1. Introduction: The Indispensable Role of Patents in Pharmaceutical Innovation

In the fiercely competitive pharmaceutical landscape, intellectual property (IP) stands as the bedrock of innovation and commercial success. Patents, in particular, are not merely legal instruments; they are strategic business assets that dictate market exclusivity, drive investment, and ultimately shape the availability of life-saving medicines. For business professionals navigating this complex industry, a deep understanding of patent filing strategies is paramount for maximizing product value and ensuring sustained profitability.

Defining Pharmaceutical Patents and Their Core Purpose

A pharmaceutical patent grants a company exclusive rights to manufacture, use, sell, or import a drug for a specific period, typically 20 years from the application date in the United States.1 This exclusivity is crucial, as it prevents other entities from commercializing the patented invention without prior permission, often through a licensing agreement.3 It is important to note that a patent does not confer the right to

make a product, but rather the right to prevent others from doing so.3 This distinction underscores the defensive power of patent protection.

Pharmaceutical patents specifically focus on chemical compounds useful in disease treatment, their therapeutic applications, methods for formulating them into medications, and processes for their manufacture.4 While legally similar to patents in other fields, pharmaceutical patents often hold higher value due to the government’s role, such as the FDA in the U.S., in policing the granted monopoly.5

The Economic Imperative: Protecting Billions in R&D Investment

The journey from drug discovery to market approval is an arduous and costly endeavor. Pharmaceutical companies invest an extraordinary amount of resources, often upwards of $2 billion, to bring a single new medication to market.2 This extensive development process, which can consume 12-13 years from initial patent filing to regulatory approval, significantly reduces the effective market exclusivity period to approximately 7-8 years.2 Without robust patent protection, recouping these substantial research and development (R&D) investments would be nearly impossible, stifling future innovation.

Patents serve as tangible assets that provide companies with the freedom to operate and maintain ownership over the drugs they develop.6 They are foundational in safeguarding the immense investment of time, resources, and ingenuity poured into drug discovery and development.6 As one industry expert highlights, “Patents ensure that the innovations and discoveries made along the way are protected, allowing companies like InfinixBio to navigate the competitive landscape of the pharmaceutical industry confidently”.6 This protection is a powerful incentive for ongoing R&D, encouraging scientists and companies to push the boundaries of what is possible in medicine.6

Why Strategic Patent Filing is a Business Critical Function

In today’s pharmaceutical industry, patent management transcends a mere legal formality; it has become a core business strategy essential for sustaining revenue streams and supporting continuous investment in innovation.2 The high costs and inherent risks associated with drug development are considerably mitigated by the clear path to profitability that patents offer to investors and pharmaceutical companies.6 Effective patent strategies are therefore vital for securing a drug’s future, ensuring that the colossal effort expended in its development is appropriately recognized and rewarded.6

The very nature of pharmaceutical patents creates a fundamental tension: they grant a temporary monopoly to incentivize the colossal R&D expenditures required for medical breakthroughs.2 However, this exclusivity inherently leads to high drug prices during the patent-protected period.7 Upon patent expiration, the market transforms dramatically, with lower-priced generic versions becoming available, often leading to significant price reductions.1 This dynamic necessitates that pharmaceutical companies employ sophisticated filing strategies not only to secure protection but also to carefully balance the recoupment of R&D costs with societal expectations for affordable and accessible medicines. The “trade-off” inherent in the patent system, where full public disclosure is exchanged for temporary market exclusivity, directly impacts how companies must strategize to maximize their commercial return while navigating public health considerations.3

2. Foundational Principles of Pharmaceutical Patentability

Securing a pharmaceutical patent hinges on meeting stringent criteria that define what constitutes a patentable invention. Understanding these core principles is the first step in developing an effective filing strategy.

What Constitutes a Patentable Pharmaceutical Invention?

For an invention to be patentable, it must satisfy three fundamental criteria: it must be novel, useful, and non-obvious.3 Novelty dictates that the invention has never been publicly disclosed in any form—whether through a seminar, an oral presentation, a poster, an abstract, a paper, or even casual discussion with colleagues.3 The non-obviousness requirement ensures that the invention is not merely an incremental or predictable development that would be apparent to someone with ordinary skill in the relevant technical field.3

An invention is broadly defined as a “new and inventive solution to a technical problem”.3 Importantly, certain subject matter is generally excluded from patentability, including abstract ideas, laws of nature, scientific principles, or human life or its parts.3 The patent system operates on a “bargain”: in exchange for government-backed protection, the inventor must fully disclose enough detail about the invention so that others can understand and replicate it once the patent term expires.3

Key Patent Types in Pharma: Compound, Formulation, Method of Use, Polymorphs

Pharmaceutical companies often pursue a multi-layered patent strategy, securing protection for various aspects of a drug to create a comprehensive “web of protection”.11 This approach involves different types of patents:

- Composition of Matter Patents: These are fundamental and cover the active pharmaceutical ingredient (API) itself.11

- Formulation Patents: These protect new ways a drug is prepared or delivered. For a new formulation of a known drug to be patentable, it must be novel and demonstrate an inventive step, typically by providing a technical effect or advantage over existing formulations.12 A prime example is AstraZeneca’s Seroquel XR, an extended-release quetiapine formulation launched in 2008, which provided valuable additional exclusivity by reducing dosing frequency from multiple times a day to once daily.12 Bristol-Myers Squibb’s Glucophage XR, an extended-release metformin formulation, similarly allowed for once-daily dosing for type II diabetics.13

- Method of Use Patents: These cover new therapeutic applications for an existing drug or drug reformulation.3 For instance, a drug initially approved for one condition might later be patented for treating a different disease.14 GSK obtained additional patent protection for its migraine treatment, Imitrex, by developing and patenting formulations for intranasal delivery.13

- Polymorph Patents: These protect different crystalline structures of a chemical compound that share the same chemical composition but exhibit varied physical properties, such as solubility.15 In jurisdictions like India, patenting polymorphs requires demonstrating “significantly enhanced efficacy,” specifically “therapeutic efficacy,” over known polymorphs. The landmark

Novartis AG vs. Union of India & Ors Supreme Court case set a high bar for proving this enhanced efficacy.15

The pursuit of these diverse patent types—compound, formulation, method of use, and polymorphs—is a deliberate strategic choice that enables pharmaceutical companies to construct a “patent thicket”.14 This intricate legal landscape, composed of multiple overlapping patents, serves as a formidable barrier against generic competition.14 While proponents argue that this strategy reflects genuine incremental innovation, critics contend that it primarily aims to delay generic entry. Regardless of the perspective, the ability to secure a diverse patent portfolio is a cornerstone of maximizing market exclusivity, providing a multi-layered defense that is difficult for competitors to navigate around.

Navigating Patent Offices: USPTO, EPO, WIPO

Global patent protection is essential for pharmaceutical products, given their worldwide markets. This necessitates navigating various national and international patent offices:

- United States Patent and Trademark Office (USPTO): As the federal agency responsible for granting U.S. patents, the USPTO provides critical resources such as Drugs@FDA (information on approved drugs), the Orange Book (identifying approved drug products with therapeutic equivalence evaluations), and the Purple Book (for FDA-licensed biological products).1

- European Patent Office (EPO): The EPO examines European patent applications, enabling inventors to secure protection in up to 44 countries.1 Its Espacenet database offers access to over 140 million patent documents globally, often including machine translations.1

- World Intellectual Property Organization (WIPO): WIPO facilitates international patent protection through its Patent Cooperation Treaty (PCT) system and hosts PATENTSCOPE, a global database providing access to PCT applications and national/regional patent documents.1 PAT-INFORMED, hosted by WIPO, allows searching patent status by a medicine’s International Non-Proprietary Name (INN).1

The increasing harmonization of classification systems, such as the Cooperative Patent Classification (CPC) jointly initiated by the USPTO and EPO, along with WIPO’s comprehensive global databases like PATENTSCOPE, indicates a clear trend toward greater standardization and transparency in patent information worldwide.1 This development means that while patent rights remain territorial, the tools available for researching and understanding the global patent landscape are becoming more integrated and powerful.19 For pharmaceutical companies, this translates into more effective competitive intelligence and freedom-to-operate analyses across diverse jurisdictions.20 However, it also implies that prior art from any part of the world can be more readily discovered and used to challenge the novelty or non-obviousness of an invention. Leveraging these global patent databases and understanding international classification systems is therefore critical for conducting comprehensive prior art searches and informing strategic market entry decisions.

3. Strategic Timing: Establishing and Maintaining Priority

In the pharmaceutical industry, where the race to market is intense and R&D cycles are exceptionally long, the timing of patent filings is as crucial as the invention itself.11

The First-to-File System: A Race to the Patent Office

The United States, like most other major jurisdictions, operates under a first-to-file patent system.11 This means that priority in patent rights is generally granted to the applicant who files first, regardless of who invented it first. Consequently, establishing an early filing date is paramount. Such a date can provide a decisive advantage over later-filed applications, particularly in crowded technological sectors, and can significantly enhance the validity and enforceability of a patent.22 The strategic imperative is clear: filing too early risks patent expiration before full commercialization, while filing too late risks being preempted by a competitor.11

Provisional Patent Applications: A Cost-Effective Head Start

Provisional patent applications are a cornerstone of strategic patent filing for pharmaceutical companies, offering a crucial balance between speed and flexibility.

Benefits for Long Pharma R&D Cycles

A provisional patent application, filed with the USPTO for utility and plant inventions, provides a low-cost method to establish an early effective filing date, or “priority date,” with fewer formal requirements than a non-provisional application.23 This is exceptionally advantageous for pharmaceutical inventions, which are characterized by lengthy and resource-intensive R&D cycles.2 The patent term, typically 20 years, is measured from the filing date of the subsequent non-provisional application, effectively providing up to an additional 12 months of protection for the invention.23 This extension can be invaluable in an industry where the effective market exclusivity is already significantly shortened by the protracted development and regulatory approval processes.2 Furthermore, filing a provisional application allows inventors to use the “patent pending” designation, which can serve as a deterrent to potential competitors and attract investment during the critical early development phases.23 A provisional application is automatically abandoned after 12 months and is not examined, offering a flexible “placeholder” without incurring immediate examination costs.23

The 12-month window provided by a provisional application before a full non-provisional filing is required is a critical strategic asset.23 This period, coupled with the ability to claim “patent pending” status, offers pharmaceutical companies an invaluable opportunity. It allows them to conduct further research, refine the invention based on new data or insights, assess the commercial potential across various markets, and secure necessary funding without jeopardizing their earliest priority date.24 This is particularly significant given the billions of dollars invested and the extensive timelines involved before a drug can be commercialized.2 The provisional application thus functions not merely as a legal formality but as a strategic pause, enabling comprehensive market validation and robust financial planning before committing to the substantial costs of a full patent prosecution.

Essential Requirements for Provisional Filings

To secure a provisional filing, applicants must provide basic information including the invention’s title, names and residences of all inventors, a correspondence address, and attorney information if applicable.23 The use of USPTO form PTO/SB/16 (Provisional Application for Patent Cover Sheet) is encouraged.23

Crucially, a detailed written description, or “specification,” of the invention is required. This must include a background of the invention, a summary clearly outlining its nature and purpose, and any necessary drawings.23 The detailed description must be sufficiently particular to enable a person skilled in the relevant art or science to make and use the invention without extensive experimentation.23 While applicants can use their own terminology, it must be understandable.23 The filing fees for provisional applications are intentionally low, at $140 for a small entity and $70 for a micro entity, making this initial step accessible.23 It is essential that the claimed subject matter in the later non-provisional application finds adequate support in the provisional application to benefit from the earlier filing date.25

Non-Provisional Applications: The Path to Patent Grant

The non-provisional patent application is the formal application that undergoes examination by a patent office and, if successful, ultimately issues as a granted patent.23 To claim the benefit of an earlier provisional filing date, the corresponding non-provisional application must be filed within 12 months of the provisional application’s filing date.11 Conducting thorough prior art searches and preparing a well-organized and complete application are critical steps to minimize delays and ensure a smooth and efficient examination process.22

4. Expanding Protection: Leveraging Continuing Applications

As pharmaceutical research and development progresses, inventions often evolve, or initial patent applications may encompass multiple distinct innovations. Continuing patent applications—including continuation, divisional, and continuation-in-part applications—are vital tools that allow innovators to adapt their patent protection as these circumstances unfold, all while maintaining the benefit of an earlier priority date.26

Continuation Applications: Refining Claims for Broader Coverage

A “continuation application” is filed to pursue additional claims to an invention that was already fully disclosed in a previously filed, still-pending “parent” application.26 This type of application utilizes the identical specification (the detailed description of the invention) as the parent application and claims the priority date based on the parent’s original filing date.26 A crucial limitation is that continuation applications cannot introduce any new subject matter or disclosure that was not present in the original parent application.26

This strategic tool is particularly valuable when a patent examiner has allowed some claims in the parent application but rejected others, or when an applicant wishes to explore different ways of claiming various embodiments of the invention without adding new technical details.26 The patent examination process can be protracted and complex, often involving initial rejections based on prior art or other patentability criteria.28 Continuation applications provide a mechanism to continue prosecution and strategically refine claims, allowing companies to adapt their claims to overcome examiner objections or to cover new competitive angles that become apparent during the initial prosecution.26 This approach ensures that the earliest possible priority date is maintained, thereby maximizing the scope and strength of protection for the core invention.

Divisional Applications: Addressing Multiple Inventions in a Single Filing

A “divisional application” becomes necessary when a patent examiner determines that an original, or “parent,” application covers “multiple, independent inventions” and issues a “restriction requirement”.27 In such cases, the applicant is compelled to divide the original application into separate applications, each focusing on a distinct invention.

While a divisional application claims independent subject matter and may include new claims that were not explicitly part of the original application’s claims, it crucially retains the same filing date as the parent application.27 This preserves the benefit of the earliest priority date for all inventions derived from the original disclosure. Pharmaceutical R&D often yields multiple distinct patentable inventions from a single research program—for example, a novel compound, a specific formulation of that compound, and a new method of using it. If these are initially filed within one application, a patent office might require them to be divided. Filing divisional applications allows companies to secure separate, robust patents for each distinct invention, thereby maximizing the overall breadth and value of their patent portfolio. This also mitigates the risk of an entire application being rejected or delayed due to issues related to unity of invention.

Continuation-in-Part (CIP) Applications: Incorporating Evolving Discoveries

A “continuation-in-part (CIP) application” is a unique and powerful tool that allows for the inclusion of new material or additional subject matter not disclosed in the original “parent” non-provisional application, while still claiming the benefit of the parent’s filing date for the common subject matter.27 A CIP application incorporates substantial portions, or all, of the earlier non-provisional application, along with the newly added content.29

This type of application is particularly beneficial in rapidly evolving fields like pharmaceuticals, where innovation is often an iterative process, and new discoveries or improvements may emerge after an initial patent application has been filed.27 It enables inventors to incorporate these new developments, enhancing the original invention and potentially extending the scope of protection.27 For any claims in the CIP application that are based solely on the newly added subject matter, their priority date will correspond to the CIP filing date. However, claims supported by the original disclosure retain the earlier priority date of the parent application.29 This proactive approach ensures that the patent portfolio evolves dynamically with the drug’s development, covering new features, improved processes, or expanded therapeutic uses that might not have been fully conceived at the time of the initial filing. This is crucial for maintaining a competitive edge and preventing competitors from “designing around” the original patent by exploiting subsequent innovations.

5. Extending Patent Life: Beyond the Standard Term

While a standard U.S. patent term is 20 years from its earliest non-provisional filing date 1, the effective market exclusivity for pharmaceutical products is often significantly shorter, typically ranging between 7-12 years.2 This reduction is primarily due to the lengthy clinical trials and regulatory review processes required before a drug can reach the market.2 This shortened exclusivity period has been widely criticized as “insufficient time for most new drugs to recoup the up-front R&D costs and earn a positive return on this investment”.2 To address this challenge, specific mechanisms exist to extend the patent term.

Patent Term Adjustment (PTA): Compensating for USPTO Delays

Patent Term Adjustment (PTA) is a statutory provision designed to compensate patentees for delays caused by the United States Patent and Trademark Office (USPTO) during the patent examination process.30 Its purpose is to ensure that inventors receive an adequate period of exclusive rights, despite administrative backlogs or other procedural delays such as interference or secrecy orders.31

PTA is calculated by subtracting any delays attributable to the applicant from the total time taken by the patent office for examination and grant.31 This adjustment can be applied to each patent within a family.30 The necessity of PTA highlights a systemic challenge within the patent examination process. For pharmaceutical companies, where every month of market exclusivity can translate into hundreds of millions or even billions of dollars in revenue 8, these administrative delays represent a direct financial threat. PTA, therefore, serves as a critical, albeit partial, mitigation tool against this “invisible tax” of bureaucratic delay, directly impacting the effective commercial lifespan of a drug. Proactive management and tracking of these delays are essential for pharmaceutical companies to maximize the granted PTA, thereby extending the commercial life of their patents and improving the return on their substantial R&D investments.

Patent Term Extension (PTE): Recovering Regulatory Review Time

Patent Term Extension (PTE) offers an opportunity to restore patent term lost specifically due to the time consumed by premarket government approval processes from regulatory agencies like the FDA.30 This mechanism can add up to five years to a patent’s life, though the total effective patent term after approval cannot exceed fourteen years.11 While PTE is reduced if PTA has also been granted, it is notably added even if the patent was subject to a terminal disclaimer.30

The lengthy regulatory approval process is an unavoidable and significant hurdle for pharmaceutical products, often consuming a substantial portion of the 20-year patent term and leading to a much shorter effective market exclusivity.2 PTE is a legislative acknowledgment of this unique challenge within the pharmaceutical industry, designed to restore some of the lost patent term. This mechanism is not merely an extension but a vital bridge, connecting the conclusion of the arduous R&D and approval phases with a commercially viable period of market exclusivity. It directly impacts a company’s ability to recoup the billions of dollars invested in drug development.

The Hatch-Waxman Act: A Framework for Balancing Innovation and Generics

Officially known as the Drug Price Competition and Patent Term Restoration Act of 1984, the Hatch-Waxman Act (HWA) fundamentally reshaped the U.S. pharmaceutical industry.32 It was a grand legislative compromise designed to balance the interests of pharmaceutical innovation with the need for affordable medicines. The Act created an expedited pathway for generic drugs to enter the market while, in exchange, allowing brand-name drug companies to extend their patents to account for time lost during the lengthy market approval process.32

The HWA streamlined the process for generic drug approval, introduced critical data exclusivities, and established effective procedures for managing patent litigation involving generic pharmaceuticals.33 Its success is evident in the dramatic increase in generic competition: prior to Hatch-Waxman, only 35% of top-selling pharmaceutical drugs faced generic competition, a figure that now exceeds 80%.33 Similarly, generic prescriptions, which constituted only 19% of all prescriptions before the Act, now account for over 90%.33 The increased availability of generics has led to substantial savings for the U.S. healthcare system, estimated at over $3.1 trillion since the Act’s passage, with $445 billion saved in 2023 alone.33

The Hatch-Waxman Act, while successfully fostering generic competition and significantly reducing healthcare costs, also established a legal framework that brand companies strategically leverage. This framework allows for practices like “evergreening” 16 and the listing of numerous secondary patents in the FDA’s Orange Book 14, which can effectively delay generic entry. This creates a continuous dynamic of legal battles and strategic maneuvering between brand and generic pharmaceutical companies, constantly reshaping market dynamics. The Act’s initial intent was to strike a balance, but its practical implementation has led to ongoing disputes over the duration and scope of market exclusivity.

6. Regulatory Exclusivities: A Parallel Layer of Market Protection

Beyond patent protection, pharmaceutical companies can secure additional periods of market exclusivity granted by the U.S. Food and Drug Administration (FDA). These regulatory exclusivities are distinct from patents; they can run concurrently with or independent of patent terms and prevent the submission or effective approval of generic drug applications (ANDAs) or 505(b)(2) applications for a specified period.34

New Chemical Entity (NCE) Exclusivity

New Chemical Entity (NCE) exclusivity provides a five-year market exclusivity period for drugs containing an active moiety that has not been previously approved by the FDA.34 During this period, the FDA cannot approve a generic or biosimilar application that relies on the innovator’s clinical data. This exclusivity is a crucial incentive, protecting the substantial investment in R&D and encouraging the development of truly novel drugs.35

Orphan Drug Exclusivity (ODE): Incentivizing Rare Disease Treatments

Orphan Drug Exclusivity (ODE) is granted to drugs developed to treat rare diseases or conditions, defined as those affecting fewer than 200,000 people in the United States.35 This exclusivity provides a robust seven-year market protection, during which the FDA is barred from approving a similar drug for the same orphan disease or condition.34 Beyond market exclusivity, ODE offers significant additional benefits, including tax credits for clinical trial expenses, waiver of FDA user fees, and research grants, all designed to incentivize the development of treatments for underserved patient populations.35

Pediatric Exclusivity (PED): Encouraging Research in Children

Pediatric Exclusivity (PED) provides an additional six months of market exclusivity. This extension is granted when a sponsor conducts and submits pediatric studies on the active moiety of their drug in response to a Written Request from the FDA.2 This additional period can be appended to existing patent or exclusivity terms, providing a valuable incentive for pharmaceutical companies to invest in pediatric research, thereby enhancing the understanding of drug safety and efficacy in children.35

The 180-Day Generic Exclusivity: A First-Mover Advantage

The 180-day generic exclusivity is a unique incentive under the Hatch-Waxman Act, granted to the “first” generic applicant who challenges a listed patent by filing a Paragraph IV certification.34 This certification asserts that the generic drug does not infringe the listed patent or that the patent is invalid or unenforceable.34 This provides the first generic manufacturer with an exclusive right to market their generic drug for 180 days.34 This period commences either from the date the generic sponsor begins commercial marketing of their product or from the date of a court decision finding the patent invalid, unenforceable, or not infringed, whichever occurs first.34

The existence of both patents (granted by the USPTO) and regulatory exclusivities (granted by the FDA) represents a layered approach to market control.34 While patents protect the invention itself, regulatory exclusivities primarily protect the

data submitted for drug approval. This distinction means that a pharmaceutical company might lose a patent challenge but still retain market exclusivity due to an FDA-granted exclusivity.35 The 180-day generic exclusivity further complicates this landscape, creating a strong incentive for generic companies to proactively challenge existing patents, which often leads to complex litigation and strategic alliances within the industry. This environment necessitates that pharmaceutical companies pursue a dual strategy: securing robust patents and simultaneously leveraging all available regulatory exclusivities to maximize market protection. Understanding that these mechanisms operate in parallel is crucial, as they significantly influence competitive dynamics and the timelines for generic market entry.

7. Global Reach: International Patent Filing Strategies

Given the global nature of pharmaceutical markets, securing patent protection in multiple jurisdictions is often a commercial imperative. However, patent rights are territorial, meaning protection must be pursued independently in each country or region of interest.3 This process can be exceptionally costly, involving engagement with numerous local patent attorneys and significant translation expenses.3

The Patent Cooperation Treaty (PCT) System: Streamlining Worldwide Protection

The Patent Cooperation Treaty (PCT) system, administered by WIPO, offers a unified procedure for filing patent applications across its 153 contracting states.24 It streamlines the initial stages of international patent protection, providing a strategic advantage for pharmaceutical companies.

Advantages for Pharmaceutical Companies

The PCT system simplifies the filing process by allowing a single international application to be filed instead of multiple national applications, thereby saving time and reducing administrative burdens.24 This is particularly beneficial for pharmaceutical companies managing extensive global R&D programs. A key advantage is the provision of a unified International Search Report (ISR) and a Written Opinion, which offer an early indication of the patentability of the pharmaceutical invention across all designated states.24 This early feedback is invaluable for making strategic decisions about which global markets to prioritize for national entry and how to refine patent claims, especially given the substantial investment in pharmaceutical development.24 For example, if the ISR reveals prior art that could impact the patentability of a new pharmaceutical compound, the company can use this information to amend claims or develop stronger arguments before committing to expensive national filings.

Perhaps the most significant advantage is that the PCT system extends the timeframe for entering national phases, typically allowing up to 30 or 31 months from the priority date to decide in which countries to pursue patent protection.24 This extended period is crucial for pharmaceutical inventions, as it provides valuable time to:

- Assess commercial potential: Conduct thorough market research in various global markets.

- Seek investment: Secure additional funding to support further development and the substantial costs of national filings.

- Refine patent strategy: Adapt the patent strategy based on evolving market dynamics, clinical trial results, and the competitive landscape.24

This structured delay allows for more informed, data-driven decisions on which global markets to prioritize, optimizing resource allocation. It also enhances overall patent portfolio management and can significantly boost licensing and commercialization opportunities by providing credible prior art analysis and patentability assessment, which is vital for securing partnerships in the highly regulated pharmaceutical industry.24

Navigating the National Phase Entry

At the conclusion of the PCT’s international phase, applicants must “enter the national phase” with their PCT application in each desired country or regional patent office.37 During this phase, each national or regional office independently assesses the application according to its specific laws and decides whether to grant protection.37 This step typically involves paying national fees and providing translations of the PCT application into the required local languages.37

The high costs and inherent risks associated with pharmaceutical development are compounded by the necessity of obtaining global patent protection.2 The PCT system functions as a strategic tool for de-risking global market entry. By delaying the commitment to expensive national filings for up to 31 months, companies can gather more comprehensive market intelligence, secure additional funding, and obtain clearer patentability assessments through the International Search Report and Written Opinion before incurring significant country-specific costs.24 This phased approach allows for more informed, data-driven decisions regarding which global markets to prioritize, thereby optimizing resource allocation and mitigating financial exposure.

Key Considerations for International Portfolio Management

Effective international patent portfolio management requires careful strategic planning. Companies should focus their efforts on geographic locations that are of primary interest to their business goals, investors, and key competitors.19 This involves a delicate balance between the desire for comprehensive global protection and the substantial costs associated with filing and maintaining patents in numerous countries.19 Furthermore, it is critical to be aware of jurisdictional differences in patent law. For example, while U.S. patent law offers a limited grace period for inventor disclosures before filing, many other jurisdictions, including those in Europe, enforce an absolute novelty requirement, making early filing before any public disclosure essential for securing global protection.3

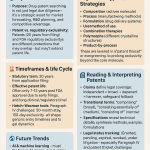

8. Maximizing Value Through Lifecycle Management and Evergreening

The pharmaceutical industry faces a significant challenge known as the “patent cliff,” where multiple blockbuster drugs lose patent protection within a short timeframe, leading to steep revenue declines for innovator companies.38 This phenomenon compels companies to adopt sophisticated lifecycle management strategies, often involving “patent evergreening,” to extend the commercial exclusivity of their products beyond the original patent term.14

Strategic Evergreening: Legitimate Innovation or Market Extension?

Patent evergreening refers to the practice of obtaining multiple patents on different aspects of a single drug to prolong its exclusivity period.14 This can include securing secondary patents on minor modifications such as new formulations, uses, dosages, or methods of delivery.14

This practice sparks considerable debate. Proponents argue that evergreening represents legitimate incremental innovation, leading to improvements in drug safety, delivery, or effectiveness, and reflecting ongoing investment in research post-market launch.14 They suggest that such modifications broaden a product’s usefulness in the marketplace.41 However, critics contend that evergreening exploits legal loopholes primarily to delay generic entry, inflate drug prices, and undermine access to affordable medicines, particularly in developing countries.14 They argue that allowing minor modifications to secure new patents may redirect R&D resources toward “profit-maximizing tweaks” rather than breakthrough discoveries, thereby stifling true innovation.14 This debate highlights a fundamental tension: at what point does an “incremental improvement” become a strategic maneuver primarily aimed at extending a monopoly rather than genuine therapeutic advancement? The answer has profound implications for drug pricing, public health, and the overall innovation ecosystem. Companies must carefully navigate this ethical and legal landscape.

Common Evergreening Techniques

Pharmaceutical companies employ various techniques to extend the market life of their products:

- New Formulations and Delivery Methods: This involves patenting new ways a drug is prepared or administered, such as extended-release versions. For example, AstraZeneca’s Seroquel XR, an extended-release formulation of quetiapine, successfully extended exclusivity by reducing dosing frequency.12 Similarly, Bristol-Myers Squibb obtained patent protection for Glucophage XR, an extended-release formulation of metformin, allowing for once-daily dosing.13 GlaxoSmithKline (GSK) also developed and patented intranasal delivery formulations for its migraine drug, Imitrex, to extend its market share.13 These new formulations, if sufficiently similar to the original drug, can also benefit from a shorter FDA approval route.13

- New Methods of Use and Indications: This strategy involves securing patents for novel therapeutic uses of an existing drug.3

- Polymorphs and Stereoisomers: Patenting different crystalline forms (polymorphs) or single enantiomers (chiral switches) of a drug is another technique. Polymorphs have the same chemical composition but different physical properties, like solubility.15 The process of “racemic switching,” where a company remarkets a racemic drug as a single enantiomer under a new patent, was a significant area, with enantiomer pharmaceutical sales reaching $160 billion in 2002.13

- Combination Drugs: Patenting new combinations of existing drugs can also extend exclusivity.11

- Metabolite Patents: Protecting the active metabolites of a drug is another method to secure additional patent coverage.11

The Role of Secondary Patents in Sustaining Revenue

These additional, or “secondary,” patents are often sought shortly before the primary compound patent expires.40 They can have different expiry dates, allowing for continued exclusivity even if the active ingredient patent lapses.40 A common practice is listing these secondary patents in the FDA’s Orange Book.14 Studies indicate that a significant proportion of drugs, specifically 91% of those obtaining patent term extensions, manage to continue their monopolies well beyond those extensions, frequently by relying on these secondary patents.32

The “patent cliff” phenomenon, which can see small-molecule drug sales plummet by 90% within months of primary patent expiration and biologics decline by 30-70% in the first year, poses a dramatic threat to pharmaceutical revenue streams.38 This forces companies to fundamentally rethink their business models.39 Secondary patents and evergreening strategies are direct responses to this existential threat.11 This indicates a strategic evolution within the pharmaceutical industry: companies are shifting from merely protecting a single drug to managing a complex portfolio of interconnected patents. Each patent within this portfolio contributes to a prolonged revenue stream, making this integrated portfolio approach critical for long-term profitability and sustained R&D investment.

9. Crafting Robust Patents: Best Practices for Strong Claims

The strength and enforceability of a pharmaceutical patent depend heavily on the precision and strategic breadth of its claims. This requires a meticulous approach, beginning long before the actual drafting process.

Deep Dive into Prior Art: The Foundation of Patentability

Before embarking on the patent drafting journey, a comprehensive and deep dive into the existing landscape of prior art is imperative.28 This involves thoroughly searching existing patents, scientific publications, and other public disclosures to identify any information that could potentially anticipate or render obvious the invention.28 It is prudent to involve multidisciplinary teams, including scientists and legal experts, in this analysis to ensure a holistic understanding of existing formulations, their mechanisms, and patent statuses.43

While prior art searches are often viewed as a compliance step to meet novelty and non-obviousness requirements, a truly “deep dive” offers a proactive risk mitigation strategy. It allows companies to strategically “navigate around existing patents” 42 and significantly reduce the risk of costly infringement lawsuits.17 More importantly, this comprehensive analysis helps to “discover white space for innovation” 11—areas with limited patent activity but significant therapeutic potential. It also aids in identifying emerging trends 20, thereby guiding R&D efforts towards areas with the highest potential for meaningful and patentable innovation.11 This transforms prior art analysis from a defensive measure into an offensive strategic tool for identifying future growth opportunities.

Drafting Claims: Balancing Breadth, Specificity, and Enforceability

Patent claims are the legal boundaries of protection for an invention.3 They are widely considered one of the most challenging legal instruments to draft with accuracy, particularly for complex inventions.44 Best practices suggest preparing the claims first, even before finalizing the detailed description and drawings, and discussing these draft claims with the inventor early in the application process.45

A robust patent portfolio should include both broad and narrow claims, as well as claims of varying scope and type (e.g., claims directed to the active ingredient, compositions containing it, methods of using the products, and processes for their preparation).19 While broad claims are generally more effective in preventing competitors from designing around the invention and proving infringement, they may also be more susceptible to validity challenges.19 To achieve maximum breadth, chemical patent claims often utilize generic “Markush structures”.5 It is advisable to avoid unnecessary limitations and negative limitations in claims, instead stating limitations in positive terms.45 Consistency in terminology is crucial, and any new words used in the claims must be clearly defined in the description.45

The precision and strategic breadth of patent claims are paramount in pharmaceutical patenting. The delicate balance required involves being broad enough to capture future variations and potential infringements, yet specific enough to avoid prior art and satisfy patentability criteria.19 The strategic use of Markush structures exemplifies the intent to maximize claim breadth.5 This highlights that claim drafting is a highly specialized skill, demanding a unique blend of legal acumen and profound scientific understanding. The quality of claims directly impacts the enforceability and commercial value of a patent. Poorly drafted claims can lead to invalidation or enable competitors to easily design around the invention, thereby undermining billions of dollars in R&D investment.

Ensuring Adequate Disclosure and Enablement

A fundamental requirement for patent validity, and a core component of the “patent bargain,” is that the patent application must fully disclose the invention.10 This means the specification must describe the invention in such full, clear, concise, and exact terms as to enable any person skilled in the pertinent art or science to make and use it without undue experimentation.19

Failure to provide a comprehensive, clear, or complete description can lead to rejection during examination or even invalidation of the patent later.28 Fields characterized by inherent unpredictability, such as biotechnology, frequently encounter challenges related to enablement due to the complexities in replicating intricate biological inventions.36 This requirement ensures that in exchange for the temporary monopoly, the inventor contributes to the public’s knowledge base, enabling others to reproduce the invention once the patent expires.42 This principle underscores that strong patents are not solely about exclusivity; they also contribute to the broader scientific commons, which, in the long run, fosters further innovation and the development of generic alternatives, ultimately benefiting public health.

10. Defending Your Portfolio: Avoiding and Addressing Invalidation

Even with meticulously drafted patents, pharmaceutical companies must be prepared to defend their intellectual property against challenges to its validity. Patent invalidation claims are a common occurrence in the highly litigious pharmaceutical industry, particularly from generic drug manufacturers.16

Common Grounds for Patent Invalidation

Several legal grounds exist for challenging the validity of a drug patent in the United States, each focusing on a different aspect of the patent’s requirements for grant and maintenance:

- Lack of Novelty (Anticipation): An invention is not patentable if it was already known or publicly disclosed before the patent application’s filing date.10 This means the invention must be entirely new and not previously disclosed by any prior art.36 A notable example is Sanofi’s Lantus insulin patent, which was successfully challenged in the U.S. after evidence emerged that the formulation had been disclosed in prior research papers.36

- Obviousness (Lack of Inventive Step): This is a frequent ground for rejection or invalidation, asserting that the invention would have been an obvious development for someone with ordinary skill in the field, lacking a significant improvement or unexpected benefits.10 In the pharmaceutical context, challenges often arise when competitors argue that combining known drugs, modifying dosages, or changing formulations would have been an obvious step, unless such modifications yielded surprising or unexpected results.36

- Lack of Written Description/Enablement: The patent application must contain a written description of the invention in terms that are sufficiently full, clear, concise, and exact to enable any person skilled in the art to make and use it without undue experimentation.10 An insufficient description that fails to adequately convey the invention can lead to the patent’s invalidation.28

- Other Grounds: These include indefiniteness (where the claims fail to particularly point out and distinctly claim the subject matter of the invention), double patenting (prohibiting more than one patent for essentially the same invention), inequitable conduct (fraud on the Patent Office), inutility, and non-patentable subject matter (e.g., mere discoveries, laws of nature, or methods of medical treatment in some jurisdictions).10

Proactive Strategies to Prevent Challenges

Preventing patent invalidation begins long before a challenge arises. Proactive measures are key:

- Comprehensive Prior Art Searches: Conducting thorough searches before filing can identify potential obstacles to patentability, allowing the patent application to be shaped to navigate around existing patents and publications, thereby minimizing the risk of future invalidation.28

- Ensure Complete and Clear Disclosure: The patent application should fully and clearly disclose the invention with detailed descriptions, drawings, and examples. This satisfies the enablement and written description requirements of patent law.28

- Avoid Overbroad and Vague Claims: Claims should be precisely tailored to cover the novel aspects of the invention without overreaching. Overbroad claims are more likely to invite challenges based on prior art, while vague claims may fail to provide clear notice of the invention’s boundaries, both of which can lead to invalidation.42

- Maintain Detailed Lab Notebooks and Documentation: Meticulous record-keeping of research, development, and experimental data is crucial. This documentation provides vital evidence for proving inventorship, dates of invention, and the unexpected results or inventive step, which can be critical in defending against invalidity claims.11

Understanding Patent Litigation and Challenges in the Pharma Industry

Patent challenges are particularly prevalent in the generics market, driven by the substantial R&D costs borne by brand companies and the enormous financial incentive for generic manufacturers to enter the market early.16 Strategies like “evergreening” and the creation of “patent thickets” provide fertile ground for generics to challenge patents, often arguing that secondary patents lack novelty or are obvious.16

The Hatch-Waxman Act plays a central role in this dynamic. Under its provisions, a generic manufacturer can file an Abbreviated New Drug Application (ANDA) with a Paragraph IV certification, asserting that a listed patent is invalid or will not be infringed.34 This filing is considered an “artificial” act of patent infringement, allowing for an early resolution of patent disputes.9 If the patent holder files an infringement lawsuit within 45 days of receiving such a notice, it triggers an automatic 30-month stay on the FDA’s final approval of the generic drug.34 This 30-month period provides a critical window for the patent dispute to be litigated in court.36

Patent invalidation challenges are not merely legal disputes but an integral component of competitive strategy in the pharmaceutical industry. The incentive of 180-day exclusivity for the first generic challenger creates a strong motivation for generics to initiate litigation.16 For brand companies, defending their patents through lawsuits and leveraging the 30-month stay is a direct extension of their market exclusivity strategy.11 This highlights that a strong patent filing strategy must be coupled with a robust litigation defense plan, as the economic stakes in these disputes are incredibly high.

11. Competitive Intelligence and Strategic Planning with DrugPatentWatch

In the fast-paced pharmaceutical industry, staying ahead requires more than just internal innovation; it demands a sophisticated understanding of the competitive landscape. Patent intelligence, particularly through specialized platforms, offers a powerful lens into competitor activities and market opportunities.

Monitoring Competitor R&D Pipelines Through Patent Filings

Patent monitoring is a systematic process of continuously tracking and analyzing patent filings by competitors or within specific technological areas.20 It provides a continuous stream of intelligence about evolving innovation landscapes, which is critical in an industry with high R&D costs and intense competition.2

Most patent applications are published 18 months after filing, creating a valuable window for intelligence.20 This predictability allows companies to systematically track new filings, gaining an early warning system for competitive threats years before products reach clinical trials or regulatory approval.20 This intelligence enables informed decisions about internal R&D investments, helping to avoid duplicative research efforts and potentially redirecting resources to more promising or less crowded therapeutic areas.20 It also facilitates more accurate forecasting of market dynamics and competitive landscapes.21

Identifying White Space and Emerging Trends

Beyond avoiding duplication, patent intelligence enables companies to identify strategic opportunities that might otherwise be missed. This includes uncovering “white spaces”—areas with limited patent activity but significant therapeutic potential—which represent attractive opportunities for innovation with reduced competitive pressure.20 By analyzing aggregate patent activity across multiple competitors, companies can discern industry-wide technology trends, such as the emergence of new target classes, increasing investment in specific technological approaches, or the abandonment of previously active research areas.21 This awareness helps R&D leaders ensure their strategies align with the cutting edge of scientific progress.20

Leveraging Patent Databases and Analytics Tools (mentioning DrugPatentWatch)

Effective patent monitoring relies on leveraging comprehensive patent databases and advanced analytics tools. Key global databases include the USPTO (United States Patent and Trademark Office), the EPO’s Espacenet, and WIPO’s PATENTSCOPE.17 These platforms offer a wealth of search options, from simple keyword searches to complex queries based on chemical structures, International Patent Classification (IPC), and Cooperative Patent Classification (CPC) codes.17

Specialized patent search software and landscaping tools like PatSnap, Derwent Innovation, and LexisNexis TotalPatent One provide advanced features such as semantic searching, automatic translation, visual patent mapping, and analytics.17 These tools streamline the search process and help visualize patent data, making it easier to spot trends and identify key players.17

DrugPatentWatch is a notable platform explicitly designed for maximizing return on investment (ROI) in drug development by monitoring competitive patent portfolios.20 It helps transform raw patent data into actionable market intelligence.20 DrugPatentWatch offers features such as accurate chemical structure recognition, automated identification of structures, names, and biological activity data, and multilingual patent support (English, Chinese, and Japanese).21 The platform’s capabilities allow for mapping competitor R&D pipelines years before clinical trial initiation or public announcements, providing early signals of shifting research priorities.21

The pharmaceutical industry is characterized by exceptionally high R&D costs and intense competition.2 The shift to a “first-to-file” system further emphasizes the importance of speed in securing intellectual property.11 In this environment, patent data, as facilitated by platforms like DrugPatentWatch, transforms into a critical strategic asset.20 It is no longer sufficient to merely file patents; companies must actively use the intelligence derived from patent filings to gain a competitive advantage, optimize R&D spending, and proactively identify market opportunities or threats. This signifies a clear evolution towards a data-driven intellectual property strategy, where information is power.20

12. Industry Insights: Quotes and Statistics on Pharma Patents

The strategic importance of patents in the pharmaceutical industry is underscored by both expert perspectives and compelling economic data.

Expert Perspectives on IP’s Importance in Pharma

Industry leaders and legal scholars consistently emphasize the critical role of intellectual property in driving pharmaceutical innovation and ensuring its commercial viability:

- “The only thing that keeps us alive is our brilliance. The only way to protect our brilliance is our patents.” – Dr. Edwin Land.44 This quote powerfully encapsulates the existential reliance of innovation-driven companies on patent protection.

- “Intellectual property is a key aspect for economic development.” – Craig Venter.46 This broadens the perspective, highlighting how robust IP frameworks contribute to national economic growth and technological advancement.

- “Respect for inventors is the key for success of a patent system.” – Kalyan C. Kankanala.47 This emphasizes the foundational cultural aspect necessary for a thriving patent system that encourages creativity.

- “The United States has an active pharmaceutical industry that has brought huge benefits to the U.S. public. Most Americans, who benefit from these advances, have little understanding of how difficult it is to create an important new medical therapy and make it available to improve public health.” – Robert Jarvik.48 This statement highlights the immense complexity and inherent value of pharmaceutical innovation, often unappreciated by the public.

- “These are not, respectfully, golf balls or other products… We need to be looking at prescription drugs as a crucial issue versus the way that other systems work, because, again, these are products that patients often don’t choose to be on but have to be on for the rest of their lives.” – Dave.41 This poignant observation underscores the unique societal and ethical considerations that differentiate pharmaceutical patents from intellectual property in other industries.

Illustrative Statistics on R&D Costs, Patent Cliffs, and Generic Impact

The financial realities of the pharmaceutical industry vividly illustrate why sophisticated patent strategies are not merely beneficial but essential:

- Companies invest upwards of $2 billion to bring new medications to market.2

- It takes an average of 12-13 years to complete the research and development activities from initial patent filing to regulatory approval.2

- This lengthy development process significantly shortens the effective market exclusivity period to approximately 7-8 years, or sometimes 7-12 years, from the total 20-year patent term.2

The disparity between the statutory patent term and the effective market exclusivity period for pharmaceuticals is a critical challenge, directly impacting a company’s ability to recoup its R&D investments.

| Metric | Value | Source Snippet |

| Standard Patent Term | 20 years from filing date | 1 |

| Average R&D + Regulatory Approval Time | 12-13 years | 2 |

| Average Effective Market Exclusivity | 7-8 years (or 7-12 years) | 2 |

- The global pharmaceutical industry is projected to face a massive $236 billion patent cliff by 2030, as patents on nearly 70 high-revenue products are set to expire.38

- Between 2010 and 2015, the expiration of numerous blockbuster medication patents caused significant financial turbulence across the sector.8 Industry analysts project an estimated

$200 billion in revenue at risk due to patent expirations in the coming five years.8 - For small-molecule drugs, sales can decline by as much as 90% within months after patent expiration.38 Biologics experience a decline of 30-70% in the first year.38

- Post-patent expiration, drug prices typically decrease by 38% to 48% for physician-administered medications and approximately 25% for oral formulations. As more generic competitors enter the market, prices can further decline to as little as 10-20% of the original branded price.8

- Generic medications collectively save the U.S. healthcare system hundreds of billions of dollars annually.8 The Hatch-Waxman Act alone has saved over

$3.1 trillion, including $445 billion in 2023.33

The statistics presented paint a vivid picture of the pharmaceutical industry as a high-stakes, high-reward environment. Billions of dollars are poured into R&D for drugs that face a dramatically shortened period of effective market exclusivity, leading to immense “patent cliffs” and significant revenue contractions.2 This reality underscores the absolute necessity of sophisticated and proactive patent filing strategies to maximize every available moment of exclusivity and ensure the recoupment of investment. The sheer scale of these financial figures reinforces why intellectual property strategy is not merely a concern for the legal department but a paramount priority for the C-suite.

13. Conclusion: Sustaining Innovation and Profitability in a Dynamic IP Landscape

The pharmaceutical industry operates at the intersection of groundbreaking scientific discovery, immense financial investment, and critical public health needs. In this complex ecosystem, robust patent filing strategies are not merely a legal formality but the indispensable engine driving innovation and ensuring commercial viability.

Key Takeaways for Pharma Business Leaders

For pharmaceutical business leaders, several critical imperatives emerge from an examination of effective patent strategies:

- Patents as Strategic Assets: Patents must be viewed and managed as core strategic business assets, essential for recouping the massive R&D investments that underpin new drug development and for sustaining the innovation pipeline that benefits patients worldwide.

- Multi-Faceted Protection: A comprehensive patent strategy demands a multi-faceted approach, encompassing early and continuous filing, diversification across various patent types (compound, formulation, method of use, polymorphs), a global perspective on protection, and proactive defense against challenges.

- Integrated IP Strategy: Intellectual property strategy cannot operate in isolation. It must be seamlessly integrated with R&D, commercialization plans, and regulatory affairs from the earliest stages of drug discovery through post-market lifecycle management. This holistic approach ensures that every innovation is adequately protected and its commercial potential maximized.

- Leveraging Competitive Intelligence: In a highly competitive market, competitive intelligence derived from patent monitoring is a non-negotiable strategic imperative. Utilizing specialized tools and platforms, such as DrugPatentWatch, enables companies to gain early insights into competitor R&D pipelines, identify white spaces for innovation, and make data-driven decisions that secure a competitive edge.

The Future of Pharmaceutical Patent Strategy

The pharmaceutical patent landscape is dynamic, constantly evolving in response to scientific advancements, market pressures, and societal demands. Future trends will likely include an increased focus on patents related to precision medicine, reflecting the shift towards highly targeted therapies.11 The growing importance of data-related patents in the realm of digital health will also reshape IP portfolios.11 Furthermore, the rise of collaborative patent strategies in complex therapeutic areas may become more prevalent, as companies seek to pool resources and expertise to tackle intractable diseases.11

Simultaneously, the industry must anticipate and adapt to potential patent reforms driven by ongoing public and governmental concerns over drug pricing.11 Navigating this evolving environment will require pharmaceutical companies to maintain exceptional agility and a continuous commitment to innovation, not just in drug discovery but also in their intellectual property management strategies. By embracing these principles, companies can sustain both their profitability and their vital contribution to global health.

Works cited

- Home – Drug Patents – LibGuides at Touro College of Osteopathic Medicine, accessed July 10, 2025, https://touromed.libguides.com/c.php?g=1263476

- Drug Patent Life: The Complete Guide to Pharmaceutical Patent Duration and Market Exclusivity – DrugPatentWatch, accessed July 10, 2025, https://www.drugpatentwatch.com/blog/how-long-do-drug-patents-last/

- Pharmaceutical Patents: an overview, accessed July 10, 2025, https://www.alacrita.com/blog/pharmaceutical-patents-an-overview

- “Pharmaceutical Patent” – Legal Definition – YouTube, accessed July 10, 2025, https://www.youtube.com/watch?v=KbJvVyp5g78

- Chemical patent – Wikipedia, accessed July 10, 2025, https://en.wikipedia.org/wiki/Chemical_patent

- Why Are Patents Important to Drug Development? | Infinix Bio, accessed July 10, 2025, https://www.infinixbio.com/why-patents-important-drug-development/

- Pharmaceutical Patent Profits Fa, accessed July 10, 2025, https://www.mckendree.edu/academics/scholars/issue11/bodem.htm

- The Impact of Drug Patent Expiration: Financial Implications, Lifecycle Strategies, and Market Transformations – DrugPatentWatch, accessed July 10, 2025, https://www.drugpatentwatch.com/blog/the-impact-of-drug-patent-expiration-financial-implications-lifecycle-strategies-and-market-transformations/

- Pharmaceutical Patent Regulation in the United States – The Actuary Magazine, accessed July 10, 2025, https://www.theactuarymagazine.org/pharmaceutical-patent-regulation-in-the-united-states/

- Invalidity defences in patent litigation – Smart & Biggar, accessed July 10, 2025, https://www.smartbiggar.ca/insights/publication/invalidity-defences-in-patent-litigation

- Optimizing Your Drug Patent Strategy: A Comprehensive Guide for Pharmaceutical Companies – DrugPatentWatch, accessed July 10, 2025, https://www.drugpatentwatch.com/blog/optimizing-your-drug-patent-strategy-a-comprehensive-guide-for-pharmaceutical-companies/

- Pharmaceutical Patenting – D Young & Co, accessed July 10, 2025, https://www.dyoung.com/en/knowledgebank/articles/pharmaceuticalpatenting0213

- Patent protection strategies – PMC, accessed July 10, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC3146086/

- Patent Evergreening In The Pharmaceutical Industry: Legal Loophole Or Strategic Innovation? – IJLSSS, accessed July 10, 2025, https://ijlsss.com/patent-evergreening-in-the-pharmaceutical-industry-legal-loophole-or-strategic-innovation/

- Crystallised Control: Unlocking the Secrets to Polymorph Patents in India – AIPPI, accessed July 10, 2025, https://www.aippi.org/news/crystallised-control-unlocking-the-secrets-to-polymorph-patents-in-india/

- What is a patent challenge, and why is it common in generics?, accessed July 10, 2025, https://synapse.patsnap.com/article/what-is-a-patent-challenge-and-why-is-it-common-in-generics

- The basics of drug patent searching – DrugPatentWatch, accessed July 10, 2025, https://www.drugpatentwatch.com/blog/the-basics-of-drug-patent-searching/

- PATENTSCOPE – WIPO, accessed July 10, 2025, https://www.wipo.int/en/web/patentscope

- Securing and Maintaining a Strong Patent Portfolio for Pharmaceuticals – PMC, accessed July 10, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC6580373/

- Maximizing ROI on Drug Development by Monitoring Competitive Patent Portfolios, accessed July 10, 2025, https://www.drugpatentwatch.com/blog/maximizing-roi-on-drug-development-by-monitoring-competitive-patent-portfolios/

- How to Track Competitor R&D Pipelines Through Drug Patent Filings – DrugPatentWatch, accessed July 10, 2025, https://www.drugpatentwatch.com/blog/how-to-track-competitor-rd-pipelines-through-drug-patent-filings/

- Filing Date Strategies for Patent Applicants – Number Analytics, accessed July 10, 2025, https://www.numberanalytics.com/blog/filing-date-strategies-for-patent-applicants

- Filing a provisional application – USPTO, accessed July 10, 2025, https://www.uspto.gov/sites/default/files/documents/Basics%20of%20a%20Provisional%20Application.pdf

- How to Navigate the International Patent Cooperation Treaty (PCT …, accessed July 10, 2025, https://patentpc.com/blog/how-to-navigate-the-international-patent-cooperation-treaty-pct

- Provisional Application for Patent – USPTO, accessed July 10, 2025, https://www.uspto.gov/patents/basics/apply/provisional-application

- Continuing patent application – Wikipedia, accessed July 10, 2025, https://en.wikipedia.org/wiki/Continuing_patent_application

- Continuation Patent Application Vs. Continuation-In-Part – Global Patent Filing, accessed July 10, 2025, https://www.globalpatentfiling.com/blog/Continuation-Patent-Application-Vs-Continuation-In-Part

- Common Reasons for Drug Patent Rejections and Solutions – DrugPatentWatch, accessed July 10, 2025, https://www.drugpatentwatch.com/blog/common-reasons-for-drug-patent-rejections-and-solutions/

- Continuation Patent Application Vs. Continuation-In-Part – Which Is …, accessed July 10, 2025, https://sagaciousresearch.com/blog/continuation-patent-application-vs-continuation-in-part/

- Maximizing Patent Term in the United States: Patent Term Adjustment, Patent Term Extension, and the Evolving Law of Obviousness-Type Double Patenting | Thought Leadership, accessed July 10, 2025, https://www.bakerbotts.com/thought-leadership/publications/2025/january/maximizing-patent-term-in-the-united-states

- What is the difference between the Patent Term Adjustment (PTA) and Patent Term Extension (PTE)? – Wysebridge Patent Bar Review, accessed July 10, 2025, https://wysebridge.com/what-is-the-difference-between-the-patent-term-adjustment-pta-and-patent-term-extension-pte

- Patent Term Extensions and the Last Man Standing | Yale Law & Policy Review, accessed July 10, 2025, https://yalelawandpolicy.org/patent-term-extensions-and-last-man-standing

- A Bipartisan Success: Celebrating 40 Years of the Hatch-Waxman Act, accessed July 10, 2025, https://www2.itif.org/2025-hatch-waxman-act-article.pdf

- Patents and Exclusivity | FDA, accessed July 10, 2025, https://www.fda.gov/media/92548/download

- FDA Regulatory Exclusivities Guide – Number Analytics, accessed July 10, 2025, https://www.numberanalytics.com/blog/fda-regulatory-exclusivities-guide

- Handling Drug Patent Invalidity Claims – DrugPatentWatch, accessed July 10, 2025, https://www.drugpatentwatch.com/blog/handling-drug-patent-invalidity-claims/

- Enter the National Phase – WIPO, accessed July 10, 2025, https://www.wipo.int/en/web/pct-system/national-phase

- Pharma Faces $236 Billion Patent Cliff by 2030: Key Drugs and Companies at Risk, accessed July 10, 2025, https://www.geneonline.com/pharma-faces-236-billion-patent-cliff-by-2030-key-drugs-and-companies-at-risk/

- How Companies Can Extract Value from Expired Drug Patents – DrugPatentWatch, accessed July 10, 2025, https://www.drugpatentwatch.com/blog/how-companies-can-extract-value-from-expired-drug-patents/

- STRATEGIES FOR DRUG PATENT EVER-GREENING IN THE PHARMACEUTICAL INDUSTRY, accessed July 10, 2025, https://www.ijpsbm.com/docs/papers/march2015/V3I302.pdf

- ‘Prescription Drugs Are Not Golf Balls’ – Opinions Clash On Patents During FTC/DOJ Listening Session – Citeline News & Insights, accessed July 10, 2025, https://insights.citeline.com/generics-bulletin/legalandip/prescription-drugs-are-not-golf-balls-opinions-clash-on-patents-during-ftcdoj-listening-session-JVYSKBPSFBHGTDL5EE2HGANYTE/

- Overcoming Patent Protection: A Guide to Patent Invalidation – TT Consultants, accessed July 10, 2025, https://ttconsultants.com/breaking-the-patent-barrier-techniques-and-tips-for-invalidation/

- How to Draft Strong Patent Claims for Drug Inventions – PatentPC, accessed July 10, 2025, https://patentpc.com/blog/how-to-draft-strong-patent-claims-drug-inventions

- Quotes on Patent Lawyers – Compiled by Homer Blair – IP Mall – University of New Hampshire, accessed July 10, 2025, https://ipmall.law.unh.edu/content/quotes-patent-lawyers-compiled-homer-blair

- Topic 9: Claim Drafting Techniques – WIPO, accessed July 10, 2025, https://www.wipo.int/edocs/mdocs/aspac/en/wipo_ip_phl_16/wipo_ip_phl_16_t9.pdf

- Intellectual Property Quotes – BrainyQuote, accessed July 10, 2025, https://www.brainyquote.com/topics/intellectual-property-quotes

- Fun IP, Fundamentals of Intellectual Property Quotes by Kalyan C. Kankanala – Goodreads, accessed July 10, 2025, https://www.goodreads.com/work/quotes/24076699-fun-ip-fundamentals-of-intellectual-property

- Pharmaceutical Industry Quotes – BrainyQuote, accessed July 10, 2025, https://www.brainyquote.com/topics/pharmaceutical-industry-quotes