Introduction: The Most Important Decision You’re (Probably) Underestimating

In the high-stakes world of pharmaceutical development, we are conditioned to focus on the big, headline-grabbing milestones: the breakthrough discovery, the pivotal Phase III trial results, the long-awaited regulatory approval. These are, without question, the moments that define success. Yet, long before the first patient is dosed, before the first submission is filed, a decision is made—often quietly, deep within the chemistry, manufacturing, and controls (CMC) department—that will profoundly shape the destiny of that drug. This is the selection of the Key Starting Material, or KSM.

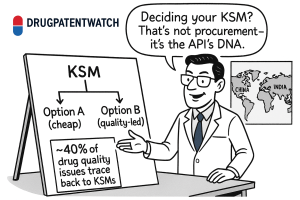

Let me be blunt: underestimating the strategic gravity of your KSM decision is one of the most common and costly mistakes in our industry. We tend to view it as a technical footnote, a mere procurement task. This is a dangerous misconception. The choice of a KSM is not the beginning of the manufacturing process; it is the genesis of your entire product’s quality, cost, and supply chain resilience. It is, in essence, the API’s DNA. Just as DNA predetermines an organism’s fundamental traits, your KSM choice predetermines your API’s impurity profile, its manufacturing efficiency, its regulatory risk, and its vulnerability to global shocks. A poor choice can embed persistent impurities that haunt you through development, trigger costly regulatory delays, and create supply chain vulnerabilities that threaten market launch.1 A brilliant choice, however, can build a foundation for consistent quality, a streamlined regulatory path, and a robust, competitive supply chain that becomes a tangible asset.

This report is designed to elevate the KSM conversation from the lab bench to the boardroom. We will move beyond the purely technical and regulatory definitions to frame KSM selection as what it truly is: a core strategic competency. We will dissect the global regulatory landscape, providing a playbook for navigating the nuanced expectations of agencies like the FDA and EMA. We will offer a robust framework for selecting the optimal KSM, balancing chemical complexity, impurity control, and commercial realities. We will then construct a blueprint for a bulletproof supply chain, transforming your sourcing strategy from a cost center into a bastion of resilience. Finally, we will look to the horizon, exploring how patent intelligence and transformative technologies like continuous manufacturing and artificial intelligence are reshaping the future of API production.

The journey from a promising molecule to a life-saving medicine is fraught with challenges. Nailing your KSM strategy won’t eliminate them all, but it will ensure you begin that journey on the strongest possible footing. Let’s explore how to turn this critical decision into your most powerful competitive advantage.

Section 1: The Strategic Cornerstone – Why Your KSM Strategy Defines API Success

To truly master your KSM strategy, you must first fundamentally reframe its importance. It is not a preliminary step to be delegated and forgotten; it is the strategic cornerstone upon which your entire API development program is built. Every subsequent decision—from process development and purification to regulatory filings and supply chain logistics—is constrained and defined by this initial choice. Problems originating at this earliest stage of the value chain inevitably cascade downstream, impacting everything from manufacturing efficiency to patient safety and market access. Let’s break down the core concepts and the high stakes involved.

1.1 Beyond the Basics: Defining KSMs, APIs, and Intermediates in a Business Context

While the terms are often used in technical discussions, understanding their precise regulatory and, more importantly, their business implications is the first step toward strategic mastery. The definitions are not just academic; they draw the lines on a map that dictates where immense cost and risk are allocated.

The Core Components of Drug Manufacturing

- Active Pharmaceutical Ingredient (API): This is the heart of any medicine. The API, also known as a bulk drug, is the specific chemical compound within a finished drug product (like a tablet or injectable) that produces the desired therapeutic effect.3 It is the molecule that interacts with the body to diagnose, cure, treat, or prevent a disease. Without the API, a pill is just an inert collection of excipients.

- Key Starting Material (KSM): Officially termed an “API Starting Material” by regulatory bodies, the KSM is the foundational building block from which the API is synthesized.1 According to the International Council for Harmonisation (ICH), it is “a raw material, intermediate, or an API that is used in the production of an API and that is incorporated as a significant structural fragment into the structure of the API”.8 A KSM is typically an article of commerce, meaning it can be purchased from suppliers, and it must have well-defined chemical properties and structure.6

- Intermediate: An intermediate is a substance produced during the synthesis of an API. It is a transient chemical compound that is formed from the KSM (or a previous intermediate) and is then converted into the next intermediate or the final API.1 Unlike KSMs, intermediates are generally not sold commercially and are produced within the controlled part of the manufacturing process.

The Crucial Business Distinction: The GMP Line in the Sand

The most critical distinction between a KSM and the raw materials that come before it is regulatory. The KSM marks the precise point in the synthesis where the stringent, and costly, principles of Good Manufacturing Practice (GMP) must be applied.1 Every manufacturing step

after the KSM is introduced—the creation of intermediates, purification, isolation of the final API—must be conducted in a GMP-compliant environment, with full process validation, rigorous documentation, and quality oversight. The steps before the KSM are not subject to these pharmaceutical GMP requirements.

This makes the designation of a KSM a pivotal strategic economic decision. By defining a material earlier in the synthetic pathway as the KSM, a company extends the umbrella of GMP compliance, increasing costs but also providing greater control and regulatory transparency. Conversely, successfully justifying a KSM that enters late in the synthesis can significantly reduce the GMP burden and overall manufacturing costs. However, this latter approach invites far greater regulatory scrutiny, as agencies become concerned about the lack of control and visibility over the crucial, complex chemistry that occurred in the non-GMP steps. This trade-off between cost and regulatory risk is at the very heart of KSM strategy.

1.2 The Ripple Effect: How KSM Quality Dictates Final Drug Quality, Cost, and Safety

The quality of your KSM is not just a starting parameter; it is a foundational attribute that echoes through the entire manufacturing process, directly influencing the safety profile, cost, and ultimate success of your final medication. A minor issue at the KSM level can propagate into major quality deviations, regulatory non-compliance, and ultimately, drug shortages that threaten patient well-being.

The Specter of Impurity Persistence

The single greatest technical challenge in KSM management is impurity persistence. Impurities present in your KSM—whether they are by-products from its own synthesis, unreacted raw materials, or residual reagents—do not simply vanish. They can be carried through multiple subsequent synthetic steps, sometimes reacting to form new, unexpected impurities, and ultimately contaminate the final API.1 Removing these “inherited” impurities late in the process can be extraordinarily difficult and expensive, and in some cases, impossible.

This is why a modern KSM strategy must be built on the principle of Quality by Design (QbD). Instead of relying on testing the final product to catch problems (a reactive approach), QbD demands that quality be built into the process from the very beginning. This means proactively understanding the impurity profile of your KSM, meticulously tracking the fate of each impurity through the synthesis, and designing a process with sufficient “purging power” to ensure a clean final API. The failure to do so is a primary cause of regulatory rejection and manufacturing failure.

The profound impact of starting materials on final drug quality cannot be overstated. Our analysis reveals a stark reality: approximately 40% of all drug quality issues can be traced back to problems with starting materials. This elevates KSM sourcing from a mere procurement function to a core quality assurance and proactive risk management imperative, demanding deep integration with research and development (R&D) and regulatory affairs.

— DrugPatentWatch Analysis

The Link to Cost of Goods Sold (COGS)

Your KSM strategy has a direct and quantifiable impact on your bottom line. The choice of KSM determines the length and complexity of the GMP-controlled portion of your synthesis. A longer GMP synthesis means more validated steps, more analytical testing, more documentation, and higher overhead, all of which drive up the Cost of Goods Sold (COGS).1

Furthermore, a well-chosen KSM can lead to a more efficient and higher-yielding chemical process. For example, selecting a KSM with a superior purity profile might eliminate the need for an extra purification step later on, saving time, materials, and money. Conversely, a poor KSM choice that introduces persistent impurities may necessitate complex, low-yield purification steps, inflating costs and reducing overall process efficiency. Strategic sourcing alone, when executed effectively, can potentially reduce overall drug production costs by up to 15%. However, hidden costs, such as import tariffs, inefficient procurement, and suboptimal inventory management, can more than double the final price of medications.

1.3 The Global Chessboard: Understanding the Current Landscape of KSM Sourcing

No KSM strategy can be developed in a vacuum. It must be informed by the geopolitical and economic realities of the global pharmaceutical supply chain—a network that has become dangerously concentrated and fragile.

The Perils of Geographic Concentration

Over the past few decades, driven by a relentless pursuit of economic efficiency, the manufacturing of KSMs and APIs has consolidated dramatically in a few key regions, primarily China and India. The statistics are staggering and paint a clear picture of systemic vulnerability:

- Over 80% of the world’s API supply is manufactured in China and India.1

- The United States, one of the largest pharmaceutical markets, imports over 60% of its APIs from these two nations.

- India, while a manufacturing powerhouse itself, is deeply dependent on China for its own upstream materials, importing as much as 70% to 90% of its KSMs and intermediates for certain drugs.11

- This has resulted in a 61% decrease in domestic API facilities in the U.S. over the last decade, with nearly 2,000 facilities closing or relocating.11

This extreme concentration has created what supply chain experts call “critical choke points”.1 A disruption in one region—whether from a natural disaster, a public health crisis like the COVID-19 pandemic, a quality failure at a major plant, or a geopolitical event—can send shockwaves through the entire global supply system, leading to widespread drug shortages.16

From Economic Strategy to National Security Threat

What began as a sound economic strategy to lower production costs has now evolved into a recognized national security concern for the United States and Europe.21 The over-reliance on a small number of foreign nations for the foundational materials of essential medicines—from antibiotics to cancer drugs—gives those nations significant geopolitical leverage.17

In response, governments are launching initiatives to de-risk their supply chains. These include programs to incentivize the “reshoring” (bringing manufacturing back domestically) or “near-shoring” (moving it to allied, geographically closer nations) of critical KSM and API production.6 India’s Production Linked Incentive (PLI) scheme and the U.S. government’s investments in domestic manufacturing are prime examples of this strategic shift.18 This evolving geopolitical landscape adds another layer of complexity to KSM sourcing decisions, forcing companies to balance cost not just against quality and regulatory risk, but also against long-term supply security and political stability.

The choice of a KSM, therefore, is the single most critical leverage point in managing the entire risk profile of a drug program. It is a decision that cascades through quality, regulatory, supply chain, and financial domains. The KSM defines the start of GMP, which in turn dictates a significant portion of manufacturing and compliance costs. Its impurity profile determines the complexity and cost of downstream purification and the risk of regulatory rejection.1 Its geographic source sets the geopolitical and logistical risk profile for the entire supply chain.1 Consequently, the KSM decision is not a siloed chemical choice but a multi-variable optimization problem that balances cost, quality, and risk. Mismanaging this decision creates liabilities in every subsequent stage of development and commercialization, reframing KSM selection from a technical task to a core strategic competency.

Section 2: The Regulatory Gauntlet – Navigating Global KSM Compliance

If the KSM is the strategic cornerstone of your API, then the regulatory framework is the complex and unforgiving terrain upon which you must build. Successfully navigating this landscape is not merely a matter of compliance; it is a prerequisite for market access. A misunderstanding of the rules, or a failure to anticipate the nuanced interpretations of different global agencies, can lead to devastating delays, costly rework, and even the outright rejection of your drug application. Mastering your KSM strategy means mastering the regulatory gauntlet.

2.1 The Rulebook: Deconstructing ICH Q7 and Q11 Guidelines

The global standards for KSM selection and control are primarily defined by two key guidelines from the International Council for Harmonisation (ICH), which brings together regulatory authorities and the pharmaceutical industry to discuss scientific and technical aspects of drug registration. Understanding these two documents is non-negotiable.

ICH Q7: Good Manufacturing Practice for Active Pharmaceutical Ingredients

ICH Q7 is the global “gold standard” for API manufacturing quality.26 While it covers the entire spectrum of API production, its most critical role in KSM strategy is to answer the question:

“When does GMP begin?”

The guideline unequivocally states that appropriate GMP standards must be applied to the manufacturing steps starting from the introduction of the designated “API Starting Material” (i.e., the KSM).8 It mandates the establishment of a comprehensive quality management system, including an independent quality unit, robust change control, and thorough documentation for every step conducted under GMP.26 This makes the formal designation of the KSM the trigger point for the entire pharmaceutical quality system. The company is responsible for designating this point and documenting a clear rationale for its choice.10

ICH Q11: Development and Manufacture of Drug Substances

If Q7 tells you when GMP starts, ICH Q11 tells you how to select and justify that starting point.31 This guideline is the central text for any regulatory submission involving a KSM. It moves away from rigid rules and toward a science- and risk-based approach, placing the burden of proof squarely on the applicant. An applicant must consider

all of the following general principles comprehensively, not just pick and choose the ones that are convenient 28:

- Significant Structural Fragment: The KSM must be incorporated as a significant structural piece of the final API. This principle is intended to distinguish a true starting material from a simple reagent, catalyst, or solvent that facilitates a reaction but doesn’t form a core part of the final molecule.28 Misinterpreting this to simply mean “structurally similar” is a common error; the intent is about contribution, not just appearance.

- Defined Chemical Properties and Structure: A KSM cannot be a crude mixture or an uncharacterized substance. It must be a well-defined chemical entity with known properties and a confirmed structure.2 This is why non-isolated intermediates, which are often transient and not fully purified or characterized, are generally considered inappropriate KSMs.28

- Impact on Impurity Profile: This is perhaps the most critical principle. ICH Q11 states that manufacturing steps that have an impact on the impurity profile of the final drug substance should normally be included in the GMP-controlled part of the process described in the regulatory application.2 This means if a particular chemical transformation is a major source of a critical impurity that ends up in your API, that step should ideally occur

after your designated KSM. - “Enough” of the Manufacturing Process: Regulators need to see enough of the synthesis under GMP to be confident in your control over the final product’s quality. A submission that defines the KSM as the penultimate intermediate in a three-step synthesis will likely be rejected because it doesn’t provide sufficient visibility into how critical quality attributes are established and controlled.13 The guideline recommends describing “multiple chemical transformation steps” under GMP to mitigate risks of contamination and to provide a basis for managing future process changes.

2.2 The Great Divide: FDA vs. EMA Interpretations and How to Bridge the Gap

While the ICH provides a harmonized set of guidelines, the world’s two most influential regulatory bodies—the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA)—often interpret and apply these principles with different philosophies. For any company seeking global market access, understanding and navigating this divide is a major strategic challenge.2

EMA’s Conservative and Process-Centric Stance

Historically, the EMA has adopted a more conservative and holistic view of the manufacturing process. European regulators often expect to see GMP controls applied earlier in the synthesis. They place a strong emphasis on understanding the entire synthetic chain, including the steps used to manufacture the KSM itself, even if those steps are non-GMP.

This tendency has been amplified by recent industry-wide crises, particularly the discovery of N-nitrosamine impurities in several classes of drugs. In response, the EMA has proposed significant updates to its guidelines that mandate a more comprehensive description of manufacturing processes. These draft rules require disclosure of all materials used (including quenching agents and gases), expression of reagents in molar equivalents, and a detailed risk assessment for the formation and carry-over of potent toxins like nitrosamines, not just in the API synthesis but also during the synthesis of the starting materials themselves. This reflects a clear regulatory desire for end-to-end process understanding and control.

FDA’s Science- and Risk-Based Flexibility

The FDA, while no less rigorous in its standards, has often demonstrated more flexibility, provided the applicant can build a powerful, data-driven scientific case.13 The agency is generally more open to accepting a later-stage KSM if the justification is supported by a robust risk assessment and comprehensive impurity fate-and-purge data that demonstrates a deep understanding of process control. However, this flexibility should not be mistaken for laxity. The FDA’s impetus for the modern guidance was concern over complex, multi-step syntheses of custom KSMs being conducted in non-GMP facilities, often in Asia, with little agency oversight into potential route changes that could introduce new impurities like heavy metals or genotoxins.

Bridging the Gap: A “Global-First” Strategy

The divergent philosophies of the FDA and EMA create a strategic imperative. Developing separate KSM strategies for each region is inefficient and risky. The most effective approach is a “global-first” strategy:

- Design for the Highest Standard: Assume from the outset that your KSM justification must satisfy the most stringent regulatory expectations, which typically align with the EMA’s process-centric view.

- Proactive and Early Engagement: Do not wait until you file your New Drug Application (NDA) or Marketing Authorisation Application (MAA) to discuss your KSM. Use early engagement opportunities, such as pre-IND meetings with the FDA and Scientific Advice procedures with the EMA, to present your proposed KSM and justification. This allows you to get crucial feedback early, align expectations, and de-risk your formal submission.2

- Develop a Unified, Robust Justification Package: Create a single, comprehensive data package that anticipates and addresses potential concerns from all relevant agencies. This unified approach minimizes rework and ensures consistency across global submissions.

2.3 Justification is Everything: Building an Unimpeachable Regulatory Case

Under the risk-based paradigm of ICH Q11, the quality of your justification is paramount. A weak or incomplete justification is one of the fastest routes to a lengthy information request cycle, which can delay approval by months or even years.

The Critical Distinction: Commercially Available vs. Custom Synthesized

Your justification requirements hinge on a critical distinction: the source of your KSM.

- Commercially Available Chemical: This is a material sold as a commodity in a pre-existing, non-pharmaceutical market.28 A key example might be a common chemical building block used in both the plastics and pharmaceutical industries. For a truly commercially available KSM, a detailed justification against ICH Q11 principles is generally not required, although you still need to provide a specification and basic information.13

- Custom Synthesized Chemical: This is a material made specifically to a drug manufacturer’s requirements, either in-house or by a contract manufacturer. Critically, even if this chemical becomes widely available from multiple suppliers, if its only use is for pharmaceutical manufacturing, it is still considered custom synthesized and requires a full, rigorous justification.2 This is a frequent point of confusion and regulatory friction.

Anatomy of a Bulletproof Justification Dossier

A successful KSM justification is a persuasive scientific narrative backed by comprehensive data. Your submission package must include the following essential components:

- Synthetic Route Diagram: A clear, unambiguous flow diagram outlining the entire synthetic route from raw materials to the final API. The proposed KSM(s) must be clearly indicated.

- Impurity Fate and Purge Study: This is the technical heart of the justification. It must provide detailed data demonstrating how every potential impurity from the KSM and prior steps is either effectively removed (purged) or transformed into a non-harmful species by the downstream process.1

- KSM Specification: A detailed specification for the proposed starting material, including validated analytical procedures and acceptance criteria for identity, assay, and purity. This must include limits for specified, unspecified, and total impurities, as well as any potentially mutagenic or elemental impurities.2

- ICH Q11 Narrative: A written justification that methodically addresses each of the general principles from ICH Q11, explaining why your chosen material is appropriate and how your control strategy ensures the quality and safety of the final API.28 For a custom-synthesized KSM, this should also include information on the synthetic route used to produce the KSM itself to justify the proposed controls.

The regulatory definition and justification of a KSM is not a static, check-the-box exercise. It is a dynamic negotiation with regulatory bodies where the strength of your scientific understanding and risk assessment determines your operational flexibility and cost structure. ICH Q11 replaced rigid rules with risk-based concepts, shifting the burden of proof entirely onto the applicant to provide a convincing scientific narrative. Regulators are increasingly concerned with what they cannot see—the non-GMP steps prior to the KSM.13 Their questions about impurity control and process understanding are proxies for this concern. Therefore, a successful justification is not about merely meeting the principles on paper; it is about demonstrating such profound process knowledge that the regulator feels confident that the risks originating in the non-GMP space are thoroughly understood and controlled. This means the “unseen” part of your supply chain is just as important as the “seen” part in your regulatory submission. A company that invests in understanding its supplier’s processes, even before the official KSM starting point, will build a much more persuasive and successful regulatory case.

Table 1: FDA vs. EMA: Key Differences in KSM Regulatory Expectations

To aid in developing a global-first strategy, the following table summarizes the key philosophical and practical differences between the FDA and EMA regarding KSMs.

| Feature | U.S. FDA Approach | European Medicines Agency (EMA) Approach | Strategic Implication for Applicants |

| Starting Point of GMP | More flexible; may accept a later-stage KSM if supported by a strong, science- and risk-based justification and robust impurity control data.13 | More conservative; generally expects GMP to be applied earlier in the synthesis to ensure adequate process control and visibility.2 | Design the process assuming the need to justify an earlier starting point for the EMA. A later point may be negotiable with the FDA, but the reverse is less likely. |

| Impurity Control Philosophy | Focuses heavily on the demonstration of impurity fate and purge. A robust study showing effective clearance can justify a later KSM. | Holistic view; concerned not only with purging but also with preventing impurity formation in the first place, requiring more detail on the KSM’s own synthesis. | The impurity control strategy must be comprehensive, addressing both formation (for EMA) and removal (for FDA). Provide data on the KSM’s synthesis route. |

| View on Custom Synthesis | Acknowledges the reality of custom synthesis but places a high burden of justification on the applicant to demonstrate control over a non-GMP process. | Highly scrutinized. The lack of GMP oversight for custom-synthesized KSMs is a primary concern, driving the demand for more process information. | Never assume a custom-synthesized material will be accepted without a full ICH Q11 justification. The “commercial availability” argument is very narrowly defined. |

| Justification for Late-Stage KSMs | Possible, but requires an exceptionally strong data package demonstrating deep process understanding and minimal risk from upstream steps. | Very challenging. The agency often argues that critical quality-defining steps (e.g., establishing stereochemistry) should be under GMP.28 | A late-stage KSM is a high-risk regulatory strategy. Be prepared with extensive data and a backup plan for designating an earlier material if challenged. |

| Role of “Commercial Availability” | A key factor for reducing the justification burden. The definition is strict: must be a commodity in a non-pharma market. | Also a key factor, but the EMA may still request information about the manufacturing process if the KSM is structurally complex or introduced very late in the synthesis. | Thoroughly document the non-pharmaceutical use of any proposed commercially available KSM with market evidence. Do not rely on simply having multiple suppliers. |

| Recent Guideline Updates | Follows ICH updates but has not issued recent standalone guidance as extensive as the EMA’s. | Proactively updating guidelines to address new risks, such as nitrosamine impurities, requiring more stringent risk assessments for starting materials. | Stay current with the latest EMA draft guidelines, as they are often a leading indicator of future global regulatory expectations. |

Section 3: The Art of the Start – A Framework for Optimal KSM Selection

With a firm grasp of the strategic and regulatory stakes, we can now turn to the practical challenge: how do you actually choose the right KSM? This is not a simple choice but a multi-variable optimization problem. The optimal KSM lies at the intersection of synthetic feasibility, robust impurity control, regulatory acceptability, and commercial viability. A disciplined, data-driven framework is essential to navigate these competing priorities and make a choice that is both scientifically sound and strategically astute.

3.1 The Influence of Synthesis: How Route and Complexity Shape Your KSM Choice

The chemical pathway you design to build your API—the synthetic route—is the primary factor that defines your universe of potential KSM candidates. The structure and complexity of this route directly influence both your internal selection process and the expectations of regulatory agencies.

Synthetic Route Complexity and Regulatory Expectations

There is a direct relationship between the length and complexity of your API synthesis and the flexibility you have in designating a KSM.

- Long, Complex Syntheses: For an API that requires ten or more chemical transformations, regulators are generally more willing to accept an intermediate that enters later in the process as the KSM. The rationale is that the numerous preceding steps provide ample opportunity for purification and control, and bringing the entire lengthy process under GMP would be economically prohibitive and practically unnecessary.

- Short, Simple Syntheses: Conversely, if your API is made in just two or three steps, regulators will almost certainly require that the very first raw material be designated as the KSM. In such cases, there is no credible argument for excluding any step from GMP oversight, as every transformation is critical to the final product’s quality.

Convergent vs. Linear Synthesis

The architecture of your synthesis also matters.

- Linear Synthesis: A traditional A → B → C → API pathway. Here, you will typically propose one KSM at an appropriate point early in the sequence.

- Convergent Synthesis: A strategy where different fragments of the molecule are synthesized separately and then joined together (e.g., A → B and C → D, then B + D → API). In this case, the principles of ICH Q11 must be applied independently to each branch of the synthesis. This means you will need to select and justify a KSM for the A → B branch and a separate KSM for the C → D branch. GMP begins at the introduction of KSM ‘A’ and KSM ‘C’ in their respective pathways.

Special Considerations for Different Modalities

The nature of the API itself introduces unique KSM considerations.

- Semi-Synthetic APIs: These molecules often start with a complex precursor isolated from a natural source (e.g., a plant extract or fermentation broth), which is then chemically modified. The natural product precursor is often the logical choice for the KSM. However, it cannot simply be treated as a raw agricultural commodity. It must be rigorously characterized, with defined specifications for purity, identity, and impurity profiles, and the extraction and purification process must be well-controlled to ensure consistency.

- Biologics and Fermentation-Derived APIs: For these products, the concept of a “starting material” is different. The rationale is established on a case-by-case basis, but it typically begins with the establishment of a well-characterized cell bank (e.g., Master Cell Bank or Working Cell Bank).9 The “manufacturing process” under GMP then includes all subsequent steps: cell culture/fermentation, harvesting, isolation, and purification.

3.2 The Impurity Chase: Mastering Fate and Purge Analysis

This is the technical crucible where your KSM justification is forged or broken. A fate and purge study is a systematic investigation designed to prove to regulators that you have a comprehensive understanding and control over every potential impurity that could arise from your KSM or the steps preceding it.1 It is your primary evidence that your process has sufficient “purging power” to deliver a consistently pure and safe API.

A Four-Step Methodology for a Robust Study

A credible fate and purge study follows a clear, logical progression:

- Identify: The first step is a thorough and systematic identification of all actual and potential impurities in the proposed KSM. This goes beyond what you see on a typical Certificate of Analysis. It includes starting materials and reagents used to make the KSM, potential by-products of that synthesis, stereoisomers, and degradation products.

- Track (Spiking Studies): To determine the fate of these impurities, you must deliberately introduce, or “spike,” known quantities of them into your lab-scale manufacturing process. You then track their concentration through each subsequent reaction, work-up (e.g., extraction, washing), and purification (e.g., crystallization, chromatography) step.

- Quantify: Using validated analytical methods, you measure the concentration of the impurity before and after each process step. This allows you to calculate a “clearance factor” or “purge factor” for that impurity at that specific step.

- Justify: The cumulative effect of all the clearance factors across the process demonstrates the overall purging capability of your synthesis. This data is used to justify the acceptance criteria in your KSM specification. For example, you can argue that a 0.5% level of Impurity X in the KSM is acceptable because your process is proven to reduce its level by a factor of 1000, resulting in a negligible amount in the final API.

The High Stakes of Mutagenic Impurities (MIs)

Regulators place extreme emphasis on the control of mutagenic impurities (MIs)—substances that can damage DNA and potentially cause cancer. These are governed by the much stricter ICH M7 guideline and are a major focus of any KSM review. Your risk assessment must be exhaustive and must consider:

- Known Mutagens: Any reagents or materials used in the synthesis (including the synthesis of the KSM) that are known mutagens.

- Structural Alerts: Any intermediates or by-products that have chemical structures known to be associated with mutagenicity.

- Control Strategy: For any potential MI, you must either demonstrate its effective removal to a level below the Threshold of Toxicological Concern (TTC) or include a specific test for it at an appropriate stage in the process. The EMA’s recent focus on nitrosamines, a class of potent MIs, underscores the critical importance of this analysis. Your assessment must convincingly show that no MIs formed or introduced before the KSM can persist and impact the final drug substance.28

3.3 Balancing Act: Commercial vs. Custom KSMs and Key Selection Criteria

The final selection of a KSM involves a strategic balancing of technical, regulatory, and commercial factors. The choice between a commercially available material and a custom-synthesized one is a primary fork in the road, each with distinct advantages and disadvantages.

The Strategic Trade-Offs

- Commercially Available KSM:

- Pros: Significantly lower regulatory justification burden; potentially lower cost due to economies of scale; possibility of multiple suppliers, which reduces supply risk.

- Cons: Little to no control over the supplier’s manufacturing process; risk of batch-to-batch variability that could impact your process; risk that the supplier may change their process or specifications without your knowledge, as their primary market may not be pharmaceuticals.

- Custom Synthesized KSM:

- Pros: Full control over the manufacturing process and specifications, ensuring material is tailored to your exact needs; greater transparency and partnership with the supplier (or full control if made in-house).

- Cons: High regulatory justification burden; often higher cost due to specialized production; significant dependency on a single or small number of qualified suppliers, creating a potential supply chain bottleneck.

A Holistic Framework: The “SELECT” Criteria

To make a holistic and defensible KSM choice, it’s useful to adapt the “SELECT” criteria, a framework originally developed for assessing pharmaceutical processes.37 When evaluating a potential synthetic route and its candidate KSMs, consider the following:

- S – Safety: Does the route to and from the KSM involve hazardous reagents, reactive intermediates, or extreme process conditions? A safer route is always preferable.

- E – Environment: What is the environmental impact? Does the process use green solvents, minimize waste (high atom economy), and have a lower carbon footprint? Sustainability is an increasingly important factor.

- L – Legal: What is the intellectual property landscape? Does the synthetic route to the KSM or its use infringe on existing patents? A thorough Freedom-to-Operate (FTO) analysis is crucial.

- E – Economics: What is the overall cost? This includes the price of the KSM, the cost of subsequent processing steps, the yield, and the throughput. The goal is to achieve the lowest sustainable COGS.

- C – Control: How well can the process be controlled to ensure consistent quality? This relates directly to the impurity profile. A route that is robust and easily controlled is superior to one that is sensitive and prone to variability.

- T – Throughput: How efficient is the process? Does it allow for high productivity and rapid cycle times? This is especially important for high-volume drugs.

By systematically evaluating potential KSMs against these criteria, you can move beyond a purely chemical or regulatory decision to one that is strategically optimized for the entire product lifecycle. The decision between a commercial and a custom KSM is not just a procurement choice; it is a strategic decision about where in the value chain a company chooses to own risk and control. Choosing a commercially available KSM effectively outsources the manufacturing risk of that material to a third party. The company accepts the risk of supply disruption and quality variability in exchange for a lower regulatory burden. Choosing a custom-synthesized KSM internalizes the manufacturing risk, either in-house or with a dedicated CMO. The company accepts a higher regulatory burden and supplier dependency in exchange for greater control over quality and process. This decision should be driven by the company’s core competencies. A company with strong chemical development and supplier management capabilities might favor a custom KSM to build a more defensible and controlled process. A virtual biotech, on the other hand, might prefer a commercially available KSM to simplify its CMC package and focus its limited resources elsewhere. The optimal KSM selection, therefore, aligns with the company’s broader business model and risk appetite. It is about strategically allocating risk and control to the parts of the supply chain where the company has the greatest competitive advantage.

Section 4: Building a Bulletproof Supply Chain – From Geopolitical Risk to Global Resilience

A perfectly selected and justified KSM is worthless if you cannot reliably source it. In today’s volatile world, building a resilient supply chain is no longer a competitive advantage; it is a fundamental requirement for survival. The era of optimizing supply chains for cost alone is over. The new paradigm demands a multi-variable approach that balances cost with security, efficiency with redundancy, and predictability with agility. For your KSM, the starting point of your entire value chain, this is doubly true.

4.1 The High Cost of Efficiency: Deconstructing Supply Chain Vulnerabilities

The modern pharmaceutical supply chain, particularly for KSMs and APIs, is a marvel of global efficiency. It is also a case study in systemic fragility. Decades of offshoring and consolidation have created a system that is highly optimized for a stable world but dangerously vulnerable to shocks.

Geopolitical and Concentration Risks

As detailed earlier, the overwhelming concentration of KSM and API manufacturing in China and India is the single greatest vulnerability. This is not a theoretical risk. The COVID-19 pandemic provided a brutal, real-world stress test. National lockdowns, export restrictions, and crippled logistics networks led to widespread disruptions and highlighted the danger of relying on a handful of distant suppliers for the world’s medicines.16

This dependency creates several layers of risk:

- Geopolitical Leverage: A trade dispute, military conflict, or deliberate export ban involving a major producing nation could instantly sever the supply of critical KSMs, creating a public health crisis in importing countries.17 This has elevated supply chain security to a matter of national security.

- Single-Facility Choke Points: The risk is often even more granular than at the country level. For many essential drugs, a significant portion of the global supply of a critical KSM or intermediate comes from a single manufacturing facility.18 A localized event—a fire, a flood, a major quality failure leading to a regulatory shutdown—at that one site can trigger a global shortage.

- Economic Fragility of Generics: The generic drug market is characterized by intense price competition, which drives manufacturer profit margins to razor-thin levels.42 This creates a vicious cycle: low margins disincentivize investment in facility modernization, robust quality management systems, and building redundant manufacturing capacity. This lack of investment makes manufacturers more susceptible to quality failures and less able to weather economic shocks, leading to market exits and further supply consolidation. This creates a brittle supply chain that is prone to breaking under stress.42

4.2 The Resilience Playbook: Strategies for Mitigating Risk

Building a resilient supply chain requires a deliberate, proactive, and multi-faceted strategy. It is about designing a network that can absorb shocks, adapt to disruptions, and recover quickly.

Diversification and Redundancy: The Cardinal Rule

The cornerstone of any resilience strategy is the elimination of single points of failure. This means embracing diversification and redundancy at every level 1:

- Dual/Multi-Sourcing: The most fundamental tactic is to qualify at least two, and preferably three, suppliers for every critical KSM. Crucially, these suppliers should be geographically dispersed to mitigate regional risks.2 Having a qualified supplier in North America and another in Europe is infinitely more resilient than having two suppliers in the same industrial park in China.

- Near-Shoring and On-Shoring: Actively explore manufacturing partners in geopolitically stable regions that are geographically closer to your key markets. For U.S. and European companies, this could mean qualifying suppliers in Mexico, Canada, or Eastern Europe. Furthermore, take advantage of government incentives designed to bring manufacturing back onshore. While domestic production may come at a higher price point, that premium should be evaluated as an insurance policy against catastrophic supply disruption.6

Visibility Through Supply Chain Mapping

You cannot manage the risks you cannot see. The complexity of the pharmaceutical supply chain often means that companies lack visibility beyond their direct Tier 1 suppliers. A critical vulnerability may lie with your supplier’s supplier (Tier 2) or even further upstream.

Comprehensive supply chain mapping is the process of systematically tracing and documenting the entire production network, from the finished drug product all the way back to the manufacturers of the KSMs and their raw material sources.17 This is a painstaking process that involves combining procurement data, regulatory filings, and direct interviews with suppliers. However, the payoff is immense. It reveals hidden dependencies, single-source choke points, and geographic concentration risks that would otherwise remain invisible until a crisis hits. Global health agencies have pioneered this “river tracing” methodology to secure the supply of essential medicines like antiretrovirals, demonstrating its power and feasibility.

From “Just-in-Time” to “Just-in-Case”

For decades, supply chain management was dominated by the “just-in-time” (JIT) philosophy, which aimed to minimize inventory and its associated carrying costs. While efficient, JIT creates a system with no slack to absorb disruptions.

For critical medicines, a shift toward a “just-in-case” model is necessary. This involves strategic inventory management, where buffer stocks of critical KSMs, intermediates, or even final APIs are deliberately held at key nodes in the supply chain.1 The size of this buffer should be determined by a risk assessment that considers the supplier’s location, the KSM’s criticality, and the lead time required to qualify and switch to an alternate source. This strategic inventory acts as a shock absorber, buying valuable time to respond to a disruption without interrupting supply to patients.

4.3 Managing Volatility: Taming Raw Material Price Fluctuations

Beyond physical disruptions, financial volatility is another significant risk in the KSM supply chain. The prices of KSMs can fluctuate wildly based on the costs of their own underlying raw materials (many of which are tied to volatile commodities like crude oil), as well as supply-demand imbalances, new regulations, or geopolitical events.50

Several strategies can help manage this price volatility:

- Long-Term Contracts and Fixed Pricing: Where possible, move away from spot-market purchases and negotiate long-term supply agreements with your key KSM partners. These contracts can often include fixed pricing for a set period or pre-defined price adjustment formulas tied to specific, transparent commodity indices. This provides predictability for both you and your supplier, fostering a more stable relationship.48

- Cost Transparency and Partnership: Work collaboratively with your suppliers to gain transparency into their cost structure. Understanding what percentage of their KSM price is driven by volatile raw materials versus fixed costs (like labor and overhead) allows for more intelligent negotiations and risk-sharing agreements.

- Financial Hedging: For KSMs whose cost is heavily influenced by a traded commodity, consider using financial instruments like futures or options contracts to hedge against adverse price movements. This can insulate your COGS from market spikes.

- Process Innovation: Invest in R&D to develop more efficient synthetic routes or to enable the use of alternative, more stable, and less costly raw materials. This is a long-term strategy but can provide the most durable protection against price volatility.

True supply chain resilience is not about eliminating risk, which is impossible, but about building strategic flexibility. This requires a fundamental shift in the corporate mindset from optimizing for the most likely scenario (the lowest cost in a stable world) to preparing for a range of possible, and increasingly probable, disruptive scenarios. The traditional supply chain is optimized for a single variable: cost. This creates a highly efficient but brittle system. Recent events have demonstrated that low-probability, high-impact disruptions are occurring with greater frequency.39 A resilient supply chain must be optimized for multiple variables: cost, speed, quality, and security. This is an inherently more complex and expensive model, involving investments in redundancy (like dual sourcing) and buffers (like strategic inventory).45 The investment in resilience, therefore, cannot be justified by traditional ROI calculations based on steady-state operations. It must be framed as a strategic insurance policy. The “premium” is the higher operational cost of diversification and inventory, and the “payout” is the avoidance of catastrophic losses—in terms of lost sales, reputational damage, and patient harm—during a disruption. Consequently, leadership must champion a new financial and operational model for the supply chain, one that values risk mitigation and business continuity on par with cost efficiency.

Section 5: The Supplier Partnership Playbook – Qualification, Management, and Quality Agreements

Building a resilient supply chain is not just about network design and inventory strategy; it is fundamentally about people and relationships. The way you select, qualify, and manage your KSM suppliers is the operational core of your entire strategy. A transactional, adversarial approach focused solely on price will yield a fragile and opaque supply chain. A collaborative, partnership-based approach built on transparency and mutual trust will create a robust, agile, and ultimately more competitive network.

5.1 More Than a Transaction: Adopting a Risk-Based Approach to Supplier Management

The foundational principle of modern supplier management is a risk-based approach. This means recognizing that not all suppliers and materials carry the same level of risk, and therefore, the intensity of your oversight should be tailored to the criticality of the component they provide.55 Wasting resources on exhaustive audits of a low-risk commodity solvent supplier while only performing a paper-based qualification of your single-source KSM manufacturer is a recipe for disaster.

A Practical Framework: Supplier Tiering

A simple yet powerful way to implement a risk-based approach is to classify your suppliers into tiers based on their potential impact on your final product quality and patient safety 57:

- Tier 1 (High Risk / Critical): This tier is reserved for suppliers of materials that have a direct and critical impact on the API. This always includes the supplier of your designated KSM. It also includes suppliers of any custom-synthesized, non-commercial intermediates and any materials that have a demonstrated impact on the final API’s purity or physical properties. These suppliers require the highest possible level of qualification and ongoing oversight.

- Tier 2 (Medium Risk): This category includes suppliers of less critical but still important materials. Examples include manufacturers of key reagents that are consumed in the reaction, significant processing aids, or primary packaging components that come into direct contact with the API. The level of oversight is substantial but may be less intensive than for Tier 1.

- Tier 3 (Low Risk): This tier is for suppliers of non-critical, commodity materials. This includes common solvents, basic inorganic reagents, or secondary packaging materials. These suppliers can typically be qualified with a less rigorous process.

This tiering system provides a clear and defensible rationale for allocating your finite quality and audit resources where they are needed most.

5.2 The Qualification Gauntlet: A Step-by-Step Process

Supplier qualification is a formal, documented process to verify that a potential supplier can consistently provide a material that meets your predefined requirements. It is a rigorous gauntlet designed to vet suppliers before they are ever allowed to enter your commercial supply chain. A best-practice qualification process is a multi-stage endeavor.59

- Initial Screening and Pre-Qualification: The process begins with a paper-based assessment. The procurement team identifies potential suppliers, and the quality unit sends out a detailed supplier qualification questionnaire. This document is designed to gather critical information about the supplier’s Quality Management System (QMS), manufacturing capabilities, process controls, regulatory inspection history (e.g., FDA 483s or Warning Letters), and financial stability.2 The responses are reviewed to create a shortlist of viable candidates.

- On-Site Audits: For all Tier 1 and most Tier 2 suppliers, an on-site audit is an indispensable step.59 This is not a simple check-the-box exercise. A well-executed audit, typically conducted by a cross-functional team including a quality auditor and a technical expert, aims to:

- Verify that the supplier’s stated procedures and systems are actually being followed on the plant floor.

- Assess the “quality culture” of the organization. Is quality a priority for management, or is it just a department?

- Evaluate the robustness of their process controls, deviation management, and change control systems.

- Confirm that facilities and equipment are fit for purpose and properly maintained.

- Sample Testing and “Fit-for-Use” Evaluation: Concurrently with the audit process, the R&D and analytical teams must conduct a thorough evaluation of sample material from the potential supplier. This goes beyond simply confirming that the material meets the written specification. It involves testing multiple, distinct batches (typically three) to assess consistency. Furthermore, the material should be run through the actual manufacturing process at a laboratory or pilot scale to ensure it performs as expected and does not introduce any unexpected process variability or impurities. This is known as a “fit-for-use” assessment.59

- Formal Approval and the Approved Supplier List (ASL): Only when a supplier has successfully passed all stages—questionnaire, audit, and sample evaluation—should they be formally approved. This approval is documented, and the supplier is added to the official Approved Supplier List (ASL), a controlled document that lists all qualified vendors for each material. No commercial material should ever be purchased from a supplier not on the ASL.

5.3 The Rulebook for Partnership: Crafting an Ironclad Quality Agreement

While a commercial supply contract governs terms like price, delivery schedules, and liabilities, it is the Quality Agreement (QA) that governs the relationship from a GMP perspective. A Quality Agreement is a formal, legally binding written contract that clearly defines and delineates the specific quality-related roles, responsibilities, and activities of both your company and your KSM supplier.65 It is arguably the most important document in your supplier relationship.

A robust Quality Agreement should be a standalone document, separate from the commercial agreement, and must be written with active participation from both parties’ Quality Units. Its essential components include 2:

- Scope and Responsibilities: A detailed responsibility matrix (often as an appendix) that clearly states which party is responsible for each specific GMP activity. This includes tasks like raw material testing, setting specifications, manufacturing, testing and release of the KSM, handling deviations and out-of-specification (OOS) results, stability testing, and record retention.

- Change Control: This is the most critical provision. The QA must establish a rigid change control procedure that contractually obligates the supplier to notify you in writing of any proposed change to their raw materials, manufacturing process, equipment, facility, or analytical methods before they are implemented. This gives you the right to review and approve changes that could potentially impact your product, preventing unwelcome surprises.

- Communication and Notification: The agreement must define the protocols and timelines for communicating critical information, such as deviations, OOS investigations, regulatory inspections of the supplier’s site, and customer complaints related to the material.

- Right to Audit: The QA should formalize your right to conduct routine periodic audits and for-cause audits (e.g., in response to a major quality issue) of the supplier’s facility, records, and data.

- Documentation and Data Integrity: The agreement should specify the requirements for batch documentation, Certificates of Analysis (CoA), and the maintenance and accessibility of records. It should also address expectations for data integrity, a major focus of regulatory inspections.

5.4 Beyond Qualification: Ongoing Performance Monitoring

Qualification is the entry ticket, not a lifetime pass. Once a supplier is on your ASL, a system for ongoing performance monitoring is essential to ensure they continue to meet your standards and to detect any negative trends early.60

An effective monitoring program includes:

- Tracking Key Performance Indicators (KPIs): Regularly track and trend objective metrics of supplier performance. Common KPIs include batch acceptance rate, number of quality-related complaints or deviations, on-time-in-full (OTIF) delivery performance, and the timeliness and effectiveness of their responses to corrective actions (CAPAs).57

- Supplier Scorecards: Consolidate these KPIs into a periodic supplier scorecard. This provides a quantitative basis for regular business review meetings with the supplier, allowing for data-driven discussions about performance and areas for improvement.

- Periodic Re-qualification: The qualification status of a supplier is not permanent. It should be periodically reviewed and re-affirmed. The frequency of this re-qualification (which may include a re-audit) should be risk-based. A high-risk Tier 1 supplier might be re-audited every two years, while a low-risk Tier 3 supplier might only require a periodic review of their documentation.

Table 2: KSM Supplier Risk Assessment Matrix

This matrix provides a simple yet powerful tool for implementing a risk-based approach to supplier management. It helps prioritize oversight activities by categorizing suppliers based on their potential impact and the likelihood of failure.

| Impact on Final Product Quality / Patient Safety | Likelihood of Supplier Failure (Low) | Likelihood of Supplier Failure (Medium) | Likelihood of Supplier Failure (High) |

| High | Strategic Partner: On-site audit every 2-3 years. Robust Quality Agreement. Collaborative forecasting and joint process improvement initiatives. | Intensive Management: On-site audit every 1-2 years. Stringent Quality Agreement with tight change control. Dual-sourcing strategy highly recommended. Increased incoming testing. | High-Risk / Mitigate or Replace: Mandatory dual-sourcing. Annual on-site audits. Hold strategic safety stock. Actively seek and qualify alternative suppliers. |

| Medium | Reliable Supplier: On-site audit at qualification, re-audit based on performance. Standard Quality Agreement. Monitor performance via scorecards. | Managed Supplier: On-site audit every 3-4 years. Quality Agreement in place. Regular performance reviews. Consider qualifying a backup supplier. | Problematic Supplier: For-cause audit required. Implement CAPA plan with supplier. Increase scrutiny and incoming testing. Begin search for alternatives. |

| Low | Standard Oversight: Paper-based qualification (questionnaire). Acceptance of CoA with periodic identity testing. | Standard Oversight: Paper-based qualification. Monitor for negative trends in quality or delivery. | Monitor Closely: Increased frequency of CoA verification. Assess potential impact of failure on non-critical processes. |

Likelihood of Supplier Failure is assessed based on factors such as financial stability, regulatory compliance history, geographic location (geopolitical risk), technological capability, and transparency.

The relationship with a critical KSM supplier should be managed not as a simple vendor-customer transaction, but as a strategic partnership—an extension of one’s own manufacturing network. A critical KSM supplier’s failure, whether in quality or supply, directly translates into the company’s failure.46 Their risk is your risk. While traditional procurement often focuses on negotiating the lowest price from a position of leverage, a partnership model focuses on creating shared value and mutual transparency. This involves sharing demand forecasts to help the supplier plan, potentially investing in their process improvements, and collaborating on risk mitigation strategies.49 A strong partnership, codified in a robust Quality Agreement, creates a more resilient and transparent supply chain. The supplier is far more likely to provide early warnings of potential issues and work collaboratively to solve them, rather than hiding problems to avoid penalties. Therefore, the most successful KSM strategies involve a cultural shift from adversarial negotiation to collaborative risk management. The investment in building these strong supplier relationships provides a return in the form of increased reliability, transparency, and resilience that far outweighs any marginal cost savings achieved through aggressive, short-sighted price negotiation.

Section 6: The Intelligence Edge – Leveraging Patent Data for Competitive Advantage

In the hyper-competitive pharmaceutical landscape, a robust KSM strategy cannot exist in a vacuum. It must be inextricably linked with a sophisticated intellectual property (IP) strategy. The synthetic route you choose, the KSM you select, and the suppliers you partner with are all decisions that have profound IP implications. Ignoring the patent landscape is akin to navigating a minefield blindfolded. Conversely, leveraging patent intelligence proactively can transform your KSM strategy from a simple sourcing plan into a powerful tool for carving out market share, deterring competition, and maximizing the commercial life of your products.

6.1 The Patent Landscape: Why IP Strategy Starts with the KSM

Your IP strategy doesn’t begin when you file a patent on your final molecule; it begins the moment you start designing the process to make it. The selection of a KSM and the synthetic route to convert it into an API are foundational decisions that must be informed by a deep understanding of the patent landscape.

Securing Freedom to Operate (FTO)

Before you invest millions in process development and clinical trials, you must have confidence that you are not infringing on someone else’s intellectual property. A Freedom to Operate (FTO) analysis is a non-negotiable due diligence step. This involves a thorough search and analysis of the patent literature to ensure that the specific chemical transformations, reagents, and conditions you plan to use are not covered by a competitor’s active “process patents”.

A process patent protects the method of making a product, not the product itself. You could have a valid patent on a novel API, but if the only viable way to manufacture it is covered by a competitor’s process patent, you are blocked from the market. Your KSM choice is central to this analysis, as it defines the starting point of the synthetic route you need to clear for FTO.

Strategic Route Selection and “Patent Thickets”

Patent intelligence is not just a defensive tool; it’s a strategic one. A comprehensive analysis of the patent landscape can reveal which synthetic pathways are heavily patented by competitors—creating dense and overlapping networks of protection often called “patent thickets”.75 Attempting to operate in such a space is an invitation for costly and time-consuming litigation.

An intelligent KSM strategy uses this data to its advantage. By identifying routes that are less crowded with IP, you can select a KSM that sets you on a clearer, more defensible path to market. This is particularly crucial for generic and biosimilar companies, whose entire business model rests on finding a non-infringing way to manufacture an off-patent drug.

The selection of the target API itself is the true cornerstone of the KSM strategy. This high-level decision must be informed by a holistic view that integrates market demand, the intensity of competitive pressures, and, critically, a deep understanding of the existing patent landscape to avoid conflicts with competitor portfolios.78

6.2 Turning Data into Market Domination with Patent Intelligence Platforms

The sheer volume and complexity of global patent data make manual analysis an impossible task. Modern IP strategy relies on specialized business intelligence platforms that aggregate, analyze, and visualize this data, turning it into actionable insights.

The Power of a Platform: Introducing DrugPatentWatch

Platforms like DrugPatentWatch have become indispensable tools for pharmaceutical strategists. They serve as a global biopharmaceutical business intelligence hub, providing a fully integrated and continuously updated database of drug patents, regulatory statuses, litigation, clinical trials, and supplier information from over 130 countries.1 Such platforms transform raw data into a strategic asset, enabling companies to make faster, more informed decisions across the entire drug lifecycle.

Strategic Use Cases for Generic and Biosimilar Companies

For companies focused on off-patent products, patent intelligence is the lifeblood of their business.

- Identifying Market Entry Opportunities: The most fundamental use is to monitor patent expiration dates and patent term extensions for blockbuster drugs. Platforms like DrugPatentWatch allow companies to build a pipeline of future generic targets and prioritize their development resources on the most lucrative opportunities.80

- Informing Paragraph IV Challenges: In the U.S., the Hatch-Waxman Act allows generic companies to challenge the validity of a branded drug’s patents. A successful “Paragraph IV” challenge can grant the first generic filer 180 days of market exclusivity, a highly valuable prize. Patent intelligence platforms are essential for analyzing the branded drug’s patent portfolio, identifying weaker secondary patents (e.g., those on formulations, polymorphs, or methods of use) that are prime candidates for a legal challenge, and tracking ongoing litigation outcomes.80

- Sourcing Non-Infringing KSMs and APIs: Once a target is selected, these platforms can help identify potential suppliers of KSMs and APIs by providing data on Drug Master File (DMF) holders and manufacturing sources disclosed in patent literature, helping to build a non-infringing supply chain from the ground up.80

Strategic Use Cases for Innovator Companies

For innovator companies, patent intelligence is a tool for both offense and defense.

- Maximizing Exclusivity through Lifecycle Management: The base patent on an API typically provides around 12-14 years of effective market exclusivity after accounting for development and regulatory review time. To maximize a drug’s commercial life, innovator companies employ sophisticated lifecycle management or “evergreening” strategies. This involves systematically filing a series of secondary patents on improvements and new inventions related to the drug throughout its life.75 These can include patents on:

- New, more stable crystalline forms (polymorphs).

- Novel formulations (e.g., extended-release versions).

- New methods of use (i.e., new therapeutic indications).

- Combination products with other drugs.

- Improved manufacturing processes.

This strategy creates the aforementioned “patent thicket,” a formidable barrier that can delay generic competition for years beyond the expiration of the original compound patent. - Competitive Intelligence: By monitoring the patent filings of competitors, a company can gain invaluable insights into their R&D pipeline, their technological focus, and their strategic direction. This allows for proactive strategy adjustments and helps identify potential partnership or acquisition opportunities.

6.3 Beyond Patents: Protecting Trade Secrets in KSM Synthesis

Not all valuable intellectual property is, or should be, patented. A trade secret is any confidential business information which provides an enterprise a competitive edge. In the context of KSM strategy, a trade secret could be an unpatented but highly optimized step in your synthetic route, a unique purification technique that provides superior impurity removal, a proprietary analytical method, or even your meticulously curated list of qualified suppliers.

Unlike patents, which require public disclosure in exchange for a limited monopoly, trade secrets are protected by one thing: secrecy. This requires a different but equally rigorous set of protection mechanisms:

- Robust Contractual Protections: All employees, contractors, and, most importantly, KSM suppliers and contract manufacturers must be bound by strong, enforceable confidentiality and non-disclosure agreements (NDAs).

- Secure Information Management: Access to sensitive process information must be strictly controlled. This involves secure data storage, password-protected document management systems, and need-to-know access policies to prevent inadvertent disclosure or theft.

The decision to patent a process innovation or protect it as a trade secret is a critical strategic choice. Patenting provides stronger, legally enforceable protection but requires disclosure and expires after 20 years. A trade secret can last forever, but it offers no protection if the secret is independently discovered by a competitor or is leaked.

Table 3: Strategic Application of Patent Intelligence in the KSM Lifecycle

This table provides a practical roadmap for integrating patent intelligence into key business decisions at each stage of the KSM and API development lifecycle.

| Development Stage | Key Strategic Question | Type of Patent Intelligence Needed | Actionable Insight Gained |

| Early R&D / API Selection | Which therapeutic areas offer the best balance of medical need and competitive white space? | Landscape analysis of patent filings by therapeutic class; analysis of patent challenger activity. | Identify crowded, highly litigious areas to avoid versus less-contested areas with greater market entry potential.79 |

| Process Development & KSM Selection | Is our proposed synthetic route for the KSM and its conversion to the API free from infringement risk? | Freedom-to-Operate (FTO) search focusing on process patents and patents for key intermediates. | Select a KSM and synthetic route that is legally defensible, avoiding costly litigation and potential market blockade.74 |

| Generic Portfolio Selection | Which high-value branded drugs are losing patent protection in the next 3-5 years? | Monitoring of patent expiration dates, patent term extensions (PTE), and regulatory exclusivities. | Prioritize and allocate R&D resources to the most commercially attractive generic development targets.80 |

| Lifecycle Management (Innovator) | How can we extend the market exclusivity of our flagship branded drug? | Analysis of competitor “evergreening” strategies; identifying patentable aspects of our own product (e.g., new formulations, uses). | Develop and file a strategic portfolio of secondary patents to create a “patent thicket” and delay generic entry.75 |

| Supplier Sourcing & Qualification | Which companies are potential manufacturers of a specific KSM or API? | Search of patent assignees and inventor information; analysis of Drug Master File (DMF) databases. | Identify and vet potential manufacturing partners with demonstrated expertise in the relevant chemistry.80 |

A company’s patent strategy and its KSM/sourcing strategy are two sides of the same coin; they must be developed in concert, not in sequence. An IP strategy that ignores manufacturing realities is unenforceable, and a manufacturing strategy that ignores IP is indefensible. Consider an innovator company that patents a novel API (the “what”). To bring it to market, they must also develop a scalable, cost-effective manufacturing process (the “how”), which begins with a KSM. If they also succeed in patenting the innovative process used to make that API, they create a much stronger and more durable barrier to entry. A generic competitor would then face the daunting task of inventing a completely new, non-infringing way to make the API, a significant technical and financial hurdle that can delay their market entry for years. Conversely, a generic company selecting a KSM must meticulously analyze the IP landscape. Choosing a KSM that is itself patented or requires a patented process for its conversion to the API is a strategic dead end. Therefore, the most robust competitive strategies are built at the intersection of chemistry and law. The KSM choice solidifies the synthetic route, and the patent strategy protects that route. Aligning these two critical functions from the very beginning creates a powerful, multi-layered competitive advantage that is exceptionally difficult for rivals to overcome.

Section 7: The Future is Now – Technological Transformation in KSM and API Manufacturing

The landscape of KSM and API manufacturing is on the cusp of a profound transformation. For decades, the fundamental approach has remained largely unchanged: large-scale batch processing in centralized facilities. Today, a confluence of technological advancements is challenging this paradigm, paving the way for a future where drug substance manufacturing is smarter, faster, more flexible, and more sustainable. Companies that embrace these technologies will not only optimize their operations but will also build a formidable competitive advantage. A forward-looking KSM strategy must anticipate and integrate these transformative trends.

7.1 The Flow Revolution: Continuous Manufacturing’s Impact on KSM and API Production

Perhaps the most significant technological shift underway is the move from traditional batch manufacturing to Continuous Manufacturing (CM). This represents a fundamental change in production philosophy.

From Batch to Flow: A Paradigm Shift

- Batch Manufacturing: The traditional model involves a series of discrete, start-stop steps. Raw materials are loaded into a large reactor, a chemical reaction is run for a set time, and the resulting intermediate is isolated, purified, and stored before being moved to the next reactor for the subsequent step. This “campaign-like” approach requires large facilities, significant inventory of intermediates, and long production cycles.

- Continuous Manufacturing (CM): In a CM process, raw materials are fed continuously into a much smaller, integrated system of reactors, purifiers, and sensors. The chemical transformations occur as the material “flows” through the system, and the final product emerges continuously at the other end.17

The Compelling Benefits of Continuous Manufacturing

The advantages of CM over batch processing are numerous and compelling, touching every aspect of KSM and API production :

- Enhanced Quality and Consistency: CM systems operate in a “steady state,” where process parameters like temperature, pressure, and flow rate are held constant. This allows for much tighter process control and results in a more consistent product with less batch-to-batch variability.89

- Increased Efficiency and Speed: By eliminating the idle time inherent in batch processing (e.g., charging, heating, cooling, discharging), CM drastically shortens production cycles. It also simplifies scale-up; instead of designing and building ever-larger reactors, production volume is increased simply by running the continuous line for a longer period. This can significantly accelerate the drug development process and reduce time-to-market.

- Reduced Footprint and Cost: CM equipment is typically much smaller and more compact than traditional batch reactors. This reduces the physical footprint of the manufacturing plant, lowering capital expenditure. Overall operating costs can be reduced by anywhere from 9% to 40% due to lower energy consumption, reduced solvent use, and higher yields.

- Improved Safety: CM systems contain a much smaller volume of hazardous materials at any given moment compared to a large batch reactor, inherently reducing the risk of a major safety incident.

Industry Adoption and Regulatory Support

While adoption has been gradual due to the high initial investment and the need for a new way of thinking, CM is no longer a theoretical concept. Leading pharmaceutical companies, including Vertex Pharmaceuticals, Pfizer, Eli Lilly, and Johnson & Johnson, have successfully gained FDA approval for drugs manufactured using continuous processes, proving its viability in a regulated environment.89 Regulatory agencies, particularly the FDA, are actively encouraging the adoption of CM, recognizing its potential to improve product quality and strengthen the resilience of the drug supply chain.89

7.2 The Sustainability Imperative: Green Chemistry in KSM Synthesis

Alongside the push for efficiency and quality, there is a growing and powerful imperative for environmental sustainability in the pharmaceutical industry. Green Chemistry provides a scientific framework for designing chemical products and processes that reduce or eliminate the use and generation of hazardous substances.93 This is not just an ethical consideration; it is increasingly a business and regulatory one.

The 12 Principles in Practice

The philosophy of green chemistry is encapsulated in 12 core principles. For KSM and API synthesis, the most impactful principles include 95:

- Waste Prevention: Designing syntheses to prevent waste rather than treating it after it has been created.

- Atom Economy: Maximizing the incorporation of all materials used in the process into the final product.

- Use of Safer Solvents and Reagents: Avoiding toxic, hazardous solvents and reagents in favor of benign alternatives.

- Design for Energy Efficiency: Conducting reactions at ambient temperature and pressure whenever possible.

- Use of Renewable Feedstocks: Sourcing raw materials from renewable sources (like biomass) rather than depleting fossil fuels.

- Catalysis: Using highly selective catalysts in small amounts is superior to using stoichiometric reagents that are consumed in the reaction.

Impact on KSM Strategy and Corporate Commitment