Last updated: July 27, 2025

Introduction

Aurobindo Pharma Ltd is a prominent player in the global pharmaceutical industry, recognized for its extensive portfolio spanning generic pharmaceuticals, APIs (Active Pharmaceutical Ingredients), biosimilars, and specialty formulations. As the pharmaceutical sector becomes increasingly competitive, understanding Aurobindo’s market positioning, core strengths, and strategic initiatives is crucial for stakeholders—including investors, healthcare partners, and competitors seeking to delineate industry dynamics. This report offers a comprehensive analysis of Aurobindo Pharma’s current standing and strategic trajectory amidst evolving market forces.

Market Position: Global Footprint and Revenue Trends

Aurobindo Pharma has established a significant global footprint, with operations spanning over 150 countries. The company's diversified revenue streams predominantly emanate from the United States, India, Europe, and emerging markets. As of FY2022, Aurobindo reported revenues exceeding USD 3 billion, reflecting its resilience amid industry disruptions such as the COVID-19 pandemic and regulatory shifts [1].

The United States remains its largest market, accounting for approximately 50-55% of revenues, owing to its broad generic portfolio and robust sales infrastructure. Europe and other developed markets contribute around 20-25%, bolstered by strategic acquisitions and targeted product launches, whereas emerging markets complete the rest, supported by local manufacturing and tailored offerings.

In terms of market share within the generic pharmaceutical sector, Aurobindo holds approximately 2-3% of the global market, positioning it among the top 10 generic manufacturers worldwide. Its competitive strength lies in its extensive portfolio of over 300 generic molecules and complex formulations, enabling it to penetrate various therapeutic areas ranging from antibiotics to cardiovascular medications.

Core Strengths Driving Competitive Advantage

1. Diversified Product Portfolio and R&D Capabilities

Aurobindo’s broad-spectrum portfolio, which includes APIs, formulations, biosimilars, and novel drug delivery systems, reduces dependency on any single therapeutic area. This diversification shields the company against market volatility in specific segments.

The company invests significantly in R&D, with approximately 8-10% of annual revenues allocated toward innovation, process optimization, and new chemical entities. Notably, Aurobindo’s biosimilars pipeline and complex generics reflect cutting-edge technological capabilities suited for high-value market segments [2].

2. Cost Leadership and Manufacturing Scale

Aurobindo’s manufacturing infrastructure is a key competitive advantage, with facilities accredited by global regulatory agencies, including the US FDA, EMA, and MHRA. Its vertically integrated production model, leveraging economies of scale, enables aggressive pricing strategies in generics markets.

The company's cost efficiency is driven by technological advancements, optimized supply chain networks, and bulk commodity procurement strategies. This cost leadership fosters higher margins and sustains pricing competitiveness.

3. Regulatory Expertise and Market Access

Acquiring and maintaining multiple regulatory approvals globally enhances Aurobindo’s market access. Its robust quality assurance systems and compliance track record bolster credibility and facilitate faster product approvals. Regulatory agility provides an edge in rapidly launching generic equivalents post-patent expiry.

4. Strategic Acquisitions and Collaborations

Aurobindo’s growth has been augmented by strategic acquisitions, including the purchase of manufacturing facilities and product portfolios from competitors. These moves expand its manufacturing capacity, product offerings, and geographic reach. Additionally, collaborations with biotech firms propel its biosimilars segment.

Strategic Insights and Future Outlook

1. Focus on Biosimilars and Specialty Segments

Aurobindo is systematically expanding its biosimilars pipeline to tap into the high-growth biologics market, projected to reach USD 537 billion by 2028 [3]. Its focus on complex formulations positions it favorably against competitors relying solely on small-molecule generics.

Furthermore, investment in niche therapeutic areas such as oncology and rare diseases aligns with global pharma trends toward personalized medicine, providing higher margins and market differentiation.

2. Innovation in Formulation Technologies

The company emphasizes advancing drug delivery platforms, including injectables, long-acting formulations, and novel delivery systems. These innovations support premium pricing and cater to markets demanding enhanced patient compliance.

3. Geographic Expansion and Market Penetration

Emerging markets like Latin America and Southeast Asia offer growth opportunities. Local manufacturing facilities and tailored marketing strategies are integral to Aurobindo’s plans to deepen market penetration in these regions.

4. Digital Transformation and Supply Chain Optimization

Leveraging Industry 4.0 technologies—such as automation, data analytics, and AI—is fundamental for operational efficiency. Streamlining supply chain networks reduces costs and enhances responsiveness to market shifts, especially under the constraints imposed by global disruptions.

5. Navigating Regulatory and Patent Landscapes

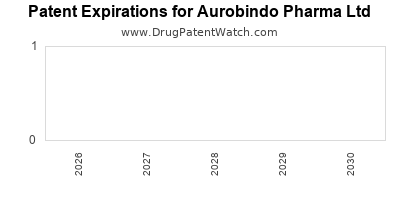

Proactive patent litigations and a strategic focus on complex generics minimize patent risks. The company’s legal expertise ensures timely product launches aligning with patent expirations, maintaining its competitive edge.

Competitive Challenges and Risks

- Regulatory Stringency: Evolving global compliance standards necessitate continuous quality improvements.

- Intense Competition: From both established players and emerging market entrants, especially in commoditized generics.

- Pricing Pressures: Price erosion in mature markets like the US due to market consolidation and payer negotiations.

- Pipeline Risks: Delays or failures in clinical development or regulatory approvals of biosimilars and novel products can hamper growth.

Conclusion

Aurobindo Pharma’s robust market position results from its diversified product portfolio, manufacturing scale, regulatory expertise, and ongoing innovation. Its strategic focus on biosimilars, specialty medicines, and regional expansion positions it well for sustained growth. However, competitive pressures and regulatory complexities necessitate vigilant strategic management. Future success hinges on leveraging technological advancements, expanding high-margin segments, and navigating regulatory terrains proactively.

Key Takeaways

- Market Position: Aurobindo is a leading global generic manufacturer, with a strong presence in the US, Europe, and emerging markets, generating over USD 3 billion annually.

- Strengths: Diversified portfolio, cost-effective manufacturing, regulatory expertise, and strategic acquisitions underpin its competitive advantage.

- Growth Drivers: Biosimilars and specialty formulations are prioritized growth segments, supported by innovation and regional expansion.

- Risks: Price erosion, regulatory challenges, pipeline uncertainties, and intense competition demand strategic agility.

- Strategic Outlook: investments in biologics, technological innovation, and geographical diversification will determine future trajectory.

FAQs

1. How does Aurobindo Pharma differentiate itself from competitors?

Aurobindo leverages its extensive, diversified product portfolio, cost-efficient manufacturing infrastructure, and strong regulatory track record, enabling it to compete effectively across multiple markets and product segments.

2. What are the main growth areas for Aurobindo Pharma?

The company’s primary growth focus includes biosimilars, complex generics, and niche therapeutic segments, complemented by geographic expansion into emerging markets.

3. How does Aurobindo manage regulatory risks?

Through robust quality management systems, proactive compliance, continuous regulatory engagement, and maintaining high standards across manufacturing facilities globally.

4. What strategic moves is Aurobindo making to enhance its biosimilars pipeline?

Aurobindo invests in R&D, collaborates with biotech firms, and develops high-value biologic products targeting lucrative markets like oncology and immunology.

5. What challenges does Aurobindo face in global markets?

Regulatory complexities, pricing pressures, intense competition from both multinational and local players, and patent litigations pose ongoing challenges.

Sources:

[1] Aurobindo Pharma Annual Report FY2022.

[2] Company R&D disclosures, investor presentations.

[3] Market analysis reports on biosimilars growth projections (Frost & Sullivan, 2022).