Executive Summary

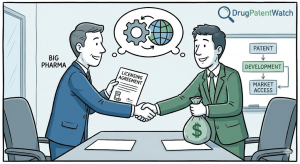

The global pharmaceutical industry currently stands at a precarious intersection of unprecedented scientific opportunity and intense financial pressure. As we move through the remainder of 2024 and look toward 2025, the traditional “blockbuster” model—reliant almost exclusively on internal discovery and long periods of patent exclusivity—is being aggressively reshaped by the imperative of external innovation. Licensing agreements have transcended their traditional role as tactical, gap-filling transactions to become the central nervous system of modern biopharmaceutical strategy.

For the C-suite executive, the business development lead, or the intellectual property (IP) attorney, the landscape has shifted fundamentally. The data reveals a stark dichotomy: while merger and acquisition (M&A) volume for “bolt-on” acquisitions remains robust, licensing deal value has surged, driven by high premiums for late-stage, de-risked assets, particularly in oncology and immunology.1 Simultaneously, the geopolitical climate—specifically the looming BIOSECURE Act in the United States—is forcing a recalibration of cross-border partnerships, particularly with Chinese biotech firms that have become prolific generators of novel molecules.2

This report offers an exhaustive analysis of the pharmaceutical licensing ecosystem. We dissect the financial anatomy of recent deals, from the rise of “biobucks” milestones to the sophisticated nuances of synthetic royalty financing. We analyze the strategic drivers compelling companies to license rather than build, the valuation methodologies that underpin billion-dollar decisions, and the regulatory tripwires that can dismantle a deal before the ink is dry.

“Licensing is an effective strategy to expand market and R&D horizon while decreasing risks and maximizing potential. It allows access to innovation and growth… The strategic importance of licensing deals is boosted by major trends like upcoming patent cliffs, the rising cost of innovation, increasing price pressures and a complex financing environment.”

— EY Global Life Sciences Report 4

Why Is Licensing Replacing Internal R&D as the Primary Growth Engine?

The Mathematical Inevitability of the Patent Cliff

The primary engine driving the current fever pitch in licensing activity is the “patent cliff”—the sharp revenue decline precipitating the expiration of exclusivity on major revenue-generating drugs. Between 2024 and 2030, the industry faces roughly $200 billion in revenue at risk as biologics and small molecules lose protection.4 This is not merely a cyclical downturn; it is a structural chasm that internal R&D productivity has failed to bridge.

Internal R&D alone is statistically insufficient to plug these revenue gaps. The cost to bring a new drug to market continues to escalate, frequently cited in the billions, while the probability of success from Phase I to approval remains stubbornly low, hovering around 11% across all modalities.5 Consequently, large pharmaceutical companies are effectively outsourcing innovation. By in-licensing assets, they transfer the early-stage scientific risk to smaller biotechs while deploying their own capital and commercial infrastructure to navigate late-stage clinical trials and regulatory hurdles.6

The “External Innovation” Imperative for Biotechs

For small to mid-sized biotech companies, the strategic driver is capital efficiency and survival. With the Initial Public Offering (IPO) market showing only modest improvement and venture capital becoming highly selective, licensing provides critical non-dilutive capital.7

- Monetization without Dilution: Licensing allows biotechs to monetize platforms or specific assets without the equity dilution associated with public offerings or desperate private rounds.

- Validation: A partnership with a major pharma player validates the smaller company’s technology, often triggering secondary investment interest from hesitant VCs.7

- Geographic Expansion: Companies like Argo Biopharma leverage licensing to access global markets (via partners like Novartis) while retaining rights or co-development options in their home territories. This “regional split” allows them to build domestic commercial capabilities while collecting royalties from the rest of the world.6

Strategic Drivers by Organization Type

| Organization Type | Primary Strategic Driver | Secondary Strategic Driver | Key Constraint |

| Big Pharma | Pipeline Replenishment: Filling revenue gaps caused by patent expirations. | Risk Diversification: Spreading bets across multiple modalities (e.g., ADCs, RNAi). | Antitrust Scrutiny: FTC oversight limiting mega-mergers.10 |

| Biotech / Startup | Non-Dilutive Capital: Funding operations without selling equity at depressed valuations. | Validation: Gaining the “stamp of approval” from a major player. | Commercial Reach: Lack of global distribution networks.7 |

| Academic Inst. | Technology Transfer: Monetizing basic research. | Public Benefit: Ensuring discoveries reach patients. | Development Capability: Lack of resources for clinical trials.6 |

How Are Modern Licensing Agreements Structured for Maximum Strategic Flexibility?

The days of simple royalty-bearing licenses are fading. Modern agreements are bespoke, complex structures designed to align risk and reward over decades. They are no longer static contracts but dynamic partnerships that evolve as clinical data matures.

The Spectrum of Deal Archetypes

1. Traditional In-Licensing vs. Out-Licensing

- In-Licensing: This is the tool of choice for Big Pharma to fill pipeline gaps. The focus is increasingly on late-stage (Phase II/III) assets to mitigate development risk. In 2024, median upfront payments for Phase II and III deals were notably higher than in 2023, reflecting a “flight to quality”.11

- Out-Licensing: A strategy for smaller firms to fund operations, or conversely, for large pharma to offload non-core assets. For instance, a major pharma might spin off an older respiratory portfolio to focus capital on high-growth oncology assets.7

2. Option-Based Agreements: The “Try Before You Buy” Model

A growing trend is the “Option-to-License” deal. Here, a large pharma pays an upfront fee for the exclusive right to license a drug after a specific trigger event, such as a Phase Ib readout. This structures the deal as a series of “gates,” allowing the licensee to bail out if data is lackluster without committing to the full package of milestones.11

- Strategic Benefit: This minimizes the licensee’s sunk cost risk while providing the licensor with immediate cash to run the trial.

- Example: Celltrion’s option deal with TriOar for the TROCAD platform ($350M potential value) allows Celltrion to test the platform on specific targets before fully committing.13

3. Co-Development and Co-Commercialization

In high-value assets, originators are refusing to hand over the keys entirely. Deals now frequently include profit-sharing arrangements (P&L splits) in key markets (like the US or EU), rather than just royalties.

- Mechanism: Instead of receiving a 15% royalty on sales, the biotech partner contributes 50% of the commercialization costs and receives 50% of the profits.

- Case Study: In the Novartis-Argo deal, Argo retained an option for a P&L split in the US for certain assets. This allows them to transition from a pure R&D shop to a commercial entity eventually, capturing a higher portion of the upside if the drug succeeds.14

4. The “NewCo” Structure: A Geopolitical Workaround

To navigate geopolitical tensions (like the BIOSECURE Act), investors are creating “NewCos” (New Companies) domiciled in neutral jurisdictions (like the US or Europe).

- Structure: A Chinese biotech licenses its global rights (excluding China) to this NewCo. The NewCo, staffed by Western management and funded by Western VC, then develops the drug for US/EU markets.

- Why It Works: This insulates the asset from direct Chinese ownership concerns, making it easier to eventually license the asset to a Big Pharma or exit via IPO in the West.15

What Do the Financials Look Like in 2024-2025?

Upfronts, Milestones, and the “Biobucks” Illusion

The headline numbers in press releases—often in the billions—are usually composed of “biobucks”: the total potential value of the deal if every conceivable milestone is met. Understanding the breakdown is crucial for evaluating the true value of a deal.

Table: Financial Component Analysis (2024-2025 Trends)

| Component | Trend Direction | Analysis |

| Upfront Payments | Stable / Selective Increase | Upfronts represented ~6-7% of total announced deal values in 2024, down from peaks in 2019. However, for “hot” assets like ADCs, upfronts remain high as a competitive differentiator.16 |

| Development Milestones | Heavy Weighting | Payments are triggered by clinical success (e.g., “First patient dosed in Phase III”) or regulatory filing (NDA acceptance). This shifts development risk back to the licensor. |

| Commercial Milestones | Sales-Based Triggers | Examples include “$100M payment upon reaching $1B in annual net sales.” These protect the licensee if the drug is approved but fails to gain market traction.17 |

| Equity Components | Increasing | Pharma partners are increasingly taking equity stakes in the licensor (e.g., Novartis in Argo) to align long-term interests and provide capital for the partner’s survival.9 |

Royalty Rates: The Long-Tail Revenue

Royalty rates are the subject of intense negotiation and are rarely flat. “Tiered” royalties are the industry standard, where the percentage increases as sales volume grows (e.g., 10% on the first $500M, 15% thereafter).

Benchmark Royalty Rates by Development Stage (2024):

- Preclinical Assets: Average royalty rates hover around 3-4%. The risk of failure is highest here, justifying the lower rate.

- Proof of Concept (Phase II): Rates jump significantly, often reaching 12-15%. The asset is “de-risked,” commanding a premium.

- Approved Products: Can command royalties of 15-25% or higher, depending on the therapeutic area and exclusivity period.19

The Rise of Synthetic Royalty Financing

One of the most significant financial innovations in recent years is the explosion of Synthetic Royalty Financing. This is a booming sub-sector where firms like Royalty Pharma or Blackstone Life Sciences buy future royalty streams for upfront cash.

- Definition: A “synthetic” royalty involves creating a royalty stream where one did not previously exist (e.g., selling a % of future direct sales), whereas a “traditional” royalty monetization involves selling an existing royalty right from a license agreement.

- Growth: In 2024, synthetic royalty transactions grew at an average annual rate of 33% over five years.

- Strategic Value: Companies prefer this over debt (which has high interest rates) or equity (which dilutes shareholders). It allows them to pull future value forward to fund current R&D.

- Major Players: Royalty Pharma alone deployed nearly $2.8 billion in capital in 2024, including a massive $950 million deal with Amgen for Imdelltra and a $1.25 billion arrangement with Revolution Medicines.20

How Is Valuation Conducted in a High-Rate Environment?

Valuing a pharmaceutical asset is distinct from standard corporate valuation because of the binary nature of clinical trials. A drug is worth zero if it fails Phase III, but billions if it succeeds.

The Risk-Adjusted Net Present Value (rNPV)

The industry standard methodology is rNPV (risk-adjusted Net Present Value), which explicitly factors in the Probability of Success (PoS) at each development stage.

The rNPV Calculation Workflow:

- Forecast Cash Flows: Project revenue based on epidemiology (patient population), expected market share, and pricing.

- Apply Probability (PoS): Multiply future cash flows by the cumulative probability of reaching the market.

- Example: A Phase II asset might have a 31% chance of reaching Phase III, and a 58% chance of moving from Phase III to Approval. The cumulative probability is 0.31 * 0.58 * 0.85 = ~15.3%.23

- Discounting: Apply a discount rate to the risk-adjusted flows.

- Big Pharma Discount Rate: Typically 8-10%.

- Biotech Discount Rate: Typically 12-18% or higher to reflect higher volatility and cost of capital.24

Why This Matters: In an rNPV model, the discount rate only accounts for the time value of money and commercial risk, because the clinical risk is already handled by the PoS adjustment. Using a high VC-style discount rate (e.g., 40%) plus risk-adjusting cash flows would be “double-counting” the risk, leading to a severe undervaluation.23

Comparables and Deal Benchmarking

Beyond rNPV, dealmakers look at “comps.” If a competitor paid $50 million upfront for a Phase I ADC (Antibody-Drug Conjugate), that sets the floor.

- Role of Intelligence Tools: DrugPatentWatch is an essential utility here. By tracking patent expiration dates and competitor pipelines, business development teams can identify which companies are desperate for assets in specific therapeutic areas. If a potential partner has a “patent cliff” approaching in 2026 for their blockbuster cardiovascular drug, they will pay a premium for a Phase III cardiovascular asset today. DrugPatentWatch allows the seller to quantify this desperation leverage.25

Where Are the Legal Landmines Buried in Contract Language?

The legal framework of a licensing agreement is where the “strategic intent” is codified. A poorly drafted clause can turn a billion-dollar asset into a liability.

Intellectual Property Due Diligence: The Linchpin

IP diligence is not just a checkbox; it is the primary driver of value.

- Freedom to Operate (FTO): It is not enough to own a patent; one must ensure the product doesn’t infringe others’ patents. This is critical in crowded fields like CRISPR or ADCs.

- Patent Term Extension: Diligence must verify how much exclusivity is truly left. If a patent expires in 3 years, the deal value collapses. Tools like DrugPatentWatch enable acquirers to reverse-engineer a target’s IP strategy and verify patent expiry dates independent of the target’s data room assertions.27

“Commercially Reasonable Efforts” (CRE)

This is the single most litigated phrase in pharmaceutical licensing.

- The Conflict: A licensor wants the licensee to push the drug as hard as possible. The licensee wants the flexibility to prioritize other assets if the licensed drug underperforms.

- Recent Litigation: In 2024, the Delaware Chancery Court ruled against Alexion Pharmaceuticals (in Shareholder Representatives LLC v. Alexion), finding they failed to use commercially reasonable efforts to develop a licensed product. Similarly, Johnson & Johnson was held liable for over $1 billion in damages regarding the Auris Health acquisition for failing to support development.29

- The Fix: Modern agreements are moving away from vague “reasonable efforts” standards to objective benchmarks, such as “efforts consistent with those used for a priority asset of similar commercial potential within the licensee’s own portfolio” or mandating specific spend levels and FTE (Full-Time Equivalent) counts.30

Termination Clauses

In 2024, several high-profile deals were terminated “for convenience” or due to reprioritization, such as Genentech’s termination of the Adaptimmune deal and BMS ending its partnership with Agenus.31

- Licensee Perspective: Needs the right to walk away if the science fails or the market shifts.

- Licensor Perspective: Needs protection. If a partner walks away, the licensor needs the IP returned promptly, often with all data generated during the partnership, and potentially a “reverse breakup fee” to cover the disruption.

Why Is CMC Now a Deal-Killer for ADCs and Biologics?

In the era of small molecules (pills), manufacturing was rarely a deal-breaker. In the era of biologics and Antibody-Drug Conjugates (ADCs), the manufacturing process is the product. CMC (Chemistry, Manufacturing, and Controls) due diligence has elevated from a technical check to a strategic gate.

The ADC Complexity Trap

ADCs are bipartite molecules: a biological antibody linked to a chemical cytotoxic payload. This requires two distinct manufacturing streams that must be conjugated under sterile conditions.

- The Risk: A breakdown in the supply chain for the linker or payload can doom the product.

- Comparability Studies: If a licensee moves manufacturing to their own facilities post-deal, they must prove to regulators (FDA/EMA) that the product is identical to the one used in clinical trials. If they cannot—a frequent issue with complex biologics—the clinical data may be invalidated, requiring costly bridging studies.33

Module 3 and Regulatory Filing

The “Module 3” section of a Common Technical Document (CTD) covers quality and manufacturing. Diligence teams must scrutinize this.

- Red Flag: If the licensor relies on a single source for a critical starting material, and that source is a “company of concern” under the BIOSECURE Act, the asset requires a costly supply chain rebuild before it can be commercialized in the US.35

How Are Geopolitics and Antitrust Reshaping the Deal Landscape?

The BIOSECURE Act: A Chilling Effect?

The BIOSECURE Act, passed by the US House in September 2024, aims to restrict US federal funding to companies that contract with “biotechnology companies of concern”—primarily Chinese firms like WuXi AppTec and BGI.3

- Impact: A survey found US life sciences companies are 30-50% less confident in collaborating with Chinese partners.37 This creates a massive headache for licensing, as many Western biotechs use Chinese CDMOs for cost efficiency.

- The Paradox: Despite this, China remains a top source of innovation. In 2024, 31% of molecules in-licensed by large pharma were sourced from China, up from 29% in 2023.11 The innovation is too good to ignore.

- Strategy Shift: We are seeing creative structuring. Instead of direct manufacturing contracts (which BIOSECURE targets), companies are structuring deals as IP licenses where manufacturing is explicitly transferred to non-Chinese CDMOs (e.g., in India or Europe) immediately upon deal closing.38

FTC Scrutiny and “Reverse Payments”

The US Federal Trade Commission (FTC) has intensified scrutiny on pharmaceutical deals under the Biden administration.

- Killer Acquisitions: The FTC is aggressively investigating acquisitions of early-stage assets that overlap with a buyer’s existing portfolio, fearing the buyer will “kill” the new drug to protect their monopoly. This has chilled M&A for direct competitors and pushed companies toward licensing, which can be structured to avoid full ownership transfer.10

- Reverse Payments: Settlements where a brand pays a generic to delay entry are under fire. Interestingly, the FTC is now looking beyond cash, scrutinizing “quantity restrictions” and other non-cash value transfers as potential antitrust violations. Licensing agreements that include “no-authorized-generic” clauses are now red flags.40

What Can We Learn from the Most Significant Deals of 2024?

Success Case: The Strategic Pivot (BMS & BioArctic)

Bristol Myers Squibb’s licensing of BioArctic’s neurodegenerative portfolio (Dec 2024) demonstrates strategic layering.

- Context: BMS had just acquired Karuna for schizophrenia (KarXT) for $14 billion.

- Strategy: Rather than another massive acquisition, BMS used a licensing structure for BioArctic’s assets. They paid a modest upfront but committed to $1.25 billion in milestones.

- Why It Worked: This allowed BMS to build a “neuroscience fortress” around KarXT without overextending their balance sheet. They utilized milestones to manage the scientific risk of the new assets while securing a pipeline for the next decade.42

Failure Case: The Clinical “Flop” (AbbVie & Cerevel)

AbbVie acquired Cerevel Therapeutics for $8.7 billion, largely for its schizophrenia drug emraclidine. In late 2024, emraclidine failed two Phase II trials (EMPOWER-1 and EMPOWER-2), missing its primary endpoint.43

- The Consequence: AbbVie absorbed a massive valuation hit because they bought the whole company.

- The Lesson: This underscores the risk of M&A versus licensing. Had this been an option-to-license deal, AbbVie could have paid a few hundred million for the option and walked away after the Phase II failure. This failure is likely to push more big pharma companies back toward option-based licensing rather than outright acquisitions for Phase II assets in neuroscience.

Success Case: The “Pipeline-in-a-Deal” (Novartis & Argo)

Novartis signed a massive deal with Argo Biopharma for RNAi assets in cardiovascular disease.

- Deal Value: $160 million upfront, $4.165 billion total.

- Significance: It validates RNAi as a mass-market modality (not just for rare diseases). It also shows how Western pharma is navigating China risks—Novartis took the ex-China rights, leaving the domestic market to Argo, thereby splitting the geopolitical risk while capturing the global upside.9

How Can Market Intelligence Tools Mitigate Risk?

In this high-stakes environment, data is the only hedge against uncertainty. Tools like DrugPatentWatch have moved from the law library to the boardroom.

Identifying “Motivated Sellers”

By tracking patent expiration dates, acquirers can identify large pharma companies with looming revenue gaps. If a company has a key patent expiring in 24 months and a thin pipeline, they are a “motivated buyer” for late-stage assets. Conversely, a biotech with a patent cliff approaching might be a “motivated seller”.25

Mapping the Competitive Landscape

Before signing a license, one must know who else is working on the same target. DrugPatentWatch allows users to map out a potential partner’s existing pipeline to identify strategic gaps or, more dangerously, overlapping assets that might lead to the shelving of the licensed drug (a “killer acquisition” scenario).25

Future Outlook: The Licensing Landscape in 2025

As we look to 2025, several trends will crystallize:

- AI-Driven Deal Sourcing: We expect to see more deals for AI-discovery platforms, but structured heavily with back-loaded milestones as the industry waits for AI-discovered drugs to prove themselves in the clinic.

- The “India Pivot”: As the BIOSECURE Act makes China difficult, licensing activity may shift toward Indian CDMOs and biotechs for manufacturing partnerships, though China will remain the R&D engine for novel molecules.

- Synthetic Royalties Mainstream: This will no longer be a niche financing tool but a standard part of the CFO’s toolkit for biotechs, effectively replacing secondary equity offerings.

Key Takeaways

- Licensing is the New R&D: With internal returns diminishing, licensing accounts for a growing share of blockbuster pipelines. It is no longer an alternative to R&D; it is the primary R&D engine for many large players.

- Structure Beats Cash: The shift toward back-loaded milestones (“biobucks”) and option-based deals reflects a risk-averse environment. Huge upfront payments are reserved only for the most competitive, de-risked assets (like late-stage ADCs).

- China is Indispensable but Risky: Despite the BIOSECURE Act, China remains a primary source of innovation. Deal structures are adapting to separate IP licensing from physical supply chains (“NewCo” models) to mitigate geopolitical risk.

- Data-Driven Valuation is Non-Negotiable: Using tools like DrugPatentWatch to map patent cliffs and rNPV models to price risk is standard practice. Gut feeling is gone; probability-weighted cash flow is king.

- Complexity Requires Specialized Diligence: For ADCs and Gene Therapy, legal diligence is insufficient. Technical (CMC) diligence regarding manufacturing scalability and supply chain integrity is a frequent deal-breaker.

- Litigation Awareness: The definition of “Commercially Reasonable Efforts” is now a battleground. Contracts must be specific, using objective benchmarks to avoid the billion-dollar liability traps seen in the Auris Health and Alexion cases.

Frequently Asked Questions (FAQ)

Q1: How does the “Patent Cliff” specifically influence licensing valuations for late-stage assets?

A: The patent cliff creates a “desperation premium.” As major pharmaceutical companies approach the expiration of key revenue drivers (e.g., Keytruda or Eliquis), they face a revenue void. This shifts leverage to licensors with Phase III assets that can launch within 1-2 years. Consequently, these assets command higher upfront payments and royalty rates because the licensee is paying not just for the drug’s value, but for the speed with which it can replace lost revenue. Tools like DrugPatentWatch are used to precisely time these cliffs and identify which buyers are most desperate, allowing sellers to price their assets aggressively.

Q2: What is the difference between a “Synthetic Royalty” and a traditional royalty?

A: A traditional royalty is a term within a license agreement where a licensee (e.g., Pfizer) pays a licensor (e.g., a biotech) a percentage of sales. A Synthetic Royalty is a financing instrument. A third-party investor (like Royalty Pharma) gives a company immediate cash in exchange for the right to receive a portion of future royalties or revenue streams. It is essentially selling a slice of future revenue to fund current operations without issuing new stock (equity dilution) or taking out a bank loan (debt). It is a tool for capital efficiency, not just IP transfer.

Q3: How are “Commercially Reasonable Efforts” (CRE) defined and enforced in modern agreements?

A: CRE clauses are the source of frequent litigation (e.g., the Shareholder Representatives LLC v. Alexion case in 2024). Historically vague, modern agreements now define CRE specifically, often benchmarking efforts against similar products in the licensee’s portfolio. For example, a contract might state that the licensee must dedicate resources equivalent to those used for its other top-tier oncology products. If a licensee “shelves” a drug after acquisition, a tightly written CRE clause allows the licensor to sue for damages or reclaim the asset, as seen in the $1 billion judgment against J&J regarding Auris Health.

Q4: Why are Antibody-Drug Conjugates (ADCs) seeing such high licensing activity compared to other modalities?

A: ADCs have reached a technological maturity that allows for “plug-and-play” deal-making. Unlike cell therapies, which require complex logistical chains, ADCs fit into existing distribution models but offer superior efficacy to small molecules. Furthermore, because ADCs are modular (Antibody + Linker + Payload), companies can license just one component (e.g., a proprietary linker platform like TriOar’s) to upgrade their own assets. This creates multiple licensing touchpoints within a single drug’s architecture, driving up deal volume.

Q5: What is the “NewCo” model in the context of US-China cross-border licensing?

A: To navigate geopolitical tensions (like the BIOSECURE Act), investors are creating “NewCos” (New Companies) domiciled in neutral jurisdictions (like the US or Europe). A Chinese biotech licenses its global rights (excluding China) to this NewCo. The NewCo, staffed by Western management and funded by Western VC, then develops the drug for US/EU markets. This structure insulates the asset from direct Chinese ownership concerns, making it easier to eventually license the asset to a Big Pharma or exit via IPO in the West, effectively bypassing the stigma or regulatory hurdles associated with direct Chinese biotech involvement.

Works cited

- Pharma Deals Half-Year Review of 2025 – IQVIA, accessed November 26, 2025, https://www.iqvia.com/library/white-papers/pharma-deals-half-year-review-of-2025

- Biopharma Trends: Focus on Innovation Amid Complexity | BCG, accessed November 26, 2025, https://www.bcg.com/publications/2025/biopharma-trends

- Impacts of the BIOSECURE Act on the Global BioTech Industry | Health-ISAC, accessed November 26, 2025, https://health-isac.org/wp-content/uploads/11.4.24_WP_ImpactsoftheBIOSECUREActontheGlobalBioTechIndustry.pdf

- Why licensing deals are a powerful source of growth in life sciences – EY, accessed November 26, 2025, https://www.ey.com/en_gl/insights/life-sciences/why-licensing-deals-are-a-powerful-source-of-growth-in-life-sciences

- Inflection Point: How Clinical Trial Results Impact Biopharma Valuations – IQVIA, accessed November 26, 2025, https://www.iqvia.com/-/media/iqvia/pdfs/library/white-papers/how-clinical-trial-results-impact-biopharma-valuations.pdf

- Licensing Agreements in the Pharmaceutical Sector – DrugPatentWatch, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/licensing-agreements-in-the-pharmaceutical-sector/

- The Top Five Drivers of a Successful Out-licensing Process | BioPharm International, accessed November 26, 2025, https://www.biopharminternational.com/view/top-five-drivers-successful-out-licensing-process

- Biopharma, Medtech Deal Reports for Q3 2025 – J.P. Morgan, accessed November 26, 2025, https://www.jpmorgan.com/insights/markets-and-economy/outlook/biopharma-medtech-deal-reports

- Argo Biopharma Announces New Deal With Novartis For Novel Molecules For Cardiovascular Diseases | Nasdaq, accessed November 26, 2025, https://www.nasdaq.com/articles/argo-biopharma-announces-new-deal-novartis-novel-molecules-cardiovascular-diseases

- Preparing for Heightened FTC Scrutiny of Pharma and Biotech Transactions – Fenwick, accessed November 26, 2025, https://www.fenwick.com/insights/events/preparing-for-heightened-ftc-scrutiny-of-pharma-and-biotech-transactions-ny

- Life Sciences Under the Microscope: Key 2024 Takeaways and What’s Ahead for 2025, accessed November 26, 2025, https://www.ropesgray.com/en/insights/alerts/2025/02/key-takeaways-from-the-life-sciences-industry-in-2024-and-whats-next

- Licensing and Collaborations in Life Sciences – Bird & Bird, accessed November 26, 2025, https://www.twobirds.com/en/insights/2024/global/licensing-and-collaborations-in-life-sciences

- Celltrion still thinking bigger than biosimilars with option for $350M antibody deal, accessed November 26, 2025, https://www.fiercebiotech.com/biotech/celltrion-still-thinking-bigger-biosimilars-option-350m-antibody-deal

- Argo Biopharma Announces Multi-Asset License and Option Agreements with Novartis for Novel Molecules for Cardiovascular Diseases, accessed November 26, 2025, https://www.argobiopharma.com/news/153.html

- Trump’s ‘America First’ investment policy raises uncertainty for US-China biotech dealmaking – Fierce Pharma, accessed November 26, 2025, https://www.fiercepharma.com/pharma/trump-america-first-investment-policy-raises-uncertainty-booming-field-us-china-biotech

- Q1 2024 Biopharma Licensing and Venture Report – J.P. Morgan, accessed November 26, 2025, https://www.jpmorgan.com/content/dam/jpmorgan/documents/cb/insights/outlook/jpm-biopharma-deck-q1-final.pdf

- Understanding Pharmaceutical Licensing Agreements – Galen Pharma, accessed November 26, 2025, https://galen-pharma.com/blog/understanding-pharmaceutical-licensing-agreements

- IQVIA Pharma Deals, accessed November 26, 2025, https://www.iqvia.com/-/media/iqvia/pdfs/library/articles/iqvia-pharmadeals-review-2024-ungated.pdf

- A Sneak Peek at Results of 2024 LES Life Sciences Royalty Rate Survey – LESI 2025 Singapore, accessed November 26, 2025, https://lesi2025.org/wp-content/uploads/2025/05/LESI-A-Sneak-Peek-at-Results-of-2024-Life-Science-Sector-Royalty-Rates-Deal-Terms-Survey.pdf

- Royalty Report: Royalty Finance Transactions in the Life Sciences 2020-2024, accessed November 26, 2025, https://www.gibsondunn.com/royalty-report-royalty-finance-transactions-in-the-life-sciences-2020-2024/

- Royalty Finance Transactions in the Life Sciences (2020-2024) | Gibson Dunn, accessed November 26, 2025, https://www.gibsondunn.com/wp-content/uploads/2025/03/Royalty-Report-Royalty-Finance-Transactions-in-the-Life-Sciences-2020-2024.pdf

- Transactions | Royalty Pharma, accessed November 26, 2025, https://www.royaltypharma.com/news/category/transactions/

- A Definitive Guide to Valuing Pharmaceutical and Biotech Companies – DrugPatentWatch, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/valuation-of-pharma-companies-5-key-considerations-2/

- Master Pharma & Biotech Discount Rates: Biopharma Valuation – BiopharmaVantage, accessed November 26, 2025, https://www.biopharmavantage.com/pharma-biotech-discount-rates

- Drug Patent Monetization Through Licensing: An Expert’s Guide to Turning IP into a Strategic Revenue Engine – DrugPatentWatch, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/drug-patent-monetization-through-licensing-an-experts-guide-to-turning-ip-into-a-strategic-revenue-engine/

- Using DrugPatentWatch to Support Out-Licensing and Partnering Decisions, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/using-drugpatentwatch-to-support-out-licensing-and-partnering-decisions/

- The Patent Playbook: A Strategic Guide to M&A and In-Licensing Targeting in the Pharmaceutical Industry – DrugPatentWatch, accessed November 26, 2025, https://www.drugpatentwatch.com/blog/the-patent-playbook-a-strategic-guide-to-ma-and-in-licensing-targeting-in-the-pharmaceutical-industry/

- Key Aspects of Pharmaceutical Due Diligence Intellectual Property Assessment—Part I – IQVIA, accessed November 26, 2025, https://www.iqvia.com/-/media/library/experts/key-aspects-of-pharmaceutical-due-diligence-intellectual-property-assessmentpart-i.pdf?vs=1

- Life Sciences Licensing and M&A Update: Catching Up on Recent …, accessed November 26, 2025, https://www.goodwinlaw.com/en/insights/publications/2024/09/alerts-lifesciences-ma-life-sciences-licensing-and-ma-update

- Biotech Licensing Caselaw Update – 2024 Year in (Brief) Review – Smith Anderson, accessed November 26, 2025, https://www.smithlaw.com/newsroom/publications/biotech-licensing-caselaw-update-2024-year-in-brief-review

- Top 20 Biopharma Deal Terminations of 2024 – PharmaShots, accessed November 26, 2025, https://pharmashots.com/22948/top-20-biopharma-deal-terminations-of-2024/

- Adaptimmune Enters into a Strategic Collaboration with Genentech to Research, Develop, and Commercialize Cancer-targeted Allogeneic T-cell Therapies, accessed November 26, 2025, https://www.adaptimmune.com/investors-and-media/news-center/press-releases/detail/197/adaptimmune-enters-into-a-strategic-collaboration-with

- CMC Regulatory Considerations for ADCs – BOC Sciences, accessed November 26, 2025, https://www.bocsci.com/blog/cmc-regulatory-considerations-for-adcs/

- Best practices for manufacturing Antibody Drug Conjugates (ADCs) – Parexel, accessed November 26, 2025, https://www.parexel.com/insights/blog/best-practices-for-manufacturing-antibody-drug-conjugates-adcs

- CMC Regulatory Considerations for Antibody-Drug Conjugates – PubMed, accessed November 26, 2025, https://pubmed.ncbi.nlm.nih.gov/37741455/

- Technical Guideline for Antibody-Drug Conjugate Pharmaceutical Study and Evaluation, accessed November 26, 2025, https://www.ccfdie.org/en/gzdt/webinfo/2024/12/1732613151853611.htm

- BIOSECURE Act Could Signal a Seismic Shift for Biopharma in US and China – BioSpace, accessed November 26, 2025, https://www.biospace.com/policy/biosecure-act-could-signal-a-seismic-shift-for-biopharma-in-us-and-china

- BIOSECURE Act could impact US biopharma drugs with half in clinical-stage development, accessed November 26, 2025, https://www.pharmaceutical-technology.com/analyst-comment/biosecure-act-could-impact-us-biopharma-drugs/

- The Guide to Life Sciences: FTC Pharma Scrutiny Expected to Continue Following Step Up in Killer Acquisition Enforcement (GCR) | News & Events | Goodwin, accessed November 26, 2025, https://www.goodwinlaw.com/en/news-and-events/news/2024/11/announcements-lifesciences-the-guide-to-life-sciences-ftc-pharma-scrutiny-expected

- Overview of FTC Actions in Pharmaceutical Products and Distribution, accessed November 26, 2025, https://www.ftc.gov/system/files/ftc_gov/pdf/2025.04.04-Overview-Pharma.pdf

- Reverse Payments: From Cash to Quantity Restrictions and Other Possibilities, accessed November 26, 2025, https://www.ftc.gov/enforcement/competition-matters/2025/01/reverse-payments-cash-quantity-restrictions-other-possibilities

- The Top 7 Biopharma Licensing Deals of 2024 – BioSpace, accessed November 26, 2025, https://www.biospace.com/business/the-top-7-biopharma-licensing-deals-of-2024

- 5 Clinical Assets That Flopped in 2024 – BioSpace, accessed November 26, 2025, https://www.biospace.com/drug-development/5-clinical-assets-that-flopped-in-2024

- Novartis returns to Argo for multifaceted $5B cardiovascular collab – Fierce Biotech, accessed November 26, 2025, https://www.fiercebiotech.com/biotech/novartis-returns-argo-multi-faceted-5b-cardiovascular-collab