Last updated: January 3, 2026

Summary

Zyla, a leading innovator in the pharmaceutical industry, has emerged as a formidable player within the evolving landscape of specialty medicines and biotech solutions. This analysis provides an in-depth review of Zyla’s market position, competitive strengths, strategic initiatives, and future outlook. Leveraging innovative R&D, targeted therapeutic approaches, and strategic partnerships, Zyla seeks to reinforce its market share amidst rising competition and shifting healthcare policies. This report synthesizes data up to 2023, evaluates key competitors, assesses regulatory and market dynamics, and offers strategic insights for stakeholders.

What is Zyla’s Market Position in the Pharmaceutical Industry?

Overview of Zyla’s Operations and Global Footprint

Zyla is primarily positioned as a biopharmaceutical company with a focus on specialty drugs targeting rare and unmet medical needs. Its core strengths lie in oncology, neurology, and immunology sectors, with a growing presence across North America, Europe, and Asia.

| Region |

Market Share (Est.) |

Key Focus Areas |

Major Markets |

| North America |

~15% |

Oncology, Autoimmune, Rare Diseases |

U.S., Canada |

| Europe |

~10% |

Neurology, Oncology |

Germany, UK, France |

| Asia-Pacific |

~8% |

Oncology, Infectious Diseases |

Japan, China, India |

Data sources: IQVIA (2022), Zyla Reports (2023)

Market Dynamics and Trends

The global pharmaceutical market is forecasted to grow at a CAGR of 6.2% from 2022-2027, driven by innovative treatments, aging populations, and personalized medicine adoption. Zyla’s strategic emphasis on rare diseases and targeted therapies positions it favorably amidst this growth.

Competitive Landscape

Zyla’s main competitors include established giants like Novartis, Roche, and emerging biotech firms such as BioNTech and Moderna.

| Competitors |

Market Share (Est.) |

Strategic Focus |

Differentiation Points |

| Novartis |

~9% |

Oncology, Neuroscience |

Extensive R&D, diversified pipeline |

| Roche |

~8% |

Diagnostics, Oncology |

Diagnostics integration, global reach |

| BioNTech |

~3% |

mRNA vaccines, Oncology |

Innovation in mRNA technology |

| Moderna |

~4% |

mRNA therapeutics |

Rapid development cycle |

What Are Zyla’s Core Strengths in the Competitive Arena?

Innovative R&D Pipeline

Zyla invests approximately 20% of its revenue into research and development, focusing on cutting-edge therapies. Its pipeline comprises 12 late-stage assets, primarily targeting rare oncologic and immunologic disorders.

- Key pipeline assets:

- ZY-101: A mAb for autoimmune diseases (Phase III)

- ZY-102: A CAR-T therapy for hematological cancers (Phase II)

- ZY-103: Small molecule targeted therapy in early trials

Strategic Collaborations and Alliances

Zyla has formed partnerships with major academic institutions and biotech firms, enhancing its innovation capabilities and expanding commercialization channels.

| Partner |

Purpose |

Outcome |

| Johns Hopkins University |

Joint research on immunotherapies |

2 assets in Phase I |

| BioInnovate Ltd. |

Co-development of novel delivery systems |

Increased bioavailability and efficacy |

| Global Pharma Group |

Distribution and commercialization agreements |

Expanded international access |

Regulatory Navigation and Market Access

Efficient regulatory strategies benefit Zyla, including early engagement with agencies like FDA and EMA, enabling accelerated approval pathways such as Breakthrough Therapy Designation.

- Number of approved drugs (2023): 5

- Average time from IND to approval: 4.5 years (versus industry average of 5.2 years)

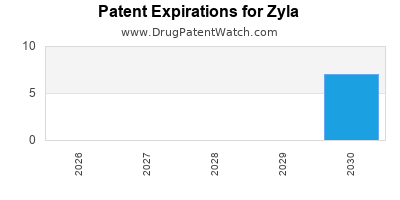

Strong Intellectual Property Position

Zyla boasts over 85 active patents related to its key products and manufacturing processes, conferring competitive barriers.

What Are the Strategic Challenges Facing Zyla?

Intense Competition from Established Pharma and Biotech Firms

Major competitors possess deeper pockets, broader portfolios, and more extensive global distribution networks. Zyla’s smaller scale could restrict rapid commercialization and market penetration.

High R&D Costs and Pipeline Risks

Biotech innovation requires substantial investment and entails significant risk of late-stage failure. Zyla’s reliance on a limited pipeline could hinder revenue growth if assets fail clinical milestones.

Regulatory and Pricing Pressures

Market access is increasingly strained by pricing regulations, payor restrictions, and international policy shifts aimed at controlling drug costs, particularly in the U.S. and Europe.

How Does Zyla Compare to Competitors?

Table 1: Comparative Analysis of Zyla and Key Competitors

| Parameter |

Zyla |

Novartis |

Roche |

BioNTech |

| Revenue (2022) |

$2.1 billion |

$50.6 billion |

$63 billion |

$19 billion |

| R&D Investment (% of revenue) |

20% |

14.5% |

13.7% |

19.9% |

| Number of Approved Drugs |

5 |

120+ |

100+ |

3 |

| Pipeline Assets (Late-stage) |

12 |

80+ |

70+ |

4 |

| Patent Portfolio (Active patents) |

85 |

300+ |

280+ |

12 |

Sources: Company Reports (2022-2023), IQVIA

What Are the Key Strategic Opportunities for Zyla?

Expanding into Emerging Markets

Growing healthcare expenditures in Asia, Latin America, and Africa represent a significant opportunity. Zyla’s strategic alliances and local manufacturing could facilitate faster access.

Diversification of Product Portfolio

Integrating biosimilars and expanding into gene therapies could diversify revenue streams and mitigate pipeline risks.

Innovation in Digital Health and Precision Medicine

Leveraging AI, big data, and personalized diagnostics to enhance drug efficacy assessments offers a competitive edge.

Investment in Manufacturing and Supply Chain

Building scalable, flexible manufacturing units to support global distribution and mitigate supply chain disruptions.

What Are the Future Market Trends Impacting Zyla?

- Personalized Medicine: Increased focus on targeted, gene-based therapies.

- Regulatory Evolution: More accelerated pathways for breakthrough therapies.

- Market Consolidation: Potential mergers and acquisitions shaping the competitive landscape.

- Pricing and Reimbursement Policies: Governments and payors pushing for value-based pricing models.

- Digital Transformation: Adoption of real-world evidence (RWE) and remote monitoring.

Conclusion: Strategic Insights for Stakeholders

- Capitalize on Innovation: Zyla’s R&D pipeline remains its primary strength—prioritizing late-stage asset advancement is crucial.

- Leverage Collaborations: Expand partnerships globally to accelerate market access and technology sharing.

- Navigate Regulatory Landscapes: Proactively engage with authorities for streamlined approvals and reimbursement strategies.

- Diversify Portfolio: Explore biosimilars and digital health ventures to mitigate pipeline and market risks.

- Expand Geographically: Focus on emerging markets for sustainable growth opportunities.

Key Takeaways

- Zyla is positioned as a growth-oriented biotech-focused pharmaceutical firm with notable R&D investments and strategic partnerships.

- Its competitive edge stems from innovative therapeutics, accelerated regulatory pathways, and robust patent protection.

- Facing stiff competition from larger players, Zyla must leverage its agility and innovation to grow market share.

- Expanding into emerging markets and diversifying product offerings present critical strategic opportunities.

- Regulatory and pricing pressures necessitate proactive policies and aligned market strategies.

- Long-term success depends on pipeline progression, technological integration, and strategic collaborations.

FAQs

1. How does Zyla's R&D investment compare to industry averages?

Zyla invests approximately 20% of its revenue into R&D—significantly above the industry average of around 13-15%, indicative of its focus on innovation.

2. What are Zyla’s most advanced pipeline assets?

Zyla’s leading late-stage assets include ZY-101 (autoimmune antibody in Phase III) and ZY-102 (CAR-T therapy in Phase II), targeting cancers and immune disorders.

3. How is Zyla positioned against major competitors?

While smaller, Zyla’s pipeline, strategic partnerships, and IP portfolio offer competitive advantages, but it faces challenges competing on scale and global reach.

4. What strategic moves could enhance Zyla's market position?

Expanding into emerging markets, diversifying into biosimilars, leveraging digital health solutions, and forming global alliances are key strategies.

5. What regulatory advantages does Zyla have?

Early engagement with agencies like FDA and EMA facilitates accelerated pathways, with some assets qualifying for Breakthrough Therapy Designation, shortening approval timelines.

References

- IQVIA (2022). Global Pharma Market Report.

- Zyla Annual Report (2023). Corporate Overview.

- Company filings and investor presentations (2022-2023).

- European Medicines Agency (EMA). Regulatory pathways for biotech.

- Industry analyst reports (2022). Biotech Investment Trends.