The LATAM Generic Market: A Land of Contradiction and Opportunity

Introduction: Beyond the Headlines of Growth

The Latin American (LATAM) generic pharmaceutical market presents a compelling, if paradoxical, narrative for global and local industry players. On the surface, it is a landscape of undeniable opportunity, a region teeming with potential and projected to experience robust expansion. Forecasts point to a market reaching between USD 37.2 billion and USD 66.69 billion by the early 2030s, propelled by a compound annual growth rate (CAGR) that analysts place confidently between 5.9% and 7.1%.1 This growth is not speculative; it is anchored in powerful, long-term fundamentals. An aging population, a burgeoning middle class with increasing healthcare awareness, and the rising prevalence of chronic, non-communicable diseases (NCDs) like diabetes, cancer, and cardiovascular conditions create a sustained, structural demand for affordable, long-term therapies.1 Simultaneously, governments across the region, grappling with escalating healthcare costs, are actively promoting generic drug use to stretch limited public funds and expand access to essential medicines.1

However, to accept this bullish headline figure at face value is to commit a fundamental strategic error. The very forecasts that trumpet this growth reveal a deeper, more complex reality. The wide variance in market size projections—from USD 31.1 billion by 2028 in one report to over USD 64 billion by 2033 in another—is not merely a statistical discrepancy.1 It is a symptom of the region’s inherent volatility and fragmentation. It reflects the immense difficulty of aggregating coherent data across a mosaic of disparate economies, fluctuating currencies, and idiosyncratic reporting standards. The hyperinflationary pressures in markets like Argentina, for instance, can dramatically skew regional aggregates, making a single, blended CAGR a dangerously misleading metric for strategic planning.

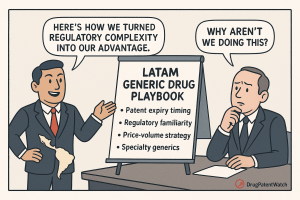

Therefore, this report moves beyond the simplistic growth narrative. It is designed as a strategic playbook for business leaders aiming to achieve not just presence, but dominance in this challenging terrain. We will dissect the market’s true complexities, revealing that success in LATAM is not a function of riding a generalized growth wave, but of mastering a series of specific, nuanced strategic disciplines. It is a region that rewards sophistication over scale, and strategic acuity over superficial investment. Through detailed case studies of the companies that have successfully navigated this labyrinth, we will distill the key lessons and forge a framework for turning the region’s inherent challenges into a source of profound and sustainable competitive advantage.

Decoding the Market Landscape: Key Drivers and Segments

To formulate a winning strategy, one must first understand the intricate machinery driving the LATAM generics market. The growth is a product of powerful, intersecting forces on both the demand and supply sides, which shape a uniquely segmented and competitive environment.

On the demand side, the primary engine is the region’s shifting epidemiological and demographic profile. The growing burden of NCDs necessitates long-term, often lifelong, treatment regimens, making the cost of medication a critical factor for both public health systems and individual households.1 This is compounded by a healthcare financing structure where out-of-pocket expenditure plays a disproportionately large role. In countries like Chile, direct household payments can account for as much as 40% of total health spending, with pharmaceuticals making up over half of that personal cost. This reality places immense pressure on patients and creates a powerful, consumer-driven demand for affordable alternatives to expensive originator brands. As one World Bank report notes, while pharmaceuticals have improved life expectancy, they “often account for a significant share of household expenditures, especially among the poor and those facing catastrophic health shocks”. This makes the value proposition of generics—delivering the same therapeutic outcome at a fraction of the price—incredibly potent.

On the supply side, the market is continually being reshaped by a “patent cliff,” a steady wave of patent expirations on blockbuster drugs that opens the door for generic competition.2 This creates a recurring pipeline of opportunities for manufacturers poised to enter the market. Governments, eager to capitalize on these events to contain spiraling public healthcare costs, are actively implementing policies to encourage generic uptake, from streamlined approval processes to public awareness campaigns.1

This interplay of drivers has created a market with distinct and strategically important segments. While simple, unbranded generics represent the largest portion of the market by volume, accounting for over 76% in 2020, the landscape is far more nuanced. Two other segments are critical for any company seeking dominance:

- Branded Generics: This segment, which involves marketing a generic molecule under a specific brand name, is exceptionally large and influential in LATAM. In the region’s contract manufacturing market, for example, branded generics accounted for a staggering 64.5% of revenue in 2024. This phenomenon is a direct consequence of the market’s unique dynamics. Where a government payer isn’t mandating the absolute cheapest option, the decision often falls to a physician or a patient paying out-of-pocket. In this environment, a trusted brand name serves as a powerful proxy for quality, safety, and reliability, mitigating the “cacophony of labels” that can confuse consumers. Local champions have masterfully built brand equity around their generic portfolios, creating a loyal following among prescribers and patients that transcends a simple price comparison.

- Biosimilars: While currently smaller, the biosimilars segment is universally recognized as the fastest-growing and most lucrative frontier. These complex, large-molecule generics are used to treat some of the most severe and costly diseases, such as cancer and autoimmune disorders. The high cost of original biologics makes the potential savings from biosimilars enormous, creating intense interest from both governments and private payers. The technical and financial barriers to entry are significantly higher than for small-molecule generics, but the rewards for those who can successfully navigate this space are substantial.

The market is further segmented by therapeutic area, with cardiovascular diseases, oncology, central nervous system (CNS) disorders, and diabetes representing major battlegrounds due to the high prevalence of these conditions.3 In terms of administration, oral dosage forms remain dominant due to ease of use, but injectables are growing rapidly, driven largely by the expansion of the biologics and biosimilars market.

To succeed, a company cannot treat these segments as monolithic. It must understand that a strategy for winning a high-volume government tender for an unbranded cardiovascular generic is fundamentally different from the strategy needed to build a trusted, physician-prescribed branded generic for pain management, or the strategy required to launch a high-science biosimilar for oncology.

The Great Divide: Foundational Challenges of a Fragmented Region

While the opportunities in LATAM are undeniable, the path to realizing them is fraught with challenges that are foundational to the region’s character. These are not temporary hurdles but structural realities that must be at the center of any viable strategy. To ignore them is to plan for failure.

The most significant challenge is the region’s profound regulatory fragmentation. Far from being a unified bloc, Latin America is a “vibrant and volatile mosaic of distinct national markets”. The dream of a pan-regional regulatory body or a single marketing authorization valid across borders remains just that—a dream. In its place is a complex patchwork of National Regulatory Agencies (NRAs), each with its own sovereignty, processes, timelines, and political pressures.4 Navigating the bureaucratic intricacies of Brazil’s ANVISA, the backlogs of Mexico’s COFEPRIS, the localized nature of Argentina’s ANMAT, and the relative agility of Colombia’s INVIMA requires distinct expertise and resources for each market. This complexity acts as a formidable non-tariff barrier to entry, creating a natural “home-field advantage” for incumbent local players who possess deep institutional knowledge and long-standing relationships.

This fragmentation is not a “bug” to be fixed but a core “feature” of the competitive landscape. The failure of top-down harmonization efforts has led to a pragmatic, bottom-up shift toward regulatory reliance.4 Recognizing their own resource limitations, many LATAM NRAs are increasingly willing to leverage the rigorous scientific assessments already completed by trusted reference authorities like the U.S. FDA or the European Medicines Agency (EMA). This shift is born not of idealism but of “practical necessity” and creates a powerful new strategic lever for companies that can plan their global filings accordingly.

Compounding the regulatory complexity are persistent economic headwinds. Chronic instability, high inflation, and severe currency devaluations—most notably in Argentina, where such pressures can dramatically impact financial reporting and profitability—are a constant reality.8 This volatility makes financial planning, pricing strategy, and supply chain costing exceptionally difficult.

Finally, operational and infrastructure challenges present a significant hurdle. Supply chain inefficiencies, logistical bottlenecks, and the critical need for robust quality control are paramount. The generic industry, in general, faces higher rates of batch rejection and manufacturing deviations compared to originators, a risk that is amplified in a region with diverse infrastructure quality. Furthermore, the region’s heavy reliance on China for Active Pharmaceutical Ingredients (APIs) introduces a significant geopolitical risk into the supply chain, a vulnerability that many governments are now seeking to mitigate by encouraging local production.1

Understanding this triad of challenges—regulatory fragmentation, economic volatility, and operational hurdles—is the first step. The next is to build a strategy that does not just mitigate them, but actively uses them to carve out a competitive advantage.

The Four Pillars of Generic Market Dominance in LATAM

Achieving leadership in the Latin American generics market is not a matter of chance; it is the result of deliberate, disciplined execution across four critical domains. These pillars—Regulatory Mastery, Intellectual Property (IP) Strategy, Pricing and Market Access, and Go-to-Market Excellence—form the foundation of a resilient and dominant regional enterprise. Success requires not just competence in each, but a sophisticated integration of all four into a cohesive strategic framework.

Pillar 1: Regulatory Mastery – From Bureaucracy to Competitive Advantage

In Latin America, the regulatory function cannot be a mere compliance back-office; it must be a forward-deployed strategic weapon. The ability to navigate the region’s complex and fragmented regulatory landscape faster and more efficiently than competitors is a primary source of competitive advantage. This mastery begins with a deep, comparative understanding of the key markets.

The “Big Four”: A Comparative Analysis

While every country has its unique quirks, the strategic calculus for the region is largely defined by the “Big Four” markets: Brazil, Mexico, Argentina, and Colombia. Each presents a distinct set of rules, challenges, and opportunities that dictate the entry strategy.

Table 1: Comparative Regulatory and IP Landscape for Generic Entry

| Parameter | Brazil | Mexico | Argentina | Colombia |

| Lead Regulatory Agency | ANVISA | COFEPRIS | ANMAT | INVIMA |

| Typical Approval Timeline (Small Molecule) | 24+ months (Notoriously complex) | 18-24 months (Prone to backlogs) | 12-18 months | 12-18 months (Considered more agile) |

| Patent Linkage System | No (Pro-access stance) | Yes (Formal system can delay generic entry) | No | No |

| Data Exclusivity Period | Limited / Case-by-case | 5 years for new chemical entities | Not consistently applied | Yes (5 years for new medicines) |

| Bioequivalence Requirement | Yes (Local studies often required) | Yes (Local studies required) | Yes | Yes |

| Key Market Challenge | Extreme bureaucracy and long timelines | Regulatory backlogs; patent linkage hurdles | Dominance of local players; economic volatility | Stringent price controls on certain drugs |

| Sources | 4 |

As the table illustrates, a one-size-fits-all approach is doomed. Brazil’s ANVISA is widely regarded as the most rigorous and bureaucratic, often requiring locally conducted bioequivalence studies and adhering to a complex pricing formula for generics. Success here demands a dedicated, highly specialized local team and a long-term investment horizon. Mexico’s COFEPRIS, while having a well-defined framework, is hampered by significant backlogs and a formal patent linkage system that provides originator companies with a powerful tool to delay generic competition.17

Argentina’s ANMAT operates within a market heavily dominated by powerful local firms, making deep market knowledge and relationships crucial.19

Colombia’s INVIMA is often seen as more transparent and agile, lacking a patent linkage system but enforcing a five-year data exclusivity period for new drugs, creating a clearer, if still challenging, pathway for generics.4

The Strategic Imperative of Regulatory Reliance

The most sophisticated players are turning the region’s fragmentation into an advantage through the strategic use of regulatory reliance. Instead of a slow, sequential, country-by-country filing process, a superior strategy is the “Global-First, Local-Adapt” model. This involves investing heavily upfront to create a comprehensive core global dossier that is designed from the outset to meet the stringent requirements of a major reference authority like the FDA or EMA.

Once this high-quality dossier is established, it can be used as a powerful lever. It can be submitted to ANVISA in Brazil to begin the long local process, while simultaneously being adapted for submission in multiple other LATAM markets that have reliance or equivalence pathways. This approach allows a company to leverage the approval from a trusted agency to potentially accelerate timelines in countries like Mexico or Colombia.4 This parallel processing compresses overall timelines, reduces redundant work, and dramatically increases the probability of achieving a first-to-market or early-entrant position in several countries at once. It transforms the regulatory process from a series of independent hurdles into an interconnected system that can be strategically navigated for speed.

Pillar 2: Intellectual Property Strategy – From Defense to Offense

For a generic manufacturer, intellectual property is not just a legal minefield to be navigated; it is the very map that reveals where treasure is buried. A passive, defensive approach to IP is a recipe for entering crowded, commoditized markets. A proactive, offensive IP strategy, powered by sophisticated intelligence, is what unlocks high-value, defensible opportunities.

Decoding the IP Battleground: Patent Linkage and Data Exclusivity

The primary IP barriers to generic entry in LATAM are patent linkage and data exclusivity. These “TRIPS-plus” provisions, often embedded in bilateral free trade agreements, go beyond the baseline requirements of the World Trade Organization and can significantly delay the entry of affordable medicines.23

- Patent Linkage: This mechanism creates a formal link between the drug regulatory authority (like COFEPRIS) and the national patent office. It effectively prevents the NRA from granting marketing approval to a generic drug if a patent listed by the originator is still in force. As seen in Mexico, this can be a powerful tool for innovators to extend their monopoly, sometimes by listing secondary patents for new formulations or uses in a practice known as “evergreening”.4 The absence of such a system in major markets like Brazil and Colombia creates a more favorable environment for generic challengers.

- Data Exclusivity: This provision protects the extensive and expensive clinical trial data submitted by the innovator company to gain its initial marketing approval. For a defined period—five years in Colombia, for example—generic manufacturers are barred from referencing this data to support their own applications. This forces them to either wait for the exclusivity period to expire or, in rare cases, conduct their own costly trials.

The Power of Patent Intelligence: Using Data to Drive Decisions

Mastering the IP landscape requires moving beyond simple patent expiry date tracking. It demands deep, continuous patent intelligence to inform every stage of the product lifecycle, from portfolio selection to launch strategy. This is where competitive intelligence platforms become indispensable.

“The expiration of a brand-name drug’s patent serves as the primary catalyst for generic market entry. This event, frequently referred to as the ‘patent cliff,’ unlocks substantial opportunities for generic manufacturers to introduce more affordable versions of existing medications, thereby driving down prices and enhancing accessibility for patients.”

Services like DrugPatentWatch provide the granular data necessary to build an offensive IP strategy. They offer integrated databases covering not just patent expirations, but also patent litigation, regulatory statuses, clinical trials, and supplier information across global markets.26 A generic company can leverage this intelligence in several critical ways:

- Proactive Opportunity Identification: Instead of waiting for patents to expire, companies can build a multi-year pipeline of targets by analyzing the entire patent landscape. This allows for long-range planning of R&D, manufacturing scale-up, and regulatory submissions.

- Strategic Risk Assessment: The most lucrative generic targets are rarely the low-hanging fruit. They are often products protected by a complex “thicket” of secondary patents. A superficial analysis might dismiss these as too risky. However, a deep dive using advanced patent intelligence can reveal which of these secondary patents are weak, poorly constructed, or potentially invalid, making them prime candidates for a legal challenge or a “design-around” strategy.

- Informed Litigation Strategy: For companies considering a Paragraph IV challenge, understanding the originator’s litigation history, the specific claims of the patents in question, and previous court or patent board rulings is critical. This data, available through platforms like DrugPatentWatch, allows a company to assess the probability of success and the potential costs of litigation, enabling them to take calculated risks that less-informed competitors would shun.

Ultimately, investing in high-quality patent intelligence transforms a company’s strategic posture. It allows them to move from being a price-taker in crowded markets to a value-creator in less-contested, higher-margin segments. It is the key to finding and unlocking the most profitable opportunities hidden within the complexity of the IP labyrinth.

Pillar 3: Pricing and Market Access – Winning the Tender and the Wallet

Pricing and market access in Latin America is a complex, two-front war. A successful company must simultaneously win the high-volume, price-driven battles of government tenders and the value-driven, higher-margin campaigns for the out-of-pocket consumer’s wallet. A single strategy for both fronts is destined to fail.

Navigating Government Price Controls and Tenders

The public sector in most LATAM countries is the single largest purchaser of medicines, but it operates under immense budgetary pressure. This has led to a variety of price control and procurement mechanisms, each requiring a tailored approach.

- In Brazil, the Drugs Market Regulation Chamber (CMED) holds significant power, setting price ceilings for different categories of drugs. Critically, generics must be priced significantly below the originator reference product—the rule mandates a price at least 35% lower than the reference, which effectively caps it at 65% of the originator price.18 Furthermore, there is a mandatory discount for all government procurement, making the public market a game of thin margins compensated by massive volume through the universal Unified Health System (SUS).18

- In Mexico, the system is in flux. The government has moved towards a centralized procurement model, first under the United Nations Office for Project Services (UNOPS) and now under IMSS-Bienestar, creating significant uncertainty for suppliers. While a maximum price regulation system exists, its effectiveness has been questioned, and the primary determinant of success in the public market is winning large, consolidated tenders.20

- Colombia employs a “supervised freedom” regime, where prices are largely market-driven, but the National Drugs and Medical Devices Pricing Commission (CNPMDM) can and does impose direct price controls on a select list of medicines deemed critical or overly expensive.

- Argentina and Chile, by contrast, generally offer more freedom in price setting, though this can be overridden by emergency measures, such as the price freezes Argentina has implemented during periods of high inflation.

Success in this public sphere requires an exceptionally lean cost structure, manufacturing efficiency, and the ability to compete aggressively on price in large-scale tenders.

The Out-of-Pocket Consumer: A Different Value Proposition

The private market is a completely different ecosystem. It is defined by the prevalence of out-of-pocket spending, which forces patients and their physicians to make direct trade-offs between cost and perceived quality.9 In this context, brand matters immensely. A “branded generic” or a “similar” from a trusted local manufacturer is often preferred over an unknown, unbranded generic, even at a slightly higher price point.

This is where physician relationships and pharmacy-level marketing become paramount. In Mexico, for instance, it is estimated that 40% of patients receive their initial treatment at pharmacy-affiliated clinics, where the product stocked and recommended by the pharmacist or clinic doctor is key. This dynamic explains the immense success of branded generic portfolios from local champions like Hypera in Brazil or Roemmers in Argentina. They have invested for decades in building trust with healthcare professionals and consumers, creating brand equity that translates directly into market share and higher margins.

This reality necessitates a “Tiered Portfolio” strategy. A single product offering cannot effectively capture both the public and private markets. A dominant player must develop a dual approach:

- The Tender Product: An unbranded, low-cost generic specifically designed and priced to win high-volume government contracts.

- The Retail Product: A branded generic, supported by a dedicated sales force, medical marketing to physicians, and in-pharmacy promotional activities to build trust and drive prescription and recommendation volume in the private market.

This bifurcated strategy allows a company to maximize volume in the public sector while simultaneously capturing the higher value and margins available in the private retail sector. It is a cornerstone of the playbook used by the most successful local players in the region.

Pillar 4: Go-to-Market Excellence – Owning the Last Mile

A brilliant regulatory strategy, a clever IP position, and a sharp pricing model are all worthless if the product cannot efficiently and reliably reach the patient. Go-to-market excellence—mastering the final steps of distribution and demand generation—is the pillar that translates strategy into sales. In the fragmented and logistically complex LATAM market, owning the “last mile” is a powerful and often underestimated competitive moat.

Mastering Distribution Channels

The physical distribution of pharmaceuticals in Latin America is often concentrated in the hands of a few powerful players. In Colombia, for example, major pharmacy chains like Cruz Verde and the vast Coopidrogas cooperative (which unites over 6,500 independent pharmacies) control a majority of the retail market.22 Securing a partnership with these entities is not just a logistical step; it is a strategic imperative for achieving national reach.

The most dominant local companies have long recognized this. Tecnoquimicas, Colombia’s largest domestic player, began its life as a distribution company. This heritage gives it an unparalleled logistical network, reaching over 100,000 clients and providing a deep understanding of distribution channels that no competitor can easily replicate. Similarly, Hypera Pharma in Brazil has built its empire not just on product acquisitions but on developing an extensive and highly efficient distribution network that ensures its diverse portfolio has premier placement in pharmacies across the country.

For a new entrant, simply signing a standard, non-exclusive distribution agreement is insufficient. The path to dominance requires a deeper commitment. This could involve the strategic acquisition of a local company with a strong, established distribution network, or the formation of a deep, exclusive strategic alliance with a major national or regional distributor. This control over the supply chain provides not only efficiency but also invaluable market intelligence, insight into prescribing patterns, and influence at the point of sale.

The Role of the Sales Force and Medical Marketing

In many LATAM markets, where formal Health Technology Assessment (HTA) frameworks are either nascent or non-existent, the role of the medical sales representative is magnified. The decision to prescribe a specific branded generic or biosimilar is often heavily influenced by the relationship-based marketing and educational efforts of a company’s sales force. Physicians rely on trusted representatives to provide them with information on new products, clinical data, and therapeutic benefits.

Therefore, building a high-quality, well-trained, and geographically extensive sales force is not an optional expense; it is a critical investment for any company launching branded generics or other value-added products. This “feet on the street” presence is essential for building relationships with Key Opinion Leaders (KOLs), educating physicians, and ultimately driving prescription volume. It is the human element of the go-to-market strategy that builds the brand trust necessary to succeed in the region’s competitive private market. The combination of a powerful distribution network and an effective sales force creates a formidable one-two punch that is exceptionally difficult for competitors to counter.

Case Studies in Regional Dominance: The Architects of Success

Theoretical frameworks are valuable, but the most profound lessons are learned from the actions of those who have already achieved success. By dissecting the strategies of the region’s most formidable players—a domestic champion, a focused multinational, and a pan-regional pioneer—we can see the four pillars of dominance in action. These case studies provide a tangible blueprint for what it takes to win in Latin America.

Table 2: Strategic Profile of Case Study Companies in LATAM

| Hypera Pharma | Viatris | Eurofarma | |

| Primary Strategic Posture | The Local Champion | The Focused Multinational | The Pan-Regional Pioneer |

| Core Geographic Focus | Brazil | Global, with focused presence in Brazil & Mexico | Pan-Latin America |

| Portfolio Mix | Branded Prescriptions, Generics/Similars, OTC, Skincare | Iconic Brands, Generics, Complex Generics, Biosimilars | Generics, Branded Prescriptions, Biosimilars, OTC |

| Primary Growth Driver | Domestic M&A, Brand Building | Post-Merger Synergy, Partnerships | International M&A, R&D Pipeline |

| Key Competitive Advantage | Deep Brazilian market integration and brand equity | Unique portfolio bridging brands and generics; focused therapeutic strategy | Pan-regional scale and integrated R&D-to-market platform |

| Sources | 35 | 39 | 3 |

Case Study 1: The Local Champion – Hypera Pharma’s Conquest of Brazil

Hypera Pharma’s story is a masterclass in how to achieve absolute dominance by “owning” a single, massive domestic market. It has become one of Brazil’s largest and most diversified pharmaceutical companies not by looking outward, but by relentlessly focusing inward, building an impregnable fortress within the Brazilian market through three core strategies.36

First, M&A as a primary growth engine. Hypera’s history is one of strategic, serial acquisition. It systematically consolidated its position by purchasing major local players like Farmasa, Neo Química, and Mantecorp.36 This was not just about buying revenue streams; it was about acquiring established brands, manufacturing capacity, and, crucially, market access. More recently, it has demonstrated the savvy to acquire iconic, high-margin brands like Buscopan and Neosaldina from multinational corporations (MNCs) that were refocusing their global portfolios. This strategy allowed Hypera to rapidly scale and deepen its presence in every corner of the Brazilian pharmacy.

Second, the masterful branding of the generic. Hypera understood early on that in Brazil’s out-of-pocket-driven market, a generic is not just a molecule; it’s a product that needs to inspire trust. It uses powerful umbrella brands like Neo Química and Mantecorp Farmasa to market its generic and “similar” products. This strategy has been wildly successful. Neo Química has become a national leader in similar products and a vice-leader in generics by volume. By investing heavily in marketing—even sponsoring the naming rights for a major football stadium, now the ‘Neo Química Arena’—Hypera has built immense brand equity, allowing its products to command loyalty and a price premium over lesser-known competitors.

Third, deep local integration and portfolio diversification. Hypera operates across multiple, synergistic business units: Branded Prescriptions, Similars and Generics, Consumer Health (OTC), and Skincare. This diverse portfolio ensures that it is an indispensable partner to pharmacies, while its deep roots in the country—with around 10,000 employees and an intricate understanding of the Brazilian consumer, physician, and regulator—give it an unparalleled home-field advantage.36

The Key Lesson from Hypera: In a market as large and complex as Brazil, deep localization, aggressive domestic consolidation, and sophisticated brand-building can create a competitive moat that is nearly impossible for even the largest and most well-funded MNCs to breach. Dominance can be achieved by becoming the undisputed champion of a single, critical geography.

Case Study 2: The Multinational Strategist – Viatris’s Post-Merger Playbook

Viatris, formed in 2020 through the landmark combination of Mylan and Pfizer’s Upjohn division, faced a classic post-merger challenge in Latin America: how to harness the scale of two legacy giants without becoming unfocused and inefficient. Its response is a case study in disciplined, modern multinational strategy for the region, built on focus, synergy, and partnership.

The first pillar of Viatris’s LATAM strategy is a deliberately focused therapeutic footprint. As Patrick Doyle, Head of Viatris Latin America, explained, the company made a conscious decision to concentrate its efforts where it could have the most impact, rather than trying to compete everywhere. It is targeting three core areas of high unmet need in the region: cardiovascular disease, central nervous system (CNS) disorders, and pain management. This focus allows Viatris to concentrate its commercial resources, build deep expertise, and develop meaningful relationships with key stakeholders in these specific fields.

Second, Viatris is uniquely positioned to bridge the traditional divide between brands and generics. It inherited a vast portfolio of generic and complex generic molecules from Mylan, combined with a stable of iconic, trusted legacy brands from Upjohn, such as Lipitor (atorvastatin) and Zoloft (sertraline).39 This dual portfolio is a powerful strategic asset in LATAM’s mixed public-private market. It allows the company to compete for price-sensitive government tenders with its generics while leveraging the brand equity of its legacy products in the private, out-of-pocket market, providing a flexible toolkit for access and affordability.

Third, partnership is elevated to a core strategic pillar. Viatris actively promotes its “Global Healthcare Gateway,” offering its extensive global infrastructure—including R&D, supply chain, regulatory, and commercial expertise—to potential partners. In Latin America, this translates into a capital-efficient expansion model. The company is establishing a direct, full-scale presence in the must-win markets of Brazil and Mexico, while leveraging a network of distributors and partners to serve other, smaller countries in the region. This avoids the immense cost of building out a direct presence everywhere, allowing for a more nimble and targeted allocation of resources.

The Key Lesson from Viatris: For a multinational corporation, the path to profitable leadership in Latin America is not through brute force or trying to be everything to everyone. A disciplined, focused strategy that concentrates on key therapeutic areas and “must-win” markets, leverages a unique portfolio to serve both public and private channels, and embraces partnerships as a tool for efficient expansion, offers a more sustainable and intelligent model for success.

Case Study 3: The Pan-Regional Pioneer – Eurofarma’s Cross-Border Expansion

While Hypera demonstrates dominance through domestic focus, Brazilian-based Eurofarma provides the blueprint for becoming a true pan-Latin American powerhouse. Starting as a national champion, Eurofarma has executed a methodical, multi-decade strategy of internationalization, transforming itself into the first 100% Brazilian-owned multinational pharmaceutical company and a leader across the continent.

Eurofarma’s strategy rests on a dual focus of maintaining domestic strength while fueling international growth. It has never taken its eye off its home market. In Brazil, it remains the most prescribed pharmaceutical company and the second-largest player in generics. The cash flow and scale generated from this dominant position in Latin America’s largest market have provided the financial firepower for its ambitious cross-border expansion. This expansion has been deliberate and systematic, and today the company has a presence in 24 countries, covering 100% of the Latin American market.

The primary vehicle for this expansion has been strategic, platform-building M&A. Eurofarma’s acquisition of Genfar, Sanofi’s generics operation with a strong presence in Colombia, Ecuador, and Peru, is a textbook example.3 With this single move, Eurofarma didn’t just buy products; it acquired an entire regional platform, including manufacturing capabilities, distribution networks, and an established brand. In a clear strategic signal, Eurofarma has designated Genfar as its unified generics brand for all of Latin America outside of Brazil, instantly creating a cohesive regional identity.3 This demonstrates a sophisticated understanding that acquiring a platform is far more efficient than building one from scratch in multiple markets.

This M&A strategy is underpinned by a deep and sustained commitment to innovation. Eurofarma invests heavily in research and development, dedicating nearly 7% of its net revenue to R&D in 2024. This investment fuels a robust pipeline of new generics, incremental product improvements, and, critically, biosimilars through its sustainable consortium, Orygen.42 This commitment ensures that its growth is not just based on acquiring existing assets but also on developing the next generation of products that will drive future revenue. The results are clear: international revenue grew by a staggering 58% in 2024 and now accounts for over a quarter of the company’s total sales.

The Key Lesson from Eurofarma: Building a pan-Latin American empire requires a long-term vision and a balanced, two-pronged approach. A company must first establish and maintain a dominant, cash-generating position in a major home market. It can then leverage that strength to fund strategic, platform-building acquisitions that accelerate entry and build immediate scale in new regions, all while continuously investing in an internal R&D pipeline to ensure sustainable, long-term growth.

The Strategic Playbook for Generic Leadership in LATAM

The journeys of Hypera, Viatris, and Eurofarma, while different, converge on a set of core strategic truths. Synthesizing these lessons provides a clear, actionable playbook for any company aspiring to generic leadership in Latin America. This is not a rigid set of instructions but a flexible framework for making the critical decisions that will define success or failure in this complex region.

Synthesizing the Lessons: A Framework for Action

A winning strategy for the LATAM generics market can be constructed around five key decisions and actions:

- Choose Your Battlefield: Define Your Strategic Posture. The first and most critical decision is to define what kind of company you aim to be in the region. There is no single “best” model, but a lack of clarity is fatal. The choice is between three archetypes:

- The Deep Domestic Champion (Hypera Model): Focus all resources on winning a single, large, critical market like Brazil or Mexico. The goal is to build an unassailable fortress through deep localization, domestic M&A, and brand building.

- The Focused Multinational (Viatris Model): Acknowledge that you cannot be everything to everyone. Select a limited number of therapeutic areas and “must-win” geographies. Leverage a unique global portfolio and embrace partnerships for capital-efficient expansion into smaller markets.

- The Pan-Regional Aggregator (Eurofarma Model): Pursue a long-term vision of regional leadership. This requires first securing a dominant, cash-cow position in a home market to fund a systematic campaign of cross-border, platform-building acquisitions.

- Build a “Reliance-Ready” Dossier: Weaponize Your Regulatory Filings. Do not approach regulatory affairs sequentially. Invest upfront in a world-class, global core dossier designed to meet the standards of the most stringent reference authorities (FDA/EMA). This “reliance-ready” package becomes a strategic asset, enabling parallel submissions across LATAM, compressing timelines, and maximizing the chance of being an early market entrant.

- Deploy Tiered Portfolios: Conquer Both Public and Private Markets. Recognize that the public tender market and the private out-of-pocket market are two distinct battlefields requiring different weapons. Develop a dual-product strategy: a low-cost, unbranded generic for high-volume, price-driven government contracts, and a separate, trusted branded generic supported by medical marketing for the value-driven retail channel.

- Weaponize Patent Intelligence: Hunt for High-Value Opportunities. Move beyond passive patent monitoring. Invest in sophisticated competitive intelligence platforms like DrugPatentWatch to proactively hunt for opportunities. Use this intelligence to dissect complex patent thickets, identify weak patents to challenge, de-risk litigation, and uncover higher-margin opportunities in less-crowded therapeutic spaces that competitors are too timid to enter.

- Control the Last Mile: Secure Your Path to the Patient. Acknowledge that distribution is not a commodity but a critical competitive advantage. The concentration of power in major pharmacy chains and distributors means that a standard agreement is not enough. Secure a definitive advantage in the “last mile” through the acquisition of a local player with a strong network, the formation of a deep and exclusive strategic partnership with a major distributor, or, for the most established players, vertical integration.

The Biosimilar Frontier: Strategies for the Next Wave

While the current market is dominated by small-molecule generics, the future of growth and value lies unequivocally in biosimilars. The strategic decisions made today regarding this segment will determine the competitive hierarchy for the next decade. However, this is not a game for everyone.

The barriers to entry are immense. The development and manufacturing of biosimilars are an order of magnitude more complex and expensive than for traditional generics, requiring significant capital investment and a high level of scientific and technical expertise.16 The regulatory pathway, while becoming clearer in markets like Brazil, is also far more demanding, often requiring extensive comparative clinical data and even Phase III trials.

This reality will inevitably drive a new wave of consolidation and stratification in the LATAM pharmaceutical landscape.

- Stratification: The market will split. A few “Tier 1” players—well-capitalized local champions like Eurofarma (with its Orygen consortium) and major MNCs like Sandoz—will have the resources to compete in the end-to-end development and commercialization of high-value biosimilars. A much larger group of “Tier 2” players will be confined to the more commoditized small-molecule space or will be forced to pivot into supporting roles, such as becoming contract manufacturing organizations (CMOs) for the Tier 1 leaders.

- Consolidation: The high costs will force smaller players to either seek partnerships or become acquisition targets. We are already seeing this, with companies like Colombia’s Tecnoquimicas actively seeking partners to enter the biosimilar field. This trend will accelerate, as scale becomes even more critical for success.

For any company with ambitions in LATAM, the biosimilar question is paramount. A decision to invest requires a long-term commitment of capital and talent. A decision not to invest requires a clear strategy for how to remain competitive and profitable in a market where the most significant growth segment is controlled by others.

Future Outlook: Preparing for Tomorrow’s Market

The Latin American generic market is not static. Several emerging trends will continue to reshape the competitive environment, and forward-thinking companies must prepare for them now.

- The Rise of Local Manufacturing: Spurred by the supply chain vulnerabilities exposed during the COVID-19 pandemic, governments across the region are increasingly implementing policies to encourage local production of both APIs and finished drugs. This will create opportunities for companies with domestic manufacturing footprints and may pose challenges for those reliant solely on imports.

- The Growth of Contract Manufacturing (CMO): The LATAM generic pharmaceuticals CMO market is expanding rapidly, with a projected CAGR of 9.3%. This provides a vital, capital-light pathway for companies to enter the market or expand production without the massive upfront cost of building their own facilities. It also offers a viable business model for local players who may lack the resources to commercialize their own products.

- Digital Transformation: The adoption of digital tools is accelerating. E-commerce platforms, like Hypera’s ihypera portal in Brazil, are creating new direct-to-consumer channels. Digital marketing is becoming a more efficient way to reach and educate healthcare professionals, and data analytics will play a greater role in understanding market dynamics and prescribing behavior.

- The Slow Creep of HTA: While the region lags behind Europe and North America, the influence of Health Technology Assessment (HTA) is growing. As public and private payers become more sophisticated, they will increasingly demand evidence of not just bioequivalence, but also cost-effectiveness and value. This will require all players, including generic and biosimilar manufacturers, to develop more sophisticated value demonstration capabilities.

The Latin American generic pharmaceutical market is, and will remain, a labyrinth. It is complex, fragmented, and challenging. But for those who approach it with the right strategic framework—choosing their battlefield, mastering the four pillars of dominance, and preparing for the next wave of innovation—it is a labyrinth with a very rich prize at its center.

Conclusion and Final Recommendations

Key Takeaways

- Embrace Fragmentation as a Strategic Reality: Do not treat Latin America as a single, monolithic market. Success requires a granular, country-by-country strategy that respects the unique regulatory, economic, and competitive dynamics of each nation. A single, blended regional forecast is a recipe for miscalculation.

- Dominance Requires a Dual-Market Approach: The LATAM market is fundamentally split between a price-driven public sector and a brand-driven private sector. Winning requires a tiered portfolio with distinct product and marketing strategies for each: low-cost unbranded generics for tenders and trusted branded generics for the out-of-pocket retail market.

- Regulatory and IP Intelligence are Offensive Weapons: The most successful companies do not view regulatory affairs and intellectual property as mere compliance hurdles. They are proactive, using sophisticated patent intelligence from platforms like DrugPatentWatch to hunt for high-value opportunities and leveraging regulatory reliance pathways to accelerate multi-market entry.

- Control the “Last Mile” of Distribution: In a region with consolidated distribution channels, securing a competitive advantage in getting the product to the pharmacy is paramount. This requires more than a standard contract; it demands deep strategic partnerships, acquisition of local players with strong networks, or vertical integration.

- Choose Your Archetype: Champion, Strategist, or Pioneer: There are multiple paths to success. A company must consciously choose its strategic posture: the deep domestic focus of a Local Champion (Hypera), the targeted, partnership-driven approach of a Focused Multinational (Viatris), or the ambitious, M&A-fueled expansion of a Pan-Regional Pioneer (Eurofarma).

- The Biosimilar Frontier Will Redefine the Landscape: The high costs and complexity of biosimilars will drive a new wave of consolidation and stratify the market. Strategic decisions about investing in this high-growth segment—or how to compete without it—will determine a company’s long-term viability and position in the regional hierarchy.

Frequently Asked Questions (FAQ)

1. Is it better for a new multinational entrant to acquire a local company or build from the ground up in LATAM?

For a multinational new to the region, acquiring a local company is almost always the superior strategy for accelerating market entry. Building from the ground up requires navigating complex regulatory approvals, establishing distribution networks, and building relationships with physicians and KOLs from scratch—a process that can take years and is fraught with risk. An acquisition, particularly of a company with a strong existing portfolio, a skilled sales force, and an established distribution network (like Eurofarma’s acquisition of Genfar), provides an instant platform. It immediately delivers market access, local expertise, and revenue, dramatically de-risking the entry and compressing the timeline to profitability.

2. How can a mid-sized generic company effectively compete against giants like Hypera or Eurofarma in a market like Brazil?

Direct, head-to-head competition across the board is likely to fail. A mid-sized company’s best strategy is to be highly selective and nimble. This involves:

- Niche Portfolio Selection: Focus on therapeutic areas or complex generic formulations that the giants may overlook or deem too small. Use advanced patent intelligence to find less-crowded opportunities.

- Leveraging CMOs: Instead of investing heavily in manufacturing, partner with a high-quality local Contract Manufacturing Organization (CMO) to reduce capital expenditure and increase flexibility. The CMO market in LATAM is growing specifically to serve this need.

- Targeted Geographic Focus: Concentrate commercial efforts on specific, high-potential regions within a large country like Brazil, rather than attempting a full national launch.

- Partnership for Distribution: Forge a strong, exclusive partnership with a regional distributor to gain access to their network without the cost of building one.

3. What is the single biggest mistake foreign companies make when entering the LATAM generics market?

The single biggest mistake is underestimating the importance of the “branded generic” and the power of local brand equity. Companies accustomed to markets where payers mandate the cheapest bioequivalent option often attempt a pure price-play strategy with unbranded generics. They fail to understand that in a region with high out-of-pocket spending, physician and patient trust is paramount. A locally recognized brand acts as a powerful signal of quality and reliability. Failing to invest in building a brand and relationships with physicians leaves a company vulnerable to local champions who have spent decades cultivating that trust.

4. With the rise of regulatory reliance, is it still necessary to have a dedicated regulatory team for each major LATAM country?

Yes, absolutely. While regulatory reliance is a powerful strategic tool for accelerating initial submissions, it is not a substitute for local expertise. A central team can prepare the core “reliance-ready” dossier, but a dedicated local team or a highly experienced local partner is still essential for several reasons:

- Navigating Local Nuances: Even with reliance, there are always unique administrative requirements, language translations, and specific forms for each country.

- Managing the Relationship: The local team manages the day-to-day relationship with the NRA, responding to queries and troubleshooting issues that inevitably arise during the review process.

- Post-Market Compliance: Local teams are responsible for pharmacovigilance, managing renewals, and handling any other regulatory issues that occur after the product is on the market.

Reliance gets you in the door faster; a local team ensures you can stay and thrive.

5. How will the increasing influence of Health Technology Assessment (HTA) change the game for generic and biosimilar companies in LATAM?

As HTA bodies become more influential, the basis of competition will subtly shift from pure price to demonstrated value, even for off-patent products. For simple generics, the impact may be minimal, as price will remain the dominant factor. However, for complex generics and especially biosimilars, the change will be significant. Companies will no longer be able to rely solely on proving bioequivalence. They will need to develop and present pharmacoeconomic data demonstrating that their product provides a cost-effective solution for the national health system. This will require a new skill set, including health economists and market access specialists, to build and communicate a compelling value proposition to payers. The companies that build this capability first will have a significant advantage in securing favorable reimbursement and formulary placement for their high-value products.

References

- Latin America Generic Drug Market Size and Report 2033 – IMARC Group, accessed August 7, 2025, https://www.imarcgroup.com/latin-america-generic-drug-market

- Latin America Generic Drugs Market Report and Forecast 2024-2032, accessed August 7, 2025, https://www.researchandmarkets.com/report/latin-america-generics-market

- Latin America Generic Drugs Companies: Key Players – Expert Market Research, accessed August 7, 2025, https://www.expertmarketresearch.com/reports/latin-america-generic-drugs-market/companies

- Regulatory Challenges in the Latin American Generic Drug Market, accessed August 7, 2025, https://www.drugpatentwatch.com/blog/regulatory-challenges-in-the-latin-american-generic-drug-market/

- INTRODUCTION: Rethinking Pharmaceutical Policies in Latin America and the Caribbean: An Overview | Journal of Law, Medicine & Ethics – Cambridge University Press, accessed August 7, 2025, https://www.cambridge.org/core/journals/journal-of-law-medicine-and-ethics/article/introduction-rethinking-pharmaceutical-policies-in-latin-america-and-the-caribbean-an-overview/DB760277E524E2A3EBA46E806CEC8DEB

- Pharmaceuticals in Latin America and the Caribbean – Players, access, and innovation across diverse models, accessed August 7, 2025, https://openknowledge.worldbank.org/bitstreams/353c099b-8aae-58f5-8a6d-c07eef593556/download

- Latin America Generic Pharmaceuticals Market Size & Outlook, 2028, accessed August 7, 2025, https://www.grandviewresearch.com/horizon/outlook/generic-pharmaceuticals-market/latin-america

- Earnings call transcript: Genomma Lab Q2 2025 sees steady sales, net income decline, accessed August 7, 2025, https://www.investing.com/news/transcripts/earnings-call-transcript-genomma-lab-q2-2025-sees-steady-sales-net-income-decline-93CH-4151765

- Latin America’s Pharmaceutical Market Access: Challenges and Opportunities in Emerging Markets – MedPath, accessed August 7, 2025, https://trial.medpath.com/news/0bbb175932232923/latin-america-s-pharmaceutical-market-access-challenges-and-opportunities-in-emerging-markets

- Pharmaceuticals in Latin America and the Caribbean : Players, Access, and Innovation Across Diverse Models (English) – World Bank Documents and Reports, accessed August 7, 2025, https://documents.worldbank.org/en/publication/documents-reports/documentdetail/766131641877985994/pharmaceuticals-in-latin-america-and-the-caribbean-players-access-and-innovation-across-diverse-models

- Latin America Generic Pharmaceuticals Contract Manufacturing Market Size & Outlook, accessed August 7, 2025, https://www.grandviewresearch.com/horizon/outlook/generic-pharmaceuticals-contract-manufacturing-market/latin-america

- HEALTH: Regulating and Promoting Generic Drugs in Latin America, accessed August 7, 2025, https://clacs.berkeley.edu/health-regulating-and-promoting-generic-drugs-latin-america

- Latin America’s Generic Drug Market Faces Regulatory Hurdles Despite Growing Middle Class and Healthcare Spending – GeneOnline, accessed August 7, 2025, https://www.geneonline.com/latin-americas-generic-drug-market-faces-regulatory-hurdles-despite-growing-middle-class-and-healthcare-spending/

- Opportunities and Challenges in the Latin American Pharmaceutical Industry – DLRC Group, accessed August 7, 2025, https://www.dlrcgroup.com/wp-content/uploads/2024/03/Whitepaper-Opportunities-Challenges-in-the-Latin-American-Pharmaceutical-Industry.pdf

- Challenges And Opportunities In Generic Drug Market Expansion Across Developing Nations, accessed August 7, 2025, https://www.jneonatalsurg.com/index.php/jns/article/view/8206

- Generating value in generics: Finding the next five years of growth – McKinsey, accessed August 7, 2025, https://www.mckinsey.com/~/media/mckinsey/dotcom/client_service/pharma%20and%20medical%20products/pmp%20new/pdfs/generating%20value%20in%20generics_final.pdf

- IP Regulations in Latin America – CHIP LAW GROUP, accessed August 7, 2025, https://www.chiplawgroup.com/ip-regulations-in-latin-america/

- Medicines regulation, pricing and reimbursement in Brazil | Journal …, accessed August 7, 2025, https://jhphs.org/sbrafh/article/view/769

- Pharmaceutical Regulations and Registration in Argentina – Artixio, accessed August 7, 2025, https://www.artixio.com/post/pharmaceutical-regulations-and-registration-in-argentina

- Mexico – Healthcare Products & Services, accessed August 7, 2025, https://www.trade.gov/country-commercial-guides/mexico-healthcare-products-services

- Pharmaceuticals in Latin America and the Caribbean – Players …, accessed August 7, 2025, https://openknowledge.worldbank.org/server/api/core/bitstreams/353c099b-8aae-58f5-8a6d-c07eef593556/content

- Colombia Pharmacy Chains Overview – Chameleon Pharma …, accessed August 7, 2025, https://www.chameleon-pharma.com/insights-on-colombias-pharmacy-chains-and-pharma-otc-market-data-until-2040/

- Intellectual property and access to medicines: an analysis of legislation in Central America, accessed August 7, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC2755309/

- Intellectual Property Rights and Sustainable Development: A Survey of Major Issues – Repositorio CEPAL, accessed August 7, 2025, https://repositorio.cepal.org/server/api/core/bitstreams/86e96e25-e66c-44dc-8d3f-dc289c96597e/content

- Intellectual Property in Latin America – Number Analytics, accessed August 7, 2025, https://www.numberanalytics.com/blog/intellectual-property-latin-america-foreign-policy

- The Simple Framework for Finding Generic Drug Winners – DrugPatentWatch, accessed August 7, 2025, https://www.drugpatentwatch.com/blog/opportunities-for-generic-drug-development/

- DrugPatentWatch | Software Reviews & Alternatives – Crozdesk, accessed August 7, 2025, https://crozdesk.com/software/drugpatentwatch

- Quick Guide to Market Access in the Latin America Healthcare and Life Sciences Sector – Baker McKenzie, accessed August 7, 2025, https://www.bakermckenzie.com/-/media/files/insight/guides/2025/market-access-guide-in-la-for-hls.pdf

- Is the Brazilian pharmaceutical policy ensuring population access to essential medicines? – PMC – PubMed Central, accessed August 7, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC3511298/

- Pharmaceutical Pricing and Reimbursement Policies in Mexico | OECD, accessed August 7, 2025, https://www.oecd.org/en/publications/pharmaceutical-pricing-and-reimbursement-policies-in-mexico_302355455158.html

- Economic tools for ensuring access to medicines in Latin American countries1, accessed August 7, 2025, https://lac.unfpa.org/sites/default/files/pub-pdf/Tobar%20%26%20Martich.%20Economics%20tools%20for%20ensuring%20access%20to%20medicines%20in%20LAC%20ENGLISH.pdf

- The Importance of Generic Medicines in Mexico, accessed August 7, 2025, https://mexicobusiness.news/health/news/importance-generic-medicines-mexico

- Colombia’s OTC & Rx Market – Chameleon Pharma Consulting, accessed August 7, 2025, https://www.chameleon-pharma.com/growth-strategies-for-otc-and-rx-pharma-companies-entering-colombia/

- Emilio Sardi – Vice President, Tecnoquimicas, Colombia – PharmaBoardroom, accessed August 7, 2025, https://pharmaboardroom.com/interviews/interview-emilio-sardi-vice-president-tecnoquimicas-colombia/

- HYPE3 Investor Relations – Hypera SA – Alpha Spread, accessed August 7, 2025, https://www.alphaspread.com/security/bovespa/hype3/investor-relations

- Corporate Profile – Hypera, accessed August 7, 2025, https://ri.hypera.com.br/en/hypera-pharma/corporate-profile/

- Top 5 Brazilian Pharma Companies – PharmaBoardroom, accessed August 7, 2025, https://pharmaboardroom.com/articles/top-5-brazilian-pharma-companies/

- 10 Pharmaceutical Companies in Brazil to Know | Built In, accessed August 7, 2025, https://builtin.com/articles/pharmaceutical-companies-in-brazil

- Our Story – Viatris, accessed August 7, 2025, https://www.viatris.com/en/about-us/our-story

- About Us – Viatris, accessed August 7, 2025, https://www.viatris.com/en/about-us

- Patrick Doyle – Head, Viatris Latin America – PharmaBoardroom, accessed August 7, 2025, https://pharmaboardroom.com/interviews/patrick-doyle-head-of-viatris-latin-america/

- About the Company – Eurofarma, accessed August 7, 2025, https://eurofarma.com/about-the-company

- 2024 Results – RI Eurofarma, accessed August 7, 2025, https://ri.eurofarma.com.br/storage/uploads/file_67e47f9c63fe67.21953739.pdf

- Top Pharmaceutical Companies in Brazil by Assets – Bullfincher, accessed August 7, 2025, https://bullfincher.io/ranking/top-pharmaceutical-companies-in-brazil-by-assets

- La Compañia – Roemmers, accessed August 7, 2025, https://roemmers.com.ar/la-compania/

- The Pharmaceutical Market for Biological Products in Latin America: A Comprehensive Analysis of Regional Sales Data | Journal of Law, Medicine & Ethics, accessed August 7, 2025, https://www.cambridge.org/core/journals/journal-of-law-medicine-and-ethics/article/pharmaceutical-market-for-biological-products-in-latin-america-a-comprehensive-analysis-of-regional-sales-data/6AE11D8A159BD46B0CA243A1BAC709A7

- Sandoz aims to consolidate position within Brazilian biosimilars R&D market through mAb trial – S&P Global, accessed August 7, 2025, https://www.spglobal.com/marketintelligence/en/mi/country-industry-forecasting.html?id=1065996469

- Pharma Intelligence for the Latin American Market, accessed August 7, 2025, https://globalhealthintelligence.com/pharma-intelligence-for-the-latin-american-market/

- A Guide to the Key Pharma Markets in Latin America, accessed August 7, 2025, https://tannerpharma.com/wp-content/uploads/2022/10/LAC-A-Guide-to-the-Key-Pharma-Markets-in-LATAM.pdf

- Reports and Publications – IQVIA, accessed August 7, 2025, https://www.iqvia.com/insights/the-iqvia-institute/reports-and-publications

- The Global Use of Medicines Outlook Through 2029 – IQVIA, accessed August 7, 2025, https://www.iqvia.com/insights/the-iqvia-institute/reports-and-publications/reports/the-global-use-of-medicines-outlook-through-2029

- Valuing the Research-based Pharmaceutical Industry in Latin America – IQVIA, accessed August 7, 2025, https://www.iqvia.com/insights/the-iqvia-institute/reports-and-publications/reports/valuing-the-research-based-pharmaceutical-industry-in-latin-america

- Global Use of Medicines 2024 – IQVIA, accessed August 7, 2025, https://www.iqvia.com/-/media/iqvia/pdfs/china/viewpoints/iqvia-institute-general-use-of-medicines-2024-for-print.pdf

- The Outlook for the Latin American Pharmaceutical Market Following the Impact of the COVID-19 Pandemic – IQVIA, accessed August 7, 2025, https://www.iqvia.com/library/publications/the-outlook-for-the-latin-american-pharmaceutical-market

- The Global Use of Medicines 2024: Outlook to 2028 – IQVIA, accessed August 7, 2025, https://www.iqvia.com/insights/the-iqvia-institute/reports-and-publications/reports/the-global-use-of-medicines-2024-outlook-to-2028

- Generics Portfolio Strength and Market Share – Umbrex, accessed August 7, 2025, https://umbrex.com/resources/industry-analyses/how-to-analyze-a-pharmaceutical-company/generics-portfolio-strength-and-market-share/

- Latin American Pharmaceutical Market Sees Rising Demand for Affordable Specialty Generic Medications Due to Aging Population and Chronic Disease Prevalence – GeneOnline, accessed August 7, 2025, https://www.geneonline.com/latin-american-pharmaceutical-market-sees-rising-demand-for-affordable-specialty-generic-medications-due-to-aging-population-and-chronic-disease-prevalence/

- Intellectual property rights are a complex issue in Latin America – H&A, accessed August 7, 2025, https://hyaip.com/en/intellectual-property-rights-are-a-complex-issue-in-latin-america/

- Delivering Most-Favored-Nation Prescription Drug Pricing to American Patients, accessed August 7, 2025, https://www.whitehouse.gov/presidential-actions/2025/05/delivering-most-favored-nation-prescription-drug-pricing-to-american-patients/

- Top 10 Pharma Companies in Mexico – PharmaBoardroom, accessed August 7, 2025, https://pharmaboardroom.com/facts/top-10-pharma-companies-in-mexico/

- Pharmaceutical manufacturing Companies in Mexico | Sales leads list by Lusha – Page 3, accessed August 7, 2025, https://www.lusha.com/company-search/pharmaceutical-manufacturing/e0f690b5b5/mexico/97/page/3/

- Mexican pharmaceutical industry booms – WEDC, accessed August 7, 2025, https://wedc.org/market-intelligence/posts/mexican-pharmaceutical-industry-booms/

- Pharmaceutical Sector in Argentina – Embassy of India, Buenos …, accessed August 7, 2025, https://www.indembarg.gov.in/content/Pharmaceutical-Sector-in-Argentina-2024.pdf

- Argentina – Biotech, Pharma, Medical Device Companies – BioPharmGuy, accessed August 7, 2025, https://biopharmguy.com/links/company-by-location-argentina.php

- Pharmaceutical manufacturing Companies in Argentina | Sales leads list by Lusha, accessed August 7, 2025, https://www.lusha.com/company-search/pharmaceutical-manufacturing/e0f690b5b5/argentina/220/

- Is the representative of the pharmaceutical industry of generic drugs in Argentina and the main business partner qualified in this area. – CAPGEN, accessed August 7, 2025, https://capgen.com.ar/en/index.html

- Top 10 Pharma Companies in Colombia – PharmaBoardroom, accessed August 7, 2025, https://pharmaboardroom.com/facts/top-10-pharma-companies-in-colombia/

- Pharmaceutical manufacturing Companies in Colombia | Sales leads list by Lusha, accessed August 7, 2025, https://www.lusha.com/company-search/pharmaceutical-manufacturing/e0f690b5b5/colombia/186/

- Top 10 Pharmaceutical Tablet Manufacturers in Colombia – Wellona Pharma, accessed August 7, 2025, https://wellonapharma.com/blog/top-10-pharmaceutical-tablet-manufacturers-in-colombia

- The Growing Importance of Specialty Generics in the Latin American Pharmaceutical Market, accessed August 7, 2025, https://www.drugpatentwatch.com/blog/the-growing-importance-of-specialty-generics-in-the-latin-american-pharmaceutical-market/

- Tevapharm – Teva Worldwide Locations, accessed August 7, 2025, https://www.tevapharm.com/teva-worldwide-locations/

- Teva Pharmaceuticals – Wikipedia, accessed August 7, 2025, https://en.wikipedia.org/wiki/Teva_Pharmaceuticals

- Teva Pharmaceutical Industries Ltd – Access to Medicine Foundation, accessed August 7, 2025, https://accesstomedicinefoundation.org/company/teva-pharmaceutical-industries-ltd/generics

- Teva Pharmaceutical Industries Ltd – Access to Medicine Foundation, accessed August 7, 2025, https://accesstomedicinefoundation.org/medialibrary/teva-1695723702.pdf

- Teva sees opportunities in Latin America, Asia – Fierce Pharma, accessed August 7, 2025, https://www.fiercepharma.com/pharma/teva-sees-opportunities-latin-america-asia

- Products | Viatris, accessed August 7, 2025, https://www.viatris.com/en/products

- Our Locations – Viatris, accessed August 7, 2025, https://www.viatris.com/en/careers/locations-near-you

- Viatris | Global Healthcare Company, accessed August 7, 2025, https://www.viatris.com/en

- Sandoz Central America & Caribbean, accessed August 7, 2025, https://www.cac.sandoz.com/en/about-us/sandoz-central-america-caribbean/

- Sandoz – Wikipedia, accessed August 7, 2025, https://en.wikipedia.org/wiki/Sandoz

- Biosimilars in Immunology | Sandoz US, accessed August 7, 2025, https://www.sandoz.com/us-en/biosimilars/immunology/

- Sandoz Site Directory, accessed August 7, 2025, https://www.sandoz.com/sandoz-site-directory/

- Brazil – Sun Pharmaceutical Industries Ltd., accessed August 7, 2025, https://sunpharma.com/brazil-en/

- Sun Pharma – Wikipedia, accessed August 7, 2025, https://en.wikipedia.org/wiki/Sun_Pharma

- About Us | Sun Pharmaceutical Industries Limited, accessed August 7, 2025, https://sunpharma.com/about-us/

- Sun Pharma – Leading Global Specialty Generic Pharmaceutical Company, accessed August 7, 2025, https://sunpharma.com/

- Global Footprint – Sun Pharmaceutical Industries Ltd., accessed August 7, 2025, https://sunpharma.com/blog/why_sunpharma/global-footprint/

- Management – Hypera, accessed August 7, 2025, https://ri.hypera.com.br/en/hypera-pharma/management/

- ESG & Integrity – RI – Hypera, accessed August 7, 2025, https://ri.hypera.com.br/en/hypera-pharma/esg_integrity/

- Corporate Governance – Eurofarma, accessed August 7, 2025, https://eurofarma.com/corporate-governance

- Sustainability Report – Eurofarma, accessed August 7, 2025, https://eurofarma.com/sustainability-report

- Grupo Roemmers – Case Study – World Bank Documents and Reports, accessed August 7, 2025, https://documents.worldbank.org/pt/publication/documents-reports/documentdetail/357341646738194071/grupo-roemmers-case-study

- Grupo Roemmers – Case Study – Documentos e informes – Banco Mundial, accessed August 7, 2025, https://documentos.bancomundial.org/es/publication/documents-reports/documentdetail/316521646737780133/grupo-roemmers-case-study

- The Argentine Dream – The Washington Post, accessed August 7, 2025, https://www.washingtonpost.com/creativegroup/investment-reports/the-argentine-dream/

- Laboratorios Bagó, Argentina – PharmaBoardroom, accessed August 7, 2025, https://pharmaboardroom.com/directory/laboratorios-bago-argentina/

- Presentación de la Compañía – Laboratorios Bagó, accessed August 7, 2025, https://www.bago.com.ar/en/presentacion-de-la-compania/

- Financial Information — Genomma Lab, accessed August 7, 2025, https://inversionistas.genommalab.com/en/financial-information/

- Public Filings – Genomma Lab — Relación con Inversionistas, accessed August 7, 2025, https://inversionistas.genommalab.com/en/public-filings/

- Tecnoquimicas – Disclosure, accessed August 7, 2025, https://disclosures.ifc.org/project-detail/SPI/25672/tecnoquimicas

- Colombian Tecnoquimicas’ USD 200 Million Manufacturing Investment – PharmaBoardroom, accessed August 7, 2025, https://pharmaboardroom.com/articles/colombian-tecnoquimicas-usd-200-million-manufacturing-investment/

- Sandoz H1 2025 slides: Biosimilars drive growth as margins expand significantly, accessed August 7, 2025, https://www.investing.com/news/company-news/sandoz-h1-2025-slides-biosimilars-drive-growth-as-margins-expand-significantly-93CH-4175490

- Why Sandoz | Sandoz, accessed August 7, 2025, https://www.sandoz.com/investors/why-sandoz/

- Investor Relations – Sandoz, accessed August 7, 2025, https://www.sandoz.com/investors/

- The Role of Patents and Regulatory Exclusivities in Drug Pricing | Congress.gov, accessed August 7, 2025, https://www.congress.gov/crs-product/R46679

- Patenting Drugs Developed with Artificial Intelligence: Navigating …, accessed August 7, 2025, https://www.drugpatentwatch.com/blog/patenting-drugs-developed-with-artificial-intelligence-navigating-the-legal-landscape/

- DrugPatentWatch 2025 Company Profile: Valuation, Funding & Investors | PitchBook, accessed August 7, 2025, https://pitchbook.com/profiles/company/519079-87

- What is ANMAT? | Argentina.gob.ar, accessed August 7, 2025, https://www.argentina.gob.ar/anmat/anmat-en/what-anmat

- The Colombian OTC and pharma market, accessed August 7, 2025, https://www.chameleon-pharma.com/the-colombian-self-medication-and-pharma-market/