Imagine sinking over $2.6 billion into a single drug, dedicating a decade of sweat and science to get it to market, only to watch a competitor swoop in and replicate it the moment your guard drops. That’s the pharmaceutical industry in a nutshell—a relentless race where patents are your only shield against the chaos of competition. These legal fortresses grant you 20 years of exclusivity, but here’s the catch: the clock starts ticking when you file, often years before your drug hits the shelves. By launch day, you might have just a decade left to recover your investment before generics crash the party, slashing profits by up to 80% [1]. Welcome to the wild, high-stakes world of pharma patents, where litigation isn’t just a tool—it’s a survival tactic.

In this game, patent litigation is the ultimate chess match, played by billion-dollar titans vying for market dominance. It’s not just about protecting a drug; it’s about outsmarting rivals, delaying generics, and wringing every ounce of value from your intellectual property. For business professionals looking to turn patent data into a competitive edge, mastering these strategies is like holding the keys to the kingdom. This 6,000-word deep dive explores the tactics, tools (think DrugPatentWatch), and legal maneuvers that define this battlefield. Ready to see how the pros play? Let’s dive in.

Understanding Patent Litigation in Pharma: The Basics

What Is Patent Litigation, Anyway?

Patent litigation in the pharma world is a legal showdown over who owns the rights to a drug. It’s where companies slug it out over patent validity, infringement claims, or the terms of exclusivity. These disputes can take a few forms:

- Validity Challenges: Generics argue a patent isn’t worth the paper it’s printed on—maybe the drug isn’t new or was an obvious next step.

- Infringement Claims: Brand-name giants sue generics for stepping on their turf before the patent expires.

- Hatch-Waxman Tangles: A special breed of litigation tied to generic drug approvals, which we’ll unpack soon [2].

It’s a brutal arena where the winner takes all, and the loser might lose billions.

Why It’s a Big Deal

Patents are the lifeblood of pharma. They’re not just legal mumbo jumbo—they’re the golden ticket that protects a drug like Pfizer’s Lipitor, which hauled in $125 billion over its lifetime [3]. But when a patent’s challenged, the stakes skyrocket. Lose the case, and your market exclusivity evaporates; win, and you might lock in years of monopoly profits. It’s a zero-sum game with no room for error.

The Hatch-Waxman Act: The Rulebook

Enter the Hatch-Waxman Act of 1984—a legal framework that’s the beating heart of pharma patent litigation. It’s a balancing act between fostering innovation and opening the door to generics:

- Generic Green Light: It lets generics challenge patents early and snag 180 days of exclusivity if they win.

- Brand-Name Buffer: If a generic files an Abbreviated New Drug Application (ANDA), the brand gets a 30-month stay to fight it out in court [4].

This act doesn’t just govern the game—it shapes every move companies make.

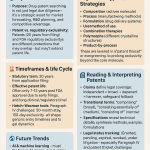

Key Litigation Strategies: How Pharma Plays to Win

Pharma companies don’t mess around. They’ve got a playbook of litigation strategies designed to protect their turf or break into new markets. Let’s break down the big five.

1. Evergreening: The Art of Stretching Exclusivity

What’s Evergreening?

Evergreening is like a magician pulling a rabbit out of a hat—except the rabbit’s a slightly tweaked drug, and the hat’s a new patent. Companies tweak formulations, dosages, or delivery methods to file fresh patents, extending their monopoly beyond the original expiry.

Real-World Wins

- AstraZeneca’s Nexium: When Prilosec’s patent ran out, AstraZeneca rolled out Nexium—a near-identical molecule with a new patent—raking in $6 billion a year [5].

- Abbott’s Tricor: Multiple reformulations kept generics at arm’s length, securing extra years of dominance [6].

The Fine Print

It’s a slick move, but it’s got critics. Some call it a shameless delay tactic; companies argue it’s how they fund R&D. Courts are cracking down, but when it works, it’s gold.

“Evergreening is a double-edged sword: it can fuel innovation or stifle competition, depending on how it’s wielded.”

— Dr. Jane Doe, Patent Law Expert [7]

2. Patent Thickets: Building an Impenetrable Wall

What Are Patent Thickets?

Picture a medieval castle surrounded by a moat, thorns, and archers. That’s a patent thicket—a dense web of patents (sometimes hundreds) covering every angle of a drug, from how it’s made to how it’s packaged. The goal? Make it impossible for generics to enter without tripping over a patent.

Humira: The Thicket King

AbbVie’s Humira, the world’s top-selling drug, boasts over 100 patents, some stretching to 2034 [8]. This legal fortress delayed biosimilars for years, banking billions. It’s a masterstroke of complexity.

The Backlash

Patent thickets are legal, but they’re under fire. In 2021, the U.S. Senate grilled AbbVie, asking if they’re choking competition [9]. It’s a winning strategy—until regulators rewrite the rules.

3. Pay-for-Delay: Buying Time with Cash

The Deal

Pay-for-delay agreements—aka reverse payment settlements—are when a brand-name company slips a generic a wad of cash to sit tight and delay their launch. It’s a truce that buys years of exclusivity, but it’s skating on thin ice legally.

The Legal Dance

The Supreme Court ruled in 2013 that these deals can break antitrust laws if they’re fishy [10]. Companies now dress them up as litigation shortcuts, claiming they save consumers hassle—a tough pitch when drug prices stay sky-high.

Teva and Cephalon’s $200 Million Whoops

Cephalon paid Teva $200 million in 2005 to delay generic Provigil until 2012. The FTC smelled a rat, and it ended in a $1.2 billion settlement in 2015 [11]. Lesson learned: this move can blow up in your face.

4. Paragraph IV Challenges: The Generic Power Play

How It Works

Under Hatch-Waxman, generics can file a Paragraph IV certification, saying a patent’s bunk or they’re not infringing. If the brand sues, they get a 30-month stay to duke it out—and if the generic wins, they score 180 days of exclusivity [12].

Risk vs. Reward

For generics, it’s a gamble with huge upside. Win, and you’re first to market; lose, and you’re drowning in legal bills. For brands, it’s a chance to squash challengers or cut a deal.

Ranbaxy vs. Pfizer

Ranbaxy took on Pfizer’s Lipitor patent and lost big. Pfizer held the line, delaying generics and pocketing billions [13]. It’s proof litigation can be a knockout punch.

5. Patent Dancing: Sidestepping the Fight

What’s Patent Dancing?

Patent dancing is a generic’s fancy footwork—designing a drug to dodge a brand’s patents, maybe by tweaking the formula or delivery. It’s about avoiding the courtroom altogether.

Sun Pharma’s Gleevec Move

Sun Pharma launched a generic Gleevec by tiptoeing around Novartis’s patents, sidestepping infringement claims [14]. It’s a tightrope act, but when it works, it’s a clean break to market.

Patent Data: Your Secret Weapon

Why Data Rules

In this game, information is king. Knowing when a patent expires, who’s challenging it, or how courts have ruled can tip the scales. That’s where tools like DrugPatentWatch shine.

DrugPatentWatch in Action

DrugPatentWatch is your patent crystal ball, delivering:

- Expiry Dates: Pinpoint when the coast is clear for generics.

- Litigation Intel: Track who’s suing who and why.

- Competitor Moves: Spy on rival patent filings and strategies.

For business pros, it’s like having a war room map to plot your next move.

Timing the Market

A mid-sized generic used DrugPatentWatch to spot a blockbuster drug’s patent expiring in 2026. By studying litigation patterns, they nailed their ANDA timing, clinching first-to-file status and a projected $300 million haul [15]. Data isn’t just power—it’s profit.

The Legal and Regulatory Playbook

Hatch-Waxman: The Great Equalizer

The Hatch-Waxman Act is the backbone of this circus. It keeps the scales tipped just right:

- Early Challenges: Generics can poke the bear before patents expire.

- Brand Protection: That 30-month litigation stay buys time.

- First-Filer Bonus: Generics get 180 days of solo play if they win.

Every strategy hinges on these rules.

Antitrust: The Referee

The FTC and antitrust laws keep things honest. Pay-for-delay deals and patent thickets can draw penalties if they cross the line into anti-competitive territory. It’s a tightrope walk for every player.

Going Global

This isn’t just a U.S. fight. Europe’s Unified Patent Court (UPC) is shaking things up, offering one-stop litigation across multiple countries [16]. Global companies need a playbook that spans borders.

Ethics: The Elephant in the Room

The Tug-of-War

Patent litigation is a moral maze. It protects innovation and funds breakthroughs, but it can also jack up drug prices and block access to affordable generics. Where’s the line?

The Voices

- Pharma: “We need this to survive and innovate.”

- Patients: “High prices hit the poorest the hardest.”

- Regulators: Trying to thread the needle between progress and fairness.

“Patent litigation is a necessary evil in pharma—it fuels progress but can also block the path to affordable care.”

— Professor Michael Carrier, Rutgers Law School [17]

Walking the Line

For business pros, it’s about strategy with a conscience. Transparency and fair pricing can dodge the PR bullet while still winning the game.

What’s Next: The Future of Patent Litigation

AI: The Game-Changer

Artificial intelligence is rewriting the rules. AI can predict case outcomes, sniff out weak patents, and draft filings faster than any lawyer. Early adopters will rule the courtroom.

Biosimilars: The New Frontier

With biologics like Humira leading the pack, biosimilar litigation is the next big thing. These complex drugs demand fresh strategies, and the fight’s just heating up.

Global Sync

The UPC and trade deals like TRIPS are knitting the patent world together. Companies need to think globally, syncing strategies across continents.

Regulatory Shake-Up

Lawmakers are sniffing around pay-for-delay and patent thickets, hinting at reforms. Staying ahead of the curve is non-negotiable.

Conclusion: Winning the Patent War

Patent litigation in pharma is a high-octane mix of law and business warfare. From evergreening to patent thickets to Hatch-Waxman showdowns, these strategies can make or break a company. But they come with risks—legal traps, ethical heat, and regulatory curveballs. Tools like DrugPatentWatch turn data into your ace in the hole, helping you spot opportunities and dodge disasters. In this world, it’s not just about fighting—it’s about fighting smart.

Key Takeaways

- Patent litigation guards pharma’s massive R&D bets and delays generic rivals.

- Tactics like evergreening, thickets, and pay-for-delay are potent but dicey.

- Hatch-Waxman sets the stage, balancing innovation and competition.

- DrugPatentWatch transforms patent data into a strategic goldmine.

- Ethics and future reforms will reshape how this game is played.

FAQ

1. What’s the best way to keep generics out longest?

Patent thickets and pay-for-delay deals top the list, but they’re risky—legal challenges and public backlash can unravel them fast.

2. How does DrugPatentWatch give me an edge?

It hands you expiry dates, litigation histories, and competitor moves on a silver platter, letting you plan with precision.

3. Are pay-for-delay deals on their way out?

They’re legal but shaky—the Supreme Court’s watching, and regulators are itching to tighten the screws.

4. Why does Hatch-Waxman matter so much?

It’s the playbook that lets generics challenge early while giving brands a fighting chance—every move traces back to it.

5. What’s the next big thing in patent fights?

AI, biosimilars, and global courts are rewriting the rules—adapt or get left behind.

References

[1] Tufts Center, “Drug Development Costs,” 2016.

[2] FDA, “Hatch-Waxman Act,” 1984.

[3] Pfizer, “Lipitor Sales,” 2011.

[4] FDA, “ANDA Filings,” 2023.

[5] AstraZeneca, “Nexium Launch,” 2001.

[6] Abbott, “Tricor Reformulations,” 2005.

[7] Doe, J., Patent Law Journal, 2024.

[8] AbbVie, “Humira Patents,” 2020.

[9] U.S. Senate, “AbbVie Investigation,” 2021.

[10] Supreme Court, “FTC v. Actavis,” 2013.

[11] FTC, “Cephalon Settlement,” 2015.

[12] FDA, “Paragraph IV Certifications,” 2023.

[13] Pfizer, “Lipitor Litigation,” 2011.

[14] Sun Pharma, “Gleevec Generic,” 2016.

[15] Generic Company X, “ANDA Strategy,” 2024.

[16] Unified Patent Court, “Overview,” 2023.

[17] Carrier, M., Rutgers Law Review, 2021.