Introduction: Beyond the Sticker Price – Redefining Cost in Pharmaceutical Procurement

In the high-stakes world of pharmaceuticals, where innovation is measured in molecules and market success in billions of dollars, the procurement function has long been viewed through a narrow, traditional lens: a cost center tasked with a singular mission of securing necessary inputs at the lowest possible price. This perspective, however, is becoming not just outdated but dangerously incomplete. As one industry observer noted, “Many supply chains are perfectly suited to the needs that the business had 20 years ago”.1 In today’s landscape—defined by unprecedented supply chain volatility, relentless regulatory pressure, and seismic market shifts—clinging to a price-centric model is a recipe for value destruction and escalating risk. The true cost of procurement is no longer simply the number on a purchase order; it is a complex, multi-layered calculus of direct expenditures, hidden operational burdens, and systemic risks that collectively determine an organization’s resilience, profitability, and reputation.

The modern imperative is a shift from simple purchasing to a strategic framework of Total Cost of Ownership (TCO). This approach reframes procurement as a critical function for enterprise-wide value creation and risk mitigation, demanding a more nuanced understanding of how costs are generated and where value is truly created. This report will dissect this new reality, moving beyond the sticker price to uncover the vast, often invisible, financial drains that plague pharmaceutical procurement. It will provide a data-driven taxonomy of these hidden costs and present a strategic, actionable roadmap for mitigating them through a synergistic combination of technological transformation, sophisticated supplier partnerships, and a forward-looking C-suite mandate.

Defining the New Procurement Paradigm

At its core, pharmaceutical procurement is bifurcated into two primary streams: direct and indirect spend. Direct procurement encompasses the acquisition of all goods and services that become part of the final product, such as Active Pharmaceutical Ingredients (APIs), raw materials, and excipients. This category is intrinsically linked to the Cost of Goods Sold (COGS) and has a direct, tangible impact on product quality, efficacy, and, by extension, the company’s bottom line and public reputation.2 Any miscalculation or disruption in direct procurement can have immediate and severe consequences, affecting production lines and patient access.2 Consequently, direct procurement teams have historically focused on building high-quality, long-term strategic relationships with a limited number of reliable suppliers to ensure consistency and collaborative innovation.2

Indirect procurement, conversely, covers all goods and services necessary for day-to-day operations but not directly incorporated into the final product. This includes a vast and fragmented array of categories such as IT software and hardware, marketing services, office supplies, consulting engagements, and facility maintenance.2 These purchases affect a company’s operating expenses rather than its COGS. Traditionally, indirect spend has been viewed as less strategically critical, often managed through decentralized, ad-hoc purchasing processes driven by the immediate needs of various departments.2 The focus is typically on short-term spend management rather than long-term supplier relationships.2

This very distinction, however, creates a significant strategic blind spot and a fertile ground for hidden costs. While a single indirect purchase may seem trivial, the cumulative effect of inefficient, unmanaged indirect spending across a global organization can substantially “erode profit margins”.3 The decentralized nature of this spend makes it incredibly “challenging to account for all expenditures,” leading to maverick spending, a lack of volume leverage, and a proliferation of unvetted suppliers.2 More critically, this framework misjudges risk. The failure of a supposedly “indirect” component—such as a critical enterprise resource planning (ERP) system, a key logistics partner, or a cybersecurity service—can paralyze a company’s operations just as effectively as a shortage of a primary raw material. Therefore, a world-class procurement organization must transcend this artificial divide. It must apply the strategic rigor, risk management, and focus on total value characteristic of direct sourcing to its most critical indirect categories. The failure to do so leaves a gaping hole in an organization’s defenses, creating a hidden vulnerability and a wellspring of unmanaged cost and risk.

This challenge is amplified by the defining forces of the current era. The industry is grappling with the persistent aftershocks of global supply chain disruptions, a tightening and ever-more-complex web of regulatory compliance, escalating input costs driven by inflation and demand for novel therapies, immense pressure to maintain flawless quality assurance, and the disruptive potential of new technologies.5 These forces are the primary generators of the hidden costs that this report will explore. In this environment, the role of the Chief Procurement Officer (CPO) is undergoing a profound evolution. The CPO is no longer a mere tactical negotiator but a strategic architect of resilience, innovation, and value. As any new CPO must establish in their first 100 days, the ultimate goal is to understand how the procurement function can “best support wider business strategies and objectives”.7 This report provides the framework for achieving that mandate.

A Taxonomy of Financial Drains: Quantifying the Hidden Costs of Pharma Procurement

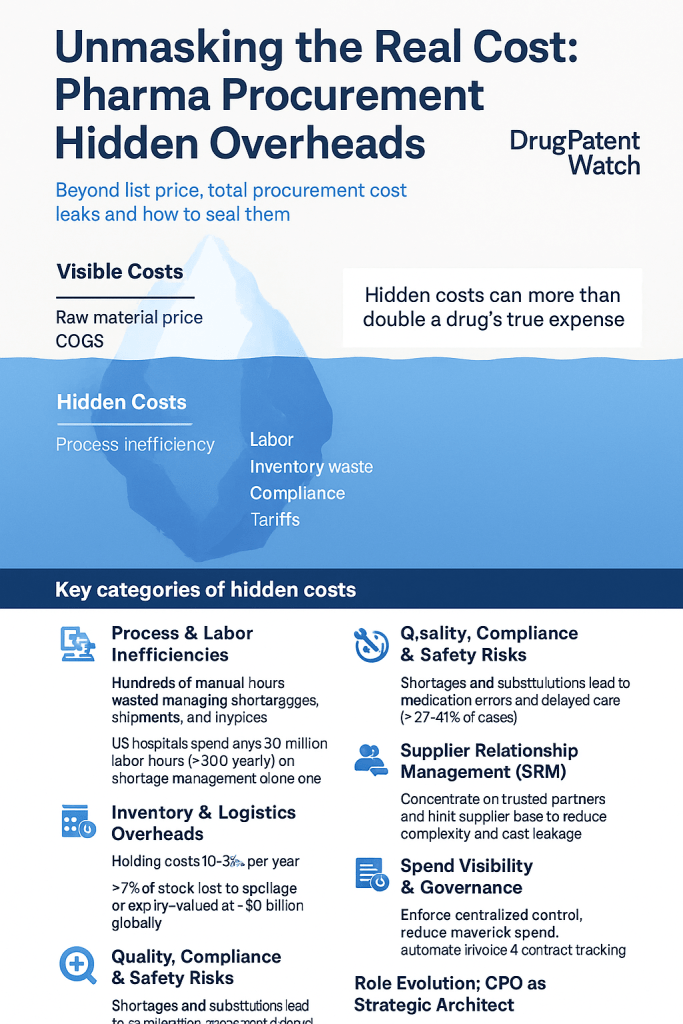

To effectively manage procurement costs, one must first see them in their entirety. The visible purchase price of a drug or raw material is merely the tip of a vast financial iceberg. Lurking below the surface is a complex array of process inefficiencies, labor burdens, supply chain frictions, and quality failures that collectively constitute the Total Cost of Ownership. This section provides a quantitative taxonomy of these hidden costs, drawing on industry data to build a compelling case for a more holistic approach to procurement management.

The Iceberg Model: Visible and Invisible Costs

The traditional view of procurement costs is dangerously simplistic. It focuses on the visible, direct costs—primarily the raw materials like APIs and excipients that are recorded in the Cost of Goods Sold (COGS).3 Indirect costs, such as operational services and supplies, are also visible on the balance sheet as operating expenses, but their strategic impact is often underestimated.2

The true financial burden, however, lies in the vast, submerged part of the iceberg—the hidden costs generated by process flaws and systemic risks associated with both direct and indirect spend. For direct procurement, any uncertainty or miscalculation in sourcing can “badly affect the profits and reputation of the business”.2 For indirect procurement, the typically decentralized and ad-hoc nature of purchasing creates a chaotic environment where spend is dispersed across countless departments, making it “challenging to account for all expenditures” without robust control measures.2 This lack of visibility and control, coupled with fragmented logistics where different teams manage their own carrier accounts, leads to scattered invoices, duplicate accounts, and a complete inability to forecast or optimize spend.8 These submerged costs, while not line items on an invoice, manifest as wasted resources, lost opportunities, and significant financial leakage.

Process and Labor Costs: The Price of Inefficiency

One of the most significant and often overlooked hidden costs is the expenditure of skilled human capital on low-value, reactive tasks. This diversion of resources represents a massive opportunity cost, pulling experts away from strategic initiatives and into perpetual fire-fighting.

The most glaring example is the labor required to manage drug shortages. A landmark 2023 survey by the healthcare improvement company Vizient quantified this burden with startling clarity. It found that hospitals across the United States spent approximately 20 million hours managing drug shortages, translating to nearly $900 million annually in labor costs alone. This figure, which more than doubled since a similar survey in 2019, represents the time pharmacists, technicians, and clinicians spend on non-value-added activities: identifying the shortage, sourcing more expensive alternative therapies, managing communications with physicians and patients, and updating internal systems.9 The problem is even more acute in specialized settings; pediatric facilities, which deal with complex dosing and a mix of adult and pediatric drugs, reported monitoring at least 25% more shortages than general hospitals.9

This inefficiency extends deep into the supply chain. In logistics, what seems like a routine task can become a significant cost driver. One analysis found that, on average, a logistics operator spends over 15 minutes manually creating each individual shipment—checking carrier rates, printing labels, and entering data. When multiplied by dozens or hundreds of packages per day, this manual effort quickly accumulates into “thousands of dollars in labor costs every month”.8

Furthermore, the lack of centralized and automated procurement systems gives rise to “maverick spending.” This occurs when internal departments bypass established procurement channels and negotiated contracts, often for indirect goods and services, leading to higher prices and non-compliant purchases.4 Each instance of maverick spend not only inflates costs but also consumes valuable procurement and finance team hours in reconciling non-standard invoices and dealing with unvetted vendors.

Supply Chain and Inventory Costs: Paying for “Just in Case”

The management of physical inventory is another major source of hidden costs. The balance between ensuring product availability and minimizing excess stock is a delicate one, and errors in either direction have significant financial consequences.

The cost associated with keeping any stock in inventory—known as carrying costs—is substantial. Industry estimates place these costs, which include warehousing, security, insurance, and the cost of capital tied up in stock, at 10% to 35% of the inventory’s total value annually.10 Therefore, any overstocking, often a direct result of inaccurate demand forecasting, directly inflates this hidden expense.

The flip side of carrying costs is the cost of stock loss. Poor inventory control procedures or inaccurate quantification can lead to a surplus of medicines that expire on the shelf. These expired or damaged products not only represent a complete loss of the initial investment but also incur additional costs for their safe destruction.10 A comprehensive study highlighted the staggering scale of this problem, revealing that over

7.1% of all pharmaceutical stock is lost within the supply chain. This figure breaks down into 4.1% of stock that perishes, spoils, or is damaged, and an additional 3% that is lost due to overproduction. The total value of this lost stock was estimated to be an astonishing $10.3 billion.11

When inventory systems fail and drug shortages occur, organizations are forced into emergency purchasing. This involves making “direct purchases outside the hospital’s traditional channels,” often at a significant price premium, to prevent disruptions to patient care.9 These reactive, high-cost transactions are a direct financial consequence of upstream failures in supply chain planning and inventory management.

Governmental and Logistical Overheads: The Multi-Layered Price Stack

The manufacturer’s price for a drug is only the starting point. As a product moves through the global supply chain, it accumulates a cascade of fees, tariffs, taxes, and markups that can dramatically inflate the final cost to the patient or provider. A World Health Organization (WHO) study that analyzed the supply chain in nine different countries found that these hidden costs, on average, increased the final price by a staggering 68.6% over the original manufacturer’s price.10

These costs are multi-layered and their impact is compounded at each step. The study identified a wide range of specific charges, including 10:

- Import Tariffs: Ranging from 0% in some countries to as high as 11.7% in South Africa.

- Value Added Tax (VAT): A significant cost layer, reaching 20% in Armenia.

- Port Charges and Clearance Fees: Adding several percentage points to the cost base.

- Wholesale and Retail Markups: The largest contributors in many cases, with retail markups reaching as high as 50% in countries like Tanzania and South Africa.

Even a seemingly small fee, such as a 1% port charge, becomes a significant expense on a multi-million-dollar pharmaceutical order.10 The compounding effect means that each new charge is applied to a cost base that already includes all previous charges, leading to an exponential increase in the final price.

Quality, Safety, and Compliance Costs: The Price of Failure

The most devastating hidden costs are those that impact patient safety and clinical outcomes. These failures not only have profound human consequences but also expose organizations to massive financial and reputational liability.

Supply chain disruptions are a direct cause of increased medical risk. The 2023 Vizient survey found that 43% of responding healthcare facilities indicated that medication errors had occurred as a direct result of drug shortages, an increase from 38% in 2019.9 These errors often happen when clinicians are forced to use unfamiliar alternative drugs or different concentrations, increasing the potential for mistakes.

Beyond errors, shortages lead to direct disruptions in care. The same survey revealed that 27% of respondents reported that drug shortages caused delays, omissions, or cancellations of patient care. Outpatient infusion services were the most affected, with a staggering 41% of patient cases being impacted.9 Each delayed or cancelled procedure represents lost revenue for the provider and, more importantly, a negative outcome for the patient, eroding trust and satisfaction.

Finally, the sheer cost of navigating the “complex web of regulations” that governs the pharmaceutical industry is a significant, if necessary, hidden cost.5 Maintaining compliance requires dedicated personnel, robust documentation and quality assurance systems, and continuous monitoring of evolving global standards, all of which represent a substantial and growing operational overhead.5

The following table synthesizes these disparate data points, providing a clear, quantified overview of the hidden cost landscape in pharmaceutical procurement.

| Cost Category | Specific Cost Driver | Quantifiable Impact / Statistic | Strategic Implication | Source(s) |

| Crisis Management Labor | Managing Drug Shortages | $900M in annual labor costs (U.S. hospitals); 20 million staff hours | Diverts highly skilled clinical and pharmacy staff from patient care and value-added activities to reactive problem-solving. | 9 |

| Manual Logistics Processing | Over 15 minutes per shipment, costing thousands per month | Creates operational bottlenecks, increases labor costs, and introduces a high potential for data entry errors. | 8 | |

| Inventory & Waste | Inventory Carrying Costs | 10-35% of inventory value annually | Directly inflates operational costs; excess capital is tied up in non-productive assets, reducing liquidity. | 10 |

| Stock Expiry & Loss | 7.1% of all stock lost in supply chain, valued at $10.3B | Represents a direct loss of revenue and product; incurs additional costs for safe disposal of expired medicines. | 11 | |

| Logistical Overheads | Tariffs, Taxes, & Markups | Adds an average of 68.6% to the manufacturer’s price | Dramatically increases the total cost of acquisition, impacting affordability and access for end-users. | 10 |

| Quality & Safety Failures | Medication Errors | 43% of medication errors linked to drug shortages | Creates immense patient safety risks, leading to potential harm, increased treatment costs, and significant legal liability. | 9 |

| Patient Care Disruptions | 27% of facilities report care disruptions; 41% of infusion cases impacted | Results in direct revenue loss, damages patient trust, and negatively impacts health outcomes. | 9 |

A deeper analysis of these interconnected costs reveals a critical truth: the quantified financial drains are not independent problems but rather a tightly linked cascade of failures. A single upstream process failure, such as inaccurate demand forecasting, can trigger a devastating domino effect across the entire cost structure. The process begins with the forecast. If it is inaccurate—a common issue that advanced technologies like AI are now being deployed to solve 12—it inevitably leads to a mismatch between supply and demand. In the case of under-forecasting, the immediate result is a drug shortage.9 This single event then sets off a chain reaction of second-order costs. The organization is hit with massive labor expenditures as teams scramble to manage the shortage ($900 million in the U.S. alone).9 Simultaneously, procurement teams are forced into the spot market for premium-priced emergency purchases to fill the gap 9, and logistics teams incur extra charges for expedited shipping.8 The third-order consequences are even more damaging. Clinicians, now working with unfamiliar alternative therapies, are more likely to make medication errors.9 Patient treatments are delayed or cancelled, impacting both health outcomes and provider revenue.9 Ultimately, trust in both the pharmaceutical manufacturer and the healthcare provider is eroded. This cascade illustrates that tackling hidden costs requires a shift in focus. Instead of treating the symptoms—like the $900 million labor bill—a strategic procurement function must diagnose and cure the underlying disease: the upstream process failures that allow such financial hemorrhaging to occur in the first place.

The Macro-Economic Gauntlet: Navigating Patent Cliffs, Regulation, and Supply Chain Volatility

The hidden costs of pharmaceutical procurement are not generated in a vacuum. They are created and massively amplified by a turbulent external environment characterized by powerful market forces, stringent regulatory frameworks, and persistent supply chain volatility. A truly strategic procurement function must therefore be adept at navigating this external gauntlet, understanding that proactive engagement with these macro trends is not optional but essential for survival and competitive advantage.

The Patent Cliff Phenomenon: From Monopoly to Mayhem

The pharmaceutical industry is perpetually navigating the “patent cliff,” a term that describes the sharp, often brutal, drop in revenue a company experiences when a blockbuster drug loses its market exclusivity.15 This is not a minor market fluctuation; it is a “seismic shift” in revenue streams that poses a recurring existential challenge. The current cliff is particularly daunting, with an estimated

$200 billion in annual revenue at risk globally between now and 2030 as major drugs face generic and biosimilar competition.15

When a drug’s patent expires, the impact on the innovator company is swift and severe. For example, when Pfizer’s cholesterol drug Lipitor lost its U.S. patent protection in 2011, its annual sales of over $10 billion plummeted by more than 50% within a single year.15 Historical trends show that a blockbuster drug can lose up to 80% of its revenue in the first year of facing competition.16 This precipitous drop in revenue places immense pressure on the entire organization, and particularly on the procurement function, to offset these losses through aggressive cost-saving initiatives and strategic repositioning across the entire product portfolio.

The patent cliff forces a dramatic and multifaceted pivot in procurement strategy. The approach to sourcing a single molecule must bifurcate almost overnight. For the original branded drug, procurement may engage in sophisticated strategies to preserve market share, such as negotiating loyalty programs with payers or leveraging what is known as the “generic paradox,” where the price of the brand-name drug is sometimes strategically increased after generic entry to maximize revenue from a small but loyal base of prescribers and patients.15

Simultaneously, for the newly available generic or biosimilar versions, the procurement strategy must execute a 180-degree turn. The focus shifts from managing a long-term, single-source relationship to orchestrating a highly competitive, multi-supplier negotiation process designed to capture the dramatic price reductions that competition brings. It is not uncommon for the price of a medication to drop by 80-90% within the first year of generic entry.15 This requires a procurement team that is agile, data-driven, and skilled in tactical, price-focused negotiations.

Adding another layer of complexity is the nature of the current patent cliff, which primarily affects large-molecule biologic drugs rather than traditional small-molecule chemicals.16 These complex medicines, derived from living cells, face competition from “biosimilars.” Unlike simple generics, biosimilars are not always perfectly interchangeable with the originator product and often present their own complex manufacturing and regulatory challenges. This can lead to a slower revenue decline for the innovator drug compared to the immediate collapse seen with small-molecule generics, but it also demands a far more nuanced sourcing and supplier qualification strategy from procurement teams looking to incorporate these new alternatives into their formularies.16

This dynamic creates a profound structural challenge for the procurement organization. The skills, processes, and mindset required to manage a strategic, long-term partnership with a sole-source supplier for an on-patent innovator drug are fundamentally different from those needed to manage an aggressive, multi-vendor, price-driven sourcing event for an off-patent generic. A successful CPO, such as Shashi Mandapaty at Johnson & Johnson or Susanna Webber at Merck 18, must therefore build and lead a bimodal procurement organization. One part of the team must excel at deep, collaborative Supplier Relationship Management (SRM) to nurture the innovation pipeline and ensure supply security for strategic assets. The other part must be a highly agile, analytically savvy, and commercially aggressive unit capable of maximizing value from the commoditized, post-patent portfolio. The hidden cost of navigating the patent cliff is not just the lost revenue; it is the organizational complexity and cultural tension of having to master two diametrically opposed sourcing philosophies simultaneously.

The Regulatory Labyrinth: Compliance as a Cost Driver

The pharmaceutical industry operates within one of the most intensely regulated environments of any sector. Procurement professionals must navigate a “complex web of regulations” enforced by bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), which govern every conceivable aspect of the supply chain, from raw material sourcing and Good Manufacturing Practices (GMP) to clinical trial conduct, packaging, and distribution channels.5

While essential for patient safety, this regulatory framework is a significant driver of both direct and hidden costs. Compliance necessitates the implementation of robust and expensive quality assurance systems, meticulous and exhaustive documentation trails, and rigorous, ongoing audits of suppliers and internal processes.5 These activities represent a substantial operational overhead that is built into the TCO of every product. Failure to comply is not an option, as it can result in crippling fines, product seizures, market access delays, and catastrophic reputational damage.

Furthermore, the regulatory landscape is not static. It is constantly evolving, forcing companies to adapt and invest continuously. Recent legislation has had a profound impact on procurement operations. The Drug Supply Chain Security Act (DSCSA) in the United States and the Falsified Medicines Directive (FMD) in Europe, for instance, have mandated the implementation of systems for end-to-end traceability of prescription drugs.14 This has compelled the industry to invest heavily in new technologies, such as 2D barcoding and, increasingly, blockchain, to create the interoperable, electronic audit trails required by law. In the U.S., the

Inflation Reduction Act (IRA) has granted Medicare the authority to directly negotiate the prices of certain high-cost drugs, fundamentally altering the pricing and contracting landscape and adding another layer of complexity that procurement teams must manage.16 These evolving requirements ensure that regulatory compliance remains a dynamic and costly challenge.

Post-Pandemic Supply Chain Realities: The New Normal of Disruption

If the patent cliff and regulation are chronic pressures, the COVID-19 pandemic was an acute shock that brutally exposed the underlying vulnerabilities of highly optimized, yet fragile, global pharmaceutical supply chains.5 The crisis triggered widespread raw material shortages, severe transportation and logistics delays, and chaotic fluctuations in demand patterns that left many organizations scrambling.5

In the aftermath, the industry’s strategic focus has pivoted decisively toward enhancing supply chain resilience. The consensus among supply chain leaders is that the hidden cost of a catastrophic supply chain failure far outweighs the visible cost of building in redundancy. As one executive panel concluded, “We have to build in additional redundancies, additional capacity, both nationally and globally”.22 This strategic shift is driving a fundamental re-evaluation of sourcing strategies. Companies are actively pursuing diversification of their supplier base to reduce reliance on single-source or single-region suppliers, particularly for critical APIs and raw materials.6 There is also a growing emphasis on local and near-shore sourcing to mitigate the risks associated with long, complex global transit routes.6 While these resilience-building measures may increase upfront procurement costs, they are now viewed as a necessary insurance policy against the far greater costs of disruption.

Compounding this challenge are the persistent macroeconomic headwinds of the post-pandemic era. As of 2025, procurement teams continue to grapple with the direct financial impacts of global inflation, rising operating costs, and evolving international shipping tariffs. These factors are increasing the baseline cost of sourcing and moving APIs, raw materials, and finished goods around the world, putting further pressure on procurement teams to find efficiencies and mitigate cost increases wherever possible.8 This new normal of perpetual disruption and cost pressure has made strategic, resilient, and agile procurement more critical than ever.

The Digital Revolution: Leveraging Technology for Unprecedented Efficiency

In the face of mounting internal and external pressures, pharmaceutical procurement can no longer afford to operate on manual processes and fragmented data. The digital revolution offers a powerful arsenal of tools designed to directly target and eliminate the hidden costs of inefficiency, opacity, and risk. For the modern CPO, embracing digital transformation is not an optional upgrade but a core strategic imperative for building a cost-effective, agile, and resilient procurement function. This section details the key technologies reshaping the landscape and provides evidence of their quantifiable impact.

E-Procurement and Automation: Digitizing the Core

The foundational layer of digital procurement transformation is the implementation of e-procurement platforms and automation tools. The primary goal of these systems is to digitize and streamline the entire procure-to-pay (P2P) lifecycle, from strategic sourcing, contract management, and purchase order creation to invoice processing and payment.24 This systematic automation directly attacks the hidden costs associated with manual labor, process delays, and uncontrolled spending.

The potential returns on this investment are substantial. A comprehensive report by McKinsey estimated that the digitization of procurement processes can generate savings of up to 25% of an organization’s total procurement spend.25 These savings are achieved by centralizing spend under management, enforcing the use of negotiated contracts, eliminating maverick buying, reducing administrative overhead, and providing a clean, centralized repository of data that can be used for strategic analysis and further optimization.8

The successful adoption of these platforms by leading pharmaceutical giants provides compelling evidence of their value. Case studies reveal a clear pattern of enhanced efficiency and significant cost savings:

- Pfizer: After implementing a dedicated eSourcing platform to streamline its procurement processes, the company reported a 30% reduction in procurement cycle times, along with significant, though unquantified, cost savings and improved supplier collaboration.25

- Roche: The implementation of a comprehensive eProcurement platform yielded even more dramatic results, enabling the company to achieve a 50% reduction in its procurement cycle times.25

- GlaxoSmithKline (GSK): By deploying a global procurement system, GSK created a centralized platform for strategic supplier management, purchase orders, and invoices. This move resulted in significant cost savings and fostered stronger, more collaborative relationships with its supply base.25

These examples demonstrate that e-procurement is not merely about replacing paper with pixels; it is about re-engineering core processes to be faster, more compliant, and more transparent, thereby freeing up valuable procurement talent to focus on strategic, value-adding activities rather than administrative tasks.

AI-Powered Demand Forecasting: From Reactive to Predictive

A primary driver of hidden costs, as detailed in Section 2, is the vicious cycle of stockouts and overstocks caused by inaccurate demand forecasting. Traditional forecasting methods, often based on simple historical sales data, are ill-equipped to handle the volatility and complexity of the modern pharmaceutical market. This is where Artificial Intelligence (AI) and Machine Learning (ML) are proving to be transformative.

AI-powered forecasting engines represent a paradigm shift from reactive to predictive supply chain management. These sophisticated algorithms can analyze massive and diverse datasets in real-time, going far beyond historical sales to incorporate a multitude of influential variables. This can include macroeconomic indicators, market trends, public health alerts, competitor activities, social media sentiment, and even epidemiological and weather patterns that might influence disease prevalence.12 By identifying subtle patterns and correlations that are invisible to human analysts, these AI models can generate demand forecasts with a level of accuracy that was previously unattainable.13

The benefits of this enhanced accuracy flow directly to the bottom line, mitigating several key hidden costs:

- Cost Reduction: By providing a more reliable demand signal, AI minimizes the risk of overstocking, which in turn reduces inventory holding costs, storage fees, and losses from expired products. It also helps avoid stockouts, eliminating the need for premium-priced emergency purchases and expensive expedited freight.12

- Automated Replenishment: The predictive power of AI can be integrated directly into inventory management systems to enable automated replenishment. Based on the forecast, the system can automatically generate and place purchase orders to maintain optimal stock levels, ensuring product availability while minimizing the risk of human error, overstocking, and waste.12

Blockchain for Integrity and Traceability: Forging a “Trust Layer”

Perhaps the most profound technological challenge in the pharmaceutical supply chain is its inherent fragmentation and opacity. The traditional “one-up, one-down” visibility model, where each participant can only see the transaction immediately before and after their own, creates a system riddled with blind spots.11 This lack of a shared, verifiable source of truth is what enables the global counterfeit drug market—an illicit enterprise valued by some estimates as high as

$431 billion annually—to thrive.11 It also makes essential processes like product recalls slow, inefficient, and overly broad.

Blockchain technology offers a foundational solution to this problem by creating a “trust layer” for the entire supply chain ecosystem. A blockchain is a decentralized, distributed, and immutable digital ledger. Every transaction—from the creation of an API batch to the final dispensing of a drug to a patient—is recorded as a cryptographically secured “block” and added to a permanent, unalterable “chain.” This chain is shared among all authorized participants, creating a single, transparent, and verifiable source of truth for the product’s entire journey.20

The practical use cases for this technology are powerful and directly address key sources of cost and risk:

- Combating Counterfeits and Ensuring Product Integrity: Blockchain provides an immutable record of a drug’s provenance. By scanning a code on the package, a pharmacist, regulator, or even a patient can instantly verify the product’s entire history on the blockchain, confirming its authenticity and ensuring it has not been tampered with or diverted. This provides a powerful defense against counterfeit products entering the legitimate supply chain.30 The technology’s immutability ensures that once a record is created, it cannot be altered, providing proof of legitimacy.33

- Streamlining Regulatory Compliance: The technology creates an automatic, unchangeable audit trail that is perfectly suited for meeting the stringent traceability requirements of regulations like the U.S. DSCSA and the European FMD.20 The

MediLedger Project stands as a leading example of this, bringing together pharmaceutical giants like Pfizer to create an industry-wide blockchain network for verifying the authenticity of saleable drug returns, as mandated by the DSCSA.30 - Improving Operational Efficiency: The use of “smart contracts”—self-executing contracts with the terms of the agreement written directly into code—can automate key business processes. For example, a smart contract could automatically trigger payment to a logistics provider the moment a shipment’s delivery and temperature integrity are confirmed on the blockchain, eliminating invoicing delays, disputes, and administrative overhead.27 This technology can also be used to manage digital product leaflets, ensuring the information is always up-to-date and dramatically reducing the risk and cost of recalls caused by outdated or incorrect paper inserts.33

- Enhancing Sustainability: Blockchain’s transparency can be leveraged for sustainability initiatives. It can create a verifiable record of a product’s carbon footprint or be used to certify that raw materials were sourced according to ethical and environmental standards, helping to prevent “greenwashing”.36

The following table summarizes the tangible returns that can be expected from investing in these key digital procurement technologies.

| Technology | Company / Initiative | Quantifiable Result | Strategic Implication (The “So What?”) | Source(s) |

| eSourcing Platform | Pfizer | 30% reduction in procurement cycle time | Frees up procurement team from tactical execution to focus on strategic tasks; accelerates overall speed-to-market for new initiatives. | 25 |

| eProcurement Platform | Roche | 50% reduction in procurement cycle time | Dramatically increases operational agility and responsiveness; reduces administrative overhead and cost. | 25 |

| AI-Powered Forecasting | Industry-wide | Reduces inventory costs & stockouts | Builds supply chain resilience by preventing shortages; protects revenue by ensuring product availability; frees up working capital. | 13 |

| Blockchain for Traceability | Industry-wide / MediLedger Project | Combats $431B counterfeit market; ensures DSCSA compliance | Protects brand reputation and patient safety; reduces risk of regulatory fines and legal liability; builds trust with consumers and partners. | 11 |

Critically, these digital tools should not be viewed as standalone solutions. They form a powerful and synergistic ecosystem where the output of one system becomes the fuel for the next, creating a virtuous cycle of escalating intelligence and optimization. The journey begins with the implementation of a foundational e-procurement platform.24 Its primary function is to automate the P2P process, but its most strategic output is the creation of a centralized, clean, and comprehensive dataset of all procurement activities. This high-quality data is the essential raw material required to train an effective AI-powered demand forecasting engine 12; without it, the AI’s predictions would be based on fragmented and unreliable information—a classic “garbage in, garbage out” scenario.

Once the AI generates more accurate demand signals, this information can be written to a shared blockchain ledger.37 This allows all supply chain partners—suppliers, contract manufacturers, logistics providers, and distributors—to see the same forecast simultaneously. This shared visibility helps to dampen the “bullwhip effect,” where small fluctuations in end-user demand are amplified into massive swings in orders further up the supply chain, leading to better coordination and system-wide efficiency. In parallel, the rich performance data captured within the e-procurement system—metrics on on-time delivery, quality acceptance rates, and pricing compliance—becomes the objective, data-driven input for a strategic Supplier Relationship Management (SRM) platform.38 This enables procurement teams to move away from subjective assessments and toward fact-based performance discussions with suppliers.

This interconnectedness reveals a crucial strategic insight: a CPO’s digital transformation roadmap cannot be a series of disconnected, ad-hoc projects. It must be a carefully phased and integrated strategy. Foundational systems that capture and structure data, like e-procurement, must come first. They create the capability to then deploy more advanced analytical and collaborative technologies like AI and blockchain. The true, transformative return on investment comes not from any single tool, but from their intelligent integration into a cohesive digital ecosystem.

The Human Element: Forging Strategic Partnerships for Long-Term Value

While technology provides the essential infrastructure for a modern procurement function, it is ultimately a tool. The full realization of its potential—and the sustainable mitigation of hidden costs—depends on a fundamental evolution in the human element of procurement: the shift from transactional, often adversarial, interactions to strategic, collaborative, and value-driven partnerships. Technology can provide the data, but strategy and relationships are what translate that data into a competitive advantage.

Strategic Supplier Relationship Management (SRM): From Adversary to Ally

In the high-stakes, highly regulated world of pharmaceuticals, the quality and reliability of the supply base are paramount. As the CPO of Ferring Pharmaceuticals, Eric Espinasse, succinctly put it, “In the pharmaceutical world, it is very difficult and effort-consuming to change the supplier base of raw materials, meaning that supplier relationships are paramount”.39 This reality necessitates a move away from purely price-based, tactical negotiations and toward a systematic approach of Strategic Supplier Relationship Management (SRM). The goal of SRM is to build long-term, mutually beneficial partnerships with an organization’s most critical suppliers, transforming the relationship from a zero-sum game of cost extraction to a collaborative quest for joint value creation.38

An effective SRM program is not a one-size-fits-all endeavor. It begins with a rigorous process of supplier segmentation. Not all suppliers warrant the same level of engagement. Organizations must classify their supply base using a matrix of strategic importance, typically weighing factors like total spend, supply criticality, operational risk, and potential for innovation.40 This allows the procurement team to tailor its approach, dedicating the most significant resources to managing “Strategic” partners while handling “Leveraged” or “Routine” suppliers with more tactical and automated processes.38

Once suppliers are segmented, the focus shifts to performance management, but with a crucial evolution in perspective. Traditional supplier scorecards often focus narrowly on operational metrics like cost, quality, and on-time delivery. While important, these metrics only tell part of the story. Leading procurement organizations, according to Gartner, are augmenting these with value-driven metrics that assess a supplier’s contribution to broader business priorities, such as collaborative innovation, supply chain resilience, and sustainability goals.38 Critically, best-in-class SRM is a two-way street. It must incorporate the “voice-of-the-supplier” through satisfaction surveys and feedback channels, allowing the buying organization to identify and fix its own process flaws that may be hindering a supplier’s performance.38

The ultimate goal of SRM is joint value creation. This is where procurement transcends its traditional role as a cost center and becomes a true value-add partner to the business. By building deep, trust-based relationships, companies can unlock new sources of value. This might involve leveraging a strategic supplier’s R&D department to co-develop a new drug formulation, collaborating with a logistics partner to re-engineer the supply chain for greater efficiency, or working with a packaging supplier on an innovative design that improves patient adherence.2 This collaborative approach, which is central to the success of life sciences companies running complex clinical trials, recognizes that suppliers are not just vendors but repositories of expertise and innovation that can be harnessed for competitive advantage.43

The Shift to Value-Based Procurement (VBP): A New Definition of “Best Price”

If SRM provides the “how” of building better supplier relationships, Value-Based Procurement (VBP) provides the philosophical “why.” VBP represents a fundamental shift in the definition of procurement success. It moves the decision-making focus away from the simple, short-term metric of initial purchase price and toward the much broader, long-term concept of total value created.45 The guiding question of VBP is not “What is the cheapest option?” but rather, “What option delivers the best possible outcome for the patient and the organization at an affordable and sustainable cost?”.45

This contrasts sharply with the traditional, volume-based procurement model. A purely cost-focused approach can inadvertently create significant hidden costs downstream. For example, purchasing a cheaper medical device might save money on the initial invoice but lead to higher rates of user error or needlestick injuries, the costs of which (additional treatment, staff time, potential litigation) far outweigh the initial savings.45 Similarly, selecting a laboratory service based solely on the lowest price per test could result in poor sample quality, leading to inaccurate results, repeat tests, and incorrect diagnoses.45

VBP, instead, evaluates procurement decisions through a holistic, multi-stakeholder lens. It considers a wide array of factors beyond price, including 45:

- Patient Outcomes and Experience: Does the product or service contribute to better, safer, and more effective care?

- Long-Term Cost Efficiencies: What is the total cost of acquisition, use, and disposal? Does the supplier provide training and support that reduces user error and improves efficiency?

- Product Quality and Reliability: Does the product meet the highest standards of quality, ensuring reproducible and accurate results?

- Supplier Services and Partnership: Does the supplier act as a true partner, offering reliable supply, technical support, and responsive service?

Implementing VBP effectively requires breaking down internal organizational silos. Procurement can no longer make decisions in isolation. It necessitates deep collaboration with clinical teams, R&D departments, laboratory staff, nurses, and quality assurance professionals.45 Together, these cross-functional teams must define what “value” means for a given product category and develop a weighted scorecard to evaluate suppliers against these holistic criteria. The success of an external-facing SRM program is therefore critically dependent on the strength of this internal, cross-functional collaboration. One cannot be truly effective without the other; VBP provides the strategic purpose that elevates SRM from a simple process to a powerful engine of value creation.

Strategic Sourcing in Practice: Case Studies

The theoretical benefits of strategic sourcing and partnership become tangible when examined through real-world examples where companies have looked beyond the obvious path to unlock significant value.

A compelling case study from Midwinter Solutions, a clinical trial supply specialist, illustrates this principle perfectly. A pharmaceutical sponsor was conducting a large-scale global oncology study and required a high-cost comparator drug. The initial, straightforward plan was to source the drug domestically for U.S. trial sites and develop a separate strategy for the rest of the world. However, this approach was fraught with hidden costs and barriers: the U.S. price was exceptionally high, and accessing the drug domestically required a level of trial disclosure the sponsor wished to avoid.47

Instead of following this conventional path, Midwinter’s procurement team developed a truly strategic global sourcing solution. They conducted a comprehensive market evaluation and identified that the drug could be sourced from the European Union at a much lower cost. The core of their strategy was to use this single, EU-sourced drug for all global trial sites, including those in the U.S. This was a complex undertaking that required navigating the FDA’s regulatory process to gain approval for using the EU-sourced product in the U.S. By providing the necessary documentation to demonstrate manufacturing equivalency, Midwinter secured FDA approval. The result was a staggering 65% reduction in comparator drug spend for the U.S. sites, a streamlined and consistent global supply chain from a single source, and the preservation of trial confidentiality. This case is a powerful demonstration of strategic sourcing in action—it required deep market knowledge, regulatory expertise, and a willingness to challenge initial assumptions to deliver transformative cost savings and operational efficiency.47

This strategic mindset is also evident at the highest levels of the industry. At Johnson & Johnson, CPO Shashi Mandapaty oversees a $30 billion annual spend with a stated focus on driving “sustainable and innovative healthcare solutions,” a clear signal of a procurement philosophy that prioritizes long-term value and partnership over short-term cost-cutting.18 Similarly, while not a pharmaceutical company, the strategy of

General Mills to deliberately diversify its supplier base geographically to mitigate risks associated with product quality and supply interruptions offers a directly transferable lesson for pharma procurement teams aiming to build greater resilience into their supply chains.48 These examples underscore that the greatest value is often found not by negotiating harder on the existing path, but by strategically finding a better path altogether.

The C-Suite Mandate: An Actionable Roadmap for Cost Optimization

The evidence is unequivocal: clinging to outdated, price-centric procurement models in the face of profound market shifts, escalating regulatory demands, and persistent supply chain fragility is no longer a viable strategy. It is a direct path to value erosion, increased risk, and a loss of competitive advantage. The transformation of procurement from a tactical cost center to a strategic value creator is therefore not just an operational improvement; it is a critical business imperative. This concluding section synthesizes the findings of this report into a strategic, actionable roadmap for the CPO and their executive peers, framing the journey as the defining challenge and opportunity for the modern pharmaceutical enterprise.

The mandate for change is clear. The future of pharmaceutical procurement is not about buying cheaper; it is about buying smarter. It is about systematically uncovering and eliminating the hidden costs that lurk beneath the surface of every transaction. This requires a holistic and integrated strategy that combines the power of digital transformation with the deep value of strategic human partnerships. By doing so, procurement can secure its rightful place as a driver of sustainable growth, enterprise-wide resilience, and, ultimately, better outcomes for the patients it serves.

A Phased Transformation Roadmap

Transforming a global procurement function is a complex, multi-year journey, not a single project. It requires a carefully phased approach that builds foundational capabilities first, then leverages those capabilities to enable more advanced, value-adding activities. The following three-phase roadmap provides a logical pathway for this transformation.

Phase 1: Foundational Visibility & Control (Months 0-6)

The first priority is to stop the bleeding and gain a clear, unified view of the current state. Without accurate data, no strategy can succeed.

- Action: The cornerstone of this phase is the implementation of a unified e-procurement platform.24 This system should consolidate as much organizational spend as possible, creating a single repository for all purchasing data. In parallel, the newly available data must be used to conduct a

comprehensive spend analysis across all categories, with a specific focus on identifying and clamping down on maverick spending by enforcing compliance with established purchasing channels and contracts.4 - Goal: The objective of this phase is to establish a single source of truth for all procurement data. This will provide, for the first time in many organizations, complete visibility into who is buying what, from whom, and at what price. The immediate outcomes are baseline cost control, improved process efficiency, and the creation of the clean, structured dataset that is essential for all subsequent phases.

Phase 2: Strategic Sourcing & Partnership Development (Months 6-18)

With a solid data foundation in place, the organization can begin to move from reactive purchasing to proactive, strategic management of its supply base.

- Action: Use the rich data from Phase 1 to conduct a formal supplier segmentation analysis, classifying the entire supply base according to strategic importance.40 With this segmentation as a guide, launch a formal

Supplier Relationship Management (SRM) program for the most critical, strategic suppliers. This program should go beyond simple performance tracking to include joint business planning, collaborative innovation initiatives, and the development of value-driven, mutually agreed-upon KPIs.38 Concurrently, initiate pilot projects in

Value-Based Procurement (VBP) for a few key product or service categories, working with cross-functional teams to define value in terms of total cost and patient outcomes.45 - Goal: The primary objective is to fundamentally shift the procurement function’s focus from tactical purchasing to strategic relationship management. This phase begins the process of unlocking value beyond price, fostering collaboration and innovation with key partners, and embedding a total value mindset into the organization’s culture.

Phase 3: Predictive Optimization & Ecosystem Leadership (Months 18+)

Having established data visibility and strategic partnerships, the organization is now positioned to deploy advanced technologies that enable a truly predictive and resilient supply chain.

- Action: Leverage the clean data from Phase 1 and the collaborative relationships from Phase 2 to deploy advanced analytics. Implement AI and Machine Learning for demand forecasting to move from reactive to predictive inventory management.13 For high-risk supply chains, such as those for high-value biologics or products destined for markets with high counterfeit rates,

participate in or lead industry blockchain consortia like the MediLedger Project to ensure end-to-end traceability and security.34 - Goal: The ultimate aim is to create a predictive, agile, and transparent supply chain ecosystem. This advanced capability not only insulates the organization from disruptions and minimizes costs but also positions the company as an industry leader in efficiency, safety, and trust, creating a powerful competitive advantage.

The Evolving Role of the CPO

This transformation cannot be delegated; it must be led from the C-suite. The role of the Chief Procurement Officer has evolved far beyond its traditional boundaries. The modern CPO must be a multi-faceted leader:

- A Technologist, who understands the digital landscape and can build a compelling business case for investment in the tools—e-procurement, AI, blockchain—that will power the future function.25

- A Diplomat, who can break down internal silos and foster a culture of deep, cross-functional collaboration between procurement, R&D, clinical, and quality teams, which is the prerequisite for successful VBP and SRM.43

- A Strategist, who can see beyond the next negotiation to architect a resilient, global supply base and who can build a bimodal procurement organization capable of managing both strategic innovation partnerships and aggressive, post-patent commoditized sourcing.

- A Change Agent, who can lead the procurement team and the wider organization through the significant cultural and process shifts required to move from a cost-centric to a value-centric paradigm.

The journey to uncover and mitigate the hidden costs of pharmaceutical procurement is challenging, but the rewards are immense. It is a journey that transforms a support function into a strategic powerhouse. By embracing this mandate, the CPO can deliver not only a healthier bottom line for the organization but also a more secure, reliable, and effective supply of life-saving medicines to the world. The path from cost center to value creator is the defining mission for the pharmaceutical procurement leader of today and tomorrow.

Works cited

- Supply Chain Quotes by Elon Musk, Sam Walton, Tim Cook, Jeff Bezos, accessed August 1, 2025, https://www.supplychaintoday.com/supply-chain-quotes/

- The Key Differences Between Direct and Indirect Procurement, accessed August 1, 2025, https://www.sdcexec.com/sourcing-procurement/erp/article/21563345/kissflow-procurement-cloud-the-key-differences-between-direct-and-indirect-procurement

- Direct vs Indirect Procurement: What’s the Difference? – Procurify, accessed August 1, 2025, https://www.procurify.com/blog/direct-vs-indirect-procurement/

- Direct vs Indirect Procurement: Know the Key Differences – Cflow, accessed August 1, 2025, https://www.cflowapps.com/direct-vs-indirect-procurement/

- Procurement in Pharma: What are the major challenges in 2024 …, accessed August 1, 2025, https://accelerateprocurement.com/procurement-in-pharma-what-are-the-major-challenges-in-2024/

- Pharmaceutical Challenges in 2024 – SEAL Systems AG, accessed August 1, 2025, https://www.sealsystems.com/blog/pharmaceutical-challenges-in-2024/

- How to succeed in your first 100 days as CPO – | Efficio US, accessed August 1, 2025, https://www.efficioconsulting.com/en-us/resources/guides/how-succeed-your-first-100-days-chief-procurement-/

- Pharma Logistics in 2025: Trends, Challenges, and Solutions – Airpals, accessed August 1, 2025, https://airpals.co/blog/pharma-logistics-cost-optimization

- New Vizient survey finds drug shortages cost hospitals nearly $900 …, accessed August 1, 2025, https://www.vizientinc.com/newsroom/news-releases/2025/new-vizient-survey-finds-drug-shortages-cost-hospitals-nearly-900m-annually-in-labor-expenses

- The hidden costs of essential medicines, accessed August 1, 2025, https://www.rhsupplies.org/uploads/tx_rhscpublications/WHO_EDM33_Hidden%20costs_2003.pdf

- Real World Blockchain Uses in the Pharmaceutical Industry – DrugPatentWatch – Transform Data into Market Domination, accessed August 1, 2025, https://www.drugpatentwatch.com/blog/real-world-blockchain-uses-in-the-pharmaceutical-industry/

- Demand Forecasts in the Pharmaceutical Sector – Optimix Solutions, accessed August 1, 2025, https://optimix-software.com/blog/supply-chain/demand-forecasts-in-the-pharmaceutical-sector/

- AI-Enabled Demand Forecasting Models in Pharmaceutical Manufacturing – PlanetTogether, accessed August 1, 2025, https://www.planettogether.com/aps-trends/the-impact-of-ai-enabled-demand-forecasting-models-in-pharmaceutical-manufacturing

- 3 things to expect from the pharmaceutical supply chain in 2024, accessed August 1, 2025, https://www.supplychaindive.com/news/3-things-to-expect-from-the-pharmaceutical-supply-chain-in-2024/705776/

- The Impact of Patent Expiry on Drug Prices – DrugPatentWatch …, accessed August 1, 2025, https://www.drugpatentwatch.com/blog/the-impact-of-patent-expiry-on-drug-prices-a-systematic-literature-review/

- The Impact of Patent Cliff on the Pharmaceutical Industry, accessed August 1, 2025, https://bailey-walsh.com/news/patent-cliff-impact-on-pharmaceutical-industry/

- Patent Expiration and Pharmaceutical Prices | NBER, accessed August 1, 2025, https://www.nber.org/digest/sep14/patent-expiration-and-pharmaceutical-prices

- Top 10: CPOs in Healthcare and Pharmaceuticals – Procurement Magazine, accessed August 1, 2025, https://procurementmag.com/top10/top-10-cpos-in-healthcare

- Practical Guidelines on Pharmaceutical Procurement for Countries with Small Procurement Agencies, accessed August 1, 2025, https://www.rhsupplies.org/uploads/tx_rhscpublications/WHO_Practical%20Guidelines%20on%20Pharmaceutical%20Procurement_2002.pdf

- How Blockchain Enhances Drug Traceability and Compliance – ARVO, accessed August 1, 2025, https://onearvoventures.com/how-blockchain-enhances-drug-traceability-and-compliance/

- The Pandemic and the Supply Chain: Gaps in Pharmaceutical Production and Distribution – PMC – PubMed Central, accessed August 1, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC7958046/

- Supply Chain Advancements Are Meeting the Moment and Beyond – McKesson, accessed August 1, 2025, https://www.mckesson.com/stories-insights/supply-chain-advancements-are-meeting-the-moment-and-beyond/

- Navigating Pharmaceutical Supply Chain Challenges | Berkley Lifesciences, accessed August 1, 2025, https://www.berkleyls.com/blog/navigating-pharmaceutical-supply-chain-challenges

- The digitalization of procurement in the pharmaceutical sector – Buy Made Easy, accessed August 1, 2025, https://www.buymadeeasy.com/en/blog/the-digitalization-of-procurement-in-the-pharmaceutical-sector

- Digital Tools Driving Procurement in the Pharmaceutical Industry, accessed August 1, 2025, https://factwise.io/blog/post/digital-tools-driving-procurement-in-the-pharmaceutical-industry

- 7 ways artificial intelligence can boost the pharmaceutical industry – Maersk, accessed August 1, 2025, https://www.maersk.com/insights/digitalisation/2024/06/18/artificial-intelligence-in-pharmaceutical-industry

- Top 20 Blockchain in Supply Chain Case Studies in 2025 – AIMultiple, accessed August 1, 2025, https://research.aimultiple.com/blockchain-in-supply-chain-case-study/

- Securing Pharmaceutical Supply Chain using Blockchain Technology – ResearchGate, accessed August 1, 2025, https://www.researchgate.net/publication/350128457_Securing_Pharmaceutical_Supply_Chain_using_Blockchain_Technology

- Role of Blockchain in Pharmaceutical Supply Chain – Debut Infotech, accessed August 1, 2025, https://www.debutinfotech.com/blog/blockchain-in-pharmaceutical-supply-chain-the-next-big-frontier

- Blockchain Technology and Supply Chain Transformation in the …, accessed August 1, 2025, https://archive.johncabot.edu/bitstreams/04b2aac0-4016-4a1c-b70b-9d3e8223e59f/download

- MediChain: Ensuring Authentic Pharmaceuticals with Blockchain Traceability – IJFMR, accessed August 1, 2025, https://www.ijfmr.com/papers/2024/3/19740.pdf

- Blockchain: a new security check for medicines – Merck Group, accessed August 1, 2025, https://www.merckgroup.com/en/research/science-space/envisioning-tomorrow/smarter-connected-world/blockchain.html

- Blockchain Your Supply Chain: Advantages for Pharmaceutical and …, accessed August 1, 2025, https://www.cevalogistics.com/en/ceva-insights/blockchain-your-supply-chain

- The Impact of Blockchain Technology on Pharmaceutical Supply Chains, accessed August 1, 2025, https://eaststreetpharmacy.com/the-impact-of-blockchain-technology-on-pharmaceutical-supply-chains.html

- (PDF) Drug Traceability using Blockchain – ResearchGate, accessed August 1, 2025, https://www.researchgate.net/publication/380976013_Drug_Traceability_using_Blockchain

- How Blockchain Can Help Pharma Companies Build More Sustainable Supply Chains, accessed August 1, 2025, https://www.pharmatrace.io/post/how-blockchain-can-help-pharma-companies-build-more-sustainable-supply-chains

- Innoplexus, accessed August 1, 2025, https://www.innoplexus.com/news/five-use-cases-for-blockchain-in-pharma-pharmaphorum

- Supplier Relationship Management: A Complete Guide – Gartner, accessed August 1, 2025, https://www.gartner.com/en/supply-chain/topics/supplier-relationship-management

- Eric Espinasse interview: ‘The more we depend on a supplier, the closer we need to be to them’ – Procurement Leaders, accessed August 1, 2025, https://procurementleaders.com/content/interview-ferring-inflation-supplier-relationships-srm/

- Developing Supplier Relationship Management Strategy in GMP, accessed August 1, 2025, https://www.gmpsop.com/how-to-develop-supplier-relationship-management-strategies-in-gmp/

- Supplier Relationship Management (SRM) Strategies for the Chemical Industry | GEP Blog, accessed August 1, 2025, https://www.gep.com/blog/strategy/supplier-relationship-management-strategies-for-chemical-industry

- 3 Lesser Known Keys To Effective Biopharma Supplier Engagement – Drug Delivery Leader, accessed August 1, 2025, https://www.drugdeliveryleader.com/doc/lesser-known-keys-to-effective-biopharma-supplier-engagement-0001

- Supplier Relationship Management in Clinical Development – Seuss+, accessed August 1, 2025, https://www.seuss.plus/blog/supplier-relationship-management-in-clinical-development/

- How Supplier Relationship Management Drives Success in Life Sciences – PharmaSource, accessed August 1, 2025, https://pharmasource.global/content/how-supplier-relationship-management-drives-success-in-life-sciences-interview-with-anirban-mukherjee/

- What is value-based procurement? The safety blog by Greiner Bio …, accessed August 1, 2025, https://www.gbo.com/en-int/podcast-blog/blog/article/what-is-value-based-procurement-vbp

- The Value-Based Purchasing (VBP) Guide – Washington State Health Care Authority, accessed August 1, 2025, https://www.hca.wa.gov/assets/program/purchaser-toolkit.pdf

- Case Study: Optimizing Global Sourcing for a Clinical Trial | Midwinter Solutions, accessed August 1, 2025, https://midwinter-solutions.com/optimizing-global-sourcing

- Strategic Sourcing Case Studies 2025 — 10 Real-World Insights, accessed August 1, 2025, https://procurementtactics.com/strategic-sourcing-case-studies/