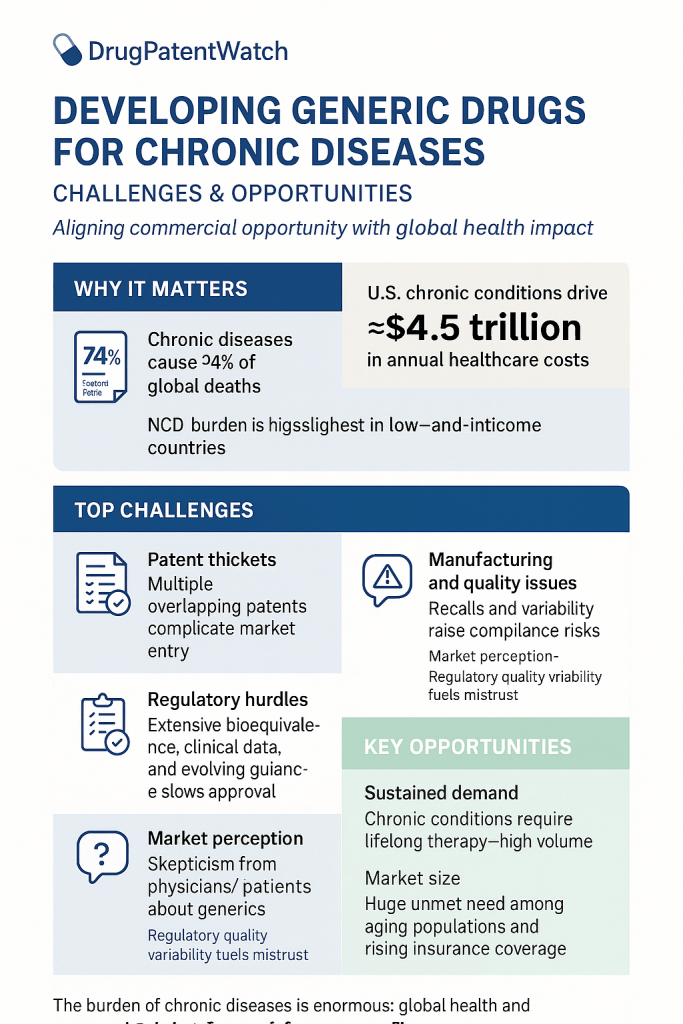

The global healthcare landscape is undergoing a profound transformation, driven significantly by the escalating burden of chronic diseases. These conditions, often referred to as Noncommunicable Diseases (NCDs), encompass a wide array of illnesses such as heart disease, stroke, cancer, diabetes, and chronic lung disease. Alarmingly, these NCDs are collectively responsible for a staggering 74% of all deaths worldwide . This is not merely a public health crisis; it presents a formidable economic and social challenge, particularly evident in low- and middle-income countries, where over three-quarters of all NCD-related deaths occur . The pervasive and growing burden of chronic diseases creates an ever-expanding market for long-term pharmaceutical interventions. Companies engaged in generic drug development are not simply entering a commercial market; they are stepping into a critical public health mission. The widespread and persistent nature of NCDs necessitates continuous management, which translates directly into a sustained, high-volume demand for medications. If these essential medications remain prohibitively expensive, patient access and adherence inevitably suffer, thereby exacerbating the public health crisis. Consequently, the provision of affordable generic options emerges not just as a business opportunity, but as a societal necessity, aligning commercial interests with broader public health goals.

The economic strain imposed by NCDs on healthcare systems globally further amplifies the demand for cost-effective pharmaceutical solutions. In the United States alone, chronic diseases are the leading drivers of an estimated $4.5 trillion in annual healthcare costs. This immense financial pressure compels governments, healthcare payers, and individual patients to actively seek more affordable alternatives for managing long-term conditions. Generic drugs, by their very nature, offer a direct and substantial pathway to this cost reduction, establishing a clear link between the escalating disease burden, healthcare expenditures, and the burgeoning demand for generic medications.

Generic drugs stand as a cornerstone of accessible and affordable healthcare. They are not merely cheaper alternatives; they are scientifically proven copies of brand-name medications. The U.S. Food and Drug Administration (FDA) mandates that generic drugs must contain the same active ingredient, strength, dosage form, and route of administration as their brand-name counterparts . This stringent requirement ensures that the core therapeutic component of the medicine is identical. The FDA rigorously ensures that generic drugs meet the same exacting quality, safety, and efficacy standards as the brand-name products they emulate . This commitment to equivalence means that generic drugs perform approximately the same in the body as their branded versions.

The significantly lower price point of generic medications—often 80-85% cheaper than brand-name equivalents—stems from a fundamental difference in their development pathway . Generic manufacturers are not required to repeat the costly, time-consuming animal and human clinical trials that are essential for the development of new drugs. Furthermore, they generally do not incur the substantial expenses associated with extensive advertising, marketing, and promotion campaigns typical of brand-name products . This inherent cost-effectiveness translates into monumental savings for patients and healthcare systems alike. For instance, in 2016, generic drugs accounted for a remarkable 89% of all prescriptions dispensed in the U.S., yet they represented only 26% of the total drug costs . This disproportionate value underscores that the economic impact of generics is not marginal; it is foundational to healthcare affordability and sustainability, creating a compelling value proposition for both patients and payers. This is not just a minor saving; it represents a systemic cost-containment mechanism that enables healthcare systems to extend their budgets further and allows patients to access necessary treatments. This makes generics an indispensable component of any sustainable healthcare model.

Moreover, the affordability of generic drugs directly enhances medication adherence, which in turn leads to improved health outcomes and reduced overall healthcare costs. High prescription drug costs frequently act as a significant barrier to patients taking their medications as prescribed, with many individuals reporting that they have skipped or postponed needed care and prescriptions due to financial concerns. Generic drugs effectively lower this financial barrier. Studies have demonstrated that patients who are initiated on generic drugs are more likely to adhere to their medication regimens compared to those started on brand-name drugs. Improved adherence directly correlates with better chronic disease management, fewer complications, and ultimately, lower long-term healthcare expenditures, including reduced hospitalizations and emergency visits. This creates a beneficial cycle: increased affordability leads to improved adherence, which results in better health outcomes, and subsequently, significant cost savings for the healthcare system.

Despite their undeniable benefits and critical role, the journey of developing and commercializing generic drugs for chronic diseases is fraught with complexities. These include navigating intricate regulatory pathways, overcoming formidable intellectual property hurdles, ensuring robust manufacturing quality and supply chain resilience, and addressing persistent patient and physician perceptions. However, within these challenges lie immense opportunities for innovative pharmaceutical companies. The evolving landscape, marked by significant patent expirations, rapid technological advancements, and a growing emphasis on value-based care, presents fertile ground for strategic growth in the generic sector, particularly in the burgeoning realms of complex generics and biosimilars. The generic drug industry is evolving beyond simple “copycat” models towards a more sophisticated landscape focused on “higher-value generics” and strategic differentiation. The intense price competition prevalent in the market for “simple” generics inevitably drives down profit margins, making this segment less attractive for sustained investment. This economic pressure compels generic manufacturers to innovate, shifting their focus towards complex generics and biosimilars that offer improved efficacy, enhanced safety, or greater convenience for patients . This strategic pivot is a natural market response to commoditization, signaling a clear move towards a more innovation-driven and value-added generic pharmaceutical sector.

Understanding the Fundamentals: What Exactly is a Generic Drug?

To fully appreciate the strategic landscape of generic drug development, it is essential to establish a foundational understanding of what constitutes a generic drug and how it differs from its brand-name counterpart, as well as from other categories of follow-on medicines like biosimilars and complex generics.

Defining Generic Drugs: Active Ingredients, Bioequivalence, and Therapeutic Equivalence

At its core, a generic drug is designed to be a pharmaceutical equivalent to its brand-name counterpart. The FDA explicitly defines a generic drug as one that must have the “same active ingredient, strength, dosage form, and route of administration as the brand-name drug”. This fundamental requirement ensures that the therapeutic component—the very essence of the medicine responsible for treating the illness or condition—is identical to that of the original product.

The cornerstone of generic drug approval is the demonstration of bioequivalence. This critical standard means that the generic drug must deliver the active ingredient to the bloodstream at approximately the same rate and to the same extent as the brand-name drug, thereby ensuring similar therapeutic effects . To establish this, generic drug companies perform rigorous pharmacokinetic studies, typically involving single-dose comparison studies in healthy volunteers . These studies measure the concentration of the active ingredient in the bloodstream at multiple time points following administration. The FDA generally considers generic drugs bioequivalent if the 90% confidence interval for the ratio of certain pharmacokinetic parameters, specifically the Area Under the Curve (AUC) and maximum concentration (Cmax), falls within an 80% to 125% range of the reference drug values . This statistical benchmark serves as the scientific gatekeeper for generic market entry, providing a quantitative assurance of comparable performance.

While the active ingredients must be identical, it is important to note that minor variations in inactive ingredients (such as fillers, dyes, or preservatives), color, flavor, and packaging are permissible . These differences are allowed as long as they do not affect the way the drug works or its overall performance in the body. This distinction is a key point that is often misunderstood by the public, sometimes leading to unwarranted concerns about generic products.

Despite these rigorous bioequivalence standards and the FDA’s official position that approved generic drugs are equivalent to their branded counterparts , there have been reported patient experiences of “undesired effects” when switching between brand-name drugs and generic formulations, or even between different generic versions . Physicians and patients have, in some instances, reported problems with generic drugs, suggesting that they do not always have the same desired impact as their branded counterparts . The FDA acknowledges these reports and encourages the generic industry to investigate the circumstances under which such problems occur. This highlights a subtle yet significant gap between scientific equivalence, as measured by pharmacokinetic parameters, and real-world patient perception, which can ultimately impact medication adherence. The existence of these reports, even if not medically significant in all cases, implies that while the pharmacokinetic profile may be equivalent, other factors—such as variations in inactive ingredients, subtle manufacturing differences beyond current detection limits, or even psychological effects—might lead to perceived or actual clinical differences for some patients. This perception, regardless of its scientific basis, can undermine patient trust and adherence, posing a critical business challenge for generic manufacturers and the broader healthcare system.

Beyond the Basics: Small Molecule Generics vs. Complex Generics vs. Biosimilars

The term “generic drug” is frequently used as an umbrella term, but the pharmaceutical landscape is far more nuanced. It encompasses distinct categories of follow-on medicines, each with varying levels of molecular complexity, development challenges, and specific regulatory pathways. Understanding these distinctions is paramount for any strategic planning within the pharmaceutical industry.

Small Molecule Generics: The Traditional Pathway

Small molecule generics represent the most common and traditional type of generic drug. These medications are typically synthesized through chemical processes and are characterized by their relatively small and straightforward molecular structures . Common examples include widely used medications such as aspirin, ibuprofen, atorvastatin (Lipitor), amlodipine (Norvasc), and metformin (Glucophage) . Their chemical identity allows for a precise duplication of the active ingredient, making them comparatively simpler to reproduce and to demonstrate bioequivalence to their brand-name counterparts. The approval process for these drugs primarily utilizes the Abbreviated New Drug Application (ANDA) pathway, which, by design, does not require the generic drug company to repeat the costly animal and clinical research already conducted for the original brand-name drug .

The chemical simplicity of small molecule drugs directly leads to lower development costs and faster market entry for generics. This, in turn, drives rapid and significant price erosion once multiple competitors emerge. The straightforward nature of their chemical structures means that synthesis and characterization are less complex, substantially reducing research and development (R&D) expenditures. Developing a small molecule generic can cost significantly less, typically ranging from $1 million to $4 million. This relatively low barrier to entry attracts numerous generic manufacturers, fostering intense competition in the market. This competition is a direct consequence of the ease of replication and the lower development cost. For instance, the entry of multiple generic companies can lead to price reductions of up to 95% when six or more competitors are present in the market. This economic dynamic underscores the need for generic manufacturers to prioritize efficiency and speed-to-market in this segment.

Biosimilars: The Biologic Counterparts

Biosimilars are a distinct category of follow-on medicines, representing versions of brand-name biological products. Unlike small molecule drugs, biological medicines are large, complex molecules that are typically manufactured from living systems, such as microorganisms (e.g., yeast, bacteria) or animal cells . Examples include vaccines, blood components, gene therapies, and complex therapeutic proteins. Due to the inherent natural variability of biological manufacturing processes, biosimilars are defined as “highly similar” to their reference product, rather than identical . This subtle but crucial distinction reflects the scientific reality that an exact replication of a complex biological molecule, with all its post-translational modifications and micro-heterogeneities, is not feasible.

Biosimilars are approved through a distinct abbreviated pathway in the U.S., specifically the 351(k) pathway under the Biologics Price Competition and Innovation Act (BPCIA), which differs from the ANDA pathway for small molecules. While this pathway avoids duplicating all the costly clinical trials required for a novel biologic, it still necessitates comprehensive comparability studies . These studies typically involve extensive analytical characterization to demonstrate structural and functional similarity, as well as animal studies and at least one comparative clinical study to confirm that there are no clinically meaningful differences between the biosimilar and the reference product in terms of safety, purity, and potency . Developing a biosimilar is a significantly more complex and costly undertaking than developing a small molecule generic, often requiring 7 to 8 years and an investment exceeding $100 million.

The “highly similar” nature and higher development cost of biosimilars create a market dynamic that is notably distinct from that of small-molecule generics. This segment offers the potential for higher margins but demands greater scientific and regulatory expertise. Because biosimilars cannot be “identical” and require more extensive and sophisticated testing than small-molecule generics, their development cost is substantially higher. This elevated barrier to entry naturally limits the number of competitors compared to the simple generic market, allowing for more sustainable profit margins. For instance, the price reduction for biosimilars compared to their reference biologics typically ranges from 15-30%, in contrast to the 80% or more seen with small-molecule generics. This implies that biosimilar development requires a different investment profile and a more sophisticated scientific approach, but also promises a more sustainable competitive landscape with less aggressive price erosion.

Complex Generics: A Spectrum of Innovation

The category of “complex generics” encompasses a broad and diverse group of pharmaceutical products that present unique challenges in their development and approval. While there is no single, universally agreed-upon definition, the FDA generally identifies them as medicines that possess complex active ingredients, formulations, dosage forms, routes of administration, or are classified as complex drug-device combination products . This wide-ranging category includes products such as transdermal patches, liposomal formulations, nanoparticles, and long-acting injectables .

The inherent complexity of these products arises from several factors. It can be challenging to demonstrate bioequivalence, particularly when the drug’s activity is not easily measured in the bloodstream or when it acts locally on a specific organ. Furthermore, complex generics often present significant hurdles related to manufacturing scale-up, the intricacies of the production process itself, and, frequently, a lack of clear and well-defined regulatory pathways . These factors collectively mean that creating and manufacturing complex generics demands higher levels of expertise, meticulous planning, and greater development costs compared to standard, small-molecule generics.

Complex generics represent a frontier where unmet medical needs intersect with significant technical and regulatory hurdles, offering substantial market differentiation and higher value for companies that can navigate these complexities. The inherent difficulty in developing these products means that fewer companies are able to successfully enter this space, leading to less market competition compared to the crowded simple generic market . This creates a “blue ocean” opportunity for pharmaceutical firms capable of overcoming the formidable technical and regulatory challenges. By successfully solving these complex problems, companies can develop what are often termed “higher-value generics” . These products offer enhanced patient benefits, such as reduced dosing frequency or improved safety profiles, and can command better pricing, allowing developers to move beyond the intense price-driven competition of simple generics.

| Feature | Small Molecule Generics | Biosimilars | Complex Generics |

| Active Ingredient Nature | Chemically synthesized | Derived from living systems (e.g., cells, microorganisms) | Chemically synthesized, but with complex structure or delivery |

| Molecular Structure | Small, simple, well-defined | Large, complex, inherent natural variability | Variable, can be small or large, but with complex formulation/delivery |

| Bioequivalence Standard | Identical active ingredient; bioequivalent (same rate & extent of absorption) | “Highly similar” to reference product; no clinically meaningful differences in safety, purity, potency | Bioequivalent, but often requires specific, non-traditional studies to demonstrate equivalence |

| Regulatory Pathway | Abbreviated New Drug Application (ANDA) | Biologics Price Competition and Innovation Act (BPCIA) 351(k) pathway | Primarily ANDA, but often requires additional studies/guidance (can also use 505(b)(2)) |

| Need for Clinical Trials | Generally not required (bioequivalence studies instead) | Targeted clinical studies required (comparability studies, immunogenicity) | May require additional clinical studies beyond standard bioequivalence (e.g., adhesion for patches) |

| Typical Development Cost | Relatively low ($1-4 million) | High (>$100 million) | Moderate to High (more than simple generics, less than biosimilars) |

| Typical Development Timeline | Shorter (e.g., 36 months pre-filing) | Longer (7-8 years) | Longer than simple generics due to complexity and regulatory ambiguity |

| Key Characteristics | Identical active ingredient, simple to reproduce, high competition, significant price erosion | “Similar but not identical,” complex manufacturing, higher margins, less competition than simple generics | Complex active ingredients, formulations, dosage forms, routes of administration, or drug-device combinations; often address unmet needs |

| Market Dynamics | High volume, low margin, intense price competition | Growing market, moderate competition, moderate price reduction (15-30%) | Emerging market, less competition, potential for higher value/margins |

Table 1: Comparison of Follow-On Drug Types

The Regulatory Labyrinth: Pathways to Market Approval

Navigating the regulatory landscape is perhaps the most critical challenge and opportunity for generic drug developers. The pathways to market approval are intricate, demanding rigorous scientific demonstration and meticulous adherence to legal frameworks. Understanding these pathways is fundamental to strategic planning and successful commercialization.

The Abbreviated New Drug Application (ANDA) Pathway in the U.S.

The Abbreviated New Drug Application (ANDA) process is the primary regulatory pathway for generic drug approval in the United States. This streamlined approach was a cornerstone of the landmark Drug Price Competition and Patent Term Restoration Act of 1984, commonly known as the Hatch-Waxman Act . The “abbreviated” nature of the ANDA process is its defining characteristic: it allows generic manufacturers to gain approval without needing to repeat the extensive and costly animal and human clinical trials for safety and effectiveness that were originally required for the brand-name drug . This efficiency significantly reduces the time and financial investment needed to bring a generic product to market.

Bioequivalence Studies: The Scientific Mandate

At the very heart of an ANDA submission lies the scientific mandate to demonstrate bioequivalence to an already approved Reference Listed Drug (RLD) . This is not a mere formality but a rigorous scientific exercise. It typically involves conducting single-dose comparison studies in healthy volunteers, where blood levels of the active ingredient are measured at multiple time points following administration of both the generic and the RLD . The objective is to prove that the generic drug delivers the same amount of active ingredient to the bloodstream at approximately the same rate as the brand-name drug, thereby ensuring comparable therapeutic effects .

The FDA generally considers generic drugs bioequivalent if the 90% confidence interval for the ratio of certain pharmacokinetic parameters—specifically, the Area Under the Curve (AUC), which represents the total amount of drug absorbed, and the maximum concentration (Cmax), which indicates the peak drug level—falls within an 80% to 125% range of the reference drug values . These statistical benchmarks are the scientific gatekeepers for generic entry. Bioequivalence studies are not just a regulatory hurdle; they are the scientific bedrock validating the generic’s therapeutic equivalence, directly influencing physician confidence and patient acceptance. The FDA’s stringent bioequivalence requirements are meticulously designed to ensure that a generic drug will perform in the body identically to its brand-name counterpart. This robust scientific validation, when effectively communicated to healthcare professionals and patients, can foster trust, which is crucial for widespread adoption and adherence, particularly for chronic conditions where consistent drug performance is paramount.

Manufacturing and Quality Control: Ensuring Consistency and Safety

Beyond demonstrating bioequivalence, an ANDA submission must provide exhaustive details on the drug’s formulation, its manufacturing process, and the comprehensive quality control measures in place. Generic manufacturers are strictly required to adhere to Current Good Manufacturing Practices (cGMP) regulations. These regulations establish the minimum requirements for the methods, facilities, and controls employed in the manufacturing, processing, and packing of a drug product. Their purpose is to ensure that every product is safe for use, contains the ingredients and strength it claims to have, and is consistently produced with the required quality .

The FDA conducts thorough reviews of these manufacturing procedures and performs on-site inspections of generic drug manufacturing facilities. These inspections are critical to verify that the manufacturer possesses the necessary facilities, equipment, and capabilities to consistently produce the drug it intends to market . This oversight also includes a requirement to demonstrate that the drug remains stable and does not break down over time, necessitating months-long “stability tests,” and that the container in which the drug is shipped and sold is appropriate for maintaining its quality.

The intense price competition inherent in the generic market, while undeniably beneficial for affordability, paradoxically creates pressures that can compromise manufacturing quality and supply chain resilience. Generic manufacturers often operate on razor-thin profit margins . This economic reality can disincentivize necessary investments in robust, resilient manufacturing processes and advanced quality control systems . The consequence of such underinvestment is a supply chain that becomes inherently prone to disruptions, quality issues, and drug shortages . This directly impacts patient access to essential medications for chronic diseases, highlighting a critical tension between the drive for cost-driven competition and the imperative for supply reliability. In such a commoditized market, cGMP compliance and a robust quality reputation are not merely regulatory necessities but critical competitive differentiators, directly influencing market share and mitigating the risks of costly recalls. Companies that consistently demonstrate superior cGMP compliance and unwavering quality assurance build trust with healthcare providers and payers. This established reputation can translate into preferred formulary placement and higher prescribing rates, offering a significant competitive edge beyond just price. Conversely, any lapse in quality can lead to severe reputational damage, product recalls, and substantial financial losses .

Labeling Requirements and Permissible Differences

The labeling information for a generic drug, including its indications for use, dosage forms, strength, and route of administration, generally must be identical to that of the Reference Listed Drug (RLD) . However, the regulatory framework allows for certain “permissible differences,” particularly concerning patents and exclusivities that may still apply to the brand-name product.

A notable provision within the Hatch-Waxman Act is the “skinny-label” mechanism. This allows a generic manufacturer to seek FDA approval for only those approved uses of the drug that are no longer protected by patents, while omitting references to still-patented uses from their generic label . This requires meticulous navigation to ensure that the removal of information does not compromise the safe use of the drug. “Skinny-labeling” is a nuanced legal strategy that enables earlier generic market entry but can expose generic manufacturers to complex patent infringement litigation, requiring sophisticated legal and patent intelligence. The ability to “carve out” patented indications allows generic companies to potentially enter the market faster, bypassing certain patent protections. However, this is far from a simple process. It demands meticulous analysis of patent claims and use codes. As demonstrated in cases such as GSK v. Teva, generic manufacturers can still face active inducement of infringement claims, even with carefully carved-out labels. This underscores the critical need for generic companies to possess robust legal counsel and to leverage advanced tools, such as those offered by DrugPatentWatch, to effectively navigate this complex intellectual property landscape.

The Hatch-Waxman Act of 1984: A Landmark Legislation

The Drug Price Competition and Patent Term Restoration Act of 1984, widely known as the Hatch-Waxman Act, stands as a landmark piece of legislation that fundamentally reshaped the pharmaceutical industry. Its core purpose was to strike a delicate balance: to increase the availability of affordable generic drugs while simultaneously preserving the incentives for pharmaceutical companies to innovate and develop new medicines.

This act achieved its objectives by establishing the ANDA pathway, which streamlined generic approvals. It also introduced a system of patent certifications (Paragraph I, II, III, and IV), allowing generic companies to challenge existing patents. Crucially, the Act provided a powerful incentive for generic entry: the concept of 180-day exclusivity for the first generic applicant to successfully challenge a listed patent . This legislation forms the bedrock of the modern generic drug industry, influencing market dynamics and competitive strategies to this day. The Hatch-Waxman Act, while over three decades old, continues to be the primary driver of generic competition and affordability. However, its very mechanisms, such as Paragraph IV challenges and the associated 180-day exclusivity, also create intense legal and market dynamics that generic companies must master. The Act’s dual purpose—promoting generics while protecting innovation—has led to a highly competitive environment. The incentives it created, particularly the 180-day exclusivity, have made Paragraph IV challenges a “routine part of doing business” for generic companies. This means that while the Act effectively delivers on its promise of lower prices, it also necessitates significant legal and strategic investment from generic firms to fully capitalize on its provisions.

The 505(b)(2) New Drug Application: A Hybrid Approach for Innovation

Beyond the traditional ANDA pathway, the 505(b)(2) New Drug Application (NDA) offers a unique and appealing regulatory strategy for pharmaceutical companies. Often referred to as a “hybrid application,” this pathway incorporates elements of both a full New Drug Application (NDA), typically used for novel chemical entities, and an Abbreviated New Drug Application (ANDA). It allows an applicant to rely, in part, on the FDA’s previous findings of safety and efficacy for a previously approved drug, or on data available in the public domain, without needing to conduct all the original clinical trials .

Leveraging Existing Data: Efficiency and Reduced Risk

The primary benefit of the 505(b)(2) pathway lies in its inherent efficiency. By leveraging existing data, it significantly reduces the need for extensive nonclinical and clinical studies that would otherwise be required for a traditional 505(b)(1) NDA . This streamlined approach translates directly into lower development costs and accelerated timelines for market entry. The ability to “bridge” known information about a previously approved active ingredient to a novel drug product or indication minimizes development risk, making it an attractive route for strategic product development.

The 505(b)(2) pathway is a strategic sweet spot for generic companies seeking to differentiate themselves and alleviate competitive pressures by developing “branded generics” or improved versions of existing drugs. In a market segment that is increasingly commoditized by simple generics, the 505(b)(2) pathway offers a distinct route to create new, differentiated products that can secure their own market exclusivity. This enables generic companies to move beyond pure price competition and capture additional value by offering improved formulations, new indications, or more convenient dosing regimens. Such differentiated products can appeal to both patients and prescribers who might otherwise be hesitant about “standard” generics, thereby enhancing market acceptance and profitability.

Ideal Candidates and Market Exclusivity Potential

Ideal candidates for the 505(b)(2) pathway are diverse and include drugs with new indications, changes in dosage form, strength, formulation, dosing regimen, or route of administration. This pathway is also suitable for new combination products or prodrugs of an existing drug . The flexibility of this pathway allows for various types of modifications that can add significant value to an existing active ingredient.

Crucially, products approved under the 505(b)(2) pathway can qualify for various types of market exclusivity, providing a period of protection from generic competition. These exclusivities are statutory and include: Orphan Drug Exclusivity (7 years for drugs treating rare diseases), New Chemical Entity (NCE) Exclusivity (5 years for a drug with no previously approved active moiety), and “Other” Exclusivity (3 years for a change to an already approved drug, such as a new way of delivering the active ingredient or a different disease indication, provided new clinical studies were conducted to support the change) . This potential for market exclusivity transforms a “generic” development effort into a high-value asset, justifying greater R&D investment and offering a more predictable return than pure generic plays. Unlike standard generics that often face immediate and steep price erosion upon market entry, 505(b)(2) products can secure periods of market exclusivity. This exclusivity acts as a protective shield, allowing companies to recoup their investment and generate substantial revenue before intense generic competition eventually emerges. This makes the 505(b)(2) pathway particularly attractive for companies aiming to build a sustainable portfolio of differentiated pharmaceutical products.

The Biosimilar Approval Pathway (351(k))

Biosimilars, as biological medicines, follow a distinct and rigorous regulatory pathway established under the Biologics Price Competition and Innovation Act (BPCIA) in the U.S., specifically the 351(k) pathway. This act, while distinct, shares many similarities with the Hatch-Waxman Act for small molecules, aiming to foster competition in the biologics market. The European Medicines Agency (EMA) has been a pioneer in biosimilar regulation, having approved its first biosimilar as early as 2006, establishing a solid framework that has influenced global development.

Demonstrating “Highly Similar”: Analytical, Animal, and Clinical Comparability

The core principle for biosimilar approval is demonstrating that the product is “highly similar” to a U.S.-licensed reference biological product, and that there are “no clinically meaningful differences” between the biosimilar and the reference product in terms of safety, purity, and potency . This standard is inherently more complex than the “bioequivalence” required for small molecules, primarily due to the intricate nature and inherent natural variability of biological products that are derived from living systems .

The approval process for biosimilars requires a comprehensive “totality of the evidence” approach. This includes extensive analytical characterization to demonstrate structural and functional similarity, often involving sophisticated laboratory techniques . In addition, animal studies and at least one comparative clinical study are typically required to assess potential differences in immunogenicity (the propensity to induce an immune response), pharmacokinetics (PK), pharmacodynamics (PD), efficacy, and safety . This rigorous scientific program is designed to avoid unnecessary repetition of large-scale, costly clinical trials that were performed for the original reference biologic, yet it remains a demanding and expensive endeavor, often taking 7 to 8 years and costing over $100 million . The “highly similar” standard for biosimilars, while abbreviated compared to a de novo biologic, demands a deeper scientific understanding and more sophisticated analytical capabilities than small-molecule generic development, reflecting the inherent complexity of biologics. Biological products, being complex, large molecules with natural variability, cannot be proven “identical” in the same way as small molecules. Therefore, the “highly similar” standard necessitates the use of advanced analytical techniques to meticulously compare structural and functional attributes. Furthermore, targeted clinical studies are crucial to definitively rule out any clinically meaningful differences. This elevates the scientific bar for biosimilar developers, requiring significant investment in specialized R&D expertise and state-of-the-art analytical platforms.

Interchangeable Biosimilars: The Path to Pharmacy-Level Substitution

Within the biosimilar landscape, a distinct and higher-tier designation exists: the “interchangeable biological product.” An interchangeable biosimilar is a biosimilar that meets additional, more stringent requirements, allowing it to be substituted for the reference product at the pharmacy level without the intervention or approval of the prescribing healthcare provider. This mirrors the routine substitution of generic drugs for brand-name drugs and is a critical factor for widespread market penetration.

To achieve interchangeability status, manufacturers must provide additional data beyond what is required for biosimilarity. This typically involves “switching studies,” where patients are observed as they alternate between the reference product and the proposed interchangeable biosimilar. The results of these studies must conclusively demonstrate that there is no decrease in effectiveness and no increase in safety risk associated with such switching . Interchangeability is the ultimate market access differentiator for biosimilars, as it unlocks the potential for widespread, automatic substitution, mirroring the market dynamics of small-molecule generics. The ability for pharmacists to substitute an interchangeable biosimilar without requiring physician approval dramatically lowers the barrier to adoption, similar to how generic small molecules achieve high market penetration. This directly and significantly impacts sales volume and market share for the biosimilar product. While the FDA’s requirement for rigorous switching studies presents an additional hurdle and investment for developers, it is a necessary step to build the profound clinical confidence required for this level of automatic substitution, making it a highly valuable regulatory achievement.

Navigating Immunogenicity and Indication Extrapolation

Two significant scientific and regulatory considerations in biosimilar development are immunogenicity and indication extrapolation.

Immunogenicity refers to the propensity of a biological product to induce an immune response in patients, typically manifesting as the development of anti-drug antibodies (ADAs) . These ADAs can potentially influence the efficacy and/or safety profile of the therapeutic agent. Assessing immunogenicity is a complex challenge; it is difficult to predict accurately in preclinical models, as animal models often lack predictive value for human immunogenicity. Consequently, robust immunogenicity assessment primarily relies on clinical trials, often requiring long-term follow-up (e.g., 1-year follow-up for chronically administered agents) to detect neutralizing ADAs that may take time to develop . The goal of immunogenicity testing is to demonstrate that the risk of ADA development with a biosimilar is no greater than with the reference product.

Indication Extrapolation is a crucial regulatory concept that allows for the approval of a biosimilar product in multiple indications for which the reference product is already approved, without requiring extensive clinical trials for each individual indication . This approach is based on the principle that if a biosimilar demonstrates biosimilarity to a reference product in one sensitive indication, it can be extrapolated to other indications, provided there is sufficient scientific justification . This justification relies on a “totality of the evidence,” including a shared mechanism of action (MOA) across the indications, similar pharmacokinetic (PK) and pharmacodynamic (PD) profiles, comparable immunogenicity, and similar toxicity profiles . While widely accepted by major regulatory bodies like the FDA and EMA as a means to avoid unnecessary repetition of clinical trials , indication extrapolation remains a point of controversy among some learned societies who advocate for clinical data to be required for all indications . Successfully navigating immunogenicity and leveraging indication extrapolation are critical for biosimilar development, balancing scientific rigor with accelerated market access and cost efficiency. Immunogenicity represents a complex biological risk that can undermine a biosimilar’s safety and efficacy. Therefore, robust assessment and mitigation strategies are absolutely essential for ensuring patient safety and securing regulatory approval. Concurrently, indication extrapolation is a powerful tool for efficiency, allowing developers to avoid redundant and prohibitively costly clinical trials for every single indication. The inherent tension lies in providing sufficient scientific justification to satisfy regulators and build clinical confidence, without incurring the full development costs associated with a de novo biologic development program.

Regulatory Challenges for Complex Generics

The “complex generics” category, while offering significant market opportunities due to its less crowded nature, presents a unique and formidable set of regulatory and scientific hurdles that distinctly differentiate them from simpler generic drugs.

Drug-Device Combination Products: Unique Considerations

Complex generics frequently include drug-device combination products, where the drug constituent part is pre-loaded in, or specifically cross-labeled for use with, a product-specific device constituent part. Common examples include inhalers, autoinjectors (such as epinephrine injection autoinjectors), and certain pre-filled syringes . For these products, the design and performance of the device directly influence the drug’s delivery to the site of action or its absorption, introducing entirely new layers of complexity in demonstrating therapeutic equivalence .

Regulatory expectations for these combination products are intricate and extend far beyond standard bioequivalence requirements. They necessitate specific scientific studies that assess not only the drug’s performance but also the device’s functionality, its interaction with the drug, and its usability by patients. The development of generic drug-device combination products demands an interdisciplinary approach, integrating pharmaceutical science with engineering and device regulatory expertise, which can be a significant bottleneck. Unlike a simple pill, the efficacy of a drug-device combination product is intrinsically tied to both the drug’s inherent properties and the device’s precise performance. This means that generic developers must not only replicate the drug’s bioequivalence but also meticulously ensure that the device delivers the drug identically and safely. This requires specialized expertise in device design, manufacturing, and regulatory compliance, making it a more capital-intensive and specialized endeavor compared to traditional generic drug development.

Advanced Formulations: Liposomes, Nanoparticles, and Long-Acting Injectables

Modern pharmaceutical science increasingly employs advanced drug delivery systems to overcome challenges associated with new chemical entities, such as poor aqueous solubility, short half-life, or extensive degradation. These innovative formulations, including liposomes, polymer- or lipid-based nanoparticles, microspheres, and long-acting injectables (LAIs), are designed to improve drug delivery, reduce dosing frequency, and minimize adverse effects, thereby offering significant patient benefits.

However, developing generic versions of these complex formulations is exceptionally challenging. They often require extensive studies beyond traditional bioequivalence methods due to their intricate design, the use of specialized excipients, and highly complex manufacturing processes . For instance, generic transdermal patches, which deliver medication through the skin, require demonstrating not only bioequivalence but also statistical non-inferiority in terms of adhesion to the skin and the potential for skin irritation and/or sensitization compared to the reference product . Similarly, long-acting injectables (LAIs) present unique challenges related to high inter-subject pharmacokinetic variability, difficulties in patient recruitment for long-term studies, and the potential for drug carryover between study periods in crossover designs . The scientific and technical hurdles in replicating advanced formulations create a natural barrier to entry for generic developers, limiting competition and preserving higher profit margins for successful entrants. The inherent complexity of these formulations—involving multi-component systems, unique excipients, and intricate manufacturing processes—makes their characterization and replication incredibly difficult . This directly translates into higher research and development costs and significantly longer development timelines. Consequently, fewer generic companies possess the capabilities to successfully develop and bring these products to market, which inherently reduces competition and allows those who succeed to capture a larger share of the market value.

The Quest for Regulatory Clarity and Tailored Guidance

A significant impediment to the development and timely market entry of complex generics is the prevailing “lack of clarity around the regulatory pathway”. Unlike simpler generic products, there are often few specific FDA guidance documents tailored to these complex products. This leads to unclear expectations from regulatory agencies and continuously evolving requirements, which can result in significantly longer approval times than for standard generics .

The ambiguity in regulatory filing persists due to several factors: the use of complex formulations and excipients, the complicated characterization required for the drug products and their components, ill-defined in vitro drug release assay methods, and a scarcity of reliable models to establish in vivo pharmacokinetics. The absence of clear, product-specific regulatory guidance for complex generics acts as a significant bottleneck, increasing development risk and delaying patient access to potentially more affordable and convenient treatments. When regulatory expectations are vague, generic developers face considerable uncertainty, leading to increased R&D costs—for example, through iterative trial-and-error testing—and prolonged development timelines. This directly impacts a company’s speed-to-market and overall profitability. Furthermore, the lack of standardized testing methods makes it harder to prove therapeutic equivalence efficiently. This regulatory “vacuum” ultimately harms patients by delaying the availability of cost-effective alternatives for managing complex chronic conditions.

Global Perspectives: Comparing FDA and EMA Approval Processes

While the U.S. FDA and the European Medicines Agency (EMA) share the fundamental goal of ensuring the safety and efficacy of medicines, their approaches to generic and biosimilar approval exhibit both notable similarities and significant divergences. Understanding these differences is crucial for pharmaceutical companies pursuing global market strategies.

Similarities and Divergences in Regulatory Frameworks

Both the FDA and EMA demand rigorous scientific assessment to ensure the quality, safety, and efficacy of generic and biosimilar products. For biosimilars, both agencies require comprehensive head-to-head comparisons across pre-clinical, clinical, pharmacokinetic (PK)/pharmacodynamic (PD) profiles, and physicochemical characterization . Both also offer scientific consultations to sponsors throughout the drug development process to provide guidance and address specific questions.

However, several key divergences exist. The EMA often bases its biosimilar guidelines on the classification of the biological molecule, with specific policies available for different product classes, whereas the FDA tends to adopt a more case-by-case approach . Their geographical jurisdictions also differ, with the EMA governing the European Union, Norway, Iceland, and Liechtenstein, while the FDA regulates products for the U.S. market. Furthermore, the FDA possesses direct authority to approve drug products in the U.S., whereas the EMA evaluates submissions and provides non-binding recommendations to the European Commission, which then makes the final legally binding decision. Exclusivity periods for biologics also vary, with 12 years in the USA and 10 years in the EU . These divergent regulatory requirements between major markets like the U.S. and EU create market fragmentation, significantly increasing development costs and complexity for generic companies aiming for global launches. If a generic or biosimilar developer intends to launch a product in both the U.S. and EU, they must navigate two potentially different sets of requirements. This can lead to redundant studies, necessitate different trial designs (e.g., involving distinct patient populations to meet specific regional criteria ), and substantially increase the complexity of regulatory submissions. This directly translates to higher research and development costs and longer overall development timelines, making global market entry a more challenging and less efficient endeavor.

Collaborative Initiatives: Towards Harmonized Development

Recognizing the challenges posed by differing regulatory requirements and the desire to streamline global drug development, both the FDA and EMA have engaged in collaborative initiatives. A notable example is the Parallel Scientific Advice (PSA) pilot program for complex generic and hybrid products, which was launched in September 2021 .

This program provides a mechanism for assessors from both agencies to concurrently exchange their views on scientific issues with applicants during the development phase of complex generic drug and hybrid products. The overarching goal of such collaboration is to drive convergence in regulatory expectations, help applicants avoid redundant work and unnecessary testing, and ultimately shorten the time to drug development and approval. International regulatory collaboration, such as the FDA/EMA PSA program, is a crucial mechanism for streamlining complex generic and biosimilar development, ultimately accelerating patient access globally. By providing concurrent scientific advice, the PSA program helps generic companies design studies and development programs that are acceptable to both major regulatory bodies from the outset. This significantly reduces the likelihood of needing to conduct separate, potentially conflicting studies, thereby cutting down on time, cost, and regulatory risk. Even partial harmonization directly translates to faster market entry and broader availability of affordable medicines for patients worldwide.

| Feature | U.S. FDA Approval (ANDA/505(b)(2)/351(k)) | European Medicines Agency (EMA) Approval (Centralized Procedure) |

| Primary Pathways | ANDA (Small Molecule Generics), 505(b)(2) (Hybrid), 351(k) (Biosimilars) | Centralized Procedure for Generics/Hybrids/Biosimilars (via Marketing Authorization Application) |

| Governing Legislation | Hatch-Waxman Act (1984), BPCIA (2010) | Directive 2001/83/EC, Regulation (EC) No 726/2004 |

| Drug Types Covered | Small Molecule Generics, Complex Generics, Biosimilars | Small Molecule Generics, Hybrid Medicines (includes many complex products), Biosimilars |

| Key Equivalence Standard | Bioequivalence (ANDA), Highly Similar (351(k)), Bridging (505(b)(2)) | Bioequivalence (Generics), Highly Similar (Biosimilars/Hybrids) |

| Clinical Trial Requirement | Abbreviated (no repeat full clinicals for ANDA/351(k)), targeted studies for 505(b)(2)/351(k) | Abbreviated (no repeat full clinicals), targeted comparability studies for biosimilars/hybrids |

| Typical Development Cost | $1-4M (simple generic), $100M+ (biosimilar) | Generally comparable to US, but specific fees may vary |

| Exclusivity Period for Biologics | 12 years | 10 years |

| Interchangeability Designation | Specific “Interchangeable Biosimilar” designation requiring switching studies | EMA/HMA state biosimilars are scientifically interchangeable; national decisions on pharmacy substitution |

| Regulatory Approach | More case-by-case for biosimilars/complex generics | Often classification-based guidelines for biological molecules |

| Decision Authority | FDA has direct approval authority | EMA provides non-binding recommendation to European Commission for final decision |

| Collaborative Initiatives | Parallel Scientific Advice (PSA) with EMA | Parallel Scientific Advice (PSA) with FDA |

Table 2: Key Regulatory Pathways Comparison (FDA vs. EMA)

Intellectual Property and Market Dynamics: The Strategic Battlefield

The pharmaceutical industry is a complex ecosystem where scientific innovation, regulatory rigor, and fierce market competition converge. At the heart of this dynamic lies intellectual property, particularly patents, which serve as both protectors of innovation and shapers of competitive dynamics. For generic drug developers, understanding this strategic battlefield is paramount to identifying opportunities and navigating potential pitfalls.

Pharmaceutical Patents: Protecting Innovation and Shaping Competition

Patents are the lifeblood of pharmaceutical innovation, providing a crucial incentive for the enormous investment required for novel drug discovery and development. They grant inventors exclusive rights to their inventions for a set period, typically 20 years from the date on which the patent application was filed in the United States . This period of exclusivity allows innovator companies to recoup their substantial R&D costs and generate profits, which can then be reinvested into further research.

Types of Patents: Compound, Formulation, Method of Use, Polymorph

Pharmaceutical companies employ a multifaceted approach to intellectual property protection, strategically layering various types of patents to safeguard their innovations and extend their market exclusivity.

- Compound Patents: These are the foundational patents, protecting the active chemical entity itself. They are typically the earliest patents filed and provide the broadest protection for the drug.

- Formulation Patents: Innovator companies frequently patent new formulations of an existing drug. A prime example is AstraZeneca’s Seroquel XR, an extended-release, once-a-day quetiapine formulation . Such formulations can offer significant patient benefits, like reduced dosing frequency, and if successfully launched and established before the basic compound patent expires, they can provide valuable additional exclusivity.

- Method of Use Patents: These patents protect specific approved indications or ways of using the drug. For instance, a drug might be patented for treating a particular disease or condition, even if the compound itself is known. These patents are particularly relevant for “skinny-labeling” strategies by generic manufacturers.

- Polymorph Patents: A drug compound can exist in various crystalline structures, known as polymorphs, which share the same chemical composition but differ in their molecular arrangements. These variations can lead to differing physical properties such such as solubility and dissolution rates . Patenting new polymorphs can effectively extend patent protection for a drug.

Innovator companies strategically layer multiple types of patents to create “patent thickets,” effectively extending their market exclusivity and delaying generic entry beyond the initial compound patent. A 20-year compound patent is often not the end of a drug’s exclusive market life. By subsequently patenting new formulations, methods of use, or polymorphs, brand companies can construct a dense and overlapping web of intellectual property rights . This practice, often referred to as “evergreening” , means that even if the primary compound patent expires, generic manufacturers may still find their market entry blocked by these ancillary patents. This forces generic companies into costly and time-consuming litigation or significantly delays their ability to bring affordable alternatives to market. This is a deliberate and sophisticated strategy employed by innovator companies to maximize their revenue streams.

Patent Term and Exclusivity Periods: A Critical Timeline

Beyond the standard patent terms, the FDA grants various types of exclusivity upon drug approval, which also serve to protect brand-name drugs from generic competition . It is important to distinguish that these exclusivities are statutory and are not added to the patent life; rather, they run concurrently or independently of existing patents . Key types of exclusivity include:

- Orphan Drug Exclusivity (ODE): Provides 7 years of market protection for drugs developed to treat rare diseases or conditions affecting fewer than 200,000 people in the U.S. .

- New Chemical Entity (NCE) Exclusivity: Grants 5 years of exclusivity for a drug that contains no active moiety (the molecule or ion responsible for the drug’s physiological or pharmacological action) that has been previously approved by the FDA .

- “Other” Exclusivity: Provides 3 years of exclusivity for changes to an already approved drug, such as a new indication, a new dosage form, or a new route of administration, provided that new clinical studies were conducted to support the approval of that change .

- Pediatric Exclusivity (PED): Adds 6 months to any existing patents and exclusivities on a drug if the sponsor conducts pediatric studies in response to a written request from the FDA .

- 180-Day Exclusivity: A crucial incentive under the Hatch-Waxman Act, granted to the “first” generic applicant who submits a substantially complete Abbreviated New Drug Application (ANDA) containing a Paragraph IV certification, thereby challenging the validity or infringement of a listed patent .

For generic developers, accurately tracking patent expiration dates and exclusivity periods is the ultimate competitive intelligence, determining the optimal window for market entry and maximizing the return on investment. The interplay of different patent types and various exclusivity periods creates an exceptionally complex “patent landscape.” A generic company’s success critically hinges on precisely identifying when all these intellectual property protections expire or can be legally challenged. This precise timing dictates when an ANDA can be filed and, crucially, when market entry becomes possible. This directly impacts the ability to secure the highly coveted “first-to-file” advantage and the potential for significant initial profits before other generic competitors enter the market. This is precisely where specialized tools, such as DrugPatentWatch, become indispensable for providing the necessary competitive intelligence.

Evergreening Strategies: Brand-Name Tactics to Delay Generic Entry

“Evergreening” refers to a range of legal, business, and technological strategies employed by brand-name pharmaceutical companies to extend the patent lifetime of their drugs, thereby retaining revenues and delaying the entry of generic competition . These tactics are often framed as “lifecycle management” but are frequently criticized for their anti-competitive effects.

Product Hopping and Minor Modifications

A common evergreening tactic is “product hopping” or “product switching,” where a brand-name company attempts to extend its patent, and consequently its revenue stream, by patenting minor variations of the original product. This can manifest in several ways:

- Changes to Dosage Form: Altering the drug from, for example, a capsule to a tablet, or vice versa.

- Chemical Changes: Introducing slight chemical modifications, such as adjusting chemical groups (a “me-too” drug) or a different enantiomeric mixture (a “chiral switch”).

- Formulation Changes: Switching from short-acting to long-acting formulations to reduce dosing frequency .

- New Inactive Ingredients or Combinations: Introducing new excipients or combining the drug with other active ingredients .

While some of these modifications can represent genuine improvements that offer meaningful benefits for patients (e.g., an easier route of administration), they are considered anti-competitive if their primary purpose is to delay generic market entry. Notable examples include the multiple sclerosis drug glatiramer acetate (Copaxone) and the Alzheimer’s drug memantine (Namenda), where product hopping tactics led to billions in additional costs for consumers before patents were challenged or invalidated. Product hopping blurs the line between genuine pharmaceutical innovation and anti-competitive behavior, forcing generic companies to invest heavily in legal challenges rather than solely in research and development. When a brand company introduces a slightly modified version of a drug just before its primary patent expires, it can effectively compel patients and prescribers to switch to the new version. This maneuver can render the original, now off-patent, version obsolete in the market, thereby delaying generic uptake. This strategic shift transforms the competitive battleground from one of scientific development to one dominated by legal disputes, requiring generic firms to allocate significant resources to challenging these new patents. Such legal battles can be a costly and time-consuming distraction from their core mission of bringing affordable medicines to market.

Patent Thickets and Legal Challenges

Brand-name companies frequently employ the strategy of creating “patent thickets”—a dense and overlapping web of patent rights on active substances, formulations, or even non-essential features of a drug—to deter generic entry . This tactic is often combined with “linkage evergreening,” a process where pharmaceutical regulators are required to “link” their evaluation of an impending generic product with an assessment of whether it might infringe an existing patent . This complex interplay of patents and regulatory processes significantly complicates the landscape for generic manufacturers.

These aggressive intellectual property tactics frequently lead to patent litigation in federal court. If the brand-name drug sponsor timely files a lawsuit following a generic company’s Paragraph IV certification (a claim that the generic drug does not infringe or that the patent is invalid), the FDA is generally prevented from approving the ANDA for 30 months while the litigation proceeds. This is known as the “30-month stay,” and it effectively delays generic market entry . Another controversial tactic employed by brand companies is “reverse payment settlements” or “pay-for-delay” agreements, where the brand company pays the generic firm to delay its market entry. The pharmaceutical patent landscape is often a battleground of legal strategies, where generic companies must be prepared for aggressive patent enforcement and litigation as an inherent part of their business model. The high stakes involved in pharmaceutical revenue streams mean that brand companies will vigorously defend their intellectual property. This transforms generic market entry into a complex legal chess match, frequently involving Paragraph IV challenges and subsequent patent infringement lawsuits. Generic firms must therefore possess strong legal departments or engage expert external counsel, coupled with a deep understanding of patent law, to successfully navigate these challenges and secure their market opportunities. This is not merely a regulatory process but a full-blown legal contest.

The Patent Cliff: A Recurring Opportunity for Generic Manufacturers

The term “patent cliff” vividly describes a critical phenomenon in the pharmaceutical industry: situations where multiple high-revenue, blockbuster brand-name drugs lose patent protection within a compressed timeframe . This event creates a massive and predictable opportunity for generic manufacturers, as it fundamentally transforms market dynamics by dissolving exclusivity protections and enabling the rapid entry of generic competition .

When patents expire, generic alternatives typically enter the market at significantly reduced price points, often initially around 30% of the original product’s cost . As additional generic manufacturers join the competition, prices frequently decline further, sometimes plummeting to as little as 10-20% of the original branded price . The patent expiration of the cholesterol-lowering drug Lipitor in 2011 serves as a prime historical example of this market transformation, leading to the widespread availability of affordable generic versions . The patent cliff is the cyclical engine of the generic pharmaceutical industry, dictating major strategic shifts and creating predictable windows of high-value opportunity. Generic companies can anticipate these patent expirations years in advance. This predictability allows for long-term strategic planning, encompassing R&D investment, manufacturing scale-up, and meticulous legal preparation for Paragraph IV challenges. The “cliff” represents a recurring, high-impact event that profoundly reshapes market share and revenue streams across the industry, making it the most significant external driver for generic business strategy.

Competitive Dynamics in the Generic Market

The generic pharmaceutical market is characterized by intense and often aggressive competition, which serves as the primary mechanism for driving down drug prices and increasing patient access to essential medicines.

The “First-to-File” Advantage and 180-Day Exclusivity

The Hatch-Waxman Act provides a powerful incentive for generic companies to be the “first-to-file” an Abbreviated New Drug Application (ANDA) that includes a Paragraph IV certification, thereby challenging the validity or enforceability of a brand-name drug’s patent . If this generic applicant successfully prevails in challenging the patent, they are granted a coveted period of 180 days of market exclusivity .

This 180-day exclusivity can be incredibly lucrative for the first generic entrant. During this period, the company has the exclusive right to market its generic drug, often pricing it strategically slightly below the branded version. This allows them to capture a significant portion of the market share and maintain higher profit margins before other generic competitors are able to enter the market and inevitably erode prices. This powerful financial incentive has transformed Paragraph IV certifications into a routine and highly competitive part of generic business strategy, with a steady uptick in such cases over the years. The “first-to-file” 180-day exclusivity is the generic industry’s equivalent of a gold rush, incentivizing aggressive patent challenges and rewarding early movers with a significant, albeit temporary, monopoly. The financial benefits of being the sole generic competitor for 180 days are substantial, enabling the first entrant to establish a strong market presence and capture significant revenue before the inevitable price collapse that follows the entry of additional competitors. This creates a fierce race to be the first, driving considerable investment in patent intelligence and legal expertise. It is a high-risk, high-reward strategy that profoundly defines much of the competitive landscape within the generic pharmaceutical sector.

Price Erosion with Increased Competition: A Race to the Bottom?

Once a generic drug successfully enters the market, drug prices typically fall substantially. The entry of even a single generic competitor can lead to a price reduction of approximately 39% compared to the brand-name drug. This price reduction accelerates dramatically with increased competition: with two generic competitors, prices can fall by 54%, and with six or more generic entrants, prices can plummet by a staggering 95% . This aggressive price erosion is a direct consequence of the competitive dynamics fostered by the Hatch-Waxman Act.

However, this intense competition and rapid price erosion also create significant challenges for generic manufacturers. Prices can be driven so low that they become unprofitable to produce, particularly for older, small-market medicines or complex sterile injectables . When profitability diminishes, manufacturers may decide to cease production, leading to market exits and a reduction in the number of suppliers. This, in turn, can make the supply chain less diversified and more prone to drug shortages . While robust generic competition is vital for patient affordability, the resulting aggressive price erosion can undermine the long-term sustainability of the generic manufacturing sector, leading to market exits and drug shortages. The very mechanism designed to lower costs—intense competition—can, if left unchecked, lead to a “race to the bottom” where profit margins become unsustainable . When drugs become unprofitable to manufacture, companies are compelled to exit the market, reducing the number of suppliers and making the supply chain vulnerable to critical shortages . This highlights a critical policy dilemma: how to maintain affordability without jeopardizing the stability and resilience of the generic drug supply, especially for essential medications used in chronic disease management.

| Number of Generic Competitors | Average Price Reduction Compared to Brand (%) | Context / Source |

| 1 | 39% | Initial entry |

| 2 | 54% | After second generic entry |

| 3-5 | 15-40% (additional savings) | After first generic entry |

| 6+ | 95% | After multiple generic entries |

Table 3: Impact of Generic Competition on Drug Prices

Overcoming Challenges in Generic Drug Development and Commercialization

The journey from a patent expiration to a successfully commercialized generic drug is fraught with challenges. Beyond the regulatory and intellectual property hurdles, generic manufacturers must contend with complexities in manufacturing, supply chain vulnerabilities, intricate reimbursement policies, and the crucial realm of patient and physician perceptions. Overcoming these obstacles requires strategic foresight, operational excellence, and a deep understanding of the broader healthcare ecosystem.

Manufacturing Excellence and Quality Assurance

Maintaining impeccable manufacturing quality is not merely a regulatory compliance exercise for generic drugs; it is a fundamental pillar of patient trust, product reputation, and ultimately, market success. Generic medications must meet the same rigorous quality standards as their brand-name counterparts .

Adherence to Current Good Manufacturing Practices (cGMP)

The FDA ensures the quality of drug products by meticulously monitoring drug manufacturers’ compliance with its Current Good Manufacturing Practice (cGMP) regulations. These regulations establish the minimum requirements for the methods, facilities, and controls used in the manufacturing, processing, and packing of a drug product. Their purpose is to ensure that every product is safe for use, contains the ingredients and strength it claims to have, and is consistently produced with the required quality . FDA assessors and investigators conduct thorough reviews of manufacturing procedures and perform on-site inspections of generic drug manufacturing facilities to verify capabilities and the accuracy of submitted information . This stringent oversight is designed to guarantee product consistency and reliability.

In a commoditized market, cGMP compliance and a robust quality reputation are not just regulatory necessities but critical competitive differentiators, directly influencing market share and mitigating the risks of costly recalls. When prices are driven down, as is common in the generic sector, there can be a perception that quality might be compromised, especially with concerns frequently raised about overseas manufacturing . Companies that consistently demonstrate superior cGMP compliance and unwavering quality assurance build profound trust with healthcare providers and payers. This established reputation can translate into preferred formulary placement and higher prescribing rates, offering a significant competitive edge that extends beyond mere price. Conversely, any lapse in quality or a significant manufacturing issue can lead to severe reputational damage, widespread product recalls, and substantial financial losses . As Cynthia Fanning, Vice President at GE Appliances, aptly noted, “To be competitive, we have to look for every opportunity to improve efficiencies and productivity while increasing quality. Lean manufacturing principles have improved every aspect of our processes” .

Quality Control Systems and Post-Market Surveillance

Robust quality control (QC) measures are essential throughout the entire manufacturing process, encompassing in-process testing and final product testing, to ensure the pharmacological potency, purity, and stability of generic drugs . Analytical methods must be meticulously validated, and batch-to-batch consistency rigorously monitored to ensure that every lot of the product meets the defined quality specifications .

Beyond pre-market approval, post-market surveillance plays an increasingly vital role in continuously monitoring the safety, efficacy, and usage patterns of generic drugs in real-world settings . This involves systematic analysis of various data sources, including adverse event reporting systems (such as the FDA Adverse Event Reporting System, FAERS) and comprehensive healthcare claim databases, to identify any potential issues or biases related to generic drug use . Post-market surveillance is an extension of quality control, providing crucial real-world data that can either reinforce or, in some cases, challenge the scientific assumptions of bioequivalence, necessitating continuous monitoring and responsiveness from generic manufacturers. While pre-market approval focuses on demonstrating bioequivalence under controlled conditions, real-world usage can sometimes reveal subtle differences or unexpected adverse events . Post-market surveillance acts as an early warning system, allowing regulators and manufacturers to detect and investigate such signals. For generic companies, proactively monitoring this data and addressing any reported issues, even if anecdotal or perception-based, is vital for maintaining product integrity, ensuring ongoing regulatory compliance, and preserving public trust, especially given existing patient and physician perceptions about generics.

Innovations in Manufacturing: Continuous Processing and Automation

Traditional batch manufacturing processes, which have long been the standard in pharmaceuticals, are often characterized by inherent inefficiencies, lengthy cycle times, and susceptibility to variability. Innovations like continuous manufacturing offer a transformative solution to these challenges. This advanced approach integrates multiple discrete steps of the manufacturing process into a single, uninterrupted system, moving raw materials through the process continuously to produce a finished product .

The benefits of continuous manufacturing are manifold. It can lead to significantly improved quality control through real-time monitoring, utilizing technologies such as Process Analytical Technology (PAT). This allows for immediate detection and correction of deviations, enhancing product consistency and reducing batch failures. Furthermore, continuous manufacturing can result in a reduced manufacturing footprint, faster production times, and greater flexibility to respond to demand fluctuations . The FDA has explicitly recognized continuous manufacturing as a key technology that can help prevent drug shortages caused by product quality and manufacturing problems. Investing in advanced manufacturing technologies like continuous processing offers generic manufacturers a pathway to overcome persistent cost pressures and quality concerns, thereby transforming operational efficiency into a strategic competitive advantage. The “razor-thin profit margins” that characterize much of the generic market make traditional manufacturing economically challenging. Continuous manufacturing, by significantly reducing direct labor costs, minimizing material waste, and drastically shortening cycle times (e.g., from 30 days to 5 days for some drugs) , can substantially lower production costs and improve overall profitability. This allows manufacturers to remain competitive while simultaneously enhancing product quality and reducing the risk of critical drug shortages, creating a powerful differentiator in the market.

Supply Chain Resilience and Addressing Drug Shortages

The generic drug supply chain, while indispensable for ensuring affordable access to medicines, is inherently complex, globally dispersed, and vulnerable to disruptions. This inherent fragility frequently leads to drug shortages, which can have profound and detrimental impacts on patient care, particularly for individuals managing chronic diseases.

Vulnerabilities in the Global Generic Drug Supply Chain

Generic drugs account for nearly 90% of all prescriptions dispensed in the U.S. , yet they are disproportionately affected by shortages. Data from 2017 to 2021 shows that the FDA received 731 “supply chain issue reports” from manufacturers, with 113 of these leading to “meaningful” shortages. A substantial majority of these shortages involved generic drugs, and many lasted for more than a year.