DICLOFENAC - Generic Drug Details

✉ Email this page to a colleague

What are the generic sources for diclofenac and what is the scope of freedom to operate?

Diclofenac

is the generic ingredient in sixteen branded drugs marketed by Zyla, Ibsa, Ibsa Inst Bio, Aurobindo Pharma Ltd, Bionpharma, Onesource Specialty, Asio Holdings, Alkem Labs Ltd, Annora Pharma, Ph Health, Taro, Torrent, Umedica, Amici Pharma, Novartis, Chartwell Rx, Novast Labs, Rk Pharma, Rubicon Research, Senores Pharms, Sun Pharm Industries, Teva, Watson Labs Teva, Actavis Mid Atlantic, Alembic, Amneal, Amneal Pharms, Aurolife Pharma Llc, Cipla, Encube, Glenmark Pharms Ltd, Hikma, Padagis Israel, Perrigo Pharma Intl, Sun Pharma Canada, Fougera Pharms, Haleon Us Holdings, Altaire Pharms Inc, Bausch And Lomb, Falcon Pharms, Rising, Sandoz, Sciegen Pharms Inc, Javelin Pharms Inc, Apotex, Epic Pharma Llc, Lupin Ltd, Lupin Pharms, Novel Labs Inc, Pai Holdings Pharm, Twi Pharms, Watson Labs Inc, Zydus Lifesciences, Horizon, Nuvo Pharms Inc, Actavis Elizabeth, Aurobindo Pharma Usa, Carlsbad, Micro Labs, Pliva, Roxane, Teva Pharms, Unique, Dexcel Ltd, Vpna, Pfizer, Actavis Labs Fl Inc, Exela Holdings, Yung Shin Pharm, and Zydus Pharms, and is included in ninety-nine NDAs. There are thirty-nine patents protecting this compound and one Paragraph IV challenge. Additional information is available in the individual branded drug profile pages.Diclofenac has forty-four patent family members in twenty-three countries.

There are forty-seven drug master file entries for diclofenac. There are four tentative approvals for this compound.

Summary for DICLOFENAC

| International Patents: | 44 |

| US Patents: | 39 |

| Tradenames: | 16 |

| Applicants: | 70 |

| NDAs: | 99 |

| Drug Master File Entries: | 47 |

| Raw Ingredient (Bulk) Api Vendors: | 114 |

| Clinical Trials: | 488 |

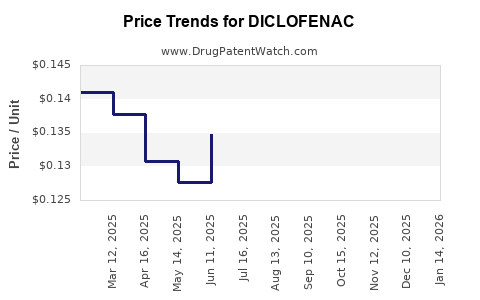

| Drug Prices: | Drug price trends for DICLOFENAC |

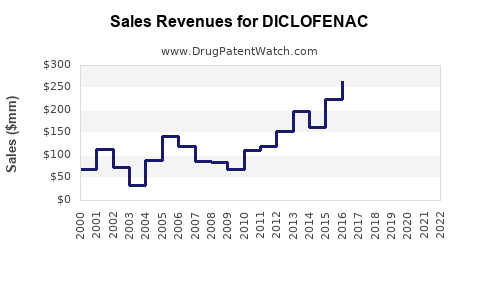

| Drug Sales Revenues: | Drug sales revenues for DICLOFENAC |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for DICLOFENAC |

| What excipients (inactive ingredients) are in DICLOFENAC? | DICLOFENAC excipients list |

| DailyMed Link: | DICLOFENAC at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for DICLOFENAC

Generic Entry Date for DICLOFENAC*:

Constraining patent/regulatory exclusivity:

Dosage:

CAPSULE;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for DICLOFENAC

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| University of Oklahoma | PHASE4 |

| British University In Egypt | PHASE2 |

| Phenikaa University | PHASE3 |

Generic filers with tentative approvals for DICLOFENAC

| Applicant | Application No. | Strength | Dosage Form |

| ⤷ Get Started Free | ⤷ Get Started Free | 1.5% W/W | SOLUTION;TOPICAL |

| ⤷ Get Started Free | ⤷ Get Started Free | 2% | SOLUTION;TOPICAL |

| ⤷ Get Started Free | ⤷ Get Started Free | 35MG | CAPSULE;ORAL |

The 'tentative' approval signifies that the product meets all FDA standards for marketing, and, but for the patents / regulatory protections, it would approved.

Medical Subject Heading (MeSH) Categories for DICLOFENAC

Anatomical Therapeutic Chemical (ATC) Classes for DICLOFENAC

Paragraph IV (Patent) Challenges for DICLOFENAC

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| ZORVOLEX | Capsules | diclofenac | 18 mg and 35 mg | 204592 | 1 | 2014-06-06 |

US Patents and Regulatory Information for DICLOFENAC

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Actavis Labs Fl Inc | DICLOFENAC SODIUM AND MISOPROSTOL | diclofenac sodium; misoprostol | TABLET, DELAYED RELEASE;ORAL | 201089-002 | Jul 9, 2012 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Asio Holdings | ZIPSOR | diclofenac potassium | CAPSULE;ORAL | 022202-001 | Jun 16, 2009 | AB | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Yung Shin Pharm | DICLOFENAC SODIUM AND MISOPROSTOL | diclofenac sodium; misoprostol | TABLET, DELAYED RELEASE;ORAL | 205143-001 | Feb 19, 2020 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Onesource Specialty | DICLOFENAC POTASSIUM | diclofenac potassium | CAPSULE;ORAL | 210078-001 | Dec 3, 2019 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Rubicon Research | DICLOFENAC POTASSIUM | diclofenac potassium | TABLET;ORAL | 075229-002 | Sep 16, 2021 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

International Patents for DICLOFENAC

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| European Patent Office | 3290030 | FORMULATION DE DICLOFÉNAC (DICLOFENAC FORMULATION) | ⤷ Get Started Free |

| Philippines | 12015500301 | A NOVEL FORMULATION OF DICLOFENAC | ⤷ Get Started Free |

| Mexico | 347290 | UNA FORMULACION NOVEDOSA DE DICLOFENACO. (A NOVEL FORMULATION OF DICLOFENAC.) | ⤷ Get Started Free |

| European Patent Office | 2421525 | FORMULATION DE DICLOFÉNAC (DICLOFENAC FORMULATION) | ⤷ Get Started Free |

| South Korea | 101580656 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Market Dynamics and Financial Trajectory for Diclofenac

More… ↓