In the dynamic world of pharmaceutical development and manufacturing, Contract Development and Manufacturing Organizations (CDMOs) have emerged as indispensable partners for biopharmaceutical companies. These specialized organizations offer a comprehensive suite of services, from early-stage research and development to full-scale commercial manufacturing. But as with any critical business relationship, understanding the financial intricacies—specifically, CDMO price benchmarking for commercial manufacturing—is paramount. How do CDMOs arrive at their pricing, and more importantly, how can your business leverage this knowledge to transform data into market domination?

The landscape is complex, with a multitude of factors influencing the final bill. It’s not simply a matter of per-unit cost; rather, it’s a symphony of variables orchestrated to meet specific project needs, regulatory demands, and market realities. Let’s embark on a journey to demystify CDMO pricing, providing you with the insights necessary to make informed, strategic decisions.

The Evolving Role of CDMOs in the Pharmaceutical Ecosystem

Gone are the days when Contract Manufacturing Organizations (CMOs) were solely focused on manufacturing, or Contract Research Organizations (CROs) handled only early-stage research. Today’s CDMOs bridge this gap, offering end-to-end solutions. This evolution reflects a growing trend towards outsourcing, driven by the need for specialized expertise, flexible capacity, and accelerated time-to-market. Pharmaceutical companies, particularly small and mid-sized firms, often lack the in-house infrastructure and capital for every stage of drug development and production. This is where CDMOs step in, providing cost-effective and efficient solutions.

The global CDMO market is experiencing robust growth, projected to reach USD 465.24 billion by 2032 from USD 238.92 billion in 2024, exhibiting a CAGR of 9.0% [6]. This significant expansion underscores the increasing reliance on these partners. But with growth comes heightened competition, pushing CDMOs to continually refine their value propositions and, by extension, their pricing strategies.

From Transactional to Strategic Partnerships

The relationship between a biopharma company and a CDMO is no longer purely transactional. It’s evolving into a strategic partnership. CDMOs are increasingly investing ahead of the curve to support customers across the full product lifecycle. This shift means that cost is still a critical factor, but it’s increasingly balanced with considerations of quality, speed, flexibility, and experience. As one industry expert noted, “The cheapest isn’t always the best. A low bid might mean cut corners or delays. ‘Price is what you pay; value is what you get,’ Warren Buffett once said. Focus on ROI—will this CDMO deliver on time and quality?” [1].

Deconstructing CDMO Pricing Models: A Multi-faceted Approach

Understanding how a CDMO structures its charges for commercial manufacturing requires a deep dive into the various pricing models they employ. There isn’t a one-size-fits-all approach; rather, CDMOs tailor their proposals based on the specific project scope, risk allocation, and desired outcomes.

1. Fee-for-Service (FFS) Model: A la Carte Approach

The Fee-for-Service model is straightforward: you pay for specific tasks or services rendered. This could include formulation development, analytical testing, or the manufacturing of a defined batch. It’s often preferred for early-stage projects where timelines and scope might be less defined.

- Pros: Transparency in individual service costs, good for projects with uncertain or evolving requirements.

- Cons: Costs can escalate if the scope expands significantly or if unexpected issues arise. It requires meticulous tracking of services to avoid “scope creep.”

2. Time and Materials (T&M) Model: Flexibility with Oversight

Under the Time and Materials model, clients are billed for the actual labor hours expended and the materials consumed. This offers greater flexibility, especially for complex projects where the exact scope or duration is difficult to predict upfront.

- Pros: Adaptability to changing project needs, ideal for R&D-heavy projects or those with iterative development.

- Cons: Requires strong oversight and clear communication to prevent cost overruns. Without transparent reporting, you might find yourself with a surprisingly hefty bill for “unexpected” hours.

3. Fixed-Price Contracts: Predictability at a Premium

A fixed-price contract locks in the total cost upfront for a defined scope of work. This model offers budgetary predictability and is often favored for well-defined, commercial-scale manufacturing projects where the process is established and risks are well understood.

- Pros: Budget certainty, reduced financial risk for the client once the contract is signed.

- Cons: CDMOs often build in buffers for unforeseen risks, meaning you might pay a premium compared to a variable model. Less flexibility if the project scope needs to change significantly.

4. Cost-Plus Model: Sharing the Load

In a cost-plus model, the client pays for the actual cost of manufacturing (materials, labor, overhead) plus an agreed-upon percentage or fixed fee as the CDMO’s profit. This model can foster greater transparency regarding the CDMO’s underlying costs.

- Pros: Transparency in cost breakdown, potential for lower costs if the CDMO achieves efficiencies.

- Cons: Less predictable than a fixed-price contract, requires trust and strong auditing capabilities to ensure costs are legitimate.

5. Performance-Based/Milestone Payments: Aligned Incentives

This model ties payments to the achievement of specific milestones or performance metrics. For instance, a payment might be triggered upon successful completion of a batch, regulatory approval, or achievement of a certain yield. This aligns the CDMO’s incentives with the client’s success.

- Pros: Motivates the CDMO to deliver results efficiently and on time, shares risk between parties.

- Cons: Requires clear and measurable milestones, potential for disputes if milestones are not clearly defined or met.

Key Factors Driving CDMO Commercial Manufacturing Costs

The price tag for commercial manufacturing is not arbitrary. It’s a carefully calculated sum influenced by a multitude of interconnected factors. Understanding these drivers is crucial for effective price benchmarking and negotiation.

1. Product Complexity and Modality: The More Intricate, The More Expensive

The nature of the drug product itself is a primary determinant of cost. Manufacturing biologics, for instance, is inherently more complex and costly than producing small molecule drugs due to specialized equipment, stringent environmental controls, and sophisticated processing requirements.

- Active Pharmaceutical Ingredient (API) Complexity: The difficulty and cost of synthesizing or producing the API significantly impact the overall price. Novel APIs with complex chemistry or limited manufacturing experience will command higher prices.

- Dosage Form: Sterile injectables, lyophilized products, and highly potent APIs (HPAPIs) require specialized facilities, equipment, and handling procedures, which drive up costs compared to solid oral dosages.

- Stability and Storage Requirements: Products requiring cold chain storage or specific environmental controls add to the manufacturing complexity and logistics costs.

2. Scale and Volume: Economies of Scale in Action

The batch size and anticipated annual volume of production play a significant role in pricing. Generally, larger volumes benefit from economies of scale, leading to a lower per-unit cost.

- Batch Size: Smaller batch sizes often have higher per-unit costs due to fixed overheads (e.g., equipment setup, cleaning, quality control) being spread across fewer units. Conversely, increasing batch size can dramatically reduce per-unit costs. As one study highlights, “reducing your batch size is proven to radically reduce your costs” [14].

- Production Frequency: Continuous manufacturing or consistent, high-volume campaigns can be more cost-effective for a CDMO than intermittent, small-volume runs, as it allows for better resource utilization.

3. Technology and Equipment Requirements: State-of-the-Art Comes at a Cost

The level of technology and specialized equipment required for a particular manufacturing process directly influences the CDMO’s investment and, consequently, their pricing.

- Advanced Technologies: CDMOs investing in cutting-edge technologies like continuous manufacturing, advanced aseptic filling lines, or specialized cell and gene therapy capabilities will factor these investments into their pricing.

- Dedicated vs. Multi-Product Facilities: Dedicated facilities for a specific product or technology may command a premium due to the focused investment and specialized infrastructure.

4. Regulatory Landscape and Quality Assurance: The Price of Compliance

Operating within the highly regulated pharmaceutical industry necessitates robust quality systems and strict adherence to Good Manufacturing Practices (GMP). These compliance requirements are a significant cost driver.

- cGMP Compliance: Maintaining cGMP standards, including rigorous quality control, validation, and documentation, requires substantial investment in personnel, training, and infrastructure.

- Regulatory Filings and Support: CDMOs often provide support for regulatory submissions (e.g., BLA, NDA) and navigating inspections, which are integral to their service offering and factored into pricing.

- Audit Support: Transparent pricing should ideally include audit support and responses, as this can be a significant hidden cost if not explicitly covered in the contract [12].

5. Location of the CDMO: Geographic Cost Variations

Geographic location can significantly impact CDMO pricing due to variations in labor costs, utility rates, and regulatory environments.

- High-Cost Regions: North America and Western Europe, with their robust infrastructure and highly skilled workforce, tend to have higher hourly rates for specialized services (e.g., $200-$300 per hour) [1].

- Cost-Advantage Regions: Asia-Pacific countries like China and India often offer lower rates (30-50% less) due to more affordable labor and materials [1]. However, considerations such as supply chain logistics, intellectual property protection, and cultural differences must be weighed against the cost savings.

6. Tech Transfer and Process Development: The Foundation of Manufacturing

The costs associated with transferring a manufacturing process from the client to the CDMO, or developing a new process, are often a significant upfront investment.

- Process Complexity: A highly complex or novel process will require more extensive tech transfer and development efforts, increasing costs.

- Analytical Method Transfer: The transfer and validation of analytical methods are critical for quality control and can be a substantial component of tech transfer costs.

- Validation Batches: The production of validation batches, necessary to prove the robustness and reproducibility of the manufacturing process, also contributes to the overall cost. Hidden costs, such as the expense of repeating batches due to equipment failure or process issues, should be scrutinized [15].

7. Value-Added Services: Beyond Basic Manufacturing

Many CDMOs offer a range of value-added services that, while beneficial, contribute to the overall pricing. These services can differentiate a CDMO and provide significant benefits to the client.

- Supply Chain Management: End-to-end supply chain solutions, including raw material sourcing, logistics, and inventory management, can streamline operations but come at a cost.

- Packaging and Labeling: Integrated packaging and labeling services reduce the need for additional vendors and can offer efficiencies.

- Analytical and Quality Control Testing: Comprehensive in-house analytical capabilities, beyond routine batch release testing, are a value-add.

- Regulatory Consulting: Expert guidance on regulatory strategy and submission preparation can be invaluable, especially for novel therapies.

- Lifecycle Management Support: CDMOs that offer support for post-commercialization activities, such as product improvements or line extensions, provide long-term value.

8. Relationship Length and Strategic Importance: Building Long-Term Value

The duration and strategic importance of the partnership can influence pricing. Long-term contracts or agreements for critical drug products may allow for more favorable pricing negotiations.

- Multi-Product Deals: Clients offering multiple products or a pipeline of future projects may secure better rates due to the potential for sustained revenue for the CDMO.

- Strategic Alignment: A CDMO might be willing to offer more competitive pricing for a project that aligns with their strategic growth areas or allows them to expand their capabilities.

The Importance of Transparent Pricing in CDMO Relationships

In an industry often characterized by complex and sometimes opaque pricing structures, transparency is becoming a sought-after commodity. Transparent pricing means the CDMO provides a detailed breakdown of all costs, leaving no hidden fees or surprises.

“Transparent pricing outlines what it will actually cost to get you to your end goal, whether it’s PPQ or a BLA… No surprises. No down-the-road shocks.” — AbbVie Contract Manufacturing [12]

This transparency is crucial for several reasons:

- Accurate Budgeting: It allows biopharma companies to forecast costs accurately and avoid unexpected expenses that can derail a project.

- True Cost Comparison: With transparent pricing, it becomes easier to compare proposals from different CDMOs on an “apples-to-apples” basis, rather than just the bottom line. Hidden fees for services like audit support, project management, or even pulling samples can significantly inflate the true cost [12].

- Stronger Partnerships: Trust is built on transparency. When a CDMO is upfront about its pricing, it fosters a more collaborative and trusting relationship, essential for long-term success.

- Risk Mitigation: Understanding the full cost structure helps identify potential financial risks early on and allows for proactive mitigation strategies.

Benchmarking CDMO Prices: Strategies for Informed Decision-Making

Benchmarking CDMO prices for commercial manufacturing is not about finding the absolute lowest price; it’s about identifying the best value proposition that aligns with your specific needs and strategic objectives.

1. Define Your Requirements with Precision

Before approaching any CDMO, have an extremely clear understanding of your project’s scope, technical requirements, timelines, and quality expectations. The more detailed your Request for Proposal (RFP), the more accurate and comparable the bids you receive will be.

- Technical Specifications: Provide precise details on the drug product, process, analytical methods, and material specifications.

- Volume Forecasts: Offer realistic and well-supported forecasts for commercial demand over a multi-year period.

- Quality Standards: Clearly articulate your quality expectations and any specific regulatory requirements.

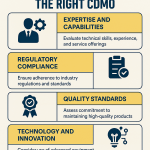

2. Cast a Wide Net, But Be Strategic

Engage with multiple CDMOs to get a range of proposals. However, don’t just send your RFP to every CDMO you find. Prioritize those with demonstrated expertise in your specific modality, dosage form, and scale.

- Specialized Expertise: For biologics or gene therapies, seek out CDMOs with a proven track record and dedicated facilities in those areas. For sterile fill-finish, look for specialists in that domain [6].

- Geographic Considerations: Evaluate CDMOs in different regions, weighing potential cost savings against logistical complexities and regulatory alignment.

3. Scrutinize Proposals Beyond the Bottom Line

When proposals start rolling in, resist the urge to simply pick the cheapest option. Dive deep into the line-item breakdowns.

- Detailed Cost Breakdowns: Demand a clear and comprehensive breakdown of all costs, including labor, materials, overheads, quality control, regulatory support, and tech transfer fees. Be wary of proposals that lump many services into a single, vague line item.

- Inclusions and Exclusions: Carefully review what is included and, more importantly, what is not included. Are there hidden fees for project management, regulatory audits, or unexpected scope changes? “If one or more of these is not included, ask why not and what the likely cost will be,” advises AbbVie Contract Manufacturing [12].

- Payment Terms: Understand the payment schedule, including upfront payments, milestone-based payments, and payment terms for recurring services.

- Capacity and Scheduling: Ensure the CDMO has the necessary capacity to meet your commercial demands and that their proposed timelines align with your market entry strategy.

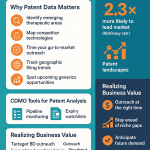

4. Leverage Industry Data and Benchmarking Tools

While direct competitor pricing is often proprietary, industry reports and intelligence platforms can provide valuable insights into market trends and average costs.

- Market Research Reports: Consult reports from reputable market intelligence firms that analyze CDMO pricing trends, regional cost differences, and specific service line item costs (e.g., sterile fill-finish, API manufacturing) [6, 11].

- Platforms like DrugPatentWatch: Resources like DrugPatentWatch, while primarily known for patent intelligence, also offer valuable business intelligence that can indirectly inform CDMO selection and pricing discussions by providing market context and competitive landscapes [1]. Understanding the commercial success rates and R&D costs associated with bringing new biopharmaceuticals to market, as detailed in some analyses, can help contextualize manufacturing expenses within the broader drug development budget [4]. For example, the estimated manufacturing cost contribution to R&D for a market-successful biopharmaceutical can be significant, potentially representing 13-17% of the total R&D budget from pre-clinical to approval [4].

- Consultants: Engage with specialized consultants who have extensive experience in CDMO selection and contract negotiation. They often have access to proprietary benchmarking data and can provide expert guidance.

5. Negotiate Strategically: The Art of the Deal

Negotiation is not a battle; it’s a dance. Approach negotiations with a clear understanding of your leverage and a willingness to find mutually beneficial solutions.

- Know Your Leverage: A large project, a long-term commitment, or a unique product might give you more bargaining power. Conversely, if your project is small or highly specialized, the CDMO might have less flexibility on price.

- Seek Value, Not Just Price: Focus on the overall value proposition. A slightly higher price from a CDMO with a proven track record, superior quality systems, and a strong cultural fit might lead to greater long-term cost savings and reduced risks.

- Be Prepared to Discuss Terms Beyond Price: Negotiations can extend beyond unit cost to include payment terms, lead times, inventory management, exclusivity clauses, and intellectual property rights [10].

- Consider Multi-Year Contracts: Longer-term agreements often allow CDMOs to offer more favorable pricing due to increased predictability of revenue and resource allocation.

- Tiered Pricing for Volume: Discuss volume-based discounts or tiered pricing structures that offer lower per-unit costs as production volumes increase.

Case Study: BioPharma Inc.’s Strategic CDMO Selection

Consider the example of BioPharma Inc., a mid-sized firm developing a biologic. They received three quotes for commercial manufacturing: $1.2M, $1.5M, and $2M. The cheapest option skimped on critical analytical services, while the priciest offered extensive, but potentially unnecessary, end-to-end support. BioPharma Inc. chose the $1.5M option because it provided robust services at a fair price, ultimately leading to on-time delivery and a project that came in 10% under budget [1]. This illustrates the importance of value assessment over simply chasing the lowest bid.

Common Pitfalls in CDMO Pricing and How to Avoid Them

Even with the best intentions, companies can fall into common traps when engaging with CDMOs for commercial manufacturing. Awareness is the first step to avoidance.

1. Focusing Solely on the Lowest Bid

As highlighted earlier, the cheapest option can often prove to be the most expensive in the long run. Hidden costs, quality issues, delays, or a lack of flexibility can quickly negate initial cost savings. Prioritize value, quality, and a strong partnership.

2. Underestimating Tech Transfer Complexity and Cost

Technology transfer is a critical phase and often a significant cost driver. Underestimating its complexity or failing to clearly define responsibilities can lead to delays and cost overruns. Ensure your contract explicitly details tech transfer activities, responsibilities, and costs [10]. Be wary of CDMOs that take your tech transfer “as is,” as laboratory-scale processes can often fall apart during commercial scale-up [15].

3. Neglecting Hidden Fees and “Surprise” Charges

Many unforeseen costs can emerge throughout a commercial manufacturing project. These can include:

- Additional analytical testing beyond routine release.

- Expedited orders or schedule changes.

- Handling of product returns or complaints.

- Excessive charges for documentation or regulatory support.

Always ask for a transparent breakdown and inquire about any services that appear to be missing or are vaguely defined [12].

4. Insufficient Due Diligence on CDMO Capabilities

A CDMO’s pricing should reflect its capabilities. If a CDMO offers an unusually low price, it’s crucial to perform extensive due diligence on their facility, equipment, quality systems, and experience with similar products. “If your CDMO doesn’t have deep-enough pockets to continuously invest in their facilities’ maintenance and upgrades, that’s a problem,” warns one expert, citing the risk of equipment failure or financial instability [15].

5. Lack of Clear Communication and Scope Management

Poor communication and ill-defined scope can lead to “scope creep” and escalating costs in Time and Materials models. Establish clear communication channels, regular progress reviews, and a robust change order process from the outset.

The Future of CDMO Pricing: Trends and Innovations

The CDMO industry is constantly evolving, and so are its pricing strategies. Several key trends are shaping the future of commercial manufacturing partnerships.

1. Integration of AI and Digital Tools

Artificial intelligence (AI) and digital tools are transforming various aspects of pharmaceutical manufacturing, from process optimization to supply chain management. CDMOs leveraging these technologies can achieve greater efficiencies, potentially leading to more competitive pricing or enhanced value. AI can help identify optimal drug formulations and improve efficiency, reducing costs [8].

2. Focus on Value-Based Pricing and Customer-Centric Approaches

CDMOs are increasingly moving towards value-based pricing, where the price reflects the value delivered to the client, rather than just the cost of production. This involves understanding customer pain points, tailoring messaging around compliance, innovation, operational excellence, and risk mitigation, and demonstrating tangible ROI [3, 5].

3. Strategic Partnerships and Risk-Sharing Models

The trend towards deeper, more strategic partnerships means more CDMOs are open to risk-sharing models, such as performance-based payments or equity stakes in early-stage biotech companies. This fosters greater alignment and shared success.

4. Adaptability to Shifting Market Requirements

The pharmaceutical market is characterized by rapid innovation and changing demands. CDMOs are prioritizing flexibility and adaptability to meet evolving client needs, which will influence their pricing models, moving towards more agile and responsive structures [8]. This includes modifying contracts to incorporate more indices and extending contract durations to ensure adaptability to shifting market requirements [5].

Key Takeaways

- CDMO price benchmarking for commercial manufacturing is a strategic imperative, not just a cost-cutting exercise. It’s about understanding value.

- Multiple pricing models exist, including Fee-for-Service, Time and Materials, Fixed-Price, Cost-Plus, and Performance-Based payments, each with its own advantages and disadvantages.

- Numerous factors influence pricing, including product complexity, scale, technology, regulatory requirements, location, tech transfer needs, and value-added services.

- Transparency is paramount in CDMO pricing to ensure accurate budgeting, true cost comparison, and a strong, trusting partnership. Hidden fees can significantly inflate the real cost.

- Effective benchmarking requires a precise definition of requirements, engagement with relevant CDMOs, meticulous scrutiny of proposals, and strategic negotiation. Don’t simply chase the lowest bid; prioritize value, quality, and partnership.

- Leverage industry insights and tools, such as market research reports and platforms like DrugPatentWatch, to inform your decision-making.

- The future of CDMO pricing is moving towards greater integration of technology, value-based approaches, and strategic risk-sharing partnerships.

Conclusion

Navigating the complexities of CDMO pricing for commercial manufacturing is a critical skill for any biopharmaceutical professional aiming for market domination. It’s not about finding the cheapest option, but about identifying the partner who offers the optimal balance of quality, expertise, flexibility, and cost-effectiveness. By meticulously benchmarking prices, understanding the underlying cost drivers, and embracing transparent and strategic negotiation, your organization can forge powerful partnerships that accelerate drug commercialization, mitigate risks, and ultimately, deliver life-changing medicines to patients worldwide. The journey from data to domination starts with a clear understanding of value, and in the world of CDMOs, that value is deeply intertwined with every aspect of their pricing.

FAQs

1. What is the single biggest factor influencing CDMO commercial manufacturing pricing?

While many factors contribute, the product’s complexity and modality (e.g., small molecule vs. biologic, sterile injectable vs. oral solid dose) often have the most significant impact, as they dictate the specialized equipment, facilities, and expertise required. This is closely followed by the scale and volume of production, due to the principle of economies of scale.

2. How can I ensure a CDMO’s quote is truly comprehensive and avoids hidden costs?

To ensure transparency, demand a highly detailed, line-item breakdown of all services and associated costs. Specifically inquire about inclusions for project management, quality control, regulatory support (including audit responses), analytical testing beyond routine release, and technology transfer activities. A truly transparent CDMO will clearly outline what is covered and what might incur additional charges.

3. Is it always more cost-effective to choose an overseas CDMO for commercial manufacturing?

Not necessarily. While CDMOs in regions like Asia-Pacific may offer lower hourly rates due to reduced labor costs, the overall cost-effectiveness must consider logistical complexities, potential supply chain disruptions, intellectual property concerns, and differences in regulatory environments. The “cheaper” option can sometimes lead to unforeseen delays and expenses, negating initial savings.

4. How do advancements in manufacturing technology, like AI and automation, impact CDMO pricing?

The integration of AI and automation can lead to increased efficiency, reduced labor costs, and improved quality control for CDMOs. While the initial investment in these technologies might be passed on to clients, in the long run, they can result in more competitive per-unit costs, faster turnaround times, and potentially higher yields, creating a win-win scenario through enhanced value.

5. Beyond price, what are the most critical non-financial factors to consider when selecting a CDMO for commercial manufacturing?

Beyond pricing, critical non-financial factors include the CDMO’s quality track record and regulatory compliance history, their technical expertise and experience with similar molecules or processes, their flexibility and responsiveness to changing project needs, the cultural fit between your teams, and their capacity and scalability to meet your long-term commercial demands.

Cited Information

- DrugPatentWatch. “The Ultimate Guide to CDMO Pricing.” Accessed July 15, 2025.

- Investors in Healthcare. “CDMOs: the changing shape of outsourcing.” Accessed July 15, 2025.

- S.A.MBasci. “CDMO Marketing: Practical Approaches for Differentiation and Growth in Biotech.” Accessed July 15, 2025.

- PMC. “Benchmarking biopharmaceutical process development and manufacturing cost contributions to R&D.” Accessed July 15, 2025.

- Simon-Kucher & Partners. “State of pricing 2024: What lies ahead for the CDMO industry?” Accessed July 15, 2025.

- Fortune Business Insights. “CDMO Market Size, Share & Trends | Growth Analysis [2032].” Accessed July 15, 2025.

- SoftwareSuggest. “DrugPatentWatch Pricing, Features, and Reviews (Jun 2025).” Accessed July 15, 2025.

- BioSpace. “U.S. Pharmaceutical CDMO Market Size to Surpass USD 84.33 Bn by 2034.” Accessed July 15, 2025.

- UPM Pharmaceuticals. “What is a CDMO & How Can CDMO Services Benefit Your Pharma Development?” Accessed July 15, 2025.

- Contract Pharma. “Negotiating a Manufacturing Agreement.” Accessed July 15, 2025.

- That’s Nice. “Active Pharmaceutical Ingredients, API: Market Insight, CDMO Pricing and Competitor Benchmarking.” Accessed July 15, 2025.

- AbbVie Contract Manufacturing. “The Benefits of Transparent Pricing.” Accessed July 15, 2025.

- Drug Development & Delivery. “CDMO CASE STUDY – AJILITY: Streamlining Drug Product Manufacturing.” Accessed July 15, 2025.

- Boost. “How reducing your batch size is proven to radically reduce your costs.” Accessed July 15, 2025.

- Bioprocess Online. “Is Selecting A CDMO Based On Contract Price Really Saving You Money In The Long Run?” Accessed July 15, 2025.