Last updated: August 6, 2025

Introduction

Vibramycin, known generically as doxycycline, is a broad-spectrum tetracycline antibiotic used for an array of bacterial infections, including respiratory tract infections, Lyme disease, and malaria prophylaxis. Since its approval, Vibramycin has maintained a significant position in both hospital and outpatient settings. This analysis explores its current market landscape, the driving forces influencing its revenue trajectory, and the potential factors shaping its future financial prospects.

Pharmaceutical Profile and Market Position

Vibramycin is supplied through multiple formulations—oral tablets, capsules, and injectable forms—facilitating versatile clinical applications. Its patent expiry in the early 2000s led to the proliferation of generic versions, intensifying market competition. Amidst this landscape, Pfizer’s Doryx (a delayed-release doxycycline formulation) and other branded versions have continued to command premium pricing, particularly in specific niches like Lyme disease and anthrax prophylaxis.

The widespread use of doxycycline continues today, underpinning its established reputation for efficacy, safety, and cost-effectiveness. Its versatility ensures steady demand across global markets, making it a staple in infectious disease management.

Market Dynamics

1. Generics and Price Competition

Post-patent expiry, generic manufacturers have captured a substantial share of the doxycycline market. The surge in generic availability has driven down prices substantially, pressing revenue margins for branded counterparts. Price erosion remains a significant challenge, especially in price-sensitive markets such as India and China, where generic penetration is high.

2. Emerging Market Growth

Emerging economies present a key growth avenue due to expanding healthcare infrastructure, increasing antibiotic consumption, and rising bacterial infection prevalence. In regions like Asia-Pacific and Africa, doxycycline's affordability and broad spectrum of activity make it a preferred choice, fostering sustained demand.

3. Prescribing Trends and Resistance

Shifts in medical guidelines and antimicrobial stewardship have influenced doxycycline utilization. Growing awareness of antibiotic resistance has led to more judicious prescribing, sometimes curtailing usage in favor of alternative therapies where resistance is documented. Conversely, doxycycline is being explored as part of combination therapies and for off-label indications, sometimes boosting demand.

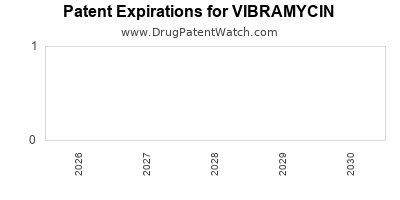

4. Regulatory Landscape and Patent Litigation

Regulatory decisions around patent protections influence market exclusivity. Patent litigations and regulatory challenges in different jurisdictions can temporarily affect supply and pricing dynamics. For instance, some markets have seen legal disputes delaying certain formulations' patent expiry benefits.

5. COVID-19 Pandemic Impact

Although doxycycline is not a registered COVID-19 treatment, its off-label use in secondary bacterial infections and potential anti-inflammatory properties have temporarily influenced demand patterns. Additionally, disruptions in supply chains and healthcare resource allocation during the pandemic presented volatility in procurement and distribution.

Financial Trajectory

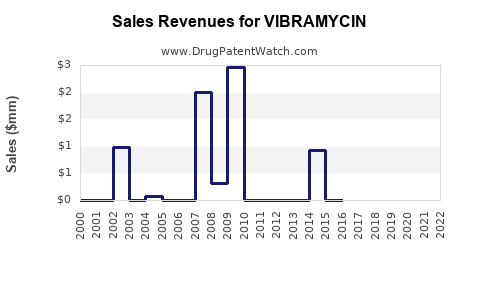

Historical Revenue Trends

Historically, Vibramycin generated billions of dollars annually for Pfizer before the advent of generics. Following patent expiration, revenues declined sharply but stabilized due to generic sales. The current global market for doxycycline is estimated at approximately USD 300-400 million annually (as of 2022), with branded versions comprising a smaller, premium segment ([1]).

Forecasted Growth and Challenges

The outlook indicates modest growth driven primarily by emerging markets and niche indications. The global antibiotic market is projected to grow at a CAGR of 3-5% over the next five years, with doxycycline contributing to this growth through steady demand.

Challenges include:

- Increasing antimicrobial resistance reducing efficacy perceptions.

- Strict regulatory controls on antibiotic use.

- Price pressures from generic competition.

- Potential development of novel antibiotics or alternative therapies.

Opportunities for Revenue Expansion

- New Indications and Approvals: Efforts to expand doxycycline's label for conditions like rosacea or certain protozoal infections can stimulate new revenue streams.

- Formulation Innovations: Enhanced formulations, such as extended-release or combination therapies, may command higher prices.

- Strategic Partnerships: Collaborations with regional manufacturers in Asia-Pacific and Africa can optimize supply and reduce costs.

Investment in R&D

While doxycycline remains a cornerstone antibiotic, pharmaceutical companies are investing cautiously in new tetracycline derivatives due to resistance concerns and market saturation. However, emerging research into doxycycline’s anti-inflammatory and antiviral properties presents potential repurposing opportunities, possibly opening alternative revenue pathways.

Market Drivers Shaping the Future

- Antimicrobial Stewardship: Growing emphasis on responsible antibiotic use may constrain certain markets but also fuel innovation in approved, well-tolerated formulations.

- Global Healthcare Spending: Increasing investment in infectious disease management, particularly in resource-limited settings, supports ongoing demand.

- Regulatory Evolution: Harmonization or tightening of regulations can influence generic entry timelines, affecting price and profit margins.

- Resistance Development: The emergence of doxycycline-resistant strains could limit efficacy, necessitating development of next-generation tetracyclines.

Risks and Uncertainties

- Resistance Patterns: The proliferation of doxycycline-resistant bacteria diminishes clinical utility, threatening future sales.

- Pricing Pressures: Healthcare systems' cost containment strategies may limit pricing flexibility, impacting revenue.

- Regulatory Barriers: Stringent approval processes and patent disputes can delay market access for new formulations or indications.

- Global Health Crises: Pandemics or outbreaks could disrupt manufacturing and distribution channels or shift focus away from antibiotics.

Conclusion

Vibramycin, with its established clinical role and widespread availability, maintains a resilient market position. However, its financial trajectory faces headwinds from generic competition, resistance issues, and evolving healthcare policies. The prospects for growth rely heavily on strategic diversification, innovation in formulations and indications, and adaptive approaches to resistance management.

Pharmaceutical stakeholders should focus on leveraging emerging markets, exploring lifecycle extension initiatives, and monitoring resistance trends to optimize profitability and sustain market relevance.

Key Takeaways

- Steady Demand in Emerging Markets: Doxycycline's affordability and efficacy will foster consistent demand, especially in Asia-Pacific and African regions.

- Pricing and Resistance Challenges: Competition from generics and rising resistance demand strategic pricing and stewardship to preserve margins.

- Diversification Opportunities: Expanding indications, formulations, and combination therapies can unlock new revenue streams.

- Regulatory Environment Impact: Patent litigations and regulatory hurdles significantly influence sales trajectories and profitability.

- Innovation as a Shield: Developing novel derivatives or repositioning doxycycline for new indications can counteract resistance-related declines.

FAQs

1. How has patent expiry affected Vibramycin’s market share?

Patent expiry led to the proliferation of generic doxycycline, significantly reducing branded sales margins and market share. Nonetheless, branded versions retain niche markets that justify premium pricing, maintaining a portion of revenue streams.

2. What are the main factors constraining doxycycline’s growth prospects?

Rising antimicrobial resistance, intense price competition from generics, and regulatory restrictions on antibiotic use are primary barriers to growth.

3. Can doxycycline be repositioned for emerging therapeutic areas?

Yes. Research into doxycycline’s anti-inflammatory and antiviral properties suggests potential for repurposing, notably in conditions like certain autoimmune diseases and viral infections, which could open alternative markets.

4. How do global health trends influence Vibramycin’s future?

Increasing global focus on infectious disease control supports demand, but antimicrobial stewardship efforts may limit prescribing volumes, impacting growth.

5. What strategic moves could pharmaceutical companies adopt to maximize Vibramycin’s value?

Investing in formulation innovations, expanding approved indications, forming regional manufacturing partnerships, and conducting research into resistance mitigation strategies are crucial to enhancing long-term profitability.

References

[1] Global Antibiotics Market Report, 2022.

[2] Pfizer Annual Reports, 2010-2022.

[3] WHO Antimicrobial Resistance Surveillance, 2021.