Last updated: July 27, 2025

Introduction

Doxycycline hyclate, a widely used broad-spectrum tetracycline antibiotic, addresses bacterial infections ranging from respiratory tract infections to sexually transmitted diseases. Its longstanding clinical efficacy and oral bioavailability have maintained steady demand across global markets. This report provides a comprehensive market analysis and price projection for doxycycline hyclate, emphasizing current trends, competitive landscape, regulatory factors, and future growth prospects.

Market Overview and Historical Context

Doxycycline hyclate was first introduced in the 1960s and quickly became a mainstay of antimicrobial therapy due to its superior pharmacokinetics and broad-spectrum activity. Despite the advent of newer antibiotics, doxycycline benefits from its low cost, established safety profile, and efficacy, securing its position in both prescription and over-the-counter segments.

The global antibiotic market was valued at approximately USD 52 billion in 2022, with doxycycline constituting a significant proportion, particularly in the dermatology, respiratory, and prophylactic indications. The increasing prevalence of resistant bacterial strains has underscored doxycycline’s continued relevance.

Current Market Dynamics

1. Regional Market Distribution

-

North America: Dominate market share driven by high prescription rates, robust healthcare infrastructure, and prevalent use in skin infections and sexually transmitted infections. The U.S. accounts for nearly 40% of the global utilization.

-

Europe: Strong demand with mature markets. Regulatory agencies like EMA have approved doxycycline formulations, supporting steady sales.

-

Asia-Pacific: Fastest growth driven by expanding healthcare access, rising bacterial infection rates, and endemic tropical diseases. Countries like India and China are major consumers.

-

Latin America and Africa: Emerging markets with increasing adoption but constrained by affordability and regulatory hurdles.

2. Therapeutic Applications and Market Drivers

- Orthopedics and Dermatology: Topical and oral formulations used to treat acne, rosacea, and skin infections.

- Respiratory Infections: Used as part of combination therapies for pneumonia and intra-abdominal infections.

- Malaria and Arboviruses: Prophylaxis in endemic regions, especially in areas with doxycycline-resistant strains.

- COVID-19 Impact: Some off-label use and research interest increased during the pandemic; however, official guidelines remain cautious.

3. Competitive Landscape

Major global pharmaceutical companies and generic manufacturers dominate doxycycline hyclate production:

- Brand Players: Pfizer, Bayer, and Teva offer branded formulations.

- Generics: Constitute over 80% of the market, with key players including Sandoz, Mylan, and Hikma.

Increased regulatory approvals for generic versions have led to intense price competition, impacting profit margins.

Regulatory and Patent Landscape

Doxycycline hyclate largely operates in the generic domain, with many patents expired or nearing expiration, facilitating market entry for generics. Regulatory agencies impose rigorous standards for manufacturing, bioequivalence, and labeling, influencing pricing strategies.

In certain regions, supply chain disruptions, as observed during the COVID-19 pandemic, prompted regulatory agencies to streamline generic approvals and encourage local manufacturing, fostering competitive pricing.

Market Challenges and Opportunities

Challenges

- Antimicrobial resistance (AMR): Growing resistance reduces doxycycline's efficacy, leading to declining prescription volumes in some regions.

- Regulatory Scrutiny: Increasing restrictions on antibiotic use to combat AMR impact demand.

- Side Effect Profile: Concerns over long-term use, especially in children and pregnant women, restrict prescribing practices.

Opportunities

- Combination Therapies: Doxycycline's inclusion in multi-drug regimens enhances efficacy and broadens its clinical application.

- Veterinary Market: Expanding use in animal husbandry as an alternative growth driver.

- New Formulations: Development of extended-release or topical formulations can stimulate demand.

Price Projections and Future Trends

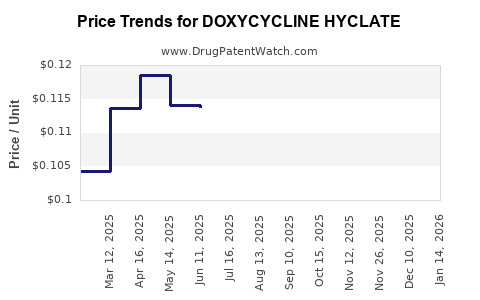

Current Pricing Landscape

- The average wholesale price (AWP) for doxycycline hyclate 100 mg capsules ranges between USD 0.10 to USD 0.30 per capsule in the U.S., with significant reductions observed due to generic competition.

- Prices in emerging markets are notably lower, often under USD 0.05 per tablet, driven by local manufacturing and reduced regulatory costs.

Projected Price Trends (2023-2030)

Based on current dynamics, competitive pressures, and regulatory considerations, doxycycline hyclate prices are expected to follow a downward trajectory, especially in generic markets:

- Short to Medium Term (2023-2025): Prices are projected to decline by approximately 10-15% annually due to increasing generic penetration and manufacturing efficiencies.

- Long Term (2026-2030): Prices could stabilize at around 25-35% below current levels in mature markets, contingent on AMR developments and regulatory policies.

In contrast, niche formulations or combination products may retain premium pricing, creating pockets of higher-margin sales.

Influencing Factors

- Regulatory Environment: Stricter antimicrobial stewardship policies can suppress demand and lower prices.

- Supply Chain Stability: Disruptions or regional manufacturing boosts influence prices—local production may lower costs.

- Emerging Markets: Growing adoption can expand volume sales, partially offsetting price declines.

Conclusion

Doxycycline hyclate remains a cornerstone antibiotic with enduring global demand, especially in generic markets. While prices are expected to decline steadily due to intense competition and regulatory pressures, opportunities for niche applications and innovative formulations persist. Stakeholders should monitor resistance patterns, regulatory landscapes, and regional demand trends to optimize pricing and market positioning.

Key Takeaways

- Doxycycline hyclate commands significant market share globally, driven by its broad-spectrum activity and affordability.

- The generics segment dominates, resulting in downward price trends, particularly in mature markets.

- Regional demand varies, with high growth potential in Asia-Pacific, provided resistance and regulatory hurdles are managed.

- Price projections indicate an annual decline of 10-15% over the next three years, stabilizing in mature markets by 2030.

- Strategies focusing on niche indications, formulation innovation, and regional manufacturing can sustain profitability amid competitive pressures.

FAQs

-

What factors most significantly influence doxycycline hyclate pricing?

Market competition, generic entry, regulatory policies, resistance trends, and supply chain stability are primary influence factors.

-

How is antimicrobial resistance impacting doxycycline hyclate's market?

Growing resistance reduces clinical efficacy, leading to decreased prescriptions in certain infections and potentially lower demand.

-

Are new formulations of doxycycline hyclate being developed?

Yes. Extended-release and topical formulations are under development to enhance compliance and expand indications.

-

What regions offer the most significant growth opportunities for doxycycline hyclate?

Asia-Pacific countries, particularly India and China, exhibit high growth potential due to expanding healthcare access and rising bacterial infection rates.

-

How do regulatory policies influence doxycycline hyclate prices?

Policies aimed at antimicrobial stewardship limit use, compelling manufacturers to adjust pricing strategies. Conversely, streamlined approval processes in emerging markets can reduce costs.

Sources:

[1] MarketWatch, “Global Antibiotics Market Report,” 2022.

[2] IQVIA, “Global Antibiotic Market Insights,” 2023.

[3] WHO, “Antimicrobial Resistance Fact Sheet,” 2022.

[4] U.S. Food and Drug Administration, “Doxycycline Hyclate Regulatory Overview,” 2023.

[5] Reuters, “Generic Antibiotic Price Trends,” 2022.