Last updated: November 7, 2025

Introduction

Diclofenac potassium is a non-steroidal anti-inflammatory drug (NSAID) widely used to alleviate pain, inflammation, and swelling associated with various acute and chronic conditions. Its market has seen significant shifts driven by clinical demand, regulatory changes, patent landscapes, and competitive forces. Understanding these market dynamics alongside its financial trajectory is essential for stakeholders aiming to capitalize on opportunities or mitigate risks associated with this pharmaceutical agent.

Pharmaceutical Profile and Therapeutic Indications

Diclofenac potassium is primarily prescribed for rapid pain relief in conditions such as dysmenorrhea, arthritis, gout, and postoperative pain due to its quick onset of action. Its rapid absorption profile, attributable to the potassium salt form, allows for prompt symptom management, which has maintained its clinical relevance despite burgeoning concerns over NSAID-associated gastrointestinal and cardiovascular risks.

Formulation and Patents:

It is available in various formulations—tablets, powders, topical gels, and injectable forms. Patents on certain formulations and delivery systems expired globally over the past decade, enabling intensified generic competition.

Market Drivers

1. Rising Prevalence of Chronic and Acute Pain Conditions

The global escalations in arthritis (osteoarthritis, rheumatoid arthritis), gout, and post-surgical pain cases fuel demand. The World Health Organization (WHO) reports an increase in musculoskeletal disorders, directly correlating with increased diclofenac potassium consumption.

2. Growing Preference for NSAIDs in Pain Management

Clinicians favor NSAIDs for their efficacy and oral bioavailability, with diclofenac potassium providing rapid relief relative to other NSAIDs. The convenience of formulations in both prescription and over-the-counter (OTC) segments bolsters its market share.

3. Expanding Markets in Emerging Economies

Developing markets such as India, China, and Brazil demonstrate rising healthcare access and increased awareness of pain management therapies. Generic formulations further lower prices, expanding consumer bases.

Regulatory and Safety Challenges

1. Cardiovascular Risks and Labeling Changes

Post-marketing studies (e.g., Johnson & Johnson’s VIGOR trial) link NSAIDs like diclofenac to increased cardiovascular events. Regulatory agencies such as the FDA and EMA now mandate explicit warnings, impacting prescription patterns and marketing strategies.

2. Gastrointestinal Toxicity Concerns

Gastrointestinal bleeding and ulceration risks necessitate co-prescription of proton pump inhibitors (PPIs), influencing prescribing behaviors and enhancing market opportunities for combined formulations.

3. Patent Expirations and Generic Proliferation

Patent cliffs around early formulations led to the proliferation of generics, reducing average selling prices (ASPs). The entry of multiple generic players has intensified price competition, squeezing profit margins, yet expanding overall volume sales.

Competitive Landscape

1. Brand-Name Drugs vs. Generics

While brands like Voltaren (by Novartis) historically commanded premium pricing, generics now dominate most markets. Key players include Teva, Mylan, Sun Pharmaceutical, and others.

2. Alternative NSAIDs and Analgesics

Market competition isn't limited to NSAIDs; opioids, acetaminophen, corticosteroids, and newer biologic agents for inflammatory conditions challenge diclofenac potassium's market share, especially amid safety concerns.

3. Market Entrants with Novel Delivery Systems

Innovations such as transdermal patches, delayed-release formulations, and combination products aim to improve safety profiles and compliance, providing differentiation amidst competition.

Market Size and Forecast: Regional and Global Outlook

Current Market Valuation (2023)

Preliminary estimates place the global diclofenac potassium market at USD 1.2 billion, predominantly driven by generic sales, with OTC segments accounting for approximately 40%. Major markets include North America, Europe, and Asia-Pacific, with the latter exhibiting the fastest growth rate (~7% CAGR) over the next five years.

Forecast Trajectory (2023–2028)

The global demand for diclofenac potassium is projected to expand at a compound annual growth rate (CAGR) of roughly 4%, reaching USD 1.6 billion by 2028. Growth factors include increased pain management needs, expanding healthcare infrastructure in emerging economies, and continued off-patent drugs proliferation.

Financial Trajectory and Revenue Streams

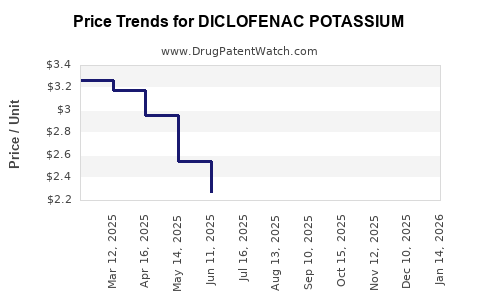

1. Revenue Impact of Patent Expiry

The end of exclusivity for many formulations has significantly lowered revenue per unit, forcing incumbent pharmaceutical companies to pivot toward volume-driven strategies. While revenue per dose diminishes, total sales volume compensates to sustain overall revenue streams.

2. Profitability of Generics vs. Branded Drugs

Generic manufacturing yields low margins (~10–15%), though high volume offsets reduced per-unit profitability. Branded formulations maintain higher margins (~20–25%) but face stiff competition post patent expiry.

3. Marketing and Distribution Dynamics

Intensified competition from generics has shifted marketing budgets towards price discounts, formulary inclusion strategies, and value-added formulations targeting pain management protocols.

Regulatory Impact on Financial Trajectory

Recent safety disclosures and label updates result in both market shrinkage in some regions and opportunities for innovators to develop safer, differentiated formulations. Companies investing in improved safety profiles or novel delivery technologies may realize premium pricing and extended market exclusivity, positively influencing financial outlooks.

Market Opportunities and Future Trends

1. Development of Safer NSAID Alternatives

There is mounting pressure to develop NSAIDs with reduced cardiovascular and gastrointestinal risks. Companies investing in selective COX-2 inhibitors or combination therapies could capitalize on a safer profile.

2. Biosimilars and Specialty Formulations

While biosimilars are more relevant for biologic drugs, the innovation landscape hints at specialty formulations, such as controlled-release patches, that could command higher margins.

3. Digital and Pharmacovigilance Integration

Enhanced pharmacovigilance systems integrated with digital health platforms enable better safety data collection, influencing regulatory decisions and enabling faster approval pathways for safer formulations.

Conclusion

The market for diclofenac potassium stands at a crossroads of growth driven by expanding pain management needs and constrained by safety concerns and competitive pressures. While revenue streams face erosion due to patent expiries and regulatory scrutiny, opportunities persist in formulation innovation, safety enhancements, and emerging markets.

Stakeholders should monitor regulatory developments closely, invest in R&D for safer NSAID profiles, and optimize pricing strategies aligned with regional healthcare dynamics to sustain financial performance.

Key Takeaways

- Market growth remains steady, fueled by rising prevalence of pain-related conditions globally, especially in emerging markets.

- Patent expiries and generics have reduced per-unit pricing, emphasizing volume-based revenue models.

- Regulatory safety concerns necessitate innovation in formulations and may open avenues for premium, safer NSAID products.

- Competitive landscape demands differentiation through safety, efficacy, and delivery systems to maintain market share.

- Future opportunities lie in developing novel formulations, safety profiles, and leveraging digital health tools for pharmacovigilance.

FAQs

1. How does patent expiry affect the profitability of diclofenac potassium?

Patent expiries open the market to cheaper generic competitors, significantly reducing brand-name prices and profit margins. Companies often compensate through increased sales volume or by developing new formulations and delivery mechanisms.

2. What are the primary safety concerns associated with diclofenac potassium?

Concerns include increased risks of cardiovascular events such as myocardial infarction and stroke, gastrointestinal bleeding, and ulceration, prompting regulatory warnings and patient contraindications.

3. Which regions represent the fastest-growing markets for diclofenac potassium?

Asia-Pacific, driven by expanding healthcare access, rising disposable incomes, and increasing prevalence of pain-related conditions, is the fastest-growing region.

4. What innovations could influence the future trajectory of diclofenac potassium?

Developments in safer NSAID formulations, transdermal delivery systems, combination therapies, and digital health integrations will shape its future market landscape.

5. How are regulatory changes impacting the market?

New safety warnings and label updates lead to shifts in prescription patterns. They also encourage innovation in safer drug development, influencing long-term market dynamics.

Sources:

[1] World Health Organization, “Musculoskeletal conditions” (2023).

[2] U.S. Food and Drug Administration, “NSAID Safety Announcement” (2022).

[3] IQVIA, “Global Pain Management Market Report” (2023).

[4] Johnson & Johnson, Clinical Trial Data on NSAIDs (2021).

[5] Market Research Future, “NSAID Market Analysis” (2022).