Introduction: The New Great Game in Global Health

Few rivalries are as consequential, yet as misunderstood, as the escalating competition between India and China in the pharmaceutical sector. This is not merely a contest between two emerging economies; it is a strategic battle that will define the future of global health security, supply chain resilience, and the very source of medical innovation for decades to come. For years, the narrative has been deceptively simple: India, the undisputed “Pharmacy of the World,” a behemoth of generic drug manufacturing built on unparalleled volume and cost-efficiency.1 Opposing it is China, the indispensable “World’s API Factory,” the foundational supplier of the raw ingredients that fuel India’s production lines and, by extension, the medicine cabinets of the world.3

But this narrative is now dangerously obsolete. A seismic shift is underway. China, leveraging immense state capital and a fiercely implemented national strategy, is making an audacious pivot. It is no longer content to be the world’s workshop; it aims to be its laboratory. The Chinese dragon is transforming, moving with breathtaking speed from a master of imitation to a formidable engine of innovation.5 This evolution presents a profound challenge to India’s long-held position and forces a critical, high-stakes question upon global decision-makers: Can the Indian pharmaceutical industry, a titan built on process chemistry and scale, evolve its model to not only defend its current territory but to redefine its influence and mount a credible challenge to China’s emerging, multi-pronged dominance?

This report moves beyond the simplistic “generics versus APIs” dichotomy to conduct a comprehensive, multi-faceted strategic analysis of this new great game. We will dissect the capabilities, strategies, and national will of these two giants, examining their foundations of power and their most critical vulnerabilities. We will journey through the policy battlegrounds of ‘Make in India’ and ‘Made in China 2025,’ evaluating their real-world impact. We will quantify the staggering innovation gap in R&D investment and patenting, explore the crucial role of quality and regulatory trust as a global litmus test, and analyze the geopolitical tailwinds of the ‘China Plus One’ strategy that are reshaping global supply chains.

The objective is to provide a clear-eyed, data-driven verdict on the future balance of power in global pharmaceuticals. For business leaders, investors, and policymakers, understanding the nuances of this rivalry is no longer optional. It is essential for navigating the risks, seizing the opportunities, and ultimately, for shaping a global healthcare ecosystem that is both resilient and innovative. The game is afoot, and its outcome will affect us all.

Section 1: A Tale of Two Titans – The Current World Order

To comprehend the future trajectory of this rivalry, we must first establish a clear baseline of the present. The Indian and Chinese pharmaceutical industries are not just large; they are foundational pillars of the global healthcare system. Yet, their structures, growth drivers, and strategic postures are profoundly different, reflecting their unique historical paths and national ambitions. One is a story of explosive, export-driven scale; the other, a tale of controlled, state-mandated transformation.

The Indian Behemoth: A Profile in Scale and Growth

India’s pharmaceutical sector is a powerhouse of staggering proportions, a testament to decades of cultivating expertise in cost-effective manufacturing and process chemistry. Its market vitals paint a picture of relentless momentum and immense global significance.

The domestic market was valued at a substantial USD 61.36 billion in 2024. More impressive, however, is its growth trajectory. Projections indicate the market will nearly triple in size, rocketing to USD 174.31 billion by 2033, driven by a formidable compound annual growth rate (CAGR) of 11.32%. This blistering pace, confirmed by multiple analyses citing CAGRs between 8% and 9.48%, is roughly double the global average, underscoring the dynamism of both domestic demand and export potential.8

This growth is fueled by a confluence of powerful drivers. Domestically, an aging population and the rising prevalence of chronic, lifestyle-related diseases are creating sustained demand. The share of chronic therapeutic drugs in the Indian market, for instance, climbed to 38.1% in the year leading up to January 2024. Simultaneously, rising healthcare awareness and expanding infrastructure, such as Delhi’s Mohalla clinics which recorded 13.9 million appointments in 2024, are bringing modern medicine to previously underserved populations.

It is on the global stage, however, that India’s influence is most keenly felt. The moniker “Pharmacy of the World” is not hyperbole; it is a statistical reality. India is the world’s largest supplier of generic medicines by volume, single-handedly meeting 20% of the entire global demand.1 Its role in developed markets is critical; it provides over

40% of the generic medicines supplied to the United States and 25% of all medicines to the United Kingdom.2 Furthermore, its contribution to global health initiatives is unparalleled, supplying over

60% of the world’s vaccines and 70% of global antiretroviral drugs for HIV treatment.8

This export prowess makes the pharmaceutical sector a vital engine of the Indian economy. Pharma exports surged to USD 27.9 billion in the 2023-2024 fiscal year, marking a robust 9.67% increase from the previous year and representing a cornerstone of the nation’s trade surplus.12

The industry’s landscape is dominated by a cadre of formidable domestic champions. Companies like Sun Pharma (the largest by revenue at over ₹20,812 crore), Dr. Reddy’s Laboratories, and Cipla have evolved from local players into multinational giants with a vast global footprint, sophisticated manufacturing networks, and deep experience in navigating the world’s most stringent regulatory environments.13 Their success has built the foundation upon which India’s global reputation rests.

The Chinese Dragon: A Profile in Ambition and Transformation

While India’s story is one of established dominance in a specific domain, China’s is one of breathtaking transformation and strategic ambition. As the world’s second-largest pharmaceutical market, its scale is undeniable, but its true significance lies in its rapid and deliberate evolution from a low-cost manufacturing base into a high-tech innovation hub.

The Chinese pharmaceutical market is, in absolute terms, the larger of the two, valued at an estimated USD 80.41 billion in 2024. Its growth, while robust, is projected at a slightly more moderate CAGR of around 7.5% to 7.8%, which will see the market expand to approximately USD 126.59 billion by 2030.16 This massive domestic market provides Chinese companies with a protected and highly profitable foundation from which to launch their global ambitions—a key strategic advantage.

The central theme of China’s modern pharmaceutical narrative is its state-mandated pivot from imitation to innovation. For decades, the world knew China as the primary, and often sole, source of Active Pharmaceutical Ingredients (APIs) and the chemical intermediates needed to produce them. It was a volume game, a model built on scale and cost.3 Today, that model is being systematically dismantled and replaced. Driven by national policies like “Healthy China 2030,” the country is pouring vast resources into research and development, aiming to become a leader in novel drug discovery.17

This strategic shift is evident in the market’s changing composition. While conventional small-molecule drugs still constitute the largest segment, the fastest-growing and most lucrative area is now biologics and biosimilars. This is not a market accident; it is the direct result of a national strategy to climb the value chain and compete in the most advanced frontiers of medicine, such as oncology, cell and gene therapies, and antibodies.17

The corporate landscape reflects this transformation. While state-owned giants like Sinopharm remain dominant, a new class of innovators is rising to global prominence. Companies such as Jiangsu Hengrui Pharmaceuticals, CSPC Pharmaceutical Group, and BeiGene are no longer just names in a supply chain directory; they are increasingly recognized as research powerhouses and coveted partners for Big Pharma, striking multi-billion-dollar licensing deals for their innovative assets.3 This marks a fundamental change in China’s role, from a mere supplier to a creator of intellectual property.

Table 1: India vs. China – Pharmaceutical Market Snapshot (2024-2033F)

| Metric | India | China |

| Market Size (2024) | USD 61.36 Billion | USD 80.41 Billion |

| Projected Market Size | USD 174.31 Billion (by 2033) | USD 126.59 Billion (by 2030) |

| CAGR (%) | 11.32% (2025-2033) | 7.8% (2025-2030) |

| Global Generics Market Share (Volume) | ~20% (World’s Largest) | Significant, but trails India |

| Global API Market Share (Value) | ~8% 10 | Dominant; ~80% of generic APIs |

A Deeper Analysis of the Competitive Landscape

A surface-level reading of the data can be misleading. While India’s higher percentage growth rate—its impressive 11.32% CAGR—seems to give it a decisive edge, a deeper analysis reveals a more complex reality. China is growing from a significantly larger absolute market base. This means that even with a slower percentage growth, the dollar-value expansion of its domestic market is immense. This larger, protected home market generates vast pools of capital for Chinese firms. These profits can then be reinvested into high-risk, long-term R&D projects—a strategic luxury that Indian firms, more dependent on the high-volume, low-margin export of generics, cannot afford to the same degree. The headline-grabbing CAGR for India, therefore, masks a foundational financial advantage for China in its quest to fund a generation of innovation.

Furthermore, the very drivers of this growth signal the divergent strategic paths these two nations are on. India’s expansion is still intrinsically linked to its traditional strengths: the mass production of generics to meet the rising tide of chronic diseases both at home and abroad, and a focus on cost-efficiency.7 China’s growth, in stark contrast, is increasingly propelled by the highest-value segments of the market: biologics, novel oncology treatments, and advanced modalities like cell and gene therapy.16 This is not a passive evolution; it is the calculated outcome of a deliberate industrial policy designed to leapfrog legacy technologies and seize the high ground of pharmaceutical value creation. The two titans are not just growing; they are growing in fundamentally different directions, setting the stage for a clash of two distinct and competing models for global influence.

Section 2: Foundations of Power – The Generics-API Symbiosis and a Critical Vulnerability

The current world order in pharmaceuticals was not built overnight. It is the product of decades of specific policy choices, national strengths, and strategic dependencies. India’s global reputation is forged in the fires of process chemistry and access to medicine, while China’s power is rooted in its near-total control over the foundational building blocks of the industry. This symbiotic relationship, however, conceals a profound and dangerous imbalance—one that represents the single greatest threat to India’s pharmaceutical sovereignty.

India’s Generics Empire: A Legacy of Process Chemistry

The genesis of India’s pharmaceutical might can be traced to a single, transformative piece of legislation: the Indian Patents Act of 1970. In a radical departure from Western intellectual property norms, this act abolished “product patents” for medicines and recognized only “process patents”.1 This masterstroke of policy meant that Indian companies were legally free to reverse-engineer patented drugs, as long as they could devise a novel manufacturing process. It was a decision that perfectly matched the nation’s strengths—a deep pool of talented chemists and a focus on frugal innovation—and it single-handedly unleashed the Indian generics industry.

This new legal framework allowed domestic champions to flourish. Companies like Cipla and Ranbaxy became world-renowned for their prowess in process chemistry, mastering the art of producing high-quality, affordable versions of life-saving medicines at a fraction of the cost of their branded counterparts.

The global impact of this capability was nothing short of revolutionary. In the early 2000s, as the HIV/AIDS epidemic ravaged sub-Saharan Africa, the Mumbai-based firm Cipla took a stand that would forever change the landscape of global public health. At a time when treatment cost upwards of $15,000 per patient per year, Cipla leveraged India’s patent laws to create a combination of antiretroviral drugs that it offered for about a dollar a day. This bold move shattered the monopoly of Western pharmaceutical giants and helped slash the annual cost of treatment to as low as $200 by 2005, saving millions of lives and cementing India’s reputation as a global health champion.

Today, that legacy has scaled to an industrial empire. India’s dominance in generics is absolute, supplying 20% of the world’s volume and holding a critical position in the healthcare systems of the US and the UK.2 This empire is the source of its current global influence and its most visible contribution to world health.

China’s API Hegemony: The Unseen Foundation of Global Pharma

If India built the world’s pharmacy, China built the factory that supplies its bricks. China’s journey to dominance in Active Pharmaceutical Ingredients (APIs) was a masterclass in strategic industrial policy. Beginning in the late 1980s and accelerating dramatically after its entry into the World Trade Organization, China systematically built its capabilities, moving from basic chemical intermediates to full-scale API manufacturing.

This ascent was fueled by a potent combination of factors. Massive economies of scale, driven by dedicated industrial zones, allowed for unparalleled production volumes. Generous government incentives, including low land prices and infrastructure support, reduced the cost of capital. Furthermore, lower utility costs and, for many years, less stringent environmental and labor regulations, created a cost structure that global competitors simply could not match.20

The result is a near-monopolistic control over the foundational layer of the global pharmaceutical supply chain. By 2023, it was estimated that China controlled approximately 80% of the global supply chain for generic APIs. This is not just market leadership; it is hegemony.

Price became China’s most effective strategic weapon. By leveraging its structural cost advantages, China was able to offer essential APIs at prices 20-30% cheaper than any other supplier in the world. This relentless price pressure systematically hollowed out API manufacturing in higher-cost regions like the United States and Europe. More critically, it also decimated India’s once self-sufficient API industry, forcing Indian formulation manufacturers to abandon local suppliers in favor of cheaper Chinese imports to remain competitive in the global generics market.

The Achilles’ Heel: Quantifying India’s API Dependency on China

Herein lies the critical vulnerability at the heart of India’s pharmaceutical power. Its magnificent generics empire is built on a foundation of sand—a foundation controlled entirely by its primary strategic rival. The statistics are stark and alarming.

Today, India imports an estimated 70% of its total API requirements from China.29 This is not a theoretical risk; it is a deeply embedded structural dependency. For many of the most essential and widely used medicines, this reliance is near-total. A government report identified 58 critical APIs for which India was heavily dependent on China; for 45 of these, the dependency was 100%.

Consider these powerful examples of China’s share of India’s imports for specific, critical bulk drugs 32:

- Paracetamol: 91%

- Ibuprofen: Near-total dependence

- Ciprofloxacin: 99.6%

- Amoxicillin: 89.9%

- Penicillin G & its salts: 95.8%

- Streptomycin: 100%

- Sulphadimidine: 100%

This is not a static problem but a worsening one that reveals a three-decade-long strategic failure. In the early 1990s, India was largely self-sufficient in APIs, with imports from China accounting for a mere 1% of its needs. By 2019, that figure had skyrocketed to over 70%.29 This dramatic shift represents a slow-motion hollowing out of India’s domestic capabilities, driven by the irresistible logic of Chinese price competitiveness.

A Deeper Analysis of a Strategic Trap

This symbiotic relationship is, in fact, a strategic trap for India. The nation’s greatest strength—its ability to mass-produce affordable generic medicines—is directly contingent on the willingness of its chief competitor to supply the necessary raw materials. This gives Beijing extraordinary and dangerous leverage. It is not an exaggeration to say that China holds a veto power over a significant portion of the world’s medicine supply. A politically motivated export restriction, a sudden price hike, or a domestic disruption in China could instantly cripple Indian pharmaceutical production, triggering global drug shortages and creating a diplomatic crisis that Beijing could exploit for geopolitical gain. The supply chain chaos during the initial phase of the COVID-19 pandemic, which caused panic among Indian policymakers, was a stark and tangible demonstration of this very vulnerability.

More alarmingly, there is compelling evidence that China is now actively weaponizing this dependency to thwart India’s attempts at self-reliance. As New Delhi rolls out its ambitious Production-Linked Incentive (PLI) scheme to encourage domestic API manufacturing, Chinese producers have responded not by competing on a level playing field, but by engaging in strategic price dumping. Recent data reveals a calculated campaign of undercutting. The landed cost of Chinese atorvastatin, a key cholesterol drug input, has been slashed by 33% to ₹8,000 per kilogram, significantly below the Indian domestic price of ₹10,000. Similarly, for the antibiotic ofloxacin, the Chinese price has been dropped by 30% to ₹2,100 per kilogram, compared to India’s domestic price of ₹2,700.

This is not simple market economics; it is strategic economic warfare. China is leveraging its immense, state-backed scale to flood the Indian market with APIs at prices that make new Indian investments economically unviable from the outset. By doing so, it aims to ensure the failure of India’s flagship self-sufficiency policy, thereby preserving India’s critical dependency and maintaining its own geopolitical leverage. India is not just in a competition; it is facing a calculated assault on its industrial sovereignty.

Section 3: The Policy Battleground – ‘Make in India’ vs. ‘Made in China 2025’

The rivalry between India and China is no longer playing out solely on factory floors or in corporate boardrooms. It has escalated into a direct confrontation of national industrial policies. On one side stands India’s ‘Make in India’ initiative, embodied by the Production-Linked Incentive (PLI) schemes—a targeted, defensive maneuver aimed at reclaiming lost ground in API manufacturing. On the other is China’s ‘Made in China 2025’—a sweeping, offensive grand strategy designed for nothing less than global technological supremacy. The clash between these two policies reveals a fundamental asymmetry in ambition, scale, and execution that will shape the competitive landscape for years to come.

India’s Counter-Offensive: The Production-Linked Incentive (PLI) Scheme

Awakened to its critical vulnerabilities by the COVID-19 pandemic, the Indian government launched a series of Production-Linked Incentive (PLI) schemes as the centerpiece of its ‘Atmanirbhar Bharat’ (Self-Reliant India) campaign. For the pharmaceutical sector, two schemes are paramount: one for Bulk Drugs with a financial outlay of ₹6,940 crore (approx. USD 900 million), and a broader one for Pharmaceuticals with an outlay of ₹15,000 crore (approx. USD 2 billion).12

The core objective is twofold. First, it is a direct assault on the nation’s dependency on China. The Bulk Drugs scheme specifically targets 41 critical Key Starting Materials (KSMs), Drug Intermediates (DIs), and APIs for which India is heavily import-reliant. The goal is to incentivize domestic manufacturing through financial rewards linked to incremental sales, thereby shoring up the supply chain. Second, the broader Pharmaceuticals scheme aims to push the industry up the value chain, encouraging diversification into complex generics, patented drugs, and biopharmaceuticals.

The policy is beginning to yield tangible, if modest, results. The PLI for Bulk Drugs has spurred significant investment, with ₹4,570 crore invested by March 2025, surpassing the initial committed target. This has led to the creation of production capacity for 25 targeted products and cumulative sales of ₹1,817 crore, which the government estimates has averted imports worth ₹1,362 crore. The broader Pharmaceuticals PLI has also shown promise, enabling domestic sales of ₹22,658 crore, including over 190 products that were manufactured in India for the first time.

However, the PLI scheme is far from a panacea and has faced significant challenges. Its design and implementation have revealed critical flaws. The Bulk Drugs scheme has been plagued by a remarkably high withdrawal rate, with 17 of the 48 initially selected beneficiaries exiting the program, signaling a disconnect between the policy’s goals and its practical viability for businesses.

A primary reason for this is the scheme’s burdensome requirements, particularly for the Small and Medium Enterprises (SMEs) that form the backbone of the API sector. Companies have struggled to meet the stringent Domestic Value Addition (DVA) mandates—90% for fermentation-based products and 70% for chemical synthesis-based products—and have been deterred by exorbitant bank guarantee requirements. These hurdles suggest a policy designed more for large, established players than for fostering a broad and resilient industrial base.

Most critically, despite these efforts, the scheme’s macro-level impact on import dependency remains questionable. Paradoxically, China’s share in India’s API imports has actually increased since the scheme’s launch, rising from 70% to 72% between 2019 and 2022. In volume terms, API imports from China grew by a staggering 30% between 2021 and 2024. This sobering data suggests that the PLI scheme, in its current form, is struggling to turn the tide against the overwhelming force of China’s scale and aggressive pricing strategies.

China’s Great Leap Forward: ‘Made in China 2025’ and ‘Healthy China 2030’

In stark contrast to India’s targeted, reactive policy, China’s approach is a comprehensive, proactive grand strategy. ‘Made in China 2025’ (MIC2025) is not merely a pharmaceutical policy; it is a national blueprint to transform China from the world’s factory into a dominant global power in ten high-tech industries, with biomedicine and high-performance medical devices as central pillars.39

The ambition is sweeping: to achieve technological self-sufficiency, reduce reliance on foreign intellectual property, and create national champions capable of competing with—and ultimately surpassing—their Western counterparts. The policy sets explicit and aggressive targets, such as increasing the domestic content of core components and materials to 70% by 2025.39

This is a whole-of-government endeavor, backed by a formidable arsenal of policy levers. The strategy is fueled by hundreds of billions of dollars in direct state funding, preferential low-interest loans, generous tax breaks for R&D, and state-supported mergers and acquisitions of foreign technology companies. It is a coordinated, top-down industrial strategy on a scale few nations could contemplate, let alone execute.

And it is working. MIC2025 has been a powerful catalyst for China’s transformation. It has directly fueled a massive surge in R&D spending, propelling Chinese firms to gain significant domestic market share at the expense of foreign multinationals. More importantly, it has ignited a wave of genuine innovation. The policy’s focus on biologics, antibody-drug conjugates (ADCs), and other advanced therapies has led to a flurry of breakthroughs, culminating in a series of major out-licensing deals where Western pharmaceutical giants are now paying billions to access Chinese-developed innovations. This represents a complete inversion of the historical dynamic and is the clearest evidence of MIC2025’s success.

A Deeper Analysis of a Strategic Mismatch

When placed side-by-side, the fundamental asymmetry between the two nations’ policies becomes glaringly apparent. India’s PLI scheme is a defensive, tactical response to a specific, existing problem: its API dependency. Its success is measured internally, by metrics like “imports avoided.” In contrast, China’s MIC2025 is an offensive, grand strategy for future global dominance. Its success is measured externally, by global market share, technological leadership, and the creation of world-beating national champions. India’s policy is reactive, aiming to fix a past strategic failure. China’s policy is proactive, designed to conquer the future. This profound difference in strategic vision and scale places India at a significant long-term disadvantage.

Furthermore, the very design of India’s policy may be inadvertently undermining its own objectives. The high withdrawal rate from the PLI scheme and the vocal complaints from SMEs about its impractical requirements point to a critical flaw: a potential disconnect between the policymakers in New Delhi and the on-the-ground realities of the industry they seek to support. By creating excessive hurdles for the very companies it needs to build a resilient API ecosystem, the policy risks slowing the pace of self-reliance. This sluggish progress plays directly into China’s hands, giving its strategy of using sustained price pressure to kill the Indian initiative a greater chance of success. The battle of policies is not just about intent; it is about effective, pragmatic execution, and on this front, China’s unified, state-driven approach currently appears far more potent.

Section 4: The Race to the Future – The Innovation Imperative

While the current battle is being fought over supply chains and manufacturing costs, the war for future dominance will be won or lost in the laboratory. The transition from a volume-based to a value-based model hinges on one critical capability: innovation. It is in this domain—the high-stakes race to discover and develop the next generation of medicines—that the chasm between China and India is at its widest and most alarming. An analysis of R&D investment, the patent landscape, and the crucial linkages between academia and industry reveals a systematic, well-oiled “innovation assembly line” in China, while India is still struggling to connect the pieces.

The R&D Investment Chasm

The raw numbers tell a stark and unambiguous story of divergent priorities. China has made scientific research a national crusade, investing a massive 2.4% of its GDP into R&D. India, by contrast, invests less than 1% of its GDP, with the figure hovering around a meager 0.64%.5 This is not just a gap; it is a canyon. In absolute terms, given the difference in GDP size, China’s R&D expenditure dwarfs India’s by an order of magnitude, providing a nearly insurmountable financial advantage.

Equally telling is the source of this funding. In most innovative economies, the private sector is the primary engine of commercially-oriented R&D. China is moving rapidly in this direction, with private industry driving a significant portion of its total R&D spend. In India, the dynamic is inverted: the government accounts for the majority of R&D spending (64%), while the private sector contributes only 36%.44 This points to a deep-seated cultural issue—a risk-averse corporate environment that has historically shied away from the long-term, high-risk bets required for true innovation.

This trend is reflected at the corporate level. While major global pharmaceutical companies typically reinvest around 15% of their sales revenue back into R&D, the average for Indian firms has historically been below 2%. Although leading companies like Dr. Reddy’s and Sun Pharma are increasing their R&D budgets, the industry as a whole lags far behind. As one expert bluntly stated, many Indian companies have traditionally been fond of “low-hanging fruits” rather than the “high risk and high reward” game of novel drug discovery.

The Patent Landscape: A Leading Indicator of Future Dominance

If R&D spending is the input, then patents are the output—a leading indicator of future market power. Here, the data signals a decisive shift in the global balance of innovation. China has transformed itself into a patenting superpower. In 2023 alone, it recorded over 1.5 million resident patent applications, a staggering figure that dwarfs the rest of the world. While India has also seen commendable growth, with an increase of over 8,700 applications in the same year, the sheer difference in scale is overwhelming.

More important than the quantity of patents is their quality and focus. China is strategically targeting the highest-value frontiers of medicine. It is now a top-five applicant location globally for both vaccine and therapeutic patents. The country has experienced a particular boom in the revolutionary field of Cell and Gene Therapy (CGT), with over 3,000 related patents granted between 2017 and 2019 alone. This demonstrates a clear, strategic intent to not just participate in but to lead the development of next-generation therapies.

India’s efforts, while growing, remain nascent in comparison. The country is increasing its patent filings, particularly in the biologics and biosimilars space, but the volume and strategic focus on cutting-edge areas like CGT and genome editing lag significantly behind China.49

In this increasingly complex intellectual property landscape, sophisticated competitive intelligence tools become indispensable. Platforms like DrugPatentWatch are crucial for companies seeking to navigate this terrain. By providing detailed analysis of patent filings, companies can track the competitive landscape, identify emerging threats from Chinese innovators, and uncover “white space” opportunities for their own R&D. For Indian firms, whether they are generic players planning a biosimilar launch or aspiring innovators, the ability to dissect a competitor’s patent “thicket” or analyze formulation strategies revealed in patent documents is no longer a luxury—it is a core requirement for survival and growth.52 Using data from resources like the FDA’s Orange Book, which is integrated into such platforms, allows for precise tracking of patent expiration timelines, enabling strategic planning for generic entry. This level of patent intelligence is fundamental to competing effectively in the modern pharmaceutical era.

The Collaboration Gap: Academia-Industry Linkages

Breakthrough innovation rarely happens in a vacuum. It thrives in ecosystems where academic discovery is seamlessly translated into industrial application. It is here that the structural differences between India and China are most profound.

China has diligently built an integrated innovation ecosystem. It has actively and successfully fostered collaboration between its universities and its pharmaceutical industry, a partnership that has become a powerful engine of its innovative capacity. Empirical studies have shown that Chinese firms with strong university linkages report higher new product sales and produce patents that are of higher quality and more exploratory in nature.55 The Chinese government reinforces this system with direct grants to support joint industry-academia projects, effectively lubricating the entire pipeline from lab to market.

India’s system, in stark contrast, is described by experts as siloed, dysfunctional, and culturally misaligned. In global rankings, India places a dismal 86th in university-industry R&D collaboration. Experts within the industry lament a system plagued by a lack of applied research in academia, deep-seated mistrust between academic and corporate leaders, and a “race to the bottom” culture that is “toxic for innovation”.5 There is a clear “brain drain” of top scientific talent, with the best minds leaving the country and rarely returning, and a pervasive lack of the risk-taking culture that is the lifeblood of breakthrough science.

A Deeper Analysis of the Innovation Race

The evidence leads to a sobering conclusion: China is systematically constructing an “innovation assembly line,” while India is still searching for the blueprints. China’s approach is a well-oiled machine. High levels of state and private R&D investment fuel a torrent of basic research in its universities. Strong and incentivized industry-university collaboration acts as a conveyor belt, efficiently moving these discoveries from the laboratory to the factory floor. The tangible results are a surge in high-quality, commercially-oriented patents and a series of blockbuster out-licensing deals that signal the arrival of Chinese innovation on the world stage. India, despite possessing a deep well of talented scientists, is hampered by a dysfunctional system. Low private sector R&D investment means less commercially-focused research is undertaken in the first place. Weak and mistrustful linkages between academia and industry create a “valley of death,” where even the promising discoveries that do emerge often fail to be commercialized. China’s lead, therefore, is not merely a function of money; it is a function of the superior structure and efficiency of its entire innovation pipeline. For India to compete, it must do more than simply increase spending; it must fundamentally rewire the relationship between its academic and industrial sectors.

Ultimately, the patent data provides the clearest and most chilling prediction of the future balance of power. The sheer volume and, more importantly, the strategic focus of patents being filed by China—in biologics, CGT, ADCs—versus India’s continued emphasis on generics and biosimilars, indicates that the competitive landscape in a decade will be unrecognizable. A patent grants a 20-year monopoly; today’s filings are a direct map of tomorrow’s market dominance. China is aggressively filing thousands of patents in the most advanced and lucrative fields of medicine, creating dense “patent thickets” that will make it incredibly difficult and expensive for Indian companies to enter these future markets, even as followers. This raises a critical strategic risk: while India is fighting yesterday’s war by onshoring APIs for today’s generic drugs, China is already conquering the territory for tomorrow’s war over biologic and cell therapy blockbusters. Without a radical shift in strategy, India risks being permanently relegated to a lower-value, less influential tier of the global pharmaceutical ecosystem.

Section 5: Quality, Speed, and Trust – The Regulatory Gauntlet

In the global pharmaceutical market, trust is the ultimate currency. For nations like India and China, whose export ambitions depend on penetrating the highly regulated markets of the United States and Europe, the quality of their products and the credibility of their regulatory systems are non-negotiable. The gatekeepers—the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA)—wield immense power, and their inspection outcomes serve as a global litmus test for compliance and manufacturing excellence. An analysis of the domestic regulatory bodies, the Central Drugs Standard Control Organization (CDSCO) in India and the National Medical Products Administration (NMPA) in China, alongside recent FDA enforcement trends, reveals a fascinating dynamic: the historical “quality gap” is rapidly closing, shifting the competition from mere compliance to a race for a “gold standard” reputation.

The Gatekeepers: CDSCO vs. NMPA

The regulatory philosophies of India and China reflect their distinct industrial trajectories. India’s Central Drugs Standard Control Organization (CDSCO), governed by the venerable Drugs and Cosmetics Act of 1940, has traditionally been geared towards facilitating the swift approval of generic drugs. Its primary focus has been on ensuring the affordability and accessibility of essential medicines for India’s vast population, a mandate that has shaped its processes and priorities.

China’s National Medical Products Administration (NMPA), conversely, has undergone a radical and strategic transformation since 2015. Recognizing that its old, notoriously slow, and opaque system was a major bottleneck to its innovation ambitions, Beijing initiated sweeping reforms to align the NMPA with global standards set by the FDA and EMA. A key part of this overhaul has been the introduction of modern regulatory pathways, including fast-track approval, priority review, and breakthrough therapy designations, all designed to accelerate the market entry of innovative and life-saving drugs.61

This philosophical divergence is reflected in their approval timelines for new drugs. While both agencies have a standard review timeline estimated at around 12 to 18 months, their expedited pathways tell a different story. India’s CDSCO offers an expedited review of 6-9 months, with recent guidelines aiming to further streamline committee recommendations to within seven days.63 China’s NMPA, however, has aggressively leveraged its new priority review pathway to also achieve a 6 to 9-month timeline for innovative drugs. This has dramatically reduced its historical “drug lag” compared to the US and EU, making China an increasingly attractive market for first-launch strategies.63

The Global Litmus Test: FDA & EMA Inspection Outcomes

For export-oriented pharmaceutical industries, domestic approval is only the first step. The ultimate validation of quality comes from passing the rigorous inspections of the FDA and EMA. Historically, both India and China have been hotspots for regulatory scrutiny, consistently topping the list of foreign countries receiving FDA Warning Letters and import alerts.66 Common citations have traditionally revolved around systemic failures in data integrity, inadequate quality control systems, and poor cleaning and sanitation protocols.

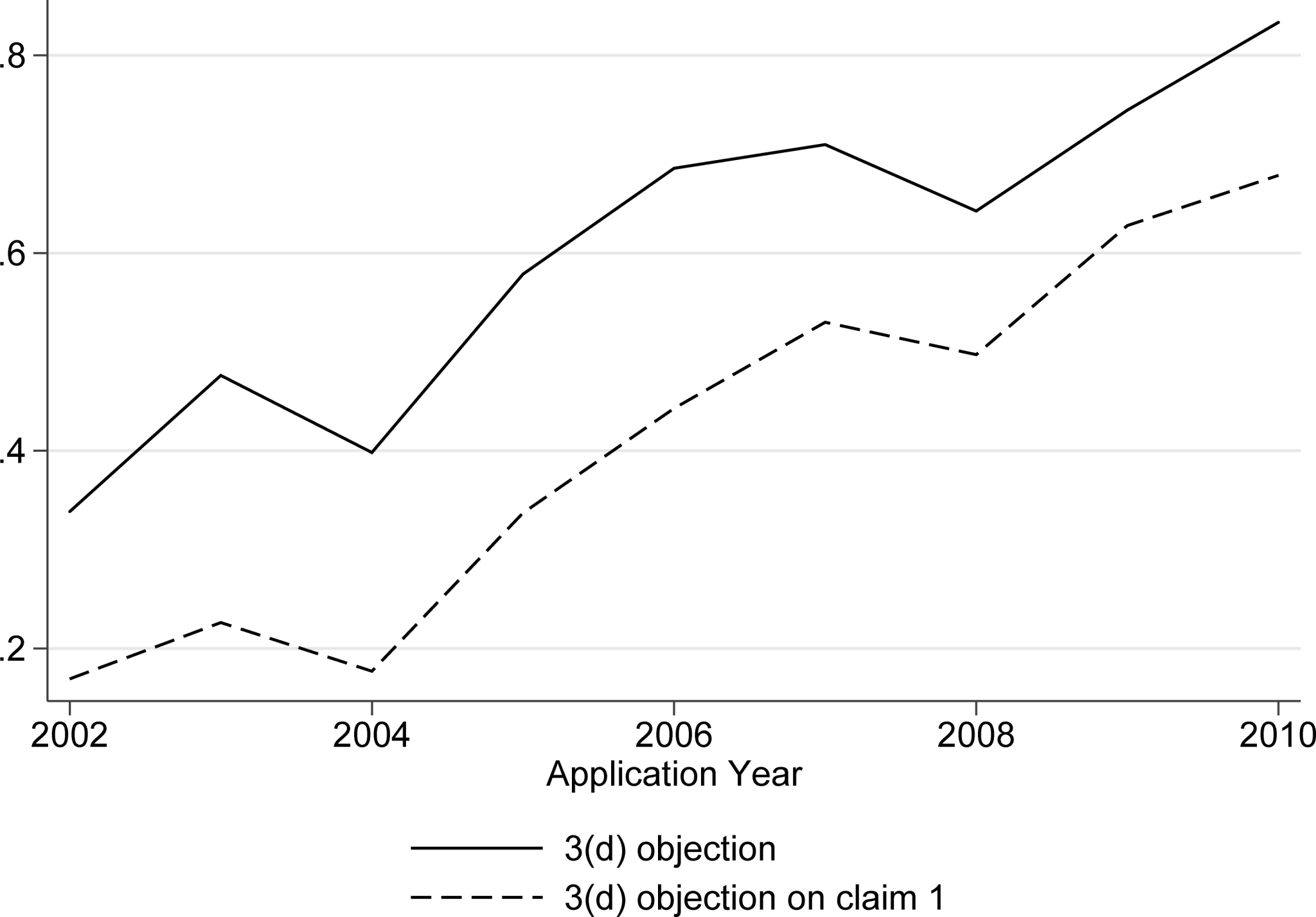

However, a closer look at recent trends reveals a significant and positive evolution, particularly in India. The data points to a sharp and sustained improvement in compliance. The rate of inspections resulting in an “Official Action Indicated” (OAI) classification—the most serious finding, which recommends regulatory action—dropped by a remarkable 50% between the 2013-14 and 2023-24 periods. More recently, the OAI rate for Indian facilities has stabilized at around 7% in 2024, a dramatic improvement from 14% in 2022 and the historical highs of 15-20% seen before the pandemic. This demonstrates a clear, measurable enhancement in the Indian industry’s quality management systems and regulatory maturity. That said, challenges persist. An analysis of FDA Warning Letters issued to Indian firms between 2022 and May 2025 shows that core issues like failure to maintain product quality and purity (24% of citations), poor data documentation (21%), and inadequate hygiene (21%) remain areas of concern.

China, meanwhile, is undergoing its own trial by fire as the FDA aggressively ramps up its post-COVID inspection activities. After a pandemic-induced lull, the number of FDA inspections in China has surged from a mere 8 in fiscal year 2022 to 159 in FY2024, with projections suggesting a return to pre-pandemic levels of over 220 in FY2025.69 Amidst this intensified scrutiny, China’s performance has been notable. Its OAI rate in FY2024 stood at

7.5%, a figure remarkably similar to India’s improved rate. However, a recurring and critical theme in recent FDA actions against Chinese firms is data integrity. Multiple warning letters have cited systemic failures in data management, raising serious questions about the reliability of records and the overall quality culture.

Table 2: Global Regulatory Scrutiny – FDA Inspection Outcomes (FY2022-2024)

| Metric | India | China |

| Total FDA Drug Inspections (CY24) | 256 | 106 (FY24) |

| OAI Classifications (CY24 / FY24) | ~18 (calculated) | 12 |

| OAI Rate (%) | ~7% (CY24) | 7.5% (FY24) |

| Common Themes in Warning Letters | Quality/Purity Failures, Data Documentation, Hygiene | Data Integrity Failures, Laboratory Oversight, Quality Systems |

A Deeper Analysis of the Race for Trust

The long-held narrative that Indian and Chinese pharmaceuticals are inherently “low quality” is becoming demonstrably outdated. The data clearly shows that both countries, under intense international pressure, are making significant strides in improving their manufacturing standards. The convergence of their OAI rates to a similar, much-improved level suggests that the old “quality gap” is closing. This shifts the nature of the competition. The new battle is no longer about simply avoiding failure and getting off import alert lists; it is about proactively demonstrating excellence. The country that can successfully brand itself as the most reliable, transparent, and consistently high-quality manufacturing partner will win the trust—and the high-value contracts—of the global pharmaceutical industry. This presents a massive strategic opportunity for India to capitalize on its improving track record and its deep experience with regulated markets.

Meanwhile, China’s radical overhaul of the NMPA represents a brilliant strategic maneuver. By creating fast, predictable, and globally-aligned regulatory pathways for innovative drugs, Beijing is transforming its regulatory body from a bureaucratic barrier into a powerful enabler of its ‘Made in China 2025’ ambitions. This regulatory modernization does more than just speed up approvals; it sends a powerful signal to the global pharmaceutical industry that China is a top-tier priority market for innovation. It actively incentivizes both domestic innovators and multinational corporations to conduct cutting-edge R&D and launch new products in China, often concurrently with the US and EU. This creates a virtuous cycle of investment, research, and commercialization that directly fuels its innovation ecosystem. India’s CDSCO, while improving, remains primarily structured around a generics-first model. This regulatory misalignment with the needs of an innovation-driven industry could become a significant bottleneck, hindering India’s own aspirations to move up the value chain. In the 21st century, regulatory agility has become a potent competitive weapon, and China is wielding it with formidable skill.

Section 6: The Geopolitical Chessboard – ‘China Plus One’ and Shifting Alliances

Beyond the internal dynamics of policy and innovation, the India-China pharmaceutical rivalry is being profoundly shaped by powerful external forces. A tectonic shift in global supply chain strategy, known as ‘China Plus One,’ is creating a once-in-a-generation opportunity for India to capture market share and redefine its role. This geopolitical tailwind, accelerated by trade tensions and a growing desire for resilience, is no longer a theoretical concept but a tangible reality, with Indian companies already reaping the early benefits. However, capitalizing on this momentum is not a foregone conclusion; it will require India to overcome its own internal challenges and prove it can be a truly viable and reliable alternative.

The ‘China Plus One’ Tailwind

The ‘China Plus One’ (C+1) strategy has emerged as a dominant theme in global boardrooms. It represents a fundamental rethinking of supply chain management, moving away from a singular focus on cost-efficiency towards a more balanced approach that prioritizes resilience, diversification, and risk mitigation.71 The strategy does not necessarily entail a complete exit from China, but rather the establishment of a second, parallel supply chain in another country to de-risk from an over-reliance on a single source.

This strategic shift has been catalyzed by a perfect storm of recent events: the US-China trade war, which introduced tariff uncertainty; rising labor costs in China, which have eroded its traditional cost advantage; and, most critically, the severe supply chain disruptions experienced during the COVID-19 pandemic, which exposed the fragility of a hyper-concentrated global manufacturing system.74

In this global realignment, India stands out as the prime beneficiary. It is widely regarded as the most logical “Plus One” destination for pharmaceutical manufacturing and R&D services, thanks to a unique combination of advantages: its existing large-scale manufacturing infrastructure, a deep pool of skilled scientific talent, significantly lower production costs (an estimated 33% lower than in the US), and, crucially, the largest number of FDA-compliant manufacturing plants outside of the United States.72

The evidence of this shift is now concrete and compelling. The C+1 effect is actively translating into new business for Indian Contract Development and Manufacturing Organizations (CDMOs) and Contract Research Organizations (CROs). A recent Goldman Sachs report, based on meetings with leading Indian firms, confirmed that companies like Syngene International, Neuland Laboratories, and Divi’s Laboratories are experiencing a significant uptick in Requests for Quotations (RFQs) from global clients specifically looking to diversify their supply chains away from China.73

More importantly, these inquiries are converting into tangible contracts:

- Case Study: Syngene International, a subsidiary of Biocon, has already signed contracts stemming directly from pilot projects related to geographic supply chain diversification.

- Case Study: Neuland Labs successfully secured three new projects from a large innovator pharmaceutical company that was explicitly shifting development work out of China.

- Case Study: TheraNym Bio, an arm of Aurobindo Pharma, announced a landmark decade-long commercial manufacturing deal with Merck Sharp & Dohme (MSD), a clear strategic win driven by the C+1 imperative.

This trend is also fueling strategic investment. Indian firms are proactively acquiring assets and building capabilities to capture this new wave of demand. Suven Pharmaceuticals’ acquisition of NJ Bio, a US-based firm specializing in antibody-drug conjugates (ADCs), is a prime example of an Indian company strategically positioning itself to win high-value development contracts that might previously have gone to China.

The Long Road to Monetization

Despite the palpable momentum, industry leaders and financial analysts caution that the full financial impact of the C+1 strategy will be a gradual process. The consensus, articulated in reports from firms like Goldman Sachs, is that while the initial contracts are being signed now, the large-scale financial benefits will likely materialize over a 3- to 5-year horizon.73 This is because the transition involves a multi-stage process, moving from initial RFQs to smaller pilot projects, and only then scaling up to full, multi-year commercial manufacturing agreements.

Furthermore, India’s ability to fully capitalize on this historic opportunity is not guaranteed. It must first overcome several significant and long-standing internal hurdles that could limit its appeal as a true alternative to China’s efficiency and scale:

- The Domestic Innovation Deficit: A persistent weakness in original R&D makes it more challenging for Indian firms to compete for the most lucrative early-stage development and manufacturing contracts for novel therapies.

- Talent Attrition: The Indian life sciences sector is plagued by high turnover rates for scientific talent, particularly at the entry level. This “employee poaching” creates a significant risk to the scalability and stability of operations as companies try to expand rapidly.

- Regulatory and Execution Delays: Industry veterans candidly warn that India’s notorious bureaucratic red tape and slower project execution speeds remain a key concern for global partners accustomed to China’s rapid pace. To be a truly viable alternative, India must demonstrate not just cost-effectiveness, but also speed and reliability.

A Deeper Analysis of a Geopolitical Catalyst

The ‘China Plus One’ movement represents far more than just a passive tailwind for India. It is a powerful external catalyst that is actively forcing internal reform within the Indian pharmaceutical industry. The sheer scale of the opportunity—billions of dollars in high-value, long-term CDMO and CRO contracts—is creating immense commercial pressure on Indian companies to finally address their long-standing weaknesses. The global demand for a reliable, high-quality alternative to China provides a compelling financial incentive to invest in upgrading quality systems, streamlining project management, and building new, advanced capabilities. We see direct evidence of this in the wave of recent investments by Indian firms in areas like biologics (Aragen, Aurigene) and ADC capacity (Cohance, Piramal Pharma), all aimed at meeting this new, sophisticated demand.76 In essence, the C+1 strategy is compelling the Indian industry to evolve faster and more strategically than it would have on its own.

Looming over this entire landscape is a potential “black swan” event: the US BioSecure Act. This proposed legislation, which aims to prohibit US federal agencies from contracting with certain Chinese biotechnology companies, represents a massive geopolitical accelerant. While its final form and passage are uncertain, the act has already sent a shockwave through the industry, signaling a clear political intent from the United States to decouple critical healthcare supply chains from China on national security grounds.73 Prudent multinational pharmaceutical companies cannot afford to ignore this signal. They are now being forced to proactively build parallel, China-free supply chains not just as a matter of good business practice, but as a matter of strategic necessity to avoid future legislative risk. This moves the C+1 conversation from “if” to “when and how,” creating enormous urgency. Should the BioSecure Act or similar legislation move forward, it could dramatically accelerate the 3- to 5-year timeline for monetization, presenting India with an unprecedented, and perhaps unrepeatable, opportunity to capture a massive share of the global pharmaceutical value chain.

Conclusion: The Verdict and a Roadmap for Redefining Influence

We return to the central, animating question of this report: Can Indian pharma redefine its global influence over China? After a comprehensive analysis of the market dynamics, industrial policies, innovation ecosystems, and geopolitical shifts, the verdict is necessarily nuanced. The answer is not a simple yes or no, but rather a strategic assessment of a two-tiered competition playing out over different timelines.

On the first tier—the battle for supremacy in the current global supply chain—the answer is a qualified yes. India has a clear and present opportunity to challenge China’s influence. By aggressively implementing its ‘Make in India’ policies and addressing the design flaws in the PLI scheme, it can significantly reduce its own critical API vulnerability, a glaring strategic weakness. Simultaneously, by leveraging the powerful tailwind of the ‘China Plus One’ strategy and continuing to improve its regulatory track record, India can position itself as the world’s most reliable and trusted manufacturing partner. It can capture a significant share of the small-molecule manufacturing and CDMO services that are actively seeking a new home, thereby consolidating its role as the indispensable “Pharmacy of the World.”

On the second tier—the race to define the future of medicine—the answer is far more challenging. Here, China has established a formidable and growing lead. Its systematic, state-driven push into innovation, fueled by massive R&D investment, a torrent of high-value patents, and an integrated academia-industry ecosystem, presents a long-term strategic threat that India is currently ill-equipped to meet. On its current trajectory, India is not on a path to match China’s R&D output, its intellectual property generation in cutting-edge fields like cell and gene therapy, or the sheer efficiency of its innovation pipeline.

This leads to a final analysis: the rivalry is bifurcating. The present is a contest over manufacturing resilience and reliability, a game India is well-positioned to play and potentially win. The future, however, is a race for innovation leadership, a race in which China is already several laps ahead.

“India’s pharmaceutical exports reached $27.9 billion in FY 2023-2024, a 9.67% increase from the previous year’s $25.4 billion. This data aligns with the Economic Survey 2024, which reports exports of $27.9 billion for FY24.”

For India to truly redefine its global influence, it cannot be content with winning only the first contest. It must pursue a bold, dual-pronged national strategy that addresses both the present and the future with equal urgency.

A Strategic Roadmap for India:

- Secure the Base: The immediate priority must be to achieve strategic autonomy in the existing pharmaceutical value chain. This requires:

- Reforming the PLI Scheme: The scheme for bulk drugs must be redesigned to be more accessible and effective for the SMEs that are the lifeblood of the API sector. This means re-evaluating the stringent Domestic Value Addition (DVA) requirements and the burdensome bank guarantees that have led to high withdrawal rates.

- Doubling Down on Quality: India must aggressively market its improving regulatory compliance record. The goal should be to move beyond mere compliance and establish “Made in India” as a global gold standard for quality and reliability, making it the clear and obvious choice for companies pursuing a ‘China Plus One’ strategy.

- Investing in Scale and Technology: Government policy should facilitate investment in large-scale, continuous manufacturing and fermentation technologies to close the cost-competitiveness gap with China in critical APIs.

- Leap to the Frontier: Securing the base is a defensive necessity; winning the future requires an offensive leap into innovation. This demands a national mission on a scale not seen before. This includes:

- Catalyzing Private Sector R&D: The government must create powerful incentives, potentially through super-deductions or R&D tax credits, to dramatically increase private sector investment in novel drug discovery, aiming to triple the industry’s R&D-to-sales ratio over the next decade.

- Forging the Academia-Industry Bridge: A fundamental overhaul of the relationship between universities and industry is required. This involves creating new institutional frameworks, funding mechanisms, and intellectual property-sharing models that encourage and reward the translation of academic research into commercial products.

- Fostering a Culture of Risk: India must create an ecosystem that celebrates and financially supports high-risk, high-reward scientific ventures. This means developing specialized biotech venture capital funds and, as industry leaders have suggested, making scientists and innovators into national heroes to inspire the next generation.

India’s path to challenging China’s burgeoning pharmaceutical empire does not lie in imitating its state-centric model. It lies in harnessing its own unique and powerful assets: the dynamism and agility of its private sector, its deep and long-standing alliances with Western democracies, its vast reservoir of scientific talent, and its proven, world-class expertise in chemistry and manufacturing. The geopolitical window of opportunity is open now, wider than ever before. Seizing it will require a level of national strategic focus, public-private collaboration, and ruthless execution that matches the boldness of the vision. The pharmacy of the world must now decide if it has the ambition to also become its laboratory.

Key Takeaways

- A Tale of Two Growth Models: The Indian pharmaceutical market is projected to grow at a faster rate (11.32% CAGR) than China’s (7.8% CAGR). However, China’s market is larger in absolute terms, providing a more substantial domestic profit base to fund its global ambitions in high-value innovation like biologics and cell therapies.

- India’s Critical Vulnerability: Despite being the “Pharmacy of the World,” India is critically dependent on China for about 70% of its Active Pharmaceutical Ingredients (APIs), with reliance reaching nearly 100% for essential antibiotics like Penicillin. This gives China significant geopolitical leverage.

- China’s Strategic Price War: Evidence suggests China is actively undercutting the prices of key APIs to make India’s Production-Linked Incentive (PLI) scheme for self-sufficiency economically unviable, a form of strategic economic warfare aimed at maintaining India’s dependency.

- The Innovation Chasm: China is out-investing India in R&D by a massive margin (2.4% of GDP vs. India’s 0.64%). This is reflected in a vast disparity in patent filings, particularly in next-generation areas like cell and gene therapy, where China is building a dominant intellectual property position for the future.

- The Quality Gap is Closing: Data from US FDA inspections shows that India has significantly improved its manufacturing compliance, with its “Official Action Indicated” (OAI) rate dropping to ~7%, on par with China’s ~7.5%. Quality is becoming less of a differentiator and more of a “table stakes” requirement, shifting the competition to reliability and trust.

- ‘China Plus One’ is a Major Catalyst: The global strategy to de-risk supply chains is providing a tangible tailwind for India. Indian CDMOs are already winning new contracts from large pharma companies looking to diversify away from China, though the full financial impact is expected over a 3-5 year horizon.

- A Dual-Strategy Imperative for India: To effectively challenge China, India must pursue a two-pronged strategy: (1) Secure the Base by achieving API self-sufficiency and becoming the undisputed global leader in quality manufacturing, and (2) Leap to the Frontier by launching a national mission to fix its broken innovation ecosystem and compete in the development of novel therapies.

Frequently Asked Questions (FAQ)

1. Is India’s reliance on China for APIs a new problem?

No, but its strategic importance has reached a critical inflection point. This dependency has been building for over two decades, as Indian manufacturers increasingly sourced cheaper raw materials from China to maintain their competitive edge in the global generics market. What has changed is the geopolitical context. The COVID-19 pandemic exposed the extreme vulnerability of this arrangement, and escalating tensions between China and the West have transformed what was once a purely economic calculation into a pressing issue of national and global health security. The risk is no longer just about price volatility; it’s about the potential for supply chain weaponization.

2. Can India’s PLI scheme truly make the country self-reliant in APIs?

On its own, the current PLI scheme is unlikely to achieve full self-reliance, though it is a crucial first step. The scheme has successfully spurred initial investment and has begun domestic production of several key APIs. However, it faces two major challenges. First, its design has proven difficult for many Small and Medium Enterprises (SMEs), which are vital to the API sector, due to high value-addition norms and financial requirements. Second, it is being actively countered by China’s aggressive price-cutting strategy, which makes it difficult for new Indian facilities to compete. For the scheme to be truly effective, it needs to be reformed to better support SMEs and be coupled with stronger trade policies to protect nascent domestic production from strategic dumping.

3. What is the single biggest advantage India has over China in this rivalry?

India’s single biggest advantage is trust and integration with the Western regulatory and political ecosystem. India has the largest number of US FDA-approved plants outside the US and decades of experience navigating the world’s most stringent regulatory systems. This deep familiarity and a proven (though sometimes challenged) track record create a level of trust that China, with its more opaque system and geopolitical friction with the West, struggles to match. As the ‘China Plus One’ strategy takes hold, this “trust premium” becomes an invaluable asset, making India the natural partner for Western companies looking to de-risk their supply chains.

4. If China is so focused on innovation, will it abandon the API market, creating an opening for India?

This is highly unlikely. China’s strategy is not to abandon one market for another but to achieve dominance across the entire value chain. While it is aggressively moving into high-value innovation (biologics, novel drugs), it views its control over the foundational API and intermediates market as a strategic asset. It provides economic stability, employment, and significant geopolitical leverage. China is more likely to automate and increase the efficiency of its existing API production to maintain its cost leadership while simultaneously using the profits from this high-volume business to fund its high-risk innovation ventures. The goal is to be both the world’s factory and its laboratory.

5. How can investors and business leaders use patent data to navigate this shifting landscape?

Patent data is a powerful predictive tool for competitive intelligence. By using specialized platforms like DrugPatentWatch, leaders can move beyond lagging indicators (like market share) and focus on leading indicators of future competition. For instance, a company can track the velocity and type of patent filings by Chinese firms in a specific therapeutic area (e.g., CAR-T cell therapy). A surge in such patents is a clear signal of future competitive pressure. Conversely, analyzing patent “white spaces” can reveal areas where R&D is sparse, representing opportunities for Indian innovators. For generic and biosimilar firms, tracking patent expiration dates and understanding the complexity of “patent thickets” is essential for planning market entry strategies and avoiding costly litigation. In this rivalry, patent analytics is the equivalent of satellite reconnaissance on the strategic battlefield.

References

- How India took over the global medicine market | TBIJ, accessed August 10, 2025, https://www.thebureauinvestigates.com/stories/2025-04-16/indias-drugs-industry-global-medicine-market

- Mapping the Global Odyssey: India’s Generic Medicine Triumph Worldwide – Invimeds, accessed August 10, 2025, https://invimeds.com/updates/global-healthcare-the-journey-of-indian-generic-medicines-to-worldwide-markets/

- The Dragon Awakes: Charting the Unstoppable Growth of Chinese Pharmaceuticals in the Global Market – DrugPatentWatch, accessed August 10, 2025, https://www.drugpatentwatch.com/blog/the-dragon-awakes-charting-the-unstoppable-growth-of-chinese-pharmaceuticals-in-the-global-market/

- China’s New Challenge: India’s Pharmaceutical Industry Gains Global Ground – Medstown, accessed August 10, 2025, https://www.medstown.com/chinas-new-challenge-indias-pharmaceutical-industry-gains-global-ground/

- Innovative Drug Discovery Research by Pharmaceutical Companies in India and China | Journal of Medicinal Chemistry – ACS Publications, accessed August 10, 2025, https://pubs.acs.org/doi/10.1021/acs.jmedchem.4c01180

- India’s Reality Check: Can We Leapfrog from Generics to Innovation Like China Has?, accessed August 10, 2025, https://pharma.economictimes.indiatimes.com/news/pharma-industry/indias-pharma-innovation-challenge-can-we-compete-with-chinas-leap/122954100

- India Pharmaceutical Market Size, Share and Growth, 2033 – IMARC, accessed August 10, 2025, https://www.imarcgroup.com/india-pharmaceutical-market

- Indian pharma sector sees growth at 8 pc CAGR, export rates spike …, accessed August 10, 2025, https://cfo.economictimes.indiatimes.com/news/indian-pharma-sector-sees-growth-at-8-pc-cagr-export-rates-spike-by-9-pc-in-2024-report/118620707

- India Pharmaceutical Market Size, Trends, Share 2032 – CMI, accessed August 10, 2025, https://www.custommarketinsights.com/report/india-pharmaceutical-market/

- Drugs & Pharmaceuticals Industry – India Market – Brickwork Ratings, accessed August 10, 2025, https://www.brickworkratings.com/Research/Drugsand%20Pharmaceuticals%20Industry-India-Nov2024.pdf

- Healing the World: A Roadmap for Making India a Global Pharma Exports Hub, accessed August 10, 2025, https://www.bain.com/insights/healing-the-world-a-roadmap-for-making-india-a-global-pharma-exports-hub/

- INDIA: THE WORLD’S PHARMACY – PIB, accessed August 10, 2025, https://static.pib.gov.in/WriteReadData/specificdocs/documents/2024/aug/doc2024822379301.pdf

- Top 25 Indian Pharma Companies by Revenues in 2024 – MedicinMan, accessed August 10, 2025, https://medicinman.net/2025/03/top-25-indian-pharma-companies-by-revenues-in-2024/

- Top 25 Pharma Companies in India: Revenue Rankings 2025, accessed August 10, 2025, https://indiapharmafranchise.com/2024/05/01/indias-top-25-pharma-companies-by-revenue-in-2024-unveiling-the-giants-of-the-pharmaceutical-industry/

- Pharmaceutical industry in India – Wikipedia, accessed August 10, 2025, https://en.wikipedia.org/wiki/Pharmaceutical_industry_in_India

- China Pharmaceutical Market Size & Outlook, 2030, accessed August 10, 2025, https://www.grandviewresearch.com/horizon/outlook/pharmaceutical-market/china

- China Pharmaceutical Market Estimated to Reach a CAGR of 7.50% during 2024-2032, Impelled by the Rising Geriatric Population – BioSpace, accessed August 10, 2025, https://www.biospace.com/china-pharmaceutical-market-estimated-to-reach-a-cagr-of-7-50-during-2024-2032-impelled-by-the-rising-geriatric-population

- China Pharma Report 2024 – PharmaBoardroom, accessed August 10, 2025, https://pharmaboardroom.com/country-reports/china-pharma-report-2024/

- Pharmaceutical industry in China – Wikipedia, accessed August 10, 2025, https://en.wikipedia.org/wiki/Pharmaceutical_industry_in_China

- The Role of China in the Global Generic Drug API Market – DrugPatentWatch, accessed August 10, 2025, https://www.drugpatentwatch.com/blog/the-role-of-china-in-the-global-generic-drug-api-market/

- China’s pharmaceutical market surging – Cytiva, accessed August 10, 2025, https://www.cytivalifesciences.com/en/us/solutions/emerging-biotech/knowledge-center/china-pharmaceutical-market

- Largest Pharmaceutical Companies in China by Revenue – Bullfincher, accessed August 10, 2025, https://bullfincher.io/ranking/top-pharmaceutical-companies-in-china-by-revenue

- The World’s Top 100 Pharma Companies: 2024 Sales Rankings – Citeline News & Insights, accessed August 10, 2025, https://insights.citeline.com/pharma-insights/the-worlds-top-100-pharma-companies-2024-sales-rankings-Z47XBTXVNJEXFCKYU7Q4EJ45XI/

- Top 10 Pharmaceutical Companies in China in 2022 by Market Capitalization – GlobalData, accessed August 10, 2025, https://www.globaldata.com/companies/top-companies-by-sector/healthcare/china-companies-by-market-cap/

- India’s Growing Importance in Generic Drug API Manufacturing – DrugPatentWatch, accessed August 10, 2025, https://www.drugpatentwatch.com/blog/indias-growing-importance-in-generic-drug-api-manufacturing/

- Indian Pharmaceutical Industry: Past, Present, and Future Outlook (2024-2030), accessed August 10, 2025, https://www.researchgate.net/publication/387445366_Indian_Pharmaceutical_Industry_Past_Present_and_Future_Outlook_2024-2030

- The API Market Giant: China’s Dominance and Its Impact – Pharmaoffer.com, accessed August 10, 2025, https://pharmaoffer.com/blog/the-downside-of-cheap-apis/

- Can India Reclaim API Throne from China? – BioSpectrum India, accessed August 10, 2025, https://www.biospectrumindia.com/features/73/25074/can-india-reclaim-api-throne-from-china.html

- Indian API industry: Emerging trends and road ahead – Pharmabiz.com, accessed August 10, 2025, https://pharmabiz.com/ArticleDetails.aspx?aid=174095&sid=21

- Final Report Survey for Novel/ Innovative and Cost-effective Technologies for Route of Synthesis to Decrease the Cost of Production of APIs which are – Department of Pharmaceuticals, accessed August 10, 2025, https://pharma-dept.gov.in/sites/default/files/Final%20Report-Survey%20of%20Novel%20Technologies%20for%20Productoion%20of%20APIs.pdf

- India’s Import Dependence on China in Pharmaceuticals: Status, Issues and Policy Options, accessed August 10, 2025, https://ris.org.in/sites/default/files/Publication/DP%20268%20Prof%20Sudip%20Chaudhuri.pdf

- China supplies over 80% of pharma raw materials – The Times of India, accessed August 10, 2025, https://timesofindia.indiatimes.com/business/india-business/china-supplies-over-80-of-pharma-raw-materials/articleshow/76453541.cms

- India still heavily reliant on China for life saving drugs despite PLI booster: Report, accessed August 10, 2025, https://m.economictimes.com/industry/healthcare/biotech/pharmaceuticals/india-still-heavily-reliant-on-china-for-life-saving-drugs-despite-pli-booster-report/articleshow/102425869.cms

- China now fighting a losing battle in India’s bulk drugs market – The Financial Express, accessed August 10, 2025, https://www.financialexpress.com/business/industry/china-now-fighting-a-losing-battle-in-indias-bulk-drugs-market/3908778/

- Production Linked Incentive (PLI) Scheme for Promotion of Domestic Manufacturing of critical Key Starting Materials (KSMs)/ Drug Intermediates and Active Pharmaceutical Ingredients (APIs) in the Country., accessed August 10, 2025, https://pharma-dept.gov.in/schemes/production-linked-incentive-pli-scheme-promotion-domestic-manufacturing-critical-key

- Made in China 2025 – Modernizing China’s Industrial Capability., accessed August 10, 2025, https://www.isdp.eu/publication/made-china-2025/

- Made in China 2025 – Institute for Security & Development Policy, accessed August 10, 2025, https://www.isdp.eu/wp-content/uploads/2018/06/Made-in-China-Backgrounder.pdf

- Made in China 2025 – Wikipedia, accessed August 10, 2025, https://en.wikipedia.org/wiki/Made_in_China_2025

- Industry-Academia Partnership for Research & Innovation – Principal Scientific Adviser, accessed August 10, 2025, https://psa.gov.in/CMS/web/sites/default/files/psa_custom_files/PSA_NOVEMBER%202024%20ISSUE_04%20DECEMBER%202024%20FINAL.pdf

- How Indian Pharma Can Become Global Leaders – ProMarket, accessed August 10, 2025, https://www.promarket.org/2023/12/21/how-indian-pharma-can-become-global-leaders/

- Indian Patent Filings (2014-2024) – icmr-ipr, accessed August 10, 2025, https://itr.icmr.org.in/filings_patent

- IP India Annual Report 2022-23, accessed August 10, 2025, https://ipindia.gov.in/writereaddata/Portal/IPOAnnualReport/1_114_1_ANNUAL_REPORT_202223_English.pdf

- Cell & Gene Therapy – Department of Biotechnology, accessed August 10, 2025, https://dbtindia.gov.in/scientific-directorates/health-interventions-equity/cell-gene-therapy

- Cracking the Code: Using Drug Patents to Reveal Competitor Formulation Strategies, accessed August 10, 2025, https://www.drugpatentwatch.com/blog/cracking-the-code-using-drug-patents-to-reveal-competitor-formulation-strategies/

- The Global Patent Thicket: A Comparative Analysis of Pharmaceutical Monopoly Strategies in the U.S., Europe, and Emerging Markets – DrugPatentWatch, accessed August 10, 2025, https://www.drugpatentwatch.com/blog/how-do-patent-thickets-vary-across-different-countries/

- Industry-University Collaboration and Commercializing Chinese Corporate Innovation – Wharton Faculty Platform – University of Pennsylvania, accessed August 10, 2025, https://faculty.wharton.upenn.edu/wp-content/uploads/2016/11/Industry-University_Chinese-Innovation.pdf

- Industry-University Collaboration and Commercializing Chinese Corporate Innovation – Wharton Faculty Platform – University of Pennsylvania, accessed August 10, 2025, https://faculty.wharton.upenn.edu/wp-content/uploads/2016/11/Industry-University-Collaboration.pdf

- ‘Toxic for innovation…’: Semiconductor expert picks China over India, slams ‘race to the bottom’ culture – BusinessToday, accessed August 10, 2025, https://www.businesstoday.in/latest/trends/story/toxic-for-innovation-semiconductor-expert-picks-china-over-india-slams-race-to-the-bottom-culture-488759-2025-08-10

- Academia-pharmaceutical industry linkage: An academic perspective – PMC – PubMed Central, accessed August 10, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11000613/

- China’s NMPA vs. US FDA: Key Differences in Biologics Review, accessed August 10, 2025, https://synapse.patsnap.com/article/chinaE28099s-nmpa-vs-us-fda-key-differences-in-biologics-review

- China’s NMPA Introduces New Revised Regulation for Drug Approval by Foreign Companies – Global Regulatory Partners, accessed August 10, 2025, https://globalregulatorypartners.com/chinas-nmpa-introduces-new-revised-regulation-for-drug-approval-by-foreign-companies/

- Navigating Regulatory Landscapes: Simplifying Compliance To Streamline The Drug Approval Process – LGM Pharma, accessed August 10, 2025, https://lgmpharma.com/blog/navigating-regulatory-landscapes-simplifying-compliance-to-streamline-the-drug-approval-process/

- CDSCO Releases New SEC Guidelines to Enhance Drug and Medical Device Approval Process – MedPath, accessed August 10, 2025, https://trial.medpath.com/news/c2be353099135eb5/cdsco-releases-new-sec-guidelines-to-enhance-drug-and-medical-device-approval-process

- New Drug Approvals in China: An International Comparative Analysis, 2019-2023 – PMC, accessed August 10, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11974572/

- U.S FDA/EMA Regulatory Inspection and Enforcement Trends – Cloudfront.net, accessed August 10, 2025, https://d2evkimvhatqav.cloudfront.net/documents/ph_fda_ema_regulatory_inspection_enforcement_trends_article.pdf?v=1594929957

- E&C Republicans Press FDA Over Inadequate Inspection of Drug Manufacturing in India and China – House Committee on Energy and Commerce, accessed August 10, 2025, https://energycommerce.house.gov/posts/e-and-c-republicans-press-fda-over-inadequate-inspection-of-drug-manufacturing-in-india-and-china

- United States: Increasing FDA inspections and enforcement in China – Are you prepared?, accessed August 10, 2025, https://insightplus.bakermckenzie.com/bm/healthcare-life-sciences/united-states-increasing-fda-inspections-and-enforcement-in-china-are-you-prepared

- International: FDA to enhance unannounced inspections of foreign manufacturing facilities in countries including China – Baker McKenzie InsightPlus, accessed August 10, 2025, https://insightplus.bakermckenzie.com/bm/dispute-resolution/international-fda-to-enhance-unannounced-inspections-of-foreign-manufacturing-facilities-in-countries-including-china

- China Plus One Strategy And Why Companies Are Adopting It – Frigate Manufacturing, accessed August 10, 2025, https://frigate.ai/contract-manufacturing/china-plus-one-strategy-and-why-companies-are-adopting-it/

- Maximizing Growth: Pharma’s China-Plus-One Strategy – SpendEdge, accessed August 10, 2025, https://www.spendedge.com/biotechnology-pharmaceutical-life-sciences/why-pharma-industry-needs-to-take-china-plus-one-strategy-seriously/

- China+1 strategy gains momentum in pharma, but full monetisation still 2-3 years away: Goldman Sachs – The Economic Times, accessed August 10, 2025, https://m.economictimes.com/industry/healthcare/biotech/pharmaceuticals/china1-strategy-gains-momentum-in-pharma-but-full-monetisation-still-2-3-years-away-goldman-sachs/articleshow/122060553.cms

- What is China Plus One Strategy: Opportunities Beyond China, accessed August 10, 2025, https://blog.intoglo.com/china-plus-one-strategy-opportunities-beyond/

- China Plus One Strategy in Action: Benefits and Opportunities – Spherical Insights, accessed August 10, 2025, https://www.sphericalinsights.com/blogs/china-plus-one-strategy-in-action-benefits-and-opportunities

- ‘China Plus 1’ Drives Early Wins for India’s Pharma Sector, Full Gains Expected in 3–5 Years, accessed August 10, 2025, https://www.outlookbusiness.com/corporate/china-plus-1-drives-early-wins-for-indias-pharma-sector-full-gains-expected-in-35-years

- China’s New Challenge: India’s Pharmaceutical Industry Gains Global Ground – Times Now, accessed August 10, 2025, https://www.timesnownews.com/business-economy/industry/chinas-new-challenge-indias-pharmaceutical-industry-gains-global-ground-article-151714775