-marketing-cost strategy that leverages the existing generic infrastructure.9

- Path B: The “Differentiated Brand” Strategy (Forgo Therapeutic Equivalence): In this strategy, the company deliberately chooses not to seek a TE rating. By being non-substitutable, the product qualifies as a sole-source drug and receives its own unique J-code. This uncouples its reimbursement from the RLD and its generics, allowing the manufacturer to set a premium, brand-like price that reflects the product’s unique value proposition.2 This is a high-margin, high-investment strategy that requires a dedicated sales force and significant marketing efforts to convince physicians and payers of the product’s superior clinical benefits to justify its higher cost.

This choice has transformed the 505(b)(2) landscape from a primarily scientific and regulatory challenge into a profound commercial one. The decision not to prove therapeutic equivalence can be far more lucrative than proving it, a concept that completely inverts the traditional generic mindset. The most important strategic question for a developer may no longer be “How do we design the bridging study?” but rather “Do we even want to be equivalent?”

Building the Value Story for Payers

Whichever path you choose, you must be prepared to articulate a compelling value story to payers. They are sophisticated, data-driven customers who will scrutinize your product from every angle. Your dossier must go beyond the FDA approval label and provide clear answers to their core questions 33:

- Uniqueness of the Product: How crowded is the market? Is it already heavily genericized? Does your product provide a true step-change in care, or is it an incremental improvement?

- Target Population and Place in Therapy: Who is the ideal patient for your product? Is it a broad population or a specific, well-defined niche where your product offers a unique advantage? Where does it fit in the established treatment algorithm?

- Cost Impact: What is the total impact on the cost of care? If the category is dominated by low-cost generics, you must present a powerful argument, supported by clinical and economic data, to justify the increased cost of your 505(b)(2) product.

Crucially, this value story cannot be an afterthought assembled post-approval. The payer strategy must be developed in parallel with the clinical strategy, beginning at the pre-IND stage.2 Your clinical trials must be designed not just to satisfy the FDA’s requirements for approval, but to generate the specific evidence—on efficacy, safety, patient-reported outcomes, and health economics—that you will need to convince payers of your product’s value and secure favorable market access.

The Blueprint for Success: Executing a Winning 505(b)(2) Program

A winning 505(b)(2) program is not the result of luck; it is the product of a disciplined, integrated, and forward-thinking process. Many companies, particularly those more familiar with the linear pathways of 505(b)(1) or 505(j), stumble when navigating the unique requirements of this hybrid route, leading to costly delays or outright failure.38 Success requires a systematic approach, which can be broken down into four critical steps.

Step 1: Rigorous Candidate Identification & The Four Pillars of Feasibility

The journey begins with identifying the right opportunity. This involves scanning the market for well-established drugs that have known drawbacks or “pain points”—poor adherence, troublesome side effects, inconvenient dosing, or unmet needs in specific patient populations.2 Once a potential candidate and modification are identified, it must be subjected to a rigorous, multi-disciplinary feasibility assessment. A successful candidate must demonstrate viability across four interconnected pillars 1:

- Scientific Viability: Does the science make sense? Is the proposed formulation chemically stable and technically achievable? Can it be manufactured consistently at scale? Are the necessary active and inactive ingredients readily available and affordable?

- Medical Viability: Does the product fill a clear and compelling unmet medical need? Does it solve a real-world problem for patients or physicians? Does it offer a favorable risk/benefit profile, and is the proposed improvement genuinely appealing to the target patient population?

- Regulatory Viability: Is there a clear and defensible regulatory path to approval? Is the existing data on the RLD and in the public literature sufficient to support reliance? What will the “scientific bridge” look like, and what is the probability of gaining FDA alignment on the proposed development plan?

- Commercial Viability: Is there a sustainable market for the product? What is the competitive landscape, including future generics of the RLD? And most importantly, what is the reimbursement outlook? Will payers recognize the added value and provide favorable coverage and pricing?

These pillars should not be viewed as a sequential checklist but as an integrated, iterative system. A weakness in one pillar must force a re-evaluation of the others. For example, if the commercial assessment reveals that payers are unwilling to reimburse a simple extended-release formulation at a premium, the team must return to the scientific drawing board. Perhaps a more advanced formulation that eliminates a key side effect is required to create a more compelling value proposition. This, in turn, would alter the medical, regulatory, and IP strategies. The process is a continuous loop of assessment and refinement.

Step 2: Mastering the IP Landscape

In parallel with the feasibility assessment, a deep and proactive analysis of the intellectual property landscape is essential. This is where specialized business intelligence platforms like DrugPatentWatch become indispensable. These tools provide the critical data needed to conduct a thorough FTO analysis, identify all relevant patent expiration dates for the RLD, and monitor the competitive environment.2 More strategically, they help you identify the “white space”—areas for innovation where you can create new, defensible patents without infringing on existing IP. This proactive intelligence is fundamental to selecting a candidate with a manageable litigation risk and a clear path to building your own proprietary protection.

Step 3: Designing the “Scientific Bridge”

This is the scientific linchpin of the 505(b)(2) application.9 The process involves a meticulous evaluation of all available data on the RLD and from the published literature. The goal is to determine exactly what is already known and accepted by the FDA, and then to identify the precise gaps that must be filled with new, sponsor-conducted studies. These bridging studies are designed to be as efficient as possible, providing just enough information to link the safety and efficacy of your new product back to the established profile of the RLD.9 This could involve a small pharmacokinetic (PK) study to compare drug absorption, a bioequivalence (BE) study, or in some cases, limited clinical trials to support a new indication or formulation.

Step 4: The Pre-IND Meeting – The Most Important Milestone

The Pre-Investigational New Drug (Pre-IND) meeting is arguably the single most important event in the entire 505(b)(2) development program. This is not a casual check-in; it is a formal, high-stakes meeting where you present your entire development plan—the product concept, the justification for reliance on external data, the detailed scientific bridging strategy, and the proposed clinical studies—to the FDA to gain their input and, hopefully, their concurrence.2

A successful Pre-IND meeting provides a clear roadmap for development, significantly de-risks the program, and is often a prerequisite for securing investor funding.2 Best practices for this critical interaction include:

- Strategic Timing: Schedule the meeting only after key product characteristics and preliminary data are defined.42

- A Comprehensive Briefing Package: Submit a detailed, data-supported package at least 30 days in advance that clearly outlines your plan and positions.41

- Well-Formulated Questions: Do not ask open-ended questions like “What should we do?” Instead, state a clear position and ask for the FDA’s agreement: “We propose to conduct Study X to bridge to the RLD. Does the Agency agree that this approach is acceptable?”.42

- Prioritization and Time Management: You will likely only have an hour. Prioritize your most critical questions first. Gain agreement on the big-picture items before getting bogged down in minor details.41

- Active Listening: The goal is to understand the agency’s perspective and requirements. Listen carefully to the feedback, and know when to move on rather than debating a point where the FDA clearly disagrees.41

By following this disciplined blueprint, you can transform the 505(b)(2) pathway from a complex regulatory hurdle into a predictable and powerful engine for value creation.

Lessons from the Field: In-Depth Case Studies

Theory and strategy are essential, but the most valuable lessons often come from the real world. By dissecting the journeys of successful 505(b)(2) products, we can see how these principles are applied in practice. Each of the following cases demonstrates a coherent strategic arc, starting with a clear unmet need, developing a targeted innovation to solve it, protecting that innovation with new IP, and building a commercial strategy tailored to the product’s unique value proposition.

Case Study 1: Aristada (aripiprazole lauroxil) – The Prodrug & Long-Acting Injectable Strategy

- Reference Listed Drug (RLD): Oral Abilify (aripiprazole) tablets, a widely used antipsychotic for schizophrenia.27

- Unmet Need: A core challenge in treating schizophrenia is medication non-adherence. Patients often struggle to take a daily oral medication consistently, leading to relapses and hospitalizations. A less frequently administered option was desperately needed.45

- Innovation: Alkermes developed aripiprazole lauroxil, an inactive prodrug of aripiprazole. This new molecule was formulated as an extended-release injectable suspension that could be administered just once every four, six, or eight weeks. This long-acting injectable (LAI) directly and effectively addresses the critical problem of patient adherence.27

- 505(b)(2) Strategy: The development program was a model of 505(b)(2) efficiency. Alkermes relied heavily on the FDA’s extensive findings of safety and effectiveness for oral Abilify. Their new studies were designed as a “scientific bridge.” They conducted Phase 1 pharmacokinetic studies and a single pivotal Phase 3 efficacy and safety study. The primary goal of these studies was to demonstrate that the exposure levels of active aripiprazole from the Aristada injection were comparable to the established therapeutic levels of the oral RLD.44

- Patient Perspective: Real-world patient experiences reflect the product’s value proposition and its challenges. Many patients and caregivers report that Aristada provides stability and clarity, helping to manage symptoms more effectively than previous medications.47 However, the product is not without significant side effects, with weight gain and akathisia (a state of severe restlessness) being commonly reported issues that can impact quality of life.47

Case Study 2: Synera (lidocaine/tetracaine) – The New Combination & Novel Delivery System Strategy

- Reference Data: The strategy for Synera was slightly different, as one component (lidocaine) was a very old, pre-1982 approved drug, while the other (tetracaine) was not approved as a single agent in the U.S. The application therefore relied on a combination of extensive published literature and new sponsor-conducted studies.27

- Unmet Need: The need for a topical anesthetic that is fast-acting, highly effective, and easy to apply before minor but painful dermatological procedures like venipuncture or biopsies, particularly in pediatric patients where minimizing distress is paramount.51

- Innovation: Synera is a fixed-dose combination of two well-known local anesthetics, lidocaine and tetracaine, delivered via a transdermal patch. The key innovation is an integrated, oxygen-activated heating element within the patch. This gentle warming of the skin is designed to increase local blood flow and enhance the rate and depth of penetration of the anesthetics, leading to a faster and more profound numbing effect.51

- 505(b)(2) Strategy: Because this was a new combination with a novel delivery system, the sponsor submitted a robust data package that included new nonclinical toxicology studies on the combination product, as well as multiple clinical trials comparing the Synera patch to placebo and other active controls to demonstrate its safety and superior efficacy for its intended uses.51

- Patient Perspective: The product label and patient information highlight both the convenience and the necessary precautions. The “peel-and-stick” application is simple, but users are warned about the potential for local skin reactions like redness (erythema) and swelling (edema).55 Critically, there are strong warnings about the high amount of residual drug in a used patch, which poses a serious risk to children or pets if ingested, and a contraindication for use during an MRI due to the patch’s metallic components.52

Case Study 3: Narcan (Naloxone Nasal Spray) – The New Route of Administration Strategy

- Reference Listed Drug (RLD): Injectable naloxone, the long-standing gold standard for reversing opioid overdose.8

- Unmet Need: The opioid crisis created an urgent public health need for a naloxone formulation that could be safely and effectively administered by laypeople—family members, friends, and first responders—without medical training, in a high-stress emergency situation. An injection was simply not a practical solution for widespread community use.8

- Innovation: The solution was a pre-filled, single-use, needle-free nasal spray device. This innovation completely transformed the product’s usability, making it accessible and intuitive for anyone to administer in an emergency.8

- 505(b)(2) Strategy: This was a classic 505(b)(2) case focused on a new route of administration. The sponsor leveraged the decades of established safety and efficacy data for injectable naloxone. The new studies focused almost exclusively on the novel delivery system. The pivotal trial was a bioavailability study in healthy volunteers designed to show that the nasal spray delivered a therapeutic concentration of the drug into the bloodstream, comparable to the injectable form.8

- IP Strategy: The core innovation was not the drug, but the device. The company secured new patents on the nasal spray delivery mechanism, providing robust IP protection for the new, user-friendly product format.8

Market Trends and Future Outlook

The 505(b)(2) pathway has evolved from a little-used regulatory provision into a dominant force in pharmaceutical development. Understanding the trajectory of its growth and the direction of future innovation is critical for any company looking to leverage this strategy for long-term success.

Analyzing the Data: A Surge in Popularity

The historical data tells a clear story. In the decade following the Hatch-Waxman Amendments of 1984, the 505(b)(2) pathway was largely overlooked as the industry focused on the new generic ANDA pathway.14 However, beginning in the early 2000s, its use began to climb dramatically.

By 2009, a remarkable 47% of all New Drug Applications approved by the FDA were 505(b)(2) submissions, signaling a fundamental shift in development strategy across the industry.22

This trend has not only continued but accelerated. In recent years, 505(b)(2) approvals have consistently and significantly outnumbered traditional 505(b)(1) NME approvals. In 2019, the FDA approved 64 NDAs via the 505(b)(2) pathway, and in 2020, that number rose to 68, representing a full 60% of all NDA approvals granted by the Center for Drug Evaluation and Research (CDER) that year.6 This surge is the direct result of the convergence of powerful market and regulatory forces: the economic pressures of the generic market, the availability of valuable market exclusivities, the efficiency gains from PDUFA user fees, and new pediatric study requirements that often necessitate a 505(b)(2) filing.14

Emerging Hotspots: Where is the Innovation Focused?

A closer look at recent approvals reveals where the most intense 505(b)(2) activity is taking place.

- Key Therapeutic Areas: While the pathway is used across virtually all areas of medicine, an analysis of approvals from 2019 to 2023 shows a clear concentration in complex and high-value therapeutic areas. Oncology (16.7%), Central Nervous System (CNS) disorders (16.2%), and Anti-infective treatments have emerged as the dominant fields.61 This demonstrates that the pathway is being used not just for simple convenience modifications, but to address significant challenges in treating complex diseases.

- Dominant Innovation Types: Consistent with historical trends, the majority of 505(b)(2) approvals continue to be for new formulations and new dosage forms. These categories represent the “sweet spot” of the pathway, allowing for meaningful improvements to existing therapies while leveraging a substantial amount of pre-existing data.6

The Future of 505(b)(2): What’s Next?

The 505(b)(2) pathway is not static; it is continually evolving in response to new technologies, market demands, and regulatory thinking. Looking ahead, several key trends will shape its future:

- Rise of Advanced Formulations: We will see a move beyond simple extended-release tablets toward more sophisticated formulation technologies. Multiparticulate (MP) systems, for example, can be engineered to create highly customized drug release profiles, improve patient compliance by allowing capsules to be opened and sprinkled on food, and enable new fixed-dose combinations of otherwise incompatible drugs.29

- Emphasis on Risk-Based Regulatory Planning: As development programs become more complex, a more formalized, risk-based approach to regulatory strategy will become the industry standard. This involves a deep analysis of regulatory precedents, early and frequent engagement with the FDA to validate development plans, and the creation of integrated roadmaps that align CMC, nonclinical, clinical, and commercial considerations from the outset.62

- A Global Perspective: The strategic principles of the 505(b)(2) pathway are not unique to the U.S. The European Union’s Hybrid Application, established under Article 10(3) of Directive 2001/83/EC, serves a similar purpose, allowing applicants to rely in part on the dossier of a reference product while providing new data to support modifications.1 As companies increasingly think globally, understanding the parallels and differences between these pathways will be crucial for efficient worldwide development.

Ultimately, the 505(b)(2) pathway is evolving from a tool for simple lifecycle management into a primary engine for patient-centric innovation. The convergence of intense payer pressure demanding “meaningful innovation” and the advancement of formulation science will push the future of 505(b)(2) development toward more clinically significant improvements that deliver demonstrable value in patient experience and health outcomes.

Conclusion: Integrating 505(b)(2) into Your Core Corporate Strategy

We have journeyed through the intricate landscape of the 505(b)(2) pathway, from its regulatory foundations and strategic value proposition to the nuances of intellectual property, commercialization, and future market trends. The overarching conclusion is clear and compelling: the 505(b)(2) pathway is no longer a peripheral tactic or a niche opportunity. It is a central, strategic function that must be woven into the very fabric of a modern pharmaceutical company’s corporate DNA.

Success in this arena demands a paradigm shift. It requires moving beyond the siloed thinking of the past, where R&D, IP law, and commercial teams operate in separate spheres. A winning 505(b)(2) program is, by its very nature, an integrated enterprise. The commercial case must inform the clinical trial design. The patent strategy must be aligned with the regulatory narrative. The scientific formulation must be purpose-built to solve a real-world medical need that payers are willing to reimburse.

The call to action for you, as a leader in this industry, is to move beyond a reactive, product-by-product approach. The goal should be to build a proactive, systematic, and repeatable capability for identifying, assessing, developing, and commercializing 505(b)(2) assets. This means cultivating cross-functional expertise, implementing disciplined evaluation processes like the “Four Pillars of Feasibility,” and fostering a culture that embraces this de-risked, value-driven model of innovation.

By making the 505(b)(2) pathway a central pillar of your long-term growth strategy, you can build a more resilient portfolio, generate valuable mid-term revenue to fuel future discovery, and, most importantly, bring meaningful improvements to patients more efficiently and effectively than ever before. This is the art of the pivot, and for those who master it, the rewards will be market leadership and sustained success.

Key Takeaways

- The Strategic Sweet Spot: The 505(b)(2) pathway is a hybrid regulatory route that offers a strategic middle ground between the high-cost, high-risk 505(b)(1) NDA for new molecules and the low-margin, commoditized 505(j) ANDA for generics.

- Compete on Value, Not Price: It provides an “escape hatch” from the generic market’s price erosion by allowing for the creation of differentiated products that can be defended on clinical value and command premium pricing.

- Dual-Pronged IP is Crucial: A robust strategy requires building a “hybrid” moat of protection, combining new, offensive patents on the specific innovation with the defensive shield of FDA-granted market exclusivities (3, 5, or 7 years).

- Payer Strategy is Paramount: FDA approval is just the first step. A recent CMS policy shift has created two distinct commercial paths: the “Branded Generic” (seeking therapeutic equivalence for volume) and the “Differentiated Brand” (forgoing equivalence to gain a unique reimbursement code and premium price). This decision must be made early and must be supported by a compelling value story for payers.

- A Disciplined, Integrated Process: Success depends on a systematic approach that includes: 1) Rigorous candidate identification based on the four pillars of feasibility (Scientific, Medical, Regulatory, Commercial); 2) Proactive IP analysis; 3) Efficient “scientific bridge” study design; and 4) A well-prepared, strategic Pre-IND meeting with the FDA.

- Solve a Real-World Problem: The most successful 505(b)(2) products are not just technically novel; they are designed to solve a tangible “pain point” associated with the reference drug, such as poor patient adherence, significant side effects, or an inconvenient dosing regimen.

Frequently Asked Questions (FAQ)

1. How early should we consider the “Branded Generic” vs. “Differentiated Brand” commercial strategy, and what is the single most important factor in that decision?

You should consider this fundamental commercial strategy at the very beginning of the process—during the initial candidate assessment and feasibility analysis, well before the Pre-IND meeting. The decision will dictate your entire clinical development plan, your target product profile, and your financial modeling. The single most important factor in the decision is the degree of demonstrable clinical benefit your innovation provides over the RLD and its generic competitors. If the improvement is minor or primarily one of convenience, the “Branded Generic” path is more realistic, as payers will be unlikely to support a significant price premium. If, however, your modification leads to a significant reduction in a serious side effect, a marked improvement in efficacy for a specific sub-population, or solves a major adherence problem that impacts clinical outcomes, you have a strong case for the high-investment, high-reward “Differentiated Brand” strategy.

2. Our company is a traditional generic manufacturer. What are the biggest operational and cultural shifts required to successfully execute a 505(b)(2) strategy?

The shift is profound. Operationally, you must build or acquire new capabilities that are not typically core to a generic business. This includes expertise in clinical development (designing and running bridging studies), regulatory strategy (navigating complex interactions with the FDA’s new drug division), and, most critically, commercial and market access (building a value proposition, engaging with payers, and potentially fielding a sales force). Culturally, the shift is from a mindset focused on cost-efficiency, manufacturing scale, and speed-to-file to one centered on innovation, clinical value, and marketing. It requires a longer investment horizon and a greater tolerance for development risk than a typical ANDA program. This often necessitates hiring new talent with branded pharmaceutical experience and empowering cross-functional teams to make integrated strategic decisions.

3. What is the most common mistake you see companies make during the Pre-IND meeting for a 505(b)(2) product?

The most common and costly mistake is failing to present a clear, well-supported plan and instead asking vague, open-ended questions. Companies often go to the FDA asking, “What studies do we need to do?” or “What do you think of our idea?” This is the wrong approach. The FDA’s role is to provide feedback on your proposed plan, not to design a development program for you. The successful approach is to present a confident, data-driven position: “Based on our analysis of the RLD’s data and the nature of our modification, we propose to conduct this specific pharmacokinetic study to establish the scientific bridge. Does the Agency agree that this proposed study is sufficient?” This demonstrates that you have done your homework and forces a specific, actionable response from the review division, providing the clarity needed to move forward.

4. Can a 505(b)(2) product ever get an “AB” rating and be substitutable if it has a different formulation from the RLD? What does that process look like?

Yes, it is possible for a 505(b)(2) product to receive an “AB” therapeutic equivalence (TE) code, but it is not automatic and can be a challenging process.37 Unlike ANDAs, the FDA does not automatically assign TE codes to 505(b)(2) approvals. The sponsor must formally request this by submitting a Citizen Petition to the agency

after the drug has been approved.64 In this petition, the sponsor must provide evidence demonstrating that their product is therapeutically equivalent to the RLD, despite the formulation differences. This often requires submitting data from specific in vivo or in vitro studies designed to prove that the differences in formulation do not affect the product’s safety or efficacy. The FDA’s review of these petitions can be slow, sometimes taking years, as they are often considered a lower priority than other agency activities.64 However, for a company pursuing the “Branded Generic” strategy, securing an “AB” rating is a critical step for achieving market access through automatic substitution.

5. We’ve identified a potential 505(b)(2) candidate, but the RLD has multiple Orange Book-listed patents. Does this automatically make it a high-risk project?

Not automatically, but it does mean that a sophisticated and proactive IP strategy is non-negotiable. The presence of multiple patents requires a deep-dive analysis, not a surface-level check. First, your innovation may be a “design around” that avoids infringing the existing patents altogether. Second, the patents themselves may be weak and vulnerable to an invalidity challenge via a Paragraph IV certification. Third, the timing matters; some patents may be expiring soon, creating a clear window for your launch. This is precisely where leveraging an intelligence platform like DrugPatentWatch is critical. It allows your IP team to dissect the RLD’s patent estate, assess the strength and scope of each patent, and identify the path of least resistance. The risk is not determined by the number of patents, but by their quality and your ability to navigate around or through them. A strong IP strategy can turn a seemingly high-risk project into a manageable and highly profitable one.

Works cited

- What Is 505(b)(2)? | Premier Consulting, accessed August 16, 2025, https://premierconsulting.com/resources/what-is-505b2/

- Beyond the Cliff: How Generic Drug Makers Can Forge Value and Market Exclusivity with the 505(b)(2) Pathway – DrugPatentWatch, accessed August 16, 2025, https://www.drugpatentwatch.com/blog/why-generic-drug-makers-may-benefit-from-505b2-approval/

- 505(b)(1) vs 505(b)(2): Understanding the Key Differences in FDA Drug Approval Processes, accessed August 16, 2025, https://vicihealthsciences.com/505b1-vs-505b2/

- FDA’s 505(b)(2) Explained: A Guide to New Drug Applications, accessed August 16, 2025, https://www.thefdagroup.com/blog/505b2

- Abbreviated Approval Pathways for Drug Product: 505(b)(2) or ANDA? – FDA, accessed August 16, 2025, https://www.fda.gov/drugs/cder-small-business-industry-assistance-sbia/abbreviated-approval-pathways-drug-product-505b2-or-anda

- Review of Drugs Approved via the 505(b)(2) Pathway: Uncovering Drug Development Trends and Regulatory Requirements – DrugPatentWatch, accessed August 16, 2025, https://www.drugpatentwatch.com/blog/review-of-drugs-approved-via-the-505b2-pathway-uncovering-drug-development-trends-and-regulatory-requirements-2/

- Utilizing 505(b)(2) Regulatory Pathway for New Drug Applications: An Overview on the Advanced Formulation Approach and Challenges – DrugPatentWatch, accessed August 16, 2025, https://www.drugpatentwatch.com/blog/utilizing-505b2-regulatory-pathway-for-new-drug-applications-an-overview-on-the-advanced-formulation-approach-and-challenges/

- Leveraging 505(b)(2) to Innovate Beyond Existing Drug Patents – DrugPatentWatch, accessed August 16, 2025, https://www.drugpatentwatch.com/blog/leveraging-505b2-to-innovate-beyond-existing-drug-patents/

- The 505(b)(2) Pathway: Unlocking a Hybrid Strategy for Drug …, accessed August 16, 2025, https://www.drugpatentwatch.com/blog/the-505b2-drug-patent-approval-process-uses-and-potential-advantages/

- overview of the 505(b)(2) regulatory pathway for new drug applications – FDA, accessed August 16, 2025, https://www.fda.gov/media/156350/download

- Draft Guidance for Industry: Determining Whether to Submit an ANDA or 505(b)(2) Application – FDA, accessed August 16, 2025, https://www.fda.gov/media/108475/download

- Understand the difference between 505(j), 505(b)(1) and … – Veeprho, accessed August 16, 2025, https://veeprho.com/understanding-difference-between-505j-505b1-and-505b2/

- Understanding the Differences Between 505(j), 505(b)(1), and 505(b)(2) Drug Approval Pathways – Pharma Growth Hub, accessed August 16, 2025, https://www.pharmagrowthhub.com/post/understanding-the-differences-between-505-j-505-b-1-and-505-b-2-drug-approval-pathways

- The 505(b)(2) Drug Approval Pathway – JONATHAN J. DARROW …, accessed August 16, 2025, https://www.fdli.org/wp-content/uploads/2019/12/Darrow.pdf

- Unveiling the 505(b)(2) Pathway: Navigating Pharmaceutical …, accessed August 16, 2025, https://www.novumgen.com/unveiling-the-505-b-2-pathway-navigating-pharmaceutical-innovation.html

- The Unapproved Drug Gold Rush: A Strategic Guide to the 505(b)(2) Pathway, Market Exclusivity, and Commercial Success – DrugPatentWatch, accessed August 16, 2025, https://www.drugpatentwatch.com/blog/unapproved-drugs-opportunities-rapid-approval-market-exclusivity/

- FDA’s drug regulatory pathways, its development strategies and regulatory considerations, accessed August 16, 2025, https://www.researchgate.net/publication/353261877_FDA’s_drug_regulatory_pathways_its_development_strategies_and_regulatory_considerations

- The 505(b)(2) Application and the ANDA – Similarities and Differences – Upadhye Tang LLP, accessed August 16, 2025, https://ipfdalaw.com/the-505b2-application-and-the-anda-similarities-and-differences/

- Using 505(b)(2) to Solve Shortfall from Generic Cliff, accessed August 16, 2025, https://www.appliedclinicaltrialsonline.com/view/using-505b2-solve-shortfall-generic-cliff

- The 505(b)(2) Drug Approval Pathway: A Potential Solution for the Distressed Generic Pharma Industry in an Increasingly Diluted ANDA Marketplace? | Sterne Kessler, accessed August 16, 2025, https://www.sternekessler.com/news-insights/insights/505b2-drug-approval-pathway-potential-solution-distressed-generic-pharma/

- Inequitable Conduct Defense During Patent Litigationin a 505(b)(2 …, accessed August 16, 2025, https://ipfdalaw.com/inequitable-conduct-defense-during-patent-litigationin-a-505b2-nda-context/

- Trends in 505(b)(2) Approvals | Contract Pharma, accessed August 16, 2025, https://www.contractpharma.com/trends-in-505-b-2-approvals/

- Extending Asset Reach and Protecting Your IP Through the 505(b)(2) Pathway, accessed August 16, 2025, https://proedcomblog.com/2020/12/01/extending-asset-reach-and-protecting-your-ip-through-the-505b2-pathway/

- The 505(b)(2) Drug Approval Pathway (Open Access) – Food and Drug Law Institute (FDLI), accessed August 16, 2025, https://www.fdli.org/2019/12/the-505b2-drug-approval-pathway/

- What is the 505(b)(2) Regulatory Pathway? – Allucent, accessed August 16, 2025, https://www.allucent.com/resources/blog/what-505b2

- HYBRID MEDICINES AND 505(B)(2) NDA APPROVAL PATHWAYS – Altasciences, accessed August 16, 2025, https://www.altasciences.com/sites/default/files/2022-04/The-Altascientist_issue6_505B2_2022.pdf

- Faster Approval Of Combination Drug Products Via The 505(b)(2 …, accessed August 16, 2025, https://premierconsulting.com/resources/blog/faster-approval-combination-drug-products-via-505b2-pathway/

- Benefits of The 505(b)(2) Pathway For Prodrugs | Allucent, accessed August 16, 2025, https://www.allucent.com/resources/blog/benefits-utilizing-505b2-pathway-prodrugs

- Exploring New Potential Through 505(b)(2) – Drug Development and Delivery, accessed August 16, 2025, https://drug-dev.com/wp-content/uploads/2025/05/Exploring-New-Potential-Through-505-2.pdf

- FDA’s 505(b)(2) Application – IP & FDA Lawyers – Upadhye Tang LLP, accessed August 16, 2025, https://ipfdalaw.com/fdas-505b2-application/

- Using 505(b)(2) to Solve the Financial Shortfall Coming Because of the Generic Cliff, accessed August 16, 2025, https://www.appliedclinicaltrialsonline.com/view/using-505b2-solve-financial-shortfall-coming-because-generic-cliff

- Intellectual Property Technology Law Journal – Sterne Kessler, accessed August 16, 2025, https://www.sternekessler.com/app/uploads/2024/10/Old-Drugs-New-Tricks-Repurposing-Through-505b2-Submissions.pdf

- Market Access for 505(b)(2) Drugs: Interview with US Payers Reveals a Better Approach, accessed August 16, 2025, https://premier-research.com/perspectives/market-access-for-505b2-drugs-interview-with-us-payers-reveals-a-better-approach/

- HOPA 2025: Understanding the Recent Changes for 505(b)(2) Drugs and Reimbursement, accessed August 16, 2025, https://www.pharmacytimes.com/view/hopa-2025-understanding-the-recent-changes-for-505-b-2-drugs-and-reimbursement

- Understanding Recent Changes to 505(b)(2) Drugs and Reimbursement – Pharmacy Times, accessed August 16, 2025, https://www.pharmacytimes.com/view/understanding-recent-changes-to-505-b-2-drugs-and-reimbursement

- Practices Face Challenges When Manufacturers Turn to Code 505(b)(2), accessed August 16, 2025, https://www.targetedonc.com/view/practices-face-challenges-when-manufacturers-turn-to-code-505-b-2-

- Return On Investment For 505(b)(2) Products: Is An “AB” Rating Possible?, accessed August 16, 2025, https://premierconsulting.com/resources/blog/return-investment-505b2-products-ab-rating-possible/

- Addressing 505(B)(2) Product Development Challenges Before They Become Problems, accessed August 16, 2025, https://www.cellandgene.com/doc/addressing-b-product-development-challenges-before-they-become-problems-0001

- DrugPatentWatch: 505(b)(2) Applications and Patent Extensions …, accessed August 16, 2025, https://www.geneonline.com/drugpatentwatch-505b2-applications-and-patent-extensions-offer-strategies-for-post-anda-market-exclusivity/

- 505(b)(2) Development Articles And Insights | Premier Consulting, accessed August 16, 2025, https://premierconsulting.com/505b2-development/

- Pre-IND Meetings: How To Achieve Success For 505(b)(2) | Premier Consulting, accessed August 16, 2025, https://premierconsulting.com/resources/blog/pre-ind-meetings-achieve-success-505b2/

- Maximizing the Value of FDA Pre-IND Meetings for Successful 505(b)(2) NDA Submissions, accessed August 16, 2025, https://www.propharmagroup.com/thought-leadership/fda-pre-ind-meetings-for-successful-505b2-nda-submissions

- Regulatory Interactions: CBER-CDER Pre-IND Meetings – NIH’s Seed, accessed August 16, 2025, https://seed.nih.gov/sites/default/files/2023-12/Pre-IND-Meetings-FDA.pdf

- 207533Orig1s000 – accessdata.fda.gov, accessed August 16, 2025, https://www.accessdata.fda.gov/drugsatfda_docs/nda/2015/207533Orig1s000OtherR.pdf

- Aripiprazole Lauroxil, a Novel Injectable Long-Acting Antipsychotic Treatment for Adults with Schizophrenia: A Comprehensive Review – MDPI, accessed August 16, 2025, https://www.mdpi.com/2035-8377/13/3/29

- Aripiprazole Lauroxil: Development and Evidence-Based Review of a Long-Acting Injectable Atypical Antipsychotic for the Treatment of Schizophrenia – PMC, accessed August 16, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11921517/

- Aristada User Reviews & Ratings – Drugs.com, accessed August 16, 2025, https://www.drugs.com/comments/aripiprazole/aristada.html

- Aristada (aripiprazole) Reviews and User Ratings: Effectiveness, Ease of Use, and Satisfaction – WebMD, accessed August 16, 2025, https://reviews.webmd.com/drugs/drugreview-170041-aristada-intramuscular

- Aristada Ratings & Reviews by Doctors | Uses & Side Effects – Sermo, accessed August 16, 2025, https://www.sermo.com/drug-ratings/aristada

- Aripiprazole lauroxil (intramuscular route) – Side effects & uses – Mayo Clinic, accessed August 16, 2025, https://www.mayoclinic.org/drugs-supplements/aripiprazole-lauroxil-intramuscular-route/description/drg-20406243

- Efficacy and safety of a lidocaine/tetracaine medicated patch or peel for dermatologic procedures: a meta-analysis – PMC, accessed August 16, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC3366310/

- Med reconciliation – UF Health, accessed August 16, 2025, https://ufhealth.org/assets/media/Professionals-Bulletins/1008-drugs-therapy-bulletin.pdf

- center for drug evaluation and – accessdata.fda.gov, accessed August 16, 2025, https://www.accessdata.fda.gov/drugsatfda_docs/nda/2006/021717s000_PharmR_P1.pdf

- Evaluation of the Depth and Duration of Anesthesia From Heated Lidocaine/Tetracaine (Synera®) Patches Compared With 5% Lidocaine (Lidoderm®) Patches Applied to Healthy Adult Volunteers | ClinicalTrials.gov, accessed August 16, 2025, https://clinicaltrials.gov/study/NCT01688518

- SYNERA (lidocaine and tetracaine) Topical Patch – accessdata.fda.gov, accessed August 16, 2025, https://www.accessdata.fda.gov/drugsatfda_docs/label/2014/021623s015s017lbl.pdf

- Lidocaine Patch with Tetracaine (Synera): How to Use – Cleveland Clinic, accessed August 16, 2025, https://my.clevelandclinic.org/health/drugs/19244-lidocaine-tetracaine-dermal-patches

- Synera (lidocaine-tetracaine) dosing, indications, interactions, adverse effects, and more, accessed August 16, 2025, https://reference.medscape.com/drug/synera-pliaglis-lidocaine-tetracaine-343668

- Using the 505(b)(2) Pathway to Streamline Regulatory Approval for Combination Products, accessed August 16, 2025, https://premier-research.com/perspectives/505b2-pathway-regulatory-combination-products/

- Hybrid Medicines And 505(b)(2) NDA Approval Pathways – Clinical Leader, accessed August 16, 2025, https://www.clinicalleader.com/doc/hybrid-medicines-and-b-nda-approval-pathways-0001

- Improving Drug Development ROI In 2017 | Premier Consulting, accessed August 16, 2025, https://premierconsulting.com/resources/blog/improve-drug-development-roi-2017/

- A Comprehensive Retrospective Analysis of Trends and Strategic …, accessed August 16, 2025, https://www.researchgate.net/publication/391462504_A_Comprehensive_Retrospective_Analysis_of_Trends_and_Strategic_Implications_of_505b2_Approvals_2019-2023

- Risk-Based Regulatory Planning: Optimizing Strategy for 505(b)(2) and Alternative Approval Pathways – BioBoston Consulting, accessed August 16, 2025, https://biobostonconsulting.com/risk-based-regulatory-planning-optimizing-strategy-for-505b2-and-alternative-approval-pathways/

- Regulatory Pathways for Super Generics – KIELTYKA GLADKOWSKI LEGAL | CROSS BORDER POLISH LAW FIRM RANKED IN THE LEGAL 500 EMEA SINCE 2019, accessed August 16, 2025, https://www.kg-legal.eu/info/pharmaceutical-healthcare-life-sciences-law/regulatory-pathways-for-super-generics/

- Some drugs that improve price competition fall through the cracks of the FDA user fees, accessed August 16, 2025, https://www.brookings.edu/articles/some-drugs-that-improve-price-competition-fall-through-the-cracks-of-the-fda-user-fees/