Putting a value on a pharmaceutical or biotechnology company is no ordinary accounting exercise. It is closer to trying to price a lottery ticket after the numbers have been chosen but before they’ve been announced. The rewards can be extraordinary, the risks are immense, and the results are often all or nothing. At the center of it all: the collision of cutting-edge science, opaque regulatory systems, powerful patent protections and relentless competition.1

Traditional valuation models, built for industries with predictable revenue streams and tangible assets, often feel like trying to measure the ocean with a teacup when applied to our world.1 How do you assign a concrete value to a company whose most precious assets are stored in a freezer and on a server, a company that may have zero revenue but a multi-billion-dollar market capitalization? How do you model a future where a single clinical trial result can double or halve a company’s value overnight?.1

This is the central challenge we’re going to tackle together. This report is not a theoretical academic paper. It is a definitive, practical guide for you—the R&D leader, the business development executive, the IP strategist, the venture capitalist, the M&A analyst—who needs to move beyond theory to application. We will deconstruct the financial models, dissect the strategic drivers, and unpack the qualitative nuances that determine true value.

Over the next 20,000 words, we will move from the foundational principles that make this industry unique to the granular, step-by-step mechanics of building a risk-adjusted valuation model. We will explore how to transform raw patent data into financial gold, how to assess the strategic premium of a platform technology, and how to read the market tea leaves to anticipate the impact of patent cliffs and biosimilar entry.

This is the alchemist’s equation. It’s about turning the lead of scientific potential into the gold of defensible, market-ready valuation. Let’s begin.

Beyond the Balance Sheet: Why Pharma Valuation is a Discipline Unto Itself

Before we can even begin to discuss financial models, we must first establish a core truth: the biopharma industry operates under a set of rules that defy conventional business logic. The value drivers are unique, the risks are existential, and the timelines are measured in decades, not quarters. Understanding these foundational pillars is not just academic; it is the essential prerequisite for any credible valuation exercise.

The Asymmetric Bet: Unpacking the High-Risk, High-Reward Paradigm

At its heart, every biopharma venture is an asymmetric bet. The investment is colossal, the probability of success is terrifyingly low, but the payoff for a single win can be industry-defining. This is the fundamental economic reality that shapes every valuation discussion.

The sheer scale of investment required is difficult to overstate. The Tufts Center for the Study of Drug Development famously estimated that the total capitalized cost to develop a new prescription drug and bring it to market is approximately $2.6 billion.2 This figure is so large because it doesn’t just account for the cost of the one successful drug; it must amortize the immense financial burden of the countless candidates that failed along the way.2

And the failures are legion. The journey from lab bench to pharmacy shelf is a brutal process of attrition. For every 5,000 to 10,000 compounds that show promise in pre-clinical testing, only a small handful—perhaps five to ten—will ever reach human trials.3 From there, the odds remain daunting. The cumulative probability of a drug successfully navigating the entire clinical and regulatory process, from pre-clinical stages all the way to market approval, is a mere 1-5%.4 This means that over 90% of drugs that enter development will fail, representing billions in sunk costs that can never be recovered.1

This creates a financial environment where risk is not a variable to be managed; it is the very air the industry breathes. A single failed Phase III trial can cost between $200 million and $500 million, instantly wiping out years of investment.1 A recent study from the Tufts CSDD, led by Ken Getz, provides a more granular view on the cost of delays, finding that while the old figure of $4 million in lost daily sales was an overstatement, the real cost is still a staggering $500,000 per day in unrealized revenue, on top of direct daily trial costs of around $40,000 to $55,000.5

Yet, this immense risk is balanced by the potential for extraordinary rewards. A single successful “blockbuster” drug can generate billions of dollars in annual revenue, creating value that not only justifies the initial investment but also funds the R&D for the next generation of medicines.4 This is the essence of the asymmetric profile: the downside is capped at the total investment, but the upside can be multiples of that, creating the high-growth, high-profit, high-risk dynamic that defines the sector.1

The Regulatory Gauntlet and the Binary Nature of Success

In most industries, success is a spectrum. A product can be a modest success, a moderate success, or a home run. In biopharma, success is often a switch—it’s either on or off. The ultimate arbiters of this switch are the global regulatory agencies, primarily the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). They are the gatekeepers of value.1

A company can have the most brilliant science, the most elegant clinical trial design, and a massive market opportunity, but without regulatory approval, the value of its lead asset is effectively zero. This creates what is known as a “binary outcome.” A drug is either approved or it is rejected. There is no middle ground.

This binary nature has a profound impact on valuation, creating sharp, discontinuous leaps in value that are rarely seen elsewhere. As one industry expert noted, a single clinical trial result or regulatory announcement can “literally double or halve a company’s market value overnight”.1 Event studies confirm this reality in the public markets. The release of clinical trial results is an economically significant event, with positive news generating statistically significant positive abnormal returns (a median of 0.8% on the day of announcement) and negative news generating statistically significant negative returns (a median of -2.0%).6 FDA approvals have a similar, powerful effect on shareholder wealth.7

This reality means that any valuation model must be able to accommodate these “go/no-go” inflection points. A standard financial model built on smooth, predictable revenue growth simply cannot capture the seismic shifts in value that occur at each major regulatory milestone.

Intellectual Property: The Bedrock of Value

What enables a company to charge a price that can recoup a $2.6 billion investment and fund future research? The answer is intellectual property (IP), specifically patents. Patents are the legal and economic foundation of the entire biopharma business model.1

A patent grants its owner a temporary period of market exclusivity—the sole right to make, use, and sell the invention without competition.1 This temporary monopoly is the critical mechanism that allows innovator companies to command premium pricing for their products. Without it, the moment a new drug was approved, competitors could reverse-engineer it and sell generic versions at a fraction of the cost, making it impossible for the innovator to ever recover their R&D investment.

Therefore, the strength, breadth, and duration of a company’s patent portfolio are among the most critical determinants of its value.4 When we analyze a company’s IP, we are not just looking at a collection of legal documents; we are assessing the structural integrity of its future revenue streams. Key considerations include:

- Composition of Matter Patents: The strongest form of protection, covering the drug molecule itself.

- Method of Use Patents: Covering the use of the drug for a specific disease.

- Formulation Patents: Protecting the specific delivery mechanism or formulation.

- Geographic Coverage: Ensuring protection in all key commercial markets.

- Remaining Patent Life: The single most important variable for forecasting future revenue.1

This system is designed to strike a delicate balance between incentivizing innovation and ensuring eventual public access to affordable medicine. Once the patents and other exclusivities expire, the floodgates open to generic and biosimilar competition. Today, an incredible 90% of all prescriptions in the U.S. are filled with lower-cost generics and biosimilars, which have collectively saved the healthcare system trillions of dollars.8 This eventual “patent cliff” is a defining feature of the industry and a central challenge in long-term valuation, a topic we will explore in great detail later.

These three pillars—the asymmetric risk/reward profile, the binary nature of regulatory success, and the foundational role of IP—combine to create a valuation environment unlike any other. They explain why a pre-revenue biotech can be worth billions and why a mature pharmaceutical giant can see its value threatened by a single patent expiration. They also dictate the tools we must use to make sense of it all. The traditional concept of financial risk, often measured by market volatility, is insufficient here. We are dealing with something more fundamental: existential, binary, scientific risk. This requires a specialized toolkit, starting with the industry’s gold standard methodology.

The Quantitative Core: A Practical Guide to Financial Valuation Methodologies

With a firm grasp of the unique principles governing our industry, we can now turn to the practical tools of the trade. How do we translate the abstract concepts of scientific potential and regulatory risk into a defensible monetary value? This section serves as your hands-on guide to the primary financial valuation models used by industry professionals. We’ll move from the foundational to the advanced, providing not just the “what” but the “why” and “how” for each approach. Remember, the goal isn’t to find a single, magic number, but to build a robust, evidence-backed framework for decision-making.

The Gold Standard: Mastering Risk-Adjusted Net Present Value (rNPV)

If there is one methodology that can be called the “gold standard” for valuing clinical-stage assets in biopharma, it is the risk-adjusted Net Present Value (rNPV) model.4 It is widely utilized and has achieved supremacy because it is purpose-built to address the central challenge we’ve discussed: the sequential, probabilistic nature of drug development.10

Unlike a standard Discounted Cash Flow (DCF) analysis that projects a single stream of future cash flows, rNPV explicitly incorporates the probability that those cash flows will ever materialize. It adjusts each future cash flow by the probability of the drug successfully advancing through each clinical and regulatory stage.10

The core formula is an elegant modification of the standard NPV:

rNPV=∑(1+r)t(Expected Cash Flowt×Probability of Successt)

Where:

- Expected Cash Flow$_t$: The projected net cash flow (revenue minus costs) in a given year t, assuming the drug is successfully launched.

- Probability of Success$_t$: The cumulative probability that the drug will reach that year t. This is the key risk-adjustment factor.

- r: The discount rate, reflecting the time value of money and commercial risk.

- t: The time period in years.

Let’s break down how to build a practical rNPV model, step-by-step.

Step 1: Define the Asset Timeline and Costs

The first step is to map out the entire development, regulatory, and commercial timeline from the asset’s current stage. This involves estimating the duration and cost of each future phase.9

- Timelines: A typical timeline might look like this: Phase II (1-2 years), Phase III (2-4 years), NDA/BLA Filing & Approval (1-2 years).9

- Costs (Cash Outflows): You must project the R&D expenses for each of these stages. These are the investments required to get to the next value inflection point.

Step 2: Estimate Market Potential and Revenues

This is often the most assumption-heavy part of the model. You need to forecast the drug’s peak annual sales if it is successfully approved and launched.3 Key inputs include:

- Target Patient Population: How many people have the disease?

- Market Penetration: What percentage of those patients can the drug realistically capture?

- Pricing: What will the annual cost of therapy be? This is a complex analysis in itself, involving competitor pricing, value demonstration to payers, and reimbursement dynamics.

- Launch Uptake Curve: Sales don’t hit their peak in year one. You must model a ramp-up period (e.g., 20% of peak in year 1, 40% in year 2, etc.) over several years post-approval.9

- Commercial Lifespan: Forecast revenues out to the expected loss of exclusivity (patent expiry), after which you’ll model a sharp decline.

Step 3: Forecast Full Cash Flows

With revenue projections in hand, you can build a full profit and loss statement for the commercial period to arrive at net cash flow. This involves subtracting post-approval costs from your revenue figures 9:

- Cost of Goods Sold (COGS): Typically 5-20% of revenue for biologics.9

- Selling, General & Administrative (SG&A): Marketing, sales force, and other commercial expenses, often 20-30% of revenue.9

- Taxes: Apply the relevant corporate tax rate.

Step 4: Apply the Probabilities of Success (PoS)

This is the defining step of the rNPV model. You must assign a probability of success for transitioning from one stage to the next, based on historical industry benchmarks. These probabilities are then multiplied to get a cumulative probability of reaching the market from the current stage.9

While these vary by therapeutic area, widely used benchmarks are a good starting point 4:

- Phase I to Phase II: ~63%

- Phase II to Phase III: ~31%

- Phase III to Approval: ~58%

- Approval (NDA/BLA Filing): ~85%

For example, the cumulative probability of a drug entering Phase II successfully reaching the market would be 0.31×0.58×0.85≈15.3%.9 You then multiply the cash flows for each year by the appropriate cumulative probability. The R&D costs in a given phase are typically weighted at 100% (since they must be spent to see the outcome), while the future commercial revenues are weighted by the cumulative probability of ever reaching that commercial stage.12

Step 5: Select a Discount Rate and Calculate Present Value

The final step is to discount all the risk-adjusted cash flows back to their present value. A crucial point of distinction arises here. In a traditional NPV analysis of a risky project, one might use a very high discount rate (e.g., 25-40%) to account for the risk of failure.12 In an rNPV model, the

risk of development failure has already been accounted for by the PoS adjustment. Therefore, the discount rate should be much lower, typically in the 10-15% range for biotech, reflecting only the time value of money and commercial (market) risk.9 This is a frequent point of confusion and a critical detail for building a credible model.

By summing the discounted, risk-adjusted cash flows (both the negative R&D costs and the positive commercial flows), you arrive at the rNPV—a single figure that represents the value of the asset today, given all the inherent risks and potential rewards of its development journey.

Discounted Cash Flow (DCF) for Commercial-Stage and Mature Companies

While rNPV is the tool of choice for clinical assets, the traditional Discounted Cash Flow (DCF) analysis remains the foundational model for valuing companies with established, stable revenue streams. This includes large pharmaceutical companies with a portfolio of marketed products, generic drug manufacturers, and contract development and manufacturing organizations (CDMOs).10

The mechanics are similar to a standard DCF: you project the company’s free cash flow over a forecast period (typically 5-10 years), calculate a terminal value, and discount both back to the present. However, for a branded pharmaceutical company, the single most critical input is modeling the patent cliff.4

Accurately forecasting the dramatic revenue erosion following a Loss of Exclusivity (LOE) is paramount. The dynamics differ significantly based on the type of drug:

- Small Molecules vs. Generics: Upon patent expiry, a branded small-molecule drug typically experiences a catastrophic drop in revenue, often losing 80-90% of its market share to generic competition within months.4 Your DCF model must reflect this near-instantaneous revenue collapse.

- Biologics vs. Biosimilars: The entry of biosimilars leads to a more gradual erosion of the originator’s revenue. Due to the complexity of manufacturing, physician and patient hesitancy, and intricate rebate negotiations with payers, the originator biologic often retains a substantial market share for several years post-LOE.4 The decline is still significant but looks more like a steep slope than a cliff.

For a large company with multiple products and a pipeline, a Sum-of-the-Parts (SOTP) valuation is often the most logical approach.10 In an SOTP analysis, you value each major component of the business separately and then add them together. This typically involves:

- Performing a DCF analysis for each major marketed product, carefully modeling its revenue out to its specific patent expiry.

- Performing an rNPV analysis for each significant late-stage pipeline asset.

- Summing the values of all these components and adjusting for corporate-level items (like cash and debt) to arrive at a total equity value.

Market-Based Approaches: Using Comparables for a Reality Check

Both rNPV and DCF are intrinsic valuation methods; they attempt to calculate a value based on the asset’s own future cash-generating potential. In contrast, market-based approaches are a form of relative valuation. They ask a simpler question: what are similar assets or companies trading for in the public market or being acquired for in recent M&A deals?.13 This method is often called Comparable Company Analysis (“Comps”) or Precedent Transaction Analysis.

The process is straightforward in theory 10:

- Identify a Peer Group: Find a set of publicly traded companies or recently acquired companies that are as similar as possible to the company you are valuing.

- Calculate Valuation Multiples: For this peer group, calculate standard valuation multiples, such as:

- Enterprise Value / Revenue (EV/Revenue)

- Enterprise Value / EBITDA (EV/EBITDA)

- Price / Earnings (P/E)

- Apply Multiples: Apply the median or average multiple from the peer group to your target company’s corresponding financial metric (e.g., its revenue or EBITDA) to derive an implied valuation.

While simple, the devil is in the details. The most critical—and most challenging—step is selecting a truly comparable peer group.16 No two biotech companies are identical. An analyst must screen for similarity across a range of factors 16:

- Industry Classification & Business Model: (e.g., small molecule vs. biologic, platform vs. single asset)

- Size: (Revenue, market capitalization)

- Geography: (Primary markets)

- Growth Rate & Profitability:

- Therapeutic Area Focus:

The great advantage of comps is that they provide a quick, market-based reality check on your intrinsic valuation.13 If your rNPV model produces a value of $2 billion, but similarly-staged public companies are trading at multiples that imply a value of only $1 billion, you need to rigorously re-examine your assumptions.

However, the limitations are significant. Finding good comps can be nearly impossible for a company with a truly novel technology. Furthermore, public market multiples are subject to the whims of investor sentiment and can swing wildly, reflecting market hype or pessimism rather than fundamental value.10 Therefore, comps are best used as a complementary tool, a way to triangulate and add context to a more rigorous intrinsic valuation.

Advanced Frameworks: Real Options Analysis (ROA) and Venture Capital (VC) Methods

For certain situations, even the rNPV model can be too rigid. This has led to the application of more advanced frameworks that are better suited to capturing specific types of value.

Real Options Analysis (ROA): Valuing Flexibility

The standard rNPV model assumes a linear path: invest in Phase I, then Phase II, then Phase III, then launch. But in reality, management has flexibility at every stage. They can choose to act based on new information.13 Real Options Analysis is a powerful framework that quantifies the value of this managerial flexibility.17

It views each stage of R&D not as a sunk cost, but as the purchase of a “call option” on the next stage of development.2 For example:

- The Investment Cost of a Phase II trial is the price of the option.

- The Underlying Asset is the value of the drug if it successfully completes Phase II.

- The Decision at the end of Phase II (based on the data) is the exercise of the option:

- Good Data: Exercise the option by investing in the Phase III trial.

- Bad Data: Let the option expire worthless, abandoning the project and cutting losses.

ROA is particularly useful for valuing assets with significant “optionality,” such as a platform technology that could be applied to multiple diseases or a drug that could be expanded into new indications.4 While mathematically complex (often employing models like Black-Scholes or binomial lattices), its core concept is crucial: it recognizes that in an uncertain environment, the flexibility to adapt, expand, or abandon is itself a valuable asset that static models like DCF and rNPV fail to capture.17

The Venture Capital (VC) Method: A Practical Approach for the Earliest Stages

For very early-stage, pre-clinical companies with no revenue and immense uncertainty, building a detailed rNPV can be an exercise in fiction. The VC Method provides a more pragmatic, top-down approach favored by early-stage investors.20

It works backward from a potential future exit 20:

- Estimate the Exit Value: Project the company’s value at a future exit event (e.g., an acquisition or IPO, perhaps 7-10 years out). This is often done by applying a revenue multiple (e.g., 5x) to the drug’s projected peak sales.

- Determine Required Return: VCs invest in high-risk ventures and require a high return on their investment to compensate for the many failures in their portfolio. This is often expressed as a multiple, such as 10x or 20x.

- Calculate Post-Money Valuation: Divide the estimated exit value by the required return. (e.g., $500M exit / 10x return = $50M post-money valuation today).

- Calculate Pre-Money Valuation: Subtract the amount of the current investment from the post-money valuation.

This method implicitly bundles all the scientific, regulatory, and market risks into a single, high hurdle rate. It is less a precise calculation of intrinsic value and more a tool for structuring a deal that provides the investor with their required potential return.

The choice of methodology is not merely technical; it’s a strategic decision dictated by the asset’s stage of development, the purpose of the valuation, and the audience you need to convince. A VC might use their method for a seed-stage investment. A Big Pharma business development team will build a detailed rNPV for a late-stage licensing deal. A public market investor will look at both an SOTP model and trading comps. As a valuation professional, your role is to be fluent in all of them, using them in concert to build a triangulated, defensible, and compelling valuation narrative.

| Methodology | Core Principle | Best For… | Key Inputs | Pros | Cons |

| Risk-Adjusted NPV (rNPV) | Discounts future cash flows that are weighted by their probability of success at each development stage. | Clinical-stage, novel drug assets and pipelines. The industry “gold standard.” 9 | Peak sales, development costs & timelines, probabilities of success (PoS), discount rate. 9 | Explicitly models the unique, stage-gated risk of drug development. Provides a granular, defensible intrinsic value. | Highly sensitive to assumptions (PoS, peak sales, discount rate). Can be complex to build and communicate. 9 |

| Discounted Cash Flow (DCF) | Discounts a company’s total future free cash flows to their present value. | Mature, commercial-stage companies with stable revenues (e.g., Big Pharma, generics, CDMOs). 10 | Revenue forecasts (incl. patent cliffs), operating margins, capital expenditures, terminal value, WACC. 13 | Foundational valuation technique. Good for valuing entire companies with existing cash flows. | Struggles with pre-revenue companies. Accurately forecasting the patent cliff is challenging but critical. 13 |

| Comparables / Precedents | Values a company based on the trading multiples (e.g., EV/EBITDA) of similar public companies or recent M&A deals. | All stages, but primarily as a “reality check” or for companies where intrinsic valuation is difficult. 13 | Peer group financials (revenue, EBITDA), transaction details, relevant multiples. 16 | Simple, quick, and grounded in current market data and sentiment. 13 | Finding truly “comparable” companies is very difficult. Market sentiment can distort value. Transaction data is often private. 10 |

| Real Options Analysis (ROA) | Values managerial flexibility by treating R&D stages and strategic decisions as financial options. | Early-to-mid-stage assets with significant strategic optionality (e.g., platform technologies, multiple indication potential). 17 | Volatility of asset value, investment costs (strike price), time to decision, risk-free rate. 2 | Captures the value of strategic flexibility that rNPV/DCF ignores. Provides a more dynamic view of value. 17 | Mathematically complex and requires sophisticated modeling. Inputs like “volatility” are difficult to estimate. 13 |

| Venture Capital (VC) Method | Works backward from a projected exit value, discounting it by a high required rate of return to find the present value. | Very early-stage, pre-revenue startups where other methods are impractical. 20 | Estimated exit value, time to exit, required investor return (e.g., 10x-20x). 20 | Simple, practical, and aligns with how early-stage investors structure deals. | Not an intrinsic valuation; highly dependent on the required return assumption. More of a deal-making tool than a valuation method. 10 |

The Engine of Future Value: A Deep Dive into Pipeline and IP Analysis

If the financial models are the engine of our valuation, then the drug pipeline and its protecting intellectual property are the high-octane fuel. A pharmaceutical company is its pipeline. Its current products are a legacy of past successes, but its future value—the value that drives M&A deals and investor enthusiasm—is locked within the portfolio of molecules currently making their perilous journey from lab to market. This section provides a framework for rigorously analyzing that pipeline and the IP fortress that guards it.

Deconstructing the Drug Pipeline: From Molecule to Market

A common mistake made by novice analysts is to assess a pipeline quantitatively—simply counting the number of drug candidates. This is a fatal flaw. A pipeline with one promising, first-in-class Phase III asset can be infinitely more valuable than a pipeline with a dozen “me-too” drugs stuck in Phase I. A proper pipeline analysis is a deeply qualitative exercise, requiring a blend of scientific, clinical, and commercial acumen.4

Here is a practical framework for conducting a thorough drug pipeline analysis, moving beyond a simple list to a strategic assessment 22:

1. Data Collection and Segmentation:

The first step is to gather a comprehensive inventory of every asset in the company’s pipeline. This data must then be segmented to reveal the company’s strategic focus.

- By Phase: How many assets are in pre-clinical, Phase I, Phase II, and Phase III? A healthy pipeline is typically balanced, with a broader base of early-stage assets feeding a select group of late-stage candidates. A pipeline with a “gap”—for instance, no assets in Phase III—may signal a future revenue shortfall when current products lose exclusivity.22

- By Therapeutic Area (TA): Where is the company placing its bets? Is it a leader in oncology? Is it diversifying into immunology or rare diseases? This reveals their areas of expertise and potential concentration risk. Over-reliance on a single TA can be dangerous if the competitive or regulatory landscape in that area shifts unfavorably.22

2. Quality Assessment of Each Key Asset:

This is the heart of the analysis. For each significant asset, especially those in mid-to-late-stage development, you must conduct a deep dive, asking a series of critical questions 4:

- Scientific Novelty: Is this a first-in-class molecule with a novel mechanism of action (MoA), or is it an incremental improvement on existing therapies? Truly innovative science commands a higher value.

- Unmet Medical Need: How significant is the problem this drug aims to solve? A drug for a debilitating disease with no effective treatments has a much clearer path to value than one entering a crowded market with multiple good options.

- Clinical Data Quality: What does the data say so far? Are the efficacy signals strong and statistically significant? Is the safety profile clean? How does it compare to the current standard of care? Early data provides crucial clues about the ultimate probability of success.11

- Competitive Landscape: Who else is developing drugs for this indication? How far along are they? Platforms like DrugPatentWatch are invaluable here, providing the competitive intelligence needed to map out rival pipelines and anticipate future market dynamics.23 A drug entering a market with three entrenched competitors faces a very different commercial reality than one with a clear field.

- Addressable Market Size: Based on the above, what is the realistic peak sales potential? This forms the basis of the revenue projections in your rNPV model.

3. Mapping Value Inflection Points:

As we’ve established, value in biopharma is not created linearly. It is created in discrete, quantum leaps at key development milestones. A crucial part of pipeline analysis is identifying when these milestones are expected to occur for the company’s key assets. The most significant value inflection points are 4:

- Positive Phase II “Proof-of-Concept” Data: This is often the first time a drug’s efficacy is tested in patients, and positive results provide a massive de-risking event that can attract partners and investors.

- Successful Pivotal Phase III Trial Results: This is the final, most expensive hurdle before regulatory submission. Strong Phase III data dramatically increases the probability of approval and thus the asset’s value.

- Regulatory Approval (FDA/EMA): The ultimate binary event that transforms a costly R&D project into a revenue-generating asset.

The value of a drug program grows exponentially as it is de-risked through these stages.24 Your analysis should produce a timeline of these expected catalysts, as they are the events that will drive the company’s valuation in the near to medium term.

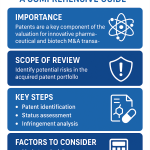

Transforming Patent Data into Financial Gold

The value generated by a successful pipeline can only be realized if it is protected by a robust intellectual property estate. Analyzing this IP fortress requires moving far beyond a simple check of the main patent’s expiration date. Sophisticated valuation requires a forensic examination of the entire patent portfolio, transforming dense legal data into critical financial model inputs.2

Key Industry Insight

The Tufts Center for the Study of Drug Development estimates that the total capitalized cost to develop a new prescription drug and bring it to market is approximately $2.6 billion. This staggering figure highlights the immense financial risk inherent in the industry and underscores why robust patent protection is not just a legal formality but the absolute bedrock of the pharmaceutical business model, enabling companies to recoup these massive investments.2

If patents are the bedrock, then detailed patent data is the geological survey map that reveals its strength and stability.2 A comprehensive analysis must dig into the following layers:

- Calculated Expiry Dates: The nominal 20-year patent term is just a starting point. The actual expiry date, which is the single most important data point for your financial model, is a calculated value. It must account for adjustments like Patent Term Adjustment (PTA) for delays during the patent office’s review and Patent Term Extension (PTE) to compensate for time lost during the FDA’s regulatory review.2

- Patent Strength and Defensibility: Not all patents are created equal. A patent that has survived multiple legal challenges in court or post-grant reviews is considered far more robust and valuable. The prosecution history—the full record of communication with the patent office—is a treasure trove of information, revealing the arguments made to get the patent granted and any limitations that were conceded, which can be potential points of attack for competitors.2

- The Full Patent Estate: A single drug is rarely protected by a single patent. Innovator companies strategically build a “patent thicket” to defend their franchise. This includes not just the core composition-of-matter patent but also a web of secondary patents covering manufacturing methods, specific formulations, delivery devices, and new methods of use (indications).2 The famous case of AbbVie’s Humira, which was protected by over 130 patents, is a masterclass in this strategy, effectively delaying biosimilar competition in the U.S. for years after the primary patent expired.14

This level of granular analysis is impossible without specialized tools. This is precisely where platforms like DrugPatentWatch become indispensable for analysts, IP lawyers, and business development teams. They aggregate, clean, and structure this incredibly complex data, providing intelligence on calculated patent expiry dates, litigation history, and competitor patent landscapes. This transforms the daunting task of IP analysis into a manageable, strategic exercise, allowing you to accurately assess the durability of a company’s market exclusivity and build more reliable financial forecasts.2

The interplay between pipeline quality and IP strength is not a one-way street; it’s a virtuous cycle. A truly novel scientific breakthrough (a high-quality pipeline asset) is more likely to receive a strong, broad composition-of-matter patent. In turn, a clever IP strategy can guide R&D efforts toward developing new formulations or indications that generate fresh patents, extending the life and maximizing the value of the initial scientific discovery. When you evaluate a company, you must assess this synergy. Is their R&D strategy designed to create defensible IP? A company that masters this alignment of science and legal strategy will always command a premium valuation.

Beyond the Numbers: Integrating Strategic Factors and Qualitative Premiums

A valuation derived purely from a spreadsheet, no matter how sophisticated the model, is incomplete. The final value of a biopharma company is often determined by factors that are difficult to quantify but are critically important to investors and acquirers. This is the “art” of valuation, where strategic judgment and qualitative assessment are layered on top of the quantitative analysis. In this section, we explore the three most significant qualitative value drivers: the power of platform technologies, the impact of the management team, and the ever-present potential for a strategic acquisition.

The Multiplier Effect: Valuing Platform Technologies

In recent years, the biopharma landscape has seen a surge in companies built not around a single drug candidate, but around a core platform technology. These are foundational technologies—like mRNA, CRISPR gene editing, or antibody-drug conjugate (ADC) platforms—that can be used to generate a multitude of different therapeutic products.25

Valuing a platform company requires a different mindset than valuing a single-asset company. A platform’s value is far greater than the sum of its current parts because it represents “multiple shots on goal”.26 If the company’s lead candidate for Disease A fails in clinical trials, it’s a setback, but it doesn’t necessarily invalidate the underlying platform, which can be quickly redeployed to generate new candidates for Disease B, C, and D.

This inherent risk mitigation is not just a theoretical benefit; it is borne out by hard data. A landmark retrospective analysis revealed a stark difference in outcomes after a lead asset failure 26:

- For traditional, non-platform companies, a lead asset failure was almost always a death sentence: a staggering 95% of these companies became defunct.

- For platform-based companies, the story was dramatically different. While still facing challenges, only 65% became defunct. A significant portion were able to survive, pivot, and advance new programs from their platform.

This resilience is a massive component of a platform’s value. The valuation framework must therefore go beyond a simple rNPV of the lead asset and assess the quality of the platform itself. Key evaluation criteria include 25:

- Robustness and Scientific Validation: How strong is the science underpinning the platform? Has it been validated through publications and early clinical data?

- Versatility: Can the platform be applied across multiple therapeutic areas and modalities? A platform that can only generate oncology drugs is less valuable than one that can also tackle immunology and rare diseases.

- Scalability and Manufacturing: Can therapies generated by the platform be manufactured consistently, at scale, and at a commercially viable cost? This is a particularly critical hurdle for complex modalities like cell and gene therapies.

- Intellectual Property: Is the core platform technology itself protected by strong, defensible patents?

From a financial modeling perspective, the value of a platform is best captured through the lens of Real Options Analysis. The platform is not just a collection of current assets; it is a portfolio of options to create future assets. Each potential new drug program that could be generated from the platform is a real option, and the aggregate value of these options can be immense, justifying a significant valuation premium over and above the calculated value of the current clinical pipeline.18

The Human Element: The Impact of the Management Team

In an industry defined by navigating profound scientific, clinical, and regulatory uncertainty, the quality of the people at the helm is a paramount, if intangible, driver of value. Investors are not just betting on a molecule; they are betting on the team’s ability to successfully guide that molecule through a minefield of potential failures.

An experienced and credible management team can dramatically de-risk a venture in the eyes of investors, particularly at the early stages when there is little clinical data to evaluate.11 Investors and potential partners look for a track record of success. Key questions include 11:

- Have the executives and scientists successfully developed drugs before?

- Do they have deep experience navigating the specific regulatory pathways required?

- Have they successfully commercialized a product and built a sales infrastructure?

- Do they have a network of relationships with key opinion leaders, investors, and potential pharma partners?

Seasoned leaders who have “done this before” add an enormous amount of credibility and can command higher valuations for their companies.11 This is not just anecdotal. Academic research applying “upper echelon theory” to the biotech industry has shown that the specific experience of the top management team—whether it’s founder-based scientific expertise or experience gleaned from working in Big Pharma—has a direct and measurable impact on firm performance.28

For an early-stage company, the management team often is the valuation story. With little else to go on, investors rely on the team’s pedigree as a proxy for the company’s potential for success. A team of serial entrepreneurs and respected scientists acts as a powerful signal to the capital markets, making it easier to raise funds at favorable terms.28

M&A Suitability and the Strategic Premium

For many biotech companies, the ultimate goal and most likely path to a major return for investors is not to become a fully integrated, commercial-stage company, but to be acquired by a larger pharmaceutical player. Consequently, a significant component of a biotech’s valuation is its potential as an M&A target.

Big Pharma is facing an existential threat: a looming patent cliff that puts hundreds of billions of dollars in revenue at risk over the next decade.29 With internal R&D productivity under pressure, they are increasingly reliant on external innovation to replenish their pipelines and fuel future growth. M&A is the primary mechanism for this, with some analyses suggesting that as much as 70% of the industry’s innovation is sourced externally through acquisitions and licensing deals.31

This creates a persistent and powerful demand for high-quality, innovative biotech assets. As Jake Henry, a senior partner at McKinsey, has noted, the trend is for Big Pharma to move “earlier and earlier upstream” to acquire promising assets before they become too expensive or are snapped up by a competitor.31 This dynamic means that a biotech’s valuation is often viewed through the lens of a potential acquirer.

This leads to the concept of a “strategic premium.” This is the amount an acquirer is willing to pay above the standalone intrinsic value calculated by a financial model. This premium is justified by the synergies and strategic value the asset brings to the acquirer.4 A company’s value is significantly enhanced if its assets:

- Fill a Strategic Gap: The asset fits perfectly into a therapeutic area where the acquirer wants to build or strengthen its presence.

- Offer Commercial Synergies: The acquirer can leverage its existing sales force and market access infrastructure to launch the new drug more efficiently and effectively.

- Provide Access to New Technology: The acquisition brings in a new platform technology that the acquirer can use to generate its own future pipeline.

- Represent Scarcity Value: The asset is a first-in-class or best-in-class treatment in a high-value market, and acquiring it keeps it out of the hands of competitors.

These three qualitative factors—platform, people, and M&A potential—are not independent variables to be added up. They form a reinforcing triangle. A powerful platform technology attracts a top-tier management team. A great team executing on a validated platform is precisely the combination that becomes a prime M&A target for Big Pharma. The potential for a lucrative acquisition exit, in turn, makes it easier for that great team to raise capital at a premium valuation in the first place. A savvy analyst must therefore assess this entire ecosystem, recognizing that these strategic factors can collectively justify a valuation far exceeding what a standalone rNPV model might suggest.

Navigating the Headwinds: Market Dynamics and External Pressures

No company exists in a vacuum. A brilliant scientific discovery can see its value diminished or destroyed by external forces beyond the lab. A comprehensive valuation must therefore look outward, analyzing the market dynamics and macro pressures that will ultimately shape a drug’s commercial fate. This includes the ever-present threat of the patent cliff, the transformative impact of biosimilar competition, and the complex, often treacherous, global landscape of pricing, reimbursement, and regulation.

The Patent Cliff: Case Studies in Value Erosion and Mitigation

The “patent cliff” is the colloquial term for the sharp, often catastrophic, decline in revenue a company experiences when its blockbuster drug loses market exclusivity.30 With an estimated US$356 billion in branded sales at risk from patent expiration between 2023 and 2028 alone, navigating this cliff is the single greatest strategic challenge for mature pharmaceutical companies.33 How a company prepares for this inevitable event is a critical component of its long-term valuation. Let’s look at some real-world examples.

The Humira Precedent: A Lesson in Post-LOE Reality

AbbVie’s immunology drug, Humira, was the undisputed king of blockbusters for years. Its sales peaked at a staggering $21.2 billion in 2022. The following year, after the first biosimilars hit the U.S. market, sales fell to $14.4 billion. In 2024, they are projected to be just under $9 billion.34 This is the patent cliff in action.

AbbVie’s mitigation strategy was years in the making. They knew this day was coming and invested heavily in developing and commercializing their next-generation immunology stars, Skyrizi and Rinvoq. In 2024, these two drugs are expected to bring in a combined $17.7 billion, almost completely filling the massive revenue hole left by Humira.34 This case study demonstrates the critical importance of proactive pipeline replenishment. A company’s value is not just in its current blockbusters, but in its demonstrated ability to develop the

next ones.

Preparing for the Storm: Merck’s Strategy for Keytruda

Perhaps the most watched patent cliff on the horizon is that of Merck’s cancer immunotherapy juggernaut, Keytruda, which generated over $29 billion in sales in 2024 and faces its key patent expiry in 2028.30 Merck’s strategy provides a playbook for proactive lifecycle management:

- Innovation on the Core Asset: Merck is developing a new, more convenient subcutaneous formulation of Keytruda. The goal is to switch the market to this improved version before 2028. If successful, biosimilars of the original intravenous Keytruda will launch into a market that has already moved on to a superior product, blunting their impact.34

- Strategic Acquisitions: Merck is actively acquiring new sources of growth. Their acquisition of Acceleron Pharma brought them Winrevair, a promising new therapy for pulmonary arterial hypertension, which analysts project could become a multi-billion dollar product and a key growth driver for the company post-Keytruda.14

These cases illustrate that the patent cliff is not a passive event to be endured, but an active, strategic battleground. A valuation of a mature pharma company must rigorously assess its lifecycle management strategy. Does the company have a credible plan to offset the impending revenue loss? The answer to that question can have a profound impact on its valuation.

The Biosimilar Impact: Reshaping R&D and Commercial Strategy

The rise of biosimilars has introduced a new and complex dynamic to the end-of-life phase for biologic drugs. Unlike the market for small-molecule generics, which is a straightforward race to the bottom on price, the biosimilar market is far more nuanced, and its impact is reshaping R&D strategy from the earliest stages.36

While the entry of biosimilars does lead to significant price erosion for the originator biologic, the market share loss is typically more gradual than the near-90% overnight collapse seen with generics.4 However, the

certainty of this eventual, intense competition has created what is known as the “innovation squeeze”.36

The traditional R&D model of developing incremental, “me-too” biologics that offer only minor improvements over the market leader is becoming increasingly untenable. Why? Because by the time such a drug is launched, the entire therapeutic class may be facing multi-source biosimilar competition, leading to a price collapse that makes it impossible to recoup the high cost of development. This pressure is forcing innovator R&D pipelines to polarize into two distinct strategies 36:

- Go for True Innovation: Focus investment on high-risk, high-reward, truly novel, first-in-class modalities where the scientific differentiation is so profound that it creates a new market and commands premium pricing.

- Play Proactive Defense: Invest in sophisticated, defensive R&D programs to develop patentable “bio-betters.”

A “bio-better” (or biosuperior) is a new version of an existing, successful biologic that has been deliberately engineered to be superior.36 This is not a biosimilar, which aims for sameness; a bio-better aims for demonstrable improvement. Examples of such improvements include:

- Enhanced Efficacy: A modified molecule with a stronger therapeutic effect.

- Improved Safety: A redesigned structure that reduces side effects.

- Greater Convenience: A new formulation that allows for less frequent dosing or a more convenient subcutaneous injection instead of an intravenous infusion.

The competitive strategy behind the bio-better is one of “preemptive obsolescence”.36 The innovator company invests in a full R&D program to get the bio-better approved and launched several years

before the original product’s patent expires. They then use their commercial muscle to switch the entire patient and prescriber base to the new, clinically superior product. By the time biosimilars of the original drug launch, they find themselves competing against a reference product that the market already considers outdated. This transforms a defensive necessity into an offensive, market-shaping maneuver, placing the R&D organization at the very center of corporate strategy.

The Global Gauntlet: Pricing, Reimbursement, and Regulatory Divergence (FDA vs. EMA)

A drug’s clinical success is only half the battle. Its ultimate commercial value, and thus its contribution to a company’s valuation, is determined by market access—what payers around the world are actually willing to pay for it. This has become an increasingly challenging gauntlet of pricing pressures, stringent value assessments, and divergent regulatory requirements.37

Any credible valuation model must account for these commercial realities. Key challenges include:

- Pricing and Reimbursement: In many countries, especially in Europe, pricing is not set freely by the manufacturer. It is negotiated with government bodies and is often contingent on a rigorous Health Technology Assessment (HTA), which evaluates the drug’s clinical and economic value compared to existing treatments.37 A drug that fails to demonstrate sufficient value may face restrictive reimbursement or a lower price, directly impacting the revenue forecasts in a DCF or rNPV model.

- Political Pressure: In the U.S., while pricing is more market-driven, it is subject to intense political and public scrutiny. Legislation like the Inflation Reduction Act (IRA) has introduced government price negotiation for certain drugs in Medicare, fundamentally altering the long-term revenue calculus for some of the industry’s biggest products.38

- Regulatory Divergence: The two most important regulatory bodies, the U.S. FDA and the European EMA, have similar goals but operate under different legal frameworks and sometimes have different requirements.39 These differences can impact drug development strategies and costs. For instance, the agencies might have disparate views on the ideal patient population for a clinical trial or different requirements for safety data, necessitating additional or separate studies to gain approval in both markets.39 These additional costs and potential delays must be factored into the expense and timeline assumptions of a valuation model.

These external forces represent significant headwinds. The traditional model of “innovate, patent, profit” is being replaced by a more complex and continuous cycle of “innovate, defend, demonstrate value, re-innovate, and switch.” A valuation must therefore assess not only the science in the pipeline but also the company’s strategic capability to navigate this treacherous external landscape. A company with a proven track record of securing favorable reimbursement and executing successful lifecycle management strategies will command a significant premium, reflecting its ability to translate scientific potential into realized commercial value.

Synthesizing the Analysis: Arriving at a Defensible Valuation Range

After journeying through the intricacies of financial models, pipeline analysis, IP law, and market dynamics, we arrive at the final, critical stage: synthesis. The goal of a valuation exercise is not to produce a single, deceptively precise number. It is to construct a compelling, evidence-backed argument for a defensible range of values. This final section explains how to bring the disparate threads of our analysis together into a coherent and persuasive whole.

Triangulation: Why a Single Method is Never Enough

As we have seen, each valuation methodology has its own strengths and weaknesses. The rNPV model is brilliant at capturing development risk but is highly sensitive to its assumptions. Comps are grounded in market reality but can be distorted by sentiment and a lack of true peers. Real Options Analysis elegantly values flexibility but can be mathematically opaque and difficult to implement.

Therefore, best practice in pharmaceutical valuation is never to rely on a single method. The most credible valuations employ a process of triangulation, using multiple methodologies to approach the question from different angles and build a more robust conclusion.13 A typical workflow looks like this:

- Establish an Intrinsic Value Foundation: Begin by building a detailed, bottom-up rNPV or SOTP model. This forms the core of your analysis, grounded in the specific fundamentals of the company’s assets, timelines, costs, and probabilities of success. This is your best estimate of the company’s intrinsic, standalone value.

- Conduct a Market-Based Reality Check: Next, perform a thorough comparable company and precedent transaction analysis. How is the public market valuing companies at a similar stage and in a similar therapeutic area? What multiples have been paid in recent M&A deals? This provides crucial external context. If your intrinsic value is wildly out of line with the market-based valuation, it forces you to rigorously question your core assumptions. Are your peak sales projections too optimistic? Is your discount rate too low?

- Layer on the Qualitative and Strategic Assessment: Finally, use the qualitative factors we’ve discussed—the strength of the platform technology, the experience of the management team, and the company’s attractiveness as an M&A target—to argue for where the company should be valued within or even above the range suggested by your quantitative models. For example, you might conclude: “Our rNPV analysis suggests a base-case value of $1.5 billion, and market comps imply a range of $1.2 to $1.6 billion. However, we believe a premium valuation approaching $2 billion is justified due to the company’s validated platform technology, which provides significant future optionality, and its best-in-class management team with a proven track record of execution.”

This triangulated approach is powerful because it is intellectually honest. It acknowledges the inherent uncertainty of the exercise and builds a case based on a convergence of evidence, rather than relying on the output of a single, fallible model.

Communicating the Story Behind the Numbers

Ultimately, a valuation is a tool for communication and persuasion. The final output is not the number itself, but the narrative that supports it. Whether you are presenting to an investment committee, a board of directors, or a potential partner, your job is to tell a clear, compelling, and credible story.

Your valuation report or presentation must transparently lay out the “why” behind the “what.” This means:

- Clearly Stating Key Assumptions: What are the peak sales forecasts, probabilities of success, and discount rates you used, and what is your justification for them?

- Conducting Sensitivity Analysis: Show how the valuation changes if key assumptions are altered. What happens if the drug is delayed by a year? What if market penetration is 10% lower than projected? This demonstrates the robustness of your model and highlights the key risks.

- Integrating the Qualitative Narrative: Weave the story of the company’s strategic advantages into the financial analysis. Don’t just state the rNPV of the pipeline; explain why this pipeline is scientifically differentiated and addresses a major unmet need. Don’t just add a generic M&A premium; explain which specific potential acquirers would be interested and why the asset is a perfect strategic fit for them.

By synthesizing the quantitative and the qualitative, you transform a dry financial exercise into a powerful strategic argument. You provide not just a number, but a deep understanding of the risks, the opportunities, and the fundamental drivers of value in a complex and dynamic industry.

Conclusion: The Future of Pharma Valuation in an Era of Unprecedented Innovation

We stand at a remarkable inflection point in the history of medicine. The pace of scientific discovery is accelerating at an unprecedented rate. Novel modalities like cell and gene therapies, RNA therapeutics, and AI-driven drug discovery are moving from the realm of science fiction to clinical reality, offering the potential to not just treat, but modify and even cure diseases that were once considered intractable.40

This wave of innovation presents both immense opportunity and profound challenges for those of us tasked with valuing the companies that drive it. The very nature of the assets we evaluate is changing. How do you apply traditional valuation models to a one-time curative gene therapy with a multi-million-dollar price tag and questions about long-term durability? How do you quantify the value of an AI-driven discovery platform that promises to shorten preclinical timelines by 30-50% but whose late-stage success rates are still unproven?.40

The principles and methodologies we have explored in this guide provide a robust foundation, but they must continually evolve. The supremacy of the rNPV model will persist because it correctly frames value as a function of probabilistic, stage-gated success. However, the inputs to that model will become more complex. We will need more sophisticated ways to forecast the uptake of curative therapies and model new payment structures like pay-over-time or outcome-based agreements.

Frameworks like Real Options Analysis will become increasingly vital, as they are better suited to capturing the immense optionality value inherent in platform technologies that can spawn dozens of future medicines. The qualitative assessment of a management team’s ability to navigate not just the FDA, but also the complex manufacturing and market access challenges of these new modalities, will carry even greater weight.

Ultimately, the core message of this report will only become more relevant. Successful valuation in this new era will demand an even deeper, more integrated blend of quantitative rigor, profound scientific and clinical understanding, and astute strategic judgment. It is a discipline that requires us to be financial modelers, amateur scientists, IP strategists, and market analysts all at once. It is the alchemist’s equation, and for those who can master its complexities, the rewards—both for investors and for patients—will be greater than ever.

Key Takeaways

- Pharma Valuation is Unique: The industry’s high-risk, high-reward nature, binary regulatory outcomes, and reliance on intellectual property make traditional valuation models insufficient. Valuation must account for existential scientific risk, not just market risk.

- rNPV is the Gold Standard: Risk-Adjusted Net Present Value (rNPV) is the predominant methodology for clinical-stage assets because it explicitly models the probability of success at each stage of development, providing a more realistic view of value than a standard DCF.

- The Pipeline is Paramount: A company’s future value is locked in its R&D pipeline. A rigorous pipeline analysis must go beyond counting candidates to qualitatively assess each asset’s scientific novelty, unmet medical need, clinical data, and competitive landscape.

- IP is the Bedrock of Value: The strength, duration, and defensibility of a company’s patent portfolio determine the longevity of its revenue streams. Sophisticated analysis of patent term extensions, litigation history, and “patent thickets” is critical.

- Triangulation is Essential: A defensible valuation is never based on a single method. Best practice involves triangulating an intrinsic value from an rNPV/DCF model with a relative value from market comparables, then layering on a qualitative assessment.

- Qualitative Factors Drive Premiums: A significant portion of a company’s value can be attributed to strategic factors that are hard to quantify but critical to success. These include:

- Platform Technologies: Offer “multiple shots on goal,” significantly de-risking the company and providing immense optionality value.

- Management Team: An experienced leadership team with a track record of success is a powerful de-risking factor and a key signal for investors.

- M&A Suitability: A company’s fit with the strategic needs of potential Big Pharma acquirers can justify a substantial “strategic premium.”

- External Forces Shape Value: Valuation must account for external market dynamics. The patent cliff is an existential threat that requires proactive lifecycle management (e.g., developing “bio-betters”). Navigating global pricing, reimbursement, and divergent regulatory environments is crucial for realizing a drug’s commercial potential.

- Valuation is a Narrative: The final output is not just a number, but a compelling, evidence-backed story that explains the assumptions, risks, and strategic rationale behind the valuation range.

Frequently Asked Questions (FAQ)

1. How do you value a preclinical asset when the probability of success is so low and the data is so limited?

Valuing a preclinical asset is one of the most challenging exercises due to the immense uncertainty. The cumulative probability of success from this stage to market is often less than 5%. Here, traditional rNPV is difficult, as cash flow projections are highly speculative. Instead, a combination of methods is used:

- Venture Capital (VC) Method: This is often the most practical approach. It focuses on the potential exit value if the drug is successful and discounts it back using a very high hurdle rate (e.g., 20-50x return) that implicitly accounts for the high risk of failure.

- Market-Based Comps: Analysts look at what has been paid for similar preclinical assets in recent licensing deals or acquisitions. These “comparable transactions” provide a market-based benchmark for a specific target, modality, or therapeutic area.

- Simplified rNPV: A high-level rNPV can be used, but it’s treated more as a framework for thinking than a precise calculation. The focus is less on exact revenue numbers and more on order-of-magnitude potential, using very low (e.g., 1-10%) probabilities of success. The value is highly sensitive to these inputs.

- Qualitative Factors Dominate: At this stage, the valuation is heavily driven by qualitative factors: the novelty of the science, the reputation of the founding scientists, the experience of the management team, and the size of the unmet medical need.

2. What are the biggest mistakes analysts make when building an rNPV model?

The most common and critical mistakes include:

- Double-Counting Risk: Using a very high discount rate (e.g., 30%) in addition to risk-adjusting the cash flows with probabilities of success. The PoS adjustment already accounts for development risk; the discount rate should be lower (10-15%) to reflect only the cost of capital and commercial risk.

- Using Generic Probabilities: Applying generic, industry-wide PoS rates to all drugs. Success probabilities vary significantly by therapeutic area (e.g., oncology has lower success rates than infectious diseases), modality (small molecule vs. biologic), and specific drug characteristics (e.g., presence of a validated biomarker). Using tailored probabilities is crucial.

- Ignoring the Patent Cliff: Forecasting revenues that extend indefinitely or decline too slowly after the loss of exclusivity. The model must reflect the sharp, dramatic revenue drop that occurs upon generic or biosimilar entry.

- Overly Optimistic Peak Sales: Projecting market penetration and pricing that are not well-supported by competitive landscape analysis and payer research. Peak sales assumptions must be rigorously justified.

- Static Assumptions: Building a model that provides a single number without performing sensitivity and scenario analysis. A good rNPV model should be a dynamic tool that shows how the valuation changes under different scenarios (e.g., development delays, lower pricing, increased competition).

3. How does the Inflation Reduction Act (IRA) specifically impact drug valuation in the US?

The IRA has a direct and significant impact on the valuation of drugs, particularly those with high sales in Medicare. Its key provisions affect the “Projected Cash Inflows” portion of any valuation model:

- Government Price Negotiation: The IRA allows Medicare to directly negotiate the price of certain top-selling small-molecule drugs after 9 years of market exclusivity and biologics after 13 years. This effectively shortens the period of premium pricing for many drugs, reducing the total lifetime revenue that can be generated. Valuation models must now incorporate a “negotiated price” scenario that can significantly lower revenues in the later years of a drug’s life.

- Inflation Rebates: Companies must pay rebates to Medicare if they increase drug prices faster than the rate of inflation. This caps the ability to use price hikes as a strategy to grow revenue from mature brands, a tactic historically used to offset volume declines.

- Impact on R&D Incentives: There is ongoing debate about how these provisions will affect R&D investment decisions. Some argue it may disincentivize the development of small-molecule drugs (due to the shorter 9-year window before negotiation) or drugs primarily for the elderly population covered by Medicare. This could lead to a “strategic discount” being applied to the valuation of assets in these categories.

4. In an M&A negotiation, how is the “strategic premium” typically quantified or justified?

The strategic premium is the amount an acquirer pays above a target’s standalone intrinsic value. While it’s negotiated, the acquirer justifies it internally (to their board and shareholders) through a rigorous analysis of expected synergies. These are typically broken down into:

- Cost Synergies: These are the easiest to quantify and defend. They include eliminating redundant corporate overhead (G&A), consolidating sales forces, and optimizing manufacturing and supply chains. Acquirers will build a detailed model projecting these cost savings over several years and calculate their net present value.

- Revenue Synergies: These are harder to quantify but can be a major driver. Examples include using the acquirer’s larger, more experienced sales force to accelerate the launch of the target’s lead asset, or bundling the target’s drug with the acquirer’s existing products to secure better formulary access from payers.

- R&D Synergies: This could involve combining research platforms to accelerate discovery, or applying the acquirer’s development expertise to de-risk and speed up the target’s pipeline.

- Financial Synergies: A large, profitable acquirer may have a lower cost of capital (WACC) than the smaller target. By applying their lower discount rate to the target’s cash flows, the present value of those flows is inherently higher to the acquirer than to the target as a standalone entity.

The sum of the present values of these synergy streams represents the maximum theoretical premium the acquirer can justify paying.

5. For a platform technology company, how do you balance the valuation of the lead asset versus the underlying platform itself?

This is a central question in biotech valuation. The approach is typically layered:

- Value the Lead Asset(s): First, you build a detailed rNPV for the lead clinical asset and any other significant assets in the pipeline. This provides a tangible, data-driven “floor” valuation based on the most advanced programs.

- Value the Platform’s “Optionality”: The value of the platform itself lies in its potential to generate future candidates that are not yet in the pipeline. This is where Real Options Analysis (ROA) is conceptually the best fit. You can model the platform as a series of options to launch new R&D programs in different therapeutic areas.

- Use Market Benchmarks: In practice, formal ROA can be complex. Analysts often use a more pragmatic approach by looking at precedent transactions. What have acquirers paid for other companies with similar platform technologies at a similar stage of validation? These market comps for platform deals provide a benchmark for the “platform premium” that exists on top of the lead asset’s value.

- Narrative and Strategic Justification: The final valuation is a blend. The analyst presents the rNPV of the lead assets as the baseline value and then builds a strong qualitative and strategic argument for the additional value of the platform, supported by market benchmarks. The argument highlights the platform’s versatility, scalability, and ability to mitigate risk (as evidenced by higher survival rates post-failure), justifying a total valuation significantly higher than that of the lead asset alone.

Works cited

- Valuation of Pharmaceutical Companies: A Comprehensive Analysis of Key Considerations, accessed October 3, 2025, https://www.drugpatentwatch.com/blog/valuation-of-pharma-companies-5-key-considerations/

- The Alchemist’s Playbook: Transforming Drug Patent Data into …, accessed October 3, 2025, https://www.drugpatentwatch.com/blog/the-alchemists-playbook-transforming-drug-patent-data-into-financial-gold-with-advanced-ip-valuation-and-financing-models/

- Using DCF In Biotech Valuation – Investopedia, accessed October 3, 2025, https://www.investopedia.com/articles/stocks/06/biotechvaluation.asp

- Valuation of Pharma Companies: 5 Key Considerations …, accessed October 3, 2025, https://www.drugpatentwatch.com/blog/valuation-of-pharma-companies-5-key-considerations-2/

- Real Cost of Delays in Drug Development: Insights from Tufts, accessed October 3, 2025, https://cyntegrity.com/the-real-cost-of-delays-in-drug-development-and-the-role-of-rbqm-and-qbd/

- Stock Market Returns and Clinical Trial Results of Investigational Compounds: An Event Study Analysis of Large Biopharmaceutical Companies | PLOS One – Research journals, accessed October 3, 2025, https://journals.plos.org/plosone/article?id=10.1371/journal.pone.0071966

- Valuation implications of pharmaceutical companies’ R&D regulatory approval notifications, accessed October 3, 2025, https://www.researchgate.net/publication/257289699_Valuation_implications_of_pharmaceutical_companies’_RD_regulatory_approval_notifications

- Intellectual Property – PhRMA, accessed October 3, 2025, https://phrma.org/policy-issues/intellectual-property

- Risk-Adjusted NPV in Biotech Valuation – Models Hub, accessed October 3, 2025, https://financialmodelshub.com/risk-adjusted-npv-explained-the-gold-standard-for-biotech-valuation/

- 2025 Ultimate Pharma & Biotech Valuation Guide …, accessed October 3, 2025, https://www.biopharmavantage.com/pharma-biotech-valuation-best-practices

- Biotech Valuation: Methods, Examples, and Calculator | Exitwise, accessed October 3, 2025, https://exitwise.com/blog/biotech-valuation

- Valuing Pharmaceutical Assets: When to Use NPV vs rNPV – Alacrita, accessed October 3, 2025, https://www.alacrita.com/whitepapers/valuing-pharmaceutical-assets-when-to-use-npv-vs-rnpv

- Understanding Pharmaceutical Valuation Models – Shane Schaffer, accessed October 3, 2025, https://shaneschaffer.com/understanding-pharmaceutical-valuation-models-a-guide-for-investors-and-analysts/

- Patent Cliff in Pharma: Navigating Disruption and Creating Opportunity – Global Pricing, accessed October 3, 2025, https://globalpricing.com/patent-cliff-in-pharma-navigating-disruption-and-creating-opportunity/

- Study: Sales Price of Originator Declines After Introduction of …, accessed October 3, 2025, https://www.pharmacytimes.com/view/study-sales-price-of-originator-declines-after-introduction-of-biosimilars

- Pharmaceutical Industry Comps Template – Download Free Excel …, accessed October 3, 2025, https://corporatefinanceinstitute.com/resources/financial-modeling/pharmaceutical-industry-comps-template/

- Intellectual Property Valuation in Biotechnology and … – WIPO, accessed October 3, 2025, https://www.wipo.int/web-publications/intellectual-property-valuation-in-biotechnology-and-pharmaceuticals/en/4-the-real-options-method.html

- Real Options Analysis (ROA) for Biotech Valuation & Portfolio Management | Inbistra, accessed October 3, 2025, https://inbistra.com/en/blog/ROA-biotech-valuation

- Real Options Analysis – Windeye Partners, accessed October 3, 2025, https://windeyepartners.com/valuation-realoptions.html

- Biotech Valuation: How to Value a Biotech Company (When So Much is Uncertain) + Calculator – Eton Venture Services, accessed October 3, 2025, https://etonvs.com/valuation/how-to-value-a-biotech-company/

- Five Ways to Value Biotech Companies Investors Should Know – Keiretsu Forum Northwest, accessed October 3, 2025, https://www.k4northwest.com/articles/five-ways-to-value-biotech-companies-investors-should-know

- Drug Pipeline Analysis – Umbrex, accessed October 3, 2025, https://umbrex.com/resources/industry-analyses/how-to-analyze-a-pharmaceutical-company/drug-pipeline-analysis/

- Understanding Pharmaceutical Competitor Analysis …, accessed October 3, 2025, https://www.drugpatentwatch.com/blog/the-importance-of-pharmaceutical-competitor-analysis/

- How to calculate the value of drugs and biotech companies – Bay Bridge Bio, accessed October 3, 2025, https://www.baybridgebio.com/drug_valuation.html

- Platform Technology Evaluation | Umbrex, accessed October 3, 2025, https://umbrex.com/resources/industry-analyses/how-to-analyze-a-biotechnology-company/platform-technology-evaluation/

- Realized value of platform-based biotech: a retrospective analysis of …, accessed October 3, 2025, https://reconstrategy.com/2025/08/realized-value-of-platform-based-biotech/

- Framework to identify innovative sources of value creation from platform technologies – PMC, accessed October 3, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC12130853/

- Top Management Teams, Business Models, and Performance of Biotechnology Ventures : An Upper Echelon Perspective – ResearchGate, accessed October 3, 2025, https://www.researchgate.net/publication/42241770_Top_Management_Teams_Business_Models_and_Performance_of_Biotechnology_Ventures_An_Upper_Echelon_Perspective

- Infographic: Pharma’s Future in Focus: World Preview 2025 | Evaluate, accessed October 3, 2025, https://www.evaluate.com/thought-leadership/world-preview-2025-infographic/

- What are Patent Cliffs and How Pharma Giants Face Them in 2024 – PatentRenewal.com, accessed October 3, 2025, https://www.patentrenewal.com/post/patent-cliffs-explained-pharmas-strategies-for-2024-losses

- The time is ripe for pharma M&A. Why are drugmakers holding out …, accessed October 3, 2025, https://www.pharmavoice.com/news/pharma-biotech-deals-valuations-acquistion/741706/

- Managing the challenges of pharmaceutical patent expiry: a case study of Lipitor, accessed October 3, 2025, https://www.emerald.com/jstpm/article/7/3/258/249506/Managing-the-challenges-of-pharmaceutical-patent

- Navigating pharma loss of exclusivity | EY – US, accessed October 3, 2025, https://www.ey.com/en_us/insights/life-sciences/navigating-pharma-loss-of-exclusivity

- 5 Pharma Powerhouses Facing Massive Patent Cliffs—And What …, accessed October 3, 2025, https://www.biospace.com/business/5-pharma-powerhouses-facing-massive-patent-cliffs-and-what-theyre-doing-about-it

- Big Pharma Companies and the Threat of Expired Patents – PBA Health, accessed October 3, 2025, https://www.pbahealth.com/elements/big-pharma-companies-and-the-threat-of-expired-patents/

- Analyzing the impact of biosimilars on biologic drug development …, accessed October 3, 2025, https://www.drugpatentwatch.com/blog/analyzing-the-impact-of-biosimilars-on-biologic-drug-development-pipelines/

- Strategies for Navigating Drug Pricing Challenges: A Global …, accessed October 3, 2025, https://www.promedsci.org/articles/Strategies%20for%20Navigating%20Drug%20Pricing%20Challenges%20%20A%20Global%20Perspective

- Deals are back: Surge in life sciences M&A fueled by sector’s capital reserves and quest for new revenue growth | EY, accessed October 3, 2025, https://www.ey.com/en_gl/newsroom/2024/01/deals-are-back-surge-in-life-sciences-m-a-fueled-by-sector-s-capital-reserves-and-quest-for-new-revenue-growth

- In-Depth Look at the Differences Between EMA and FDA | Mabion, accessed October 3, 2025, https://www.mabion.eu/science-hub/articles/similar-but-not-the-same-an-in-depth-look-at-the-differences-between-ema-and-fda/

- Biopharma Trends 2025 – Boston Consulting Group, accessed October 3, 2025, https://web-assets.bcg.com/9b/75/1c0db8bf4ee5b159b1d732ab6f1e/focusing-on-innovation-amid-complexity-jan-2025.pdf

- Biopharma Trends: Focus on Innovation Amid Complexity | BCG, accessed October 3, 2025, https://www.bcg.com/publications/2025/biopharma-trends