Introduction: The Strategic Imperative of Excipient Switching

In the dynamic landscape of pharmaceutical manufacturing, companies are perpetually seeking innovative pathways to optimize operations, enhance product performance, and manage costs without ever compromising the bedrock principles of patient safety and drug efficacy. Amidst this intricate balancing act, the strategic management of pharmaceutical excipients has emerged as a pivotal area of focus. Often relegated to the background as “inactive ingredients,” these seemingly innocuous components are, in reality, the silent architects of a drug’s success. This report aims to equip business professionals with a comprehensive understanding of excipient switching, transforming it from a mere cost-cutting exercise into a powerful lever for competitive advantage and sustained market leadership.

1.1. Excipients: The Unsung Heroes of Pharmaceutical Formulations

What exactly are excipients, and why do they command such strategic importance? At their core, excipients are substances meticulously formulated alongside the active pharmaceutical ingredient (API) in a medication . While they do not exert direct therapeutic effects, their roles are undeniably indispensable across the entire drug lifecycle, from formulation and manufacturing to patient administration and shelf life .

Consider their diverse and critical functions: excipients can enhance the API’s therapeutic properties, facilitate optimal drug absorption, reduce viscosity for liquid formulations, and significantly improve solubility, especially for poorly soluble compounds . During the manufacturing process, excipients are crucial for improving the handling of active substances and facilitating powder flow, ensuring that a drug can be efficiently produced and consistently delivered . Indeed, virtually all marketed drugs contain excipients, which often make up a greater proportion of the final formulation by weight than the active ingredient itself .

For far too long, excipients were dismissed as mere “inactive” or “inert” components. This perception, however, is a profound misnomer. Early assumptions that these ingredients had negligible effects on pharmacodynamics and pharmacokinetics have been thoroughly debunked by empirical evidence . It is now widely understood that excipients can be a key determinant of dosage form performance, directly influencing how a drug behaves within the body and how effectively it achieves its therapeutic objective . This fundamental redefinition elevates excipients from passive fillers to critical components that profoundly influence drug stability, bioavailability, and the overall patient experience . Recognizing this shift is not merely an academic exercise; it is crucial for strategic decision-making in excipient switching, as it underscores the necessity for rigorous evaluation that extends far beyond just material cost. The impact of an excipient is far from passive; it is an active participant in the drug’s journey.

1.2. Why Excipient Switching is a Business Imperative: Beyond Mere Cost-Cutting

The decision to switch excipients is driven by a complex interplay of strategic factors, extending well beyond the immediate allure of cost reduction . Pharmaceutical companies consider these changes for a multitude of reasons, including supply chain simplification, addressing specific patient sensitivities, and enhancing the overall market appeal of a product .

One of the most obvious drivers is the potential for significant cost reduction. Opting for a different excipient that is either cheaper or more readily available can lead to substantial savings in production expenses . A compelling illustration of this is the generic drug market. Generic drugs, which frequently involve strategic excipient switching, can be an astonishing 80% to 85% cheaper than their branded counterparts. This considerable price difference is primarily attributable to the reduced development costs associated with generics and the judicious selection of alternative excipients .

Beyond direct cost savings, excipient switching plays a crucial role in bolstering supply chain resilience. In an era marked by increasing global supply chain disruptions—be they natural disasters, pandemics, or geopolitical instabilities —diversifying excipient sources or transitioning to more stable alternatives can significantly enhance supply chain integrity and mitigate risks . This proactive approach ensures continuity of supply, a paramount concern in an industry where product shortages can have severe patient consequences.

Furthermore, excipient changes can dramatically influence a pharmaceutical product’s market appeal and align with patient-centric development goals. Such modifications can improve patient tolerability, for instance, by switching from excipients known to cause adverse reactions like certain dyes or lactose for intolerant patients . They can also enhance product stability and optimize bioavailability, ensuring the drug remains effective throughout its shelf life and is absorbed optimally by the body . Improvements in organoleptic properties, such as taste and appearance, or extending shelf life directly influence patient compliance and preference, thereby boosting market appeal . For a drug that tastes better or is easier to swallow, patient adherence often improves, leading to better therapeutic outcomes.

The pharmaceutical excipients market itself is a testament to this growing strategic importance. Valued at $9.51 billion in 2022, it is projected to reach an impressive $14.72 billion by 2033, demonstrating a compound annual growth rate (CAGR) of 5.81% from 2024 to 2033 . This robust growth is fueled by the rising global demand for drug formulations, continuous advancements in the pharmaceutical industry, and the increasing recognition of excipients’ critical roles in enhancing drug stability, bioavailability, and safety .

While cost-cutting often serves as an immediate impetus, the broader implications of excipient switching extend profoundly to competitive advantage and market differentiation. If excipients can improve patient compliance, extend shelf life, or enhance bioavailability, they transcend their perceived “inactive” status to become powerful tools for comprehensive product improvement. This perspective shifts the paradigm from excipient management as a reactive cost-saving measure to a proactive strategic initiative. Companies that master the art and science of excipient switching can not only significantly reduce expenses but also create superior, more patient-friendly products. This ability to innovate at the excipient level can lead to gains in market share and the cultivation of stronger brands, particularly within the highly competitive generic sector where patent expirations continually open new opportunities .

2. The Multifaceted Role of Excipients in Drug Performance

To truly appreciate the strategic implications of excipient switching, one must first understand the profound and often underestimated roles these “inactive” ingredients play in a drug’s journey from manufacturing line to patient efficacy. They are far more than mere fillers; they are the architects of a drug’s form, function, and fate within the body.

2.1. Core Functions and Their Impact on Drug Delivery

Excipients are integral to the physical form and manufacturability of a drug product . Their functions are diverse and critical, forming the backbone of effective drug delivery systems:

- Binders: These substances impart cohesiveness to the powder mix, which is absolutely essential for the formation of robust tablets or granules. Common examples include starch, various cellulose derivatives (such as hydroxypropyl cellulose), and polyvinylpyrrolidone (PVP) . Without effective binders, tablets would simply crumble.

- Fillers/Diluents: When the active pharmaceutical ingredient is present in very small quantities, fillers add necessary bulk to the formulation, aiding in the manufacturing process and ensuring accurate dosing for patients. Lactose, microcrystalline cellulose, calcium phosphate, and mannitol are frequently used for this purpose .

- Disintegrants: These excipients are designed to expand and dissolve when wet, causing tablets or capsules to rapidly break apart in the gastrointestinal tract. This rapid breakdown is crucial for facilitating the timely release of the active ingredients for absorption. Croscarmellose sodium, crospovidone, and sodium starch glycolate are prime examples .

- Lubricants & Glidants: During the high-speed manufacturing of tablets and capsules, lubricants reduce friction between particles and the surfaces of processing equipment, preventing sticking to tablet punches or machine dosators. Glidants, often used in combination with lubricants, promote powder flow by reducing interparticle friction. Magnesium stearate, talc, and colloidal silicon dioxide are widely employed .

- Coatings: Tablet coatings serve multiple purposes: they protect active ingredients from deterioration by moisture in the air, mask unpleasant tastes, and make large or difficult-to-swallow tablets easier for patients. Beyond functionality, coatings also provide color for easy identification and branding, enhancing the aesthetic appeal of medications . Hydroxypropyl methylcellulose (HPMC) films and gelatin capsules are common coating materials .

- Solubilizers & Surfactants: For poorly soluble drugs, these excipients are vital. They enhance solubility, stability, and dispersibility of the drug within the formulation, which directly translates to improved absorption and bioavailability in the body. Polyethylene glycol (PEG), cyclodextrins, and polysorbates are frequently used solubilizers and surfactants .

- Preservatives: These are added to prevent microbial growth in formulations, thereby extending the product’s shelf life and ensuring its safety over time. Benzalkonium chloride and methylparaben are typical examples .

- Colorants, Flavors, Sweeteners: These excipients are added for aesthetic purposes, to mask unpleasant tastes, and to improve patient acceptance and compliance, especially for pediatric populations. Titanium dioxide for opaque colors, fruit extracts for flavors, and sucrose or sorbitol for sweetness are commonly utilized .

The description of these various excipient functions reveals a profound truth: each excipient does not operate in isolation but contributes to a complex, interconnected system within the drug product. For instance, a lubricant like magnesium stearate, while essential for manufacturing convenience by preventing sticking, can, as a side effect, decrease tablet disintegration and dissolution, thereby negatively impacting bioavailability. This intricate web of functionality means that changing one excipient can trigger a cascade of ripple effects across multiple critical quality attributes (CQAs) and process parameters. A holistic understanding of these excipient interactions and their cumulative impact on the final product’s performance is therefore paramount. It necessitates a systems-thinking approach, where changes are evaluated not in isolation, but within the entire formulation and manufacturing ecosystem, much like understanding how a single adjustment to an orchestra’s seating arrangement can alter the entire sound.

2.2. Excipients as Determinants of Pharmacokinetics and Pharmacodynamics

Beyond their roles in formulation and manufacturing, excipients can significantly influence a drug’s pharmacokinetics (how the body processes the drug – absorption, distribution, metabolism, excretion, or ADME) and pharmacodynamics (how the drug affects the body) . They are not just passive carriers; they are active modulators of a drug’s journey through the biological system.

Excipients possess the ability to modify drug absorption, distribution, metabolism, and excretion . For example, certain lipid-based excipients can enhance drug absorption by subtly affecting physiological processes within the body, such as stimulating bile flow and pancreatic juice secretion. This physiological interaction demonstrates a deeper level of influence than simply providing bulk or aiding flow.

Furthermore, specialized excipients, particularly rate-controlling polymers, can precisely modify drug release profiles. This can manifest as sustained release (SR), delayed release (DR), or extended release (ER), ensuring that the active ingredient reaches its intended target site at the right concentration and at the optimal time . This controlled delivery is crucial for maintaining therapeutic levels, reducing side effects, and improving patient convenience.

The concept of excipients actively shaping drug delivery can be powerfully illustrated through an analogy. Consider the case of paclitaxel, a widely used chemotherapy agent. In an innovative formulation, paclitaxel is bound to albumin nanoparticles. These nanoparticles act rather like a “Trojan Horse,” enabling the drug to navigate inside the body without challenge or rejection, delivering its potent (though toxic) payload directly to where it is needed, such as tumor sites. This excipient-enabled strategy improves the therapeutic benefits of paclitaxel by enhancing specificity and reducing systemic toxicity compared to traditional systemic treatments. This example makes it clear that excipients are evolving from passive carriers to active participants in drug delivery, enabling advanced therapies, targeted delivery, and ultimately, improved patient outcomes . This evolution opens entirely new avenues for innovation and competitive advantage, moving far beyond the confines of traditional dosage forms.

2.3. Ensuring Drug Stability and Shelf Life

Excipients are absolutely crucial for maintaining the stability and integrity of drug products throughout their expected shelf life. They act as guardians, protecting active pharmaceutical ingredients (APIs) from degradation caused by environmental factors such as moisture, light, and oxygen . This protective role is fundamental to ensuring a drug maintains its potency and safety over time.

These protective mechanisms are diverse. Excipients can actively prevent the degradation of the API, for instance, by reducing oxidative degradation through the inclusion of antioxidants like ascorbic acid . They can also sequester oxidation-inducing metal ions by acting as chelating agents, thereby mitigating a common pathway for drug breakdown. Without these stabilizing properties, many active ingredients would quickly lose their efficacy or even become harmful.

However, this critical role in stability presents a significant duality. An incorrect excipient choice can, paradoxically, promote API degradation . This means that while excipients are intended to stabilize, they can become “silent saboteurs” if incompatible with the API or other formulation components. Such incompatibilities can lead to reduced potency, the formation of harmful byproducts, or a compromised shelf life . For instance, chemical reactions like hydrolysis, where ambient humidity degrades the active ingredient, or oxidation, often catalyzed by metal ions, can occur in the presence of certain excipients. Similarly, ionized excipients may react with soluble ionized agents to form insoluble salts. This inherent duality underscores the necessity of rigorous pre-formulation studies and comprehensive compatibility screening to identify potential interactions early in development . The cost of identifying and mitigating these incompatibilities upfront is invariably far less than the immense financial and reputational damage incurred from a product recall or market withdrawal due to stability issues. This highlights that stability is not a given; it is a carefully engineered outcome, intricately reliant on the excipient profile and its interactions within the formulation.

3. Navigating the Complexities: Risks and Challenges in Excipient Switching

While the allure of cost savings and enhanced product performance drives excipient switching, the path is fraught with technical, safety, and regulatory complexities. A misstep can lead to significant consequences, from product recalls to compromised patient outcomes.

3.1. Potential Impacts on Drug Product Quality and Performance

Excipient changes are not merely cosmetic; they can fundamentally alter a drug’s performance.

3.1.1. Bioavailability and Dissolution Profile Alterations

One of the most critical concerns in excipient switching is the potential impact on a drug’s dissolution and, consequently, its bioavailability . Altered bioavailability can directly affect a drug’s efficacy, leading to suboptimal therapeutic effects, or, in more severe cases, raise safety concerns due to unexpected drug exposure .

The mechanisms through which excipients can modify drug absorption are diverse and often subtle. For example, osmotically active excipients such as sugar alcohols like mannitol and sorbitol, or polyethylene glycol (PEG), can significantly reduce drug absorption. They achieve this by increasing the gastrointestinal (GI) fluid volume, which dilutes the intraluminal drug concentration, and by reducing small intestinal transit time . This means the drug has less time and a lower concentration to be absorbed effectively.

Consider the detailed evidence: studies have shown that sorbitol, a common sugar alcohol, can reduce the absorption of BCS Class III drugs (high solubility, low permeability) like ranitidine by as much as 45% at a 5g dose . In contrast, the same 5g of sorbitol had no discernible impact on metoprolol, a BCS Class I drug (high solubility, high permeability) . This disparity highlights that BCS Class III drugs are notably more sensitive to the effects of absorption-modifying excipients . Furthermore, commercial solutions containing approximately 1.6g of sorbitol reduced cimetidine (another Class III drug) absorption by 19% . These detailed examples demonstrate that seemingly minor excipient changes can have major clinical consequences, particularly for drugs whose absorption is already a limiting factor.

Another class of excipients, surfactants like sodium lauryl sulfate (SLS), have been shown in vitro to potentially increase the permeability of certain drugs in Caco-2 monolayers by opening tight junctions or damaging membrane integrity . However, human in vivo data has not consistently demonstrated such an effect, underscoring the complexities of translating in vitro findings to clinical reality . Other surfactants (e.g., Vit-E-PEG, polysorbate 80) and polymers (e.g., NaCMC) have been identified as inhibitors of P-glycoprotein (P-gp) in cell cultures, which could theoretically increase drug absorption by inhibiting efflux transporters .

The impact of excipients on physiological processes—such as GI transit time, luminal volumes, membrane permeability, and even metabolism within the GI tract—is profound and often non-obvious . The detailed examples of sorbitol and mannitol reducing ranitidine absorption by significant percentages demonstrate that seemingly minor excipient changes can have major clinical consequences, especially for BCS Class III drugs, which are inherently more sensitive. This reality necessitates a deep understanding of the API’s Biopharmaceutics Classification System (BCS) class and the excipient’s potential physiological interactions. Relying solely on in vitro data for complex excipient changes can be inherently risky, underscoring the critical importance of in vivo bioequivalence studies or robust biowaiver justifications, particularly for drugs where absorption is a critical performance attribute .

3.1.2. API-Excipient Compatibility Issues and Degradation

The intimate contact between an excipient and an API within a formulation creates a fertile ground for potential chemical or physical interactions. These interactions, if not properly understood and controlled, can compromise the stability, bioavailability, or therapeutic efficacy of the drug .

For example, certain excipients can inadvertently lead to the degradation of the active ingredient through chemical reactions such as hydrolysis, where ambient humidity penetrates the drug preparation, or oxidation, often catalyzed by metal ions present in the drug or even its packaging. Such degradation can result in reduced drug potency or, more alarmingly, the creation of harmful byproducts . Another form of incompatibility can occur when ionized excipients react with soluble ionized agents, leading to the formation of insoluble salts, which can severely impact drug dissolution and absorption. Physical incompatibilities, such as phase separation or crystallization, can also arise, affecting the consistency and uniformity of the formulation.

Excipients, while intended to stabilize, can thus become “silent saboteurs” if incompatible, actively causing degradation, reducing potency, or generating toxic byproducts . This represents a critical risk that might not manifest immediately but could emerge long after initial formulation, during storage or distribution. The necessity for “thorough pre-formulation studies and advanced compatibility screening techniques” is a direct and indispensable response to this inherent risk. The upfront investment in identifying and mitigating these incompatibilities early in the development process is demonstrably far less than the immense financial and reputational costs associated with a product recall or market withdrawal due to stability issues. This underscores that ensuring stability is not a passive outcome but a carefully engineered process, heavily reliant on a meticulously chosen excipient profile and a deep understanding of its potential interactions.

3.1.3. Manufacturing Process Challenges and Batch Variability

Manufacturing processes in the pharmaceutical industry are often finely tuned and highly sensitive to the properties of raw materials. Consequently, changes in excipient properties can significantly disrupt these processes, leading to a cascade of issues such as poor powder flow, inconsistent tablet weight, and content non-uniformity . Such deviations can directly impact the quality and consistency of the final drug product.

A pervasive challenge stems from variability in excipient grade, source, and manufacturing processes, which can result in unacceptable batch-to-batch variability in the finished drug product . For instance, a study on amlodipine besylate immediate-release tablets revealed that variations in microcrystalline cellulose (MCC) originating from different manufacturers or even different grades from the same manufacturer could alter its lignin content, which in turn impacted the in vitro drug release profile . This demonstrates that seemingly minor differences in excipient attributes can have a profound “domino effect” on production. The statement that “inconsistent excipient properties can alter drug performance” directly links raw material variability to finished product quality, emphasizing the delicate balance required in pharmaceutical manufacturing.

This inherent sensitivity means that manufacturing processes are not merely susceptible to change; they are acutely vulnerable. A change in an excipient, even if perceived as minor, can disrupt established parameters like flowability or compressibility, leading to significant production inefficiencies, increased waste, and deviations from quality standards . This reality necessitates not only rigorous testing of new excipients but also the implementation of a robust change control system and, potentially, the re-validation of manufacturing processes to ensure consistent product quality and avoid costly manufacturing failures . Therefore, effective change management in excipient switching is not just about regulatory compliance; it is about safeguarding operational efficiency and product integrity.

3.2. Patient Safety and Tolerability Concerns

The pharmaceutical industry’s ultimate responsibility is patient safety. While excipients are often termed “inactive,” their potential to cause adverse reactions or introduce harmful contaminants is a critical consideration in any switching decision.

3.2.1. Allergenicity, Toxicity, and Adverse Reactions

Despite the common perception of excipients as “inert,” they can, in fact, trigger adverse reactions in sensitive individuals. These reactions range from mild intolerances to severe allergic responses, including anaphylaxis . Common culprits include lactose, which can cause issues for lactose-intolerant patients, and certain dyes or preservatives like parabens and polyethylene glycol (PEG) .

Beyond allergic reactions, toxicity issues can emerge from cumulative exposure to specific excipients, particularly when administered in high doses over prolonged periods, as seen with some polyethylene glycol (PEG) or paraben exposures . Even more alarmingly, impurities or contaminants within excipients pose a significant threat. Historical incidents involving diethylene glycol (DEG) contamination, which led to mass poisoning epidemics when inadvertently used in pharmaceutical preparations, serve as a stark reminder of these dangers. More recently, recalls of certain hand sanitizers and aerosol drug products due to benzene contamination highlighted the risks associated with inactive ingredients like carbomers or isobutane. Benzene, a known human carcinogen, necessitates immediate recalls if found above 2 ppm.

The phrase “hidden dangers” perfectly encapsulates the inherent risk associated with excipients. The fact that excipients can cause severe anaphylaxis, as observed with PEG and polysorbates in some COVID-19 vaccines , or be contaminated with carcinogens like benzene , shatters any lingering illusion of their absolute inertness. This is not merely a quality control issue; it is a direct patient safety and public health crisis. This reality mandates stringent quality control measures throughout the supply chain, thorough safety assessments for all ingredients—including their chemical decomposition products —and a proactive approach to identifying and mitigating risks. This includes considering individual patient factors, such as genetic predispositions to excipient hypersensitivity, which can influence how a patient reacts to a particular excipient.

3.2.2. Real-World Consequences: Case Studies of Excipient-Related Issues

The theoretical risks associated with excipient switching are given stark reality through numerous real-world case studies of product failures. These incidents serve as cautionary tales, highlighting the severe repercussions of inadequate excipient management.

Product recalls due to issues like discoloration or contamination, such as the benzene contamination found in certain hand sanitizers and aerosol products linked to excipients like carbomers or isobutane , are tangible manifestations of excipient-related failures. These events lead to damaged brand reputation, significant economic losses, exposure to legal liability, and, most importantly, patient mistrust and direct harm. A retrospective study conducted in Kenya, for instance, revealed that a staggering 97.2% of recalled generic products were due to discoloration, affecting up to 70 batches in some instances. This statistic points to a potential systemic issue in generic manufacturing concerning excipient quality control.

The high percentage of generic drug recalls due to quality issues like discoloration presents a critical paradox. While excipient switching demonstrably enables significant cost savings for generic drugs, making them 80-85% cheaper than their branded counterparts , this cost-efficiency can inadvertently introduce higher quality risks if not managed with meticulous precision. This suggests that the true cost of a seemingly “cheap” excipient can be astronomical when factoring in the repercussions of a recall. For generic manufacturers, therefore, achieving “cost-cut without compromise” demands an even more stringent commitment to quality management and risk assessment for excipients than for innovator drugs, to avoid the severe financial and reputational repercussions of recalls.

The challenges extend to bioavailability and stability issues. Excipient changes can lead to significant hurdles in demonstrating therapeutic equivalence and long-term stability, particularly for complex formulations like modified-release drugs or those with a narrow therapeutic index . It is estimated that approximately 40% of new chemical entities (NCEs) encounter difficulties with solubility and bioavailability during their formulation stages, underscoring the inherent challenges in drug development where excipients play a pivotal role .

Manufacturing variability is another common pitfall. Changes in excipient manufacturers or grades can introduce subtle yet critical variations in physicochemical properties, such as particle size, moisture content, density, or crystallinity. These variations can substantially affect the final drug product’s quality, influencing attributes like tablet hardness and disintegration time . A study on amlodipine besylate immediate-release tablets, for example, demonstrated that variability in microcrystalline cellulose (MCC) from different manufacturers or grades significantly impacted the established design space and the overall quality of the drug product .

These challenging cases and failures represent the “hidden icebergs” beneath the surface of excipient switching. The consequences are not merely financial; they can involve severe patient harm and significant regulatory sanctions. The fact that many issues stem from “inadvertent” use or “variability” underscores the need for extreme vigilance and comprehensive risk assessment. The pharmaceutical industry must prioritize patient safety and product quality above all else when considering excipient changes. This necessitates embracing a “safety-first” mindset, implementing robust risk management frameworks (such as those outlined in ICH Q9), investing in advanced analytical characterization, and maintaining strict change control protocols to proactively prevent these costly and dangerous failures.

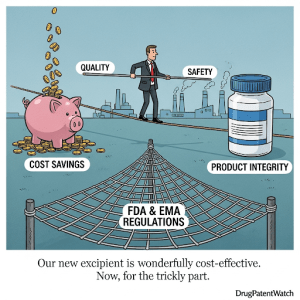

4. The Regulatory Labyrinth: Compliance in Excipient Switching

The pharmaceutical industry operates under a strict regulatory framework designed to ensure product safety, quality, and efficacy. Excipient switching, despite its business advantages, is not exempt from this scrutiny. Navigating the global regulatory landscape is a critical success factor, demanding meticulous documentation, rigorous testing, and a proactive approach to change management.

4.1. Global Regulatory Frameworks: FDA, EMA, and ICH Guidelines

Pharmaceutical regulations and standards are unequivocal: they mandate the comprehensive identification and safety assessment of all ingredients in drugs, including their chemical decomposition products . Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) enforce stringent regulations that necessitate the use of high-quality excipients, thereby driving market growth and compliance efforts across the industry .

4.1.1. Understanding BCS-Based Biowaivers and Excipient Risk

Regulatory agencies have established rigorous in vivo bioequivalence (BE) standards to ensure that generic drugs perform comparably to their reference products. However, in certain circumstances, these agencies may waive the in vivo requirement, granting a “biowaiver” for some oral products based on the Biopharmaceutics Classification System (BCS) . The BCS categorizes drugs into four classes based on their solubility and intestinal permeability.

For BCS Class I drugs (high solubility-high permeability), the risk of excipient effects on absorption is generally considered low. For a biowaiver to be granted, excipients that may affect the absorption of the active pharmaceutical ingredient (API) must be qualitatively the same (identical chemistry, grade, and characterization) and quantitatively similar (within ±10% of the excipient’s weight in the reference product, with a cumulative difference within ±10%) . For all other excipients, qualitative and quantitative differences are generally acceptable .

Conversely, BCS Class III drugs (high solubility-low permeability) are considered at a higher risk due to their inherent low permeability and potential for site-specific absorption within the gastrointestinal tract. For a biowaiver in this class, all excipients must be qualitatively the same and quantitatively similar (within ±10% by weight, with a cumulative difference within ±10%), with only limited exceptions for components like film coatings or capsule shells . This stringent criterion operates under the assumption that all excipients in Class III drugs could potentially affect drug absorption .

The International Council for Harmonisation (ICH) M9 Guidance, finalized in 2020 and adopted by the FDA in May 2021, is a globally recognized guideline that allows for BCS-based biowaivers. This guidance is notably more restrictive than prior FDA guidance regarding excipient risk, particularly for Class III drugs . It mandates a mechanistic and risk-based approach for biowaiver proposals, requiring careful consideration of transporter-mediated drug absorption .

The regulatory concept of “qualitatively the same and quantitatively similar” (Q1/Q2) for excipients in biowaivers implies a degree of flexibility. However, the detailed examples of sorbitol and mannitol impacting BCS Class III drugs demonstrate that even small quantitative differences can have significant in vivo effects . This creates a critical tension between regulatory definitions of “similarity” and the actual physiological impact of excipient changes. Therefore, pharmaceutical companies must transcend mere quantitative similarity and demonstrate true functional equivalence, supported by robust scientific data and a deep mechanistic understanding. This often means investing in predictive models and analytical characterization capabilities that can truly assess in vivo performance, even when pursuing a biowaiver. The regulatory landscape demands not just compliance, but a profound scientific justification for every excipient decision.

4.1.2. SUPAC and ANDA Requirements for Post-Approval Changes

The FDA’s Scale-Up and Post-Approval Changes (SUPAC) guidances, such as SUPAC-IR for immediate-release solid oral dosage forms, provide a structured framework for managing changes to approved drug applications. These guidances categorize excipient changes into three levels of impact, which directly dictate the required regulatory submission pathway:

- Level 1 (Negligible Impact): These are minor changes considered unlikely to affect product quality or performance. Examples include minor adjustments in color or flavor, or excipient amounts within specific percentages (e.g., ±5% for fillers, ±0.5% for binders). Such changes typically require only an annual report notification to the FDA, with bioequivalence (BE) demonstrated via in vitro dissolution testing (a biowaiver) .

- Level 2 (Significant Impact Potential): These are more substantial changes that could potentially alter product quality or performance. This level includes changes in the technical grade of an excipient or amounts greater than Level 1 but up to a two-fold increase, provided total additive changes do not exceed 10%. These changes necessitate a CBE-30 (Changes Being Effected in 30 days) or CBE-0 (Changes Being Effected at time of submission) supplement, with BE typically demonstrated via the dissolution profile similarity factor f2 .

- Level 3 (Likely Significant Impact): These are major changes with a high likelihood of significantly impacting product quality. Examples include adding or deleting an excipient, additive excipient changes exceeding 10%, or a change in granulation solvent. These changes require a Prior Approval Supplement (PAS), meaning FDA approval must be received before the product made with the change can be distributed, and often necessitate in vivo BE testing .

For Abbreviated New Drug Applications (ANDAs), which are submissions for generic drugs, excipient changes generally require “Q1/Q2” equivalence. This means the test formulation must have qualitatively the same (Q1) and quantitatively the same (Q2) excipients as the reference product, with specified allowable qualitative and quantitative differences .

The SUPAC and ANDA guidelines effectively create a tiered “regulatory ladder” where the level of required documentation and testing directly correlates with the perceived risk of the excipient change. This tiered approach compels companies to conduct thorough scientific data and risk analyses to justify their chosen submission pathway . Strategic excipient switching therefore demands a deep understanding of these regulatory tiers. Companies must proactively assess the potential impact of any proposed change, gather the necessary scientific data to support their assessment, and align their internal change control processes with regulatory expectations. This proactive approach is essential to avoid costly delays, outright rejections, or the unexpected burden of in vivo studies, ensuring that regulatory compliance is an integral part of the cost-cutting strategy, not an afterthought.

4.2. Mastering Change Control Management in Pharmaceutical Manufacturing

In the highly regulated pharmaceutical industry, change is inevitable, but it must be meticulously managed. Change control is not merely a bureaucratic exercise; it is a systematic process for managing and documenting alterations to a product, process, or system, and it is absolutely critical for ensuring the consistent quality, safety, and efficacy of pharmaceutical products. This systematic approach is a core component of Good Manufacturing Practice (GMP) guidelines.

4.2.1. Systematic Approach to Managing Formulation Changes

The change control process is a structured journey that begins with the initiation of a formal change request. This request, detailing the reason for the change and its potential impact, then undergoes a rigorous review and evaluation by cross-functional teams. These teams typically include experts from quality assurance, regulatory affairs, and manufacturing, ensuring a holistic assessment of the proposed modification. A critical step in this process is a thorough risk assessment, which identifies potential hazards and their severity. Following this, the change request proceeds through an approval process, leading to documentation, validation activities, necessary regulatory notifications, and finally, implementation.

Any alteration, particularly those involving raw material suppliers or excipients, can have a direct and profound impact on product quality, manufacturing formulae, the integrity of the registration dossier, and even the finished product’s shelf life. This complexity necessitates a robust and systematic approach.

While often perceived as a bureaucratic hurdle, change control is explicitly designed as a “proactive approach to managing modifications” and is considered a “critical and frequently used concept” within the pharmaceutical industry. Its primary purpose is to prevent deviations from established processes and ensure continuous compliance. It acts as a vital safeguard against unintended consequences, especially given the intricate interdependencies within pharmaceutical manufacturing. Therefore, effective change control is not just about ticking boxes; it is about embedding a culture of continuous improvement and proactive risk mitigation. It demands robust internal processes, clear and consistent communication across all relevant departments, and an unwavering commitment to thorough evaluation. This ensures that cost-saving excipient switches do not inadvertently compromise product quality or patient safety, thereby protecting both the bottom line and public trust.

4.2.2. Documentation, Validation, and Regulatory Notifications

Meticulous documentation is the cornerstone of effective change control in pharmaceuticals. A full description of all Chemistry, Manufacturing, and Controls (CMC) changes must be maintained, accompanied by a relevant summary of data from studies and tests performed to assess the effects of each change on product quality . This documentation should include explicit cross-references to internal change control and validation protocols, as well as standard operating procedures (SOPs) used to assess or demonstrate the change’s impact .

Validation activities are equally crucial. For significant changes, a minimum of three production batches should be run as trials to ensure that the change has no adverse impact on product quality and that the manufacturing process remains robust and consistent . These validation studies provide the empirical evidence necessary to support the safety and efficacy of the modified product.

The nature of regulatory notifications varies depending on the assessed impact level of the change, ranging from inclusion in an annual report for minor changes, to a CBE-30 or CBE-0 supplement for moderate changes, and a Prior Approval Supplement (PAS) for major changes . Adhering to these specific notification requirements is paramount for regulatory compliance and timely market access.

The emphasis on a “full description of the CMC changes,” a “relevant summary of data from studies and tests,” and “cross-references to change control and change validation protocols” points to the creation of an exhaustive “audit trail.” This comprehensive documentation is not merely for compliance; it serves as the scientific evidence that justifies the change and provides assurance of quality to internal stakeholders and regulatory bodies alike. Investing in robust data management systems and fostering a culture of meticulous documentation are therefore critical. This “audit trail of assurance” provides the necessary transparency and scientific justification for regulatory bodies, minimizing potential delays and demonstrating due diligence in all excipient switching initiatives. It transforms regulatory requirements from burdensome obligations into strategic assets that underpin product integrity and market confidence.

5. Strategic Framework for Successful Excipient Switching

Achieving “cost-cut without compromise” in excipient switching demands a strategic, scientific, and systematic approach. It’s about designing quality in from the outset, rigorously testing every change, and continuously innovating to meet evolving market and patient needs.

5.1. Embracing Quality by Design (QbD) Principles

Quality by Design (QbD) represents a paradigm shift in pharmaceutical development. It is a systematic approach that begins with predefined objectives, emphasizing a deep understanding of both the product and the manufacturing process, all grounded in sound scientific principles and robust quality risk management . The core tenet of QbD is that quality must be “designed into the product” from its inception, rather than merely tested for at the end of the manufacturing process.

5.1.1. Defining Critical Quality Attributes (CQAs) and Design Space

Central to the QbD philosophy is the meticulous definition of Critical Quality Attributes (CQAs). These are the physical, chemical, biological, or microbiological properties or characteristics of a drug product that must be maintained within an appropriate limit, range, or distribution to ensure the desired product quality . Identifying CQAs for excipient-containing formulations is crucial, as it provides clear targets for development and control.

Furthermore, QbD involves establishing a “design space.” This is a multidimensional region encompassing input variables (such as material attributes and process parameters) that has been scientifically proven to ensure product quality . Within this design space, changes can often be made without requiring a new regulatory submission, provided the product remains within the established boundaries.

QbD effectively functions as a “GPS” for formulation development, guiding the process away from empirical trial-and-error towards a predictive, risk-based approach . By precisely defining CQAs and establishing a design space, companies can gain a profound understanding of how excipient changes might impact critical product characteristics before engaging in extensive and costly manufacturing. This foresight allows for proactive adjustments and significantly reduces the likelihood of expensive failures later in the development cycle. Implementing QbD principles for excipient switching therefore allows companies to systematically explore the impact of different excipients, identify optimal ranges for their use, and accurately predict product performance. This, in turn, streamlines development, minimizes risk, and ensures consistent quality even when excipient changes are introduced.

5.1.2. Leveraging Risk Assessment and Design of Experiments (DoE)

The power of QbD is amplified through its integration of sophisticated tools like risk assessment and Design of Experiments (DoE). These methodologies are instrumental in identifying and mitigating sources of variability early in the development process .

Risk assessments, which are inherently iterative, should always be founded on sound scientific knowledge and directly linked to the ultimate goal of patient protection. The level of effort, formality, and documentation involved in the quality risk management process should be commensurate with the level of risk posed by the excipient or the proposed change . Tools such as Failure Mode Effects Analysis (FMEA) are commonly employed to systematically identify potential failure modes, their causes, and their effects on product quality.

Design of Experiments (DoE) is a powerful statistical methodology that enables scientists to systematically investigate the effects of multiple input variables (e.g., different excipients, their concentrations, or process parameters) on various output responses (e.g., tablet hardness, dissolution rate). DoE helps to understand the complex interplay of these critical method parameters (CMPs) on performance, aiding in the selection of optimal conditions and the establishment of a “knowledge space” for excipient behavior within the formulation.

Risk assessment and DoE transform the speculative question of “what if we switch excipients?” into a more definitive “what will happen if we switch excipients within these defined parameters?” . By systematically mapping inputs to outputs, companies can transition from a reactive problem-solving mode to proactive prediction and control. The IPEC-PQG risk assessment model, supported by organizations like EFPIA, provides a concrete, industry-recognized framework for assessing excipient risks from source to finished product, considering factors like chemical hazards, microbiological risks, and the excipient’s function in the formulation . This scientific rigor minimizes unforeseen issues during scale-up and commercial manufacturing, making excipient switching a more predictable and significantly less risky endeavor. It empowers data-driven decisions that judiciously balance cost savings with unwavering quality assurance.

5.2. Rigorous Analytical Characterization and Equivalence Testing

The quality of excipients is not merely important; it is foundational, considering they can constitute up to 90% of a medicine’s composition . The suitability of an excipient for its intended use is fundamentally defined by attributes such as its identity, strength, and purity . However, achieving true quality and interchangeability goes far beyond basic compliance.

5.2.1. Advanced Techniques for Excipient Functionality Assessment

While pharmacopoeial specifications provide essential baseline purity and identity criteria, they often fall short in fully capturing an excipient’s functional properties . This means that conformance to these standard specifications alone does not provide sufficient confidence that an excipient will perform according to its intended purpose within a complex drug formulation. To truly understand and predict an excipient’s behavior, advanced analytical techniques are indispensable for comprehensive characterization and performance assessment .

These sophisticated techniques provide a deeper understanding of excipient properties and their interactions with APIs:

Table 1: Key Analytical Techniques for Excipient Characterization and Equivalence

| Technique Category | Specific Techniques | Measures/Assesses | Relevance to Excipient Switching |

| Thermal Analysis | Differential Scanning Calorimetry (DSC), Thermogravimetric Analysis (TGA), Isothermal Microcalorimetry | Physical transformations (melting, crystallization, glass transition), degradation kinetics, heat flow changes, weight loss upon heating | API-excipient compatibility, stability, polymorphic changes, moisture content impact |

| Spectroscopic Methods | Fourier Transform Infrared (FT-IR), Raman Spectroscopy, Nuclear Magnetic Resonance (NMR) | Chemical interactions, functional groups, molecular structure, crystallinity, polymorphism | Detecting chemical incompatibilities, identifying degradation products, assessing structural integrity of API and excipient |

| Chromatographic Methods | High-Performance Liquid Chromatography (HPLC), Gas Chromatography (GC), LC-Mass Spectrometry (LC-MS/MS) | Purity, impurity profiles, degradation products, quantification of components | Identifying and quantifying impurities, monitoring degradation pathways, ensuring product purity after excipient change |

| Particle Characterization | Laser Light Diffraction, Optical Microscopy, Dynamic Light Scattering (DLS) | Particle size distribution (PSD), shape, surface area, morphology, density, flowability | Predicting powder flow, compressibility, dissolution rate, content uniformity, and manufacturing processability |

| Other Techniques | X-ray Diffraction (XRD), Isothermal Stress Testing, Rheology | Crystalline forms, polymorphic changes, moisture sorption, viscosity, flow properties | Assessing solid-state stability, hygroscopicity, and rheological behavior for liquid/semi-solid formulations |

The observation that “conformance to pharmacopoeial specifications does not provide sufficient confidence that an excipient will perform according to its intended purpose” is a critical realization for pharmaceutical professionals. It means relying solely on standard purity tests is insufficient; companies must delve “beyond the label” into functional properties. The availability of these advanced analytical techniques provides the essential tools to achieve this deeper understanding . Investing in sophisticated analytical capabilities and the expertise to interpret their data is not an overhead cost but a strategic necessity. It enables a more profound comprehension of excipient functionality, allowing for more informed switching decisions and proactive mitigation of potential performance issues, thereby safeguarding product quality and patient safety.

5.2.2. Ensuring Functional Equivalence Across Suppliers and Batches

A significant challenge in excipient management arises from the fact that materials from different suppliers, or even different batches from the same supplier, can exhibit distinct functional behaviors despite meeting identical pharmacopoeial specifications. This phenomenon, often termed the “supplier variability trap,” means that while two excipient lots may appear analytically equivalent on paper, one might perform flawlessly in production while the other causes significant manufacturing issues or compromises product quality.

Specification equivalence is crucial for determining if different analytical procedures or materials from different sources produce the same results, but it is only the first step . The true test lies in functional equivalence. It is not uncommon for analysts to conduct exhaustive upfront tests on variations of an excipient from different sources to confirm equivalence, only to find that in actual production, one variation works and the other does not. This highlights the inadequacy of relying solely on basic physicochemical parameters; functional testing that mimics real-world processing conditions is often necessary .

Companies must therefore establish robust supplier qualification programs that extend beyond mere analytical testing to include comprehensive functional performance evaluations relevant to their specific formulations and manufacturing processes . This requires close collaboration with excipient manufacturers, demanding that suppliers provide detailed dossiers with information supporting the drug manufacturer’s risk assessment. It also necessitates a willingness to invest in comprehensive equivalence studies that assess how excipient changes impact critical process parameters and final product attributes. This proactive engagement helps mitigate the “supplier variability trap,” ensuring consistent excipient performance and ultimately, consistent drug product quality.

5.3. Innovative Formulation Development and Optimization

The journey of drug development is a continuous quest for optimization, and excipients are increasingly at the forefront of this innovation. Strategic formulation development, particularly in the context of excipient selection and replacement, is paramount to achieving superior drug products.

5.3.1. Pre-Formulation Studies and Compatibility Screening

The foundation of successful drug formulation lies in comprehensive pre-formulation studies. This initial stage involves the detailed characterization of both the API and all proposed excipients, with the primary objective of identifying potential incompatibilities early in the development process . This proactive approach is critical because chemical or physical interactions between the API and excipients can compromise drug stability, bioavailability, or therapeutic efficacy .

These studies encompass a wide array of assessments, including:

- Solubility and Dissolution: Understanding how the API and excipients behave in various solvents and physiological conditions .

- Permeability: Assessing the drug’s ability to cross biological membranes, which can be influenced by excipients .

- Polymorph/Salt Screening: Identifying different crystalline forms of the API and their interactions with excipients, as these can affect stability and bioavailability .

- Solid-State and Solution-State Stability: Evaluating the stability of the API alone and in combination with excipients under various environmental stresses (e.g., heat, humidity, light) .

- Ionization Properties: Understanding how pH changes might affect the drug and excipient interactions .

- Particle Size Distribution: Characterizing the physical properties of powders, which impact flowability and compressibility .

The emphasis on “early identification” of incompatibilities and the potential “costly” consequences of “failure to carry out the appropriate characterization tests” directly echo the business adage: prevention is cheaper than cure. Investing in comprehensive pre-formulation and compatibility studies is not an optional expense but a strategic upfront investment that significantly de-risks the entire drug development and manufacturing process. This proactive screening minimizes the likelihood of costly late-stage failures, product recalls, or regulatory setbacks, thereby making excipient switching a more efficient, predictable, and ultimately more successful endeavor.

5.3.2. The Rise of Multifunctional, Natural, and Novel Excipients

The excipients market is undergoing a profound transformation, moving beyond traditional, single-function ingredients to embrace a new generation of sophisticated materials. This evolution is driven by the increasing complexity of drug formulations, the demand for enhanced patient-centricity, and the relentless pursuit of improved drug delivery.

One significant trend is the development of multifunctional excipients. These innovative materials can perform multiple roles within a drug formulation, such as simultaneously improving solubility, enhancing bioavailability, and controlling drug release . For example, a high-functionality excipient might provide better flow characteristics, act as a disintegrant, and allow for higher drug loading due to superior compressibility . This reduces the number of excipients needed, simplifying formulations and minimizing potential interactions.

There is also a growing focus on natural and plant-based excipients. This shift is partly driven by increasing environmental concerns and consumer preferences for more sustainable products, but also by the potential benefits these materials offer in terms of biocompatibility and reduced side effects .

Furthermore, the industry is witnessing the emergence of truly novel excipients, which include nanoexcipients and “smart excipients” . Nanoexcipients, for instance, are being developed to significantly improve drug solubility and targeted delivery, particularly for challenging compounds with poor water solubility or bioavailability . “Smart excipients” represent a breakthrough by responding to specific stimuli or environmental conditions to modulate drug release, thereby improving drug efficacy, reducing side effects, and enhancing patient compliance . These advanced excipients are explicitly deemed “critical to the development of new drug modalities and therapies” .

Another area of significant innovation is co-processed excipients. These are new composite materials formed by combining two or more previously approved excipients, resulting in novel functionalities that surpass those of the individual components . For example, co-processed excipients can dramatically improve the speed and efficiency of tablet and capsule manufacturing. A patented blend of mannitol and hydroxypropyl methylcellulose (HPMC), PEARLITOL® CR-H, allows for sustained release in direct compression formulations, opening new opportunities in controlled release drug delivery that typically require more complex wet granulation processes.

These developments signify a profound shift where excipients are no longer just supporting actors; they are becoming “innovation catalysts” . The development of multifunctional, natural, and novel excipients signifies a paradigm shift where excipients actively enable new drug modalities and delivery systems, rather than merely facilitating existing ones. This proactive role can unlock new product opportunities, address unmet medical needs (e.g., pediatric formulations, abuse-deterrent opioids ), and provide a significant competitive edge in the market. Companies that actively monitor, invest in the research and development of, and strategically adopt these advanced excipients are positioning themselves at the forefront of pharmaceutical innovation.

6. Unlocking Competitive Advantage: Economic and Intellectual Property Strategies

Beyond immediate cost savings, strategic excipient management offers profound opportunities for competitive advantage. This involves not only optimizing supply chains but also shrewdly navigating the complex landscape of intellectual property to protect innovations and gain market insights.

6.1. Cost Reduction and Supply Chain Optimization through Strategic Excipient Management

The pharmaceutical industry constantly seeks avenues for efficiency, and the supply chain offers substantial opportunities for cost reduction. Companies can achieve annual cost reductions of at least 10% through targeted supply chain improvements. Strategic sourcing, which includes shifting manufacturing outsourcing to new, more cost-effective markets like India and China, and negotiating volume discounts with preferred suppliers, can lead to significant savings .

Excipient selection and sourcing directly influence the differentiation and profitability of generic drugs . As previously noted, generic drugs are often 80-85% cheaper than their branded counterparts, a cost advantage partly attributable to the judicious choice of excipients . This highlights that excipients are not just raw materials; they are fundamental “value multipliers” for the final drug product . Their true worth extends far beyond their material cost. The right excipient can enhance bioavailability, extend shelf life, or improve patient adherence, all of which translate into sustained demand and increased profitability . This perspective shifts procurement and supply chain strategies for excipients from a purely transactional, cost-focused model to a strategic partnership model that prioritizes long-term value, quality, and supply chain resilience. This involves building strong supplier relationships and leveraging digital transformation for enhanced transparency and proactive risk management.

6.1.1. The Generic Drug Market and Excipient Profitability

The global pharmaceutical landscape is significantly shaped by the increasing demand for generic medicines. This demand is primarily driven by the expiration of patents on blockbuster drugs and the pervasive global efforts to reduce healthcare costs. This trend, in turn, fuels a substantial need for cost-effective and versatile excipients . The patent expiry of blockbuster drugs creates what can be termed a “generic market gateway,” where large volumes of excipients are required for the formulation of generic versions .

While the “patent cliff”—the phenomenon where multiple blockbuster drugs lose patent protection within a short timeframe—is often viewed as a significant threat to innovator companies, leading to steep revenue declines , for the excipient market, it represents a substantial opportunity. Generic manufacturers must reformulate these off-patent drugs, often with different excipients, to achieve bioequivalence and meet their cost targets. This creates a surge in demand for excipients that are not only cost-effective but also capable of ensuring the required performance and regulatory compliance for generic formulations. Excipient manufacturers and suppliers who proactively track these patent expirations using tools like DrugPatentWatch can anticipate these demand shifts and strategically tailor their offerings to the specific needs of the generic market, thereby gaining a significant competitive advantage. This foresight allows them to position themselves as indispensable partners in the generic drug development cycle.

6.1.2. Building Resilient Supply Chains and Supplier Partnerships

Optimizing pharmaceutical supply chains requires more than just efficient logistics; it demands robust collaboration and proactive risk management involving all stakeholders, particularly excipient suppliers. The inherent complexities and potential vulnerabilities of global supply chains, exacerbated by events like natural disasters, pandemics, or political unrest , underscore the critical need for resilience.

Building long-term partnerships with reliable excipient suppliers is a cornerstone of this strategy. Such partnerships foster transparency in communication, leading to quicker resource allocation, shared insights into changing market trends, and collective mitigation of risks. For instance, selecting suppliers who utilize dedicated equipment for excipient manufacturing significantly minimizes the risks of cross-contamination, a critical quality concern in pharmaceutical production.

The critical impact of excipient quality and the potential for supply chain disruptions highlight that a purely transactional relationship with suppliers is insufficient. The imperative is to move beyond mere procurement to a true “partnership imperative.” The need for “robust communication between excipient suppliers and drug manufacturers” and the cultivation of “long-term partnerships” transform procurement into a strategic function. This means companies must invest in deep supplier qualification processes, including comprehensive auditing and ongoing performance monitoring. It also involves fostering collaborative relationships where quality assurance and reliability are valued above just the lowest price. This strategic shift ensures not only consistent excipient quality but also a resilient supply chain capable of withstanding unforeseen disruptions, thereby safeguarding product integrity and market availability.

6.2. Intellectual Property: Protecting and Leveraging Excipient Innovations

Intellectual property (IP), particularly patents, serves as the very backbone of pharmaceutical innovation. Patents grant exclusive rights to inventors for a set period, providing a powerful incentive for the colossal investments in research and development (R&D) required to bring new drugs to market . However, the role of IP extends beyond the active pharmaceutical ingredient (API) to encompass the often-overlooked realm of excipients.

6.2.1. Patenting Strategies for Novel Excipients and New Uses

Novel excipients are increasingly recognized as valuable assets capable of providing significant intellectual property protection. This protection can manifest both in the form of excipient licensing agreements and through formulation-specific IP directly tied to a drug product . Patents can cover the unique chemical composition of a drug, its specific method of manufacture, or its intended medical use. Crucially, formulation patents are designed to protect new ways a drug is prepared or delivered, offering a distinct layer of protection beyond the API itself .

A particularly intriguing aspect of IP strategy involves patenting new uses for old inventions. Even if an existing excipient itself is not patentable due to prior art, a novel application or use for that excipient can indeed be patented. This allows pharmaceutical companies to repurpose existing materials in innovative ways, extending their commercial life and creating new value.

The development of co-processed excipients represents another fertile ground for IP. These materials, which combine two or more previously approved excipients into a new composite with novel functionality, can also be patented . For example, a patent might cover a co-processed binary mixture designed to enhance the dissolution profile of a poorly soluble drug .

Given the increasing sophistication and functional importance of excipients—including multifunctional, nano-sized, and “smart” variants—they are rapidly becoming “IP goldmines” . Patenting novel excipients, their innovative new uses, or their co-processed forms allows companies to create new revenue streams and establish market exclusivity that extends beyond the patent life of the API. This necessitates a strong IP strategy that includes thorough prior art searches, comprehensive freedom-to-operate (FTO) assessments, and a deep understanding of patentability criteria specifically for formulations and excipient modifications . Proactive IP management in this area can provide a significant competitive edge.

6.2.2. Navigating Patent Cliffs and “Evergreening” with Excipient Modifications

The pharmaceutical industry faces a recurring and significant challenge known as the “patent cliff,” where blockbuster drugs lose their patent protection, leading to dramatic revenue declines for innovator companies as generic competition floods the market . To mitigate this, pharmaceutical companies often employ strategies collectively known as “evergreening.” This involves securing new patents for minor modifications, improvements, or novel applications of existing products, often through new formulations or dosage forms, thereby prolonging commercial exclusivity .

Excipient modifications are a common and powerful technique in these evergreening strategies. For instance, developing extended-release versions of a drug, creating new administration routes (e.g., switching from intravenous to oral), or altering dosage forms can be achieved through strategic excipient changes . These modifications, while sometimes incremental in therapeutic benefit, can be sufficient to warrant new patents and extend market exclusivity. The example of a spray-dried HPV vaccine formulation using a specific combination of sugars and an amino acid to enhance thermostability illustrates how excipient innovation can extend a product’s viability and market reach.

The concept of “evergreening” illustrates the strategic “chessboard” of pharmaceutical IP. Excipient changes, far from being minor technical adjustments, become crucial moves to extend market exclusivity and mitigate the severe impact of patent cliffs. This is a complex interplay of legal, scientific, and business strategy, where every formulation decision can have profound IP implications. Innovator companies must leverage excipient-related innovations as an integral part of their lifecycle management strategies to extend product profitability. Conversely, generic companies must meticulously analyze these “evergreening” patents to identify opportunities for “designing around” the new claims or challenging their validity, which frequently leads to complex and costly patent litigation . Understanding this dynamic is essential for both innovators and generics in the competitive pharmaceutical landscape.

6.2.3. Competitive Intelligence: Harnessing Patent Data with DrugPatentWatch

In the fiercely competitive pharmaceutical sector, information is power. Patent analysis provides a wealth of data that can be transformed into actionable intelligence, revealing crucial pathways for growth, innovation, and strategic positioning . This goes beyond simply avoiding infringement; it involves proactively shaping market strategy.

This intelligence includes tracking patent expirations, which serve as a “generic market gateway” signaling opportunities for new product development . Analyzing secondary patents—those covering formulations, new uses, or manufacturing processes rather than the API itself—can uncover unmet formulation needs or reveal competitor strategies for extending product lifecycles . Monitoring emerging technologies and novel excipients through patent filings provides early warnings of disruptive innovations and potential new market segments .

Leveraging global patent databases and understanding international classification systems are critical for conducting comprehensive prior art searches and informing strategic market entry decisions. These tools allow companies to identify white spaces for innovation, assess the patent landscape surrounding specific excipients, and evaluate the freedom-to-operate for new formulations.

DrugPatentWatch is a particularly valuable resource for competitive intelligence in this domain. By systematically analyzing patent data, it helps businesses understand market trends, technological advancements, and competitor strategies related to excipients . This platform provides a “crystal ball” for market dynamics. By analyzing competitor patent filings on excipients or formulations, companies can anticipate future product launches, identify technological shifts, and uncover unmet formulation needs.

Table 2: Strategic Uses of Patent Data in Excipient Management

| Patent Data Application | Strategic Benefit | Relevance to Excipient Switching |

| Tracking Patent Expirations | Identifies “generic market gateway” opportunities for new product development. | Informs generic drug manufacturers on optimal timing for ANDA filings and excipient selection for cost-effective bioequivalent formulations. |

| Analyzing Secondary Patents (Formulation, Method of Use) | Uncovers competitor “evergreening” strategies and identifies specific formulation needs or innovations. | Helps innovators extend product lifecycle through excipient modifications; enables generic companies to “design around” or challenge formulation patents. |

| Monitoring Emerging Technologies & Novel Excipients | Provides early detection of disruptive innovations and potential new market segments. | Guides R&D investments in new excipient development or adoption; identifies opportunities for licensing novel excipients. |

| Freedom-to-Operate (FTO) Analysis | Mitigates legal risks by ensuring new formulations or excipient uses do not infringe existing patents. | Essential before launching new products or implementing excipient switches to avoid costly litigation. |

| Competitive Landscape Mapping | Understands competitor strengths, weaknesses, and strategic focus in excipient development and use. | Informs strategic partnerships, M&A decisions, and market positioning in the excipient supply chain. |

Integrating patent intelligence from platforms like DrugPatentWatch into R&D, procurement, and business development strategies is crucial for proactive decision-making. It allows companies to identify licensing opportunities, mitigate infringement risks, and strategically position themselves in the evolving excipient market, ultimately turning complex patent information into a tangible competitive advantage.

7. Case Studies: Lessons from the Pharmaceutical Frontier

Theory is one thing, but real-world examples illuminate the profound impact of excipient switching, showcasing both triumphant innovations and cautionary tales. These case studies underscore the critical importance of scientific rigor, regulatory foresight, and strategic planning.

7.1. Successful Excipient Switches: Achieving Cost Savings and Performance Improvements

Successful excipient switching demonstrates how strategic formulation adjustments can lead to significant economic benefits and enhanced product performance without compromising quality.

- Generic Drug Cost Reduction: The widespread adoption of generic drugs stands as a prime example of successful cost containment in healthcare. Generic drugs, which frequently involve the strategic switching of excipients, can be 80% to 85% cheaper than their branded counterparts . This substantial cost reduction is primarily attributed to lower development costs and the careful selection of different, often more affordable, excipients. This strategy has played a pivotal role in making essential medicines more accessible and significantly lowering overall healthcare expenses.

- Capsule-to-Tablet Transition for Cost-Efficiency: Many pharmaceutical companies initially develop drugs in capsule form during early clinical trials due to their cost-effectiveness and ease of formulation. However, upon commercialization, a strategic transition to tablet formulations is often pursued to achieve improved manufacturing efficiency and substantial cost reduction .

- Case Study: Starch 1500®:Microcrystalline Cellulose (MCC) Blend: A highly effective strategy for this transition involves utilizing a Starch 1500® and Microcrystalline Cellulose (MCC) blend in both capsule and tablet formulations. This specific blend facilitates a seamless shift, crucially maintaining consistent dissolution profiles, which is vital for regulatory approval and patient efficacy, while simultaneously avoiding the need for extensive stability studies and overcoming regulatory hurdles . This blend offers numerous benefits, including enhanced content uniformity for low-dose APIs, superior compressibility for robust tablet formation, improved disintegration time, better powder flow, and overall formulation flexibility . This case illustrates how a well-chosen excipient system can streamline manufacturing and reduce costs across different dosage forms.

- Enhanced Thermostability for Vaccines: Maintaining the stability of vaccines, particularly their thermostability, is a critical challenge, as it often necessitates expensive cold chain logistics. Excipients play a vital role in prolonging vaccine shelf life and enhancing their resistance to temperature fluctuations, thereby reducing the reliance on a stringent cold chain.

- Case Study: HPV Vaccine Formulation: A compelling example is a spray-dried, virus-like particle HPV vaccine formulation. This innovative formulation, which incorporates a specific combination of three sugars (mannitol, trehalose, and dextran) and the amino acid leucine as excipients, demonstrated remarkable stability. It retained high levels of potency (immunogenicity) even after being stored for over a year at 37°C. This achievement highlights how excipients can significantly expand a product’s reach, making it viable in regions with limited cold chain infrastructure, and substantially reduce distribution costs.

- Improved Drug Delivery with Nanoparticles: Excipients are increasingly central to the development of advanced drug delivery systems, enabling more precise and effective therapies.

- Case Study: Paclitaxel Bound to Albumin Nanoparticles: In the field of chemotherapy, paclitaxel, a potent anticancer drug, has been formulated by binding it to albumin nanoparticles. This excipient-enabled delivery system functions much like a “Trojan Horse,” allowing the drug to be delivered directly to tumor sites with significantly improved specificity and reduced systemic toxicity compared to conventional systemic formulations. This innovation, driven by the strategic use of an excipient, enhances therapeutic benefits and improves patient outcomes by minimizing off-target effects.

These successful cases clearly demonstrate that excipient switching is not merely about replacing a component to save money; it is fundamentally about optimizing the entire drug product. The “cost-cut” is often a direct byproduct of “compromise-free” innovation, leading to better patient outcomes (e.g., improved compliance, targeted delivery) and expanded market access (e.g., thermostable vaccines). Companies that view excipient innovation as a core strategy for product differentiation and market leadership are actively seeking out and developing novel and multifunctional excipients that can unlock new therapeutic possibilities and manufacturing efficiencies.

7.2. Challenging Switches and Product Failures: A Cautionary Tale for the Industry

While the benefits of excipient switching are compelling, the pharmaceutical industry is replete with cautionary tales of challenging switches and outright product failures. These incidents serve as stark reminders of the profound risks inherent in excipient changes when not managed with utmost scientific rigor and regulatory foresight. These cases represent the “hidden icebergs” that can sink a product if not carefully navigated.