I. The Strategic Imperative: Why 505(b)(2) Matters in Modern Pharma

A. Navigating the Pharmaceutical Landscape: A Quest for Efficiency and Innovation

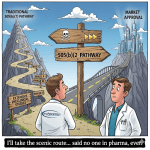

The pharmaceutical industry operates within a demanding ecosystem, characterized by an incessant drive for groundbreaking therapies alongside the formidable challenges of escalating costs and prolonged development timelines. Bringing a novel drug to market via the traditional New Drug Application (NDA) pathway, codified under Section 505(b)(1) of the Federal Food, Drug, and Cosmetic (FD&C) Act, can be an arduous journey, often spanning 10 to 15 years and incurring expenditures that can soar into the billions of dollars.1 This immense investment in time and capital underscores the critical need for pharmaceutical companies to identify and leverage alternative pathways that can streamline market entry, mitigate inherent risks, and optimize their return on investment.

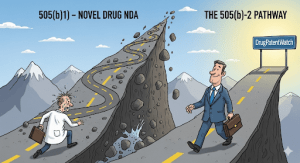

Within this high-stakes arena, the 505(b)(2) pathway has emerged as a profoundly strategic tool, offering a nuanced approach to drug approval that deftly balances the pursuit of innovation with the imperative for efficiency. The industry faces an inherent tension: the relentless demand for new and improved treatments from patients and healthcare providers, juxtaposed with the economic realities of drug development. Companies are under increasing pressure to innovate, yet simultaneously control spiraling research and development (R&D) costs and shorten development timelines. Traditional 505(b)(1) NDAs, while essential for truly novel chemical entities, represent the pinnacle of expense and time commitment. Conversely, Abbreviated New Drug Applications (ANDAs) under Section 505(j) offer a swift and cost-effective route for generic copies, but they inherently lack innovation and significant market differentiation. The 505(b)(2) pathway directly addresses this dual pressure. By permitting reliance on existing data, it provides a faster and less expensive route to market while still enabling the creation of new, differentiated products with substantial commercial value.2 This represents a fundamental evolution in strategic thinking for many pharmaceutical enterprises, moving beyond the binary choice of either developing a completely novel drug or a mere generic copy. This pathway is not merely a regulatory technicality or a convenient loophole; it is a structural response to the prevailing economic realities in drug development. It effectively lowers the barrier to entry for a broader spectrum of companies, including smaller and generic firms, allowing them to participate in the innovation landscape in ways that might otherwise be financially prohibitive.

B. The Hybrid Advantage: Bridging the Gap Between Novelty and Generics

The 505(b)(2) pathway is frequently characterized as a “hybrid” application, a designation that aptly captures its ingenious blending of elements from both the full NDA (505(b)(1)) and the Abbreviated New Drug Application (ANDA) (505(j)).1 This unique positioning allows applicants to seek approval for modified versions of previously approved drugs by strategically leveraging existing safety and efficacy data. The core mechanism involves relying on information that was not generated by or for the applicant, thereby eliminating the need to repeat extensive preclinical and clinical studies from their inception.1 This strategic reliance on pre-existing data is precisely what underpins its reputation as a “streamlined route” and positions it as a “strategic sweet spot” in the complex tapestry of pharmaceutical development.1

The very definition of 505(b)(2) as a “hybrid” pathway inherently implies a focus on incremental, yet often clinically significant, innovation. Unlike the 505(b)(1) route, which is tailored for New Chemical Entities (NMEs) representing substantial, de novo innovation, or the 505(j) pathway, which is essentially a “copy” requiring little to no new innovation, 505(b)(2) is specifically designed for “modified or improved versions of existing innovator drugs”.1 This distinction is crucial because it indicates that the pathway actively fosters improvements in areas directly impacting patient care and commercial viability. Consider, for instance, advancements in patient convenience, enhancements to safety profiles, or the exploration of new therapeutic applications. These are the hallmarks of 505(b)(2) innovation, rather than solely focusing on the discovery of entirely new molecular entities. The legal framework’s explicit allowance for partial reliance on existing data directly influences and shapes the direction of pharmaceutical R&D. It encourages a shift in focus from solely

de novo discovery to the optimization and repurposing of known active ingredients. This, in turn, leads to a distinct type of innovation that is both efficient and highly valuable, expanding the therapeutic landscape by making existing treatments better, safer, or more accessible.

C. Unlocking Competitive Edge Through Regulatory Acumen

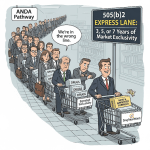

For business professionals navigating the intricate pharmaceutical market, a profound understanding and skillful navigation of the 505(b)(2) pathway transcends mere regulatory compliance. It transforms into a potent mechanism for value creation and a formidable source of competitive advantage.1 This pathway offers a compelling suite of benefits, including the potential for significant market exclusivity—ranging from three, five, or even seven years—alongside substantially reduced development costs and accelerated timelines.1 These advantages empower companies to effectively differentiate their products in a crowded marketplace and alleviate the intense competitive pressures that characterize the industry.1 For example, the pathway enables companies to address specific, often overlooked, unmet patient needs, such as developing oral film formulations for individuals who experience difficulty swallowing traditional tablets, thereby carving out distinct and profitable market spaces.

In an environment where “vanilla generic programs are commoditized and fighting for pennies on bottles,” the 505(b)(2) pathway presents a “unique opportunity” for both small molecule generic manufacturers and established brand companies alike. The ability to secure a period of market exclusivity for a modified product, a benefit typically unavailable to standard generics, fundamentally redefines how regulatory strategy is perceived and executed within an organization. It elevates regulatory affairs from a purely compliance-focused department to a pivotal, strategic arm of the business. This means that companies that cultivate a deep understanding of the nuances of 505(b)(2) and integrate this knowledge into their overarching business development framework are uniquely positioned to establish profitable niches, extend the commercial lifecycles of their existing products, and gain a significant lead over competitors who remain confined to the more traditional 505(b)(1) or 505(j) approaches. The pathway actively encourages a deeper, more synergistic integration of regulatory, research and development, and commercial teams, fostering a holistic approach to product development and market strategy.

II. Decoding the 505(b)(2) Pathway: Foundations and Legal Framework

A. A Historical Perspective: The Hatch-Waxman Amendments of 1984

The 505(b)(2) pathway, far from being a recent regulatory innovation, has its origins deeply embedded in the legislative landscape of the United States. Its genesis can be traced back to the seminal Drug Price Competition and Patent Term Restoration Act of 1984, universally recognized as the Hatch-Waxman Amendments.1 This landmark legislation was meticulously crafted with a dual, ambitious intent: to foster robust innovation in the development of new drugs while simultaneously facilitating the timely entry of generic drugs into the market, thereby enhancing competition and ultimately reducing healthcare costs for consumers.1 The 505(b)(2) provision was specifically designed to address and “eliminate the redundancy of conducting studies on drugs that have already received approval”. This critical foresight allowed the Food and Drug Administration (FDA) to consider and rely upon pre-existing data when reviewing an application, even if that data was not originally developed by or for the current applicant.1

What is particularly noteworthy about Hatch-Waxman’s legacy is its unintended role as a catalyst for innovation through the 505(b)(2) pathway. While the Act is predominantly celebrated for establishing the generic drug pathway (505(j)) to spur competition and lower drug prices 6, it simultaneously codified the 505(b)(2) pathway.6 Initially, the 505(b)(2) provision was conceived as a measure for efficiency, aiming to avoid “unnecessary duplication of studies”.1 However, over the decades, a confluence of subsequent regulatory and market dynamics transformed its role. The gradual accumulation of various market exclusivities and expedited approval programs, which were notably

unavailable to generic drugs, coupled with the introduction of new pediatric study requirements, inadvertently steered an increasing number of manufacturers towards the 505(b)(2) pathway.13 This historical trajectory reveals that what began as a pragmatic measure for streamlining efficiency evolved into a powerful engine for the development of differentiated and value-added pharmaceutical products. The long-term impact of legislative frameworks can extend far beyond their initial, explicit objectives. The 505(b)(2) pathway, initially “little used” in the years immediately following its creation , has since become a major force in drug development, demonstrating how regulatory foresight, combined with evolving market pressures, can profoundly reshape an entire industry’s approach to innovation.

B. Defining the 505(b)(2) NDA: A Hybrid Approach to Drug Approval

At its core, a 505(b)(2) New Drug Application (NDA) is a comprehensive submission that, much like a full NDA, contains complete reports of safety and effectiveness.1 However, its defining characteristic and the source of its strategic advantage lie in its flexibility: it permits “at least some of the information required for approval [to come] from studies not conducted by or for the applicant”.1 This critical provision allows applicants to leverage a wealth of pre-existing data, including publicly available scientific literature or the FDA’s own prior findings regarding the safety and efficacy of a previously approved “reference listed drug” (RLD).2

1. Reliance on Existing Data: The Cornerstone Principle

The ability to rely on existing data forms the bedrock principle that fundamentally distinguishes the 505(b)(2) pathway from traditional drug development routes. This pivotal provision significantly reduces the necessity for duplicative preclinical and extensive clinical studies, which are notoriously the most time-consuming and resource-intensive components of conventional drug development. It empowers companies to effectively “create a bridge between what is already known about the previously approved reference drug and the novel drug product or indication”.2

This unparalleled ability to leverage data not generated by the applicant fundamentally de-risks the entire development process. Traditional drug development is fraught with high rates of failure, particularly in the early clinical phases, often due to unforeseen safety or efficacy issues. By initiating development with an active ingredient whose safety and efficacy profile is already well-established, companies pursuing the 505(b)(2) pathway significantly reduce this inherent “risk of failure”. This intrinsic de-risking aspect makes 505(b)(2) projects exceptionally “attractive to investors”. The reliance on existing, established safety and efficacy data directly translates into a reduced risk profile for the new drug development, which in turn accelerates funding decisions and enhances the overall appeal of the project to financial stakeholders.

2. Mandatory Safety and Effectiveness Reports: Upholding Rigor

Despite the significant advantage of relying on existing data, it is crucial to understand that a 505(b)(2) application is by no means a shortcut that bypasses rigorous scientific scrutiny. It remains a New Drug Application and, as such, mandates the submission of “complete safety and effectiveness reports”.1 The strength and quality of evidence required to demonstrate the safety and effectiveness of the proposed drug are precisely the same as those demanded for a full 505(b)(1) application. This unwavering commitment to comprehensive data ensures that while the development process may be streamlined and more efficient, the stringent standards for patient safety and drug efficacy, which are the hallmarks of FDA approval, are never compromised. The pathway is designed to avoid redundant studies, not to lower the bar for patient protection.

C. Distinguishing the Pathways: 505(b)(1) vs. 505(b)(2) vs. 505(j)

To fully appreciate the strategic value and unique positioning of the 505(b)(2) pathway, it is essential to understand how it stands apart from the other two primary FDA drug approval routes: the traditional New Drug Application (505(b)(1)) and the Abbreviated New Drug Application (505(j)).1 Each pathway serves a distinct purpose within the regulatory framework, catering to different types of pharmaceutical innovation and commercial objectives.

1. The Full NDA (505(b)(1)): Pioneering New Chemical Entities

The 505(b)(1) pathway represents the conventional and most comprehensive route for drug approval. It is primarily reserved for “new” or “innovative” drugs, most notably New Chemical Entities (NMEs) – active ingredients that have never before been approved by the FDA.1 This pathway demands a complete and exhaustive set of preclinical (animal) and clinical (human) data, which must typically be generated

de novo by or for the applicant through extensive, original investigations.1 Consequently, the 505(b)(1) route is the most time-consuming, often requiring 10 to 15 years of development, and the most expensive, with costs frequently exceeding a billion dollars.1 It is the pathway for truly groundbreaking scientific discoveries, but it comes with a commensurate level of risk and investment.

2. The Abbreviated New Drug Application (505(j)): The Generic Route

The 505(j), or Abbreviated New Drug Application (ANDA), pathway is specifically designed for generic drug products. These generics are essentially “copies” of already-approved Reference Listed Drugs (RLDs).1 The central criterion for approval through this pathway is demonstrating bioequivalence to the RLD, meaning the generic must deliver the active ingredient to the body at the same rate and extent as the innovator product.1 This pathway typically requires little to no new clinical data for safety and efficacy, as it relies entirely on the FDA’s previous findings for the RLD.4 While ANDAs offer significant advantages in terms of speed and cost-effectiveness, they provide minimal innovation and generally grant limited market exclusivity, usually a 180-day period for the first generic applicant to challenge patents.4

3. The 505(b)(2) as a Strategic “Sweet Spot”

The 505(b)(2) pathway occupies a unique and highly strategic “middle ground” between the resource-intensive 505(b)(1) and the commoditized 505(j) routes.3 It is specifically tailored for modifications and improvements to existing drugs, encompassing a wide array of innovations such as new dosage forms, novel routes of administration, new combinations of active ingredients, or new indications for already-approved drugs.1 These innovations lead to the creation of a distinct drug product, which, crucially, can qualify for its own periods of market exclusivity.1 This hybrid nature enables innovation and market differentiation without the full burden of

de novo development, thereby carving out a distinct competitive space.

The consistent description of 505(b)(2) as “part-way between” 13 or a “hybrid” 1 of the full NDA and generic pathways is more than just a descriptive label; it underscores its unique value proposition. It is, in essence, the “Goldilocks” pathway: “more expensive than an ANDA but usually less costly than a full NDA” , and capable of offering “stronger patent protection than drugs approved through the ANDA pathway”. This careful balance of development cost, time to market, and intellectual property protection positions it as a “strategic sweet spot”. For pharmaceutical companies, especially those holding established active ingredients or seeking to expand their product portfolios efficiently, the 505(b)(2) pathway presents a compelling risk-adjusted return profile. It is the preferred route for “value-added medicines” in a market that increasingly demands both innovative improvements and greater affordability.

| Feature | 505(b)(1) (Full NDA) | 505(b)(2) (Hybrid NDA) | 505(j) (ANDA – Generic) |

| Purpose | Approval for a completely new drug product (New Chemical Entity – NME) 4 | Approval for modified versions of previously approved drugs | Approval for generic versions of Reference Listed Drugs (RLDs) 4 |

| Data Reliance | Full preclinical & clinical data generated by applicant 4 | Relies partly on existing data (literature, FDA findings) + new bridging studies 4 | Focus on bioequivalence to RLD, no new clinical trials for safety/efficacy 4 |

| Innovation Level | Significant innovation (new molecule/mechanism) 4 | Innovation in formulation, dosage, route, indication, combination, etc. | Little to no new innovation (a “copy”) 4 |

| Development Time | Longest (typically 10-15 years) 1 | Moderate (typically 3-5 years) 3 | Shortest (often < 2 years post-patent expiry) |

| Development Cost | Most expensive (up to $1 billion+) 1 | More expensive than ANDA, less than 505(b)(1) ($50M-$100M) 3 | Least expensive |

| Potential Market Exclusivity | 5 years (NCE) + pediatric, orphan, etc. | 3 years (new clinical investigations), 5 years (NCE), 7 years (Orphan) 1 | 180 days (first filer) 4 |

| Examples | New Chemical Entities (e.g., Mounjaro ) | Modified versions of existing drugs (e.g., Qbrelis, Spravato, Bendeka 21) | Generic Metformin HCl Extended-Release Tablets |

III. Types of Innovations Flourishing Under 505(b)(2)

The 505(b)(2) pathway’s remarkable versatility is vividly demonstrated by the broad and diverse spectrum of drug innovations it successfully shepherds to market. This pathway is uniquely suited for fostering the development of modified or improved versions of existing innovator drugs, ultimately leading to distinct drug products that enhance patient care and expand therapeutic options. It is a testament to the idea that innovation is not solely about discovering entirely new molecules, but also about optimizing and repositioning existing ones to meet evolving medical needs.

A. Enhancing Patient Experience: New Dosage Forms and Routes of Administration

One of the most prevalent and impactful applications of the 505(b)(2) pathway involves the creation of novel dosage forms or the introduction of new routes of administration for existing active ingredients.1 These modifications are often directly aimed at improving patient convenience, enhancing adherence to prescribed regimens, and bolstering overall safety, thereby addressing previously unmet medical needs in a practical and impactful way.3

1. Oral Solutions and Extended-Release Formulations

The development of new oral solutions, particularly for patient populations facing dysphagia (difficulty swallowing tablets), represents a common and highly beneficial use of this pathway. A prime example is Qbrelis, an oral solution of the angiotensin-converting enzyme (ACE) inhibitor lisinopril, which received approval via the 505(b)(2) pathway in 2016.21 This formulation offered a vital new option for patients who struggled with solid oral dosage forms, vividly demonstrating how this pathway can facilitate formulation innovation to meet specific patient needs. Similarly, extended-release (ER) formulations are frequently developed through this route. These formulations are designed to maintain therapeutic drug levels over a longer period, which can significantly improve patient compliance by reducing the frequency of dosing. Various methylphenidate products, for instance, have been approved via 505(b)(2) as extended-release capsules or chewable tablets, making medication management simpler for patients.9

2. Novel Delivery Mechanisms: Topical, Injectable, and Nasal Sprays

Beyond oral modifications, the 505(b)(2) pathway also plays a pivotal role in facilitating the approval of drugs with entirely new routes of administration, such as topical creams, innovative injectable systems, or nasal sprays.1 A particularly notable example is Narcan® (naloxone hydrochloride) nasal spray, a life-saving combination product approved via 505(b)(2). This product provided a critical, easy-to-administer solution for opioid overdose emergencies, highlighting the pathway’s utility in developing advanced drug delivery technologies that can dramatically improve patient outcomes and enhance public health response capabilities.3

Many 505(b)(2) innovations, like oral solutions for patients with dysphagia (e.g., Qbrelis) or nasal sprays designed for emergency use (e.g., Narcan), are not centered on the discovery of new active ingredients. Instead, their value proposition lies in how the drug is delivered or how it is utilized. These seemingly subtle changes directly and profoundly impact patient compliance and convenience.22 Improved patient compliance, in turn, frequently translates into superior therapeutic outcomes, which is a powerful driver of market adoption and commercial success. This demonstrates that addressing specific “patient needs” is a key and highly effective driver for 505(b)(2) development. The 505(b)(2) pathway actively encourages a market strategy that prioritizes “value-added medicines” – products that differentiate themselves through an enhanced patient experience, rather than solely through novel pharmacological mechanisms. This strategic focus can lead to robust market positioning and sustained commercial viability, even for active ingredients that have been on the market for an extended period.

B. Synergistic Solutions: Novel Combinations of Active Ingredients

The 505(b)(2) pathway is frequently leveraged for the approval of new combination products, which involve the innovative pairing of two or more active ingredients.1 These carefully designed combinations can offer a multitude of therapeutic advantages over the administration of individual components. Such benefits often include enhanced efficacy, a reduction in adverse side effects (by allowing lower doses of individual components or by counteracting specific side effects), or a simplification of complex treatment regimens.3 Examples frequently include fixed-dose combinations or multi-drug products that are designed to address complex medical conditions more holistically, providing more comprehensive and convenient therapeutic solutions. This approach underscores the pathway’s utility in creating synergistic treatments that improve overall patient management and outcomes.

C. Expanding Therapeutic Horizons: New Indications for Approved Drugs

Drug repurposing, also known as drug repositioning—the strategic identification of new uses for existing, already-approved drugs—represents another highly significant application of the 505(b)(2) pathway.1 By identifying novel indications for compounds whose safety profiles are already well-characterized, companies can significantly extend the utility and commercial lifespan of these assets while circumventing a substantial portion of the early-stage development risks and costs associated with entirely new molecular entities. A compelling illustration of successful drug repurposing through this pathway is Spravato (esketamine), a nasal spray formulation of ketamine, which received 505(b)(2) approval in 2019 for the treatment of severe treatment-resistant depression.3 This approval not only addressed a critical unmet medical need in mental health but also showcased the pathway’s flexibility in bringing innovative treatments to market by leveraging existing pharmacological knowledge.

Repurposing drugs for new indications via the 505(b)(2) pathway is a highly attractive strategic maneuver. The fundamental safety profile of the active ingredient is already well-established, which dramatically reduces the most unpredictable and costly phases of traditional drug development. This allows companies to concentrate their clinical efforts primarily on demonstrating efficacy for the newly proposed indication.12 This approach perfectly encapsulates the “lower risk” and “lower cost” benefits that are hallmarks of the 505(b)(2) pathway.1 Drug repurposing through 505(b)(2) is a shrewd method to extract additional value from existing intellectual property, open new revenue streams, and address pressing unmet medical needs far more rapidly than would be possible through

de novo drug discovery. It stands as a powerful testament to the principle that innovation is not exclusively about inventing something entirely new, but frequently about applying existing knowledge and assets in novel and impactful ways.

D. Beyond the Conventional: Prodrugs, Branded Generics, and Drug-Device Combinations

The versatility of the 505(b)(2) pathway extends to several other innovative product types that do not fit neatly into the traditional “new drug” or “generic” molds. It is, for instance, an ideal route for the approval of prodrugs.1 Prodrugs are pharmacologically inactive compounds that undergo metabolic conversion within the body to yield an active drug. This strategic modification can significantly improve crucial pharmacokinetic (PK) properties, such as absorption, distribution, metabolism, and excretion (ADME), ultimately leading to enhanced bioavailability, improved safety profiles, and increased therapeutic efficacy.

The pathway is also highly suitable for branded generics, which are essentially modified versions of existing generic drugs. These products leverage the 505(b)(2) route to introduce differentiating features—such as a new dosage form, strength, or formulation—that allow them to stand out in a highly competitive and often commoditized generic market.1 This strategy allows companies to command better pricing and market share compared to undifferentiated generic copies.

Furthermore, the 505(b)(2) pathway is increasingly utilized for the approval of drug-device combinations.1 These innovative products integrate pharmaceutical components with medical device technologies to create sophisticated delivery systems or novel treatment approaches. Such combinations can dramatically improve efficacy, enhance safety, and significantly optimize the patient experience. As previously noted, Narcan nasal spray, which combines the drug naloxone with a user-friendly nasal delivery device, serves as a compelling example of a successful drug-device combination approved via the 505(b)(2) pathway, demonstrating its capacity to address critical public health needs through integrated technological solutions.

E. Addressing Unmet Needs: The Role of 505(b)(2) in Orphan Drug Development

The 505(b)(2) pathway holds particular significance and value in the development of treatments for rare diseases, often referred to as orphan drugs. For these conditions, the traditional drug development process can be prohibitively expensive and exceptionally challenging, primarily due to the inherently small patient populations available for clinical trials.1 The reduced development burden (in terms of both cost and time) offered by the 505(b)(2) pathway, combined with the substantial incentive of seven-year orphan drug exclusivity, creates a powerful commercial viability for these otherwise economically unfeasible projects.2 This extended period of market protection makes it attractive for companies to invest in therapies for underserved patient populations. Indeed, in 2020, over one-third (36%) of all NDA approvals for orphan drugs were successfully developed and approved via the 505(b)(2) pathway.

The synergy between the 505(b)(2) pathway’s reduced development burden and the substantial 7-year orphan drug exclusivity creates a powerful incentive for developing therapies for rare diseases. This is particularly critical in scenarios where full Phase 1-3 clinical development programs might otherwise be entirely unfeasible due to the limited patient pool. This alignment of regulatory efficiency and market protection transforms previously economically unviable projects into attractive investment opportunities. The 505(b)(2) pathway thus plays a vital role in addressing significant public health needs by making drug development for rare diseases more accessible and sustainable for pharmaceutical companies. This effectively aligns business incentives with broader societal benefits, fostering innovation in areas that might otherwise be neglected.

| Type of Innovation | Description | Key Benefits | Example Drug (Approval Year) |

| New Dosage Forms | Changes in physical form (e.g., tablet to oral solution, immediate-release to extended-release) 1 | Improved patient compliance, easier administration (e.g., for dysphagia), reduced dosing frequency 21 | Qbrelis (Lisinopril Oral Solution) (2016) Methylphenidate ER products (various years) |

| New Routes of Administration | Changing how the drug is given (e.g., oral to nasal spray, topical, injectable) 1 | Faster onset, improved bioavailability, enhanced patient convenience, targeted delivery 3 | Narcan (Naloxone Nasal Spray) (2015) Sustol (Granisetron SQ Injection) (2016) |

| New Combinations | Combining two or more active ingredients in a novel product 1 | Enhanced efficacy, reduced side effects, simplified treatment regimens 3 | Mucinex DM (Dextromethorphan/Guaifenesin) |

| New Indications (Repurposing) | Finding new therapeutic uses for an already approved drug 1 | Reduced development risk (known safety profile), faster market entry, expanded utility of existing assets 12 | Spravato (Esketamine Nasal Spray) (2019) 21 |

| Prodrugs | Inactive compounds converted to active drugs in the body 1 | Improved PK properties (ADME), increased bioavailability, selective targeting, protection from rapid elimination | Gabapentin enacarbil (Horizant) |

| Branded Generics | Modified versions of existing generics with differentiating features 2 | Market differentiation, potential for new exclusivity, competitive advantage in crowded markets | (General category, specific examples often proprietary) |

| Drug-Device Combinations | Products integrating a drug with a medical device for delivery 2 | Innovative delivery systems, improved efficacy, enhanced patient experience 21 | Narcan (Naloxone Nasal Spray) (2015) |

| Orphan Drugs | Treatments for rare diseases 2 | Addresses unmet medical needs, qualifies for 7-year exclusivity, lower development cost/risk 2 | Qutenza (Capsaicin patch) |

IV. Regulatory Requirements and Navigating the Approval Process

Successfully navigating the 505(b)(2) pathway demands a meticulous understanding of its unique regulatory requirements and the strategic orchestration of a well-defined development plan. It is a route that, while offering substantial advantages, can be “challenging but offers tremendous opportunity” for sponsors who approach it with diligence and expertise.

A. The Art of the “Scientific Bridge”: Leveraging Existing Data

The cornerstone of any successful 505(b)(2) application lies in the meticulous construction of a “scientific bridge.” This bridge serves to establish a robust connection between the proposed new drug product and the existing data it relies upon.2 The fundamental purpose of this bridge is to scientifically demonstrate that the new product’s safety and efficacy can be confidently inferred, at least in part, from the referenced data, thereby minimizing the need for duplicative and resource-intensive studies.2

1. Publicly Available Literature and FDA’s Prior Findings

Applicants pursuing the 505(b)(2) pathway can draw upon a diverse array of sources to construct their scientific bridge. These typically include comprehensive published scientific literature and, crucially, the FDA’s own prior findings regarding the safety and effectiveness of an approved drug, often referred to as the Reference Listed Drug (RLD).2 The FDA’s “Approved Drug Products With Therapeutic Equivalence Evaluations,” widely known as the “Orange Book,” serves as an indispensable resource for identifying RLDs and accessing their associated patent and exclusivity information.4 Diligent review of these sources is paramount for initial strategic planning and identifying the most appropriate RLD to reference.

2. Bridging Studies: Demonstrating Equivalence and Safety

While leveraging existing data is a core advantage, new “bridging studies” are frequently indispensable to firmly establish the scientific link between the proposed product and the RLD. This is particularly true when there are meaningful differences in formulation, dosage, or route of administration between the new product and the referenced drug.2 These studies are meticulously designed to scientifically connect the new product to the established safety and efficacy profile of the RLD, thereby justifying the reliance on existing data.

a. Comparative Bioavailability and Pharmacokinetics (PK/PD)

Phase 1 comparative bioavailability (BA) and pharmacokinetic (PK) studies are among the most common types of bridging studies employed. These investigations are designed to establish bioequivalence or to demonstrate that the new product exhibits a “favorable” PK profile when compared to the innovator product.9 For example, in the case of Bendeka®, an anti-cancer agent, a comparative BA study was absolutely crucial to establish the necessary scientific bridge to its Reference Listed Drug, Treanda®, allowing reliance on Treanda’s established safety and efficacy data. Such studies are fundamental in confirming that the modified drug behaves predictably within the body.

b. Addressing Differences: When Additional Clinical Studies are Needed

The extent and nature of new studies required for a 505(b)(2) application are highly dependent on the specific differences between the proposed product and the RLD.2 Significant modifications, such as a change in the route of administration, the introduction of novel excipients, or a new dosage regimen, may necessitate additional nonclinical (animal) or clinical (human) studies beyond simple bioequivalence. These could include toxicology studies, or even more extensive Phase 2 and Phase 3 clinical trials, if the changes are substantial enough to potentially alter the drug’s safety or efficacy profile.4 The case of Sustol®, an extended-release subcutaneous injection, vividly illustrates this point. The incorporation of a novel polymer and changes in the dosage regimen led to extensive nonclinical and clinical programs, underscoring that the “abbreviated” nature of 505(b)(2) is not a uniform concept.

The case studies (Bendeka, GT123, Sustol) clearly illustrate that the “abbreviated” nature of the 505(b)(2) pathway is not a one-size-fits-all proposition. While some applications may indeed require minimal new studies, others, particularly those incorporating novel excipients or significant alterations in delivery mechanisms, can necessitate substantial new nonclinical and clinical investigations. This “wide spectrum of program requirements and strategies” means that the perceived benefits of “lower cost and accelerated development” 1 are highly variable and contingent on the specific product modifications. Consequently, companies cannot adopt a standardized approach to 505(b)(2) development. A thorough, early-stage feasibility assessment, encompassing detailed scientific and regulatory analysis, is absolutely paramount to accurately predict timelines, costs, and the ultimate likelihood of approval. Failing to account for the potential complexity of the “scientific bridge” can lead to significant and costly delays, or even “product-development failure”.2 This underscores the critical need for deep scientific and regulatory expertise from the very outset of a 505(b)(2) program.

B. The Critical Pre-IND Meeting: Setting the Stage for Success

The 505(b)(2) development process typically commences with a crucial pre-Investigational New Drug (pre-IND) meeting with the FDA.2 This early engagement with the regulatory agency is paramount, serving as a strategic opportunity to “gain FDA input and concurrence” on the proposed development strategy. Discussions at this meeting are critical for aligning on the scope of necessary studies, the Chemistry, Manufacturing, and Controls (CMC) strategy, and the overall clinical research plans.2

1. Objectives and Strategic Planning for FDA Concurrence

The primary objective of a 505(b)(2) pre-IND meeting is to minimize the number of new studies required by securing early FDA agreement on the reliance strategy. This involves clearly articulating the product’s characteristics, its current development status, and the specific feedback sought from the FDA. It is often most effective to pose well-formulated questions that clearly state the sponsor’s position and explicitly seek the FDA’s concurrence. Obtaining this early FDA “buy-in” is not merely a procedural step; it is a critical factor for securing necessary investments and demonstrating a clear path forward to potential financial stakeholders. Proactive and well-prepared pre-IND meetings directly lead to a clearer, more predictable development pathway, significantly reducing the likelihood of costly late-stage surprises and accelerating overall time to market. This is a critical step in translating regulatory understanding into a tangible competitive advantage.

2. Chemistry, Manufacturing, and Controls (CMC) Considerations

The Chemistry, Manufacturing, and Controls (CMC) strategy constitutes a key discussion point during pre-IND meetings for 505(b)(2) products.2 It is essential to demonstrate that the clinical trial materials intended for Phase I studies are representative of the planned commercial manufacturing process, including packaging considerations. The Bendeka® case study, for instance, highlighted the paramount importance of submitting a complete and robust CMC package, even when the application leverages a drug master file (DMF) from the Reference Listed Drug (RLD). This underscores that CMC is not a minor detail to be addressed later in the process, but rather a foundational element that requires early strategic planning and FDA alignment to ensure a smooth progression through development and approval.

C. Data Submission Expectations: A Comprehensive Overview

Despite its abbreviated nature in terms of leveraging existing data, a 505(b)(2) NDA still necessitates a comprehensive and meticulously organized submission of information to the FDA. The application must contain full reports of safety and effectiveness, which are then supplemented by any new data derived from bridging studies or other investigations deemed necessary to support the specific modifications.1 A critical aspect of this submission is the clear identification of those portions of the application that rely on information not owned by the applicant or for which the applicant does not possess a direct right of reference. This requirement underscores the need for meticulous documentation, transparent referencing of external data, and thorough justification for how all referenced and newly generated data collectively support the safety and efficacy of the proposed drug product.

D. Common Regulatory Hurdles and How to Overcome Them

Despite the strategic advantages it offers, the 505(b)(2) pathway is not without its complexities and potential pitfalls. “Regulatory complexity” stands out as a significant hurdle, demanding a profound understanding of evolving FDA expectations and the nuanced ability to craft a compelling “scientific bridge” that satisfies agency requirements.3 The consequences of mishandling the early stages of 505(b)(2) development can be severe, potentially leading to “product-development failure”.2 Beyond the scientific and regulatory intricacies, other challenges frequently arise, including the potential for intellectual property disputes with the holders of patents related to the Reference Listed Drug (RLD), and the ongoing need to strike a delicate balance between leveraging existing data and demonstrating sufficient innovation through new studies.3

The recurring emphasis on “regulatory complexity” and the stark warning that “mishandled” early steps can result in “product-development failure” points directly to the critical importance of specialized expertise.2 This is not merely about retaining a regulatory consultant; it necessitates having a team capable of anticipating reviewer expectations, proactively avoiding missteps, and meticulously crafting compelling, review-ready documents. It also involves a collaborative approach, “working with regulatory experts and aligning the filing strategy with FDA requirements” from the outset. The success of a 505(b)(2) program, therefore, is not solely dependent on the inherent merits of the drug product itself, but equally, if not more so, on the strategic and regulatory acumen of the development team. Investment in this specialized expertise is as crucial as the investment in the underlying research and development activities.

V. Trends in 505(b)(2) Approvals: A Data-Driven Analysis

The 505(b)(2) pathway has undergone a remarkable evolution since its inception, transforming from an often-overlooked provision into a significant and increasingly dominant force in pharmaceutical development. A thorough understanding of these trends is indispensable for strategic planning and identifying future opportunities within the industry.

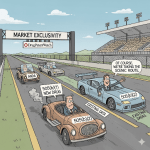

A. Historical Trajectory: From Underutilized to Mainstream (1993-Present)

Following its establishment by the Hatch-Waxman Amendments in 1984, the 505(b)(2) pathway was initially “little used”. However, its utilization began to gain traction in the 1990s, experiencing a notable surge in 2004. Since that pivotal year, 505(b)(2) approvals have consistently surpassed the number of new molecular entities (NMEs) approved under the traditional 505(b)(1) pathway, with over forty new approvals annually.13 In 2020, for instance, 68 NDAs utilized the 505(b)(2) pathway, accounting for a substantial 60% of all NDA approvals granted by the Center for Drug Evaluation and Research (CDER).33 While some reports suggest that 505(b)(2) approvals “outpaced generic drug approvals, accounting for 40% of all new FDA approvals” in 2024 , it is important to contextualize this with official FDA annual reports, which typically categorize approvals by NMEs versus non-NMEs, rather than directly comparing 505(b)(2) to generics in their primary novel drug summaries.25 Nevertheless, the trend is clear: in Fiscal Year (FY) 2023, the FDA approved 55 505(b)(2) applications , further solidifying its mainstream status.

The dramatic and sustained increase in 505(b)(2) approvals, consistently exceeding NME approvals for over a decade, signifies what can be described as a “silent revolution” in drug development. While the approval of NMEs often garners significant media attention, 505(b)(2) products are quietly, yet profoundly, expanding therapeutic options and improving patient care. The statistic indicating that 505(b)(2) approvals constituted 60% of all NDA approvals in 2020 is particularly striking, demonstrating that this “hybrid” approach has, in fact, become the dominant form of NDA approval. This trend suggests a maturation in the pharmaceutical industry’s approach to innovation, where optimizing existing compounds and addressing specific patient needs through formulation enhancements or new uses is now recognized as being as critical, if not more so, than the discovery of entirely new molecules. This shift carries profound implications for R&D investment strategies, encouraging a greater focus on lifecycle management and the development of differentiated follow-on products.

B. Driving Forces Behind the Surge in Approvals

Several interconnected factors have converged to fuel the increased utilization and remarkable success of the 505(b)(2) pathway over the past two decades.

1. Accumulating Exclusivities and Expedited Programs

Legislative enactments have progressively created powerful incentives for 505(b)(2) applications that are simply unavailable to Abbreviated New Drug Applications (ANDAs). These incentives include various forms of market exclusivities, such as the seven-year orphan drug exclusivity for rare diseases, the five-year new chemical entity (NCE) exclusivity, and the three-year exclusivity granted for new clinical investigations that are essential to approval. Furthermore, 505(b)(2) applications are eligible to benefit from the FDA’s expedited development and approval programs, including Fast Track, Accelerated Approval, Priority Review, and Breakthrough Therapy designations, none of which are accessible to ANDAs. A notable example is Aduhelm (aducanumab) for Alzheimer’s disease, approved via 505(b)(2) in 2021, which received Fast Track, Priority Review, and Accelerated Approval designations, underscoring the strategic advantage these programs offer.3

2. User Fee Funding and Reduced Review Times

The Prescription Drug User Fee Act (PDUFA), enacted in 1992, fundamentally reshaped the FDA’s review process. PDUFA allowed pharmaceutical manufacturers to pay fees to the FDA, which in turn enabled the agency to hire additional staff and resources, thereby accelerating the review and approval process for NDAs, including 505(b)(2) applications.13 While the application fees for 505(b)(2) submissions are higher than those for ANDAs, the potential for significantly faster approval times—with standard reviews often completed in around 10 months and priority reviews in as little as 6 months—frequently outweighs the increased cost, making it a commercially attractive proposition.9

3. New Pediatric Study Requirements

Regulatory mandates, such as the Pediatric Research Equity Act (PREA) of 2003, have also played a role in steering applications towards the 505(b)(2) pathway. PREA requires sponsors to conduct pediatric investigations for new active ingredients, indications, dosage forms, dosing regimens, or routes of administration. This meant that many modified versions of older products, which might otherwise have pursued the ANDA suitability petition pathway, could no longer do so if new studies were required to address pediatric populations. This effectively channeled such applications towards the more comprehensive, yet still streamlined, 505(b)(2) pathway.

4. Heightened Competition in the Generic Market

The increasingly intense competition within the Abbreviated New Drug Application (ANDA) generic drug market has exerted significant pressure on generic manufacturers. This pressure has compelled them to seek avenues for differentiation beyond simply producing bioequivalent copies of originator drugs.7 The 505(b)(2) pathway offers a compelling solution, providing a route to create “distinct drug product[s] with its own exclusivity rights”. This ability to develop differentiated products and secure market exclusivity provides a crucial competitive edge in what has become a highly commoditized market.1

The surge in 505(b)(2) approvals is not attributable to a single isolated factor but rather a complex and dynamic interplay of regulatory incentives and market forces. Legislative incentives, such as the various exclusivities and expedited programs, made the pathway inherently more attractive. User fees then provided the financial mechanism to enable faster review times. Simultaneously, new pediatric study requirements effectively compelled certain innovations away from the ANDA pathway. Finally, the heightened competition in the generic market served as a powerful market pull, pushing companies to actively seek differentiation. This creates a continuous feedback loop: regulatory changes create new opportunities, market pressures drive companies to exploit these opportunities, leading to an increase in approvals, which in turn reinforces the pathway’s strategic importance. This dynamic underscores that pharmaceutical companies must continuously monitor both regulatory shifts and evolving market dynamics to identify and capitalize on emerging opportunities. A static regulatory strategy, in this rapidly changing environment, is destined to fall behind.

C. Dominant Product Categories and Therapeutic Areas

An in-depth analysis of 505(b)(2) approvals reveals discernible patterns in the types of products and therapeutic areas that most frequently leverage this pathway, providing valuable insights for future development strategies.

1. New Dosage Forms, Formulations, and Combinations

From 1993 through 2016, a significant majority—84%—of all 505(b)(2) approvals were concentrated within three primary classification codes: Type 3 (New Dosage Forms), accounting for 35% of approvals; Type 5 (New Formulations or Other Differences), comprising 33%; and Type 4 (New Combinations), representing 16%.13 This overwhelming predominance underscores the pathway’s inherent strength in facilitating improvements and modifications to existing active ingredients. More recent data, spanning from 2019 to 2023, continues to affirm this trend, showing a strong and consistent presence of reformulations, with new dosage forms (Type 3) and new formulations or other differences (Type 5) collectively accounting for a “substantial portion of approvals”. This consistent pattern highlights the enduring value of optimizing existing therapies to enhance patient experience, improve efficacy, or broaden accessibility.

2. Key Therapeutic Areas: Oncology, CNS, Anti-infectives, and Rare Diseases

While 505(b)(2) approvals span a wide array of therapeutic areas, reflecting the pathway’s broad applicability 33, certain medical fields have emerged as particularly prominent. Between 2019 and 2023, Oncology (16.7%), Central Nervous System (CNS) disorders (16.2%), and anti-infective treatments were consistently identified as key therapeutic areas for 505(b)(2) development. Furthermore, the pathway’s critical role in orphan drug development is undeniable, with over one-third of all orphan drug NDAs in 2020 successfully utilizing this route. Illustrative examples of 505(b)(2) oncology drugs include albumin-bound paclitaxel, bendamustine, and bortezomib, showcasing the pathway’s contribution to advanced cancer treatments.

The concentration of 505(b)(2) approvals in specific therapeutic areas such as Oncology, CNS disorders, and Anti-infectives suggests that these fields either possess a high unmet medical need for incremental improvements or offer particularly fertile ground for repurposing existing compounds. For instance, better formulations for cancer drugs might reduce side effects, or new delivery methods for CNS drugs could more effectively cross the blood-brain barrier. However, this concentration also indicates a “highly competitive landscape” within these areas , which might prompt some companies to strategically “explore and build expertise in less saturated therapeutic areas”. While it might seem logical to follow the trends in dominant therapeutic areas, doing so also means entering a more competitive space. Companies should carefully analyze whether their unique capabilities, perhaps in a specific drug delivery technology, could provide a distinct advantage in a less saturated but still medically viable niche, or if they possess the substantial resources required to compete effectively in these highly sought-after therapeutic areas.

D. Manufacturer Landscape: Small Players and Generic Firms Leading the Charge

The 505(b)(2) pathway is notably not the exclusive domain of large, established pharmaceutical innovators. An examination of approvals from 1993 to 2016 reveals that 505(b)(2) products were sponsored by an impressive 318 unique applicants. Significantly, over 60% of these applicants had only a single 505(b)(2) application, indicating a highly dispersed and competitive market landscape. Generic manufacturers played a substantial role, sponsoring 35% of these approvals, with leading applicants often being traditionally generic drug manufacturers such as Mylan, Cipla, Teva, and Fresenius. This trend strongly suggests a “blurring of the distinction between generic and brand-name manufacturers” 13, as traditionally generic firms increasingly leverage the 505(b)(2) pathway to create differentiated, value-added products that transcend simple bioequivalence.

The high number of unique applicants and the notable prevalence of smaller or generic manufacturers as sponsors strongly suggest that the 505(b)(2) pathway effectively lowers the barrier to entry for drug development. Unlike the massive capital and extensive infrastructure typically required for a 505(b)(1) New Molecular Entity (NME), the reduced costs and strategic reliance on existing data make this pathway accessible to a much broader range of companies. This “democratization” of innovation allows smaller players to effectively innovate and compete against larger, more established pharmaceutical firms. This fosters a more dynamic and competitive pharmaceutical ecosystem. For smaller companies, 505(b)(2) is not merely an approval pathway; it represents a viable and attractive business model for growth and market entry. For larger companies, this implies increased competition from unexpected quarters and a compelling need to adapt their own strategies to incorporate value-added product development and lifecycle management.

| Time Period | Total 505(b)(2) Approvals | Breakdown by Classification Code (1993-2016) | Top Therapeutic Areas (2019-2023) | Leading Manufacturers (1993-2016) |

| 1993-2016 | 628 | Type 3 (New Dosage Forms): 35% Type 5 (New Formulations/Other Differences): 33% Type 4 (New Combinations): 16% Others (Type 7, 1, 2, 8): 16% | Not specified for this period, but broadly diverse. | Mylan, Cipla, Teva, Fresenius (primarily generic manufacturers) |

| 2019-2023 | 943 (from 2003-2023) (55 in FY2023) (68 in 2020) | Strong presence of Type 3 (New Dosage Forms) and Type 5 (New Formulations/Other Differences) | Cancer (16.7%) CNS disorders (16.2%) Anti-infective treatments | Teva Pharmaceuticals USA Inc. (leading by approval count for 2019-2023) |

VI. Intellectual Property and Market Exclusivity: The Competitive Edge

For business professionals, the true strategic power of the 505(b)(2) pathway extends well beyond the immediate goal of regulatory approval. It delves into the critical and often complex realm of intellectual property (IP) and market exclusivity. This is precisely where a deep understanding and skillful leveraging of patent data can be transformed into a decisive competitive advantage, shaping a company’s market position and long-term profitability.

A. Patent Protection for 505(b)(2) Products: Beyond the Reference Drug

A significant strategic benefit inherent in the 505(b)(2) pathway is the potential to obtain new and distinct patent protection for the modified drug product, even if the active pharmaceutical ingredient (API) itself is already off-patent.10 This crucial aspect empowers companies to “innovate beyond existing patents” and to “secure new intellectual property (IP)” that can provide a fresh period of market differentiation and protection.

1. New Patents for Formulations, Indications, and Delivery Systems

Innovations developed and approved through the 505(b)(2) pathway, such as novel dosage forms (e.g., extended-release formulations, oral films), new routes of administration (e.g., nasal sprays, topical creams), new combinations of active ingredients, or new indications for existing drugs, can all be subject to new patent grants.3 These newly secured patents provide targeted protection for the specific innovation, effectively differentiating the 505(b)(2) product from generic copies that might emerge after the original RLD patents expire. This strategic layering of IP extends the product’s market presence and commercial viability.

The ability to obtain new patent protection for 505(b)(2) products and for modifications to existing drugs implies that companies can strategically construct “patent clusters” or “patent thickets” around their differentiated products. This is a widely adopted strategy to maximize intellectual property protection and to deter potential generic competition, even after the original Reference Listed Drug (RLD) patents have expired. The inherent “potential for legal challenges” from RLD patent holders 3 further underscores that IP strategy in this space is often as much about defensive positioning as it is about offensive innovation. Companies pursuing the 505(b)(2) pathway must integrate patent attorneys and IP strategists into their development teams from the earliest stages. A robust IP strategy encompasses not only the proactive securing of new patents but also meticulous freedom-to-operate analyses and a preparedness for potential litigation, all of which can significantly impact market entry and long-term profitability.

2. Navigating the Orange Book and Patent Certifications

The FDA’s “Orange Book” serves as the authoritative public resource, listing all approved drug products along with their associated patent and exclusivity information.4 While 505(b)(2) applicants strategically rely on data from an RLD, they must still meticulously navigate the complex patent landscape pertaining to that RLD. A key distinction exists: unlike Abbreviated New Drug Application (ANDA) applicants, 505(b)(2) applicants are not required to certify to a patent if the “delist request flag” is set to ‘Y’ in the Orange Book, indicating that the patent holder has requested its removal. However, despite this provision, the potential for legal challenges from RLD patent holders remains a recognized and significant hurdle in the 505(b)(2) process.3 Therefore, a thorough understanding of the Orange Book and proactive patent analysis are essential for mitigating legal risks and ensuring a smoother path to market.

B. Market Exclusivity: A Shield Against Competition

Beyond the protection afforded by patents, 505(b)(2) products can also qualify for FDA-granted market exclusivity. This exclusivity provides a defined period during which the FDA is precluded from approving certain competing applications, effectively shielding the approved product from immediate generic or similar competition.1 This period of protection is a powerful commercial asset, enabling companies to recoup their significant R&D investments and establish a firm market share before the inevitable emergence of generic competition.

1. Understanding 3-Year, 5-Year, and 7-Year Exclusivities

The type and duration of market exclusivity granted to a 505(b)(2) product are contingent upon the nature of the innovation and the specific clinical studies conducted to support the application:

- 5-year New Chemical Entity (NCE) Exclusivity: This is granted to new drug applications for products containing active moieties that have never been previously approved by the FDA, either alone or in combination.1 While NCE exclusivity is most commonly associated with 505(b)(1) NDAs for truly novel drugs, a 505(b)(2) application can indeed qualify if it introduces a new active ingredient that meets the NCE criteria.1

- 3-year “Other” Exclusivity: This period of exclusivity is granted for a drug product containing an active moiety that has been previously approved, provided the application includes reports of “new clinical investigations (other than bioavailability studies) conducted or sponsored by the sponsor that were essential to approval”.2 This is a common form of exclusivity for 505(b)(2) applications involving new indications, changes in dosage forms, strengths, or routes of administration, where new clinical data was pivotal for approval.

- 7-year Orphan Drug Exclusivity: This is a powerful incentive granted for drugs designated for rare diseases or conditions.2 It provides a substantial period of market protection, making the development of therapies for underserved patient populations more commercially viable.

2. Strategic Implications of Exclusivity for Market Entry

Market exclusivity, regardless of its duration, offers a crucial window of opportunity for pharmaceutical companies to firmly establish their product in the market, cultivate brand recognition, and maximize revenue before the onset of generic competition.5 This protected period is a significant factor in the overall commercial viability and attractiveness of 505(b)(2) projects to investors.2

The various forms of market exclusivity are not merely regulatory grants; they are strategic assets that directly influence a product’s commercial potential. This exclusivity provides a tangible “competitive advantage” 1 and enables companies to “recover their investment prior to the emergence of generic competitors”. The fact that 505(b)(2) products can qualify for these protected periods, unlike standard generics, significantly enhances their commercial appeal. Companies must, therefore, strategically plan their 505(b)(2) applications to maximize the potential for exclusivity. This involves careful study design to ensure that any “new clinical investigations” are indeed “essential to approval” to secure the valuable 3-year exclusivity, or proactively pursuing orphan drug designations to qualify for the longer 7-year period. Such foresight directly impacts long-term profitability and market leadership.

C. Leveraging DrugPatentWatch for Competitive Intelligence

In the highly dynamic and competitive landscape of 505(b)(2) drug development, access to robust and timely competitive intelligence is absolutely paramount. Tools such as DrugPatentWatch are invaluable resources for business professionals seeking to translate complex patent data into actionable competitive advantage.59

1. Monitoring Patent Expirations and Generic Entry Opportunities

DrugPatentWatch provides a comprehensive database of drug patents, including critical information on generic entry opportunities and precise patent expiry dates.60 This functionality empowers companies to proactively identify “invalidity opportunities” and to “anticipate generic entry windows” for Reference Listed Drugs (RLDs). Such foresight is crucial for informing their own 505(b)(2) development timelines and shaping their market entry strategies to capitalize on emerging opportunities.61

2. Analyzing Competitor Activity and Patent Landscape

The DrugPatentWatch platform enables users to effectively monitor biosimilar and 505(b)(2) activity across the industry, track competitor patents, and identify potential vulnerabilities in existing intellectual property portfolios.60 By meticulously analyzing the patent landscape, companies can pinpoint “gaps where new innovations won’t infringe and secure their own IP”. This proactive intelligence helps in “anticipating potential infringement risks” and identifying strategic opportunities for collaborations or licensing agreements, thereby safeguarding their market position.

3. Identifying Strategic Gaps and Opportunities

Beyond mere monitoring, DrugPatentWatch assists in the critical process of identifying unmet market needs, evaluating the potential for meaningful modifications to existing drugs, and assessing the intellectual property opportunities for prospective 505(b)(2) candidates.22 By providing “accurate, actionable, and timely intelligence,” the platform plays a pivotal role in facilitating better decision-making in portfolio management and guiding R&D focus areas.60

The repeated emphasis on DrugPatentWatch’s capabilities in tracking patents, exclusivities, and competitor activity highlights that success in the 505(b)(2) space is increasingly data-driven. It is no longer sufficient to merely possess a sound scientific idea; one must also thoroughly comprehend the intricate “patent landscape” and the evolving “competitive dynamics” of the market.22 This allows companies to not only “identify market opportunities” but also to “safeguard intellectual property”.61 Competitive intelligence platforms are no longer optional but have become essential tools for pharmaceutical companies aiming to effectively leverage the 505(b)(2) pathway. They enable proactive decision-making, mitigate risks (such as avoiding patent infringement), and help identify lucrative market niches, ultimately maximizing the commercial success of 505(b)(2) products.

VII. Case Studies: Illustrative Successes and Lessons Learned

Examining specific drugs approved via the 505(b)(2) pathway provides invaluable real-world context, illustrating how the regulatory framework translates into tangible commercial and patient benefits, while also revealing the challenges that can arise during development.

A. Qbrelis (Lisinopril Oral Solution): Addressing Patient Needs Through Formulation

Qbrelis, an oral solution of the widely used ACE inhibitor lisinopril, received approval through the 505(b)(2) pathway in 2016.21 This innovative formulation provided a crucial new option for patients, particularly pediatric and geriatric populations, who often face significant challenges in swallowing traditional tablets.21 The application for Qbrelis strategically relied on the well-established safety and efficacy profile of lisinopril, a drug with a long history of use. Bridging studies were conducted to demonstrate that the oral solution maintained a comparable safety and efficacy profile to the tablet formulation, ensuring that the new dosage form delivered the same therapeutic benefits without introducing new risks. This case exemplifies how the 505(b)(2) pathway can facilitate patient-centric formulation innovation, directly addressing unmet needs and improving medication adherence.

B. Spravato (Esketamine Nasal Spray): Repurposing for Mental Health

Spravato (esketamine), a nasal spray formulation of ketamine, was approved via the 505(b)(2) pathway in 2019 for the treatment of severe treatment-resistant depression.3 This approval represents a significant and impactful example of drug repurposing, effectively extending the utility of a known compound to address a critical and often debilitating unmet medical need in mental health. The nasal spray delivery mechanism offered a novel route of administration that provided rapid onset of action, a particularly important characteristic for acute psychiatric conditions, and potentially improved patient experience compared to other routes. Spravato’s journey highlights the 505(b)(2) pathway’s capacity to bring innovative solutions to market by leveraging existing pharmacological knowledge and adapting it for new indications and improved delivery.

C. Bendeka (Bendamustine HCl Injection): Enhancing Convenience and Safety

Bendeka® (bendamustine HCl) injection, an anti-cancer agent, successfully navigated the 505(b)(2) pathway to approval. This product strategically differentiated itself from its Reference Listed Drug (RLD), Treanda® (which was an intravenous (IV) powder requiring reconstitution prior to administration), by being formulated as a ready-to-use IV solution. This re-formulation addressed a significant unmet need for convenience in clinical settings, reducing preparation time and potential for errors. Furthermore, Bendeka®’s new formulation demonstrated improved compatibility with closed system transfer components, enhancing safety for healthcare professionals who handle cytotoxic drugs. A comparative bioavailability study was a key component of its approval, establishing the necessary scientific bridge to the existing data for Treanda®. This case illustrates how the 505(b)(2) pathway can be utilized to introduce practical improvements that enhance both operational efficiency and safety in clinical practice.

D. Navigating Complexity: Insights from GT123 and Sustol

The case studies of GT123 and Sustol® serve as powerful reminders that the “abbreviated” nature of the 505(b)(2) pathway can encompass a wide spectrum of complexity, and that “no two drugs are alike” in their development requirements.26

- GT123: This product, an oral extended-release capsule intended for analgesic use, leveraged existing data from its Reference Listed Drug (RLD), AB456 (a subcutaneous solution). However, the significant change in the route of administration (from subcutaneous injection to oral capsule) and the incorporation of a novel excipient necessitated additional studies. Specifically, a single-species, one-month Good Laboratory Practice (GLP) toxicology study was required to qualify the novel excipient. A Phase 1 bioequivalence study was also crucial for establishing the scientific bridge, comparing the absolute maximum absorption (Cmax) and overall exposure (AUC) of GT123 and AB456 at both initial dosing and steady state. This demonstrates that even with reliance on an RLD, substantial new nonclinical and clinical work may be needed.

- Sustol®: Developed as an extended-release subcutaneous injection for the prevention of acute and delayed nausea and vomiting associated with chemotherapy, Sustol® presented a particularly complex 505(b)(2) development program. The core of its innovation lay in the use of a novel polymer to achieve extended release of granisetron, differentiating it from the approved IV reference, Kytril. However, this novel polymer, combined with changes in dosage regimen, route of administration, and pharmacokinetics, triggered extensive nonclinical and clinical evaluations. The product’s highly viscous nature also introduced human factors challenges, requiring careful assessment of how patients or caregivers would interact with the prefilled syringe delivery device to ensure proper dosing. These complexities resulted in a large nonclinical and clinical program, along with robust post-marketing requirements, making the Sustol® submission resemble a full 505(b)(1) program in its scope.

These cases collectively illustrate that the “abbreviation” offered by 505(b)(2) is not uniform. While some applications might indeed require minimal new studies, others, particularly those involving novel excipients or substantial changes in delivery, can necessitate significant nonclinical and clinical work. This wide spectrum of program requirements and strategies means that the “lower cost and accelerated development” benefits are highly variable and context-dependent. Consequently, companies cannot adopt a “one-size-fits-all” approach to 505(b)(2) development. A thorough, early-stage feasibility assessment, encompassing detailed scientific and regulatory analysis, is absolutely paramount to accurately predict timelines, costs, and the likelihood of success. This reinforces the need for strong regulatory expertise from the outset, as underestimating the complexity of the “scientific bridge” can lead to significant and costly delays, or even product-development failure.

VIII. Market Access and Reimbursement Challenges

While the 505(b)(2) pathway offers undeniable advantages in drug development and regulatory approval, successfully navigating market access and reimbursement for these differentiated products presents its own distinct set of complexities. This is particularly true given the evolving landscape of payer policies, which can significantly impact a product’s commercial viability post-approval.

A. The Evolving Landscape of CMS J-Codes and Therapeutic Equivalence

A pivotal and impactful shift occurred in 2022 when the Centers for Medicare & Medicaid Services (CMS) reinterpreted its policy regarding J-code reimbursement for 505(b)(2) drugs.15 Historically, CMS typically grouped multisource generic 505(b)(2) drugs under the same Healthcare Common Procedure Coding System (HCPCS) J-code as their Reference Listed Drug (RLD) and other generics, effectively treating them as therapeutically equivalent.15 This practice often simplified reimbursement. However, effective January 1, 2023, CMS issued a new ruling stating that 505(b)(2) drugs

not deemed therapeutically equivalent by the FDA would now be considered “sole-source drugs” and would be assigned unique J-codes. This significant decision impacts not only newly approved 505(b)(2) drugs but also necessitates a review and revision of coding for previously approved 505(b)(2) drugs dating back to 2003.

B. Implications for Pricing, Contracting, and Payer Engagement

This fundamental shift in CMS policy has created what can only be described as a “cascade of reimbursement complexities” for 505(b)(2) product manufacturers. Each non-therapeutically equivalent 505(b)(2) drug may now be reimbursed differently from its reference product, leading to potential complications in prior authorizations, billing procedures, and an increased likelihood of claim denials. Manufacturers are now faced with a critical strategic decision: whether or not to actively request a Therapeutic Equivalence (TE) assessment from the FDA. This decision directly influences whether their product will be assigned its own unique J-code and, consequently, its own average sales price.32 This evolving landscape necessitates a highly refined and integrated commercialization strategy, encompassing crucial decisions regarding pricing models, contracting agreements with payers, distribution channels, and the nature and intensity of engagement with payers.62

The CMS J-code policy change reveals a critical and often challenging disconnect between FDA approval and CMS reimbursement. While FDA approval focuses on establishing a drug’s safety and efficacy, CMS reimbursement decisions are heavily influenced by therapeutic equivalence and cost considerations. A 505(b)(2) drug might be approved as a valuable innovation, but if it is not subsequently deemed therapeutically equivalent by the FDA and thus receives a unique J-code from CMS, it can face significant “operational challenges for oncology infusion centers” and “additional challenges with regards to substitution policies”.15 This directly impacts the product’s “market access and commercialization” success.62 Companies must now integrate reimbursement strategy much earlier in the 505(b)(2) development process. The scientific and regulatory strategy, particularly concerning the design of bridging studies, needs to be meticulously aligned with the commercial strategy, especially regarding the pursuit of a therapeutic equivalence rating. This ensures that the product is not only approved but also achieves commercial success and broad accessibility for patients.

C. The Criticality of Therapeutic Equivalence Designation

It is imperative for manufacturers to understand that the FDA does not automatically assign a Therapeutic Equivalence (TE) rating to 505(b)(2) drugs. Instead, manufacturers must actively and specifically request this designation.15 If a TE request is not submitted and granted, the product remains unclassified in terms of therapeutic equivalence and is consequently considered non-therapeutically equivalent, leading to its assignment of a unique J-code. Recognizing the growing importance of this designation, Congress has mandated that the FDA evaluate therapeutic equivalence for certain 505(b)(2) drugs either at the time of initial FDA approval or within 180 days thereafter.62 This legislative push further elevates the decision to pursue TE to a critical strategic choice for manufacturers, directly impacting their product’s market competitiveness and reimbursement prospects.

The fact that FDA does not automatically assign therapeutic equivalence to 505(b)(2) drugs, and that manufacturers must request it, creates a significant post-approval strategic imperative.15 If a product does not achieve a TE designation, it is likely to encounter “operational challenges” for healthcare providers and “may be reimbursed differently” by payers.15 This means that the regulatory journey for a 505(b)(2) drug does not conclude with its approval; it extends into crucial post-market strategic decisions that profoundly influence its commercial viability. Companies must conduct a thorough market access assessment

before filing their 505(b)(2) application to ascertain the commercial value of a TE rating. This pre-filing analysis should influence the initial development strategy and the scope of bridging studies undertaken, ensuring that the product is not only approved but also positioned for optimal commercial success and patient access.

IX. Future Outlook: Shaping the Next Wave of 505(b)(2) Innovation

The 505(b)(2) pathway is far from static; it is a dynamic regulatory mechanism that continues to evolve, shaped by the relentless pace of scientific advancements, ongoing regulatory interpretations, and the ever-changing demands of the pharmaceutical market. Anticipating these emerging trends is not merely an academic exercise but a critical component of long-term strategic planning for any pharmaceutical enterprise.

A. Emerging Trends: Real-World Evidence and Advanced Drug Delivery

The future trajectory of 505(b)(2) approvals is likely to witness an increased emphasis on the integration of real-world evidence (RWE) to support applications. This could potentially further streamline the development process by leveraging data generated from routine clinical practice, rather than solely relying on traditional randomized controlled trials. Concurrently, continuous advancements in drug delivery technologies are poised to drive a greater number of 505(b)(2) applications. Companies will increasingly seek to improve patient compliance, optimize therapeutic efficacy, and enhance safety profiles through innovative formulations. This includes the development of sophisticated oral films, advanced extended-release systems, transdermal patches, and novel nasal sprays, all designed to offer superior patient experiences and clinical outcomes.3 These technological leaps will open new avenues for product differentiation within the 505(b)(2) framework.

B. The Blurring Lines: Generic and Brand-Name Manufacturers in the 505(b)(2) Space