Optimizing the Biosimilar Supply Chain: A Strategic Imperative for Competitive Advantage

The pharmaceutical industry stands at a pivotal juncture, experiencing a profound transformation propelled by the burgeoning biosimilar market. These biological medicines, while not exact replicas of their reference products, are poised to revolutionize healthcare by enhancing patient access and significantly alleviating the escalating burden of drug costs. For business professionals and pharmaceutical leaders, understanding and proactively addressing the inherent complexities within the biosimilar supply chain is no longer merely an operational challenge; it is a strategic imperative that directly influences competitive positioning and long-term market success.

The Biosimilar Revolution: A Strategic Imperative

The advent of biosimilars marks a significant evolution in drug development, offering a critical pathway to more affordable and accessible advanced therapies. This section will delineate what biosimilars are, explore the explosive growth trajectory of their market, and underscore why a robust and resilient supply chain is fundamental to realizing their full potential.

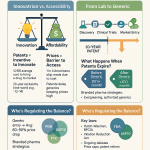

Defining Biosimilars: More Than Just Generics

At its core, a biosimilar is a biological medicine that demonstrates high similarity to an already approved biological “reference medicine” across crucial parameters such as safety, efficacy, quality, and immunogenicity . Unlike small molecule generics, which are chemically identical copies produced through synthesis, biosimilars are large, intricate protein-based therapeutics derived from living cell systems using recombinant DNA technology . This biological origin introduces an inherent degree of natural variability, encompassing aspects like glycosylation and protein folding, which means an exact replication of the originator product is biologically impossible. Consequently, biosimilars are characterized as “highly similar,” rather than identical.

The regulatory pathways for biosimilar approval reflect this inherent complexity. Both the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA) have established comprehensive and rigorous guidelines to ensure that biosimilars meet the same stringent standards of pharmaceutical quality, safety, and efficacy as their reference products . The EMA, a pioneer in this field, introduced its regulatory framework in 2005, while the FDA followed suit with the Biologics Price Competition and Innovation Act (BPCIA) of 2009. These agencies demand extensive comparability studies spanning physicochemical, biological, non-clinical, and clinical parameters to definitively ascertain that no clinically meaningful differences exist between the biosimilar and its reference product .

The fundamental distinctions between biosimilars (as biologics) and small molecule drugs extend beyond their definition and regulatory oversight. Biologics are considerably larger and more complex, impacting every facet of their lifecycle from manufacturing to patient administration and stability. Small molecule drugs, typically composed of 20 to 100 atoms with a molecular mass under 1 kilodalton (kDa), can be manufactured by chemical synthesis and often administered orally, with their activity primarily dependent on chemistry . In stark contrast, therapeutic proteins, which form the active substances of most biologics and biosimilars, range from 1 kDa to over 10 kDa, containing thousands of atoms, and frequently fold into complex three-dimensional structures vital for their biological activity. They are generally not orally active, necessitating systemic administration via injection, and are inherently more sensitive to environmental factors like heat and membrane permeability. This profound difference in molecular structure and origin means that every stage of the supply chain, from raw material sourcing to manufacturing and distribution, must account for subtle variations that could influence quality, safety, and efficacy. This is not merely a regulatory technicality; it represents an operational reality that demands specialized infrastructure, stringent quality control measures, and advanced analytical techniques throughout the supply chain.

The Exploding Market: Growth, Potential, and Economic Impact

The global biosimilars market is not merely growing; it is experiencing an exponential expansion, fueled by the impending patent expirations of numerous blockbuster biologics and a burgeoning demand for more affordable therapeutic alternatives . Valued at approximately USD 34.43 billion in 2024, market projections indicate a substantial surge to USD 175.99 billion by 2034, reflecting a robust Compound Annual Growth Rate (CAGR) of 17.78%. Other analyses are even more optimistic, forecasting a market size of USD 357.50 billion by 2034, with an impressive CAGR of 24.9%. The United States market, in particular, is anticipated to lead this growth from 2025 to 2035, driven by the loss of exclusivity for multi-billion-dollar biologics such as Keytruda, Stelara, and Eylea.

The economic implications of biosimilar adoption are profound. These products offer substantial cost savings to healthcare systems and patients, serving as a lower-cost alternative to often prohibitively expensive originator biologic medications . Studies have estimated significant cost reductions: up to 30% for biosimilars targeting rheumatoid arthritis and 15-25% for those used in cancer treatment . Real-world examples from countries like Norway and Germany further illustrate this economic benefit, with the introduction of biosimilars leading to price reductions of 70% and 20% respectively for reference biologic medications . Cumulatively, the U.S. healthcare system has already realized an estimated $23.6 billion in savings from the use of biosimilars.

Beyond the direct financial benefits, biosimilars play a critical role in enhancing patient access to life-changing therapies. They provide treatment options for chronic and often debilitating conditions such as diabetes, autoimmune diseases, and various cancers, thereby improving patients’ quality of life by mitigating disease progression and alleviating symptoms . The affordability they introduce makes these vital treatments accessible to a broader patient population that might otherwise face insurmountable cost barriers .

While biosimilars undeniably drive significant cost savings, a delicate balance must be maintained to ensure the long-term health of the market. Unfettered price erosion, often a consequence of intense competition, can paradoxically undermine manufacturers’ willingness to sustain investment in biosimilar development and supply, potentially leading to future supply shortages . This creates a tension between maximizing immediate cost reductions and fostering a stable, diversified supply for the future. To navigate this, policymakers and payers must look beyond short-term price advantages and implement sustainable contracting and reimbursement models. These models should incentivize manufacturers to continue developing and maintaining robust biosimilar portfolios, perhaps by incorporating value-based criteria beyond mere price in tenders and ensuring an equitable distribution of cost savings across the entire healthcare ecosystem . The enduring vitality of the biosimilar market hinges on this strategic foresight.

Table 1: Global Biosimilar Market Size and Growth Projections

| Source | Base Year (2024) Market Size | Projected Market Size (2025) | Projected Market Size (2033/2034) | CAGR (2025-2034) |

| Biospace | USD 34.43 Billion | USD 40.36 Billion | USD 175.99 Billion (by 2034) | 17.78% |

| NovaOne Advisor | USD 38.69 Billion | USD 48.33 Billion | USD 357.50 Billion (by 2034) | 24.9% |

| DataMintelligence | USD 22.58 Billion | N/A | USD 171.79 Billion (by 2033) | 25.5% |

Table 2: Estimated Cost Savings from Biosimilars by Therapeutic Area

| Therapeutic Area | Estimated Cost Savings | International Examples of Price Reduction |

| Rheumatoid Arthritis | 20-30% | Norway: 70% reduction in reference biologic price |

| Cancer Treatment | 15-25% | Germany: 20% reduction in reference biologic price |

| Inflammatory Bowel Disease | 10-20% | N/A |

| Psoriasis | 15-30% | N/A |

Why Supply Chain Resilience is Paramount for Biosimilars

The unique characteristics of biosimilars fundamentally elevate the importance of supply chain resilience. Unlike the relative robustness of small molecule drugs, biologics are large, complex protein-based molecules produced within delicate living systems. This inherent fragility renders them exceptionally sensitive to environmental variables such as temperature, humidity, and light throughout their entire lifecycle . This sensitivity mandates precise handling and storage conditions, from the moment of manufacture to the final patient administration.

Adding another layer of complexity is the globalized nature of pharmaceutical production and distribution. The biosimilar industry, much like the broader pharmaceutical sector, operates on a worldwide scale. Raw materials are frequently sourced from diverse emerging economies, including Brazil, China, India, and Israel, while primary manufacturing hubs are often concentrated in regions like the United States and Europe . This global dispersion introduces a myriad of logistical challenges, including intricate customs procedures, varying regulatory requirements, and exposure to geopolitical risks .

The consequences of supply chain disruptions in this intricate ecosystem can be severe. A failure in the cold chain, a shortage of critical raw materials, or an unforeseen geopolitical event can compromise product efficacy, leading to substantial economic losses for manufacturers and, most critically, endangering patient health through drug shortages . The COVID-19 pandemic served as a stark reminder of these vulnerabilities, underscoring the urgent need for robust and adaptable supply chain strategies .

The inherent fragility and globalized nature of biosimilar supply chains expose them to a significantly higher risk profile compared to traditional small molecule drug supply chains. This vulnerability, acutely highlighted by recent global upheavals, fundamentally challenges the efficiency-driven “just-in-time” (JIT) model that has long been a cornerstone of many industries. Instead, the biosimilar sector is compelled to shift towards a “just-in-case” philosophy, where prioritizing resilience and redundancy becomes paramount. This strategic reorientation means that companies must proactively invest in buffer inventories, diversify their sourcing channels, and cultivate flexible manufacturing capacities, even if these measures entail higher upfront costs . The long-term value derived from such investments lies in their ability to mitigate catastrophic risks, including widespread stockouts, regulatory non-compliance, and severe reputational damage. Ultimately, this strategic investment in business continuity and patient safety transcends purely cost-driven decisions, ensuring continuous patient access and safeguarding market share in a volatile global landscape.

Navigating the Regulatory and Intellectual Property Maze

The journey of a biosimilar from initial concept to widespread patient availability is intricately shaped by a complex web of regulatory requirements and formidable intellectual property challenges. A deep understanding of these pathways and potential obstacles is not merely a legal necessity; it is a strategic imperative for successful market entry and sustained competitive advantage.

Global Regulatory Pathways: FDA, EMA, and Harmonization Efforts

The regulatory landscape for biosimilars is defined by established frameworks from key authorities, primarily the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA). The EMA, having pioneered its regulatory pathway in 2005, and the FDA, which established its framework under the Biologics Price Competition and Innovation Act (BPCIA) of 2009, both operate on the foundational principle of demonstrating “high similarity” to a reference product . This ensures that biosimilars exhibit no clinically meaningful differences in terms of safety, purity, and potency when compared to their originator counterparts .

While sharing common overarching goals, the specific approaches of these regulatory bodies exhibit notable differences. The FDA’s pathway emphasizes a comprehensive demonstration of biosimilarity through analytical studies, animal studies, and clinical studies, with a mandatory requirement for at least one clinical study to assess immunogenicity . In contrast, the EMA’s approach centers on a thorough comparability exercise that encompasses physicochemical and biological properties, followed by non-clinical and clinical studies. Historically, the EMA has often required more extensive clinical testing, particularly efficacy trials conducted in sensitive clinical models .

Despite ongoing efforts to streamline and harmonize regulatory processes globally, full alignment remains an elusive goal. Persistent differences in requirements, such as the need for locally sourced reference products in some jurisdictions, the continued demand for comparative animal toxicology studies in certain countries (even as most health authorities no longer require them), variations in clinical study designs, and the mandate for local ethnic population data in specific regions, continue to pose challenges . This regulatory divergence often compels biosimilar developers to undertake redundant studies, significantly increasing development timelines and costs.

The existence of differing regulatory requirements between major markets like the FDA and EMA, coupled with further variations in local mandates, creates a complex and fragmented global landscape. This fragmentation is not merely a bureaucratic inconvenience; it functions as a strategic market entry barrier. Companies are thus faced with a critical decision: either to selectively target specific markets, incur substantial additional costs by conducting redundant studies to meet diverse requirements, or devise a multi-pronged global development strategy. This inherent regulatory divergence inevitably prolongs the time required for biosimilars to reach global markets, thereby limiting their potential for widespread cost savings and patient access. For businesses, this translates directly into increased research and development expenditure, extended time-to-market, and the necessity of maintaining highly specialized regulatory affairs teams. Strategic planning must meticulously account for these regulatory nuances, potentially prioritizing markets that offer more aligned or streamlined approval pathways to optimize resource allocation and accelerate market entry.

The regulatory landscape for biosimilars is, however, continuously evolving. Health authorities are actively assessing accumulated data and experience to refine their requirements, aiming to streamline development processes and clarify the most appropriate and useful data for biosimilar assessment. A significant trend in this evolution is the increasing integration of Real-World Data (RWD) and Real-World Evidence (RWE). This shift extends beyond their traditional use in post-approval safety surveillance to encompass earlier phases of drug development and product assessment across various stages . This dynamic environment necessitates continuous monitoring and adaptation from biosimilar developers.

Interchangeability: The Game Changer for Market Adoption

The concept of interchangeability represents a pivotal development in the biosimilar landscape, holding the potential to significantly accelerate market adoption and enhance patient access. An interchangeable biosimilar is defined as a biosimilar product that can be substituted for its reference product at the pharmacy level without requiring prior consultation with the prescribing healthcare professional, mirroring the practice common with generic small molecule drugs . This “pharmacy-level substitution,” however, remains subject to state-specific laws in the U.S. .

To achieve this coveted interchangeable status, a biosimilar must undergo rigorous evaluation demonstrating that it will produce the same clinical result as the reference product in any given patient. Crucially, it must also show that any alternating or switching between the biosimilar and the reference product does not introduce additional safety risks or diminish efficacy. Historically, demonstrating this often necessitated a dedicated “switching study.” However, recent draft guidance from the FDA suggests a potential shift, indicating that this requirement might be relaxed or made more flexible, acknowledging that existing analytical and clinical data could be sufficient to support an interchangeability designation.

The impact of interchangeability on market uptake is substantial. It significantly streamlines the prescribing and dispensing process, making it easier for patients to access these more affordable therapeutic options . Without this designation, adoption can be considerably slower, often due to a cautious approach from physicians and patients, and the operational complexities it introduces at the pharmacy level . The ability for automatic pharmacy-level substitution, conferred by interchangeability, directly influences payer behavior. It simplifies formulary management and creates a strong incentive for payers to include interchangeable biosimilars, given the assurance of higher uptake and the resulting cost savings .

As of early 2025, the FDA has granted interchangeable status to several biosimilars, signaling a growing trend. Notable examples include denosumab-bbdz (marketed as Jubbonti and Wyost) and adalimumab-aaty (Yuflyma), with more products anticipated to receive this designation . For biosimilar manufacturers, pursuing interchangeability, despite the additional development burden and investment it may entail, can be a critical strategic decision. It has the potential to significantly accelerate market penetration and secure favorable formulary positions. This designation effectively shifts a portion of the competitive dynamic from physician-level prescribing decisions to pharmacy-level substitution, which can help overcome some of the observed physician reluctance to prescribe biosimilars. This also implies that competitive intelligence efforts should closely monitor competitors’ progress and strategies related to interchangeability.

The Patent Thicket: A Formidable Barrier to Entry

The term “patent thicket” describes a dense, intricate web of overlapping patents that collectively cover a single drug. These thickets are often strategically deployed by originator companies, with many patent applications filed years after initial drug approval, primarily to extend their market monopolies . A prominent example is AbbVie’s Humira, which was protected by over 250 patents, effectively delaying biosimilar entry until 2023, despite its initial launch in 2002 . This strategy prioritizes corporate profits over broader patient access and fair market competition, leading to significant delays in the availability of more affordable biosimilar alternatives and contributing to inflated drug prices . As patent attorney Ha Kung Wong observed, “Thickets force biosimilar developers to navigate dozens of overlapping claims, delaying affordable alternatives by years” .

The strategic objectives behind patent thickets are clear: to prolong market exclusivity and erect formidable barriers to litigation. For instance, the extensive patenting around Humira extended its U.S. exclusivity to an astonishing 39 years, generating an estimated $47.5 million per day in revenue before biosimilar entry . Challenging the numerous patents within such a thicket, sometimes exceeding 70 patents per drug, can cost biosimilar developers millions of dollars in legal fees and prolong market entry for years. The case of Revlimid, where litigation lasted 18 years, exemplifies how these legal maneuvers can block generic versions even after primary patents have expired . This practice also has a chilling effect on innovation, as it incentivizes “evergreening”—where 78% of new patents protect existing drugs rather than fostering novel therapies—and can suppress smaller firms that face significantly higher litigation risks in thicket-heavy fields like biologics .

The deliberate delay of biosimilar market entry through patent thickets is not merely a legal inconvenience; it directly impacts the supply chain by limiting the number of available manufacturers for a given biologic. This reduction in supply diversity inherently makes the supply chain less resilient to disruptions . The “weaponization” of patents through these thickets not only inflates drug prices but also creates an artificial bottleneck in the supply chain, hindering the natural diversification that biosimilar competition would otherwise introduce. This, in turn, renders the entire healthcare system more vulnerable to drug shortages and less efficient in its allocation of resources. For biosimilar companies, navigating these patent thickets becomes a critical supply chain risk mitigation strategy, demanding deep legal expertise and sophisticated competitive intelligence.

Understanding the “Patent Dance” and its Strategic Implications

The Biologics Price Competition and Innovation Act (BPCIA) established a unique pre-litigation framework, widely known as the “patent dance,” specifically designed to facilitate the early resolution of patent disputes between the reference product sponsor (RPS) and the biosimilar applicant . The intricate choreography of this process begins with the biosimilar applicant providing the RPS with a confidential copy of its abbreviated Biologics License Application (aBLA) and detailed manufacturing information. In response, the RPS has 60 days to provide a comprehensive list of unexpired patents it believes could be infringed by the biosimilar, along with any licensing offers. A critical consequence for the RPS is that failure to timely list a patent generally precludes them from suing on that patent until the biosimilar is commercially marketed, compelling originators to be meticulously prepared .

The biosimilar applicant then has 60 days to respond, potentially listing additional relevant patents and providing detailed, claim-by-claim statements outlining factual and legal bases for invalidity, unenforceability, or non-infringement. The RPS then counters with its own detailed arguments . This structured information exchange, with its fixed deadlines and detailed disclosure requirements, creates a strategic “chess match” designed to address information asymmetry between the parties. The RPS, holding patent rights, initially lacks detailed knowledge of the biosimilar’s product and process, while the biosimilar applicant needs to understand the full scope of the RPS’s patent claims .

The “patent dance” culminates in two distinct phases of patent litigation. Phase I is triggered when parties attempt to agree on a subset of patents for immediate litigation. If no agreement is reached, the biosimilar applicant informs the RPS of the patents they will litigate, obligating the RPS to file an infringement action within 30 days. Phase II is initiated by the biosimilar applicant’s “notice of intended commercial marketing” at least 180 days prior to launch, allowing the RPS to seek a preliminary injunction on any remaining patents from the exchanged lists .

A landmark Supreme Court decision in Sandoz Inc. v. Amgen Inc. (2017) fundamentally reshaped the “patent dance” by confirming its optionality. This ruling granted biosimilar applicants significant strategic flexibility: they can now choose to bypass the entire information exchange and trigger litigation immediately by providing the 180-day notice, even before FDA approval . This strategic flexibility can potentially accelerate market entry.

The BPCIA’s “patent dance” is not merely a legal procedure; it functions as a dynamic competitive intelligence battleground. This structured information exchange inherently reveals critical insights into an originator’s patent strategy and a biosimilar’s manufacturing process. The optionality introduced by the Sandoz v. Amgen ruling means that strategic decisions regarding participation in the dance are heavily influenced by the quality of competitive intelligence gathered and the associated risk assessment. For businesses, this necessitates a seamless collaboration between legal and intellectual property teams, and their commercial and supply chain strategists. A comprehensive understanding of the opponent’s patent portfolio, the ability to anticipate their legal maneuvers, and the informed decision of whether to engage in the dance or bypass it, all demand sophisticated competitive intelligence. This intelligence can directly inform manufacturing process design, enabling companies to design around existing patents, optimize market entry timing, and even shape pricing strategies, thereby directly impacting supply chain readiness and market penetration.

Leveraging Patent Intelligence for Competitive Edge

In the highly competitive and legally intricate biosimilar landscape, competitive intelligence (CI) is often regarded as a strategic “secret weapon”. It empowers companies to transition from a reactive stance to proactive positioning, fundamentally shaping their launch and defense strategies.

Platforms like DrugPatentWatch provide critical features for navigating this complex environment and securing a competitive advantage . Such tools are instrumental in identifying patents that are “ripe for challenge,” meaning those most vulnerable to invalidation. This capability is integral to conducting a thorough freedom-to-operate (FTO) analysis, which is essential for understanding potential infringement risks and assessing the strength of invalidity arguments. Furthermore, these platforms facilitate in-depth analysis of patent strength, allowing companies to precisely understand the scope of each claim and identify potential barriers to market entry.

Continuous monitoring is another invaluable aspect. With resources like DrugPatentWatch, companies can continuously track competitor patent portfolios, actively monitoring pipeline drugs and biologics, analyzing company profiles, and scrutinizing patent filing and litigation activity to detect early signs of competitor movements. This includes tracking litigation to anticipate early generic entry and studying the outcomes of past patent challenges to refine future strategies.

Mapping the patent landscape is crucial for strategic decision-making. DrugPatentWatch offers strategic insights into the broader biologics patent landscape, enabling companies to identify emerging patent trends, uncover “white spaces” (areas with less patent protection), and anticipate competitive threats . This capability allows biosimilar companies to systematically pinpoint the weakest links within an originator’s patent thicket, prioritize specific patents for inter partes review (IPR) challenges at the Patent Trial and Appeal Board (PTAB), and strategically design their products or processes to circumvent existing patents.

The proactive use of patent intelligence also optimizes research and development (R&D) and business development efforts. By providing real-time insights into competitor activity, platforms like DrugPatentWatch enable companies to move beyond reactive responses to proactive strategic adjustments. This allows for the optimization of R&D priorities, the refinement of patent filing strategies, and the alignment of business development efforts to maximize competitive advantage and accelerate time-to-market.

Patent thickets and the associated litigation represent significant barriers to biosimilar market entry. By utilizing tools that provide comprehensive patent intelligence, such as DrugPatentWatch, biosimilar developers can proactively identify vulnerable patents or “white spaces” within the patent landscape. This enables them to strategically design their products or select market entry points in a manner that minimizes legal risks. This approach is not merely about winning lawsuits; it is fundamentally about avoiding them or significantly shortening their duration. Reducing legal uncertainty and accelerating market entry directly translates into a more predictable and efficient supply chain. Fewer legal disputes mean fewer delays, more stable production planning, and potentially earlier patient access to affordable medicines. Therefore, patent intelligence, empowered by platforms like DrugPatentWatch, functions as an indirect yet powerful tool for supply chain de-risking and optimization, contributing significantly to a company’s overall competitive posture.

Manufacturing Complexities: The Heart of Biosimilar Production

The journey from a living cell to a life-saving biosimilar product is a remarkable scientific achievement, yet it is simultaneously fraught with intricate manufacturing complexities. These hurdles, which significantly surpass those encountered in the production of traditional small molecule drugs, profoundly influence the stability, quality, and ultimately, the supply chain resilience of biosimilars.

From Living Cells to Life-Saving Drugs: Unique Production Hurdles

Biologics, including biosimilars, are fundamentally distinct from small molecule drugs due to their biological origin and inherent complexity. They are large, intricate molecules, such as monoclonal antibodies and other therapeutic proteins, produced using living organisms . These molecules typically comprise thousands of atoms and fold into precise three-dimensional structures that are essential for their biological activity. This stands in stark contrast to small molecule drugs, which are relatively simple chemical compounds manufactured through chemical synthesis .

The use of living cell systems, such as Chinese Hamster Ovary (CHO) or Human Embryonic Kidney 293 (HEK293) cells, introduces a natural and unavoidable variability into the production process. This inherent biological variability makes it impossible to create an exact, identical replica of the originator product . This variability often manifests in post-translational modifications (PTMs), including glycosylation, phosphorylation, and oxidation. These PTMs are not mere structural nuances; they significantly influence a biologic’s stability, efficacy, and potential immunogenicity in patients .

Achieving consistent PTM profiles across manufacturing batches is a major hurdle. This challenge arises from differences in the chosen expression systems, variations in cell culture conditions (such as pH, oxygen levels, and nutrient availability), and diverse bioprocessing variables (like purification methods or buffer composition) . Consequently, each biosimilar manufacturer must independently develop specialized cell lines and meticulously optimized production protocols to consistently produce products that are biologically comparable to the reference biologic .

The complexity is further compounded by the growing diversity of new biological modalities entering the pipeline, such as bi- and tri-specific antibodies, fusion proteins, and advanced cell and gene therapies. These modalities present even greater challenges in development, manufacturing, and analytical characterization compared to conventional monoclonal antibodies. They frequently necessitate advanced cell-line development techniques and additional, more complex downstream processing steps. Scaling these intricate processes is often more difficult, demanding highly tailored solutions and increasingly driving reliance on Contract Development and Manufacturing Organizations (CDMOs).

The inherent variability in biological manufacturing processes means that the specific cell line, culture conditions, and purification methods chosen by a biosimilar manufacturer directly dictate the “similarity” of their product to the reference biologic. This is not just a technical detail; it represents a fundamental quality and regulatory challenge. Any deviation can impact product quality, safety, and immunogenicity, potentially leading to regulatory hurdles or even product failure. This deep connection between the manufacturing process and product quality means that supply chain risk mitigation for biosimilars must begin at the earliest stages of research and development and process design. Companies are compelled to invest heavily in Quality-by-Design (QbD) principles, Process-Analytical-Technology (PAT), and in silico modeling to anticipate risks and optimize bioequivalence from the very outset . This also explains why the development costs for biosimilars remain substantial, despite abbreviated clinical trial requirements, as the manufacturing “recipe” is both complex and proprietary.

Table 3: Key Differences: Small Molecule Drugs vs. Biologics

| Feature | Small Molecule Drugs | Biologics (including Biosimilars) |

| Molecular Size | Small (e.g., < 1 kDa, 20-100 atoms) | Large (e.g., 1-10 kDa for peptides, >10 kDa for proteins, 5,000-50,000 atoms) |

| Complexity | Simple chemical compounds | Complex, often folded 3D structures |

| Manufacturing | Chemical synthesis | Living cell systems (recombinant DNA technology) |

| Variability | Exact replication possible (generics) | Inherent natural variability (glycosylation, folding, impurities) |

| Administration | Various routes, often oral | Systemic routes (e.g., injection) |

| Stability | Generally more robust, less temperature-sensitive | Highly sensitive to temperature, light, humidity |

| Specificity | Can have off-target effects | Tend to exhibit much higher specificity |

Raw Material Sourcing: Ensuring Quality and Mitigating Risk

The procurement of raw materials for biosimilar manufacturing is a critical and often precarious undertaking. These materials, particularly cell culture media and reagents, are paramount because they directly influence cellular growth, viability, and ultimately, the productivity and quality of the final biosimilar product . The purity of these raw materials can vary significantly depending on the supplier and the specified grade, necessitating exceptionally rigorous assessment and qualification processes .

Key challenges in raw material sourcing are multifaceted. The pervasive threat of counterfeit products, which may contain low-quality active pharmaceutical ingredients (APIs) or incorrect dosages, represents a significant risk to product integrity and patient safety. Furthermore, the globalized nature of sourcing often means materials are procured from emerging economies, such as Brazil, China, India, and Israel, introducing additional expenses in the form of trade tariffs and customs duties. Regulatory delays in the approval processes for these materials can also slow down time-to-market and impact profitability.

A historical challenge, particularly for mammalian cell culture media, has been the reliance on bovine sera. While providing essential growth factors, sera introduce substantial batch-to-batch variation and carry an inherent risk of introducing adventitious agents, such as viruses . This has driven a significant industry shift towards serum-free and chemically defined media, though identifying and controlling the critical components within these complex formulations remains a challenge .

To mitigate these risks, manufacturers must implement comprehensive risk assessment and mitigation strategies. This involves evaluating raw materials based on a multitude of factors: traceability and the regulatory environment of the country of origin, the manufacturing technique (distinguishing between animal-derived and animal-derived component-free materials), assurance of supply from the vendor, the criticality of the component to the final product, the historical annual acceptance rate and usage volume, and the availability of compendial test data . Effective supplier management is crucial, including identifying high-grade materials and, where possible, opting for animal-derived component-free media to reduce variability and contamination risk . The process of qualifying a new supplier is notoriously lengthy, often taking up to 24 months, with procurement itself requiring 16-24 weeks .

The extreme sensitivity of biosimilar manufacturing to raw material quality means that any compromise at this initial stage can ripple through the entire production process, profoundly affecting product quality, consistency, and even regulatory approval. The globalized nature of sourcing introduces geopolitical, regulatory, and quality control risks, transforming raw material procurement into a critical vulnerability point within the supply chain. Consequently, companies must move beyond simple cost-based procurement to adopt a sophisticated, risk-based approach. This necessitates investing in advanced analytical methods for material characterization and strategically diversifying their raw material suppliers to build resilience. Recognizing that the “cheapest” raw material could lead to exponentially higher costs down the line due to batch failures, recalls, or regulatory non-compliance is paramount for safeguarding the integrity and efficiency of the biosimilar supply chain.

The Unyielding Demand for Cold Chain Excellence

The inherent fragility of biologics and biosimilars necessitates an unwavering commitment to cold chain management throughout their entire journey, from the manufacturing facility to the patient’s bedside. These products are highly sensitive to temperature fluctuations, and any deviation from specified conditions can compromise their efficacy or even render them harmful . Many biosimilars require storage within a narrow range of 2°C to 8°C, while advanced cell and gene therapies may demand ultra-low temperatures of -70°C or even below .

Maintaining these precise temperature conditions demands highly specialized infrastructure. This includes warehouses and transport vehicles equipped with real-time monitoring technology, capable of continuously tracking temperature, humidity, and location . The industry has responded with significant innovations, such as advanced freezer technologies offering reliable cooling to -80°C or -100°C, high-performance insulated packaging utilizing materials like vacuum panels, and IoT-enabled containers that provide real-time temperature monitoring and automated alerts for deviations . These technological advancements are critical for ensuring product stability and preventing waste.

Regulatory bodies globally, including the FDA and EMA, impose stringent requirements to ensure product quality throughout the distribution process. Good Distribution Practice (GDP) guidelines, along with specific regulations like 21 CFR Part 211.150 in the U.S., mandate qualified equipment, validated packing and shipping processes, and robust systems for monitoring environmental conditions . Companies must be able to demonstrate unequivocally that their products remained within the labeled temperature ranges. Failure to comply can result in products being deemed adulterated, leading to severe regulatory actions such as product seizures or recalls . Furthermore, manufacturers establish stability data and excursion allowances, which define permissible, brief deviations from ideal temperature ranges. Any excursion beyond these supported limits necessitates immediate reporting for a thorough quality assessment .

Despite technological advancements, risk control remains a constant challenge. Potential losses can arise from refrigeration failures, customs delays, or improper handling at any point in the chain. Effective customs management and strict regulatory compliance are paramount, requiring certified warehouses, specially conditioned transportation, meticulously trained personnel, and accurate documentation to avoid delays and penalties.

The extreme cold chain requirements for biosimilars are not merely logistical hurdles; they represent fundamental barriers to entry for less-equipped market participants and constitute a significant cost driver for all. Companies that master cold chain management, by leveraging advanced technologies and implementing robust processes, gain a distinct competitive advantage in terms of product integrity, regulatory compliance, and broader market reach. Conversely, inadequate cold chain infrastructure in certain regions can severely limit patient access to these life-saving therapies, despite their affordability benefits. Therefore, investment in cutting-edge cold chain technologies and comprehensive quality systems is no longer optional; it is a strategic necessity for biosimilar manufacturers aiming for global market penetration and enduring supply chain resilience. This also highlights a significant aspect of social responsibility: addressing cold chain disparities is crucial for ensuring equitable access to essential biologics in low-income countries.

Table 4: Cold Chain Temperature Requirements for Biologics/Biosimilars

| Temperature Range | Description | Examples of Products/Therapies | Implications of Deviation |

| 2°C to 8°C (36°F–46°F) | Standard refrigeration for many biologics | Vaccines, Insulin, Monoclonal Antibodies (e.g., Humira) | Reduced drug efficacy, potential harm to patients |

| -20°C or below | Freezing conditions | Certain vaccines, specific biologics | Loss of product integrity, irreversible damage |

| -70°C or below | Ultra-low temperature (ULT) deep-freezing | Certain vaccines (e.g., mRNA COVID-19), Cell and Gene Therapies | Complete loss of efficacy, product rendered unusable |

Market Dynamics and Demand Forecasting: Predicting the Unpredictable

The commercial success of biosimilars hinges not only on robust manufacturing and regulatory prowess but also on an astute understanding of dynamic market forces. Accurately forecasting demand and navigating the complex interplay of multiple market entrants, physician preferences, and payer policies present unique and formidable challenges.

Challenges in Forecasting Biosimilar Uptake and Demand Volatility

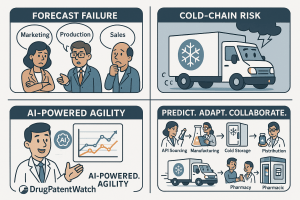

Forecasting demand for biosimilars is an inherently challenging endeavor, often likened to navigating a new, uncharted territory. Unlike established drug categories, the biosimilar market segment is relatively nascent, frequently lacking the extensive historical data that typically informs accurate demand predictions . This paucity of reliable historical information often leads to inaccurate commercial forecasts, which can result in significant overinvestment in sales teams and production capacity, ultimately eroding profit margins .

The demand for biosimilars can be highly unpredictable, exhibiting considerable volatility. This is influenced by a confluence of factors, including evolving treatment protocols, shifts in patient and physician preferences, and intense market competition . External disruptions, such as unforeseen transportation issues or adverse weather conditions, can further exacerbate these demand fluctuations, creating sudden spikes or drops that defy traditional forecasting models.

The pharmaceutical supply chain is also characterized by long lead times from suppliers and the potential for disruptions on the manufacturer’s side. These factors can create a persistent mismatch between supply and demand, leading to costly overstock situations or, critically, stockouts that impact patient access.

Adding to these external complexities are internal organizational challenges. Siloed data systems and a lack of seamless collaboration between key internal departments—such such as marketing, production, and sales—can result in fragmented and ultimately inaccurate forecasts. This departmental misalignment prevents a holistic view of market dynamics and internal capabilities, undermining the effectiveness of supply chain planning.

The confluence of limited historical data, unpredictable demand fluctuations, and long lead times creates a highly volatile and difficult-to-predict market environment for biosimilars. This is more than just challenging; it represents a near-chaotic system where even minor changes in market dynamics or regulatory shifts can have disproportionately large impacts on uptake and profitability. This inherent unpredictability necessitates a fundamental shift from traditional, linear forecasting models to more agile, scenario-based approaches. Such approaches must leverage advanced analytics, artificial intelligence (AI), and real-time data to provide a clearer picture of the market . Companies must cultivate flexible supply chains capable of rapid adaptation, and their competitive intelligence efforts need to prioritize real-time market sensing and competitor movements rather than relying solely on historical trends.

Table 5: Key Challenges in Biosimilar Demand Forecasting

| Challenge | Description | Impact on Supply Chain & Business |

| Limited Data Availability | New market segment lacks extensive historical sales/uptake data. | Inaccurate forecasts, overstocking/stockouts, sub-optimal resource allocation. |

| Inaccurate Forecasts | Stem from incomplete data, manual processes, rapid growth, or personnel shifts. | Erosion of margins due to overinvestment, missed sales opportunities. |

| Demand Fluctuations | Unpredictable changes due to treatment protocols, patient preferences, market competition, external disruptions (weather, transport). | Backups, out-of-stock situations, inability to meet patient needs. |

| Long Lead Times & Supplier Variability | Extended supplier lead times or manufacturer disruptions. | Mismatch between supply & demand, leading to excess or insufficient product. |

| Departmental Misalignment | Siloed data and poor collaboration between internal departments (marketing, production, sales). | Inaccurate and ineffective forecasts, missed strategic opportunities. |

Physician and Payer Adoption: Influencing Market Penetration

The successful market penetration of biosimilars is heavily contingent upon the willingness of healthcare providers to prescribe them and the policies adopted by payers regarding their coverage and reimbursement. This complex interplay creates a significant hurdle for biosimilar uptake.

Historically, healthcare providers in both the U.S. and Europe have approached biosimilars with a degree of caution . This hesitancy often stems from a limited familiarity with biosimilar products, a corresponding lack of prescribing comfort, and lingering concerns regarding their safety, efficacy, the principle of extrapolation (applying data from one indication to others), and interchangeability . This perception gap has frequently allowed more expensive, brand-name medications to retain their market dominance. Consequently, targeted education campaigns are crucial to bridge this knowledge gap and foster greater confidence among clinicians.

Payer policies, particularly those related to formulary placement and reimbursement structures, exert a powerful influence over biosimilar uptake . Originator companies frequently offer substantial, and often opaque, rebates to Pharmacy Benefit Managers (PBMs) in exchange for preferred formulary placement. This practice can create misaligned incentives for PBMs, encouraging them to favor branded biologics even when biosimilars offer a lower list price . This dynamic often limits the market penetration of biosimilars.

Interchangeability status, while costly and complex for manufacturers to attain, can significantly boost uptake by enabling automatic pharmacy-level substitution . Without it, adoption can be slower due to the need for physician intervention and operational complexities at the pharmacy. However, the landscape is shifting. The experience with Humira biosimilars demonstrated that decisive payer actions, such as CVS Caremark removing brand Humira from its formularies, can rapidly reorient market share towards biosimilars .

Governments and regulatory bodies are increasingly implementing policies designed to promote biosimilar adoption. For example, the Inflation Reduction Act (IRA) in the U.S. has increased reimbursement rates for biosimilars (to Average Sales Price (ASP) plus 8% of the reference biologic’s ASP), creating a direct economic incentive for their use .

The practice of originator companies offering substantial, often opaque, rebates to PBMs for formulary preference creates what can be described as a “rebate wall.” This wall effectively negates the lower list price of biosimilars, leading to slower uptake. This is not merely a commercial challenge; it is a systemic issue that prevents the full realization of healthcare savings and distorts market signals that are crucial for efficient supply chain planning. This “rebate wall” also creates operational inefficiencies for healthcare providers, who must manage multiple drugs with similar efficacy but vastly different pricing models. It further limits the incentives for manufacturers to invest in biosimilars, potentially leading to a “biosimilar void” where patent expirations do not translate into robust market competition. Overcoming this requires policy changes that promote transparency in pricing and reimbursement, along with incentives for value-based contracting that benefit all stakeholders. Such reforms are essential for fostering a more efficient and resilient biosimilar supply chain.

The Impact of Multiple Entrants on Market Share and Pricing

The entry of multiple biosimilar competitors into a market segment following the patent expiration of a reference biologic profoundly reshapes market dynamics, leading to intensified competition and significant pricing pressures. As numerous biosimilars for a given reference product, such as Humira, enter the U.S. market, competition escalates rapidly . This intense rivalry inevitably drives down prices, resulting in rapid and substantial price erosion. Discounts can range dramatically, often from 40% to as high as 86% off the reference biologic’s price .

While being the first to market can offer a temporary advantage, the acquisition of interchangeability designation is increasingly recognized as a critical factor for long-term success, particularly for facilitating pharmacy-level substitution . However, some payers may not necessarily prioritize this formal designation if they already consider biosimilars effectively interchangeable without it.

The uptake of biosimilars can be a gradual process, as originator brands often employ aggressive strategies to defend their market share, including sophisticated portfolio-level rebating . For instance, despite the launch of the first biosimilar, Humira retained an astonishing 96% of its market share more than a year later, until a major PBM’s formulary decision dramatically shifted the landscape. The practice of manufacturers introducing the same biosimilar product at multiple price points can also introduce considerable confusion into the market.

The increased competition from multiple biosimilar entrants undeniably drives down prices and generates significant cost savings for healthcare systems. However, this aggressive price erosion, particularly when coupled with complex and opaque rebate structures, can create an unsustainable market environment for biosimilar manufacturers. This situation may lead to market exits or a reduction in future investment in biosimilar development . This presents a paradox: while competition is beneficial for short-term savings, unchecked price wars can undermine the long-term sustainability and resilience of the biosimilar supply chain by disincentivizing new entrants and reducing overall supply diversity. Therefore, policymakers and industry stakeholders must devise mechanisms, such as minimum purchasing volumes or value-based contracting, that strike a balance between immediate cost savings and ensuring a viable, competitive market for biosimilars. This strategic approach is essential for securing a robust and diversified supply of these critical medicines for the future .

Strategic Solutions for a Resilient Biosimilar Supply Chain

Having thoroughly examined the intricate challenges inherent in the biosimilar supply chain, the focus now shifts to proactive strategies essential for building robust and resilient operations. This necessitates a multi-pronged approach, integrating comprehensive diversification, strategic partnerships with specialized organizations, and the transformative power of cutting-edge digital technologies.

Diversification Strategies: Beyond Geographic Boundaries

Supply chain diversification is far more than simply engaging multiple suppliers; it is a foundational strategy aimed at embedding flexibility and redundancy to mitigate risks and enhance agility across the entire network . This holistic approach encompasses a variety of dimensions, including diversifying suppliers, fundamentally reimagining manufacturing and distribution processes, and establishing robust backup plans for logistics .

Geographic diversification stands as a critical component, particularly given the geopolitical risks, potential for trade disruptions, and intellectual property concerns associated with over-reliance on a single region, such as China . Building secondary sourcing channels in diverse regions like Southeast Asia, Eastern Europe, or Mexico, or even exploring reshoring options, is crucial for mitigating these vulnerabilities . Estimates from McKinsey suggest that up to 60% of pharmaceutical sourcing could potentially be diversified .

Beyond geography, diversifying manufacturing technologies is gaining prominence. Embracing Advanced Manufacturing Technologies (AMTs) significantly enhances quality assurance, reduces downtime, lowers per-unit production costs after initial investment, and boosts overall agility and flexibility. This approach diversifies how drugs are produced, shifting from traditional batch manufacturing to more innovative and resilient processes.

Supplier diversification extends beyond mere geographic spread. It involves cultivating strong relationships with multiple strategic suppliers, meticulously defining clear criteria for their selection, and implementing robust governance and performance monitoring frameworks . This also includes diversifying raw material sources, with a growing emphasis on animal-derived component-free options to reduce variability and contamination risks .

While not strictly a supply chain strategy, product portfolio diversification across various therapeutic areas (e.g., oncology, autoimmune diseases, ophthalmology, endocrinology) can mitigate market-specific risks and ensure broader patient access, indirectly contributing to supply chain stability .

Furthermore, diversifying inventory management practices is essential. Implementing risk-based inventory management, which includes maintaining appropriate levels of excess capacity or buffer inventory, enables rapid scale-up during emergencies without disrupting routine production.

Finally, advancing regulatory harmonization among partner countries can be considered a form of regulatory diversification. This streamlines cross-border operations, making geographic diversification more feasible and enabling more agile responses to drug shortages .

Diversification, across geography, suppliers, and manufacturing technologies, often entails increased upfront costs and introduces additional logistical complexity. However, this is not merely a reactive measure to current disruptions; it is a proactive strategy for long-term business continuity and resilience. It systematically reduces exposure to single points of failure, mitigates geopolitical risks, and ensures sustained product availability, which is paramount in healthcare. For business professionals, this means framing diversification as a strategic investment that safeguards revenue, protects brand reputation, and ensures patient trust, rather than simply a cost center. It is about building an inherently more robust and adaptable supply chain that can effectively weather unforeseen storms, ultimately becoming a significant source of competitive advantage in a volatile global market.

The Indispensable Role of CMOs and CDMOs

Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs) have emerged as indispensable partners in the biosimilar supply chain, serving as a critical bridge between groundbreaking research and large-scale patient access. These specialized organizations excel at scaling up production from early-stage research to the mass manufacturing required to meet global demand . They adeptly navigate complex regulatory landscapes, ensure stringent quality control, and manage the intricate logistics of distribution .

CDMOs, in particular, offer comprehensive, end-to-end solutions that integrate research and development with commercial-scale manufacturing . Their deep expertise in drug formulation, process development, and large-scale manufacturing ensures that products are manufactured with the highest quality standards and in full compliance with regulatory requirements . This specialized knowledge is especially vital for biosimilars, given their complex molecular structures and the inherent challenges associated with production scalability .

One of the most compelling advantages of partnering with CDMOs is the significant reduction in capital expenditures for pharmaceutical companies, who might otherwise need to build and maintain their own expensive production infrastructure . Furthermore, CDMOs provide unparalleled operational flexibility, allowing companies to efficiently scale production up or down in response to fluctuating market demand without incurring heavy fixed investments .

Beyond manufacturing, CDMOs offer crucial support with regulatory aspects, assisting with the preparation of Investigational New Drug (IND) and New Drug Application (NDA) formats and ensuring compliance with regulatory agencies such as the FDA and EMA . Their proficiency in managing technology transfer, validating processes, and implementing continuous process improvement initiatives helps prevent disruptions and significantly accelerates time-to-market for biosimilar products .

The industry trend is increasingly shifting towards collaborative risk management models with CDMOs. This involves moving away from traditional penalty-based agreements to models that reward shared achievements, thereby fostering a deeper level of trust and accountability within these critical partnerships .

Given the immense capital expenditure and specialized expertise required for biosimilar manufacturing, coupled with the challenges of scaling complex modalities, CDMOs are not merely outsourced vendors; they are strategic partners. Their ability to provide end-to-end solutions, regulatory expertise, and operational flexibility directly addresses key supply chain hurdles. For smaller biosimilar developers, CDMOs democratize market entry by providing access to infrastructure and knowledge that would otherwise be prohibitively expensive. For larger companies, they enable portfolio diversification and risk mitigation by distributing manufacturing across multiple partners, thereby enhancing overall supply chain agility and responsiveness to market demands without requiring significant in-house investment. This strategic shift allows internal resources to be reallocated from building and maintaining infrastructure to managing these vital external partnerships.

Embracing Digital Transformation: AI, Blockchain, and IoT

The future of biosimilar supply chains is inextricably linked to digital transformation. Advanced technologies such as Artificial Intelligence (AI), Blockchain, and the Internet of Things (IoT) are no longer mere buzzwords; they are rapidly becoming indispensable tools for enhancing visibility, optimizing operations, and building unparalleled resilience.

AI-Driven Predictive Analytics for Optimized Operations

Artificial Intelligence (AI) and machine learning (ML) are revolutionizing biosimilar development and supply chain management by significantly improving efficiency and accuracy . AI-driven predictive analytics, for instance, can analyze vast datasets, including historical sales figures, product expiration dates, and seasonal demand fluctuations, and even integrate real-time social media sentiment to forecast future demand with remarkable precision . This capability is instrumental in determining optimal inventory levels, thereby minimizing costly stockouts and overproduction, which is particularly crucial for managing the inherent demand volatility in the biosimilar market .

AI algorithms also play a pivotal role in proactive risk mitigation. They can identify potential disruptions, such as raw material shortages, geopolitical events, or natural disasters, and provide early-warning signals, enabling companies to proactively adjust their logistics strategies . Companies that have integrated AI into their supply chain operations have reported substantial benefits, with some achieving up to a 50% reduction in disruptions .

In terms of quality control and process optimization, AI is a game-changer. It can monitor and compare the physicochemical, biological, and immunological properties of biosimilars against their reference products, detecting even subtle aberrations and ensuring that batch-to-batch variability remains within acceptable limits . AI can also accelerate critical processes like cell line development by predicting the performance of different cell lines and optimizing formulation and dosage forms based on historical data .

Beyond manufacturing, AI streamlines clinical trials. It can process large volumes of clinical and genomic data to identify and stratify appropriate patient cohorts for comparative clinical studies, thereby reducing trial duration and improving the accuracy of efficacy and safety endpoints . Real-world applications of AI in supply chain management are already evident across various industries. Companies like Amazon and Walmart leverage AI for sophisticated inventory management, while DHL utilizes it for route optimization, and Unilever employs it for robust supplier risk management . In the pharmaceutical sector, Merck has implemented IoT sensors combined with predictive analytics in its factories to improve production uptime by 20% .

Traditional supply chain management often operates in a reactive mode. AI, through its predictive analytics capabilities, transforms this into a proactive system. By analyzing vast, disparate datasets and identifying subtle patterns, AI acts as a sophisticated “nervous system” for the supply chain, providing real-time intelligence and actionable recommendations . This enables the anticipation of demand spikes, the early detection of potential disruptions, and the optimization of complex manufacturing processes. This shift from reactive to proactive management, powered by AI, not only improves efficiency and reduces costs but fundamentally enhances the resilience and responsiveness of the biosimilar supply chain. It empowers companies to make data-driven decisions that minimize waste, prevent stockouts, and consistently maintain product quality, ultimately ensuring continuous patient access and securing a significant competitive advantage.

Blockchain for Unparalleled Traceability and Transparency

Blockchain technology is emerging as a transformative force in pharmaceutical supply chains, offering a decentralized, transparent, and tamper-proof infrastructure that creates a permanent, auditable record of every transaction from origin to destination . This inherent immutability significantly enhances visibility, facilitates the early detection of discrepancies, and ensures that all participating parties operate from a single, shared source of truth .

One of blockchain’s most compelling applications in the pharmaceutical sector is its formidable ability to combat counterfeit drugs . By enabling stakeholders to scan QR codes or barcodes, they can instantly verify the drug’s origin and access a complete audit trail, thereby substantially reducing the risk of counterfeit products entering the legitimate supply chain .

Blockchain also plays a crucial role in ensuring regulatory compliance. It helps companies adhere to stringent regulations, such as the Drug Supply Chain Security Act (DSCSA) in the U.S., by providing immutable records of product movement and environmental conditions . Smart contracts, self-executing agreements stored on the blockchain, can automate compliance checks, automatically validating drug authenticity based on predefined criteria like expiration dates and proper storage conditions. This automation minimizes manual oversight and significantly reduces human error .

The distributed ledger technology at the heart of blockchain provides a shared, single version of the truth, granting permissioned participants enhanced visibility across all supply chain activities . This fosters greater trust among supply chain partners and streamlines processes like supplier onboarding by creating an immutable record of vendor details . Furthermore, blockchain can be seamlessly integrated with IoT sensors to record real-time data on critical parameters like temperature, humidity, and location. This creates an immutable record for cold chain management, ensuring accountability and providing verifiable proof of product integrity throughout transit .

The global pharmaceutical supply chain, particularly for complex biosimilars, involves numerous intermediaries and spans diverse geographical locations . This inherent fragmentation often leads to information silos, a lack of trust among disparate partners, and increased vulnerability to counterfeiting . Blockchain’s core attributes—decentralization, immutability, and transparency—directly address these systemic issues by providing a single, shared, and verifiable source of truth across all participants. By acting as a “trust protocol,” blockchain can revolutionize how supply chain partners interact, fostering greater collaboration, reducing disputes, and significantly enhancing the integrity and security of biosimilar products. This not only mitigates the risk of counterfeit drugs but also streamlines regulatory compliance and improves the speed and accuracy of product recalls, ultimately safeguarding patient safety and bolstering consumer confidence in biosimilars.

Real-World Examples of Digital Innovation in Pharma Supply Chains

The successful implementation of AI and blockchain technologies is no longer theoretical; it is manifesting in tangible real-world applications across the pharmaceutical supply chain, providing compelling case studies of digital transformation.

The MediLedger Consortium in the U.S., comprising major pharmaceutical companies like Pfizer and Gilead Sciences, leverages an Ethereum-based permissioned blockchain. This consortium focuses on verifying drug authenticity and tracking transaction histories across the supply chain, driven by the mandates of the DSCSA. Its implementation has led to enhanced interoperability, a reduction in counterfeit products, and streamlined product recalls .

VeChain, a blockchain platform specializing in supply chain management, partnered with DNV GL and the Shanghai government to launch a blockchain-enabled vaccine tracking system. This system provides end-to-end tracking of vaccine production, transportation, and storage through the integration of IoT sensors .

DHL and IBM have collaborated on blockchain trials, developing a prototype to track pharmaceuticals from their origin to the consumer. This system meticulously logs temperature and maintains chain-of-custody records, built upon the robust IBM Blockchain Platform .

Beyond blockchain, AI and IoT are also driving significant advancements. Pfizer, for instance, has established a 24/7 supply chain control tower specifically for its temperature-controlled logistics. This “control tower” allows teams to monitor shipments in real-time and intervene immediately in cases of route disruptions or temperature excursions, ensuring product integrity. Merck has implemented IoT sensors across its manufacturing facilities to collect real-time data on equipment performance and environmental variables. By applying predictive analytics to this data, Merck has successfully reduced unexpected downtime and minimized production variability, enhancing efficiency . Furthermore, Novartis has adopted digital twin technology to simulate production processes and virtually test changes before physical implementation. This innovative approach has reduced tech transfer time and validated process changes across its global manufacturing sites .

These successful real-world examples of AI and blockchain implementation are not isolated incidents; they represent a growing trend towards comprehensive digital transformation across the pharmaceutical supply chain. These technologies are most impactful when seamlessly integrated across the entire ecosystem, from raw material suppliers to manufacturers, distributors, and even healthcare providers. This indicates that competitive advantage in the biosimilar market will increasingly depend not only on a company’s internal digital capabilities but also on its ability to foster digital collaboration and interoperability across its entire supply chain network. Companies that lead in this digital transformation will be better positioned to manage risks, optimize costs, and ensure consistent supply, ultimately gaining a significant competitive edge in a dynamic market.

Building a Sustainable and Ethical Biosimilar Ecosystem

Beyond the immediate pursuit of operational efficiencies and market gains, the long-term viability, societal acceptance, and enduring trust in the biosimilar industry are fundamentally dependent on its unwavering commitment to sustainability and ethical practices. This encompasses responsible environmental stewardship in manufacturing, a deep-seated social responsibility across the entire value chain, and a proactive adaptation to evolving regulatory expectations, particularly concerning post-market surveillance and real-world evidence.

Environmental Sustainability in Biomanufacturing

Environmental sustainability in biopharmaceutical manufacturing is a comprehensive endeavor, aiming to reduce environmental burdens and foster progress towards more circular economies throughout the entire product and manufacturing process life cycle . This involves a systematic identification and implementation of alternatives across procurement, materials, logistics, equipment, manufacturing processes, and packaging .

Key areas of focus include a concerted effort to reduce reliance on fossil energy sources, actively exploring and integrating renewable options such as local wind, solar photovoltaics, and geoexchange heat pump systems . Minimizing water consumption and waste, alongside optimizing overall resource efficiency, are also paramount .

The adoption of sustainable design principles and operational practices is crucial. This includes employing integrative design processes, systems thinking, and advanced mathematical modeling to identify comprehensive environmental impacts and prioritize effective solutions . Strategic considerations for facility location, such as proximity to green energy grids and raw material sources, can significantly reduce carbon emissions from transportation. Furthermore, reducing cleanroom classifications through the use of automated, closed manufacturing equipment and continuous processing can substantially decrease energy demand for HVAC systems and associated cleaning regimes . Waste management is another critical aspect, with efforts focused on optimizing processes to use sustainable materials, reducing overall consumption, and implementing robust waste management programs, including recycling single-use plastics. While single-use materials offer benefits over traditional stainless steel (e.g., reduced water and chemical use), concerns about landfill volume necessitate ongoing recycling initiatives and product redesign efforts .

While often perceived as a compliance burden or a separate “green” initiative, environmental sustainability in biomanufacturing is directly correlated with operational efficiency. Reducing energy consumption, water usage, and waste inherently leads to cost savings and optimized resource allocation. Furthermore, strong environmental performance significantly enhances a company’s brand reputation and attracts environmentally conscious investors and consumers, thereby increasing its market appeal. Investing in sustainable biomanufacturing practices is not merely about corporate social responsibility; it is a strategic move that improves the bottom line and strengthens market position. It can also mitigate future regulatory risks and enhance supply chain resilience by promoting resource efficiency and circular economy principles, making the entire operation more robust against resource scarcity and environmental shocks.

Social Responsibility and Ethical Sourcing Across the Value Chain

The concept of supply chain sustainability extends far beyond purely financial considerations, encompassing a deep recognition of the human and environmental impact of product supply chains . Adopting an ethical, “people-first” approach is essential for addressing vulnerabilities related to human rights, modern slavery, and health and safety within increasingly intricate global supply chains .

Leading organizations, such as Pfizer, have adopted comprehensive principles aligned with ethical, social, and environmental responsibilities to ensure the sustainability of their business and the communities in which they operate . These principles are often rooted in frameworks like the Pharmaceutical Supply Chain Initiative (PSCI) Principles for Responsible Supply Chain Management . The PSCI Principles address five core areas of responsible business practice: ethics, labor, health & safety, environment, and management systems, setting clear expectations for all suppliers within the pharmaceutical supply chain .

Ethical sourcing mandates partnering with suppliers who are committed to operating responsibly, respecting human rights, providing safe and healthy work environments, and minimizing adverse impacts on the communities where they operate . This involves rigorous supplier conduct reviews, including regular Environment, Health, and Safety (EHS) assessments, avoiding new relationships with high-risk partners, and providing targeted training and improvement plans for existing suppliers .

A truly sustainable biosimilar market must also be patient-centric. This means ensuring an equitable distribution of the value created by cost savings, leading to consistently reduced out-of-pocket expenditures for patients . Engaging patients and their advocates in the development of market sustainability frameworks is crucial to ensure that their needs remain at the forefront . Furthermore, policies that induce biosimilar uptake or promote preferential treatment, such as forced switching without considering physician and patient choice, should be approached with caution. Such practices can jeopardize supply continuity and erode patient confidence in biosimilars, undermining long-term market sustainability.

In an increasingly transparent and socially conscious world, ethical lapses by any link in the supply chain can severely damage a company’s reputation, lead to consumer backlash, and incur significant legal and financial penalties. This risk is particularly amplified for life-saving drugs like biosimilars, where public trust is paramount. Therefore, integrating social responsibility and ethical sourcing principles, such as those advocated by the PSCI, is no longer a “nice-to-have” but a critical component of comprehensive supply chain risk management. It ensures not only regulatory compliance but also builds consumer and investor confidence, fosters stronger supplier relationships, and contributes to a more resilient and reputable supply chain. This proactive approach safeguards against future disruptions caused by ethical breaches and strengthens the overall “social license to operate” for biosimilar manufacturers.

Evolving Regulatory Frameworks and the Power of Real-World Evidence

The regulatory landscape governing biosimilars is in a state of continuous evolution, reflecting the dynamic nature of scientific understanding and market experience. Health authorities are constantly assessing new data to streamline approval processes and refine their requirements for the necessary evidence.

Post-market surveillance is an indispensable component of this framework, vital for ensuring the long-term safety and efficacy of biosimilars once they are on the market. While specific requirements for post-market data collection vary by region—for example, South Korea and India mandate local clinical data submission post-authorization—there is a growing global consensus on the need for effective utilization of Real-World Data (RWD) and Real-World Evidence (RWE) .

RWE, derived from routinely collected patient health and healthcare delivery data (such as electronic health records, medical claims data, and disease registries), has historically been instrumental in supporting post-market safety surveillance . However, its integration into the regulatory process is expanding. RWE is increasingly being used to support earlier phases of drug development and to assess products across various stages of their lifecycle . The FDA, for its part, is explicitly committed to fully realizing the potential of fit-for-purpose RWD to generate robust RWE that can advance the development of therapeutic products and strengthen regulatory oversight throughout the entire medical product lifecycle .

The global pharmaceutical community recognizes the need for greater harmonization of RWE and RWD programs. Such harmonization would facilitate the effective use of these data, driving further innovation in drug development and ultimately leading to increased patient and societal benefits from biosimilars .