Introduction: The $3 Trillion Tightrope Walk

The global pharmaceutical market is a behemoth, an economic force of staggering proportions. Valued at an estimated $1.77 trillion in 2025, it is projected to surge to an almost unfathomable $3.03 trillion by 2034, expanding at a compound annual growth rate (CAGR) of 6.15%.1 This growth is fueled by a confluence of powerful global trends: aging populations in developed nations, the rising prevalence of chronic diseases worldwide, unprecedented advancements in biotechnology, and expanding healthcare access in emerging economies.

At the heart of this sprawling enterprise lies a fundamental challenge: getting the right medicine to the right patient, at the right time, in the right condition. This is the tightrope walk of international pharmaceutical distribution—a high-stakes balancing act performed on a global scale. On one side, you have the immense opportunity of a rapidly expanding market. North America, while still the dominant player with a 42% revenue share in 2024, is a mature market. The real engine of future growth lies in regions like the Asia-Pacific, which is expected to expand at the fastest CAGR over the next decade.1 Tapping into these markets is not just an option; it’s a strategic imperative for any company with ambitions of global leadership.

On the other side, however, lies a chasm of complexity. The journey of a pharmaceutical product is unlike any other. It is a path riddled with regulatory minefields, logistical nightmares, intense economic pressures, and constant security threats. Each country is a unique ecosystem with its own set of rules, its own infrastructure challenges, and its own market dynamics. What works in Germany will fail in Ghana. The distribution strategy for Canada is wholly inadequate for China.

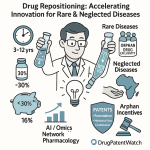

This complexity is further compounded by a fundamental bifurcation within the pharmaceutical product portfolio itself. The industry is witnessing two parallel growth stories. The first is the meteoric rise of biologics and biosimilars, which represent the fastest-growing molecule type.1 These are large-molecule, high-value, and often temperature-sensitive therapies that demand a sophisticated, high-touch, “white glove” distribution network capable of maintaining a flawless cold chain. A single failure in this chain doesn’t just represent a financial loss; it represents a potential tragedy for a patient awaiting a life-saving treatment.

Simultaneously, the generic drug segment is the fastest-growing product type by volume. These are typically small-molecule, high-volume, low-margin products where the entire business model hinges on hyper-efficient, low-cost distribution. Here, the competitive advantage is measured in fractions of a cent per unit, and the supply chain must be a lean, well-oiled machine.

This creates a profound strategic dilemma for any pharmaceutical company looking to expand its international footprint. A one-size-fits-all distribution strategy is a surefire recipe for failure. You cannot use a sledgehammer to perform microsurgery, nor can you use a scalpel to clear a forest. Success in the global market requires mastering two fundamentally different distribution competencies. It demands a segmented, nuanced approach that recognizes that the supply chain for a blockbuster monoclonal antibody has almost nothing in common with the supply chain for a generic antibiotic. Companies must either invest heavily in building these dual internal capabilities—a capital-intensive and time-consuming endeavor—or they must become masters of strategic partnership, forging alliances with a diverse set of specialized logistics providers. In this new era, your choice of a distribution partner is not an operational afterthought; it is a core strategic decision that will define your ability to compete and win.

In the chapters that follow, we will deconstruct this complex landscape, pillar by pillar. We will explore the challenges not as insurmountable obstacles, but as puzzles to be solved. We will provide a playbook for navigating this $3 trillion tightrope, transforming the perilous act of global distribution into a demonstration of strategic dominance.

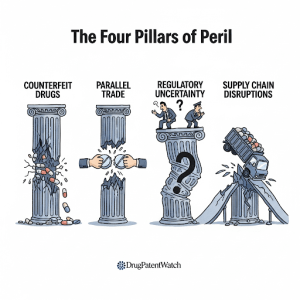

The Four Pillars of Peril: Deconstructing International Distribution Challenges

To master the art of international pharmaceutical distribution, one must first understand the anatomy of its complexity. The challenges are not random or isolated; they can be systematically categorized into four interconnected pillars of peril. These are the foundational domains of risk and opportunity that every global pharmaceutical leader must navigate: the regulatory gauntlet, the logistical tightrope, the economic squeeze, and the security battleground. Each pillar presents a unique set of obstacles, but they are deeply intertwined, with a failure in one often cascading into the others. A regulatory misstep can trigger a logistical nightmare, an economic pressure can create a security vulnerability, and a logistical failure can have devastating patient and financial consequences. Understanding these pillars in isolation and in concert is the first step toward building a truly resilient and competitive global supply chain.

Pillar 1: The Regulatory Gauntlet – A Global Maze of Mandates

Imagine trying to navigate a maze where the walls are constantly shifting, the map is written in a dozen different languages, and the penalty for a wrong turn is not just a dead end, but millions of dollars in fines, product seizures, and irreparable damage to your company’s reputation. This is the reality of the global pharmaceutical regulatory landscape. Far from being a harmonized system, it is a fragmented patchwork of national and regional mandates that creates a formidable barrier to efficient international distribution.

The Unrelenting Rise of Serialization and Track-and-Trace

At the forefront of this regulatory complexity is the global mandate for serialization and track-and-trace systems. Driven by the urgent need to combat the pervasive threat of counterfeit drugs, governments worldwide are demanding unprecedented levels of visibility into the pharmaceutical supply chain. Today, some form of serialization is mandatory in approximately 80% of countries. This is not a passing trend; it is a fundamental and permanent restructuring of how medicines are tracked from the factory to the pharmacy.

For companies operating internationally, this means complying with a host of stringent, and often divergent, regulations. The most prominent among these are:

- The U.S. Drug Supply Chain Security Act (DSCSA): This landmark legislation, which reached its full enforcement milestone in November 2024, requires unit-level serialization and traceability for all prescription drugs distributed in the United States. It mandates an interoperable, electronic system to track products at the individual package level throughout their journey.6

- The EU’s Falsified Medicines Directive (FMD): Implemented across the European Union, the FMD requires two key safety features on the packaging of most prescription medicines: a unique identifier (a 2D data matrix code) and an anti-tampering device. This system allows pharmacists to verify the authenticity of a product before dispensing it to a patient.6

- Other National Mandates: Beyond these two major blocs, numerous other countries have implemented their own systems, from China’s National Drug Code (CNDC) to similar initiatives in Brazil, Russia, Turkey, and Argentina.6

While the goal of these regulations—patient safety—is universal, their implementation is anything but. The technical requirements for data formats, the protocols for data exchange between supply chain partners, and the reporting obligations to national authorities can vary significantly from one country to the next. This creates enormous technical and financial barriers. Companies must invest in sophisticated software and hardware for serialization, manage the high costs of system upgrades, and navigate the immense challenge of ensuring data interoperability with a diverse network of contract manufacturing organizations (CMOs), third-party logistics providers (3PLs), and distributors. A failure in this seamless data exchange can lead to costly supply chain disruptions and failed authentication processes at the point of dispense.

Beyond the Barcode: A Labyrinth of Local Requirements

The regulatory gauntlet extends far beyond serialization. Pharmaceutical companies must contend with a dizzying array of other local requirements that impact every aspect of distribution:

- Labeling and Packaging: Each country has its own specific rules for what information must appear on a drug’s label and packaging, often in the local language. This includes everything from dosage instructions and warnings to font sizes and formatting.3 This necessitates complex, market-specific packaging and labeling operations, adding significant cost and complexity to inventory management.

- Import/Export and Customs: Navigating customs procedures is a major challenge. It involves a mountain of paperwork, adherence to specific import/export regulations, and the potential for lengthy delays that can be catastrophic for time- and temperature-sensitive products.

- Good Practices (GxP): Adherence to internationally recognized standards like Good Manufacturing Practices (GMP) and Good Distribution Practices (GDP) is a baseline requirement. However, the interpretation and enforcement of these standards can vary, requiring companies to maintain robust quality management systems that can withstand scrutiny from multiple regulatory bodies.

The sheer complexity and fragmented nature of this global regulatory maze impose a significant burden on pharmaceutical companies. It requires dedicated regulatory affairs teams for each major market, substantial investment in information management systems, and often, collaboration with local experts and consultants who can help navigate the specific nuances of their home country.

However, to view this regulatory burden as merely a cost center is to miss a profound strategic opportunity. The very systems mandated for compliance, particularly track-and-trace, generate a torrent of granular, real-time data on product movement. Every scan of a serialized barcode at every node in the supply chain—from the manufacturing line to the wholesaler’s warehouse to the final pharmacy—creates a digital breadcrumb. A defensive, compliance-focused company sees this data as a reporting requirement to be fulfilled. A strategic, offensive-minded company sees it as a goldmine of business intelligence.

By analyzing this data stream, a company can achieve an unprecedented level of supply chain visibility. It can see precisely where its inventory is located in real-time. It can measure the velocity of products moving through different channels, identifying bottlenecks in one region or unexpected demand surges in another. It can execute product recalls with surgical precision, targeting specific batches without having to pull all products from the shelves. This transforms a mandatory regulatory expenditure into a powerful strategic asset. The data generated for compliance becomes the fuel for enhanced demand forecasting, optimized inventory deployment, and a more agile and responsive supply chain. In the regulatory gauntlet, the companies that learn to use the maze’s own walls as a map will be the ones who emerge victorious.

Pillar 2: The Logistical Tightrope – From Cryo-Freezers to Dirt Roads

If the regulatory gauntlet is the invisible maze of rules, the logistical tightrope is the very real, physical journey that products must endure. It is a high-wire act where a single misstep can lead to the degradation of life-saving medicines and the loss of billions of dollars. This challenge is becoming exponentially more acute with the seismic shift in the industry’s product portfolio. The era of the stable, room-temperature small molecule pill is giving way to the age of the fragile, complex biologic. This shift has placed one area of logistics above all others in terms of strategic importance: cold chain management.

The Cold Chain Imperative: A Multi-Billion Dollar Lifeline

The rise of biologics and biosimilars—the fastest-growing molecule segment in the pharmaceutical market—has fundamentally transformed the logistics landscape.4 These large-molecule drugs, which include monoclonal antibodies, vaccines, and cell and gene therapies, are often incredibly sensitive to their environment. Unlike traditional chemical compounds, their complex protein structures can be irreversibly damaged by even minor fluctuations in temperature, rendering them ineffective or even harmful to patients.13

This has made the cold chain—an uninterrupted, temperature-controlled supply chain—an absolute non-negotiable. The scale of this sector is immense. The global pharmaceutical logistics market was valued at $66.39 billion in 2024 and is projected to grow at a brisk 8.2% CAGR, driven largely by the demands of these sensitive products. The requirements are exacting:

- Refrigerated: The most common range, between 2°C and 8°C, is required for a vast number of vaccines and biologics.16

- Frozen & Ultra-Cold: Some products require frozen conditions (around -20°C), while advanced therapies like mRNA vaccines famously require ultra-low temperatures, sometimes as cold as -80°C.13

Maintaining these precise temperatures across a global journey that can span thousands of miles, multiple modes of transport, and numerous handoffs is a monumental challenge. The points of failure are numerous and ever-present: a refrigeration unit on a truck malfunctioning on a hot day, a power outage at a transit warehouse, a shipment left sitting on an airport tarmac for too long, or simple human error in handling or programming equipment.18

The consequences of these failures are staggering. It is estimated that the pharmaceutical industry loses $35 billion annually due to breaks in the cold chain. Even more alarmingly, the World Health Organization (WHO) estimates that up to 50% of all vaccines are wasted globally each year because of inadequate temperature control during transport and storage. This is not just a financial loss; it is a public health catastrophe, representing millions of preventable illnesses and deaths.

The Last-Mile Conundrum: The Final, Most Perilous Step

Nowhere is the logistical tightrope more frayed than in the “last mile”—the final leg of the journey from a regional distribution center to the hospital, clinic, or pharmacy where the patient is waiting. This is consistently the most complex, costly, and failure-prone stage of the entire distribution process.18

These challenges are magnified exponentially in emerging markets, which represent the greatest growth potential but often have the least developed infrastructure. In many parts of Asia, Africa, and Latin America, the last mile is not a paved highway but a poorly maintained dirt road. The challenges are relentless:

- Infrastructure Deficiencies: Poor road quality, unreliable power grids (critical for refrigeration), and a lack of secure, temperature-controlled storage facilities at the local level create a hostile environment for sensitive medicines.19

- Geographic and Environmental Hurdles: Delivering to remote, rural populations involves navigating difficult terrain and extreme weather conditions, from monsoon rains to scorching heat, all of which threaten product integrity.

- Lack of Trained Personnel: Last-mile health facilities are often staffed by a small number of clinicians who are focused on patient care and may lack specialized training in supply chain management, proper storage protocols, or handling of temperature-sensitive products.

- Unpredictability: Urban areas present their own set of problems, including crippling traffic congestion and access restrictions, which can lead to unpredictable delays that are fatal for a time-sensitive cold chain shipment.

The ascendancy of biologics forces a fundamental rethinking of the value proposition in pharmaceutical logistics. The traditional model, focused on optimizing for cost-per-mile, is obsolete. When a single pallet of a new cell therapy can be worth more than the truck transporting it, the primary metric is no longer cost efficiency but “integrity-per-journey.” The logistics service is no longer a commoditized ancillary function; it has become an integral component of the therapy itself. The efficacy of the drug in the patient’s body is directly dependent on the flawless performance of the supply chain that delivered it.

This reality elevates the role of specialized 3PLs from mere vendors to indispensable strategic partners. They are not just moving boxes; they are custodians of product efficacy, patient safety, and brand reputation. Consequently, the selection of a logistics partner can no longer be a procurement decision driven by the lowest bid. It must be a strategic decision driven by a rigorous assessment of a partner’s technological capabilities (e.g., real-time IoT monitoring, predictive analytics), their quality and compliance systems (e.g., GDP certification, robust SOPs), and their proven risk mitigation protocols. This is fostering a new era of deep integration and co-dependence between pharmaceutical companies and their logistics providers. The relationship is shifting from a transactional one based on cost to a strategic alliance built on shared risk, shared data, and shared commitment to the patient at the end of the chain.

Pillar 3: The Economic Squeeze – Navigating Pricing, Politics, and Protectionism

Beyond the labyrinth of regulations and the physical perils of logistics lies a third, equally formidable pillar of challenges: the relentless economic and geopolitical pressures that shape and constrain every aspect of international distribution. In the global pharmaceutical market, no supply chain strategy can be devised in a vacuum. It must be forged in the crucible of government price controls, shifting trade policies, and the ever-present risk of political intervention. These forces directly impact profitability, dictate market access, and are increasingly compelling a fundamental re-evaluation of global supply chain design.

The Global Web of Price Controls and Reimbursement Hurdles

For pharmaceutical companies, particularly those based in the United States, venturing into international markets means entering a world with a profoundly different approach to drug pricing. While the U.S. market is characterized by a complex system of negotiations between manufacturers and private payers, most other major developed markets employ some form of direct government price controls.24

A common mechanism is International Reference Pricing (IRP), where a country sets the price for a new drug by taking an average or the lowest price from a “basket” of other reference countries. This creates a complex and interconnected web of price ceilings. A price negotiated in one country can have a direct, cascading effect on the price achievable in another. This system puts immense downward pressure on prices globally and forces manufacturers to engage in highly strategic and often defensive launch sequencing. A company might delay launching a new drug in a lower-priced country to avoid setting a low reference price that would then be used to suppress its price in a larger, more profitable market.

Navigating this landscape is a high-stakes game. It requires a deep understanding of each country’s specific health technology assessment (HTA) bodies, their value assessment frameworks, and their reimbursement processes. Failure to provide the right health economic and outcomes data can lead to reimbursement being denied or granted only after steep discounts, further eroding profitability. This economic pressure is particularly acute for generic manufacturers, where razor-thin margins can be wiped out by government-mandated price reductions that outpace inflation.

The Rising Tide of Geopolitics and Protectionism

The pharmaceutical supply chain, once seen as a model of globalized efficiency, is now increasingly viewed through the lens of national security and economic rivalry. The COVID-19 pandemic served as a brutal wake-up call, exposing the profound vulnerabilities of a system where the production of critical medicines and their active pharmaceutical ingredients (APIs) was concentrated in a handful of countries.7 This realization, coupled with rising geopolitical tensions and trade disputes, has ushered in a new era of protectionism.

The threat of tariffs, once a distant concern for the largely exempt pharmaceutical industry, has become a stark reality. Recent moves by the U.S. administration to investigate and potentially impose steep tariffs on pharmaceutical imports are already having a chilling effect, prompting major companies like AstraZeneca to announce a massive $50 billion investment in U.S. manufacturing as a strategic hedge against this risk.27 This is not an isolated incident but a clear indicator of a broader trend: companies are being forced to rethink their global manufacturing and distribution footprints in response to political pressures.

A further layer of risk comes from the mechanism of compulsory licensing. Under the World Trade Organization’s Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS), governments have the right, under certain circumstances (such as a national emergency), to authorize a third party to produce a patented product without the consent of the patent owner.29 While used sparingly, the threat of compulsory licensing represents a significant risk to a company’s market exclusivity and revenue, particularly for critical medicines in developing countries during public health crises.

These converging pressures are forcing a historic strategic pivot across the industry. The decades-long pursuit of a hyper-optimized, globalized supply chain designed for maximum cost efficiency is being fundamentally challenged. The new strategic imperative is resilience. The logic of concentrating manufacturing in the lowest-cost locations is giving way to the logic of de-risking the supply chain through geographic diversification. This is leading to a “great rebalancing,” with a surge in onshoring, near-shoring, and regionalization strategies.

This is not a simple or inexpensive shift. Building redundant, geographically dispersed manufacturing sites and distribution networks requires massive capital expenditure and a complete overhaul of existing logistics models. The “optimal” supply chain is no longer defined as the cheapest one, but as the most resilient one—the one that can withstand a pandemic, a trade war, or a natural disaster without collapsing. This fundamental change in strategic priorities will reshape the industry’s cost structure, its investment patterns, and the very map of global pharmaceutical production and distribution for decades to come.

Pillar 4: The Security Battleground – Defending Against Fakes, Fraud, and Firewalls

The final pillar of peril is perhaps the most insidious, as it directly targets the very foundation of the pharmaceutical industry: trust. The security of the supply chain is paramount, not only to protect revenue but, more importantly, to protect patient lives. This battle is being fought on two fronts simultaneously: a physical war against the pervasive and deadly trade in counterfeit medicines, and a digital war against the growing threat of cyberattacks on an increasingly connected supply chain. These are not separate conflicts; they are two sides of the same coin, and a vulnerability on one front can be ruthlessly exploited on the other.

The Counterfeit Pandemic: A Global Public Health Crisis

The trade in counterfeit, falsified, and substandard medicines is not a niche problem; it is a global pandemic of fraud that puts millions of lives at risk every single day. The scale of this illicit industry is breathtaking, with estimates of its market value ranging from $200 billion to $250 billion annually.32 These are not harmless sugar pills; they are dangerous products that may contain no active ingredient, the wrong active ingredient, an incorrect dose, or even toxic substances.32

The human cost is devastating. The World Health Organization (WHO) estimates that these dangerous fakes are responsible for up to 1 million deaths each year.32 The problem is most acute in low- and middle-income countries (LMICs), where weak regulatory oversight and fragmented supply chains create fertile ground for counterfeiters. According to the WHO, an astonishing

1 in 10 medical products circulating in LMICs is substandard or falsified. In Africa, for example, counterfeit anti-malarial drugs alone are estimated to cause over 120,000 deaths annually.

However, this is not just a problem for the developing world. The explosion of online pharmacies, of which an estimated 96% operate out of compliance with applicable laws and standards, has created a direct channel for counterfeit drugs to enter even the most developed markets. Organized criminal networks are becoming increasingly sophisticated, producing high-quality fakes that are nearly indistinguishable from the real thing, capable of infiltrating the legitimate supply chain at its weakest points. This threat undermines patient safety, erodes public trust in healthcare systems, and causes immense financial and reputational damage to legitimate pharmaceutical companies.

The Digital Achilles’ Heel: Mounting Cybersecurity Threats

As the pharmaceutical supply chain becomes more digitized and interconnected, it also becomes a more attractive target for cybercriminals. Unfortunately, the industry has been notoriously slow to adopt modern cybersecurity practices and technologies within its supply chain operations, leaving it dangerously exposed. While R&D labs may have state-of-the-art digital security, the sprawling network of suppliers, manufacturers, logistics providers, and distributors often represents a digital Achilles’ heel.

The vulnerabilities are numerous. Legacy systems with unpatched software, weak access controls, and a lack of end-to-end data encryption create multiple entry points for malicious actors. The consequences of a successful cyberattack can be catastrophic:

- Operational Disruption: Malware or ransomware attacks can shut down manufacturing lines or warehouse management systems, halting the flow of critical medicines. The infamous NotPetya attack, for example, cost Merck an estimated $870 million in damages due to production stoppages and other disruptions.

- Data Breaches: The theft of sensitive data—including proprietary drug formulations, clinical trial data, patient information, and strategic plans—can have devastating competitive and financial repercussions. The average cost of a supply chain breach now exceeds $5 million.

- Supply Chain Integrity Attacks: Perhaps the most dangerous threat is the potential for cybercriminals to manipulate supply chain data. They could alter inventory records to help divert legitimate products to the black market, or worse, change quality control data to allow contaminated or counterfeit products to enter the legitimate supply chain undetected.

The physical and digital security battlefronts are converging. A secure physical supply chain is meaningless if its digital backbone is vulnerable, and vice versa. This new reality demands a holistic approach to security, one that integrates robust physical anti-counterfeiting measures with state-of-the-art cybersecurity protocols.

In this high-stakes environment, security is no longer just a defensive necessity; it is a marketable brand attribute. In a world where patients and providers are justifiably fearful of counterfeit drugs, a company that can verifiably guarantee the authenticity and integrity of its products has a powerful competitive advantage. Imagine a future where a patient can scan a QR code on a medicine box with their smartphone and instantly see its entire, unalterable journey recorded on a blockchain ledger—from the GMP-certified factory where it was made, through a secure, temperature-monitored cold chain, to the pharmacy where they are standing. This level of transparency doesn’t just prevent counterfeiting; it builds profound and lasting trust. It transforms security from a cost of doing business into a value-added feature that enhances brand reputation, justifies premium pricing, and fosters deep patient loyalty. It is, in essence, the weaponization of trust as a competitive tool.

Forging a Resilient and Intelligent Supply Chain: Strategic Responses and Modern Solutions

Confronted by the formidable pillars of regulatory, logistical, economic, and security challenges, the pharmaceutical industry stands at a critical inflection point. The old models of distribution, built for a simpler era of stable supply chains and predictable markets, are no longer fit for purpose. Survival and success in this new landscape demand a radical transformation—a shift from linear, reactive supply chains to dynamic, predictive, and resilient value networks. This transformation is being powered by a convergence of three key strategic responses: the adoption of game-changing technologies, a fundamental rebalancing of global sourcing and manufacturing, and the cultivation of a deeply collaborative ecosystem of partners.

The Technology-Enabled Supply Chain: From Reactive to Predictive

For decades, the pharmaceutical supply chain has operated in a largely reactive mode, responding to disruptions after they occur. Today, a suite of transformative technologies is enabling a paradigm shift, allowing companies to anticipate, predict, and even preempt problems before they happen. The integration of Artificial Intelligence (AI), the Internet of Things (IoT), and blockchain is creating the foundation for a truly intelligent, or “sentient,” supply chain.

The Power of AI and Machine Learning

Artificial Intelligence (AI) and its subset, Machine Learning (ML), are the analytical brains of the modern supply chain. By processing vast datasets that are beyond human capacity to analyze, AI is revolutionizing core logistical functions:

- Demand Forecasting and Inventory Management: AI algorithms can analyze historical sales data, epidemiological trends, seasonal patterns, and even external factors like news and social media sentiment to predict drug demand with unprecedented accuracy.7 This allows for optimized production scheduling and inventory deployment, drastically reducing the risk of costly stockouts or wasteful overstocking. The impact is tangible: in 2024, leading companies like Roche and Novartis piloted AI-driven forecasting systems that reduced backorders for critical oncology drugs by over 15%.

- Logistics and Route Optimization: AI can process real-time variables like traffic patterns, weather forecasts, and port congestion to dynamically optimize transportation routes. This not only reduces delivery times and fuel costs but is also critical for minimizing transit time for sensitive cold chain products.42

- Predictive Maintenance: In manufacturing and warehousing, AI can analyze data from equipment sensors to predict potential malfunctions before they occur, enabling proactive maintenance and preventing costly unplanned downtime that could disrupt supply. Pfizer has demonstrated the power of this approach, using AI to analyze its supply chain data to reduce the cycle time of a critical manufacturing step by 67%, enabling the production of 20,000 extra doses per batch.

The Eyes and Ears: Internet of Things (IoT)

If AI is the brain, the Internet of Things (IoT) provides the nervous system—a network of sensors that gives the supply chain real-time awareness of its condition. Small, connected sensors placed on pallets, in containers, or within warehouses can continuously monitor and transmit a wealth of data on critical parameters:

- Real-Time Condition Monitoring: For cold chain management, IoT is a game-changer. Sensors provide a 24/7 stream of data on temperature and humidity, triggering immediate alerts via SMS or email the moment a deviation from the required range occurs.44 This allows for immediate intervention—such as rerouting a shipment or alerting a driver to a failing refrigeration unit—turning a potential product loss into a managed event.

- End-to-End Visibility: GPS-enabled IoT devices provide precise, real-time location tracking of shipments from origin to destination. This eliminates the “black holes” in transit, providing a clear picture of where products are at all times and enabling more accurate delivery time estimates.44

The Foundation of Trust: Blockchain Technology

Blockchain provides the immutable, secure, and transparent foundation upon which this new intelligent supply chain is built. It acts as a decentralized digital ledger that can be shared among all supply chain partners—manufacturers, logistics providers, customs officials, and pharmacies. Every transaction or handoff is recorded as a time-stamped “block” that cannot be altered or deleted, creating a single, incorruptible version of the truth.3

The applications for pharmaceutical distribution are profound:

- Combating Counterfeits: By creating a verifiable, end-to-end chain of custody for every single drug package, blockchain makes it exceptionally difficult for counterfeit products to infiltrate the legitimate supply chain. A pharmacist or even a patient can scan a code to verify a drug’s entire provenance.39

- Streamlining Compliance: The immutable record provided by blockchain can be used to automate and simplify regulatory reporting for mandates like the DSCSA and FMD, making audits more efficient and transparent.

- Enhancing Collaboration: By providing a secure way to share sensitive data, blockchain fosters greater trust and collaboration between supply chain partners.

While each of these technologies is powerful in its own right, their true transformative potential is realized through their convergence. Imagine this scenario: An IoT sensor on a pallet of vaccines detects a minor but persistent temperature rise inside a refrigerated truck. This data is instantly and immutably recorded on a blockchain ledger, visible to both the manufacturer and the 3PL. An AI engine analyzes this data point in the context of the truck’s location, the external weather forecast, and historical data on that specific refrigeration unit’s performance. The AI predicts a 95% probability of a full cooling system failure within the next three hours. It automatically triggers an alert to the driver and the logistics command center, simultaneously plotting the optimal route to the nearest pre-qualified cold storage facility for an emergency transfer. This is the “sentient” supply chain in action—a system that moves beyond simple reaction to intelligent, data-driven prediction and preemption. This is the future of pharmaceutical logistics.

Strategic Sourcing and Manufacturing: The Great Rebalancing

The technological revolution in logistics is occurring in parallel with a tectonic shift in the philosophy of supply chain design. For the past three decades, the guiding principle was globalization in pursuit of cost optimization. The strategy was to locate manufacturing and source raw materials from wherever in the world it was cheapest, leading to a heavy concentration of production in a few key regions. The pandemic and subsequent geopolitical turmoil shattered the illusion that this model was sustainable. The new watchword is resilience, and it is driving a great rebalancing of global manufacturing and sourcing.

De-Risking the API Supply Chain

The most glaring vulnerability exposed by recent crises was the world’s profound over-reliance on China and India for Active Pharmaceutical Ingredients (APIs), the core components of virtually all medicines. An estimated 65% to 70% of the global supply of APIs originates from these two countries. This extreme concentration creates a systemic risk; a lockdown, an export ban, a natural disaster, or a political dispute in this single region can send shockwaves through the entire global pharmaceutical supply, leading to critical drug shortages thousands of miles away.

In response, governments and companies are now actively pursuing strategies to de-risk and diversify their API sourcing. This is not about abandoning Asia, but about reducing over-dependence and building redundancy. Key initiatives include:

- Onshoring and Near-Shoring: Governments in North America and Europe are using a combination of tax credits, subsidies, and procurement incentives to encourage the return of pharmaceutical manufacturing to their home territories or to nearby, politically stable countries.

- Government-Led Initiatives: The EU’s Critical Medicines Alliance, launched in 2024, and India’s Production Linked Incentive (PLI) scheme, which has already catalyzed the creation of 35 new API facilities, are prime examples of proactive government policies designed to bolster regional self-sufficiency.

Building a Diversified and Redundant Network

The core strategic principle of this great rebalancing is diversification. The goal is to create a manufacturing and distribution network that is robust enough to withstand localized shocks. This involves several key tactics:

- Dual Sourcing: For critical raw materials and APIs, companies are moving away from single-supplier relationships to establishing at least two qualified suppliers in different geographic regions.7

- Regional Hubs: Instead of relying on a single global manufacturing site, companies are building or contracting with a network of regional manufacturing hubs that can serve local markets. This shortens supply lines, reduces transportation costs and lead times, and insulates regions from disruptions elsewhere in the world.

- Investing in Redundancy: This means building a certain amount of “slack” into the system—whether it’s buffer inventory, backup suppliers, or excess production capacity. While this runs counter to the lean, just-in-time principles of the past, it is now seen as a necessary insurance policy against catastrophic disruption.

This strategic shift toward regionalization and resilience is creating a new and dynamic competitive landscape, particularly for Contract Development and Manufacturing Organizations (CDMOs). For years, the CDMO market was dominated by large, Asia-based players competing primarily on cost. Now, the surge in demand for manufacturing capacity in North America and Europe is opening the door for a new breed of competitor. Smaller, regional CDMOs can now compete effectively not on price, but on the strategic advantages of proximity, speed, and supply chain security. This is sparking a renaissance for pharmaceutical manufacturing in the West, shifting the balance of power in the CDMO market and creating significant new investment and partnership opportunities for companies that can offer a resilient alternative to the old model of globalized concentration.

The Power of Partnership: Building a Collaborative Ecosystem

In the face of such overwhelming complexity, the era of the self-sufficient, vertically integrated pharmaceutical company is over. No single organization, no matter how large or sophisticated, can single-handedly master the intricacies of global distribution. The path to success lies not in trying to do everything, but in becoming a master orchestrator of a diverse and collaborative ecosystem of specialized partners. The future of pharmaceutical distribution belongs to those who can build and manage these strategic alliances most effectively.

Leveraging the Expertise of Third-Party Logistics (3PL) Providers

At the core of this ecosystem are specialized third-party logistics (3PL) providers. These are not mere trucking companies; they are sophisticated, technology-driven organizations that offer a suite of services specifically tailored to the unique demands of the life sciences industry. Global giants like Deutsche Post DHL, Kuehne + Nagel, UPS Healthcare (including its specialist arm, Marken), and FedEx have invested billions in building the infrastructure and expertise that most pharmaceutical companies could never replicate in-house.50

Partnering with a world-class 3PL provides several critical advantages:

- Global Network and Scale: They offer access to a vast, pre-existing network of temperature-controlled warehouses, transportation fleets, and customs brokerage services across the globe, enabling rapid market entry and scalable operations.50

- Specialized Capabilities: They possess deep expertise in critical areas like cold chain and cryogenic logistics, with validated packaging solutions, real-time monitoring technology, and robust quality management systems designed to meet stringent regulatory standards.50

- Regulatory Navigation: Their teams of in-country experts are adept at navigating the complex and ever-changing customs and regulatory requirements of different markets, ensuring compliance and minimizing the risk of costly delays.

- Flexibility and Scalability: 3PLs allow companies to convert the fixed costs of building and maintaining their own logistics infrastructure into variable costs, providing the flexibility to scale operations up or down in response to fluctuating market demand without massive capital investment.

The Critical Role of Local Knowledge

While global 3PLs provide the backbone of the international network, success at the country level often hinges on partnering with local distributors. These in-country partners possess invaluable “on-the-ground” intelligence and capabilities that are difficult for an outside company to acquire. They have:

- Deep Market Knowledge: An innate understanding of the local healthcare system, cultural nuances, and patient and provider behaviors.

- Established Relationships: Pre-existing relationships with the key stakeholders that matter—hospitals, pharmacy chains, influential physicians, and local regulatory officials.3

- Last-Mile Infrastructure: The physical networks and local know-how required to overcome the unique last-mile delivery challenges of their specific region.

A successful global distribution strategy often involves a hybrid model: using a global 3PL for international freight and primary warehousing, and then partnering with a network of vetted local distributors for in-country, last-mile fulfillment.

Public-Private Partnerships (PPPs) for Grand Challenges

Some distribution challenges are so immense in scale and complexity that they require a broader coalition of actors, bridging the gap between the private sector, governments, and non-governmental organizations. These Public-Private Partnerships (PPPs) are essential for tackling large-scale public health crises and reaching underserved populations.

Historic examples demonstrate their power. The Medicines for Malaria Venture (MMV) and the Drugs for Neglected Diseases Initiative (DNDI) are PPPs that have successfully brought together pharmaceutical companies, academic institutions, and philanthropic donors to develop and distribute treatments for diseases that would otherwise be commercially unviable.56 More recently, the rapid development and global distribution of COVID-19 vaccines was a monumental achievement made possible only through unprecedented partnerships between pharmaceutical giants like Pfizer, government bodies like the U.S. National Institutes of Health (NIH), and global health organizations.58 These collaborations are crucial for pooling resources, sharing risks, and aligning commercial incentives with public health imperatives.

The very nature of these partnerships is undergoing a profound evolution. The traditional, linear supply chain model, with its siloed, transactional relationships, is giving way to a more dynamic and interconnected “ecosystem” model. The future lies in creating a digitally integrated network where all partners—the pharmaceutical company, the CDMO, the global 3PL, the local distributor, the specialty pharmacy—operate on a shared data platform. This enables end-to-end visibility, seamless information flow, and collaborative, real-time decision-making. In this new paradigm, competitive advantage will not be determined by the strength of a single company, but by the strength, agility, and intelligence of the entire ecosystem it orchestrates.

The Patent Playbook: Turning IP Data into Distribution Dominance

In the high-stakes world of pharmaceuticals, intellectual property—specifically patents—is the bedrock of value creation. Patents provide the period of market exclusivity necessary for innovator companies to recoup the billions of dollars invested in research and development.61 However, for the savvy supply chain strategist, patent data is much more than just a legal shield; it is a powerful strategic intelligence tool. By systematically analyzing the global patent landscape, companies can predict market shifts, preempt competitive threats, and make far more informed decisions about where, when, and how to distribute their products. This is the patent playbook—a guide to transforming IP data from a legal concern into a source of profound competitive advantage.

Using Patent Intelligence to Predict and Preempt Competition

The lifecycle of a blockbuster drug is defined by its patent status. During the period of market exclusivity, the innovator company enjoys a monopoly, allowing for premium pricing and high margins. But this period is finite. The moment the key patents expire, the market is thrown into turmoil by the arrival of generic competitors. This event, famously known as the “patent cliff,” is one of the most disruptive forces in the industry, capable of wiping out 80-90% of a drug’s revenue in a remarkably short period.61

The steepness of this revenue decline is directly proportional to the speed and intensity of generic competition. The data is clear and consistent:

- With the entry of the first few generic competitors (around 3), brand-name drug prices typically fall by about 20%.64

- As the market becomes saturated with 10 or more competitors, prices can plummet by a staggering 70-80% relative to the pre-generic brand price.64

For a supply chain and distribution strategist, being able to accurately predict the timing and intensity of this event is invaluable. This is where patent intelligence platforms like DrugPatentWatch become indispensable. By providing a comprehensive database of patent expiration dates, patent term extensions, ongoing litigation, and regulatory exclusivities, these tools allow companies to build sophisticated predictive models.65 A key predictor of how intensely a drug’s patents will be challenged is its market size; blockbuster drugs with large revenue streams are far more likely to attract early and numerous patent challenges from generic manufacturers seeking a piece of the prize.

This predictive capability has profound implications for distribution strategy. For the innovator company, knowing that a key product will face a wave of generic competition in, for example, three years, allows for proactive planning. They can begin to strategically shift their distribution and marketing resources toward newer, patent-protected products in their pipeline. They can explore lifecycle management strategies, such as developing a new, patent-protected formulation of the drug, to extend its commercial life. Or they can use the time to negotiate long-term contracts with payers and pharmacy benefit managers (PBMs) to lock in favorable terms before the market becomes commoditized.

This patent intelligence is not just a high-level strategic concern; it is a critical input for long-range logistics planning. The number of patent challengers and filers of Abbreviated New Drug Applications (ANDAs) is a powerful leading indicator of future supply chain complexity. A drug with a crowded field of patent challengers signals that, upon patent expiry, the market will fragment almost overnight. The distribution model will need to shift dramatically from a controlled, lower-volume system for a single branded product to a chaotic, high-volume, multi-competitor environment for a commoditized generic. This requires a completely different logistical setup: different warehousing strategies to handle products from multiple manufacturers, different freight contracts optimized for high volume and low cost, and different order management systems to handle a more fragmented customer base. By monitoring the patent landscape, the logistics team can anticipate this shift years in advance and begin preparing the necessary infrastructure, ensuring a smooth transition rather than a panicked reaction.

Aligning Global Market Entry with the International Patent Landscape

The strategic value of patent intelligence becomes even more pronounced when planning for international expansion. A fundamental principle of patent law is that patents are territorial; a patent granted by the U.S. Patent and Trademark Office provides no protection whatsoever in Brazil, India, or Germany.31 To secure market exclusivity, a company must file for and be granted a patent in every single country where it wishes to sell its product.70

This creates a complex global patchwork of patent protection. A drug may be protected by a strong patent in the United States and Europe, but have no patent protection in certain developing countries that have different patentability standards or where the company chose not to file. This patchwork is the strategic map for global market entry.

Patent Data as a Market Selection Tool

A comprehensive international IP strategy involves more than just filing patents. It requires a deep analysis of the existing patent landscape in target markets to ensure “Freedom to Operate” (FTO)—that is, to ensure that a new product does not infringe on any pre-existing patents held by competitors in that country.

This is where global patent databases become a critical tool for business development and distribution planning. By using a service like DrugPatentWatch to analyze the patent landscape for a specific therapeutic class across multiple countries, a company can:

- Identify “White Space” Opportunities: Discover markets with relatively low patent congestion, indicating a less crowded competitive field and a potentially easier path to market entry.73

- Avoid “Patent Thickets”: Identify markets where competitors have created dense and overlapping webs of patents (known as “patent thickets”) designed to block new entrants. Attempting to enter such a market could be prohibitively expensive and fraught with legal risk.

- Plan Staggered Launches: For a generic manufacturer, this intelligence is pure gold. It allows them to devise a strategic, staggered international launch plan. They can prioritize entering markets where the originator’s patent has already expired or was never granted, allowing them to secure a valuable first-mover advantage and establish market share before tackling more legally complex regions.66

Beyond these direct applications, the international patent landscape can be used as a sophisticated proxy for a market’s overall commercial attractiveness and maturity. The process of filing, prosecuting, and defending patents is expensive and time-consuming.61 Companies only undertake this significant investment in markets where they anticipate a substantial return. Consequently, a country with a robust patent system and a high volume of pharmaceutical patent filings is also likely to possess other characteristics of a mature market: a stable government, a well-developed healthcare infrastructure, established and reliable distribution channels, and a reimbursement system that values and pays for innovation.

This provides a powerful and efficient method for market prioritization. Instead of starting with a broad, top-down analysis of the economic and demographic data of fifty potential countries, a market entry strategist can begin with the patent data. By analyzing patent filing trends, they can quickly identify the 10-15 markets where the world’s leading innovator companies are already placing their strategic bets. This “patent-first” approach allows a company to focus its business development, regulatory affairs, and distribution planning resources on the most promising and viable opportunities, creating a more efficient and effective path to global expansion.

Regional Spotlights: Case Studies in International Distribution

The theoretical pillars of challenge and the strategic responses we’ve discussed are not abstract concepts; they manifest in unique and powerful ways in different parts of the world. To bring these ideas to life, it’s essential to examine how they play out on the ground. In this section, we will turn our focus to three distinct and strategically vital regions: the European Union, the Asia-Pacific, and Sub-Saharan Africa. Each presents a unique microcosm of the broader challenges of international pharmaceutical distribution, requiring tailored strategies and a deep understanding of the local context.

Case Study 1: The European Union – A Harmonized Market with Hidden Complexities

On the surface, the European Union appears to be a model of a harmonized market. With a single regulatory body—the European Medicines Agency (EMA)—for centralized drug approvals and the free movement of goods between member states, it offers the allure of a unified bloc of over 450 million people. However, beneath this veneer of harmony lies a layer of complexity that can trip up even the most seasoned distribution strategists.

The primary challenge is twofold. First is the rigorous enforcement of the Falsified Medicines Directive (FMD). This EU-wide track-and-trace system requires unique identifiers and anti-tampering devices on all prescription medicine packs, which must be verified at the point of dispense.6 While the goal is laudable, achieving compliance across 27 member states, each with its own national medicines verification system, requires a massive investment in technology and process integration. A failure to seamlessly exchange serialization data between a manufacturer, its 3PL, and the national systems can result in legitimate products being blocked at the pharmacy, leading to lost sales and patient access issues.

The second, and perhaps more unique, challenge is the phenomenon of parallel trade. Because the EU is a single market but drug prices are still set at the national level, a significant price differential often exists for the same drug between different member states. This creates a lucrative arbitrage opportunity for wholesalers to buy a drug in a lower-priced country (e.g., Greece or Portugal) and resell it in a higher-priced country (e.g., Germany or the UK), undercutting the manufacturer’s official price. This parallel trade, estimated to be worth over €6.3 billion in 2022, creates immense forecasting challenges for manufacturers, disrupts their intended pricing strategies, and can lead to unpredictable product shortages in the lower-priced source countries.

A successful distribution strategy for the EU, therefore, requires a dual focus. Operationally, it demands a robust, FMD-compliant serialization and data management system that can function flawlessly across the entire bloc. Strategically, it requires a sophisticated pricing and distribution model that anticipates and manages parallel trade flows. This may involve tiered pricing strategies, carefully managed supply quotas for certain markets, or direct-to-pharmacy distribution models that limit the ability of parallel traders to access large volumes of product. Mastering the EU market means looking beyond the promise of harmonization and preparing for its hidden complexities.

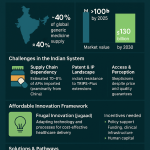

Case Study 2: The Asia-Pacific Growth Engine – Taming the Dragon and the Tiger

The Asia-Pacific region is the undisputed engine of future growth for the pharmaceutical industry, projected to be the fastest-growing market in the world.1 The sheer scale is breathtaking, with the regional pharmaceutical market expected to reach

$503.9 billion by 2030, growing at a CAGR of 7.1%. However, “Asia-Pacific” is not a single market; it is a vast and incredibly diverse collection of nations, each with its own unique challenges. The two giants of the region, China and India, exemplify this diversity.

China, the world’s second-largest pharmaceutical market, offers immense opportunity but is governed by a complex and rapidly evolving regulatory body, the National Medical Products Administration (NMPA). Gaining market access requires navigating a stringent approval process and a centralized procurement system that exerts significant pricing pressure. Logistically, while major coastal cities boast world-class infrastructure, distributing products to the vast rural interior presents significant last-mile challenges.

India, on the other hand, is a global powerhouse in generics and vaccine manufacturing, supplying an estimated 40% of the U.S.’s generic needs and 60% of the world’s vaccine orders. Its strength lies in low-cost, high-volume production. However, its domestic distribution network is highly fragmented, with a complex web of wholesalers and distributors. Infrastructure outside of major metropolitan areas can be unreliable, and maintaining an unbroken cold chain is a persistent challenge.

A successful strategy for the Asia-Pacific region must be built on a foundation of flexibility and deep local partnerships. It’s virtually impossible for a foreign company to navigate these markets alone. Success requires forging strong alliances with local distributors who understand the regulatory nuances, have established relationships with healthcare providers, and possess the on-the-ground infrastructure to manage the last mile. Furthermore, technology plays a crucial role. Leveraging IoT for real-time shipment and temperature tracking, and using data analytics for demand forecasting in these dynamic markets, are not luxuries but necessities. Finally, product adaptation is key—from creating packaging and labeling in local languages to developing formulations that are stable in hot and humid climates.

Case Study 3: Sub-Saharan Africa – Building Chains Where None Exist

If the EU is about navigating complexity and Asia is about managing diversity, Sub-Saharan Africa is often about building distribution networks from the ground up. For many parts of the continent, the challenge is not optimizing an existing supply chain, but creating one where it barely exists. The hurdles are immense and fundamental.

The last-mile delivery problem is at its most extreme here. Vast distances, poor or non-existent road networks, and a lack of reliable electricity make the delivery of any medicine a challenge, let alone temperature-sensitive ones. The cold chain infrastructure that is taken for granted in developed markets is often completely absent.19 This is a primary reason why access to modern medicines and vaccines remains tragically low in many regions.

Compounding this is the overwhelming threat of counterfeit drugs. With weak regulatory enforcement and porous borders, Sub-Saharan Africa is a primary target for counterfeiters. As noted earlier, an estimated 1 in 10 medical products in the region is fake or substandard, leading to hundreds of thousands of preventable deaths each year.35

Overcoming these profound challenges requires innovative models that move beyond traditional distribution strategies. The most successful initiatives in Africa have been born from collaboration:

- Public-Private Partnerships (PPPs): Organizations like Gavi, the Vaccine Alliance, and The Global Fund to Fight AIDS, Tuberculosis and Malaria have created powerful PPPs. They bring together the funding of donor governments, the expertise of pharmaceutical companies, and the on-the-ground reach of NGOs and local health ministries to procure and distribute essential medicines on a massive scale.

- Technological Leapfrogging: In a region that often lacks legacy infrastructure, there is a unique opportunity to leapfrog directly to next-generation technologies. A prime example is Zipline, a company that uses autonomous drones to deliver blood products, vaccines, and other medical supplies to remote clinics in countries like Rwanda and Ghana. This model completely bypasses the challenges of road-based transport, enabling rapid, on-demand delivery of critical supplies.

- Digitization: The case of Rwanda’s nationwide digital network for medical supply distribution is another powerful example. By creating a single, real-time platform to connect the Ministry of Health, distribution centers, hospitals, and clinics, the country has dramatically improved visibility, forecasting, and the overall efficiency of its healthcare supply chain, tracking medicines all the way to the individual patient.

Success in Africa is not about replicating Western models. It is about building new ones, forged through partnership, powered by innovative technology, and designed specifically for the unique challenges and opportunities of the continent.

The Future of Pharmaceutical Distribution: Predictions and Strategic Imperatives

As we look to the horizon, it’s clear that the forces reshaping pharmaceutical distribution are not abating; they are accelerating. The confluence of scientific breakthroughs, technological innovation, shifting consumer expectations, and a volatile global landscape is setting the stage for an even more dynamic and challenging decade ahead. For leaders in the industry, staying ahead of the curve requires not just adapting to current trends, but anticipating the future of the supply chain and building the capabilities to thrive within it.

Emerging Trends Shaping Tomorrow’s Supply Chain

Several macro-trends are poised to define the next era of pharmaceutical distribution. These are not futuristic fantasies; they are developments already in motion that will become mainstream over the next five to ten years.

The Rise of Direct-to-Patient (DTP) and Decentralized Models

The traditional, linear distribution model—manufacturer to wholesaler to pharmacy to patient—is beginning to fray at the edges. The rise of personalized medicine, cell and gene therapies, and digital health platforms is fueling a powerful shift towards more direct and decentralized models.83

- Direct-to-Patient (DTP): For many rare disease and specialty therapies, the DTP model is becoming the standard. Drugs are shipped directly from a specialty pharmacy or the manufacturer to the patient’s home. This provides greater control over the patient experience, improves adherence monitoring, and is often necessary for therapies that require specialized handling or administration support.

- Decentralized Clinical Trials: The COVID-19 pandemic accelerated the adoption of decentralized clinical trials, where investigational drugs are shipped directly to trial participants’ homes, and data is collected remotely. This model requires a highly sophisticated and reliable DTP logistics capability.

- Direct-to-Pharmacy/Hospital: To gain greater control over pricing and combat parallel trade, some manufacturers are experimenting with models that bypass the wholesaler and sell directly to large pharmacy chains or hospital networks.

These models demand a completely new set of logistical competencies, focused on individual, high-touch deliveries rather than bulk pallet shipments.

The Sustainability Mandate: The Green Supply Chain

The environmental impact of the global supply chain is coming under intense scrutiny from regulators, investors, and consumers alike. The pharmaceutical industry, with its energy-intensive manufacturing processes and complex global transportation networks, will face increasing pressure to build “greener” supply chains. This will become a key competitive differentiator and, in many jurisdictions, a regulatory requirement.

Key focus areas will include:

- Reducing Carbon Footprint: Optimizing transportation routes to reduce fuel consumption, shifting from air freight to sea freight where possible, and adopting electric vehicles for last-mile delivery.

- Sustainable Packaging: A major push towards reusable, temperature-controlled packaging solutions to reduce waste from single-use insulated shippers. There is also a growing focus on using recyclable and biodegradable materials for secondary packaging.85

- Green Manufacturing: Adopting more energy-efficient processes and renewable energy sources in manufacturing and warehousing facilities.

The Empowered Consumer and the Demand for Transparency

Patients are no longer passive recipients of healthcare. Empowered by the internet and data from wearable devices and personal genetic tests, they are becoming active, informed consumers who demand more from the healthcare system. This consumerization of healthcare will have a direct impact on the supply chain. Patients will increasingly expect the same level of convenience, speed, and transparency from their pharmacy as they do from Amazon. They will want to know where their medicine is, when it will arrive, and, crucially, that it is authentic and has been handled properly. This will accelerate the adoption of technologies like blockchain and real-time tracking that can provide this end-to-end visibility directly to the end-user.

Organizational Agility as the Ultimate Differentiator

Perhaps the most important trend of all is the recognition that we are living in an era of “permacrisis”. The future will not be a return to stability; it will be a continuous stream of volatility, driven by geopolitical unrest, climate-related natural disasters, cyber threats, and future pandemics.

In this environment, the most critical competitive advantage will not be scale or cost, but organizational agility. The companies that will win will be those that can navigate, pivot, and bounce back from disruption faster and more effectively than their rivals.26 This requires building a supply chain that is not just efficient, but also flexible, resilient, and intelligent. It demands a culture of proactive risk management, an embrace of predictive analytics, and a network of collaborative partners who can act in concert to overcome unforeseen challenges.

Conclusion: From Supply Chain to Value Chain

The journey we have taken through the complex world of international pharmaceutical distribution reveals a clear and powerful truth: the role of the supply chain has fundamentally and irrevocably changed. It can no longer be viewed as a back-office, operational function—a mere cost center focused on moving boxes from point A to point B. In the 21st-century pharmaceutical industry, the supply chain is the strategy.

It has evolved into a strategic Value Chain, a critical enabler of competitive advantage where value is created or destroyed at every step.

- Value is created when a robust, compliant track-and-trace system not only secures the supply chain but also provides the business intelligence to outmaneuver competitors.

- Value is created when a flawless cold chain ensures that a billion-dollar biologic therapy reaches a patient with its efficacy perfectly intact, delivering the life-changing outcome it promised.

- Value is created when a deep understanding of the international patent landscape allows a company to strategically sequence its market entries, maximizing revenue and patient access.

- Value is created when a resilient, geographically diversified manufacturing network allows a company to continue supplying critical medicines to patients while its rivals are paralyzed by a geopolitical crisis.

The challenges are immense, but the path forward is clear. It requires a relentless commitment to harnessing the power of technology—not as a collection of shiny objects, but as an integrated system for creating a predictive, self-aware supply network. It demands a shift in mindset from transactional relationships to deep, collaborative partnerships, building ecosystems of trust and shared data. And it calls for a new breed of leader, one who understands that in this industry, the quality of your logistics is inseparable from the quality of your medicine.

The companies that embrace this new reality—that invest in the technology, the partnerships, and the intelligence to build the resilient, patient-centric value chains of the future—will not only navigate the perils of the global market. They will dominate it. They will be the ones who fulfill the ultimate promise of this industry: to deliver the miracle of modern medicine to every corner of the globe, safely, reliably, and with unwavering integrity.

“An estimated 1 in 10 medical products circulating in low- and middle-income countries is either substandard or falsified, according to new research from WHO… Not only is this a waste of money for individuals and health systems that purchase these products, but substandard or falsified medical products can cause serious illness or even death.”

— World Health Organization (WHO), 2017

Key Takeaways

- The Market is a High-Stakes Duality: The global pharmaceutical market is projected to reach $3.03 trillion by 2034, with growth driven by two distinct segments: high-value, sensitive biologics and high-volume, low-margin generics. Success requires mastering two different distribution strategies—a high-touch, integrity-focused model for the former and a hyper-efficient, cost-focused model for the latter.

- Regulation is a Double-Edged Sword: Complying with a fragmented web of global regulations, especially track-and-trace mandates like the U.S. DSCSA and EU FMD, is a major operational and financial burden. However, the data generated by these systems offers a strategic opportunity to gain unprecedented supply chain visibility, which can be leveraged for improved forecasting and efficiency.

- Resilience Trumps Cost Efficiency: Geopolitical instability, trade wars, and the lessons of the COVID-19 pandemic have ended the era of pure cost optimization in supply chain design. The new strategic imperative is resilience, driving a “great rebalancing” toward onshoring, regional manufacturing hubs, and diversified sourcing of critical APIs to reduce over-reliance on single countries.

- Technology is the Key Enabler: The convergence of Artificial Intelligence (for predictive analytics), the Internet of Things (for real-time monitoring), and Blockchain (for security and traceability) is creating “sentient” supply chains. These technologies are essential for managing the complexities of cold chain logistics, combating counterfeits, and shifting from a reactive to a predictive operational model.

- Partnerships are Non-Negotiable: No company can navigate the global landscape alone. Success depends on building a collaborative ecosystem of partners, including specialized global 3PLs for scale and expertise, local distributors for in-country knowledge, and public-private partnerships for tackling large-scale public health challenges.

- Patent Intelligence is a Strategic Weapon: Patent data is a powerful tool for competitive advantage. By using platforms like DrugPatentWatch, companies can predict the timing and intensity of generic competition to inform their distribution and pricing strategies. Analyzing the international patent landscape is also critical for prioritizing market entry and identifying regions with the most favorable commercial and regulatory environments.

- Security is a Brand Differentiator: In an environment of widespread counterfeit drugs and growing cyber threats, a verifiably secure supply chain is a powerful tool for building trust. Companies that can demonstrate the integrity of their products from factory to patient can create a strong brand advantage and foster patient loyalty.

Frequently Asked Questions (FAQ)

1. How can a small or mid-sized pharmaceutical company with limited resources effectively prioritize its international distribution strategy?

For smaller companies, a “patent-first” approach to market selection is highly effective. Instead of conducting costly, broad-based market research across dozens of countries, they can leverage patent intelligence databases like DrugPatentWatch to analyze where larger, innovator companies are concentrating their patent filings for similar therapeutic classes. This data serves as a powerful proxy for markets with attractive commercial potential, established regulatory pathways, and robust healthcare infrastructure. By focusing on a shortlist of these “proven” markets, smaller companies can concentrate their limited resources where the probability of success is highest. Furthermore, they should prioritize a partnership-heavy model, leveraging the existing networks of specialized 3PLs and in-country distributors rather than attempting to build expensive infrastructure themselves.

2. What is the single biggest misconception executives have about implementing blockchain technology in their supply chain?

The biggest misconception is that blockchain is a standalone “magic bullet” for traceability. Many executives view it as a turnkey technology that can simply be “plugged in” to solve all security and transparency problems. In reality, blockchain’s value is entirely dependent on the quality of the data that enters it and its integration with other systems. A blockchain is an immutable ledger; if you feed it bad data, it becomes an immutable record of bad data. Its true power is only unlocked when it is part of a converged technology stack, serving as the secure data integrity layer for information generated by IoT sensors (for real-time condition data) and analyzed by AI engines (for predictive insights). The strategic focus should be on building this integrated ecosystem, not just on “implementing blockchain.”

3. With the rise of biologics, is the traditional pharmaceutical wholesaler model becoming obsolete?

The traditional wholesaler model is not becoming obsolete, but its role is evolving and bifurcating. For high-volume, small-molecule generics and OTC products, the wholesaler’s role as a hyper-efficient aggregator and distributor remains critical for achieving broad market access at a low cost. However, for many high-value, specialty biologics and cell and gene therapies, the model is shifting. These products often require a more controlled, limited distribution network involving specialty pharmacies and direct-to-patient (DTP) logistics providers who can manage complex reimbursement, ensure patient adherence, and maintain a flawless cold chain. Therefore, the future will see a dual-channel system where manufacturers rely on traditional wholesalers for broad-market products and a network of specialty distributors for their high-touch biologic portfolios.

4. How will the increasing focus on sustainability tangibly impact pharmaceutical distribution costs and strategies?

Initially, the shift to a more sustainable supply chain will likely increase operational costs. Investments in reusable temperature-controlled packaging, electric vehicle fleets, and energy-efficient warehouses require significant upfront capital. The reverse logistics needed to manage reusable packaging also adds a layer of complexity and cost. However, in the medium to long term, these investments can lead to a net positive financial impact. Reduced waste from single-use packaging, lower energy consumption, and optimized transportation routes can generate significant cost savings. Strategically, sustainability will become a “license to operate” in many markets, particularly in Europe, where regulations and consumer preferences are shifting rapidly. Companies with verifiably “green” supply chains will have a competitive advantage in securing contracts with environmentally-conscious health systems and will be better positioned to attract talent and investment.

5. As supply chains become more regionalized, what is the biggest risk that companies need to mitigate?

The biggest risk of regionalization is creating new, albeit different, points of concentration and failing to address vulnerabilities further upstream. For example, onshoring the final drug product manufacturing to the U.S. or Europe provides little security if 100% of the critical starting materials or APIs for that drug are still sourced from a single overseas supplier. A truly resilient strategy requires a multi-layered approach to diversification. Companies must map their supply chains down to the tier-two and tier-three supplier level to identify and mitigate these hidden concentration risks. The goal is not just to have a factory in every region, but to ensure that each regional hub has a diversified and redundant network of suppliers for its critical inputs, creating a web of resilience rather than a series of isolated and potentially vulnerable regional fortresses.

References

- Precedence Research. (2025, June 16). Pharmaceutical Market (By Type: Prescription, Over-the-counter (OTC); By Molecule Type: Conventional Drugs (Small Molecules), Biologics & Biosimilars (Large Molecules); By Product: Branded, Generic; By Disease; By Route of Administration; By Age Group; By Distribution Channel) – Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2025-2034. Retrieved from https://www.precedenceresearch.com/pharmaceutical-market

- Grand View Research. (n.d.). Global Pharmaceutical Market Size & Outlook, 2024-2030. Retrieved from https://www.grandviewresearch.com/horizon/outlook/pharmaceuticals-market-size/global

- Towards Healthcare. (n.d.). Pharmaceutical Market Size Projects USD 3,033.21 Billion by 2034. Retrieved from https://www.towardshealthcare.com/insights/pharmaceutical-market-sizing

- Technavio. (2025, February 6). Pharmaceuticals Wholesale & Distribution Market to grow by USD 896.5 Billion from 2024-2028, Driven by Growing Global Pharmaceutical Sales, Report on How AI is Driving Market Transformation. PR Newswire. Retrieved from https://www.prnewswire.com/news-releases/pharmaceuticals-wholesale–distribution-market-to-grow-by-usd-896-5-billion-from-2024-2028–driven-by-growing-global-pharmaceutical-sales-report-on-how-ai-is-driving-market-transformation—technavio-302369842.html

- Technavio. (n.d.). Pharmaceuticals Wholesale And Distribution Market size to grow by USD 976.2 billion from 2024 to 2029, Growing initiatives on global pharmaceutical sales to drive growth. Technavio Newsroom. Retrieved from https://newsroom.technavio.org/pharmaceuticals-wholesale-and-distributionmarket