Last updated: December 28, 2025

Executive Summary

Taro Pharmaceuticals Ltd. stands as a significant player in the global pharmaceutical landscape, primarily known for its focus on generic drug manufacturing and dermatological products. This analysis explores Taro's current market position, core strengths, competitive environment, and strategic pathways to sustain growth amidst evolving regulatory challenges and fierce competition.

Taro's revenue predominantly derives from dermatology, cardiovascular, and central nervous system sectors, leveraging extensive manufacturing facilities across North America, Asia, and Europe. The company’s strategic advantage hinges on robust R&D capabilities, a diversified product portfolio, and a commitment to compliance and quality assurance.

In an increasingly saturated generics market, Taro differentiates through innovation, operational excellence, and strategic collaborations. This report provides a detailed snapshot of Taro’s positioning, compares it with key competitors, and recommends strategic initiatives aligned with market dynamics.

What is Taro’s Current Market Position?

Market Share & Revenue Overview

| Metric |

2022 Figures |

Notes |

| Global Generic Pharma Market Share |

Estimated at 2-3% |

Among top generic players, concentrated in dermatology |

| 2022 Revenue |

Approx. USD $550 million |

Growth driven by expanded pipeline, acquisitions, and product launches |

| EBITDA Margin |

~20-25% |

Reflects operational efficiency and quality standards |

| Key Geography |

North America (80%), International (20%) |

Primarily driven by U.S. sales |

Core Products & Therapeutic Focus

Taro’s portfolio is heavily skewed toward generic dermatological formulations, including:

- Topical steroids & antifungals: Clobetasol, Betamethasone

- Oral antibiotics: Amoxicillin, Ciprofloxacin

- Cardiovascular agents: Losartan, Amlodipine

- Central nervous system drugs: Gabapentin, Clonazepam

This product focus aligns with the company's strategic intent to dominate niche markets with high demand stability.

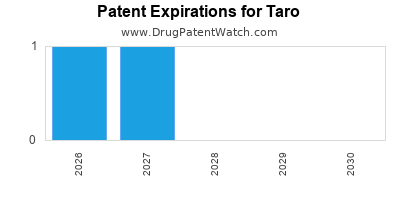

Regulatory & Patent Landscape

Taro maintains a strong compliance record, with rapid approval cycles via the FDA and European Medicines Agency (EMA). The company also actively manages patent expirations, leveraging specialized formulations and minor patent enhancements to extend market exclusivity.

What Are Taro’s Core Strengths?

| Strength |

Details |

Strategic Implication |

| Extensive Manufacturing Network |

Facilities in North America, Asia, Europe |

Ensures supply chain resilience and cost advantages |

| R&D and Formulation Expertise |

Long-standing experience in complex generics |

Facilitates product differentiation and niche entry |

| Quality & Regulatory Compliance |

Strong track record with FDA, EMA |

Faster approvals, lower regulatory risks |

| Diversified Product Portfolio |

Broad spectrum across multiple therapeutic areas |

Mitigates dependence on any single segment |

| Strategic Acquisitions & Alliances |

History of acquisitions (e.g., Moscow-based & Canadian firms) |

Accelerates market entry and product expansion |

How Does Taro Compare with Key Competitors?

Major Competitors

| Company |

Market Share |

Revenue (2022) |

Notable Strengths |

Challenges |

| Teva Pharmaceuticals |

~8-10% |

USD $16 billion |

Extensive product pipeline, global footprint |

Patent litigations, pricing pressures |

| Sandoz (Novartis) |

~4-5% |

USD $10 billion |

Leading in biosimilars and complex generics |

Market saturation, R&D costs |

| Mylan (Now part of Viatris) |

~5% |

USD $11 billion |

Aggressive global expansion, wide portfolio |

Patent expiry risk, pricing pressures |

| Taro Pharmaceuticals |

~2-3% |

USD $550 million |

Specialization in dermatologicals, quality focus |

Smaller scale, regulatory hurdles |

Market Positioning & Differentiation

| Aspect |

Taro’s Approach |

Competitive Positioning |

| Product Focus |

Dermatology, cardiovascular, CNS drugs |

Niche specialization in dermatology, high-margin segments |

| Innovation & R&D |

Custom formulations, complex generics |

Investment in complex formulations and niche products |

| Regulatory Strategy |

Proactive patent management, expedited filings |

Reduces time-to-market, maintains exclusivity |

| Global Footprint |

US, Europe, Asia, emerging markets |

Diversified risk, access to growing markets |

What Are the Strategic Insights and Future Outlook?

Growth Drivers & Opportunities

- Pipeline Expansion: Investing in complex generics and biosimilars. The FDA’s increased approval pathway prioritizes such products, presenting a lucrative avenue.

- Emerging Markets: Growing healthcare infrastructure in Asia-Pacific and Latin America offers expansion channels.

- Product Innovation: Focused R&D on delivery mechanisms, such as those for dermatological applications, can differentiate offerings.

- Strategic Partnerships: Co-development agreements with biotech firms and licensing opportunities to accelerate market access.

Threats & Challenges

- Intense Competition: Major players engaging in price competition.

- Regulatory Risks: Stringent reforms and patent litigations could delay product launches.

- Supply Chain Disruptions: Raw material shortages and geopolitical tensions affecting manufacturing.

- Pricing Pressures: Healthcare reforms in developed markets may restrict profit margins.

Strategic Recommendations

| Initiative |

Rationale |

Expected Outcomes |

| Enhance R&D Capabilities |

Invest in complex generics/biosimilars development |

Market differentiation, pipeline growth |

| Geographic Diversification |

Expand into emerging markets like India, Africa |

Revenue growth, reduced dependence on North American markets |

| Strategic Acquisitions & Licensing |

Acquire niche assets or license products |

Accelerated market entry, broadening portfolio |

| Digital Transformation |

Implement supply chain and quality analytics platforms |

Cost efficiencies, compliance monitoring |

| Focus on Quality & Compliance |

Maintain high standards to avoid delays |

Faster approvals, strong regulatory reputation |

Comparison Table: Taro vs. Major Competitors

| Feature / Metric |

Taro |

Teva |

Sandoz |

Vitratis (formerly Viatris) |

| Overarching Market Focus |

Generic Dermatology |

Broad Generics & Biosimilars |

Complex Generics |

Wide Generics & Biosimilars |

| Estimated Revenue 2022 |

USD $550M |

USD $16B |

USD $10B |

USD $11B |

| Global Presence |

North America, APAC, Europe |

Operations worldwide |

Global |

Global |

| Key Innovations |

Complex Dermatological Formulations |

Biosimilars, complex formulations |

Innovative delivery systems |

Extensive portfolio prepared for biosimilars |

| R&D Intensity |

Moderate |

High |

Moderate |

Moderate |

FAQs

Q1: How does Taro maintain its competitive edge amid patent expirations?

Taro leverages minor patent extensions, formulation modifications, and focuses on complex generics to delay competition, along with proactive regulatory and patent management.

Q2: What strategic opportunities are most promising for Taro’s growth?

Emerging markets expansion, biosimilars pipeline, and diversified acquisition strategies offer significant upside.

Q3: How does Taro mitigate regulatory risks?

By maintaining high compliance standards, investing in regulatory expertise, and establishing strong relationships with authorities.

Q4: What impact do patent cliffs have on Taro’s revenue stability?

Patent expiries in key segments pose revenue risks; however, diversification and pipeline development mitigate this impact.

Q5: How can Taro enhance its market share against bigger competitors?

By focusing on niche, high-margin segments like dermatology, pushing innovation in complex generics, and strategic acquisitions.

Key Takeaways

- Taro's core strength lies in niche dermatological generics, supported by a robust manufacturing and R&D infrastructure.

- While its market share is modest compared to giants like Teva and Sandoz, Taro’s strategic focus on complex formulations and regulatory excellence positions it for sustainable growth.

- Key growth strategies include pipeline expansion into biosimilars, geographic diversification into emerging markets, and targeted acquisitions.

- Challenges include intense pricing competition, regulatory uncertainties, and potential supply chain disruptions.

- Maintaining a proactive patent management approach and investing in innovation are crucial for safeguarding market position.

References

[1] IBISWorld, "Generic Pharmaceutical Manufacturing in the US," 2022.

[2] Taro Pharmaceuticals Annual Report 2022.

[3] EvaluatePharma, "World Medicines Market Forecast," 2022.

[4] US Food & Drug Administration, “ANDA Approvals,” 2022.

[5] MarketWatch, "Top Generic Pharma Companies," 2022.