The pharmaceutical and biotechnology industries stand at a pivotal juncture, facing a confluence of challenges that threaten traditional research and development (R&D) models. Despite record R&D investments, which now exceed $300 billion annually, the sector grapples with declining productivity and immense strain on budgets. For business professionals navigating this complex landscape, understanding these pressures is not just an academic exercise; it is a critical step toward strategic survival and sustained growth.

A Critical Juncture: Understanding the Pressures on Pharma R&D

The current environment for pharmaceutical R&D is characterized by several formidable headwinds. These challenges, if not addressed strategically, could severely impede the industry’s ability to deliver life-saving innovations and maintain profitability.

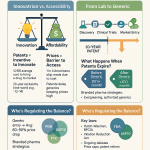

The Looming Patent Cliff and Revenue Erosion

One of the most immediate and significant threats facing the biopharmaceutical sector is the impending “patent cliff.” This phenomenon refers to the expiration of patents on high-profile, blockbuster drugs, which subsequently opens the market to lower-cost generic alternatives. Between 2025 and 2029, an estimated $350 billion of revenue is at risk due to these exclusivity losses. By 2030, drugs collectively worth $350 billion annually will face patent expirations, exerting immense pressure on revenue streams.

This massive loss of protected revenue is more than just a financial problem; it serves as a powerful catalyst for strategic re-evaluation across the entire enterprise. The sheer scale of the revenue at risk necessitates a robust pipeline of new, innovative therapies to fill the void. This situation compels companies to adopt a proactive, multi-faceted strategic response. It is not merely about finding any new drug, but rather about discovering highly profitable, novel drugs that can compensate for the impending revenue decline. This economic reality pushes companies towards aggressive strategies, including mergers and acquisitions (M&A) to acquire promising late-stage assets or innovative platforms , in-licensing agreements to gain rapid access to breakthrough innovations , and a renewed focus on internal R&D directed toward areas of high unmet medical need and novel mechanisms of action (MoAs) to secure new intellectual property . The patent cliff thus transforms from a singular financial threat into a powerful driver for industry-wide strategic transformation and accelerated innovation, making R&D a central competitive battleground.

Escalating Costs and Diminishing Returns on Investment

The cost of bringing a new drug to market continues its relentless ascent, averaging $2.229 billion in 2024, an increase from the previous year . Other analyses place this figure even higher, at $2.3 billion or $2.6 billion . These astronomical costs encompass the extensive expenses of conducting clinical trials, prolonged development timelines, and persistently decreasing success rates across the pipeline.

Compounding this, R&D margins are projected to decline significantly, from 29% of total revenue down to 21% by the end of the decade. The internal rate of return (IRR) for R&D investment, a key measure of profitability, plummeted to a trough of just 1.5% by 2019. However, recent data indicates a rebound, with the average forecast IRR for the top 20 drugmakers climbing back to 5.9% in 2024 .

This rebound in R&D IRR, despite the backdrop of rising costs, carries significant implications. It suggests that strategic, high-impact innovation can still deliver substantial value, but it also underscores the critical need for smarter capital allocation and rigorous risk mitigation. The recent uplift in IRR is heavily influenced by the success of “first-in-class” therapies, such as GLP-1 agonists. If GLP-1 assets were excluded from Deloitte’s model, the cohort’s 2024 IRR would have dropped from 5.9% down to 3.8%, and average peak-sales forecasts per asset would have been clipped from $510 million to $370 million . This stark difference highlights that “me-too” drugs are becoming less profitable, and that true innovation in areas of high unmet need is paramount. The industry is learning that simply increasing R&D spending is insufficient; the quality and strategic focus of that spending, coupled with efficient risk management, are essential for improving returns and sustaining innovation. This necessitates a “brave and bold” approach to scientific pursuits, funneling capital into novel mechanisms of action .

Persistent Attrition Rates and Prolonged Development Timelines

The pharmaceutical R&D pipeline is notoriously challenging, marked by persistently high attrition rates that act as a significant “sinkhole” for investment. The success rate for Phase 1 drugs has plummeted to just 6.7% in 2024, a sharp decline from 10% a decade ago. This means that a staggering amount of capital is expended on projects that ultimately fail. The industry collectively burned $7.7 billion on clinical trials for assets that were ultimately terminated in the most recent cycle . Indeed, it is estimated that only one in 5,000 investigational drugs ever makes it to human testing, and of those, only one ultimately receives regulatory approval .

Furthermore, the total development time for a drug, from Phase 1 to regulatory filing, now exceeds 100 months, representing a 7.5% increase over the past five years . These prolonged timelines exacerbate the financial burden and delay patient access to new therapies.

High attrition rates and prolonged timelines create a vicious cycle of increased cost and risk. This situation demands early, data-driven “go/no-go” decisions to ensure capital efficiency and pipeline velocity. The solution lies in embracing a “fail fast” and “fail cheap” philosophy. This requires smarter decision-making, leveraging data-driven strategies and artificial intelligence (AI) models to optimize trial designs and identify promising candidates earlier in the process . Trials need to be designed as critical experiments with clear success or failure criteria, rather than as exploratory fact-finding missions. The adoption of adaptive trial designs, which utilize modern statistical methods, can further reduce the number of participants required and expedite critical decisions . Crucially, companies must cultivate the discipline to terminate programs that do not demonstrate strong “Signs of Clinical Activity” (SOCA), as exemplified by Pfizer’s transformative approach . This strategic de-risking of the pipeline at every stage transforms potential failures into early learnings, freeing up resources for more promising ventures. The focus shifts from simply advancing drugs to strategically optimizing the flow of innovation, rather than merely managing individual assets.

Navigating Regulatory Complexities and Intense Market Competition

The regulatory landscape, while designed to ensure drug safety and efficacy, often presents a significant burden that contributes to declining R&D productivity. Increased regulatory requirements and the growing need for extensive research to meet payer demands add layers of complexity and cost to the development process . Simultaneously, the industry faces high barriers to market entry and intense clinical competition, making it challenging for new therapies to gain traction even if approved.

However, the regulatory environment is not solely a barrier; it also offers strategic “fast lanes” for truly innovative therapies that address high unmet medical needs. For instance, the FDA’s increased support for accelerated approval pathways resulted in 24 accelerated approvals and label expansions in 2024. While these pathways offer opportunities for faster market access, companies must balance speed with rigorous evidence generation to succeed in a competitive and tightly regulated environment.

Expedited pathways, such as Breakthrough Therapy designation, Orphan Drug designation, and Fast Track, are typically granted for drugs addressing serious conditions with significant unmet medical need . This incentivizes R&D in these challenging but potentially high-impact areas. Companies that can demonstrate significant clinical benefit early in development are rewarded with faster market access, which directly impacts revenue generation and competitive positioning. This means that regulatory strategy must become an integral part of R&D planning, rather than an afterthought. Companies should design trials and develop drug candidates with these regulatory “fast lanes” in mind, aligning R&D priorities with areas where regulatory incentives are strongest.

Why Revitalization is Not an Option, But a Strategic Imperative

The confluence of these challenges—patent cliffs, soaring costs, high attrition, and intense competition—paints a clear picture: incremental improvements are no longer sufficient. The biopharmaceutical industry must undergo a fundamental transformation to survive and thrive in the coming decades.

R&D is not merely a cost center; it is the indispensable engine of future growth and market leadership. The notion that cutting R&D spending to hit short-term margin targets is a viable strategy is a dangerous fallacy that jeopardizes future competitiveness . Sustained investment in science is non-negotiable for maintaining pipeline momentum and securing market leadership .

The long-term viability of a biopharma company is directly tied to its ability to continuously innovate and replenish its pipeline. In a patent-driven industry, market exclusivity is finite. Without a continuous stream of new, protected intellectual property, a company’s revenue base will inevitably erode. R&D is the primary mechanism for generating this new IP. Therefore, a stagnant R&D pipeline directly translates to a shrinking future revenue base and a loss of competitive positioning. This elevates R&D from a departmental function to a CEO-level capital allocation responsibility, as strategic investment in science directly impacts long-term shareholder value and market leadership . The “brave, bold” approach to science, focusing on areas of high unmet medical need and novel mechanisms of action , becomes a strategic necessity for survival and growth.

This statement from industry leaders underscores the strategic imperative of continuous R&D investment.

Strategic Pillars for R&D Revival: Charting a New Course

To navigate the complex challenges and seize emerging opportunities, pharmaceutical companies must embrace a multi-faceted approach to R&D pipeline revitalization. This involves a strategic shift across technology, collaboration, operational efficiency, and portfolio management.

| Strategic Pillar | Core Concept | Key Benefit |

| Data-Driven Discovery | Leverage AI/analytics for precision & speed | Accelerated R&D, Enhanced precision, Cost savings |

| Open Innovation & Partnerships | Collaborate externally for expertise & risk | Risk sharing, Diversified pipeline, Faster market access |

| Agility & Efficiency | Adopt Agile/Lean methodologies | Accelerated development, Waste reduction, Improved quality |

| Portfolio Reimagination | Focus on unmet needs & transformative science | Higher ROI, Sustainable profitability, Market leadership |

| Talent & Culture | Cultivate innovation mindset & bridge skill gaps | Sustained innovation, Enhanced collaboration |

Data-Driven Discovery: Unleashing the Power of AI and Advanced Analytics

In an era of finite budgets and intense competition, adopting data-driven strategies is no longer optional; it is paramount. Artificial intelligence (AI) and machine learning (ML) offer transformative potential to address the persistent challenges of high costs, lengthy timelines, and low success rates in drug discovery .

AI in Drug Discovery: From Target Identification to Lead Optimization

AI is revolutionizing drug development by significantly speeding up the discovery process, improving accuracy, and potentially saving billions of dollars . It has the capacity to slash development costs by identifying the most promising drug candidates early, thereby minimizing wasted resources, with potential savings estimated at up to $100 billion annually for the industry . At its core, ML models analyze vast datasets to identify potential drug candidates, predict their efficacy, and optimize their chemical structures .

The applications of AI span the entire drug discovery continuum:

- Target Identification: AI accelerates the discovery of relevant biological targets in disease through advanced computational analysis of biological datasets, including omics data (genomics, transcriptomics, proteomics) and network pharmacology . Natural Language Processing (NLP) extracts crucial insights from vast scientific texts to map complex molecular interactions, revealing previously overlooked targets.

- Lead Discovery & Optimization: AI-enhanced high-throughput screening (HTS) and virtual screening prioritize candidate molecules based on predicted properties, dramatically reducing the time and resources traditionally required . AI introduces an unmatched level of precision to drug design by analyzing molecular data and predicting how compounds will interact with the human body. This capability leads to the design of drugs that are more targeted, effective, and have fewer side effects .

- Preclinical Safety (ADMET & Toxicology): AI is highly influential in evaluating new drug candidates for safety, efficacy, toxicity, and pharmacological responses. It leverages diverse data and sophisticated architectures, such as Transformer-based models like ChemBERTa, to analyze molecular features for solubility and toxicity prediction, thereby reducing preclinical attrition rates .

The impact of AI extends far beyond mere efficiency gains; it fundamentally alters the scope of what is possible in drug development. By analyzing complex molecular data and predicting interactions with unprecedented precision, AI can enable the pursuit of previously “undruggable” targets, expanding the therapeutic landscape. This precision also facilitates the shift towards personalized medicine, where AI’s ability to analyze genetic profiles and health records allows for predicting which drugs are most likely to work for a given patient. This moves the industry beyond a “one-size-fits-all” approach to truly customized treatments, fundamentally changing the philosophy of treatment . AI is not just a tool for optimization; it is a transformative technology that redefines the boundaries of drug discovery, opening up new frontiers for patient benefit and market opportunity.

| R&D Stage | AI/ML Application | Key Benefit/Impact | Relevant Source(s) |

| Target Identification | Omics data analysis, Network pharmacology, NLP | Faster target ID, Uncovering novel targets | |

| Lead Discovery & Optimization | Virtual screening, AI-enhanced HTS, Precision design | Enhanced precision, Improved efficacy, Reduced side effects | |

| Preclinical Safety | Predictive toxicology, ADMET prediction | Reduced preclinical attrition, Proactive risk mitigation | |

| Clinical Trials | Patient stratification, Site selection, Real-time monitoring | Accelerated recruitment, Faster data collection, Cost-effective trials | |

| Drug Repurposing | Analyzing large datasets, Identifying new indications | Faster time-to-market, Reduced risk, Cost-effective new therapies |

Revolutionizing Clinical Trials with AI and Real-World Evidence (RWE)

Clinical trials, traditionally a bottleneck in drug development, are being revolutionized by the integration of AI and Real-World Evidence (RWE). AI significantly improves clinical trial efficiency by identifying the most suitable participants based on their medical histories and genetic data. This optimization enhances patient recruitment, speeds up data collection, and allows for real-time detection of issues . AI-driven models can identify drug characteristics, patient profiles, and sponsor factors to design trials that are more likely to succeed, shifting the paradigm from exploratory fact-finding to critical experimentation.

Real-World Data (RWD), which includes information routinely collected from sources like electronic health records (EHRs), medical claims data, and disease registries, is increasingly being leveraged. Real-World Evidence (RWE), derived from the analysis of RWD, is gaining significant traction and is routinely used by the FDA to support regulatory decisions, including approvals for new indications and satisfaction of post-approval study requirements .

Innovative trial designs, such as umbrella studies (investigating multiple therapies in a single study), Bayesian clinical trials (reducing participant numbers over time), and basket/multi-indication trials (efficiently testing novel therapies), further reduce the total number of required participants . RWE can even supplement participant data, enriching control arms and potentially reducing the need for large, traditional control groups .

The convergence of AI and RWE in clinical trials enables a more adaptive, patient-centric, and efficient development pathway. This transforms clinical development from a linear, resource-intensive process into a dynamic, data-optimized feedback loop. Instead of rigid, large-scale trials, AI can predict optimal designs and patient profiles, while RWE can “borrow” data for control arms, significantly reducing the number of patients needed and accelerating timelines. This approach also fosters patient-centricity through simpler protocols informed by patient-burden assessments, which in turn improves enrollment and engagement . Furthermore, AI allows for real-time performance tracking and dynamic adjustments to trial conduct, creating a continuous feedback loop for optimization . This integrated approach not only saves time and money but also makes trials more ethical (fewer patients exposed to experimental drugs), more representative (better patient matching), and ultimately, more successful in bringing essential treatments to market quicker.

The Promise of Drug Repurposing: A Faster, Cost-Effective Path to Patients

Drug repurposing, also known as repositioning or reprofiling, involves identifying new therapeutic uses for existing compounds. This strategy significantly reduces risks, saves time, and accelerates innovation because it leverages drugs that have already undergone extensive preclinical and clinical safety testing . This means much of the initial safety and toxicity data is already available, lowering the overall risk of failure compared to developing a completely new drug.

Historically, drug repurposing often occurred serendipitously. However, AI and advanced analytics are transforming this approach, moving it beyond chance discoveries to a data-driven, strategic science, especially for rare diseases and conditions without existing treatments . AI accelerates this process by analyzing large datasets and pinpointing potential new therapeutic applications for approved medications .

Successful Repurposing: Beyond Serendipity to Strategic Science

The history of drug development is replete with examples of successful repurposing, many of which have had a profound impact on patient care:

- Semaglutide (Ozempic/Wegovy): Initially developed for type 2 diabetes, this GLP-1 receptor agonist has since been approved for weight management and obesity treatment, with emerging research suggesting its potential for addressing alcohol and drug addiction .

- Sildenafil (Viagra): Originally investigated for heart conditions, it found a new life and widespread use in treating erectile dysfunction .

- Thalidomide: Despite its tragic past associated with severe congenital disorders, it was later repurposed and is now used under strict guidelines to treat certain cancers (e.g., multiple myeloma) and inflammatory conditions .

- Iproniazid: This monoamine oxidase inhibitor, initially tested for tuberculosis, serendipitously led to observed improvements in mood, appetite, and sleep in patients, thereby initiating the era of MOA inhibitors for depression .

- Fenfluramine: After being launched as an appetite suppressant in the 1960s and subsequently withdrawn, it was re-approved in the 2020s for seizures associated with Dravet syndrome and Lennox–Gastaut syndrome .

- COVID-19 Pandemic: The urgency of the pandemic underscored the value of repurposing. AI-driven efforts rapidly identified promising treatments like remdesivir and dexamethasone, demonstrating the transformative potential of this approach in public health emergencies .

Drug repurposing, amplified by AI, represents a strategic shift from pure de novo drug discovery to a more agile, risk-mitigated innovation model that can rapidly address unmet medical needs and public health crises. It allows companies to “de-risk” their pipeline by leveraging known safety profiles and existing data, making it a highly attractive investment in a high-attrition environment. This approach is particularly powerful for rare diseases, where traditional development is often cost-prohibitive, and for rapid responses to global health emergencies. This shifts R&D investment from solely long-shot, high-risk new chemical entities to a balanced portfolio that includes lower-risk, faster-to-market repurposed assets. Consequently, repurposing, especially with AI, is not just a secondary strategy; it is becoming a primary, strategic pathway for innovation, offering a competitive edge in speed-to-market and resource efficiency.

Beyond Internal Walls: Embracing Open Innovation and Strategic Partnerships

The traditional “Fully Integrated Pharmaceutical Company” (FIPCo) model, where most R&D activities are conducted in-house, is evolving. It is giving way to a “Fully Integrated Pharmaceutical Network” (FIPNet), which emphasizes collaboration and external knowledge sourcing . This paradigm shift recognizes that no single company can possess all the necessary expertise or resources to tackle the complexity of modern drug discovery.

The Strategic Value of In-Licensing and Out-Licensing Agreements

Life sciences licensing involves the transfer of specific rights to use, produce, or sell intellectual property (IP), allowing companies to leverage each other’s innovations, whether it is a drug formulation, a therapeutic active pharmaceutical ingredient (API), or a new healthcare technology . These agreements are not just transactional tools; they are strategic instruments for risk-sharing, accelerating market access, and addressing internal capability gaps, transforming R&D from a solitary pursuit to a collaborative ecosystem.

- In-Licensing: This occurs when a company (licensee) acquires rights from a licensor to develop and commercialize their IP, often involving royalties or upfront fees . This approach is highly advantageous for biotech companies needing access to breakthrough innovations or patented products. It offers an effective route to access cutting-edge IP and commercialize new drugs or healthcare solutions faster. By in-licensing a technology, companies can diversify their R&D pipelines, access new therapeutic areas, or extend their product range without starting from scratch . The significant increase in cross-border licensing deals, such as the 14 deals worth $18.3 billion completed by U.S. firms with Chinese biotechs in the first half of 2025, signals a strategic pivot toward aggressive in-licensing to accelerate innovation and reduce R&D costs .

- Out-Licensing: Conversely, out-licensing is when a company (licensor) grants rights to a licensee, expanding their reach without direct commercialization . Pharmaceutical companies frequently use out-licensing to monetize IP they developed but are not producing in-house. This strategy provides companies with revenue from royalties, allowing them to expand distribution and reach new markets through licensees, effectively leveraging their intellectual property for financial gain without the burden of direct manufacturing or marketing .

Beyond these primary forms, other types of licensing include exclusive versus non-exclusive agreements, patent versus technology licensing, field of use licensing, territory licensing, and sublicensing . Licensing allows companies to share the financial burden associated with R&D and regulatory compliance, particularly in expensive clinical trials. This de-risks individual projects and the overall pipeline. Accessing existing technologies and IP avoids years of independent development and substantial funding , directly addressing the challenge of prolonged timelines. Furthermore, companies can access expertise or resources they lack in-house, enabling expansion into new therapeutic areas or modalities without massive internal investment . Licensing is thus a dynamic portfolio management tool that allows companies to optimize their R&D spend, fill pipeline gaps, and respond rapidly to market opportunities, fostering a more flexible and capital-efficient innovation model.

Collaborative Models: From CROs to Public-Private Ventures

The pharmaceutical industry has seen a growing share of its R&D spending directed towards Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs). This outsourcing trend is projected to accelerate, with spending estimated to more than double the 2014 total within the next four years . This shift reflects a broader embrace of collaborative models that extend beyond traditional internal R&D.

Eli Lilly’s FIPNet (Fully Integrated Pharmaceutical Network) model exemplifies a holistic approach to open innovation, integrating outsourcing, open innovation-led R&D, and corporate venturing . Key initiatives under this model include:

- Chorus: Developed to explore alternative R&D approaches, Chorus operates on a “lean to proof of concept” (L2POC) model for de-prioritized internal projects. It leverages external experts and vendors for experimental design, drug delivery, manufacturing, toxicology, and clinical work, enabling a “Quick win fast fail” strategy that speeds up decisions and reduces costs .

- InnoCentive: An internet-based crowdsourcing platform, InnoCentive connects “Seekers” (companies with research problems) with “Solvers” (scientists offering solutions). This platform helped Lilly accelerate R&D and develop intermediate compounds at reduced costs by tapping into a global community of experts .

- TBDDI (Tuberculosis Drug Discovery Initiative): A not-for-profit public-private partnership (PPP), TBDDI involves collaborations with organizations like Merck and the Bill and Melinda Gates Foundation. Lilly contributes its compound library and research tools to accelerate early-stage TB drug discovery, demonstrating a commitment to shared scientific goals .

- Open Innovation Drug Discovery Program (PD2 & TD2): Under these programs, Lilly shares internal molecules and computational methods with external scientists (primarily academia and small biotechnology companies) for screening and optimization. Lilly retains priority negotiation rights for discoveries, fostering external research while benefiting from new insights .

AstraZeneca also demonstrates a strong commitment to open innovation. Since 2014, the company has forged 450 new collaborations across 40 countries, resulting in 425 preclinical studies planned or ongoing and 35 clinical trials planned or ongoing . They actively partner with academia and industry, sharing compound libraries and expertise to investigate ambitious research topics and identify active compounds .

Open innovation and strategic outsourcing are not just about cost reduction or capacity augmentation; they represent a fundamental redefinition of the R&D operating model. This approach enables access to diverse expertise, shared risk, and accelerated knowledge discovery in a hyper-competitive landscape. The shift to complex diseases and novel modalities (e.g., cell and gene therapies, antibody-drug conjugates) requires highly specialized skills that may not exist or be cost-effective to build in-house . CROs, CDMOs, and academic collaborations provide this expertise on demand. PPPs and open platforms allow companies to pool resources and share the financial and scientific risk of early-stage, high-uncertainty research. Crowdsourcing and sharing internal resources with external scientists can generate novel insights and identify promising candidates much faster than internal efforts alone, effectively reducing the “batch size” of experiment-based work . Furthermore, virtualized R&D models minimize internal infrastructure buildup, allowing companies to scale R&D capacity up or down more flexibly . The future of R&D is increasingly networked, and companies that master the art of external collaboration and leverage diverse ecosystems of innovation will gain a significant competitive advantage in terms of speed, cost, and scientific breadth.

Navigating Mergers & Acquisitions: Preserving Value and Integrating Legacy Data

Increased M&A activity is a prominent strategy for pharmaceutical and biotech companies to address patent cliffs, expand pipelines, and gain access to innovative technologies . M&A is expected to drive growth, facilitate entry into new markets, and secure access to emerging technologies like cell and gene therapy and AI-enabled R&D .

However, these transactions come with significant challenges, particularly concerning IT infrastructure. Post-merger, IT systems, especially in R&D environments, rarely align, leading to duplicated and incompatible systems such as Electronic Lab Notebooks (ELNs), Laboratory Information Management Systems (LIMS), and data warehouses . Without a clear plan, valuable experimental, clinical, and regulatory data can be lost, or outdated systems may be kept running indefinitely, draining IT budgets and introducing compliance risks .

The preservation of legacy data is crucial for several reasons: it is critical for compliance with regulatory bodies, essential for intellectual property (IP) defense, and holds significant scientific value for future experiments, modeling, or AI applications . Relying on “tribal knowledge,” where only former employees know how to find or interpret key data, is unsustainable . Modern, life sciences-focused digital preservation strategies are therefore essential to ensure that data remains structured, searchable, and usable for future applications .

The impact of M&A on R&D success rates is complex. Merged and acquired companies have shown higher Phase I and Phase III failure rates compared to industry benchmarks, despite often increasing R&D spending . This could be attributed to integration uncertainty, particularly personnel turnover, and other resource allocation issues .

While M&A is a powerful tool for pipeline expansion, its success hinges on meticulous post-merger integration, particularly in preserving and leveraging legacy R&D data. This data is not just an asset; it can be a significant liability if mishandled. Losing this institutional memory of scientific discovery means losing the evidentiary trail for patents and regulatory filings, the foundational basis for future experiments and AI applications, and the ability to meet compliance requirements for long-term record keeping. Mishandling this data can lead to costly legal battles, regulatory penalties, and a diminished ability to innovate. The observed higher failure rates post-M&A could be a direct consequence of disrupted R&D continuity and lost knowledge. For M&A to truly revive an R&D pipeline, the integration strategy must prioritize a robust digital preservation plan for scientific data, transforming potential “hidden risks” into long-term value.

Agility and Efficiency: Transforming Operations with Lean and Agile Methodologies

Pharmaceutical companies are increasingly adopting Agile and Lean mindsets to become more competitive, lower development costs, and increase speed to market . These methodologies, though originating outside the biopharma sector, offer powerful frameworks for optimizing R&D processes.

Cultivating an Agile Mindset in R&D: Accelerating Development Cycles

Agile, initially developed for software development, provides a flexible approach that helps overcome the “slow, sequential steps that can stifle innovation” often found in traditional R&D . It fundamentally increases collaboration, improves communication, and enables teams to spot and resolve development obstacles early, before they escalate into significant problems .

A compelling example of Agile’s impact comes from a pharmaceutical company that managed to double its R&D capacity without needing new resources or investment simply by extending Agile practices to over a dozen departments . Key aspects of Agile implementation include daily progress meetings, akin to Scrum-like standups, and breaking down traditional silos to form cross-functional teams. This restructuring can dramatically reduce the time required for complex processes; for instance, one global pharma company reduced the time to create and implement a brand strategy from over two years to just 90 days by reducing team sizes from 40+ members to 8-12 .

Despite these benefits, implementing Agile practices in pharma R&D presents challenges. Employees are often highly specialized and comfortable in siloed work environments, and company cultures can be rigid, prioritizing stability over experimentation . Successful implementation typically requires an end-to-end redesign of processes to minimize hand-offs and improve workflow .

According to McKinsey, critical success factors for Agile pharma implementation include: a strong vision for the goals and expected changes; a dedicated team to manage and communicate cultural shifts; supporting the development of new skills (e.g., in analytics, clinical trial design, and vendor management); and continuous course correction guided by Key Performance Indicators (KPIs) .

Agile’s true power in pharma R&D lies in its ability to foster an experimentation culture and rapid decision-making, directly combating the inherent uncertainty and high failure rates of drug development. Drug discovery is a process of hypothesis testing with a high probability of failure. Agile’s “fail fast” mentality, iterative cycles (which can be seen as reducing the batch size of experiments), and continuous feedback loops (like daily progress meetings) are perfectly suited to this environment. This approach encourages early identification of non-viable paths, saving significant resources. The shift to cross-functional teams breaks down knowledge silos, allowing for more holistic problem-solving and faster decision-making, which is critical when rapid decision-making is a key success factor . Pfizer’s “Dare to Try” program exemplifies this experimentation culture, combining Agile software tools, training, and cross-functional collaboration . Agile is not just a project management methodology; it is a cultural and operational transformation that aligns R&D processes with the scientific reality of drug development, turning uncertainty into a managed opportunity for learning and adaptation.

Lean Principles for Streamlined Development and Waste Reduction

Lean manufacturing principles, first developed for the automotive sector, are equally applicable to pharmaceuticals to streamline processes, reduce waste, and enhance value . These principles can be adapted to optimize R&D workflows, leading to significant efficiencies.

The core principles of Lean manufacturing, as applied to pharmaceuticals, include:

- Value Identification: Understanding what the end-users—patients, healthcare providers, and regulators—value most. This guides R&D efforts to focus on delivering what truly matters .

- Value Stream Mapping: Analyzing the flow of materials, processes, and information during R&D to identify bottlenecks, redundancies, and non-value-adding steps. Resolving these issues improves efficiency .

- Continuous Flow: Maintaining smooth and uninterrupted processes, minimizing delays and aligning R&D activities with strategic goals. This ensures each step transitions smoothly without significant wait times .

- Pull System: In R&D, this translates to advancing projects or conducting experiments only when there is a clear demand or need, avoiding unnecessary work or “overproduction” of data that does not directly contribute to a decision .

- Perfection (Kaizen): Fostering a culture of continuous improvement, regularly reviewing and updating R&D processes, systems, and quality. This involves cross-functional teams identifying improvement opportunities .

Implementing these principles can lead to multi-fold benefits: high efficiency through streamlined processes, reduced waste by avoiding overproduction and optimizing resource utilization, reduced costs through waste minimization, improved product quality by reducing variability and defects, and increased adaptability to market and regulatory changes .

Applying Lean principles to R&D extends beyond manufacturing, enabling the identification and elimination of “waste” in the scientific process itself. In R&D, waste can manifest as redundant experiments, unnecessary hand-offs between teams, prolonged decision cycles, flawed experimental designs, or scientists spending excessive time searching for data. By applying value stream mapping to the R&D pipeline, companies can identify these non-value-adding steps, streamline workflows, and ensure that every activity directly contributes to advancing a promising candidate or generating critical insights. This directly impacts the “productivity” metric (output per input) that the industry struggles with . Lean principles thus provide a framework for optimizing the flow of scientific knowledge and decision-making within R&D, ensuring that resources are directed efficiently towards high-value activities, accelerating discovery, and ultimately, improving the return on R&D investment.

Portfolio Reimagination: Focusing on “Right-to-Win” and Unmet Medical Needs

To thrive amidst intense competition, pharmaceutical companies must carefully assess where they have a “right-to-win” and strategically build and sustain leading portfolios. This requires a fundamental reimagining of the R&D portfolio.

Prioritizing Transformative Science and Novel Modalities

The industry is strongly urged to funnel capital into “areas of high unmet medical need” and to pioneer novel mechanisms of action (MoAs) . Despite this imperative, only 32% of biopharma executives surveyed plan to prioritize transformative science over “me-too” drugs, highlighting an “open goal” for companies willing to be genuinely bold.

Therapeutic areas characterized by high incidence, mortality, and significant quality-of-life deficits naturally attract more research funding due to the potential for enormous public health impact. Examples include oncology and neurological disorders, which continue to see substantial resource allocation . The maturation of technologies such as high-throughput screening, genomics, proteomics, and advanced imaging further facilitates the development of precision medicine in these complex areas .

A strategic shift towards “first-in-class” science and novel modalities, driven by unmet medical need and technological advancements, is essential not only for scientific breakthroughs but also for securing sustainable market leadership and premium pricing in a competitive landscape. “Me-too” drugs typically face intense competition and pricing pressure, leading to diminishing commercial performance. In contrast, transformative, first-in-class therapies, especially for high unmet needs, command premium pricing and market exclusivity, delivering significantly higher IRRs and peak sales. The success of GLP-1s, for instance, dramatically illustrates this point . This strategic focus is about securing a “right-to-win” in a crowded market by creating new market segments or dominating existing ones with superior efficacy. Technological and scientific advances, such as genomics and precision medicine, enable this by making previously intractable diseases addressable . Therefore, portfolio strategy must evolve from simply filling slots to actively seeking and investing in truly disruptive innovations that redefine treatment paradigms, ensuring long-term profitability and patient impact.

Learning from Blockbusters: The GLP-1 Phenomenon and Beyond

The success of GLP-1 agonists in diabetes and obesity has been nothing short of phenomenal. This class of drugs significantly boosted the industry’s R&D IRR, with Deloitte’s analysis showing that if GLP-1 assets were excluded, the cohort’s 2024 IRR would have dropped from 5.9% to 3.8% . Similarly, average peak-sales forecasts per asset would have been clipped from $510 million to $370 million . The revenue mix also reflects this profound impact: obesity’s share of forecast sales rocketed from 1% in 2022 to 16% in 2024, while oncology’s share slipped from 32% to 26%. This phenomenon vividly demonstrates the upside of breaking ranks and venturing into therapeutic areas that others may have overlooked or underestimated.

The GLP-1 phenomenon illustrates that bold, contrarian bets on novel mechanisms in overlooked or evolving therapeutic areas, even those outside traditional “hot” fields like oncology, can yield disproportionately high returns and reshape market dynamics. While oncology remains a crowded house in terms of R&D attention , the GLP-1 success highlights the value of thinking “contrarian” and identifying untapped “white space”. This is not just about finding a new drug; it is about identifying a new market opportunity or a new therapeutic approach to a widespread condition. Furthermore, GLP-1s also demonstrate “knock-on benefits to multiple disease indications, such as NASH, cardiovascular disease, and Alzheimer’s”. This shows how a single innovative platform can generate multiple revenue streams and expand market reach. Companies should therefore cultivate a culture that encourages bold, unconventional thinking and rigorous market analysis to identify emerging trends and therapeutic areas with high, untapped commercial potential, rather than solely following established industry trends.

The Human Element: Cultivating a Culture of Innovation and Excellence

Even the most advanced technologies and sophisticated strategies are only as effective as the people and culture driving them. Revitalizing an R&D pipeline fundamentally depends on nurturing the human capital within the organization.

Bridging the Skill Gap: Strategic Workforce Planning for Future R&D

A significant challenge facing the biopharmaceutical industry is a structural mismatch between the supply and demand for critical R&D skills. Demand for digital skills, particularly in AI and digital trial enablement, has increased two to three times over the past five years, while the demand for foundational skills like chemical synthesis and statistical analysis has remained steady . Although the absolute number of professionals with AI/ML skills is growing (a 26% increase from 2023 to 2024), the overall talent pool is only growing by 15% . This disparity creates a widening skill gap.

Strategic workforce planning is essential for getting the right talent in the right place to meet the demands of an evolving R&D portfolio . This proactive approach involves defining future demand for capabilities and roles based on the portfolio’s evolution and implementing a comprehensive strategy to measure and secure critical skills, especially in areas where competition for talent is high . This encompasses sourcing specific capabilities for emerging modalities (e.g., cell and gene therapy) and ensuring expertise in foundational skills (e.g., IT infrastructure, experience design) .

Sustaining the workforce requires offering clear, achievable career trajectories and fostering a culture of continuous learning and development to enhance employee satisfaction and retention . Building the workforce involves investing in programmatic and comprehensive learning journeys that move away from episodic interventions towards continuous learning. This includes coaching managers on required capabilities, empowering and challenging teams, fostering collaboration, and supporting the whole person. Managers must be held accountable for their role in developing talent . Empowering R&D professionals with learning tools and access to experts can also enhance their ownership of development, creating a robust development ecosystem .

The growing skill gap in digital and emerging R&D areas is not just an HR challenge; it is a strategic bottleneck that can impede pipeline revitalization. If companies cannot acquire or develop the necessary digital and specialized skills, their ambitious AI-driven drug discovery and clinical trial optimization strategies will remain theoretical. This creates a critical impediment to pipeline velocity. The solution extends beyond external recruitment; it requires a comprehensive “fit-for-purpose strategy” that includes upskilling existing talent, fostering a discovery mindset where fear of failure is reduced, equipping managers to develop talent, and breaking down silos through cross-functional teams to share knowledge and build collective expertise . Talent management is a strategic imperative for R&D. Companies that proactively invest in and cultivate the right skills and a supportive environment will be better positioned to leverage new technologies and accelerate their pipelines.

Fostering Cross-Functional Collaboration and an Experimentation Culture

Cross-functional collaboration, which involves combining expertise from various departments such as R&D, marketing, medical affairs, and sales, is crucial for creating unified strategies and ensuring regulatory compliance . This integrated approach ensures that sales teams can communicate accurate, evidence-based information to healthcare providers, while marketing teams develop compelling messaging strategies .

Effective collaboration is supported by various tools and strategies: AI-powered analytics (e.g., ACMA’s medaffairsAI) can analyze data trends to enable personalized customer interactions and provide actionable insights . Frequent cross-functional meetings promote openness, stimulate idea sharing, and help resolve disputes . Establishing joint Key Performance Indicators (KPIs) ensures that all departments strive for the same goals, and collaboration platforms facilitate easy task management and communication, especially for global teams .

Breaking down rigid silos and forming cross-functional working groups significantly increases organizational agility, transparency, and employee engagement . Pfizer, for example, developed an experimentation culture through its “Dare to Try” program, which combines Agile software tools, training, and cross-functional collaboration .

A culture that embraces experimentation and cross-functional collaboration is the bedrock of sustained R&D innovation, transforming setbacks into learning opportunities and accelerating the translation of scientific insights into patient solutions. In drug discovery, failure is an inherent part of the process; as Thomas Edison famously stated, “I have not failed. I’ve just found 10,000 ways that won’t work” . A culture of experimentation normalizes these setbacks as learning opportunities, encouraging scientists to “dare to try” new approaches without fear of chastisement . Cross-functional teams ensure that insights from R&D, clinical, regulatory, and commercial are integrated early, leading to more robust drug candidates and patient-centric solutions. This reduces duplicated efforts and conflicting messages, streamlining processes and maximizing impact . It is about fostering collective intelligence and shared accountability. The “soft” aspects of culture and collaboration are, in fact, “hard” drivers of R&D productivity. Companies that can effectively foster an environment where diverse perspectives are valued, failures are learned from, and teams work seamlessly across functions will significantly enhance their capacity for sustained innovation.

Competitive Intelligence: Turning Patent Data into Strategic Advantage

For business professionals, leveraging patent data is not merely a legal or administrative task; it is a critical component of competitive intelligence that can provide profound strategic advantage.

Decoding the Landscape: Patent Data as Strategic Market Intelligence

Patent data serves as a powerful window into future market developments. Each patent application signals a company’s intent to bring something new into the market or protect an emerging technology, often years before products or services come to fruition . By continuously monitoring patent filings within an industry, companies can predict upcoming shifts in market demand, anticipate customer needs, and identify areas that will offer long-term profitability and market relevance .

This proactive approach helps uncover competitors’ moves, technological focus areas, and potential market expansions. By closely following the patent filings of key competitors, companies can obtain early warning signals of their upcoming innovations, allowing R&D teams to adjust their own innovation roadmap, avoid direct competition, or strategically position their product development to respond to or counter those moves .

Patent data, when analyzed strategically, transforms from a legal formality into a proactive competitive intelligence tool, providing a predictive roadmap of the industry’s future and enabling “right-to-win” portfolio decisions. By tracking patent activity across therapeutic areas or technologies, companies can forecast emerging trends and allocate R&D resources to high-growth areas before they become crowded. This process helps identify “white spaces” or patent gaps for innovation . Understanding a competitor’s patent portfolio (e.g., broad diversification versus narrow focus) can reveal their broader business strategy, allowing for tailored R&D efforts or even pre-emptive M&A or licensing moves . Furthermore, proactive Freedom to Operate (FTO) analysis based on patent data can prevent costly infringement lawsuits by allowing companies to design around existing patents or negotiate licenses early in R&D . Patent intelligence is not just defensive (protecting IP) but offensive (informing strategic R&D and market entry). It allows companies to shape their future rather than merely react to it.

| Benefit Category | Specific Advantage | How Patent Data Enables It |

| Strategic Market Intelligence | Predicts market shifts & emerging trends | Analyzing filing trends, identifying new technology areas |

| Competitive Foresight | Uncovers competitor roadmaps & focus areas | Monitoring competitor patent portfolios, analyzing their IP strategy |

| Risk Mitigation | Ensures Freedom to Operate (FTO) | Proactive FTO analysis, identifying potential infringement risks |

| Innovation Enhancement | Identifies patent gaps & white spaces | Patent mapping, cross-referencing existing IP with emerging fields |

| IP Portfolio Strengthening | Attracts investment, secures market dominance | Demonstrating robust IP protection, strategic portfolio expansion |

Proactive IP Management: Protecting and Expanding Your Portfolio

A strong patent portfolio is a powerful magnet for investors, providing crucial assurance that a company’s innovations are protected and that there is a clear pathway to market exclusivity and profitability . Patents are essential for establishing and maintaining a competitive position in the market, preventing competitors from developing and marketing similar products, thereby allowing the patent holder to dominate the market for the duration of the patent term, typically 20 years from the filing date . Strategic approaches, such as utilizing Supplementary Protection Certificates (SPCs) in regions where they are offered, can extend the effective patent life, allowing companies to maximize their return on investment .

Proactive IP management, informed by continuous patent intelligence, is a dynamic process that extends beyond initial filing to encompass strategic lifecycle management, portfolio optimization, and continuous adaptation to competitive and technological shifts. This requires strategic timing of patent filings to maximize effective market exclusivity . It also necessitates continuous monitoring of competitor filings and market activities to anticipate threats and opportunities . Furthermore, it involves portfolio optimization, identifying areas of strength and weakness in the patent portfolio and strategically expanding or pruning it, including identifying “patent gaps” for new innovation . This dynamic approach ensures that IP is a living asset that provides sustained competitive advantage and underpins the long-term health of the R&D pipeline.

Leveraging DrugPatentWatch for Unparalleled Insights and Competitive Edge

DrugPatentWatch stands as a leading global biopharmaceutical business intelligence platform, providing accurate, actionable, and timely intelligence essential for making informed strategic decisions . It offers a fully integrated database of drug patents and other critical information, incorporating data directly from the US FDA, Patent and Trademark Office, and various other global data sources .

Identifying Market Entry Opportunities and Patent Expirations

DrugPatentWatch provides comprehensive data on patent expirations, allowing users to search by year or by patent number . This feature is invaluable for generic manufacturers, enabling them to identify market entry opportunities by knowing precisely when branded drugs will lose exclusivity. Conversely, it allows branded companies to anticipate competition and proactively plan for the impact of generics . The platform also enables businesses to identify first-time generic entrants and anticipate future formulary budget requirements for healthcare payers .

DrugPatentWatch transforms raw patent expiration data into actionable intelligence, allowing both generic and branded companies to proactively strategize market entry, portfolio adjustments, and lifecycle management. This directly impacts revenue forecasting and R&D investment decisions. For generic companies, knowing patent expiration dates is critical for planning R&D, manufacturing, and regulatory filings to be first-to-market. For branded companies, this data allows for proactive lifecycle management strategies, such as developing new formulations, combinations, or indications to extend exclusivity, or preparing for the inevitable revenue dip. This is not just about a date; it is about a strategic window of opportunity or vulnerability. DrugPatentWatch empowers businesses to move from reactive responses to patent expirations to proactive, data-driven strategic planning that optimizes market potential and mitigates revenue risk.

Monitoring Litigation and Competitor Activities

Beyond static data, DrugPatentWatch offers dynamic, real-time competitive intelligence. The platform provides detailed data on litigation, including Paragraph IV challenges, which are critical for understanding generic challenges to branded drugs. It also facilitates monitoring of competitor patent filings and broader market activities . Users can set up daily email alerts and access global coverage of patents from over 130 countries, ensuring they are always informed of the latest developments .

This real-time monitoring capability translates into a significant strategic edge for R&D and business development. Litigation data, such as Paragraph IV challenges, reveals which generic companies are targeting specific branded drugs, allowing innovators to prepare their defense or settlement strategies. Monitoring competitor patent filings provides early signals of their R&D investments, therapeutic focus, and potential new product launches, enabling proactive adjustments to one’s own R&D pipeline—for example, pivoting away from crowded areas or accelerating a competing asset. The global coverage and alert system ensure that companies are not caught off guard by international developments. DrugPatentWatch thus acts as a strategic radar, providing the granular, timely intelligence needed to navigate the complex competitive and legal landscape of the pharmaceutical industry, ensuring that R&D decisions are made with a full understanding of the external environment.

Case Studies in Revival: Lessons from Industry Leaders

Examining the journeys of industry leaders who have successfully revitalized their R&D pipelines offers invaluable blueprints for other organizations facing similar challenges.

Pfizer’s R&D Turnaround: A Blueprint for Success

Over the past decade, Pfizer has achieved a remarkable turnaround in its R&D productivity. By the end of 2020, the company boasted an industry-leading clinical success rate of 21%, a tenfold increase from a mere 2% in 2010, and significantly above the industry benchmark of approximately 11% . This improvement was achieved without compromising scientific innovation, as 75% of Pfizer’s approvals between 2016 and 2020 received at least one expedited regulatory designation, such as Breakthrough Therapy .

Pfizer’s R&D productivity turnaround was driven by a multi-pronged strategy emphasizing three key aspects:

- Biology: A deeper understanding and sharpened focus on scientific foundations and expertise in specific therapeutic areas led to strong success rates and innovative programs .

- Modalities: Diversification of drug modalities, while maintaining core capabilities in small molecules, expanded the range of potential drug targets .

- Decision-making: Enhanced objective and quantitative methods, including the pivotal “Signs of Clinical Activity (SOCA)” paradigm, enabled rapid progression of strong programs and early termination of weaker ones .

The SOCA paradigm is an evolution of a prior framework, built on retrospective analysis, that stipulated three fundamental elements for a development candidate to have potential for a desired pharmacological effect: exposure at the site of action, binding to the pharmacological target, and expression of pharmacological activity from the site of action. The current SOCA framework prospectively uses either Proof of Mechanism (POM) and/or Early Signal of Efficacy (ESOE) as stage gates for further clinical investments. Each early clinical development program is expected to have a SOCA strategy and prespecified target values that are reviewed and agreed upon before initiating relevant studies. This paradigm aims to answer crucial questions quickly and efficiently, leading to informed go/no-go decisions or significantly increasing confidence in the investigational product while minimizing parallel investments. Pfizer has systematically applied this paradigm across its entire early drug development portfolio.

A compelling example is the oral glucagon-like peptide-1 (GLP-1) Danuglipron for type 2 diabetes mellitus and obesity, which was accelerated by 12 months due to strong ESOE data and the use of Model Informed Drug Development (MIDD) . Conversely, the anti-myostatin antibody domagrozumab for Duchenne muscular dystrophy failed because it progressed without clear POM or SOCA, leading to a longer, more expensive trial that could have been de-risked earlier .

This R&D turnaround also laid the foundation for the “lightspeed” progression of the Pfizer-BioNTech COVID-19 vaccine (COMIRNATY). Pfizer’s vaccine portfolio historically had a strong end-to-end development success rate (56% as of year-end 2020). The “lightspeed” paradigm, characterized by effective and nimble decision-making, streamlined governance, full funding from inception, and parallel R&D activities, enabled the rapid development and approval of the COVID-19 vaccine in just 221 days from the start of First-in-Human (FIH) studies. This approach is now being applied to other key programs, such as the COVID-19 oral antiviral treatment candidate, Paxlovid.

Pfizer’s turnaround demonstrates that a disciplined, data-driven decision-making framework (SOCA) combined with strategic focus and an agile operational model (“Lightspeed”) can fundamentally transform R&D productivity. This approach turns high failure rates into opportunities for rapid learning and acceleration. Pfizer’s success was not random; it was systematic. The SOCA paradigm directly addresses the “attrition sinkhole” . By establishing clear, early scientific and efficacy hurdles, they forced early “go/no-go” decisions, preventing costly late-stage failures, which aligns perfectly with the “fail fast” principle. The “Lightspeed” paradigm further illustrates that when scientific confidence is high (due to strong SOCA), traditional sequential processes can be compressed through parallelization and streamlined governance, accelerating time to market significantly. This proves that strategic decision-making and operational agility are as crucial as scientific breakthroughs. Pfizer provides a compelling blueprint for other companies struggling with R&D productivity, underscoring the importance of integrating scientific rigor with operational discipline and a culture that prioritizes early, informed decision-making to de-risk and accelerate the pipeline.

AstraZeneca’s Innovation Journey: A Commitment to Open Science

AstraZeneca’s journey offers another powerful lesson in R&D revitalization. During a challenging period in the early 2010s, the company notably resisted investor pressure to reduce R&D spending. Instead, it made a strategic decision to increase its focus on innovation, a long-term commitment that ultimately resulted in AstraZeneca becoming a global oncology leader with a redefined portfolio of drugs.

This unwavering commitment to R&D is complemented by a robust open innovation strategy. Since 2014, AstraZeneca has established 450 new collaborations across 40 countries, leading to 425 preclinical studies planned or ongoing and 35 clinical trials planned or ongoing . The company actively partners with academia and industry, sharing compound libraries and expertise to investigate ambitious research topics and identify active compounds . These collaborations bring mutual benefits, contributing new insights to diverse areas of science .

AstraZeneca’s journey exemplifies that a sustained, contrarian commitment to R&D investment, coupled with a robust open innovation strategy, can lead to long-term market leadership and a redefined, high-impact portfolio, even in periods of financial pressure. The company’s decision to prioritize “innovation funding” as “non-negotiable” during a challenging period was a bold, contrarian move that yielded significant returns. This sustained investment allowed them to build deep scientific capabilities and a robust pipeline. Open innovation then amplified this by expanding their reach to external expertise and diverse research topics globally . It also facilitated resource pooling, where sharing compound libraries and data reduced individual R&D burdens and accelerated discovery. Furthermore, leveraging external insights helped de-risk targets or compounds earlier in the development process. This demonstrates that long-term vision and strategic capital allocation to R&D, even when it is difficult, coupled with a proactive embrace of external collaboration, are critical for building a resilient, innovative pipeline and achieving sustained market leadership.

Key Takeaways

The revitalization of a pharmaceutical R&D pipeline is a complex but essential endeavor for sustained success in a rapidly evolving industry. Several critical themes emerge from the analysis:

- R&D is the Lifeblood: The pharmaceutical R&D pipeline is not merely a cost center but the indispensable engine for future growth and market leadership. It demands C-suite level strategic attention to overcome formidable challenges such as patent cliffs, escalating costs, and persistently high attrition rates.

- Data as the New Discovery Engine: Artificial intelligence and advanced analytics are fundamentally transforming every stage of drug development. From accelerating target identification and optimizing lead compounds to revolutionizing clinical trials and facilitating drug repurposing, these technologies offer unprecedented precision, efficiency, and the ability to tackle previously “undruggable” diseases.

- Embrace the External Ecosystem: Open innovation, strategic licensing (both in-licensing and out-licensing), and robust partnerships with Contract Research Organizations (CROs), Contract Development and Manufacturing Organizations (CDMOs), and academic institutions are essential. These collaborations diversify pipelines, share risks, provide access to specialized expertise, and accelerate market access.

- Agility and Lean for Velocity: Adopting Agile and Lean methodologies in R&D can significantly accelerate development cycles, improve cross-functional collaboration, and eliminate waste. This fosters a culture of rapid experimentation and continuous improvement, crucial for navigating the inherent uncertainties of drug discovery.

- Strategic Portfolio Reimagination: Prioritizing “first-in-class” science, novel modalities, and areas of high unmet medical need, informed by astute market foresight (as exemplified by the GLP-1 phenomenon), is crucial for securing a “right-to-win” in competitive landscapes and ensuring sustainable profitability.

- Talent and Culture are Paramount: Bridging skill gaps through strategic workforce planning, fostering cross-functional collaboration, and cultivating an experimentation-driven culture are fundamental human elements. These underpin successful R&D revitalization, transforming setbacks into learning opportunities and accelerating the translation of scientific insights into patient solutions.

- Patent Data: Your Strategic Compass: Leveraging specialized tools like DrugPatentWatch to decode the patent landscape provides invaluable competitive intelligence. This enables proactive intellectual property management, identification of market entry opportunities, and informs agile R&D strategy, ensuring a sustained competitive edge.

Frequently Asked Questions (FAQ)

What are the primary indicators that a pharmaceutical R&D pipeline needs revitalization?

Key indicators that a pharmaceutical R&D pipeline requires revitalization include a declining R&D Internal Rate of Return (IRR), consistently high attrition rates in early and late-stage clinical trials (e.g., a Phase 1 success rate plummeting to 6.7% in 2024). Other signs include prolonged development timelines, now exceeding 100 months from Phase 1 to filing , a significant portion of future revenue at risk from upcoming patent expirations (estimated at $350 billion between 2025 and 2029) , and a noticeable lack of “first-in-class” or transformative assets in late-stage development. Strained R&D budgets and increasing costs per new drug approval further signal a critical need for strategic intervention .

How can AI specifically help reduce the high costs associated with drug development?

AI significantly reduces drug development costs by optimizing processes across the R&D continuum. In early-stage development, it uses predictive models to identify the most promising drug candidates more efficiently, thereby minimizing wasted resources on less viable compounds. In clinical trials, AI enhances efficiency by identifying suitable participants more quickly, speeding up data collection, and enabling real-time detection of issues. This leads to faster, more cost-effective trials. The industry could potentially save up to $100 billion annually through AI-driven efficiencies .

What is the role of “open innovation” in modern pharmaceutical R&D, and how does it differ from traditional outsourcing?

Open innovation in modern pharmaceutical R&D goes beyond traditional outsourcing by actively seeking and integrating external ideas, expertise, and resources into the R&D process. This transforms a company from a “Fully Integrated Pharmaceutical Company” (FIPCo) into a “Fully Integrated Pharmaceutical Network” (FIPNet) . While outsourcing typically involves contracting out specific tasks (e.g., to CROs or CDMOs for capacity augmentation), open innovation fosters deeper collaborations, shared risk, and co-creation of intellectual property. Examples like Eli Lilly’s Chorus and InnoCentive platforms or AstraZeneca’s extensive collaborations demonstrate how it accelerates discovery, provides access to specialized expertise, and de-risks the pipeline by leveraging a broader scientific ecosystem.

Why is patent data considered a “strategic compass” for R&D, and how can business professionals leverage it?

Patent data is considered a “strategic compass” for R&D because it provides early, actionable intelligence on market trends, competitor activities, and innovation landscapes years before products reach the market . Business professionals can leverage it to:

- Predict Market Shifts: Identify emerging technologies and therapeutic areas with increased patent activity.

- Uncover Competitive Moves: Gain insights into competitors’ R&D focus, potential product launches, and broader business strategies.

- Identify Patent Gaps: Discover underserved areas with low patent saturation that present novel innovation opportunities.

- Mitigate Risks: Conduct Freedom to Operate (FTO) analyses to avoid potential infringement and inform licensing decisions early in the R&D process.

Tools like DrugPatentWatch are crucial for collecting, analyzing, and transforming this raw data into a competitive advantage, informing portfolio management and market entry strategies .

How does a “fail fast” approach, often associated with Agile methodologies, contribute to R&D productivity in an industry with high attrition rates?

In an industry where only one in 5,000 investigational drugs makes it to approval and Phase 1 success rates are as low as 6.7% , a “fail fast” approach is crucial for R&D productivity. It means designing experiments and development pathways to quickly and cost-effectively validate or invalidate hypotheses. By making early, data-driven “go/no-go” decisions (as exemplified by Pfizer’s SOCA paradigm) , companies avoid sinking significant resources (e.g., $7.7 billion burned on terminated clinical trials) into projects that are likely doomed. This approach frees up valuable capital and human talent to be reallocated to more promising candidates, thereby accelerating the overall pipeline velocity and significantly improving the return on R&D investment.

References

- Biopharma RD Faces Productivity And Attrition Challenges In 2025, accessed July 16, 2025, https://www.clinicalleader.com/doc/biopharma-r-d-faces-productivity-and-attrition-challenges-in-2025-0001

- Predicting Drug Market Potential – DrugPatentWatch – Transform …, accessed July 16, 2025, https://www.drugpatentwatch.com/blog/predicting-drug-market-potential/

- Legacy Data in Pharma M&A: A Hidden Risk with Long-Term Impact …, accessed July 16, 2025, https://www.sciy.com/en/blog/legacy-data-in-pharma-m-a-a-hidden-risk-with-long-term-impact.html

- Life Sciences Licensing Agreements Guide: Key Types & Strategies, accessed July 16, 2025, https://www.excedr.com/blog/life-sciences-licensing-agreements-guide

- From 1.5% to 5.9%: Deloitte explores what’s fueling Big Pharma’s …, accessed July 16, 2025, https://www.drugdiscoverytrends.com/from-1-5-to-5-9-deloitte-digs-into-whats-fueling-big-pharmas-rd-irr-climb/

- Pharma’s Rx for R&D | McKinsey & Company, accessed July 16, 2025, https://www.mckinsey.com/featured-insights/sustainable-inclusive-growth/charts/pharmas-rx-for-r-and-d

- What Do You See As The Cause Of Declining RD Productivity, accessed July 16, 2025, https://www.lifescienceleader.com/doc/what-do-you-see-as-the-cause-of-declining-r-d-productivity-0001

- The Role of AI in Drug Development: A Guide to Understanding 7 …, accessed July 16, 2025, https://www.smartims.com/blog/the-role-of-ai-in-drug-development-a-guide-to-understanding-7-impacts/

- Charting the path to patients: Optimizing drug pipelines | McKinsey, accessed July 16, 2025, https://www.mckinsey.com/industries/life-sciences/our-insights/charting-the-path-to-patients

- Speed up biopharma clinical trials to boost R&D output | McKinsey, accessed July 16, 2025, https://www.mckinsey.com/industries/life-sciences/our-insights/accelerating-clinical-trials-to-improve-biopharma-r-and-d-productivity

- Achieving end-to-end success in the clinic: Pfizer’s learnings on …, accessed July 16, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC8719639/

- What are the therapeutic areas that receive the most attention in …, accessed July 16, 2025, https://synapse.patsnap.com/article/what-are-the-therapeutic-areas-that-receive-the-most-attention-in-terms-of-their-drug-rd-pipeline

- Capital Allocation is Strategy: Five Imperatives for Biopharma Leaders, accessed July 16, 2025, https://www.pharmexec.com/view/capital-allocation-biopharma-leaders

- AI-Driven Drug Discovery: A Comprehensive Review | ACS Omega, accessed July 16, 2025, https://pubs.acs.org/doi/10.1021/acsomega.5c00549

- How AI Can Improve Pharmaceutical R&D – Binariks, accessed July 16, 2025, https://binariks.com/blog/ai-in-pharma-r-and-d/#:~:text=Machine%20Learning%20(ML),efficacy%2C%20and%20optimize%20chemical%20structures.

- Pharma trends and predictions for 2025: An incoming CEO’s perspective | pharmaphorum, accessed July 16, 2025, https://pharmaphorum.com/rd/pharma-trends-and-predictions-2025-incoming-ceos-perspective

- Real-World Evidence | FDA, accessed July 16, 2025, https://www.fda.gov/science-research/science-and-research-special-topics/real-world-evidence

- The Promise of Drug Repurposing: A Faster, Cost-Effective Path to New Therapies, accessed July 16, 2025, https://www.agilisium.com/blogs/the-promise-of-drug-repurposing-a-faster-cost-effective-path-to-new-therapies

- Repositioning Old Drugs for New Battles: The Expanding Role of Drug Repurposing in Cancer, Inflammation, and Metabolic Disease. – Aroc Journal, accessed July 16, 2025, https://arocjournal.com/journal/repositioning-old-drugs-for-new-battles-the-expanding-role-of-drug-repurposing-in-cancer-inflammation-and-metabolic-disease/

- Drug repurposing: Clinical practices and regulatory pathways – PMC, accessed July 16, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC12048090/

- Drug Repurposing Strategies, Challenges and Successes | Technology Networks, accessed July 16, 2025, https://www.technologynetworks.com/drug-discovery/articles/drug-repurposing-strategies-challenges-and-successes-384263

- Open Innovation in Pharmaceutical Industry: A case … – DiVA portal, accessed July 16, 2025, http://www.diva-portal.org/smash/get/diva2:824465/FULLTEXT01.pdf

- The State of Competitive Intelligence in Pharma: Key Trends for …, accessed July 16, 2025, https://northernlight.com/competitive-intelligence-in-pharma-key-trends/

- Success Stories and Case Studies | AstraZeneca Open Innovation, accessed July 16, 2025, https://openinnovation.astrazeneca.com/success_stories.html

- Putting people at the center of the R&D talent model in … – McKinsey, accessed July 16, 2025, https://www.mckinsey.com/industries/life-sciences/our-insights/putting-people-at-the-center-of-the-r-and-d-talent-model-in-life-sciences

- Agile in Pharma: Achieving Agility Despite Heavy Regulations, accessed July 16, 2025, https://businessmap.io/agile/industries/agile-pharma

- Into the Aftermath of M&A – Applied Clinical Trials, accessed July 16, 2025, https://www.appliedclinicaltrialsonline.com/view/aftermath-ma

- Mergers and Acquisitions (M&As) in Pharmaceutical Markets: Associations with Market Concentration, Prices, Drug Quantity, So – HHS ASPE, accessed July 16, 2025, https://aspe.hhs.gov/sites/default/files/documents/ec5de77c72cff3abf802b5e9c6cc8ae4/aspe-pharma-ma-report.pdf

- Agile in the Pharmaceutical Industry: A Quick Guide – Teamhood, accessed July 16, 2025, https://teamhood.com/agile/agile-pharma/

- Lean Manufacturing in Pharmaceuticals – Pharma Now, accessed July 16, 2025, https://www.pharmanow.live/pharma-manufacturing/lean-manufacturing-pharmaceuticals

- Pharma R&D Productivity Dips, but Efficiency Gains Shine – Clarivate, accessed July 16, 2025, https://clarivate.com/life-sciences-healthcare/blog/pharma-rd-productivity-dips-but-efficiency-gains-give-hope/

- The Winning Formula: Cross-Functional Collaboration as a Catalyst, accessed July 16, 2025, https://medicalaffairsspecialist.org/blog/the-winning-formula-cross-functional-collaboration-as-a-catalyst

- Top 7 innovation quotes to inspire your business – Myriad Associates, accessed July 16, 2025, https://www.myriadassociates.ie/resources/news/2021/7-innovation-quotes-business/

- The 25 Best Innovation Quotes to Inspire Business Leaders, accessed July 16, 2025, https://www.plusxinnovation.com/blog/25-best-innovation-quotes

- 70 Research Quotes to Inspire Your Work – Qualtrics, accessed July 16, 2025, https://www.qualtrics.com/blog/research-quotes/

- Leveraging Patent Data to Inform R&D Strategy: A Guide for In …, accessed July 16, 2025, https://patentpc.com/blog/leveraging-patent-data-to-inform-rd-strategy-a-guide-for-in-house-counsel

- Managing Patent Portfolios in the Pharmaceutical Industry – PatentPC, accessed July 16, 2025, https://patentpc.com/blog/managing-patent-portfolios-in-the-pharmaceutical-industry

- DrugPatentWatch Pricing, Features, and Reviews (Jun 2025), accessed July 16, 2025, https://www.softwaresuggest.com/drugpatentwatch

- DrugPatentWatch Review – Crozdesk, accessed July 16, 2025, https://crozdesk.com/software/drugpatentwatch/review