I. Introduction: The End of an Era and the Dawn of a New Value Equation

For decades, the pharmaceutical industry operated under a clear and powerful covenant: the patent. This legal instrument, granting an inventor the sole right to market their creation for a 20-year term, was more than just a form of intellectual property; it was the central economic engine of the entire biopharmaceutical ecosystem.1 It stood as the “backbone of medical innovation” and the “cornerstone of pharmaceutical innovation,” providing the temporary, legally sanctioned monopoly essential for recouping the vast, high-risk investments required to bring a new medicine from the laboratory to the patient.2 This system created a direct, almost linear relationship between the strength and duration of a patent portfolio and the potential for investor returns. Consequently, the primary tool for valuing a pharmaceutical company was, for a long time, a meticulous analysis of its patents—their scope, their defensibility, and, most critically, their expiration dates.

However, this long-standing model is fracturing under the immense pressure of three converging crises. First, the industry is staring down an unprecedented patent cliff, a recurring and structural feature of the market that threatens to wipe out hundreds of billions of dollars in annual revenue for some of the world’s most successful medicines between now and 2030.4 This is not a distant storm but a present and clear danger that tests the resilience of even the most established companies.

Second, this external threat is compounded by an internal crisis of productivity. The cost to develop a new drug has spiraled into the billions, yet the probability of success remains dismally low.7 The industry is caught in an economic paradox: it is spending more on research and development (R&D) than ever before in history, only to see its return on that investment stagnate, creating a vicious cycle of rising costs and diminishing returns.9

Finally, even when a company successfully navigates the gauntlet of R&D and secures market approval, it faces a third crisis: a formidable squeeze from payers and policymakers. Around the globe, and most notably in the premium-priced U.S. market, governments and commercial insurers are exerting unprecedented pricing pressure, demanding not just clinical efficacy but demonstrable, real-world value and cost-effectiveness.4 The era of unquestioned pricing power, a key benefit of the patent-granted monopoly, is decisively over.

These forces have rendered the traditional, patent-centric valuation model dangerously incomplete. Sophisticated investors, business development teams, and corporate strategists now recognize that a company’s future value cannot be determined by a simple countdown clock on its key patents. The next evolution in pharmaceutical investing requires a more holistic, multi-pillar valuation framework. This new model looks beyond the patent estate to assess the durable, and often less tangible, sources of competitive advantage that will define the winners of the next decade.

This report will argue that the future of pharmaceutical value creation and investment rests on four interconnected pillars: the power and scalability of a company’s underlying Technology Platforms; its strategic mastery of the complex Regulatory Labyrinth of exclusivities; its achievement of Operational and Digital Supremacy in manufacturing, supply chain, and data analytics; and its ability to attract and retain elite Human Capital. By dissecting each of these pillars through data-driven analysis and real-world case studies, this report will provide a comprehensive roadmap for identifying and building the resilient, innovative, and enduringly valuable pharmaceutical enterprises of the future.

II. The Unraveling of the Old Model: Why Patents Are No Longer Enough

The patent remains a foundational element of the pharmaceutical business model, but its singular dominance as a predictor of long-term value is eroding. The confluence of predictable revenue collapses, unsustainable R&D economics, and mounting pricing pressures has exposed the vulnerabilities of a strategy that relies too heavily on a finite period of market exclusivity. Understanding the scale of these challenges is the first step toward appreciating why a new, more resilient investment framework is not just an opportunity, but a necessity for survival.

A. The Great Patent Cliff of the 2020s: A Recurring Existential Threat

The term “patent cliff” is a colloquialism, but one that aptly captures the phenomenon: a sharp, sudden, and often catastrophic decline in revenue that a company experiences when a blockbuster drug loses its legal protection and faces a flood of generic or biosimilar competition.5 This is not a new challenge, but the scale and frequency of these events in the current decade represent a seismic shift in the industry’s financial landscape.4

Quantifying the Chasm

The financial stakes of the current patent cliff are staggering. Industry analysts project that between now and 2030, over $200 billion in annual revenue is at risk as approximately 190 drugs, including an estimated 69 blockbusters, are set to lose their market exclusivity.4 This is not a distant, abstract threat; it is a recurring structural feature of the pharmaceutical market that perpetually tests corporate resilience and strategic foresight.5 The pressure is immense, as a blockbuster drug can lose up to 80% of its revenue within the first year of facing generic competition, forcing companies to scramble to offset these monumental losses.4 For a company heavily reliant on a single product, this cliff represents an existential threat that can erode investor confidence, depress stock prices, and severely limit the capital available for future innovation.5

Historical Precedent as a Warning

The devastating impact of past patent cliffs serves as a stark warning to the industry. The cases of Pfizer’s Lipitor (atorvastatin) and Bristol-Myers Squibb/Sanofi’s Plavix (clopidogrel) are textbook examples of this value destruction.

- Lipitor: Once the world’s best-selling drug, generating billions in annual revenue for Pfizer, Lipitor experienced a stunning drop in sales upon its patent expiration in late 2011. In one quarter alone, sales plummeted by 71%.12 In the first full year after losing exclusivity, worldwide revenues fell by 59%, from $9.5 billion in 2011 to just $3.9 billion in 2012, a loss of over $5.5 billion in a single year.5

- Plavix: This anti-platelet blockbuster, with peak sales of around $9 billion, faced a similar fate upon its patent expiry in 2012, with a significant and rapid drop in sales as cheaper generic alternatives flooded the market.5

These events are not mere revenue dips; they are valuation-destroying cataclysms that underscore the fragility of a business model built solely on a single, time-limited asset.

The Current Wave: Keytruda, Opdivo, and Eliquis on the Brink

The lessons of Lipitor and Plavix are acutely relevant today, as a new cohort of mega-blockbusters approaches its own loss of exclusivity (LOE). The drugs at risk represent tens of billions in annual revenue, and the companies that depend on them are in a race against time to diversify and innovate.13

- Keytruda (pembrolizumab): Merck’s immuno-oncology titan, which generated over $29 billion in 2024, is projected to lose U.S. exclusivity around 2028. Analysts project its sales could decline by 19% in the first year post-expiration, falling from a projected $33.7 billion to $27.4 billion.5

- Opdivo (nivolumab) and Eliquis (apixaban): Bristol-Myers Squibb faces a particularly concentrated risk, with two of its largest products facing LOE in the coming years. Together, these drugs accounted for a significant portion of the company’s 2024 revenue, highlighting the immense pressure on its pipeline to deliver replacements.13

This looming wave of expirations makes it unequivocally clear that relying on a single patent-protected asset, no matter how successful, is an unsustainable long-term strategy.

B. The R&D Productivity Paradox: Spending More, Getting Less

Compounding the external threat of the patent cliff is an internal, systemic crisis in R&D productivity. The economic model that justified massive R&D spending with the promise of blockbuster revenues is breaking down, caught in a paradox of escalating costs and stagnant output.

The Staggering Cost of Innovation

The investment required to bring a new drug to market has reached almost unfathomable levels. In 2019, the pharmaceutical industry collectively spent $83 billion on R&D, an amount that, when adjusted for inflation, is approximately ten times what the industry spent per year in the 1980s.7 This spending intensity is also growing as a share of revenue; in 2019, drug companies spent about a quarter of their net revenues on R&D, nearly double the share they spent in 2000.7

This massive industry-wide investment translates to a breathtaking cost per asset. While estimates vary, recent studies place the average capitalized cost to develop a single new drug—including the cost of failures—at $2.23 billion.8 Some analyses have placed the figure even higher, at over $2.5 billion.15 This figure accounts not only for the direct out-of-pocket expenses for clinical trials and research but also for the capital costs tied up for over a decade and, most importantly, the enormous expenditures on the many drug candidates that fail along the way.7

The Valley of Death: Attrition Rates and the R&D ROI Crisis

Despite this unprecedented level of spending, success in drug development remains the exception, not the rule. The journey from the lab to the market is a high-attrition gauntlet often referred to as the “valley of death.” On average, only about 12% of drugs that enter Phase 1 clinical trials will ultimately gain FDA approval.7 This means that for every successful new medicine, roughly eight others have failed, often after hundreds of millions of dollars have already been invested, particularly in costly late-stage trials.8

The result of this dynamic—skyrocketing costs and persistently high failure rates—is a crisis in R&D productivity. A recent McKinsey analysis revealed that industry-level R&D return on investment (ROI) has been effectively flat since 2012, indicating a decade of stagnant productivity despite ever-increasing investment.9 This unsustainable economic model forces companies to price their few successful drugs high enough to cover the costs of the many failures, a practice that is becoming increasingly untenable in the current policy environment.

The pursuit of true breakthrough innovation in the post-blockbuster era is, paradoxically, a primary driver of this economic strain. The “low-hanging fruit” of chemically simple drugs for diseases with well-understood mechanisms has largely been picked.16 The industry has necessarily pivoted toward more complex and challenging targets, leading to a focus on specialty drugs, biologics, and novel therapeutic modalities like cell and gene therapies.7 These advanced therapies, while holding immense promise for patients, come with their own set of profound challenges. They often have unique and poorly understood toxicology profiles, complex and costly manufacturing processes, and difficult delivery mechanisms that require entirely new scientific solutions.18 This inherent complexity drives up the cost and duration of clinical trials, further increasing the financial risk of each program.20 Thus, the very scientific ambition required to address today’s unmet medical needs is straining the traditional, asset-by-asset R&D model to its breaking point, creating a powerful incentive for a new paradigm that can de-risk and streamline this process.

C. The Squeeze from Payers and Policymakers: The End of Pricing Power

The final force unraveling the old model is the erosion of pricing power. The ability to command premium prices during the period of patent-protected market exclusivity was the critical variable that made the high-risk, high-cost R&D model viable. That variable is now under sustained assault from both governments and commercial payers.

The IRA’s Long Shadow

In the United States, the largest and most profitable pharmaceutical market, the Inflation Reduction Act (IRA) represents a fundamental and permanent shift in the landscape. For the first time, the law grants Medicare the authority to directly negotiate the prices of certain high-expenditure drugs.4 This policy directly challenges the industry’s long-held ability to set launch prices based on factors like recouping R&D investment and what the market will bear. The IRA introduces significant uncertainty into long-term revenue forecasting and fundamentally alters the economic calculus for developing drugs, particularly for small-molecule therapies that are subject to negotiation sooner than biologics.10

The Global Shift to Value-Based Reimbursement

This pricing pressure is not confined to the U.S. market. Globally, health technology assessment (HTA) bodies and national payers are moving away from simply reimbursing for a drug based on its regulatory approval. They are increasingly demanding robust evidence of its value relative to existing standards of care.21 This requires companies to generate compelling

Health Economics and Outcomes Research (HEOR) data demonstrating not only clinical efficacy but also cost-effectiveness and a positive impact on the overall healthcare system, such as reducing hospitalizations or other long-term costs.

The strategic implication of this global trend is profound. The era of securing premium pricing for drugs that offer only incremental improvements over existing therapies is over. A company’s ability to develop, articulate, and scientifically prove a compelling value proposition to a skeptical audience of payers is no longer a post-approval marketing function; it is a core competency that must be integrated into R&D from the earliest stages. For investors, this means that future revenue projections must be discounted to account for this new pricing reality. A company’s market access strategy and its ability to generate the evidence needed to support it have become critical components of its fundamental investment case.

III. The First Pillar of the New Model: Investing in Engines, Not Just Assets

As the foundations of the old, single-asset blockbuster model crumble, a new and far more resilient investment thesis has emerged: backing technology platforms. This represents the most significant strategic shift in biopharma investing in a generation. Rather than placing high-risk, binary bets on individual drug candidates, sophisticated capital is now flowing toward companies that have built scalable, multi-product “engines” of innovation. These platforms—core, repeatable technologies capable of generating an entire pipeline of therapeutic programs—are fundamentally reshaping the calculus of risk, return, and long-term value creation.

A. The Strategic Imperative of Platform Technologies

The move toward platform investing is a direct response to the economic and scientific challenges plaguing the traditional R&D model. A platform provides a systematic, repeatable method for generating and optimizing new medicines, de-risking the innovation process and creating multiple pathways to value.22

Redefining the Investment Thesis

A technology platform can be defined as an underlying technology that powers numerous applications.22 In biotechnology, this includes foundational systems like messenger RNA (mRNA) synthesis and delivery, CRISPR-Cas gene editing, RNA interference (RNAi), and artificial intelligence (AI)-driven discovery engines. An investment in a platform company is not a bet on a single molecule’s journey through clinical trials; it is an investment in the machinery that produces the molecules. This marks a reorientation away from the high-risk, all-or-nothing outcomes that have long defined drug development.22

The Venture Capital Viewpoint

The flow of venture capital (VC) provides the clearest evidence of this paradigm shift. An analysis by McKinsey found that from 2019 to 2021, VC firms invested over $52 billion globally in therapeutic-based biotech companies. A staggering two-thirds of that capital was directed toward start-ups with platform technologies.23 This preference is not a fleeting trend but a new “steady state.” Venture capitalists now see an ideal financing ratio of 2:1 or even 3:1 in favor of platform companies over single-asset companies, reflecting a belief that this balanced approach is the most effective way to deploy risk capital and generate sustainable returns.24

“In a market that increasingly rewards foresight, resilience, and innovation at scale, the biotechnology venture fund must look beyond the molecule to the machinery that produces it. Platform technologies are not just investments; they are engines of exponential value.”

— Chairman and Managing Director, The Hamptons Group 22

The Investor’s Edge: Diversification, Resilience, and Layered Returns

For investors, the platform model offers a superior risk-reward profile built on three key advantages:

- Inherent Portfolio Diversification: A single investment in a platform company provides immediate, built-in diversification across multiple therapeutic programs and disease targets. This structure naturally dilutes the risk associated with the failure of any single clinical program, a stark contrast to the concentrated risk of a single-asset company.22

- Resilience and Adaptability: In the traditional model, the failure of a lead asset is often a fatal blow. For a platform company, it is a data point. A retrospective analysis found that while most non-platform companies faded away after a lead program failed, 30% of platform companies whose first asset failed are still in active preclinical or clinical development today.25 The underlying technology can be rapidly redeployed to new targets, often incorporating the learnings from the initial failure to increase the probability of success for subsequent programs.

- Multiple “Shots on Goal” and Layered Returns: Platforms create a cascade of value-creation opportunities. Beyond the development of an internal pipeline, value can be externalized through asset spinouts, structured partnerships, and strategic licensing deals.22 This creates multiple, ongoing value inflection points and a variety of potential exit scenarios, offering layered, recurring returns over a much longer horizon than the binary outcome of a single drug approval.22

B. The Six Platforms Defining the Future of Biotech

Investor excitement is currently concentrated around a handful of next-generation platforms that promise to tackle disease with unprecedented precision and efficiency. These six areas, identified by McKinsey as attracting the most significant VC funding, represent the technological frontier of modern medicine.23

- Cell Therapy 2.0: The first generation of autologous CAR-T therapies, while revolutionary, is hampered by complex, patient-specific manufacturing and safety concerns. The next wave of investment is focused on overcoming these hurdles. This includes developing allogeneic or “off-the-shelf” cell therapies from healthy donor cells, harnessing different immune cells like Natural Killer (NK) cells to better target solid tumors, and pioneering in vivo cell therapy, where the patient’s own body is instructed to produce the therapeutic cells, eliminating external manufacturing entirely.

- Next-Generation Gene Therapies: The discovery of CRISPR-Cas9 unlocked the potential to edit the human genome, but it has limitations. The next generation of platforms is moving toward greater precision and safety. This includes RNA-based editing tools (like ADAR and CRISPR-Cas13) for transient, reversible edits; novel editing technologies like base and prime editors that can make a wider range of DNA changes without causing double-strand breaks; and epigenetic modulators that can turn genes on or off without altering the DNA sequence itself.

- Precision Medicine: This platform approach uses advanced diagnostics and analytics to tailor treatments to an individual’s unique genetic and biological profile. The cutting edge of this field involves advanced multi-omic tools that can scan millions of circulating biomarkers (DNA, RNA, proteins, metabolites) to detect diseases like cancer at their earliest stages, and AI-driven platforms that can sift through massive genomic datasets to discover novel biomarkers and drug targets for specific patient subpopulations.

- Machine Learning-Enabled Drug Discovery: AI is being leveraged to fundamentally re-engineer the slow, inefficient process of early-stage drug discovery. These platforms use machine learning (ML) models to analyze vast biological datasets to identify new disease targets, design novel molecules with desired properties from scratch (rational drug design), and predict a compound’s efficacy and toxicity before it ever enters a lab, dramatically accelerating preclinical timelines and reducing failure rates.

- Targeting the “Undruggable”: The vast majority of disease-causing proteins cannot be effectively targeted by traditional small-molecule drugs or antibodies because they lack suitable binding sites. New platforms are emerging to tackle these “undruggable” targets. The most prominent are protein degraders, such as proteolysis-targeting chimeras (PROTACs), which don’t just block a protein’s function but co-opt the cell’s natural machinery to destroy the target protein entirely.

- Novel Delivery Methods: The most sophisticated drug is useless if it cannot get to the right cells in the body safely and effectively. This is a major bottleneck for gene therapies, RNA medicines, and other complex biologics. Significant investment is flowing into platforms designed to solve this delivery challenge, including the engineering of improved viral vectors (like adeno-associated viruses, or AAVs) with better tissue-targeting capabilities, the development of non-viral biological vehicles like exosomes, and the optimization of lipid nanoparticles (LNPs) to deliver their cargo beyond the liver.

C. Case Study in Platform Mastery: The mRNA Revolution (Moderna)

No company better exemplifies the power of the platform model than Moderna. Its ability to develop, manufacture, and deploy a highly effective COVID-19 vaccine in less than a year was not a stroke of luck; it was the culmination of a decade-long, focused investment in building a versatile and repeatable mRNA technology platform.27

From Concept to Global Vaccine

Moderna’s platform is an end-to-end system for designing and producing mRNA medicines. It starts with identifying a target protein, designing an mRNA sequence that provides the instructions for making that protein, and then manufacturing that mRNA and encapsulating it in a delivery vehicle (an LNP).27 Because the fundamental process is the same regardless of the target protein, the platform allows for the rapid and parallel design of multiple drug candidates. The COVID-19 pandemic served as the ultimate, high-stakes proof-of-concept for the platform’s core advantages: speed and adaptability.

Valuation Beyond a Single Product

The investment thesis for Moderna (MRNA) is a pure platform play. While the company is experiencing a significant near-term revenue decline from its peak COVID-19 vaccine sales and is operating with a high cash burn rate, its long-term valuation is anchored not in a single product but in the immense potential of its underlying engine.28 The company is leveraging its validated platform to build a deep and diverse pipeline of

48 programs in development, including 36 in clinical studies.29

Investors are valuing the platform’s potential to generate a stream of future products across multiple high-value therapeutic areas, including next-generation infectious disease vaccines (e.g., combination COVID/flu shots), personalized cancer vaccines that instruct the body to attack a patient’s specific tumor mutations, and therapies for rare genetic diseases.28 The company’s strategy, as communicated to investors, is to accelerate these investments—with a projected R&D budget of $4.5 billion for 2023—to deliver the greatest possible impact through its mRNA platform.29 The valuation of Moderna is a bet on the continued productivity of its innovation engine.

D. Case Study in Sustained Innovation: The RNAi Breakthrough (Alnylam)

If Moderna’s story is about the explosive speed of a validated platform, Alnylam Pharmaceuticals’ journey is a testament to the enduring value created by methodically building and defending a platform over the long term. Alnylam pioneered the entire field of RNA interference (RNAi) therapeutics, a new class of medicines that can “silence” disease-causing genes.

A 15-Year Journey to Validate a Platform

The scientific promise of RNAi was recognized with a Nobel Prize in 2006, but translating that promise into actual medicines was a monumental challenge.31 For its first decade, Alnylam toiled on what its head of R&D called “the singular challenge that stands out above all”: delivery.32 The small interfering RNA (siRNA) molecules at the heart of the therapy were quickly destroyed by enzymes in the blood and could not get into the target cells. The company spent over

15 years and more than $1.6 billion in R&D investment to solve this fundamental problem.32

The Payoff: A Reproducible Drug Development Engine

Alnylam’s persistence paid off with the development of two proprietary and highly effective delivery platforms: Lipid Nanoparticles (LNPs) for intravenous administration and N-acetylgalactosamine (GalNAc) conjugates for subcutaneous administration.31 These technologies provided a safe and reliable way to get siRNA molecules to their target tissue (primarily the liver), creating a modular and reproducible drug development engine.

This engine has proven to be remarkably productive. Since its first FDA approval in 2018, Alnylam has brought six RNAi therapeutics to market and has built a robust clinical pipeline targeting rare genetic diseases, cardiovascular conditions, and neurological disorders.31

The success of Alnylam demonstrates a crucial concept for investors: a mature, validated technology platform creates a powerful and durable competitive moat. The company’s core value lies not just in its individual approved drugs, but in its deep, proprietary expertise and extensive patent estate surrounding its LNP and GalNAc delivery technologies.34 This creates a steep barrier to entry. A competitor cannot simply design a new siRNA molecule; they must also independently solve the complex and costly problem of delivering it to the correct cells in the body.32 This deep, process-based know-how is far more difficult to replicate or “design around” than a single patent on a drug’s chemical structure. For investors, Alnylam’s platform represents a long-term value-creation machine, with the potential to continue leveraging its delivery moat to generate new products for years to come, long after the patents on its first medicines have expired.

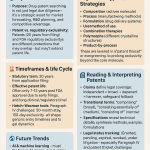

IV. The Second Pillar: Mastering the Regulatory Labyrinth

While patents form the initial layer of intellectual property protection, they are only half of the story. A second, equally critical and often more durable source of market protection comes from regulatory exclusivities granted directly by the U.S. Food and Drug Administration (FDA). In an era where the effective life of a patent is often compressed by a decade or more of development and regulatory review, a sophisticated understanding and strategic use of these exclusivities is no longer an ancillary legal tactic but a core pillar of a company’s investment case. For investors, a company’s ability to navigate this regulatory labyrinth can create significant, predictable, and often undervalued sources of competitive advantage.

A. The Other Half of the Monopoly: Patents vs. Regulatory Exclusivities

To build a robust investment thesis, it is essential to understand the fundamental distinction between these two forms of protection. They are not interchangeable; they are distinct, complementary shields that operate independently to protect a drug’s market position.

Defining the Difference

A patent, issued by the U.S. Patent and Trademark Office (USPTO), protects an invention—be it a new chemical compound, a method of use, or a manufacturing process—from being made, used, or sold by others for a 20-year term from the filing date.2

Regulatory exclusivity, by contrast, is a marketing right granted by the FDA upon a drug’s approval. It prevents the FDA from approving a competing generic (Abbreviated New Drug Application, or ANDA) or biosimilar application for a statutorily defined period, regardless of the patent landscape.36

One of the most effective analogies for this distinction is that of real estate development.37 A patent is like the deed to a piece of land; it proves ownership of the invention. Exclusivity, on the other hand, is like a government-issued zoning permit that declares, for a set number of years, no one else is even allowed to

apply to build a competing structure on adjacent land. This regulatory “zoning permit” can often provide a stronger and more predictable barrier to entry than the patent “deed” alone.

The Strategic Value of an Impermeable Barrier

The independence of exclusivity from the patent system is its greatest strategic strength. Patents can be, and frequently are, challenged in court by generic manufacturers. A successful legal challenge can invalidate a patent or find that a generic product does not infringe, opening the door to competition years before the patent’s nominal expiration date.

Regulatory exclusivity, however, acts as a final, impermeable barrier. During a drug’s period of, for example, New Chemical Entity (NCE) exclusivity, the FDA is legally barred from approving a generic application.37 This holds true even if the generic applicant has successfully challenged and invalidated every single one of the innovator’s patents in court. This provides a guaranteed, predictable period of market monopoly that serves as a critical backstop, de-risking the substantial investment required for drug development and providing investors with a layer of security that a patent portfolio alone cannot offer.3

B. The Strategist’s Arsenal: A Deep Dive into Key Exclusivity Types

The FDA provides several types of regulatory exclusivity, each designed to incentivize different kinds of innovation. For strategists and investors, these are not just regulatory footnotes; they are powerful tools that can be leveraged to maximize an asset’s commercial lifespan.

- New Chemical Entity (NCE) Exclusivity: This is the foundational exclusivity for truly novel drugs. It grants five years of market protection for a drug containing an active ingredient that has never before been approved by the FDA.5 This exclusivity is a cornerstone of the Hatch-Waxman Act, designed to reward the high-risk, high-cost R&D associated with bringing a first-in-class molecule to market.

- Orphan Drug Exclusivity (ODE): This is one of the most powerful incentives in modern drug development. It provides seven years of market exclusivity for a drug approved to treat a rare disease or condition, defined in the U.S. as one affecting fewer than 200,000 people.2 ODE has transformed the economics of the industry, making the development of drugs for small patient populations a highly profitable and strategically attractive endeavor.

- Pediatric Exclusivity (PED): This is a unique and often immensely valuable tool. As a reward for conducting FDA-requested studies of a drug in children, a company is granted an additional six months of exclusivity. Critically, this six-month extension is added to all existing patents and regulatory exclusivities that a drug has.5 For a blockbuster drug generating billions of dollars in annual sales, this six-month period of additional monopoly can be worth more than the entire development cost of many other drugs, representing an exceptionally high return on investment.

- Qualified Infectious Disease Product (QIDP) Exclusivity: To combat the growing threat of antibiotic resistance and stimulate a flagging R&D pipeline for new anti-infectives, this exclusivity grants an additional five years of market protection, which is added on top of any other exclusivities the drug may have, such as NCE exclusivity.38

- New Clinical Investigation Exclusivity: This exclusivity rewards continued innovation for drugs already on the market. It provides three years of protection for a new indication, new dosage form, or other significant change to an approved drug, provided the change required new clinical studies to be conducted.6 This incentivizes companies to continue investing in their products throughout their lifecycle, expanding their utility for patients.

C. Integrating Exclusivity Strategy into the Investment Thesis

To maximize value in the current environment, exclusivity planning cannot be a post-approval afterthought; it must be a core component of a drug’s development strategy and an investor’s due diligence process from the very beginning.

From R&D to ROI

Decisions made in the earliest stages of R&D can have direct and massive financial consequences years down the line. For example, the strategic decision to pursue an orphan indication for a new cancer drug is not just a clinical choice; it is a financial one that could unlock seven years of ODE.37 Similarly, planning for and budgeting for pediatric studies early in the development process can secure the highly lucrative six-month PED extension. R&D, clinical, and regulatory teams must work in lockstep to identify and pursue these opportunities, as they are fundamental drivers of an asset’s long-term value.

The Role of Competitive Intelligence

An investor’s due diligence must now extend beyond the patent portfolio to include a thorough analysis of a target company’s current and potential exclusivity strategy. This requires a deep understanding of the regulatory landscape and access to sophisticated competitive intelligence. Tools like DrugPatentWatch have become invaluable in this context, as they provide an integrated platform for tracking not only patent filings and litigation but also the complex web of regulatory exclusivities for both innovator and competitor products.39 By monitoring the complete exclusivity landscape, investors and business development teams can identify a competitor’s vulnerabilities, anticipate the timing of generic entry with greater precision, and uncover “white space” opportunities to build a more defensible position for their own portfolios.39 A company that can demonstrate a thoughtful, multi-layered exclusivity strategy presents a significantly more attractive and de-risked investment opportunity.

| Table 1: Strategic Value of Key U.S. Regulatory Exclusivities for Investors | |||

| Exclusivity Type | Duration | Eligibility Criteria | Strategic Implication for Investors |

| New Chemical Entity (NCE) | 5 years | Drug contains an active moiety never previously approved by the FDA. | De-risks investment in novel, first-in-class drug development by providing a guaranteed baseline of market protection. |

| Orphan Drug (ODE) | 7 years | Drug treats a rare disease or condition affecting <200,000 people in the U.S. | Transforms niche markets into highly profitable, defensible assets with extended monopoly periods. A key driver of M&A activity. |

| Pediatric (PED) | 6 months | Granted upon completion of FDA-requested pediatric studies. | Offers a high-ROI extension for established products. The 6 months are added to all existing patents and exclusivities, making it exceptionally valuable for blockbusters. |

| Qualified Infectious Disease Product (QIDP) | 5 years (additional) | Drug designated by FDA as a QIDP for treating serious or life-threatening infections. | Provides a powerful incentive to invest in the high-need, but historically less profitable, area of antibiotic and anti-infective R&D. |

| New Clinical Investigation | 3 years | Approval of a new indication or other significant change requires new clinical studies. | Rewards and protects investment in lifecycle management, allowing companies to expand a drug’s market and create new value from an existing asset. |

V. The Third Pillar: Building Indefensible Moats Through Operational and Digital Supremacy

In the new pharmaceutical landscape, competitive advantage is no longer derived solely from the intellectual property protecting a molecule. Increasingly, durable, defensible moats are being built from “softer” assets: superior manufacturing capabilities, resilient and intelligent supply chains, and the mastery of data and artificial intelligence. These operational and digital capabilities are becoming hard sources of value, creating barriers to entry that can be just as formidable as a patent. For investors, a company’s prowess in these areas is a direct indicator of its ability to execute, scale, and compete in the complex world of modern therapeutics.

A. The Supply Chain as a Strategic Weapon in the Age of Biologics

The transition from chemically synthesized small molecules to complex, living biologics—and now to cell and gene therapies—has elevated the supply chain from a back-office logistical function to a core strategic imperative.41 For these advanced therapies, the manufacturing process and the supply chain are inextricably linked to the product’s safety, efficacy, and commercial viability.

From Back Office to Boardroom

The regulatory mantra for biologics and cell therapies is “the process is the product”.42 This means that the way a therapy is manufactured—the specific cell lines, growth media, genetic modification techniques, and purification protocols—fundamentally defines the final therapeutic. This reality reframes manufacturing and supply chain expertise not as a commoditized service but as a core competency and a source of durable competitive advantage. A company that has mastered the complex art of producing these therapies at scale has an asset that is difficult and time-consuming for a competitor to replicate.

The Unique Challenges of “Living Drugs”

The logistical hurdles for cell and gene therapies are unprecedented in their complexity. Unlike a pill that can be stored at room temperature, these are often living drugs that require a meticulously controlled and monitored journey from the manufacturing facility to the patient’s bedside.43

- Cryogenic Logistics: Many of these therapies must be transported and stored at ultra-low temperatures (often below -150°C) in specialized cryogenic shippers to maintain their viability. This “cold chain” must be unbroken and verifiable.

- Chain of Custody and Identity: For autologous therapies, where a patient’s own cells are extracted, modified, and re-infused, maintaining a perfect chain of identity is a matter of life and death. The therapy manufactured from Patient A’s cells must get back to Patient A, and only Patient A. This requires sophisticated tracking and digital systems.

- Just-in-Time Coordination: These are not mass-produced products. The entire supply chain often revolves around a single patient, requiring precise, just-in-time coordination between the apheresis center where cells are collected, the manufacturing site, and the hospital where the patient is waiting for infusion.43

A single failure at any point in this chain—a shipment delay, a temperature deviation, a data error—can result in the loss of an irreplaceable, life-saving dose and a catastrophic setback for the patient and the company.

Strategic Implication for Investors

Given these high stakes, an investor’s due diligence process must now rigorously assess a company’s operational readiness. This involves scrutinizing its manufacturing capabilities, the quality and experience of its Contract Development and Manufacturing Organization (CDMO) partners, and the robustness of its digital supply chain infrastructure.41 A company that has invested in building a resilient, scalable, and compliant supply chain is not just mitigating risk; it is building a competitive advantage that will be critical for a successful product launch and long-term commercial success.

B. AI and Data as the New Currency of R&D

The second operational pillar transforming the industry is the strategic deployment of artificial intelligence and data analytics across the entire value chain. This is moving beyond isolated pilot projects to become a fundamental driver of efficiency and innovation.

AI-Powered Drug Discovery

The use of AI and machine learning to re-engineer the drug discovery process is no longer a futuristic concept; it is delivering tangible results today. AI platforms can analyze massive biological datasets to identify novel drug targets, screen billions of virtual compounds to find promising leads, and predict a molecule’s potential efficacy and toxicity with increasing accuracy.45

- Case in Point: Companies like Exscientia and Insilico Medicine have become pioneers in this space, successfully using their AI platforms to take novel drug candidates from initial concept to human clinical trials in a fraction of the time and cost of traditional methods.47

- The Economic Impact: The potential for value creation is enormous. Analysts at Morgan Stanley Research estimate that even modest improvements in early-stage drug development success rates enabled by AI could generate the cost savings needed to fund the successful development of an additional four to eight novel medicines each year.15 This represents a potential 15% increase in the industry’s innovative output, driven purely by efficiency gains.

Real-World Evidence (RWE) for Value Demonstration

In an environment dominated by value-based care, the data generated in randomized controlled trials (RCTs) is no longer sufficient. Payers and physicians want to know how a drug performs in the messy, complex reality of everyday clinical practice. Real-World Evidence (RWE)—derived from sources like electronic health records, insurance claims data, and patient registries—provides this crucial insight.40 A company with strong capabilities in generating and analyzing RWE can more effectively demonstrate its product’s long-term effectiveness, its comparative value against competitors, and its overall economic benefit to the healthcare system, which is critical for securing favorable reimbursement and market access.

Decentralized and Patient-Centric Trials

The COVID-19 pandemic served as a massive catalyst for the adoption of decentralized clinical trials (DCTs), which use digital health technologies (wearables, telemedicine, remote monitoring) to bring the trial to the patient, rather than forcing the patient to travel to a central site.49 This is a significant driver of value and efficiency. DCTs can dramatically accelerate patient enrollment, reduce costly dropout rates, provide more continuous and realistic data, and increase the diversity of the trial population to better reflect the real world.49 Companies that master the operational complexities of DCTs will have a distinct advantage in the race to bring new medicines to market faster and with more robust data.

The power of a platform-based model is magnified by its ability to generate and leverage data as a compounding asset. Unlike a single-asset company, where data from a trial is a discrete endpoint, a platform company is constantly running related experiments and clinical programs. Each of these programs generates vast amounts of biological, manufacturing, and clinical data.26 This proprietary data can be fed back into the platform’s central AI and machine learning models, creating a virtuous cycle. The models become “smarter” and more predictive with each new dataset they process.45 For example, data from a failed trial for one cancer type might reveal crucial insights about the platform’s delivery mechanism or a specific biomarker signature that directly informs and de-risks the next program in the pipeline. In this model, data is not a static byproduct of R&D; it is a compounding strategic asset. The more the platform is utilized, the more powerful its predictive capabilities become, creating a growing competitive advantage that is exceptionally difficult for a new entrant, with no such historical data, to replicate. Investors must begin to value this proprietary data asset as a key component of a platform company’s long-term potential.

VI. The Fourth Pillar: The Human Capital Advantage

In an industry where value is created through knowledge, discovery, and innovation, the ultimate source of competitive advantage is people. As the pharmaceutical sector undergoes a profound technological and strategic transformation, the ability to attract, retain, and empower elite talent has become a critical determinant of success. For investors, the quality, experience, and adaptability of a company’s leadership and scientific teams are no longer soft metrics; they are primary, and perhaps the most important, leading indicators of a company’s potential to thrive in a complex and rapidly evolving landscape.

A. The Intensifying War for 21st-Century Talent

The strategic shift toward data-driven, platform-based R&D and complex biologic manufacturing has fundamentally altered the talent profile required for success. The demand for new, interdisciplinary skillsets is exploding, creating a fierce competition for a limited pool of experts.

The New Skillsets in Demand

The modern biopharma company is no longer staffed solely by bench chemists and clinical trial managers. The new era demands a fusion of deep scientific knowledge with advanced technological fluency. The most sought-after professionals are those who can operate at the intersection of biology and data science.50

- Computational Biologists and Bioinformaticians: These experts are essential for analyzing the massive genomic, proteomic, and clinical datasets that fuel precision medicine and AI-driven discovery platforms.51

- AI and Machine Learning Specialists: As AI becomes central to R&D, there is intense demand for specialists who can build, train, and deploy the algorithms that are accelerating drug discovery and optimizing clinical trials.50

- Regulatory Experts for Novel Modalities: Navigating the FDA with a first-in-class cell therapy or a novel gene editing platform requires a specialized form of regulatory expertise that is in short supply.51

- Bioprocess and Manufacturing Engineers: With the rise of biologics, the demand for engineers who can solve the challenges of large-scale production and maintain quality control has skyrocketed.50

A Supply-Side Bottleneck

The pool of world-class talent in these emerging, highly specialized fields is finite. This creates a classic supply-and-demand imbalance. As economic theory posits, simply increasing the demand for innovation through R&D subsidies or tax credits is inefficient if the supply of skilled innovators is inelastic. In such a scenario, increased spending may only serve to drive up the wages of the existing talent pool without significantly increasing the volume of innovative output.53 This makes talent acquisition and retention not just an HR function, but a central strategic challenge that can become a bottleneck to a company’s growth.

Innovative Recruitment and Retention Strategies

Leading companies recognize this challenge and are adopting more creative strategies to win the war for talent.

- Expanding the Talent Pool: Rather than insisting on candidates with direct biotech experience, forward-thinking companies are looking for analogous skills in adjacent, highly regulated industries like aerospace, where complex processes and strict protocols are the norm.55

- Building a Mission-Driven Brand: In a competitive market, compensation is not the only factor. A LinkedIn survey revealed that 75% of biotech candidates prioritize companies with strong, mission-driven values.51 A compelling vision to impact patient lives can be a powerful recruitment tool.

- Investing in Lifelong Learning: Companies like Biogen are creating internal “Digital Academies” to continuously upskill their existing workforce in critical areas like AI-driven drug discovery and advanced bioinformatics, fostering a culture of innovation and future-proofing their talent base.51

B. The Investor’s Premium on Proven Leadership

While a brilliant scientific idea is the necessary spark for a new biotech venture, it is rarely sufficient for success. The journey from a promising discovery to a marketed therapy is long, expensive, and fraught with scientific, regulatory, and commercial perils. In this high-stakes environment, venture capital firms and other sophisticated investors place an enormous premium on the quality and experience of the management team.

Experience as a De-Risking Factor

There is no substitute for having “been there, done that.” A leadership team and scientific advisory board composed of individuals who have successfully navigated the drug development process before is one of the most powerful de-risking factors for an early-stage investment.56 Their track record provides a crucial signal of credibility and competence.

The “Seeing Around Corners” Advantage

Experienced leaders bring more than just technical expertise. They bring invaluable pattern recognition, allowing them to anticipate common pitfalls and make smarter strategic decisions. They also bring extensive networks of relationships with other investors, potential pharma partners, key opinion leaders, and regulatory officials, which can be instrumental in helping a young company scale efficiently and overcome obstacles.59

The due diligence process for an early-stage biotech company is often more about the people than the product itself. A common maxim in venture capital is that an “A” team with a “B” idea is a more attractive investment than a “B” team with an “A” idea. The reasoning is straightforward: a world-class team has the capability to recognize when an initial approach is not working, pivot the strategy, and find a new path to success. A less experienced team, even with a brilliant initial concept, is more likely to stumble when faced with the inevitable challenges of drug development. Therefore, a rigorous assessment of the leadership team’s track record, resilience, and strategic acumen must be a core component of any sound investment valuation.

VII. The Final Hurdle: Reimagining Market Access and Commercialization

A groundbreaking scientific discovery, a scalable technology platform, and a world-class team are all essential components of a valuable pharmaceutical enterprise. However, they are not sufficient. In the final, critical stage of the value chain, even the most innovative therapy can fail if it cannot successfully navigate the increasingly complex and unforgiving landscape of pricing, reimbursement, and public perception. The ability to not only create clinical value but also to demonstrate and communicate that value to a diverse set of stakeholders—payers, physicians, patients, and policymakers—has become the final, and often highest, hurdle to commercial success.

A. Navigating the New Pricing Paradigm

The economic environment for pharmaceuticals has fundamentally changed. The days of launching a drug at a premium price and implementing steady, predictable price increases throughout its lifecycle are over. The new paradigm demands a more sophisticated and evidence-based approach to pricing and market access.

Life After the IRA

The Inflation Reduction Act has permanently altered the risk calculation for drugs marketed in the United States. With Medicare now empowered to negotiate prices, companies can no longer assume that they will have a decade or more of unfettered pricing freedom.4 The strategic imperative has shifted. Companies must now focus on demonstrating overwhelming clinical and economic value from day one to justify a strong launch price and to enter future price negotiations from a position of strength. This requires generating robust comparative effectiveness and health economic data much earlier in the development process.

The Rise of Innovative Contracting

In response to payer demands for accountability, the industry is seeing a rise in value-based contracts (also known as outcome-based contracts). In these arrangements, the price a payer pays for a drug is linked directly to its real-world performance in their patient population.21 For example, a manufacturer of a new cholesterol-lowering drug might agree to provide a larger rebate if a certain percentage of patients do not reach their target cholesterol levels. While these contracts require a sophisticated infrastructure for collecting and analyzing real-world data, they offer a powerful way to align the interests of manufacturers and payers. They allow innovative companies to compete on the basis of the value their products deliver, creating a defensible moat against competitors who are forced to compete solely on price.

B. Case Study in Market Access Missteps: The Sovaldi Story (Gilead)

Perhaps no single case better illustrates the critical importance—and the potential pitfalls—of market access strategy than the launch of Gilead Sciences’ Sovaldi (sofosbuvir). The story is a powerful cautionary tale about what can happen when a revolutionary clinical breakthrough collides with the realities of healthcare economics and public perception.

A Cure at What Cost?

Sovaldi was a true medical miracle. It was a key component of the first all-oral regimen that could cure Hepatitis C, a chronic and often fatal liver disease, in over 90% of patients with a simple 12-week course of treatment.60 It was a paradigm-shifting advance over the previous standard of care, which involved lengthy injections with debilitating side effects and had a much lower cure rate. However, Gilead launched Sovaldi in 2013 at a price of

$1,000 per pill, or $84,000 for a full course of treatment.61

The Backlash and Its Consequences

The price tag ignited an immediate and intense public and political firestorm. While Gilead argued that the price was justified by the drug’s value—it cured a deadly disease and would save the healthcare system billions in long-term costs like liver transplants—that argument was quickly overwhelmed by the sticker shock.60 Payers, both public and private, were faced with the prospect of billions of dollars in new spending to treat the millions of people infected with Hepatitis C. The backlash was swift and severe.

- Congressional Inquiries: The U.S. Senate launched a high-profile investigation into Gilead’s pricing strategy, concluding that it was driven primarily by a focus on maximizing revenue.62

- Payer Restrictions: To control costs, insurance companies and state Medicaid programs implemented strict access restrictions, often refusing to cover the drug for patients until their liver disease had progressed to an advanced stage.61

- Public Outrage: Patient advocacy groups and the media heavily criticized the company, framing the issue as one of corporate greed putting a cure out of reach for those who needed it most.61

Lessons Learned for Investors

Sovaldi was an immense commercial success, becoming one of the most lucrative drug launches in history.61 However, the controversy surrounding its launch had lasting consequences. It fundamentally changed the public conversation around drug pricing in the U.S. and arguably created the political momentum that eventually led to the passage of the price negotiation provisions in the IRA.

The key lesson from the Sovaldi case is that market access is no longer just about securing a favorable reimbursement decision from an insurer. It is also about managing public perception and political risk. A company’s pricing strategy must be defensible not only on economic grounds (in Gilead’s case, the need to recoup the $11 billion it paid to acquire Pharmasset, the company that discovered the drug) but also on ethical and societal grounds.62 For investors, this adds a new layer to the due diligence process. A company’s “social license to operate” is now a tangible factor that must be considered in any risk assessment. A brilliant drug with a tone-deaf market access strategy can create a firestorm of negative attention that can damage a company’s reputation, invite government scrutiny, and ultimately limit its long-term commercial potential.

VIII. Conclusion: A New Framework for Pharmaceutical Investing

The tectonic plates of the pharmaceutical industry are shifting. The old, patent-centric model that defined value creation for half a century is no longer a reliable guide to the future. The relentless pressure of the patent cliff, the crushing economics of R&D, and the end of unchecked pricing power have converged to force a necessary evolution. The era of betting on a single blockbuster asset with a 20-year patent runway is giving way to a more complex, dynamic, and ultimately more resilient investment landscape.

Synthesizing the Four Pillars

The future of successful pharmaceutical investing will be defined by a new, multi-dimensional framework for assessing value. The most durable and successful enterprises will be those that build their competitive advantage not on the finite life of a single patent, but on the enduring strength of four interconnected pillars:

- Platform Technologies: The strategic core of the modern biopharma company is a scalable, repeatable innovation engine. Investing in platforms over single assets diversifies risk, fosters resilience, and creates multiple, layered pathways to long-term value.

- Regulatory Mastery: In an environment of compressed patent life, the strategic use of FDA-granted regulatory exclusivities provides a critical, predictable, and often undervalued layer of market protection. It is a powerful tool for extending a product’s commercial life and de-risking investment.

- Operational and Digital Supremacy: For complex modern therapeutics, “how” a drug is made and delivered is as important as “what” it does. Superior capabilities in manufacturing, supply chain logistics, and the strategic use of AI and data are becoming formidable, hard-to-replicate competitive moats.

- Human Capital: Ultimately, innovation begins with people. In the intensifying war for talent, the ability to attract, retain, and empower a world-class team of scientists, engineers, and experienced leaders is the most fundamental driver of success.

The Investor’s New Due Diligence Checklist

This new reality demands a new set of questions for investors, business development teams, and strategists. The old checklist is obsolete. To identify the winners of the next decade, the due diligence process must evolve.

- Instead of asking: “What is the patent life of the lead asset?”

- One must now ask: “How scalable, defensible, and adaptable is the company’s underlying technology platform? What is the company’s integrated strategy for layering regulatory exclusivities to maximize the commercial lifecycle? How robust and scalable are its manufacturing and supply chain capabilities, particularly for complex biologics? Does the leadership team have a proven track record of success in this specific modality and therapeutic area?”

Final Word: From Finite Patents to Enduring Value

This evolution beyond a singular reliance on patents should not be viewed as a threat to the industry, but as a maturation. It marks a necessary and healthy shift away from an investment model based on assets with a finite, predictable shelf life. The new model favors the building and backing of resilient, adaptable, and continuously innovating enterprises. These are the companies that will be capable of creating enduring value—for patients, for the healthcare system, and for the shareholders who have the foresight to invest in their future. The next generation of success will belong not to those who simply own a patent, but to those who build an enterprise worthy of sustaining innovation long after that patent has expired.

IX. Key Takeaways

- The Patent-Centric Model is Obsolete: Relying solely on patent expiration dates for valuation is no longer sufficient due to the immense pressure from the recurring patent cliff, unsustainable R&D costs (averaging over $2 billion per new drug), and aggressive pricing controls from payers and governments like the U.S. Inflation Reduction Act.

- Invest in Platforms, Not Just Products: The most significant shift in biotech investing is the focus on scalable technology platforms (e.g., mRNA, RNAi, AI-driven discovery) that can generate a pipeline of products. This approach inherently diversifies risk, builds resilience against individual clinical failures, and creates multiple opportunities for value creation through partnerships and spinouts.

- Regulatory Exclusivities are a Critical Asset: FDA-granted exclusivities (like Orphan Drug, Pediatric, and NCE) provide a powerful and often more predictable layer of market protection than patents alone. A sophisticated strategy to secure and layer these exclusivities can add years of monopoly revenue and significantly enhance an asset’s value.

- Operational Excellence is a Competitive Moat: For complex biologics and cell/gene therapies, manufacturing and supply chain capabilities (“the process is the product”) are a formidable barrier to entry. Likewise, mastery of AI in R&D and the use of Real-World Evidence (RWE) are creating significant efficiency gains and are now critical for demonstrating value to payers.

- The War for Talent is a Key Value Driver: In a knowledge-based industry, the quality of human capital is paramount. The demand for new, interdisciplinary skills (e.g., computational biology, data science) and the investor premium placed on experienced, proven leadership teams make talent acquisition and retention a central pillar of a company’s long-term value.

- Market Access is the Final, Critical Hurdle: A brilliant drug can fail commercially without a sophisticated market access strategy. This now includes not only securing reimbursement through value-based contracts but also managing public perception and political risk to maintain a “social license to operate,” as highlighted by the Gilead/Sovaldi case.

- A New, Holistic Valuation is Required: The future of pharmaceutical investing demands a multi-pillar assessment that evaluates a company’s Technology Platform, Regulatory Strategy, Operational/Digital Capabilities, and Human Capital in concert.

X. Frequently Asked Questions (FAQ)

1. How has the Inflation Reduction Act (IRA) fundamentally changed the risk calculation for pharmaceutical investors?

The IRA has fundamentally changed the risk calculation by introducing direct government price negotiation for certain drugs covered by Medicare, effectively ending the era of unchecked pricing power in the largest U.S. pharmaceutical market. For investors, this means that long-term revenue projections for new drugs, especially small molecules, must be modeled with greater uncertainty and potentially lower peak sales. It elevates the importance of a drug’s ability to demonstrate significant clinical and economic value from launch to justify its price and places a premium on therapies for which there are no alternatives, as these may be in a stronger negotiating position.

2. When evaluating a preclinical biotech, how should investors balance the potential of its technology platform against the lack of clinical data for a lead asset?

Investors should view the platform as the primary asset and the lead candidate as its first “proof-of-concept.” The evaluation should focus on the platform’s fundamentals: Is the underlying science robust? Is the technology truly differentiated and defensible? Is it scalable and applicable to multiple high-value targets? While the lead asset’s preclinical data is important, its failure would not necessarily invalidate the investment if the platform itself is sound. A strong platform offers resilience and “multiple shots on goal,” which mitigates the binary risk of a single preclinical asset. The quality and track record of the management team in translating platform science into clinical candidates is also a critical de-risking factor.

3. Beyond Orphan Drug Exclusivity, what is the most undervalued regulatory tool for extending a drug’s commercial life?

Pediatric Exclusivity (PED) is arguably the most undervalued and highest ROI regulatory tool. While Orphan Drug Exclusivity provides a powerful seven-year monopoly for a specific rare disease, PED offers a six-month extension that applies to all existing patents and other regulatory exclusivities a drug holds. For a blockbuster drug generating billions in annual revenue, this six-month extension can be worth several billion dollars in additional sales, often for a fraction of that cost to run the required pediatric studies. It is a powerful lifecycle management tool that should be planned for early in a drug’s development.

4. For cell and gene therapies, why is a company’s manufacturing and supply chain strategy just as important as its clinical trial results?

For cell and gene therapies, the manufacturing process is inextricably linked to the product itself—a concept known as “the process is the product.” The safety, efficacy, and consistency of these “living drugs” are fundamentally defined by how they are made, stored, and transported. A failure in the complex, often cryogenic, supply chain or an inability to scale manufacturing can render even a clinically successful therapy commercially unviable. Therefore, investors must conduct due diligence on a company’s manufacturing and logistics capabilities with the same rigor they apply to its clinical data, as operational failure is as significant a risk as clinical failure.

5. What are the top three non-scientific skills that are now critical for a biotech leadership team to possess in order to attract top-tier investment?

- Capital Allocation Acumen: The ability to strategically deploy limited resources, make tough go/no-go decisions on pipeline assets, and articulate a clear, milestone-driven path to value creation is paramount for earning investor confidence.

- Regulatory and Market Access Fluency: Leaders must possess a deep, strategic understanding of global regulatory pathways and payer landscapes. They need to be able to craft a compelling value narrative supported by robust health economic data to navigate pricing and reimbursement hurdles.

- Cross-functional Leadership and Storytelling: The ability to build and lead integrated teams that bridge science, data, and commerce is essential. Furthermore, leaders must be compelling storytellers who can articulate a clear, credible vision for how their science will translate into a commercially successful product that meets a significant unmet need, inspiring both their teams and their investors.

Works cited

- The Patent Portfolio as a Strategic Asset: A Comprehensive Guide to …, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/leveraging-a-drug-patent-portfolio-for-success/

- Drug Patents: How Pharmaceutical IP Incentivizes Innovation and Affects Pricing, accessed August 18, 2025, https://www.als.net/news/drug-patents/

- Optimizing Your Drug Patent Strategy: A Comprehensive Guide for Pharmaceutical Companies – DrugPatentWatch, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/optimizing-your-drug-patent-strategy-a-comprehensive-guide-for-pharmaceutical-companies/

- The Impact of Patent Cliff on the Pharmaceutical Industry, accessed August 18, 2025, https://bailey-walsh.com/news/patent-cliff-impact-on-pharmaceutical-industry/

- The End of Exclusivity: Navigating the Drug Patent Cliff for Competitive Advantage, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/the-impact-of-drug-patent-expiration-financial-implications-lifecycle-strategies-and-market-transformations/

- Strategies to Maximize Product Value Amid Loss of Exclusivity in the Pharmaceutical Industry – DrugPatentWatch, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/strategies-to-maximize-product-value-amid-loss-of-exclusivity-in-the-pharmaceutical-industry/

- Research and Development in the Pharmaceutical Industry …, accessed August 18, 2025, https://www.cbo.gov/publication/57126

- Drug development cost pharma $2.2B per asset in 2024 as GLP-1s drive financial return: Deloitte – Fierce Biotech, accessed August 18, 2025, https://www.fiercebiotech.com/biotech/drug-development-cost-pharma-22b-asset-2024-plus-how-glp-1s-impact-roi-deloitte

- Strengthening the R&D operating model | McKinsey, accessed August 18, 2025, https://www.mckinsey.com/industries/life-sciences/our-insights/strengthening-the-r-and-d-operating-model-for-pharmaceutical-companies

- Next in pharma 2025: The future is now – PwC, accessed August 18, 2025, https://www.pwc.com/us/en/industries/pharma-life-sciences/pharmaceutical-industry-trends.html

- The Patent Cliff: From Threat to Competitive Advantage – Esko, accessed August 18, 2025, https://www.esko.com/en/blog/patent-cliff-from-threat-to-competitive-advantage

- What is a patent cliff, and how does it impact companies? – Patsnap Synapse, accessed August 18, 2025, https://synapse.patsnap.com/article/what-is-a-patent-cliff-and-how-does-it-impact-companies

- Navigating the oncology patent cliff: Strategic imperatives for big pharma | BioPharma Dive, accessed August 18, 2025, https://www.biopharmadive.com/spons/navigating-the-oncology-patent-cliff-strategic-imperatives-for-big-pharma/756120/

- Evolving Pharmaceutical Strategies in a Post-Blockbuster World: Navigating Innovation, Access, and Market Dynamics – DrugPatentWatch, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/evolving-pharmaceutical-strategies-in-a-post-blockbuster-world/

- Why Artificial Intelligence Could Speed Drug Discovery – Morgan Stanley, accessed August 18, 2025, https://www.morganstanley.com/ideas/ai-drug-discovery

- Unlocking Productivity in Biopharmaceutical R&D – Boston Consulting Group, accessed August 18, 2025, https://www.bcg.com/publications/2016/unlocking-productivity-in-biopharmaceutical-rd—the-key-to-outperforming

- Emerging Challenges and Opportunities in Pharmaceutical Manufacturing and Distribution, accessed August 18, 2025, https://www.mdpi.com/2227-9717/9/3/457

- Addressing the challenges of developing new modality drugs | Drug …, accessed August 18, 2025, https://www.drugdiscoverynews.com/addressing-the-challenges-of-developing-new-modality-drugs-16248

- Open Innovation and Regulatory Challenges in New Modality Development: The Pivotal Role of Contract Development and Manufacturing Organisations in Advancing Antibody Drugs – PMC – PubMed Central, accessed August 18, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11706900/

- Drug Development – HHS ASPE, accessed August 18, 2025, https://aspe.hhs.gov/reports/drug-development

- Effective Tactics for Pricing and Reimbursement in Today’s Market, accessed August 18, 2025, https://www.pharmaceuticalcommerce.com/view/effective-tactics-for-pricing-and-reimbursement-in-today-s-market

- Platform Technology in Biotechnology Venture Capital – Hamptons Group, accessed August 18, 2025, https://hamptonsgroup.com/blog/biotechnology-venture-fund-platform-investing

- Next-generation platform technologies are driving the … – McKinsey, accessed August 18, 2025, https://www.mckinsey.com/industries/life-sciences/our-insights/what-are-the-biotech-investment-themes-that-will-shape-the-industry

- Navigating biotech investment cycles — the true north … – BioCentury, accessed August 18, 2025, https://www.biocentury.com/article/654643/navigating-biotech-investment-cycles-the-true-north-guest-commentary

- Realized value of platform-based biotech: a retrospective analysis of 220 companies, accessed August 18, 2025, https://reconstrategy.com/2025/08/realized-value-of-platform-based-biotech/

- Framework to identify innovative sources of value creation from platform technologies – PMC, accessed August 18, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC12130853/

- Moderna’s mRNA Platform, accessed August 18, 2025, https://www.modernatx.com/power-of-mrna/modernas-mrna-platform

- Moderna’s SWOT analysis: mRNA pioneer faces pivotal year for stock – Investing.com, accessed August 18, 2025, https://www.investing.com/news/swot-analysis/modernas-swot-analysis-mrna-pioneer-faces-pivotal-year-for-stock-93CH-4191611

- Moderna Announces Advances Across mRNA Pipeline and …, accessed August 18, 2025, https://investors.modernatx.com/news/news-details/2023/Moderna-Announces-Advances-Across-mRNA-Pipeline-and-Provides-Business-Update/default.aspx

- buy moderna inc. (mrna) 4.15.2024 – Expeditors International of Washington Inc (EXPD), accessed August 18, 2025, https://www.ship.edu/globalassets/business/imp/student_reports/moderna.pdf

- How RNAi Works | Alnylam® Pharmaceuticals, accessed August 18, 2025, https://www.alnylam.com/our-science/the-science-of-rnai

- A drug 15 years in the making: Alnylam’s quest to prove RNAi | BioPharma Dive, accessed August 18, 2025, https://www.biopharmadive.com/news/a-drug-15-years-in-the-making-alnylams-quest-to-prove-rnai/505971/

- Taking RNAi from interesting science to impactful new treatments | MIT News, accessed August 18, 2025, https://news.mit.edu/2024/alnylam-pharmaceuticals-turns-rnai-research-into-impactful-new-treatments-0513

- Alnylam Outpaces The Market With RNAi Growth Story – Finimize, accessed August 18, 2025, https://finimize.com/content/alny-asset-snapshot

- The Role of Patents and Regulatory Exclusivities in Drug Pricing – FAS Project on Government Secrecy, accessed August 18, 2025, https://sgp.fas.org/crs/misc/R46679.pdf

- The Role of Patents and Regulatory Exclusivities in Drug Pricing | Congress.gov, accessed August 18, 2025, https://www.congress.gov/crs-product/R46679

- Using Drug Exclusivities for Unrivaled Market Dominance – DrugPatentWatch, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/the-strategic-labyrinth-navigating-drug-exclusivities-for-unrivaled-market-dominance/

- Maximizing Patent Protection with FDA Exclusivities – Number Analytics, accessed August 18, 2025, https://www.numberanalytics.com/blog/maximizing-patent-protection-fda-exclusivities

- DrugPatentWatch has been a game-changer for our business, accessed August 18, 2025, https://www.drugpatentwatch.com/

- The Art of the Second Act: A Six-Step Framework for Mastering Late …, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/6-steps-to-effective-late-stage-lifecycle-drug-management/

- Building Better CDMO Supply Chain Readiness – Cryoport Systems, accessed August 18, 2025, https://www.cryoport.com/bio-blog-building-better-cdmo-supply-chain-readiness/

- Unlocking Competitive Advantage with the Top 10 Services You Didn’t Know You Needed, accessed August 18, 2025, https://www.drugpatentwatch.com/blog/top-10-cdmo-services-you-didnt-know-you-needed/

- Unique Challenges of the Cell & Gene Therapy Supply Chain – ParkourSC, accessed August 18, 2025, https://www.parkoursc.com/archives/4208

- Digitalized supply chains are essential to biopharma’s future – Deloitte, accessed August 18, 2025, https://www.deloitte.com/us/en/insights/industry/health-care/end-to-end-digitalization-of-biopharma-supply-chain.html

- AI and machine learning: Revolutionising drug discovery and transforming patient care – Roche, accessed August 18, 2025, https://www.roche.com/stories/ai-revolutionising-drug-discovery-and-transforming-patient-care

- Are biotechnology investors overestimating the utility of AI and machine learning in drug discovery? – Patsnap Synapse, accessed August 18, 2025, https://synapse.patsnap.com/article/are-biotechnology-investors-overestimating-the-utility-of-ai-and-machine-learning-in-drug-discovery

- AI in Pharma: Top 9 Use Cases You Should Know – Litslink, accessed August 18, 2025, https://litslink.com/blog/use-cases-of-ai-in-pharma-how-to-leverage-it

- 10 Case Studies of Successful Implementation of AI in Healthcare By SciMedian., accessed August 18, 2025, https://scimedian.in/10-case-studies-of-successful-implementation-of-ai-in-healthcare/

- Next in pharma: How can pharmaceutical companies drive value growth? – PwC, accessed August 18, 2025, https://www.pwc.com/us/en/industries/pharma-life-sciences/next-in-pharma-trends.html

- The Impact Of Industry Trends On Pharma And Biotech Talent Acquisition | Scientific Search, accessed August 18, 2025, https://scientificsearch.com/blog/the-impact-of-industry-trends-on-pharma-and-biotech-talent-acquisition/

- Navigating Talent Acquisition in 2025: Biotech and Pharma in Focus – GQR, accessed August 18, 2025, https://www.gqr.com/blog/2025/01/navigating-talent-acquisition-in-2025-biotech-and-pharma-in-focus

- Key Hiring Trends in Pharma & Healthcare: Insights from DIA 2025 | Barrington James, accessed August 18, 2025, https://www.barringtonjames.com/resources/blog/key-hiring-trends-in-pharma—healthcare–insights-from-dia-2025/

- Innovation and human capital policy – LSE CEP, accessed August 18, 2025, https://cep.lse.ac.uk/pubs/download/dp1763.pdf

- Innovation and Human Capital Policy – National Bureau of Economic Research, accessed August 18, 2025, https://www.nber.org/system/files/working_papers/w28713/w28713.pdf

- Looking Ahead at Recruitment in the Biopharma Industry – Boehringer Ingelheim, accessed August 18, 2025, https://www.boehringer-ingelheim.com/us/about-us/looking-ahead-recruitment-biopharma-industry

- Biotech Valuation: Methods, Examples, and Calculator | Exitwise, accessed August 18, 2025, https://exitwise.com/blog/biotech-valuation

- Valuation Methods Investors Use for Biotech Startups, accessed August 18, 2025, https://www.excedr.com/blog/valuation-methods-investors-use-for-biotech-startups

- VC Due Diligence Process for Life Sciences Investments – Excedr, accessed August 18, 2025, https://www.excedr.com/blog/vc-due-diligence-process-for-life-sciences-investments