The Labyrinthine Landscape of Pharmaceutical Pricing

The pharmaceutical industry exists in a complex ecosystem where the fundamental economic principles of supply and demand are heavily influenced, and often distorted, by a unique confluence of factors: the immense costs of research and development, the criticality of medical need, the intricate web of regulatory frameworks, and the diverse objectives of numerous stakeholders.1 For business professionals seeking to carve out a dominant position in this dynamic market, a granular understanding of these underlying forces is not merely beneficial; it is absolutely essential.

Economic Foundations and Market Realities

At its core, pharmaceutical pricing is a delicate balancing act, striving to reconcile the imperative for profitability with the societal demand for accessible, life-saving medications. The economic principles at play here are often far from the textbook ideal of a perfectly competitive market.

Supply, Demand, and Inelasticity for Essential Medicines

Consider the basic tenets of supply and demand. In a competitive market, price is determined at the intersection of these two curves. However, for many pharmaceuticals, particularly those addressing life-threatening or debilitating conditions, demand is profoundly inelastic.2 Patients facing cancer, HIV, or other severe illnesses often have no viable alternatives and are willing to pay a premium, regardless of the price, to alleviate suffering or prolong life.2 This inherent inelasticity grants pharmaceutical companies significant pricing power, allowing them to set prices that might seem exorbitant in other sectors, even when production costs are relatively low.3 Conversely, for non-life-threatening conditions, demand can be more elastic, making patients more sensitive to price changes and potentially leading them to seek alternative treatments or forego treatment entirely if costs are too high.

R&D Costs: The Innovation Imperative

A cornerstone argument for high drug prices revolves around the monumental costs and inherent risks associated with pharmaceutical research and development (R&D).1 Developing a new drug is a long, arduous, and incredibly expensive journey, typically spanning over a decade from concept to market and costing billions of dollars.6 Estimates for the average cost to develop a new drug range from $879.3 million to $2.3 billion, with the clinical phase alone accounting for approximately 69% of overall R&D expenditures.6 This figure is often cited as a justification for high launch prices, as companies must recoup these investments and fund future innovation, especially given the high failure rate—only about 11% of drug candidates entering clinical trials ultimately succeed.9 This substantial upfront investment, coupled with the high probability of failure, creates a unique economic pressure that profoundly shapes pricing strategies.

Uniqueness, Efficacy, and Competition

The market dynamics for a drug are heavily influenced by its uniqueness, proven efficacy, and the competitive landscape.1 A drug that offers a truly novel mechanism of action, superior efficacy, or addresses a previously unmet medical need can command a higher price due to its distinct value proposition.1 Conversely, if a market is saturated with multiple drugs treating the same condition, new entrants are likely to face pressure to price lower. Competition from generic or biosimilar products, once patents expire, serves as a powerful force in driving down prices.2 This interplay of innovation, clinical benefit, and market rivalry dictates how much a company can realistically charge and how long it can sustain premium pricing.

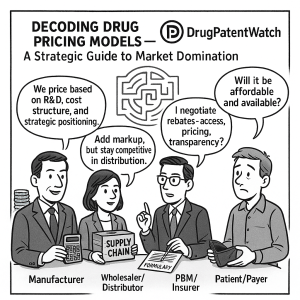

Key Stakeholders and Their Influence

The pharmaceutical pricing ecosystem is a multi-stakeholder arena, each participant wielding distinct influence over the final price and patient access. Understanding these roles is crucial for any strategic market approach.

Manufacturers: The Price Setters

Pharmaceutical manufacturers are the initial arbiters of a drug’s list price when it is first introduced to the market. Their pricing decisions are informed by a complex calculus that includes R&D costs, production expenses, regulatory requirements, and competitive analysis. While manufacturers control the initial list price, the journey of a drug through the supply chain involves various adjustments and negotiations that significantly alter the final cost paid by patients and payers.

Wholesalers and Distributors: The Supply Chain Backbone

Wholesalers and distributors act as the logistical arteries of the pharmaceutical supply chain, transporting drugs from manufacturers to pharmacies and healthcare providers, ensuring a steady supply.5 While their margins are often regulated, particularly in countries like Germany, they play a vital role in ensuring product availability and can influence the final cost through their markups and efficiency.11

PBMs and Insurers: Gatekeepers of Access and Cost

Pharmacy Benefit Managers (PBMs) are powerful intermediaries, acting as the nexus between pharmacies, plan sponsors, manufacturers, and wholesalers.5 Their primary function is to manage drug benefits for insurers and employers, aiming to reduce drug costs for their clients by negotiating rebates and discounts with manufacturers.5 PBMs create and maintain formularies—lists of covered drugs—and their decisions heavily influence which medications patients can access and at what cost.13 However, their role has drawn increasing scrutiny due to concerns about transparency, with allegations that they sometimes retain a portion of negotiated rebates or engage in “spread pricing,” charging health plans more than they reimburse pharmacies, thereby potentially inflating drug costs.13 The three largest PBMs—Express Scripts, CVS Caremark, and OptumRx—processed approximately 79% of all prescription drugs in 2022, serving about 290 million Americans, highlighting their immense market power.

Insurance companies, as payers, manage drug benefits and are key negotiators in the pricing landscape. Their coverage decisions, formulary placements, and negotiated discounts directly impact patient out-of-pocket expenses and manufacturer revenue.

Government Agencies: Regulators and Purchasers

Governments wield significant influence through their roles in creating and implementing regulations that directly impact drug pricing and reimbursement. In many countries, governments regulate pharmaceutical prices through mechanisms such as price controls, reference pricing, or direct negotiation.2 In the U.S., while the government traditionally has not directly set prices for most drugs, federal programs like Medicare and Medicaid are major purchasers, and recent legislation like the Inflation Reduction Act of 2022 has empowered Medicare to negotiate prices for certain high-cost drugs.1

Healthcare Providers and Patients: The Frontline and End-Users

Healthcare providers (HCPs), including physicians, hospitals, and pharmacies, are on the front lines of drug dispensation and patient care.5 Their prescribing decisions are influenced by a drug’s efficacy, safety, and perceived value, but also by its cost and formulary status.1 Patients, as the ultimate consumers, bear the direct impact of drug prices through co-pays, deductibles, and out-of-pocket expenses. High prices can limit patient access, forcing individuals to forego treatment or seek more affordable alternatives.2 This can lead to critical issues like medication non-adherence, which carries substantial economic ramifications and adverse health outcomes.18

Historical Evolution of Drug Pricing and Regulation

The current complex landscape of pharmaceutical pricing is a product of decades of evolving regulatory frameworks, market forces, and societal demands. A historical perspective reveals the dynamic interplay between innovation incentives and access imperatives.

A Glimpse into the Past: US Regulatory Milestones

The United States, notably, has historically operated with less centralized drug price regulation compared to many other developed nations, leading to significantly higher drug prices.20 This unique trajectory is marked by several pivotal legislative acts.

Early Regulations and the FDA’s Genesis

Federal controls over the drug supply in the U.S. began as early as 1848 with the Drug Importation Act, aiming to prevent adulterated drugs from entering the country. The U.S. Pharmacopeia was established in 1820, setting standards for drugs. The Pure Food and Drugs Act of 1906 prohibited interstate commerce in misbranded and adulterated foods and drugs, laying the groundwork for modern drug regulation. Subsequent acts, such as the Durham-Humphrey Amendment of 1952, defined prescription-only drugs, further shaping the market. These early milestones primarily focused on drug quality, safety, and labeling, rather than direct price controls.22

Medicare Part D and the Negotiation Ban

A significant turning point occurred in 2003 with the passage of the Medicare Prescription Drug, Improvement, and Modernization Act, which created Medicare Part D. While providing a much-needed prescription drug benefit for seniors, this act notably included a provision that prevented Medicare, the nation’s largest single-payer healthcare system, from directly negotiating drug prices with manufacturers. This effectively allowed drug companies to set their own prices for a vast segment of the market, contributing to the unregulated pricing variations seen in the U.S.. This legislative choice has been a central point of contention in the ongoing debate over drug affordability.

The Affordable Care Act (ACA) and Coverage Expansion

The Patient Protection and Affordable Care Act (ACA), enacted in 2010, aimed to expand health insurance coverage and reduce the impact of healthcare spending on households. While not directly imposing price controls, the ACA introduced provisions like a 50% discount on brand-name drugs for seniors within the Medicare Part D “donut hole” and aimed to close this coverage gap by 2020. The law’s broader impact on increasing insured populations indirectly influenced market dynamics and the demand for pharmaceuticals.

The Inflation Reduction Act (IRA) and Medicare Negotiation

More recently, the Inflation Reduction Act (IRA) of 2022 marked a historic shift in U.S. drug pricing policy.1 This landmark legislation empowers the U.S. Department of Health and Human Services to negotiate the prices of select high-cost prescription drugs covered under Medicare Part D, beginning in 2026, and Medicare Part B, starting in 2028.1 The first ten drugs selected for negotiation under this act were announced in August 2024, with estimated savings of $6 billion for Medicare and $1.5 billion in out-of-pocket costs for beneficiaries in 2026. This represents a significant departure from the previous non-negotiation stance and is expected to put a check on skyrocketing drug prices.

Global Regulatory Approaches: A Comparative Analysis

While the U.S. has historically favored a less regulated approach, many other developed nations have long employed systematic mechanisms to control drug prices, leading to notable international price disparities. In 2022, U.S. drug prices across all categories were nearly three times higher than in 33 OECD comparison countries, with brand-name drugs being 422% of prices in those countries.24

European Price Controls and Harmonization Efforts

European countries have a long history of government intervention in pharmaceutical pricing. Mechanisms include product price controls (e.g., France, Italy, Portugal, Spain), reference pricing (e.g., Germany, Netherlands), and profit controls (e.g., UK).15 The European Medicines Agency (EMA), founded in 1995, plays a crucial role in assessing medicine efficacy and safety across the EU, promoting research and innovation, and harmonizing regulatory standards. While EMA focuses on scientific assessment and safety, individual member states retain significant autonomy over pricing and reimbursement decisions.

In France, drug prices are determined based on added therapeutic value and external reference pricing, with negotiations setting prices and limiting increases. France also prohibits price increases after launch and reduces prices on older drugs to fund newer ones. The UK’s National Health Service (NHS) controls prices through voluntary and statutory schemes, regulating profits and imposing levies if spending exceeds caps.29 Germany’s AMNOG process, implemented in 2011, evaluates new drugs’ benefits and negotiates reimbursement prices, with older drugs often subject to reference pricing.12 These stringent price controls in Europe have been linked to lower drug prices compared to the U.S., but also raise concerns about potential impacts on innovation and timely access to new medicines.26

Canada’s Patented Medicine Prices Review Board (PMPRB)

Canada operates a hybrid system of drug price control, primarily through the Patented Medicine Prices Review Board (PMPRB), established in 1987.15 The PMPRB’s mandate is to regulate the prices of patented medicines to ensure they are not excessive, balancing intellectual property rights with consumer protection and healthcare sustainability.33 The Board considers factors such as prices in other countries, prices of comparable drugs, and changes in the Consumer Price Index (CPI). This system has historically resulted in Canadian drug prices being lower than in the U.S., and has influenced R&D spending commitments from the pharmaceutical industry.

International Reference Pricing (IRP) and its Global Impact

International Reference Pricing (IRP), or external reference pricing, is a widely adopted price control mechanism where governments consider drug prices in other countries to inform or establish their own domestic prices.20 Nearly all EU member countries and most OECD countries utilize some form of IRP, often as a negotiation factor rather than a direct price-setting mechanism.

While IRP can be an effective cost-containment tool, it presents complexities. Prices may not be directly comparable across markets due to differences in disease burden, willingness to pay, market structures, and components included in prices (e.g., taxes, distributor margins). A significant concern is the potential for distorted incentives: pharmaceutical manufacturers may delay product launches or limit supply to low-price countries that are used as reference points, to avoid triggering lower prices in higher-value markets. This highlights a tension between national cost control and global access to innovation.

Traditional and Emerging Drug Pricing Models

The pharmaceutical industry employs a diverse array of pricing models, ranging from long-established methods to innovative new approaches designed to navigate the complexities of modern healthcare systems and high-cost therapies.

Foundational Pricing Strategies

Understanding the bedrock of pharmaceutical pricing is essential before delving into its more intricate variations.

Cost-Plus Pricing: Simplicity vs. Market Dynamics

Cost-plus pricing is a straightforward strategy where a company determines a product’s selling price by adding a fixed markup (usually a percentage) to its total unit cost, encompassing R&D, manufacturing, regulatory, and overhead expenses.5 This method is commonly used by generic pharmaceutical companies due to their lower R&D burdens. While it offers simplicity and ensures cost recovery, it often fails to account for market demand, competitive pressures, or the perceived value of the drug to patients and payers. In highly competitive markets, cost-plus pricing may not be optimal for maximizing revenue or market share.

Value-Based Pricing: Aligning Price with Outcomes

Value-based pricing (VBP) is a strategy that sets a drug’s price based on its perceived value to the market, which includes its efficacy, safety, impact on patient outcomes, and cost-effectiveness within the healthcare system.5 This approach moves beyond mere production costs to reflect the actual health gains and societal benefits a drug delivers.40 For innovative and unique products, VBP is often considered the most appropriate strategy.

VBP requires a comprehensive assessment of a medicine’s benefits and then aligning net prices with that assessed value. While conceptually appealing, implementing VBP can be challenging due to difficulties in measuring real-world outcomes, collecting timely and accurate data, and navigating existing pricing structures and regulations that may not be compatible.41 Despite these hurdles, VBP holds significant potential to bring value to pharma companies, payers, patients, and providers, particularly in critical therapeutic areas like oncology and cardiovascular disease.

Competitive Pricing: Navigating Market Saturation

Competitive pricing is driven by what competitors offer for similar products in the market.5 Companies using this strategy set their prices relative to their rivals, often aiming to gain market share or ensure a drug reaches a larger population quickly by offering lower prices (penetration pricing). This approach is frequently employed by small and medium-sized pharmaceutical companies. In markets with many competitors, prices tend to be lower, while limited competition allows for higher pricing.

Volume-Based Pricing and Tendering

Volume-based pricing ties the price per unit to the quantity of products sold; the more units sold, the lower the price per unit.38 This strategy is often utilized by large pharmaceutical companies with high sales volumes. Tendering involves a competitive bidding process where a single or limited number of winners are awarded contracts to supply medicines, often used to drive down prices, particularly for off-patent drugs. While effective for cost savings, broad tenders can sometimes undervalue therapeutic differences between medicines and erode innovation incentives.

Skimming and Penetration Pricing

Skimming pricing involves charging a high initial price for an in-demand drug and then gradually lowering it over time. This strategy is typically used for novel, highly differentiated products with little competition. Conversely, penetration pricing involves offering prices lower than the competition to quickly gain market share or ensure rapid adoption by a larger patient population.

Complex Pricing Mechanisms and Adjustments

Beyond the core strategies, the pharmaceutical market employs several complex mechanisms that influence the actual transaction price of a drug.

Wholesale Acquisition Cost (WAC), Average Wholesale Price (AWP), and Average Manufacturer Price (AMP)

These terms represent different benchmarks in the drug pricing chain :

- Wholesale Acquisition Cost (WAC): This is the manufacturer’s list price, the highest price at which the drug can be sold to wholesalers or distributors.

- Average Wholesale Price (AWP): Often used by pharmacies as a pricing benchmark, AWP is typically higher than WAC, as it includes a markup for wholesalers and distributors.

- Average Manufacturer Price (AMP): This represents the average price paid by wholesalers to manufacturers for a drug. AMP is crucial for government programs like Medicaid, which use it to set reimbursement rates.

These benchmarks, while seemingly straightforward, contribute to the opacity of drug pricing, as the actual price paid by the end-user can vary significantly.

Gross-to-Net Adjustments, Discounts, and Rebates

The “gross-to-net adjustment” refers to the reduction applied to the WAC price to account for various discounts and rebates given to wholesalers, PBMs, and other intermediaries. These adjustments can substantially reduce the net price of a drug received by the manufacturer. Rebates, often negotiated confidentially between manufacturers and PBMs/insurers, are a significant component of these adjustments, influencing formulary placement and market access.13 While intended to lower costs, the complex interplay of rebates can sometimes lead to higher list prices, as manufacturers may raise prices to accommodate larger rebates, which do not always translate into lower out-of-pocket costs for patients.

Tiered Pricing: Segmentation for Access and Profitability

Tiered pricing involves setting different prices for the same treatment across various market segments or for different payer types.39 This allows pharmaceutical companies to adapt their pricing to the specific needs and characteristics of each market or payer. For instance, a company might set a higher price in a market with limited competition and a lower price in a more competitive or price-sensitive market. This strategy also extends to patient-facing costs, where insurance plans categorize drugs into tiers (e.g., generic, preferred brand, non-preferred brand, specialty), with higher tiers typically incurring greater out-of-pocket costs for patients. This encourages the use of more cost-effective options when available.

Innovative Payment Models: A Glimpse into the Future

The rising costs of novel therapies, particularly in areas like gene therapy, have spurred the development of innovative payment models that move beyond traditional fee-for-service arrangements. These models aim to align drug costs with real-world effectiveness and manage budget impact.

Outcomes-Based Agreements (OBAs) and Risk-Sharing Agreements (RSAs)

Outcomes-Based Agreements (OBAs), also known as performance-based risk-sharing agreements, link a drug’s price to its real-world efficacy and patient outcomes.42 In these arrangements, a pharmaceutical company and an insurer agree on specific performance targets; if achieved, an additional payment is triggered from the insurer to the drug maker, or a rebate is provided if outcomes are not met.42 This model aims to ensure that the cost of medication reflects its actual value, incentivizing manufacturers to develop truly effective treatments and sharing the financial risk between parties.41

A well-publicized example is Novartis’s Entresto, a heart failure drug. In 2016, Novartis entered agreements with private insurers like Harvard Pilgrim, Cigna, and Aetna, offering additional rebates if hospitalization rates among patients prescribed Entresto were higher than expected. In return, Entresto received preferred formulary status, leading to lower patient co-payments and increased prescribing. These agreements are particularly useful when there is uncertainty about a drug’s effectiveness in real-world settings or in highly competitive markets.

Subscription Models: The “Netflix” Approach

The “Netflix model” for drug pricing is a subscription-based framework where payers (typically government health programs) provide a fixed upfront payment to a pharmaceutical company for unlimited access to specific medications over a defined period.51 This decouples payment from volume, offering budget certainty for healthcare systems and potentially broader access for patients.

Louisiana pioneered this model for hepatitis C treatments, securing unlimited access to generic Epclusa through a five-year contract with Asegua Therapeutics (a Gilead subsidiary). By capping spending at $35 million, the state aimed to treat 10,000 Medicaid beneficiaries and prison inmates by 2020, a tenfold increase over previous rates. The UK has also explored this model for new antibiotics to incentivize R&D against resistant bacteria, addressing a market failure where traditional volume-based models offer insufficient returns for antibiotic development.51

Annuity-Based and Warranty Models

Annuity-based contracts extend payments or rebates over time, breaking them into installments based on achieving defined outcome metrics. This model can reduce the immediate financial burden of high-cost, single-administration therapies, offering cash flow benefits to payers. For example, GSK’s Strimvelis, a gene therapy, has utilized an annuity-based model where payments are made over time, with reductions if predetermined outcome measures are not met.

The warranty model offers a guaranteed rebate or remediation if negative financial or health outcomes occur. This allows payers to recoup funds from manufacturers if the drug’s performance does not meet established goals.

Gene Therapy Pricing: Unique Challenges and Solutions

Gene therapies represent a new frontier in medicine, offering the potential for one-time cures for devastating diseases. However, they come with unprecedented price tags, averaging $2 million to $3 million for a single administration.54 These high upfront costs, coupled with the inherent uncertainty surrounding long-term efficacy and safety data, pose significant challenges for payers.54 For instance, treating all eligible U.S. sickle cell disease patients on Medicaid with a $2 million gene therapy could require over $120 billion in additional funds.

Innovative payment models, such as distributed payments (spreading costs over time) and rebate-based payments (upfront payment with a rebate tied to outcomes), are being explored to address these challenges. The Centers for Medicare & Medicaid Services (CMS) is even exploring a Cell and Gene Therapy Access Model to negotiate and administer outcomes-based agreements for these therapies, recognizing the need for novel approaches to ensure access and manage budget impact.

Market Dynamics, Competition, and Strategic Imperatives

Market domination in the pharmaceutical sector is not solely about developing breakthrough drugs; it hinges on a sophisticated understanding of market dynamics, the strategic use of intellectual property, and a keen awareness of the broader societal context.

The Critical Role of Patent Protection

Patents are the bedrock of the pharmaceutical business model, granting temporary monopolies that allow companies to recoup their substantial R&D investments and incentivize future innovation.9 However, the strategic manipulation of these protections has become a contentious issue.

Patent Lifecycle and Market Exclusivity

A drug patent typically grants exclusive rights to manufacture and sell a new drug for 20 years from the filing date.57 This period of market exclusivity is crucial for innovator companies to generate revenue without generic competition. However, the effective patent life is often shorter due to lengthy regulatory approval processes. Once a patent expires, generic manufacturers can enter the market with bioequivalent versions, typically priced 80-85% lower than their branded counterparts, leading to a rapid decline in the original drug’s market share and revenue. This “patent cliff” is a major strategic challenge for pharmaceutical companies.

Evergreening and Patent Thickets: Extending Monopoly

“Evergreening” refers to strategies employed by pharmaceutical companies to extend market exclusivity beyond the original patent term by securing secondary patents on minor modifications, such as new formulations, uses, dosages, or methods of delivery.59 While some argue these represent incremental innovations, critics contend they primarily serve to delay generic entry and inflate drug prices.59

“Patent thickets” are dense webs of numerous, overlapping patents on a single drug, designed to deter generic or biosimilar competition due to the high cost and risk of litigation.61 For instance, AbbVie amassed over 100 patents for Humira, delaying biosimilar entry until 2023 despite its 2002 launch, generating billions in revenue.61 These practices are seen by many as systemic abuses of intellectual property protections that prioritize corporate profits over patient access.

Pay-for-Delay and Product Hopping

“Pay-for-delay” or “reverse payment” settlements occur when a brand-name drug manufacturer pays a generic company to delay its market entry, resolving patent litigation.56 Critics argue these agreements are anticompetitive, allowing the brand to maintain high prices without risking patent invalidation. “Product hopping” involves a brand manufacturer switching the market to a new, similar product with later-expiring patents just before the original drug’s patent expires.63 This can make it difficult for generic versions of the older product to be automatically substituted, thereby extending market dominance and high prices.

Competitive Patent Analysis: A Strategic Tool

For businesses, competitive patent analysis is a crucial strategic tool. By meticulously analyzing patent landscapes, including the Orange Book listings (which describe FDA-approved products and their patents), companies can identify potential patent thickets, assess the strength of competitor IP, and anticipate generic entry timelines. This intelligence is vital for informing R&D investments, market entry strategies, and potential litigation. Tools like DrugPatentWatch provide critical data and insights into patent expiry dates, market exclusivity, and competitive intelligence, enabling pharmaceutical companies to plan their product lifecycles and market strategies effectively. Understanding these patent dynamics is paramount for maintaining a competitive edge and ensuring sustained market presence.

Market Failures and Their Systemic Implications

The pharmaceutical market, despite its innovative prowess, is inherently prone to several market failures that necessitate intervention to ensure socially optimal outcomes.3

Information Asymmetry and Agency Problems

A fundamental market failure is information asymmetry, where pharmaceutical companies possess extensive knowledge about their products’ effectiveness, safety, and value, while patients and even physicians often lack complete, unbiased information. This imbalance can lead to “agency problems,” where patients rely on physicians as their agents, but physicians may be influenced by marketing or lack comprehensive comparative effectiveness data, potentially leading to suboptimal prescribing practices. Health insurance can further exacerbate this by creating a “moral hazard,” making insured patients less sensitive to drug prices, potentially increasing demand.

Inelastic Demand and Monopoly Pricing

As discussed, the demand for essential medicines is often need-based and inelastic, meaning patients will pay a premium regardless of price.2 When coupled with the market exclusivity granted by patents, this inelastic demand allows pharmaceutical companies to engage in “monopoly pricing,” setting prices significantly above marginal cost.3 While patents are intended to incentivize innovation, this monopoly power can lead to prices that are unaffordable for many, particularly in low- and middle-income countries, creating a profound ethical dilemma between incentivizing innovation and ensuring equitable access.3

Externalities and Public Goods Characteristics

The consumption of pharmaceuticals can generate significant externalities. Positive externalities include herd immunity from vaccines, benefiting society beyond the individual patient. Conversely, negative externalities, such as the development of antimicrobial resistance due to inappropriate antibiotic use, can have widespread societal costs. Research and development, particularly basic research, also exhibits characteristics of a public good – it is non-rivalrous and non-excludable – leading to potential under-provision by the private market if not adequately incentivized. These externalities mean that market forces alone cannot optimally allocate resources for pharmaceutical development and access.

The Human Cost: Affordability, Access, and Adherence

The economic and market dynamics of drug pricing have profound human consequences, impacting patient health, financial well-being, and global health equity.

Patient Out-of-Pocket Costs and Financial Toxicity

High drug prices translate directly into significant out-of-pocket costs for patients through co-pays, deductibles, and co-insurance. In the U.S., these costs are a major barrier to care, with nearly 30% of Americans reporting that they have not taken their medication as prescribed due to expense. This can lead to “financial toxicity,” where patients are forced to make agonizing choices between life-saving medications and other essential needs like food or housing, often leading to overwhelming medical debt or bankruptcy. This phenomenon undermines the very purpose of medical innovation.

Impact on Patient Adherence and Health Outcomes

The inability to afford medications directly impacts patient adherence, which carries substantial economic ramifications and severe health risks.18 Medication non-adherence contributes to an estimated $500 billion in avoidable healthcare costs annually in the U.S., leading to more frequent hospitalizations, emergency room visits, and costly medical interventions.66 For instance, non-adherence is estimated to cause as many as 25% of hospitalizations each year. Studies show that over 1.1 million Medicare patients alone could die over the next decade because they cannot afford their prescribed medications.

Global Health Disparities and Access to Essential Medicines

The challenges of drug affordability are even more acute on a global scale, exacerbating existing health disparities. Nearly 2 billion people globally—more than a quarter of the world’s population—lack regular access to essential medicines due to issues of unavailability, unaffordability, inaccessibility, or poor quality.68 In low-income countries, imported brand-name pharmaceuticals are often prohibitively expensive, and even generic medicines may not be readily available. This creates a morally indefensible two-tiered healthcare system where health outcomes are dictated by economic privilege rather than medical need.

Drug Shortages: A Compounding Crisis

Compounding the crisis of high prices are persistent drug shortages, which have become a serious global public health challenge.71 In 2023, there was an average of 301 drugs in shortage per quarter in the U.S., a 13% increase from the previous year. These shortages, often caused by manufacturing issues, supply chain disruptions, or lack of incentives to produce low-margin generics, drive up healthcare costs and compromise treatment outcomes.19 Hospitals face increased expenses to manage shortages, sometimes adding as much as 20% to their drug costs as they seek alternative suppliers or more expensive substitutes. For consumers, shortages can lead to higher out-of-pocket costs, increased time and effort to locate medications, and adverse health outcomes due to treatment delays or suboptimal alternatives.

Strategic Imperatives for Market Domination

Achieving market domination in the pharmaceutical industry requires more than just scientific breakthroughs; it demands a sophisticated, data-driven, and ethically grounded strategic approach that navigates complex pricing models, regulatory landscapes, and societal expectations.

Leveraging Data and Analytics for Pricing Intelligence

In an increasingly competitive and regulated environment, superior pricing intelligence is a non-negotiable asset.

Real-World Evidence (RWE) and Health Technology Assessments (HTA)

Real-world evidence (RWE), derived from sources like electronic health records, claims data, and patient registries, is becoming increasingly vital for demonstrating a drug’s value beyond controlled clinical trials.41 Health Technology Assessments (HTA) systematically evaluate the clinical, economic, social, and ethical value of pharmaceuticals, providing evidence-based information to inform pricing and reimbursement decisions.2 Companies that can effectively generate and leverage compelling RWE to support HTA submissions can justify premium pricing and secure favorable market access.74 This involves integrating evidence requirements across clinical, R&D, health economics and outcomes research (HEOR), regulatory, and payer stakeholders.

AI-Driven Pricing and Market Access Strategies

Artificial intelligence (AI) is rapidly transforming pharmaceutical R&D, and its potential in pricing and market access (PRMA) is immense.77 AI algorithms can process vast datasets to identify patterns, predict drug efficacy and safety, and optimize manufacturing processes, leading to reduced R&D costs and faster time to market.7 In PRMA, AI can enable faster and more informed pricing adjustments, predict HTA outcomes with high accuracy, and align pricing strategies with unmet medical needs identified by healthcare professionals. For example, AI-driven predictive analytics can forecast treatment outcomes across different patient populations, allowing for more precise and defensible pricing models. This technological leap allows for dynamic pricing strategies that respond to evolving market conditions, emerging clinical evidence, and changing patient needs, providing a significant competitive advantage.

Navigating Regulatory Complexities and Policy Advocacy

The regulatory environment is a critical determinant of pricing flexibility and market access. Strategic engagement with policymakers and a proactive approach to compliance are paramount.

Understanding the Regulatory Environment

Each market presents its own unique regulatory landscape, from stringent price controls in Europe to the evolving negotiation powers in the U.S..38 A deep understanding of these diverse frameworks is essential for tailoring pricing strategies and ensuring commercial viability.38 Companies must closely monitor legislative and regulatory reforms, anticipating “pricing cliffs” imposed by new acts like the IRA and adapting their strategies accordingly.

Lobbying and Patient Advocacy: A Dual-Edged Sword

The pharmaceutical industry is a significant player in federal lobbying, spending substantial amounts to influence policy.82 While this can protect industry interests, it also draws scrutiny. Patient advocacy groups play a crucial role in drug pricing policy, with some, like Patients for Affordable Drugs, advocating exclusively for lower prices and challenging industry influence.84 However, some patient advocacy groups have deep financial and operational ties to pharmaceutical companies, leading to accusations of acting as “industry front groups” that align with corporate priorities, even opposing drug price negotiations. For a company, navigating this landscape requires careful consideration of public perception and ethical engagement.

Global Market Access and Launch Sequencing

In a globalized pharmaceutical market, prices in one country often influence prices in many others due to international reference pricing and parallel trade. This necessitates a cohesive global pricing strategy developed before a product’s first launch.86 Strategic launch sequencing, typically starting in high-price countries to establish a higher reference price, is a common tactic to maximize global revenues. However, optimal sequences are complex, requiring careful consideration of expected prices, referencing processes, and the costs of delaying launches in different markets.

Fostering Innovation and Sustainable Access

Ultimately, long-term market domination rests on a commitment to both groundbreaking innovation and ensuring that these life-changing therapies are accessible to patients.

Balancing R&D Investment with Affordability

The tension between the high costs of R&D and the imperative for drug affordability is a persistent ethical and economic dilemma.10 While high prices are often justified by the need to fund risky research, critics argue that a significant portion of pharmaceutical spending goes to marketing and administration rather than R&D. For instance, in 2020, 7 out of 10 of the largest pharmaceutical companies spent more on sales and marketing than on R&D. The challenge lies in finding a sustainable equilibrium that rewards innovation without creating insurmountable barriers to access.

Public-Private Partnerships and Innovative Funding

Addressing complex health challenges, especially in areas like rare diseases, often requires collaborative efforts between public and private sectors.89 Public-private partnerships (PPPs) can share risks, accelerate drug development, and work in areas of high unmet medical need and societal value. Innovative funding models for rare diseases, beyond traditional donations, include public-private resource pooling alliances, sales-linked donations, and government-matched contributions. For example, Singapore’s Rare Disease Fund leverages donations with government-matched contributions to support patients with high-cost medicines. These models are crucial for fostering innovation in niche markets while improving patient access.

The Ethical Compass: Profit vs. Public Health

The fundamental question of whether pharmaceutical companies should prioritize profit or public health lies at the heart of the drug pricing debate.10 Many ethical frameworks argue that excessively profiting from human suffering, particularly when effective treatments exist, is morally reprehensible.10 When a drug’s affordability dictates a person’s survival or quality of life, it challenges the very notion of human dignity and the universal right to health. A truly dominant market position, therefore, must integrate an ethical compass, recognizing that sustainable success in pharmaceuticals is inextricably linked to societal well-being and equitable access to life-saving innovations.10

“Americans pay too much for their prescription drugs. That makes today’s announcement historic. For the first time ever, Medicare negotiated directly with drug companies and the American people are better off for it.” — U.S. Department of Health and Human Services (HHS) Secretary Xavier Becerra, August 2024

Key Takeaways

- Complexity is the Constant: Pharmaceutical pricing is not a simple supply-and-demand equation. It’s a multi-faceted challenge influenced by R&D costs, intellectual property, regulatory frameworks, and a diverse array of stakeholders, each with their own objectives.

- Innovation Demands Investment, but Access is Paramount: High R&D costs are a legitimate factor in drug pricing, incentivizing the development of breakthrough therapies. However, this must be balanced with the ethical imperative of ensuring patient access and affordability, as high prices lead to non-adherence and adverse health outcomes.

- Patents are Powerful, and Their Manipulation is Scrutinized: Patent protection is critical for incentivizing innovation, but strategies like evergreening, patent thickets, and pay-for-delay agreements can extend monopolies and delay generic competition, contributing to high drug prices. Strategic competitive patent analysis, utilizing resources like DrugPatentWatch, is essential for market players.

- Traditional Models Evolve, Innovative Models Emerge: While cost-plus and competitive pricing remain foundational, the industry is increasingly adopting value-based pricing, outcomes-based agreements, and even subscription models to align price with real-world patient benefits and manage budget impact, particularly for high-cost novel therapies like gene therapies.

- Regulatory Landscapes are Diverging: The U.S. is shifting towards more direct price negotiation (e.g., Inflation Reduction Act) after decades of limited intervention, while Europe and Canada have long employed various price controls and reference pricing mechanisms. Navigating these diverse global regulatory environments is crucial for market access.

- Market Failures Demand Intervention: Information asymmetry, inelastic demand for essential medicines, and the presence of externalities mean that the pharmaceutical market, left unchecked, often fails to deliver socially optimal outcomes, necessitating government and societal involvement to ensure equitable access.

- Data and AI are the Future of Pricing Intelligence: Leveraging real-world evidence, Health Technology Assessments, and AI-driven analytics will be critical for pharmaceutical companies to justify value, optimize pricing strategies, and adapt dynamically to evolving market conditions and patient needs.

FAQ Section

1. Why are drug prices in the United States significantly higher than in other developed countries?

Drug prices in the United States are notably higher than in most other developed countries primarily due to a less regulated market and the absence of centralized price negotiation mechanisms for a long time.1 Unlike many European nations or Canada, which employ government-led price controls, reference pricing, or direct negotiations, the U.S. government traditionally did not directly set prices for most drugs.1 This allowed pharmaceutical companies greater flexibility to set prices based on what the market would bear, especially for patented drugs with no competition.1 While the Inflation Reduction Act of 2022 has introduced Medicare price negotiation for certain drugs, this is a recent development, and the overall market remains less regulated compared to global counterparts.1

2. How do “patent thickets” and “evergreening” impact drug affordability and competition?

“Patent thickets” and “evergreening” are strategies used by pharmaceutical companies to extend the market exclusivity of their drugs beyond the original patent term, thereby delaying generic competition and impacting affordability.59 “Evergreening” involves obtaining secondary patents on minor modifications of existing drugs, such as new formulations or uses, which may offer incremental benefits but primarily serve to prolong monopoly periods. “Patent thickets” refer to the accumulation of numerous, overlapping patents on a single drug, creating a complex and costly legal barrier for generic manufacturers attempting to enter the market.61 These tactics can stifle competition, keep drug prices artificially high for longer periods, and ultimately burden patients and healthcare systems with inflated costs.61

3. What is value-based pricing, and how does it aim to address the high cost of new therapies?

Value-based pricing (VBP) is a pharmaceutical pricing strategy that links a drug’s price to its demonstrated clinical value, patient outcomes, and overall cost-effectiveness within the healthcare system.38 Instead of pricing based solely on R&D costs or competitor prices, VBP aims to ensure that the cost reflects the actual health benefits and societal value the medication delivers.40 For high-cost, innovative therapies, especially those with uncertain long-term outcomes, VBP models, such as outcomes-based agreements, can involve rebates or adjusted payments if the drug does not achieve agreed-upon performance targets in the real world.42 The goal is to incentivize the development of truly impactful treatments, share financial risk between manufacturers and payers, and make expensive medications more accessible by tying their cost directly to their proven effectiveness.

4. How do Pharmacy Benefit Managers (PBMs) influence drug prices, and what are the main criticisms against them?

Pharmacy Benefit Managers (PBMs) are intermediaries that manage prescription drug benefits for health insurers, employers, and government programs.5 They influence drug prices primarily by negotiating rebates and discounts with drug manufacturers, creating formularies (lists of covered drugs), and establishing pharmacy networks.13 While PBMs claim to reduce costs for their clients through these negotiations, they face significant criticism for a lack of transparency.13 Key criticisms include retaining a portion of the negotiated rebates rather than passing the full amount to insurers or patients, and engaging in “spread pricing,” where they charge health plans more for a drug than they reimburse the pharmacy, pocketing the difference.13 These practices are alleged to contribute to higher drug list prices and out-of-pocket costs for patients, despite the PBMs’ stated goal of cost reduction.13

5. What are “subscription models” in drug pricing, and where have they been successfully implemented?

“Subscription models,” often referred to as the “Netflix model” in drug pricing, are innovative payment frameworks where a payer (typically a government health program) pays a fixed upfront fee to a pharmaceutical company for unlimited access to specific medications over a defined period, rather than paying per prescription.51 This approach aims to provide budget certainty for healthcare systems and expand patient access by decoupling payment from volume. This model has seen successful implementation in the treatment of Hepatitis C in U.S. states like Louisiana and Washington. Louisiana, for instance, secured unlimited access to generic Epclusa for its Medicaid beneficiaries and prison inmates through a five-year contract, significantly increasing treatment rates while capping overall spending. The UK has also explored this model for new antibiotics to incentivize their development by ensuring predictable returns for manufacturers, regardless of the volume used, thereby combating antimicrobial resistance.51

References

- How Pharmaceutical Companies Price Their Drugs in the U.S., accessed July 27, 2025, https://www.investopedia.com/articles/investing/020316/how-pharmaceutical-companies-price-their-drugs.asp

- Health Economics of Pharmaceutical Pricing – Number Analytics, accessed July 27, 2025, https://www.numberanalytics.com/blog/health-economics-pharmaceutical-pricing

- Pharmaceutical Market Failures → Term, accessed July 27, 2025, https://pollution.sustainability-directory.com/term/pharmaceutical-market-failures/

- The high cost of prescription drugs: causes and solutions – PMC, accessed July 27, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC7311400/

- A Pharma Pricing and Agreements Primer in Today’s Complex …, accessed July 27, 2025, https://www.pharmaceuticalcommerce.com/view/a-pharma-pricing-and-agreements-primer-in-today-s-complex-landscape

- Drug Development – HHS ASPE, accessed July 27, 2025, https://aspe.hhs.gov/reports/drug-development

- From lab to launch: AI’s impact on pharma drug development – Schneider Electric Blog, accessed July 27, 2025, https://blog.se.com/datacenter/2025/05/22/lab-launch-ai-impact-pharma-drug-development/

- Pharma’s Rx for R&D | McKinsey & Company, accessed July 27, 2025, https://www.mckinsey.com/featured-insights/sustainable-inclusive-growth/charts/pharmas-rx-for-r-and-d

- Patents and Drug Pricing: Why Weakening Patent Protection Is Not in the Public’s Best Interest – American Bar Association, accessed July 27, 2025, https://www.americanbar.org/groups/intellectual_property_law/resources/landslide/2025-spring/drug-pricing-weakening-patent-protection-not-best-interest/

- Ethical Drug Pricing: Innovation, Access & Global Health Equity …, accessed July 27, 2025, https://amistalabs.org/ethical-drug-pricing-access-global-health-equity/

- Defining the Stakeholders – SpecialtyRx Toolkit, accessed July 27, 2025, https://www.specialtyrxtoolkit.org/industry/specialty-drug-environment/defining-the-stakeholders

- Pharmacy Wholesale Drug Prices in Germany: Ensuring Transparency, Access, and Compliance – Go Pharmazie.com, accessed July 27, 2025, https://go.pharmazie.com/en/pharmacy-wholesale-drug-prices-in-germany/

- Insurance Topics | Pharmacy Benefit Managers | NAIC, accessed July 27, 2025, https://content.naic.org/insurance-topics/pharmacy-benefit-managers

- What Pharmacy Benefit Managers Do, and How They Contribute to Drug Spending, accessed July 27, 2025, https://www.commonwealthfund.org/publications/explainer/2025/mar/what-pharmacy-benefit-managers-do-how-they-contribute-drug-spending

- The pricing of pharmaceuticals: an international comparison – PubMed, accessed July 27, 2025, https://pubmed.ncbi.nlm.nih.gov/1525794/

- Prescription drug prices in the United States – Wikipedia, accessed July 27, 2025, https://en.wikipedia.org/wiki/Prescription_drug_prices_in_the_United_States

- Negotiating for Lower Drug Prices Works, Saves Billions – CMS, accessed July 27, 2025, https://www.cms.gov/newsroom/press-releases/negotiating-lower-drug-prices-works-saves-billions

- Drug Costs and Their Impact on Care | Arnold Ventures, accessed July 27, 2025, https://www.arnoldventures.org/stories/drug-costs-and-their-impact-on-care

- Drug Prices and Shortages Jeopardize Patient Access to Quality …, accessed July 27, 2025, https://www.aha.org/news/blog/2024-05-22-drug-prices-and-shortages-jeopardize-patient-access-quality-hospital-care

- International reference pricing for prescription drugs – Brookings Institution, accessed July 27, 2025, https://www.brookings.edu/articles/international-reference-pricing-for-prescription-drugs/

- Ethical Drug Pricing – The Hastings Center for Bioethics, accessed July 27, 2025, https://www.thehastingscenter.org/briefingbook/ethical-drug-pricing/

- Milestones in U.S. Food and Drug Law – FDA, accessed July 27, 2025, https://www.fda.gov/about-fda/fda-history/milestones-us-food-and-drug-law

- The History of Drug Regulation | FDA, accessed July 27, 2025, https://www.fda.gov/about-fda/histories-fda-regulated-products/history-drug-regulation

- International Prescription Drug Price Comparisons: Estimates Using 2022 Data – HHS ASPE, accessed July 27, 2025, https://aspe.hhs.gov/sites/default/files/documents/277371265a705c356c968977e87446ae/international-price-comparisons.pdf

- International Prescription Drug Price Comparisons: Estimates Using 2022 Data – HHS ASPE, accessed July 27, 2025, https://aspe.hhs.gov/sites/default/files/documents/8e057b0a094e6f9b9d01171fce6698f4/international-price-comparisons.pdf

- The Risks of Adopting Foreign Price Controls for Drugs – Truth on the Market, accessed July 27, 2025, https://truthonthemarket.com/2025/05/09/the-risks-of-adopting-foreign-price-controls-for-drugs/

- EMA’s history | European Medicines Agency (EMA), accessed July 27, 2025, https://www.ema.europa.eu/en/about-us/history-ema

- What Can the United States Learn from Pharmaceutical Spending Controls in France?, accessed July 27, 2025, https://www.commonwealthfund.org/publications/issue-briefs/2019/nov/what-can-united-states-learn-drug-spending-controls-france

- How are medicines prices set in the UK? – The House of Commons Library, accessed July 27, 2025, https://commonslibrary.parliament.uk/how-are-medicines-prices-set-in-the-uk/

- Drug Pricing – UK Parliament, accessed July 27, 2025, https://www.parliament.uk/globalassets/documents/post/postpn_364_Drug_Pricing.pdf

- Pricing & Reimbursement Laws and Regulations 2024 | Germany – Global Legal Insights, accessed July 27, 2025, https://www.globallegalinsights.com/practice-areas/pricing-reimbursement-laws-and-regulations/germany/

- Drug Pricing Regulation in the U.S., UK, and EU: Assessing Trade-offs – AAF, accessed July 27, 2025, https://www.americanactionforum.org/insight/drug-pricing-regulation-in-the-u-s-uk-and-eu-assessing-trade-offs/

- Appendix I Historical Context, accessed July 27, 2025, http://www.pmprb-cepmb.gc.ca/view.asp?ccid=1086

- Prescription Drug Prices in Canada and the United States—Part 2 Why the Difference? – Fraser Institute, accessed July 27, 2025, https://www.fraserinstitute.org/sites/default/files/DrugPricesWhytheDifference.pdf

- Efpia – Principles for application of international reference pricing systems, accessed July 27, 2025, https://www.efpia.eu/media/15406/efpia-position-paper-principles-for-application-of-international-reference-pricing-systems-june-2014.pdf

- www.netsuite.com, accessed July 27, 2025, https://www.netsuite.com/portal/resource/articles/financial-management/cost-plus-pricing.shtml#:~:text=With%20cost%2Dplus%20pricing%2C%20a,markup%20as%20a%20fixed%20amount.

- Cost-plus pricing – Wikipedia, accessed July 27, 2025, https://en.wikipedia.org/wiki/Cost-plus_pricing

- Pharma Pricing Strategies – Supra.tools, accessed July 27, 2025, https://supra.tools/pharma-pricing-strategies

- Exploring the Various Pricing Models Adopted by the … – N3PR, accessed July 27, 2025, https://www.n3pr.com/post/pricing-models-used-in-the-pharmaceutical-industry

- A value-based approach to pricing An EFPIA position paper, accessed July 27, 2025, https://www.efpia.eu/media/677284/a-value-based-approach-to-pricing-2.pdf

- Value-based pricing in pharmaceuticals – KPMG International, accessed July 27, 2025, https://assets.kpmg.com/content/dam/kpmg/xx/pdf/2016/10/value-based-pricing-in-pharmaceuticals.pdf

- Strategies To Address The Challenges Of Outcomes-Based Pricing Agreements For Pharmaceuticals | Health Affairs Forefront, accessed July 27, 2025, https://www.healthaffairs.org/do/10.1377/forefront.20170403.059449/

- PHARMACEUTICAL CONTRACTING: FROM VOLUME … – Eversana, accessed July 27, 2025, https://www.eversana.com/wp-content/uploads/dlm_uploads/2019/06/Pharmaceutical_Contracting_From_Volume_to_Value_EVERSANA_White_Paper_.pdf

- Tender of Medicines – Merck Position Statement, accessed July 27, 2025, https://www.merckgroup.com/company/who-we-are/en/healthcare/Tenders_of_Medicines.pdf

- – UNSUSTAINABLE DRUG PRICES:. TESTIMONY FROM THE …, accessed July 27, 2025, https://www.govinfo.gov/content/pkg/CHRG-116hhrg41983/html/CHRG-116hhrg41983.htm

- Pricing Strategies in Pharma – Number Analytics, accessed July 27, 2025, https://www.numberanalytics.com/blog/ultimate-guide-pricing-strategies-drug-development

- Lifecycle of a Drug: Pricing and Paying – International Foundation for Gastrointestinal Disorders, accessed July 27, 2025, https://iffgd.org/wp-content/uploads/Lifecycle_of_a_Drug_Pricing_and_Paying.pdf

- Outcomes-Based Pharmaceutical Contracts: An Answer to High U.S. …, accessed July 27, 2025, https://www.commonwealthfund.org/sites/default/files/documents/___media_files_publications_issue_brief_2017_sep_seeley_outcomes_based_pharma_contracts_ib.pdf

- Outcome-Based Agreements in the Ozempic Era | Lyfegen, accessed July 27, 2025, https://www.lyfegen.com/post/linking-drug-prices-to-success-the-power-of-outcome-based-agreements-in-the-ozempic-era

- The national budget impact of managed entry agreement strategies …, accessed July 27, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11616773/

- A ‘Netflix’ Model for Drug Pricing to Bring Treatments to More People …, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/a-netflix-model-for-drug-pricing-to-bring-treatments-to-more-people/

- Could Netflix-style subscription models work for medicines? – Pharmaceutical Technology, accessed July 27, 2025, https://www.pharmaceutical-technology.com/features/subscription-payment-for-medicines/

- Unique Payment Models – Pharmacy Healthcare Solutions LLC, accessed July 27, 2025, https://phslrx.com/unique-payment-models/

- Innovative payment models in cell & gene therapy: Trends … – ZS, accessed July 27, 2025, https://www.zs.com/insights/innovative-payment-models-cell-and-gene-therapies

- Balancing Efficacy and Value for Cell and Gene Therapy Through Value-Based Pricing, accessed July 27, 2025, https://www.pharmacytimes.com/view/balancing-efficacy-and-value-for-cell-and-gene-therapy-through-value-based-pricing

- The Role of Patents and Regulatory Exclusivities in Drug Pricing …, accessed July 27, 2025, https://www.congress.gov/crs-product/R46679

- The Impact of Patent Expirations on the Pharmaceutical Industry, accessed July 27, 2025, https://www.jocpr.com/articles/the-impact-of-patent-expirations-on-the-pharmaceutical-industry-10233.html

- The Impact of Patent Expirations on Generic Drug Market Entry – PatentPC, accessed July 27, 2025, https://patentpc.com/blog/the-impact-of-patent-expirations-on-generic-drug-market-entry

- Patent Evergreening In The Pharmaceutical Industry: Legal …, accessed July 27, 2025, https://ijlsss.com/patent-evergreening-in-the-pharmaceutical-industry-legal-loophole-or-strategic-innovation/

- Evergreen Drug Patent Database – UC College of the Law, accessed July 27, 2025, https://sites.uclawsf.edu/evergreensearch/

- The Dark Reality of Drug Patent Thickets: Innovation or Exploitation? – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/the-dark-reality-of-drug-patent-thickets-innovation-or-exploitation/

- In the case of brand name drugs versus generics, patents can be bad medicine, WVU law professor says, accessed July 27, 2025, https://wvutoday.wvu.edu/stories/2022/12/19/in-the-case-of-brand-name-drugs-vs-generics-patents-can-be-bad-medicine-wvu-law-professor-says

- Increasing Competition To Lower Drug Prices – Patients For Affordable Drugs, accessed July 27, 2025, https://www.patientsforaffordabledrugs.org/strategy/increasing-competition/

- FACT SHEET: BIG PHARMA’S PATENT ABUSE COSTS AMERICAN …, accessed July 27, 2025, https://www.csrxp.org/fact-sheet-big-pharmas-patent-abuse-costs-american-patients-taxpayers-and-the-u-s-health-care-system-billions-of-dollars-2/

- Pricing of pharmaceuticals is becoming a major challenge for health systems – The BMJ, accessed July 27, 2025, https://www.bmj.com/content/368/bmj.l4627

- Factors affecting Cost-Related Medication Non-Adherence among …, accessed July 27, 2025, https://www.medrxiv.org/content/10.1101/2024.03.11.24304136v1.full-text

- Economic Impact of Medication Nonadherence on Healthcare Costs, accessed July 27, 2025, https://adheretech.com/medication-nonadherence-economics/

- Strategy-access | Essential medicines and pharmaceutical policies – WHO EMRO, accessed July 27, 2025, https://www.emro.who.int/essential-medicines/strategy-access/

- Access to medicines through health systems in low- and middle-income countries – PMC, accessed July 27, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC6901066/

- “Silent Murder” – dandc.eu, accessed July 27, 2025, https://www.dandc.eu/en/article/medicines-are-too-expensive-poor-people-developing-countries-local-production-could-make

- USP Expert Discusses Balancing Drug Cost, Quality, and Access in a Changing Trade Landscape – Pharmacy Times, accessed July 27, 2025, https://www.pharmacytimes.com/view/usp-expert-discusses-balancing-drug-cost-quality-and-access-in-a-changing-trade-landscape

- (PDF) THE ECONOMIC IMPLICATIONS OF DRUG SHORTAGES: ANALYZING MARKET DYNAMICS AND PRICING STRUCTURES – ResearchGate, accessed July 27, 2025, https://www.researchgate.net/publication/387190494_THE_ECONOMIC_IMPLICATIONS_OF_DRUG_SHORTAGES_ANALYZING_MARKET_DYNAMICS_AND_PRICING_STRUCTURES

- Impact of Drug Shortages on Consumer Costs – HHS ASPE – HHS.gov, accessed July 27, 2025, https://aspe.hhs.gov/sites/default/files/documents/87781bc7f9a7fc3e6633199dc4507d3e/aspe-rtc-costs-drug-shortages.pdf

- Full article: The Current Landscape of HTA Framework and Key …, accessed July 27, 2025, https://www.tandfonline.com/doi/full/10.1080/19466315.2025.2495307?src=exp-la

- Use of health technology assessments in specialty drug coverage decisions by US commercial health plans – JMCP.org, accessed July 27, 2025, https://www.jmcp.org/doi/10.18553/jmcp.2025.31.3.289

- Pricing and Market Access – IQVIA, accessed July 27, 2025, https://www.iqvia.com/solutions/commercialization/commercial-analytics-and-consulting/pricing-and-market-access

- Revolutionizing Drug Costs: Harnessing the Power of AI, accessed July 27, 2025, https://www.lindushealth.com/blog/revolutionizing-drug-costs-harnessing-the-power-of-ai

- Unlocking the potential of AI in Pricing, Reimbursement and Market Access (PRMA), accessed July 27, 2025, https://www.lifesciencedynamics.com/press/articles/unlocking-the-potential-of-ai-in-pricing-reimbursement-and-market-access-prma/

- 5 Essential Pharmaceutical Pricing Tactics Driving 2024 Healthcare …, accessed July 27, 2025, https://www.numberanalytics.com/blog/5-essential-pharmaceutical-pricing-tactics-healthcare-innovation

- The Role of Regulatory Affairs in Global Drug Pricing and Market Access, accessed July 27, 2025, https://www.companysconnects.com/post/the-role-of-regulatory-affairs-in-global-drug-pricing-and-market-access

- Establishing a Drug Pricing Strategy – Sidley Austin LLP, accessed July 27, 2025, https://www.sidley.com/en/-/media/uploads/establishing-a-drug-pricing-strategy.pdf?la=en

- Pharmaceuticals / Health Products Summary • OpenSecrets, accessed July 27, 2025, https://www.opensecrets.org/industries/indus.asp?Ind=H04

- Pharmaceuticals, political money, and public policy: a theoretical and empirical agenda – PubMed, accessed July 27, 2025, https://pubmed.ncbi.nlm.nih.gov/24088146/

- About Us – Patients For Affordable Drugs, accessed July 27, 2025, https://www.patientsforaffordabledrugs.org/about-us/

- Big Pharma Puppet Groups Are Keeping Your Drug Prices High, accessed July 27, 2025, https://jacobin.com/2025/05/big-pharma-drug-prices-lobbying

- Global pricing strategies for pharmaceutical goods, accessed July 27, 2025, http://plg-group.com/wp-content/uploads/2014/03/Global-pricing-strategies-for-pharmaceutical-goods-Eckhard-.pdf

- Pharmaceutical Pricing & Market Access Strategy – GlobalData, accessed July 27, 2025, https://marketaccess.globaldata.com/product-solutions/pharmaceutical-pricing-and-market-access-strategy/

- New Study: In the Midst of COVID-19 Crisis, 7 out of 10 Big… – AHIP, accessed July 27, 2025, https://www.ahip.org/news/articles/new-study-in-the-midst-of-covid-19-crisis-7-out-of-10-big-pharma-companies-spent-more-on-sales-and-marketing-than-r-d

- Innovative Funding Models for Treatment of Rare Diseases – IQVIA, accessed July 27, 2025, https://www.iqvia.com/-/media/iqvia/pdfs/asia-pacific/white-papers/innovative-funding-models-for-treatment-of-rare-diseases.pdf

- The Value of Public-Private partnerships – Rare Disease Moonshot, accessed July 27, 2025, https://www.rarediseasemoonshot.eu/about-us/the-value-of-public-private-partnerships/

- Balancing Health and Profits: Ethics in the Pharmaceutical Industry – Digital Commons @ Shawnee State University, accessed July 27, 2025, https://digitalcommons.shawnee.edu/cgi/viewcontent.cgi?article=1020&context=business_ethics_3100

- Prescription Drugs: Access, Affordability and the Human Cost – Tom Spencer, accessed July 27, 2025, https://www.spencertom.com/2025/07/26/economics-of-prescription-drugs-pricing-patents-and-access/

- The Bioethics of Medicines Access: Challenges Ahead, accessed July 27, 2025, https://www.numberanalytics.com/blog/bioethics-medicines-access-challenges-ahead

- The Ethics of Medication Access: A Public Health Perspective – Number Analytics, accessed July 27, 2025, https://www.numberanalytics.com/blog/ethics-of-medication-access-public-health-perspective

- Executive Order to Lower U.S. Drug Prices Could Hurt the Poorest …, accessed July 27, 2025, https://www.thinkglobalhealth.org/article/executive-order-lower-us-drug-prices-could-hurt-poorest-countries

- Six drug pricing models have emerged to improve product access and affordability – PwC, accessed July 27, 2025, https://www.pwc.com/us/en/industries/health-industries/library/6-drug-pricing-models.html

- Comparing Prescription Drugs in the U.S. and Other Countries: Prices and Availability, accessed July 27, 2025, https://aspe.hhs.gov/reports/comparing-prescription-drugs

- (PDF) REFERENCE PRICING FOR PHARMACEUTICALS: BENEFITS, RISKS AND SYSTEMIC CHALLENGES – ResearchGate, accessed July 27, 2025, https://www.researchgate.net/publication/392723059_REFERENCE_PRICING_FOR_PHARMACEUTICALS_BENEFITS_RISKS_AND_SYSTEMIC_CHALLENGES

- The Effect of Drug Pricing Policies on Healthcare Equity and Affordability, accessed July 27, 2025, https://www.jbclinpharm.org/articles/the-effect-of-drug-pricing-policies-on-healthcare-equity-and-affordability-13081.html

- Alternative Payment Models for Innovative Medicines: A Framework for Effective Implementation – PMC, accessed July 27, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC12170698/

- How AI in Pharma Cuts Costs and Speeds Discovery – Relevant Software, accessed July 27, 2025, https://relevant.software/blog/ai-in-pharma/

- Gene therapy access: Global challenges, opportunities, and views from Brazil, South Africa, and India, accessed July 27, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC9171243/

- Prescription Drug Costs | Pros, Cons, Debate, Arguments, Economy, Laws, Government, & Regulation | Britannica, accessed July 27, 2025, https://www.britannica.com/procon/prescription-drug-costs-debate

- Drug price setting and regulation in France – Irdes, accessed July 27, 2025, https://www.irdes.fr/EspaceAnglais/Publications/WorkingPapers/DT16DrugPriceSettingRegulationFrance.pdf

- Pricing & Reimbursement | Clayton Utz, accessed July 27, 2025, https://www.claytonutz.com/insights/2022/september/global-legal-insights-pricing-and-reimbursement-2022

- The Pharmaceutical Benefits Scheme in Australia – GSK AU, accessed July 27, 2025, https://au.gsk.com/media/6259/gsk-viiv-the-pbs-in-australia-feb-2018.pdf

- Funding Opportunities for Rare Diseases at FDA, accessed July 27, 2025, https://www.fda.gov/about-fda/center-drug-evaluation-and-research-cder/funding-opportunities-rare-diseases-fda

- Debates over orphan drug pricing: a meta-narrative literature review – PMC, accessed July 27, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11887186/

- Challenges to the Availability and Affordability of Essential …, accessed July 27, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC10276598/

- Navigating the future of commercial in biopharma – Deloitte, accessed July 27, 2025, https://www.deloitte.com/us/en/insights/industry/health-care/future-of-commercial-in-pharma.html

- The impact of drug shortages on drug prices: evidence from China – Frontiers, accessed July 27, 2025, https://www.frontiersin.org/journals/public-health/articles/10.3389/fpubh.2023.1185356/full

- Next in pharma 2025: The future is now – PwC, accessed July 27, 2025, https://www.pwc.com/us/en/industries/pharma-life-sciences/pharmaceutical-industry-trends.html

- Projections of Public Spending on Pharmaceuticals: A Review of Methods – PMC, accessed July 27, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11929675/

- Competition in Prescription Drug Markets, 2017-2022 – HHS ASPE, accessed July 27, 2025, https://aspe.hhs.gov/reports/competition-prescription-drug-markets

- The Competition Prescription: A Market-Based Plan for Affordable Drugs – FREOPP, accessed July 27, 2025, https://freopp.org/whitepapers/a-market-based-plan-for-affordable-prescription-drugs/

- What Most-Favored-Nation Status Could Mean for Pharmaceutical Stocks – Nasdaq, accessed July 27, 2025, https://www.nasdaq.com/articles/what-most-favored-nation-status-could-mean-pharmaceutical-stocks

- Public Opinion on Prescription Drugs and Their Prices – KFF, accessed July 27, 2025, https://www.kff.org/health-costs/poll-finding/public-opinion-on-prescription-drugs-and-their-prices/