Part 1: The True Price of Innovation: Deconstructing the Multi-Layered Cost of a Drug Patent

Introduction: Beyond the Filing Fee – The Patent Cost Iceberg

When business leaders, investors, or even seasoned R&D professionals ask, “How much does a drug patent cost?”, they are often thinking about a line item on a spreadsheet—a discrete, manageable expense associated with filing legal documents. The initial figures quoted, often in the range of $10,000 to $50,000 for attorney and filing fees, seem substantial but are ultimately deceptive.1 They represent merely the visible tip of a colossal financial iceberg. The true cost of a drug patent is a far more complex and staggering figure, with the vast majority of its mass submerged in the deep, cold waters of multi-billion-dollar research and development, protracted global prosecution, and the ever-present threat of multi-million-dollar post-grant defense.2

This report is designed to illuminate that entire iceberg. We will move beyond the superficiality of official fee schedules to conduct a comprehensive financial autopsy of a pharmaceutical patent’s lifecycle. A drug patent is not a simple legal certificate; it is the capstone of a monumental investment, the legal embodiment of a decade or more of high-risk scientific exploration, and the absolute cornerstone of a biopharmaceutical company’s market valuation and competitive standing. To misunderstand its cost is to misunderstand the fundamental economics of the entire industry.

The journey begins not in a law office, but in a laboratory. The real expense, often dwarfing all other costs combined, lies in the research and development that precedes any patent application.2 For every successful drug that ultimately receives patent protection and reaches the market, thousands of promising compounds fail, and the cost of these failures must be absorbed by the rare successes.2 This foundational investment, which we will explore in detail, is the true price of innovation. From there, the costs cascade through domestic and international legal frameworks, each with its own schedule of fees, translation requirements, and procedural hurdles. And even after a patent is granted, the financial commitment is far from over. The patent must be maintained through periodic annuity payments and, most critically, defended against challenges from competitors—a process that can easily run into the millions of dollars.3

In the following sections, we will dissect each of these cost centers, providing a granular, data-driven analysis for business professionals who need to turn this financial knowledge into a competitive advantage. We will explore not just the “what” of the costs, but the “why”—the strategic and economic drivers that shape them. Because in the high-stakes world of pharmaceutical development, the companies that thrive are not just the ones with the best science, but the ones with the most sophisticated understanding of the price of protecting it.

The Strategic Imperative: Why Understanding Cost is a Competitive Advantage

Why does a granular understanding of patent costs matter so profoundly? Because in the biopharmaceutical sector, intellectual property is not a secondary legal function; it is a primary driver of corporate strategy and valuation. A nuanced grasp of the full cost spectrum is therefore not a mere accounting exercise but an indispensable tool for strategic planning, risk management, and competitive positioning.

Many executives, particularly in emerging biotech firms or those outside the direct IP function, fall into a dangerous strategic blind spot. They narrowly define “patent cost” as the initial legal and filing fees, leading to severe under-budgeting for the complete product lifecycle. While the initial insight is that R&D is the largest single cost, a more critical realization is that this narrow view of patenting expenses creates a profound strategic vulnerability. A company that fails to accurately forecast and budget for the entire cost lifecycle—especially the exponential expenses of international filing and the potential for defensive litigation—may find itself with a groundbreaking therapy but without the financial resources to protect its most valuable asset when it matters most. This can lead to a catastrophic loss of market exclusivity, investor confidence, and future revenue.

Conversely, a company that masters this financial calculus can wield it as a competitive weapon. Accurate cost forecasting enables more precise R&D portfolio management, allowing leaders to make smarter bets on which projects to advance based on a realistic assessment of the total investment required to protect them globally. It informs partnership and licensing negotiations, providing a clearer picture of the value being exchanged. It also underpins a more robust approach to competitive intelligence. By analyzing the patenting costs and strategies of rivals, companies can better anticipate their market moves, identify vulnerabilities in their IP portfolios, and discover “white space” opportunities for their own innovation.

This is where sophisticated business intelligence platforms like DrugPatentWatch become invaluable. They provide the data necessary to monitor competitor patent portfolios, track patent expiration dates, and analyze litigation outcomes.4 When this external market data is combined with a firm’s internal, comprehensive understanding of its own patent cost structure, it creates a powerful framework for making data-driven decisions that can secure market leadership and maximize return on investment. This report aims to provide the internal half of that equation, correcting the dangerous misconception of patent cost and transforming it into a pillar of sound business strategy.

| Visible Costs (Above the Waterline) | Hidden & Indirect Costs (Below the Waterline) |

| Initial USPTO Filing, Search & Examination Fees | Capitalized Research & Development (R&D) Costs (including failures) |

| Patent Attorney Drafting & Filing Fees | Opportunity Costs (forgone investments) |

| Patent Prosecution Fees (Office Action Responses, RCEs) | International Prosecution Costs (PCT, National Phase Entry) |

| Post-Grant Issue Fees | Patent Translation Fees (often the largest global filing expense) |

| Tri-annual USPTO Maintenance Fees | Foreign Counsel & Agent Fees |

| Professional Patent Drawings | International Annuity/Maintenance Fees (often annual) |

| Litigation & Enforcement Costs (Discovery, Expert Witnesses, Court Fees) | |

| Post-Grant Challenge Costs (IPR, PGR) | |

| Portfolio Management & Pruning Costs | |

Part 2: The Foundation of Value: The Colossal Cost of Pharmaceutical R&D

The $2.6 Billion Question: Unpacking the Tufts CSDD Landmark Figure

The journey to understanding the cost of a drug patent must begin long before any legal documents are drafted. It starts in the lab, with the monumental financial undertaking of pharmaceutical research and development. The most widely cited figure for this endeavor comes from the Tufts Center for the Study of Drug Development (CSDD), which, in a landmark 2016 study, estimated the average cost to develop a new prescription drug and bring it to market at a staggering $2.6 billion.2 This figure has been updated and debated, with other estimates ranging from under $1 billion to over $2.8 billion, but its scale underscores a fundamental truth about the industry.6

It is crucial for business leaders to understand what this number truly represents. It is not a simple calculation of out-of-pocket expenses for a single successful drug. Instead, it is a capitalized cost, a sophisticated financial metric that accounts for two critical, often overlooked, factors:

- The Cost of Failure: The pharmaceutical R&D process is characterized by an exceptionally high attrition rate. For every new medicine that successfully navigates the gauntlet of preclinical and clinical trials to gain FDA approval, thousands of other compounds fall by the wayside.2 Only about 12% of drugs that enter clinical trials ever receive approval.8 The billions of dollars spent on these failed projects are not simply written off; they are a necessary cost of discovery that must be financially carried by the few products that succeed. The Tufts CSDD model incorporates these costs of failure into the total for each approved drug.

- The Time Value of Money (Opportunity Cost): Drug development is a marathon, not a sprint, typically taking 10 to 15 years from initial discovery to market approval.9 During this decade-plus period, the capital invested in a drug candidate is tied up and cannot be used for other potentially profitable ventures. This “opportunity cost”—the expected returns that investors forego while a drug is in development—is a very real economic expense. The Tufts CSDD study calculates these time costs and capitalizes them over the development period, adding them to the out-of-pocket R&D spending to arrive at the final $2.6 billion figure.12 In their analysis, these time costs accounted for nearly half of the total capitalized cost.12

While the Tufts figure is an industry benchmark, it is not without its critics. Some analyses argue that the figure is inflated because it relies on confidential, unaudited data provided by pharmaceutical companies.14 Others contend that it fails to adequately account for the substantial contribution of public funding from government bodies like the National Institutes of Health (NIH), which often underwrites the foundational basic research that leads to new drug discoveries.15 Despite these debates, the consensus remains that developing a new medicine is an extraordinarily capital-intensive and high-risk endeavor, and this massive upfront investment is the first and largest “cost” that a drug patent must ultimately justify and protect.

Industry-Wide Investment: The PhRMA Perspective

The massive cost of developing a single drug is not an anomaly but a reflection of the industry’s fundamental business model. Data from the Pharmaceutical Research and Manufacturers of America (PhRMA), the industry’s primary trade association, provides a macro-level view of this commitment to innovation.

According to PhRMA’s annual surveys, its member companies consistently invest staggering sums into R&D. In 2019, this figure reached $83 billion.16 By 2021, it had surged to a record high of $102.3 billion.17 Over the past two decades, PhRMA members have invested more than $1.1 trillion in the search for new medicines.17 This level of investment establishes the biopharmaceutical sector as the most R&D-intensive industry in the U.S. economy, investing on average six times more in R&D as a percentage of sales than all other manufacturing industries.8

This R&D intensity is a critical metric. In 2021, PhRMA members devoted approximately one out of every five dollars of revenue directly back into R&D.17 This demonstrates a powerful feedback loop: the revenues generated from currently patented medicines are the primary source of funding for the discovery of future patented medicines. This economic reality is central to the industry’s justification for the patent system and the pricing power it confers. Without the market exclusivity provided by patents, which allows companies to generate the revenue necessary to sustain such high levels of R&D reinvestment, the engine of pharmaceutical innovation would, by this logic, grind to a halt.

The Biologics Premium: Analyzing the Cost Differential Between Small Molecules and Biologics

The pharmaceutical landscape is increasingly dominated by two distinct classes of drugs: traditional small-molecule chemical compounds and large-molecule biologics, which are derived from living organisms.18 While both are subject to the patent system, their underlying scientific complexity, development pathways, and manufacturing processes lead to significant differences in their associated costs and strategic considerations.

Recent comprehensive studies comparing the two have revealed a clear “biologics premium.” The median development cost for a biologic is estimated to be $3.0 billion, significantly higher than the $2.1 billion median for a small-molecule drug.18 This higher cost is driven by more complex manufacturing processes and often more intricate clinical trial designs.20 However, this greater investment comes with a higher probability of success; biologics have demonstrated higher clinical trial success rates at every phase of development compared to their small-molecule counterparts.18

This economic divergence extends directly to their intellectual property and market dynamics. Biologics are protected by a far denser web of patents—a median of 14 patents per drug compared to just 3 for small molecules.18 This allows for the creation of formidable “patent thickets” that significantly delay competition. Consequently, the median time to market entry for a competing biosimilar is 20.3 years from the innovator’s launch, whereas generic versions of small-molecule drugs appear after just 12.6 years.18

This extended period of market exclusivity, combined with higher treatment costs (median annual cost of $92,000 for biologics vs. $33,000 for small molecules), translates into substantially higher revenues. Biologics achieve a higher median peak revenue ($1.1 billion) than small molecules ($0.5 billion) and generate more revenue in each year following their approval.18

The entire IP and regulatory system appears structured to reward the higher investment required for biologics. Beyond the denser patent protection they typically secure, biologics are granted a longer period of regulatory data exclusivity by the FDA—12 years compared to 5 years for a New Chemical Entity (NCE).11 This legislative framework has recently been amplified by the Inflation Reduction Act (IRA) of 2022. The IRA’s Medicare price negotiation program, a landmark policy designed to control drug costs, contains a critical distinction: it exempts biologics from negotiation for the first 11 years after their FDA approval, while small-molecule drugs are only exempt for the first 7 years.18

This legislative action creates a powerful and unambiguous financial incentive for pharmaceutical companies to prioritize investment in their biologics pipelines over small-molecule programs. The potential for a longer, uninterrupted period of high revenue, now codified into law, makes biologics a strategically more attractive bet. For any executive team planning its R&D portfolio, this differential treatment is no longer just a regulatory nuance; it is a multi-billion-dollar strategic multiplier that will shape the future of pharmaceutical innovation.

| Metric | Small Molecules | Biologics | |

| Median Development Cost | $2.1 Billion | $3.0 Billion | |

| Median Patents Filed per Drug | 3 | 14 | |

| Median Time to Generic/Biosimilar Entry | 12.6 Years | 20.3 Years | |

| Median Peak Annual Revenue | $0.5 Billion | $1.1 Billion | |

| Regulatory Data Exclusivity (U.S.) | 5 Years (NCE) | 12 Years | |

| IRA Medicare Negotiation Exemption | 7 Years | 11 Years | |

| Data synthesized from studies cited in 18 and regulatory information from.11 | |||

Part 3: The Price of Protection: A Granular Breakdown of U.S. Patent Prosecution Costs

The Most Critical Investment: The Role and Cost of a Patent Attorney

Once a promising drug candidate emerges from the crucible of R&D, the process of securing legal protection begins. At this stage, the single most significant and critical direct expense is the cost of retaining a skilled patent attorney. Pharmaceutical and biotechnology patents are among the most complex instruments in intellectual property law, requiring a deep understanding of organic chemistry, molecular biology, pharmacology, and the intricate case law that governs them. Skimping on legal expertise is a false economy that can lead to a weak patent, easily challenged and circumvented by competitors, rendering the multi-billion-dollar R&D investment dangerously exposed.

The fees for a top-tier patent attorney or firm in the biopharmaceutical space reflect this high level of specialization. For drafting and filing a non-provisional utility patent application for a complex pharmaceutical invention, companies should budget for attorney fees ranging from $15,000 to $50,000 or more.1 While some attorneys may quote fees in the $8,000 to $15,000 range for less complex inventions, the technical and legal rigor required for a drug patent typically places it at the higher end of this spectrum.7

These substantial upfront fees typically cover a suite of essential services 2:

- Initial Consultation and Strategy: Working with the inventors to fully understand the invention, its nuances, and its potential applications to devise the optimal patenting strategy.

- Patentability Search and Opinion: Conducting a thorough search of prior art (existing patents and scientific literature) to assess the novelty and non-obviousness of the invention. This can cost between $2,000 and $5,000 on its own and is critical for drafting a defensible application.7

- Application Drafting: The core task of writing the patent application itself. This is a meticulous process of describing the invention in precise scientific and legal terms, defining its scope through a series of “claims” that will form the boundaries of the legal protection.

- Filing and Formalities: Preparing and submitting the application and all associated documents with the United States Patent and Trademark Office (USPTO).

As Sarah Bro of the law firm Bitlaw notes, “The cost to draft the application and get the application allowed at the patent office can range from about $10,000 to $25,000 or more, but you should budget between $15,000 and $20,000 before a patent issues on your invention”.7 For the high-stakes world of pharmaceuticals, budgeting at the higher end of this range is a prudent and necessary investment.

Decoding the USPTO Fee Schedule

Beyond attorney fees, applicants must pay a series of official government fees directly to the USPTO. While smaller than legal costs, these fees are mandatory and can add up, especially for complex applications. The USPTO fee structure is tiered based on the size of the applicant, offering significant discounts for smaller entities.23

- Large Entity: The default status, typically for companies with 500 or more employees.

- Small Entity: For companies with fewer than 500 employees, individuals, non-profits, or universities. Fees are generally reduced by 60%.

- Micro Entity: A status for individual inventors or startups with very low income and a limited patent history. Fees are reduced by 80%.

Given the scale of the pharmaceutical industry, most established companies will file as a Large Entity. The core fees for filing a non-provisional utility patent application include three main components, which will see an increase effective January 19, 2025 25:

- Basic Filing Fee: The fee to submit the application. For a large entity, this will increase from $320 to $350.25

- Search Fee: The fee for the USPTO to conduct its own search for prior art. This will increase from $700 to $770.25

- Examination Fee: The fee for a patent examiner to review the application for compliance with all legal requirements. This will increase from $800 to $880.25

Therefore, the baseline government cost just to get an application in the door and reviewed will be approximately $2,000 for a large entity starting in 2025.25 However, this is just the beginning. Additional fees are levied based on the application’s complexity, particularly the number of claims, which are the legally operative sentences that define the invention’s scope. As of 2025, fees for excess claims will increase significantly, with the fee for each claim over 20 doubling to $200 and the fee for each independent claim over three rising to $600.25 These fees are designed to encourage concise and focused applications.

The Prosecution Gauntlet: Budgeting for Office Actions and RCEs

Filing a patent application is not the end of the process; it is the opening move in a lengthy dialogue with the USPTO known as “patent prosecution.” It is exceptionally rare for a patent to be granted as originally filed. The vast majority of applications receive at least one rejection from the patent examiner, known as an “Office Action”.22 Each Office Action requires a detailed legal and technical response, which incurs additional attorney fees.

Responding to an Office Action is a complex task that involves analyzing the examiner’s arguments, reviewing the cited prior art, and crafting a response that may include amending the patent claims and presenting legal arguments to overcome the rejection. The cost for an attorney to prepare and file a single response typically ranges from $3,500 to $5,000, and can be even higher for particularly complex rejections in the biotech space, sometimes reaching $7,000 to $10,000.7 A typical application will go through one to three rounds of these rejections before being allowed or abandoned.22

If an applicant is unable to overcome the examiner’s rejections after a “Final” Office Action, they may need to file a Request for Continued Examination (RCE). An RCE essentially pays for another round of examination. The USPTO’s 2025 fee schedule sets the cost for a first RCE at $1,500 for a large entity, but the fee for a second and any subsequent RCEs will increase dramatically by 43% to $2,860.28 This tiered structure is a clear signal from the USPTO to encourage more efficient prosecution and discourage endless rounds of negotiation.

This entire prosecution phase, from first filing to final allowance, can take several years and add tens of thousands of dollars in legal fees to the total cost of the patent. A conservative budget should account for at least two Office Action responses, bringing the total cost for a U.S. patent from initial drafting through issuance to a range of $30,000 to $70,000 or more.

A particularly noteworthy aspect of the USPTO’s 2025 fee changes is the introduction of new, highly targeted fees that appear designed to address specific patenting strategies, particularly those associated with “patent thickets.” The new surcharges for filing continuing applications more than six years ($2,700) or nine years ($4,000) after the earliest priority date are a direct financial disincentive against the practice of keeping a patent family alive for years through long chains of continuation applications.27 Similarly, the new tiered fees for filing an Information Disclosure Statement (IDS) with more than 50, 100, or 200 citations penalize the “document dumping” strategy some applicants use to overwhelm examiners.28 These changes are not merely about revenue; they represent a policy shift. They alter the cost-benefit analysis of traditional lifecycle management tactics and compel IP strategists to be more deliberate and efficient, directly impacting the long-term budget and strategy for protecting a blockbuster drug.

| Fee Type (Large Entity) | Description | Cost (USD, Effective Jan 2025) | |

| Basic Filing Fee | Initial fee to submit a non-provisional utility application. | $350 | |

| Search Fee | Fee for the USPTO to conduct a prior art search. | $770 | |

| Examination Fee | Fee for the USPTO to substantively examine the application. | $880 | |

| Excess Independent Claim Fee | Fee for each independent claim in excess of three. | $600 | |

| Excess Total Claim Fee | Fee for each claim (independent or dependent) in excess of twenty. | $200 | |

| Request for Continued Examination (RCE) – 1st | Fee to continue prosecution after a final rejection. | $1,500 | |

| Request for Continued Examination (RCE) – 2nd+ | Increased fee for second and subsequent RCEs. | $2,860 | |

| Continuing Application Surcharge (≥ 6 years) | New fee for filing a continuation/divisional ≥ 6 years after the earliest benefit date. | $2,700 | |

| Continuing Application Surcharge (≥ 9 years) | New, higher fee for filing a continuation/divisional ≥ 9 years after the earliest benefit date. | $4,000 | |

| Utility Issue Fee | Fee paid after the patent is allowed to have it officially grant and publish. | $1,290 | |

| Data sourced from the official USPTO fee schedules and analyses.23 | |||

Part 4: Going Global: The Exponential Costs of International Patent Protection

The PCT Pathway: A Gateway to Global Protection

In today’s interconnected world, a U.S.-only patent strategy is rarely sufficient for a drug with blockbuster potential. Pharmaceutical markets are global, and protecting an innovation in key regions like Europe and Asia is essential for maximizing its commercial value. However, filing individual patent applications in dozens of countries simultaneously would be prohibitively expensive and logistically overwhelming.

The primary tool for managing this process is the Patent Cooperation Treaty (PCT), an international agreement administered by the World Intellectual Property Organization (WIPO). Filing a single “international” PCT application allows an applicant to preserve the right to seek patent protection in over 150 member countries.33 Critically, the PCT application does not result in a global patent. Instead, it acts as a strategic placeholder, providing a unified formal filing and a centralized international search process. Its most significant benefit is time: it delays the need to enter the expensive “national phase”—the process of filing and prosecuting individual applications in each desired country or region—for up to 30 or 31 months from the initial priority filing date.34 This gives companies nearly two and a half years to conduct further research, assess commercial viability, and secure funding before committing to the massive costs of global protection.

The upfront costs for a PCT application itself are substantial, typically consisting of three main fees 35:

- Transmittal Fee: A relatively small administrative fee paid to the national patent office that acts as the “Receiving Office” (e.g., the USPTO). For the USPTO, this is $285.34

- International Filing Fee: A fee paid to WIPO for processing the application. As of 2025, this is approximately $1,603 for the first 30 pages, plus $18 for each additional page.24

- Search Fee: A significant fee paid to an International Searching Authority (ISA) to conduct a prior art search. The choice of ISA matters, as fees vary. For example, using the USPTO as the ISA costs $2,400, while using the European Patent Office (EPO) costs $2,094.34

In total, the initial government fees for filing a PCT application can easily range from $4,000 to $5,000, not including the attorney fees for preparing and filing the application, which can add several thousand dollars more.21

The National Phase Onslaught: Cost Breakdowns for Key Markets

The real financial challenge of global patenting begins at the end of the PCT period, when a company must enter the national phase in each target jurisdiction. This is where costs begin to multiply rapidly, as each country or region has its own official fees, local attorney requirements, and, most importantly, translation needs.

The European Patent Office (EPO)

The EPO provides a centralized system for obtaining patent protection in up to 40+ European countries. An applicant files a single application, which undergoes a single examination process. If granted, the patent must then be “validated” in each individual member country where protection is desired, which involves additional fees and translation requirements. The initial costs for entering the European phase and prosecuting the application are significant 2:

- Filing Fee: €135 (for online filing).

- Search Fee: €1,520.

- Examination Fee: €1,915.

- Designation Fee: €685 (to designate all member states).

These core official fees alone total over €4,300. When combined with fees for European patent attorneys, who are required to represent the applicant, the upfront cost can easily exceed €6,000 to €10,000 before any validation costs are incurred.2 A unique and costly feature of the EPO system is the requirement to pay annual renewal fees for the application

while it is still pending, starting from the third year after filing.38 These fees escalate over time, adding a significant ongoing expense during the prosecution phase.

The Japan Patent Office (JPO)

Japan is a critical market for pharmaceuticals, but securing a patent there involves a distinct and costly process. The official fees at the JPO are structured differently from those in the U.S. or Europe. A key expense is the Request for Examination fee, which is calculated based on a base fee plus an additional fee for each patent claim.41

- National Phase Entry Fee: ¥14,000 (approx. $100).

- Request for Examination Fee: ¥138,000 (base) + ¥4,000 per claim. For an application with 20 claims, this fee alone would be ¥218,000 (approx. $1,400).

However, the official fees are dwarfed by the costs of translation and local counsel. A Japanese patent attorney, or benrishi, must be retained. The total cost for national phase entry in Japan, including translation and attorney fees, frequently exceeds ¥1,000,000 (approximately $9,000 to $10,000 or more).2

The China National IP Administration (CNIPA)

China has become one of the most important pharmaceutical markets and a prolific patent-filing jurisdiction. While the official fees at CNIPA are relatively low compared to other major offices, the overall cost is driven by translation and local agent fees.2

- Filing Fee: CNY 900 (approx. $120).

- Substantive Examination Fee: CNY 2,500 (approx. $350).

The minimal official fees for filing and examination total around CNY 3,450 (less than $500).43 However, the application must be translated into Mandarin, and a local Chinese patent agent must be engaged. These professional service fees are the primary cost drivers, bringing the total for national phase entry in China into the range of several thousand dollars.

The Great Multiplier: The Staggering Cost of Patent Translation

Across all non-English-speaking jurisdictions, the single largest and most variable expense is patent translation. A pharmaceutical patent application is a highly technical and lengthy document, often running 50 pages or more. Translating this dense scientific and legal text requires specialized expertise and is priced accordingly.

Estimates for high-quality, professional patent translation vary, but they consistently represent a major budget item. Costs can range from $0.20 to $0.30 per word, meaning a typical 13,000-word application could cost $2,600 to $3,900 for a single language.41 Broader estimates place the cost anywhere from $2,000 to as high as $10,000 per translation, depending on the language, complexity, and urgency.21 For a company pursuing protection in Japan, China, South Korea, and several European countries, the cumulative translation costs alone can easily exceed $20,000 to $30,000, often surpassing the official fees and even the local attorney fees in those jurisdictions.

This cost asymmetry between filing in English-speaking versus non-English-speaking countries creates significant strategic choke points for companies, especially startups and mid-sized biotechs with limited capital. The decision of whether to pursue a patent in Japan or China is not merely a legal or market consideration; it is a major financial hurdle. The upfront cost for a single non-English jurisdiction can be 5 to 10 times higher than for an English-speaking one, consuming a disproportionate share of the IP budget. This forces a rigorous, early-stage analysis where the potential market size and competitive landscape of a country must be weighed directly against the substantial and immediate cost of entry. It is a critical trade-off that can define the global footprint and ultimate commercial success of a new drug.

| Jurisdiction | Official Fees (USD Est.) | Local Counsel Fees (USD Est.) | Translation Cost (USD Est.) | Total Estimated Cost per Country (USD Est.) |

| United States | $2,000 – $3,000 | (Included in Prosecution) | N/A | $30,000 – $70,000 (Full Prosecution) |

| European Patent Office | $4,500 – $6,000 | $4,000 – $8,000 | N/A (if filed in English) | $8,500 – $14,000 (to grant, pre-validation) |

| Japan | $1,500 – $2,500 | $3,000 – $5,000 | $3,000 – $6,000 | $7,500 – $13,500 |

| China | $500 – $1,000 | $2,000 – $4,000 | $2,500 – $5,000 | $5,000 – $10,000 |

| Note: These are high-level estimates for initial national phase entry and do not include ongoing prosecution or maintenance fees. Attorney fees are highly variable. U.S. cost reflects the entire prosecution process for comparison. | ||||

Part 5: The Long Tail of Ownership: Managing Post-Grant Costs and Defending Your Asset

The Meter is Always Running: Patent Maintenance (Annuity) Fees

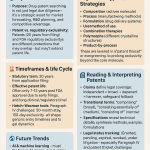

Securing a patent is not a one-time purchase; it is an ongoing financial commitment. To keep a patent in force for its full 20-year term, owners must pay periodic maintenance fees (often called “annuities” or “renewal fees”) to the respective patent offices. These fees are deliberately structured to escalate over time, forcing patent holders to periodically reassess the commercial value of their protected inventions and abandon those that are no longer worth the cost of maintenance.2

In the United States, maintenance fees for a utility patent are due at three specific intervals after the patent is granted 2:

- 3.5 years: $2,150 (for a large entity, as of 2025)

- 7.5 years: $4,040

- 11.5 years: $8,280

The cumulative cost to maintain a single U.S. patent for its full term is $14,470 in official fees alone.23 For a pharmaceutical company with a portfolio of hundreds or even thousands of patents, these fees represent a significant and recurring operational expense that must be carefully managed.

The system in Europe is even more demanding. The European Patent Office requires the payment of annual renewal fees for the application before it is even granted, beginning with the third year from the filing date.38 These pre-grant annuities escalate sharply, with the third-year fee at €690 and the fourth-year fee at €845 as of April 2024.46 After the European patent is granted and validated in individual countries, separate annual renewal fees must be paid to each national patent office to keep the patent in force in that specific country.39 This creates a complex and costly administrative burden for maintaining broad European protection. Similarly, Japan and China also require annual annuity payments to maintain a patent’s validity.41

The Ultimate Cost: Budgeting for Patent Litigation

While maintenance fees are a predictable and manageable expense, the single largest potential cost in a patent’s lifecycle is litigation. A patent grants the right to exclude others, but this right is not self-enforcing. If a competitor infringes, the patent holder must be prepared to defend their rights in court. Conversely, a company launching a new product must be prepared to defend against infringement lawsuits from competitors. In the high-stakes pharmaceutical industry, where a single blockbuster drug can generate billions in annual revenue, patent litigation is common, complex, and extraordinarily expensive.

The most authoritative data on these costs comes from the American Intellectual Property Law Association (AIPLA) Report of the Economic Survey, which provides a detailed breakdown of median litigation costs based on the amount of money at risk.49 For a pharmaceutical patent infringement case where more than $25 million is at stake—a common scenario for a successful drug—the financial commitment is immense:

- Median cost through the end of discovery: $3.0 million.

- Median total cost through trial and appeal: $5.5 million.

Even for cases with lower stakes, the costs are substantial. For cases with $1 million to $10 million at risk, the median total cost is $2.0 million.52 The AIPLA survey also provides specific data for Hatch-Waxman litigation (also known as ANDA litigation), which involves generic drug challengers. In these cases, with less than $1 million at risk, the median total cost can still reach $900,000.52 Other sources corroborate these figures, with the average cost of a pharmaceutical patent lawsuit estimated to be between $2.3 million and $4 million.2

These multi-million-dollar figures are driven by several factors 3:

- Legal Fees: Elite patent litigation attorneys command hourly rates ranging from $400 to over $1,200.3 A complex case can involve a team of lawyers working for several years.

- Discovery: This is the most expensive phase of litigation, involving the collection and review of millions of documents, depositions of key personnel, and extensive legal motions.

- Expert Witnesses: Pharmaceutical cases rely heavily on testimony from scientific and economic experts, who charge significant fees for their analysis and court appearances.

The sheer scale of these costs has profound strategic implications. The high, front-loaded expense of the discovery phase creates a powerful financial weapon. A well-capitalized incumbent can leverage the threat of a multi-million-dollar lawsuit to deter smaller generic or biosimilar challengers, regardless of the legal merits of the patents in question. The cost of proving a patent is invalid can be so ruinous that it forces challengers into settlements that delay market entry. In this context, the cost of litigation is not just a consequence of a dispute; it becomes a strategic barrier to competition, effectively extending a drug’s monopoly and demonstrating that the ability to afford a legal battle can be as valuable as the patent itself.

According to the American Intellectual Property Law Association (AIPLA) Report of the Economic Survey, the median cost for a patent infringement lawsuit with over $25 million at risk is $3.0 million through the discovery phase alone, and rises to $5.5 million for a case that goes through the end of trial and appeal.52

| Due Date (Post-Grant) | Fee Amount (USD) | Cumulative Cost (USD) | |

| 3.5 Years | $2,150 | $2,150 | |

| 7.5 Years | $4,040 | $6,190 | |

| 11.5 Years | $8,280 | $14,470 | |

| Data based on the USPTO Large Entity fee schedule effective January 2025.23 | |||

| Amount at Risk | Median Cost Through Discovery (USD) | Median Total Cost Through End of Trial (USD) | |

| Less than $1 Million | $250,000 | $500,000 | |

| $1 – $10 Million | $600,000 | $1,500,000 | |

| $10 – $25 Million | $1,225,000 | $2,700,000 | |

| More than $25 Million | $2,375,000 | $4,000,000 | |

| Data from the 2019 AIPLA Report of the Economic Survey for patent infringement litigation.52 Note: More recent surveys may show different figures, but these provide a representative scale. | |||

Part 6: The Strategic Calculus: ROI, Lifecycle Management, and Cost-Saving Measures

Calculating the ROI: The Payoff for the High Price of Patenting

After dissecting the immense costs associated with every stage of a drug patent’s life—from the multi-billion-dollar R&D gamble to the multi-million-dollar litigation risk—the ultimate question for any business is: what is the return on this investment? The answer is found in the period of market exclusivity that the patent provides. This temporary monopoly allows a company to set prices at a level that not only recoups the total investment but also generates the profits necessary to fund the next generation of research.6

The clearest illustration of a patent’s value is the phenomenon known as the “patent cliff.” When a blockbuster drug’s key patents expire and generic competitors enter the market, the results are swift and dramatic. The innovator company can see its market share plummet by over 80%, with drug prices falling by as much as 90% as competition intensifies.53 The loss of exclusivity for multiple major drugs can threaten over $230 billion in industry revenue in just five years.57 This precipitous drop in revenue, far exceeding the cumulative costs of obtaining and maintaining the patent, is the most powerful demonstration of the patent’s immense return on investment.

Despite the high costs and risks, the potential returns continue to drive the industry. According to a 2024 report from Deloitte, the projected return on investment in pharmaceutical R&D has rebounded from a low of 1.2% in 2022 to a healthier 5.9%.58 This improvement is driven by a surge in high-value products in late-stage pipelines, with the average forecast peak sale for new assets rising to $510 million.58 This demonstrates that while the costs are enormous, the financial rewards for successful, well-protected innovation remain compelling.

This entire economic model creates a complex feedback loop. The high costs of R&D and patenting necessitate high prices during the exclusivity period. These high prices and the resulting revenues are what attract the private capital required to fund the next wave of high-risk R&D.60 As analyses from the Congressional Budget Office (CBO) and others have shown, there is a direct link between expected future revenues and current R&D investment.61 Policies aimed at lowering drug prices by weakening patent protection or imposing price controls will, according to this economic logic, inevitably reduce the incentive for innovation. This creates a fundamental societal trade-off that every industry leader must understand and articulate: the balance between affordable access to today’s medicines and the development of tomorrow’s cures.

The Economics of “Patent Thickets”: A Cost-Benefit Analysis

Given the immense value of market exclusivity, it is a rational business strategy for companies to seek to extend it for as long as legally possible. This has given rise to a set of practices sometimes called “evergreening” or, more formally, “lifecycle management,” the most prominent of which is the creation of “patent thickets”.65 A patent thicket is a dense web of overlapping patents covering various aspects of a single drug, such as its formulation, method of use, manufacturing process, or delivery device.5

From a purely financial perspective, the cost-benefit analysis of this strategy is overwhelmingly positive. Consider the case of AbbVie’s Humira, one of the best-selling drugs of all time. AbbVie built a patent thicket of over 100 patents around the drug.70 The cost of prosecuting these additional patents, perhaps a few million dollars in total, is minuscule compared to the revenue they protected. By creating a formidable legal barrier that delayed the entry of biosimilar competitors in the U.S. for years, this strategy helped protect annual revenues that reached as high as $7.6 billion for Humira alone.70 The return on investment for those secondary patents was astronomical.

While critics argue that such practices exploit legal loopholes to stifle competition and keep prices high without offering significant new therapeutic value, from a corporate fiduciary standpoint, they represent a highly effective and rational business strategy.71 The legal costs of creating and defending a patent thicket are a rounding error compared to the billions in revenue preserved by delaying generic or biosimilar entry by even a single year. This stark economic reality ensures that lifecycle management and the strategic use of secondary patents will remain a central pillar of pharmaceutical business strategy.

Practical Cost-Saving Strategies for Startups and Mid-Sized Firms

While large pharmaceutical companies can leverage massive legal budgets, smaller biotech startups and mid-sized firms must adopt a more disciplined and strategic approach to manage patent costs without sacrificing quality. For these companies, every dollar spent on IP must be justified and optimized.75

Several practical strategies can help manage these costs effectively:

- Strategic Use of Provisional Applications: Filing a U.S. provisional patent application is a cost-effective way to establish an early priority date for an invention without the high upfront cost of drafting a full non-provisional application.22 This provides a 12-month window to conduct further research, secure funding, and assess the commercial potential before committing to the more expensive non-provisional and international filings.77

- Focused Portfolio Management: Not all patents are created equal. Companies should focus their resources on obtaining strong protection for their core, “choke point” innovations—such as the composition of matter for a new therapeutic.78 It is equally important to conduct regular portfolio reviews and be willing to “prune” or abandon patents that are no longer commercially relevant or strategically valuable, thereby saving on escalating maintenance fees.79

- Selective Global Filing: The allure of global protection must be tempered by a realistic assessment of costs versus market opportunity. Before incurring the high expenses of national phase entry and translation, companies must conduct rigorous market analysis. It may be more strategic to focus on a few key markets (e.g., U.S., EPO, Japan) rather than pursuing protection in every available country.80

- Leverage Business Intelligence: Proactive use of competitive intelligence is crucial for cost-effective IP strategy. Platforms like DrugPatentWatch allow companies to monitor the patent landscapes in their therapeutic areas, track the IP activities of competitors, and identify potential “white space” opportunities where the path to a strong patent may be less crowded and contentious.4 This data-driven approach enables companies to allocate their limited IP budgets to the areas with the highest potential for return and the lowest risk of costly legal battles.

- Meticulous Documentation: One of the most effective yet often overlooked cost-saving measures is rigorous documentation from the very beginning of the R&D process. Well-maintained and detailed lab notebooks provide the clear evidence of invention needed by patent attorneys to draft a strong, defensible application more efficiently, reducing legal fees and strengthening the patent’s validity from the outset.57

By combining these tactical measures with a clear-eyed, strategic vision, even companies with limited resources can build a valuable and cost-effective patent portfolio that protects their innovation and drives business success.

Key Takeaways

- The Iceberg of Costs: The true cost of a drug patent extends far beyond official filing fees. The largest single cost is the capitalized R&D investment, which often exceeds $2.6 billion per successful drug when accounting for failures and the time value of money.

- Attorney Fees Dominate Direct Costs: The most significant direct expense in obtaining a patent is legal counsel. Drafting a complex pharmaceutical patent application can cost $20,000 to $50,000+, with ongoing prosecution fees for responding to office actions adding tens of thousands more.

- Global Filing is an Exponential Cost Multiplier: Securing international patent protection is essential but expensive. Each new jurisdiction adds its own official fees and local attorney costs. Patent translation for non-English-speaking countries is a major driver, often costing thousands of dollars per country.

- Post-Grant Costs are Substantial and Unpredictable: Maintaining a patent requires escalating annuity payments over its 20-year life. The greatest potential cost is litigation, where defending or enforcing a high-stakes pharmaceutical patent can easily exceed $4 million.

- Cost is a Strategic Weapon: Understanding the full cost lifecycle is a competitive advantage. It enables better budgeting, risk management, and strategic decision-making. The high cost of litigation can itself be used as a barrier to deter competitors.

- Strategy Dictates ROI: The immense costs of patenting are justified by the market exclusivity they provide, which is essential for recouping R&D investment. Strategic lifecycle management, including the creation of “patent thickets,” is a rational, high-ROI business practice for extending this exclusivity.

- Biologics Command a Premium: Developing and patenting biologics is more expensive than for small molecules, but they are rewarded with denser patent protection, longer periods of market exclusivity, and higher revenue potential, a trend amplified by recent legislation like the IRA.

Frequently Asked Questions (FAQ)

1. Why are pharmaceutical patent costs so much higher than in other technology sectors like software or mechanical devices?

Pharmaceutical patents carry exceptionally high costs for three primary reasons. First, the underlying R&D investment is orders of magnitude greater, often exceeding $2 billion, compared to other industries.2 This massive upfront risk necessitates the strongest possible legal protection. Second, the scientific and legal complexity is extreme. A drug patent must precisely define novel chemical structures, formulations, and methods of treatment, and navigate a dense landscape of prior art and complex case law, requiring highly specialized and expensive legal counsel.2 Third, the stakes are higher. A single successful drug patent can protect a revenue stream worth billions of dollars annually, making both the initial investment in a robust application and the subsequent cost of defending it in litigation a necessary business expense.

2. How do “patent thickets” financially benefit a pharmaceutical company, and what are the direct costs of creating one?

A “patent thicket” is a portfolio of many overlapping patents covering a single drug product. The financial benefit is immense: it dramatically increases the cost and complexity for a generic or biosimilar competitor to enter the market.66 A challenger must analyze and potentially litigate dozens of patents instead of just one, making a legal challenge financially unfeasible for all but the largest competitors. This can delay competition for years, preserving billions in monopoly revenue. The direct cost of creating the thicket is comparatively minuscule. For example, if filing and prosecuting an additional 100 secondary patents costs an average of $50,000 each, the total investment would be $5 million. For a drug like Humira, which generated over $7 billion in a single year, this $5 million investment to delay competition and protect that revenue stream represents an extraordinary return on investment.70

3. What is the single most underestimated cost for a biotech startup when planning its global patent strategy?

For a biotech startup planning to go global, the most consistently underestimated cost is patent translation. While executives may budget for official filing fees and foreign attorney fees, the cost of translating a lengthy, technical patent application into multiple languages can be staggering. A single translation into a language like Japanese or Chinese can cost between $3,000 and $6,000 or more.36 When a startup targets multiple non-English-speaking markets, these translation costs can quickly accumulate to become the single largest line item in the international filing budget, often exceeding all the official government fees combined. Failure to budget for this “great multiplier” can derail a global strategy before it even begins.

4. How has the Inflation Reduction Act (IRA) changed the long-term cost-benefit analysis of developing biologics versus small-molecule drugs?

The IRA has significantly tilted the financial incentives toward the development of biologics. The Act’s Medicare drug price negotiation program exempts biologics from negotiation for 11 years post-approval, compared to only 7 years for small-molecule drugs.18 This four-year difference in protection from government price setting is strategically massive. It means a successful biologic has a longer guaranteed window to generate peak revenues without downward price pressure from Medicare. While biologics have higher upfront R&D costs (median $3.0B vs. $2.1B), this extended protection period increases their potential lifetime revenue and ROI, making them a more attractive long-term investment for pharmaceutical companies and their investors compared to small molecules.

5. Beyond litigation, what is the most significant “hidden” post-grant cost, and how can companies manage it?

Beyond the catastrophic potential of litigation, the most significant hidden post-grant cost is the cumulative expense of maintaining a large, aging, and geographically diverse patent portfolio. This includes escalating tri-annual maintenance fees in the U.S. and, more demandingly, annual annuity payments in Europe and many other jurisdictions for every single patent in every single country.39 For a company with hundreds of patents, these fees can quietly grow into a multi-million-dollar annual expense. The best way to manage this is through proactive and disciplined portfolio management. Companies should conduct regular reviews to identify patents that are no longer central to their commercial strategy or that protect secondary technologies with low value. By strategically “pruning” the portfolio and allowing these lower-value patents to lapse, a company can free up significant capital to invest in protecting its most important current and future innovations.

References

2

Works cited

- www.drugpatentwatch.com, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/how-much-does-a-drug-patent-cost-a-comprehensive-guide-to-pharmaceutical-patent-expenses/#:~:text=The%20cost%20of%20a%20drug%20patent%20goes%20far%20beyond%20official,%2410%2C000%20to%20%2450%2C000%20or%20more.

- How Much Does a Drug Patent Cost? A Comprehensive Guide to Pharmaceutical Patent Expenses – DrugPatentWatch – Transform Data into Market Domination, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/how-much-does-a-drug-patent-cost-a-comprehensive-guide-to-pharmaceutical-patent-expenses/

- Managing Drug Patent Litigation Costs – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/managing-drug-patent-litigation-costs/

- Thanks to DrugPatentWatch, we have optimized our workflow and …, accessed July 27, 2025, https://www.drugpatentwatch.com/

- How Drug Life-Cycle Management Patent Strategies May Impact Formulary Management, accessed July 27, 2025, https://www.ajmc.com/view/a636-article

- Patents and Drug Pricing: Why Weakening Patent Protection Is Not in the Public’s Best Interest – American Bar Association, accessed July 27, 2025, https://www.americanbar.org/groups/intellectual_property_law/resources/landslide/2025-spring/drug-pricing-weakening-patent-protection-not-best-interest/

- Drug Patent Filing Costs Explained: A Hefty Price Tag for Pharmaceutical Innovation, accessed July 27, 2025, https://chemintel360.com/drug-patent-filing-costs-explained-a-hefty-price-tag-for-pharmaceutical-innovation/

- Research & Development Policy Framework – PhRMA, accessed July 27, 2025, https://www.phrma.org/policy-issues/research-development

- Patent Problems Create Higher Drug Prices. Time to Fix the System – R Street Institute, accessed July 27, 2025, https://www.rstreet.org/commentary/patent-problems-create-higher-drug-prices-time-to-fix-the-system/

- The Cost of Drug Development: How Much Does It Take to Bring a Drug to Market? (Latest Data) | PatentPC, accessed July 27, 2025, https://patentpc.com/blog/the-cost-of-drug-development-how-much-does-it-take-to-bring-a-drug-to-market-latest-data

- Drug Patent Life: The Complete Guide to Pharmaceutical Patent …, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/how-long-do-drug-patents-last/

- Tufts Center for the Study of Drug Development – Cost of Developing New Drugs, accessed July 27, 2025, https://www.appliedclinicaltrialsonline.com/view/tufts-center-study-drug-development-cost-developing-new-drugs

- BACKGROUNDER How the Tufts Center for the Study of Drug Development Pegged the Cost of a New Drug at $2.6 Billion BOSTON, accessed July 27, 2025, https://keionline.org/sites/default/files/cost_study_backgrounder.pdf

- R&D Cost Estimates: MSF Response to Tufts CSDD Study on Cost to Develop a New Drug, accessed July 27, 2025, https://www.doctorswithoutborders.org/latest/rd-cost-estimates-msf-response-tufts-csdd-study-cost-develop-new-drug

- R&D Costs For Pharmaceutical Companies Do Not Explain Elevated US Drug Prices | Health Affairs Forefront, accessed July 27, 2025, https://www.healthaffairs.org/content/forefront/r-d-costs-pharmaceutical-companies-do-not-explain-elevated-us-drug-prices

- PhRMA member companies invested $83 billion in research and development last year, accessed July 27, 2025, https://phrma.org/blog/phrma-member-companies-invested-83-billion-in-research-and-development-last-year

- PhRMA member companies’ R&D investments reach record high of $102.3 billion in 2021, accessed July 27, 2025, https://phrma.org/blog/phrma-member-companies-rd-investments-reach-record-high-of-1023-billion-in-2021

- 1 Differential Legal Protections for Biologics vs. Small-Molecule Drugs in the US Olivier J. Wouters, PhD1, accessed July 27, 2025, http://eprints.lse.ac.uk/126180/1/2024.08.03_manuscript.pdf

- Differential Legal Protections for Biologics vs Small-Molecule Drugs in the US – PubMed, accessed July 27, 2025, https://pubmed.ncbi.nlm.nih.gov/39585667/

- The Economics of Biosimilars – PMC, accessed July 27, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC4031732/

- Patent Cost Breakdown: Types, Fees & Budget Considerations – UpCounsel, accessed July 27, 2025, https://www.upcounsel.com/how-much-does-a-patent-cost

- Patent Application Cost (Bitlaw Guidance), accessed July 27, 2025, https://www.bitlaw.com/guidance/patent/what-does-a-patent-application-cost.html

- USPTO Patent Fees – Neustel Law Offices, accessed July 27, 2025, https://neustel.com/uspto-patent-fees/

- USPTO fee schedule, accessed July 27, 2025, https://www.uspto.gov/learning-and-resources/fees-and-payment/uspto-fee-schedule

- New USPTO Patent Fees Go Into Effect January 19, 2025 – Fish & Richardson, accessed July 27, 2025, https://www.fr.com/insights/thought-leadership/blogs/new-uspto-patent-fees-go-into-effect-january-19-2025/

- Summary of 2025 patent fee changes – USPTO, accessed July 27, 2025, https://www.uspto.gov/learning-and-resources/fees-and-payment/summary-2025-patent-fee-changes

- Setting and Adjusting Patent & Trademark Fees During Fiscal Year 2025 for the USPTO – American Intellectual Property Law Association, accessed July 27, 2025, https://www.aipla.org/detail/news/2024/11/21/setting-and-adjusting-patent-trademark-fees-during-fiscal-year-2025-for-the-uspto

- USPTO Publishes Final Fees for 2025 | Foley & Lardner LLP, accessed July 27, 2025, https://www.foley.com/insights/publications/2024/11/uspto-publishes-final-fees-2025/

- Responding to USPTO Office Actions in Patent Filing – TT Consultants, accessed July 27, 2025, https://ttconsultants.com/how-to-respond-to-uspto-office-actions-during-patent-filing/

- The cost to draft a patent application/respond to an office action : r/patentlaw – Reddit, accessed July 27, 2025, https://www.reddit.com/r/patentlaw/comments/qwuun0/the_cost_to_draft_a_patent_applicationrespond_to/

- Patent Fee Updates – Law Offices of Snell & Wilmer, accessed July 27, 2025, https://www.swlaw.com/publication/patent-fee-updates/

- USPTO Fee Schedule – Current, accessed July 27, 2025, https://www.uspto.gov/sites/default/files/documents/USPTO-fee-schedule_current.pdf

- Understanding Patent Lifetimes and Costs – IamIP, accessed July 27, 2025, https://iamip.com/understanding-patent-lifetimes-and-costs/

- PCT fees in US dollars – USPTO, accessed July 27, 2025, https://www.uspto.gov/patents/basics/international-protection/patent-cooperation-treaty/pct-fees-us-dollars

- Fees and Payments – PCT System – WIPO, accessed July 27, 2025, https://www.wipo.int/en/web/pct-system/fees/index

- PCT Patent cost: Everything You Need to Know – UpCounsel, accessed July 27, 2025, https://www.upcounsel.com/pct-patent-cost

- Patent Translation Services, accessed July 27, 2025, https://patenttranslationsexpress.com/patent-translation-services/

- European patent application timeline with expected costs – Fillun, accessed July 27, 2025, https://www.fillun.com/european-patent-application-timeline-with-expected-costs

- Fees in proceedings before the European Patent Office – Wikipedia, accessed July 27, 2025, https://en.wikipedia.org/wiki/Fees_in_proceedings_before_the_European_Patent_Office

- Patent renewal – What is the process? – Visit our website — Pintz & Partners, accessed July 27, 2025, https://pintz.com/patent-renewals

- How Much Does It Cost to File a Patent in Japan?, accessed July 27, 2025, https://origamipatentfirm.com/2025/07/15/how-much-does-it-cost-to-file-a-patent-in-japan/

- Patent – Fee Schedule for international clients 2025 | IPStart Intellectual Property Law Firm, accessed July 27, 2025, https://ipstart.jp/en/schedule-of-fees-for-international-clients/

- China National Intellectual Property Administration Fees, accessed July 27, 2025, https://english.cnipa.gov.cn/col/col3000/index.html

- Patent protection cost in China – European Commission – Intellectual Property Helpdesk, accessed July 27, 2025, https://intellectual-property-helpdesk.ec.europa.eu/patent-protection-cost-china_en

- Patent Cost Breakdown: Understanding the Investment | TTC – TT Consultants, accessed July 27, 2025, https://ttconsultants.com/the-total-cost-of-obtaining-a-patent-start-to-finish/

- European Patent Office fee increase as of 01 April 2024, accessed July 27, 2025, https://www.boehmert.de/en/fee-increase-by-epo/

- Increases to EPO fees from 1 April 2024 – Page White Farrer, accessed July 27, 2025, https://www.pagewhite.com/news/increases-to-epo-fees-from-1-april-2024

- EPO Official Fee increase from 1 April 2024 – Venner Shipley, accessed July 27, 2025, https://www.vennershipley.com/insights-events/epo-official-fee-increase-from-1-april-2024/

- The Hidden Price of Patent Wars: How Legal Costs Are Killing Innovation – Ramey LLP, accessed July 27, 2025, https://www.rameyfirm.com/the-hidden-price-of-patent-wars-how-legal-costs-are-killing-innovation

- Patent Litigation Costs – IP Insurance, accessed July 27, 2025, https://ip.insure/patent-litigation-costs/

- 2023 Report of the Economic Survey – American Intellectual Property Law Association, accessed July 27, 2025, https://www.aipla.org/home/news-publications/economic-survey/2023-report-of-the-economic-survey

- AIPLA Report of the Economic Survey – IPWatchdog.com, accessed July 27, 2025, https://ipwatchdog.com/wp-content/uploads/2021/08/AIPLA-Report-of-the-Economic-Survey-Relevant-Excerpts.pdf

- The Impact of Patent Expiry on Drug Prices: A Systematic Literature Review – PMC, accessed July 27, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC6132437/

- Pharmaceutical Patent Profits Fa, accessed July 27, 2025, https://www.mckendree.edu/academics/scholars/issue11/bodem.htm

- Strategic Patenting by Pharmaceutical Companies – Should Competition Law Intervene? – PMC, accessed July 27, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC7592140/

- Potential Impact of the IRA on the Generic Drug Market – Lumanity, accessed July 27, 2025, https://lumanity.com/perspectives/potential-impact-of-the-ira-on-the-generic-drug-market/

- The Patent Playbook Your Lawyers Won’t Write: Patent strategy development framework for pharmaceutical companies – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/the-patent-playbook-your-lawyers-wont-write-patent-strategy-development-framework-for-pharmaceutical-companies/

- Maximizing ROI on Drug Development by Monitoring Competitive Patent Portfolios, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/maximizing-roi-on-drug-development-by-monitoring-competitive-patent-portfolios/

- Measuring the return from pharmaceutical innovation 2024 | Deloitte US, accessed July 27, 2025, https://www.deloitte.com/us/en/Industries/life-sciences-health-care/articles/measuring-return-from-pharmaceutical-innovation.html

- The price of innovation – the role of drug pricing in financing pharmaceutical innovation. A conceptual framework – PMC – PubMed Central, accessed July 27, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC6442120/

- Analysis Finds Meaningful Impact on Pharmaceutical Innovation From Reduced Revenues, accessed July 27, 2025, https://schaeffer.usc.edu/research/pharmaceutical-innovation-revenues-drug-prices/

- CBO Estimates Drug Savings for Reconciliation-2022-07-08 – Committee for a Responsible Federal Budget, accessed July 27, 2025, https://www.crfb.org/blogs/cbo-estimates-drug-savings-reconciliation

- Alternative Approaches to Reducing Prescription Drug Prices | Congressional Budget Office, accessed July 27, 2025, https://www.cbo.gov/publication/60812

- Alternative Approaches to Reducing Prescription Drug Prices – Congressional Budget Office, accessed July 27, 2025, https://www.cbo.gov/publication/58793

- $52.6 Billion: Extra Cost to Consumers of Add-On Drug Patents – UCLA Anderson Review, accessed July 27, 2025, https://anderson-review.ucla.edu/52-6-billion-extra-cost-to-consumers-of-add-on-drug-patents/

- STAT quotes Sherkow on pharmaceutical patents – College of Law, accessed July 27, 2025, https://law.illinois.edu/stat-quotes-sherkow-on-pharmaceutical-patents/

- The Impact of Patent Thickets on Portfolio Strategy – PatentPC, accessed July 27, 2025, https://patentpc.com/blog/the-impact-of-patent-thickets-on-portfolio-strategy

- The Role of Patents and Regulatory Exclusivities in Drug Pricing | Congress.gov, accessed July 27, 2025, https://www.congress.gov/crs-product/R46679

- Patent Thickets: A Barrier to Innovation? – Number Analytics, accessed July 27, 2025, https://www.numberanalytics.com/blog/patent-thickets-innovation-barrier

- FACT SHEET: BIG PHARMA’S PATENT ABUSE COSTS AMERICAN PATIENTS, TAXPAYERS AND THE U.S. HEALTH CARE SYSTEM BILLIONS OF DOLLARS – CSRxP.org, accessed July 27, 2025, https://www.csrxp.org/fact-sheet-big-pharmas-patent-abuse-costs-american-patients-taxpayers-and-the-u-s-health-care-system-billions-of-dollars-2/

- Patent thickets are pricing Americans out of medicine – FREOPP, accessed July 27, 2025, https://freopp.org/oppblog/patent-thickets-are-pricing-americans-out-of-medicine/

- ICYMI: New Report Shows Cost of Big Drug Companies’ Patent Abuse, Advocates for a More Affordable Market Call for Solutions to Increase Competition – Pharmaceutical Care Management Association, accessed July 27, 2025, https://www.pcmanet.org/pcma-blog/icymi-new-report-shows-cost-of-big-drug-companies-patent-abuse-advocates-for-a-more-affordable-market-call-for-solutions-to-increase-competition-2/02/15/2023/

- Patent Abuses Keep Prescription Drugs Unaffordable | Issue Brief | Healthcare, accessed July 27, 2025, https://americafirstpolicy.com/issues/patent-abuses-keep-prescription-drugs-unaffordable

- In the case of brand name drugs versus generics, patents can be bad medicine, WVU law professor says, accessed July 27, 2025, https://wvutoday.wvu.edu/stories/2022/12/19/in-the-case-of-brand-name-drugs-vs-generics-patents-can-be-bad-medicine-wvu-law-professor-says

- Cost-Effective Patent Financing: A How-To Strategy Guide for Startups | PatentPC, accessed July 27, 2025, https://patentpc.com/blog/cost-effective-patent-financing

- Developing a Patent Cost Reduction Strategy for Mid-Sized Companies | PatentPC, accessed July 27, 2025, https://patentpc.com/blog/developing-a-patent-cost-reduction-strategy-for-mid-sized-companies

- Filing Strategies for Maximizing Pharma Patents: A Comprehensive Guide for Business Professionals – DrugPatentWatch, accessed July 27, 2025, https://www.drugpatentwatch.com/blog/filing-strategies-for-maximizing-pharma-patents/

- Patent Strategy for Biotech Startups – A Complete Guide | Insights, accessed July 27, 2025, https://outlierpatentattorneys.com/patent-strategy-for-biotech-startups

- Strategies for Managing Patent Budgets Without Sacrificing Quality – PatentPC, accessed July 27, 2025, https://patentpc.com/blog/strategies-for-managing-patent-budgets-without-sacrificing-quality

- Intellectual Property Strategy for Biotech Companies – Excedr, accessed July 27, 2025, https://www.excedr.com/resources/intellectual-property-strategy-for-biotechs

- Tufts Report Puts Cost Of R&D At $2.6B Per New Drug – Bioprocess Online, accessed July 27, 2025, https://www.bioprocessonline.com/doc/tufts-report-puts-cost-of-r-d-at-b-per-new-drug-0001

- Tufts Study Finds Big Rise In Cost Of Drug Development – C&EN, accessed July 27, 2025, https://cen.acs.org/articles/92/web/2014/11/Tufts-Study-Finds-Big-Rise.html

- synergbiopharma.com, accessed July 27, 2025, https://synergbiopharma.com/biologics-vs-small-molecules/#:~:text=Small%20molecule%20development%20typically%20costs,success%20rates%20in%20clinical%20trials.

- How expensive is it to patent? – Reddit, accessed July 27, 2025, https://www.reddit.com/r/Patents/comments/1diblih/how_expensive_is_it_to_patent/

- How much does a patent cost? | Richards Patent Law Firm, accessed July 27, 2025, https://www.richardspatentlaw.com/faq/how-much-does-a-patent-cost/

- Patent fees – Innovation, Science and Economic Development Canada, accessed July 27, 2025, https://ised-isde.canada.ca/site/canadian-intellectual-property-office/en/patents/patent-fees

- Paying PCT Fees for International Patent Application – WIPO, accessed July 27, 2025, https://www.wipo.int/en/web/paying-for-ip-services/pct-fees

- Fees for international applications (applicable as of 1 January 2025) | epo.org, accessed July 27, 2025, https://www.epo.org/en/applying/fees/international-fees/important-fees

- JPO Fee Increases Effective April 1, 2022 – ONDA TECHNO Intl. Patent Attys., accessed July 27, 2025, https://www.ondatechno.com/en/news/patent/p1361/

- Japan: International Application Fees Revised: January 1, 2025, accessed July 27, 2025, https://www.asamura.jp/en1/2024/12/03/japan-international-application-fees-revised-january-1-2025/

- JPO Issuance and Post-Issuance Fees Increases from April 2022: Early Bird Payment Plan Deadline Fast Approaching | SAEGUSA & Partners, accessed July 27, 2025, https://www.saegusa-pat.co.jp/english/ipupdate/1903/

- Registration & Maintenance in Japan Patent Law – Q&A, accessed July 27, 2025, https://www.kipb-jp.com/faq/8/registration-and-maintenance

- Patent Government Fees – Registration China, accessed July 27, 2025, https://www.registrationchina.com/patent/government-fees/

- China’s National Intellectual Property Administration Releases Fee Information for Requesting Patent Term Adjustments and Extensions, accessed July 27, 2025, https://www.chinaiplawupdate.com/2024/08/chinas-national-intellectual-property-administration-releases-fee-information-for-requesting-patent-term-adjustments-and-extensions/

- Where can I find official information about patent fees in China? | epo.org, accessed July 27, 2025, https://www.epo.org/en/service-support/faq/searching-patents/asian-patent-information/china/sources-information/where-3

- FEES, accessed July 27, 2025, https://english.cnipa.gov.cn/transfer/patentapplication/howtofilepctapplication/917549.htm

- Let’s see what you’ve got. – Patent Registrar, accessed July 27, 2025, https://www.patentregistrar.com/patent-translation-filing-prices/

- FAQs and Benefits for Our Patent Translation Services, accessed July 27, 2025, https://www.patentregistrar.com/patent-translation-filing-services/

- Patent cost | Use our calculator for Patents at fixed-price — Lightbringer, accessed July 27, 2025, https://www.lightbringer.com/cost-calculator

- IP LITIGATION COSTS – WIPO, accessed July 27, 2025, https://www.wipo.int/edocs/pubdocs/en/wipo_pub_121_2010_01.pdf

- Understanding the Financial Implications of Patent Expirations – Qualifyze, accessed July 27, 2025, https://www.qualifyze.com/resources/understanding-the-financial-implications-of-patent-expirations/

- Drug Competition Series – Analysis of New Generic Markets Effect of Market Entry on Generic Drug Prices – HHS ASPE, accessed July 27, 2025, https://aspe.hhs.gov/sites/default/files/documents/510e964dc7b7f00763a7f8a1dbc5ae7b/aspe-ib-generic-drugs-competition.pdf

- Generic Competition and Drug Prices | FDA, accessed July 27, 2025, https://www.fda.gov/about-fda/center-drug-evaluation-and-research-cder/generic-competition-and-drug-prices

- HOW INCREASED COMPETITION FROM GENERIC DRUGS HAS AFFECTED PRICES AND RETURNS IN THE PHARMACEUTICAL INDUSTRY JULY 1998 – Congressional Budget Office, accessed July 27, 2025, https://www.cbo.gov/sites/default/files/105th-congress-1997-1998/reports/pharm.pdf

- IP strategy for biotech startups (best practices and pitfalls to avoid) – Basel Area, accessed July 27, 2025, https://baselarea.swiss/knowledge-hub/ip-strategy-for-biotech-startups/