DOXYCYCLINE HYCLATE - Generic Drug Details

✉ Email this page to a colleague

What are the generic drug sources for doxycycline hyclate and what is the scope of freedom to operate?

Doxycycline hyclate

is the generic ingredient in fifteen branded drugs marketed by Pliva, Mayne Pharma, Warner Chilcott, Bausch, Chartwell Rx, Teva, Actavis Labs Fl Inc, Ajanta Pharma Ltd, Alembic, Amneal Pharms, Bionpharma, Changzhou Pharm, Chartwell, Halsey, Heather, Hikma Intl Pharms, Interpharm, Macleods Pharms Ltd, Mutual Pharm, Nesher Pharms, Par Pharm, Pvt Form, Ranbaxy, Strides Pharma, Sun Pharm Industries, Superpharm, Watson Labs, Zhejiang Yongtai, Zydus Lifesciences, Collagenex, Pfizer, Fresenius Kabi Usa, Rachelle, Hikma, Mylan Labs Ltd, Zydus Pharms, Amneal, Aspiro, Dr Reddys, Gland, Heritage, Kindos, Lupin Ltd, Ph Health, Precision Dose Inc, Slate Run Pharma, Steriscience, West-ward Pharms Int, Den-mat, Actavis Elizabeth, Aurobindo Pharma Usa, Impax Labs Inc, Lupin, Prinston Inc, Rising, Acella, Amneal Pharms Co, Apotex, Avet Lifesciences, Chartwell Molecular, Dr Reddys Labs Sa, Epic Pharma Llc, Heritage Pharma, Mylan, Novel Labs Inc, Oryza, Pharmobedient, Praxgen, Strides Pharma Intl, Torrent, Chartwell Pharma, and Galderma Labs Lp, and is included in one hundred and nine NDAs. There are four patents protecting this compound and seven Paragraph IV challenges. Additional information is available in the individual branded drug profile pages.Doxycycline hyclate has two patent family members in two countries.

There are fifteen drug master file entries for doxycycline hyclate. Seventy-six suppliers are listed for this compound.

Summary for DOXYCYCLINE HYCLATE

| International Patents: | 2 |

| US Patents: | 4 |

| Tradenames: | 15 |

| Applicants: | 72 |

| NDAs: | 109 |

| Drug Master File Entries: | 15 |

| Finished Product Suppliers / Packagers: | 76 |

| Raw Ingredient (Bulk) Api Vendors: | 120 |

| Clinical Trials: | 25 |

| Patent Applications: | 7,383 |

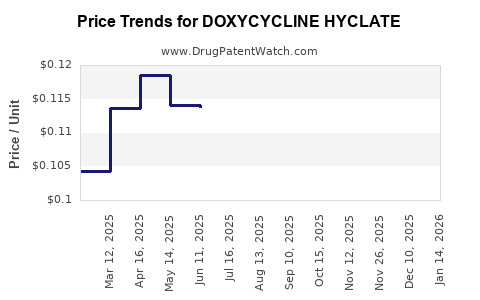

| Drug Prices: | Drug price trends for DOXYCYCLINE HYCLATE |

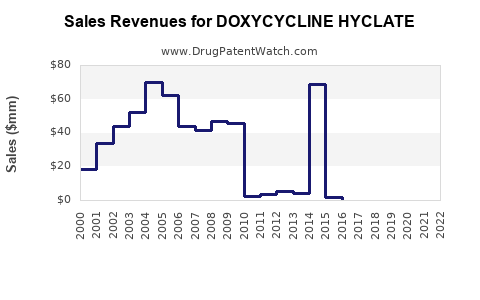

| Drug Sales Revenues: | Drug sales revenues for DOXYCYCLINE HYCLATE |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for DOXYCYCLINE HYCLATE |

| What excipients (inactive ingredients) are in DOXYCYCLINE HYCLATE? | DOXYCYCLINE HYCLATE excipients list |

| DailyMed Link: | DOXYCYCLINE HYCLATE at DailyMed |

Recent Clinical Trials for DOXYCYCLINE HYCLATE

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Chinese University of Hong Kong | Phase 4 |

| University of Karachi | Phase 1/Phase 2 |

| The Jinnah Postgraduate Medical Centre, Karachi, Sindh 75510, Pakistan | Phase 1/Phase 2 |

Pharmacology for DOXYCYCLINE HYCLATE

| Drug Class | Tetracycline-class Drug |

Anatomical Therapeutic Chemical (ATC) Classes for DOXYCYCLINE HYCLATE

Paragraph IV (Patent) Challenges for DOXYCYCLINE HYCLATE

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| DORYX MPC | Delayed-release Tablets | doxycycline hyclate | 60 mg and 120 mg | 050795 | 1 | 2017-09-28 |

| DORYX MPC | Delayed-release Tablets | doxycycline hyclate | 50 mg | 050795 | 1 | 2015-11-05 |

| DORYX MPC | Delayed-release Tablets | doxycycline hyclate | 80 mg | 050795 | 1 | 2015-07-01 |

| DORYX MPC | Delayed-release Tablets | doxycycline hyclate | 200 mg | 050795 | 1 | 2014-05-19 |

| DORYX MPC | Delayed-release Tablets | doxycycline hyclate | 150 mg | 050795 | 1 | 2008-12-19 |

US Patents and Regulatory Information for DOXYCYCLINE HYCLATE

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Warner Chilcott | DOXYCYCLINE HYCLATE | doxycycline hyclate | TABLET;ORAL | 062593-001 | Aug 28, 1985 | DISCN | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Epic Pharma Llc | DOXYCYCLINE HYCLATE | doxycycline hyclate | TABLET;ORAL | 062269-002 | Nov 8, 1982 | AB | RX | No | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Actavis Elizabeth | DOXYCYCLINE HYCLATE | doxycycline hyclate | TABLET, DELAYED RELEASE;ORAL | 090134-003 | May 22, 2018 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for DOXYCYCLINE HYCLATE

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Mayne Pharma | DORYX | doxycycline hyclate | TABLET, DELAYED RELEASE;ORAL | 050795-003 | Jun 20, 2008 | ⤷ Get Started Free | ⤷ Get Started Free |

| Mayne Pharma | DORYX | doxycycline hyclate | TABLET, DELAYED RELEASE;ORAL | 050795-006 | Dec 19, 2014 | ⤷ Get Started Free | ⤷ Get Started Free |

| Mayne Pharma | DORYX | doxycycline hyclate | TABLET, DELAYED RELEASE;ORAL | 050795-005 | Apr 11, 2013 | ⤷ Get Started Free | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

International Patents for DOXYCYCLINE HYCLATE

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Australia | 2005299253 | Improved tabletting process | ⤷ Get Started Free |

| World Intellectual Property Organization (WIPO) | 2006045152 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Market Dynamics and Financial Trajectory of Doxycycline Hyclate: An In-Depth Analysis

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.