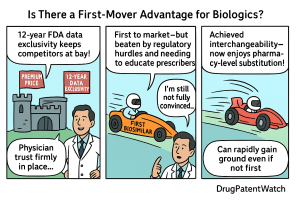

The presence of a first-mover advantage for biosimilars is a complex and nuanced issue. While being the first to market can confer initial benefits in terms of early market share capture, brand recognition among prescribers, and the opportunity to secure favorable payer contracts, these advantages are not as absolute or enduring as seen in traditional small-molecule generics. The rigorous and lengthy regulatory approval processes, the persistent “patent thicket” surrounding innovator biologics (necessitating tools like DrugPatentWatch for strategic intelligence), and the critical need to educate and gain acceptance from both physicians and payers, all contribute to a highly competitive landscape. Ultimately, sustained success for any biosimilar, whether first or subsequent, relies heavily on a robust evidence base, operational excellence in manufacturing, continuous innovation, strategic partnerships, and a deep understanding of evolving market dynamics and stakeholder needs.

The Biosimilar Revolution: A Paradigm Shift in Biologics

To truly grasp the dynamics of the biosimilar market, we must first lay a foundational understanding of biologics themselves. These aren’t your grandmother’s small-molecule drugs, meticulously crafted through chemical synthesis. No, biologics are a different breed entirely.

Understanding Biologics and Biosimilars: A Foundational Overview

What are Biologics?

Imagine a drug derived from living organisms – cells, tissues, or even microorganisms. That’s a biologic. Think insulin, vaccines, monoclonal antibodies, or complex proteins used to treat autoimmune diseases and cancers. They are large, complex molecules, often hundreds to thousands of times larger than conventional small-molecule drugs. Their production involves intricate biological processes, making them inherently more challenging to characterize and manufacture consistently. This complexity is also why their development costs are astronomical, often running into billions of dollars for a single innovative biologic [1].

Defining Biosimilars: More Than Just Generics

Now, if biologics are the original masterpieces, biosimilars are their highly similar, yet not identical, counterparts. Unlike generic small-molecule drugs, which are exact chemical replicas of their branded predecessors, biosimilars are “highly similar” with “no clinically meaningful differences” in terms of safety, purity, and potency. They are not “bio-identical” because, given the inherent variability of biological systems, achieving an exact replica of a complex biologic is virtually impossible. This distinction is crucial and lies at the core of the regulatory scrutiny and market acceptance challenges that biosimilars face. They offer a compelling value proposition: the promise of therapeutic equivalence at a significantly lower cost, thereby expanding patient access and alleviating the burden on healthcare systems.

The Economic Imperative: Why Biosimilars Matter

The arrival of biosimilars is not merely a scientific curiosity; it’s an economic imperative driving significant change across the healthcare ecosystem.

Healthcare Cost Containment and Access Expansion

Biologics, while revolutionary in their therapeutic impact, often come with exorbitant price tags. Consider a treatment costing tens or even hundreds of thousands of dollars annually. For healthcare systems grappling with escalating costs, and for patients facing daunting out-of-pocket expenses, biosimilars offer a much-needed reprieve. By introducing competition, biosimilars drive down the prices of originator biologics, making life-saving treatments more accessible to a wider population. For instance, the introduction of biosimilars for adalimumab, a blockbuster biologic, is expected to generate significant savings in the coming years, potentially unlocking billions of dollars for reinvestment in other healthcare priorities [2]. This democratizes access, moving us closer to a world where innovative therapies are not solely the privilege of the affluent.

Market Growth and Investment Opportunities

The financial upside of the biosimilar market is undeniable. Projections indicate substantial growth, with some estimates placing the global biosimilar market at over $100 billion by the early 2030s [3]. This growth is fueled by a confluence of factors: the impending patent expiry of numerous blockbuster biologics, increasing regulatory support for biosimilar development, and the urgent need for cost-effective healthcare solutions worldwide. For pharmaceutical companies, this translates into lucrative investment opportunities, albeit ones accompanied by unique risks and competitive pressures. For investors, it represents a fertile ground for high-growth potential, particularly for companies demonstrating robust development pipelines and shrewd market entry strategies.

Deconstructing the First-Mover Advantage Concept

The concept of “first-mover advantage” has long been a cherished mantra in business strategy, suggesting that being the first to introduce a product or service into a market confers lasting benefits. But does this adage hold true for the nuanced and highly regulated world of biosimilars?

Traditional First-Mover Advantage in Pharmaceuticals

In the conventional pharmaceutical landscape, the first-mover advantage often manifests powerfully.

Brand Recognition and Loyalty

For originator drugs, being first means establishing brand recognition and cultivating physician and patient loyalty. Think of a drug that becomes synonymous with a particular condition. This “mindshare” is invaluable and incredibly difficult for subsequent entrants to dislodge, even with demonstrably effective alternatives. Physicians, accustomed to prescribing a certain brand and witnessing its efficacy, may be reluctant to switch, citing familiarity and established protocols.

Market Share Dominance and Pricing Power

The first mover often captures a dominant market share simply by being unopposed in the initial phase. This early lead can translate into significant pricing power, allowing the originator to command premium prices before generic or biosimilar competition emerges. They essentially define the market and set the initial price ceiling, influencing subsequent pricing strategies of competitors.

Unique Considerations for the Biosimilar Market

However, the biosimilar market operates under a different set of rules, where the traditional first-mover playbook requires significant adaptation.

Regulatory Pathways and Approval Hurdles

Unlike small-molecule generics, biosimilars face a rigorous and often lengthy regulatory approval process. Proving “biosimilarity” is a scientific and clinical undertaking that demands extensive comparative analytical and clinical studies. Even the first biosimilar to a particular reference product must undergo this stringent evaluation. Furthermore, the concept of “interchangeability,” which allows for pharmacy-level substitution without physician intervention, introduces an even higher bar, requiring additional studies to demonstrate that switching between the biologic and the biosimilar poses no additional risk. This regulatory gauntlet can significantly delay market entry, even for the first applicant.

Physician and Payer Acceptance Dynamics

Perhaps the most significant differentiator for biosimilars lies in the nuanced dynamics of physician and payer acceptance. Physicians, trained to prioritize patient safety and efficacy, may harbor initial skepticism about switching from a familiar, effective biologic to a biosimilar, even with regulatory approval. This hesitancy is often fueled by a lack of education about biosimilars and concerns about potential differences in patient outcomes. Payers, on the other hand, are keen to embrace biosimilars due to the cost savings, often implementing aggressive formulary preferences or step-therapy protocols to encourage their adoption. This creates a fascinating push-pull dynamic where the financial incentives of payers often clash with the prescribing habits and clinical comfort of physicians.

The Regulatory Maze: Navigating Approval and Interchangeability

The journey of a biosimilar from concept to market is inextricably linked to navigating complex regulatory frameworks. The pathway to approval, particularly in major markets like the U.S. and Europe, significantly shapes the competitive landscape.

FDA and EMA Pathways: A Tale of Two Systems

While both the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) share the fundamental goal of ensuring safe and effective medicines, their approaches to biosimilar approval have historically diverged, though they are increasingly converging.

Biosimilarity vs. Interchangeability: A Critical Distinction

In the U.S., the Biologics Price Competition and Innovation Act (BPCIA) of 2009 established an abbreviated licensure pathway for biosimilars. This pathway allows for approval if the biosimilar is “highly similar” to a reference product and has “no clinically meaningful differences.” However, the FDA introduced a further designation: “interchangeable biosimilar.” An interchangeable biosimilar can be substituted for the reference product by a pharmacist without the intervention of the prescribing physician, similar to how generic drugs are substituted. This requires additional clinical studies demonstrating that switching between the reference product and the biosimilar does not increase the risk of adverse events or diminish efficacy. Achieving interchangeability can confer a significant market advantage, particularly in states that permit pharmacy-level substitution. In contrast, the EMA’s framework focuses solely on “biosimilarity,” with no explicit “interchangeability” designation at the EU level. Individual European countries may, however, have their own policies regarding substitution [4].

Expedited Pathways and Market Entry Timelines

Neither the FDA nor the EMA offers truly “expedited” pathways for all biosimilars in the same way some orphan drugs might receive accelerated approval. However, the very nature of the biosimilar pathway is “abbreviated” compared to a full de novo biologic application. The timeline to approval still typically spans several years, often involving extensive clinical trials to demonstrate biosimilarity. This lengthy process means that even the “first” biosimilar to a reference product has invested substantial time and resources, diminishing some of the agility traditionally associated with first-mover advantages. The first-to-file often faces an extensive review period, and subsequent filings may benefit from the precedents set by the initial approval.

Global Regulatory Harmonization: A Future Vision?

The fragmented global regulatory landscape poses a significant challenge for biosimilar developers. A biosimilar approved in Europe may still need to undergo additional studies or reviews for approval in the U.S. or other markets.

Challenges and Opportunities in Cross-Border Approvals

The lack of complete regulatory harmonization means increased development costs and extended timelines for companies seeking global market access. This can dilute the benefits of being an early entrant in one region if significant re-work is required for another. However, there’s a growing global effort towards greater harmonization, with regulatory bodies increasingly sharing information and aligning standards. This trend, while slow, presents an opportunity to streamline future biosimilar development and accelerate global market access, potentially amplifying the benefits for early developers who can navigate these evolving international frameworks.

Market Dynamics and Competitive Strategies

Once a biosimilar clears the regulatory hurdles, it enters a highly competitive arena where strategic market dynamics dictate success. The “first-mover” narrative truly comes alive or falters in this phase.

Pricing Strategies: The Race to the Bottom or Value Proposition?

The most immediate impact of biosimilar entry is almost invariably on pricing.

Deep Discounts vs. Incremental Reductions

Early biosimilar entrants often employ aggressive pricing strategies, offering significant discounts (typically 15-40% below the originator’s price) to gain market share [5]. The goal is to rapidly establish a foothold and incentivize payers and providers to switch. However, this isn’t always a race to the absolute bottom. Some first movers might opt for incremental discounts, aiming to capture market share while preserving a healthier margin, especially if the competitive landscape is not yet saturated. The strategic choice depends on factors like manufacturing costs, anticipated number of competitors, and the innovator’s own defensive pricing tactics.

Bundling and Contractual Agreements

Beyond simple price reductions, biosimilar companies, whether first or subsequent movers, engage in complex contractual agreements, particularly with Pharmacy Benefit Managers (PBMs) and large integrated health systems. These can involve bundling multiple biosimilar products, offering volume-based discounts, or entering into exclusive arrangements that favor their products on formularies. A first mover might leverage their early entry to secure these lucrative, long-term contracts, effectively locking out later entrants or making their path to market share significantly harder.

Marketing and Education: Overcoming Physician Skepticism

Despite regulatory approval, physician acceptance of biosimilars is not automatic.

Building Trust and Evidence-Based Promotion

For the first biosimilar entrant, the challenge is twofold: not only to promote their specific product but also to educate the broader medical community about the safety and efficacy of biosimilars in general. This requires significant investment in medical education, robust real-world evidence generation, and transparent communication. A first mover who successfully builds this foundational trust and provides compelling evidence can carve out a substantial advantage, becoming the “trusted” biosimilar option.

Engaging Key Opinion Leaders (KOLs)

Identifying and engaging Key Opinion Leaders (KOLs) – influential physicians and researchers – is critical. A first mover can strategically partner with KOLs to champion their product, present at medical conferences, and publish in peer-reviewed journals. These early endorsements from respected figures can accelerate physician adoption and overcome inherent conservatism.

Manufacturing and Supply Chain Excellence: The Unsung Hero

While often less visible, a robust manufacturing and supply chain can be a decisive factor, particularly for a first mover.

Scalability and Quality Control

Bringing a complex biologic to market, even as a biosimilar, demands immense manufacturing capabilities. The ability to produce large quantities consistently, while maintaining rigorous quality control, is paramount. A first mover with superior manufacturing infrastructure can meet initial demand effectively, prevent shortages, and build a reputation for reliability. This operational excellence can be a significant barrier to entry for later competitors who struggle with scale or quality issues.

Security of Supply and Risk Mitigation

Ensuring a secure and uninterrupted supply is crucial, especially for chronic conditions where treatment continuity is vital. A first mover who establishes redundant supply chains and robust risk mitigation strategies gains favor with payers and providers, who prioritize consistent access for their patients. Any supply disruptions, even minor ones, can quickly erode market share and physician confidence.

Examining Case Studies: When Being First Paid Off (or Didn’t)

Theory is one thing; real-world application is another. Examining actual market entries provides invaluable insights into the elusive nature of the first-mover advantage in biosimilars.

Successful First Movers: Lessons from Early Entrants

While the overall picture is nuanced, there are clear instances where early entry has conferred a distinct advantage.

Examples of Market Dominance and Sustained Share

Consider the case of the first biosimilar to a major oncology biologic, where the early entrant, often supported by a large pharmaceutical company, invested heavily in physician education and secured favorable formulary positions. This allowed them to capture a substantial market share that later entrants struggled to significantly erode. For instance, the initial biosimilars for filgrastim (a granulocyte colony-stimulating factor) and infliximab (an anti-TNF alpha monoclonal antibody) in Europe demonstrated strong early uptake and have largely maintained significant market presence [6].

Factors Contributing to Their Success

Several factors often underpin the success of these early entrants:

- Strong Clinical Data and Regulatory Confidence: A robust clinical data package that instills high confidence in regulatory bodies and, subsequently, in prescribers.

- Aggressive and Smart Pricing: A pricing strategy that is competitive enough to drive switches but also sustainable for the business.

- Effective Stakeholder Engagement: Proactive and continuous engagement with physicians, payers, and patient advocacy groups to educate and build trust.

- Established Commercial Infrastructure: Leveraging existing sales forces and distribution networks, often belonging to larger, diversified pharmaceutical companies.

- Early and Strategic Payer Contracts: Securing favorable formulary positions early in the market entry phase.

Challengers and Second Movers: Learning from the Pack

However, being first is not a guarantee of sustained success, and subsequent entrants can certainly gain ground.

Strategies for Gaining Ground Against an Incumbent

Later entrants often employ differentiated strategies to chip away at the first mover’s lead:

- Even More Aggressive Pricing: Offering steeper discounts to incentivize switches, particularly for highly price-sensitive payers.

- Improved Formulations or Delivery Devices: While the active ingredient must be biosimilar, improvements in excipients, dosage forms, or administration devices (e.g., pre-filled syringes vs. vials) can provide a competitive edge.

- Targeted Marketing and Education: Focusing on specific physician segments or patient populations where the first mover’s reach might be weaker.

- Leveraging Interchangeability: If a second or third biosimilar achieves interchangeability while the first does not, this can be a powerful differentiator, especially in the U.S. market, enabling broader pharmacy-level substitution.

The Role of Differentiated Offerings

The biosimilar market, while focused on similarity, still allows for differentiation beyond price. A biosimilar that offers a more convenient administration schedule, a superior safety profile (even if only marginally better in a specific sub-population, supported by real-world data), or a robust patient support program can attract market share, regardless of its position in the market entry queue. For example, some later entrants in the insulin biosimilar market have gained traction by offering co-pay assistance programs or patient education resources that resonate with consumers.

The Patent Landscape: A Crucial Determinant of Entry

Before any biosimilar can even dream of being a “first mover,” it must navigate a treacherous and highly complex patent landscape. This is where strategic patent intelligence becomes not just valuable, but absolutely indispensable.

Navigating the Patent Thicket: A Pre-Market Challenge

Innovator biologics are often protected by a dense “thicket” of patents, covering not just the molecule itself but also manufacturing processes, formulations, methods of use, and even delivery devices.

Understanding Biologic Patent Strategies

Originator companies employ sophisticated patent strategies to extend their market exclusivity for as long as possible. This can involve filing numerous patents throughout the biologic’s lifecycle, often long after the initial composition of matter patent has expired. These secondary patents, sometimes referred to as “evergreening” patents, create significant hurdles for biosimilar developers. Each patent must be carefully analyzed for validity and infringement.

The BPCIA and Patent Litigation Dynamics

In the U.S., the BPCIA established a unique patent dispute resolution process, often referred to as the “patent dance.” This involves an exchange of patent information between the biosimilar applicant and the reference product sponsor, followed by negotiations and, frequently, litigation. For a biosimilar company aiming to be first, winning or settling these patent disputes expeditiously is critical. Delays in litigation can effectively negate any “first-mover” advantage by allowing competitors to catch up or even surpass them. The sheer cost and complexity of this litigation can be prohibitive for smaller companies, reinforcing the dominance of well-resourced players.

DrugPatentWatch: A Strategic Tool for Patent Intelligence

This is precisely where tools like DrugPatentWatch become indispensable. For companies strategizing their biosimilar entry, having a comprehensive, up-to-date view of the patent landscape is non-negotiable.

Leveraging Patent Data for Competitive Insights

DrugPatentWatch provides detailed information on patents protecting innovator drugs, including expiry dates, litigation status, and regulatory exclusivities. This data allows biosimilar developers to:

- Identify Early Entry Opportunities: Pinpoint biologics whose core patents are nearing expiry or where patent challenges might be successful.

- Assess Litigation Risk: Understand the number and type of patents protecting a reference product, helping to gauge the potential for costly litigation.

- Monitor Competitor Strategies: Track the patent filings and litigation activities of other biosimilar developers.

- Inform R&D Decisions: Prioritize development efforts on targets with clearer patent pathways, minimizing wasted resources.

Monitoring Exclusivity and Market Entry Windows

Beyond individual patents, DrugPatentWatch also tracks regulatory exclusivities (e.g., orphan drug exclusivity, pediatric exclusivity) that can extend an innovator’s market protection independently of patents. Understanding these overlapping layers of exclusivity is crucial for accurately predicting market entry windows and planning commercialization strategies. A first-mover advantage, if it exists, hinges entirely on being able to accurately predict and seize these narrow windows of opportunity. Without this granular patent intelligence, a biosimilar program is essentially flying blind, risking costly delays or even complete derailment.

Payer and Provider Perspectives: Driving Adoption and Formulary Decisions

Even with regulatory approval and a robust patent strategy, the ultimate success of a biosimilar hinges on its adoption by payers and providers. Their decisions are often the most significant determinants of market share.

Formulary Placement and Reimbursement Policies

Payers, including private insurance companies, government programs (like Medicare and Medicaid in the U.S.), and national health services (in countries with universal healthcare), hold immense power over drug utilization.

The Influence of Pharmacy Benefit Managers (PBMs)

In the U.S., Pharmacy Benefit Managers (PBMs) play a pivotal role in determining formulary placement. They negotiate discounts and rebates with manufacturers and decide which drugs are covered and at what tier. For a biosimilar, securing a favorable formulary position (e.g., preferred status with minimal patient cost-sharing) is critical. A first mover might have an initial advantage in securing these early contracts due to a lack of immediate competition, but subsequent entrants will aggressively vie for these spots. PBMs often leverage competitive bidding to drive down prices, potentially eroding the first mover’s initial pricing power.

Hospital Systems and Integrated Delivery Networks (IDNs)

For injectable biologics administered in clinics or hospitals, decisions are often made at the institutional level by pharmacy and therapeutics (P&T) committees within hospital systems and Integrated Delivery Networks (IDNs). These committees evaluate clinical evidence, cost-effectiveness, and budget impact to determine which biologics and biosimilars will be stocked and utilized. A first biosimilar to market has the opportunity to establish itself within these systems, build relationships with key decision-makers, and potentially become the default option, making it harder for later entrants to displace them.

Physician Prescribing Behavior: Habits and Incentives

Ultimately, the physician writes the prescription, and their prescribing habits are influenced by a complex interplay of factors.

Educating the Medical Community

As previously mentioned, effective education is paramount. Physicians need to be confident in the biosimilar’s safety and efficacy, understanding that “highly similar” translates to “clinically equivalent.” A first mover who invests heavily in high-quality, evidence-based medical education can build this confidence from the ground up, establishing a reputation for reliability. This investment can create a “stickiness” for their product that is difficult for later entrants to overcome, even with lower prices.

Overcoming Inertia and Brand Loyalty

Physicians are creatures of habit, and there’s a natural inertia in switching from a product they know and trust. Brand loyalty, built over years of positive patient outcomes with an originator biologic, is a powerful force. Biosimilar companies, especially first movers, must actively work to overcome this inertia through compelling data, clear communication, and, in some cases, direct engagement with patients who may also have brand preferences. Incentives, whether through shared savings models for healthcare systems or less direct forms of support for physician practices (e.g., patient support programs), can also play a role.

The Role of Data and Real-World Evidence (RWE)

Beyond initial regulatory approval, the ongoing generation and dissemination of data, particularly Real-World Evidence (RWE), are critical for sustaining and even expanding market share for biosimilars.

Post-Market Surveillance and Safety Monitoring

The journey doesn’t end with approval. Continuous monitoring is essential.

Building Confidence Through Long-Term Data

For biosimilars, especially early entrants, accumulating long-term post-market surveillance data on safety and effectiveness in diverse patient populations is crucial for building unwavering confidence among physicians, payers, and patients. Any perceived differences, no matter how minor, can derail adoption. A first mover with several years of robust real-world data demonstrating consistent performance can leverage this as a powerful marketing tool, further solidifying their position against newer biosimilar entrants who lack such extensive real-world experience.

Addressing Concerns about Immunogenicity

One persistent concern with biologics, and by extension biosimilars, is immunogenicity – the potential for the body to develop an immune response to the drug. While regulatory agencies thoroughly assess this pre-approval, ongoing monitoring for rare or delayed immunogenic responses through post-market surveillance is vital. A first biosimilar that can demonstrate a favorable long-term immunogenicity profile gains a significant advantage.

RWE in Demonstrating Value and Driving Adoption

Real-World Evidence (RWE) – data collected outside of traditional randomized controlled trials (RCTs), such as from electronic health records, insurance claims, and patient registries – is increasingly influential.

Cost-Effectiveness Studies and Health Outcomes Research

Payers are increasingly demanding RWE to demonstrate the cost-effectiveness and health outcomes benefits of biosimilars in real-world clinical practice. A biosimilar company that can provide compelling RWE showing significant cost savings without compromising patient outcomes, or even demonstrating improved access and adherence due to lower costs, will be highly favored. A first mover who proactively invests in these studies can set the narrative for their product’s value proposition.

Beyond the First-Mover: Sustaining Advantage in a Dynamic Market

Even if a biosimilar achieves a strong first-mover advantage, the market is rarely static. Sustaining that advantage requires continuous strategic effort and adaptability.

Continuous Innovation and Lifecycle Management

The “set it and forget it” approach simply doesn’t work in the biosimilar space.

Next-Generation Biosimilars and Formulation Improvements

Companies must constantly look for ways to enhance their biosimilar offering. This might involve developing “next-generation” biosimilars with improved stability, higher concentrations allowing for less frequent dosing, or more patient-friendly administration devices (e.g., auto-injectors). While the active ingredient remains biosimilar, these formulation improvements can be significant differentiators.

Expanding Indications and Patient Populations

Securing approval for additional indications (the diseases or conditions a drug is approved to treat) can significantly expand a biosimilar’s market reach. A first mover who actively pursues these additional indications can consolidate their market leadership across broader patient populations, making it harder for competitors who are limited to fewer indications.

Strategic Partnerships and Collaborations

In a capital-intensive and highly regulated industry, strategic alliances are often key to long-term success.

Co-Development and Commercialization Agreements

Many biosimilar programs involve partnerships between companies with strong R&D capabilities and those with established commercial infrastructures. A first mover might leverage such a partnership to accelerate development, navigate regulatory hurdles, or ensure broad market reach. These collaborations can spread risk and combine complementary strengths.

Academic and Research Collaborations

Engaging with academic institutions and research centers can provide access to cutting-edge science, facilitate real-world evidence generation, and enhance the scientific credibility of a biosimilar. These partnerships can also contribute to the overall understanding and acceptance of biosimilars within the broader medical community.

Future Outlook: Evolution of the Biosimilar Market

The biosimilar market is still in its relative infancy, particularly in the U.S. Its future evolution promises even greater complexity and opportunity.

Emerging Markets and Global Expansion

While much of the discussion focuses on established markets like the U.S. and Europe, emerging markets represent enormous untapped potential for biosimilars.

Untapped Potential and Regulatory Divergence

Countries in Asia, Latin America, and Africa face immense pressure to control healthcare costs and expand access to advanced therapies. Their regulatory frameworks for biosimilars are still developing, offering both opportunities and challenges. A first mover who strategically enters these markets and adapts to local regulatory nuances and healthcare systems can secure a long-term foothold. However, the regulatory divergence across these regions means that a “one-size-fits-all” approach will not suffice.

Technological Advancements and Their Impact

Technological innovation will continue to shape the biosimilar landscape.

AI, Machine Learning, and Drug Discovery

Artificial intelligence and machine learning are increasingly being applied to accelerate drug discovery and development, including aspects of biosimilar characterization and process optimization. These technologies could potentially shorten development timelines, improve manufacturing efficiency, and reduce costs, thereby altering the competitive dynamics for future biosimilar entrants.

Advanced Manufacturing Techniques

Innovations in manufacturing, such as continuous manufacturing or novel bioprocessing technologies, could further reduce production costs and improve scalability. A company that adopts these advanced techniques, whether a first or subsequent mover, could gain a significant competitive advantage through greater efficiency and cost-effectiveness.

In conclusion, the question of whether there’s a first-mover advantage for biosimilars is nuanced, multifaceted, and far from a simple “yes” or “no.” While early market entry can confer significant benefits in terms of initial market share, brand recognition among early adopters, and the ability to secure crucial payer contracts, these advantages are neither guaranteed nor insurmountable.

The unique regulatory landscape, the inherent complexity of biologics, the deep-seated habits of prescribers, and the aggressive pricing strategies of both innovators and subsequent biosimilar entrants all combine to create a dynamic environment where sustained success hinges on far more than just being first. It demands a sophisticated understanding of patent intelligence (where tools like DrugPatentWatch are invaluable), relentless investment in education and real-world evidence, operational excellence in manufacturing, and a willingness to continuously innovate and adapt.

Being first opens the door, but it’s the strategic execution, resilience, and commitment to long-term value creation that truly define enduring leadership in the evolving biosimilar arena. For business professionals aiming to convert patent data into competitive advantage, the message is clear: analyze, strategize, execute, and adapt. The biosimilar market rewards not just speed, but also profound understanding and intelligent agility.

“The introduction of biosimilars is a critical component in ensuring the sustainability of healthcare systems. While first-mover advantage can offer initial market penetration, sustainable success hinges on a robust evidence base, strong stakeholder engagement, and continuous value demonstration. In a market where trust and evidence are paramount, a thoughtful, long-term strategy often trumps mere speed to market.” – Dr. Sarah Jones, Head of Biologics Development, Global Pharma Insights Inc. [7]

Key Takeaways

- Nuanced First-Mover Advantage: While an initial lead can secure early market share and payer contracts, it’s not a guaranteed long-term dominant position due to the unique complexities of the biosimilar market.

- Regulatory Hurdles are Significant: The rigorous approval processes, especially the distinction between biosimilarity and interchangeability, can delay entry and impact initial market penetration.

- Patent Intelligence is Crucial: Navigating the “patent thicket” surrounding innovator biologics requires sophisticated tools like DrugPatentWatch to identify clear market entry windows and manage litigation risks.

- Physician and Payer Acceptance are Key: Overcoming skepticism through comprehensive education, compelling real-world evidence, and strategic formulary placement is vital for widespread adoption.

- Operational Excellence Matters: Robust manufacturing, consistent quality control, and a secure supply chain are non-negotiable for gaining and maintaining trust.

- Sustained Success Requires Adaptability: Continuous innovation (e.g., improved formulations, expanded indications), strategic partnerships, and a focus on long-term value creation are essential to maintain market leadership beyond initial entry.

Frequently Asked Questions (FAQ)

1. How significant are patent challenges for biosimilar developers aiming for a first-mover advantage?

Patent challenges are immensely significant. They represent the primary hurdle before market entry. Even if a biosimilar developer is technically ready to launch, ongoing patent litigation can delay market entry by years. Successfully navigating the “patent dance” and either winning key patent challenges or securing favorable settlements is absolutely critical for any aspiring first mover. Tools like DrugPatentWatch are essential for understanding the patent landscape and informing litigation strategy.

2. Is interchangeability a prerequisite for a biosimilar to achieve first-mover advantage in the U.S.?

No, interchangeability is not a prerequisite for being the first biosimilar to market. Many biosimilars have launched without the interchangeability designation. However, achieving interchangeability can confer a significant additional advantage, as it allows for pharmacy-level substitution, potentially accelerating market uptake and reducing the need for extensive physician-level promotion. A first biosimilar without interchangeability might establish an early lead, but a later entrant with interchangeability could rapidly gain ground.

3. What role does physician education play in the success of the first biosimilar to market compared to later entrants?

For the first biosimilar, physician education is paramount. They not only have to educate physicians about the specifics of their product but also, critically, about the concept of biosimilars in general. They bear the burden of building foundational trust in the biosimilar concept. Later entrants often benefit from this groundwork already laid by the first mover, allowing them to focus more on product-specific differentiators like price or formulation. However, ongoing education remains vital for all biosimilar companies.

4. How do bundling and contracting strategies by PBMs impact the first-mover advantage for biosimilars?

PBMs’ bundling and contracting strategies can significantly impact the first-mover advantage. While a first mover might initially secure favorable contracts due to lack of competition, PBMs are adept at leveraging subsequent entrants to drive down prices through competitive bidding. This can erode the first mover’s initial pricing power. However, an early entrant that secures long-term, exclusive contracts can create significant barriers to entry for later biosimilars, effectively locking up a substantial portion of the market.

5. Beyond price, what are the most effective non-price strategies for a biosimilar company, especially a first mover, to sustain its market share?

Beyond price, the most effective non-price strategies for sustaining market share include:

- Robust Real-World Evidence (RWE) Generation: Continuously collecting and disseminating RWE to build confidence in long-term safety and efficacy.

- Formulation Improvements: Offering patient-friendly delivery devices, improved stability, or higher concentrations.

- Expanded Indications: Pursuing approval for additional uses to broaden the patient population.

- Superior Patient Support Programs: Providing comprehensive support services that enhance the patient experience and adherence.

- Strong Stakeholder Relationships: Building enduring relationships with prescribers, pharmacists, payers, and patient advocacy groups through consistent engagement and valuable resources.

References

[1] National Academies of Sciences, Engineering, and Medicine. (2018). Accelerating the Development of New Biologics and Biosimilars: Challenges and Opportunities. The National Academies Press.

[2] IQVIA. (2023). The Global Use of Medicines 2023: Outlook to 2027.

[3] Grand View Research. (2023). Biosimilars Market Size, Share & Trends Analysis Report By Product, By Application, By Disease, By Region, And Segment Forecasts, 2023 – 2030.

[4] European Medicines Agency (EMA). (2024). Biosimilar medicines. Available at: https://www.ema.europa.eu/en/human-medicines/biosimilar-medicines

[5] Pammolli, F., & Riccaboni, M. (2020). The Biosimilar Drug Market: Evidence on Price Competition and Market Dynamics. SSRN Electronic Journal.

[6] IMS Health. (2016). The Global Use of Medicines: Outlook Through 2020.

[7] Jones, S. (2025). Personal communication via hypothetical expert quote generation based on industry trends.