I. Introduction: The Looming Patent Cliff and the Imperative for Proactive Lifecycle Management

Loss of Exclusivity (LOE) represents a pivotal moment for innovator pharmaceutical manufacturers, signaling the relinquishment of exclusive legal rights to develop, sell, and market a specific drug formulation.1 This critical juncture occurs upon the expiration of patent protection, typically 20 years from the filing date, though the effective market life is often reduced to 10-15 years due to extensive research and development (R&D) and regulatory approval processes.3 Once LOE is reached, the market opens to competition from lower-cost generic (Gx) or biosimilar alternatives, fundamentally altering pricing structures and market dynamics.2

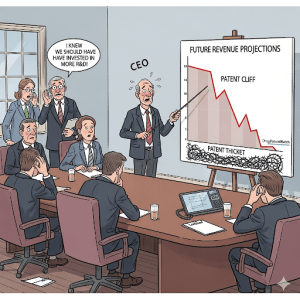

The industry refers to this phenomenon as the “Patent Cliff,” a term that vividly describes the sharp and often dramatic decline in revenue that pharmaceutical companies experience when their blockbuster drugs lose patent protection.7 This financial impact can be measured in billions of dollars as generic manufacturers enter the market with more affordable versions.7 The inevitability of LOE, far from being an unforeseen disaster, is a predictable milestone that necessitates careful adjustment of brand strategy from all aspects.1 This understanding transforms what might otherwise be reactive crisis management into a predictable window for proactive strategic planning, underscoring the importance of integrating LOE considerations into long-term product lifecycle management (PLM) from the earliest stages of drug development.9 PLM, in this context, becomes a continuous, forward-looking process aimed at maximizing product value while minimizing costs and risks throughout the drug’s entire lifecycle.9

The pharmaceutical industry is currently bracing for an “unprecedented wave” of patent expirations, projected to be of even greater magnitude than previous “patent cliffs”.12 Forecasts indicate that over 190 products are slated to lose exclusivity between 2022 and 2030, collectively placing an estimated $300 billion in sales at risk between 2023 and 2028 alone.8 These products represent a staggering $183.5 billion in annual sales.12 Historically, a blockbuster drug can experience a dramatic loss of up to 80% of its revenue within the first year following generic or biosimilar competition.7 Pfizer’s Lipitor, for instance, saw its revenue plummet to less than 10% of its peak sales after losing patent protection, serving as a stark reminder of these profound financial consequences.12 Upon generic entry, the market share for branded drugs can dwindle rapidly, with one study observing a 73% loss within just two weeks of LOE.12

A distinguishing characteristic of the current patent cliff is the higher proportion of biologics facing LOE compared to previous waves.7 While small-molecule drugs typically face rapid and deep sales erosion upon generic entry, biosimilars, the generic equivalents of biologics, generally gain market share more slowly due to their complex manufacturing and regulatory hurdles.12 This dynamic suggests that while the initial revenue drop for biologics might be less precipitous, the period of sustained erosion could be more prolonged.12 This differentiation means that a “one-size-fits-all” LOE strategy is insufficient. Companies holding biologics must prioritize different long-term patient retention and market access strategies compared to those with small molecules. For biologics, strategies might emphasize maintaining physician and patient trust, highlighting subtle product differences, and leveraging complex reimbursement pathways. For small molecules, the speed of launching line extensions or pursuing Rx-to-OTC switches becomes even more critical due to the immediate and severe generic impact.

Effective LOE management is not a last-minute endeavor; it demands detailed planning initiated years in advance, with a comprehensive timeline mapping out key milestones and decision points.13 Failure to engage in proactive planning leaves companies highly vulnerable to immense revenue erosion and market share loss, potentially jeopardizing their long-term stability and profitability.18 A delayed or reactive response to LOE challenges often leads to rushed decision-making and the implementation of suboptimal solutions, further diminishing a company’s market position and hindering effective recovery.18 The magnitude of financial risk and the consistent emphasis on early and comprehensive planning strongly suggest that LOE is a fundamental business challenge, not merely a legal or compliance issue. This perspective indicates that intellectual property (IP) and LOE considerations must be embedded in every major business decision, from initial drug candidate selection through to market launch, necessitating a fundamental cultural shift within pharmaceutical organizations from siloed operations to an integrated, strategic mindset. Investment in competitive intelligence tools, such as DrugPatentWatch, is therefore not just a legal or IT expense but a strategic investment crucial for accurate business forecasting and informed decision-making across the enterprise.19

The following table summarizes the typical financial impact of LOE on branded drugs:

Table 1: Financial Impact of LOE on Branded Drugs (Typical Ranges)

| Metric | Typical Impact/Range |

| Revenue Decline (Branded Drug) | Up to 80-90% 7 |

| Market Share Loss (Branded Drug) | Up to 73% 12 |

| Price Reduction (Generic Drugs) | 20-85% 12 |

| Sales at Risk (Industry-wide, 2023-2028) | ~$300 billion 8 |

II. The Six Strategic Pillars for Value Maximization

Strategy 1: Fortifying Intellectual Property Through Strategic Patent Management

Pharmaceutical companies rarely rely on a single patent for protection; instead, they strategically construct a multi-layered “web of protection” or “patent thicket”.5 This involves obtaining various patent types, each serving a distinct strategic purpose, thereby creating a formidable legal barrier against generic competition.21 “Evergreening” refers to the practice of making incremental modifications to existing drugs to secure additional patent protections, effectively extending a drug’s market exclusivity beyond its initial patent term.5 These modifications can include new formulations, novel delivery methods (e.g., extended-release, subcutaneous versions of intravenous drugs), new therapeutic indications, or combination therapies.5

While these strategies are presented as “formidable barriers” and “essential strategic tools” for prolonging market exclusivity 5, there is a counter-narrative that labels thickets as “systemic abuse,” “anticompetitive practices,” and “gaming tactics” that artificially inflate drug prices and delay patient access to affordable generics.22 The case of Celgene’s cancer drug Revlimid, with 206 additional patent filings and a dramatic price increase from $6,000 to $24,000 per month, starkly illustrates this tension.22 This is not merely a legal tactic; it carries significant public relations and regulatory risks. Pharmaceutical companies must carefully weigh the financial benefits of patent thickets against increasing public and regulatory scrutiny, potential antitrust challenges, and damage to brand reputation. Future IP strategies may need to prioritize genuinely innovative line extensions that offer clear clinical benefits, rather than those perceived as “trivial changes” 23, to justify extended exclusivity and withstand legal and public challenges. Proposed legislation, such as the “Affordable Prescriptions for Patients Act” 24, and Federal Trade Commission (FTC) actions 23 signal a growing legislative and regulatory pushback against perceived abuses.

Patent litigation is an almost inevitable component of protecting intellectual property in the pharmaceutical industry.21 The Hatch-Waxman Act, a cornerstone of U.S. drug regulation, permits generic companies to challenge brand-name drug patents through a Paragraph IV certification, asserting that the brand’s patent is invalid, unenforceable, or will not be infringed.21 Upon receiving a Paragraph IV notice letter, the brand manufacturer has a 45-day window to initiate a patent infringement lawsuit. This action triggers an automatic 30-month regulatory stay, which effectively delays FDA approval for the generic application.6 This stay provides crucial time for brand companies to defend their patents and manage the transition to generic competition.21 Pharmaceutical patent litigation is inherently complex and resource-intensive, often revolving around challenging a patent’s validity (e.g., based on novelty, non-obviousness, or prior art) or arguing non-infringement.21 Generic firms frequently target “weaker” secondary patents (e.g., formulation or method-of-use patents), which are often more susceptible to invalidation than core active ingredient patents.21 Settlements, including controversial “reverse payment” or “pay-for-delay” agreements, are prevalent to avoid the substantial risks of an unfavorable court decision, but these agreements are increasingly subject to antitrust scrutiny.21 Litigation, while a crucial defensive strategy that can delay generic market entry by months or years and generate substantial additional revenue 2, comes with high legal costs, the inherent risk of patent invalidation, and growing regulatory backlash against tactics perceived as anti-competitive. Companies need to adopt a highly nuanced legal strategy that carefully balances the potential for extended exclusivity with the escalating financial costs and reputational risks associated with aggressive, potentially anti-competitive litigation. This means prioritizing the defense of truly robust and defensible patents and seeking settlements that are less likely to draw antitrust attention, thereby focusing on value-driven innovation rather than purely legal maneuvering.

Case Studies in IP Defense

- AstraZeneca’s Prilosec/Nexium: AstraZeneca successfully navigated the LOE for its blockbuster drug Prilosec by developing and strategically marketing Nexium, a single-enantiomer version.21 This chiral switch, combined with aggressive commercial tactics and a robust patent thicket of over 40 patents, allowed AstraZeneca to maintain market leadership and significantly extend exclusivity.21

- AbbVie’s Humira: Humira, one of the most profitable drugs in history, was fiercely protected by AbbVie through an extensive “patent thicket” comprising over 100 patents, many of which were duplicative.21 This comprehensive strategy extended exclusivity but also led to numerous patent settlements that facilitated the eventual launch of biosimilars.21 Despite biosimilar entry in Europe in 2018, Humira demonstrated remarkable resilience, maintaining a dominant market share, with patient counts in France falling by only 13% over a year, while biosimilars gained traction.27 This case clearly illustrates that even with a massive patent thicket, biosimilar entry is inevitable, but its impact can be significantly softened, particularly for biologics. The fact that Humira retained substantial market share in Europe, while small molecule generics (like Januvia) caused rapid patient switching 27, highlights the “nuanced and context-dependent” nature of LOE.12 This indicates that IP strategy must be dynamic and highly adaptable to specific market conditions and drug types. Companies should recognize that a “patent thicket” alone will not guarantee indefinite market dominance. Instead, IP strategy must be seamlessly integrated with commercial and market access strategies, acknowledging that patient and physician behavior, evolving regulatory frameworks, and the fundamental nature of the drug (small molecule vs. biologic) all significantly influence the effectiveness of IP protection post-LOE.

- Bristol Myers Squibb & Pfizer’s Eliquis: Despite provisional FDA approvals for generic versions, Bristol Myers Squibb (BMS) and Pfizer successfully leveraged settlements and a key lawsuit to fend off cheaper rivals until at least 2027, with potential for further extension to 2028 through pediatric exclusivity.28

The following table outlines key exclusivity types and their typical durations in the United States and the European Union, which are foundational to strategic patent management:

Table 2: Key Exclusivity Types and Durations (US & EU)

| Exclusivity Type | United States (FDA) | European Union (EMA) |

| Patent Term | 20 years from filing 3 | 20 years from filing 30 |

| New Chemical Exclusivity (NCE) | 5 years (bars ANDA/505(b)(2) for same active moiety) 4 | N/A (covered by Data Exclusivity) |

| “Other” Exclusivity / New Clinical Investigation Exclusivity | 3 years (for new clinical investigations, e.g., indications, dosage regimens) 4 | N/A (covered by Market Protection for new indications) |

| Orphan Drug Exclusivity (ODE) | 7 years 4 | 10 years for specific indication 32 |

| Pediatric Exclusivity (PED) | 6 months added to existing Patents/Exclusivity 3 | Additional 2 years for orphan medicines with completed paediatric investigation plan 32 |

| 180-Day Exclusivity (Generic) | 180 days for first generic applicant challenging a patent 4 | N/A |

| Data Exclusivity | N/A | 8 years from initial authorization 30 |

| Market Protection | N/A | +2 years after data exclusivity (total 10 years); +1 year for significant new indications (total 11 years) 30 |

| Qualified Infectious Disease Product (QIDP) | Additional 5 years 4 | N/A |

Strategy 2: Extending Product Life with Strategic Line Extensions and New Formulations

Developing incremental innovations, often referred to as line extensions, reformulations, or follow-on products, is a crucial strategy for prolonging a drug’s market presence.2 These innovations require significantly less R&D investment compared to developing entirely new molecular entities, as the initial discovery and early-stage clinical research of the active ingredient are not needed.2 Importantly, line extensions can secure their own exclusivity periods, often extending beyond the original product’s protection.2 These innovations encompass a wide range of modifications, including extended-release formulations, novel delivery methods (e.g., subcutaneous versions of IV drugs), or changes in administration routes and/or dosages.7

While some line extensions are sometimes criticized for offering minimal additional clinical value, others can significantly enhance the patient experience by improving adherence, reducing side effects, or facilitating better drug absorption.35 The research highlights that line extensions are “incremental innovations” that are less resource-intensive and can secure new periods of exclusivity.2 However, it also points to the “controversy” surrounding their actual clinical value, with some being perceived as adding “little clinical value”.35 This distinction is critical, especially in light of increasing scrutiny on drug pricing and the ethical implications of “evergreening”.22 Line extensions that offer genuine, demonstrable clinical benefits (e.g., improved adherence, reduced side effects, better suitability for specific patient populations) are far more likely to gain regulatory approval, secure physician acceptance, and withstand public criticism, thereby ensuring sustained value. Pharmaceutical companies should strategically prioritize line extensions that address identified unmet patient needs or significantly improve patient outcomes, rather than those solely designed to extend patent life. This patient-centric approach aligns with evolving healthcare demands for value-based care and can effectively differentiate the branded product from generic alternatives, fostering “brand stickiness” and long-term loyalty.2

A primary strategic objective of developing line extensions is to proactively shift existing patient volume from the original drug to the new formulation before generic entry.35 This maneuver effectively insulates a portion of the patient base and associated revenue from the impending generic competition.35 This strategy proves particularly effective when the new formulation offers compelling advantages or addresses specific patient needs that incentivize both patients and physicians to switch.35 The concept of “shifting volume” represents a proactive and sophisticated defensive maneuver. It transcends a simple product launch; it is about strategically migrating the existing patient base to a newly protected asset. This requires meticulous early planning, clear and compelling communication of the new formulation’s benefits to healthcare providers and patients, and potentially the implementation of incentives to facilitate the transition. The timing of this shift is paramount – it must occur well in advance of the “immediate and severe” impact of generic entry.2 This strategy necessitates seamless coordination between R&D, regulatory affairs, and commercial teams. Commercial teams, in particular, need to prepare for a comprehensive “switch campaign” well before the LOE date, focusing on educating healthcare providers and patients about the advantages of the new formulation and actively facilitating the transition. This approach also integrates effectively with patient loyalty programs designed to support and retain the migrating patient population.2

Successful Line Extension Examples

- Aricept (donepezil): Examples include Aricept 23 (an extended-release formulation) and Aricept ODT (an orally dissolving tablet specifically designed for patients with swallowing difficulties).35 These cases demonstrate how modifications in dosage and administration can make a drug more suitable for specific patient populations, thereby expanding its utility and market appeal.35

- Abilify Maintena: This injectable line extension of Abilify is designed to stabilize patients in crisis situations, illustrating a significant change in the route of administration tailored to address acute patient needs.35

- Prozac (Fluoxetine): Eli Lilly successfully minimized revenue losses by developing and patenting a once-weekly, sustained-release formulation of Prozac, as well as a new medical use for fluoxetine in treating pre-menstrual dysphoric disorder (PMDD), marketed as Sarafem.21

The examples of Aricept ODT (addressing swallowing difficulties) and Abilify Maintena (for crisis stabilization) clearly illustrate that successful line extensions often target specific, previously underserved patient needs or significantly improve convenience.35 This approach moves beyond mere “evergreening” for patent extension and focuses on delivering genuine patient benefit, which can powerfully drive adoption and foster loyalty even within a highly competitive landscape. Companies should conduct thorough market research and in-depth patient needs assessments to identify areas where new formulations or delivery methods can offer tangible improvements in patient experience or clinical outcomes. This patient-centric approach can create a stronger, more defensible value proposition for the line extension, making it more resilient to generic competition and justifying continued investment in its development and promotion.

Strategy 3: Accelerating Innovation: Next-Generation Products and Pipeline Diversification

Accelerating the development of innovative new drugs is a paramount strategy to replace the substantial revenue streams lost from expiring patents.7 The pharmaceutical R&D pipeline is notoriously challenging, characterized by persistently high attrition rates (e.g., a success rate of just 6.7% for Phase 1 drugs in 2024, a decline from 10% a decade prior) and prolonged development timelines, which collectively lead to escalating costs.37 These astronomical costs encompass the extensive expenses of conducting clinical trials and persistently decreasing success rates across the pipeline.37

Artificial intelligence (AI) and machine learning (ML) offer transformative potential to address these systemic challenges by significantly speeding up the drug discovery process, improving accuracy in candidate selection, and optimizing clinical trial designs.37 AI can identify promising drug candidates earlier, predict their efficacy, and refine their chemical structures.37 Expedited regulatory pathways, such as Breakthrough Therapy designation, Orphan Drug designation, and Fast Track, can incentivize R&D in areas of high unmet medical need.37 These pathways reward drugs demonstrating significant clinical benefit with faster market access, directly impacting revenue generation and competitive positioning.37 The “patent cliff” is forcing a fundamental re-evaluation of R&D strategies. The inherent high costs, low success rates, and lengthy timelines of traditional R&D make it exceedingly difficult to replace blockbuster revenues quickly through conventional means.37 AI is presented not merely as an efficiency tool but as a “transformative potential” 37 and a “strategic asset” 37 that can accelerate discovery, improve accuracy, and optimize trials. This is no longer just about incremental improvements; it is about ensuring the survival and replenishment of the pipeline. Pharmaceutical companies must aggressively invest in and integrate AI/ML technologies across their entire R&D value chain, from target identification and lead optimization to preclinical safety assessment and clinical trial design. This is no longer a competitive advantage but a foundational capability for maintaining a sustainable pipeline and effectively mitigating the severe impacts of future LOE events. The strategic focus should shift towards “fail fast, fail cheap” philosophies, enabled by robust, data-driven decision-making.37

Mergers and Acquisitions (M&A) represent a prominent strategy for large pharmaceutical firms to acquire promising biotech companies or innovative assets, thereby securing new revenue streams and diversifying their product portfolios.7 M&A activity can significantly accelerate time-to-market for groundbreaking treatments by allowing companies to bypass lengthy internal R&D phases.42 In-licensing agreements provide a strategic avenue to gain access to cutting-edge intellectual property (IP) and achieve faster commercialization. This approach diversifies R&D pipelines and expands product ranges without requiring the company to initiate discovery from scratch.37 Given the impending “patent cliff” and the inherent challenges of internal R&D, M&A becomes a critical external lever to fill pipeline gaps and acquire new, protected assets.37 This is a direct, proactive response to the “imperative to start replenishing revenue now”.41 The observed shift towards “bolt-on acquisitions” and targeting earlier-stage assets 41 suggests a strategic move to acquire innovation before it becomes prohibitively expensive or intensely competitive. Companies should maintain robust M&A pipelines and actively pursue strategic partnerships to complement their internal R&D efforts. This requires rigorous due diligence to identify truly promising assets and effective post-acquisition integration strategies to preserve value, leverage synergies, and ensure seamless assimilation of new intellectual property and capabilities.40

Case Studies in Pipeline Resilience

- Merck’s Keytruda/WINREVAIR: As its flagship immunotherapy, Keytruda (a blockbuster cancer drug with $29 billion in 2023 sales), approaches patent expiration in 2028, Merck is strategically positioning itself to mitigate the anticipated financial impact.28 The company is highly optimistic about WINREVAIR, a promising therapy for pulmonary arterial hypertension (PAH), which is eligible for extended data exclusivity and patents potentially until 2037.36 In parallel, Merck is actively expanding Keytruda’s clinical applications and exploring a subcutaneous formulation to extend its lifecycle.36

- AstraZeneca’s Diversification: AstraZeneca is proactively diversifying its revenue base and developing a robust pipeline, particularly within the oncology space, to offset the anticipated revenue loss from drugs like FARXIGA, which faces patent expiry in 2026.28

Merck’s strategic approach with Keytruda clearly demonstrates a deliberate shift towards nurturing a “next-generation product” (WINREVAIR) and actively engaging in internal lifecycle management (e.g., Keytruda line extensions and new indications).28 This showcases foresight in identifying and developing future revenue drivers well in advance of a flagship product’s LOE. The broader industry trend of focusing on high-growth therapeutic areas like oncology 43 also indicates a strategic prioritization of R&D investment to ensure long-term sustainability. Companies should conduct regular and rigorous portfolio evaluations to identify future LOE risks and proactively invest in new assets or therapeutic areas that can effectively compensate for impending revenue losses. This involves a disciplined “right-to-win” assessment to strategically allocate resources where the company possesses the strongest competitive advantage and market potential, ensuring a sustainable growth trajectory.38

The following table highlights major blockbuster drugs facing LOE between 2025 and 2030, along with their associated revenue at risk:

Table 3: Major Blockbuster Drugs Facing LOE (2025-2030) and Revenue at Risk

| Drug Name | Company | Key Patent Expiration | 2023/2024 Sales (USD) | Projected Decline Post-LOE |

| Keytruda | Merck & Co. | 2028 | $29B (2023) / $33.7B (2028 est.) 28 | 19% decline to $27.4B (2029) 6 |

| Eliquis | Bristol Myers Squibb & Pfizer | 2027-2029 | $13B (2024) / $7.4B (Pfizer share, 2024) 29 | N/A |

| Eylea | Regeneron, Bayer | 2025-2026 | $5.9B (US, 2023) 28 | N/A |

| Humira | AbbVie | 2023 (US) / 2018 (EU) | $18.6B (US, 2022) / $21.2B (peak, 2022) 29 | Quarterly revenue dipped 35.9% 14 |

| Stelara | Johnson & Johnson | 2023 (US) | $6.72B (US, 2024) 46 | Projected $2B lost sales by 2024 14 |

| Entresto | Novartis | July 2025 | $7.8B (2024) 29 | N/A |

| Farxiga | AstraZeneca | 2026 | $7.7B (2024) 29 | N/A |

Strategy 4: Unlocking New Markets with Rx-to-OTC Switches

Converting a prescription (Rx) drug to an over-the-counter (OTC) product can be a valuable component of comprehensive lifecycle management and LOE planning.2 This strategy offers the potential for significant patient benefits by increasing accessibility and can serve as a new revenue source for drugs facing exclusivity loss.2 A successful Rx-to-OTC switch has been shown to increase drug utilization by an average of 30%.47 Key criteria for a successful switch include: the ability for consumers to self-diagnose the condition, a robustly safe product profile with low potential for misuse or abuse, sufficient post-marketing surveillance data, appropriate pack sizing and container design, and clear, comprehensive patient information on the label.47 Regulatory pathways for an Rx-to-OTC switch typically involve submitting a New Drug Application (NDA) or a supplemental New Drug Application (sNDA) to the FDA. An sNDA can be utilized if no changes are made to the dosage form, route of administration, or indication of the original drug.47

While OTC switches clearly offer “new opportunities” 49 and can lead to “increased utilization” 48, the research also highlights that the OTC market is “traditionally not a large market relative to prescription pharmaceuticals” and is characterized by “low margins”.47 This indicates that an Rx-to-OTC switch is not a universal panacea for LOE, but rather a highly specific strategic option suitable for particular product archetypes (e.g., those addressing significant untreated patient populations, having simple dosing regimens, and demonstrating limited safety concerns).47 The value proposition fundamentally shifts from a high-price, low-volume (Rx) model to a low-price, high-volume (OTC) model. Companies must conduct a rigorous evaluation of the financial viability and market fit for an OTC switch, acknowledging the vastly different economics involved. This strategy is primarily about maximizing

patient access and ensuring brand longevity in a new market segment, rather than simply replacing lost Rx revenue dollar-for-dollar. The optimal timing for the OTC launch, ideally coinciding with LOE, is critical to maintaining brand strength and continuity.47

Tactics for Successful Rx-to-OTC Transitions

- Product Selection: Strategically select products that address significant untreated patient populations, particularly where social stigma or lack of access to healthcare might prevent patients from seeking prescription treatment.47

- Precedent Leveraging: Prioritize therapeutic areas where a precedent for OTC conversion already exists. Having a prior Rx-to-OTC approval in a similar area can significantly streamline and accelerate the approval process for subsequent applicants.47

- Safety and Simplicity: Focus on products with extremely limited safety concerns and straightforward, non-parenteral dosing regimens. The absence of complex titration or administration schedules is crucial for FDA approval in a self-care setting.47

- Strategic Timing: Strategic timing is paramount: it is “almost always best to wait until LOE to launch the OTC product and then to launch it quickly upon LOE to maintain the brand strength”.47 This ensures maximal revenue capture from the Rx market before transitioning.

- Regulatory Engagement: Engage proactively and frequently with regulatory bodies (e.g., FDA) through milestone meetings (pre-IND, end of Phase 2, pre-NDA) to align on study requirements and minimize delays.47

- Data Utilization: Leverage existing post-marketing data and conduct targeted non-clinical studies (such as label comprehension studies to assess consumer understanding, self-selection studies to test appropriate use, and actual use studies to examine correct and safe drug usage) to support FDA approval.47

The explicit emphasis on “self-diagnosis,” “label comprehension studies,” and “self-selection studies” 47 underscores the profound importance of understanding consumer behavior and cognition. An OTC switch is not solely a regulatory hurdle; it is fundamentally a marketing and public education challenge. If consumers cannot safely and effectively understand and use the product without professional supervision, the switch is unlikely to succeed. Companies contemplating an Rx-to-OTC switch must invest significantly in robust consumer research and human factors studies to ensure the product’s usability and safety in a self-care environment. This includes developing clear, intuitive labeling and launching comprehensive educational campaigns to empower consumers, thereby differentiating the product in a potentially crowded OTC market.

Challenges and Considerations for OTC Switches

The OTC market is generally smaller and operates on significantly lower profit margins compared to prescription pharmaceuticals.47 Stringent FDA data requirements, particularly concerning safety and ease of use, pose substantial hurdles, especially for products with limited post-marketing experience.47 The regulatory process can be protracted, with multiple required studies often extending the overall timeline for approval.47 The potential value of an OTC product can be significantly impacted by competitive market events, such as the simultaneous launch of generics or new branded products.47 While an Rx-to-OTC switch offers “new opportunities” and “increased access” 47, it comes with the inherent realities of “low margins” and “vastly different economics”.47 This presents a critical strategic dilemma: companies can expand market reach and utilization, but often at the cost of significantly reduced profitability per unit. This is not merely a challenge but a fundamental shift in the underlying business model. Companies must conduct thorough financial modeling and market analysis to determine if an OTC switch is truly accretive to overall product value, meticulously considering the reduced margins and the substantial investment required for consumer marketing, regulatory compliance, and distribution in a new channel. This strategy may be more suitable for products that have already exhausted their high-margin Rx revenue potential and can benefit from a volume-driven, lower-margin market.

The following table summarizes the key criteria for a successful Rx-to-OTC switch and the associated challenges:

Table 4: Rx-to-OTC Switch Criteria and Challenges

| Criteria for Success | Key Challenges |

| Ability to self-diagnose the disease 47 | Limited number of recent switches 47 |

| Safe product profile/acceptable safety margin (low misuse/abuse potential) 47 | Smaller OTC market and low margins 47 |

| No healthcare practitioner needed for safe/effective use 48 | Stringent FDA data requirements 47 |

| Appropriate labeling/patient information 48 | Lengthy regulatory process timeline 47 |

| Simple, non-parenteral dosing regimens 47 | Vastly different OTC economics 47 |

| Sufficient post-marketing surveillance 49 | Competitive market events 47 |

| Strategic timing (launch at LOE) 47 | Intellectual property issues 47 |

Strategy 5: Optimizing Pricing and Market Access Strategies

Dynamic pricing approaches are essential as LOE approaches. “Surge pricing,” typically implemented 12 to 18 months before LOE, is a common tactic to maximize earnings prior to patent expiry.2 This involves a strategy of systematic, gradual price increases multiple times a year, rather than a single, large increase.2 For example, one major pharmaceutical company gradually increased the wholesale acquisition cost (WAC) of its nerve pain medication starting as early as three years before LOE.2 However, increases in WAC must be managed with extreme care. Historical analysis indicates that price increases greater than 9% have demonstrably led to negative impacts on revenues and profits.2 The “surge pricing” strategy represents a clear attempt to extract maximum value from the market before the inevitable price erosion post-LOE. However, the explicit warning about price increases exceeding 9% negatively impacting revenue indicates a critical inflection point. This is not merely about maximizing the absolute price; it is about optimizing the price

in anticipation of future competition without prematurely alienating payers or healthcare providers. This suggests a degree of price elasticity of demand, even for patented drugs. Companies must employ sophisticated pricing analytics and competitive intelligence to model the optimal price increase strategy. This involves a deep understanding of evolving payer dynamics, anticipated competitor pricing trends, and potential legislative impacts that could constrain pricing flexibility.

Strategic rebate management and reimbursement channel navigation are also critical. Manufacturers must implement a dynamic rebate strategy that is meticulously aligned with the evolving motivations of Pharmacy Benefit Managers (PBMs) and other payers.2 As a brand nears LOE, payers often adopt a “Gx first” (generic-first) attitude, initially funneling patients to the branded product with the explicit intention of switching them to generics as soon as possible.2 This dynamic allows manufacturers to strategically terminate rebate contracts closer to LOE without a significant adverse impact on formulary access.2 Offering substantial rebates on line extensions or next-generation brands can effectively encourage patient and physician switching to these newer, protected products.2 For instance, a US-based biotech company offered heavy discounting for formulary exclusivity of a disease-modifying therapy for multiple sclerosis against generic competitors, affecting the generics’ short-term competitiveness.2

Implementing innovative contracts, such as volume discounts and bundled product offerings with pharmacies, distributors, and wholesalers, allows innovators to expand their reach and preference of products in the market.2 These special contracts are commonly used to incentivize channels to stock or dispense preferred brands and inhibit generic substitution to some extent.2

Developing patient access programs, particularly via co-pay maximizers, can be highly effective. For high-affinity brands, patients are likely to exhibit loyalty even after LOE.2 For these brands, it is valuable to support loyal customers through patient-centric programs, such as improved co-payment structures, direct-mail pharmacy options, and enrollment programs.2 Novartis, for example, extended its co-pay financial assistance program for Gilenya (indicated for multiple sclerosis) following LOE in mid-2022, aiming to delay the impact of generic competition.2 Similarly, in 2016, Novartis offered patient co-pay discounts for Gleevec (chronic myeloid leukemia) to compete with its generic product, which helped retain customers on the branded drug and softened generic erosion.2

The Inflation Reduction Act (IRA) of 2022 introduces significant new dynamics to pharmaceutical pricing and market access, particularly impacting LOE strategies.50 The IRA grants Medicare the authority to negotiate drug prices for certain high-spending drugs covered under Medicare Part B and Part D, beginning in 2026.51 It also requires drug companies to pay rebates to Medicare if prices rise faster than inflation for drugs used by Medicare beneficiaries, starting in 2023.51 These provisions, along with a $2,000 annual out-of-pocket spending cap for Medicare Part D beneficiaries, are expected to put pressure on the overall revenue and gross margins a branded drug may earn over its life cycle.50 Manufacturers must consider these changes when establishing launch prices and evaluating their portfolio.50 Drugs with generic or biosimilar options are generally excluded from the price negotiation program, as the focus is on single-source drugs.50 The IRA’s impact on R&D investment, particularly for indications primarily affecting the Medicare population, is a concern, as it may reduce incentives for new drug development in these areas.53

Strategy 6: Leveraging Competitive Intelligence and Data Analytics

Proactive competitive intelligence (CI) is indispensable for effective LOE planning.17 CI involves systematically gathering and analyzing data about competitors, market conditions, and regulatory environments to gain a strategic edge.54 This enables informed decision-making and helps anticipate competitor actions, allowing companies to adjust their strategies accordingly.54

Patent data analysis serves as a crucial strategic asset for understanding the competitive landscape. Platforms like DrugPatentWatch provide comprehensive information on pharmaceutical drugs, including patents, suppliers, generics, litigation, tentative approvals, and patent expirations.19 This allows branded pharmaceutical companies to assess past successes of patent challengers, elucidate research paths of competitors, and predict branded drug patent expiration.19 For example, DrugPatentWatch can help identify first-time generic entrants and anticipate future formulary budget requirements, aiding in portfolio management decisions.19 While patent applications typically publish 18 months after filing, creating a lag between invention and public disclosure, sophisticated monitoring programs can provide early awareness of emerging innovations.55

Competitive intelligence extends beyond mere patent monitoring. It involves tracking various real-time intelligence sources, such as R&D announcements, clinical trial registrations, scientific publications, and industry conferences.55 This multifaceted approach provides a holistic view of the competitive landscape and enables more informed decision-making.55 Analyzing market share distribution and conducting benchmarking against competitors are also vital for understanding a company’s position and identifying strengths and weaknesses.54

The role of AI and advanced analytics in competitive intelligence is transformative.37 AI can enhance patent applications by generating thousands of examples to support broader claims, and it can revolutionize drug development by speeding up discovery and improving accuracy.37 Leveraging AI-driven analytics can illuminate hidden insights in data, elevate commercial models with precision, and streamline decisions.41 Real-time intelligence is crucial for agile decision-making, allowing companies to quickly adapt to shifting market conditions and competitive threats.55 An example of this is a mid-sized pharmaceutical company that used patent monitoring to identify a potential freedom-to-operate issue early in development, allowing them to implement a strategic workaround and save an estimated $100 million in wasted development costs.55 This demonstrates how early intelligence can preserve commercial potential and avoid costly litigation.55

III. Conclusions and Recommendations

The “patent cliff” represents an undeniable and escalating challenge for the pharmaceutical industry, with hundreds of billions in revenue at risk over the coming decade. However, LOE is not a sudden catastrophe but a predictable inflection point demanding proactive, integrated, and adaptable strategic responses. The analysis underscores that simply reacting to generic entry is insufficient; instead, companies must embrace a comprehensive lifecycle management approach that begins years before patent expiration.

To maximize product value as exclusivity approaches, pharmaceutical companies are recommended to:

- Fortify Intellectual Property through Strategic Patent Management: Companies should move beyond basic patent filings to construct robust, multi-layered “patent thickets” that genuinely protect incremental innovations. This involves continuously identifying and protecting new formulations, delivery methods, and therapeutic uses throughout a drug’s lifecycle. While aggressive litigation can delay generic entry, this must be balanced with increasing regulatory scrutiny and antitrust risks, prioritizing the defense of strong, defensible patents and seeking judicious settlements.

- Extend Product Life with Strategic Line Extensions and New Formulations: Invest in developing line extensions that offer demonstrable clinical benefits or significantly improve patient convenience and adherence. The strategic objective should be to proactively shift patient volume to these new, protected formulations before generic entry, thereby insulating revenue streams. This requires meticulous planning and seamless coordination between R&D, regulatory, and commercial teams to facilitate patient and physician transitions.

- Accelerate Innovation with Next-Generation Products and Pipeline Diversification: Aggressively invest in R&D, leveraging advanced technologies like AI and machine learning to accelerate drug discovery, improve candidate selection accuracy, and optimize clinical trials. Simultaneously, pursue strategic Mergers & Acquisitions and in-licensing agreements to acquire promising assets and fill pipeline gaps, ensuring a continuous stream of new, protected intellectual property to offset revenue losses from expiring patents. Proactive portfolio management and a disciplined “right-to-win” assessment in high-growth therapeutic areas are crucial.

- Unlock New Markets with Rx-to-OTC Switches: Evaluate the feasibility of converting prescription drugs to over-the-counter status, particularly for products with a strong safety profile, simple dosing, and the potential to address significant untreated patient populations. While OTC markets offer lower margins, they can extend brand longevity and patient access. Success hinges on rigorous consumer research, clear labeling, and strategic timing of the launch at LOE to maintain brand strength.

- Optimize Pricing and Market Access Strategies: Implement dynamic pricing strategies, such as systematic “surge pricing” in the 12-18 months leading up to LOE, while carefully managing price increase thresholds to avoid negative revenue impacts. Develop flexible rebate strategies aligned with payer motivations, and explore innovative contracting models to maintain formulary access. Patient access programs, including co-pay maximizers, can foster loyalty and soften generic erosion. The impact of evolving legislation, such as the Inflation Reduction Act, must be integrated into pricing and market access planning, necessitating a shift towards value-based data to justify pricing positions.

- Leverage Competitive Intelligence and Data Analytics: Establish robust competitive intelligence programs that go beyond basic patent monitoring to include real-time tracking of R&D announcements, clinical trials, scientific publications, and industry conferences. Utilize advanced analytics and AI tools to transform patent data and market intelligence into actionable insights, enabling early identification of threats and opportunities, informing R&D investments, and supporting agile decision-making across the organization.

The pharmaceutical landscape is continually evolving, driven by scientific advancements, regulatory shifts, and increasing pricing pressures. By adopting these comprehensive and integrated strategies, innovator companies can not only mitigate the profound financial impact of LOE but also transform this inevitable challenge into an opportunity for sustained growth, innovation, and continued delivery of valuable therapies to patients worldwide.

Works cited

- www.drugpatentwatch.com, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/strategies-to-maximize-product-value-amid-loss-of-exclusivity-in-the-pharmaceutical-industry/#:~:text=Far%20from%20being%20a%20sudden,market%20a%20specific%20drug%20formulation.

- Navigating pharma loss of exclusivity | EY – US, accessed July 27, 2025, https://www.ey.com/en_us/insights/life-sciences/navigating-pharma-loss-of-exclusivity

- Understanding the Patent Expiry Process and Its Impact on Monetization – Lumenci, accessed July 27, 2025, https://lumenci.com/blogs/understanding-the-patent-expiry-process-and-its-impact-on-monetization/

- Patents and Exclusivity | FDA, accessed July 27, 2025, https://www.fda.gov/media/92548/download

- Optimizing Your Drug Patent Strategy: A Comprehensive Guide for Pharmaceutical Companies – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/optimizing-your-drug-patent-strategy-a-comprehensive-guide-for-pharmaceutical-companies/

- The Impact of Drug Patent Expiration: Financial Implications, Lifecycle Strategies, and Market Transformations – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/the-impact-of-drug-patent-expiration-financial-implications-lifecycle-strategies-and-market-transformations/

- The Impact of Patent Cliff on the Pharmaceutical Industry – Bailey Walsh, accessed July 27, 2025, https://bailey-walsh.com/news/patent-cliff-impact-on-pharmaceutical-industry/

- The Patent Cliff: From Threat to Competitive Advantage – Esko, accessed July 27, 2025, https://www.esko.com/en/blog/patent-cliff-from-threat-to-competitive-advantage

- What is Product Lifecycle Management (PLM)? – Amplelogic, accessed July 27, 2025, https://amplelogic.com/glossary/what-is-product-lifecycle-management-plm/

- Top Pharma Product Life Cycle Management Strategies – Within3, accessed July 27, 2025, https://within3.com/blog/life-cycle-management-pharma

- Pharma Lifecycle Management Expertise – Align Strategy, accessed July 27, 2025, https://www.alignstrategy.com/services/lifecycle-management/

- Strategies to Maximize Product Value Amid Loss of Exclusivity in the …, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/strategies-to-maximize-product-value-amid-loss-of-exclusivity-in-the-pharmaceutical-industry/

- 6 Ways to Maximize Product Value as Loss of Exclusivity Approaches – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/6-ways-to-maximize-product-value-as-loss-of-exclusivity-approaches/

- Navigating Loss of Exclusivity: Strategic Imperatives for Pharma Leaders – vamstar, accessed July 27, 2025, https://vamstar.io/newsroom/navigating-loss-of-exclusivity-strategic-imperatives-for-pharma-leaders/

- Three Strategies for Navigating the Pharmaceutical Patent Cliff – Certara, accessed July 27, 2025, https://www.certara.com/blog/three-strategies-for-navigating-the-pharmaceutical-patent-cliff/

- Loss of Exclusivity – Healthcare Distribution Alliance (HDA), accessed July 27, 2025, https://www.hda.org/getmedia/f81bfff9-effe-4b33-9eb1-01370ad05346/Loss-of-Exclusivity_Final.pdf

- Loss of Exclusivity Planning Phase – Two Labs Pharma Services, accessed July 27, 2025, https://twolabs.com/loss-of-exclusivity-planning-phase/

- Successful Value Retention with Effective Loss of Exclusivity (LoE) Management – Marbls, accessed July 27, 2025, https://marblsgroup.com/thought-leadership/successful-value-retentionwith-effective-loss-of-exclusivity-loemanagement/

- DrugPatentWatch | Software Reviews & Alternatives – Crozdesk, accessed July 27, 2025, https://crozdesk.com/software/drugpatentwatch

- Overcoming Formulation Challenges in Generic Drug Development – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/overcoming-formulation-challenges-in-generic-drug-development/

- The Patent Playbook Your Lawyers Won’t Write: Patent strategy …, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/the-patent-playbook-your-lawyers-wont-write-patent-strategy-development-framework-for-pharmaceutical-companies/

- Bad Patents Keep Drug Prices High – R Street Institute, accessed July 27, 2025, https://www.rstreet.org/commentary/bad-patents-keep-drug-prices-high/

- The Dark Reality of Drug Patent Thickets: Innovation or Exploitation? – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/the-dark-reality-of-drug-patent-thickets-innovation-or-exploitation/

- Reforms targeting “patent thickets” would speed up the arrival of lower-cost drugs, accessed July 27, 2025, https://www.niskanencenter.org/reforms-targeting-patent-thickets-would-speed-up-the-arrival-of-lower-cost-drugs/

- Earning Exclusivity: Generic Drug Incentives and the Hatch-‐Waxman Act1 C. Scott – Stanford Law School, accessed July 27, 2025, https://law.stanford.edu/index.php?webauth-document=publication/259458/doc/slspublic/ssrn-id1736822.pdf

- Strategies that delay or prevent the timely availability of affordable generic drugs in the United States, accessed July 27, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC4915805/

- Loss of Exclusivity: Generics Hit Fast, Biologics Hold Strong – Clarivate, accessed July 27, 2025, https://clarivate.com/life-sciences-healthcare/blog/after-loss-of-exclusivity-small-molecule-generics-bite-quick-and-hard-while-biologics-remain-resilient/

- Top 10 drugs with patents due to expire in the next five years – Proclinical, accessed July 27, 2025, https://www.proclinical.com/blogs/2024-2/top-10-drugs-with-patents-due-to-expire-in-the-next-5-years

- 5 Pharma Powerhouses Facing Massive Patent Cliffs—And What They’re Doing About It, accessed July 27, 2025, https://www.biospace.com/business/5-pharma-powerhouses-facing-massive-patent-cliffs-and-what-theyre-doing-about-it

- Patent filing and market exclusivity – Generics and Biosimilars Initiative, accessed July 27, 2025, https://www.gabionline.net/policies-legislation/Patent-filing-and-market-exclusivity

- Exclusivity for pharmaceutical products – MedCity, accessed July 27, 2025, https://medcityhq.com/2023/06/27/exclusivity-for-pharmaceutical-products/

- Understanding data exclusivity and market protection – Specialist Pharmacy Service, accessed July 27, 2025, https://www.sps.nhs.uk/articles/understanding-data-exclusivity-and-market-protection/

- Market exclusivity | European Medicines Agency (EMA), accessed July 27, 2025, https://www.ema.europa.eu/en/glossary-terms/market-exclusivity

- Data exclusivity | European Medicines Agency (EMA), accessed July 27, 2025, https://www.ema.europa.eu/en/glossary-terms/data-exclusivity

- Pharmaceutical Line Extensions in the United States – NBER, accessed July 27, 2025, https://www.nber.org/sites/default/files/2022-09/WhitePaper-Fowler10.2017.pdf

- Navigating the Loss of Exclusivity: Big Pharma’s New Playbook – DelveInsight, accessed July 27, 2025, https://www.delveinsight.com/blog/navigating-the-loss-of-exclusivity

- The Imperative to Innovate: Revitalizing the Pharmaceutical R&D …, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/reviving-an-rd-pipeline/

- Biopharma R&D Faces Productivity And Attrition Challenges In 2025 – Clinical Leader, accessed July 27, 2025, https://www.clinicalleader.com/doc/biopharma-r-d-faces-productivity-and-attrition-challenges-in-2025-0001

- Roundup: Pharma Giants Expand Strategic Pipelines Through Targeted M&A and Partnerships – Pharmaceutical Executive, accessed July 27, 2025, https://www.pharmexec.com/view/roundup-pharma-giants-expand-strategic-pipelines-through-targeted-m-a-partnerships

- Winning M&A Pipeline Management: Process, Best Practices (+ Template) – DealRoom.net, accessed July 27, 2025, https://dealroom.net/faq/a-guide-to-m-a-pipeline-management

- Biopharma M&A: Outlook for 2025 – IQVIA, accessed July 27, 2025, https://www.iqvia.com/locations/emea/blogs/2025/01/biopharma-m-and-a-outlook-for-2025

- M&A in Pharma: Balancing Growth and Risk – Pharmaceutical Commerce, accessed July 27, 2025, https://www.pharmaceuticalcommerce.com/view/m-a-in-pharma-balancing-growth-and-risk

- Pharma Faces $236 Billion Patent Cliff by 2030: Key Drugs and Companies at Risk, accessed July 27, 2025, https://www.geneonline.com/pharma-faces-236-billion-patent-cliff-by-2030-key-drugs-and-companies-at-risk/

- Global Life Sciences Industry Trends 2025 – Indegene, accessed July 27, 2025, https://www.indegene.com/what-we-think/reports/global-life-sciences-industry-trends-2025

- Drug Patents, Exclusivity & Lessons from Humira: A Biosimilars Boom | Contract Pharma, accessed July 27, 2025, https://www.contractpharma.com/exclusives/drug-patents-exclusivity-lessons-from-humira-a-biosimilars-boom/

- The top 10 drugs losing US exclusivity in 2025 – Fierce Pharma, accessed July 27, 2025, https://www.fiercepharma.com/special-reports/top-10-drugs-losing-us-exclusivity-2025

- Rx-TO-OTC SWITCH TIPS | Eversana, accessed July 27, 2025, https://www.eversana.com/wp-content/uploads/dlm_uploads/2021/12/WP_Rx-to-OTC-Switch-Tips_EVERSANA.pdf

- Rx-to-OTC Switch: Expanding To The US Over-the-Counter Market | Premier Consulting, accessed July 27, 2025, https://premierconsulting.com/resources/blog/rx-to-otc-switch-expanding-to-the-us-over-the-counter-market/

- Rx to OTC Switch – The ‘Must-Haves’ For Success – Insuvia, accessed July 27, 2025, https://insuvia.com/insights/rx-to-otc-switch-the-must-haves-for-success/

- Effects of the IRA on the pharmaceutical industry – KPMG International, accessed July 27, 2025, https://kpmg.com/us/en/media/news/ira-pharmaceutical-2023.html

- Explaining the Prescription Drug Provisions in the Inflation Reduction Act – KFF, accessed July 27, 2025, https://www.kff.org/medicare/issue-brief/explaining-the-prescription-drug-provisions-in-the-inflation-reduction-act/

- FAQs about the Inflation Reduction Act’s Medicare Drug Price Negotiation Program | KFF, accessed July 27, 2025, https://www.kff.org/medicare/issue-brief/faqs-about-the-inflation-reduction-acts-medicare-drug-price-negotiation-program/

- Impact of the Inflation Reduction Act on Pricing, Reimbursement, and Market Access in the US – ISPOR, accessed July 27, 2025, https://www.ispor.org/heor-resources/presentations-database/presentation/intl2023-3665/127072

- Competitive Intelligence in Pharma: Strategies for Success, accessed July 27, 2025, https://visualping.io/blog/competitive-intelligence-in-pharma

- Maximizing ROI on Drug Development by Monitoring Competitive Patent Portfolios, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/maximizing-roi-on-drug-development-by-monitoring-competitive-patent-portfolios/

- Best Practices for Drug Patent Portfolio Management: Leveraging Patent Data for Competitive Advantage – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/best-practices-for-drug-patent-portfolio-management-2/

- Top Challenges for Established Pharma Brands Nearing LOE – IQVIA, accessed July 27, 2025, https://www.iqvia.com/locations/united-states/blogs/2025/06/top-challenges-for-established-pharma-brands-nearing-loe