A Comprehensive Industry Report regarding the Technological, Economic, and Regulatory Transformation of the Pharmaceutical Sector (2025-2030)

Executive Summary: The End of the Beginning

The pharmaceutical industry currently stands at a precipice that is as terrifying as it is exhilarating. For decades, the sector has been governed by Eroom’s Law—the observation that drug discovery becomes slower and more expensive over time, despite improvements in technology. The cost to bring a new asset to market has ballooned to over $2 billion, with a failure rate that hovers stubbornly around 90% once a candidate enters clinical trials.1 This inefficiency has created a crisis of productivity where the return on investment for R&D has been in secular decline, forcing major players to rely on mergers and acquisitions rather than internal innovation to replenish pipelines.

However, as we move through 2025, the narrative is shifting fundamentally. We have moved past the initial “hype cycle” of artificial intelligence—where every startup with a Python script claimed to cure cancer—and entered a phase of industrialized reality. The question is no longer if AI will change drug development, but how quickly incumbents can adapt before they are rendered obsolete. This is not merely an incremental improvement in efficiency; it represents a paradigm shift in how biological questions are asked and answered.

This report argues that AI is not merely a tool for efficiency; it is becoming the primary engine of biological interrogation. From the FDA’s landmark January 2025 guidance legitimizing AI in regulatory submissions 3 to the first Phase 2a successes of AI-generated molecules by Insilico Medicine 4, the theoretical promise is converting into clinical proof. Yet, the road is paved with failures, as evidenced by Recursion’s discontinuation of the REC-994 trial 5, reminding us that while AI can predict chemistry, biology remains maddeningly complex. The divergence between success in early-stage discovery and the stubborn challenges of late-stage clinical translation defines the current moment.

We are witnessing a bifurcation in the market. On one side are the “AI-native” biotechs (Recursion, Insilico, Exscientia) effectively acting as tech firms that do biology, treating data as their primary asset and the drug as a physical manifestation of that data. On the other are the giants—Pfizer, Novartis, Sanofi—who are aggressively integrating these capabilities to defend their market dominance.6 The interplay between these two groups—through partnerships, acquisitions, and competition—will define the industry’s structure for the next decade.

This report provides an exhaustive analysis of this transformation, covering the technical leaps in generative models, the shifting regulatory sands, the geopolitical risks of the Biosecure Act, and the critical role of intellectual property data in training the next generation of algorithms. It delves into the granular details of specific clinical trials, the nuances of new machine learning architectures like diffusion models and equivariant neural networks, and the strategic imperatives for executives navigating this new landscape.

1. The Economic Imperative: Why the Old Model is Dying

1.1 The Innovation Crisis and Eroom’s Law

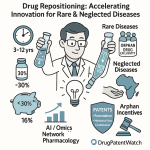

The traditional drug discovery model is fundamentally a lottery, a brute-force exercise in empiricism that is becoming increasingly unsustainable. Researchers historically screen millions of compounds against a biological target, hoping for a “hit” that binds effectively. This process is inefficient, costly, and prone to failure. The attrition rate is catastrophic: for every 10,000 compounds synthesized, only one typically gains FDA approval. Eroom’s Law (Moore’s Law spelled backward) captures this diminishing return: the number of new drugs approved per billion US dollars spent on R&D has halved roughly every nine years since 1950.

This crisis is not just about money; it is about time and opportunity cost. Developing a new drug takes an average of 10-15 years. In a world of rapidly aging populations and emerging health threats, this timeline is unacceptable. AI promises to invert this model entirely. Instead of screening existing libraries of molecules, generative AI allows researchers to design molecules with specific properties de novo. This shift from “discovery by luck” to “discovery by design” is the central economic thesis of AI in pharma. It transforms drug discovery from a search problem into an engineering problem.

“AI will not replace discovery teams. But discovery teams using AI will outpace those who don’t.”

— Huspi Report, 2025 8

The implications of this shift are profound. If the probability of success in early discovery can be doubled, and the time to reach the clinic halved, the economics of the entire industry change. Smaller markets—such as rare diseases—become viable targets because the cost of entry drops. This democratization of discovery could lead to a proliferation of treatments for conditions that were previously ignored due to poor unit economics.

1.2 Market Sizing and Investment Velocity

The financial stakes driving this transformation are immense, attracting capital from traditional life sciences investors and tech-focused venture capital alike. Analysts project the AI in drug discovery market to explode from approximately $2.6 billion in 2025 to between $8 billion and $20 billion by 2030, representing a Compound Annual Growth Rate (CAGR) of roughly 26–31%.8 Other estimates are even more bullish, predicting the broader AI in pharmaceuticals market could reach $21.51 billion by 2035.9

This growth is driven by a desperate need to compress timelines. If AI can reduce the preclinical phase from 5-6 years to 18 months, the Net Present Value (NPV) of a drug asset increases dramatically. This value capture comes from two sources: first, the direct reduction in R&D operational expenditure (OpEx); and second, and more importantly, the extended period of patent exclusivity on the market before generic entry. Every month saved in development is a month of peak sales added to the backend of the product’s lifecycle.

Investment trends in 2025 reflect this urgency. Venture capital funding for AI drug discovery totaled $2.7 billion through the first three quarters of 2025 alone.10 We are seeing a maturation of the investment thesis. In the early 2020s, money flowed into any company with “AI” in its pitch deck. Today, investors are discerning. Capital is concentrating in “platform” companies that can demonstrate not just algorithmic prowess but the ability to generate proprietary data at scale. This “flight to quality” is evident in the massive fundraising rounds for companies like Xaira Therapeutics and Isomorphic Labs.10

1.3 The Efficiency Dividend

Beyond discovery, AI is wringing inefficiencies out of the clinical trial process, which accounts for the lion’s share of drug development costs. Patient recruitment, often the bottleneck of clinical development, is being revolutionized. Sanofi, for instance, is collaborating with OpenAI and Formation Bio to develop tools that reduce patient recruitment timelines “from months to minutes” by optimizing recruitment strategy and content creation.11

The economic argument is simple: failing faster is valuable, but succeeding faster is transformative. AI allows companies to kill unpromising projects earlier in the pipeline—before they enter expensive human trials—thereby reallocating capital to assets with a higher probability of success (PoS). McKinsey estimates that generative AI could unlock $60 billion to $110 billion annually for the pharmaceutical industry.12 This value is not theoretical; it is beginning to manifest in the operational metrics of early adopters who report reduced cycle times and lower costs per lead series.

2. The 2025 Clinical Landscape: Hype Meets Hard Data

2024 and 2025 have been the years of “show me the data.” The industry has moved beyond press releases about “partnerships” to scrutinizing clinical readouts. The results are a mixed bag, providing a realistic view of AI’s current capabilities and limitations. We are leaving the phase of unbridled optimism and entering a phase of clinical calibration.

2.1 The Triumph: Insilico Medicine’s ISM001-055

In November 2024, Insilico Medicine provided a resounding validation for the sector. They announced positive topline results from a Phase 2a trial of ISM001-055, a drug designed entirely by AI to target TNIK (Traf2- and NCK-interacting kinase) for Idiopathic Pulmonary Fibrosis (IPF).4 This event is significant because it represents the first time a drug discovered and designed by generative AI has shown efficacy in a patient population for a complex chronic disease.

The trial enrolled 71 patients across 21 sites in China. The drug showed a dose-dependent improvement in Forced Vital Capacity (FVC), a key measure of lung function. Patients on the highest dose (60 mg QD) saw a mean improvement of 98.4 mL from baseline after 12 weeks, compared to a decline of -62.3 mL in the placebo group.4

Why this matters:

- Novel Target, Novel Molecule: Unlike many “AI” drugs that are repurposed existing compounds, this was a “moonshot” program. The target (TNIK) was identified by Insilico’s AI engine, PandaOmics, as being relevant to fibrosis. The molecule itself was designed by their generative chemistry engine, Chemistry42.

- Speed: The program moved from target discovery to preclinical candidate nomination in just 18 months, and to Phase 1 in under 30 months—roughly half the time of the traditional industry average.13

- Validation: Its success in a Phase 2a trial—the “valley of death” where efficacy usually fails—is a critical proof point. It suggests that AI can not only find safe molecules (Phase 1) but effective ones that modulate disease biology in humans.13

2.2 The Setback: Recursion’s REC-994

Conversely, Recursion Pharmaceuticals faced a difficult reality in May 2025. Their lead asset, REC-994 for Cerebral Cavernous Malformation (CCM), was discontinued after long-term extension data failed to show sustained improvements in MRI results or functional outcomes.5

REC-994 was an AI-repurposed molecule. Recursion used its phenomics platform—which analyzes cellular images to detect morphological changes—to identify that an existing superoxide scavenger could reverse the cellular phenotype of CCM.

- The Signal: In preclinical models and cellular assays, the signal was clear. The AI correctly identified biological activity.

- The Noise: Translation to human efficacy in a complex, chronic neurological disease proved elusive. While the Phase 2 SYCAMORE trial met its primary safety endpoint, the secondary efficacy endpoints (lesion volume reduction) seen at 12 months were not sustained in the long-term extension.5

- The Lesson: This failure highlights the “translation gap.” AI is powerful at identifying cellular correlations, but human biology is a system of systems. A drug might work in a cell (phenotype) but fail in an organ due to compensatory mechanisms, bioavailability issues, or disease heterogeneity that a cellular model cannot capture.

This setback has likely accelerated Recursion’s move toward consolidation, driving their acquisition of Exscientia. By combining Recursion’s massive industrial biology scale with Exscientia’s precision chemistry capabilities, they aim to bridge the gap between identifying a target and designing a molecule that works in the human body.8

2.3 The Pivot: Exscientia and BenevolentAI

The sector is also witnessing a “flight to quality” and strategic pruning. Exscientia, prior to the Recursion merger, discontinued its A2A receptor antagonist program (EXS-21546) after determining it wouldn’t achieve a suitable therapeutic index.15 Similarly, BenevolentAI faced failures in atopic dermatitis with BEN-2293, which met safety endpoints but failed to show statistical significance in efficacy compared to placebo.16

These failures have forced a restructuring. BenevolentAI laid off significant staff and closed US offices to extend its cash runway, pivoting back to early-stage discovery partnerships where its technology can add value without the massive capital risk of clinical development.17 This trend suggests a maturing market where “AI companies” are realizing that becoming a full-stack biotech is exceptionally difficult and capital-intensive.

2.4 Clinical Success Rates: The 80-90% Anomaly

A striking statistic has emerged from recent analyses: AI-discovered molecules are showing an 80-90% success rate in Phase I clinical trials, compared to the historical industry average of 40-65%.18

Analysis: This statistic is often cited as proof of AI’s dominance, but it requires nuance. Phase I trials primarily test for safety and pharmacokinetics (PK)—how the drug moves through the body.

- Why AI wins here: AI is exceptionally good at solving for “drug-like” properties—solubility, permeability, metabolic stability, and toxicity (ADMET). By optimizing these parameters in silico before a molecule is ever synthesized, AI ensures that the molecules entering the clinic are physically robust and less likely to fail due to “bad chemistry.”

- The Phase II Cliff: However, the Phase II success rates (efficacy) currently track closer to historical averages (~40%).20 This indicates that while AI has solved the “chemistry” problem (making a good molecule), predicting “biology” (efficacy in a complex disease) remains the “final frontier.” The Recursion REC-994 failure is a prime example of a molecule that was safe (passed Phase 1) but not efficacious (failed Phase 2).

2.5 Emerging Clinical Candidates

Beyond the headlines, a robust pipeline of AI-generated assets is advancing.

- Verge Genomics: Is conducting a proof-of-concept study for VRG50635 in ALS. Uniquely, they are using novel digital biomarkers (voice, mobility) to detect efficacy signals earlier than traditional endpoints, leveraging AI not just for drug design but for trial measurement.22

- Schrödinger: Is advancing SGR-1505, a MALT1 inhibitor for B-cell malignancies. Phase 1 data presented in mid-2025 showed encouraging safety and preliminary efficacy, leading to FDA Fast Track designation.23

- Relay Therapeutics: Is progressing RLY-2608, a PI3Kα inhibitor designed using their Dynamo platform which combines AI with physics-based simulations. They are initiating a Phase 3 trial in breast cancer, marking one of the most advanced AI-enabled assets in the industry.25

3. Technological Leaps: Beyond Structure Prediction

3.1 The AlphaFold 3 and RoseTTAFold Era

The release of AlphaFold 3 by Google DeepMind and Isomorphic Labs has fundamentally altered the playing field. Unlike its predecessor, AlphaFold 2, which predicted static protein structures, AlphaFold 3 predicts the interactions of proteins with DNA, RNA, and—crucially—small molecule ligands.26

Technical Nuance:

- Unified Framework: AlphaFold 3 uses a diffusion-based architecture (similar to image generators) to predict the 3D coordinates of atoms. It replaces the “Evoformer” module of AlphaFold 2 with a “Pairformer” and eliminates the need for Multiple Sequence Alignments (MSAs) in some contexts, making it faster and more versatile.28

- Impact: This allows researchers to model the “docking” of a potential drug into a protein target with unprecedented accuracy. It reportedly achieves at least a 50% improvement in interaction prediction over existing methods.29

- Competition: It isn’t the only game in town. Tools like RoseTTAFold All-Atom are providing open-source alternatives, democratizing access to high-fidelity structural biology. While AlphaFold 3 currently leads in accuracy, the open nature of RoseTTAFold allows for rapid community iteration.30

3.2 Diffusion Models: The Generative Engine

Just as diffusion models (like Stable Diffusion) revolutionized image generation, they are now revolutionizing molecular design. Models like DiffDock and others treat molecular generation as a “denoising” process. They start with random noise and iteratively refine it into a molecular structure that fits a specific 3D protein pocket.31

Why Diffusion?

- Exploration vs. Exploitation: Traditional methods (like genetic algorithms) often get stuck in local optima—finding “good enough” molecules similar to what is already known. Diffusion models can explore chemical space far more broadly. They can “invent” molecules that medicinal chemists might consider counter-intuitive but which possess superior binding or pharmacokinetic properties.

- Permutation Invariance: Diffusion models handle the graph structure of molecules (nodes and edges) naturally, respecting the fact that a molecule is the same regardless of how you rotate it in space (unlike some older sequence-based models).31

3.3 Equivariant Neural Networks (ENNs)

A critical advancement in 2025 is the widespread adoption of E(3) Equivariant Graph Neural Networks (EGNNs) for protein analysis. In 3D space, a molecule’s properties shouldn’t change just because you rotate the frame of reference. Standard neural networks struggle with this, requiring massive data augmentation (showing the network the same molecule rotated 100 ways) to learn this invariance.

ENNs are mathematically designed to be rotation-invariant by default. This makes them incredibly data-efficient. They can learn from smaller datasets because they “understand” the physics of 3D space implicitly. This is crucial for tasks like predicting protein-protein interaction sites or assessing the quality of a predicted structure.33

3.4 Lab-in-the-Loop and Self-Driving Labs

The future isn’t just AI; it’s AI connected to robotics. Companies like Recursion and Insitro are building “closed-loop” systems. The AI designs an experiment, robots execute it (e.g., creating thousands of “mini-brains” on a chip), the data is fed back into the AI to retrain the model, and the cycle repeats.

This automated iteration creates a flywheel effect. The AI doesn’t just learn from static historical data; it actively queries biological reality to fill the gaps in its knowledge. This “active learning” approach is reducing the number of experiments needed to find a hit by orders of magnitude.35

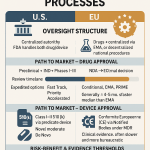

4. The Regulatory Tectonics: The FDA Enters the Chat

For years, regulatory uncertainty was the biggest barrier to AI adoption. Sponsors were terrified that using a “black box” algorithm would result in a rejected NDA (New Drug Application). In January 2025, the FDA changed everything.

4.1 The January 2025 Draft Guidance

The FDA issued the draft guidance: “Considerations for the Use of Artificial Intelligence to Support Regulatory Decision-Making for Drug and Biological Products”.3 This is a watershed moment that moves AI from a “nice to have” to a regulated “must have.”

Key Components of the Guidance:

| Component | Description | Implication for Sponsors |

| Risk-Based Framework | Scrutiny depends on impact. High-risk AI (e.g., determining dose or endpoints) faces rigorous validation. Low-risk AI (e.g., back-office sorting) faces less. | Sponsors must classify their AI use cases early and allocate validation resources accordingly. |

| Methodological Transparency | The “black box” is not an excuse. Sponsors must document data sources, training methods, and logic. | Requires a complete audit trail of the AI’s development. “Proprietary algorithm” is no longer a shield against disclosure. |

| Credibility Assessment | A 7-step process to prove the model works for a specific “Context of Use” (COU). | Validation is not general; it is specific. A model valid for toxicity prediction is not automatically valid for efficacy. |

| Lifecycle Management | Requirement to monitor models for “drift” post-deployment. | AI is treated like a living system. Sponsors must prove the model remains accurate as patient populations change. |

4.2 EMA and Global Alignment

The European Medicines Agency (EMA) is moving in lockstep, having published a reflection paper on AI in the medicinal product lifecycle. Their focus mirrors the FDA’s but adds a stronger emphasis on ethical AI, preventing bias in training data, and ensuring “human-centric” oversight.37 This alignment between the FDA and EMA reduces the regulatory friction for global pharma companies, allowing them to deploy AI strategies across major markets simultaneously.

4.3 Critical Path Innovation Meetings (CPIM)

The FDA is actively encouraging dialogue through Critical Path Innovation Meetings (CPIM). Recent topics in 2024 and 2025 have included “Electroencephalography (EEG)-based AI-powered method to improve clinical trials” and “AI image analysis software for oncology,” signaling the agency’s openness to novel AI endpoints.39 This creates a pathway for sponsors to “pre-validate” their AI tools before locking them into a pivotal trial.

5. Intellectual Property: The Hidden Battleground

While scientists worry about binding affinity, business development teams worry about ownership. Generative AI poses a unique threat: if an AI “invents” a molecule, who owns it? And does it infringe on existing patents?

5.1 The Inventorship Conundrum

The USPTO and courts have consistently ruled that an AI cannot be a named inventor.40 This creates a legal fiction where human scientists must claim “significant contribution” to AI-generated outputs to secure patents. This requires a meticulous paper trail showing that the human prompted, guided, and validated the AI’s output. The “inventive step” must be human, even if the heavy lifting was algorithmic.

5.2 Freedom to Operate (FTO) by Design

This is where data strategy becomes a competitive advantage. Generative AI models are prone to “hallucinating” molecules that already exist or are protected by patents. If a company spends millions developing a drug only to find it infringes on a competitor’s patent, the investment is incinerated.

The Role of Patent Data:

To prevent this, leading companies are integrating patent data directly into the generative process. They are training models not just on chemical properties (via databases like ChEMBL), but on the legal landscape.

5.3 Strategic Intelligence: The DrugPatentWatch Advantage

In this high-stakes environment, static databases are insufficient. Platforms like DrugPatentWatch have become critical infrastructure for the AI-driven pharma stack.

By aggregating and structuring global patent expiry data, litigation history, and regulatory exclusivities, DrugPatentWatch allows AI models to perform “Freedom to Operate by Design”.42

- Mechanism: Instead of checking FTO after a molecule is designed, the AI uses data from DrugPatentWatch as a constraint during the generation phase. The algorithm is penalized for generating structures that overlap with active patents (Markush structures) and rewarded for exploring “white space” where IP is available.42

- Multi-Objective Optimization: Advanced models now optimize for “Patentability” alongside “Potency” and “Solubility.” This “designing around” capability transforms the patent from a barrier into a map of opportunity.42

- Predictive Power: Beyond FTO, machine learning models utilize DrugPatentWatch data to predict when competitors will lose exclusivity. By analyzing litigation outcomes and settlement trends, these models can forecast generic entry dates with higher accuracy than simple patent expiration dates, allowing companies to time their “Bio-better” launches perfectly.44

“A deep, granular understanding of the entire patent ecosystem allows for the creation of a rich, multi-dimensional feature set… This is where platforms like DrugPatentWatch become essential.”

— DrugPatentWatch Blog 44

6. Geopolitics and the Supply Chain: The Biosecure Act

Drug development does not happen in a vacuum. The intensifying rivalry between the US and China is severing the global biotech supply chain, creating a massive risk factor for AI companies.

6.1 The Biosecure Act Impact

The BIOSECURE Act, moving through the US Congress in 2025, aims to prohibit US companies from contracting with “biotechnology companies of concern,” explicitly targeting Chinese giants like WuXi AppTec and WuXi Biologics.46

- The Disruption: WuXi is embedded in the supply chains of countless US biotech and pharma companies. They provide the “wet lab” muscle for many virtual AI biotechs. WuXi is estimated to be involved in up to 25% of drugs used in the US.48

- The AI Vulnerability: Many “AI-first” biotechs are virtual—they design in the cloud but hire labs (CROs) to synthesize and test the molecules. A significant volume of this work is currently outsourced to Chinese firms due to speed and cost. If this access is cut off, the “design-make-test” cycle could slow down significantly or become much more expensive.48

- The Opportunity: This is forcing a massive reshoring or “friend-shoring” of CRO/CDMO services. US and European CDMOs are scrambling to pick up the slack, but capacity constraints loom. This creates a strategic opening for AI-driven automation in the US—robotics labs that can replace the manual labor arbitrage of overseas CROs.

6.2 The China-US Tech Race

The US-China competition extends to the technology itself. China is aggressively investing in AI and quantum computing for drug discovery, viewing it as a national security priority.49

- Data Supremacy: China’s centralized ability to aggregate health data gives it a potential advantage in training large models. However, US leadership in generative AI algorithms (OpenAI, Google DeepMind) remains a counterweight.

- The Arms Race: Reports suggest a “biotech arms race,” with both nations viewing leadership in AI drug discovery as critical for economic and military security.50 This geopolitical friction will likely lead to bifurcated technology stacks, where Western AI models cannot train on Chinese data and vice versa.

7. Strategic M&A: The Consolidation Wave

The fragmented landscape of “AI for Drug Discovery” startups is collapsing into a few dominant platforms. The era of the standalone “AI tool” company is ending; the era of the vertically integrated “TechBio” pharma is beginning.

7.1 The Recursion + Exscientia Merger

The definitive M&A event of 2024/2025 is the combination of Recursion and Exscientia.

- Rationale: Recursion brings massive biological data generation (phenomics) and industrial scale. Exscientia brings precision chemistry and a proven track record of putting molecules into the clinic.

- The Goal: Together, they aim to build an end-to-end “TechBio” giant capable of challenging legacy pharma. This merger signals that scale matters—you need both biology and chemistry, data generation and drug design, to succeed.8

7.2 Big Pharma’s “Bolt-on” Strategy

Major players like Pfizer and Sanofi are not necessarily acquiring these companies outright but are signing massive, back-loaded partnership deals.

- Sanofi: Has adopted an “all-in” strategy, partnering with Recursion, Formation Bio, and OpenAI to overhaul its entire pipeline. They are betting that AI can compress timelines by years.11

- Pfizer: Under R&D Chief Chris Boshoff, Pfizer is using AI to improve “R&D productivity.” CEO Albert Bourla emphasizes operational efficiency—using AI to design better trials and recruit faster—as much as discovery. They are looking for immediate ROI.51

- Novartis: CEO Vas Narasimhan maintains a “grounded” expectation. He views AI as a tool to shave months off timelines, not a magic wand. He has publicly stated that while AI helps with productivity, the “big gains” in drug discovery are likely 5+ years away. Novartis is focusing on specific use cases rather than a wholesale platform replacement.7

8. Failure Modes: Why AI Still Hallucinates

Despite the hype, AI is not magic. It fails, and understanding why is crucial for investors and R&D heads.

8.1 The Data Quality Trap

AI models are only as good as the data they are trained on. In biology, public datasets are often noisy, biased, or irreproducible.

- Bias: If a model is trained primarily on clinical data from European ancestry, it may fail to predict drug responses in other populations, leading to safety issues or lack of efficacy in diverse real-world populations.53

- Hallucination: Generative models can create molecules that are chemically unstable or impossible to synthesize (synthetic accessibility). While newer models constrain for this, it remains a risk. “Digital chemistry” must obey the laws of “physical chemistry”.54

8.2 The Biology Gap

We still do not understand the fundamental biology of many diseases (e.g., Alzheimer’s, complex cancers). AI can optimize a molecule to hit a target perfectly, but if the target is wrong (i.e., inhibiting it doesn’t cure the disease), the drug will fail in Phase 2 or 3.

- The Recursion Case: This was likely the case with Recursion’s CCM trial. The AI optimized a molecule for a phenotypic signal (cell shape), but that signal was not a perfect proxy for the complex disease pathology in the human brain.

- The Lesson: AI is a hypothesis generator. It cannot fix a flawed biological hypothesis.

9. Future Outlook: The Road to 2030

9.1 Generative Biology

We are moving from “Generative Chemistry” (making small molecules) to “Generative Biology” (designing new proteins, antibodies, and gene therapies). The success of AlphaFold 3 paves the way for designing entirely new biological mechanisms—proteins that do not exist in nature but perform specific therapeutic functions.27

9.2 The “Digital Twin” in Trials

By 2030, we expect a significant portion of control arms in clinical trials to be synthetic. Using “Digital Twins”—AI models of patients based on real-world data—companies can run smaller, faster trials by simulating the placebo group rather than recruiting real patients. This is already being piloted in rare diseases where recruiting control groups is difficult.35

9.3 Financial Projections

The consensus is that AI will shave 25-50% off the cost of preclinical discovery. However, the total cost of R&D may not drop linearly; instead, companies will likely reinvest those savings to run more programs, increasing the “shots on goal.” The winners will be those with the best proprietary data, not just the best algorithms.

Key Takeaways

- Reality Has Arrived: AI in drug discovery has graduated from theoretical hype to clinical reality. Insilico Medicine’s Phase 2a success is the proof of concept the industry needed.

- Phase 1 vs. Phase 2 Divergence: AI is excellent at solving for safety and pharmacokinetics (80-90% Phase 1 success), but predicting human efficacy remains the primary bottleneck (Phase 2 success remains ~40%).

- Regulatory Legitimacy: The FDA’s January 2025 guidance provides the rulebook. Compliance requires methodological transparency—”black boxes” are not viable for regulatory submission.

- IP Intelligence is Critical: Generative AI must be constrained by legal reality. Platforms like DrugPatentWatch are essential for integrating patent landscapes into the design process to ensure Freedom to Operate.

- Geopolitics Risk is a Supply Chain Risk: The Biosecure Act forces a decoupling from Chinese CDMOs. Companies must audit their AI’s “physical” supply chain immediately.

FAQ: Navigating the AI Pharma Landscape

Q1: If AI makes drug discovery cheaper, will drug prices actually come down?

Answer: Likely not in the short term. While AI reduces the cost of failure and speeds up discovery (preclinical), the most expensive part of drug development is the clinical trials (Phase 2/3), which involve real humans and regulatory logistics. AI optimizes these but doesn’t eliminate them. Furthermore, companies will likely price drugs based on value delivered to the patient, not the cost of R&D. However, generics may enter markets faster due to AI-driven patent expiry prediction, lowering long-term costs.

Q2: Can AI really “invent” a drug, and can that invention be patented?

Answer: Currently, no. Patent offices (USPTO, EPO) require a human inventor. However, AI is a sophisticated tool. If a human uses AI to solve a problem and directs the process, the human is the inventor. The challenge lies in “generative” output where the human prompt is vague. Future legal battles will likely focus on the “degree of human intervention.”

Q3: How does the Biosecure Act affect AI drug discovery companies specifically?

Answer: Many “AI-first” biotechs are virtual—they design in the cloud but hire labs (CROs) to synthesize and test the molecules. A significant volume of this work is currently outsourced to Chinese firms like WuXi AppTec due to speed and cost. The Biosecure Act forces these companies to find new partners in the US, Europe, or India, likely increasing costs and timelines temporarily during the transition.

Q4: Why did Recursion’s AI-designed drug fail while Insilico’s succeeded?

Answer: It’s a matter of target complexity vs. molecule design. Insilico used AI to find a target (TNIK) and design a molecule for fibrosis—a difficult but mechanically understood pathway. Recursion used “phenomics” (looking at cell shape changes) to find a drug for a cerebral vascular malformation. The phenotypic signal in a dish didn’t translate to a clinical cure in the brain. This underscores that biology is still the hardest part of the equation.

Q5: What is the single most valuable asset for an AI drug discovery company in 2025?

Answer: Proprietary data. Algorithms are becoming commoditized (anyone can use AlphaFold 3 or RoseTTAFold). The competitive moat is built on clean, standardized, proprietary wet-lab data that no one else has. This is why Recursion bought Exscientia and why Big Pharma is guarding their historical clinical data vaults so jealously.

Works cited

- From Failure to Innovation: How AI is Reshaping Drug Trials in Pharma, accessed November 20, 2025, https://lifesciences.enago.com/blogs/how-ai-is-reshaping-drug-trials-in-pharma

- Harnessing Artificial Intelligence in Drug Discovery and Development – ACCC Cancer, accessed November 20, 2025, https://www.accc-cancer.org/acccbuzz/blog-post-template/accc-buzz/2024/12/20/harnessing-artificial-intelligence-in-drug-discovery-and-development

- Artificial Intelligence in Software as a Medical Device – FDA, accessed November 20, 2025, https://www.fda.gov/medical-devices/software-medical-device-samd/artificial-intelligence-software-medical-device

- Insilico Medicine announces positive topline results of ISM001-055 for the treatment of idiopathic pulmonary fibrosis (IPF) developed using generative AI, accessed November 20, 2025, https://insilico.com/news/tnik-ipf-phase2a

- Recursion’s REC-994 – Alliance to Cure Cavernous Malformation, accessed November 20, 2025, https://www.alliancetocure.org/home/research-clinical-trials/completed-research-projects/rec-994/

- PODCAST | Speed, Scale, and Science — How Pfizer Is Reshaping Drug R&D with GenAI, accessed November 20, 2025, https://www.cdomagazine.tech/podcasts/podcast-speed-scale-and-science-how-pfizer-is-reshaping-drug-rd-with-genai

- AI in Drug Discovery: 2025 Trends, Tools & Use Cases – Ideas2IT, accessed November 20, 2025, https://www.ideas2it.com/blogs/ai-in-drug-discovery

- The Future of AI in Drug Development: 10 Trends That Will Redefine R&D (2025–2030), accessed November 20, 2025, https://huspi.com/blog-open/the-future-of-ai-in-drug-development-10-trends-that-will-redefine-rd/

- AI in Pharmaceuticals Market Unlocking Precision Drug Design with Future Therapies, accessed November 20, 2025, https://www.towardshealthcare.com/insights/ai-in-pharmaceuticals-market-sizing

- Q4 2025 PitchBook Analyst Note: AI in Drug Development, accessed November 20, 2025, https://pitchbook.com/news/reports/q4-2025-pitchbook-analyst-note-ai-in-drug-development

- Breakthroughs or bottlenecks? Pharma industry outlook, trends and strategies for 2025 – ZS, accessed November 20, 2025, https://www.zs.com/insights/pharmaceutical-trends-2025-outlook-ai-supplychain-and-beyond

- Generative AI in the pharmaceutical industry: Moving from hype to reality – McKinsey, accessed November 20, 2025, https://www.mckinsey.com/industries/life-sciences/our-insights/generative-ai-in-the-pharmaceutical-industry-moving-from-hype-to-reality

- First Generative AI Drug Begins Phase II Trials with Patients | Insilico Medicine, accessed November 20, 2025, https://insilico.com/blog/first_phase2

- Recursion Presents Phase 2 Data for REC-994 in CCM in Late-Breaking Oral Presentation at the International Stroke Conference, accessed November 20, 2025, https://ir.recursion.com/news-releases/news-release-details/recursion-presents-phase-2-data-rec-994-ccm-late-breaking-oral/

- AI-Generated Drug Candidates Are Here, But Clinical Trial Wins Need More Time, accessed November 20, 2025, https://medcitynews.com/2023/12/ai-generated-drug-candidates-are-here-but-clinical-trial-wins-need-more-time/

- Inconclusive efficacy of BenevolentAI’s AD drug leaves the company guessing, accessed November 20, 2025, https://www.clinicaltrialsarena.com/news/benevolentai-atopic-dermatitis-ad/

- BenevolentAI Layoffs: What Happened & Why? – Sunset, accessed November 20, 2025, https://www.sunsethq.com/layoff-tracker/benevolentai

- How AI is Transforming Drug Discovery Processes in 2025 – VASRO GmbH, accessed November 20, 2025, https://vasro.de/en/impact-ai-drug-discovery-2025/

- Transforming Drug Discovery with AI: Insights & Future Trends | ZeClinics CRO, accessed November 20, 2025, https://www.zeclinics.com/blog/ai-is-transforming-drug-discovery/

- How successful are AI-discovered drugs in clinical trials? A first analysis and emerging lessons – PubMed, accessed November 20, 2025, https://pubmed.ncbi.nlm.nih.gov/38692505/

- The Potential of Artificial Intelligence in Pharmaceutical Innovation: From Drug Discovery to Clinical Trials – MDPI, accessed November 20, 2025, https://www.mdpi.com/1424-8247/18/6/788

- All Press – Verge Genomics, accessed November 20, 2025, https://www.vergegenomics.com/all-press

- Schrödinger Reports Encouraging Initial Phase 1 Clinical Data for SGR-1505 at EHA Annual Congress, accessed November 20, 2025, https://ir.schrodinger.com/press-releases/news-details/2025/Schrdinger-Reports-Encouraging-Initial-Phase-1-Clinical-Data-for-SGR-1505-at-EHA-Annual-Congress/default.aspx

- Schrödinger Receives Fast Track Designation for SGR-1505 for the Treatment of Relapsed/Refractory Waldenström Macroglobulinemia, accessed November 20, 2025, https://ir.schrodinger.com/press-releases/news-details/2025/Schrdinger-Receives-Fast-Track-Designation-for-SGR-1505-for-the-Treatment-of-RelapsedRefractory-Waldenstrm-Macroglobulinemia/default.aspx

- Our Science – Relay Therapeutics, accessed November 20, 2025, https://relaytx.com/pipeline/

- Review of AlphaFold 3: Transformative Advances in Drug Design and Therapeutics – NIH, accessed November 20, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11292590/

- Rational drug design with AlphaFold 3 – Isomorphic Labs, accessed November 20, 2025, https://www.isomorphiclabs.com/articles/rational-drug-design-with-alphafold-3

- AlphaFold3 and its improvements in comparison to AlphaFold2 | by Falk Hoffmann – Medium, accessed November 20, 2025, https://medium.com/@falk_hoffmann/alphafold3-and-its-improvements-in-comparison-to-alphafold2-96815ffbb044

- AlphaFold 3 predicts the structure and interactions of all of life’s molecules – Google Blog, accessed November 20, 2025, https://blog.google/technology/ai/google-deepmind-isomorphic-alphafold-3-ai-model/

- AlphaFold 3: an unprecedent opportunity for fundamental research and drug development – Oxford Academic, accessed November 20, 2025, https://academic.oup.com/pcm/article/8/3/pbaf015/8180385

- Diffusion Models in De Novo Drug Design – ACS Publications – American Chemical Society, accessed November 20, 2025, https://pubs.acs.org/doi/10.1021/acs.jcim.4c01107

- Speeding up drug discovery with diffusion generative models | MIT News, accessed November 20, 2025, https://news.mit.edu/2023/speeding-drug-discovery-with-diffusion-generative-models-diffdock-0331

- E(3) equivariant graph neural networks for robust and accurate protein-protein interaction site prediction – PubMed Central, accessed November 20, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC10499216/

- 3D-equivariant graph neural networks for protein model quality assessment | Bioinformatics | Oxford Academic, accessed November 20, 2025, https://academic.oup.com/bioinformatics/article/39/1/btad030/6986970

- Navigating the AI revolution: a roadmap for pharma’s future – Drug Target Review, accessed November 20, 2025, https://www.drugtargetreview.com/article/157270/navigating-the-ai-revolution-a-roadmap-for-pharmas-future/

- Key takeaways from FDA’s draft guidance on use of AI in drug and biological life cycle, accessed November 20, 2025, https://www.dlapiper.com/insights/publications/2025/01/fda-releases-draft-guidance-on-use-of-ai

- Artificial intelligence | European Medicines Agency (EMA), accessed November 20, 2025, https://www.ema.europa.eu/en/about-us/how-we-work/data-regulation-big-data-other-sources/artificial-intelligence

- European Regulator Clarifies Guidance on the Use of AI in the Medicinal Product Lifecycle | GoodLifeSci, accessed November 20, 2025, https://goodlifesci.sidley.com/2024/10/22/european-regulator-clarifies-guidance-on-the-use-of-ai-in-the-medicinal-product-lifecycle/

- Critical Path Innovation Meeting (CPIM) Topics Held to Date – FDA, accessed November 20, 2025, https://www.fda.gov/drugs/novel-drug-approvals-fda/critical-path-innovation-meeting-cpim-topics-held-date

- Patentability and predictability in AI-assisted drug discovery – Akin Gump, accessed November 20, 2025, https://www.akingump.com/a/web/kAJxgkjHh1XoyABdxDtAf1/8MiCMH/patentability-and-predictability-in-ai-assisted-drug-discovery-web-v3.pdf

- Generative AI, drug discovery, and US patent law | DLA Piper, accessed November 20, 2025, https://www.dlapiper.com/en-cl/insights/publications/synthesis/2024/generative-ai-drug-discovery-and-us-patent-law

- The Missing Ingredient: Why Patent Data Is the Key to Unlocking AI-Powered Drug Discovery – DrugPatentWatch, accessed November 20, 2025, https://www.drugpatentwatch.com/blog/the-missing-ingredient-why-patent-data-is-the-key-to-unlocking-ai-powered-drug-discovery/

- An AI Approach to Generate Novel Pharmaceuticals using Patent Data: Revolutionizing Drug Discovery and Navigating Intellectual Property, accessed November 20, 2025, https://www.drugpatentwatch.com/blog/an-ai-approach-to-generate-novel-pharmaceuticals-using-patent-data/

- Advanced Models for Predicting Pharma Stock Performance in the Face of Patent Expiration, accessed November 20, 2025, https://www.drugpatentwatch.com/blog/advanced-models-for-predicting-pharma-stock-performance-in-the-face-of-patent-expiration/

- The Formulary Compass: How Drug Patent API Datafeeds Are Revolutionizing Formulary Automation – DrugPatentWatch – Transform Data into Market Domination, accessed November 20, 2025, https://www.drugpatentwatch.com/blog/the-formulary-compass-how-drug-patent-api-datafeeds-are-revolutionizing-formulary-automation/

- Impacts of the BIOSECURE Act on the Global BioTech Industry | Health-ISAC, accessed November 20, 2025, https://health-isac.org/wp-content/uploads/11.4.24_WP_ImpactsoftheBIOSECUREActontheGlobalBioTechIndustry.pdf

- Will the BIOSECURE Act Stall Biopharma Progress?, accessed November 20, 2025, https://wewillcure.com/insights/entrepreneurship/funding-and-models/will-the-biosecure-act-stall-biopharma-progress

- WuXi partnerships at risk as lawmakers target Chinese ties to biopharma | PharmaVoice, accessed November 20, 2025, https://www.pharmavoice.com/news/lawmakers-target-chinese-biopharma-wuxi/713792/

- Deep Dive: The State of the US-China Biotech Race | Contrary Research, accessed November 20, 2025, https://research.contrary.com/deep-dive/the-state-of-the-us-china-biotech-race

- AI arms race: US and China weaponize drones, code and biotech for the next great war, accessed November 20, 2025, https://www.foxnews.com/politics/ai-arms-race-us-china-weaponize-drones-code-biotech-next-great-war

- Pfizer’s 2025 Priorities: A Roadmap to Innovation and Excellence, accessed November 20, 2025, https://insights.pfizer.com/jpm-2025

- Novartis CEO discusses how AI will impact drug development – YouTube, accessed November 20, 2025, https://www.youtube.com/watch?v=oCVRy1mY07k

- Making sense of AI: bias, trust and transparency in pharma R&D – Drug Target Review, accessed November 20, 2025, https://www.drugtargetreview.com/article/183358/making-sense-of-ai-bias-trust-and-transparency-in-pharma-rd/

- From hype to reality – The future of generative AI and automation in drug discovery, accessed November 20, 2025, https://itbrief.co.uk/story/from-hype-to-reality-the-future-of-generative-ai-and-automation-in-drug-discovery