Executive Summary

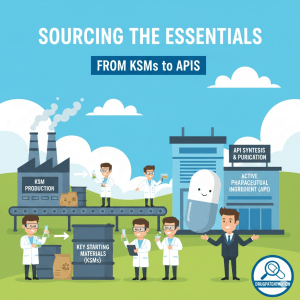

The global pharmaceutical industry is currently navigating a period of unprecedented structural realignment. For the better part of three decades, the sector operated under a unified strategic mandate: cost optimization through globalization. This era, defined by the aggressive outsourcing of chemical synthesis to low-cost geographies, successfully suppressed the Cost of Goods Sold (COGS) for Active Pharmaceutical Ingredients (APIs) but inadvertently constructed a supply chain of profound fragility. Today, the Key Starting Material (KSM)—the molecular foundation upon which all APIs are built—has become the focal point of a new industrial revolution characterized by geopolitical decoupling, regulatory intensification, and technological disruption.

In 2024 and 2025, the narrative has shifted from “just-in-time” efficiency to “just-in-case” resilience. The data is stark: China continues to dominate the global production of KSMs, accounting for roughly 40% of global API volume and serving as the primary source for India’s generic drug industry.1 However, this concentration is now viewed as a systemic risk rather than an economic advantage. Trade tensions, export controls, and factory accidents in critical chemical parks have exposed the vulnerability of Western healthcare systems to single-source dependencies in the East.

This report provides an exhaustive, expert-level analysis of the KSM sourcing landscape. We deconstruct the regulatory battlegrounds where definitions of “starting materials” can alter capital requirements by millions of dollars. We scrutinize the economic realities of the “China Plus One” strategy, separating optimistic rhetoric from the logistical challenges of emerging hubs like Vietnam and the infrastructure gaps in India. Furthermore, we examine the transformative ROI of continuous manufacturing and green chemistry—technologies that are finally making domestic production economically viable. By leveraging deep patent intelligence from platforms like DrugPatentWatch, we demonstrate how forward-looking companies are turning data into supply chain security.

Part I: The Regulatory Battlefield – Defining the Key Starting Material

The High Stakes of KSM Designation

In the complex lexicon of pharmaceutical manufacturing, few terms carry as much financial and operational weight as “Key Starting Material” (KSM). While often used interchangeably with “API Starting Material” in industry vernacular, the distinction—and the regulatory acceptance of that distinction—is the fulcrum upon which the entire Quality Management System (QMS) rests.4

The fundamental definition, derived from ICH Q11 guidelines, posits that a starting material is a raw material, an intermediate, or an API that is used in the production of an API and is incorporated as a significant structural fragment into the structure of the API.5 Crucially, the designation of a KSM marks the “line in the sand” where Good Manufacturing Practice (GMP) controls must formally begin. Steps prior to the KSM are generally non-GMP, while every step post-KSM must adhere to rigorous, expensive, and auditable GMP standards.

The Economic Incentives of “Late” Designation

Pharmaceutical manufacturers face a powerful economic incentive to push the KSM designation as far down the synthetic route as possible—a strategy known as “late-stage designation.” By successfully justifying a complex, advanced intermediate as a KSM, a manufacturer can realize substantial operational benefits:

- Reduction of GMP Burden: Fewer steps under strict GMP oversight translate to significantly lower documentation costs, reduced environmental monitoring expenses, and less capital-intensive facility requirements for the early chemistry. This allows companies to utilize standard fine chemical plants for earlier steps rather than expensive, pharma-grade facilities.7

- Sourcing Flexibility and Cost Reduction: Non-GMP intermediates can often be sourced from a wider pool of fine chemical suppliers who do not carry the overhead of GMP compliance. This competition lowers the Cost of Goods Sold (COGS). Furthermore, changing suppliers for non-GMP materials is generally faster and requires less regulatory filing (e.g., variations or supplements) than changing suppliers for registered GMP steps.7

- Accelerated Development Timelines: By designating a material later in the synthesis, the validation requirements for upstream steps are reduced, potentially speeding up the timeline to filing a Drug Master File (DMF) or Marketing Authorization Application (MAA).9

The Regulatory Pushback: Impurity Control and Visibility

However, regulatory bodies like the FDA and EMA are continuously tightening the net. They are increasingly skeptical of short synthetic routes where complex molecules effectively “appear” as starting materials without a transparent lineage. Their primary concern is impurity purging. If a KSM enters the process only one or two steps before the final API, there are limited unit operations (crystallizations, distillations, extractions) available to remove impurities, particularly mutagenic ones that may have been generated in the “invisible” non-GMP steps.10

The EMA’s reflection paper on starting materials explicitly warns that assessors will not accept “third party confidential information” to justify the purity of an advanced intermediate if the applicant cannot demonstrate full knowledge of its synthesis.12 If a regulator rejects a proposed KSM designation—arguing it is actually an intermediate—the sponsor acts at their own peril. The consequences of rejection are severe:

- Forced Redesignation: The sponsor may be forced to redesignate the material as an intermediate.

- Retrospective Validation: This triggers a requirement to validate upstream steps retrospectively.

- Supplier Audits: The upstream supplier must be audited to GMP standards, which they may not meet.

- Market Delay: These remediation activities can delay market entry by months or years, destroying the commercial viability of the product.4

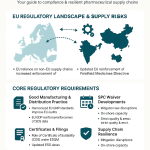

Regulatory Divergence: FDA vs. EMA Approaches

While harmonization efforts like ICH Q11 aim to create a unified standard, nuanced differences remain in how US and EU regulators assess KSMs. A sourcing strategy that satisfies the FDA may fail under EMA scrutiny, necessitating a “highest common denominator” approach for global products.

Table 1: Comparative Analysis of Regulatory Approaches to KSM Designation

| Feature | FDA Approach (US) | EMA Approach (EU) |

| Guidance Basis | ICH Q11 & ICH Q7; Focuses heavily on the risk to drug substance quality and the capability of the process to purge impurities.10 | ICH Q11 & Reflection Papers; Places stricter scrutiny on “custom syntheses” and the propinquity (closeness) of the KSM to the final API.12 |

| Justification Focus | Emphasizes the applicant’s ability to demonstrate control strategy. If you can prove impurities are purged, FDA is sometimes more flexible on the starting point.9 | Emphasizes the complexity of the molecule and the number of chemical transformation steps performed under GMP. Very critical of short GMP routes (e.g., fewer than 3 steps).5 |

| Scrutiny of Suppliers | Increasing use of remote interactive evaluations and requests for complete supply chain maps to mitigate drug shortage risks.16 | Requires synthesis details of starting materials to be transparent to the applicant; “blind” sourcing from third parties is explicitly rejected.17 |

| Redefinition Impact | May issue Complete Response Letters (CRL) citing manufacturing deficiencies if KSM controls are deemed inadequate or facilities are non-compliant.18 | Likely to issue “Major Objections” during the assessment phase, forcing a redefinition of the starting point before approval can proceed.17 |

Case Study: The Cost of Redefinition

A recent analysis of regulatory interventions highlights the tangible risks of aggressive KSM designation. In one case study involving a stereoselective synthesis, the Authority requested a redefinition of the starting material because the proposed KSM was deemed “too complex” and the remaining GMP route consisted of only two chemical steps. The regulator argued that this short route provided insufficient assurance that unexpected impurities from the non-GMP synthesis of the KSM would be purged effectively.

The manufacturer was forced to:

- Redefine the KSM to a precursor material used earlier in the synthesis.

- Bring three additional chemical steps under the GMP envelope.

- Conduct new supplier audits and process validations for those steps.

This intervention fundamentally altered the cost structure of the API and significantly impacted the project timeline, serving as a warning that regulatory agencies are prioritizing supply chain transparency over manufacturing convenience.20

The “Significant Structural Fragment” Debate

The requirement that a KSM contribute a “significant structural fragment” is designed to prevent the use of near-final APIs as starting materials. However, this definition remains subjective and is often the subject of intense debate between applicants and assessors.

- Commodity Chemicals: Simple, commercially available chemicals (e.g., benzene, toluene, basic alcohols) are rarely KSMs; they are classified as raw materials. Their impurity profiles are well-understood and generally pose low risk.

- Custom Synthesized Materials: This is the critical gray area. If a supplier creates a unique molecule specifically for one pharma client, regulators often view this as outsourced manufacturing rather than raw material sourcing. Consequently, the regulatory expectation is that the sponsor must control the manufacturing process of this custom material as if it were done in-house. The “commercial availability” argument—stating that a material is a KSM simply because it can be bought—is no longer sufficient justification without scientific data on impurity fate and purging.6

Part II: The Geopolitical Chokehold – Mapping Global Dependence

The China-India Nexus: A Structural Vulnerability

To understand the current sourcing crisis, one must look beyond the balance sheets and look at the map of global chemical production. The pharmaceutical supply chain is not a diversified network; it is a funnel that narrows precariously into East Asia.

China’s Dominance:

China is the undisputed “World’s API Factory.” It produces roughly 40% of the world’s APIs by volume and is the dominant supplier of KSMs globally.1

- Scale and Volume: China accounts for 13% of U.S. API imports directly, but this figure is misleadingly low because it does not account for the KSMs sent to other countries for final processing.8 KSMs originating in China often flow into India or Europe, where they are converted into APIs before being exported to the US.

- Dependency of India: India, often hailed as the “Pharmacy of the World,” imports 70-80% of its total API and KSM requirements from China.2 For critical antibiotics like penicillin, cephalosporins, and macrolides, this dependency rises to nearly 90-100%.21 India effectively acts as a massive processing hub for Chinese intermediates.

- Pricing Power as a Weapon: Chinese producers have historically utilized state subsidies and massive economies of scale to undercut global prices, driving competitors out of the market. In late 2024, Chinese manufacturers slashed prices on 41 key APIs and KSMs by 40-50%, a move interpreted by analysts as an attempt to maintain market dominance against rising Indian competition and prevent the diversification of supply chains.22

India’s Role:

India supplies 48% of U.S. API imports and is the largest provider of generic medicines globally.8 However, its manufacturing base acts largely as a downstream processor. If China sneezes—via an export ban, a factory explosion in a chemical park, or a diplomatic spat—India’s pharmaceutical industry catches a cold, and the U.S. healthcare system risks developing pneumonia.

The “China Plus One” Strategy: Myth vs. Reality

In response to supply chain disruptions during the COVID-19 pandemic and rising geopolitical tensions, Western pharmaceutical companies have aggressively pursued a “China Plus One” strategy—maintaining Chinese suppliers while cultivating alternative sources in India, Vietnam, or Europe to mitigate risk.

1. India’s Production Linked Incentive (PLI) Scheme

The Indian government has recognized this strategic vulnerability and launched a massive Production Linked Incentive (PLI) scheme, allocating over $2 billion to boost domestic manufacturing of 53 critical KSMs and APIs that were previously imported almost exclusively from China.23

- Strategic Intent: The goal is backward integration—reviving the fermentation and basic chemical industries that withered under Chinese price pressure.

- Progress Report: By 2025, 48 projects had been approved under the scheme. Significant capacity has been created for fermentation-based products like Penicillin G, which India had ceased producing decades ago.21

- Operational Challenges: Despite these incentives, Indian manufacturers struggle with higher utility costs, land acquisition hurdles, and a lack of the integrated chemical parks that give China its logistical edge. The “backward integration” into basic chemicals remains a multi-year hurdle, and for now, the dependency on Chinese precursors remains high.2

2. Vietnam and Emerging Hubs

Vietnam is positioning itself as a low-cost alternative, attracting Foreign Direct Investment (FDI) through tax breaks and favorable trade deals.26 However, its chemical industry infrastructure is nascent compared to China’s. Vietnam is currently viable for formulation (FDF) and packaging but lacks the deep petrochemical and fine chemical ecosystem required for complex KSM synthesis in the immediate term.

3. Reshoring to the West

The U.S. and Europe are attempting to reclaim manufacturing capacity for essential medicines, driven by national security concerns.

- United States: The White House issued executive orders in 2025 to fill a Strategic Active Pharmaceutical Ingredients Reserve (SAPIR), mandating domestic sourcing for essential medicines.27 This policy push has triggered a wave of investment. Companies like Eli Lilly have opened massive new facilities (e.g., in Concord, North Carolina) to support injectable production 28, and Amgen has operationalized a new biomanufacturing site in Ohio.29

- Europe: The EU is leveraging the “Health IPCEI” (Important Project of Common European Interest) to fund re-industrialization. EUROAPI has received state support to upgrade facilities for peptide and oligonucleotide production in France, aiming to reduce reliance on Asian imports for these high-value modalities.30

Supply Chain Disruptions: The 2024-2025 Landscape

The fragility of this concentrated network was exposed repeatedly in 2024 and 2025, serving as a constant reminder of the volatility inherent in the current model.

- Factory Accidents: A massive explosion at a chemical plant in Weifang, China, in May 2025 disrupted the supply of key pesticide and pharmaceutical intermediates, sending shockwaves through the market.31 Similarly, fatal blasts in Telangana and Andhra Pradesh, India, highlighted the safety risks and regulatory oversight gaps that persist in the rush to ramp up production.32

- Export Bans: In a move reminiscent of the pandemic era, nations have used export controls as leverage. The U.S. added 32 entities to its trade blacklist in late 2025, including Chinese and Indian firms involved in dual-use technologies, further complicating procurement for companies with entangled supply chains.33

- Logistic Bottlenecks: The Red Sea crisis and the Panama Canal drought in 2024 drove up shipping costs and extended lead times for KSMs traveling from Asia to Europe and the Americas.34 These logistic choke points force companies to hold higher safety stocks, tying up working capital.

Part III: Strategic Sourcing in a Data-Driven Era

Leveraging Patent Intelligence for Competitive Advantage

In the high-stakes game of generic drug launches, timing is everything. Sourcing managers cannot simply react to market demand; they must anticipate it years in advance to secure KSM supply before competitors do. This is where patent intelligence platforms like DrugPatentWatch become indispensable tools for the procurement function.

Predictive Sourcing

By monitoring patent expiration dates, generic manufacturers can identify “entry points”—the precise dates when a branded drug loses exclusivity and opens to competition. DrugPatentWatch aggregates global patent data, litigation status, and regulatory exclusivity periods (e.g., pediatric or orphan drug exclusivity) to provide a calculated “Probable Generic Entry” date.35

- Reverse Engineering the Timeline: A sourcing manager uses this data to work backward. If a patent expires in 2027, API sourcing must begin in 2024, KSM supplier qualification in 2023, and synthetic route evaluation in 2022. This visibility allows procurement to be proactive rather than reactive.

- Volume Forecasting: Patent data helps estimate the potential market size and the number of potential competitors (via ANDA filings), allowing procurement to negotiate volume-based contracts with KSM suppliers well before the rush.36

Monitoring Competitor Supply Chains

Patent filings often reveal more than just chemical structures; they disclose manufacturing processes. If a competitor files a patent for a new polymorphic form or a novel synthesis route, it signals their manufacturing strategy.

- Formulation Patents: Monitoring these filings via DrugPatentWatch can reveal which specific excipients or KSM grades a competitor is likely to use. A supplier who identifies this early can “front-run” the demand, securing capacity for the specific grade of material required.37

- Litigation Signals: A “Paragraph IV” certification notice is a public declaration of war by a generic challenger against a brand. Sourcing teams monitoring these notices via DrugPatentWatch know that the challenger has likely already secured an API source and completed pivotal batch manufacturing. This serves as a critical signal to accelerate their own timelines or risk being left behind.38

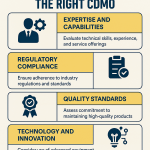

The Supplier Qualification Gauntlet

Sourcing KSMs is no longer a “lowest bid wins” exercise. It is a multi-dimensional risk management discipline.

The Risk Matrix Approach

Modern procurement teams utilize weighted decision matrices to evaluate suppliers objectively. A low price is meaningless if the supplier has a history of FDA warning letters or operates in a geopolitically unstable region that could be hit with 25% tariffs overnight.

Table 2: Weighted KSM Supplier Decision Matrix Example

| Criterion | Weight | Supplier A (China) | Supplier B (India) | Supplier C (Europe) |

| Regulatory History (FDA/EMA Audits) | 30% | 6/10 (Minor 483s) | 5/10 (Warning Letter 2022) | 10/10 (Clean History) |

| Supply Chain Resilience (Backward Integration) | 25% | 9/10 (In-house KSMs) | 6/10 (Imports KSMs from China) | 8/10 (Dual sourced) |

| Cost Competitiveness | 20% | 10/10 (Lowest Price) | 9/10 (Competitive) | 4/10 (Highest Price) |

| Geopolitical Risk | 15% | 3/10 (High Tariff/Trade War Risk) | 7/10 (Moderate Risk) | 9/10 (Stable) |

| Sustainability/Green Chemistry | 10% | 5/10 (Standard) | 6/10 (Standard) | 9/10 (Advanced) |

| Weighted Score | 100% | 6.95 | 6.60 | 8.15 |

Note: In this model, Supplier C wins despite significantly higher costs because regulatory and geopolitical risks are heavily penalized. This reflects the modern priority of resilience over pure cost..39

The Audit Checklist

With the rise of remote auditing and increased regulatory scrutiny, the audit checklist has evolved. It now includes specific checks for:

- Data Integrity: Is raw data on instrument hard drives matching the summary reports? Inconsistencies here are a common cause of FDA Warning Letters.18

- Traceability: Can the supplier trace the starting materials of their starting materials? This is critical for nitrosamine risk assessments, where impurities in basic solvents can contaminate the final drug.

- Financial Health: Is the supplier financially stable enough to withstand a 6-month payment delay or a trade war tariff spike? A financially fragile supplier is a supply chain break waiting to happen.42

Part IV: Technology as the Great Equalizer

Continuous Manufacturing & Flow Chemistry: The ROI of Modernization

For decades, batch processing has been the industry standard. It is understood, regulatory pathways are clear, and equipment is depreciated. However, batch processing is inefficient, labor-intensive, and requires large footprints—making it difficult to operate profitably in high-cost Western countries.

Flow Chemistry (Continuous Manufacturing) is changing this calculus. By running reactions continuously in small reactors rather than large tanks, manufacturers can achieve transformative efficiencies:

- Reduced Footprint: A continuous plant can occupy 1/10th the space of a batch plant, drastically reducing construction and HVAC costs. This is a crucial factor for reshoring, where land and construction costs are high.43

- Improved Safety: Hazardous reactions (e.g., nitrations, hydrogenations, azidations) are safer in small volumes, allowing the use of high-energy chemistries that are impossible in large batch reactors. This opens up new, more efficient synthetic routes.44

- Lower Costs: Detailed techno-economic analyses show that continuous manufacturing can reduce Capital Expenditure (CapEx) by 20-76% and Operating Expenditure (OpEx) by up to 40% compared to batch processing.45

Adoption Trends:

Major CDMOs are heavily investing in these technologies to service Western clients who demand domestic production but cannot afford batch economics.

- SK pharmteco is expanding its continuous manufacturing capabilities in the U.S. to support peptide production.47

- WuXi STA continues to expand its flow chemistry platforms to meet global demand for safer, scalable processes.48

- The U.S. market for flow chemistry is projected to grow at a CAGR of 10.3% through 2030, driven by this reshoring wave and the need for process intensification.49

Green Chemistry: Sustainability as a Cost Saver

Green chemistry is no longer just a Public Relations exercise; it is a hard-nosed procurement strategy. With solvent usage accounting for a massive portion of waste (and cost) in API manufacturing, “greener” processes that recycle solvents or use enzymatic catalysis directly impact the bottom line.

- Solvent Recovery: Increasing solvent recovery rates from 30% to 70% can reduce cradle-to-grave emissions by 26%. More importantly, it significantly lowers procurement costs for solvents like Acetonitrile and THF, insulating manufacturers from market volatility.50

- Enzymatic Synthesis: Biocatalysis often operates at ambient temperature and pressure, reducing energy bills and eliminating the need for expensive metal catalysts like Palladium. This reduces both the direct material cost and the cost of removing heavy metals from the final API.51

Part V: The Economics of KSMs – 2024/2025 Price Trends

Understanding the price volatility of specific KSMs is critical for budget forecasting. The 2024-2025 period has seen divergent trends driven by sector-specific demands outside of pharma, particularly from the Electric Vehicle (EV) and automotive sectors.

1. Lithium Carbonate (Pharmaceutical Grade)

Used in the synthesis of various APIs and as a treatment for bipolar disorder, Lithium pricing is heavily impacted by the EV battery market.

- Trend: Prices stabilized in late 2025 around $11.18/kg in Europe and $9.04/kg in Northeast Asia.52

- Driver: While demand is robust due to the EV boom, a surplus of supply from new mining projects coming online in Australia and South America has kept a lid on prices, benefitting pharma buyers who compete for the same raw material.53

2. Palladium (Catalyst)

Palladium is essential for hydrogenation and cross-coupling reactions in API synthesis.

- Trend: Prices have fallen from historical highs to around $953 – $1,000 per ounce in early 2025.54

- Driver: Slowing demand from the automotive sector (where it is used in catalytic converters) as the world shifts to EVs has created an oversupply. This structural shift offers significant relief to pharma manufacturers using palladium-catalyzed reactions.55

3. Solvents (Acetonitrile & THF)

- Acetonitrile: Prices in the US hovered around $2,477/MT in Q2 2025, significantly higher than the $1,212/MT seen in China.56 This persistent price disparity drives the continued importation of Chinese solvents despite tariff risks, as the cost arbitrage is too high to ignore for many generic manufacturers.

- Tetrahydrofuran (THF): Prices dropped in late 2025 (e.g., $2.30/kg in Europe), driven by reduced demand in the textiles (spandex) sector. This creates a favorable buying window for pharma procurement teams to lock in long-term contracts.57

4. Antibiotic Intermediates (Penicillin G)

- Trend: Prices for Penicillin G Sodium declined in late 2025 to approx. $46,000/MT in the US.58

- Driver: Enhanced production capacity in India (post-PLI scheme implementation) and normalized global supply chains have eased the pandemic-era shortages, stabilizing the market for this critical antibiotic backbone.59

Part VI: Case Studies in Resilience and Failure

Success Story: Lupin’s Digital Pivot

Lupin Limited, a major Indian multinational, successfully integrated its manufacturing, supply chain, and procurement under a single “Global Technical Operations” umbrella. By leveraging AI and predictive analytics, they optimized inventory levels and reduced stockouts, transforming their supply chain from a cost center to a strategic asset.

- Key Insight: “Digital transformation and automation aren’t just enablers—they are the foundation of world-class operations. Every digital solution we implement must deliver tangible results, whether it’s improving batch cycle times or reducing waste.” — Christoph Funke, CTO.3

Cautionary Tale: Regulatory Rejection due to CMC Deficiencies

In 2024 and 2025, the FDA issued numerous Complete Response Letters (CRLs) citing manufacturing deficiencies, highlighting the risks of inadequate supplier oversight.

- Stealth BioTherapeutics: Received a CRL for its drug elamipretide due to observations at a third-party manufacturing facility, despite no efficacy issues with the drug itself. This case underscores a critical lesson: your supplier’s failure is your failure.60

- Johnson & Johnson: Faced a CRL for a lung cancer therapy due to inspection issues at a manufacturing site, delaying a critical product launch and ceding market time to competitors.61

- Lesson: Regulatory due diligence on CDMOs and KSM suppliers is as critical as clinical trial success. The FDA’s new policy of releasing CRLs to the public (radical transparency) means these failures now carry immediate reputational damage.62

Part VII: The Path Forward – Recommendations for 2025

As we look toward the latter half of the decade, the “new normal” for KSM sourcing is defined by transparency, redundancy, and technology.

- Adopt “China Plus One” with Eyes Open: Diversify into India for fermentation and generic APIs, but look to Europe and the US for complex, high-value KSMs where IP protection and flow chemistry can offset higher labor costs. Do not assume India is independent of China; verify the backward integration of your Indian suppliers.

- Integrate Patent Data into Procurement: Use tools like DrugPatentWatch not just for legal strategy, but as a supply chain forecasting tool. Know when the generic wave is coming and lock in KSM supply contracts 24 months in advance to avoid the price spikes associated with patent cliffs.

- Invest in Process Innovation: Move legacy batch processes to continuous manufacturing where possible. The regulatory path (ICH Q13) is now clear, and the economic argument (OpEx savings, safety, footprint) is undeniable. This is the only viable path to cost-competitive Western manufacturing.

- Prepare for “Radical Transparency”: With the FDA moving to release CRLs and detailed deficiency letters, manufacturing failures will become public reputational risks. Ensure your KSM suppliers are audit-ready at all times and that data integrity is unimpeachable.

The sourcing of KSMs has evolved from a transactional purchasing function into a strategic capability that defines the survival of pharmaceutical companies. In a world of trade wars and pandemics, the molecule matters, but the supply chain matters more.

Key Takeaways

- Regulatory Definition is Economic Destiny: Designating a material as a “KSM” late in the synthesis saves money but invites regulatory rejection. A scientific justification based on impurity purging is non-negotiable.

- China Remains Unavoidable: Despite “China Plus One” rhetoric, China still controls the “pre-KSM” market. India is an alternative for intermediates but relies on China for basic chemicals.

- Technology Enables Reshoring: Continuous manufacturing and flow chemistry reduce the CapEx/OpEx gap between Western and Asian manufacturing, making domestic production of critical medicines economically feasible.

- Data Predicts Supply: Patent intelligence platforms like DrugPatentWatch are essential for predicting generic entry points and managing the supply chain timeline for new launches.

- Price Volatility is Sector-Coupled: Pharma pricing for materials like Lithium and Palladium is increasingly dictated by the automotive and energy sectors, requiring cross-industry market intelligence.

FAQ: Sourcing KSMs for Pharmaceutical APIs

Q1: What is the difference between a “Key Starting Material” (KSM) and a raw material?

A: A raw material is a basic chemical used to produce APIs or intermediates (e.g., solvents, reagents). A KSM is a specific type of raw material or intermediate that contributes a significant structural fragment to the API. The designation of a KSM is the point where GMP (Good Manufacturing Practice) standards formally apply to the manufacturing process. Steps prior to the KSM can be non-GMP; steps after must be GMP.4

Q2: Why are regulators pushing back on “late-stage” KSM designation?

A: Regulators like the FDA and EMA are concerned about impurities. If a KSM is introduced only 1-2 steps before the final API, there are fewer opportunities to purify the drug and remove potentially toxic or mutagenic byproducts generated during the non-GMP synthesis of that KSM. Regulators demand “propinquity” (distance) to ensure safety.5

Q3: How can DrugPatentWatch help in API sourcing?

A: DrugPatentWatch provides data on patent expirations, litigation (Paragraph IV filings), and regulatory exclusivity. Procurement teams use this to predict when a generic market will open, allowing them to identify and qualify API/KSM suppliers years in advance. It also helps monitor competitor supply chains by tracking their patent filings for specific formulations or synthesis routes.35

Q4: What is the “China Plus One” strategy, and is it working?

A: It is a business strategy to diversify sourcing beyond China to avoid over-reliance. While companies are moving some production to India, Vietnam, and Europe, China still dominates the global supply of basic KSMs and intermediates. India, for instance, still imports ~70% of its KSM needs from China, meaning the “Plus One” is often still tethered to the original source.2

Q5: How does Flow Chemistry reduce the cost of API manufacturing?

A: Flow chemistry (continuous manufacturing) replaces large batch reactors with small, continuous tubes/reactors. This reduces the physical footprint of the factory (lowering construction and energy costs), improves safety for hazardous reactions, and offers better yield and quality control. Studies show it can reduce Capital Expenditure (CapEx) by up to 76% and Operating Expenditure (OpEx) by 40%.45

Works cited

- Pharmaceuticals are China’s next trade weapon – Atlantic Council, accessed November 26, 2025, https://www.atlanticcouncil.org/blogs/econographics/sinographs/pharmaceuticals-are-chinas-next-trade-weapon/

- The Pharmaceutical Gambit: An Analysis of Why India Lags China and a Roadmap to Competitive Parity – DrugPatentWatch – Transform Data into Market Domination, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/the-pharmaceutical-gambit-an-analysis-of-why-india-lags-china-and-a-roadmap-to-competitive-parity/

- Christoph Funke – Interview – ET Pharma – Building a tech-driven …, accessed November 26, 2025, https://www.lupin.com/christoph-funke-interview-et-pharma-building-a-tech-driven-operations-eco-systems-to-adapt-to-global-shifts-25-02-2025/

- How to Find Key Starting Materials (KSMs) for Pharmaceutical APIs – DrugPatentWatch, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/how-to-find-key-starting-materials-ksms-for-pharmaceutical-apis/

- EMA and FDA approval of regulatory starting materials – European Pharmaceutical Review, accessed November 26, 2025, https://www.europeanpharmaceuticalreview.com/article/130745/approval-of-regulatory-starting-materials/

- Key Starting Materials (KSMs) – Department of Pharmaceuticals, accessed November 26, 2025, https://pharma-dept.gov.in/sites/default/files/REVISED%20GUIDELINES%20FOR%20BULK%20DRUGS-29-10-2020_1.pdf

- Drug APIs Start Here: How to Nail Your KSM Strategy – DrugPatentWatch, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/apis-start-here-how-to-nail-your-ksm-strategy/

- Sourcing Key Starting Materials (KSMs) for Pharmaceutical Active Pharmaceutical Ingredients (APIs): A Strategic Imperative for Resilience – DrugPatentWatch – Transform Data into Market Domination, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/sourcing-the-key-starting-materials-ksms-for-pharmaceutical-active-pharmaceutical-ingredients-apis/

- Postapproval Changes to Drug Substances Guidance for Industry – FDA, accessed November 26, 2025, https://www.fda.gov/media/115733/download

- Q11 Development and Manufacture of Drug Substances (Chemical Entities and Biotechnological/Biological Entities) Questions and An – FDA, accessed November 26, 2025, https://www.fda.gov/media/103162/download

- ICH Q11 Questions & Answers – Selection & Justification of Starting Materials., accessed November 26, 2025, https://database.ich.org/sites/default/files/Q11_TrainingDeck_Final_2018_0522.pdf

- Reflection paper on the requirements for selection and justification of starting materials for the manufacture of chemical active substances – IPQpubs, accessed November 26, 2025, https://www.ipqpubs.com/wp-content/uploads/2014/11/WC500175228.pdf

- Strategies for Defending Regulatory Starting Materials Designation – WuXi STA, accessed November 26, 2025, https://sta.wuxiapptec.com/wp-content/uploads/2023/10/rsm-webinar-executive-summary.pdf

- Q7A Good Manufacturing Practice Guidance for Active Pharmaceutical Ingredients – FDA, accessed November 26, 2025, https://www.fda.gov/regulatory-information/search-fda-guidance-documents/q7a-good-manufacturing-practice-guidance-active-pharmaceutical-ingredients

- Reflection paper on the use of starting materials-intermediates collected from different sources in the manufacturing of biologi – European Medicines Agency (EMA), accessed November 26, 2025, https://www.ema.europa.eu/en/documents/scientific-guideline/reflection-paper-use-starting-materials-and-intermediates-collected-different-sources-manufacturing-biological-medicinal-products_en.pdf

- Remote Auditing Best Practices & Checklist for Regulatory Compliance – The FDA Group, accessed November 26, 2025, https://www.thefdagroup.com/blog/remote-auditing-best-practices-checklist

- Starting Materials For Active Substances Redefinition of GMP-Starting Materials, accessed November 26, 2025, https://www.edqm.eu/documents/52006/115291/ws1-k_olofsson-starting_materials_for_apis.pdf/ffec92c6-c381-490e-7b5e-f07cc7fa328d?t=1630581454804

- Top 10 FDA CRL Drivers (2020–2024) – Compliance Insight, accessed November 26, 2025, https://www.compliance-insight.com/top-10-fda-crl-drivers-2020-2024/

- EU’s Stringent Standards to RSM Designation— A Peek into Two Recent Cases – Medium, accessed November 26, 2025, https://medium.com/@allen-che/regulatory-starting-materials-stringent-paths-in-the-eu-8536eb92188f

- Starting Material – Concept and Impact on Pharmaceutical Regulations – Sigarra, accessed November 26, 2025, https://sigarra.up.pt/faup/en/pub_geral.show_file?pi_doc_id=159306

- China’s Shadow over India’s Medical Supply Chains – Observer Research Foundation, accessed November 26, 2025, https://www.orfonline.org/expert-speak/china-s-shadow-over-india-s-medical-supply-chains

- China Now Producing Dozens of Drugs Below Market Price – Dumping Them Globally is Next Move, accessed November 26, 2025, https://prosperousamerica.org/china-now-producing-dozens-of-drugs-below-market-price-dumping-them-globally-is-next-move/

- India’s Push for API Self-Reliance Under the PLI Scheme – Ingredients, accessed November 26, 2025, https://www.pharmaindustrial-india.com/news/indias-push-for-api-self-reliance-under-the-pli-scheme

- PRODUCTION LINKED INCENTIVE (PLI) SCHEME FOR PROMOTION OF DOMESTIC MANUFACTURING OF CRITICAL KEY STARTING MATERIALS (KSMS)/ DRUG INTERMEDIATES (DIS) AND ACTIVE PHARMACEUTICAL INGREDIENTS (APIS) IN INDIA. – Lukmaan IAS Blog, accessed November 26, 2025, https://blog.lukmaanias.com/2025/02/21/production-linked-incentive-pli-scheme-for-promotion-of-domestic-manufacturing-of-critical-key-starting-materials-ksms-drug-intermediates-dis-and-active-pharmaceutical-ingredients-apis-in-ind/

- 48 Projects have been approved under the Production Linked Incentive Scheme for promotion of domestic manufacturing of critical Key Starting Materials (KSMs) / Drug Intermediates (DIs) and Active Pharmaceutical Ingredients (APIs) in India, accessed November 26, 2025, https://www.pib.gov.in/PressReleasePage.aspx?PRID=2146914

- China Plus One Strategy And Why Companies Are Adopting It – Frigate Manufacturing, accessed November 26, 2025, https://frigate.ai/contract-manufacturing/china-plus-one-strategy-and-why-companies-are-adopting-it/

- Ensuring American Pharmaceutical Supply Chain Resilience by Filling the Strategic Active Pharmaceutical Ingredients Reserve – The White House, accessed November 26, 2025, https://www.whitehouse.gov/presidential-actions/2025/08/ensuring-american-pharmaceutical-supply-chain-resilience-by-filling-the-strategic-active-pharmaceutical-ingredients-reserve/

- accessed November 26, 2025, https://www.pharmaceutical-technology.com/projects/eli-lilly-parenteral-products-facility-concord/#:~:text=Eli%20Lilly%20opened%20a%20facility,an%20investment%20of%20%242bn.

- accessed November 26, 2025, https://www.ohiodiscoverycorridor.com/news-press/amgen-announces-major-expansion-in-ohio#:~:text=Amgen%20announced%20its%20entry%20into,class%20biotech%20and%20biopharmaceutical%20operations.

- Press Release With Med4Cure, EUROAPI accelerates pharmaceutical innovation at the service of health sovereignty, accessed November 26, 2025, https://www.euroapi.com/sites/default/files/2025-10/euroapi-press-release-october-23-2025.pdf

- At least five reported killed in large explosion at China chemical plant – Al Jazeera, accessed November 26, 2025, https://www.aljazeera.com/news/2025/5/27/at-least-five-reported-killed-in-large-explosion-at-china-chemical-plant

- Indian pharmaceutical factory explosion leaves 42 dead – World Socialist Web Site, accessed November 26, 2025, https://www.wsws.org/en/articles/2025/07/08/xygm-j08.html

- Additions and Revisions to the Entity List – Federal Register, accessed November 26, 2025, https://www.federalregister.gov/documents/2025/09/16/2025-17893/additions-and-revisions-to-the-entity-list

- BioPharma Supply Cost Trends: April 2024 – PharmaSource, accessed November 26, 2025, https://pharmasource.global/content/biopharma-supply-cost-trends-april-2024/

- The Formulary Compass: How Drug Patent API Datafeeds Are Revolutionizing Formulary Automation – DrugPatentWatch – Transform Data into Market Domination, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/the-formulary-compass-how-drug-patent-api-datafeeds-are-revolutionizing-formulary-automation/

- How to Identify Profitable Generic Drug Opportunities Using Patent …, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/how-to-identify-profitable-generic-drug-opportunities-using-patent-expiration-data/

- Competitive Intelligence in Excipients: How to Know Your Market Share in Every Drug, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/competitive-intelligence-in-excipients-how-to-know-your-market-share-in-every-drug/

- The Pre-Approval Playbook: How to Identify Generic Entrants and Turn Data into Dominance, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/customer-success-how-do-we-identify-generic-entrants-before-they-get-fda-approval/

- An introduction to the weighted decision matrix – Lucid Software, accessed November 26, 2025, https://lucid.co/blog/weighted-decision-matrix

- A Comprehensive Guide to Using a Weighted Decision Matrix for Prioritization, accessed November 26, 2025, https://www.launchnotes.com/blog/a-comprehensive-guide-to-using-a-weighted-decision-matrix-for-prioritization

- Landy International MARCS-CMS 679066 — June 12, 2024 – FDA, accessed November 26, 2025, https://www.fda.gov/inspections-compliance-enforcement-and-criminal-investigations/warning-letters/landy-international-679066-06122024

- USP General Chapter <1083> Supplier Qualification, accessed November 26, 2025, https://www.usp.org/sites/default/files/usp/document/supply-chain/apec-toolkit/USP%20GC1083.pdf

- Economic Analysis of Batch and Continuous Biopharmaceutical Antibody Production: A Review – PMC – NIH, accessed November 26, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC6432653/

- Continuous Flow Chemistry: Revolutionizing Pharma Manufacturing, accessed November 26, 2025, https://www.contractpharma.com/library/continuous-flow-chemistry-revolutionizing-pharma-manufacturing/

- Economic Analysis of Integrated Continuous and Batch Pharmaceutical Manufacturing – University of Edinburgh Research Explorer, accessed November 26, 2025, https://www.research.ed.ac.uk/files/17335353/IECR_2011.pdf

- Sustainability and Techno-Economic Assessment of Batch and Flow Chemistry in Seven Industrial Pharmaceutical Processes – ACS Publications, accessed November 26, 2025, https://pubs.acs.org/doi/10.1021/acssuschemeng.4c09289

- SK pharmteco Boosts Domestic Peptide Scale-Up with Investment in California Facility, accessed November 26, 2025, https://www.skpharmteco.com/news-insights/press-release/sk-pharmteco-boosts-domestic-peptide-scale-up-with-investment-in-california-facility/

- WuXi STA Starts Construction of New Site in Taixing China, accessed November 26, 2025, https://sta.wuxiapptec.com/wuxi-sta-starts-construction-of-new-site-in-taixing-china/

- The United States Flow Chemistry Market Size & Outlook, 2030, accessed November 26, 2025, https://www.grandviewresearch.com/horizon/outlook/flow-chemistry-market/united-states

- Decarbonizing API manufacturing: Unpacking the cost and regulatory requirements, accessed November 26, 2025, https://www.mckinsey.com/industries/life-sciences/our-insights/decarbonizing-api-manufacturing-unpacking-the-cost-and-regulatory-requirements

- (PDF) Using Green Chemistry in Pharmaceutical Manufacturing – ResearchGate, accessed November 26, 2025, https://www.researchgate.net/publication/386080129_Using_Green_Chemistry_in_Pharmaceutical_Manufacturing

- Lithium Carbonate Price Trend, Index & Forecast 2025 – IMARC Group, accessed November 26, 2025, https://www.imarcgroup.com/lithium-carbonate-pricing-report

- Lithium – Price – Chart – Historical Data – News – Trading Economics, accessed November 26, 2025, https://tradingeconomics.com/commodity/lithium

- Palladium Prices in 2025: Key Trends Shaping the Market Outlook, accessed November 26, 2025, https://www.ipmi.org/news/palladium-prices-2025-key-trends-shaping-market-outlook

- PGM Price Trends in 2025 & Beyond: What Catalytic Converter Recyclers Need to Know, accessed November 26, 2025, https://www.brmetalsltd.com/pgm-price-trends-in-2025-beyond-what-catalytic-converter-recyclers-need-to-know/

- Acetonitrile Prices, News, Chart, Analysis and Forecast – IMARC Group, accessed November 26, 2025, https://www.imarcgroup.com/acetonitrile-pricing-report

- Tetrahydrofuran (THF) Price Index, Chart 2025 & Trend – IMARC Group, accessed November 26, 2025, https://www.imarcgroup.com/tetrahydrofuran-pricing-report

- Penicillin G Sodium Prices, Chart, News and Forecast – IMARC Group, accessed November 26, 2025, https://www.imarcgroup.com/penicillin-g-sodium-pricing-report

- US Penicillin G Sodium Prices Decline by 30 Dollars, Further Ease Anticipated in October, accessed November 26, 2025, https://www.chemanalyst.com/NewsAndDeals/NewsDetails/us-penicillin-g-sodium-prices-decline-by-30-dollars-further-ease-anticipated-39541

- Stealth BioTherapeutics Announces “Path Forward” Despite Disappointing Delay for Ultra-rare Barth Syndrome, accessed November 26, 2025, https://stealthbt.com/stealth-biotherapeutics-announces-path-forward-despite-disappointing-delay-for-ultra-rare-barth-syndrome/

- Update on U.S. regulatory review of subcutaneous amivantamab, accessed November 26, 2025, https://www.jnj.com/media-center/press-releases/update-on-u-s-regulatory-review-of-subcutaneous-amivantamab

- FDA Announces Real-Time Release of Complete Response Letters, Posts Previously Unpublished Batch of 89, accessed November 26, 2025, https://www.fda.gov/news-events/press-announcements/fda-announces-real-time-release-complete-response-letters-posts-previously-unpublished-batch-89

- DrugPatentWatch API, accessed November 26, 2025, https://www.drugpatentwatch.com/api.php

- The Unseen Connection: Turning Drug Patent Data into Supply Chain Gold, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/the-unseen-connection-turning-drug-patent-data-into-supply-chain-gold/

- Maximizing Growth: Pharma’s China-Plus-One Strategy – SpendEdge, accessed November 26, 2025, https://www.spendedge.com/biotechnology-pharmaceutical-life-sciences/why-pharma-industry-needs-to-take-china-plus-one-strategy-seriously/