1. Introduction:

Biopharmaceutical Business Intelligence (BI) encompasses the systematic collection, analysis, and interpretation of data pertaining to the biopharmaceutical industry. This process is crucial for supporting strategic decision-making across various critical functions, including research and development, clinical operations, regulatory affairs, manufacturing, and commercialization. In the dynamic and highly competitive biopharmaceutical landscape, characterized by rapid scientific advancements, evolving regulatory requirements, and intense market pressures, the ability to leverage timely and accurate business intelligence is paramount for sustained success.1

The role of BI in the biopharmaceutical industry is critical for several reasons. It enables companies to stay ahead of market trends, understand the competitive environment, identify emerging opportunities, and proactively mitigate potential risks. By providing data-driven insights, BI empowers organizations to make informed decisions regarding product development, market entry, investment strategies, and overall business growth. Furthermore, in an industry where research and development costs are substantial and timelines are often lengthy, effective BI can optimize resource allocation and improve the efficiency of drug development processes.3

This report aims to identify the leading providers of biopharmaceutical business intelligence services. It will delve into the various categories of BI services relevant to the industry, compare the key features and capabilities of prominent service providers, discuss emerging trends shaping the future of BI in this sector, and offer recommendations for selecting the most appropriate service to meet specific organizational needs. The scope of this analysis includes services offering competitive intelligence, market analysis, clinical trial data, regulatory information, patent data, and financial deals tracking, all of which are essential for professionals within the biopharmaceutical domain seeking to enhance their strategic decision-making capabilities.

The biopharmaceutical industry operates with significant financial stakes, where the cost of bringing a new drug to market can range from millions to billions of dollars.4 This substantial investment, coupled with development timelines that can extend over a decade, underscores the critical need for accurate and timely business intelligence to minimize financial risks. Informed decisions at each stage of the drug lifecycle, facilitated by comprehensive BI, can potentially reduce the likelihood of costly failures and optimize the allocation of limited resources, directly impacting the profitability and long-term viability of biopharmaceutical companies.3

Moreover, the nature of drug development has become increasingly complex with the rise of biologics and advanced therapies like gene therapies.3 These innovative treatments involve intricate biological mechanisms and necessitate the analysis of vast and diverse datasets, including genomic, proteomic, and clinical information. Consequently, BI services catering to this sector must possess the sophistication to effectively aggregate, analyze, and interpret this complex information, providing meaningful insights that drive research, development, and treatment strategies in these cutting-edge areas.3

Finally, the biopharmaceutical industry is subject to stringent regulatory oversight and faces the constant challenge of securing market access and favorable reimbursement for its products.1 Navigating the complex regulatory landscape across different global regions and demonstrating the value of new therapies to payers are fundamental to commercial success. Therefore, BI services that offer up-to-date intelligence on regulatory requirements, approval processes, and market access dynamics are indispensable for companies to strategically plan their development and commercialization efforts, thereby avoiding costly delays and overcoming barriers to market entry.1

2. Understanding the Needs of the Biopharmaceutical Industry for Business Intelligence:

The biopharmaceutical industry has multifaceted needs for business intelligence that span the entire value chain, from the initial stages of drug discovery to post-market surveillance.

In the realm of drug discovery and development, BI plays a crucial role in monitoring emerging research trends, identifying novel therapeutic targets, and gaining a deeper understanding of disease mechanisms.7 It involves the analysis of scientific literature, patent filings, and conference data to pinpoint emerging technologies and potential avenues for collaboration. The increasing application of Artificial Intelligence (AI) and machine learning in drug design and target identification 9 has further amplified the need for BI services that can track the activities and progress of companies specializing in these innovative approaches. For example, companies like AI Superior, Recursion Pharmaceuticals, Atomwise, Schrödinger, and BenevolentAI are at the forefront of using AI to accelerate research and optimize drug discovery.9 Monitoring their advancements is essential for the broader biopharmaceutical industry to understand the transformative potential of AI in this field. Furthermore, platforms like AlphaSense aggregate regulatory content from sources such as ClinicalTrials.gov and PubMed 10, providing critical updates on the progress and outcomes of clinical trials, including those of competitors, and offering insights into the regulatory landscape for new drug approvals. The convergence of AI with biopharmaceuticals is driving the need for BI services that offer visibility into the progress of AI-powered drug discovery companies, as AI transforms how new medicines are being developed.9 The biopharmaceutical sector also increasingly focuses on personalized medicine, which necessitates BI tools capable of analyzing patient-specific data and tracking the development of targeted therapies tailored to individual patient profiles.2 Moreover, given the high stakes associated with clinical trials, monitoring clinical trial data is paramount for assessing the efficacy and safety of new drugs and understanding the competitive landscape.1

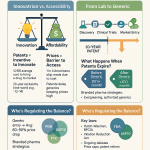

Market analysis constitutes another critical need for BI in the biopharmaceutical industry. This includes determining the size of the market, identifying growth rates, and forecasting future trends across various therapeutic areas and geographical regions.3 BI also involves analyzing patient populations, the prevalence of specific diseases, and areas of unmet medical need. Furthermore, it is essential for forecasting drug sales and assessing the overall market potential, including anticipating the impact of patent expirations on market dynamics.1 Reports from market research firms such as Grandview Research, P&S Intelligence, Mordor Intelligence, and Fortune Business Insights provide estimations of the global biopharmaceutical market size, projecting figures ranging from USD 421.58 billion to USD 479.9 billion in 2024/2025, with anticipated growth to USD 621.65 billion to USD 1.369 trillion by 2030/2034.3 This growth trajectory underscores the significant opportunities within the market and the importance of BI services in understanding market dynamics and potential. The consistent growth projected for the biopharmaceutical market highlights the crucial role of BI for companies aiming to capitalize on these opportunities by identifying promising segments and regions.3 The dominance of monoclonal antibodies in the market also indicates a strong demand for BI focused on this significant class of biologics.3 The increasing prevalence of chronic diseases and the aging global population are key drivers for this market expansion, further emphasizing the need for BI to provide insights into these demographic and epidemiological trends.3

Monitoring the competitive landscape is also a fundamental requirement for biopharmaceutical companies. This involves tracking the activities of competitors, including their research and development pipelines, product launches, marketing strategies, and strategic partnerships.1 Analyzing competitors’ financial performance, deal-making activities, and intellectual property portfolios is also crucial. Moreover, identifying emerging competitors and disruptive technologies is essential for maintaining a competitive edge. AlphaSense is recognized as a leading competitive intelligence tool for the biopharmaceutical sector, aggregating vast amounts of research and offering AI-powered features for in-depth competitor monitoring.10 Platforms like Pharmaprojects, BioCentury BCIQ, Cortellis, and AdisInsight are also established BI services that provide comprehensive tracking of the pharmaceutical R&D pipeline and competitive intelligence.7 The availability of numerous competitive intelligence platforms signifies the strong emphasis within the biopharmaceutical industry on understanding the strategies and actions of competitors to maintain a competitive advantage.7 Different platforms often specialize in various aspects of competitive intelligence, suggesting that companies might need to utilize multiple services to gain a comprehensive view of the competitive arena.16 User feedback on platforms like Cortellis, GlobalData, and TA Scan underscores the importance of data quality, ease of use, and pricing when selecting competitive intelligence tools.16

Regulatory compliance is another area where BI is indispensable. Biopharmaceutical companies must stay informed about evolving regulatory requirements, guidelines, and drug approval processes across different geographical regions.1 Monitoring regulatory decisions and potential changes that could impact drug development and commercialization is also critical. Furthermore, ensuring ongoing compliance with pharmacovigilance and safety reporting regulations is paramount. Tarius is a service specifically highlighted for providing global regulatory information for human drugs and biologics 7, while AlphaSense aggregates regulatory content from sources like the FDA and EMA.10 The stringent regulatory environment in the biopharmaceutical industry necessitates access to accurate and up-to-date regulatory intelligence to avoid costly delays and penalties.2 The global nature of the biopharmaceutical market further complicates BI needs, requiring intelligence on regulations across multiple countries and regions.7 The increasing focus on patient safety and the use of real-world evidence is also driving the need for BI services that can assist companies in monitoring drug safety and generating real-world data for regulatory submissions and market access.1

Finally, BI plays a vital role in shaping commercialization strategies. This includes analyzing market access and reimbursement landscapes, understanding pricing dynamics and competitive pricing strategies, identifying key opinion leaders and potential partners, and monitoring sales performance and marketing effectiveness.1 IQVIA is a prominent provider of business intelligence that aids in pricing and market access by leveraging its extensive commercial healthcare data.8 Proxima Research International offers BI solutions designed to improve engagement with healthcare professionals and optimize sales performance.20 Successful commercialization in the biopharmaceutical sector hinges on a thorough understanding of payer environments and market access, making BI services offering this intelligence crucial for market success.8 The growing scrutiny on drug pricing also necessitates BI tools that can provide comprehensive pricing data and insights into pricing regulations across various markets.21 The trend towards integrating CRM systems with BI further underscores the importance of using data-driven insights to enhance engagement with healthcare professionals and optimize sales and marketing efforts.20

3. Leading Biopharmaceutical Business Intelligence Service Providers: An In-Depth Look:

Several key players offer comprehensive business intelligence services tailored to the unique needs of the biopharmaceutical industry. These providers offer a range of solutions, from in-depth market analysis to real-time competitive intelligence and regulatory updates.

IQVIA 8: IQVIA stands as a major provider of BI services, leveraging its vast repository of commercial healthcare data to offer a comprehensive suite of solutions.19 Their core offerings include market analysis, which helps clients understand their own and their competitors’ market position across various drugs, diseases, and geographies.19 They also assist in identifying potential opportunities for growth and in refining business models to meet the specific requirements of different regions.19 For established products, IQVIA provides legacy brand performance reviews and assessments of the potential impact of loss of exclusivity.19 Furthermore, their services extend to understanding the payer environment and predicting the impact of competitor launches.19 A key strength of IQVIA lies in its unparalleled data assets, which include a significant number of tracked deals since 1996 and comprehensive data on thousands of drugs across numerous diseases.19 They also utilize machine learning to generate actionable insights from this data.19 IQVIA’s solutions cover the entire spectrum of the biopharmaceutical lifecycle, from research and development to real-world evidence generation and commercialization.8 Their focus on the “Human Data Science Cloud” and “Healthcare-grade AI” signifies a commitment to employing advanced technologies for extracting deep insights from complex healthcare data.8 The breadth of their offerings allows biopharmaceutical companies to address multiple BI needs through a single, integrated provider.

AlphaSense 10: AlphaSense is a leading competitive intelligence platform that aggregates content from over 10,000 high-quality sources relevant to the biopharmaceutical industry.10 This includes a wide array of information such as company documents, industry research reports, expert insights from key opinion leaders, news outlets covering medical and business developments, and crucial government and regulatory data.10 A key feature of AlphaSense is its AI-powered semantic search, known as Smart Synonyms™, which enhances the accuracy and comprehensiveness of research by understanding user intent and identifying conceptually related terms.10 The platform also incorporates sentiment analysis to gauge market perception of companies and industry trends.10 Furthermore, AlphaSense offers business-grade generative AI tools, including Smart Summaries for quick insights from earnings transcripts and Enterprise Intelligence for applying AI-powered search to internal company data.10 AlphaSense provides robust capabilities for competitor analysis, enabling companies to track their rivals’ product pipelines, pricing strategies, commercialization efforts, and research and development activities.10 The platform’s ability to aggregate diverse content and leverage sophisticated AI-driven search and analysis makes it a powerful tool for biopharmaceutical companies seeking a competitive edge.

GlobalData 7: GlobalData provides extensive data and insights into the global pharmaceutical market, covering a wide range of areas including clinical trials, epidemiology, and market intelligence.7 Their offerings span the entire pharmaceutical value system, providing in-depth analysis, exclusive news, and access to detailed databases.30 Key features include a regulatory milestones tracker, comprehensive data on clinical trials (including rare and niche diseases), epidemiology forecasts, and detailed company intelligence.30 GlobalData also maintains a significant database of deals, encompassing over 85,000 mergers, acquisitions, strategic alliances, and financial transactions.30 Additionally, they offer opportunities for analyst engagement, allowing clients to directly interact with their experts.30 GlobalData’s partnership with PMLiVE to publish rankings of top biopharmaceutical companies further highlights their role in providing industry benchmarks.28 They also offer a “Pharma Contacts” database, which provides information on key decision-makers within biopharmaceutical organizations, facilitating networking and business development.29 While users have praised the comprehensiveness of GlobalData’s data and insights, some have noted a potentially steep learning curve associated with the platform.34

Clarivate Life Sciences 7: Clarivate Life Sciences offers a suite of subscription-based services covering areas such as bibliometrics, business and market intelligence, competitive profiling, patent information, and regulatory compliance.7 Their key products include Cortellis, Web of Science, Derwent Innovation, and the newly launched DRG Fusion.39 Clarivate provides comprehensive data on scientific literature, biological pathways, drug pipelines, clinical trial protocols, patient populations, global regulatory requirements, deals, and patents.40 Their solutions cater to various stages of the biopharmaceutical lifecycle, from discovery and clinical development to regulatory submission and commercialization.40 A recent strategic move includes the acquisition of Global QMS, aimed at expanding their workflow automation capabilities for clinical, regulatory, and quality management.49 The launch of DRG Fusion underscores their growing focus on real-world data analytics, particularly for commercial applications and understanding patient journeys.41 Clarivate’s portfolio of well-established brands like Web of Science and Cortellis reflects their long-standing reputation in providing valuable data and insights to the scientific and pharmaceutical communities.39

DrugPatentWatch 7: DrugPatentWatch specializes in providing global business intelligence focused on patent information for both biologic and small molecule drugs.7 Their database includes patent applications from over 130 countries, offering critical insights into drug exclusivity and market competition.7 Key features of DrugPatentWatch include patent tracking, identification of potential market entry opportunities, support for portfolio management decisions, identification of the first generic entrants for a given drug, and tools for conducting prior art searches.7 The company’s specialization in patent intelligence makes it a valuable resource for biopharmaceutical companies seeking to understand the intellectual property landscape surrounding their products and those of their competitors. Their early establishment in 2002 highlights the long-recognized importance of patent intelligence within the industry.7

BioCentury BCIQ 7: BioCentury BCIQ offers a unique approach to biopharmaceutical business intelligence by combining the insights from BioCentury’s publications with four comprehensive relational databases.7 These databases cover deal analysis, providing details on licensing and acquisition activities; pipeline analysis, offering information on drug development stages and licensing opportunities; financial analysis, presenting investment trends and opportunities; and company analysis, delivering detailed profiles and analyses of life science companies.7 This integrated approach allows users to connect the strategic insights from BioCentury’s reports with the underlying financial, pipeline, and company data, providing a holistic view of the biopharmaceutical business environment. BioCentury BCIQ’s focus on the business and financial aspects of the industry makes it particularly valuable for professionals involved in corporate strategy and business development.

Cortellis 7: Cortellis provides business intelligence through a modular structure, offering three key modules: Clinical Trials Intelligence, Competitive Intelligence, and Regulatory Intelligence.7 The Clinical Trials Intelligence module offers detailed information on trial designs, endpoints, and combination therapies.7 The Competitive Intelligence module covers drug pipelines, deals, financial data, forecasts, and company profiles.7 The Regulatory Intelligence module helps users track regulatory changes, understand drug submission routes, and monitor pharmacovigilance information.7 User feedback suggests that Cortellis has a robust search function and provides valuable data on drug programs, including preclinical and clinical data, development status, patents, and regulatory status.16 The modularity of Cortellis allows users to subscribe to the specific areas of intelligence that are most relevant to their needs, potentially offering a cost-effective solution.

AdisInsight 7: AdisInsight distinguishes itself by publishing profiles of drug programs, clinical trials, safety reports, and company deals with content authored by scientists.7 This emphasis on scientific expertise ensures a high level of accuracy and detail in the information provided. The datasets covered by AdisInsight include comprehensive information on drugs, clinical trials, company deals, and safety reports.7 The scientist-authored content makes AdisInsight a particularly valuable resource for research and development teams, as well as medical affairs professionals seeking in-depth scientific understanding of biopharmaceutical developments.

Medtrack 7: Medtrack offers a broad range of data on pharmaceutical and biotechnology companies, products, patents, deals, licenses, and venture capital financing.7 Its comprehensive coverage of these key business and intellectual property aspects of the biopharmaceutical industry provides users with a holistic view of the market landscape. The inclusion of venture capital financing data makes Medtrack a valuable tool for investors and companies seeking to understand the funding environment within the sector.

PharmaCircle 7: PharmaCircle delivers content, global insights, and analysis across the pharmaceutical, biotechnology, medical device, and animal health industries.7 Its coverage spans research, development, regulatory activities, clinical trials, and commercial activities. This broad scope, extending beyond just pharmaceuticals and biotech to include medical devices and animal health, makes PharmaCircle a useful resource for companies with diversified interests across the wider life sciences sector.

IPD Analytics 7: IPD Analytics focuses on forecasting key market events, such as new product entries and loss of exclusivity, as well as analyzing other competitive factors that impact product positioning and life cycles within the healthcare and technology sectors.7 Their expertise in predictive analytics helps biopharmaceutical companies anticipate future market dynamics and proactively adjust their strategies.

5. Comparative Analysis of Key Features and Capabilities:

The leading biopharmaceutical business intelligence service providers offer a diverse range of features and capabilities. A comparative analysis across several key parameters can help in understanding their strengths and suitability for different organizational needs.

| Provider | Data Comprehensiveness | Analytical Tools | AI Integration | User Interface | Pricing (Indicative) |

| IQVIA | Extensive commercial, clinical, and real-world data 19 | Sophisticated analytics, machine learning-driven insights 19 | Healthcare-grade AI 8 | Not explicitly detailed | Varies based on needs |

| AlphaSense | Aggregates 10,000+ sources (company, industry, expert, news, regulatory) 10 | Semantic search (Smart Synonyms™), sentiment analysis, generative AI (Smart Summaries, Assistant) 10 | Strong AI integration across search, summarization, and sentiment analysis 10 | Not explicitly detailed | Varies based on needs |

| GlobalData | Broad coverage across pharmaceutical value system (market, clinical, regulatory, deals, epidemiology) 7 | Comprehensive data analysis, regulatory milestones tracker, epidemiology forecasts 30 | AI features mentioned in some areas 17 | Can be complex for new users 34 | $45,000 – $62,441 per year 38 |

| Clarivate Life Sciences | Wide range (literature, pipeline, regulatory, patent, deals, real-world data) 40 | Strong analytics, including Cortellis platform, Web of Science, Derwent Innovation, DRG Fusion 41 | Leveraging AI in various products 41 | Not explicitly detailed | $2,586 – $161,105 per year 53 |

| DrugPatentWatch | Specializes in global patent intelligence for biologic and small molecule drugs 7 | Patent tracking, market entry analysis, portfolio management insights, prior art searching 7 | Not explicitly detailed | Not explicitly detailed | Not available |

| BioCentury BCIQ | Integrated reports and databases (deals, pipeline, financials, company) 7 | Analysis tools within the databases | Not explicitly detailed | Not explicitly detailed | Not available |

| Cortellis | Modular structure (clinical trials, competitive, regulatory) 7 | Robust search function, data analysis within modules 16 | Leveraging AI in some areas 41 | Not explicitly detailed | Varies based on modules |

| AdisInsight | Focus on scientist-authored profiles (drugs, trials, deals, safety) 7 | Analysis within profiles | Not explicitly detailed | Not explicitly detailed | Not available |

| Medtrack | Broad data coverage (companies, products, patents, deals, licenses, VC financing) 7 | Analysis tools for various data types | Not explicitly detailed | Not explicitly detailed | Not available |

| PharmaCircle | Wide coverage (pharma, biotech, medical device, animal health) 7 | Analysis across covered industries | Not explicitly detailed | Not explicitly detailed | Not available |

| IPD Analytics | Specializes in forecasting new product entry and loss of exclusivity 7 | Predictive analytics | Not explicitly detailed | Not explicitly detailed | Not available |

Data comprehensiveness varies significantly among providers. IQVIA boasts extensive commercial, clinical, and real-world data, making it particularly strong for market-related intelligence.19 AlphaSense aggregates a vast array of content types, providing a broad perspective on the industry.10 GlobalData offers deep coverage across the pharmaceutical value chain, including specialized areas like epidemiology.7 Clarivate Life Sciences provides a wide range of data spanning scientific literature, patents, regulatory information, and real-world evidence.40 DrugPatentWatch stands out for its specialization in global patent intelligence.7

The sophistication of analytical tools also differs. IQVIA and Clarivate offer advanced analytics, including machine learning capabilities.19 AlphaSense excels in AI-powered search, summarization, and sentiment analysis.10 GlobalData provides comprehensive data analysis tools and specific trackers for areas like regulatory milestones.30

AI integration is an emerging trend, with providers like AlphaSense and IQVIA heavily leveraging AI to enhance their platforms.8 GlobalData and Clarivate are also incorporating AI into their offerings.17

User interface and experience can be a critical factor in platform adoption. While specific details on the user interface of most platforms are not readily available, user feedback suggests that GlobalData’s platform can be complex for new users.34

Pricing models vary, and costs can be substantial, ranging from tens of thousands to over a hundred thousand dollars annually, depending on the scope and features required.38

6. Emerging Trends and the Future of Biopharmaceutical Business Intelligence:

The field of biopharmaceutical business intelligence is continuously evolving, driven by technological advancements and the changing needs of the industry. Several key trends are shaping the future of this critical domain.

One of the most significant trends is the increasing adoption of AI and machine learning technologies.1 AI and ML are revolutionizing how biopharmaceutical companies analyze data, enabling more sophisticated predictive modeling and the generation of personalized insights.1 These technologies are being applied across various aspects of the industry, from accelerating drug discovery processes 9 to enhancing competitive intelligence efforts by providing deeper analysis of vast datasets.10 The ability of AI and ML algorithms to identify hidden patterns and trends in complex data is proving invaluable for making more informed and data-driven decisions throughout the biopharmaceutical value chain.

Another prominent trend is the growing importance of real-world evidence (RWE).1 Regulatory agencies and payers are increasingly recognizing the value of RWE in evaluating the effectiveness and safety of biopharmaceutical products in real-world clinical settings. Consequently, BI services are adapting to incorporate RWE data and analytics into their offerings. For instance, Clarivate Life Sciences recently launched DRG Fusion, a platform specifically designed for commercial analytics using integrated real-world data.41 This shift towards RWE underscores the need for BI solutions that can effectively collect, integrate, and analyze data from diverse sources such as electronic health records and claims databases.

The industry is also witnessing a move towards integrated data solutions.7 Biopharmaceutical professionals require a holistic understanding of the market and competitive landscape, which necessitates platforms that can seamlessly integrate data from multiple sources. Unified platforms that bring together scientific literature, clinical trial data, regulatory information, patent filings, market trends, and financial transactions into a single view can significantly streamline analysis and improve the efficiency of decision-making processes.

Finally, the increasing focus on personalized medicine is influencing the evolution of biopharmaceutical business intelligence.2 As therapies become more targeted and tailored to individual patient characteristics, there is a growing need for BI services that can analyze patient-specific data, such as genomic information and treatment responses. These platforms will play a crucial role in tracking the development and commercialization of personalized medicines, ultimately contributing to more effective and patient-centric healthcare solutions.

Works cited

- Leading Strategic Intelligence Solutions for the Pharmaceutical Industry, accessed May 10, 2025, https://www.pharmaceutical-technology.com/buyers-guide/strategic-intelligence-pharma/

- Unveiling the Future of Pharma: Harnessing Business Intelligence – Blog – PharmaVenue, accessed May 10, 2025, https://www.pharmavenue.com/blog/pharma-info/unveiling-the-future-of-pharma-harnessing-business-intelligence/

- Biopharmaceutical Market Size, Share | Industry Report, 2030 – Grand View Research, accessed May 10, 2025, https://www.grandviewresearch.com/industry-analysis/biopharmaceutical-market

- Biopharmaceuticals Market Size & Growth Report, 2024-2030 – P&S Intelligence, accessed May 10, 2025, https://www.psmarketresearch.com/market-analysis/biopharmaceuticals-market

- Biopharmaceuticals Market Size, Share, Forecast, [2032] – Fortune Business Insights, accessed May 10, 2025, https://www.fortunebusinessinsights.com/biopharmaceuticals-market-106928

- Biopharmaceuticals Market Size Boosts 12.5% CAGR by 2034 – Towards Healthcare, accessed May 10, 2025, https://www.towardshealthcare.com/insights/biopharmaceuticals-market-is-rising-rapidly

- What are the top Biopharmaceutical Business Intelligence Services? – DrugPatentWatch, accessed May 10, 2025, https://www.drugpatentwatch.com/blog/what-are-the-top-biopharmaceutical-business-intelligence-services/

- Business Intelligence – IQVIA, accessed May 10, 2025, https://www.iqvia.com/solutions/commercialization/brand-strategy-and-management/business-intelligence

- Top Biotech AI Companies | Leading Innovation in 2025 – AI Superior, accessed May 10, 2025, https://aisuperior.com/biotech-ai-companies/

- Pharma and Biotech Competitive Intelligence – AlphaSense, accessed May 10, 2025, https://www.alpha-sense.com/solutions/pharma-and-biotech-competitive-intelligence/

- Artificial Intelligence (AI) In Biopharmaceutical Market Report 2034 – Precedence Research, accessed May 10, 2025, https://www.precedenceresearch.com/artificial-intelligence-in-biopharmaceutical-market

- 25 Leading AI Companies to Watch in 2025: Transforming Drug Discovery and Precision Medicine – BioPharma APAC, accessed May 10, 2025, https://biopharmaapac.com/analysis/32/5655/25-leading-ai-companies-to-watch-in-2025-transforming-drug-discovery-and-precision-medicine.html

- 12 AI drug discovery companies you should know about in 2025 – Labiotech.eu, accessed May 10, 2025, https://www.labiotech.eu/best-biotech/ai-drug-discovery-companies/

- Single-use Technologies for Biopharmaceuticals: Global Markets – BCC Research, accessed May 10, 2025, https://www.bccresearch.com/market-research/biotechnology/single-use-technologies-biopharmaceuticals-report.html

- Biopharmaceuticals Market Report | Industry Analysis, Size & Forecast – Mordor Intelligence, accessed May 10, 2025, https://www.mordorintelligence.com/industry-reports/global-biopharmaceuticals-market-industry

- Thoughts on pharma intel databases like Evaluate, GlobalData, etc. : r/biotech – Reddit, accessed May 10, 2025, https://www.reddit.com/r/biotech/comments/17umw0x/thoughts_on_pharma_intel_databases_like_evaluate/

- Anyone use a Pharma Intelligence Platform? : r/biotech – Reddit, accessed May 10, 2025, https://www.reddit.com/r/biotech/comments/1g1zpo0/anyone_use_a_pharma_intelligence_platform/

- How business intelligence can transform the pharmaceutical industry – Softweb Solutions, accessed May 10, 2025, https://www.softwebsolutions.com/resources/business-intelligence-solution-for-pharma.html

- Business Intelligence – IQVIA, accessed May 10, 2025, https://www.iqvia.com/da/solutions/commercialization/brand-strategy-and-management/business-intelligence

- Exploring Business Intelligence In The Pharmaceutical Industry | Proxima Research, accessed May 10, 2025, https://proximaresearch.com/uz/en/news/exploring-business-intelligence-in-the-pharmaceutical-industry/

- GlobalData | Drug Pricing and Market Access Database, accessed May 10, 2025, https://marketaccess.globaldata.com/

- Pharmaceutical Pricing & Market Access Strategy – GlobalData, accessed May 10, 2025, https://marketaccess.globaldata.com/product-solutions/pharmaceutical-pricing-and-market-access-strategy/

- Pharma: Pharmaceutical Prices (POLI) Databases Overview – GlobalData, accessed May 10, 2025, https://www.globaldata.com/marketplace/pharmaceuticals/pharmaceutical-prices-poli-database/

- Pharma: Pharmaceutical Prices (POLI) Insights Package Databases Overview – GlobalData, accessed May 10, 2025, https://www.globaldata.com/marketplace/pharmaceuticals/pharmaceutical-prices-poli-insights-package/

- Pharmaceutical Pricing & Market Access Strategy – Frequently Asked Questions, accessed May 10, 2025, https://marketaccess.globaldata.com/product-solutions/pharmaceutical-pricing-market-access-strategy-faq/

- 29 Data Analysis Companies Worldwide | Biotech Careers, accessed May 10, 2025, https://www.biotech-careers.org/business-area/data-analysis

- Top 7 Life Science Analytics Companies – Verified Market Research, accessed May 10, 2025, https://www.verifiedmarketresearch.com/blog/top-life-science-analytics-companies/

- GlobalData partners with PMLiVE to bring top biopharmaceutical company rankings on a single platform, accessed May 10, 2025, https://www.globaldata.com/media/business-fundamentals/globaldata-partners-with-pmlive-to-bring-top-biopharmaceutical-company-rankings-on-a-single-platformglobaldata-partners-with-pmlive-to-bring-top-biopharmaceutical-company-rankings-on-a-single-platform

- Pharma: Contacts Databases Overview – GlobalData, accessed May 10, 2025, https://www.globaldata.com/marketplace/pharmaceuticals/pharma-contacts/

- Pharmaceutical Industry Business Development – GlobalData, accessed May 10, 2025, https://www.globaldata.com/industries-we-cover/pharmaceutical/

- GlobalData – Pharmaceutical Technology, accessed May 10, 2025, https://www.pharmaceutical-technology.com/contractors/data/globaldata-pharma/

- Site Survey, BioPharm Insight & BioPharm Clinical – GlobalData, accessed May 10, 2025, https://www.globaldata.com/infinata/

- Pharmaceutical Review Designations – Trends and Industry Insights – GlobalData, accessed May 10, 2025, https://www.globaldata.com/store/report/pharmaceutical-review-designations-trend-analysis/

- GlobalData Pros and Cons | User Likes & Dislikes – G2, accessed May 10, 2025, https://www.g2.com/products/globaldata/reviews?qs=pros-and-cons

- Clients Industry Future – GlobalData, accessed May 10, 2025, https://www.globaldata.com/who-we-are/clients/

- 127 GlobalData Customer Reviews & References | FeaturedCustomers, accessed May 10, 2025, https://www.featuredcustomers.com/vendor/globaldata

- GlobalData Reviews 2025: Details, Pricing, & Features – G2, accessed May 10, 2025, https://www.g2.com/products/globaldata/reviews

- Global Data Software Pricing & Plans 2025: See Your Cost – Vendr, accessed May 10, 2025, https://www.vendr.com/marketplace/global-data

- Clarivate – Wikipedia, accessed May 10, 2025, https://en.wikipedia.org/wiki/Clarivate

- Biopharma intelligence solutions – accelerate patient-centric outcomes – Clarivate, accessed May 10, 2025, https://clarivate.com.cn/products/biopharma/

- Clarivate Launches DRG Fusion – A New Life Sciences Analytics Product Powered by Real-World Data, accessed May 10, 2025, https://ir.clarivate.com/news-events/press-releases/news-details/2025/Clarivate-Launches-DRG-Fusion—A-New-Life-Sciences-Analytics-Product-Powered-by-Real-World-Data/default.aspx

- Life Sciences and Healthcare | Clarivate, accessed May 10, 2025, https://careers.clarivate.com/life-sciences-and-healthcare

- Clarivate Launches DRG Fusion – A New Life Sciences Analytics Product Powered by Real-World Data – PR Newswire, accessed May 10, 2025, https://www.prnewswire.com/news-releases/clarivate-launches-drg-fusion—a-new-life-sciences-analytics-product-powered-by-real-world-data-302349862.html

- Clarivate Plc Company Profile – Overview – GlobalData, accessed May 10, 2025, https://www.globaldata.com/company-profile/clarivate-plc/

- Introducing life sciences solutions from Clarivate Analytics, accessed May 10, 2025, https://discover.clarivate.com/LifeSciencesPA

- Clarivate Analytics: Read reviews and ask questions | Handshake, accessed May 10, 2025, https://app.joinhandshake.com/employers/clarivate-analytics-106824

- 47 Clarivate Customer Reviews & References | FeaturedCustomers, accessed May 10, 2025, https://www.featuredcustomers.com/vendor/clarivate-analytics

- Clarivate Reviews and Clients – DesignRush, accessed May 10, 2025, https://www.designrush.com/agency/profile/clarivate

- Clarivate Acquires Global QMS, Inc., Expanding Life Sciences & Healthcare Segment into New Markets, accessed May 10, 2025, https://clarivate2023indexrb.q4web.com/news-events/press-releases/news-details/2024/Clarivate-Acquires-Global-QMS-Inc.-Expanding-Life-Sciences–Healthcare-Segment-into-New-Markets/default.aspx

- Senior Renewals Account Manager, Life Sciences (remote) – Job at Clarivate Analytics US LLC in Philadelphia, PA – Milwaukee Jobs, accessed May 10, 2025, https://www.milwaukeejobs.com/j/t-Senior-Renewals-Account-Manager-Life-Sciences-remote-e-Clarivate-Analytics-US-LLC-l-Philadelphia,-PA-jobs-j82535408.html

- Clarivate Acquires Global QMS, Inc. | NISO website, accessed May 10, 2025, https://www.niso.org/niso-io/2024/05/clarivate-acquires-global-qms-inc

- Clarivate MSc Life Sciences Research Analyst Job – Apply Online – BioTecNika, accessed May 10, 2025, https://www.biotecnika.org/2024/01/clarivate-msc-life-sciences-research-analyst-job-apply-online/

- Clarivate Analytics Software Pricing & Plans 2025 – Vendr, accessed May 10, 2025, https://www.vendr.com/marketplace/clarivate-analytics

- Consultant, Pricing & Market Access (Life Sciences) – Clarivate Analytics | Built In, accessed May 10, 2025, https://builtin.com/job/consultant-pricing-market-access-life-sciences/4771825

- Consultant, Pricing & Market Access (Life Sciences) – Clarivate, accessed May 10, 2025, https://careers.clarivate.com/job/JREQ132140/Consultant-Pricing-Market-Access-Life-Sciences

- Clarivate Analytics Consultant Pricing Market Access Job New York – ZipRecruiter, accessed May 10, 2025, https://www.ziprecruiter.com/c/Clarivate-Analytics/Job/Consultant,-Pricing-&-Market-Access-(Life-Sciences)/-in-New-York,NY?jid=a5b829f997262faa

- Clarivate hiring Consultant, Pricing & Market Access (Life Sciences) – Himalayas.app, accessed May 10, 2025, https://himalayas.app/companies/clarivate/jobs/consultant-pricing-market-access-life-sciences

- Historic Prices – Clarivate – Q4 Inc., accessed May 10, 2025, https://clarivate2023indexrb.q4web.com/stock/historic-prices/default.aspx

- Clarivate doubled their revenue to $2.5B in 4 years, yet the stock price fell by 4x, accessed May 10, 2025, https://www.worldofdaas.com/p/clarivate

- Innovative solutions for the Pharma industry, accessed May 10, 2025, https://www.bisiona.com/