The pharmaceutical and biotechnology sectors operate at the cutting edge of scientific discovery, yet their success hinges equally on meticulous execution and strategic partnerships. In this complex ecosystem, Contract Development and Manufacturing Organizations (CDMOs) have emerged as indispensable allies, transforming from mere service providers into pivotal strategic partners. Understanding the intricacies of a CDMO contract is no longer a mere legal exercise; it is a critical business imperative that can dictate a product’s journey from concept to commercialization, ultimately shaping a company’s competitive standing.

The Strategic Imperative: Why CDMO Partnerships Matter More Than Ever

The modern pharmaceutical landscape is characterized by accelerating innovation, escalating costs, and an increasingly stringent regulatory environment. Amidst these pressures, the strategic engagement of CDMOs has become a cornerstone of efficient drug development and manufacturing.

The Evolving Landscape of Pharmaceutical Development

The role of external partners in the pharmaceutical industry has undergone a significant transformation. What began as a transactional relationship with Contract Manufacturing Organizations (CMOs) has evolved into a deeply integrated partnership with CDMOs.

The Modern CDMO: Beyond Traditional CMOs

A CDMO is a specialized entity that offers comprehensive services spanning the entire drug development and manufacturing lifecycle for pharmaceutical and biotech firms. Unlike their predecessors, CMOs, which focused primarily on large-scale production, CDMOs provide end-to-end support, encompassing active pharmaceutical ingredient (API) development, formulation development, regulatory compliance, clinical trial management, process development, upscaling, and commercial production.1 This expanded scope reflects a fundamental shift from a purely transactional vendor relationship to a strategic partnership model. The integrated nature of CDMO services streamlines the drug development and manufacturing process, enabling faster, more efficient, and cost-effective production of pharmaceutical products. This comprehensive approach reduces the need for clients to manage multiple vendors across different development stages, thereby simplifying communication, mitigating handoff risks, and potentially accelerating overall timelines. The deeper integration into a client’s core research and development (R&D) strategy is a direct consequence of this shift, highlighting the CDMO’s growing influence beyond mere execution, extending into strategic advisory roles.

Drivers of CDMO Engagement: Cost, Capacity, and Expertise

Pharmaceutical companies engage CDMOs to address a multitude of challenges inherent in drug development and manufacturing. These include managing the exorbitant costs associated with in-house development and manufacturing, overcoming internal capacity constraints, navigating complex regulatory landscapes, accessing cutting-edge technology and innovation, and accelerating speed to market. CDMOs offer access to specialized expertise, established quality systems, and deep regulatory compliance knowledge that might be difficult or cost-prohibitive for individual companies to maintain internally. For smaller biotech companies, partnering with a CDMO can provide access to specialized expertise, larger manufacturing capacity, guidance through intricate regulatory requirements, and a faster pathway to market. This convergence of cost, capacity, and expertise drivers underscores that CDMO engagement is not merely a tactical necessity but a strategic imperative. For smaller biotechs, CDMOs democratize access to capabilities that would otherwise demand massive capital investment, effectively leveling the playing field. For established pharmaceutical companies, CDMOs offer unparalleled flexibility and specialized focus that might be challenging to sustain internally across a diverse product pipeline. This signifies that CDMOs are increasingly becoming enablers of innovation and market access for companies of all sizes, making the CDMO contract a foundational element of a true partnership framework.

The CDMO as a Strategic Partner: Unlocking Competitive Advantage

The value proposition of a CDMO extends far beyond simply manufacturing a product; it encompasses accelerating development, mitigating risks, and providing access to advanced technologies.

Accelerating Timelines and Speed to Market

One of the most compelling advantages of collaborating with a CDMO is the potential for significantly accelerated development timelines. CDMOs are typically equipped with state-of-the-art facilities, advanced technologies, and extensive technical know-how, enabling them to streamline processes and expedite various stages of development. This efficiency can translate into faster formulation development, quicker analytical method validation, and overall accelerated progress through the development pipeline. Given that the drug development process typically spans 10 to 15 years and incurs costs averaging $2.6 billion USD, every day saved in development directly impacts a drug’s commercial viability and market exclusivity.4 A quicker market entry, especially for a drug protected by patents, means an extended period of market exclusivity and a higher potential for revenue generation. This direct correlation between CDMO efficiency and the client’s financial success and competitive positioning underscores the strategic importance of this acceleration. Therefore, a robust CDMO contract should include clear milestones, performance incentives, and strong project management clauses that explicitly reflect this urgency and its financial implications.

Mitigating Risk and Navigating Complexity

Drug development is inherently fraught with risks, from scientific uncertainties to regulatory hurdles and operational challenges. CDMOs serve as strategic partners in risk mitigation by leveraging their extensive experience to effectively navigate these complexities. Their exposure to a diverse range of projects provides a unique knowledge base, enabling them to anticipate potential issues and implement proactive measures to prevent them from becoming significant hurdles. This collaborative approach to risk management shifts the paradigm from reactive problem-solving to proactive, strategic foresight. Proactive risk mitigation, particularly through integrated solutions and robust supply chain management, significantly reduces the likelihood of costly delays, batch failures, or regulatory non-compliance. This, in turn, safeguards the client’s substantial investment and protects its reputation in a highly scrutinized industry. The emphasis on “proactive measures” and “anticipating potential issues” indicates that the CDMO’s value transcends its direct service offerings, extending to its strategic advisory capacity. Consequently, the CDMO contract should clearly define risk allocation, establish communication protocols for early risk identification, and delineate the CDMO’s responsibilities in developing and implementing comprehensive mitigation strategies, moving beyond simple indemnification. CDMOs with robust contingency plans and diverse supplier partnerships are inherently better equipped to mitigate operational risks, further solidifying their role as essential partners in navigating industry complexities.

Accessing Innovation and Specialized Technologies

Maintaining cutting-edge infrastructure and specialized expertise for every drug modality in-house is often prohibitively expensive and impractical for many pharmaceutical companies. CDMOs bridge this gap by providing access to innovative technologies and expertise in the latest trends and advancements in clinical development and manufacturing. They are equipped with state-of-the-art facilities and technologies that might not be available within a client’s internal operations. The global CDMO market is experiencing robust growth, largely driven by the increasing demand for advanced therapeutics such as gene therapies and biologics, which necessitate specialized equipment and advanced manufacturing technologies.7 Many CDMOs possess specialized technological capabilities that original equipment manufacturers (OEMs) and biotech firms rely on to develop innovative solutions. This positions CDMOs as innovation hubs, democratizing access to advanced technologies and specialized expertise, thereby fostering broader pharmaceutical innovation. By centralizing these expensive and specialized capabilities, CDMOs enable more companies, particularly smaller biotechs, to pursue novel drug candidates, accelerating the overall pace of pharmaceutical innovation. This also means CDMOs are not merely manufacturing partners but also technology partners, actively driving the industry forward. The CDMO contract should therefore reflect this technological partnership, addressing intellectual property (IP) generated from new processes or technologies, and ensuring the client has appropriate access to and understanding of the CDMO’s technological advancements relevant to their product.

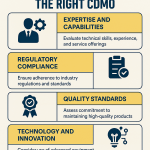

Laying the Foundation: Strategic CDMO Selection and Due Diligence

A successful CDMO partnership begins long before the contract is signed. A well-informed selection process, underpinned by rigorous due diligence, is the crucial first step towards establishing a robust and enduring collaboration.

Defining Your Needs: From Project Scope to Cultural Fit

The initial phase of CDMO selection requires a clear and precise articulation of the client’s specific needs, extending beyond technical requirements to encompass operational, regulatory, financial, and cultural considerations.

Technical Capabilities and Operational Excellence

The technical prowess and operational capacity of a CDMO are fundamental considerations. Companies should establish well-defined selection criteria that translate internal project requirements into objective, actionable benchmarks. For example, instead of a vague desire for “biologics experience,” a criterion might specify “minimum five years of aseptic fill-finish experience with monoclonal antibodies and a track record of three or more commercial launches”. This level of precision enables “apples-to-apples comparisons” among CDMOs. A rigorous assessment of the CDMO’s technical capabilities, including their equipment, technology, and the skill level of their personnel, is essential to ensure alignment with project requirements. Expertise in process development, scale-up, and technology transfer (tech transfer) is also paramount. By forcing such specificity in defining technical criteria, the client organization is compelled to thoroughly understand its own project’s nuanced technical needs. This internal clarity significantly reduces the likelihood of “scope creep” or unforeseen technical challenges later in the project, which are major contributors to cost overruns and delays. It also empowers the client to objectively evaluate and justify their CDMO choice, fostering internal alignment and building a stronger foundation for the partnership. The Request for Proposal (RFP) process should be designed to elicit these specific capabilities, and the contract’s Scope of Work should directly reflect this granular understanding.

Regulatory Track Record and Quality Systems

Regulatory compliance is the non-negotiable bedrock of the pharmaceutical industry. A CDMO’s regulatory track record, including successful agency inspections and experience navigating relevant regional or global submissions, is a critical selection criterion. Their quality standards, encompassing cGMP compliance, data integrity systems, and the overall quality management infrastructure, must be rigorously assessed. Compliance with Good Manufacturing Practices (GMP) is not merely a formality; it is essential to ensure the safety and efficacy of pharmaceutical products. A quality audit serves as an important initial step in aligning quality expectations, often conducted even before contract signing, to proactively identify potential risks and gaps in the CDMO’s processes and quality systems. For diagnostic and life science products, ISO 13485 certification is a key indicator of a robust Quality Management System (QMS), demonstrating an organization’s ability to consistently meet regulatory standards. A CDMO’s regulatory and quality history serves as a direct proxy for its risk profile and long-term reliability, directly influencing the client’s market access and brand integrity. Beyond simply looking for a clean record, understanding how a CDMO responded to past FDA 483s or warning letters (if any) provides forensic insight into the effectiveness of their corrective and preventive action (CAPA) systems and their overarching quality culture. A CDMO that demonstrates a capacity to learn from its mistakes and implement robust remediation strategies exhibits a higher level of maturity and reliability, which directly mitigates future regulatory risks for the client and helps ensure product integrity. A “mature quality system” can lead to a “more efficient and low-risk onboarding process” , directly translating to project efficiency and reduced operational friction. Therefore, the contract must explicitly reference the Quality Assurance Agreement (QAA) and incorporate stringent quality clauses, acknowledging that the client (as the product owner) retains ultimate responsibility for product quality and regulatory compliance.

Financial Stability and Long-Term Viability

A CDMO partnership, particularly for commercial manufacturing, represents a significant, often long-term, commitment. Assessing the CDMO’s financial stability, including its long-term viability, history of facility investment, and absence of significant ownership risks, is crucial. This involves reviewing audited financial statements, understanding their investment history, and examining future infrastructure plans to ascertain their ongoing operational sustainability. Identifying potential ownership structure risks, such as significant private equity involvement or imminent acquisitions, is also important, as these factors can influence the CDMO’s strategic focus and resource allocation. Furthermore, any expansion constraints or known capital limitations should be considered, as these can directly impact the feasibility of project growth. Financial stability is not merely about avoiding bankruptcy; it is about ensuring the CDMO’s capacity for sustained investment in technology, infrastructure, and talent, which is vital for long-term scalability and innovation. A financially robust CDMO is better positioned to support the client’s product through its entire lifecycle, from early clinical trials to full commercialization, and to adapt to evolving market demands. Conversely, an unstable CDMO might be forced to cut corners, delay critical investments, or even cease operations, thereby jeopardizing the client’s supply chain and market presence. Changes in ownership structure, such as a private equity buyout, can fundamentally alter a CDMO’s strategic priorities, potentially impacting existing client relationships. Therefore, the contract should include provisions that allow for monitoring of the CDMO’s financial health and provide clear off-ramps or transition plans in case of significant financial distress or a change of control.

Communication, Transparency, and Cultural Alignment

Beyond the technical, regulatory, and financial aspects, the human element of the partnership is paramount. The CDMO’s customer service history, including client feedback regarding transparency and responsiveness, and its cultural fit—encompassing working style, risk tolerance, decision-making agility, and communication practices—are vital considerations. The importance of “overcommunication” cannot be overstated; it is essential for fostering transparency, resolving misunderstandings, overcoming challenges, and facilitating quick troubleshooting when issues arise. Effective project management, which includes anticipating problems before they occur and consistently keeping partners informed of any changes, is a key attribute of a quality CDMO. Cultural alignment and a commitment to “overcommunication” serve as predictive indicators of a CDMO’s ability to navigate unforeseen challenges collaboratively, transforming potential conflicts into shared problem-solving opportunities. In the complex and high-stakes environment of drug development, problems are an inevitability. A CDMO that prioritizes “overcommunication” and demonstrates a strong “cultural fit” is more likely to engage in transparent dialogue, admit issues early, and collaborate on solutions rather than concealing problems or resorting to blame. This proactive communication significantly reduces the “cost of delays or failures” and cultivates long-term trust, which is invaluable in a multi-year partnership. While difficult to quantify in a contract, these elements should be thoroughly explored during the due diligence and negotiation phases, perhaps through structured interviews and reference checks. The contract can, however, reinforce this commitment through clear reporting requirements, defined escalation procedures, and dispute resolution clauses that favor collaborative problem-solving.

The Due Diligence Checklist: A Comprehensive Approach

Thorough due diligence is the process of validating a CDMO’s claims and assessing its suitability as a partner. This involves a deep dive into various operational, legal, and financial aspects.

Quality and Compliance Assessment

Due diligence mandates a comprehensive review of the CDMO’s compliance policies, regulatory communications, records of product recalls, adverse experience reports, and the results of past FDA inspections. It is crucial to confirm that the CDMO’s manufacturing contracts and internal manuals adhere to GMP standards. Additionally, an examination of their compliance with Health Insurance Portability and Accountability Act (HIPAA) regulations concerning protected health information is essential. This meticulous review of past performance and documented systems is crucial for validating a CDMO’s claims. A detailed review of compliance history, including past FDA Form 483s or warning letters, provides a forensic understanding of the CDMO’s quality culture and its capacity to remediate issues effectively. This directly impacts the client’s regulatory risk exposure. Beyond simply looking for a clean record, understanding how a CDMO responded to past deficiencies reveals the effectiveness of their corrective and preventive action (CAPA) system and their overall quality culture. A CDMO that demonstrates a commitment to learning from its mistakes and implementing robust remediation measures exhibits a higher level of maturity and reliability, which directly mitigates future regulatory risks for the client and helps ensure product integrity. The contract’s Quality Agreement should build upon these findings, specifying audit rights, deviation management protocols, and reporting requirements that reflect the level of trust established during this rigorous due diligence phase.

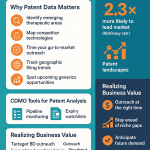

Intellectual Property Scrutiny

Intellectual property (IP) is often the most valuable asset for pharmaceutical companies, making its protection during outsourcing paramount. Due diligence requires compiling a comprehensive summary of all the CDMO’s IP, including trademarks, patents, copyrights, and web domains. It involves a thorough examination of their trade secrets and assessing the firm’s ability to protect and maintain their security and confidentiality. A review of all agreements related to the use of third-party IP is essential, as is determining whether the CDMO is utilizing any IP for which the assignment of rights is incomplete or defective. This scrutiny also extends to reviewing the CDMO’s IP litigation history, instances of infringement, and their internal processes for developing and protecting IP. Furthermore, determining the eligibility of any patents for term extension and understanding the market exclusivity terms attached to products is vital for strategic planning. IP due diligence extends beyond merely confirming ownership; it is about identifying potential “IP contamination” risks and understanding the CDMO’s IP strategy, which directly impacts the client’s freedom to operate and long-term competitive advantage. The concept of “IP contamination” can arise when a CDMO’s “background IP” or “lessons learned from customer-to-customer” are inadvertently or inappropriately used in the development or manufacturing of a client’s product, leading to disputes over “developed IP” ownership. Thorough IP scrutiny during due diligence helps identify if the CDMO has a history or practices that could lead to such issues, influencing how IP clauses are drafted to prevent future “tug-of-war” scenarios. Understanding the CDMO’s IP development process also provides insight into its innovation culture and its approach to safeguarding proprietary information. Therefore, the IP clauses in the contract must be meticulously crafted to clearly define ownership of pre-existing (background) and newly developed (foreground) IP, and to prevent any unintended co-mingling or misappropriation.

Financial and Business Stability Analysis

A CDMO’s financial health directly impacts its ability to fulfill long-term commitments, invest in necessary upgrades, and withstand economic pressures. Due diligence in this area includes obtaining a current valuation of the firm, identifying any deferred tax liabilities or assets, outlining transfer pricing policies, reviewing recent tax audits (up to five years prior), and describing any overseas activity or sale-and-leaseback transactions. Beyond basic financial health, analyzing the CDMO’s tax and financial structures, such as transfer pricing and overseas activity, can reveal operational complexities or potential vulnerabilities that might impact long-term costs or supply chain stability. Details like “transfer pricing policies” and “overseas activity” are not just accounting specifics; they can indicate the CDMO’s global operational footprint, its tax efficiency strategies, and its exposure to geopolitical or economic risks in different jurisdictions. A complex, multi-jurisdictional financial structure might introduce unforeseen costs or regulatory challenges for the client, particularly concerning supply chain resilience and global distribution. The contract should therefore consider these global financial implications, especially in multi-year agreements, and include clauses that address cost adjustments related to currency fluctuations or changes in tax regulations.

Evaluating Past Partnerships and Client History

A CDMO’s past performance is often the most reliable predictor of future success. It is crucial to review the CDMO’s history with past clients to understand their ability to maintain strong, reliable partnerships. This involves requesting detailed case studies and client references to gain insights into their past performance on similar projects, with a particular focus on delivery timelines, quality benchmarks, and issue resolution processes. A history of unmet commitments, communication breakdowns, or recurring deficiencies should be considered significant red flags requiring further investigation. Evaluating past partnerships provides a qualitative validation of the CDMO’s “cultural fit” and “trustworthiness,” attributes that are often difficult to assess through quantitative metrics alone but are crucial for navigating the inevitable challenges of drug development. Beyond just “success stories,” actively seeking out and scrutinizing instances of “unmet commitments, communication breakdowns, or recurring deficiencies” provides a deeper understanding of how the CDMO handles adversity. This reveals their problem-solving approach, their transparency, and their commitment to partnership values—elements that are critical when “nothing’s going to go well. There’s always something going wrong”. A CDMO that can openly discuss past challenges and demonstrate how they were effectively resolved builds greater trust and confidence. While not directly contractual, this information heavily influences the negotiation of clauses related to performance metrics, dispute resolution, and termination for cause, as it informs the client’s risk tolerance and the appropriate level of oversight required.

The Competitive Bidding Process: Ensuring a Strategic Match

The selection of a CDMO is a strategic decision that extends far beyond simply choosing the lowest bidder. A well-structured competitive bidding process is essential to ensure a strategic match.

A well-structured CDMO selection process involves defining and prioritizing clear criteria, developing a thorough RFP template, and effectively managing initial screenings. It is crucial to conduct a competitive bidding process to carefully analyze all available options, and providing a bid tab structure can be helpful in ensuring that all potential companies categorize and define their proposals in a consistent format. A common pitfall is placing too much emphasis on price alone; the cost of delays or failures in drug development is exceedingly high, making the right partner, even at a premium, a far more valuable investment. The competitive bidding process, when executed strategically (i.e., beyond merely comparing prices), serves as an initial “stress test” for potential CDMOs. It reveals their commitment to detail, their level of transparency, and their collaborative spirit even before formal engagement. The willingness of a CDMO to engage thoroughly in a detailed RFP process, provide transparent cost breakdowns, and discuss nuanced aspects like technology transfer complexities before contract signing is a strong indicator of their future partnership quality. As one expert noted, “If a CDMO isn’t willing to go through this exercise with you to earn your business, what will it be like working with them once you have committed?”. This early engagement reveals their commitment to alignment and proactive problem-solving. The insights gained during this phase directly inform the negotiation strategy, highlighting areas of potential friction or alignment that need to be explicitly addressed in the final contract.

Table 1: Key CDMO Services Across Drug Development Stages

| Drug Development Stage | CDMO Services |

| Drug Discovery & Development | API development, Formulation development, Analytical development, Research & Innovation in laboratory (identifying promising compounds, testing molecular compounds, optimal dosages) 1 |

| Preclinical Research | Laboratory and animal testing (risk, toxicity, dosage, safety parameters), Analytical testing, Method development & validation 3 |

| Clinical Research (Phase 1, 2, 3) | Clinical trial management, Clinical trial material production, Clinical manufacturing (solid oral dose, liquids, semi-solids, aseptic fill-finish), ICH stability testing, QP release of clinical drug, Inventory management, Distribution for clinical use 1 |

| FDA Review | Regulatory compliance, Regulatory support, Compilation of CMC information for regulatory submission, Assistance with FDA filings 1 |

| Commercial Production & Post-Market | Commercial production, Upscaling, Commercial manufacturing, Packaging and labeling, Distribution, Storage, Inventory management, Order fulfillment, Quality control, Customer support 1 |

This table provides a comprehensive overview of the extensive range of services offered by modern CDMOs, from the nascent stages of drug discovery to post-market activities. By mapping these services to specific drug development phases, it clarifies the CDMO’s integral role throughout the entire product lifecycle. This visual representation helps stakeholders grasp the strategic depth of CDMO engagement, demonstrating that these organizations are not merely manufacturing plants but deeply integrated partners across the entire drug journey. This understanding reinforces the necessity for a comprehensive contract that covers these diverse activities and their associated risks and responsibilities.

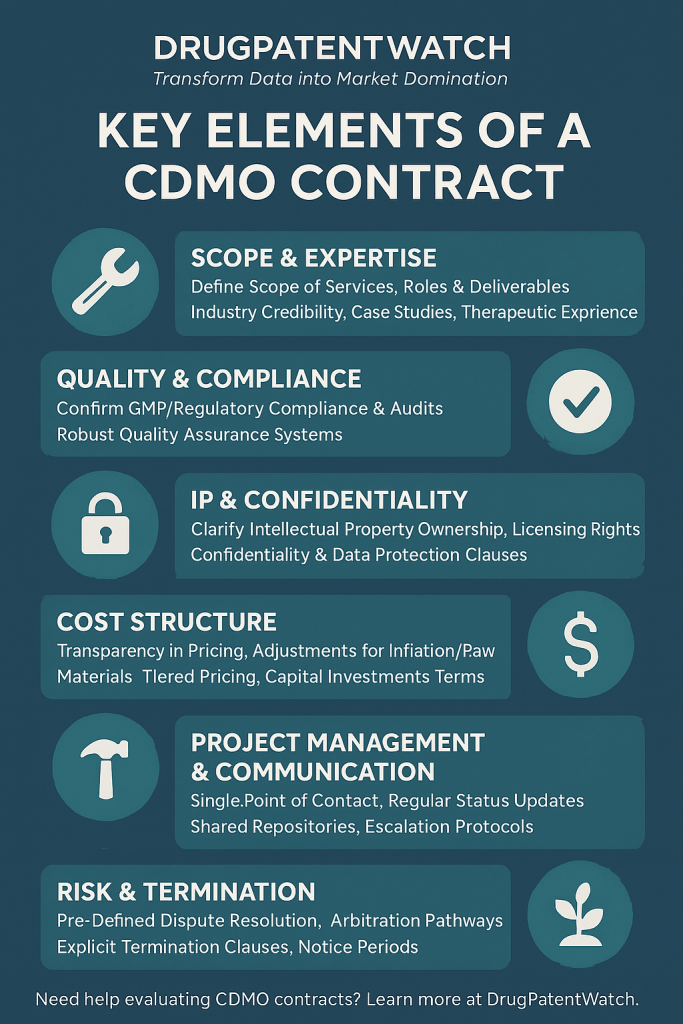

The Anatomy of a Robust CDMO Contract: Essential Clauses for Protection and Performance

The CDMO contract is the legal framework that governs the partnership, defining roles, responsibilities, and expectations. A well-structured contract protects both parties while fostering an environment conducive to successful drug development and manufacturing.

Foundational Elements: Setting the Stage for Collaboration

These clauses establish the fundamental parameters of the CDMO engagement, laying the groundwork for all subsequent operational and legal provisions.

Scope of Work: Precision in Deliverables and Responsibilities

The Scope of Work (SOW) clause is the blueprint of the partnership, outlining the specific tasks and responsibilities of the CDMO. It must include a detailed description of the products to be produced, their precise specifications (such as size, color, materials, and functionality), the quantity of products to be manufactured, and any special requirements or customizations. This meticulous definition ensures that the CDMO has a clear understanding of what is expected, thereby reducing the risk of errors and omissions. A common pitfall in CDMO partnerships is overlooking detailed project scope and goals, where sponsors often provide only high-level objectives, hoping the CDMO’s expertise will “fill in the gaps”. This ambiguity frequently leads to misunderstandings, missed timelines, and significant budget overruns. A meticulously defined SOW, which includes explicit success metrics, transforms abstract objectives into measurable deliverables, acting as a critical risk mitigation tool against “scope creep” and potential financial disputes. By outlining “deliverables, critical milestones, and quality criteria in a written document” and defining “success metrics” (e.g., yield targets for an upstream fermentation process or specific release criteria for finished drug product) , the SOW becomes a powerful mechanism for managing expectations and holding both parties accountable. This proactive definition prevents “small misunderstandings” from “balloon[ing] into missed timelines and budget overruns” , directly impacting project cost and speed. Furthermore, it serves as the foundational basis for any future change orders, ensuring that modifications are managed systematically.

Term and Termination: Defining the Partnership’s Lifecycle

The Term and Termination clause specifies the duration of the agreement and the precise conditions under which it can be ended. This includes the start date, end date, any provisions for extending the term, and the circumstances that may trigger termination, such as a material breach of contract, failure to meet quality standards, or insolvency of either party. Crucially, it also addresses notice periods for termination and outlines obligations that survive termination, such as confidentiality and intellectual property rights. A Master Services Agreement (MSA) typically defines the overarching relationship term (e.g., three years, extendable), while individual Product Schedules, which detail specific projects, often contain clauses allowing them to continue even after the MSA’s expiry. This interplay between the MSA’s term and individual Product Schedules’ survival clauses demonstrates a strategic approach to fostering long-term partnerships while maintaining flexibility for specific projects. This structure enables clients to build enduring strategic relationships with preferred CDMOs, a factor that can influence pricing through “Relationship Length and Strategic Importance” , while retaining the agility to manage individual drug programs independently. The survival clauses for IP and confidentiality are paramount, as they protect the client’s core assets even after the operational relationship concludes, emphasizing the enduring nature of these legal obligations beyond active manufacturing. Negotiating termination clauses requires foresight into potential future scenarios, including product discontinuation, significant changes in market demand, or the client’s own acquisition, ensuring that the exit strategy is as clear and well-defined as the entry strategy.

Pricing and Payment Terms: Transparency and Predictability

This clause meticulously details the cost of the goods or services, the payment schedule, accepted methods of payment, any penalties for late payments, and potential discounts for early payments. It should also specify whether pricing is fixed, subject to review, or dependent on fluctuations in raw material costs or exchange rates.21 Pricing mechanisms can vary, including fixed prices, volume-based pricing, or even retroactive discounts or premiums based on actual volumes purchased. Common payment breakdowns, such as a downpayment upon acceptance of a purchase order, a percentage paid upon shipment, and the remainder paid after receipt of goods, are often included, alongside clauses addressing currency fluctuations beyond a predefined threshold. Financial terms are a frequent source of contention if not clearly articulated, making predictability in costs vital for budgetary planning. The choice of pricing model—such as Fee-for-Service (FFS), Time and Materials (T&M), Fixed-Price, Cost-Plus, or Performance-Based/Milestone Payments—reflects the risk appetite and desired transparency of both parties, moving beyond simple cost to define shared financial incentives. For instance, an FFS model is straightforward but might lack transparency regarding underlying costs, whereas a Cost-Plus model offers greater transparency but less predictability. Performance-Based or Milestone Payments, by linking compensation to the achievement of “clear and measurable milestones,” align the CDMO’s incentives directly with the client’s success. The selection of a pricing model is a strategic decision that influences the CDMO’s motivation and the client’s budgetary control. For example, a fixed-price contract offers budgetary predictability but might come at a premium, while a cost-plus model fosters transparency but necessitates robust auditing capabilities to ensure costs are legitimate. Therefore, negotiation should focus on aligning the pricing model with the project’s risk profile and the desired level of transparency and shared incentive, rather than solely pursuing the lowest bid. As industry experts often caution, “The cheapest isn’t always the best. A low bid might mean cut corners or delays”.

Core Operational and Quality Assurances

These clauses delve into the operational heart of the CDMO partnership, ensuring that quality, regulatory adherence, and supply chain efficiency are meticulously managed.

Quality Control and Inspection: Upholding Standards

The Quality Control and Inspection clause is paramount, outlining the stringent quality standards that products must meet and the precise procedures for verifying compliance. It specifies the methods and frequency of inspections, whether conducted by the CDMO, the client, or a neutral third party. This includes the implementation of in-process controls, rigorous testing throughout manufacturing, and the meticulous maintenance of accurate and detailed records. Routine quality audits and inspections are crucial for verifying that the CDMO is consistently complying with GMP standards and client expectations, and they also serve as valuable opportunities to identify areas for continuous improvement. In the pharmaceutical industry, quality is non-negotiable. This clause ensures rigorous adherence to standards throughout the manufacturing process. Beyond mere compliance, robust quality control and inspection clauses foster a culture of continuous improvement and shared accountability, transforming oversight into a collaborative enhancement process. The emphasis on “in-process controls and testing” and “routine quality audits” signifies that quality is not a static endpoint but an ongoing, dynamic process. These clauses empower the client to actively participate in maintaining and improving quality, rather than simply reacting to failures. The “feedback loop with our clients” enabled by digital platforms can further enhance this, allowing CDMOs to “take feedback from customers to help improve processes”. This transforms quality control from a policing function to a collaborative mechanism for achieving operational excellence. Consequently, the contract should specify clear reporting mechanisms for quality data, detailed deviation management procedures, and comprehensive access to records, enabling transparent oversight and joint problem-solving.

Regulatory Compliance: Navigating the Maze of Guidelines

The contract must explicitly outline the CDMO’s responsibilities in adhering to all applicable regulatory requirements, most notably Good Manufacturing Practices (GMP) and other relevant industry standards. Non-compliance in the pharmaceutical industry can lead to severe consequences, including substantial penalties, hefty fines, and potentially devastating product recalls. Regulatory compliance is the most critical aspect of pharmaceutical manufacturing, and this clause must clearly delineate responsibilities to ensure unwavering adherence to global standards. Regulatory compliance clauses, particularly those embedded within Quality Agreements, are not just about avoiding penalties; they are about establishing a shared governance framework that ensures product safety and facilitates market access across diverse global jurisdictions. The FDA’s Quality Agreements Guidance explicitly states that the “owner is ultimately responsible for ensuring that ‘processes are in place to assure the control of outsourced activities and the quality of purchased material'”. This means the contract must go beyond simply mandating compliance; it must detail how compliance is achieved, meticulously monitored, and thoroughly documented. The Quality Assurance Agreement (QAA) becomes the operational blueprint for shared cGMP responsibilities, covering everything from quality unit activities to change control and audits.13 This shared responsibility necessitates that the contract fosters active collaboration, rather than merely dictating compliance. Furthermore, the contract should anticipate evolving regulatory landscapes and include mechanisms for adapting processes and documentation accordingly, ensuring the CDMO’s flexibility to meet future requirements.

The Critical Role of Quality Agreements (QAA)

The Quality Assurance Agreement (QAA) is a legally binding document that complements the main CDMO contract, focusing specifically on quality-related responsibilities. The FDA considers the QAA a “critical tool” for ensuring a successful relationship, as it clearly defines the respective cGMP-related roles and responsibilities between the owner and the contract facility. The QAA should address key areas such as the activities of each party’s quality units, responsibilities concerning facilities and equipment, materials management, product-specific considerations, laboratory controls, and comprehensive documentation protocols. It is explicitly stated that while the contract facility’s quality unit is responsible for rejecting or approving its deliverables (e.g., test results, in-process materials), the owner’s quality operations are ultimately responsible for approving or rejecting drugs, including final product release. The QAA acts as the operational backbone of the CDMO partnership, translating high-level contractual obligations into granular, actionable cGMP responsibilities, thereby enabling effective risk management and seamless product lifecycle management. By detailing “roles, responsibilities, and communication protocols” for quality units, “materials management,” “laboratory controls,” and “change control” , the QAA operationalizes the cGMP requirements. This level of detail is crucial for preventing “deviations or excursions” during manufacturing and ensuring successful product release. It also reinforces the “owner’s ultimate responsibility” for drug approval and rejection , even when activities are outsourced, emphasizing the critical need for robust oversight and collaborative engagement. Clients should prioritize finalizing the QAA early in the process, ideally before the main commercial agreement, to avoid deferring critical quality details to a later, potentially rushed, stage.

Adherence to Good Manufacturing Practices (GMP)

Good Manufacturing Practices (GMPs) represent a set of guidelines that outline the processes and conditions necessary for the safe and effective production of pharmaceutical products. These guidelines cover all aspects of manufacturing, including processes, facilities, equipment, and staff training. CDMOs are expected to implement robust Quality Management Systems (QMS) that encompass Standard Operating Procedures (SOPs), GMPs, and continuous monitoring and improvement processes. GMP compliance is fundamental to ensuring drug quality and patient safety. Adherence to GMP, supported by a robust QMS, signifies a CDMO’s unwavering commitment to a “culture of excellence,” which is crucial for building stakeholder trust and accelerating time to market. Beyond merely following established rules, a CDMO that implements a “robust, harmonized quality framework” and embeds a “culture of excellence” demonstrates a proactive approach to quality. This approach builds “stakeholder trust”—encompassing regulatory bodies, partners, and, most importantly, patients—and minimizes the risk of costly delays or product recalls, ultimately accelerating the drug’s journey to market. The contract should not only mandate GMP compliance but also define clear mechanisms for auditing, reporting deviations, and implementing corrective actions to ensure continuous adherence and improvement.

Delivery and Shipping: Ensuring Timely Supply Chain Flow

The Delivery and Shipping clause specifies the agreed-upon delivery schedule, the chosen shipping methods, and allocates responsibility for shipping costs. It also outlines any penalties for late delivery and details the CDMO’s responsibilities for proper storage and distribution of the product in accordance with regulatory bodies.1 Timely delivery is of paramount importance for both clinical trials and commercial supply, as it directly impacts patient access and market presence. Clear delivery and shipping terms, coupled with robust supply chain management, are essential for mitigating logistical risks that can derail project timelines and disrupt market supply. Delays in delivery, particularly for critical clinical trial materials, can significantly impact trial timelines, patient enrollment, and overall study integrity. For commercial products, supply chain disruptions can lead to stockouts, lost revenue, and damage to brand reputation. Therefore, the contract needs to address not just the delivery terms but also the CDMO’s broader supply chain management capabilities, including raw material sourcing, inventory management, and distribution logistics. Proactive risk mitigation within the supply chain is vital for ensuring uninterrupted supply. Clients should consider incorporating provisions for supply chain visibility, real-time tracking, and comprehensive contingency plans for potential disruptions, especially in today’s dynamic global landscape.

Safeguarding Your Assets: IP, Confidentiality, and Data

These clauses are designed to protect the client’s most valuable intangible assets: intellectual property and proprietary information.

Intellectual Property Rights: Ownership, Licensing, and Protection

The Intellectual Property (IP) Rights clause is a cornerstone of the CDMO contract, addressing the ownership and use of intellectual property created during the manufacturing process. It must meticulously specify who owns the rights to any new inventions, designs, or processes that arise during the collaboration. The concept of “IP contamination” is a significant concern, which can occur when a CDMO’s background IP is inadvertently or inappropriately utilized in the creation of a customer’s product, or when third-party IP is incorporated without proper authorization. Various IP ownership models exist, including jointly owned IP, customer-owned IP (often based on the principle of “I paid for it, I bought it”), or ownership that follows inventorship. Some models involve the CDMO licensing developed IP to the customer, or vice versa, and may even include “springing licenses” to background IP under specific conditions. IP is often the most valuable asset in pharmaceutical companies, making its protection in a CDMO contract paramount. The choice of IP ownership model (e.g., “I paid for it, I bought it” versus inventorship) has profound long-term implications for the client’s freedom to operate, its competitive landscape, and its ability to switch manufacturers in the future. While “jointly owned” IP might initially appear to be a fair solution, it can lead to complex and costly disputes later on. A “customer-owned” model, where the client pays for and retains ownership of the IP, is often preferred by clients to maintain “freedom to operate” and the flexibility to transition manufacturing to another partner.16 However, CDMOs may resist relinquishing rights to their platform improvements or general “lessons learned” from working with various customers.16 The “ownership follows inventorship” model often benefits the CDMO, as inventions are typically conceived using their resources or employees. The contract must clearly specify who owns what IP created throughout the agreement, particularly when the developed IP is not clearly or solely related to one party’s product or the other’s platform, as such ambiguities are a common source of disputes. This clause requires meticulous negotiation, potentially including provisions for “springing licenses” to background IP that become effective only if certain conditions are met (e.g., a lack of supply or capacity constraints), to ensure the client’s operational flexibility and supply chain resilience.

Table 2: IP Ownership Models in CDMO Contracts: Pros and Cons

| IP Ownership Model | Description | Client Pros | Client Cons | CDMO Pros | CDMO Cons |

| Jointly Owned IP | Both parties have equal rights to the developed IP. | Appears “fair”; avoids in-depth negotiation upfront. | Can lead to complex disputes over use, licensing, and enforcement; difficult to switch manufacturers without consent. | Appears “fair”; avoids in-depth negotiation upfront. | Can limit full commercial exploitation; potential for disputes with co-owner. |

| Customer-Owned IP (“I Paid For It”) | Client owns all developed IP, as they funded the development. | Full freedom to operate; easier to switch manufacturers; control over IP strategy; potential to block competitors. | CDMO may charge a premium; may still need a license to CDMO’s background IP. | May lose rights to platform improvements; potential for customer to take business elsewhere easily. | May need a license from customer for future use of developed IP. |

| Ownership Follows Inventorship | IP owned by the party whose employees conceived the invention. | Clear in theory if client’s team is primary inventor (e.g., device design). | Often benefits CDMO as inventions are typically conceived using CDMO resources/employees; difficult to switch manufacturers. | CDMO likely retains ownership of more developed IP; can leverage for other clients. | Client may demand a license for use, potentially costly or cumbersome. |

| CDMO Owns Developed IP, Customer Licenses Back | CDMO owns developed IP, grants client a license (e.g., fully paid-up, royalty-free, sublicensable). | Operational flexibility to move business elsewhere (if license allows); avoids patent drafting/prosecution costs. | No direct ownership; reliance on CDMO’s IP protection efforts; may lack full control. | Retains ownership of platform improvements; customer bears patent costs; IP can revert if client doesn’t maintain. | May need to grant broad, royalty-free licenses, limiting direct revenue. |

| Customer Owns Developed IP, CDMO Licenses Back | Client owns developed IP, grants CDMO a license (e.g., for internal use, other clients). | Full control and ownership; can dictate terms of CDMO’s use. | May need to grant CDMO a license, potentially limiting exclusivity. | Operational flexibility to practice the invention; can use “lessons learned” across clients. | No direct ownership; may not be able to fully commercialize the IP. |

| Springing License to Background IP | CDMO grants a limited license to its background IP that becomes effective only if certain conditions are met (e.g., lack of supply, capacity constraints). | Provides operational flexibility and backup supply in specific adverse scenarios. | Limited scope of license; only triggered under specific conditions. | Protects CDMO’s core IP while offering customer a safety net. | Requires careful definition of triggering events and scope. |

This table highlights the inherent trade-offs in negotiating IP ownership models. Understanding the pros and cons for both the client and the CDMO under each model is crucial for strategic negotiation. It helps business professionals understand why certain models might be advocated by one party over another and how to strategically approach these discussions to achieve a “win-win” outcome. It also emphasizes the long-term implications of IP decisions on market strategy and competitive positioning.

Confidentiality and Data Security: Protecting Proprietary Information

The Confidentiality clause obligates both parties to maintain the secrecy of sensitive information, defining what constitutes confidential information (such as trade secrets, business plans, and proprietary data), specifying the duration of the obligation, and outlining any exceptions (e.g., publicly available information or legally required disclosures). It also typically mandates the return or destruction of confidential information upon the agreement’s termination. Protecting sensitive R&D, manufacturing, and commercial data is paramount for maintaining a competitive advantage. With the increasing adoption of “digitalization” and “AI-driven processes,” confidentiality extends beyond traditional documents to encompass data ownership, usage rights (especially concerning AI), and robust cybersecurity measures, which introduce new layers of risk and necessitate explicit contractual safeguards.34 The scope of “confidential information” significantly expands to include vast amounts of operational data, process parameters, and analytical results. The contract must explicitly address “data ownership and usage,” particularly concerning the CDMO’s right to use client data for “retraining models or even competitive intelligence purposes”. Without clear limitations, clients risk losing control over proprietary data or exposing themselves to fines for privacy violations. This means that cybersecurity measures and data integrity controls become integral to the confidentiality clause, not just separate considerations. The contract should specify data governance frameworks, audit rights for data systems, and clear protocols for notification and remediation in case of data breaches, reflecting the evolving digital landscape and the heightened importance of data integrity.

Managing the Unforeseen: Risk, Liability, and Dispute Resolution

Even the most meticulously planned partnerships can encounter unforeseen challenges. These clauses provide the framework for managing risks, allocating financial responsibility, and resolving disputes.

Indemnification and Limitation of Liability: Allocating Risk Fairly

Indemnification clauses provide a financial safeguard against potential legal claims, ensuring that one party (the indemnifier) agrees to cover the losses or damages of the other party (the indemnitee) under specific circumstances defined in the contract.21 This mechanism effectively transfers financial burden, protects against unexpected losses, and offers legal protection against third-party claims.37 Conversely, Limitations of Liability clauses cap the amount or type of damages that each party can be held responsible for, often excluding consequential damages (such as lost profits) and setting an overall monetary cap on liability.21 Common exceptions to these liability caps typically include gross negligence, willful misconduct, breaches of confidentiality, and intellectual property obligations. These clauses are fundamental to risk allocation, defining who bears the financial burden when unforeseen issues arise. They are frequently among the most heavily negotiated terms in a CDMO contract due to their significant financial and strategic implications. The negotiation of indemnification and liability clauses is a direct reflection of the parties’ risk appetite and their confidence in each other’s operational integrity, ultimately shaping the true cost of the partnership beyond the stated price. The “allocations of risk” are inherently “reflected in pricing”. A CDMO might accept lower margins if its liability is capped, while a client might agree to pay a premium for broader indemnification. The negotiation of these clauses reveals how each party assesses and is willing to bear risk, particularly for “bad acts” like gross negligence or willful misconduct, which are typically uncapped. This is where the findings from due diligence, such as a CDMO’s regulatory track record, directly influence the contractual terms. Clients should advocate for exceptions to liability caps for issues directly within the CDMO’s control, such as IP infringement or cGMP failures, as these directly impact product viability and market access. A fair solution for batch failures often involves dividing responsibility, where the manufacturer does not charge extra fees for re-production, and the drug developer covers all or most of the cost of raw materials and other out-of-pocket expenses. This exemplifies a practical risk-sharing model that can be applied to other areas of potential dispute.

Force Majeure and Supply Chain Resilience: Preparing for Disruptions

Force Majeure clauses define unforeseeable events—such as natural disasters, pandemics, geopolitical turmoil, labor strikes, or governmental actions—that may excuse a party from performing its contractual obligations.39 These clauses should specify duration limits for force majeure relief, outline termination triggers, define mitigation efforts expected from both parties, and establish requirements for timely notice. Effective force majeure clauses mandate that affected parties actively mitigate the impact of disruptions and collaborate to minimize losses. Recent global events have underscored the critical importance of robust force majeure clauses in ensuring supply chain continuity. A well-crafted force majeure clause is not merely a legal escape hatch but a strategic framework for collaborative crisis management, ensuring business continuity and shared responsibility during unforeseen supply chain disruptions. The clause should extend beyond a boilerplate list of events to explicitly require “timely communication” and “mitigation efforts” from both parties. This fosters a collaborative approach to navigating disruptions, rather than simply allowing one party to cease performance. For instance, if a CDMO faces raw material shortages due to a natural disaster, the clause should mandate immediate communication and joint exploration of alternative sourcing or production sites. This directly impacts supply chain resilience and the client’s ability to maintain market supply. Clients should consider tailoring force majeure clauses to industry-specific supply chain risks, such as regulatory changes impacting pharmaceutical production, to enhance contractual resilience and align legal protections with operational realities.

Dispute Resolution Mechanisms: Pathways to Amicable Solutions

The Dispute Resolution clause outlines the agreed-upon methods for resolving any disputes that may arise during the course of the agreement, such as mediation, arbitration, or litigation. Multi-tiered clauses, which typically begin with good-faith negotiations, escalate to mediation, and then, if necessary, proceed to binding arbitration or litigation, are increasingly common. The primary objective of these multi-tiered approaches is to resolve disputes at early, less expensive stages. Such clauses should include clear conditions precedent for each step, definite timelines for initiating and completing each process, and automatic advancement mechanisms if deadlines are not met. Even in the most robust partnerships, disagreements are inevitable. A clear dispute resolution process prevents prolonged and costly legal battles. Multi-tiered dispute resolution mechanisms are a contractual embodiment of a “relationship-first” approach, prioritizing collaborative problem-solving over adversarial litigation to preserve long-term partnerships. By compelling negotiation and mediation first, these clauses encourage parties to find “business-oriented solutions before legal determinations”. This is particularly important given that “resolving conflict is rarely a linear process”. Such clauses have been shown to save “an average of 60% on litigation costs and resolve conflicts 70% faster”. The contract should clearly define the scope of disputes covered, the governing law, and the selection process for neutral third parties, ensuring enforceability and a fair process.

Other Critical Clauses: Assignment, Subcontracting, and Warranties

Beyond the major clauses, several other provisions play a vital role in managing operational and legal contingencies, ensuring continuity and accountability within the CDMO partnership.

Assignment, Transfer, and Subcontracting

Assignment clauses typically require prior written consent from the other party for the transfer of the agreement, though exceptions are often made for corporate affiliates or in the context of mergers, consolidations, or asset transfers. Subcontracting provisions specify the conditions under which the CDMO may utilize third-party subcontractors for any part of the services, while crucially stipulating that the CDMO remains fully liable for the acts and omissions of its subcontractors. These clauses address common operational and legal contingencies, ensuring continuity and accountability within the partnership. These “standard” clauses are critical for managing hidden risks, particularly concerning supply chain control and the quality assurance of outsourced elements. The subcontracting clause is especially important for maintaining supply chain resilience. While CDMOs often rely on specialized third-party providers (e.g., for specific analytical testing, raw materials, or specialized manufacturing steps), the client needs assurance that the CDMO remains fully liable for the subcontractor’s performance and compliance. This prevents a “blame game” if a subcontractor causes issues that impact product quality or timelines. Clients should seek transparency regarding the CDMO’s subcontracting network and ensure that the CDMO’s internal quality systems extend effectively to their subcontractors.

Representations and Warranties

Warranties are contractual assurances that products will meet specified standards and be free from defects. For example, the CDMO may warrant that the products will be free from defects and meet the agreed specifications, while the client may warrant the accuracy of provided specifications and payment capability. These clauses are essential for establishing the baseline quality and performance expectations. Strong warranties on product specifications are crucial for the client’s regulatory submissions, clinical trial success, and ultimate market release.

Table 3: Essential CDMO Contract Clauses and Their Purpose

| Clause Category | Specific Clause | Purpose |

| Foundational | Scope of Work | Defines specific tasks, deliverables, and quality standards to be met by the CDMO, ensuring clear expectations and reducing errors. |

| Term & Termination | Specifies the duration of the agreement and conditions for its orderly conclusion, including notice periods and surviving obligations. | |

| Pricing & Payment | Details costs, payment schedules, methods, and terms for adjustments, ensuring financial transparency and predictability. | |

| Operational & Quality | Quality Control & Inspection | Outlines quality standards, verification procedures, and inspection methods to ensure product integrity and compliance. |

| Regulatory Compliance | Defines the CDMO’s responsibilities in adhering to all applicable regulations (e.g., GMP), minimizing regulatory risk for the client. | |

| Quality Assurance Agreement (QAA) | A supplementary agreement detailing specific cGMP roles, responsibilities, and communication protocols for quality activities. | |

| Delivery & Shipping | Specifies delivery schedules, shipping methods, cost allocation, and storage/distribution responsibilities to ensure timely supply. | |

| Safeguarding Assets | Intellectual Property Rights | Addresses ownership, use, and protection of IP created or utilized during the manufacturing process. |

| Confidentiality & Data Security | Obligates both parties to protect sensitive information, defining confidential data, its duration, and security protocols. | |

| Risk Management | Indemnification | Allocates financial responsibility for potential losses or legal claims, ensuring one party compensates the other under defined circumstances. |

| Limitation of Liability | Caps the amount or type of damages each party can be held responsible for, managing financial exposure. | |

| Force Majeure | Defines unforeseeable events that may excuse non-performance, outlining mitigation efforts and communication requirements during disruptions. | |

| Dispute Resolution | Establishes mechanisms (e.g., negotiation, mediation, arbitration) for resolving disagreements efficiently and amicably. | |

| Other Critical | Assignment, Transfer & Subcontracting | Governs the transfer of the agreement and the use of third-party subcontractors, ensuring continuity and accountability. |

| Representations & Warranties | Provides assurances regarding product quality, performance, and adherence to specifications, establishing baseline expectations. |

This table provides a comprehensive, at-a-glance overview of the essential components of a robust CDMO contract. By categorizing these clauses, it helps stakeholders understand the logical structure of such an agreement and how each provision contributes to overall protection and performance. This serves as a valuable checklist for both drafting and reviewing agreements, ensuring that no critical element is overlooked and reinforcing the interconnectedness of contractual provisions.

Mastering the Negotiation: Strategies for a Win-Win CDMO Agreement

Negotiating a CDMO contract is a strategic art, transforming a potentially contentious process into a collaborative effort that generates long-term value. Avoiding common pitfalls and leveraging key negotiation points are crucial for success.

Common Pitfalls to Avoid in CDMO Contract Negotiations

Even experienced professionals can fall prey to common mistakes that undermine the negotiation process and jeopardize the future partnership.

Overemphasis on Price: The Illusion of Savings

A pervasive mistake in CDMO contract negotiations is placing an undue emphasis on the lowest bid. While cost is undeniably a critical factor, a singular focus on price can be deceptive; “the cheapest option can often prove to be the most expensive in the long run”. The true cost of delays, batch failures, or quality issues is prohibitively high, making the selection of the right partner, even if it entails a premium, a far more economically sound decision. A myopic focus on price alone frequently leads to longer-term problems stemming from incompatible cultures, differing expectations, and a lack of mutual understanding. A singular focus on price commoditizes what should be a strategic partnership, leading to hidden costs from quality issues, delays, and a lack of flexibility that far exceed any initial savings. A CDMO that low-balls a proposal might be tempted to “leave out necessary work” or “thrive on expensive change orders”. This creates a cycle of “difficult debates” and “frequent rehashing of what ‘was in the contract’,” which erodes trust and hinders collaboration. The long-term impact on “speed to market” and “product quality” invariably outweighs any upfront discount. This underscores the imperative for a holistic value assessment that extends beyond the bottom line. Negotiation should prioritize “value, quality, and a strong partnership” over the lowest price, integrating performance metrics and risk-sharing into the financial discussion.

Underestimating Technology Transfer Complexities

Some sponsors mistakenly assume that transferring lab protocols to a CDMO’s facilities will be a direct “plug-and-play” process. In reality, technology transfer can be one of the most challenging and complex phases of the entire partnership. Underestimating its inherent complexities or failing to clearly define responsibilities for this phase can lead to significant delays and substantial cost overruns. Underestimating tech transfer complexities is a common blind spot that can cascade into significant project delays and cost escalations, revealing a lack of foresight in the client’s internal planning. The “plug-and-play” assumption is a dangerous one in this context. Successful technology transfer requires meticulous planning, a clear definition of responsibilities (including who is accountable for conducting and costing various activities) , and a robust change control process to manage unforeseen issues. If a CDMO demonstrates unwillingness to “go through this exercise with you to earn your business” during the negotiation phase, it should be considered a significant red flag. This pitfall highlights the importance of the client’s internal preparedness and their ability to articulate the technical nuances of their process effectively. The contract should include a dedicated section for technology transfer, detailing its scope, timelines, responsibilities, success criteria, and cost allocation for any potential rework or optimization.

Lack of Clear Communication and Scope Management

Poor communication and an ill-defined scope are perennial sources of conflict and can lead to “scope creep” and escalating costs. In a purely transactional relationship, the CDMO may only update the client when contractually obligated or when critical issues arise, leaving clients in the dark about emerging problems. Misaligned expectations, particularly when contractual agreements lack specificity, can lead to profound frustration, strained relationships, and ultimately, project failure. Insufficient communication and vague scope management create a breeding ground for “hidden” problems that fester and escalate, ultimately undermining trust and project viability. When a CDMO updates “only when they must” , it creates an information asymmetry where small issues can “quickly escalate into unmanageable crises”. This lack of transparency erodes trust and renders proactive problem-solving impossible. A robust change control process and “regular check-ins” are crucial for effectively managing scope and preventing “surprise” charges. This pitfall directly links to the importance of cultural fit and “overcommunication” discussed earlier, emphasizing that open dialogue is not merely a courtesy but a strategic necessity. The contract should mandate regular reporting, define clear communication protocols, establish clear escalation pathways, and include a formal change control procedure with associated cost implications.

Misaligned Incentives and Internal Dysfunctions

Internal misalignments within a CDMO, particularly between business development (BD) and technical operations teams, can lead to situations where projects are enthusiastically pursued by BD but later declined due to technical incompatibility or capacity limitations. This creates significant frustration for clients and erodes trust. BD teams are often incentivized to generate leads even when the CDMO is at full capacity, and sales staff may lack the technical scrutiny required for early project filtering. Conversely, clients can also contribute to this pitfall by being inadequately prepared, with their needs and goals not clearly defined. Internal misalignments within a CDMO (e.g., between sales and operations) or within the client organization (e.g., unclear needs) are systemic weaknesses that manifest as external partnership failures, highlighting the critical need for internal strategic alignment before engaging external partners. A “disempowered sales team” and “operational inefficiencies” at the CDMO signal deeper organizational dysfunction. Similarly, a client’s “sponsor dysfunction”—characterized by unclear needs and goals—makes it impossible for the CDMO to accurately assess project fit. These internal issues directly translate into external partnership failures, underscoring that a successful CDMO relationship originates from a well-oiled internal machine. It is imperative to align internal “must-haves against nice-to-haves” before approaching CDMOs. Clients should conduct thorough internal alignment workshops before engaging CDMOs, and CDMOs should invest in improving internal communication and refining “fuzzy fit” criteria to avoid damaging their reputation and client relationships.

Table 4: Common Pitfalls in CDMO Negotiations and Mitigation Strategies

| Pitfall | Consequences | Mitigation Strategy |

| Overemphasis on Price | Hidden costs, quality issues, delays, incompatible cultures, long-term problems, expensive change orders. | Focus on overall value, quality, and strong partnership; assess total cost of ownership; prioritize partner fit over lowest bid. |

| Underestimating Technology Transfer Complexities | Significant delays, cost overruns, quality compromises, operational friction. | Develop detailed tech transfer plans; clearly define responsibilities and success criteria; build in contingency. |

| Lack of Clear Communication & Scope Management | Scope creep, escalating costs, misunderstandings, missed timelines, project failure, erosion of trust, unmanaged crises. | Establish clear communication channels; mandate regular check-ins and progress reviews; implement robust change control processes; define success metrics. |

| Misaligned Incentives & Internal Dysfunctions | Wasted time, frustration, damaged relationships, project rejections, operational inefficiencies, lost trust. | Ensure internal alignment of project needs and goals before CDMO engagement; CDMOs should improve internal communication between BD and operations; define clear go/no-go criteria. |

This table clearly identifies common negotiation traps, their direct consequences, and actionable mitigation strategies. By pairing each pitfall with its impact and a practical solution, the table provides immediate, actionable guidance. This moves beyond simply listing problems to offering solutions, reinforcing the report’s actionable insights. It also visually summarizes the interconnectedness of these pitfalls, demonstrating how a weakness in one area (e.g., communication) can exacerbate problems in others (e.g., scope creep, cost overruns).

Key Negotiation Points and Client Leverage

Successful negotiation hinges on understanding the various levers available to clients and strategically addressing critical contractual elements.

Pricing Models: Beyond Fee-for-Service

CDMO pricing models are diverse, including Fee-for-Service (FFS), Time and Materials (T&M), Fixed-Price, Cost-Plus, and Performance-Based/Milestone Payments. Each model offers distinct advantages and disadvantages. For instance, a Fixed-Price contract provides budgetary predictability, while a Cost-Plus model offers greater transparency regarding the CDMO’s underlying costs. Performance-Based or Milestone Payments are designed to align the CDMO’s incentives directly with the client’s success. Understanding the nuances of these different pricing models allows clients to choose one that best aligns with their project’s risk profile and desired financial predictability. The strategic selection of a pricing model is a powerful negotiation lever that can shift risk, incentivize performance, and foster greater transparency, moving beyond a simple transactional exchange to a shared financial destiny. For early-phase development with high uncertainty, a T&M or Cost-Plus model might be more appropriate due to its flexibility and transparency. In contrast, for commercial manufacturing of a well-defined product, a Fixed-Price model offers predictability. Performance-based models, by tying payments to “clear and measurable milestones” , directly incentivize the CDMO to deliver results efficiently, effectively sharing risk and fostering alignment. This allows clients to leverage their negotiating position to align financial outcomes with project success. Clients should “scrutinize proposals beyond the bottom line” , understanding how each pricing model impacts risk allocation and the CDMO’s motivation.

Defining Performance Metrics and KPIs

Measurable performance metrics are essential for tracking progress, ensuring accountability, and driving continuous improvement. Key performance indicators (KPIs) commonly include cost, punctuality, reliability, and consistent quality. More specific KPIs encompass batch success rates, deviation frequency, out-of-specification (OOS) incidents, inquiry responsiveness, manufacturing cycle times, and product defect rates. While “Reliable on-time delivery” is often the top selection driver for clients, it has historically ranked lower in actual CDMO performance. Explicitly defining KPIs in the contract transforms vague expectations into quantifiable targets, enabling objective performance monitoring and fostering a data-driven culture of accountability and continuous improvement. By contractually obligating the CDMO to report on specific KPIs (e.g., “98% on-time delivery for clinical or commercial batches” or maintaining a “defect rate below 1%”) , clients can ensure accountability and drive performance improvements. The discrepancy between client importance and CDMO performance on “Reliable on-time delivery” highlights a critical area for negotiation and contractual enforcement. KPIs also provide valuable data for “benchmarking CDMO performance against industry standards and internal expectations”. The contract should specify the reporting frequency, methodology, and consequences (e.g., penalties, re-performance) for failing to meet agreed-upon KPIs, linking performance directly to commercial terms.

Ensuring Flexibility and Scalability

Drug development is an inherently dynamic process, requiring the ability to adjust production volumes and processes in response to clinical trial progression or fluctuating market demand. A high-quality CDMO partner must possess the flexibility to scale production to meet clinical and commercial needs across all development phases. They should have the necessary resources to continually expand production capabilities to avoid bottlenecks that could impede time to market. Furthermore, their equipment and facilities must be designed to accommodate changes in production volume. Contractual provisions for flexibility and scalability are essential for future-proofing the partnership, allowing the client to adapt to unpredictable market demands and scientific breakthroughs without incurring costly re-negotiations or necessitating a change in vendor. The ability to “scale up production to meet future demands” or even “scale down for personalization” represents a critical strategic advantage. The contract should include clauses that define how production volumes can be adjusted, how new equipment or processes will be integrated, and the associated costs and timelines. This foresight prevents bottlenecks that “can slow time to market” and ensures the CDMO remains a viable partner as the product matures or market conditions shift. Negotiating capacity reservation, technology upgrades, and the cost implications of scaling up or down should be central to the contract, especially for long-term agreements.

Navigating IP and Liability Discussions

Intellectual property (IP) and liability clauses are frequently the most contentious points in negotiation due to their significant financial and strategic implications. Drug developers typically favor complete IP ownership to maintain their freedom to operate and potentially block competitors. Conversely, manufacturers seek to limit their liability for damages (ee.g., lost profits) and cap their overall financial exposure, with common exceptions for gross negligence, willful misconduct, breaches of confidentiality, and IP obligations. For batch failures, a fair solution often involves dividing responsibility, where the manufacturer does not charge extra fees for re-production, and the drug developer covers the cost of raw materials. Successful negotiation of IP and liability clauses requires a deep understanding of each party’s core business risks and a willingness to find mutually beneficial solutions that balance protection with operational realities. The “tug-of-war” over IP ownership means clients must prioritize their “freedom to operate” and ability to switch manufacturers, while CDMOs seek to protect their platform improvements and proprietary processes. Similarly, liability caps are crucial for CDMOs to manage financial exposure, but clients must ensure that the CDMO is incentivized to avoid “purposefully or negligently contaminating intellectual property” or failing to adhere to cGMP. The “fair solution” for batch failures, where the CDMO re-performs for free but the client covers raw materials , exemplifies a practical risk-sharing model that can be applied to other areas of potential dispute. Leverage in these discussions stems from a clear articulation of the client’s strategic priorities (e.g., market entry, IP protection) and a willingness to compromise on less critical points to achieve overall alignment.

Best Practices for Effective Negotiation

Beyond understanding specific clauses, the process of negotiation itself benefits from strategic planning and a collaborative approach.

Developing a Comprehensive Business Term Sheet